As a treasury manager, articulating the complexity of your risk management strategies on a resume can be a significant challenge. Our guide offers clear examples and powerful phrasing strategies to help you communicate your expertise effectively, ensuring your resume stands out to potential employers.

- Sample industry-leading professional resumes for inspiration and treasury manager resume-writing know-how.

- Focus recruiters' attention on what matters most - your unique experience, achievements, and skills.

- Write various resume sections to ensure you meet at least 95% of all job requirements.

- Balance your treasury manager technical expertise with personality to stand out amongst candidates.

If the treasury manager resume isn't the right one for you, take a look at other related guides we have:

- Audit Manager Resume Example

- Hotel Accounting Resume Example

- Financial Advisor Resume Example

- Accounting Supervisor Resume Example

- Public Accounting Auditor Resume Example

- Financial Management Analyst Resume Example

- Tax Director Resume Example

- Financial Assistant Resume Example

- Financial Accounting Resume Example

- Loan Processor Resume Example

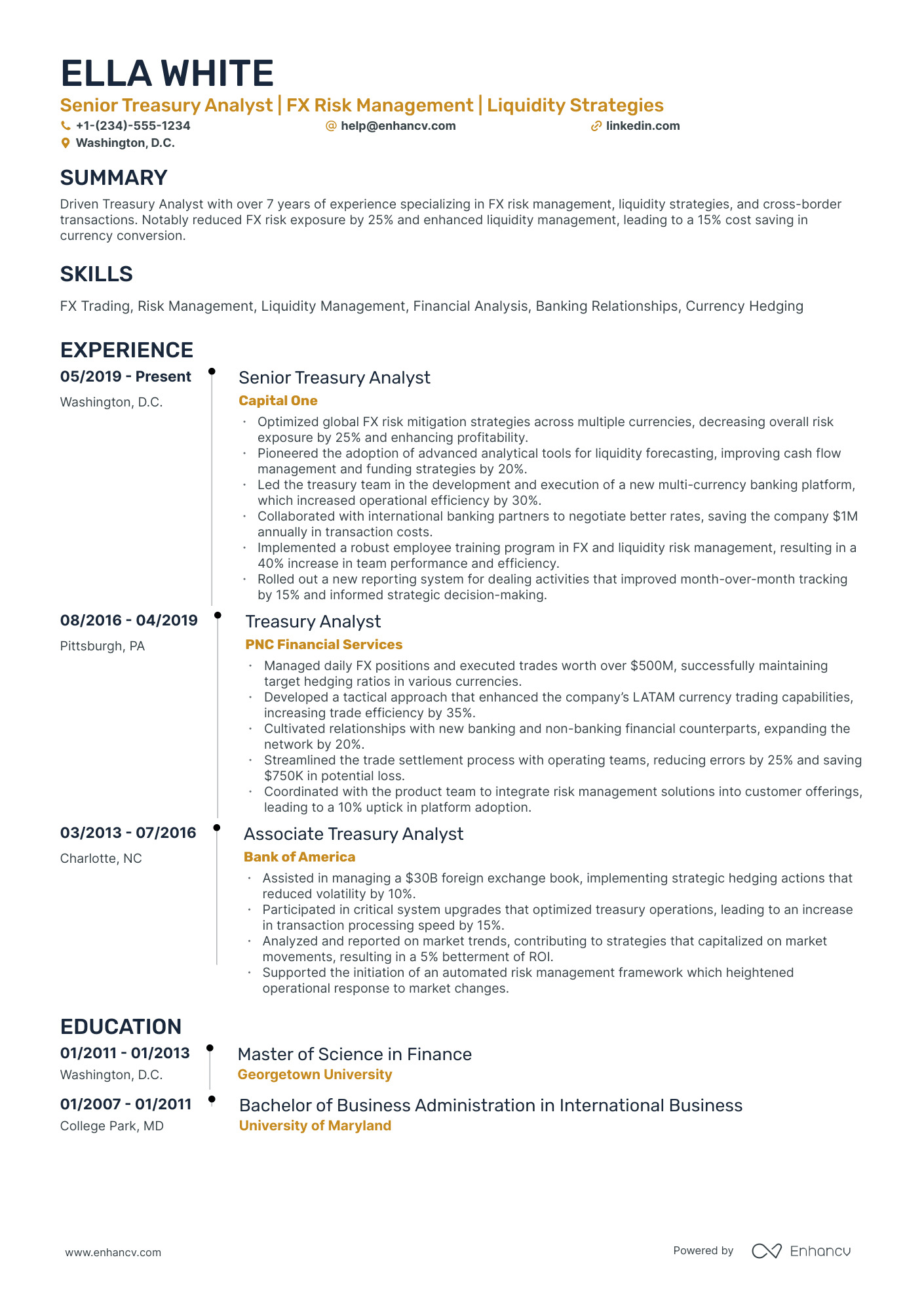

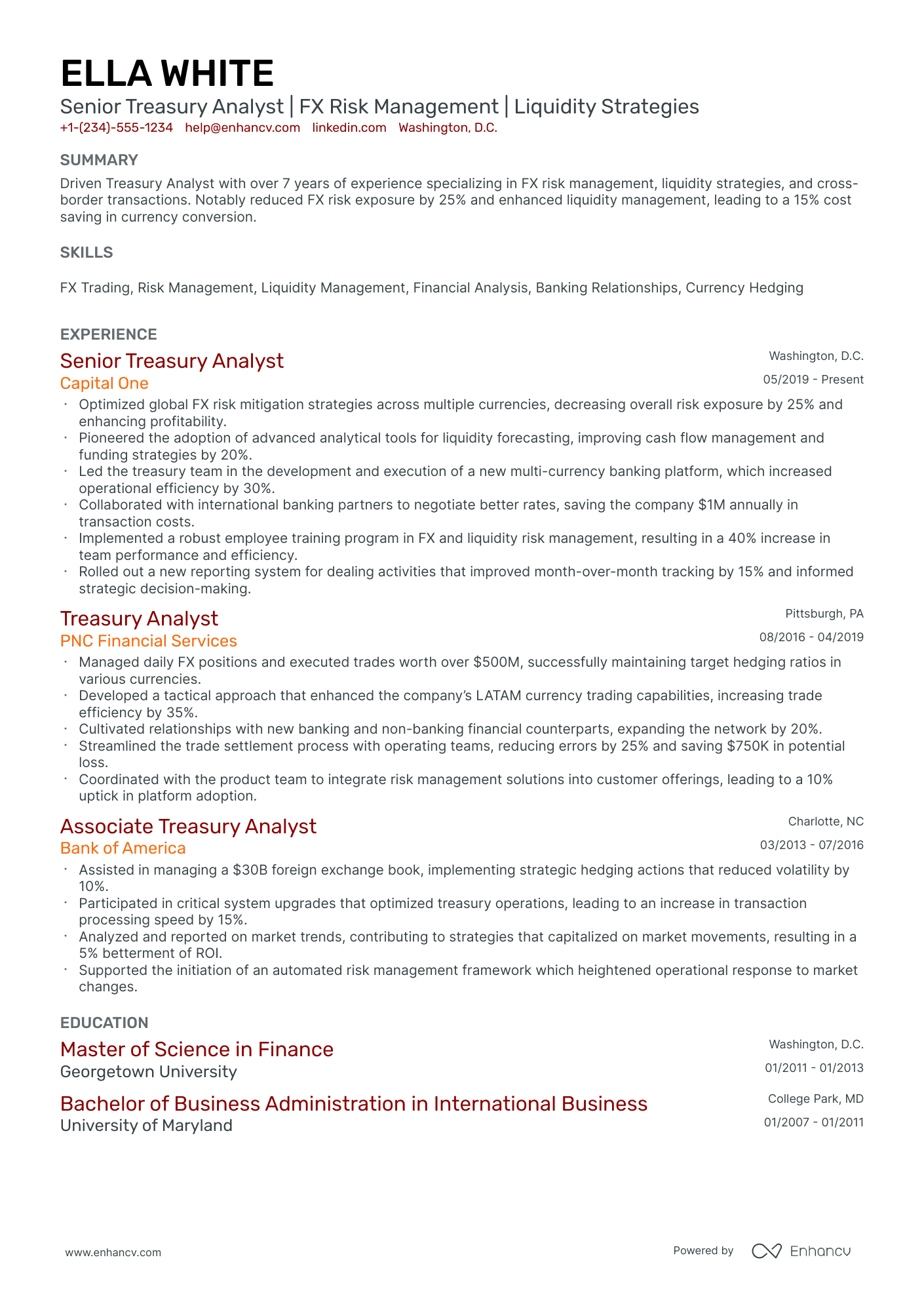

Formatting the layout of your treasury manager resume: design, length, and more

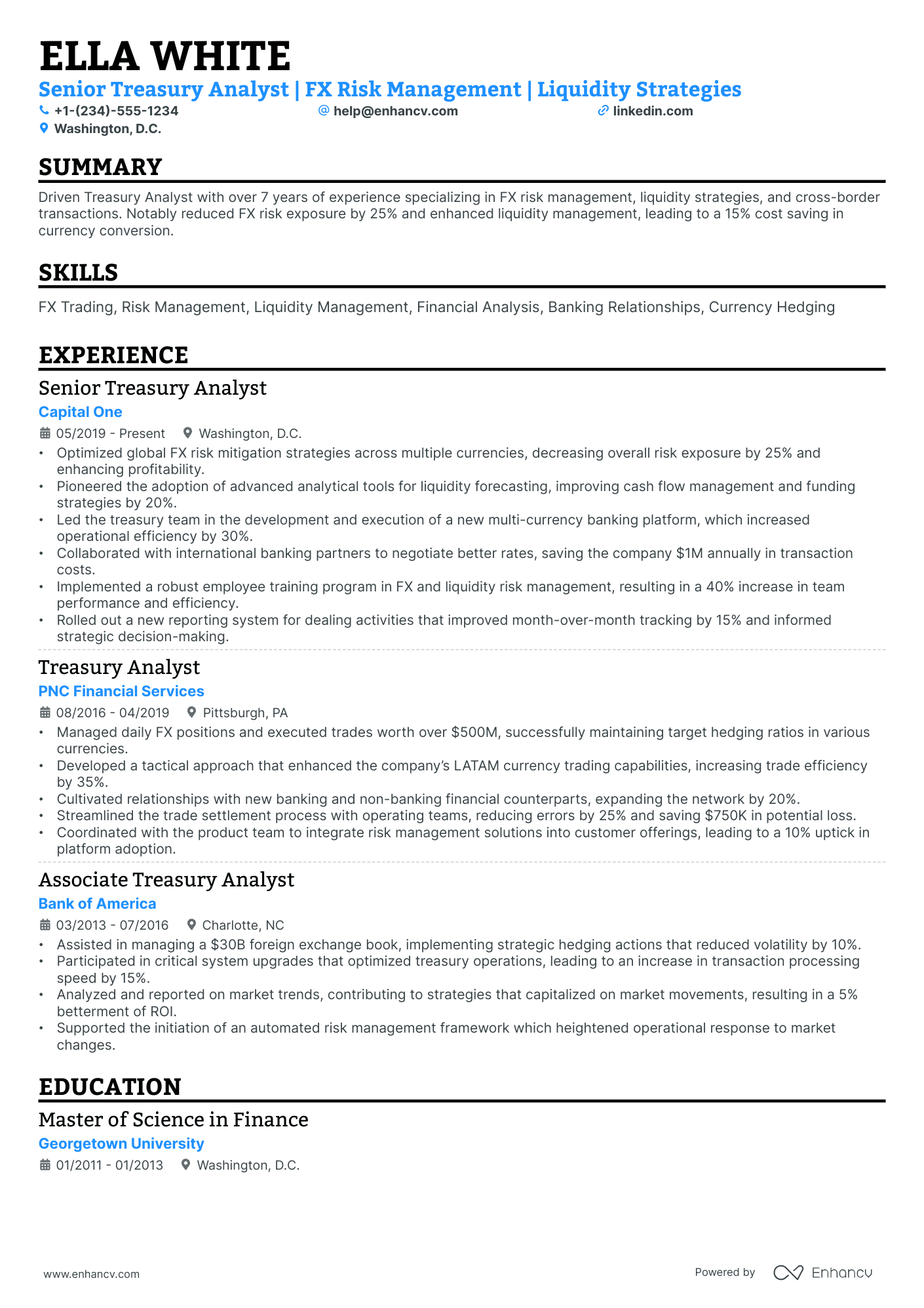

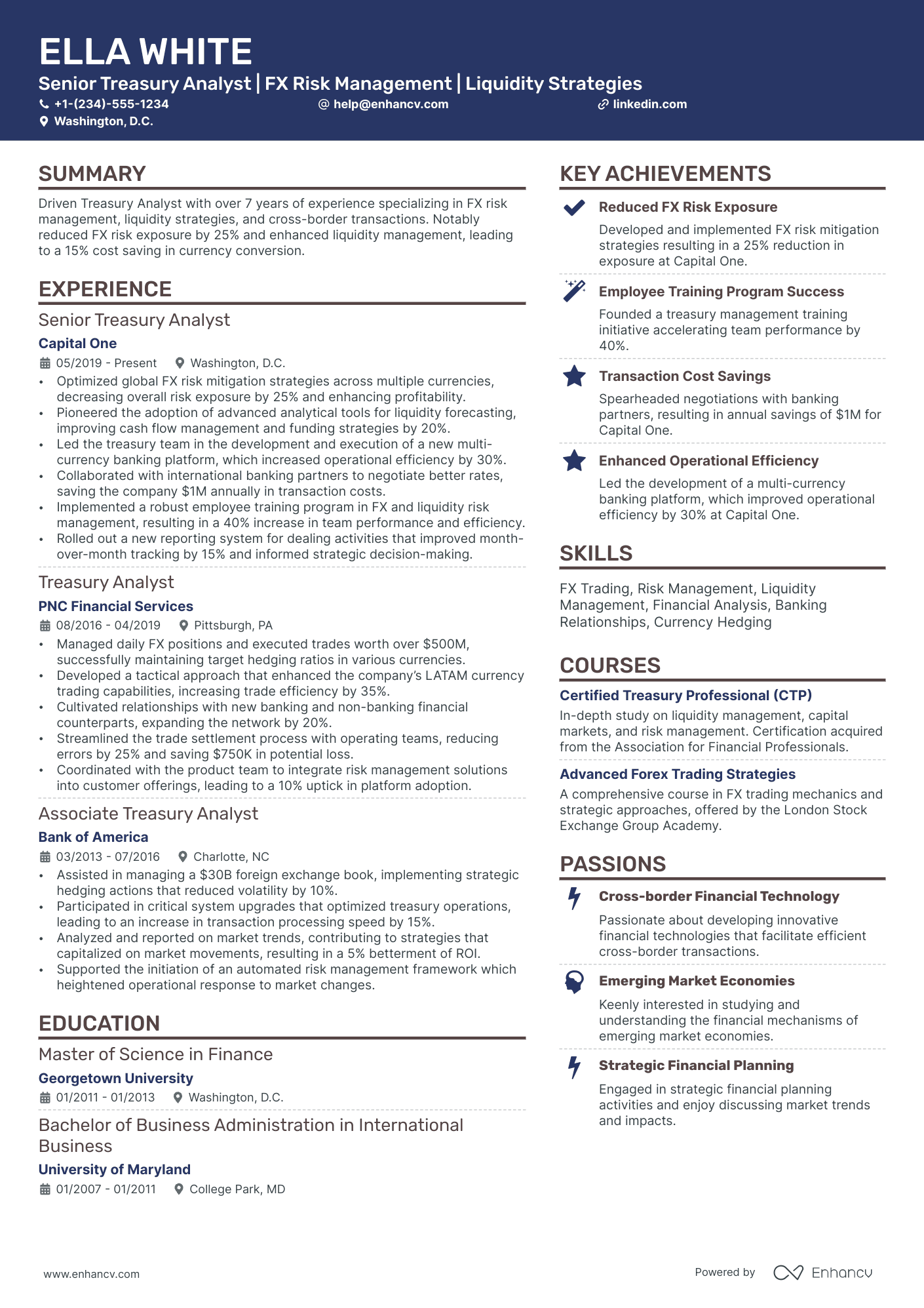

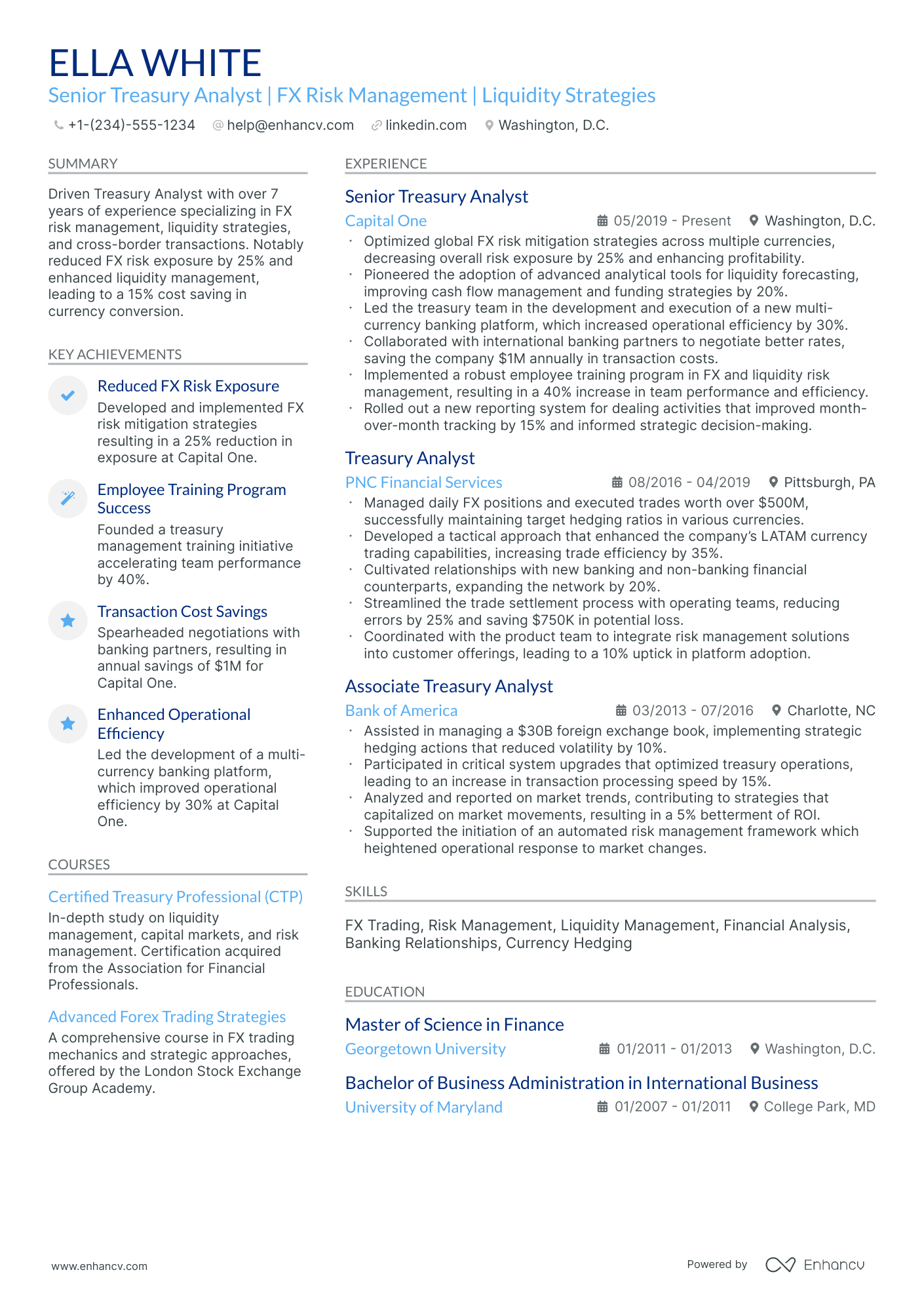

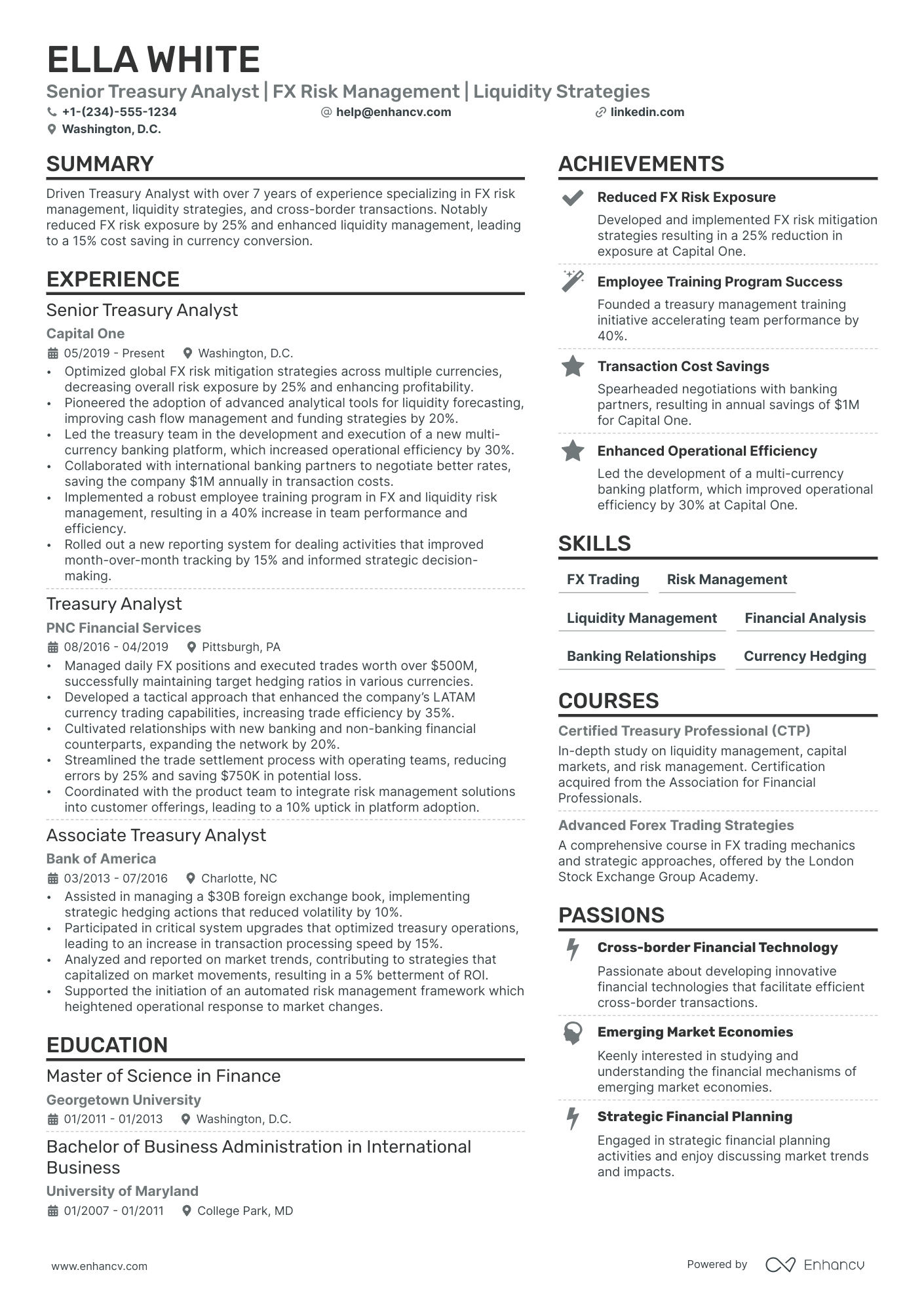

When it comes to the format of your treasury manager resume , you've plenty of opportunities to get creative. But, as a general rule of thumb, there are four simple steps you could integrate into your resume layout.

- If you have plenty of experience, you'd like to showcase, invest in the reverse-chronological resume format . This format focuses on your latest experience items and skills you've learned during your relevant (and recent) jobs.

- Don't go over the two-page limit, when creating your professional treasury manager resume. Curate within it mainly experience and skills that are relevant to the job.

- Make sure your treasury manager resume header includes all of your valid contact information. You could also opt to display your professional portfolio or LinkedIn profile.

- Submit or send out your treasury manager resume as a PDF, so you won't lose its layout and design.

Adjust your resume layout based on the market – Canadian resumes, for example, may follow a unique format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have some basic certificates, don't invest too much of your treasury manager resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

The key to your treasury manager job-winning resume - present your expertise with these sections:

- A header to make your resume more scannable

- Snapshot of who you are as a professional with your resume soft skills, achievements, and summary or objective

- Job advert keywords in the skills section of your resume

- Resume experience quantifying your past job successes with metrics

- A relevant education, certification, and technical sills section to provide background to your technological/software capabilities

What recruiters want to see on your resume:

- Proficiency in cash flow management and forecasting.

- Experience with liquidity management and investment strategies.

- Expertise in financial risk analysis and hedging techniques.

- Strong understanding of capital markets, corporate finance, and financial instruments.

- Advanced competency in financial software, treasury management systems (TMS), and ERP integration.

Advice for your treasury manager resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

Take a look at how real-life treasury manager professionals have presented their resume experience section - always aiming to demonstrate their success.

- Spearheaded a strategic hedging program to reduce foreign exchange exposure by 45%, significantly protecting the company's international revenue streams.

- Managed cash positioning and forecasting for this multinational corporation, optimizing fund allocation across 30+ bank accounts and reducing idle cash by 25%.

- Implemented new treasury management software that automated 80% of manual processes, elevating team productivity and reducing errors.

- Orchestrated the company's $200M debt issuance, coordinating with investment banks and legal counsel to ensure seamless execution.

- Drove the development of the company's investment policy, leading to a diversified portfolio that outperformed benchmarks by 10%.

- Enhanced treasury operations by introducing robust compliance measures that significantly mitigated financial risk and aligned with international regulatory requirements.

- Negotiated and secured a $500M revolving credit facility, improving the company's liquidity and broadening its capital structure.

- Developed and implemented risk management policies that decreased the company's interest rate risk by 30% through effective use of swap agreements.

- Played a pivotal role in the acquisition of a smaller competitor by leading the due diligence process from a treasury perspective, involving cash flow analysis and integration planning.

- Supervising a team of 10 treasury analysts in managing daily cash operations, increasing departmental efficiency by 20% year-over-year.

- Crafted and executed a capital allocation strategy that repatriated over $50M in foreign earnings at minimal tax cost due to strategic planning.

- Oversaw company-wide liquidity stress testing procedures, enhancing financial stability and readiness for potential economic downturns.

- Redesigned cash management workflows using Lean Six Sigma methodologies, which cut down cross-border transaction costs by 20%.

- Managed the successful transition to a centralized treasury system for operations in 15 countries, facilitating standardized global processes and improved cash visibility.

- Instrumental in negotiating term and conditions for a syndicated loan of $350M that funded strategic company expansions with favorable interest rates.

- Designed and executed a cash repatriation plan that streamlined the process and significantly decreased the effective tax rate for foreign dividends.

- Successfully managed the company’s investment portfolio of over $1 billion, consistently yielding returns above corporate objectives.

- Established a cross-functional team to integrate risk management solutions, which appreciably reduced credit risk across key customer accounts.

- Executed a comprehensive capital structure reorganization which reduced long-term debt by $150M and optimized the balance sheet for future growth initiatives.

- Led treasury technology enhancements that included the implementation of an integrated payment platform, reducing processing times by 35%.

- Established and chaired the Treasury Committee which successfully set policies to govern cash management, investments, and corporate finance activities in line with organizational objectives.

- Managed and executed the company's first-ever green bond issuance, raising $250M for sustainability projects and enhancing the company's ESG profile.

- Simplified the treasury reporting process through the introduction of BI tools, reducing report generation time by 50% while also increasing data accuracy.

- Cultivated banking relationships that facilitated the implementation of innovative cash pooling arrangements, optimizing the group's cash efficiency by 30%.

Quantifying impact on your resume

- Document the size of the cash and investment portfolio you have managed, as this quantifies your experience with large financial resources.

- State the percentage reduction in costs you achieved through renegotiation of banking fees, which demonstrates cost-saving capabilities.

- List the amount of foreign currency transactions managed, showing proficiency in dealing with exchange rate risks.

- Quantify the improvements in liquidity ratios under your management, revealing your skill in liquidity management.

- Detail the successful debt issuance amount you have overseen, proving your competence in corporate financing.

- Present the percentage increase in investment returns you accomplished, indicating your adeptness in investment strategies.

- Illustrate your efficiency by citing the reduction in time to close monthly financial books under your management.

- Specify the scale of cash flow forecasting you conducted, reflecting your ability to predict and prepare for future financial needs.

Action verbs for your treasury manager resume

What can candidates do about their resume, if they have no experience

Job requirements can sometimes be answered by other elements you could make more prominent in your treasury manager resume.

Thus, you'd be substituting your lack of experience with your relevant:

- Education with details of skills you've obtained that align with the job

- Internships and short-term jobs that are once more dedicated to putting your expertise in the spotlight

- Skills section answering basic and - potentially - more specific job qualifications

- Strengths or accomplishments to show the unique value you present, even as a candidate with less or no professional experience in the industry.

Recommended reads:

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Popular treasury manager hard skills and soft skills for your resume

Apart from assessing your professional expertise, recruiters are on the lookout for whether your skills align with the job.

Your profile would thus be assessed in regard to your:

- Hard or technical skills - your ability to perform on the job using particular technologies or software

- Soft skills - how you adapt, communicate, and thrive in different environments.

Both types of skills - hard and soft skills - are important for your resume, so make sure to create a dedicated skills section that:

- Lists up to five or six skills that align with the job advert.

- Integrates vital keywords for the industry, but also reflects on your personal strengths.

- Builds up further your skills with an achievements section within which you explain what you've achieved thanks to using the particular skill.

- Aims to always quantify in some way how you've used the skill, as it's not enough to just list it.

What are the most sought out hard and soft skills for treasury manager roles?

Check out the industry's top choices with our two dedicated lists below:

Top skills for your treasury manager resume:

Treasury Management Systems (TMS)

Financial Modeling

Cash Flow Forecasting

Banking Software

Risk Management Tools

Excel Advanced Functions

Accounting Software (e.g., SAP, Oracle)

Payment Processing Systems

Foreign Exchange Management

Regulatory Compliance Software

Analytical Thinking

Attention to Detail

Communication Skills

Problem Solving

Leadership

Negotiation Skills

Time Management

Strategic Planning

Interpersonal Skills

Adaptability

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Maximizing your treasury manager resume: education and certification sections

To effectively showcase your industry knowledge in your treasury manager resume, it's important to properly list your education and certifications.

For the education section, ensure you include:

- Higher education degrees pertinent to the industry or those at a postgraduate level;

- The start and end dates of your education, along with the name of the institution you graduated from;

- Your GPA and relevant coursework, but only if they are impressive and applicable to the role.

Additionally, create a separate certifications section to spotlight your most notable recognitions. Another excellent place to feature a leading industry certificate is in your resume header, right after your name.

Below is a list of key industry certifications that are often sought after by recruiters

The top 5 certifications for your treasury manager resume:

- Certified Treasury Professional (CTP) - Association for Financial Professionals (AFP)

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

- Certified Management Accountant (CMA) - Institute of Management Accountants (IMA)

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Recommended reads:

Practical guide to your treasury manager resume summary or objective

First off, should you include a summary or objective on your treasury manager resume?

We definitely recommend you choose the:

- Resume summary to match job requirements with most noteworthy accomplishments.

- Resume objective as a snapshot of career dreams

Both the resume summary and objective should set expectations for recruiters as to what your career highlights are.

These introductory paragraphs (that are no more than five sentences long) should help you answer why you're the best candidate for the job.

Industry-wide best practices pinpoint that the treasury manager resume summaries and objectives follow the structures of these samples:

Resume summaries for a treasury manager job

- With over 12 years of dedicated treasury management experience in high-volume finance sectors, the candidate has a proven track record of reducing costs by 20% through strategic foreign exchange hedging and implementing robust cash management systems. Mastery of SAP and Oracle Financials, alongside a Certified Treasury Professional credential, denote a strong fit for complex financial environments.

- Armed with 15 years of financial expertise while serving as a Chief Accountant, this seasoned professional now seeks to apply their extensive knowledge of risk assessment, liquidity management, and investment strategies in a treasury management capacity. Notable accomplishments include the successful negotiation of a $50 million line of credit that increased operational cash flow by 30%.

- Eager to transition from a decade-long accomplished position as a financial analyst in the tech industry, where meticulous data analysis and predictive modeling led to a 25% increase in cost-saving measures, this candidate is poised to apply analytical acumen and deep understanding of market trends in the pivotal role of treasury management.

- Transitioning from a senior role in corporate finance where responsibilities included managing a $100 million budget and identifying a 15% savings in operational costs, this professional is adept at leveraging their strategic planning, and financial reporting skills to excel in the dynamic field of treasury management.

- Seeking an entry-level opportunity, this recent finance graduate exhibits an ardent interest in innovating cash management practices and strengthening financial controls. Their capstone project, which involved a comprehensive analysis of cash flow optimization, highlights an objective to contribute fresh perspectives and energy to managing fiscal operations. Dedication to professional growth through continuous learning is a cornerstone of their approach.

- As a new entrant to the finance industry, this demonstrably ambitious professional is focused on securing a position where they can exploit their passion for economic strategy and strong quantitative skills. With a recent MBA in Finance and an award-winning thesis on cash flow optimization in SMEs, the objective is to deliver impactful financial solutions and grow expertise in treasury functions.

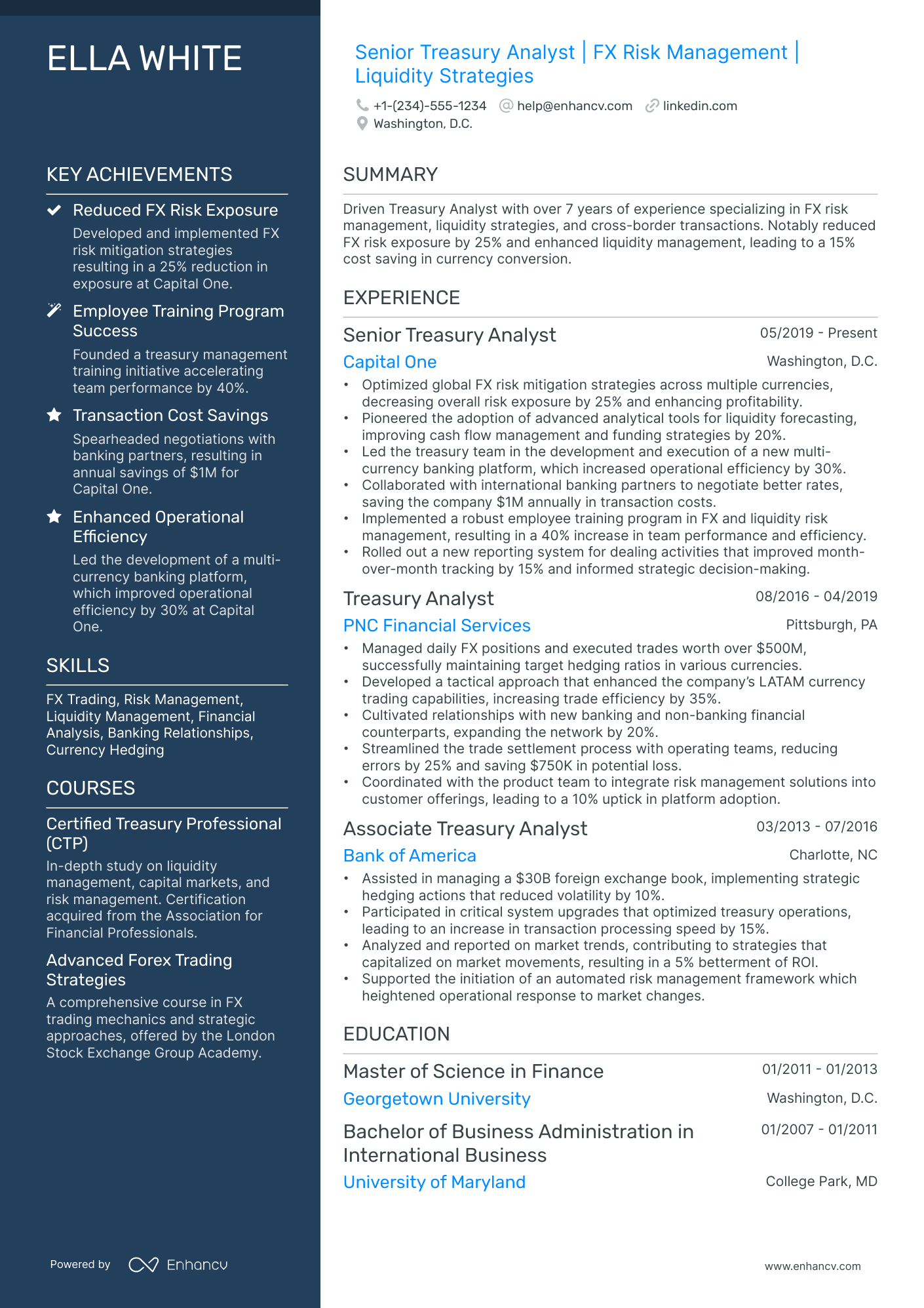

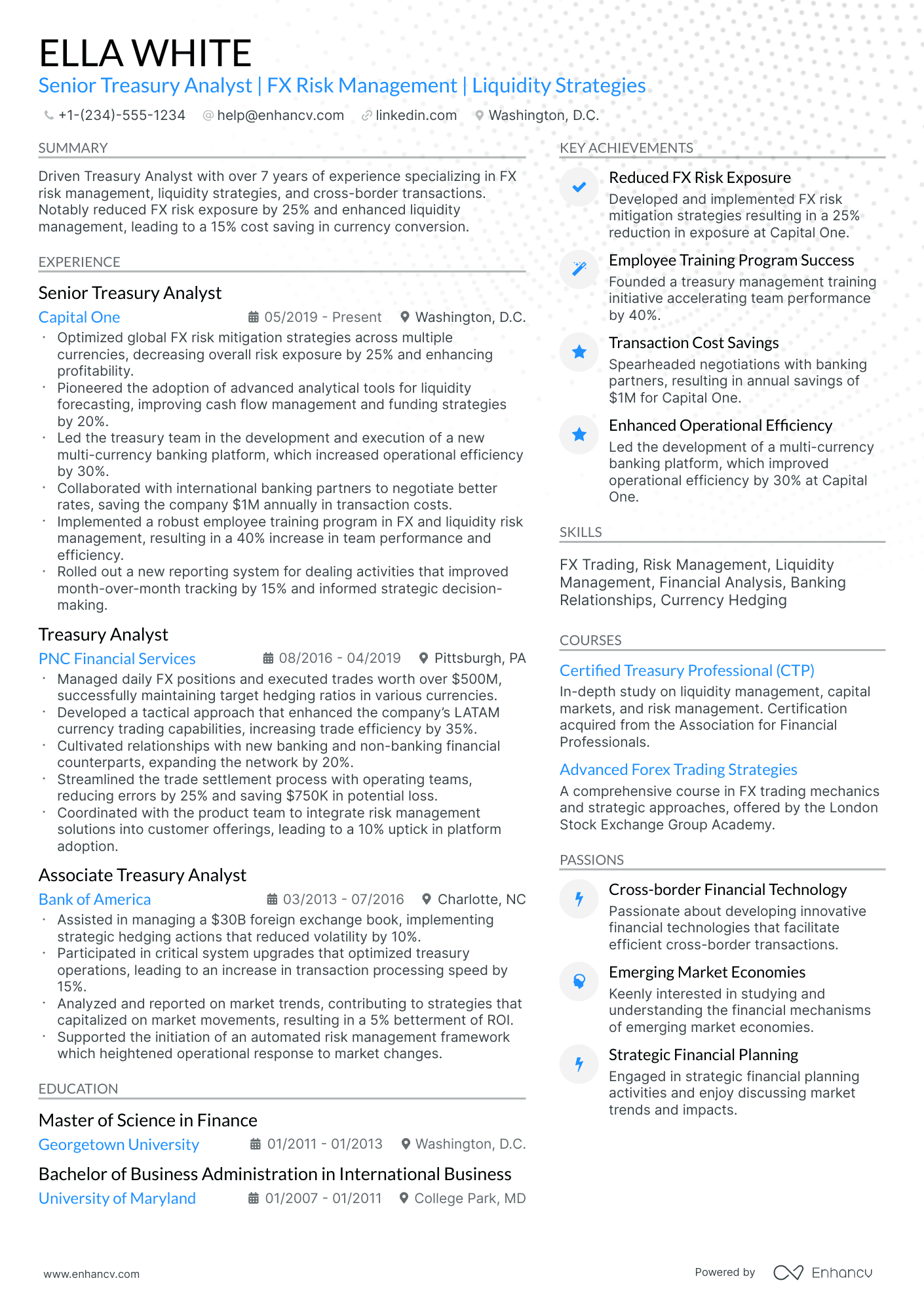

Other treasury manager resume sections to support your expertise and skills

Recruiters are always on the lookout for that treasury manager candidate who brings about even more value to the role.

This can be either via their personality or additional accreditations they have across the industry.

Add to your resume any of the four sections that fit your profile:

- Projects for your most impressive, cutting-edge work;

- Awards or recognitions that matter the most;

- Publications further building up your professional portfolio and accreditations;

- Hobbies and interests to feature the literature you read, how you spend your time outside of work, and other personality traits you deem may help you stand out .

Key takeaways

- Ensure your treasury manager resume uses a simple, easy-to-read format that reflects upon your experience and aligns with the role;

- Be specific within the top one-third of your resume (header and summary or objective) to pinpoint what makes you the ideal candidate for the treasury manager role;

- Curate information that is tailored to the job by detailing skills, achievements, and actual outcomes of your efforts;

- List your certifications and technical capabilities to demonstrate your aptitude with specific software and technologies;

- The sections you decide on including on your treasury manager should pinpoint your professional expertise and personality.