According to the US Bureau of Labor Statistics, employment of accountants is projected to grow by 4% from 2022 to 2032. However, the job comes with its challenges. Difficult clients, poor resourcing, unrealistic deadlines, and bosses who think accounting software does all the work are common hurdles. Even if you excel at the actual job, you still need to navigate the recruiting process.

When searching for an accounting job, your resume must stand out. Highlight your financial skills and detail your experience in managing records. Use this guide to create a resume that makes a strong impression on recruiters.

Key takeaways

- Organize your work history and career advancement in accounting in reverse chronological order.

- Develop a compelling resume summary that emphasizes your key qualifications, accounting approach, and significant accomplishments.

- Present both technical and interpersonal skills, including expertise in accounting software and strong analytical capabilities.

- Underscore the impact of your accounting work using specific metrics.

- Tailor your resume for each job by aligning your skills and experiences with the specific requirements of the position.

- Share details about your education and relevant certifications to show you're qualified and knowledgeable in accounting.

- If you don't have work experience, highlight any internships, personal projects and volunteer work that prove your accounting skills.

An impactful resume for accountants is essential, so let’s explore the best way to format it to underline your skills and expertise.

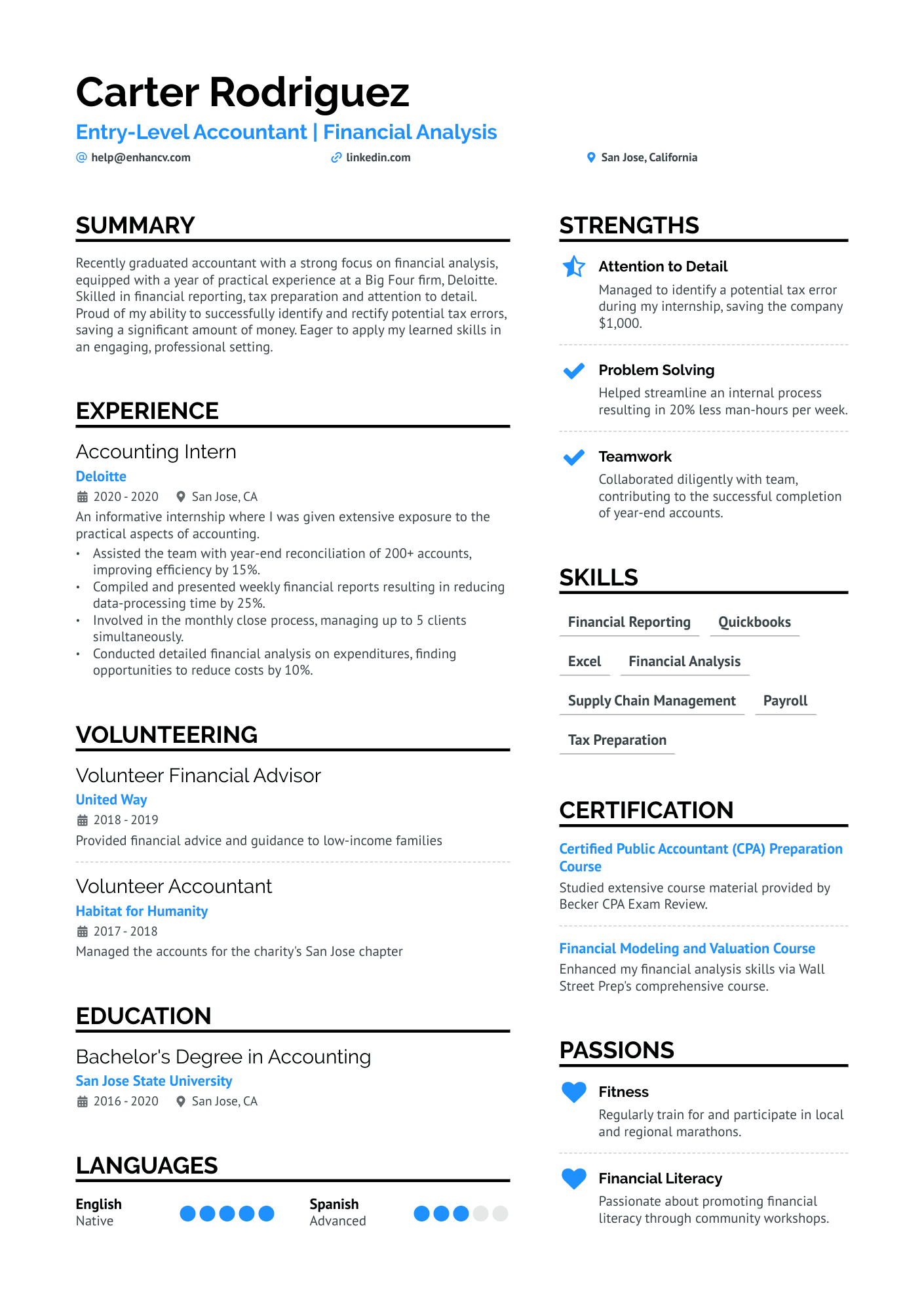

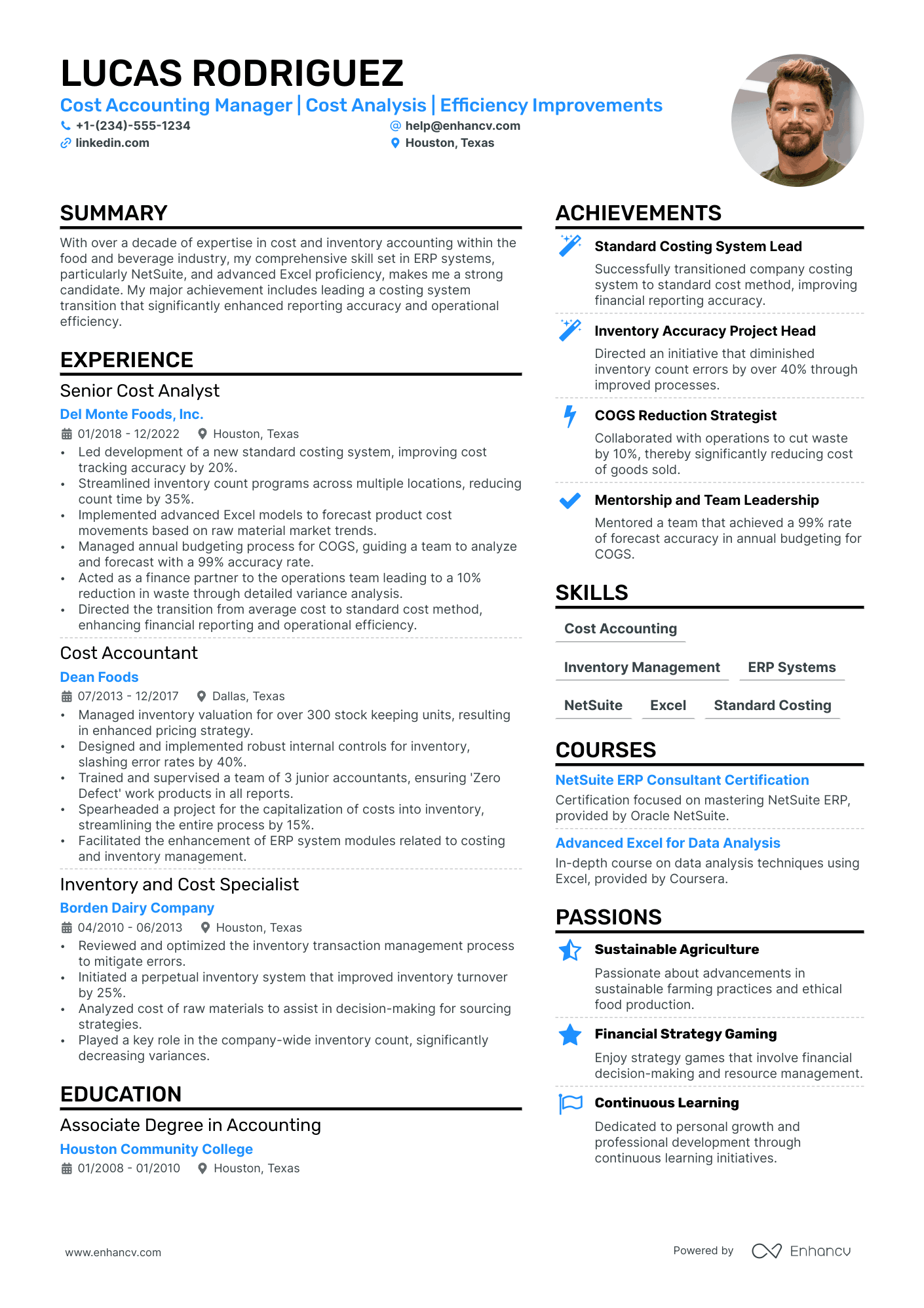

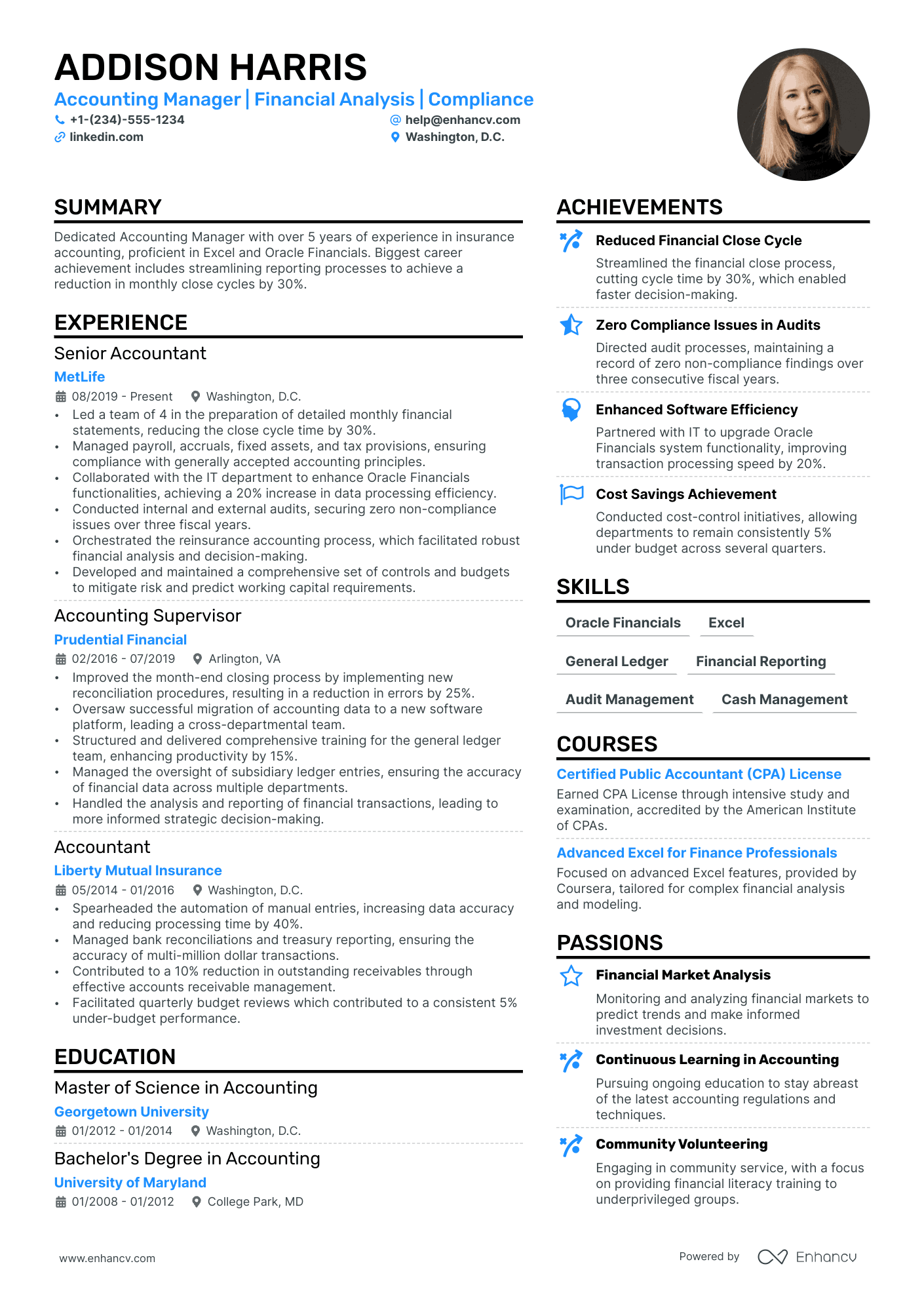

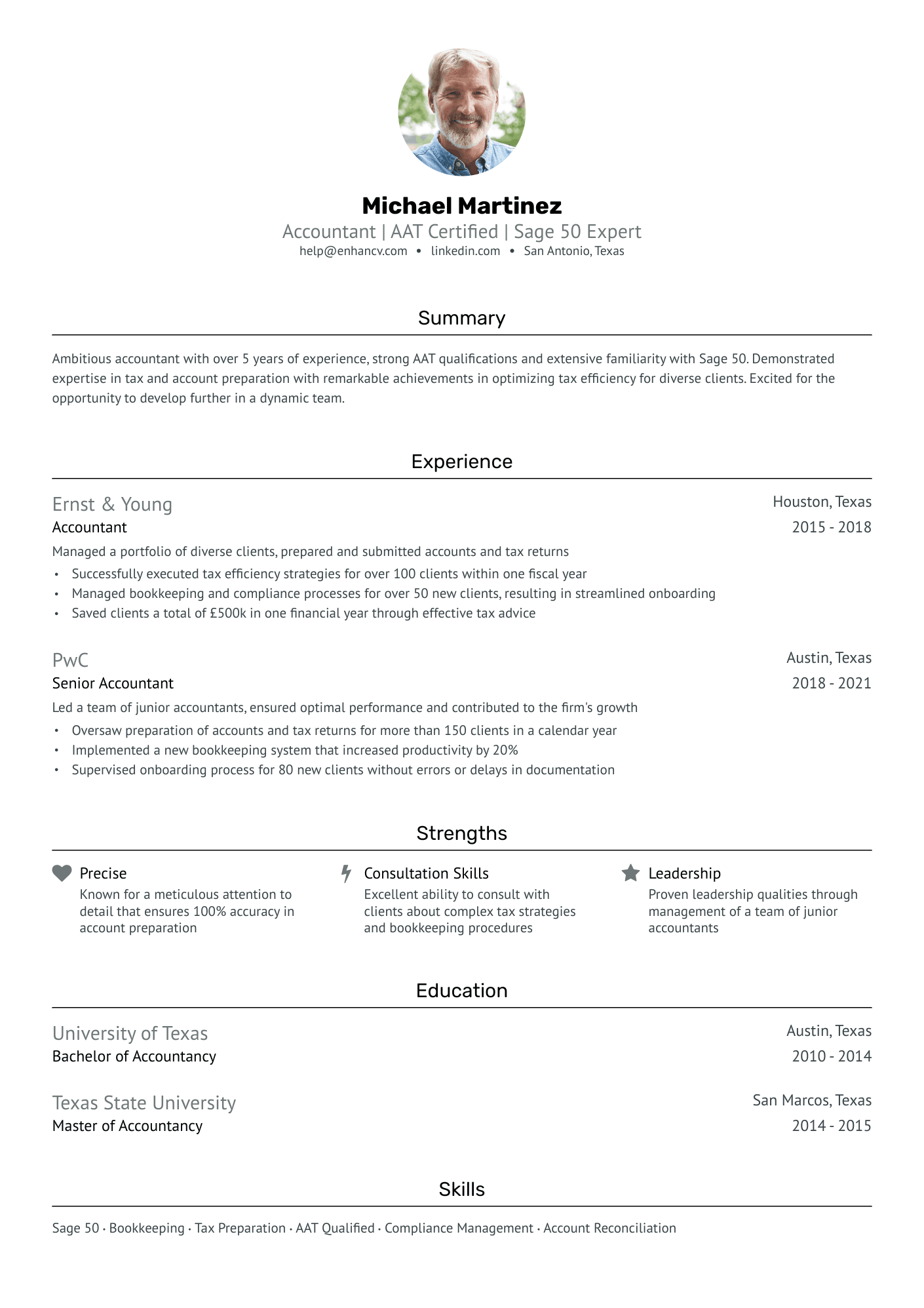

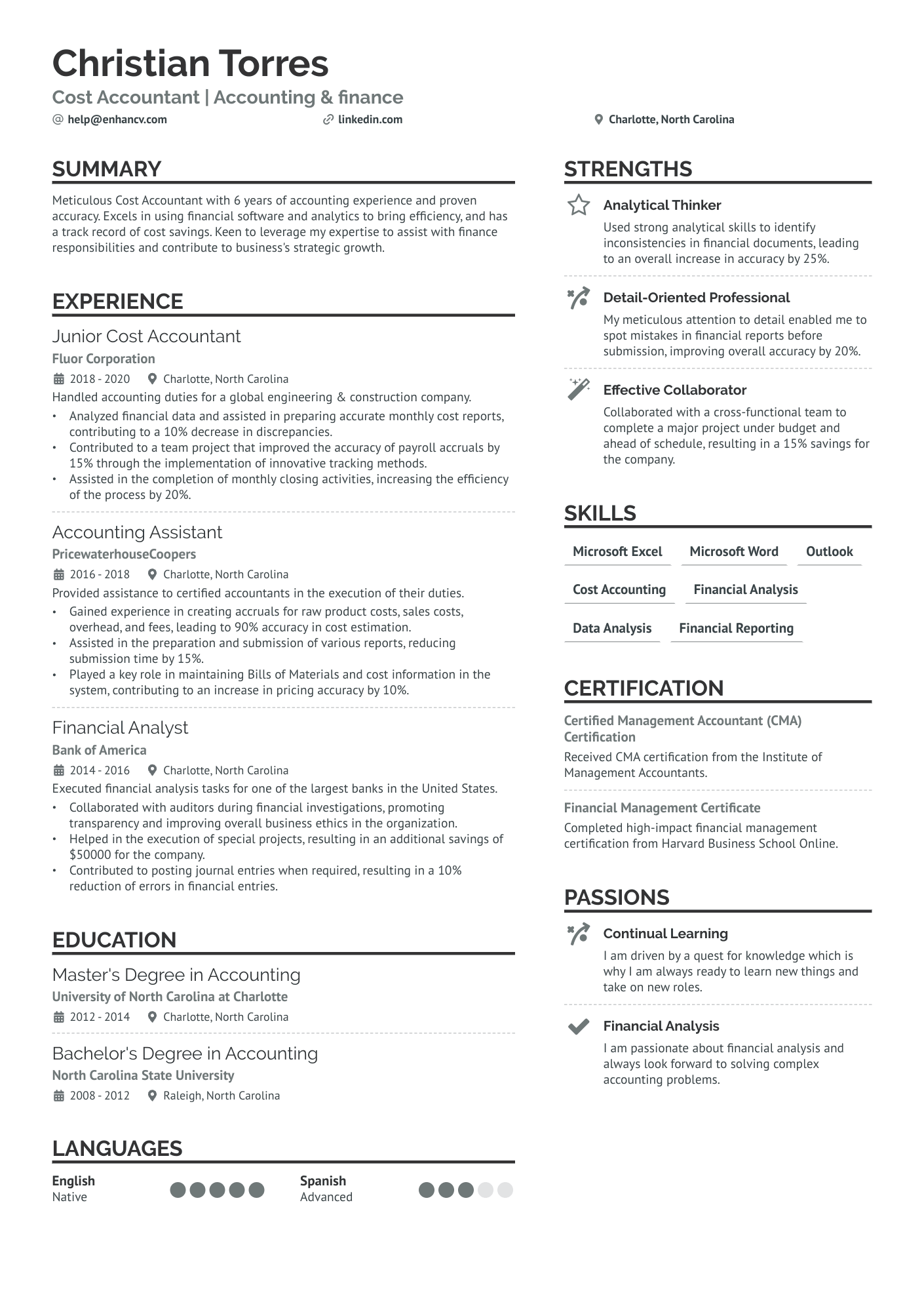

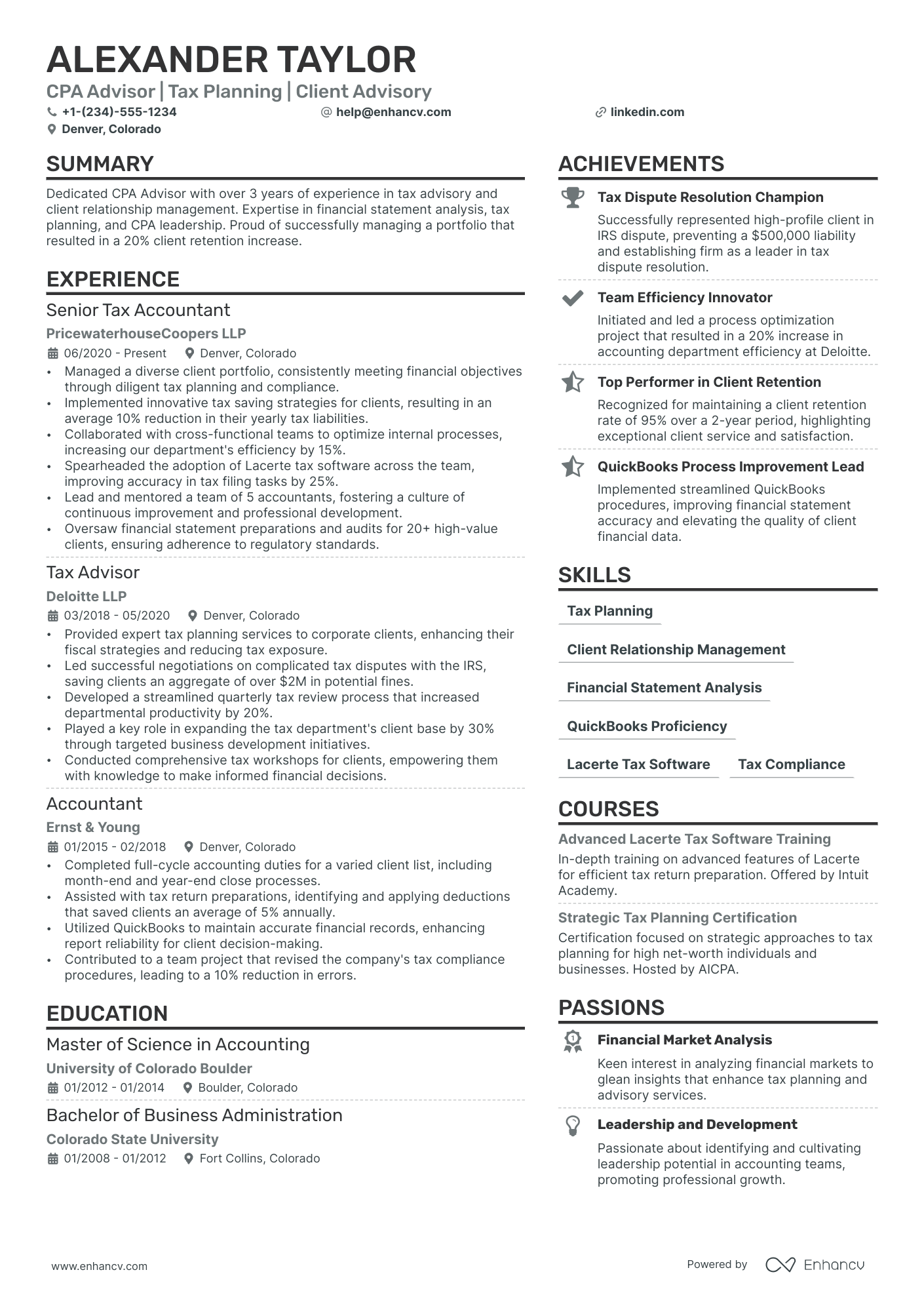

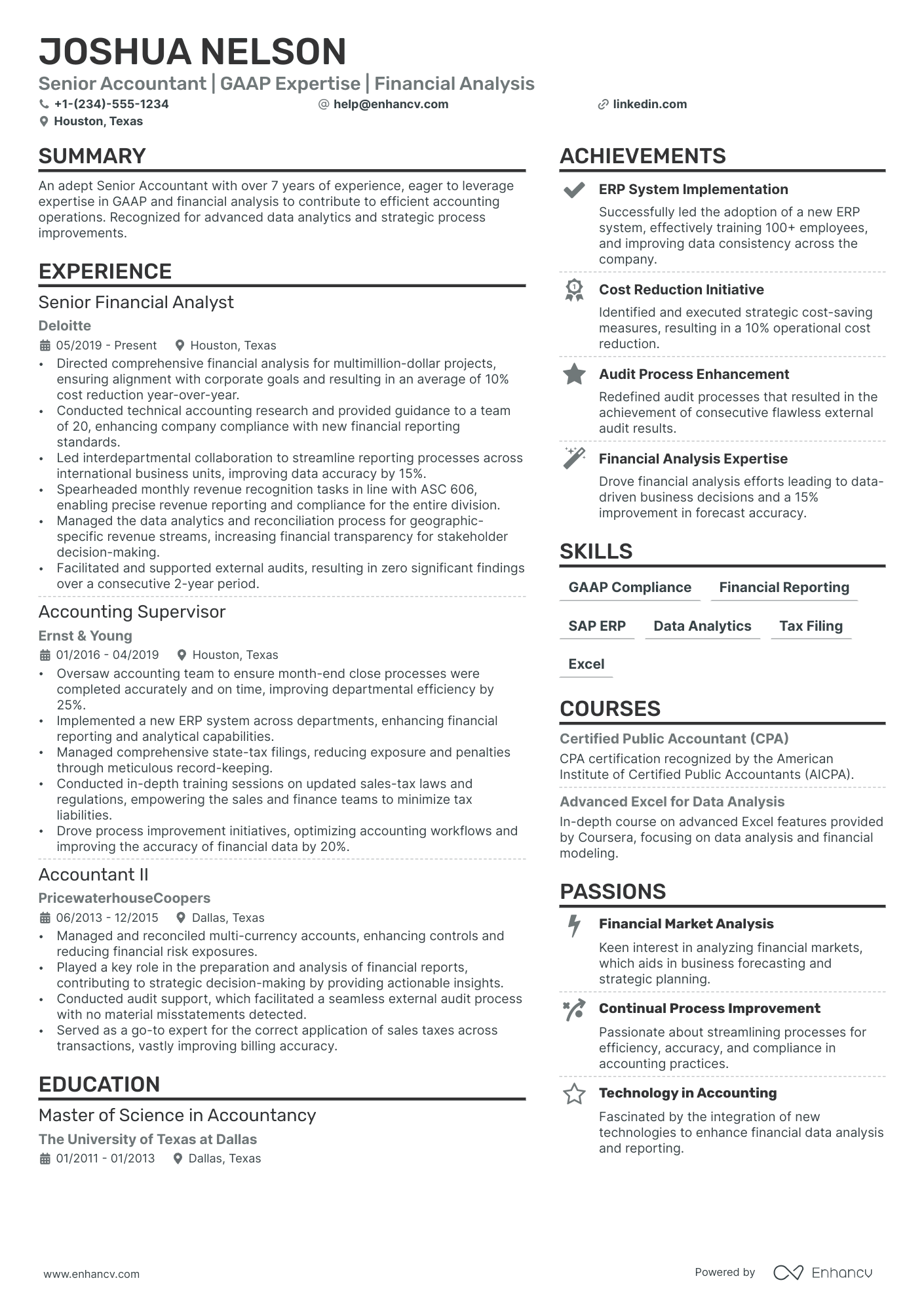

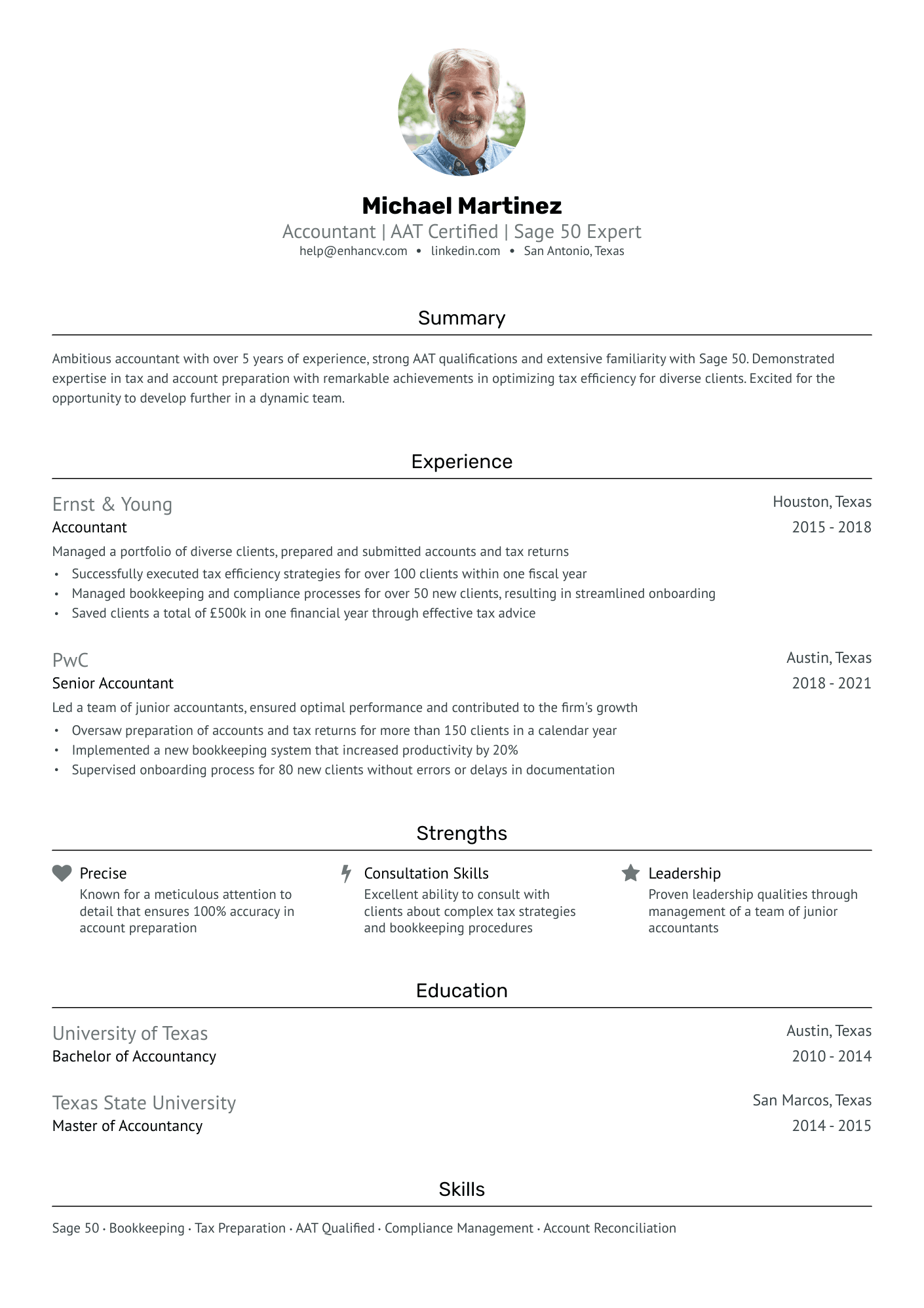

Accountant resume sample

Below, you’ll find an accountant resume sample to guide you.

Andrew Green

Accountant

help@enhancv.com | @linkedin.com | San Francisco, California

Summary

Detail-oriented and organized Accountant with 4 years of experience managing financial transactions, preparing accurate financial statements, and ensuring compliance with tax regulations. Proficient in QuickBooks and Excel, with a strong understanding of GAAP and a proven track record of maintaining accurate records.

Experience

Accountant

Smith & Associates, San Francisco, CA

June 2020 - Present

- Managed accounts payable and receivable, ensuring timely and accurate processing of transactions.

- Reconciled bank statements monthly, identifying and resolving discrepancies to maintain financial accuracy.

- Prepared financial statements, including balance sheets, income statements, and cash flow statements, resulting in timely reporting.

- Assisted with budgeting and forecasting, providing detailed financial analysis to support decision-making.

- Maintained accurate and up-to-date accounting records, improving record-keeping efficiency by 15%.

Junior Accountant

Financial Solutions Inc., San Francisco, CA

June 2018 - May 2020

- Supported the accounting team with daily tasks, including data entry and financial report generation.

- Assisted in the preparation of monthly financial statements, ensuring accuracy and timeliness.

- Performed bank reconciliations and identified discrepancies, contributing to financial accuracy.

- Participated in internal audits, verifying the accuracy of financial records and controls.

Education

Bachelor of Science in Accounting

University of California, Berkeley, Berkeley, CA

2014 - 2018

- Related Coursework: Advanced Accounting Principles, Taxation and Business Strategy, Financial Statement Analysis, Auditing and Assurance Services, Managerial Accounting, Corporate Finance

Certifications

- Certified Public Accountant (CPA)

- QuickBooks Certified User

Skills

- Financial Reporting

- Tax Compliance

- Accounts Payable and Receivable

- Bank Reconciliations

- Budgeting and Forecasting

- Microsoft Excel

Languages

- English (Fluent)

- Spanish (Intermediate)

How to format an accountant resume

There are three main formats to consider for your accountant resume: reverse chronological, functional, and combination. Typically, the reverse chronological format is the most effective choice for this type of resume.

This approach organizes your job experience from the newest position to the oldest, focusing on your professional development and practical experience. It suits applicants with a steady accounting career, effectively illustrating their advancement and relevant qualifications.

Here's the ideal order for your resume sections, which we'll cover in detail later:

- Header

- Summary/objective

- Professional experience

- Education

- Certifications

- Key skills

- Languages

This structure is preferred by recruiters for its natural and appealing organization.

Now, let's dive into the specifics:

Resume designs

- Keep consistent margins of about 1 inch to maintain readability, and opt for a two-column template for a sleek, professional appearance.

- Choose straightforward fonts like Rubik or Lato, sized between 10 and 12 points, and choose soft colors to highlight your skills.

- Limit the resume to one page if you have less than 10 years of experience, but senior professionals can extend it to two pages if needed.

Contact information

- Make sure your name is spelled the same way across all your application documents. Match the job title on your resume to the one you're applying for. For instance, if the job is for a Tax Accountant, use those exact words on your resume. This helps streamline the hiring process.

- Add a resume headline to emphasize your key skills and experiences, which is particularly helpful in the diverse field of accounting.

- Provide a professional email address and include a link to your LinkedIn profile, if it’s up-to-date.

- To adhere to US resume standards and prevent biases, don’t include a photo of yourself.

File format

- Use a straightforward file name like "AndrewGreenAccountantResume.pdf" so recruiters can easily find your resume.

- Save your resume as a PDF unless the job posting requests a different format. PDFs maintain formatting and are easily parsed by ATS.

Different regions expect different formats – Canadian resumes, for example, may look unique.

PRO TIP

Don’t fear the ATS. Focus on matching the job description language, formatting dates and bullet points correctly. Plus, avoid keyword stuffing. Keep your resume clear and readable for both systems and humans.

Want to know if your resume is ATS-friendly? Check it with our free AI tool below!

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once the resume format is set, let's emphasize your experience in accounting.

How to write your accountant resume experience

Including your professional experience on an accountant's resume is important because it underscores your hands-on skills, builds trust, and shows your experience in managing finances. It demonstrates to potential employers your expertise in real-world accounting.

Emphasize your major accomplishments with quantifiable results, such as increasing financial efficiency, reducing expenses, and improving accuracy.

Ensure your resume is clear and structured by using bullet points and listing your experience in reverse chronological order. Tailor your resume to the job requirements to convince the recruiter you’re the right candidate.

Why to tailor your accountant resume to the job description and hot to do it correctly

Tailoring your resume to the job description ensures that your most relevant qualifications are front and center. This strategy helps you stand out and can make a big difference in getting noticed by hiring managers. By mentioning the exact skills and experiences the employer needs, you make it easy for them to see why you’re a great fit for the job.

This is known as a targeted resume. But how to do it in the right way?

Here are some useful tips:

- Read the job offer carefully and find out the skills and qualifications outlined, and weave these specific keywords into your job descriptions.

- Spotlight elements of your prior roles that correlate with the new job’s requirements, such as proficiency in accounting tools, financial analysis, or budget oversight.

- Quantify your achievements to illustrate the results of your contributions, such as "lowered expenses by 10%."

- Underline job titles and duties that align closely with the position you're applying for, even if it necessitates emphasizing particular aspects of your past experience.

Here’s an example of an accountant job listing we’ll focus on to customize our work experience entry. Take a look at the job details.

Accountant

The Accountant will:

- Manage all aspects of the accounting cycle, including accounts payable and receivable, bank reconciliations, and journal entries.

- Reconcile bank statements and identify discrepancies

- Prepare accurate and timely financial statements, such as balance sheets, income statements, and cash flow statements.

- Assist with budgeting and forecasting.

- Maintain accurate and up-to-date accounting records

- Calculate and file federal, state, and local taxes.

- Analyze financial data and trends to identify areas for improvement.

- Maintain strong internal controls and ensure adherence to accounting policies and procedures.

- Ensure compliance with all relevant accounting standards and tax regulations

- Communicate effectively with other departments, such as sales and operations.

- Stay up-to-date on current tax laws and accounting standards.

- May participate in audits or respond to inquiries from auditors

Required skills

- Minimum of 3—4 years of experience in a similar role.

- Strong understanding of Generally Accepted Accounting Principles (GAAP).

- Proficient in accounting software, such as Unanet, UKG, or QuickBooks.

- Excellent analytical and problem-solving skills.

- Strong attention to detail and accuracy.

- Excellent communication and interpersonal skills.

- Government contracts experience is a plus

- Strong experience with Microsoft Excel is preferred

Let's take a look at how we've customized the entry below:

- •Handled all aspects of the accounting cycle, including accounts payable and receivable, bank reconciliations, and journal entries, managing transactions worth over $5M each year.

- •Reconciled bank statements and pinpointed discrepancies, cutting errors by 1o% and ensuring financial records were accurate.

- •Assisted in budgeting and forecasting, which led to a 12% boost in budget accuracy.

- •Kept accounting records up-to-date and accurate, enhancing record-keeping efficiency by 20%.

- •Applied GAAP to maintain compliance and improve financial accuracy.

- •Used accounting software like QuickBooks to streamline financial processes, boosting efficiency by 20%.

Now the customized resume fit the job ad requirements because it:

- Highlights GAAP application for compliance and accuracy improvement.

- Emphasizes QuickBooks use, boosting process efficiency by 20%, meeting technical skill needs.

- Demonstrates impact with metrics: managing $5M transactions, reducing errors by 10%, improving efficiency by 20%.

- Covers essential skills: handling accounts, reconciling statements, budgeting, and accurate record-keeping.

- Suggests strong Excel proficiency with 12% budgeting accuracy and 20% efficiency improvements.

How to quantify your experience on a resume

Using numbers and results on your resume is key—it brings your achievements to life. If possible include specific metrics like percentages, dollar amounts, or other clear figures to prove your impact.

For instance, an accountant’s experience section could include these bullet points:

- Include metrics on improving financial accuracy, such as "increased budget accuracy by 12% through detailed forecasting."

- Underscore cost-saving achievements, such as "reduced operational costs by 15% through expense audits and vendor negotiations."

- Detail revenue growth contributions, such as "boosted revenue by 10% through efficient billing and collection practices."

- Mention process improvements, such as "enhanced record-keeping efficiency by 20% with automated accounting software."

- Specify compliance improvements, such as "ensured 100% compliance with tax regulations, avoiding penalties and fines."

Even if you're just starting out in accounting, this strategy can help you shine. Discover how in the next section.

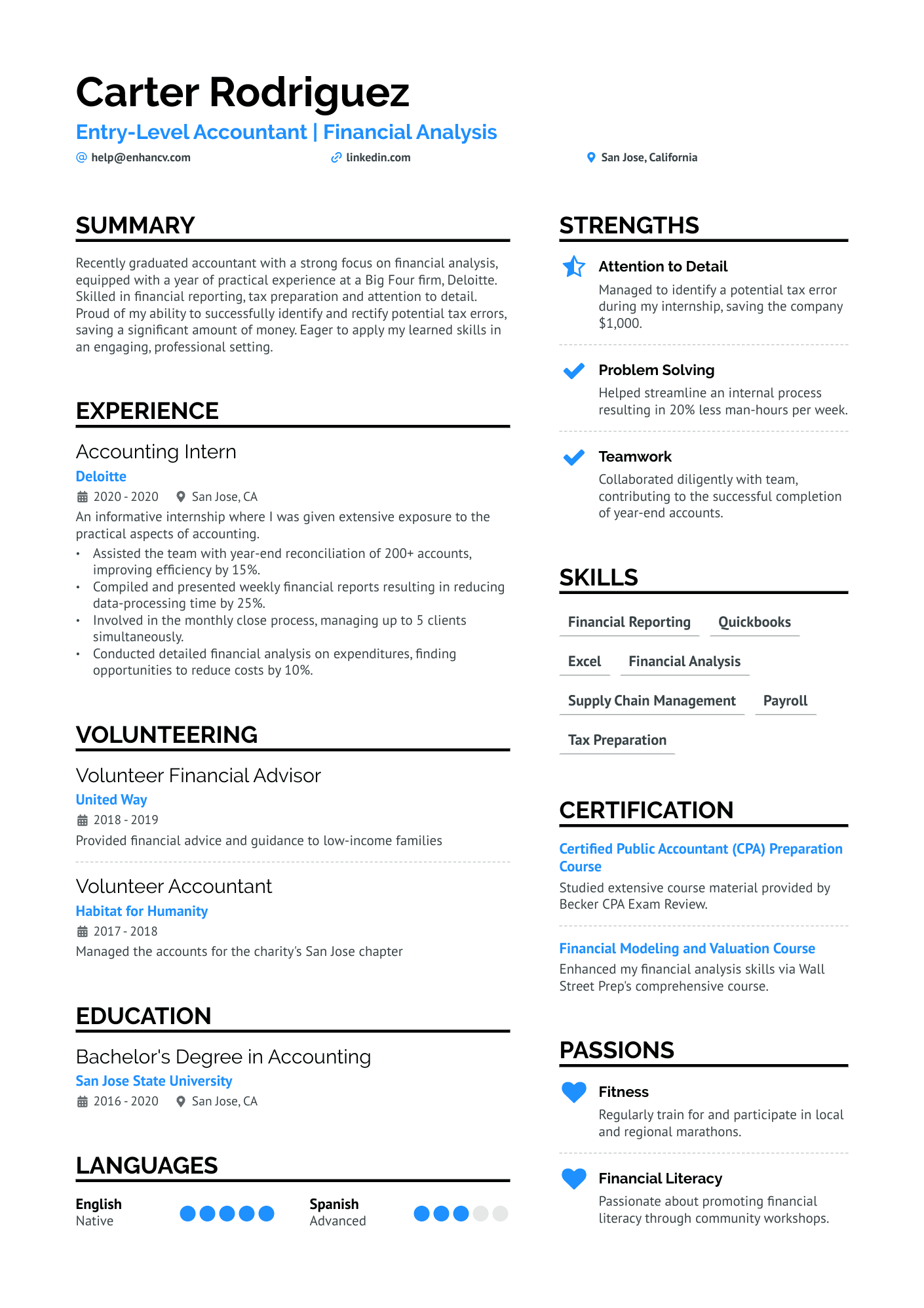

How do i write an accountant resume with no experience

Diving into an accounting career can be both exciting and demanding, particularly if you lack extensive experience. But don’t stress! You can still put together an accountant resume that highlights your potential and makes you shine.

Here are some helpful tips:

- Use a functional resume format to spotlight your skills and academic accomplishments.

- Opt for a simple template to maintain a professional appearance despite limited experience.

- Detail relevant coursework and academic projects that show your grasp of accounting principles and problem-solving abilities.

- Show recruiters that you possess the technical skills and familiarity with accounting software, like QuickBooks or Excel, required for the role by underlining your technical training or courses.

- Focus on your transferable skills. Summer jobs or internships, even if unrelated to accounting, can help you develop valuable skills like financial analysis or data entry, so be sure to include them.

- Highlight any practical experience with financial documents, such as creating balance sheets or income statements.

- Add volunteer experience or extracurricular activities that involve accounting responsibilities or teamwork.

Resume objective for entry-level accountant

On an entry-level resume for accountants, an objective statement is important because it demonstrates your career goals and eagerness to enter the field, even if you have little work experience.

For a top-notch objective statement, make sure to:

- State your career goals or the position you're interested in.

- Shape it to the role and employer, incorporating keywords from the job listing to show your goals align with their requirements.

- Emphasize the key skills or qualifications that will assure hiring managers that you are an ideal candidate.

- Illustrate how your abilities can benefit the company and contribute to its success.

Let's delve into examples of effective objective statements.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your experience is clear, let’s move to the skills section of your accountant resume.

How to list your hard and soft skills on your resume

Having both soft and hard skills on your accounting resume is crucial. It demonstrates that you're not only proficient with numbers but also effective in dealing with people, making you an ideal candidate for the role.

Here's a closer look:

- Hard skills are the core competencies of your job. These include abilities you've acquired through education and experience, such as proficiency with accounting software, preparing financial statements, and handling tax filings.

- Soft skills focus on how you interact with others. They encompass your communication abilities, teamwork, and problem-solving skills.

Here are some specific suggestions that you can include in your resume.

Best hard skills for your accountant resume

- QuickBooks

- Microsoft Excel

- SAP

- Oracle Financials

- Xero

- Sage 50

- FreshBooks

- NetSuite

- TurboTax

- Tally ERP

- ADP

- Intacct

- Paychex

- TaxSlayer

- Yardi

Here are some key people skills that are in high demand for accountants. These skills should be woven into various resume sections, such as the summary or experience parts, where they can be easily quantified and described. For example, you could demonstrate problem-solving like this: “Resolved discrepancies in financial records, saving the company $50,000 annually.”

Best soft skills for your accountant resume

- Attention to detail

- Problem-solving

- Organization

- Adaptability

- Analytical thinking

- Time management

- Work ethics

- Communication

- Multitasking

- Patience

- Conflict resolution

- Critical thinking

- Integrity

- Leadership

- Customer service

- Negotiation skills

- Decision making

Now that the essential skills for accountants are clear, it's important to focus on certifications and education. These qualifications are key to demonstrating your commitment and expertise.

How to list your certifications and education on your resume

Your resume’s education section needs to reflect your primary accounting and technical competencies. Customize this section to match the job description, similar to your work experience. Employers review this to verify that you possess the necessary training to support your abilities.

Must-haves for your education section:

- Degree and major

- University name

- Graduation date

- Relevant coursework

- Honors and awards

Take a moment to see an example tailored to the job description shared below.

- •Completed coursework in Financial Accounting, Taxation, and Auditing.

- •Participated in the Accounting Club and served as the Treasurer.

- •Graduated with honors.

- •Conducted a senior project on event management and customer service.

This example effectively demonstrates a well-rounded educational background, tailored to an accountant's role, for several reasons:

- It includes a Bachelor's Degree in Accounting, showcasing a solid educational foundation.

- The entry includes the degree/diploma, institution, location, and date range, providing a clear and complete picture of the applicant's educational history.

- Specific bullet points highlight relevant coursework, achievements, and extracurricular activities. This shows the candidate's active engagement and excellence in their field.

- Including the GPA for the Bachelor's degree demonstrates academic excellence, making the candidate more attractive to potential employers.

You can further improve your resume by adding a solid certifications section. Accountants may not always need specific certifications, but having them can improve your qualifications and career prospects.

Best certifications for your accountant resume

Your educational background is set, so let's create an engaging resume summary that captures your professional strengths as an accountant.

How to write your accountant resume summary

Acting as a critical section of an accountant's resume, the summary offers a brief yet impactful introduction to your career milestones. It’s meant to capture hiring managers' interest by highlighting the most impressive aspects of your professional path.

Make your accountant summary impressive with these practical tips:

- State your years of experience in accounting to highlight your expertise.

- Emphasize key skills relevant to the position, such as proficiency in accounting software, tax compliance, or financial reporting.

- Quantify your achievements to provide concrete proof of your impact.

- Customize your summary to mirror the language and requirements of the job listing, underlining how your background makes you the perfect fit.

Check this good example.

This summary demonstrates key accounting experience and certifications, using specific achievements to prove impact. It uses strong action words and metrics to show the applicant's proactive approach.

Now that you have the knowledge, you can design a powerful resume. Use Enhancv’s resume builder to tailor your content and layout perfectly.

Additional sections for an accountant resume

Adding optional sections to an accountant's resume lets you show a wider variety of skills and experiences, setting you apart by showcasing distinctive aspects of your professional journey.

Additional sections to include if you have space:

- Professional affiliations: Indicates your involvement in the accounting community, such as memberships in AICPA or IMA, enhancing your credibility and showing ongoing professional development.

- Passions: Any hobbies can reflect your personality and suggest a well-rounded character, potentially aligning personal passions with financial analysis and management trends.

- Language skills: Illustrates your ability to communicate in multiple languages, which is valuable in diverse teams and international accounting contexts.

In conclusion

This guide provides key strategies for creating an impressive accountant resume, boosting your chances of attracting hiring managers. By showcasing your skills, experiences, and unique traits, you're setting yourself up for a successful career move.

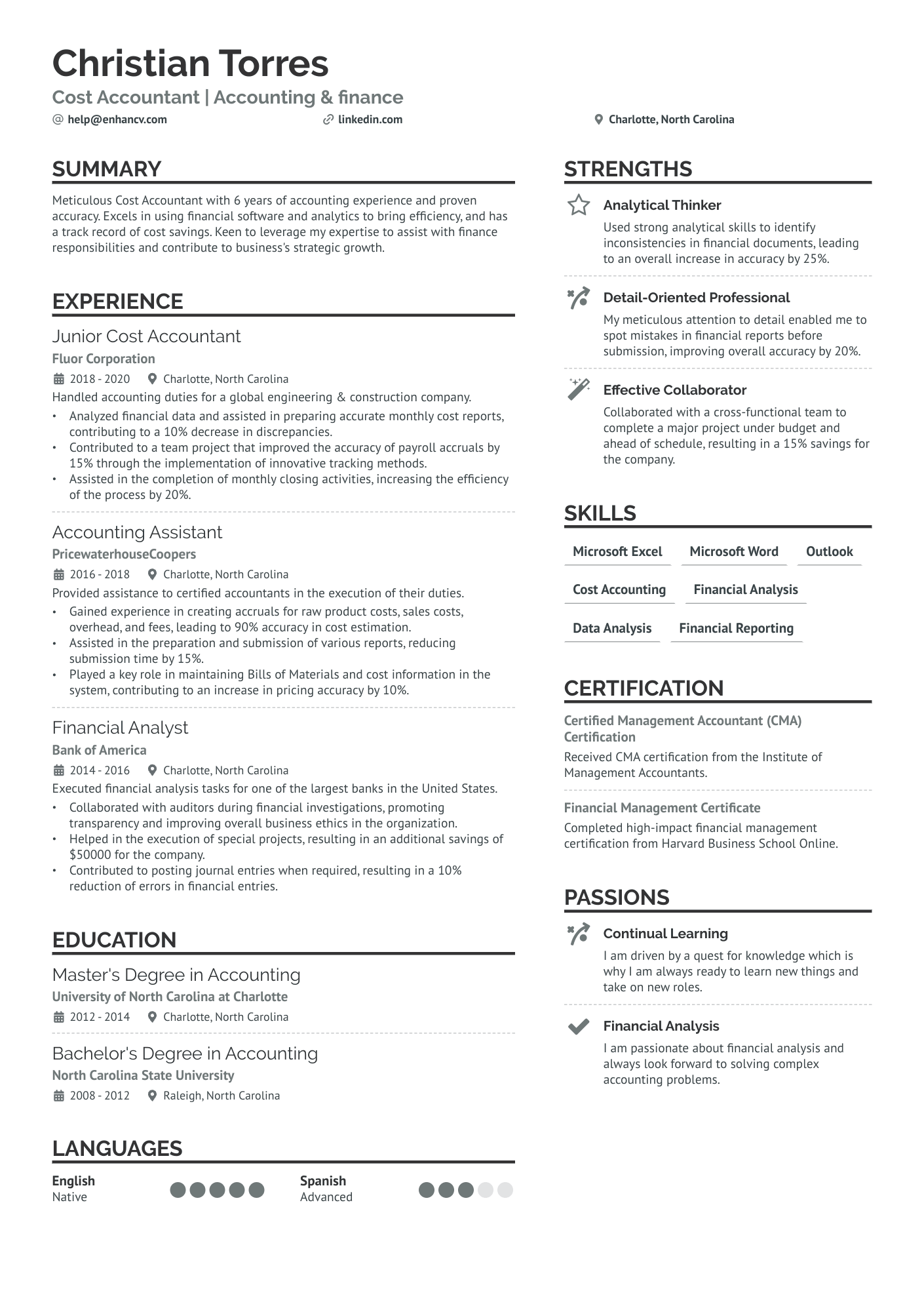

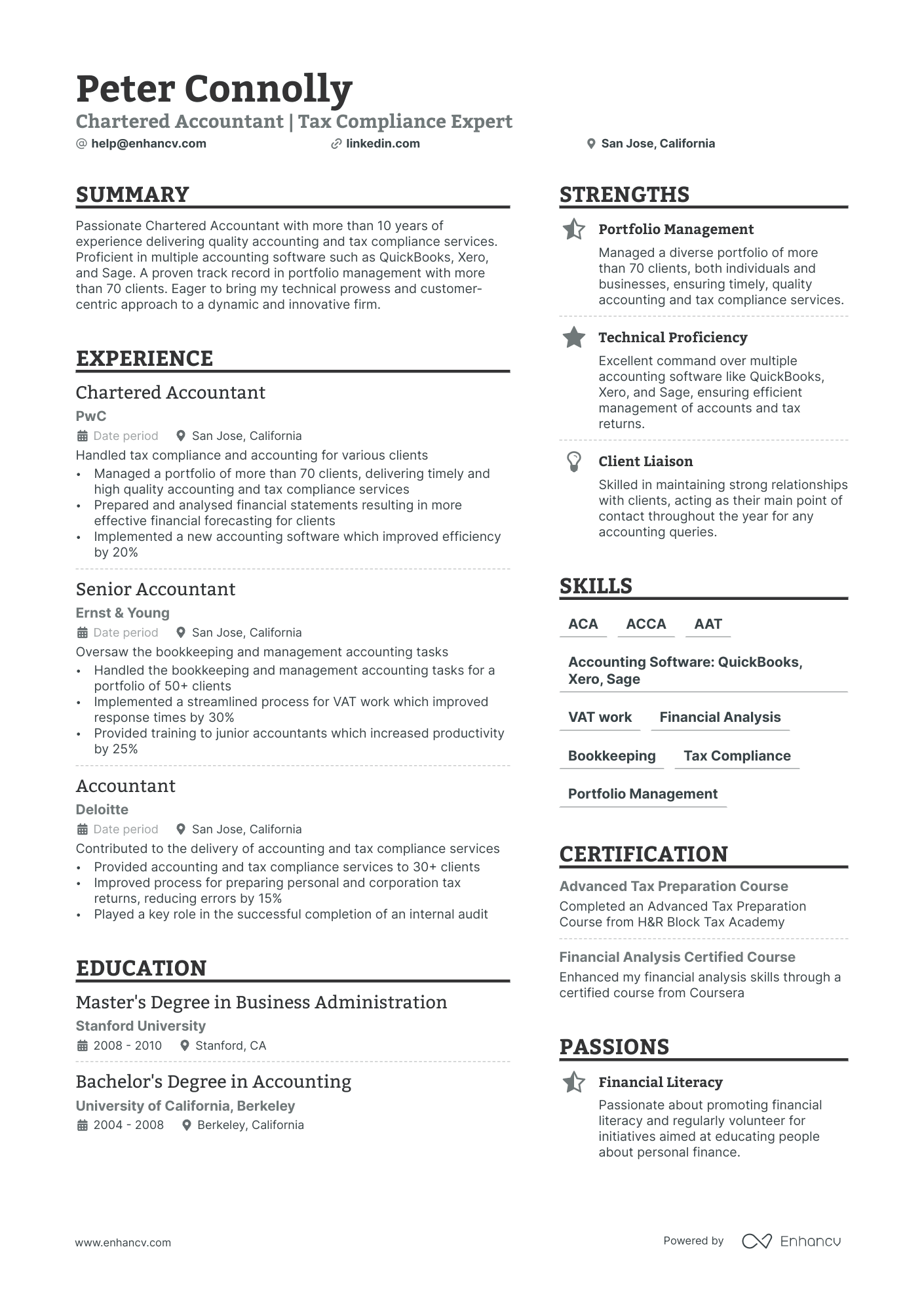

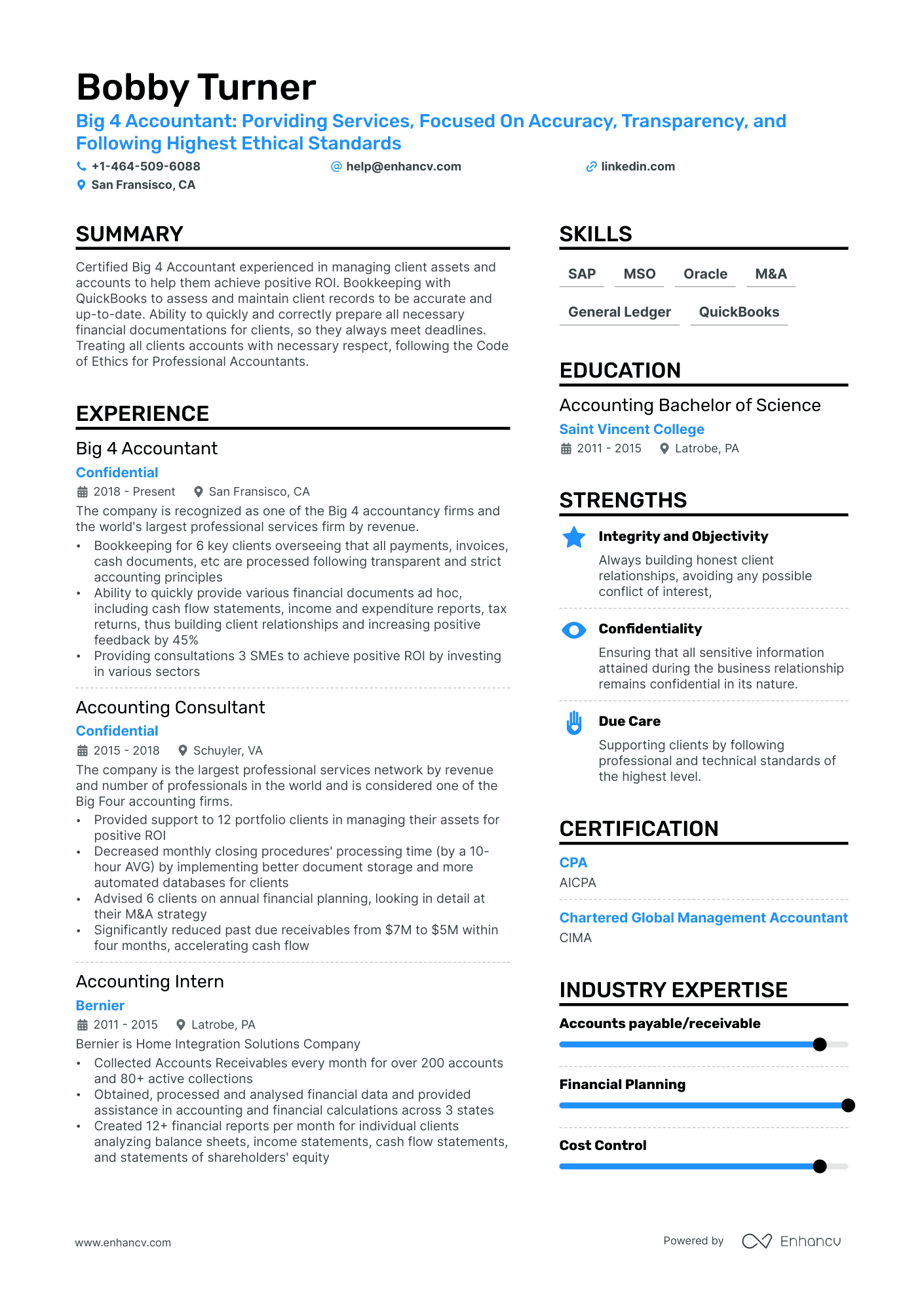

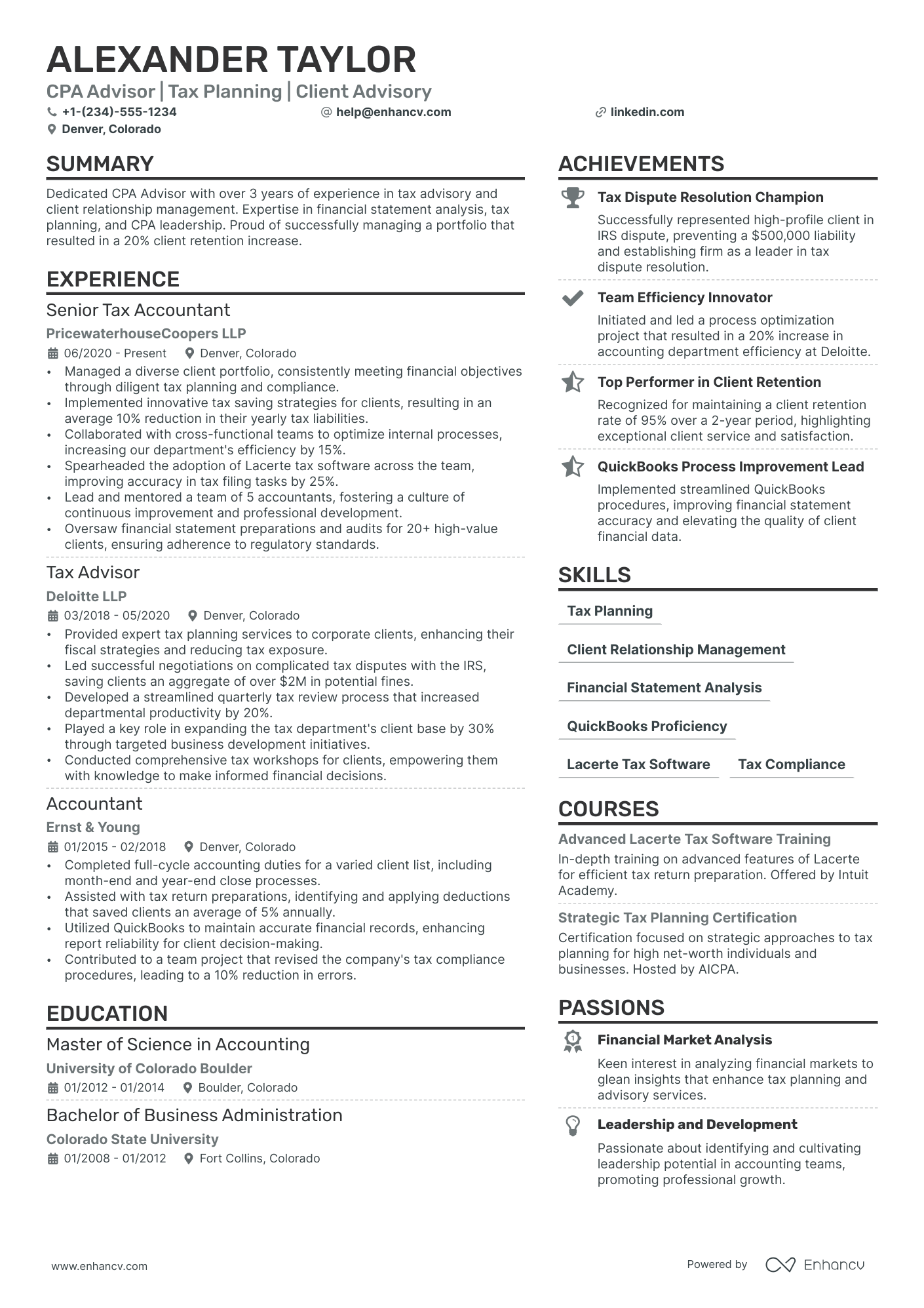

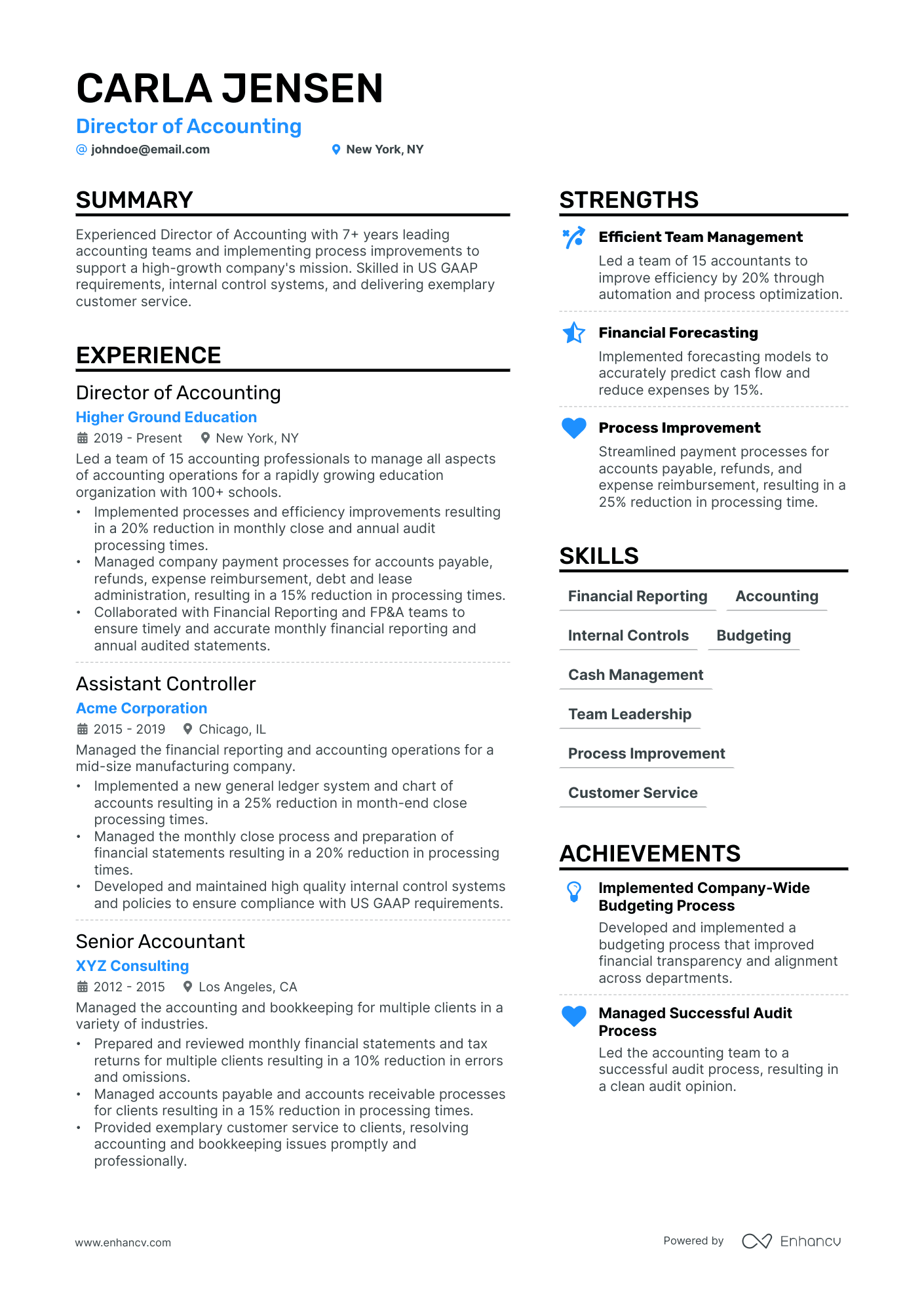

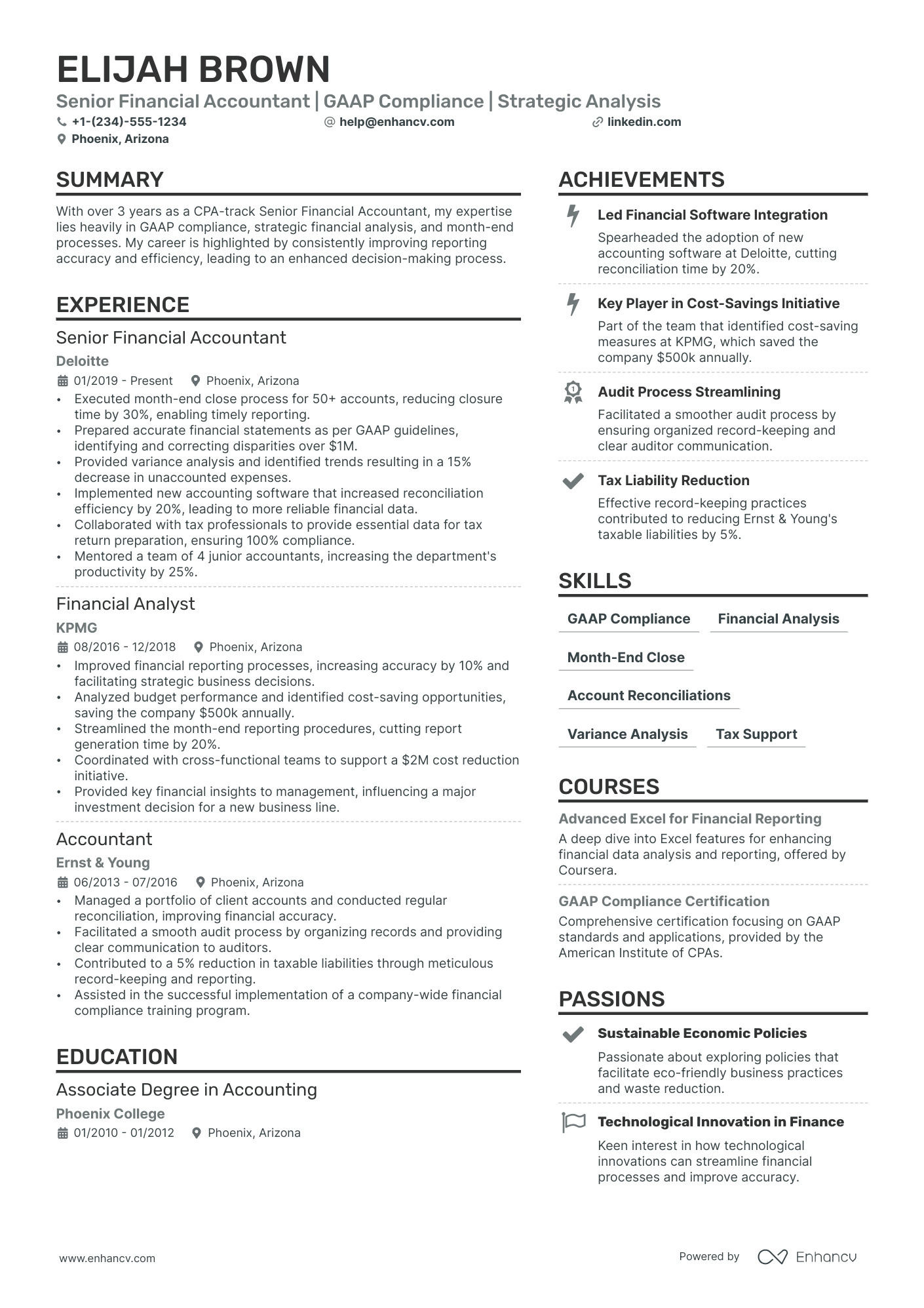

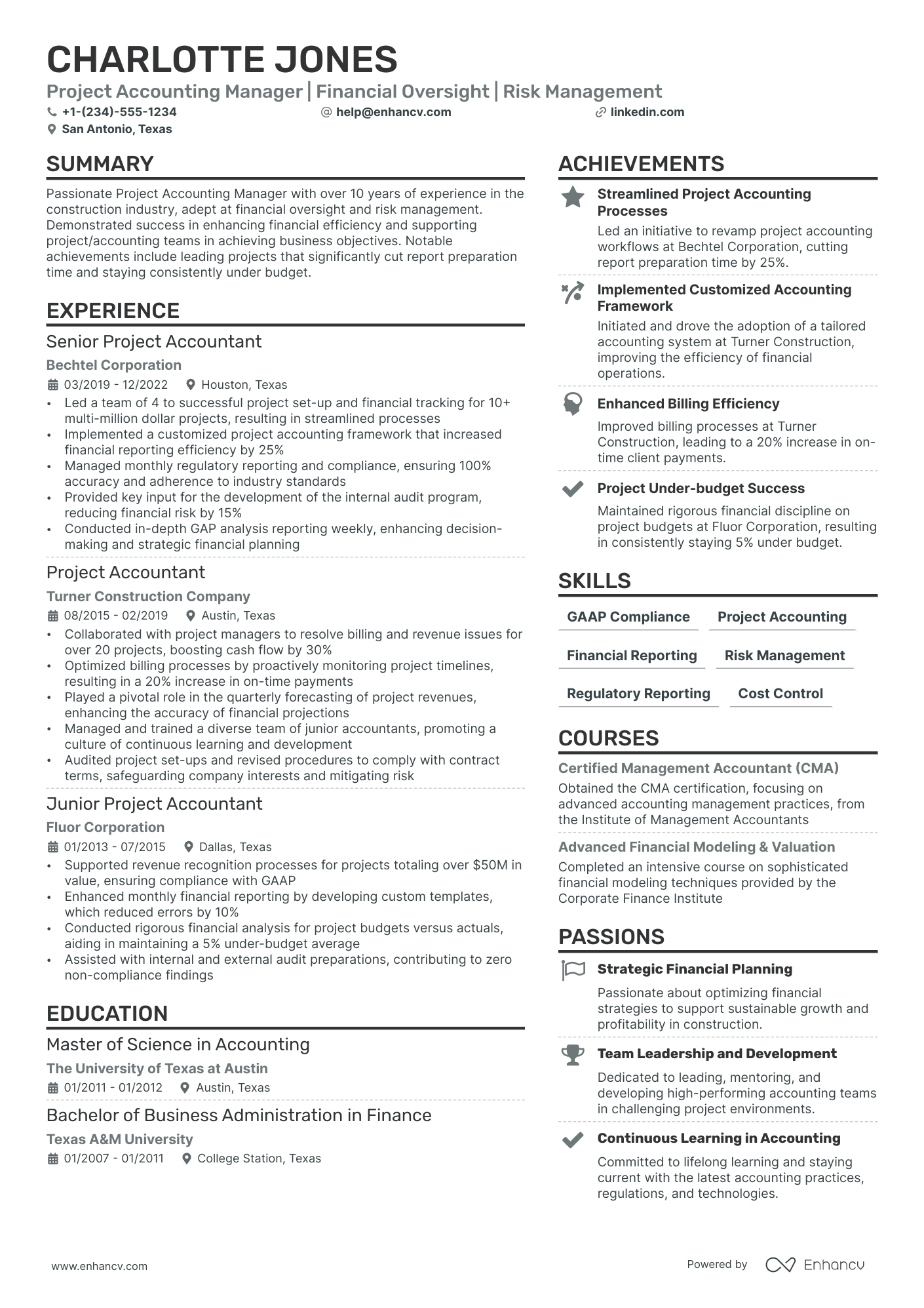

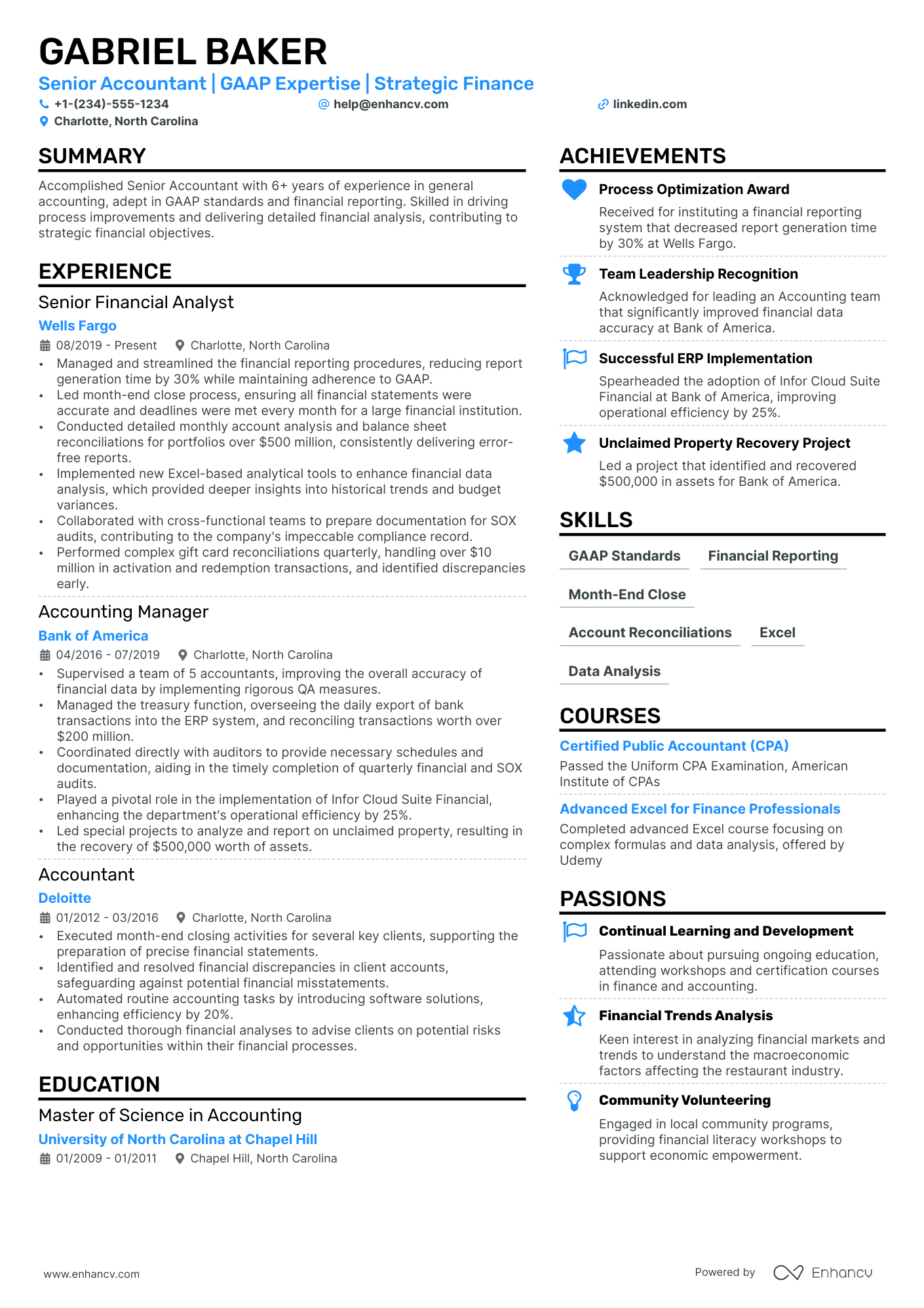

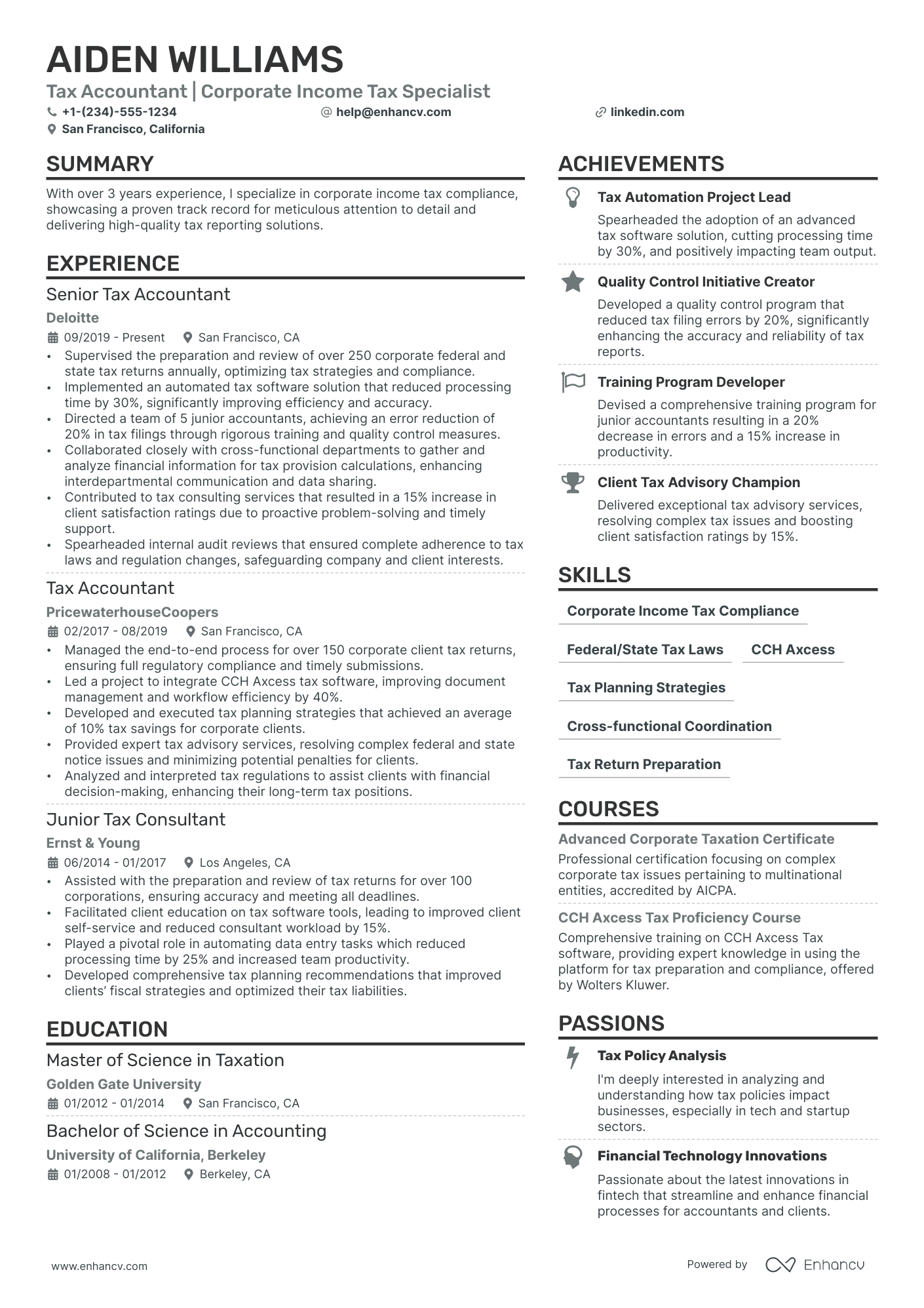

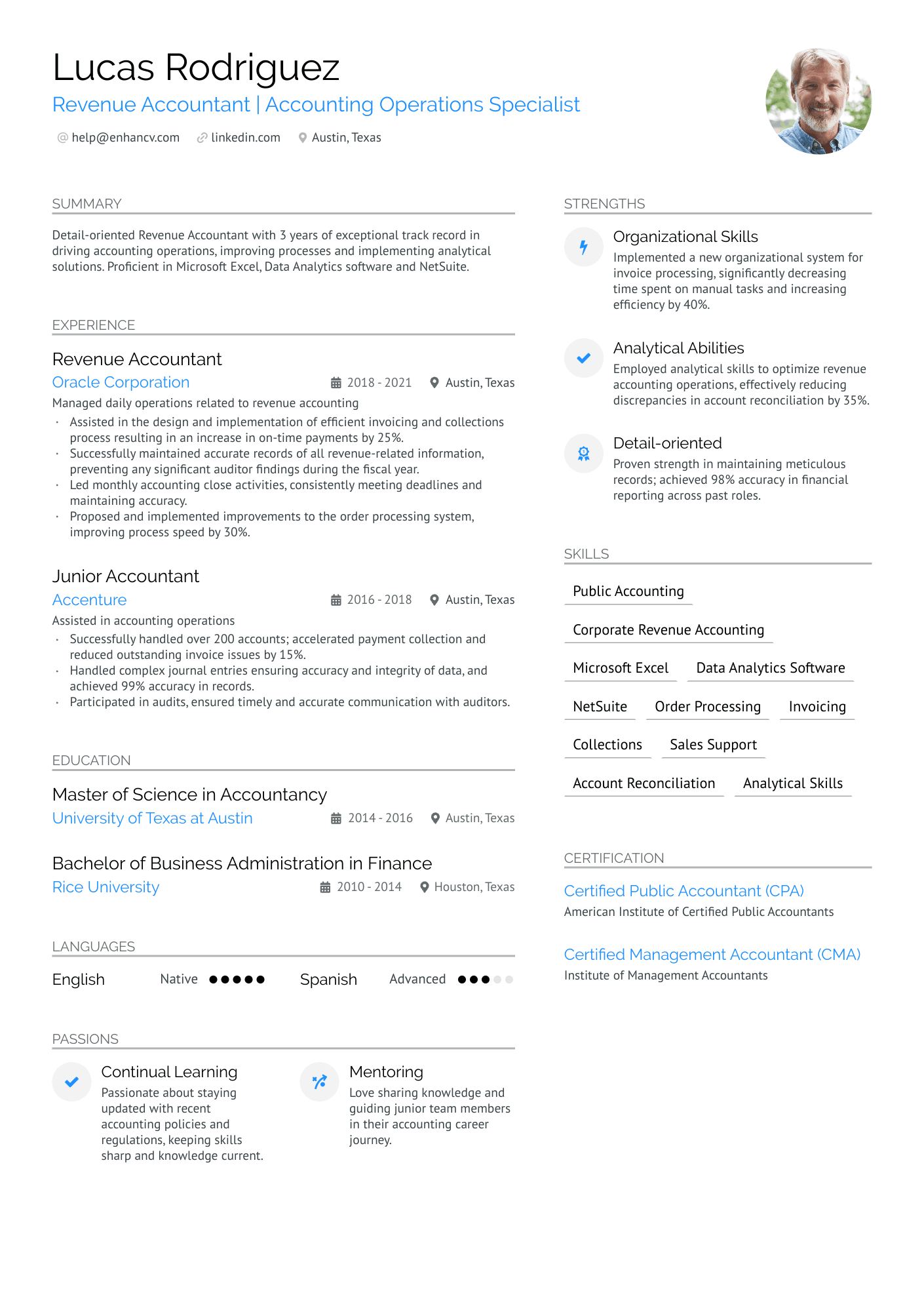

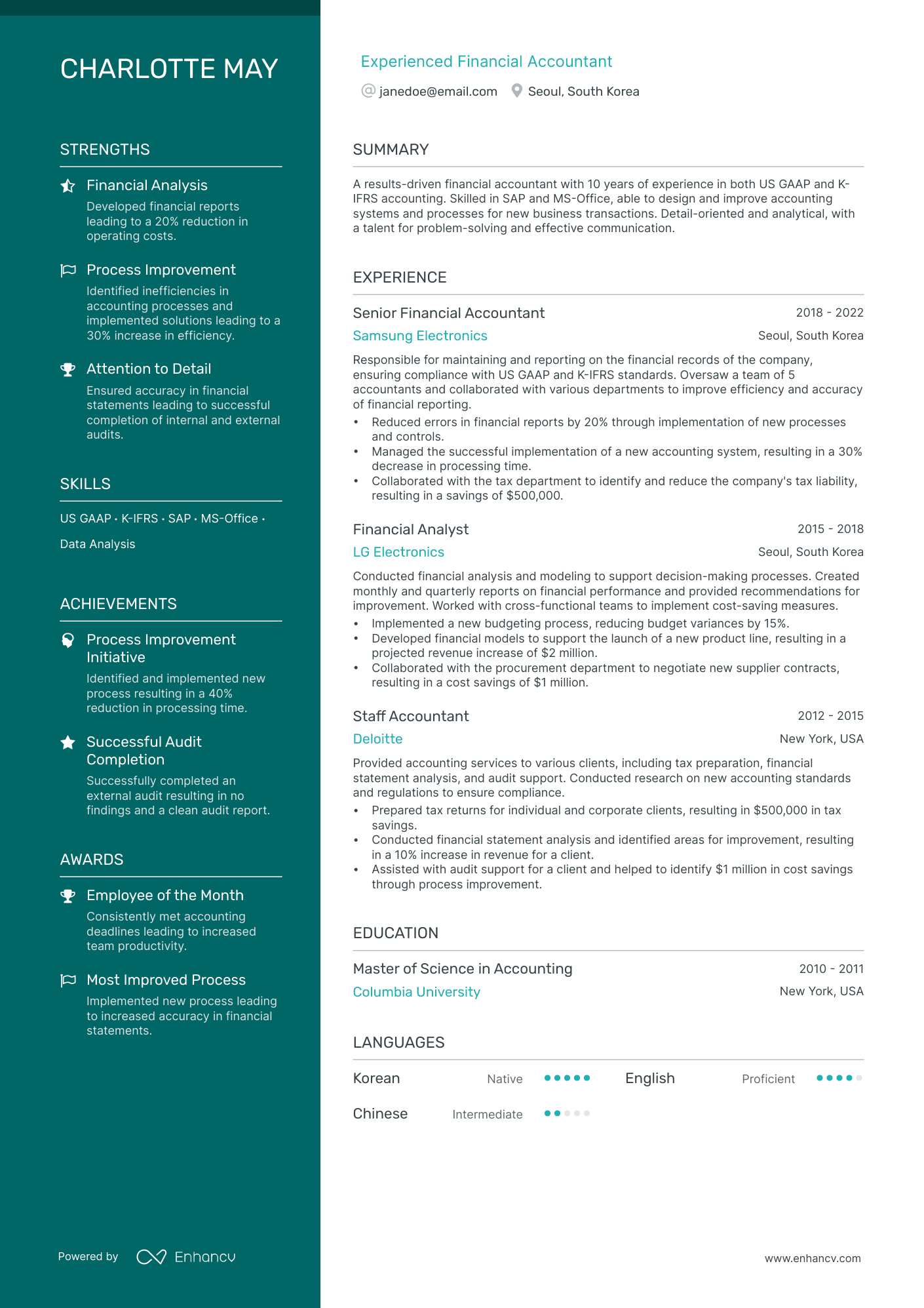

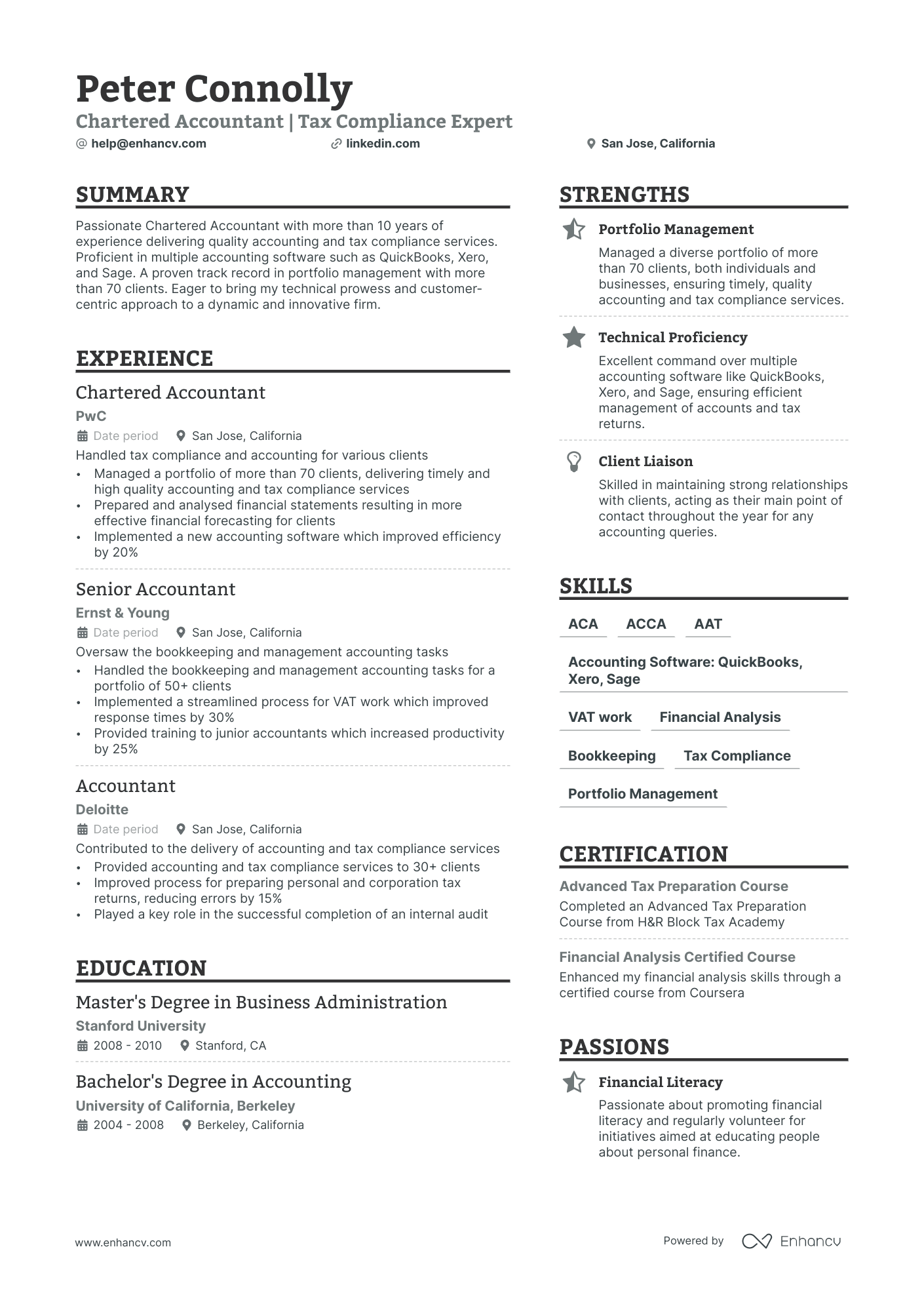

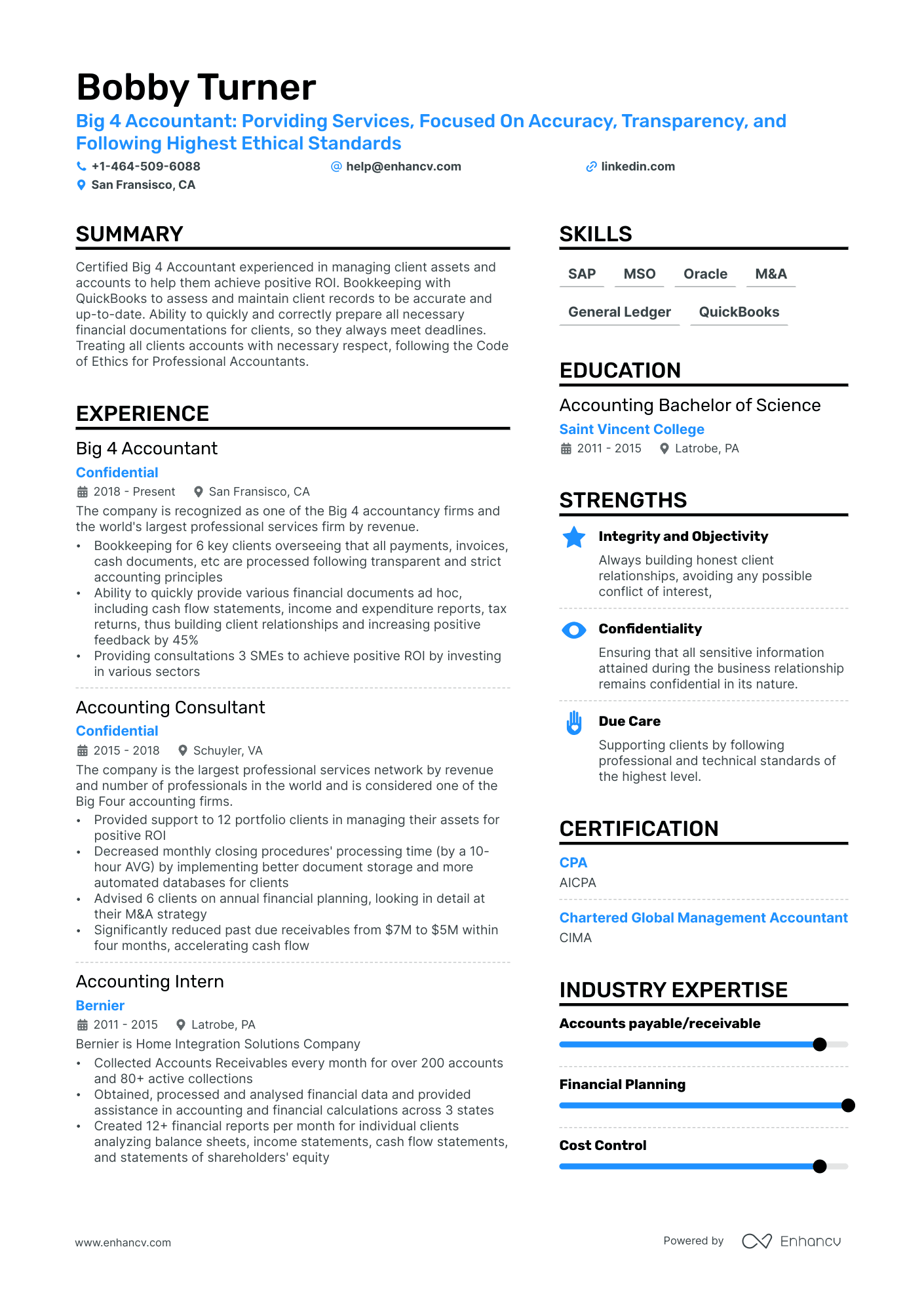

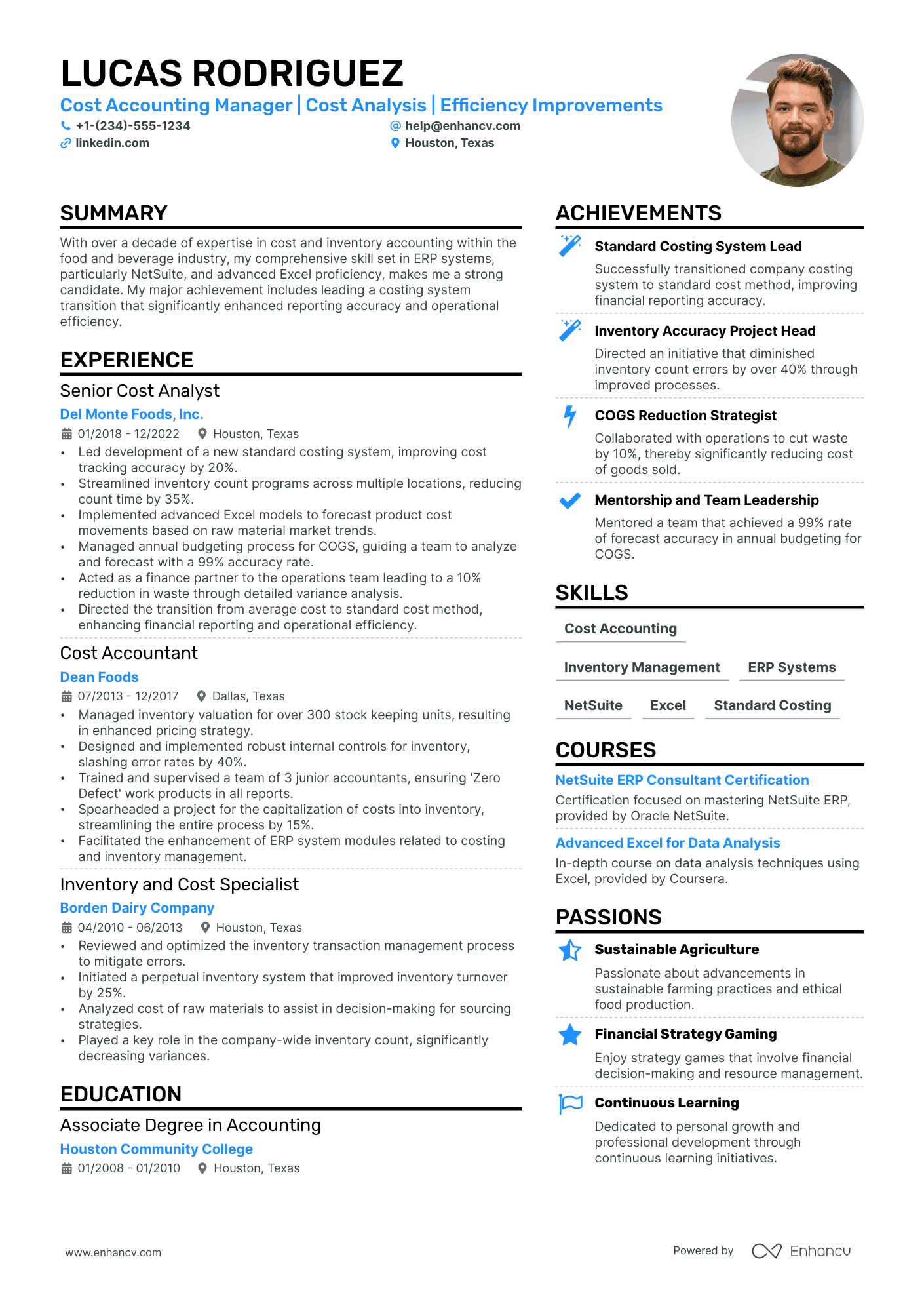

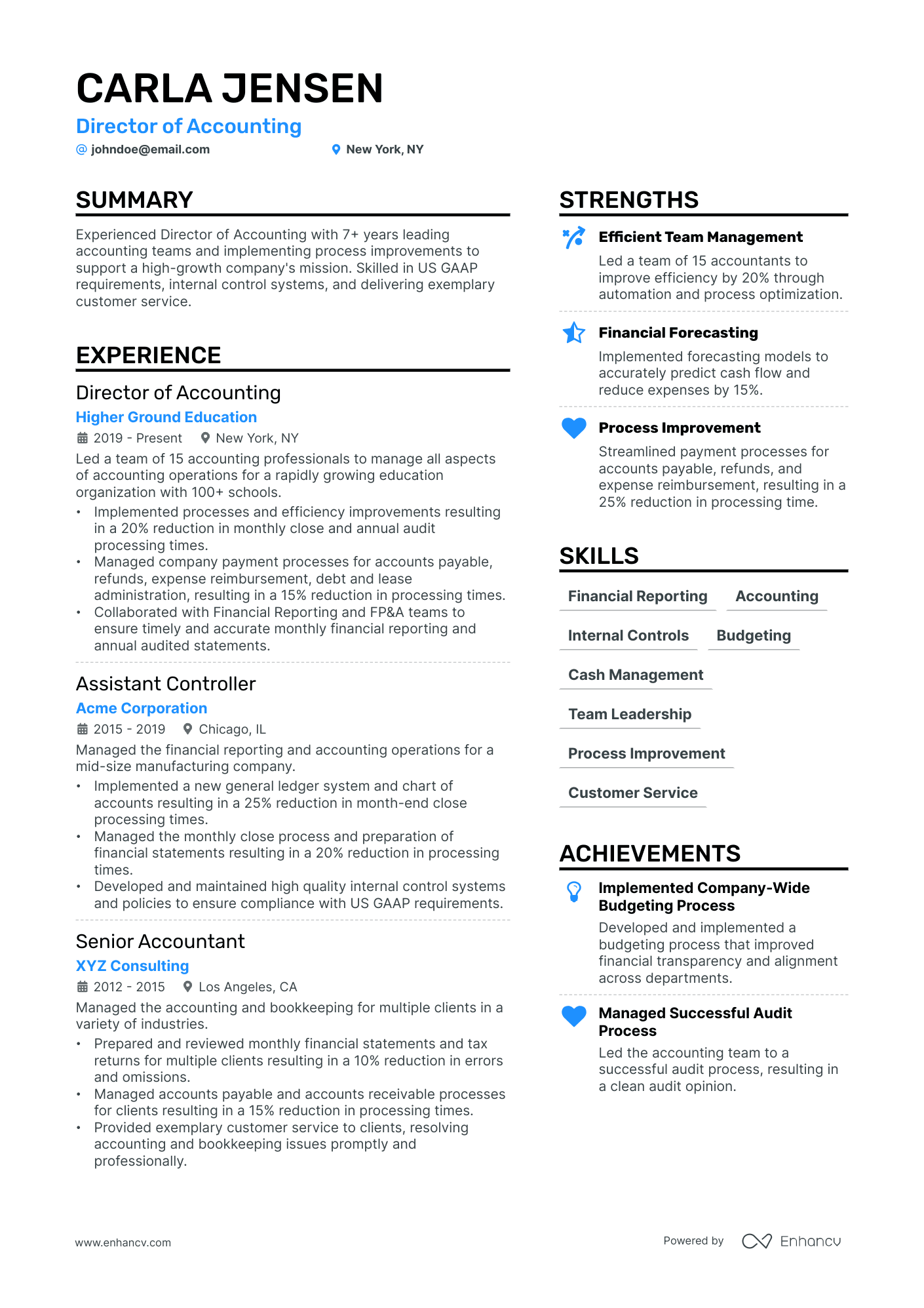

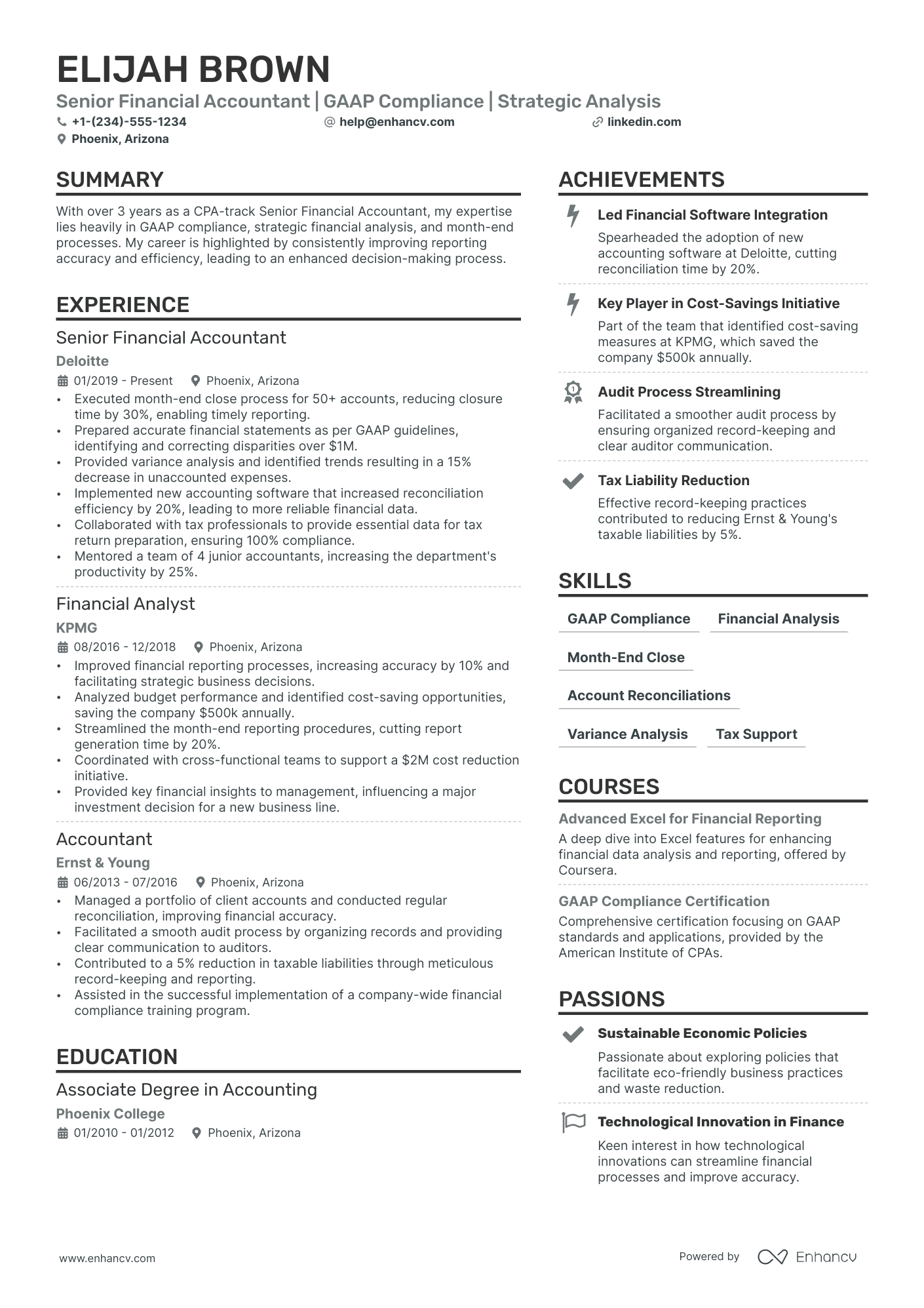

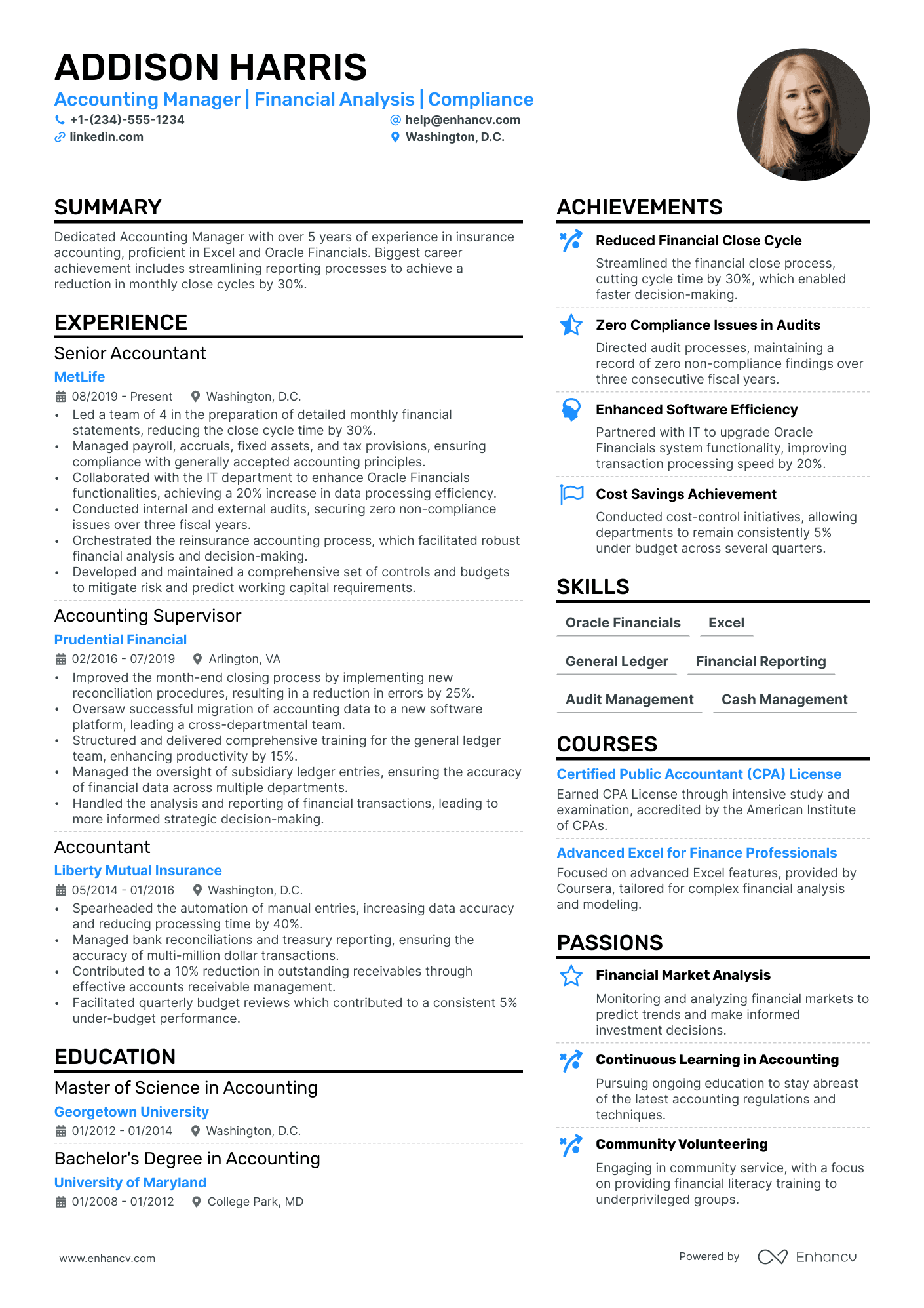

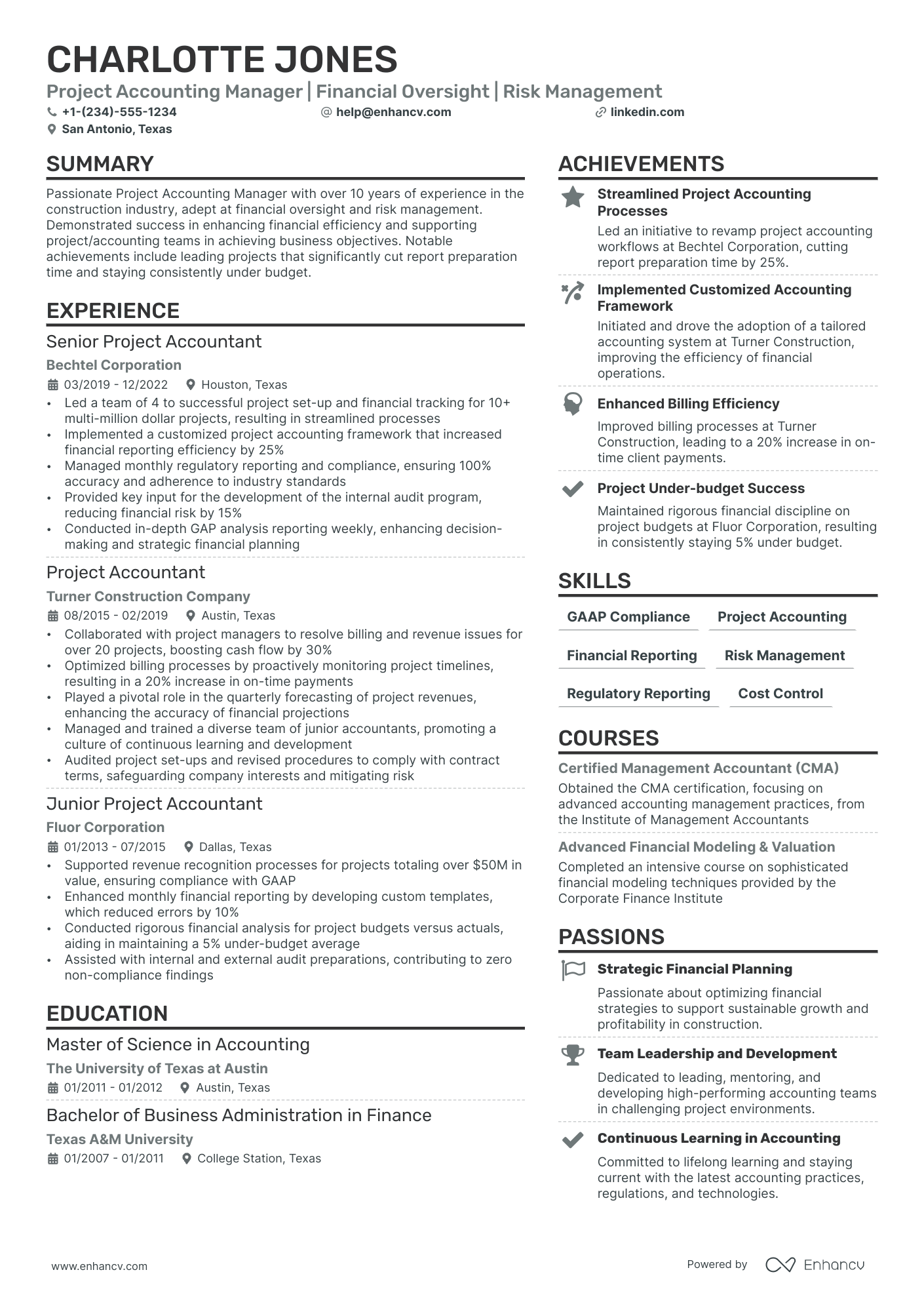

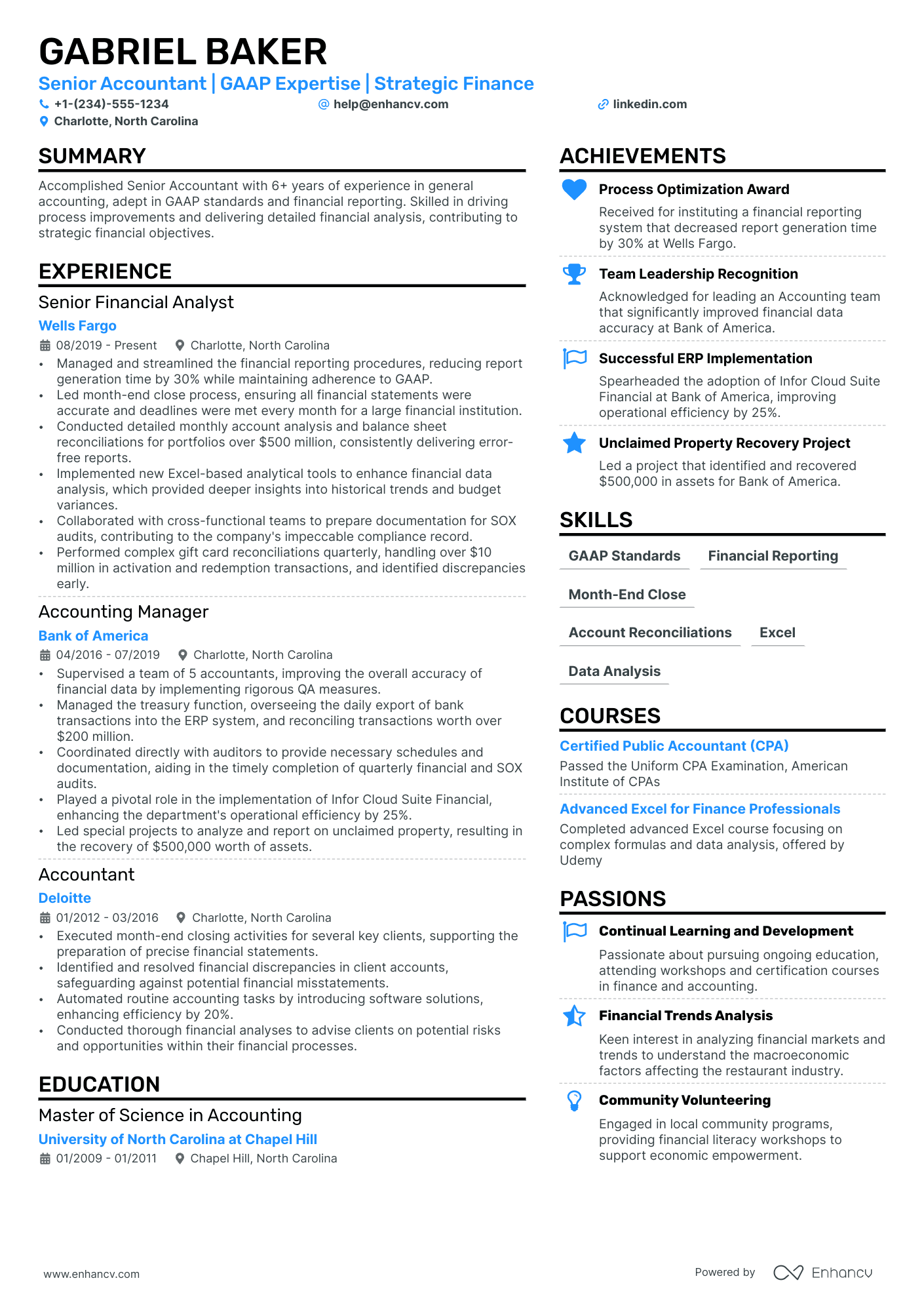

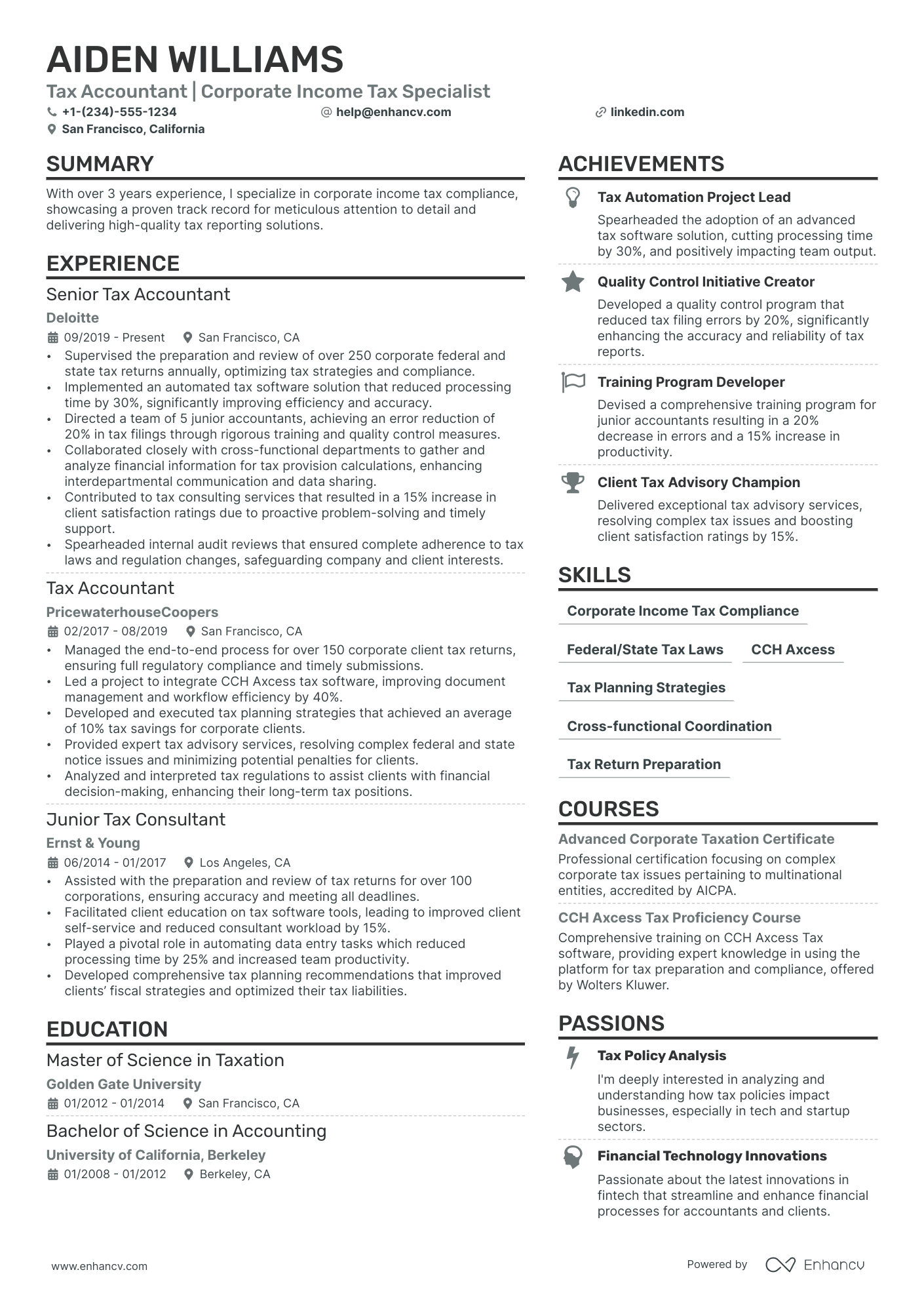

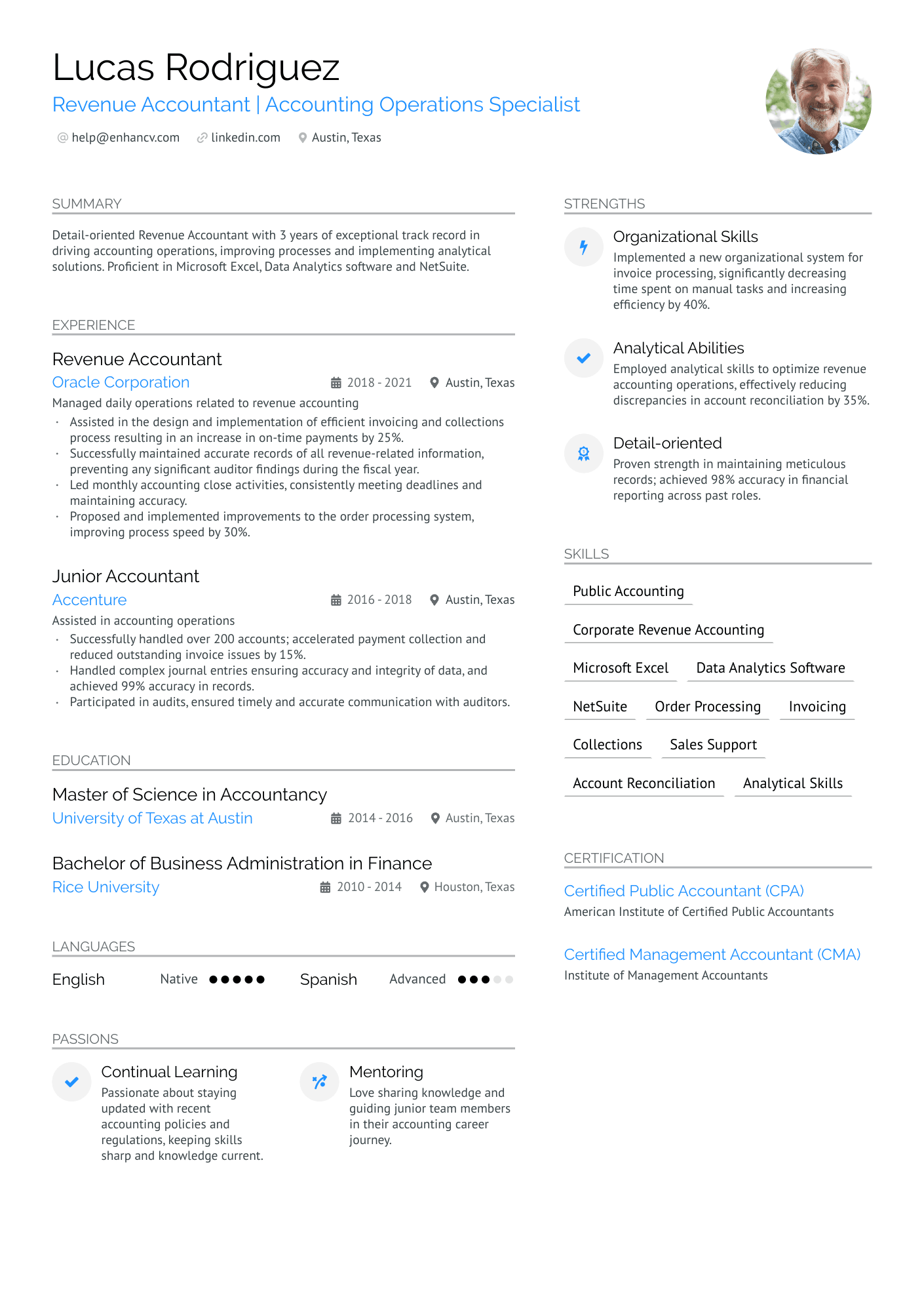

Accounting resume examples

By Experience

By Role