Crafting a CV that effectively showcases your financial expertise and customer service skills is a significant challenge for a personal banker. Our guide offers tailored advice and robust examples to help you highlight your accomplishments and secure your next role in the banking sector.

- Design and format your professional personal banker CV;

- Curate your key contact information, skills, and achievements throughout your CV sections;

- Ensure your profile stays competitive by studying other industry-leading personal banker CVs;

- Create a great CV even if you happen to have less professional experience, or switching fields.

When writing your personal banker CV, you may need plenty of insights from hiring managers. We have prepared industry-leading advice in the form of our relevant CV guides.

CV examples for personal banker

By Experience

Senior Personal Banker

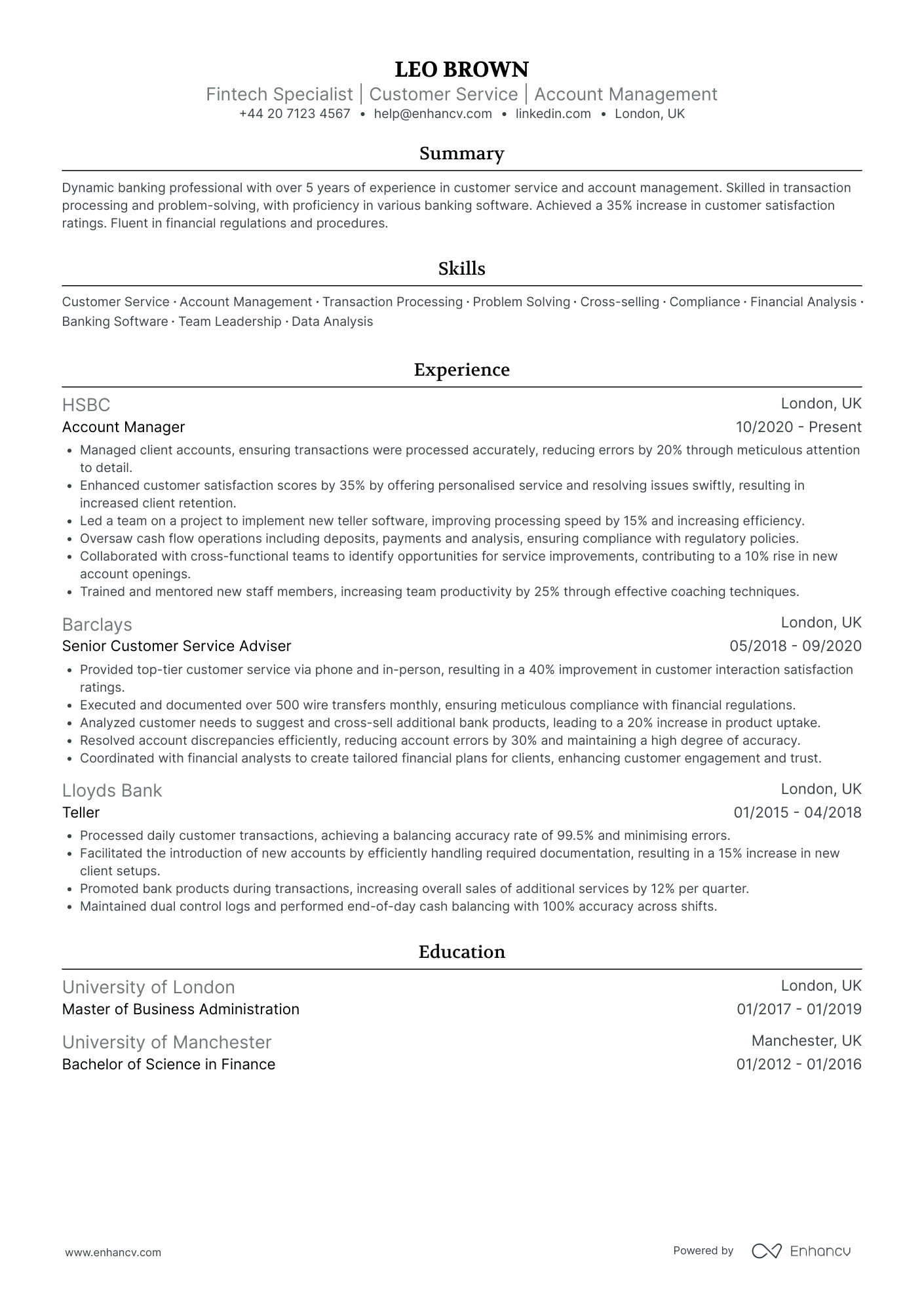

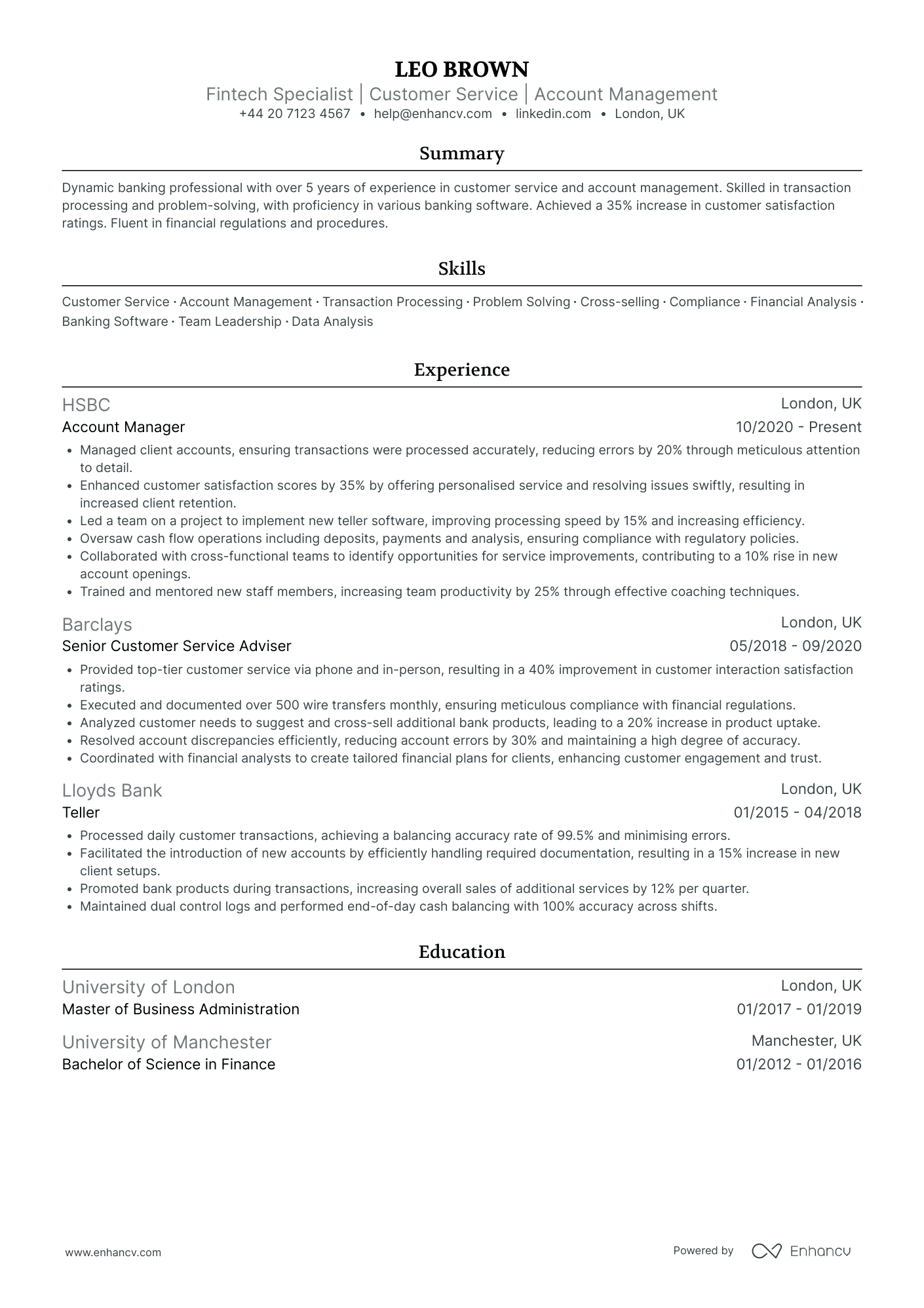

- Clarity and Structure - The CV is well-organized with clearly defined sections such as Experience, Education, Skills, Achievements, and more. This layout aids in quick navigation and provides the reader with easy access to the candidate's career details and accomplishments.

- Career Ascension and Growth - Leo’s career trajectory is well-mapped, showing steady growth from a Teller role to an Account Manager position at a leading bank. This progression underscores increasing responsibility and expertise, validating their capacity for leadership and complex project handling.

- Technical proficiency and industry tools - The CV highlights familiarity with various banking software, illustrating the candidate's adeptness with industry-specific tools essential for transaction processing and error reduction. This technical depth stands out as a strong asset in the fintech sector.

Junior Personal Banker

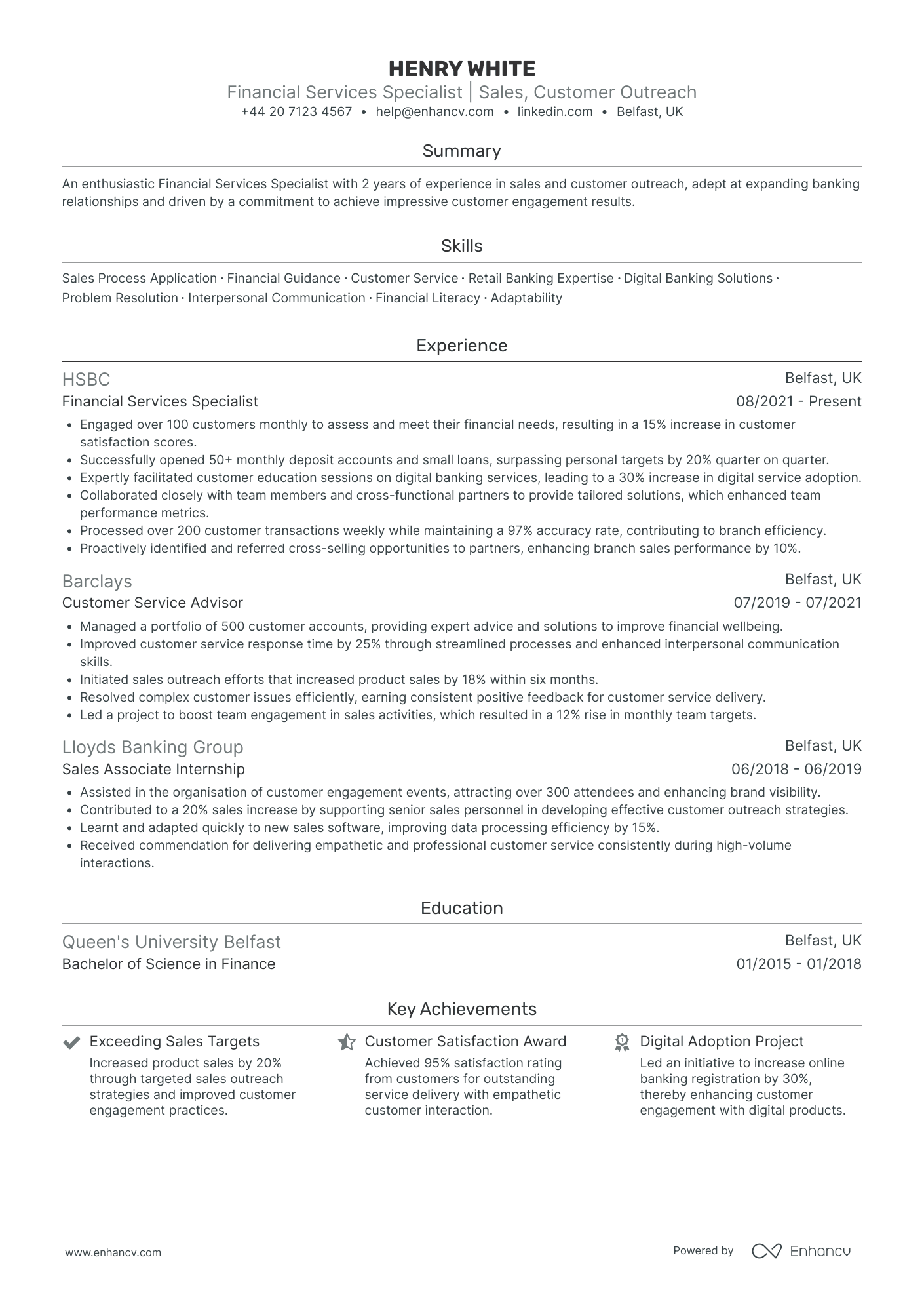

- Structured and Cohesive Presentation - The CV stands out due to its clear, structured presentation, ensuring that each section is concise and easy to follow. With a clear header and well-organized sections, it effectively guides the reader through the candidate's qualifications, experience, achievements, and skills without overwhelming with unnecessary detail.

- Progressive Career Trajectory - Henry White's career demonstrates significant growth within the financial services sector, showcasing a consistent upward trajectory from a Sales Associate Internship to a Financial Services Specialist role. This progression highlights both personal ambition and the acquisition of skills that paved the way for leadership in sales and customer outreach.

- Influence of Soft Skills and Leadership - The CV emphasizes Henry's exemplary soft skills and leadership abilities, particularly through initiatives aimed at improving team productivity and customer satisfaction. By noting achievements such as spearheading team engagement strategies and facilitating educational sessions, the CV highlights key interpersonal and leadership attributes.

Lead Personal Banker

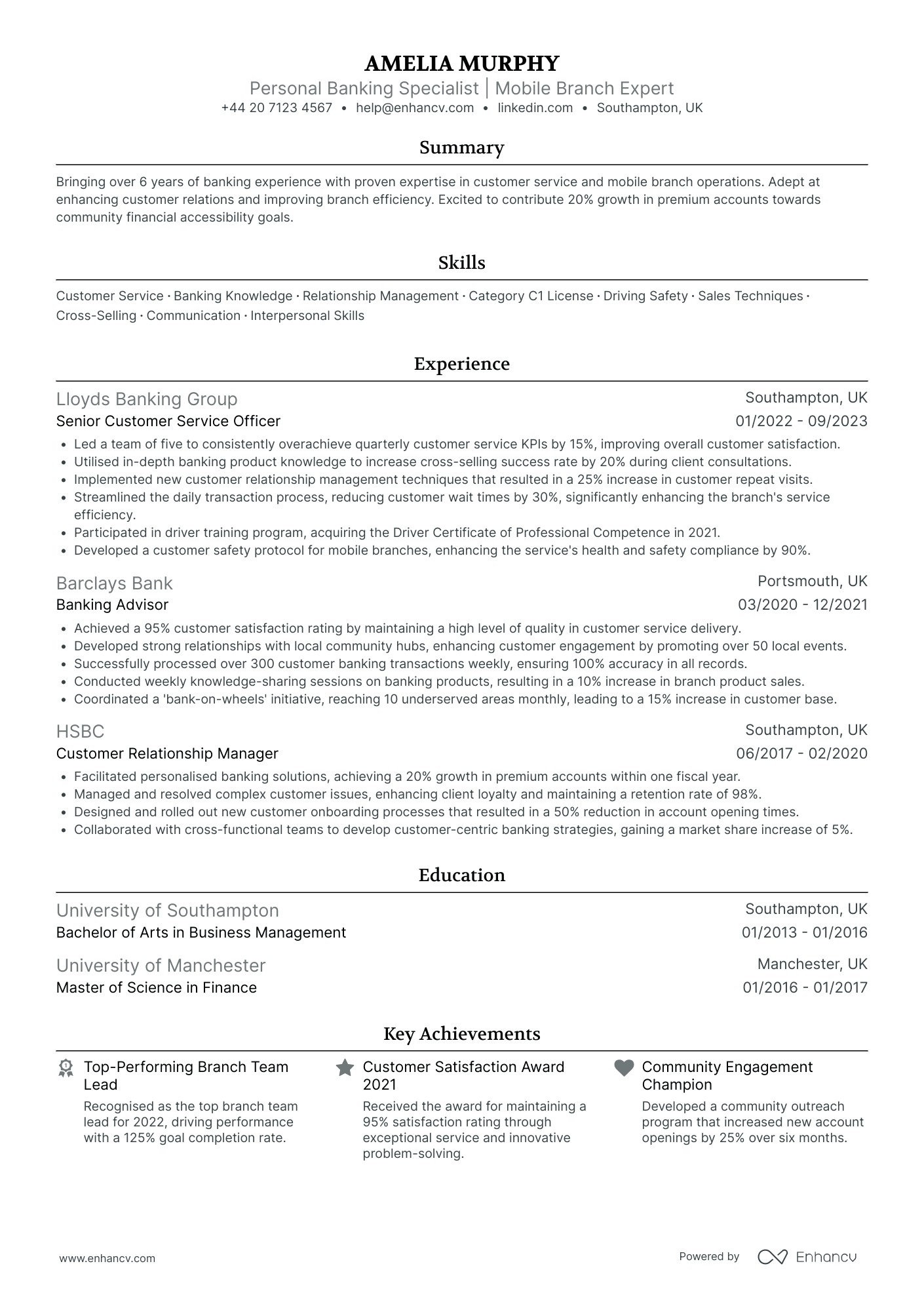

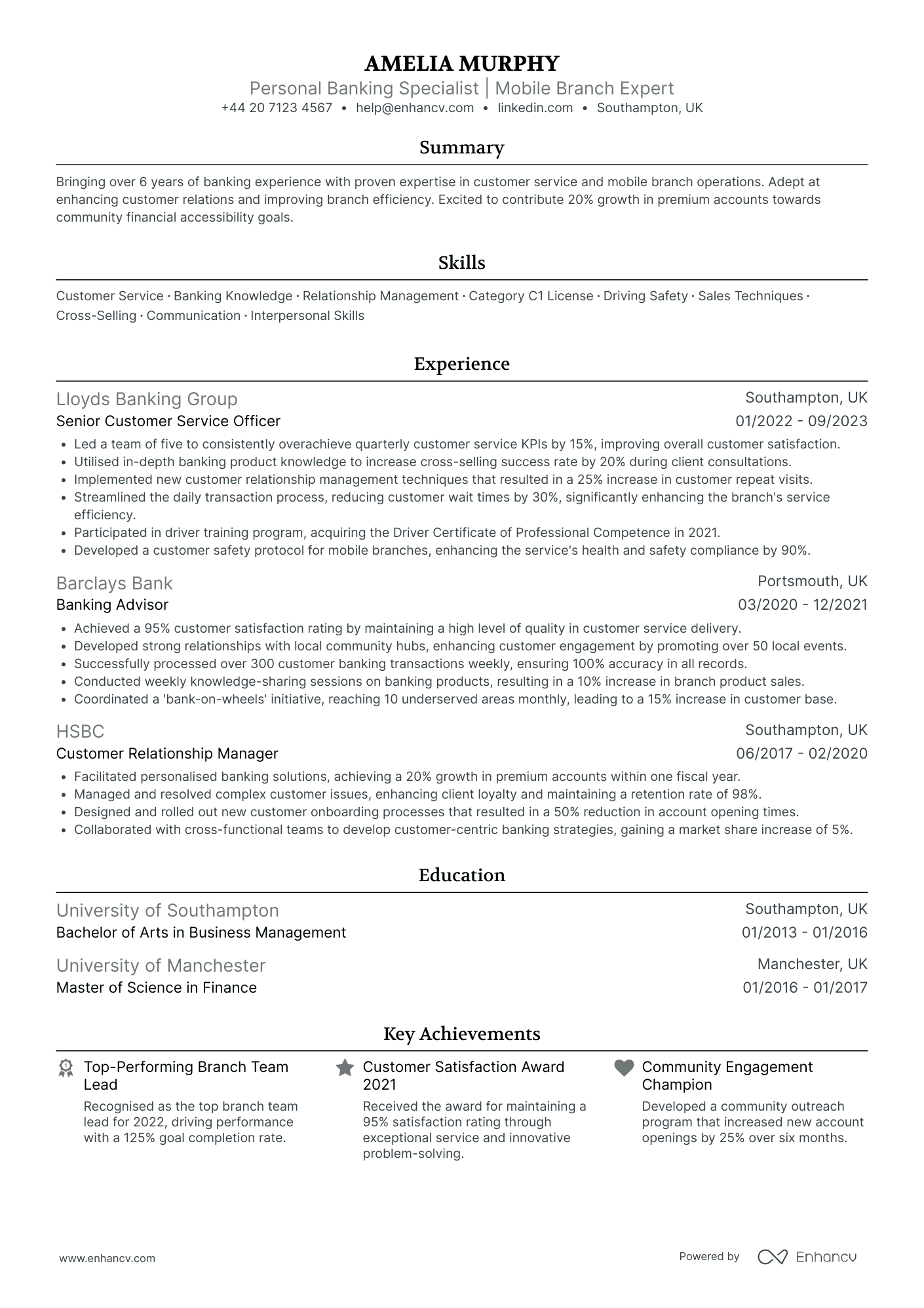

- Effective Presentation and Clarity - The CV is structured with clear sections that make it easy to navigate. The concise presentation of work experiences, skills, and achievements ensures that each element is quickly understood by potential employers, highlighting Amelia Murphy's experience and qualifications succinctly.

- Notable Career Progression and Growth - Amelia Murphy’s career trajectory showcases a steady upward progression within the banking industry, with promotions from a Customer Relationship Manager to a Senior Customer Service Officer. This reflects her capability to grow and adapt in different roles, achieving substantial improvements in customer service and operations efficiency.

- Outstanding Achievements with Concrete Impact - The CV highlights measurable achievements that reveal business-oriented outcomes. For instance, the 25% increase in customer repeat visits and 30% reduction in wait times at Lloyds Banking Group demonstrate significant contributions to both operational efficiency and customer satisfaction.

Associate Personal Banker

- Consistent career progression in banking - Samuel’s CV showcases a strong trajectory within the banking sector, with clear growth from a Business Banking Advisor to a Relationship Manager. Each role builds on the previous one, demonstrating not just promotions, but an expansion of responsibilities and influence within the industry.

- Effective use of metrics to demonstrate impact - The CV excels in using quantitative data to highlight achievements, such as increasing client satisfaction scores by 40% and achieving a 25% rise in team awareness of corporate banking products. These metrics provide concrete evidence of Samuel's effectiveness and the tangible improvements he has facilitated in his roles.

- Diverse skill set applicable to banking roles - Samuel has developed a comprehensive array of skills including Relationship Management, Risk Management, and Digital Banking Solutions. This diverse expertise, coupled with certifications in credit risk management and corporate banking solutions, makes him versatile and well-prepared for varied challenges in the banking sector.

By Role

Personal Banker for Retail Services

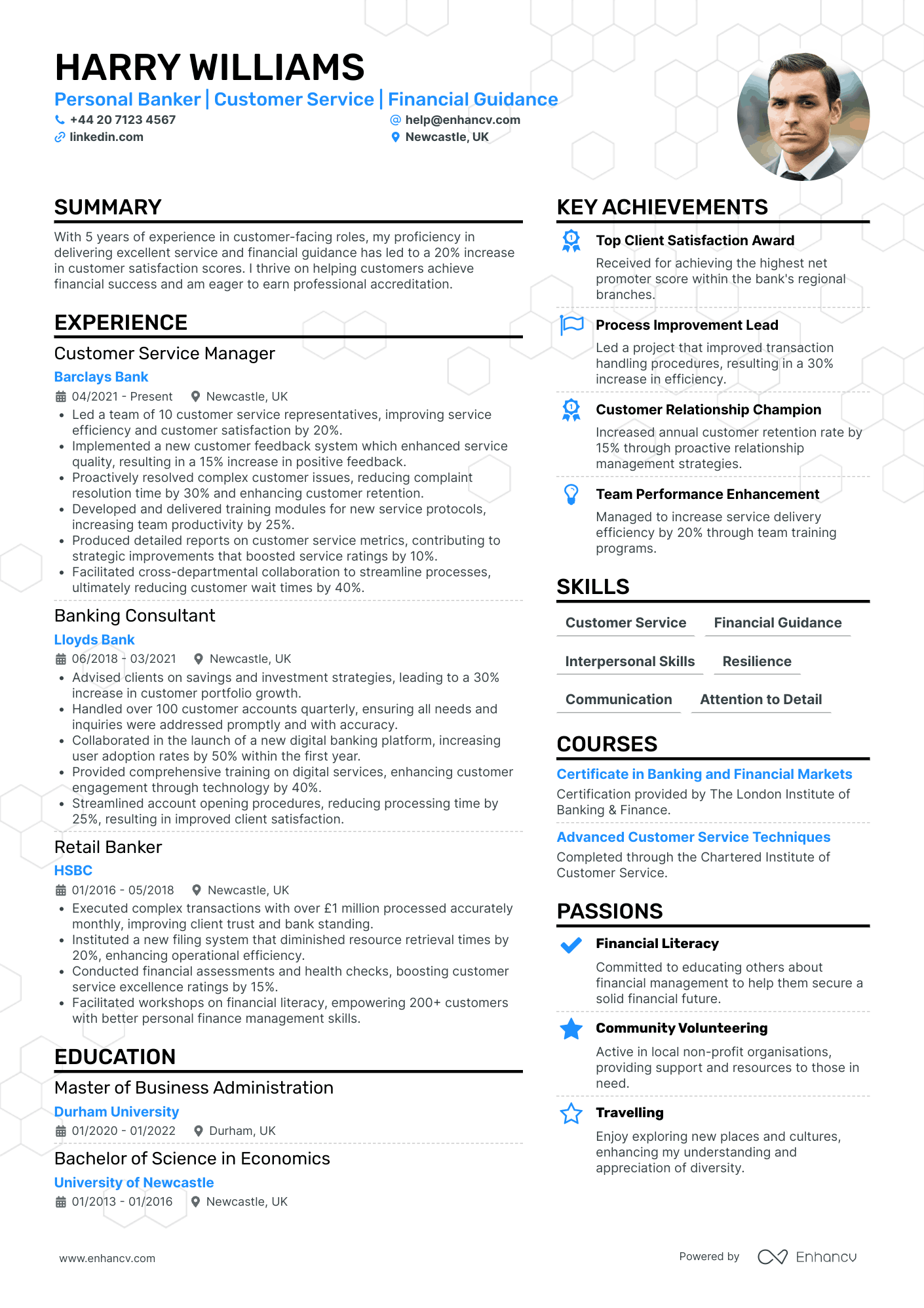

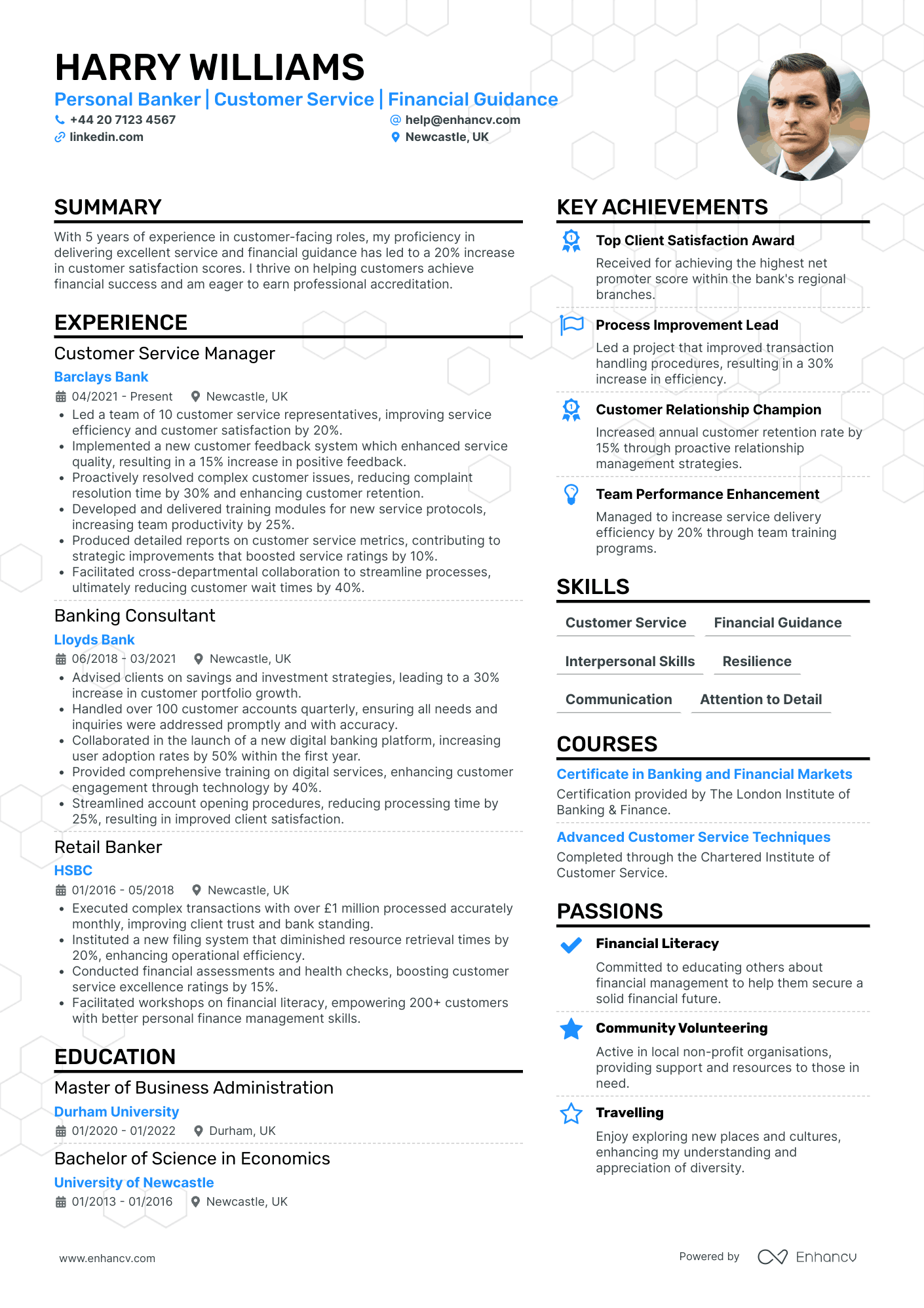

- Clear career progression and leadership impact - The CV outlines a clear career trajectory from a Retail Banker to a Customer Service Manager, demonstrating consistent growth in responsibilities and leadership roles. The progression reflects an individual willing to take on challenges and drive impact within the banking sector.

- Real-world impact through quantifiable achievements - Harry’s accomplishments, such as a 30% increase in customer portfolio growth and reducing wait times by 40%, highlight tangible results with a direct impact on customer satisfaction and service efficiency. These achievements underline a profound contribution to business objectives.

- Diverse skill set encompassing financial acumen and customer service - The CV skill section lists a diverse array of competencies including financial guidance and customer service, suggesting the ability to handle multifaceted roles. Harry's focus on interpersonal skills and communication further emphasizes adaptability in customer-centric environments.

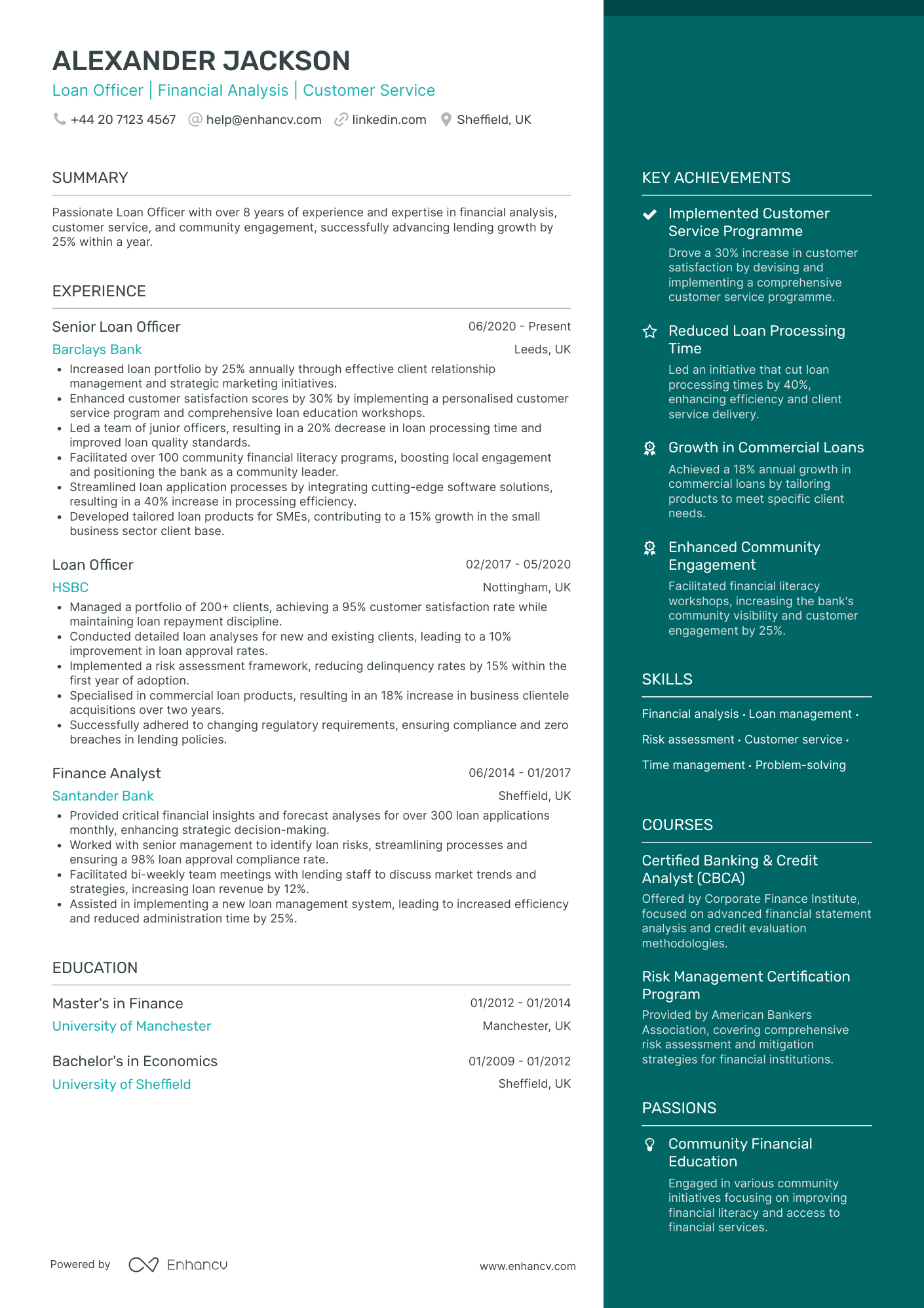

Personal Banker for Business Services

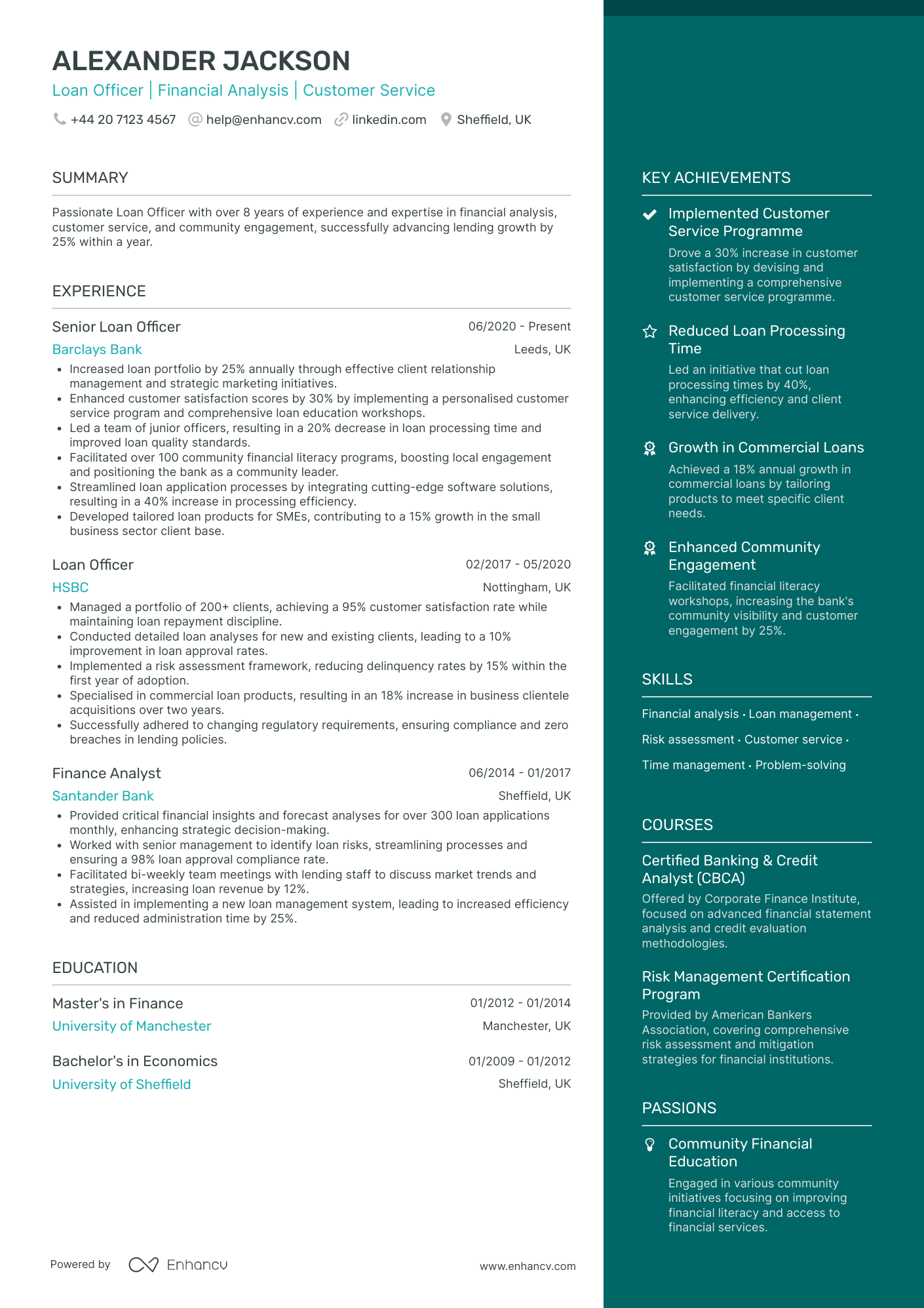

- Concise and Structured Content Presentation - Alexander Jackson's CV is well-organized, with headers clearly delineating sections such as experience, education, and achievements. The use of bullet points under each job role allows for quick absorption of information, helping to emphasize key accomplishments without overwhelming the reader.

- Progressive Career Trajectory - Throughout his career, Alexander has shown a pattern of growth and advancement. Starting as a Finance Analyst, he moved into roles that increasingly involved leadership and broader responsibility, culminating in his current position as a Senior Loan Officer, reflecting significant professional development and trust in his competencies.

- Notable Achievements with Industry Impact - The CV includes achievements that demonstrate tangible business outcomes, such as increasing the loan portfolio by 25% and enhancing customer satisfaction by 30%. These outcomes highlight Alexander's ability to drive growth and positively affect the business's bottom line while also contributing to community engagement and customer relations.

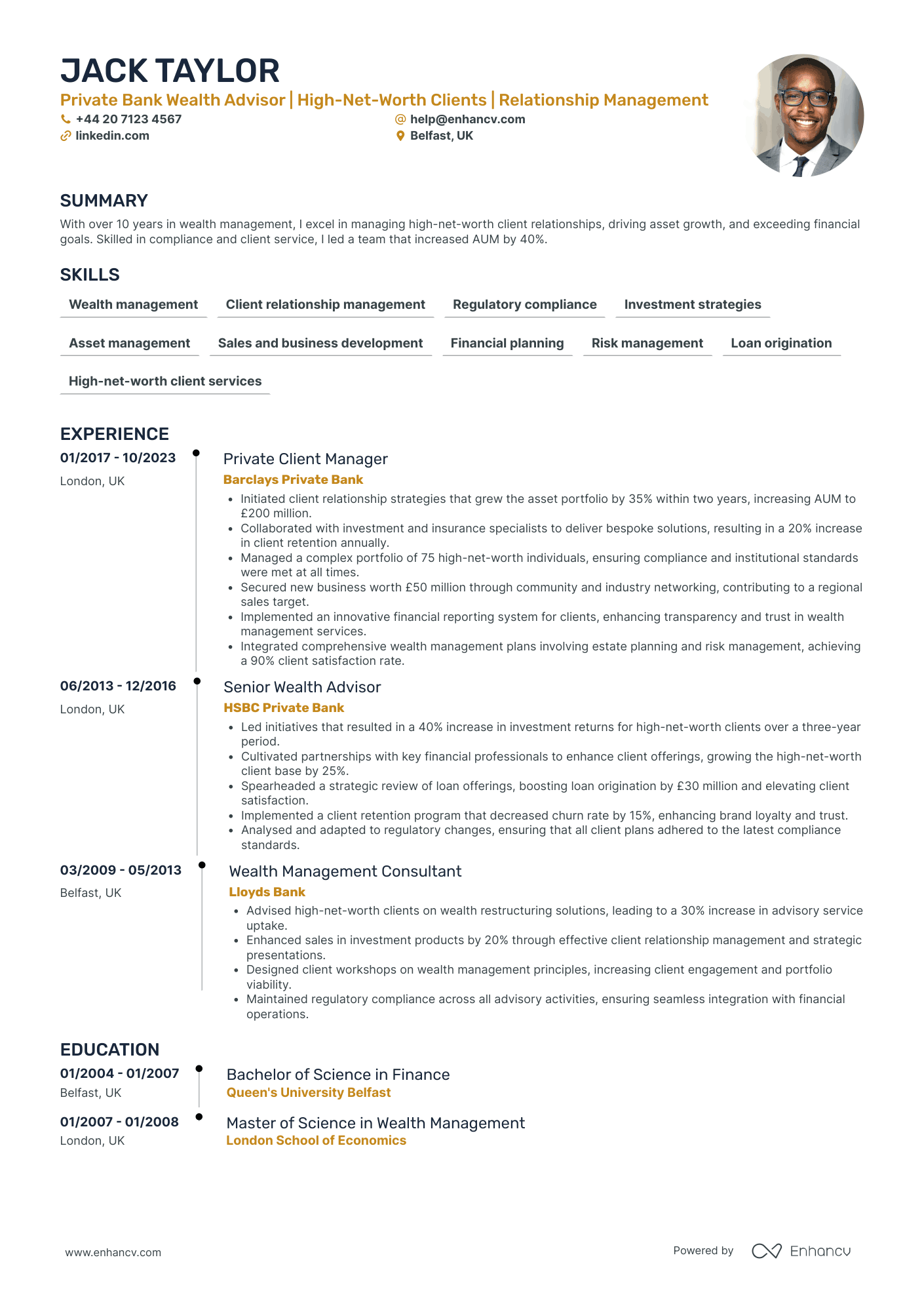

Personal Banker for Wealth Management

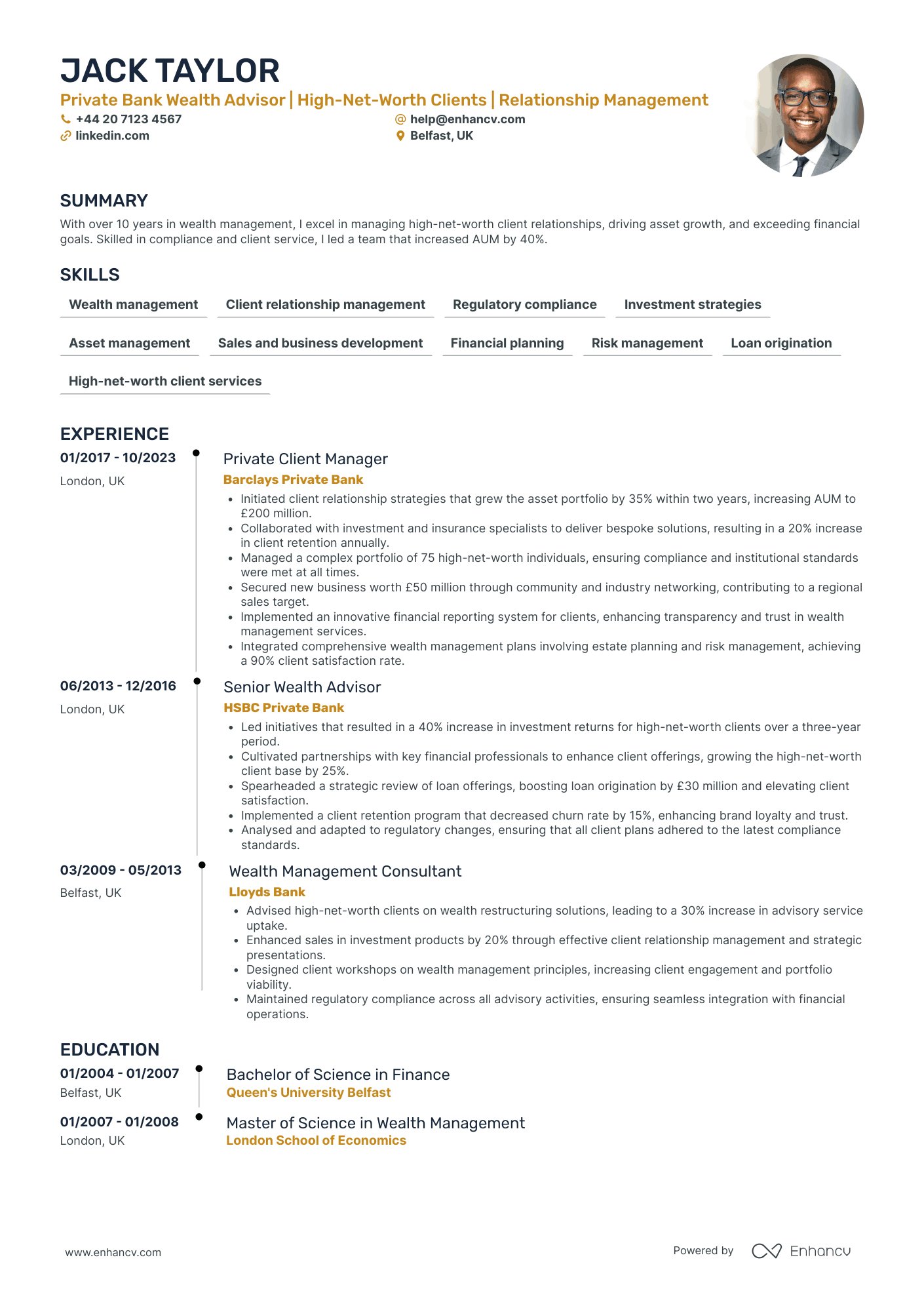

- Structured Presentation of Key Details - The CV is organized with precision, showcasing each section in a logical order that highlights Jack Taylor's expertise and experience. The use of bullet points under each job position succinctly presents his accomplishments, making the information easy to digest and ensuring that key achievements do not get lost in dense paragraphs.

- Continuous Career Advancement in Wealth Management - Jack Taylor's career trajectory demonstrates significant growth and progression within the wealth management industry. Starting as a Wealth Management Consultant, advancing to Senior Wealth Advisor, and ultimately holding a position as a Private Client Manager, reflects his successful navigation and upward movement in this competitive sector.

- Achievements with Strategic Business Impact - The CV effectively emphasizes Jack's accomplishments by linking them to broader business outcomes. For instance, his efforts in increasing assets under management by 40% and enhancing client retention demonstrate not just numerical success but also strategic insight into driving long-term business growth and client loyalty, underscoring his value to potential employers.

Personal Banker for Mortgage Services

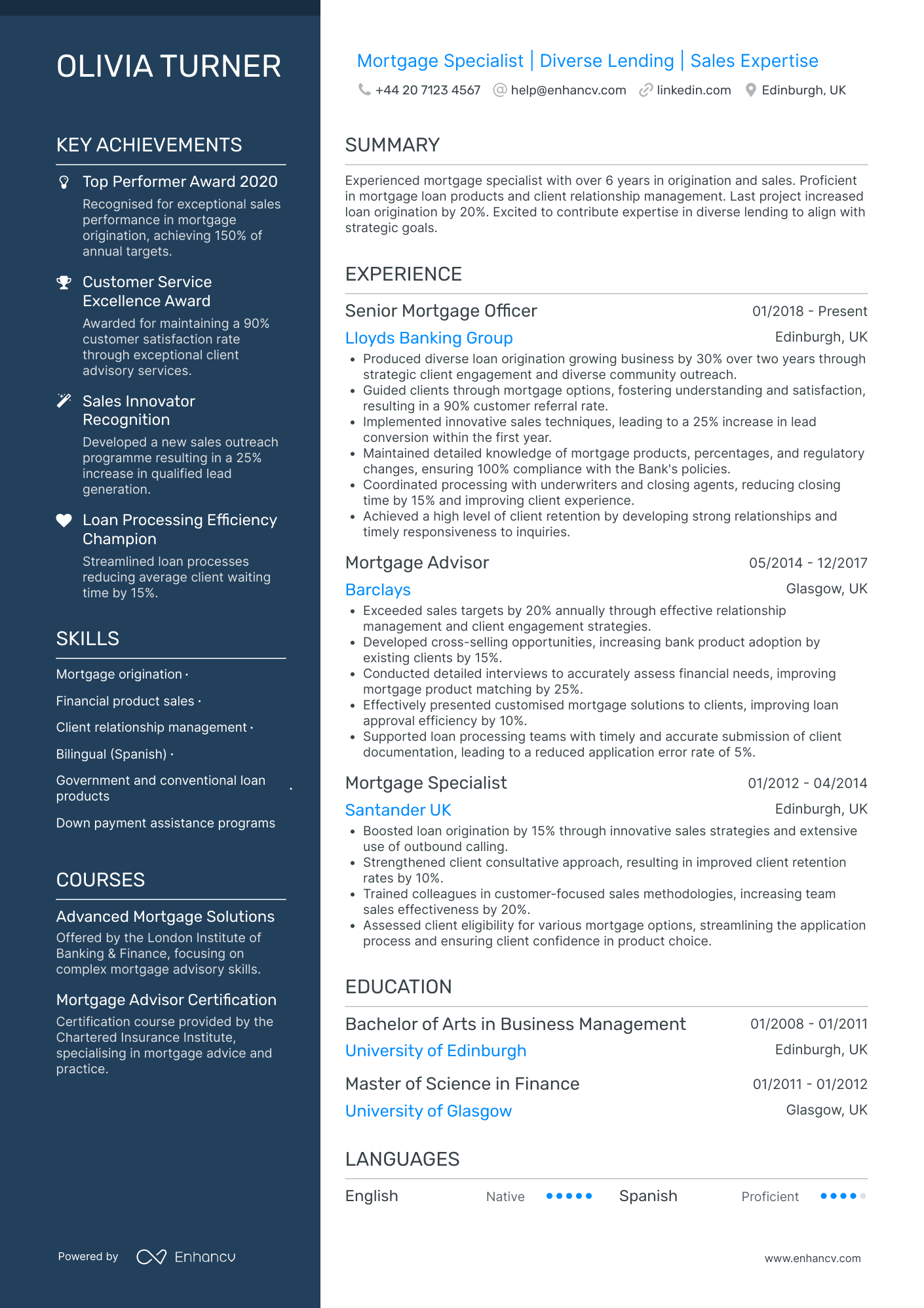

- Effective Use of Achievements - Each job position is backed by significant achievements, such as a 90% customer referral rate and a 25% increase in personal sales conversion, demonstrating Olivia's capacity to deliver tangible business results. These accomplishments are woven seamlessly into the CV, enhancing the narrative of Olivia's capability to exceed targets and drive business growth.

- Strategic Career Growth - Olivia's career trajectory showcases a natural progression from a Mortgage Specialist to a Senior Mortgage Officer, indicating her upward mobility within the industry. She has consistently moved from roles centered around sales to positions that integrate strategic oversight and team leadership, highlighting her advancement in responsibility and scope within the mortgage sector.

- Industry-Specific Expertise and Tools - The CV reflects proficiency in niche elements of mortgage lending, such as down payment assistance programs and government loan products, which are crucial in her field. Olivia’s specific certifications in mortgage advisory and advanced mortgage solutions underscore her technical depth and ongoing commitment to industry-specific education.

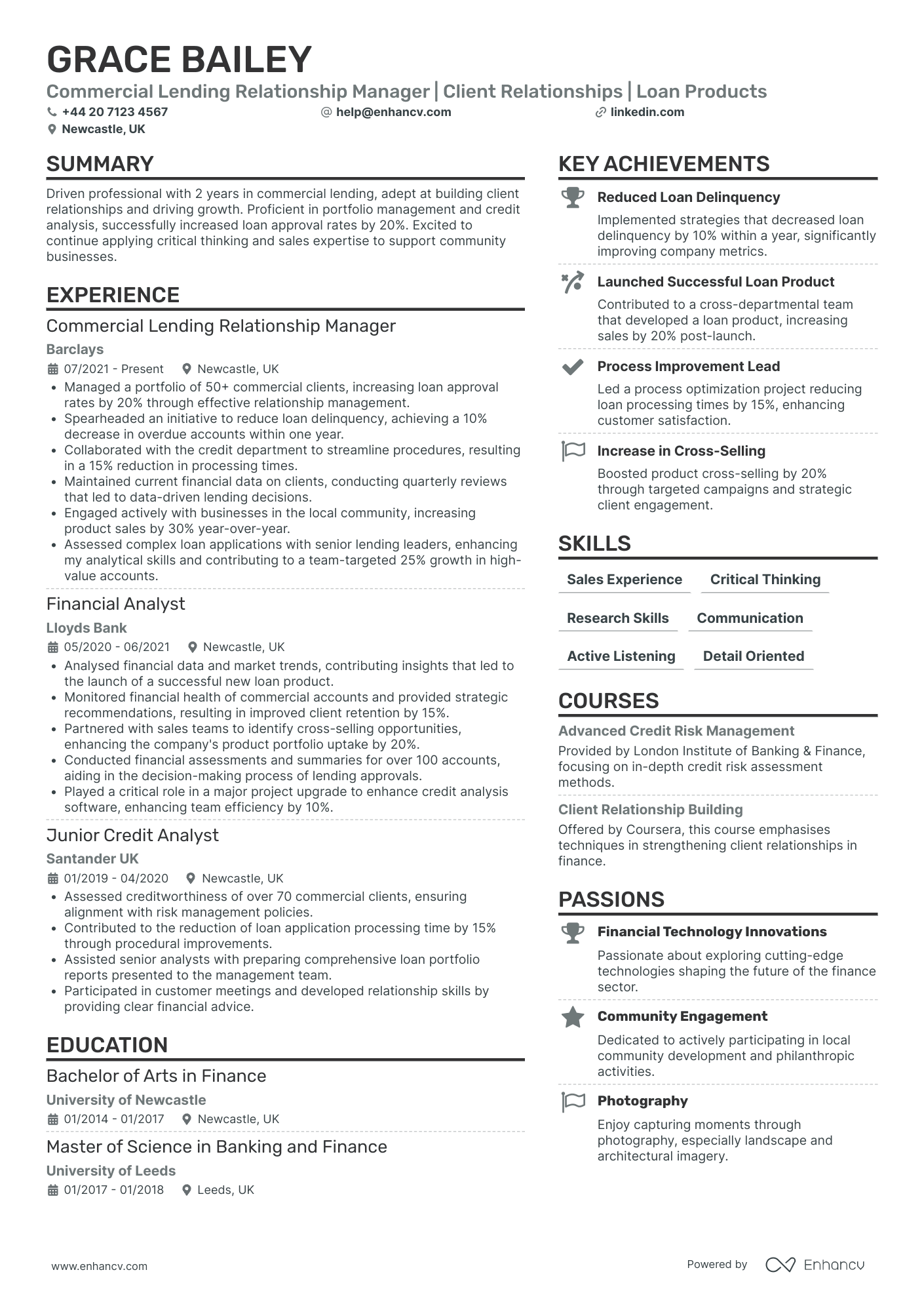

Personal Banker for Commercial Lending

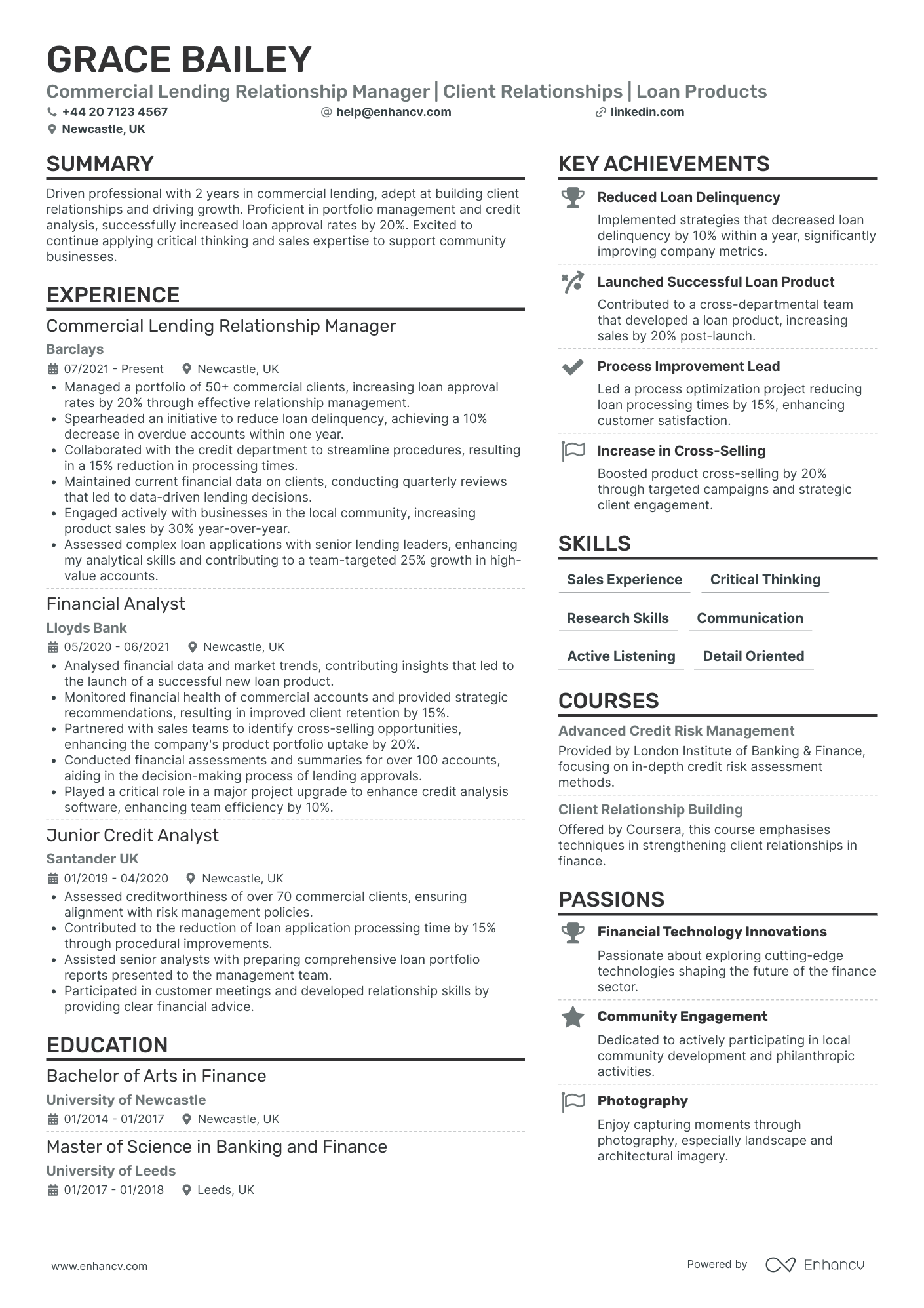

- Clear content presentation - Grace's CV is structured with clarity, emphasizing content conciseness which ensures the reader quickly grasps key career milestones and competencies. This clear layout highlights her experiences and skills related to commercial lending succinctly, avoiding unnecessary jargon and making essential information accessible at a glance.

- Impressive career trajectory - Over a concise period, Grace has advanced from a Junior Credit Analyst to a Commercial Lending Relationship Manager. This progression not only indicates her capacity for professional growth and increased responsibility but also reflects her commitment to the financial sector and her consistent performance in lending roles, making her a strong candidate for future leadership positions.

- Tangible achievements with business impact - The CV accentuates Grace’s achievements with a clear focus on tangible outcomes like a 20% increase in loan approval rates and a 10% decrease in loan delinquency. These accomplishments underscore not only Grace's ability to contribute to business objectives but also her potential for driving significant enhancements in financial operations.

Personal Banker for Private Banking

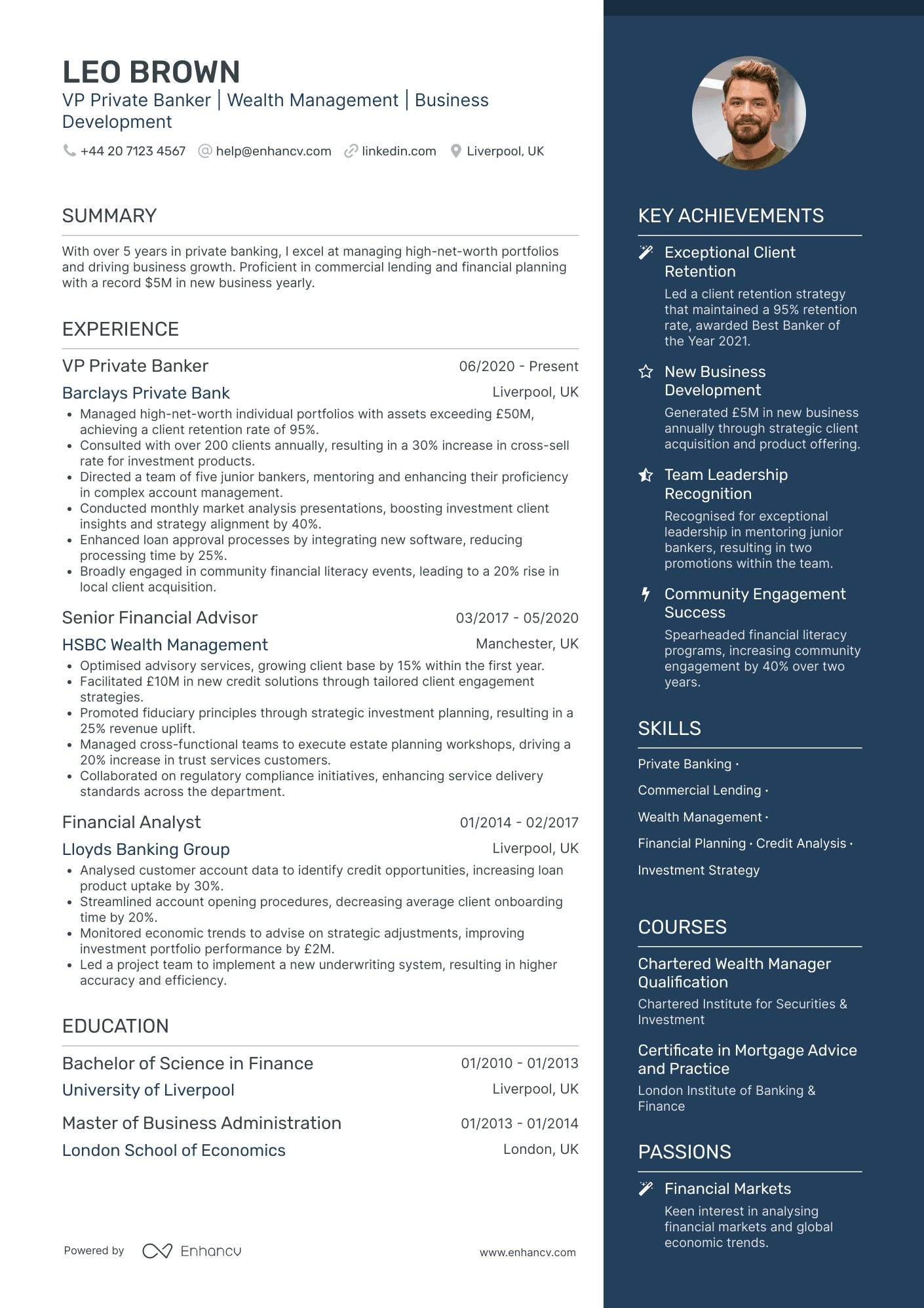

- Structured and easy to follow - The CV is well-organized with clear headings for each section, making it easy for the reader to navigate through Leo's experience, skills, and accomplishments. It maintains conciseness by using bullet points to highlight key responsibilities and achievements, ensuring clarity and impact in the presentation.

- Illustrates progressive career growth - Leo Brown's career trajectory showcases a strong upward movement from a Financial Analyst to the role of VP Private Banker. This progression reflects his growing expertise and leadership in the banking and wealth management sectors, demonstrated by his shift from a more analytical role to one focused on business development and client relationship management.

- Emphasizes leadership and mentoring skills - Leo's experience, particularly at Barclays Private Bank, highlights his leadership abilities. He directs a team of junior bankers, mentoring them and contributing to their professional growth, as evidenced by promotions within the team. This underlines his capability to inspire and develop talent, essential for his senior role.

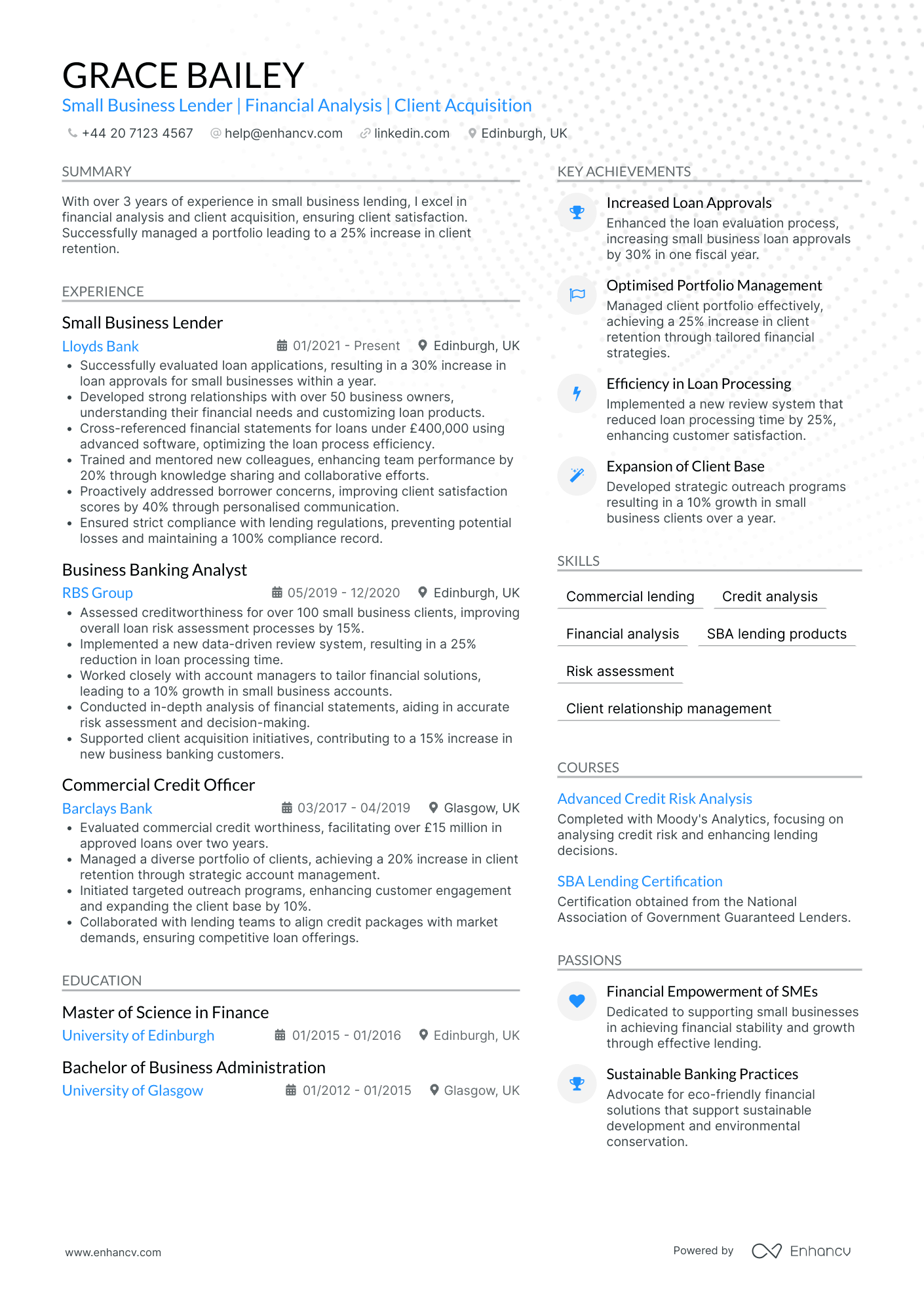

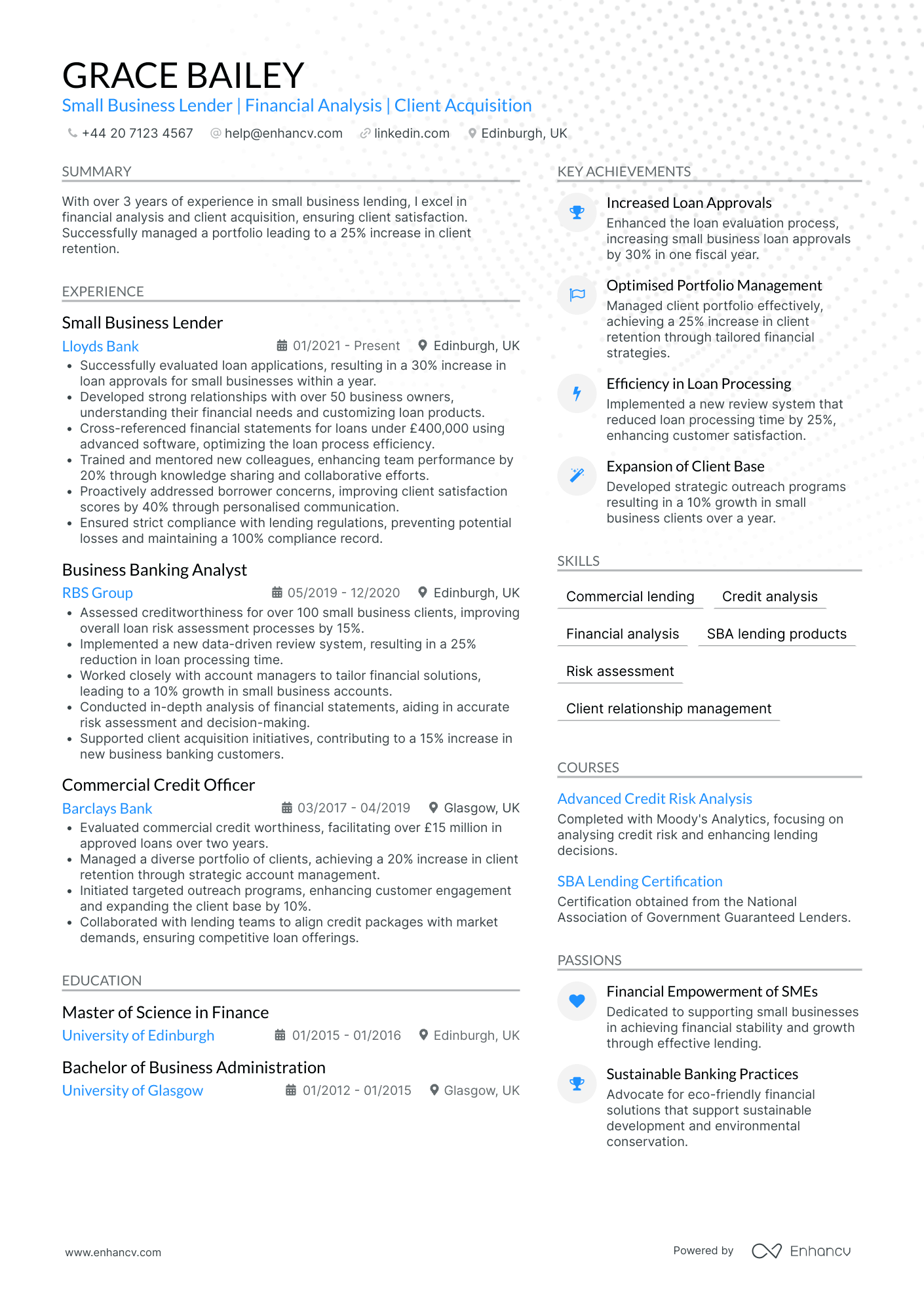

Personal Banker for Small Business Services

- Structured for Clarity and Impact - Grace Bailey's CV is meticulously structured, with clearly defined sections such as experience, education, skills, and achievements, making it easy to navigate. Each section is concise yet comprehensive, allowing the reader to grasp her qualifications and career trajectory quickly. Bullet points are used effectively to convey key responsibilities and accomplishments, ensuring the information is both digestible and impactful.

- Demonstrated Career Progression and Specialization in Finance - Grace's career trajectory highlights significant growth within the financial services sector. Starting as a Commercial Credit Officer and advancing to a Small Business Lender at Lloyds Bank, her progression underscores her increasing responsibilities and specialization in small business lending. This demonstrates her consistent development and expertise within a specific niche of the finance industry.

- Utilizes Industry-Specific Tools and Methodologies - The CV emphasizes Grace's proficiency with industry-specific tools such as Lender’s Cooperative software and advanced financial analysis methodologies. Her ability to implement data-driven systems and optimize loan processes illustrates a deep technical understanding and application of financial tools that are crucial for effective lending operations.

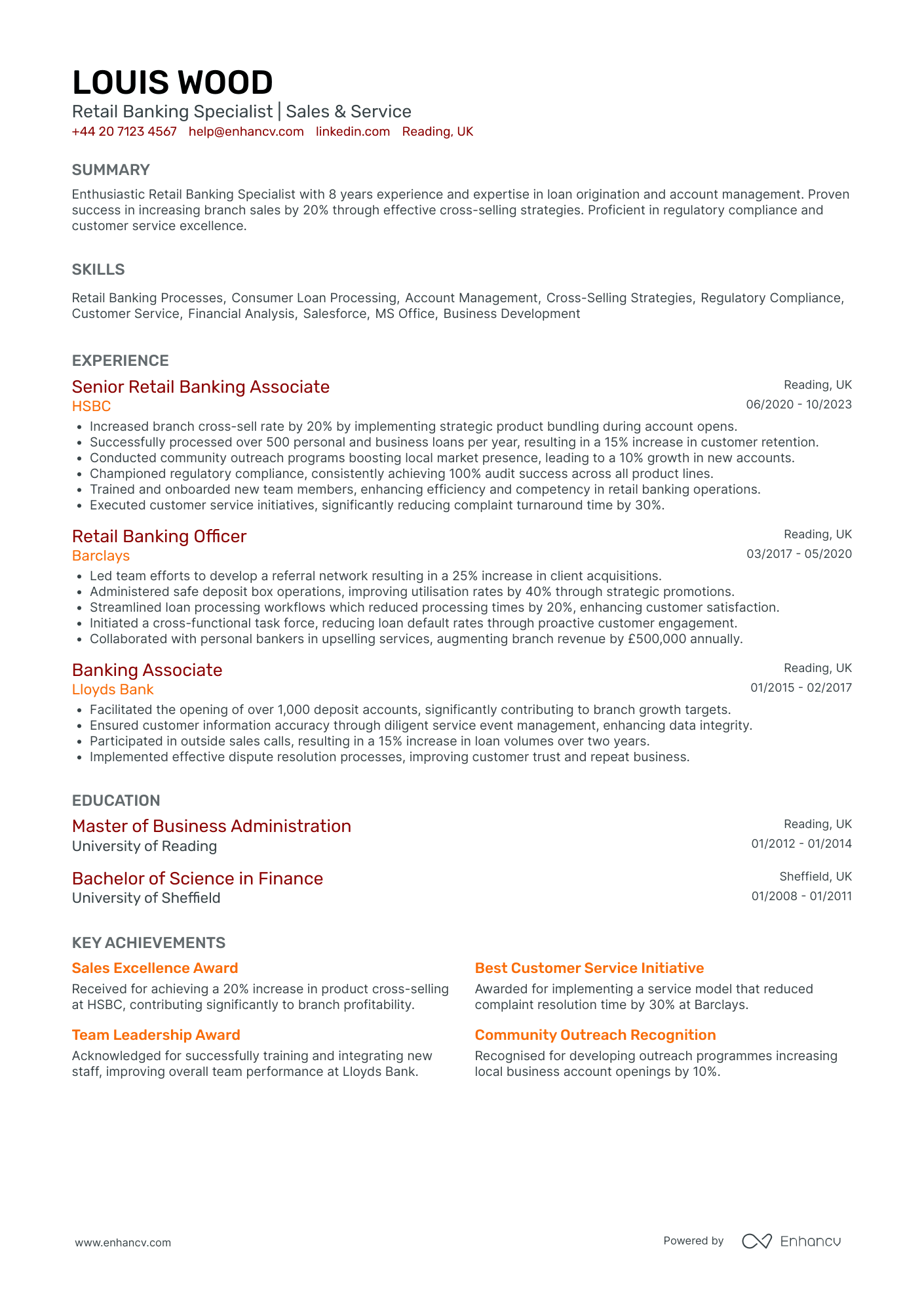

Personal Banker for Corporate Banking

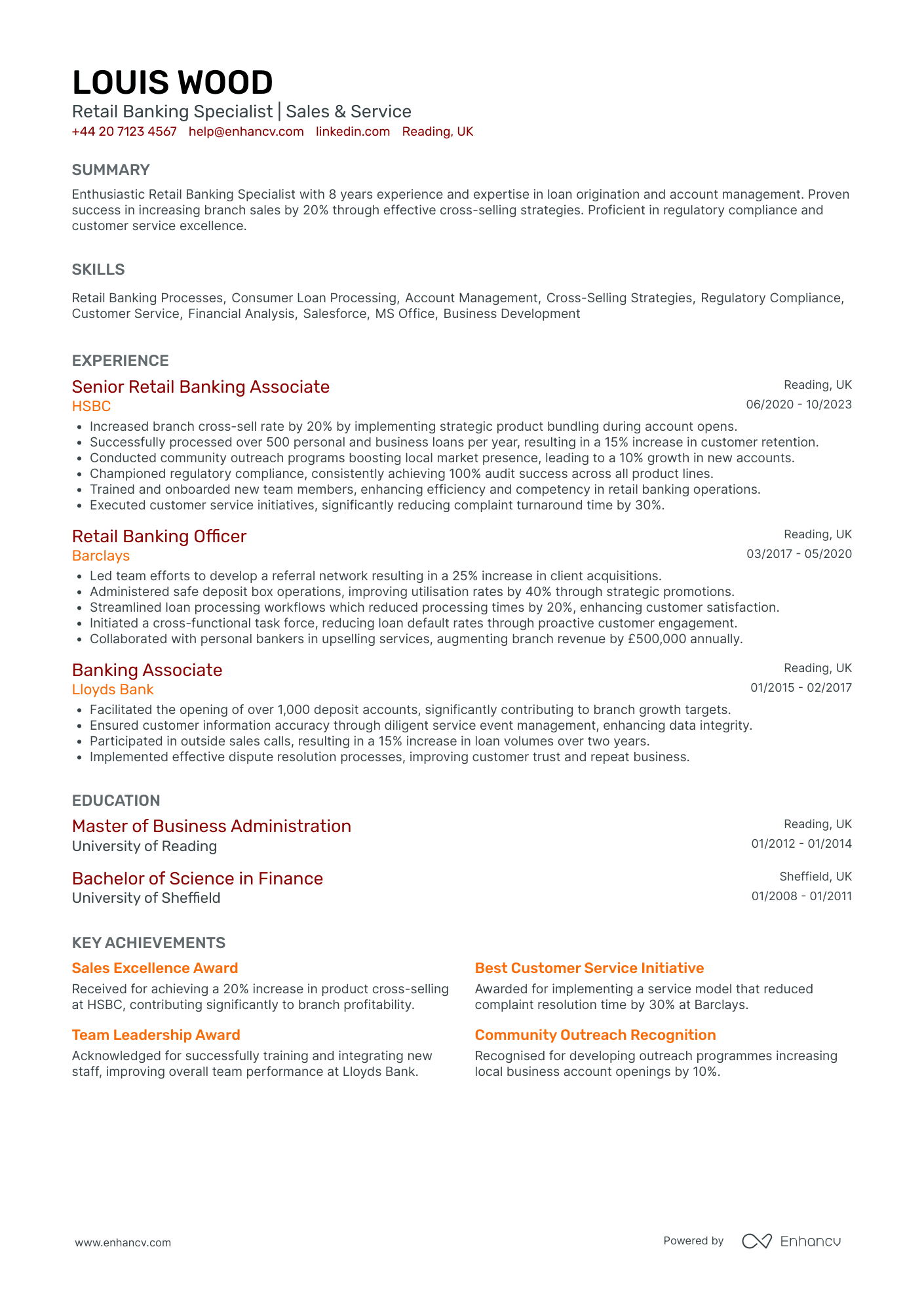

- Clear Structure and Concise Presentation - The CV is well-organized, beginning with a detailed header and leading into a succinct summary. Each section clearly delineates different aspects of the candidate's experience, with bullet points providing easy-to-read accomplishments and responsibilities. This layout ensures quick comprehension and highlights the most pertinent information.

- Impressive Career Growth and Consistent Advancements - Louis Wood's career trajectory demonstrates consistent upward mobility within the retail banking sector. Starting as a Banking Associate and progressively moving up to a Senior Retail Banking Associate showcases his dedication and effectiveness in leadership roles, indicating his capability to handle more responsibility over time.

- Significant Achievements with Tangible Impact - The CV emphasizes achievements that translate into business success, particularly the 20% increase in branch sales and additional £500,000 annual branch revenue through effective cross-selling and upselling. These accomplishments illustrate not just the ability to set and achieve targets, but to significantly grow business value and drive operational success.

Personal Banker for Investment Services

- Clear and Structured Presentation - The CV is structured in a logical and easy-to-read format, with each section clearly delineated and information concisely presented. The use of bullet points for detailing responsibilities and achievements ensures that key information is easily accessible, catering effectively to recruiters' quick scanning abilities.

- Progressive Career Growth - Scarlett's career trajectory shows a clear upward progression from a Financial Advisor to a Senior Private Banker. This indicates strong professional development, advancement based on experience, and recognition of her growing expertise within the wealth management sector. Her roles demonstrate increasing responsibilities, which suggest leadership qualities and industry impact.

- Achievements Linked to Business Success - The CV highlights several major achievements with direct relevance to business success, such as increasing client assets by 30% and enhancing customer satisfaction. These accomplishments showcase Scarlett's ability to deliver results that contribute significantly to organizational growth, emphasizing her value as a high-performing asset in the wealth management industry.

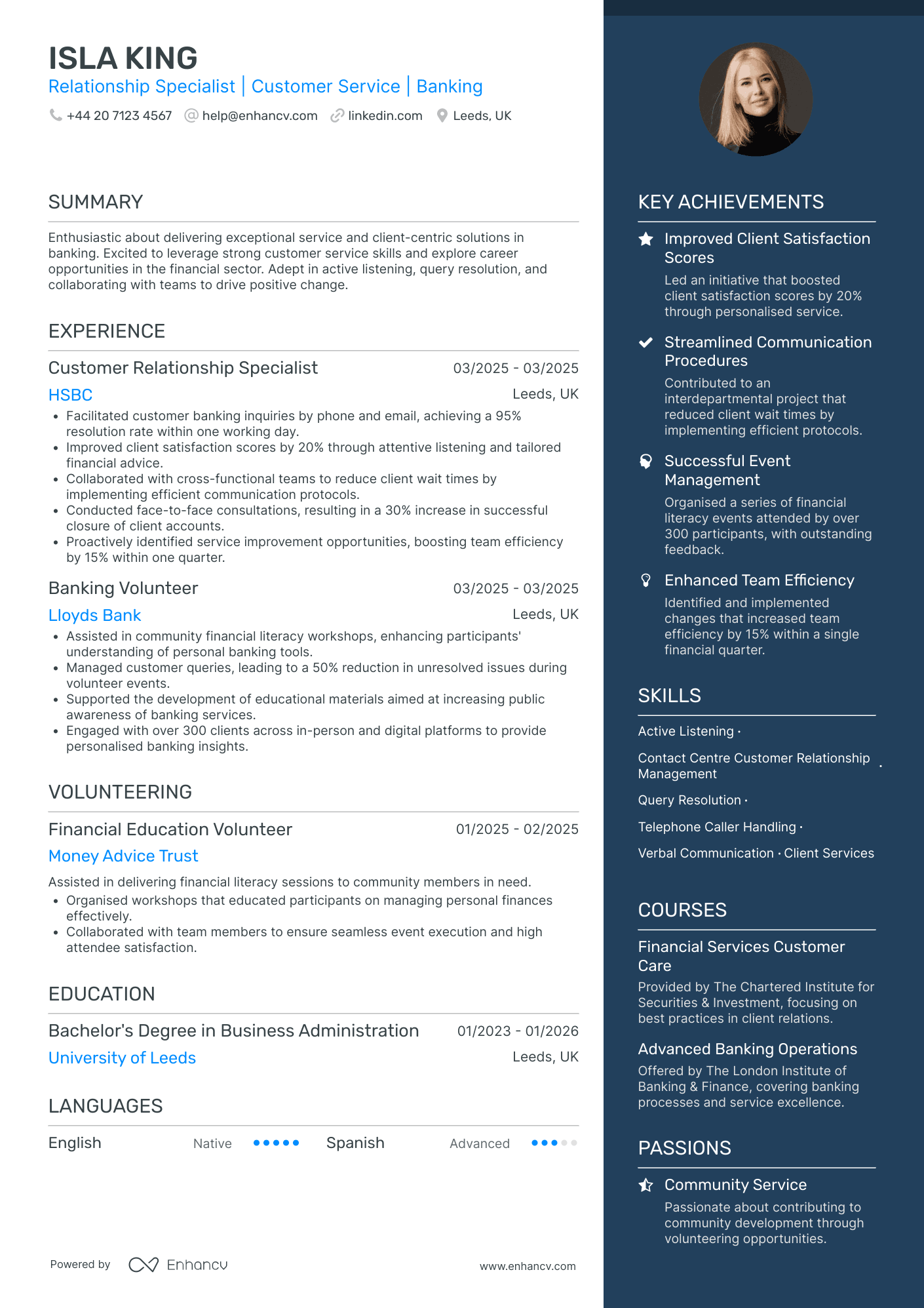

Personal Banker for International Banking

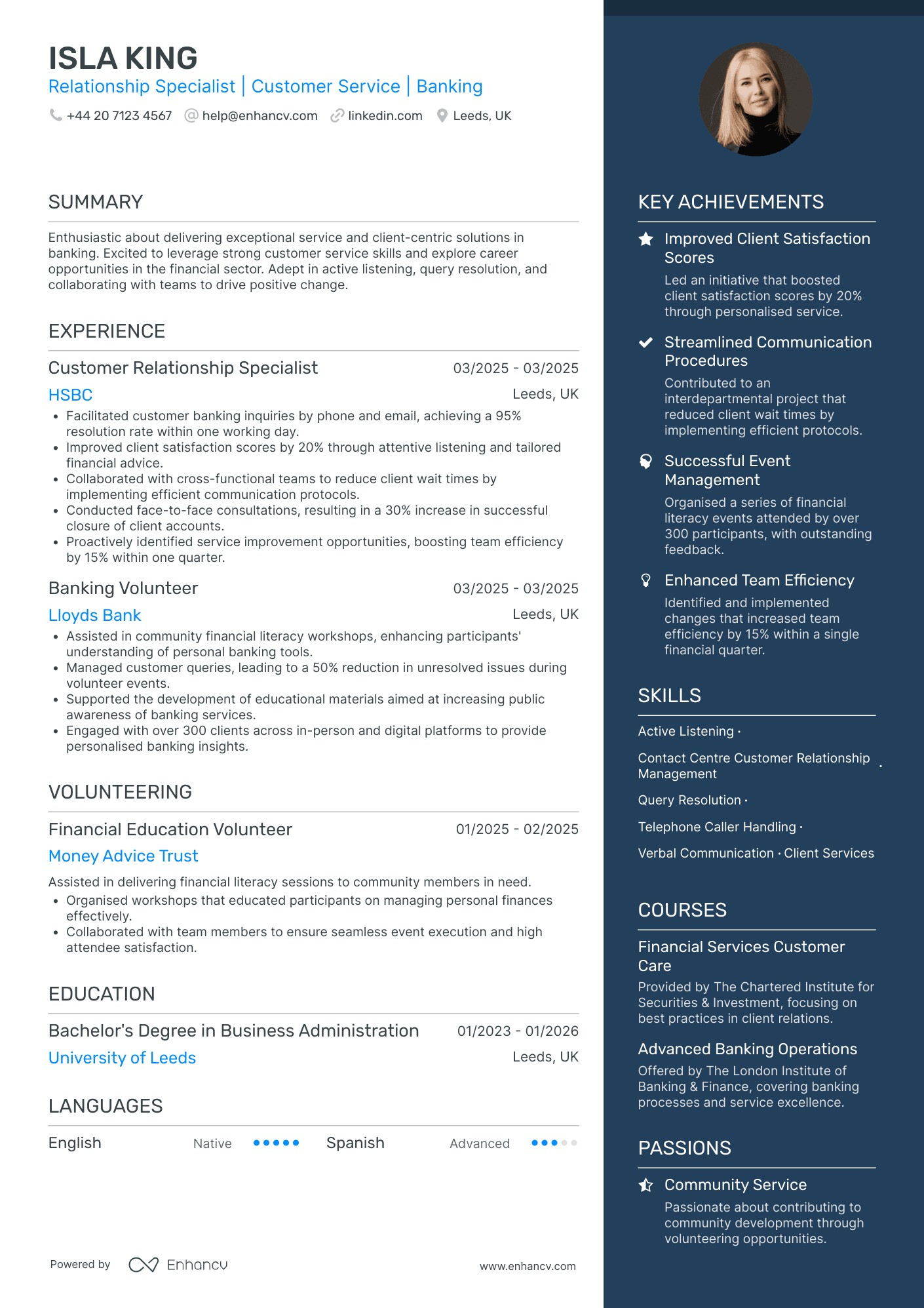

- Strong Emphasis on Customer-Centric Skills - The CV places a significant focus on client relations and customer service by illustrating specific skills like active listening, query resolution, and personalized client services. This clear emphasis on customer-centricity is crucial for roles in banking and finance, where customer satisfaction and retention are pivotal.

- Achievements Highlighted Through Quantifiable Success - The achievements section effectively uses quantifiable outcomes to highlight Isla's capabilities, such as a 95% resolution rate for inquiries and a 20% improvement in client satisfaction scores. These metrics provide concrete evidence of the candidate's impact, making the CV more compelling against business objectives.

- Variety in Experience Across Roles and Volunteering Activities - Isla's CV stands out by showcasing a diverse range of experiences that span professional roles and volunteer work. This diverse experience reflects adaptability and a proactive approach to skill development, emphasizing hands-on exposure through both formal positions and community engagement activities, adding depth to her profile.

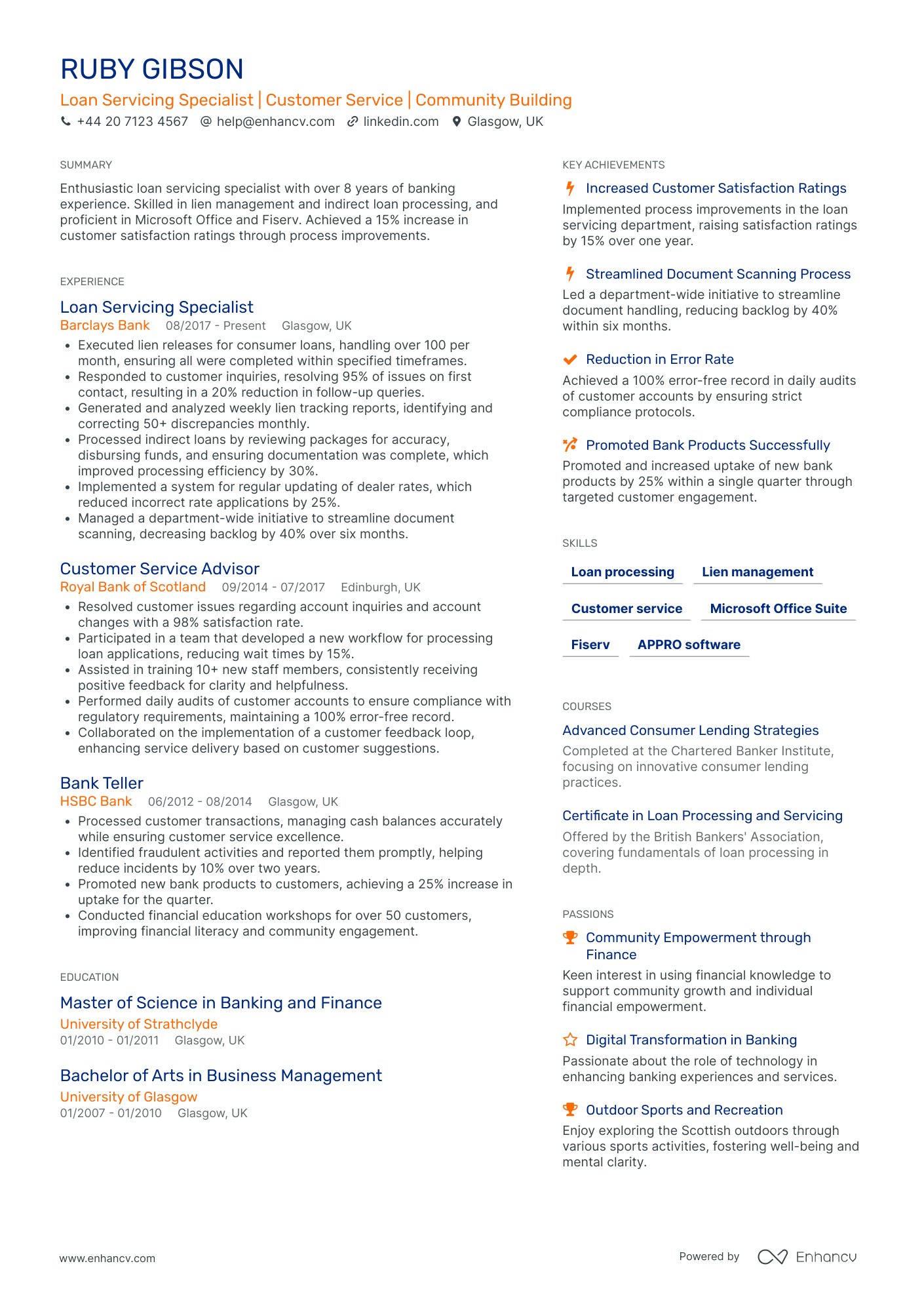

Personal Banker for Consumer Lending

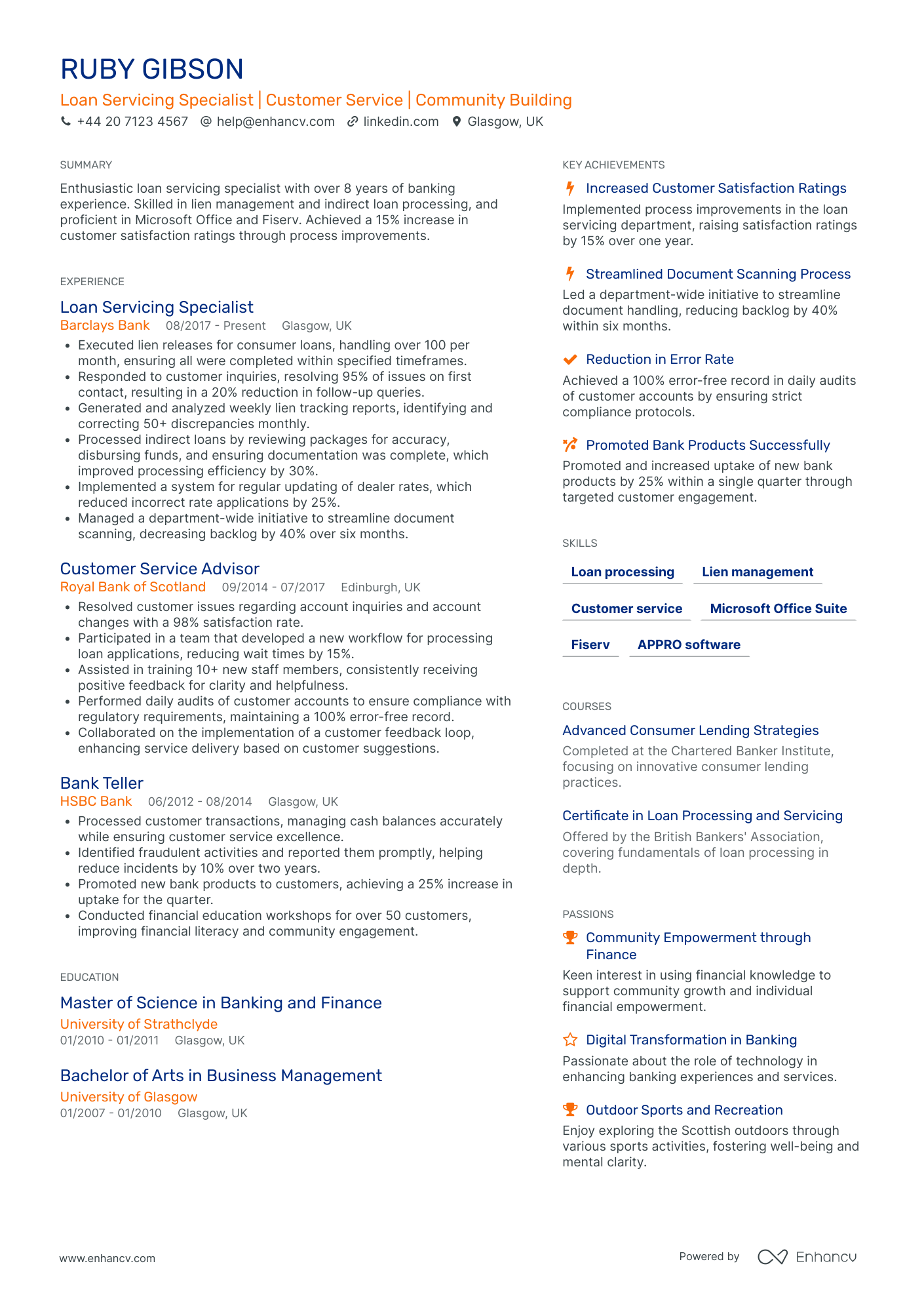

- Logical Career Progression - Ruby Gibson’s career trajectory demonstrates a clear growth path in the banking industry, advancing from a Bank Teller to a Loan Servicing Specialist. This progression highlights an increasing level of responsibility and expertise, suggesting a dedicated and upward-moving career in financial services.

- Use of Industry-Specific Tools and Technologies - The CV effectively showcases Ruby's proficiency with banking software such as Fiserv and APPRO, which are essential tools for loan processing and service efficiency. This technical depth is particularly relevant in demonstrating her capability to enhance process efficiencies in a financial setting.

- Strong Focus on Process Improvement and Efficiency - Ruby Gibson’s achievements reflect significant business impacts, such as a 15% increase in customer satisfaction and a 40% reduction in document scanning backlog. These outcomes not only demonstrate her problem-solving skills but also highlight her ability to implement effective process improvements that positively affect customer service and operational efficiency.

Personal Banker for Credit Card Services

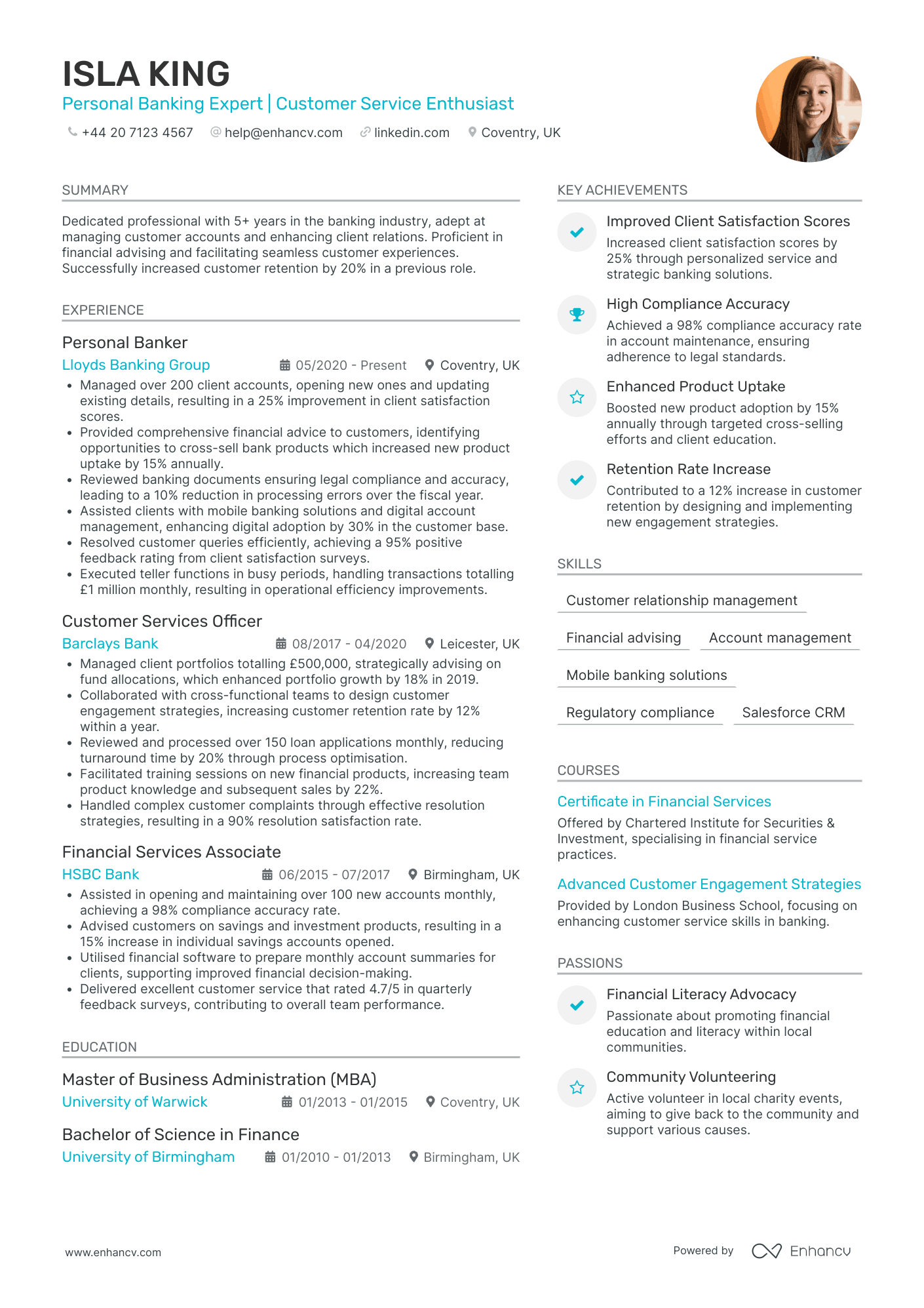

- Strategic career progression - Isla King’s CV presents a clear trajectory of growth within the banking industry, moving from a Financial Services Associate to a Personal Banker. Each role builds on previous experiences, showcasing a pathway of increasing responsibility and complexity, notably in managing and enhancing client relations.

- Emphasis on achievements with business impact - The CV highlights specific accomplishments, such as improving customer satisfaction scores by 25% and boosting product uptake by 15%. These metrics are not just numbers; they demonstrate a clear link to enhanced business outcomes, such as customer retention and sales enhancements.

- Comprehensive skills and adaptability - Isla King effectively showcases a diverse set of skills that include customer relationship management, financial advising, and regulatory compliance, all vital to the banking sector. Additionally, her adaptability is evident through her experience with cross-functional teams and digital banking solutions, indicating a readiness to embrace and lead through changes in banking technology.

Personal Banker for Treasury Services

- Clear and Structured Presentation - The CV presents information in a clear, structured manner, making it easy to follow the candidate’s career progression. The sections are organized logically, guiding the reader smoothly from the summary through experience, education, skills, and achievements, which enhances readability and comprehension.

- Progressive Career Trajectory - Sienna West's career showcases a clear upward trajectory from Financial Analyst to VP Treasury, indicating significant professional growth. This progression within notable institutions such as HSBC and Barclays highlights her capability to take on increased responsibilities and leadership roles within the finance sector.

- Innovative Financial Leadership - The CV highlights Sienna's expertise in asset-liability management and creating innovative financial strategies, such as the development of dashboards that improved financial reporting accuracy by over 30%. This demonstrates an ability to leverage technical tools for enhancing business operations, which is critical in financial leadership positions.

Personal Banker for Asset Management

- Strategic Career Growth and Promotions - Samuel Campbell's career demonstrates a clear upward trajectory within the asset management and financial services industry, progressing from an Associate Analyst at Deutsche Bank to a Vice President at Barclays Investment Bank. His promotions reflect a consistent increase in responsibility and the ability to lead complex M&A transactions successfully.

- Industry-Specific Expertise and Technical Tools - The CV highlights Samuel's proficiency in financial modeling, valuation techniques, and his extensive experience with M&A in the asset management sector. His use of advanced financial models and strategic integrations post-acquisition showcases his technical depth and ability to leverage industry-specific methodologies to drive growth and optimize operations.

- Impactful Achievements with Business Relevance - Samuel's accomplishments are not only quantitative but also demonstrate significant business impact, such as reducing operational costs post-acquisition by 15%, increasing division revenue by 12% annually, and closing high-profile cross-border transactions valued at over £2.5 billion. These achievements illustrate his capability to add substantial value to the organizations he works for.

Personal Banker for Trade Finance

- Logical and Structured Content Presentation - The CV is well-organized, detailing the candidate's experience, education, skills, and achievements in a clear and concise manner. This systematic approach ensures that the reader can easily follow Amelia Murphy's career progression and understand her capabilities without any ambiguity.

- Robust Career Growth and Leadership - Amelia's career trajectory reflects consistent growth and leadership in the finance industry. Moving from a Trade Finance Officer to Vice President, she has continually taken on more significant roles, showcasing her ability to lead teams and manage large-scale financial operations effectively.

- Strategic Achievements with Quantifiable Impact - The CV highlights impressive achievements, such as a 30% increase in revenue and a 40% boost in transaction speed. These accomplishments underscore her capacity to drive strategic outcomes that significantly enhance business performance, demonstrating her value to any prospective employer.

Personal Banker for Capital Markets

- Effective Content Presentation - The CV is structured clearly and concisely, utilizing bullet points and sections that enhance readability. Each segment is well-defined, from experience to education, allowing the reader to easily identify Freya's key qualifications and achievements without being bogged down by excessive detail.

- Career Trajectory and Growth - Freya's career demonstrates a significant upward trajectory from a Capital Markets Analyst at Barclays to the Director of Capital Markets at LendingTree. This growth reflects her expanding expertise and leadership capabilities within the industry, highlighting her ability to ascend to roles with greater responsibility and strategic impact.

- Industry-Specific Expertise in AI and Innovative Solutions - The CV stands out by emphasizing Freya's proficiency in AI-driven lending models and fintech strategies. Her focus on integrating technology into financial services not only showcases technical depth but also positions her as a forward-thinking leader in the finance sector, aligning with the industry's push towards digital transformation.

Formatting your personal banker CV to meet the role expectations

Staring at the blank page for hours on end, you still have no idea how you should start your professional personal banker CV. Should you include more colours, two columns, and which sections? What you should remember about your CV format is this - ensure it's minimalistic and doesn't go over the top with fancy fonts and many colours. Instead, focus on writing consistent content that actually answers the job requirements. But, how about the design itself :

- Use the reverse chronological order to showcase your experience, starting with your most recent role;

- Include your contact details (email address, phone number, and location) - and potentially your professional photo - in the header;

- Must-have CV sections include summary or objective, experience, education, and skills: curate the ones that fit your profile;

- Your professional personal banker CV should be between one-to-two pages long: select the longer format if you have more experience.

A little bit more about your actual CV design, ensure you're using:

- plenty of serif or sans serif font (e.g. Montserrat, Exo 2, Volkhov) as they are Applicant Tracker System (ATS) compliant. Avoid the likes of Arial and Times New Roman because most candidates' CVs are in this typography.

When submitting your CV, are you still not sure what format it should be? Despite the myth that has been circling around, most modern ATS systems are perfectly capable of reading PDFs. This format is an excellent choice as it keeps all of your information intact.

PRO TIP

Use font size and style strategically to create a visual hierarchy, drawing the reader's eye to the most important information first (like your name and most recent job title).

The top sections on a personal banker CV

- Personal profile states your banking experience, showcasing ability to build customer relationships and manage accounts effectively.

- Key achievements highlight significant milestones or results, proving your success in previous finance roles.

- Professional experience lists your past roles with focus on financial advisory, sales, and client service responsibilities.

- Educational background includes banking or finance-related qualifications, demonstrating industry knowledge and expertise.

- Relevant skills showcase competencies in financial products, IT systems, and client management, vital for a personal banker.

What recruiters value on your CV:

- Highlight your financial literacy by detailing your understanding of banking products and services, showing that you have the essential knowledge needed to advise customers effectively.

- Emphasise your sales skills, providing examples of how you've met or exceeded targets in previous roles, as personal bankers often have goals related to selling financial products.

- Demonstrate your relationship-building capabilities by mentioning customer retention rates or positive feedback, showcasing your talent in cementing client trust and loyalty.

- Showcase your problem-solving skills by describing scenarios where you've helped clients navigate financial difficulties or make sound investment decisions, reflecting your ability to manage complex client needs.

- Include any relevant certifications like Chartered Banker or similar qualifications, signifying your commitment to professional development and adherence to industry standards.

Recommended reads:

How to present your contact details and job keywords in your personal banker CV header

Located at the top of your personal banker CV, the header presents recruiters with your key personal information, headline, and professional photo. When creating your CV header, include your:

- Contact details - avoid listing your work email or telephone number and, also, email addresses that sound unprofessional (e.g. koolKittyCat$3@gmail.com is definitely a big no);

- Headline - it should be relevant, concise, and specific to the role you're applying for, integrating keywords and action verbs;

- Photo - instead of including a photograph from your family reunion, select one that shows you in a more professional light. It's also good to note that in some countries (e.g. the UK and US), it's best to avoid photos on your CV as they may serve as bias.

What do other industry professionals include in their CV header? Make sure to check out the next bit of your guide to see real-life examples:

Examples of good CV headlines for personal banker:

- Personal Banker | Expert in Wealth Management | Certified Financial Planner | 8+ Years of Experience

- Senior Personal Banker | Mortgage Solutions Specialist | Delivering Customer Excellence | 10-Year Track Record

- Personal Banking Advisor | Investment Portfolio Strategist | Engaging Retail Banking Professional | 5 Years Experience

- Client Relationship Manager | Retail Banking & Savings Expert | CIFD Accredited | 12 Years Dedicated Service

- Financial Services Consultant | Personal Banking & Lending | Anti-Money Laundering Authority | 7+ Years Expertise

- Junior Personal Banker | Aspiring Wealth Advisor | Focused on Customer Success | Chartered Banker In-Training

Your personal banker CV introduction: selecting between a summary and an objective

personal banker candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you personal banker CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a personal banker job:

- Seasoned personal banker with over 7 years of experience administering financial services to a diverse portfolio, successfully managing assets worth £5 million. Demonstrated expertise in investment strategies, adept in risk assessment, with a proven record of enhancing client satisfaction and retention through customised financial planning.

- Dynamic professional with 10 years in the retail sector, eager to transfer a wealth of customer service experience into the personal banking industry. Commended for exceptional sales performance and client relationship building, bringing strategic financial product knowledge to forge robust client partnerships in banking.

- Accomplished educator looking to apply 8 years of communication and analytical skills to personal banking, driven by the ambition to facilitate clients’ financial growth. Excelled in developing and implementing educational programmes, primed to translate these skills into crafting tailored financial advice for banking clientele.

- Former healthcare manager transitioning into personal banking, bringing forth strong organisational abilities and a detail-oriented approach from 12 years of experience managing patient care services. Adept at financial administration and eager to leverage these competencies to empower clients in achieving their financial objectives.

- As a recent finance graduate, my objective is to utilise my theoretical knowledge of banking and finance, coupled with my interning experience at a local branch, to support clients in their financial journeys while fostering a robust understanding of market dynamics and customer service excellence.

- Aiming to integrate a passion for numbers and people-centric service as an entrant in personal banking. With a degree in business administration and hands-on experience through academic projects, I am highly motivated to develop practical skills and contribute to client financial success.

The best formula for your personal banker CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Developed a comprehensive understanding of the bank's financial products and services to offer personalised solutions, resulting in a 20% uptick in client portfolio growth.

- Managed personal client portfolios with high attention to detail, ensuring financial advice and services were in line with individual client's goals and risk tolerance.

- Utilised CRM software to track client interactions and transactions, leading to an improvement in customer service and a 15% increase in client retention rates.

- Collaborated effectively with the credit team to facilitate the approval process for loans and lines of credit, accelerating turnaround time by 25%.

- Continuously met and exceeded quarterly sales targets by at least 10% through strategic planning and a customer-centric approach to banking solutions.

- Implemented financial workshops for clients on topics such as investment strategies, retirement planning, and debt management, enhancing client financial literacy.

- Regularly reviewed and adhered to all financial regulations and policies, ensuring full compliance and zero infractions during routine audits.

- Provided exceptional customer service, consistently receiving positive feedback in client surveys, with a 95% satisfaction rate.

- Pioneered a referral initiative with the wealth management department, generating a 30% increase in cross-selling opportunities.

- Managed a portfolio of 200+ high-net-worth clients, consistently achieving a 95% satisfaction rating through personalised financial guidance and prudent investment advice.

- Successfully oversaw £25m in client assets, implementing strategies that generated an average return of 8% year-over-year.

- Led a cross-functional team on the 'Future Investments Initiative', a project intended to inform and guide clients towards sustainable and ethical investment, resulting in a 20% uptake in such products.

- Introduced and promoted digital banking services to over 1,000 customers, significantly enhancing client engagement and reducing in-branch traffic by 30%.

- Developed and executed financial plans for clients, directly contributing to a 40% increase in investment portfolio sign-ups within my first year.

- Conducted regular financial seminars and workshops for clients, focusing on retirement planning and wealth management, contributing to a 25% uplift in client knowledge and empowerment.

- Single-handedly revitalised a client book that had been stagnant for two years, resulting in a 15% increase in revenue through strategic relationship management.

- Implemented a risk assessment protocol for reviewing personal loan applications, leading to a 10% reduction in defaults.

- Orchestrated the branch’s end-to-end mortgage offering, directly facilitating over £50m in approved mortgage loans.

- Instrumental in driving the branch's customer acquisition strategy, signing up an average of 50 new accounts per month.

- Enhanced branch performance through the introduction of a targeted customer service training programme, which raised the customer service index by 12 points.

- Negotiated with third-party financial service providers to broaden our product suite, bringing in two new insurance products that increased overall sales by 18%.

- Consistently exceeded quarterly sales targets by 20% through effective client needs analysis and tailored financial solution offerings.

- Played a pivotal role in migrating branch operations to a new banking platform, which streamlined client transactions and reduced processing time by 25%.

- Facilitated financial literacy workshops for over 500 individuals, increasing the community's awareness of personal finance management.

- Spearheaded the development of an innovative credit assessment tool, improving loan qualification efficiency by 35%.

- Collaborated with the marketing department to create a groundbreaking rewards program, attracting 5,000+ new clients to the bank.

- Managed large-scale corporate client transactions, averaging £10m monthly while maintaining regulatory compliance and mitigating risk.

- Designed and implemented a comprehensive wealth management plan, which attracted investments totalling upwards of £30m.

- Monitored and adjusted investments to align with market changes, protecting clients' portfolios during volatile periods and ensuring consistent growth.

- Collaborated closely with high-profile clients to facilitate customised loan solutions, resulting in a 20% growth in loan portfolio.

- Led a team of personal bankers, driving branch performance to top regional sales charts for three consecutive years.

- Innovated a client onboarding process that reduced time-to-first-deposit by 50%, significantly improving client satisfaction and retention.

- Strategically expanded the branch's foreign exchange service offerings, capturing a new market segment and boosting related revenue by 30%.

How to ensure your personal banker CV stands out when you have no experience

This part of our step-by-step guide will help you substitute your experience section by helping you spotlight your skill set. First off, your ability to land your first job will depend on the time you take to assess precisely how you match the job requirements. Whether that's via your relevant education and courses, skill set, or any potential extracurricular activities. Next:

- Systematise your CV so that it spotlights your most relevant experience (whether that's your education or volunteer work) towards the top;

- Focus recruiters' attention to your transferrable skill set and in particular how your personality would be the perfect fit for the role;

- Consider how your current background has helped you build your technological understanding - whether you've created projects in your free time or as part of your uni degree;

- Ensure you've expanded on your teamwork capabilities with any relevant internships, part-time roles, or projects you've participated in the past.

Recommended reads:

PRO TIP

Describe how each job helped you grow or learn something new, showing a continuous development path in your career.

Mix and match hard and soft skills across your personal banker CV

Your skill set play an equally valid role as your experience to your application. That is because recruiters are looking for both:

- hard skills or your aptitude in applying particular technologies

- soft skills or your ability to work in a team using your personal skills, e.g. leadership, time management, etc.

Are you wondering how you should include both hard and soft skills across your personal banker CV? Use the:

- skills section to list between ten and twelve technologies that are part of the job requirement (and that you're capable to use);

- strengths and achievements section to detail how you've used particular hard and soft skills that led to great results for you at work;

- summary or objective to spotlight up to three skills that are crucial for the role and how they've helped you optimise your work processes.

One final note - when writing about the skills you have, make sure to match them exactly as they are written in the job ad. Take this precautionary measure to ensure your CV passes the Applicant Tracker System (ATS) assessment.

Top skills for your personal banker CV:

Financial Analysis

Credit Analysis

Customer Service

Financial Planning

Regulatory Compliance

Risk Management

Banking Software Proficiency

Loan Processing

Investment Advisory

Sales Techniques

Communication

Problem-Solving

Attention to Detail

Relationship Building

Time Management

Empathy

Adaptability

Teamwork

Negotiation

Customer Orientation

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Listing your university education and certificates on your personal banker CV

The best proof of your technical capabilities would be your education and certifications sections. Your education should list all of your relevant university degrees, followed up by their start and completion dates. Make sure to also include the name of the university/-ies you graduated from. If you happen to have less professional experience (or you deem it would be impressive and relevant to your application), spotlight in the education section:

- that you were awarded a "First" degree;

- industry-specific coursework and projects;

- extracurricular clubs, societies, and activities.

When selecting your certificates, first ask yourself how applicable they'd be to the role. Ater your initial assessment, write the certificate and institution name. Don't miss out on including the completion date. In the below panel, we've curated relevant examples of industry-leading certificates.

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Recommended reads:

Key takeaways

Your successful job application depends on how you well you have aligned your personal banker CV to the job description and portrayed your best skills and traits. Make sure to:

- Select your CV format, so that it ensures your experience is easy to read and understand;

- Include your professional contact details and a link to your portfolio, so that recruiters can easily get in touch with you and preview your work;

- Write a CV summary if you happen to have more relevant professional experience. Meanwhile, use the objective to showcase your career dreams and ambitions;

- In your CV experience section bullets, back up your individual skills and responsibilities with tangible achievements;

- Have a healthy balance between hard and soft skills to answer the job requirements and hint at your unique professional value.