Crafting a financial accounting resume often entails effectively showcasing your technical skills and attention to detail amidst a sea of competing candidates. Our guide provides tailored strategies to help you articulate your unique expertise and qualifications, ensuring you stand out to prospective employers.

- Aligning the top one-third of your financial accounting resume with the role you're applying for.

- Curating your specific financial accounting experience to get the attention of recruiters.

- How to list your relevant education to impress hiring managers recruiting for the financial accounting role.

Discover more financial accounting professional examples to help you write a job-winning resume.

- Portfolio Manager Resume Example

- Accounting Supervisor Resume Example

- Treasury Manager Resume Example

- Finance Associate Resume Example

- Actuary Resume Example

- Construction Accounting Resume Example

- Financial Reporting Analyst Resume Example

- Purchase Accounting Resume Example

- Financial Planning Analyst Resume Example

- Private Equity Resume Example

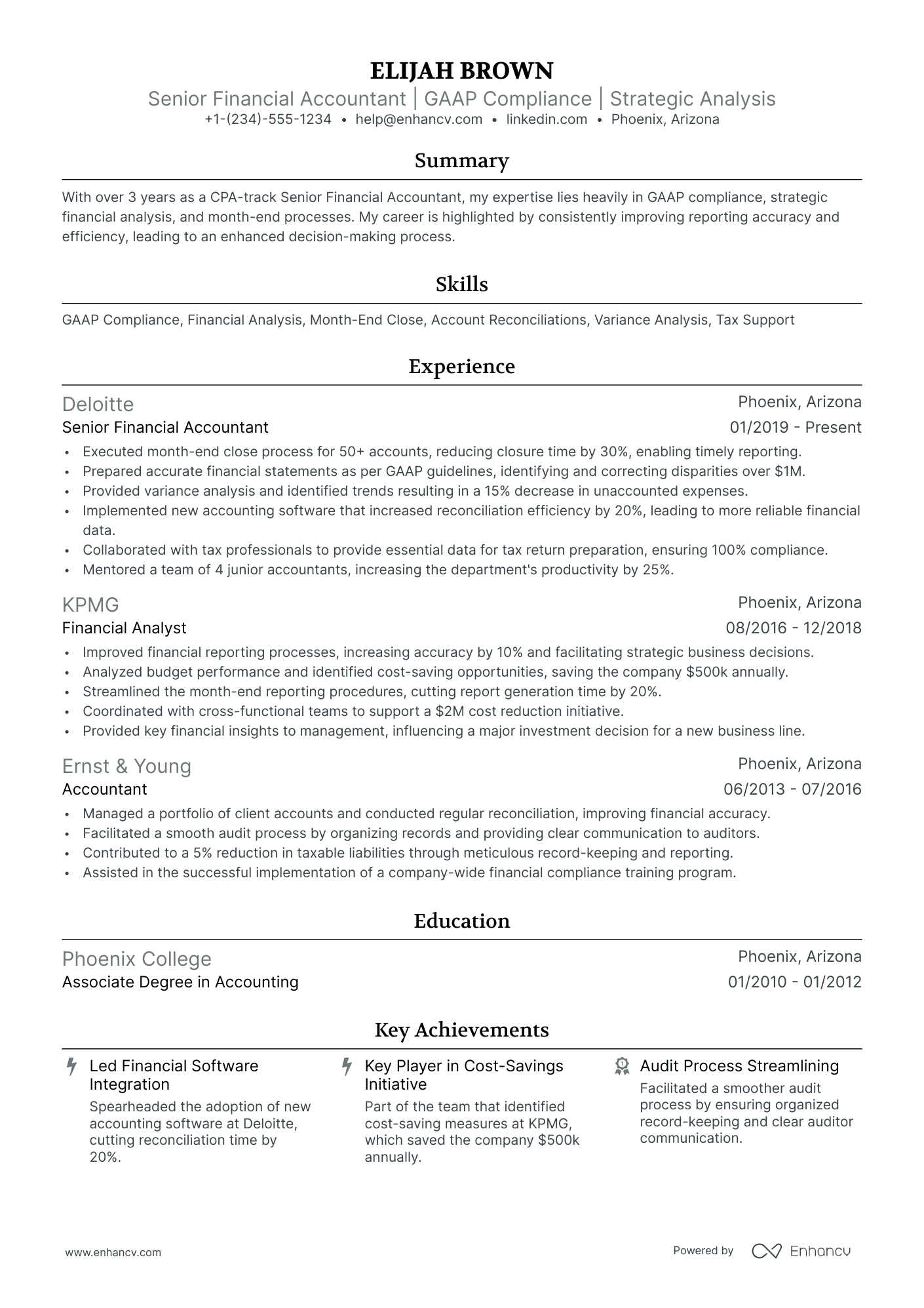

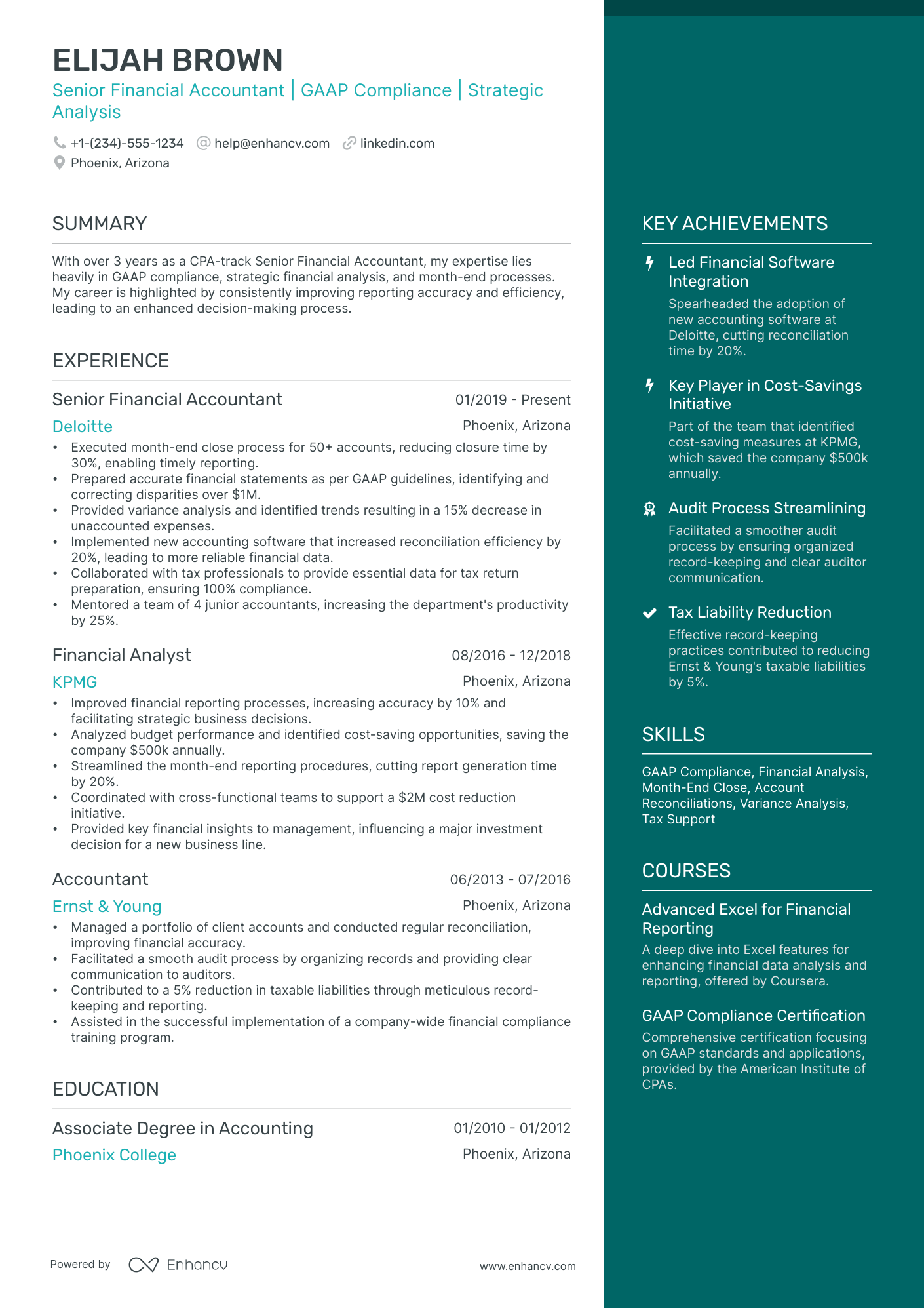

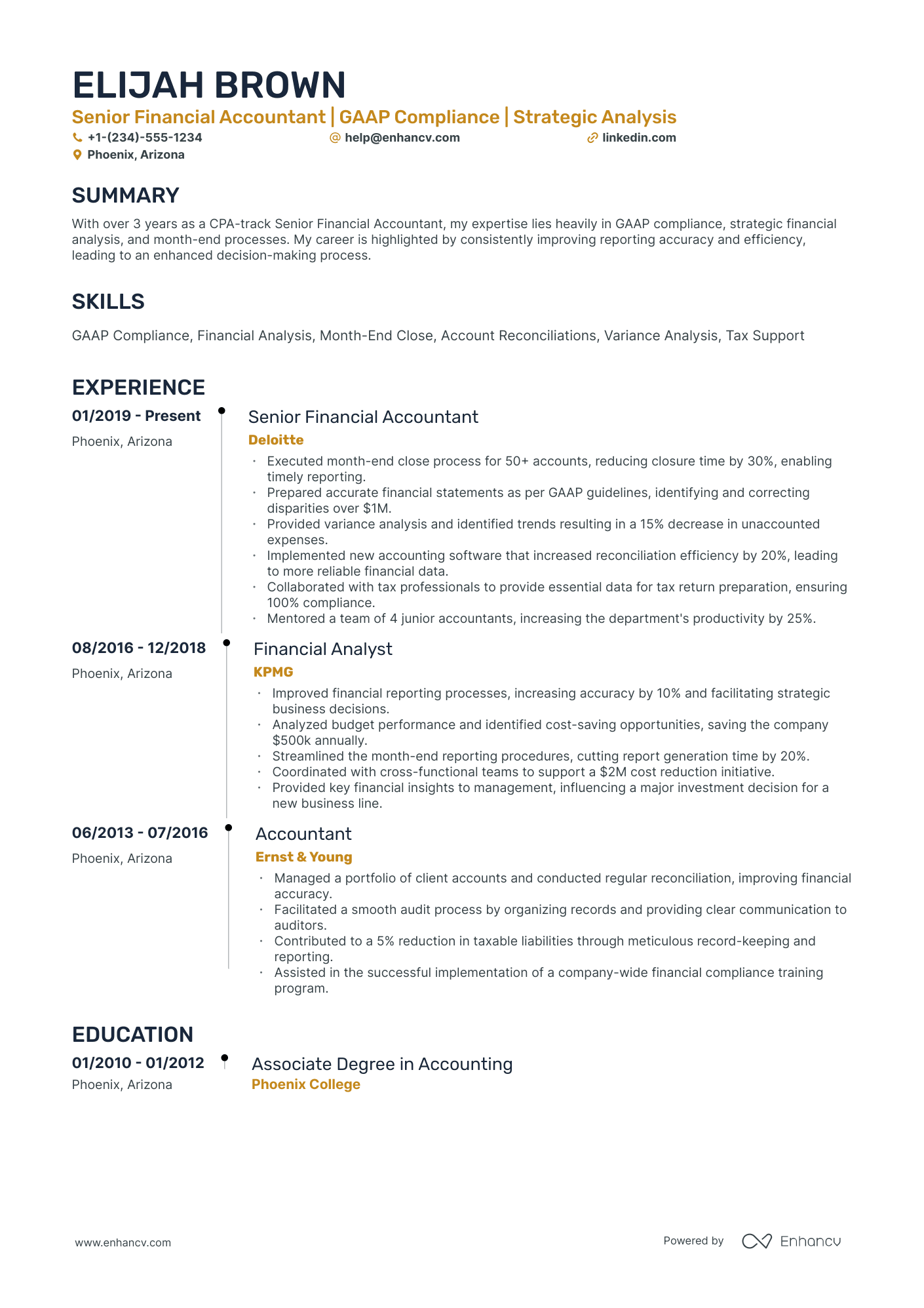

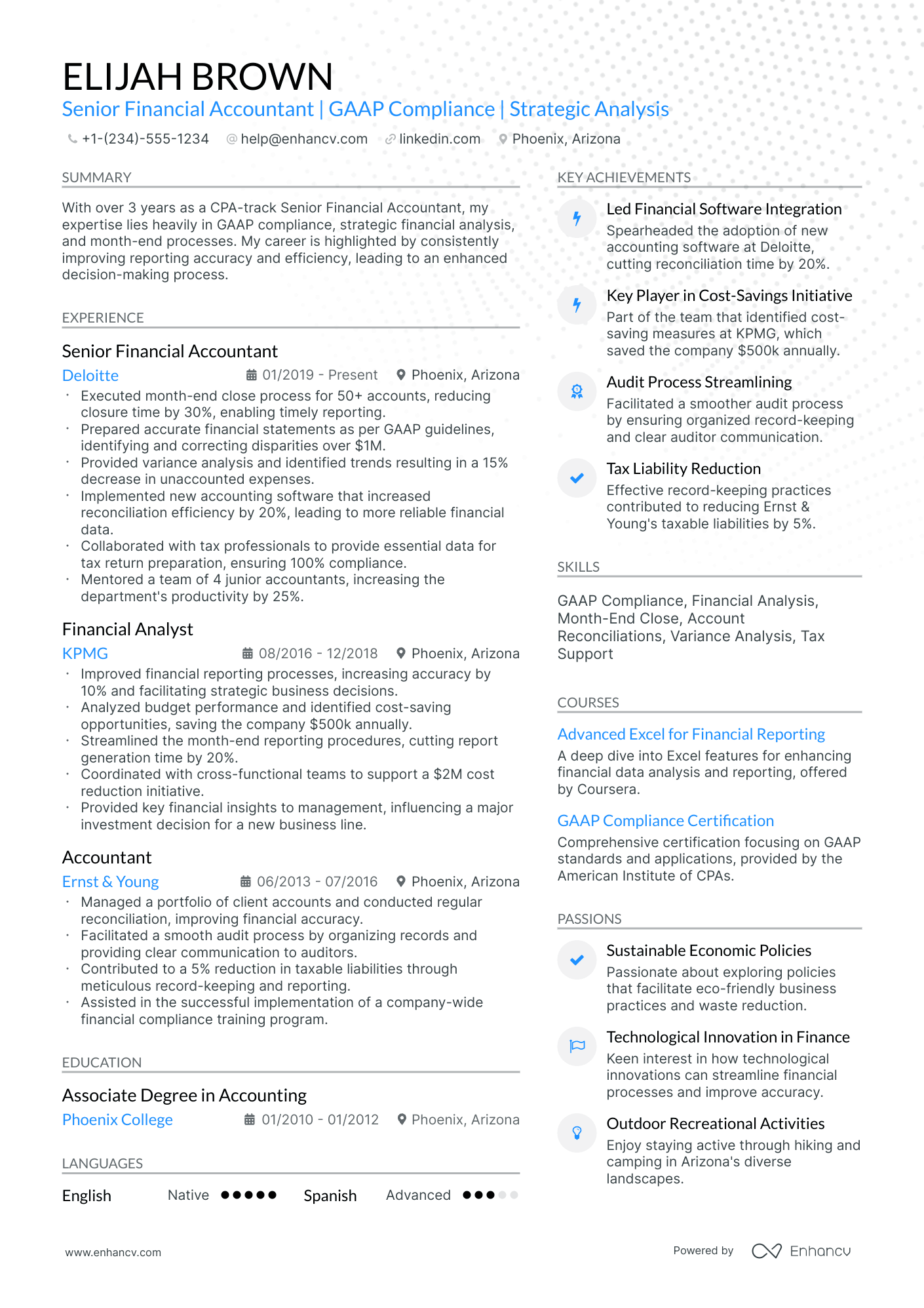

Professional financial accounting resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

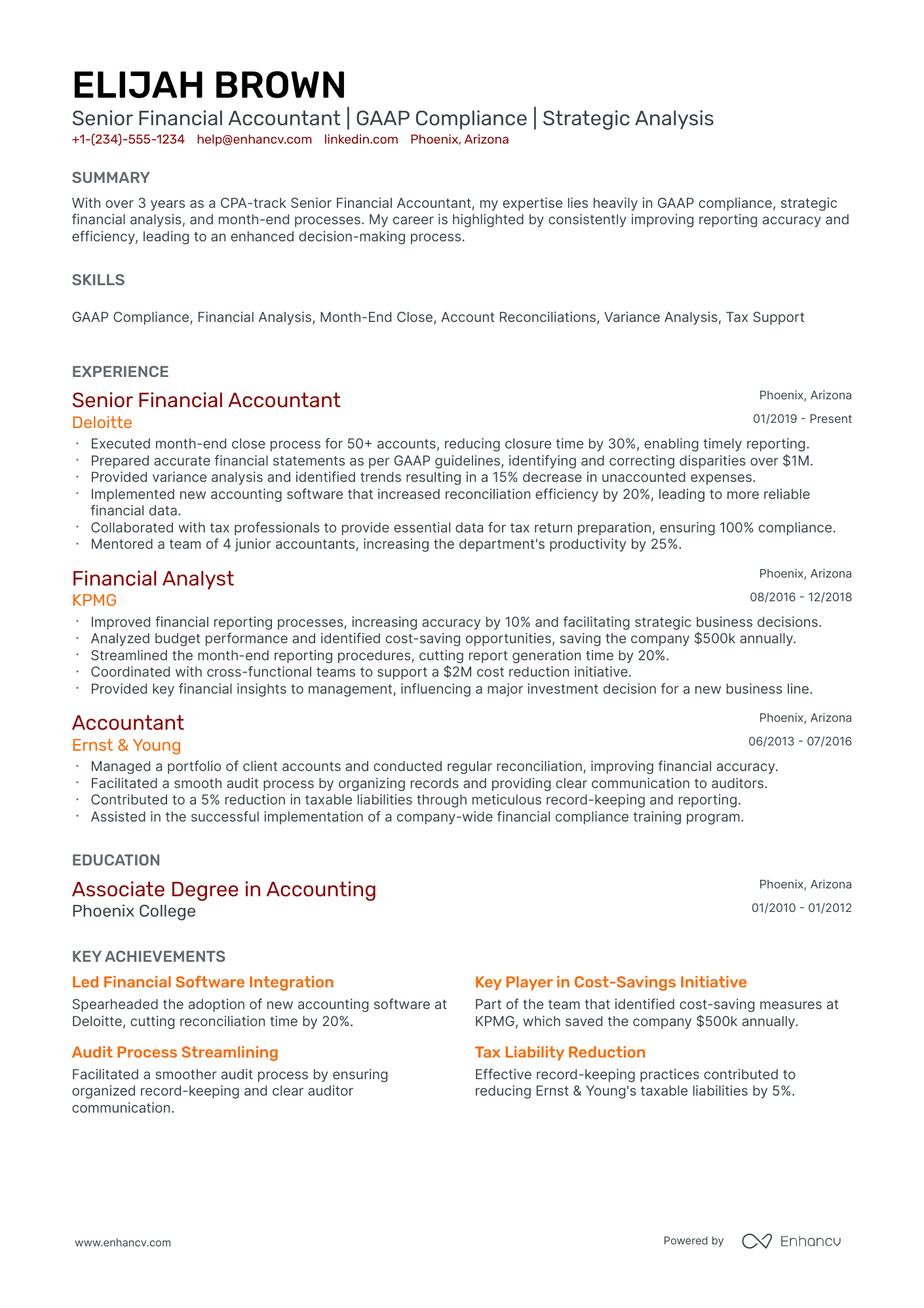

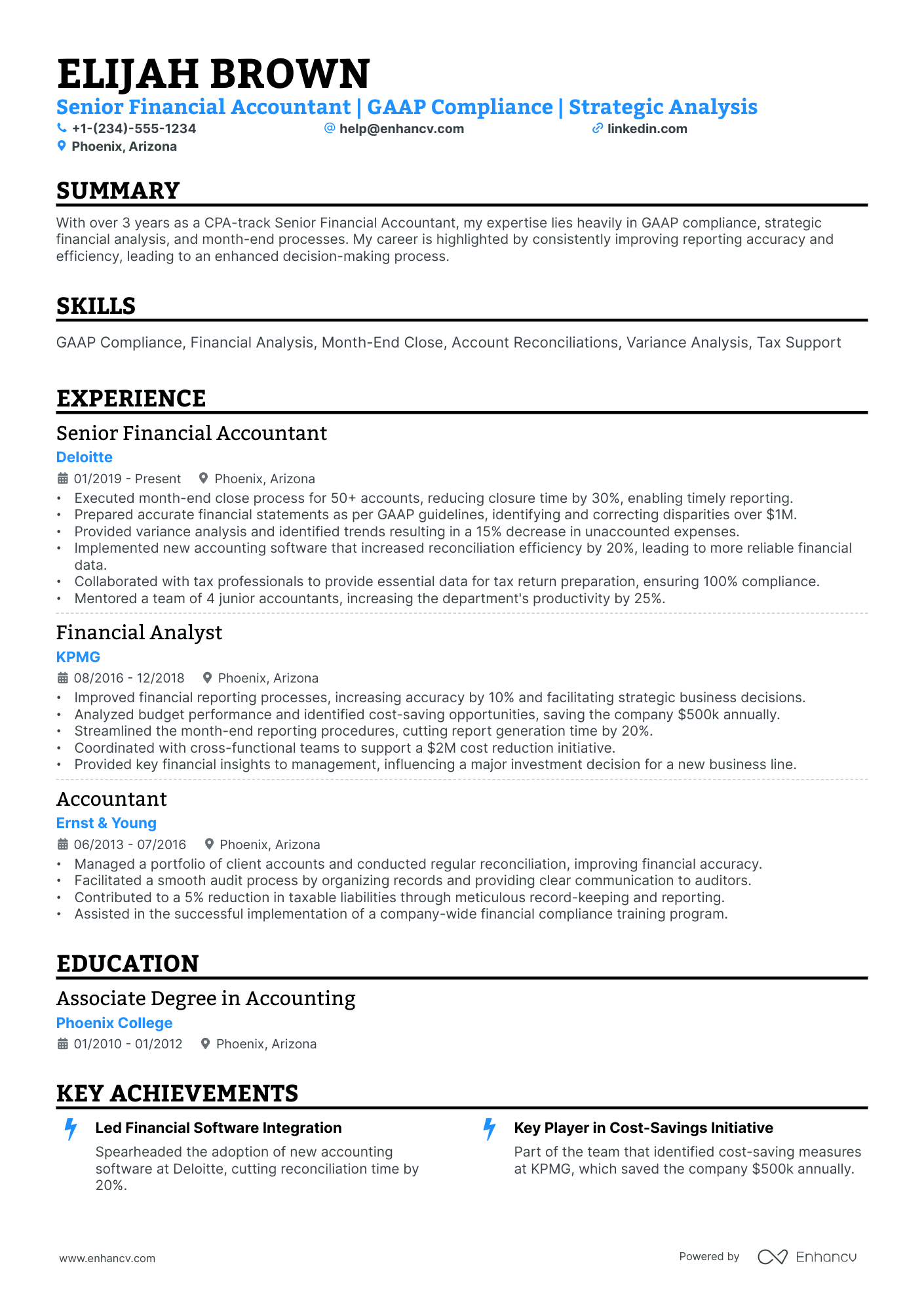

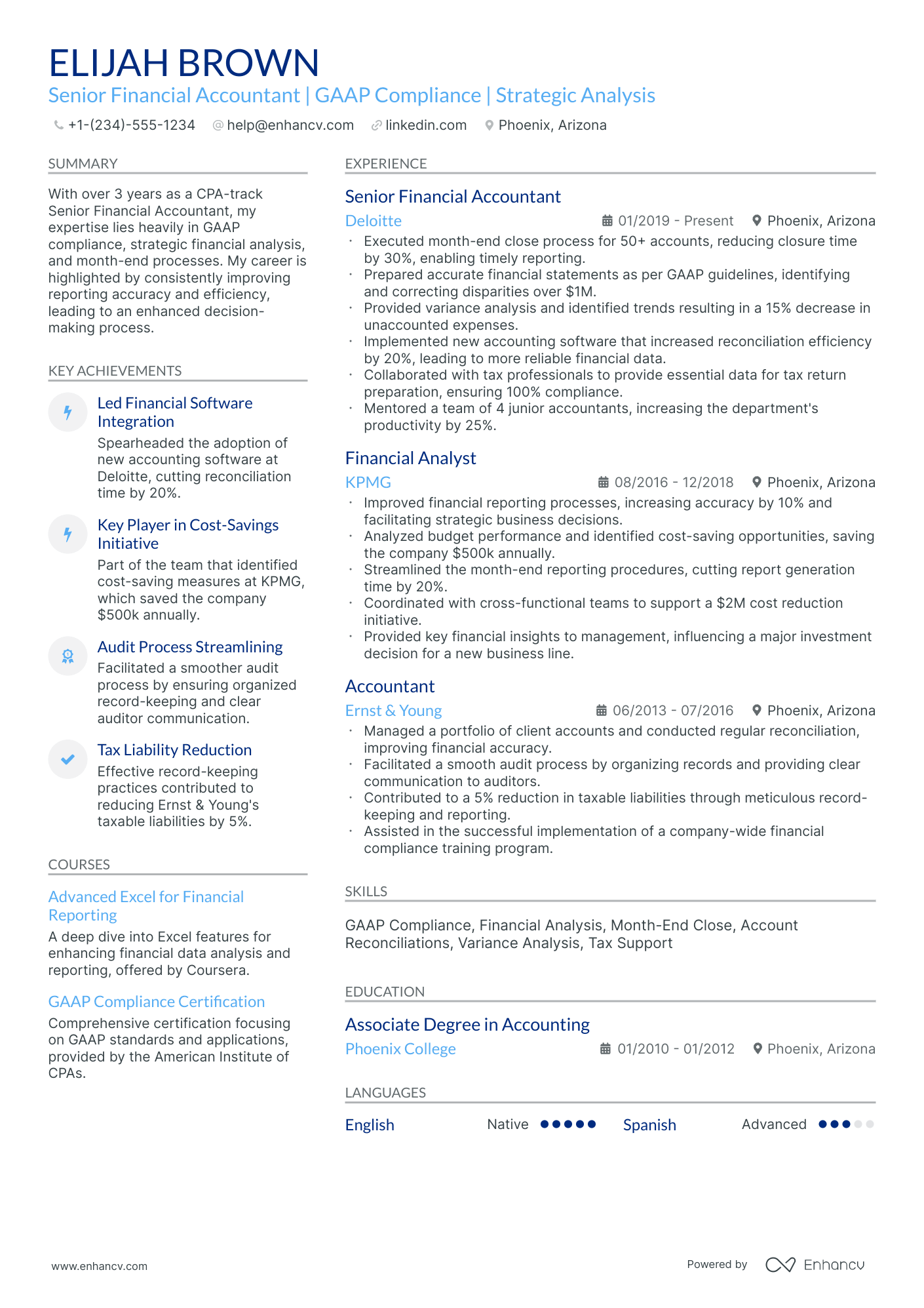

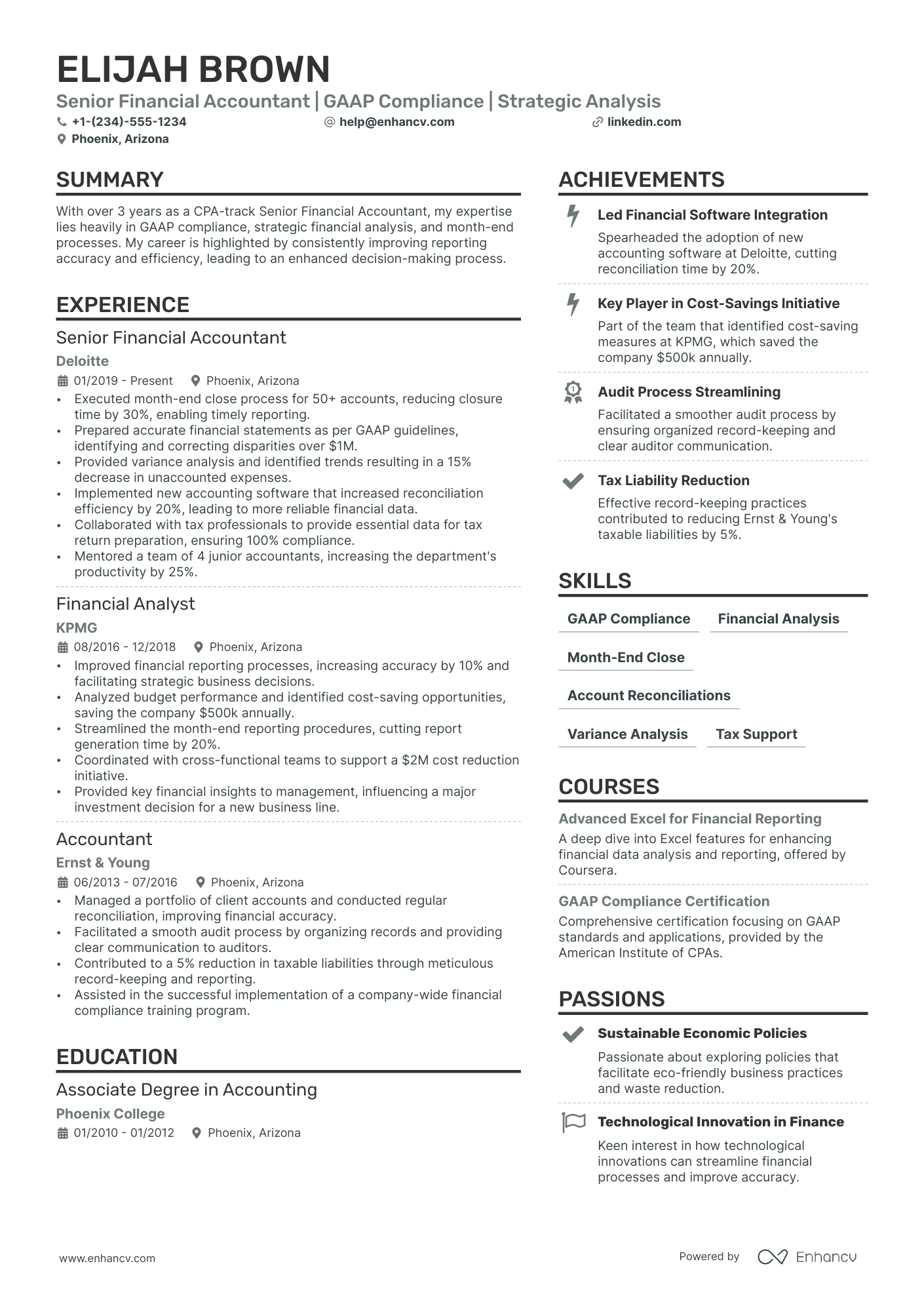

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Customize your resume for the market – a Canadian format, for example, might vary in structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

Ensure your financial accounting resume stands out with these mandatory sections:

- Header - the section recruiters look to find your contact details, portfolio, and potentially, your current role

- Summary or objective - where your achievements could meet your career goals

- Experience - showcasing you have the technical (and personal) know-how for the role

- Skills - further highlighting capabilities that matter most to the financial accounting advert and your application

- Certifications/Education - staying up-to-date with industry trends

What recruiters want to see on your resume:

- Proficiency in accounting software (e.g., QuickBooks, SAP, Oracle Financials).

- Understanding of financial regulations and standards (e.g., GAAP, IFRS).

- Demonstrated experience with financial reporting, reconciliation, and analysis.

- Detail-oriented with a strong emphasis on accuracy and consistency in financial data.

- Experience with month-end and year-end closing processes.

Advice for your financial accounting resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

Take a look at how real-life financial accounting professionals have presented their resume experience section - always aiming to demonstrate their success.

- Managed a team of 6 accountants, ensuring accurate financial reporting compliant with GAAP, which improved report accuracy by 25%.

- Led the quarterly and annual closing process for a Fortune 500 company, reducing close cycle time by 15%.

- Directed the implementation of a new ERP system that streamlined accounting processes and improved financial data accessibility for cross-departmental teams.

- Executed detailed financial analysis for project investments totaling over $10M, identifying cost savings of 12% while optimizing resource allocation.

- Prepared complex consolidated financial statements for international subsidiaries, enhancing the transparency and understanding of overseas operations.

- Collaborated with internal audit teams to facilitate annual audits, reducing discrepancies and strengthening internal controls.

- Coordinated the successful migration of financial data to a cloud-based accounting system, improving data security and reducing costs by 18%.

- Administered budget forecasting activities, assisting in the management of a $5M departmental budget with a variance of less than 2%.

- Conducted financial statement analysis and presented findings to management, influencing strategic planning and decision-making processes.

- Oversaw the processing of accounts payable and receivable cycles, achieving an error rate of less than 1% and improving cash flow management.

- Reduced month-end closing time from 10 days to 6 days through the optimization of accounting procedures and staff training.

- Participated in the successful negotiation of supplier payment terms, which extended cash liquidity by 20 days on average.

- Managed the inter-company transactions and reconciliations for over 15 international entities, ensuring accuracy and compliance with foreign exchange regulations.

- Successfully automated key financial reporting tasks, which saved 200 man-hours annually and reduced reporting errors.

- Facilitated a 10% reduction in outstanding accounts receivable through the development and implementation of a stricter credit control system.

- Initiated a cost-saving initiative that identified redundant expenses resulting in annual savings of $300,000.

- Prepared and analyzed monthly financial performance reports, identifying key trends that informed management's decision-making process.

- Served as a key member of the team that integrated the accounts of a newly acquired subsidiary, ensuring a smooth transition and continuity of financial reporting.

- Performed in-depth financial audits for internal departments, unveiling inefficiencies that were corrected to prevent revenue leakage of approximately 5% per annum.

- Managed external audit processes, coordinating with auditors to provide necessary documentation and explanations, leading to zero audit adjustments.

- Created comprehensive financial models that forecasted company growth scenarios, providing strategic insights for long-term planning.

- Designed and executed a successful training program for new accounting software that increased department productivity by 30%.

- Collaborated with IT to develop a custom financial dashboard, which allowed for real-time monitoring of operational costs.

- Negotiated terms with accounting software vendors, resulting in a cost reduction of 20% while obtaining enhanced features for the finance team.

Quantifying impact on your resume

- Include the total amount of assets you managed and how effectively you allocated them.

- List any cost reductions you achieved through improved financial strategies or negotiations.

- Detail the percentage growth in revenue year-over-year for which you were responsible.

- State the number of audit or compliance projects you led and their impact on company finances.

- Mention specific budgets you have managed, emphasizing your proficiency with large figures.

- Showcase how many financial reports you've compiled and the complexities involved.

- Quantify improvements in financial accuracy or the reduction of errors during your tenure.

- Illustrate the scale of financial databases or systems you have implemented or improved.

Action verbs for your financial accounting resume

No experience, no problem: writing your financial accounting resume

You're quite set on the financial accounting role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

The right balance between hard skills and soft skills for your financial accounting resume

Wondering what the perfect financial accounting resume looks like? The candidate's profile meets job requirements by balancing both hard skills and soft skills across their resume.

- Hard skills are all the technologies you're apt at using . Prove you have the right technical background by listing key industry hardware/software in your financial accounting resume skills section and noteworthy certifications.

- Soft skills are both your personal, mindset, communication, analytical, and problem-solving talents . Use your financial accounting resume achievements section to show how you've used a particular soft skill to reach a tangible outcome.

When writing about your unique skill set, always make sure to refer back to the job advert to see what are the key requirements. This ensures you've tailored your resume so that it matches closer to what the ideal candidate profile is.

Top skills for your financial accounting resume:

GAAP

IFRS

QuickBooks

SAP

Oracle Financial Services

Excel

Financial Reporting Software

Tax Preparation Software

Accounting Information Systems

Data Analysis Tools

Attention to Detail

Analytical Thinking

Problem Solving

Time Management

Communication

Team Collaboration

Adaptability

Critical Thinking

Organizational Skills

Ethical Judgment

PRO TIP

If you happen to have some basic certificates, don't invest too much of your financial accounting resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Discover the perfect certification and education to list on your financial accounting resume

Value the insights your resume education section offers. It can shed light on various proficiencies and experiences tailored for the job.

- Add only college or university degrees, stating the institution and duration.

- If you're nearing the end of your degree, note your graduation date.

- Weigh the pros and cons of including unrelated degrees - it might not be your best choice with so little space on your resume.

- Talk about your educational achievements if they amplify your relevant experience.

There are so many certificates you can list on your resume.

Just which ones should make the cut?

- List your prominent higher education degree in a separate box, alongside the name of the institute you've obtained it from and your graduation dates

- Curate only relevant certificates that support your expertise, hard skills, and soft skills

- Certificates that are more niche (and rare) within the industry could be listed closer to the top. Also, this space could be dedicated to more recent certifications you've attained

- Add a description to your certificates or education, only if you deem this could further enhance your chances of showcasing your unique skill set

When listing your certificates, remember that it isn't a case of "the more, the merrier", but rather "the more applicable they are to the industry, the better".

Recruiters have hinted that these are some of the most in-demand certificates for financial accounting roles across the industry:

The top 5 certifications for your financial accounting resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Certified Management Accountant (CMA) - Institute of Management Accountants (IMA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Internal Auditor (CIA) - Institute of Internal Auditors (IIA)

- Chartered Accountant (CA) - Various global chartered accountancy bodies such as Institute of Chartered Accountants in England and Wales (ICAEW), Institute of Chartered Accountants of Scotland (ICAS), etc.

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Recommended reads:

Financial accounting resume summaries or objectives: real-world samples for best industry practices

Grasp recruiters' attention from the get-go of your application with a professional financial accounting resume summary or objective.

It's wise to select the:

- Resume objective , if you don't happen to have much experience alignment and would like to more prominently feature your dreams and personality.

- Resume summary , if you'd like to have a more standard approach to your application and feature up to five career highlights to help you stand out.

Writing your resume summary or objective should be tailored to each role you apply for.

Think about what would impress the recruiters and go from there.

But, if you need further help with this introductory section, check out some real-world samples in the next part of this guide:

Resume summaries for a financial accounting job

- Seasoned Accountant with 12 years of experience in financial reporting and analysis, adept at GAAP and tax laws. Held fiduciary responsibility for managing a $50M budget at XYZ Corp, driving a 20% cost reduction over 3 years. Specializes in strategic planning, forecasting, and improving financial controls.

- Dynamic CPA with over 8 years at top accounting firms, mastering complex financial transactions and compliance. Orchestrated a thorough audit that saved Acme Inc. $5M in potential fines. Excels in leveraging technology to streamline processes and enhance accuracy in financial reporting.

- Licensed Attorney transitioning to financial accounting, bringing a unique perspective on regulatory compliance and risk management. With 10 years at a high-stakes law firm, proficient in contract analysis and seeking to apply a meticulous eye to financial systems and controls in the accounting sector.

- Experienced Project Manager with an MBA pivoting to finance accounting, wielding sharp analytical skills and a mastery of managing budgets up to $30M. Eager to transfer robust project management methodologies and a proven track record of improving operational efficiency to the discipline of financial accounting.

- Aspiring Financial Accountant eager to apply a strong foundation in business principles and a passion for financial analytics. Committed to acquiring hands-on experience and contributing to a team focused on delivering high-quality financial reporting. Aims to utilize exceptional data analysis skills and academic knowledge from a B.S. in Finance.

- Graduate in Economics with honors, intent on beginning a career in financial accounting. Keen to develop expertise in ledger management, tax preparation, and financial analysis through practical experience. Aiming to bring fresh insights and a dedication to learning and professional growth in a challenging accounting environment.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Extra sections to include in your financial accounting resume

What should you do if you happen to have some space left on your resume, and want to highlight other aspects of your profile that you deem are relevant to the role? Add to your financial accounting resume some of these personal and professional sections:

- Passions/Interests - to detail how you spend both your personal and professional time, invested in various hobbies;

- Awards - to present those niche accolades that make your experience unique;

- Publications - an excellent choice for professionals, who have just graduated from university or are used to a more academic setting;

- Volunteering - your footprint within your local (or national/international) community.

Key takeaways

- Invest in a concise financial accounting professional presentation with key resume sections (e.g. header, experience, summary) and a simple layout;

- Ensure that the details you decide to include in your resume are always relevant to the job, as you have limited space;

- Back up your achievements with the hard and soft skills they've helped you build;

- Your experience could help you either pinpoint your professional growth or focus on your niche expertise in the industry;

- Curate the most sought-after certifications across the industry for credibility and to prove your involvement in the field.