Navigating the complex world of accounting terminology and tailoring your CV to highlight industry-specific skills can be a daunting challenge. Our guide offers clear, step-by-step advice to help you craft a CV that showcases your expertise and stands out to employers in the accounting sector.

- Design and format your professional accounting CV;

- Curate your key contact information, skills, and achievements throughout your CV sections;

- Ensure your profile stays competitive by studying other industry-leading accounting CVs;

- Create a great CV even if you happen to have less professional experience, or switching fields.

When writing your accounting CV, you may need plenty of insights from hiring managers. We have prepared industry-leading advice in the form of our relevant CV guides.

Resume examples for accounting

By Experience

Senior Accounting Specialist

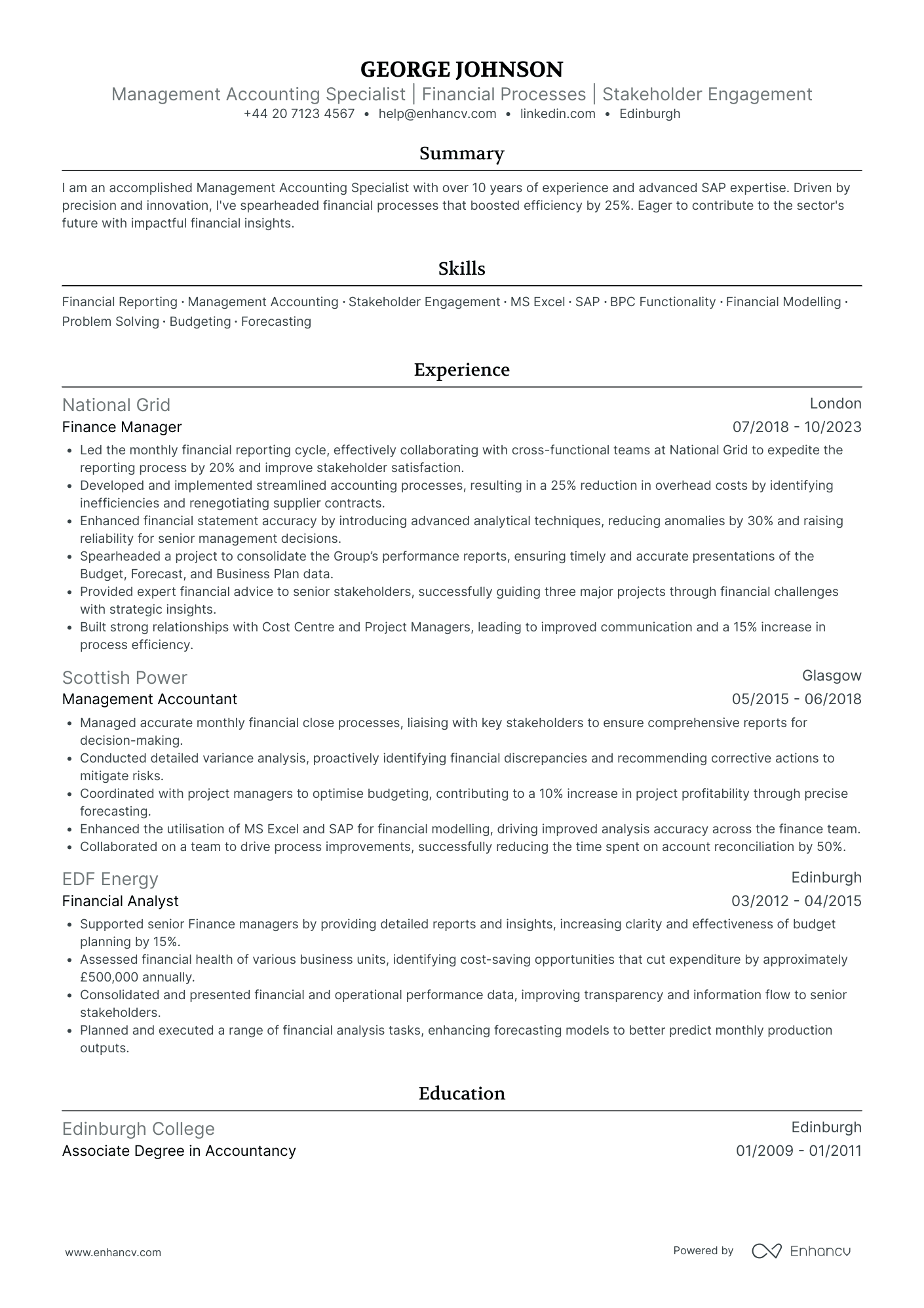

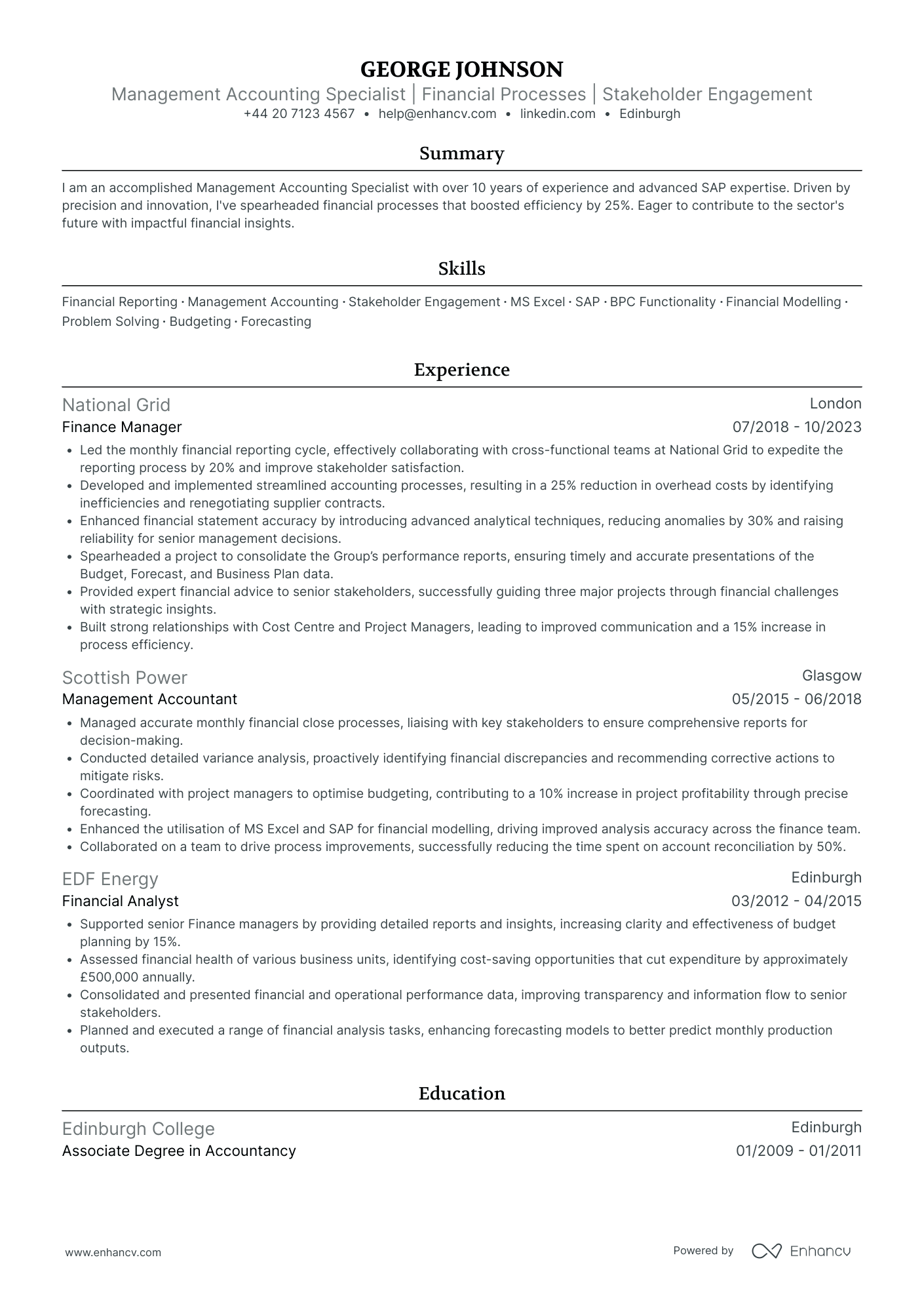

- Clear and Structured Presentation - The CV is well-organized, presenting information in distinct sections that enhance readability and clarity. Each section, from experience to education, is concise yet detailed, allowing the reader to grasp key insights quickly. This structured layout ensures that all crucial information is easily accessible without overwhelming the reader.

- Impressive Career Trajectory - George Johnson demonstrates a robust career progression, moving from a Financial Analyst to a Finance Manager. This trajectory highlights not only professional growth but an expanding scope of responsibility, expertise, and leadership in the field of accounting and finance, particularly in energy-related industries such as EDF Energy and Scottish Power.

- Integration of Advanced Tools and Techniques - The CV emphasizes the use of sophisticated tools such as SAP and advanced Excel-based financial modeling. This showcases technical depth, ensuring processes are streamlined and analyses are accurate. The inclusion of courses like Advanced Financial Modelling signifies a commitment to maintaining high competency with current tools and methodologies.

Junior Accounting Analyst

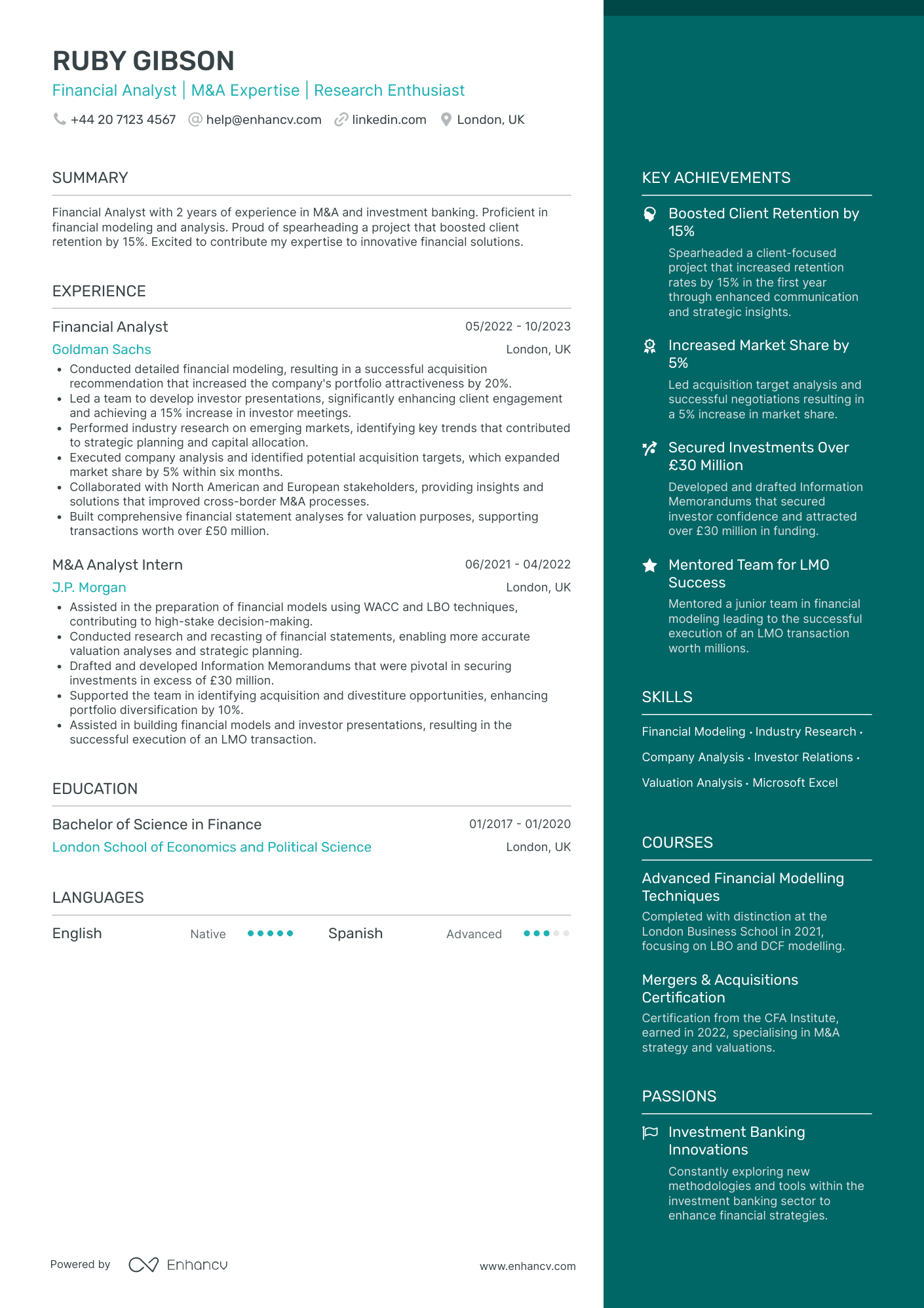

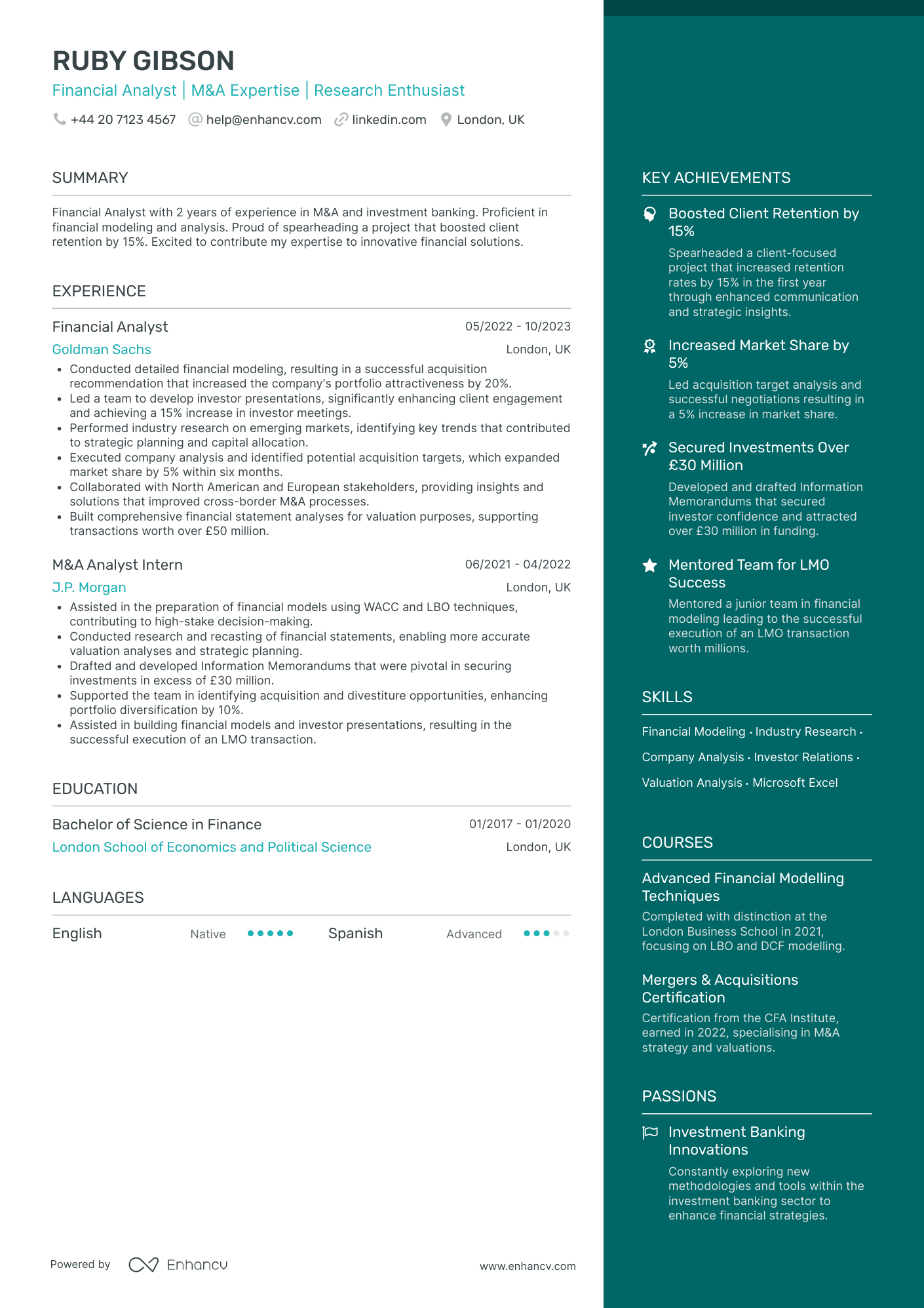

- Structured and Clear Presentation - The CV is well-organized, beginning with essential personal details and a concise summary that highlights the candidate's proficiency in financial analysis and M&A. It effectively uses bullet points in the experience section to allow for clarity and quick reading, showcasing key responsibilities and achievements without overwhelming detail.

- Strong Career Growth and Industry Relevance - Ruby's career trajectory demonstrates a strong growth path, beginning with an internship at J.P. Morgan and progressing to a role at Goldman Sachs within a short span. This progression in renowned financial institutions reflects her competence and increasing responsibility in the M&A sector, validating her capability and dedication to the field.

- Demonstration of Financial Modeling Expertise - The CV highlights specific, industry-relevant skills such as financial modeling using WACC and LBO techniques, and the development of comprehensive financial statement analyses. These are critical tools in M&A and investment banking, underscoring Ruby's technical proficiency which aligns directly with her job functions.

Entry-Level Accounting Assistant

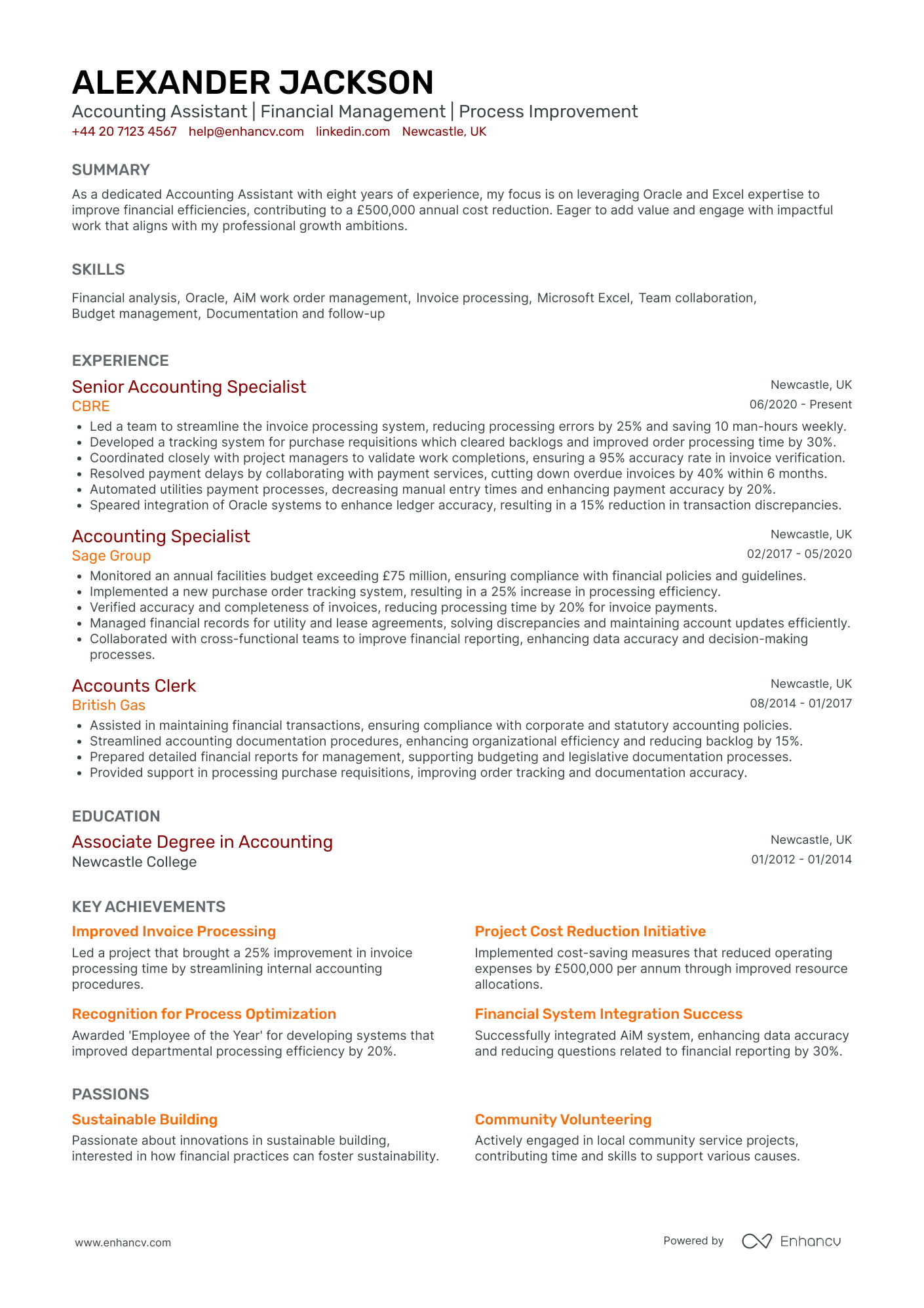

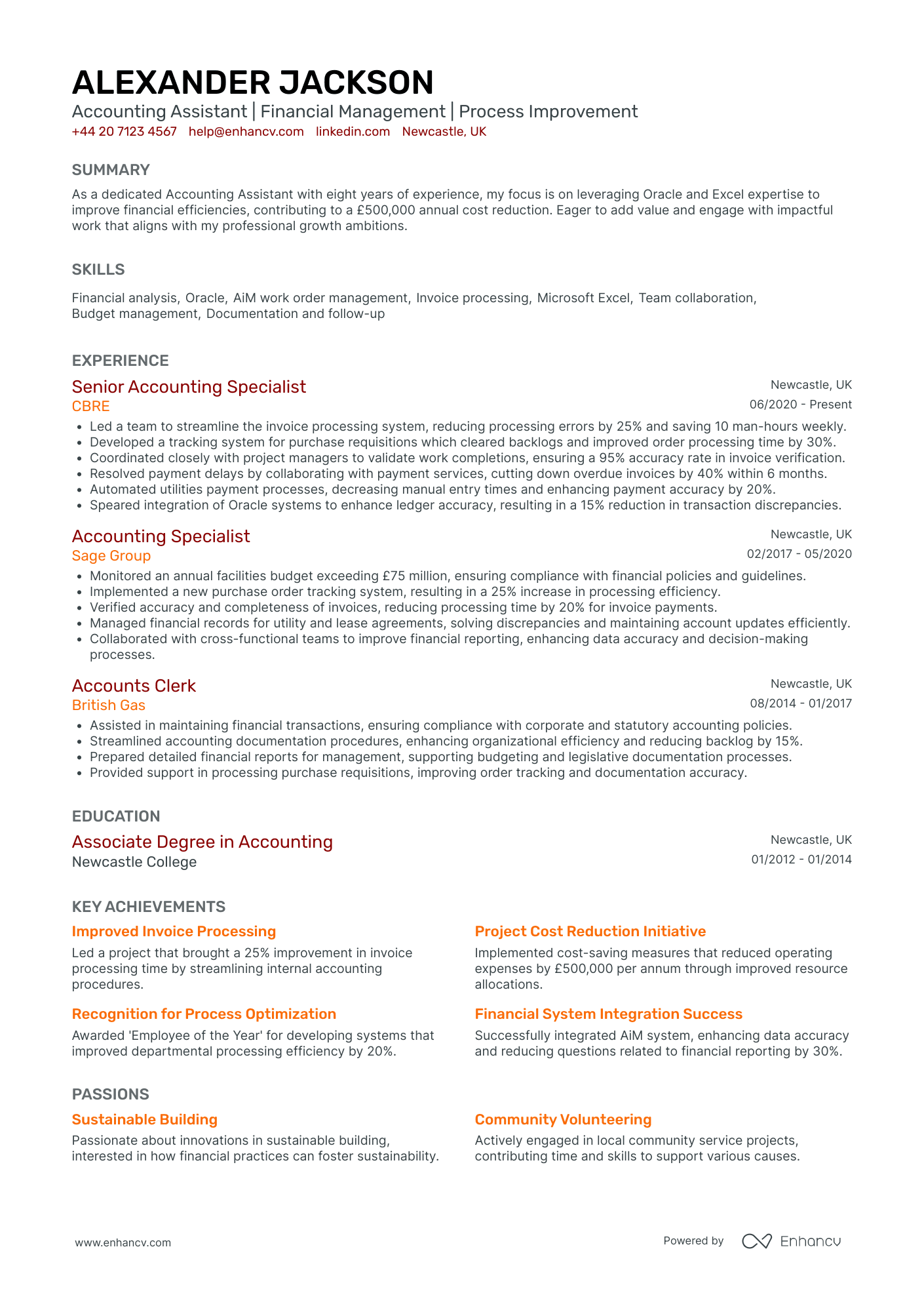

- Structured content presentation - The CV is structured in a manner that clearly outlines the candidate's professional trajectory, education, skills, and personal interests. This clarity aids in understanding the breadth of Alexander Jackson's expertise, with concise bullet points effectively summarizing his responsibilities and achievements.

- Consistent career growth - Alexander's progression from an Accounts Clerk to a Senior Accounting Specialist demonstrates ongoing career development and increasing responsibility. Each role illustrates a step up in complexity and leadership, showcasing his ability to adapt and grow within the financial management sector.

- Notable achievements and business impacts - The CV highlights several significant accomplishments, such as leading projects that improved invoice processing time and reduced operating expenses by £500,000 per annum. These achievements emphasize Alexander’s capacity to contribute positively to business operations, underscoring his ability to deliver measurable improvements and strategic value.

Mid-Level Accounting Auditor

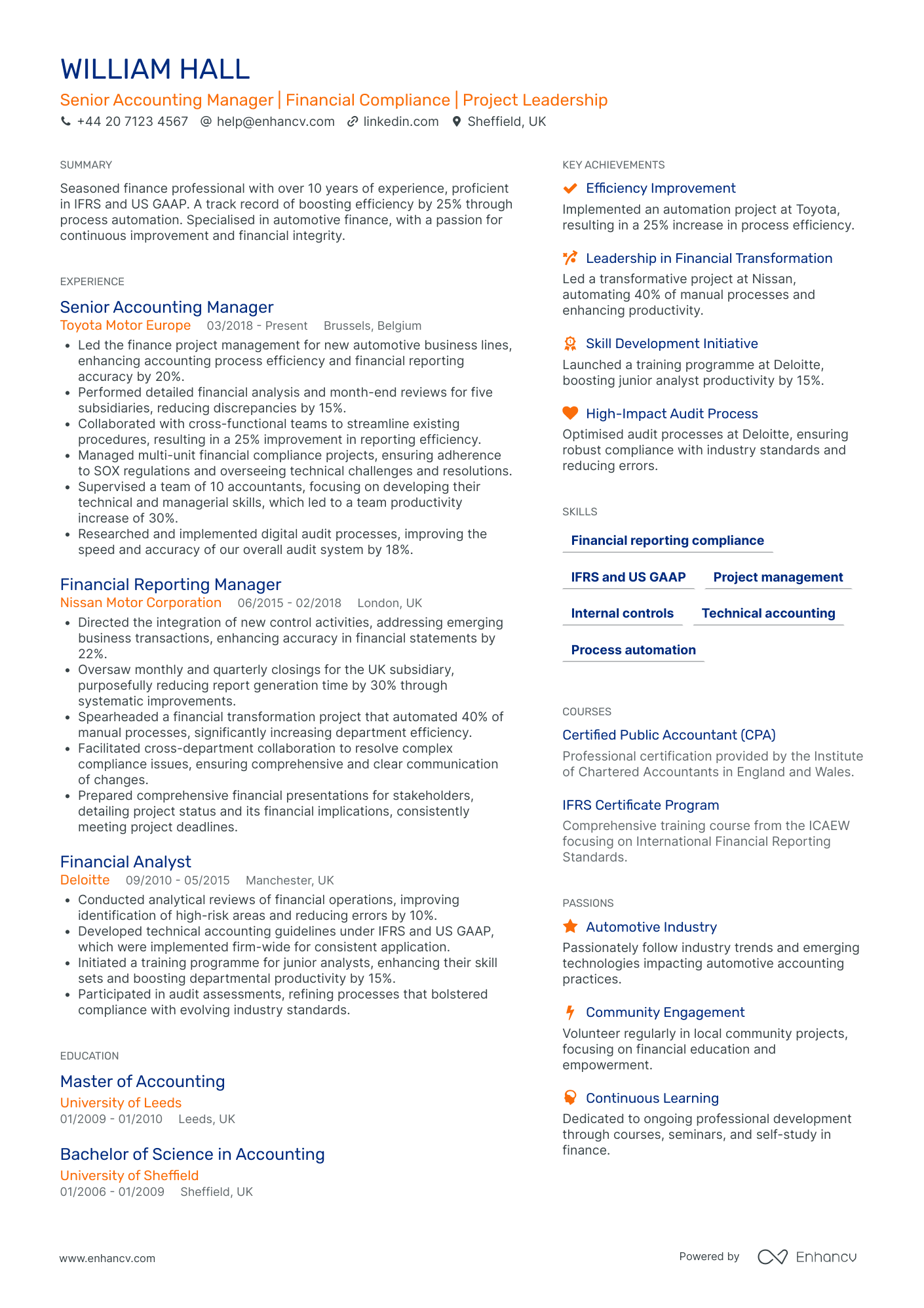

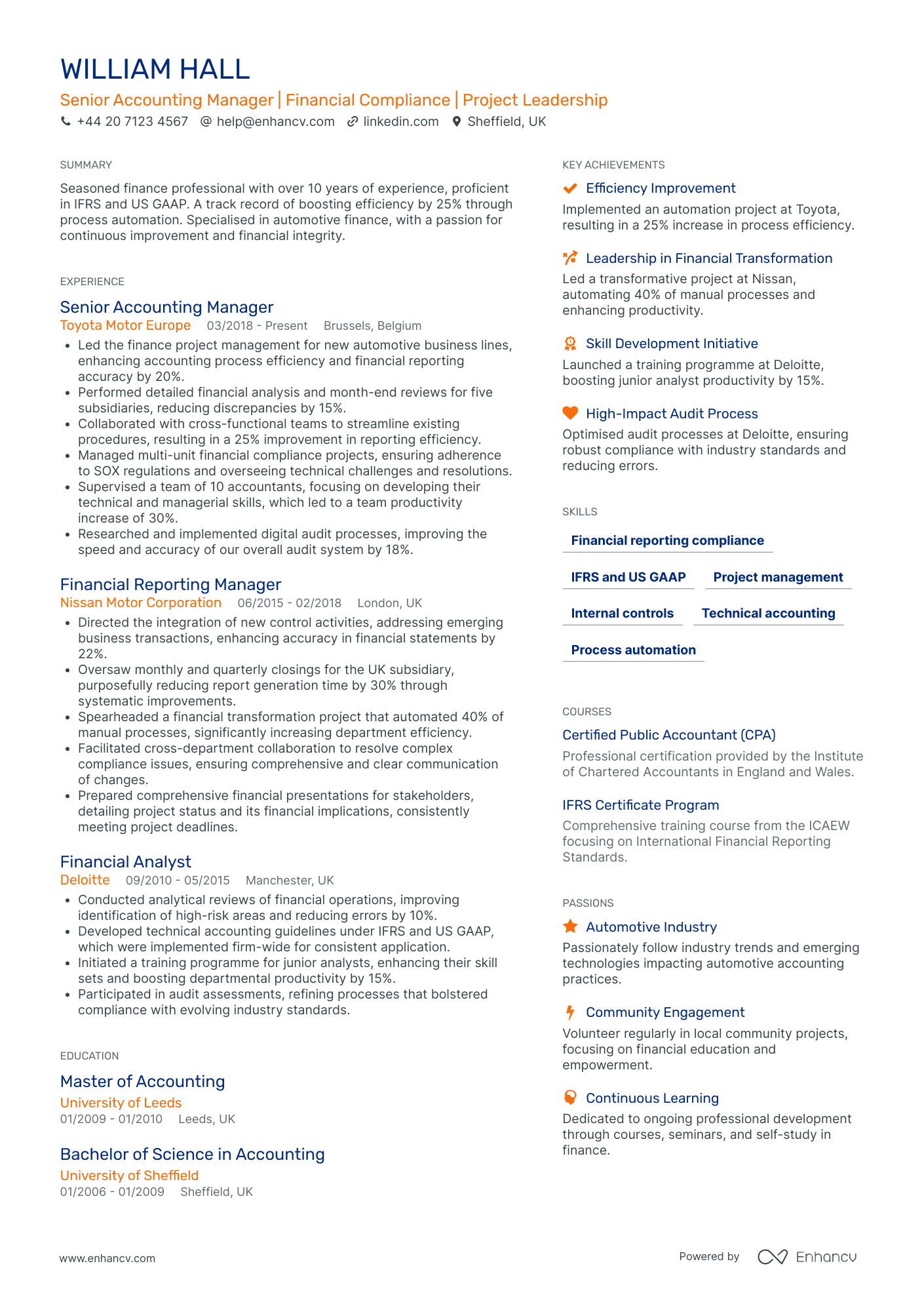

- Structured Experience With Quantifiable Achievements - The CV effectively provides a chronological layout of William Hall's career, detailing roles in well-known automotive companies like Toyota and Nissan. Each position includes specific, quantifiable achievements, such as leading projects that increased process efficiency by 25% and reducing report generation time by 30%, showcasing a clear pattern of delivering impactful results.

- Career Growth and Industry Adaptation - William’s progression from a Financial Analyst at Deloitte to a Senior Accounting Manager at Toyota demonstrates a consistent upward trajectory in his career. This evolution reflects not only his professional growth and expertise in accounting but also an adaptable nature, as he navigated roles in different leading automotive corporations, cultivating insights into both compliance and leadership.

- Integration of Technical Skills in Financial Contexts - The CV highlights specialized skills in IFRS and US GAAP, emphasizing William's proficiency in handling global financial reporting standards. This technical depth is complemented by his expertise in process automation and audit compliance, presenting a strong foundation in both theoretical and practical financial methodologies critical to maintaining accuracy and efficiency in financial management.

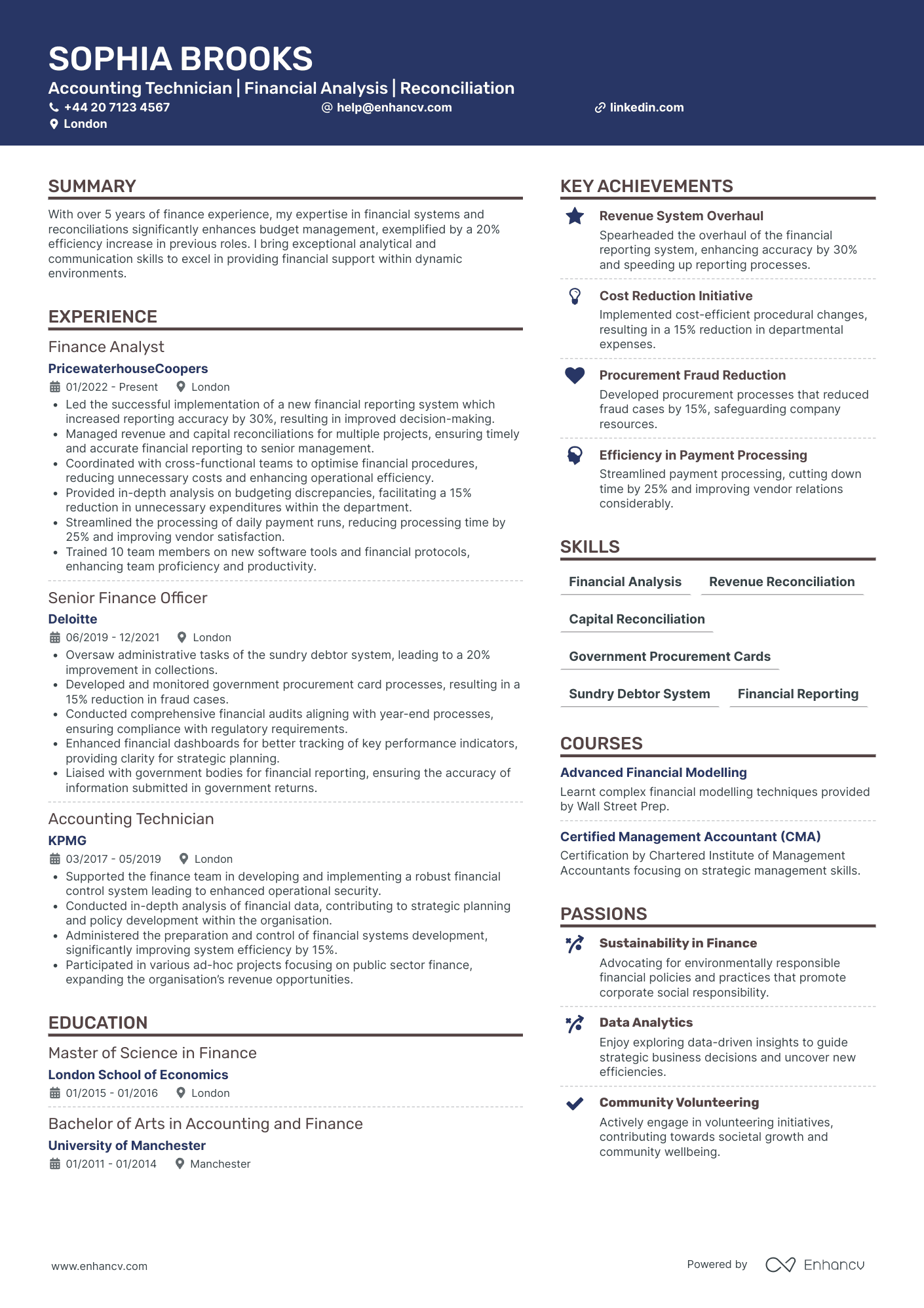

Advanced Accounting Technician

- Structured Presentation and Clarity - The CV is meticulously organized, starting with personal details and contact information, followed by sections that highlight a strong educational background, relevant work experience, and a comprehensive skill set. Each section is clear and concise, allowing the reader to quickly understand the candidate's qualifications and experience.

- Consistent Career Growth in Finance - The candidate demonstrates a clear career progression within major financial firms such as KPMG, Deloitte, and PricewaterhouseCoopers. This trajectory shows a steady advancement from an Accounting Technician to a Finance Analyst, indicating increased responsibility and expertise in financial management and analysis.

- Significant Achievements with Business Impact - The CV emphasizes measurable achievements, such as increasing reporting accuracy by 30% and reducing departmental expenses by 15%. These accomplishments are not only quantified but are also contextualized to show a direct positive impact on business operations and decisions, underscoring the candidate's value contribution.

By Role

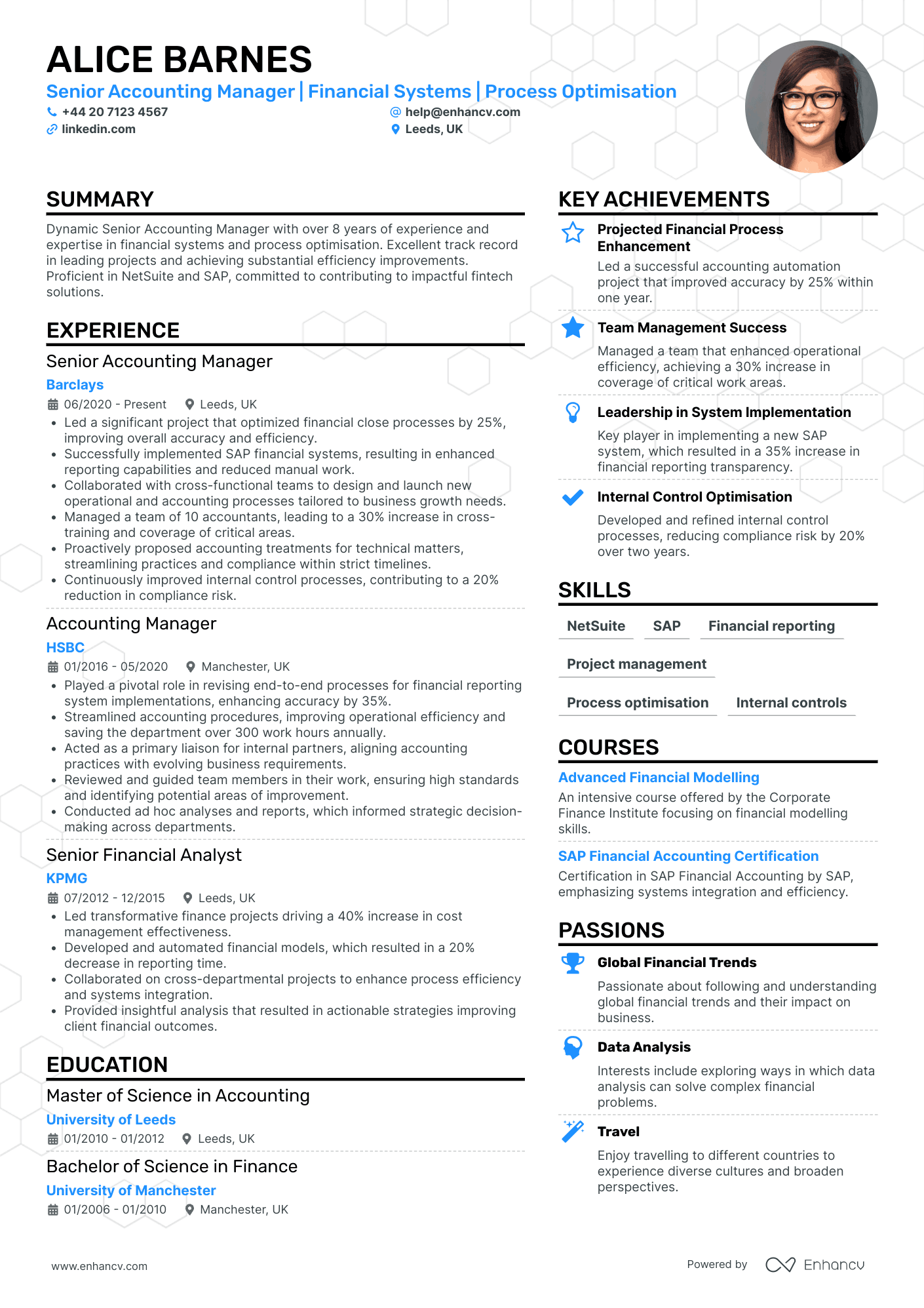

Accounting Manager

- Clear Representation of Experience and Growth - Alice Barnes' CV clearly outlines her progressive career trajectory from a Senior Financial Analyst at KPMG to a Senior Accounting Manager at Barclays. This upward movement demonstrates her growing expertise and leadership capabilities in the financial industry, underpinned by promotions and increasing responsibility at each stage.

- Emphasis on Process and Systems Improvement - The CV highlights her specialization in financial systems like NetSuite and SAP, solidifying her technical depth and understanding of complex financial software. Alice has successfully implemented these systems to enhance reporting and reduce manual tasks, showcasing her ability to drive technological improvements within financial operations.

- Leadership and Team Management Success - Alice's leadership skills are evident in her management of a ten-person team at Barclays, which resulted in a significant increase in cross-training and critical area coverage. Her ability to guide and improve team performance reflects her strong interpersonal and managerial competencies, essential for senior management roles.

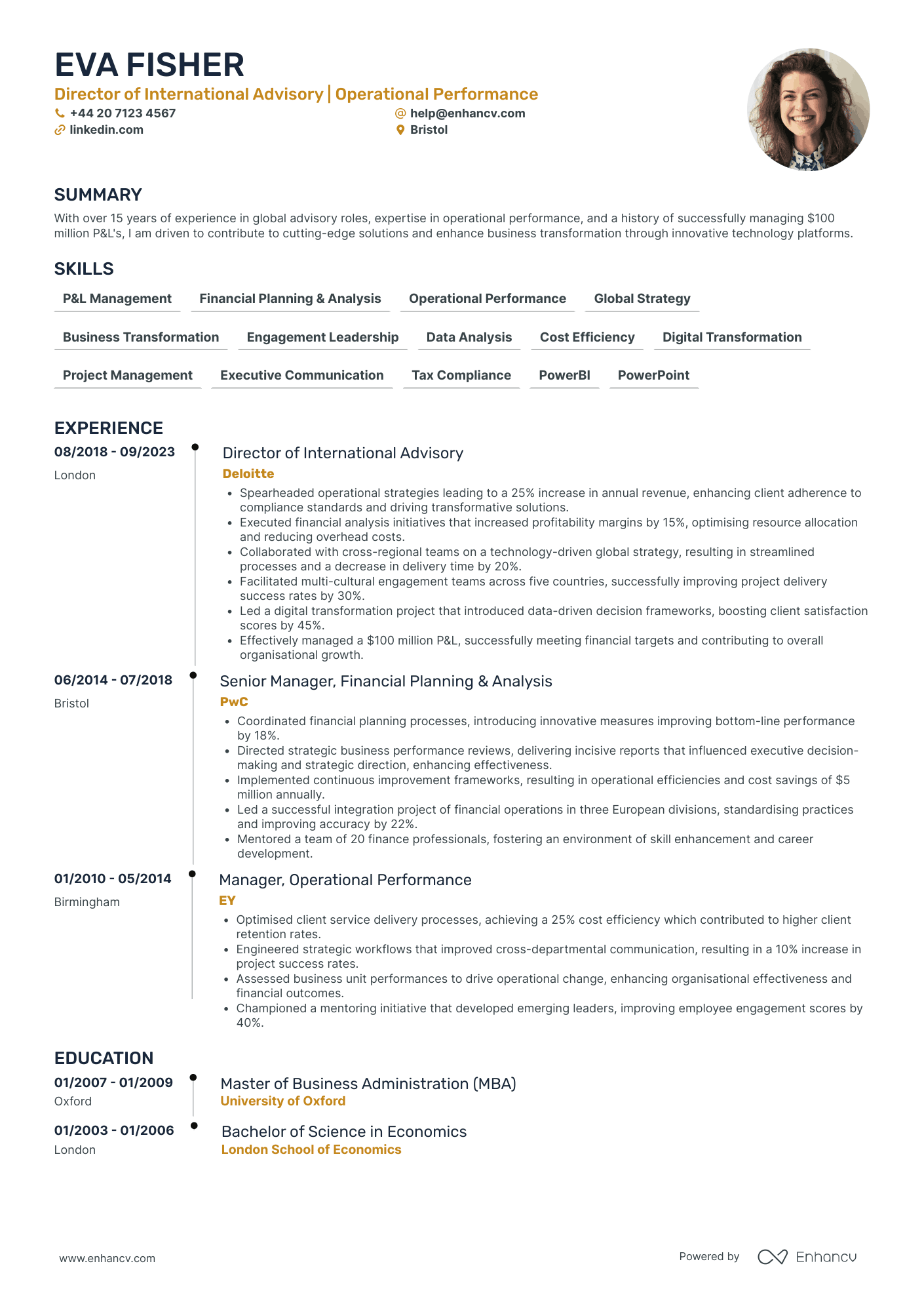

Accounting Operations Director

- Comprehensive Career Progression - Eva Fisher’s CV is a testament to her upward career trajectory, demonstrated by her advancement from a Manager at EY to a Director at Deloitte. This clearly outlines her growth and capacity to tackle increased responsibilities and leadership roles over time.

- Strategic and Cross-Functional Expertise - Her roles have consistently required interdisciplinary collaboration and the integration of diverse functional areas, such as managing cross-regional teams and executing multinational projects, which highlight her ability to function and adapt across different business landscapes and cultures.

- Impact-Driven Achievements - With highlights such as spearheading operational strategies that resulted in a 25% revenue increase, Eva's achievements are not only numerically significant but demonstrate an ability to drive impactful business changes that contribute to overarching corporate objectives.

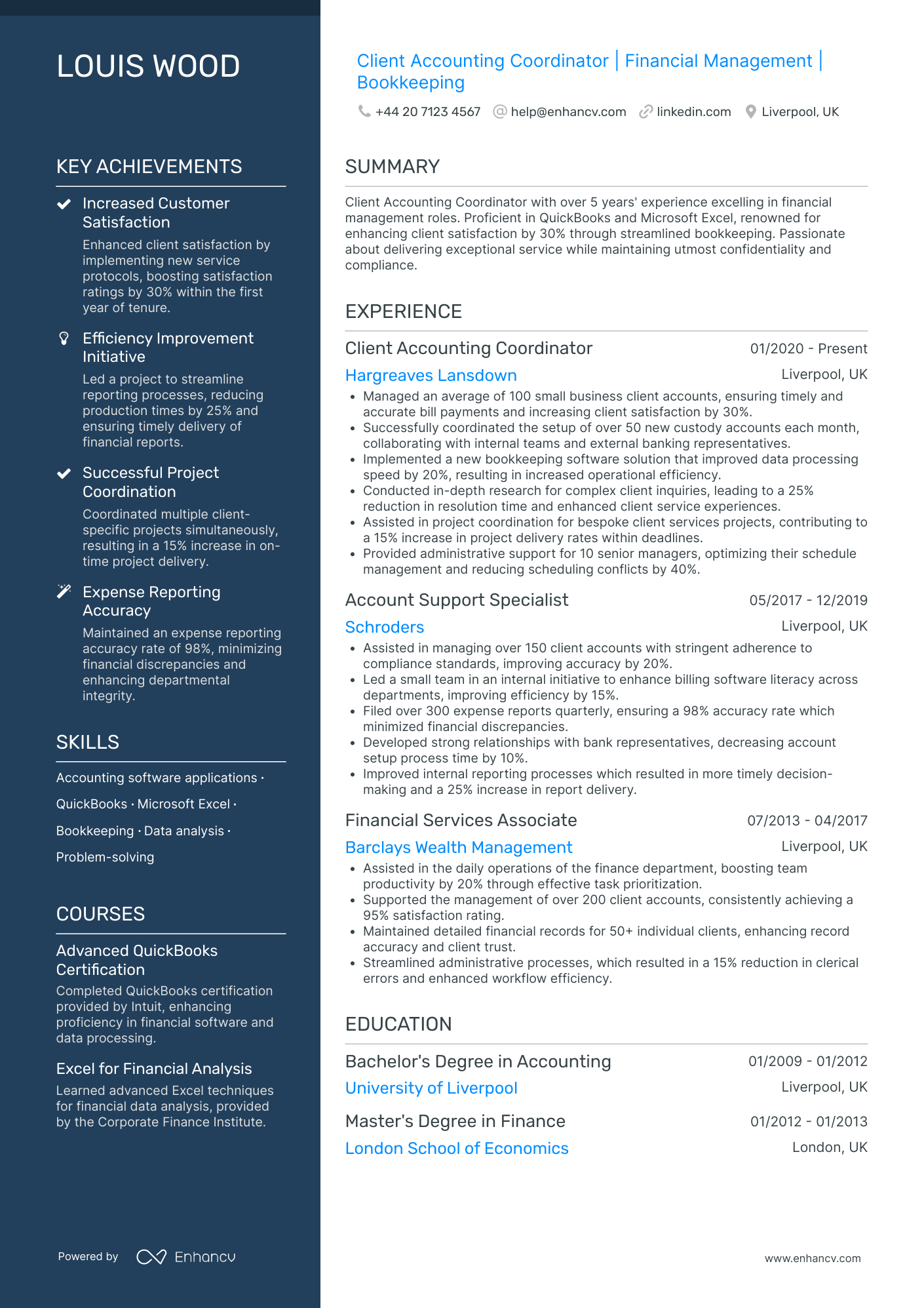

Non-Profit Accounting Coordinator

- Comprehensive Career Development - Louis Wood's CV outlines a clear trajectory of growth, progressing from a Financial Services Associate to his current role as a Client Accounting Coordinator. The experiences gathered at reputable financial institutions highlight his ability to scale responsibilities and adapt to increasingly complex roles, showcasing a robust career development path.

- Specialized Technical Expertise - The CV features Louis' proficiency in industry-standard tools such as QuickBooks and Microsoft Excel, emphasized through formal certifications. This technical depth stands out as it underlines his capability to implement efficiency-boosting software solutions and enhance data processing within financial management initiatives.

- Impressive Achievements with Business Impact - Louis' documented achievements, like increasing client satisfaction by 30% and reducing accounting resolution times by 25%, not only include remarkable figures but also illustrate their significance through enhanced client service experiences and optimized operational workflows. These accomplishments underscore his ability to drive substantial impact within his roles.

Healthcare Accounting Consultant

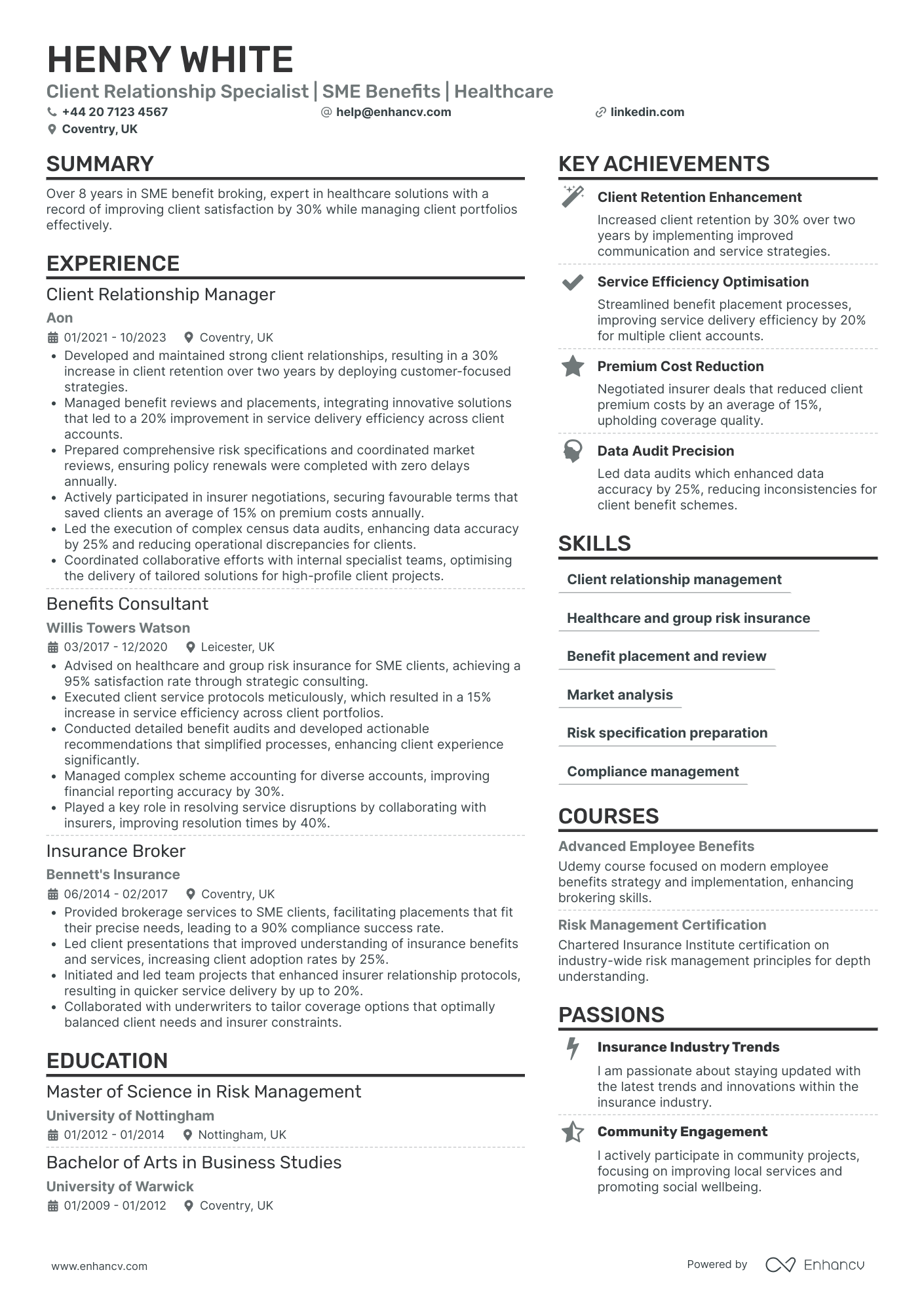

- Cohesive Career Progression - Henry White's CV illustrates a seamless and strategic career trajectory, showcasing a clear advancement from Insurance Broker to Client Relationship Manager. This path highlights his consistent growth within the industry, reflecting both increased responsibilities and depth of expertise in client management and brokering.

- Industry-Specific Technical Mastery - The CV demonstrates a profound understanding of SME benefit broking, with expertise in healthcare solutions and risk management. Notable methodologies include integrating innovative service strategies and executing complex census data audits, revealing industry-specific technical skills that enhance service delivery and client satisfaction.

- Impact-Oriented Achievements - The document effectively emphasizes Henry’s ability to drive tangible business outcomes, such as a 30% increase in client retention, a 15% reduction in premium costs, and a 20% improvement in service efficiency. These achievements underscore his proficiency in implementing strategic initiatives that substantially benefit clients and organizations alike.

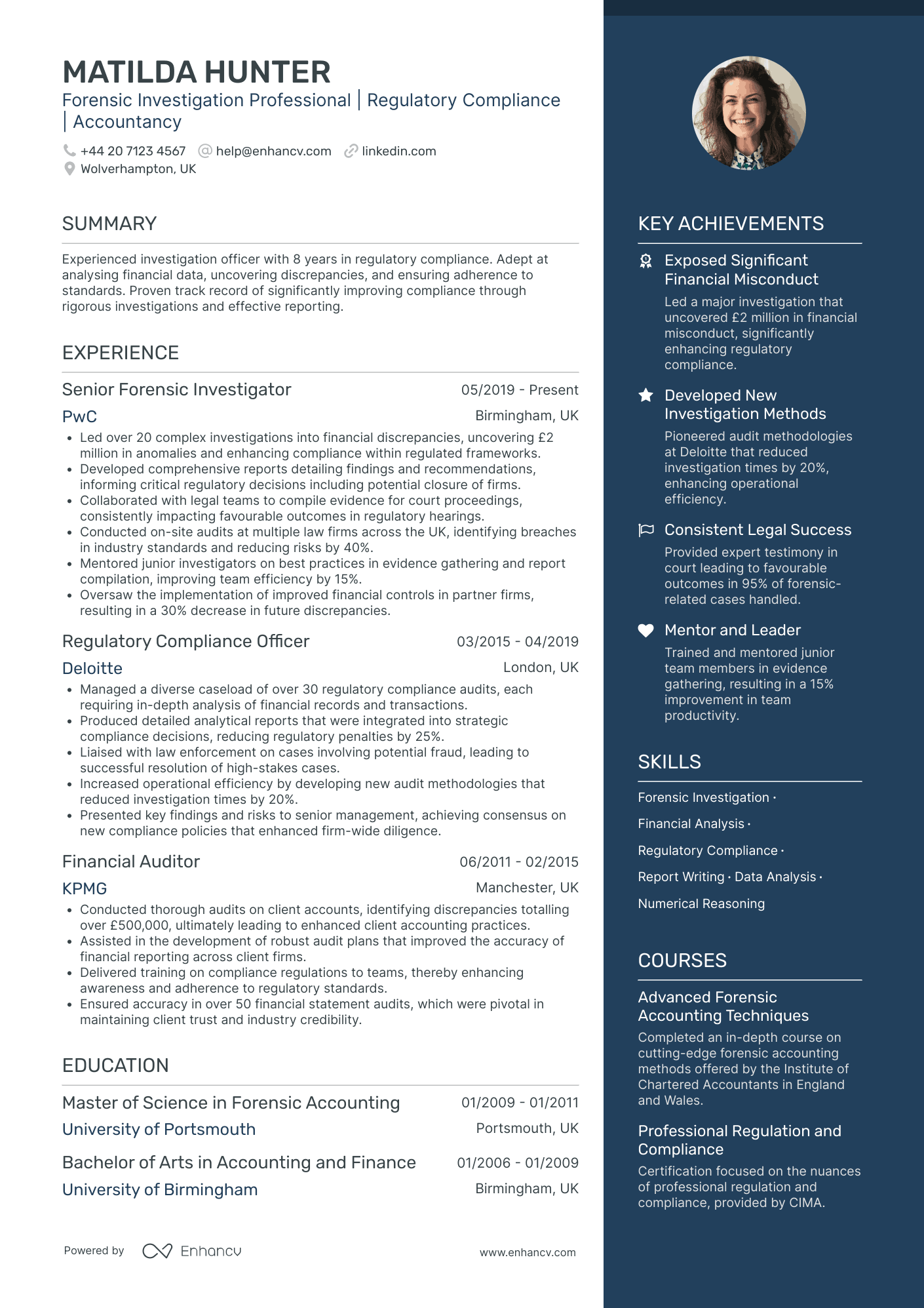

Forensic Accounting Investigator

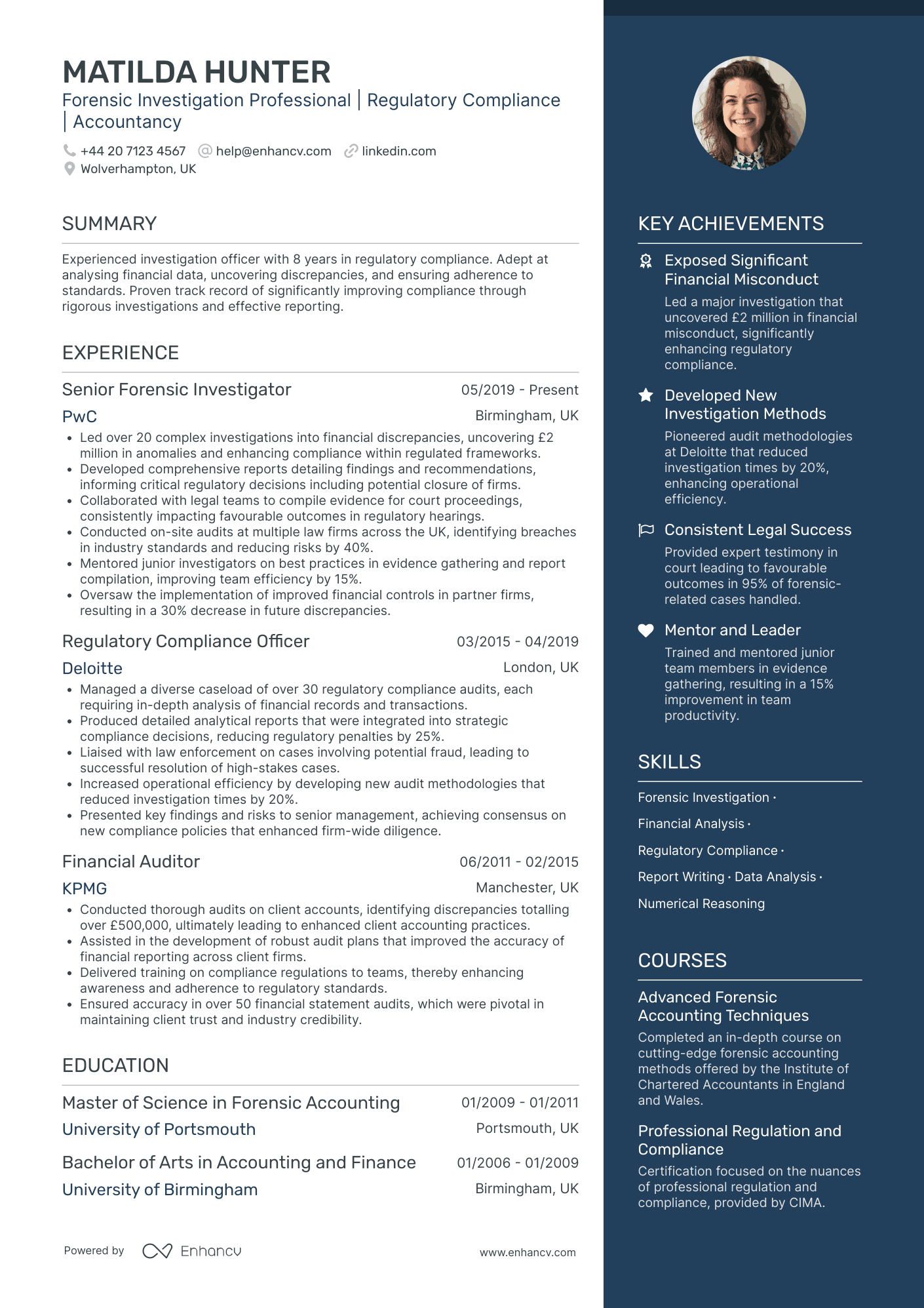

- Structured and Concise Presentation - The CV stands out with its well-organized sections and clear, concise language, making it easy to navigate through the candidate's qualifications, experience, and skills. Each segment provides the necessary information without overwhelming the reader, ensuring clarity in communication.

- Proven Career Progression - Matilda Hunter’s career trajectory exemplifies continuous growth within the forensic investigation and accountancy fields. Her advancement from a Financial Auditor to a Senior Forensic Investigator at leading firms like PwC and Deloitte highlights her upward mobility and adaptability in complex and evolving roles.

- Impactful Achievements - The CV underscores Matilda’s achievements with a strong business impact, such as uncovering £2 million in financial misconduct at PwC and developing audit methodologies that improved operational efficiency by 20% at Deloitte. These accomplishments not only showcase her technical expertise but also illustrate her contribution to enhancing regulatory compliance and operational processes.

Accounting Systems Administrator

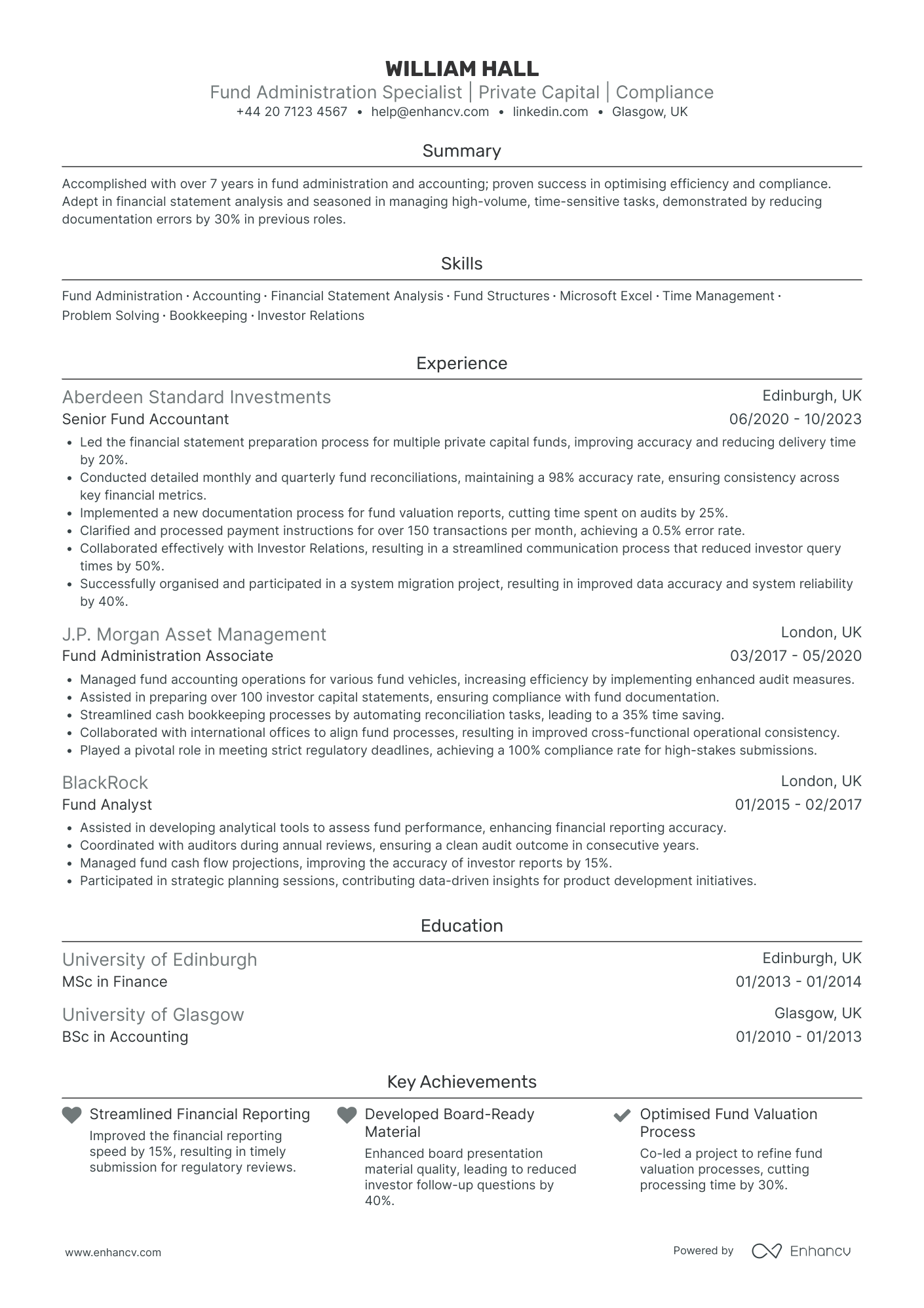

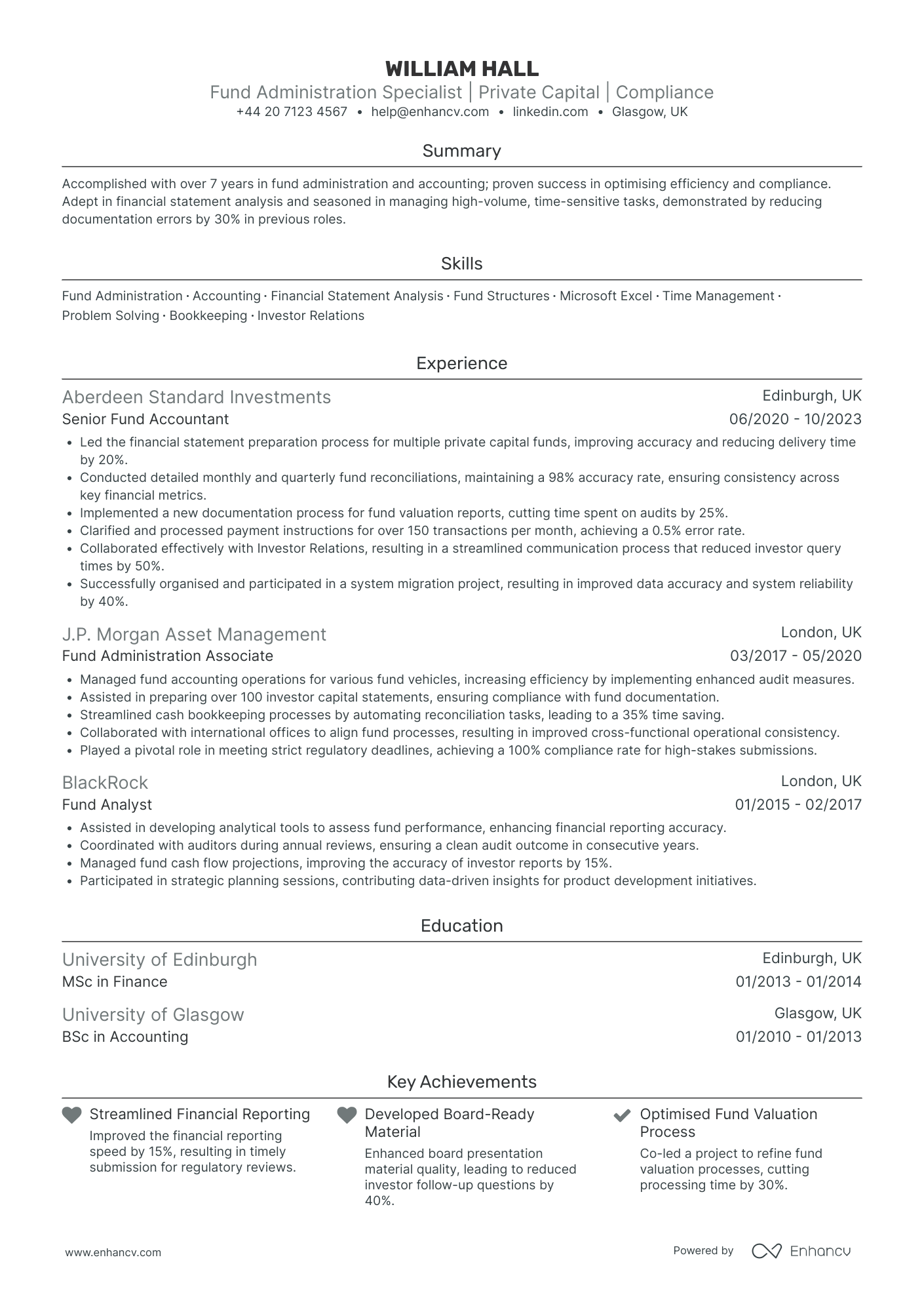

- Structured for Clarity and Impact - The CV uses a well-organized format that presents information in a clear and concise manner. Headers and bullet points are effectively utilized to highlight key experiences and achievements, ensuring the reader can quickly comprehend the breadth of the candidate's expertise in fund administration and accounting.

- Proven Career Progression and Industry Depth - This CV demonstrates a strong career trajectory, with the candidate progressing from Fund Analyst at BlackRock to a Senior Fund Accountant at Aberdeen Standard Investments. This progression reflects their growing expertise and leadership in the field, underscoring a strong commitment to the private capital and fund administration industry.

- Achievements with Significant Business Impact - The document shines through its emphasis on quantifiable achievements, such as reducing documentation errors by 30% and optimizing fund valuation processes, which resulted in a notable decrease in processing time. These highlights underscore the candidate's ability to drive efficiency and compliance, both crucial elements in fund administration roles.

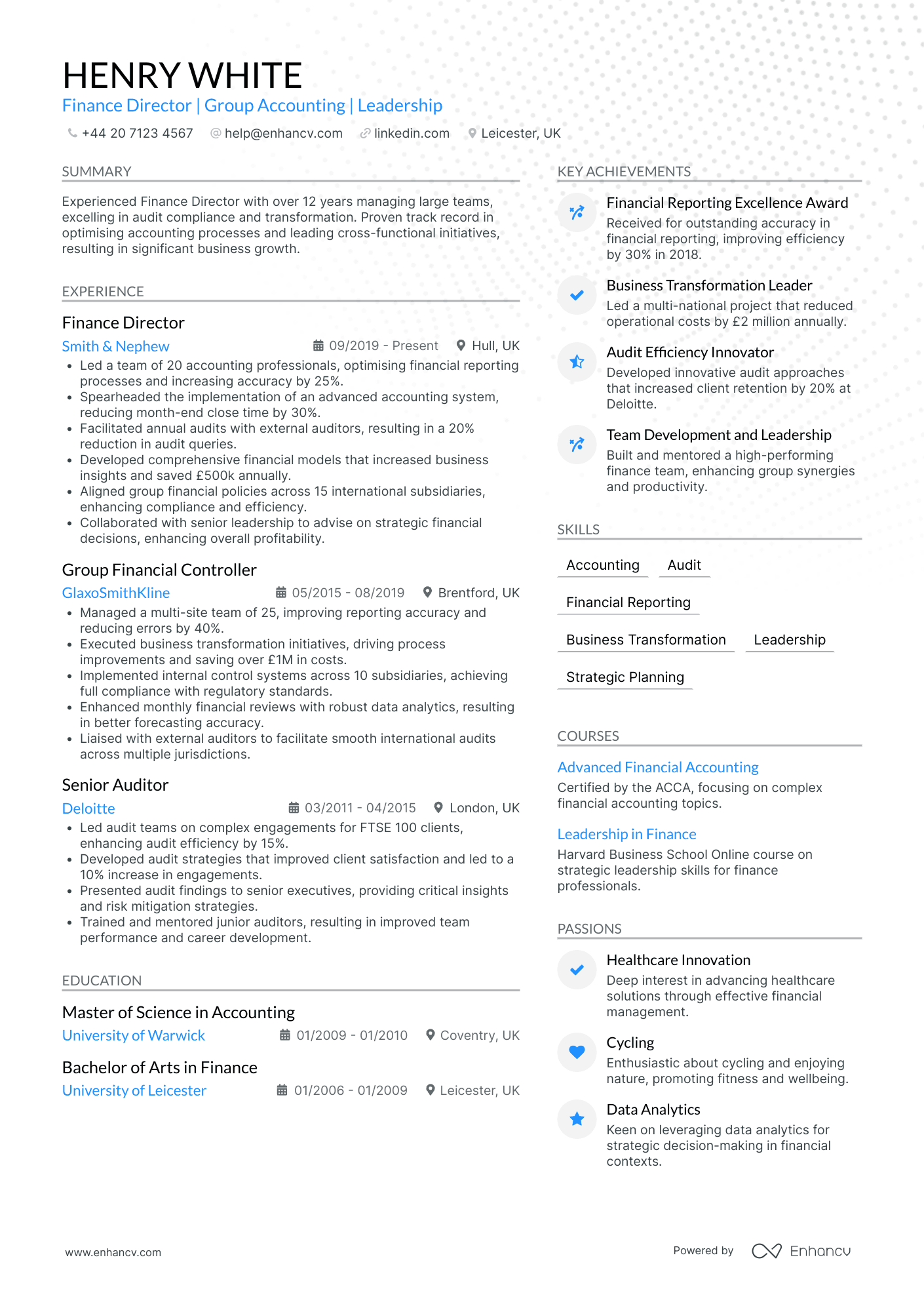

Environmental Accounting Advisor

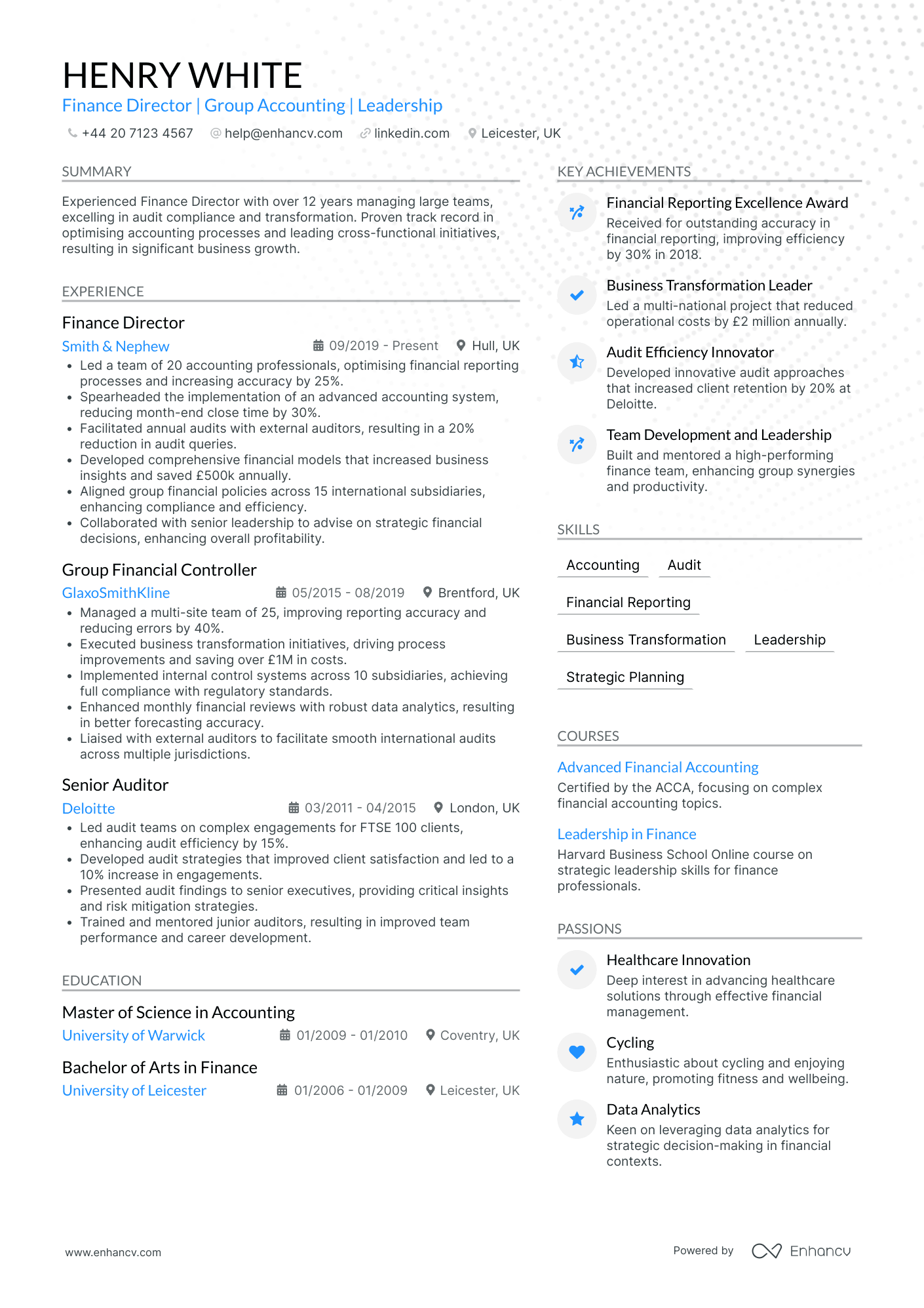

- Strategic Career Progression - Henry White's career trajectory is a testament to his strategic growth within the finance sector, moving from Senior Auditor roles to pivotal leadership positions such as Finance Director. His roles at prestigious firms like Deloitte and GlaxoSmithKline underscore a clear path of increased responsibility and industry significance.

- Impactful Achievements with Quantifiable Results - The CV effectively conveys White’s achievements, translating them into measurable outcomes that resonate with business impact, such as saving over £1 million in costs and reducing audit queries by 20%. These metrics not only highlight his competence but also his ability to drive substantial financial efficiencies.

- Comprehensive Financial and Technical Expertise - Henry White’s CV integrates his broad proficiency in financial tools like Sage X3 and Microsoft Navision alongside data analytics capabilities. This dual focus on financial and technical depth aligns him with expert roles that demand a synthesis of these competencies, particularly in business transformation and strategic planning.

Accounting Research Analyst

- Structured and Concise Presentation - The CV is presented with a clear heading structure that efficiently organizes sections on experience, education, skills, and achievements. Each role is supplemented with concise bullet points that detail responsibilities and accomplishments, allowing potential employers to quickly identify the candidate's competencies and value.

- Progressive Career Trajectory - The candidate’s career progression showcases a clear growth path within the financial sector, moving from a Financial Analyst to Senior Equity Analyst. The experience reflects an increase in responsibility and expertise, indicative of the candidate’s ability to adapt and excel in different roles within major investment firms.

- Impactful Achievements with Business Relevance - The achievements section highlights the candidate’s direct impact on portfolio value and operational efficiencies. By quantifying contributions, such as a 15% portfolio increase and 25% reporting speed improvement, the CV communicates the tangible benefits of the candidate’s work to potential employers.

Investment Accounting Supervisor

- Structured and Streamlined Presentation - The CV is meticulously organized with clear sections for each aspect of the candidate's professional background, making it easy for hiring managers to navigate through the information. The concise format emphasizes the most pertinent details of the candidate's experiences and skills, maintaining a strong focus on relevance to the fund administration role.

- Progressive Career Trajectory - Charlie Thomas demonstrates a logical and consistent growth in the finance industry, advancing from a Finance Analyst role to a Fund Administration Associate at top-tier institutions. This highlights a proactive approach to career development and expertise in progressively complex responsibilities within fund management.

- Industry-Related Achievements and Impact - The CV highlights significant achievements such as improving reporting accuracy and reducing operational costs, portraying a candidate who not only performs duties but also actively contributes to business efficiency. These accomplishments underscore the high impact of the candidate's work within prominent financial firms, aligning with the strategic goals of potential employers in the investment sector.

Accounting Project Manager

- Concise Structure and Clarity - The CV is well-organized, starting with a succinct summary that captures essential expertise in project accounting within the real estate sector. Each section is cleanly presented, accommodating a comprehensive view of skills, experience, education, and achievements without overwhelming the reader.

- Career Growth and Industry Focus - A progressive career path is evident, showcasing growth from a general accountant to a specialized project accountant in real estate finance. This trajectory reflects a focused dedication to mastering niche industry skills and advancing through increasingly complex roles at reputable firms.

- In-Depth Industry Expertise - The CV emphasizes real estate-specific financial skills, like transaction modeling and reconciliation. Tools such as SAP and advanced Excel usage highlight technical proficiency, further supported by industry-specific certifications that underscore technical depth and domain expertise.

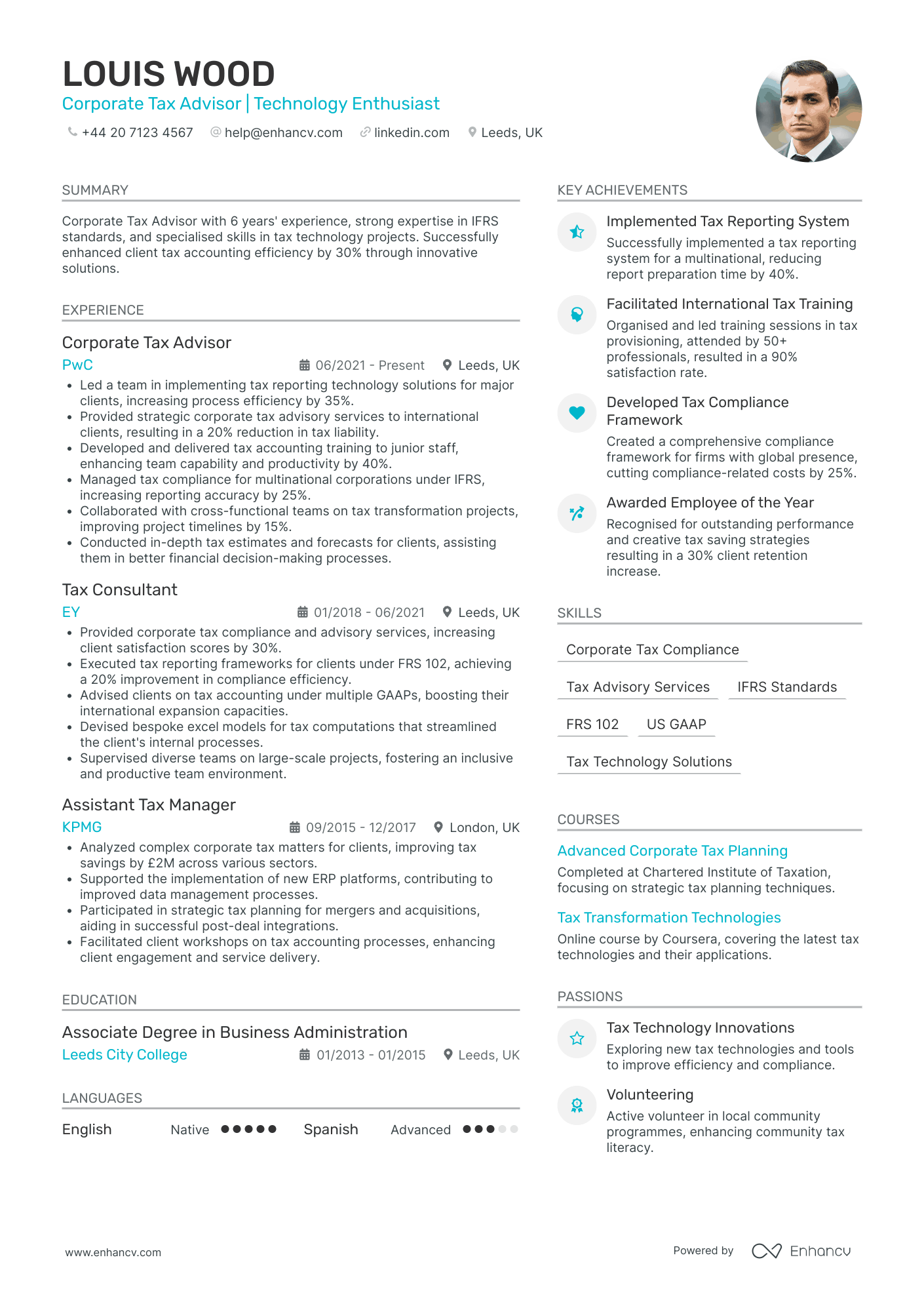

Tax Accounting Specialist

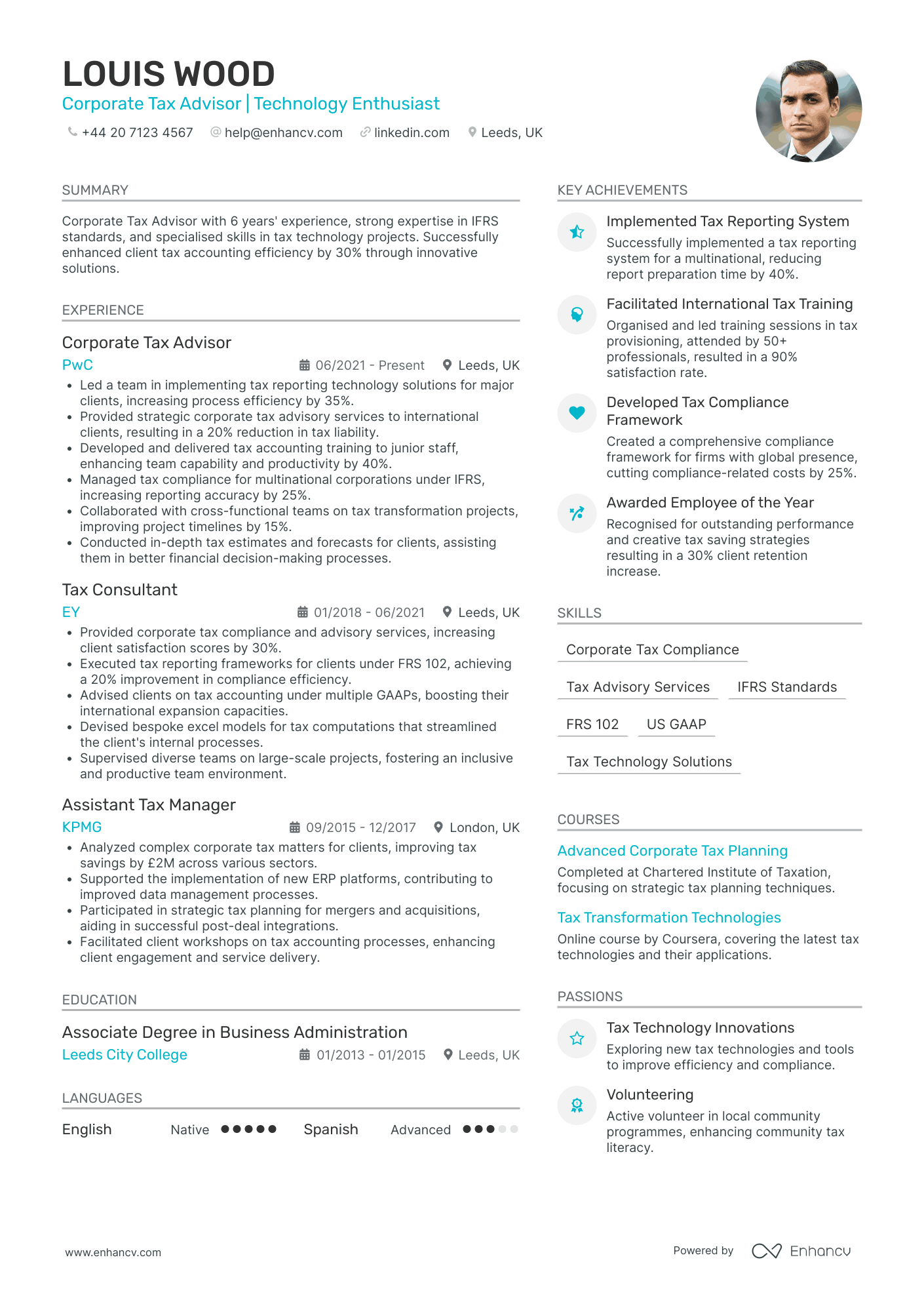

- Content Presentation and Clarity - This CV excels in presenting information clearly and concisely, using bullet points to highlight key achievements and responsibilities. The structured format, including distinct sections for experience, education, and skills, allows for easy reading and comprehension, effectively guiding the reader through the candidate's professional journey without overwhelming them.

- Career Trajectory and Growth - Louis Wood's CV highlights a robust career trajectory, showcasing progression from an Assistant Tax Manager at KPMG to a Corporate Tax Advisor at PwC. Each position reflects a step up in responsibility and influence within the corporate tax advisory sector, illustrating the candidate's ambition and capability to take on more complex roles over the years.

- Industry-Specific Skills and Methodologies - The CV stands out by detailing expertise in specialized areas such as IFRS standards, tax technology solutions, and international tax compliance. Specific skills in ERP systems and excel modeling demonstrate the candidate's technical depth and ability to leverage advanced tools to drive efficiency and accuracy in tax reporting and advisory services.

Retail Accounting Officer

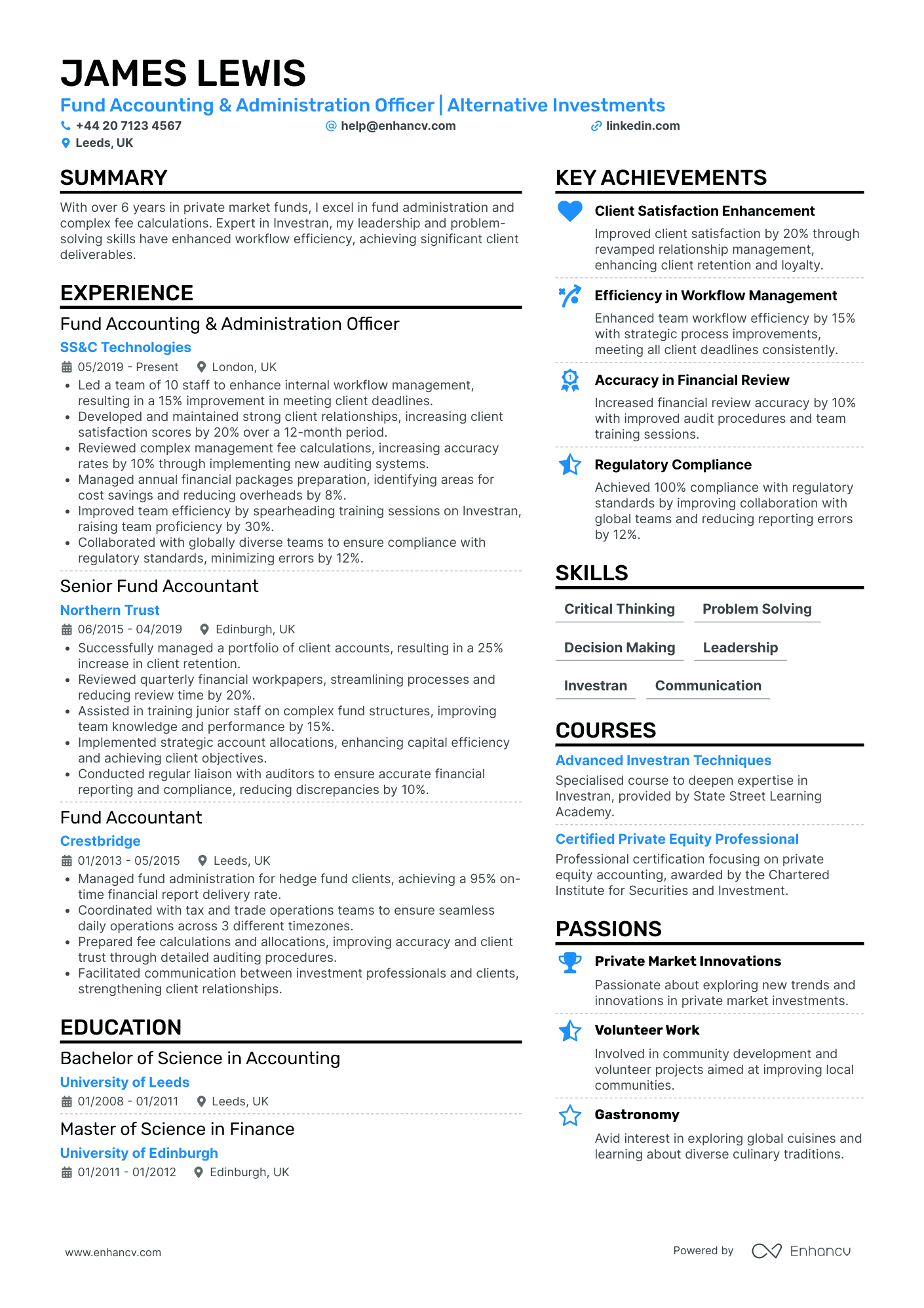

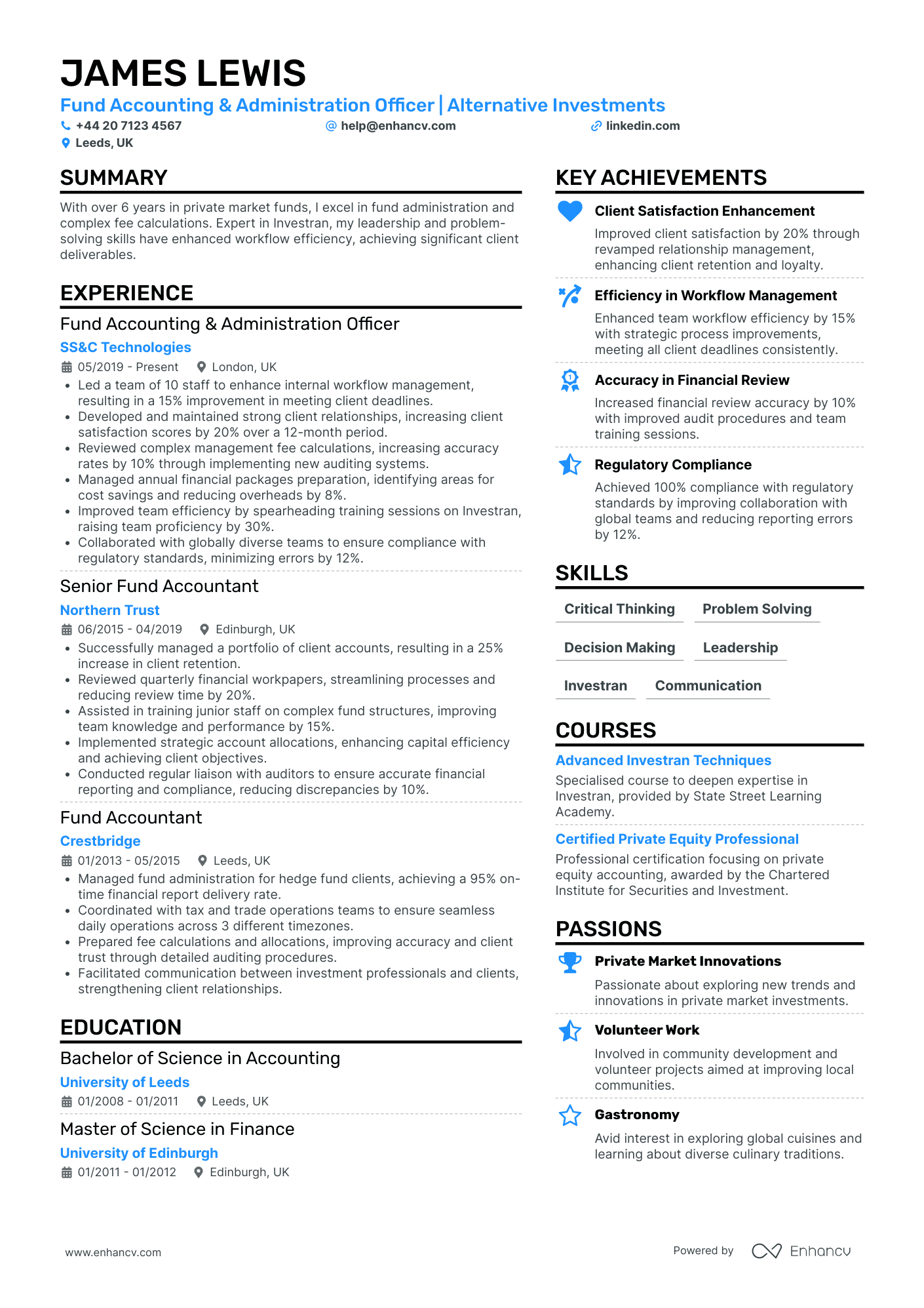

- Concise Presentation of Experience - The CV is structured with clear headings and organized sections, making it easy to navigate through James Lewis's professional history. Each job role includes key achievements and responsibilities presented with bullet points, ensuring quick accessibility to the most pertinent details.

- Progressive Career Growth - James's career trajectory demonstrates steady growth, advancing from a Fund Accountant to a leadership role as a Fund Accounting & Administration Officer. This progression within notable firms emphasizes his capability to take on greater responsibilities and showcase his expertise in fund management.

- Deep Expertise in Financial Tools - The CV highlights specific proficiency in industry tools like Investran, showcasing James’s technical depth in fund accounting. His advanced training and use of these tools underline his specialized knowledge, setting him apart in alternative investments management.

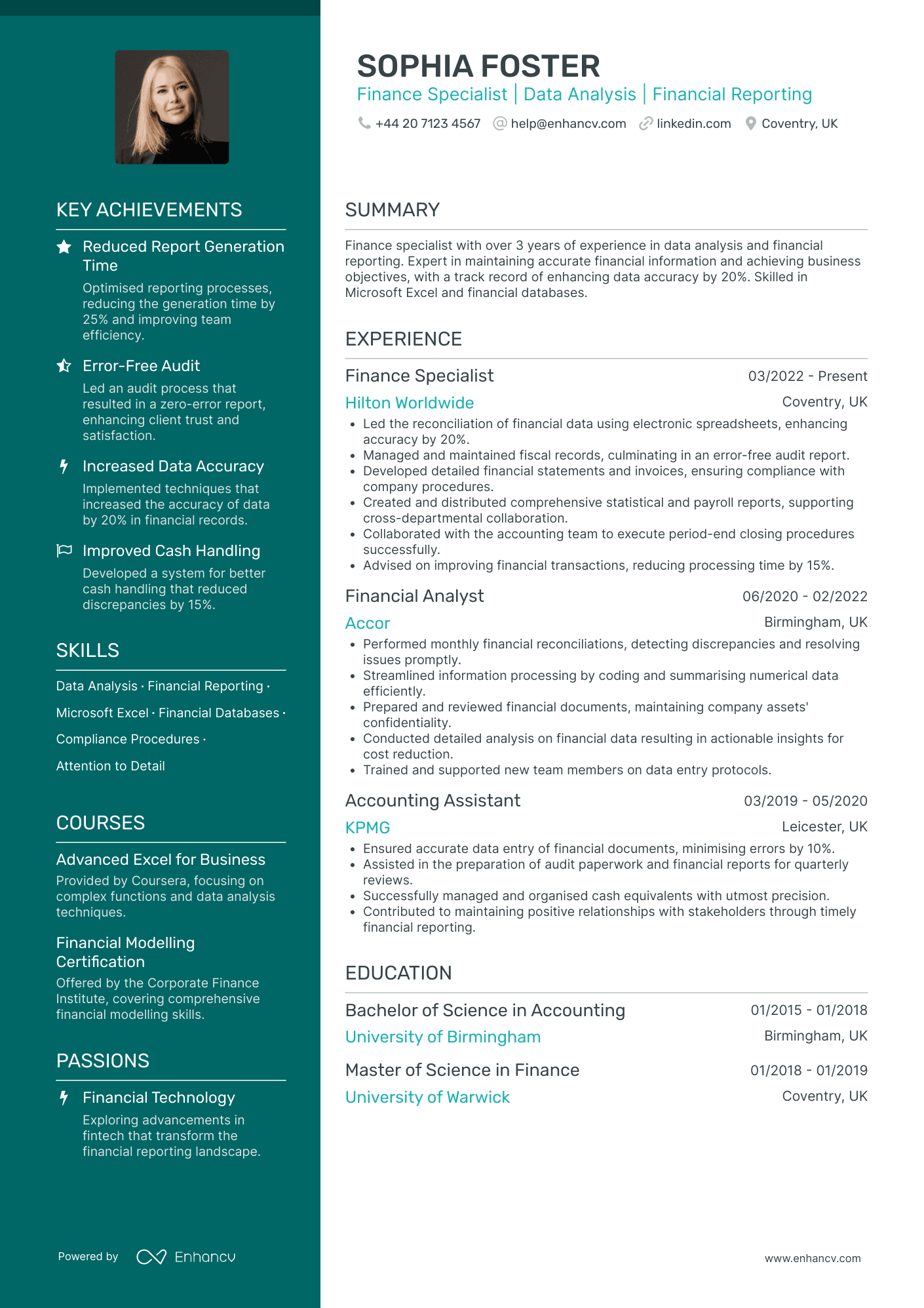

Government Accounting Clerk

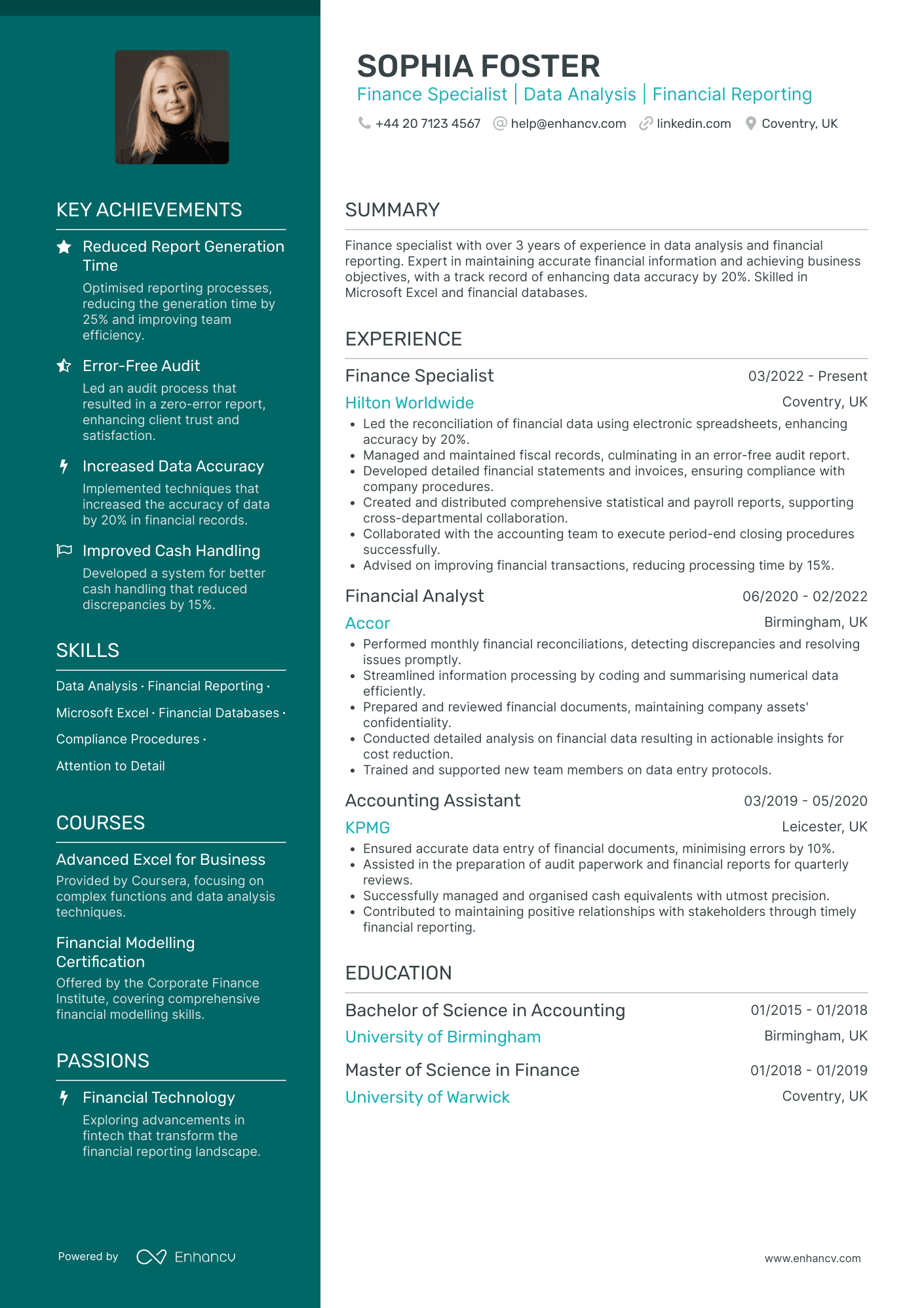

- Progression from Entry-Level to Specialist Roles - Sophia's career trajectory is well-defined, moving from an Accounting Assistant at KPMG to a Finance Specialist at Hilton Worldwide. This growth indicates her ability to take on increased responsibilities and complex financial tasks, showcasing her adaptability and dedication to advancing within the finance sector.

- Effective Use of Industry-Specific Tools and Skills - The CV highlights Sophia’s proficiency with essential financial tools and methodologies, notably her expertise in Microsoft Excel and financial databases. Her focus on compliance procedures and attention to detail are critical skills in the financial industry, ensuring accuracy and reliability in her financial analyses and reports.

- Quantifiable Achievements with Business Impact - Sophia’s achievements are well-documented, such as leading audit processes resulting in error-free reports and reducing report generation time by 25%. These accomplishments demonstrate her capability to enhance operational efficiency and contribute to overall business success by aligning financial practices with organizational goals.

Cost Accounting Manager

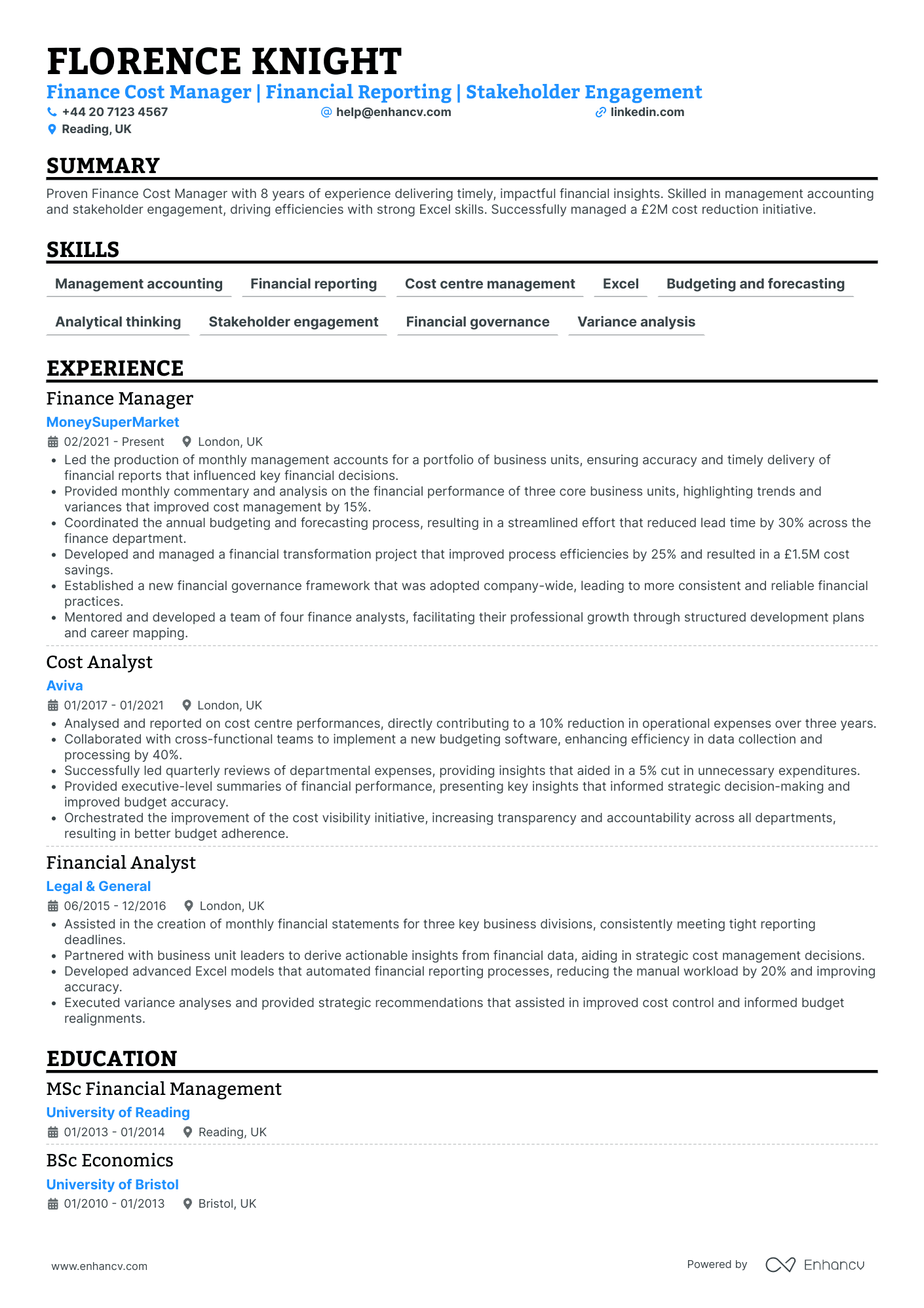

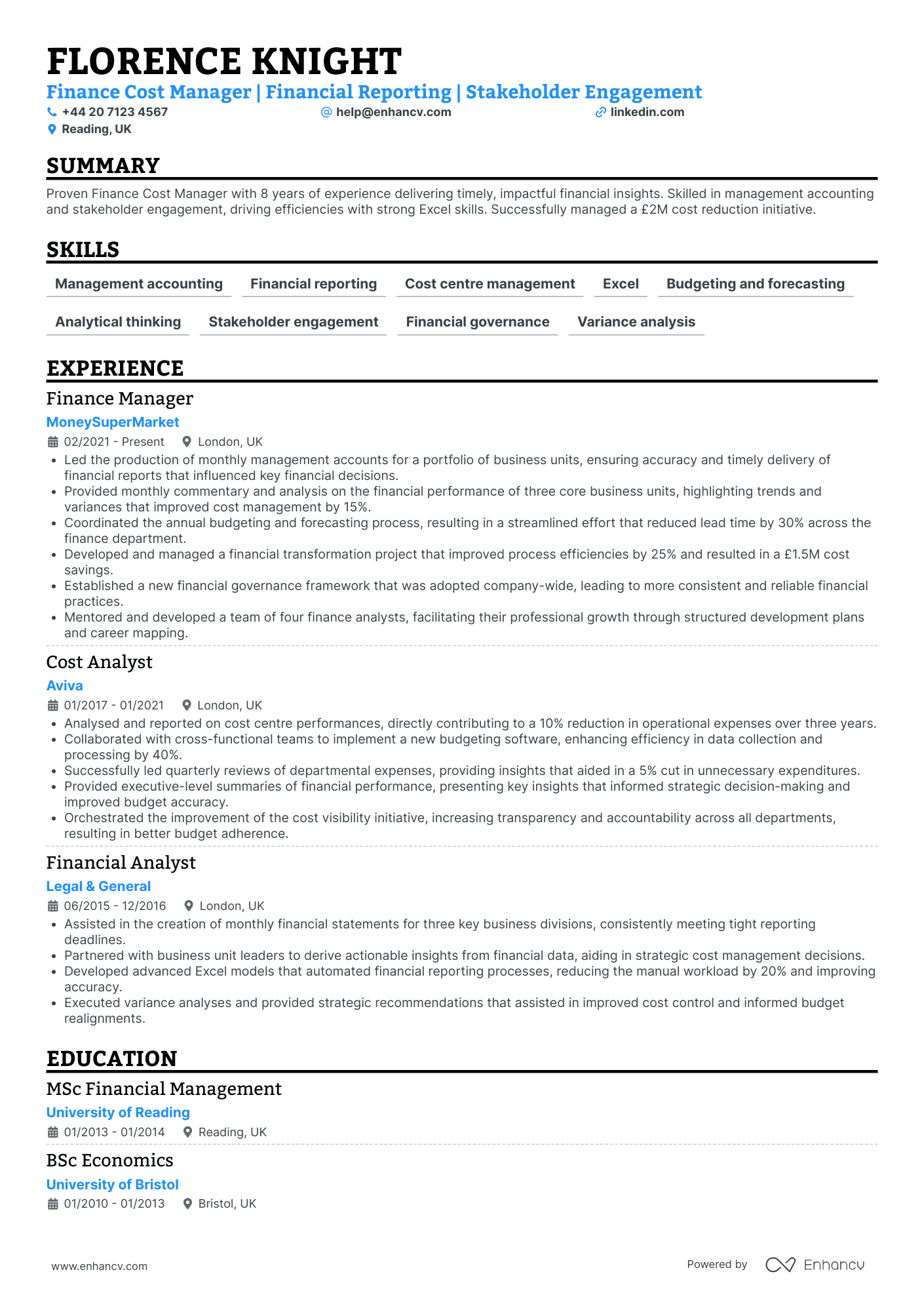

- Structured and Impactful Presentation - The CV is well-organized, presenting information in a clear and concise manner. Each section is distinctly categorized, allowing hiring managers to quickly identify key components such as experience, education, and achievements. Bullet points under each job role succinctly capture the candidate's responsibilities and successes, making it easy to understand the depth and breadth of their professional journey.

- Demonstrated Leadership and Stakeholder Engagement - Florence Knight’s CV highlights her leadership capabilities with experience mentoring a team and developing their potential. Her role as a mentor to finance analysts demonstrates not only her leadership skills but her ability to foster growth and development within her team. Furthermore, her consistent emphasis on stakeholder engagement throughout different positions underlines her capability to navigate complex organizational dynamics effectively.

- Strategic Achievements with Tangible Results - The CV showcases significant achievements with specific numerical results, reflecting the candidate’s focus on generating impactful and quantifiable outcomes. Projects like leading a £2M cost reduction initiative and improving process efficiencies by 25% underscore her ability to drive strategic improvements that strongly align with business objectives, demonstrating not just her operational skills but also her strategic thought process.

Chief Accounting Officer

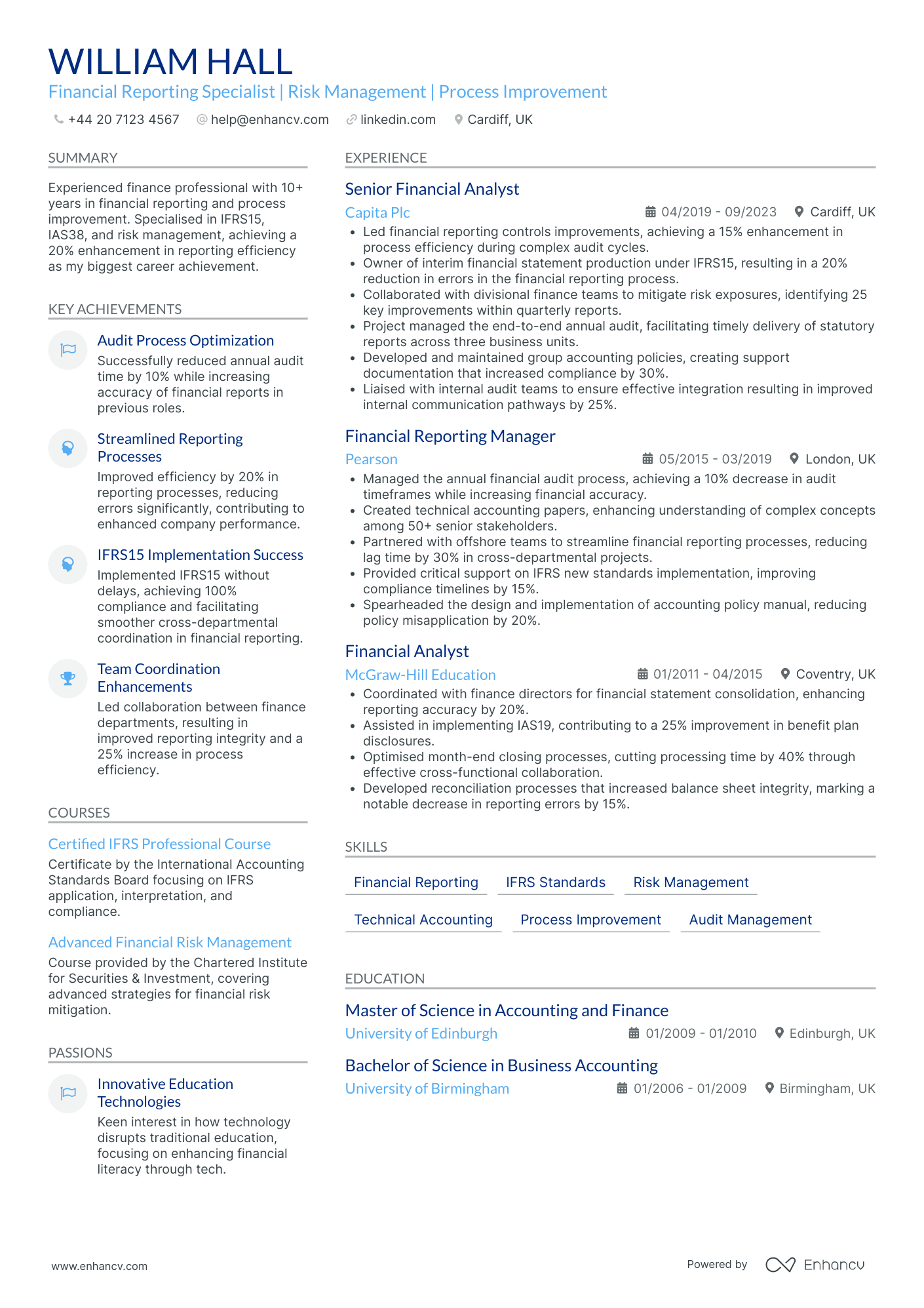

- Structured and Concise Presentation - The CV is well-organized with clear sections, making it easy to navigate through qualifications, experience, and achievements. Each section is concise, effectively communicating the candidate's capabilities without overwhelming the reader with unnecessary details.

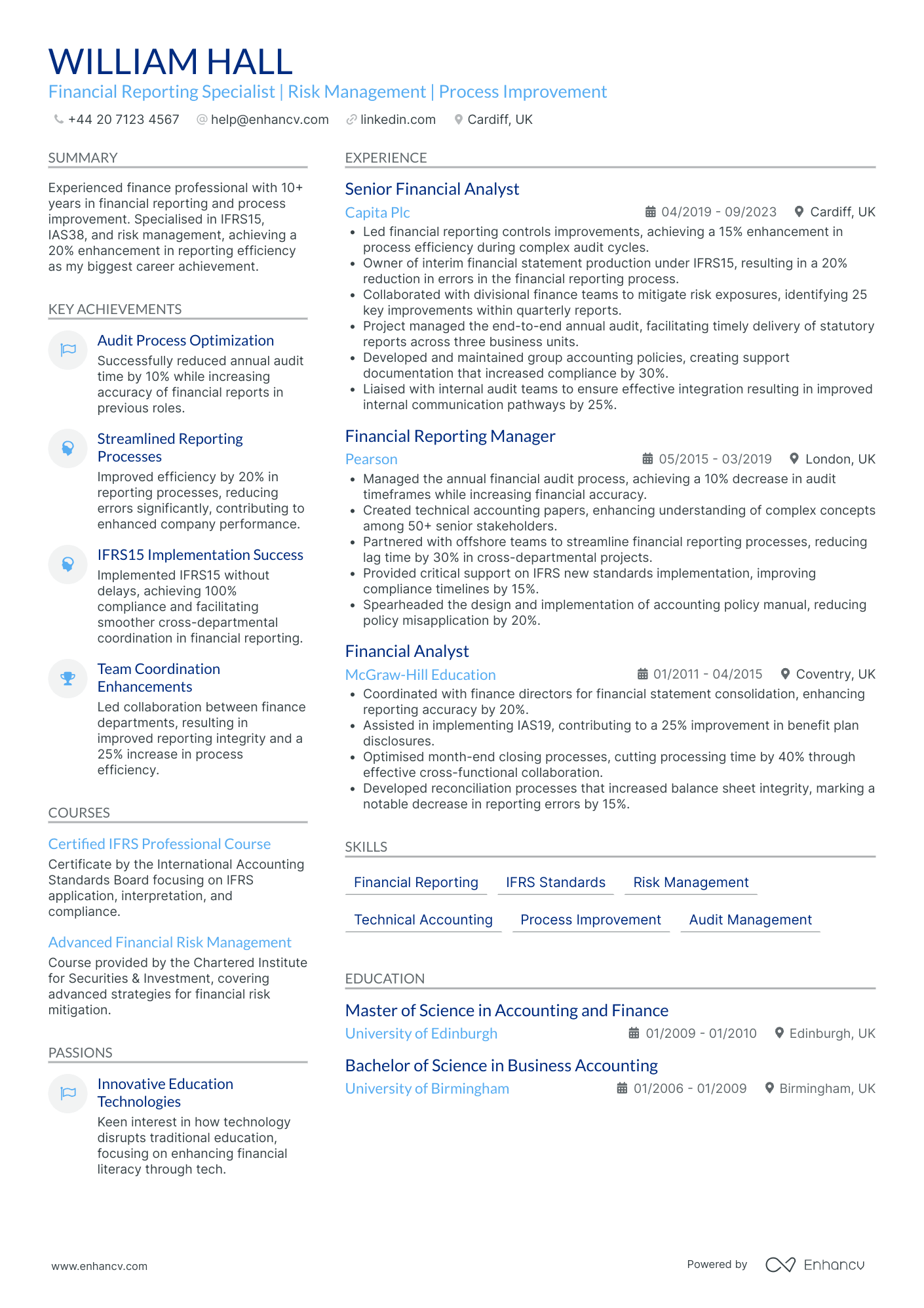

- Clear Career Progression - The career trajectory of William Hall is highlighted through progressive roles from a Financial Analyst to a Senior Financial Analyst. Each position demonstrates increased responsibility, showcasing his growth and the trust placed in him by notable companies like Capita Plc and Pearson.

- Technical Mastery in Financial Reporting - William's expertise in industry-specific standards such as IFRS15, IAS38, and IAS19 is prominently highlighted. His accomplishments in error reduction, compliance improvement, and process optimization using these frameworks underscore his deep technical knowledge and ability to implement standards effectively.

Structuring your accounting CV layout: four factors to keep in mind

There are plenty of best practices out there for your CV layout and design. At the end of the day, a clear format and concise CV message should be your top priority. Use your CV design to enhance separate sections, bringing them to the forefront of recruiters' attention. At the same time, you can write content that:

- Follows the reverse chronological order in the experience section by first listing your most recent jobs;

- Incorporates your contact information in the header, but do skip out on the CV photo for roles in the UK;

- Is spotlighted in the most important sections of your CV, e.g. the summary or objective, experience, education, etc. to show just how you meet the job requirements;

- Is no longer than two-pages. Often, the one-page format can be optimal for your accounting CV.

Before submitting your CV, you may wonder whether to export it in Doc or PDF. With the PDF format, your information and layout stay intact. This is quite useful when your CV is assessed by the Applicant Tracker System (or the ATS) . The ATS is a software that scans your profile for all relevant information and can easily understand latest study on the ATS , which looks at your CV columns, design, and so much more.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a accounting CV

- Contact Information is vital for any CV to ensure the recruiter can reach out easily.

- A Professional Summary showcases your accounting expertise and career highlights.

- Work Experience details past roles that demonstrate your accounting skills and achievements.

- Key Accounting Skills section highlights specific competencies like tax preparation or auditing.

- Education and Certifications show relevant degrees, CPA status, or other accounting qualifications.

What recruiters value on your CV:

- Highlight your qualifications by including any accounting-specific certifications, such as ACCA, CIMA, or AAT, which demonstrate your knowledge and skills in the field.

- Emphasise your proficiency in accounting software and systems, like Sage, QuickBooks, or advanced Excel skills, which are essential for modern accounting roles.

- Detail your relevant experience with financial reporting, tax preparation, audit, and compliance, and how you've contributed to financial efficiency and accuracy in past roles.

- Mention any industry-specific experience you have, for example, in public accounting, corporate finance or in a particular sector such as retail or manufacturing, to show your adaptability and sector knowledge.

- Provide examples of your attention to detail and analytical skills through quantifiable achievements in budgeting, forecasting, and financial analysis, which are crucial in accounting.

Recommended reads:

Tips and tricks on writing a job-winning accounting CV header

The CV header is the space which most recruiters would be referring most often to, in the beginning and end of your application. That is as the CV header includes your contact details, but also a headline and a professional photo. When writing your CV header:

- Double-check your contact details for spelling errors or if you've missed any digits. Also, ensure you've provided your personal details, and not your current work email or telephone number;

- Include your location in the form of the city and country you live in. If you want to be more detailed, you can list your full address to show proximity to your potential work place;

- Don't include your CV photo, if you're applying for roles in the UK or US, as this may bias initial recruiters' assessments;

- Write a professional headline that either integrates the job title, some relevant industry keywords, or your most noteworthy achievement.

In the next part of our guide, we'll provide you with professional CVs that showcase some of the best practices when it comes to writing your headline.

Examples of good CV headlines for accounting:

- Chartered Accountant | Taxation Expert | ACCA | Financial Reporting | 8+ Years Experience

- Junior Accountant | AAT Qualified | Payroll & Reconciliation Specialist | Emerging Financial Analyst

- Senior Financial Controller | CPA | Strategic Planning & Risk Management | 15 Years Leadership

- Management Accountant | CIMA | Budgeting Guru | Cost Reduction Strategies | 10 Years in Finance

- Forensic Accountant | Fraud Prevention | FCA | Data Analysis Expertise | 12 Years Industry Insight

- Assistant Auditor | CA Intermediate | Compliance & Regulatory Frameworks | Internal Controls | 5 Years Practice

Opting between a accounting CV summary or objective

Within the top one third of your accounting CV, you have the opportunity to briefly summarise your best achievements or present your professional goals and dreams. Those two functions are met by either the CV summary or the objective.

- The summary is three-to-five sentences long and should narrate your best successes, while answering key requirements for the role. Select up to three skills which you can feature in your summary. Always aim to present what the actual outcomes were of using your particular skill set. The summary is an excellent choice for more experienced professionals.

- The objective is more focused on showcasing your unique value as a candidate and defining your dreams and ambitions. Think about highlighting how this current opportunity would answer your career vision. Also, about how you could help your potential employers grow. The objective matches the needs of less experienced candidates, who need to prove their skill set and, in particular, their soft skills.

Still not sure about how to write your CV opening statement? Use some best industry examples as inspiration:

CV summaries for a accounting job:

- Seasoned accounting professional with over 15 years of experience overseeing financial operations within the retail sector. Expert in crafting detailed financial reports, conducting meticulous audits, and implementing cost-saving strategies that have saved firms upwards of $500,000 annually.

- Diligent Chartered Accountant with 10-plus years navigating the complexities of financial compliance and strategic tax planning for multinational corporations. Prides in improving operational efficiency by streamlining accounting processes, contributing to an average revenue growth of 12% year-on-year.

- Dynamic former Financial Analyst aiming to leverage a decade of expertise in market analysis and investment strategy to transition into the accounting field. Strong foundation in financial modeling and statistical analysis, combined with an MBA focused on financial accounting.

- Accomplished IT Project Manager pivoting into accounting, armed with strong analytical skills and detail-oriented approach acquired over 8 years. Bringing forth a robust understanding of budget management and a proven record of reducing project costs by 20% through strategic resource allocation.

- Aspiring to embark on an accounting career, equipped with a fresh Bachelor's degree in Finance and a genuine zeal for quantitative analysis. Eager to develop and apply a robust set of accounting skills through hands-on experience, aiming to contribute to long-term financial success.

- Recent graduate in economics with a strong academic grounding in accounting principles, excited to dive into the accounting profession. Driven to utilise analytical and organisational skills in practising meticulous financial record-keeping and support fiscal decision-making processes.

How to meet job requirements with your accounting CV experience

We've now reached the essence of your actual CV - your experience section. This is the space where you can list your career roles and on-the-job successes. Many candidates tend to underestimate just how much time and effort they should put into writing this CV section. Your experience shouldn't be a random list of your responsibilities, but instead:

- Match the job description with your skills, values, and accomplishments;

- Start each bullet with a strong action verb, followed up with one key skill and your outcome of applying this skill;

- Spotlight parts of your career history that are relevant to the job you're applying for.

Before we move on, make sure to check out some professional CV experience sections.

Best practices for your CV's work experience section

- Efficiently managed a portfolio of 50+ clients, ensuring timely and accurate financial statement preparation and reporting, in compliance with GAAP and applicable financial reporting standards.

- Streamlined accounts payable and receivable processes, improving cash flow management and reducing average debtor days by 15% within one financial year.

- Played a key role in budgeting and forecasting, collaborating with department heads to project annual expenses and revenues with a variance of less than 3%.

- Implemented a new accounting software system which increased the productivity of the accounting team by 25% and reduced errors in data entry.

- Successfully led a cross-departmental team in a cost-reduction initiative, resulting in a 10% decrease in operational expenses through strategic renegotiations with suppliers.

- Conducted in-depth financial analyses to advise management on long-term financial planning and business expansion strategies, influencing decisions on two major projects.

- Regularly reconciled complex accounts, ensuring the accuracy of financial information, and provided detailed reports to support the external audit process with zero audit adjustments.

- Developed comprehensive tax strategies in compliance with HMRC regulations, resulting in a 20% reduction in the effective tax rate for the company.

- Trained and mentored junior accountants and interns, fostering a culture of continuous learning and development within the finance team.

- Managed a portfolio of 50+ client accounts, ensuring compliance with financial regulations and standards, which led to a 15% decrease in compliance issues

- Spearheaded the implementation of a new accounting software that increased department efficiency by 25% and reduced report generation time by half

- Successfully negotiated with suppliers to extend payment terms from 30 to 60 days, improving the company's cash flow by 20%

- Oversaw a team of 10 accountants, improving team productivity by 30% through targeted training and performance incentives

- Implemented a monthly close process that reduced the close cycle from 10 to 6 days, contributing to more timely financial reporting

- Conducted quarterly budget reviews that resulted in identifying 10% cost savings across various departments, reallocating resources to critical growth areas

- Streamlined the reconciliation process for inter-company accounts, which improved reporting accuracy and cut reconciliation time by 35%

- Led a project to reduce accounts receivable days, which succeeded in decreasing the average from 45 to 30 days, enhancing cash flow

- Coordinated with the IT department to develop custom financial reporting tools that helped address specific stakeholder needs more effectively

- Assisted in preparing annual budgets with a focus on cost reduction, identifying opportunities that resulted in a 10% decrease in overhead costs

- Processed payroll for over 200 employees accurately and on time each month, maintaining a 99.9% error-free record over 4 years

- Contributed to the successful external audit process by providing thorough documentation and explanations for financial transactions

- Collaborated with the accounts receivable team to implement a customer payment portal, which reduced late payments by 20%

- Provided key financial data for management reports, leading to more informed strategic decision-making

- Engaged in continuous professional development, becoming proficient in new accounting software which increased personal productivity by 10%

- Contributed to the development of a comprehensive financial reporting package to assist with merger and acquisition due diligence, which facilitated two successful mergers

- Reviewed and improved the monthly, quarterly, and annual reporting processes to enhance the transparency and efficiency of financial disclosures

- Advised on tax strategies and implications for international operations, which saved the company an estimated 5% on international tax liabilities

- Played a pivotal role in the integration of accounting functions following a company acquisition, ensuring a seamless transition for employees and systems

- Designed and implemented robust financial modelling tools to forecast and analyse company performance, enhancing the agility of the business in response to market changes

- Developed financial controls and budgets which guided the company during economic uncertainty, enabling it to emerge in a strong financial position

- Implemented a new accounting structure within the company to centralise functions and reduce duplicate efforts, increasing department efficiency by 20%

- Drove a 15% reduction in operational costs by identifying inefficiencies and recommending solutions within the procurement and inventory management systems

- Managed the successful transition of all accounting systems during a critical software upgrade, which included the training and support for over 40 staff members

What to add in your accounting CV experience section with no professional experience

If you don't have the standard nine-to-five professional experience, yet are still keen on applying for the job, here's what you can do:

- List any internships, part-time roles, volunteer experience, or basically any work you've done that meets the job requirements and is in the same industry;

- Showcase any project you've done in your free time (even if you completed them with family and friends) that will hint at your experience and skill set;

- Replace the standard, CV experience section with a strengths or achievements one. This will help you spotlight your transferrable skills that apply to the role.

Recommended reads:

PRO TIP

If you have experience in diverse fields, highlight how this has broadened your perspective and skill set, making you a more versatile candidate.

The CV skills' divide: between hard and soft skills

Of course, you may have read the job requirements plenty of times now, but it's key to note that there is a difference between technical and personal skills. Both are equally relevant to your job application. When writing about your skill set, ensure you've copy-pasted the precise skill from the job requirement. This would not only help you ensure you have the correct spelling, but also pass any Applicant Tracker System (ATS) assessments.

- Hard skills show your technological capabilities. Or whether you'll be a good technical fit to the organisation. Ensure you've spotlighted your hard skills in various sections of your CV (e.g. skills section, projects, experience) by including the technology and what you've attained;

- Soft skills pinpoint your personality and people or communication skills, hinting at if you'll easily accomodate into the team or organisation. Quantify your soft skills in your CV achievements, strengths, summary/objective, and experience sections. Always support your soft skills with how they've helped you grow as a professional.

Top skills for your accounting CV:

General Accounting

Financial Reporting

Tax Preparation

Account Reconciliation

Auditing

Budget Forecasting

Accounts Payable

Accounts Receivable

Cost Accounting

Financial Analysis

Attention to Detail

Problem-Solving

Time Management

Organisation

Communication

Critical Thinking

Adaptability

Integrity

Initiative

Teamwork

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Education and more professional qualifications to include in your accounting CV

If you want to showcase to recruiters that you're further qualified for the role, ensure you've included your relevant university diplomas. Within your education section:

- Describe your degree with your university name(-s) and start-graduation dates;

- List any awards you've received, if you deem they would be impressive or are relevant to the industry;

- Include your projects and publications, if you need to further showcase how you've used your technical know-how;

- Avoid listing your A-level marks, as your potential employers care to learn more about your university background.

Apart from your higher education, ensure that you've curated your relevant certificates or courses by listing the:

- name of the certificate or course;

- name of the institution within which you received your training;

- the date(-s) when you obtained your accreditation.

In the next section, discover some of the most relevant certificates for your accounting CV:

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Recommended reads:

Key takeaways

Here are five things you need to remember about writing your accounting CV for success:

- Sort your experience based on the reverse chronological order, starting with your most recent career items, to showcase how you've grown your career;

- Include within your CV header your relevant contact details, a headline that could spotlight your unique value, and a photo - if you're applying for roles outside the UK or US;

- Decide to use the CV summary, if you happen to have more professional experience, and an objective, if you want to showcase your career goals;

- Within the experience section, write your bullets using action verbs, skills, and success, instead of just merely listing your on-the-job responsibilities;

- Prove your technical skills, using your education and certificates, and your soft skills, with your achievements and strengths sections.