As a tax director, your resume must deftly showcase your deep understanding of tax regulations and your strategic leadership skills. Our guide provides targeted advice to help you highlight these crucial competencies and craft a resume that sets you apart in a competitive market.

- Tax director resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out tax director skills that should make your resume.

- Styling the layout of your professional resume: take a page from tax director resume examples.

How to write about your tax director achievements in various resume sections (e.g. summary, experience, and education).

- Financial Professional Resume Example

- Functional Accounting Resume Example

- Purchasing Director Resume Example

- Night Auditor Resume Example

- Senior Finance Manager Resume Example

- Assistant Finance Manager Resume Example

- Financial Advisor Resume Example

- Bid Manager Resume Example

- Accounting Supervisor Resume Example

- Accounting Assistant Resume Example

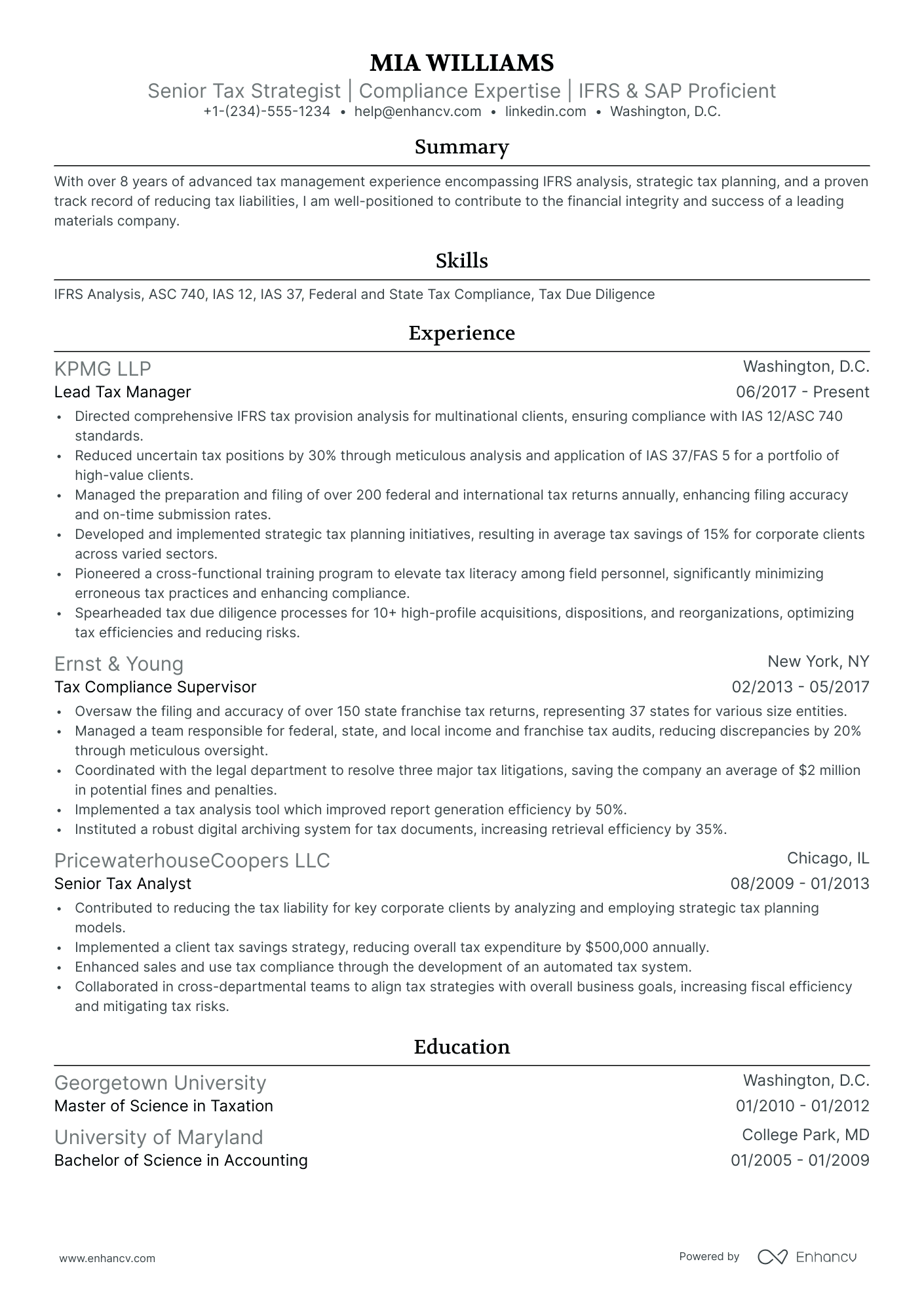

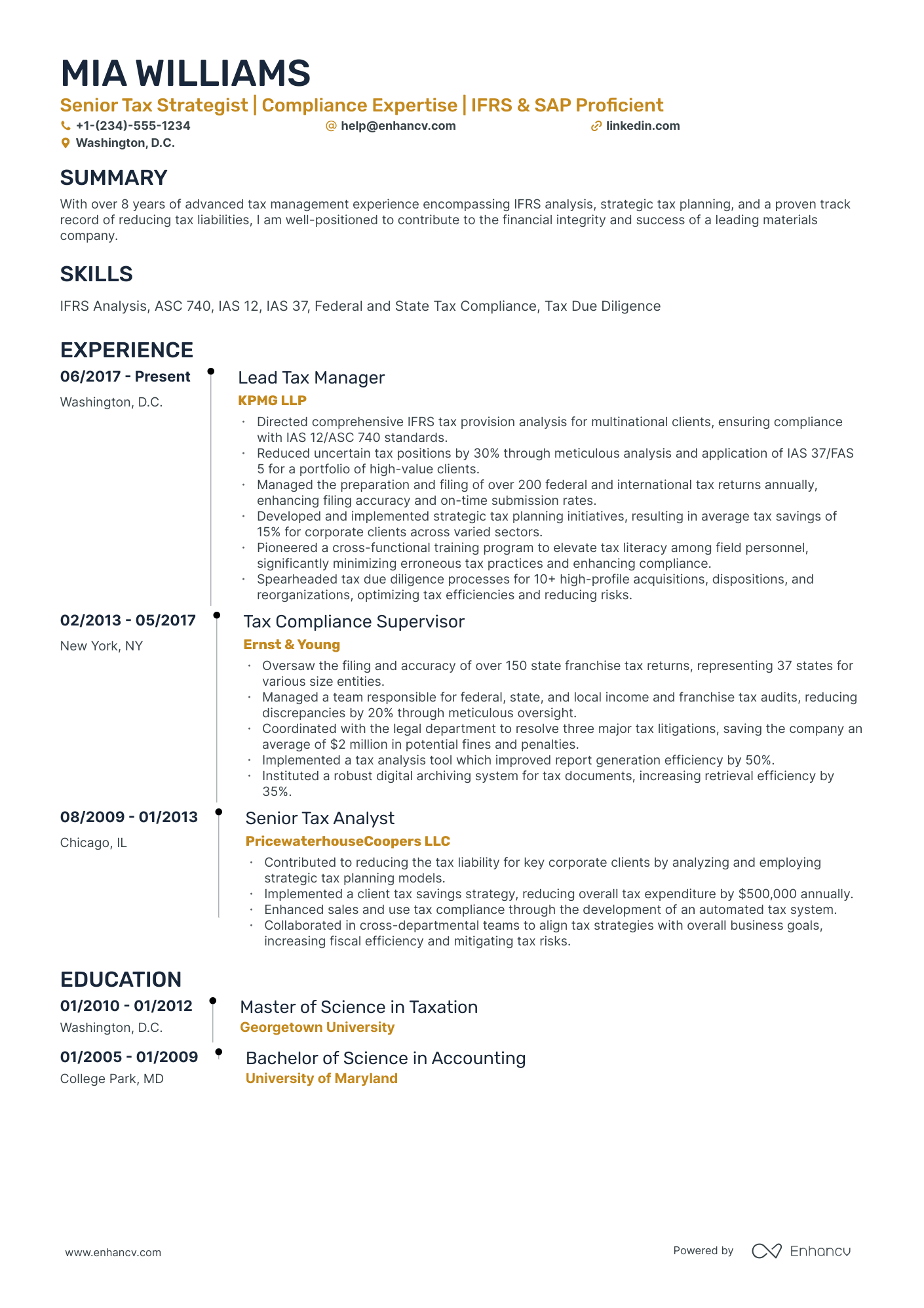

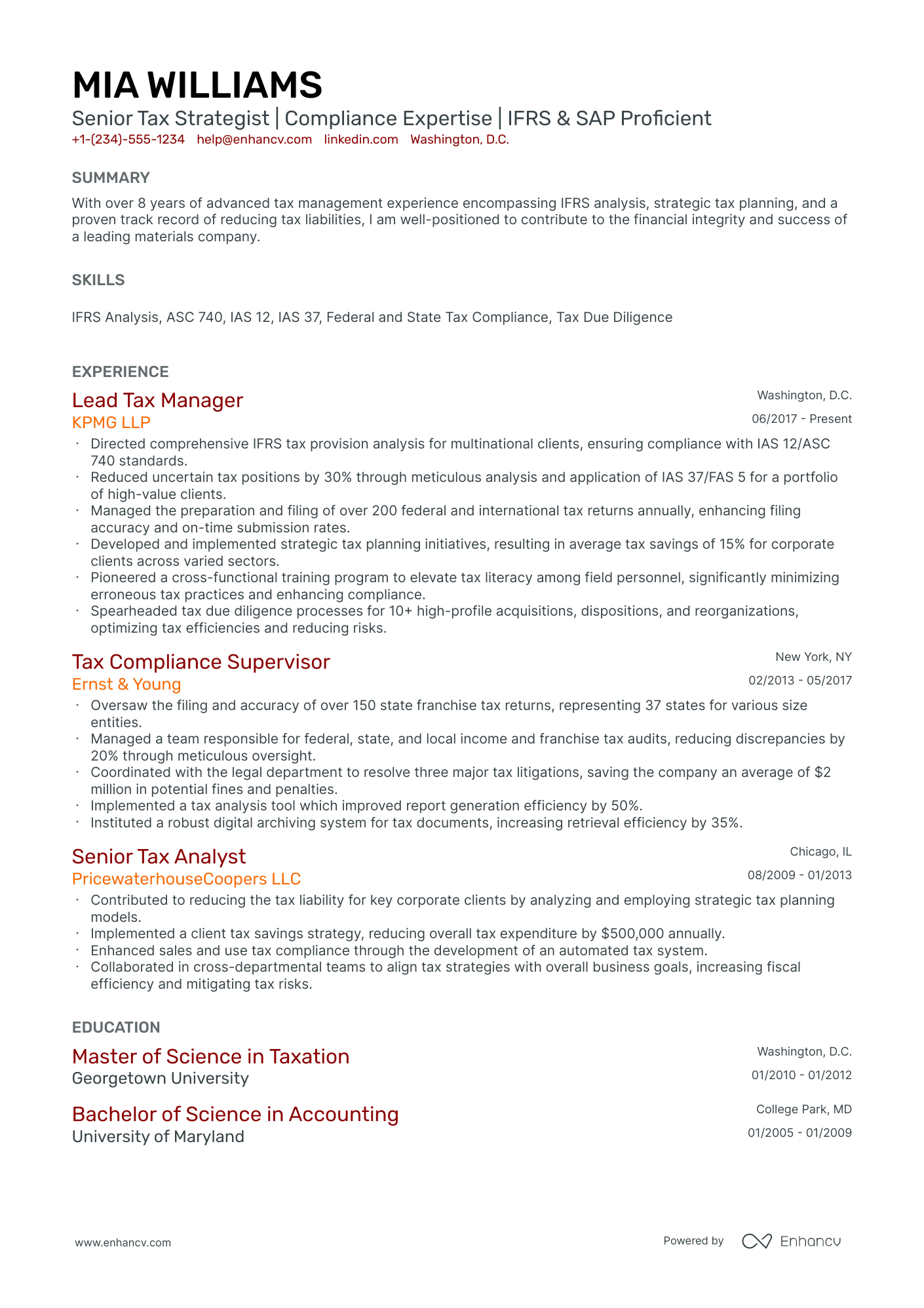

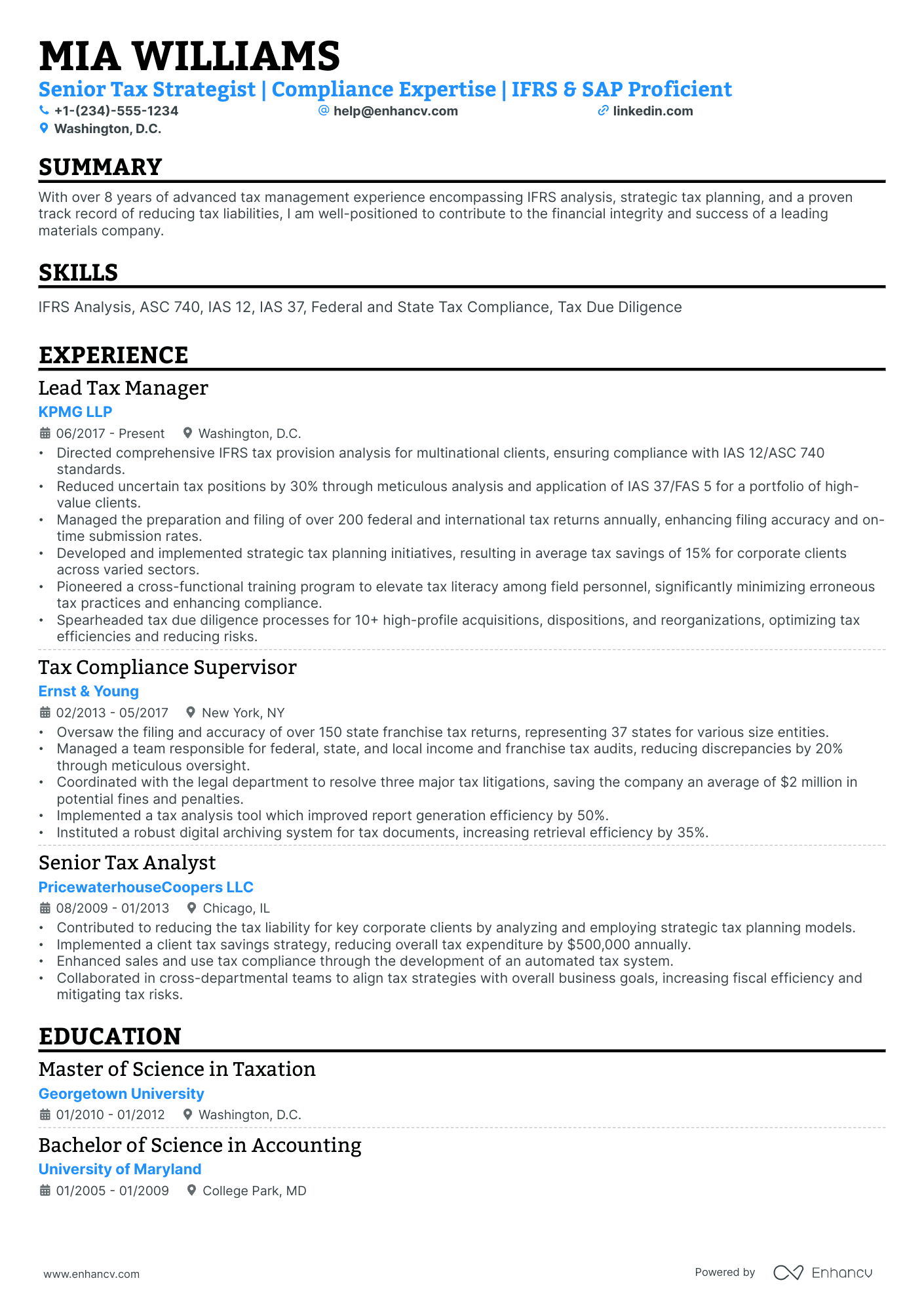

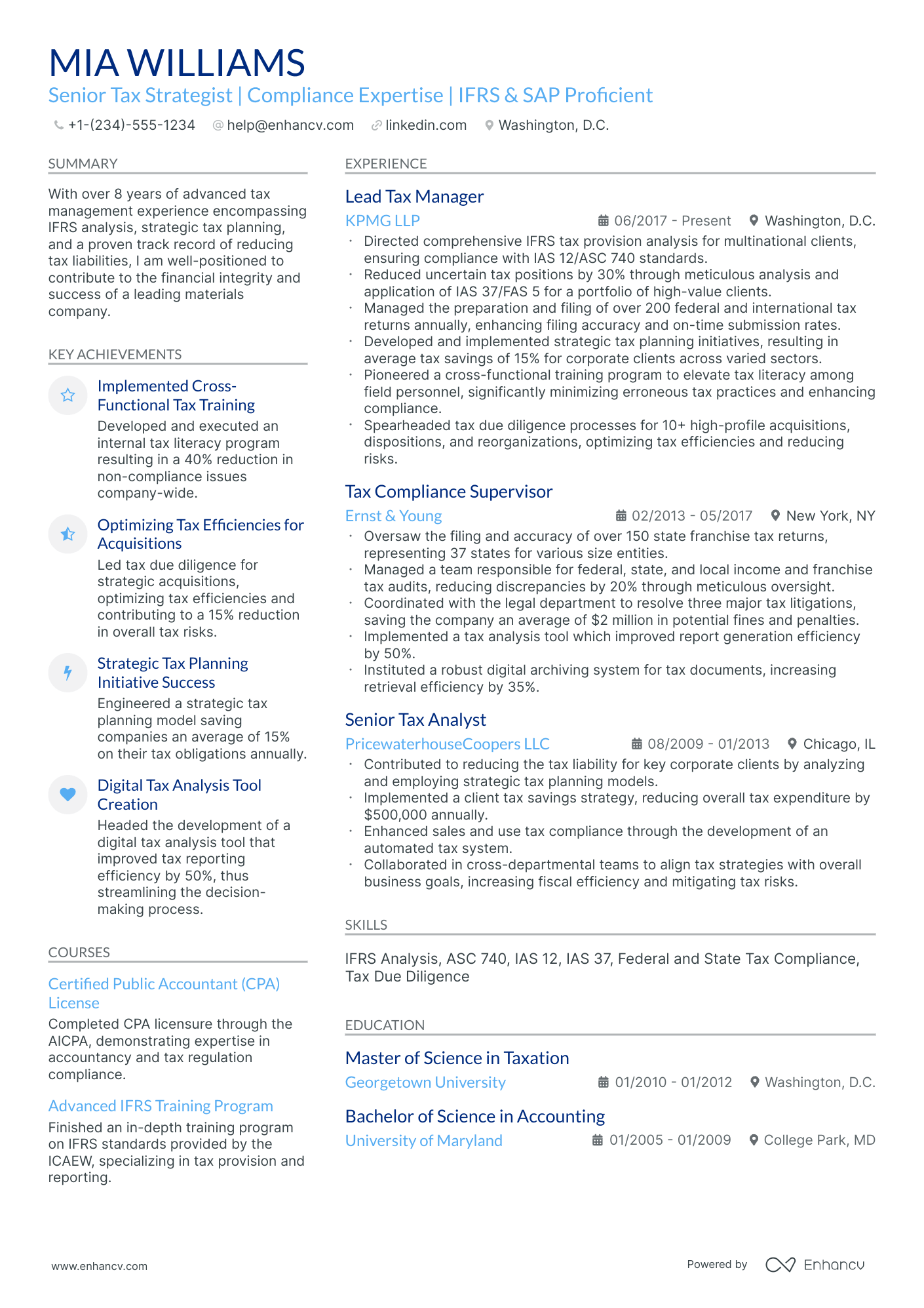

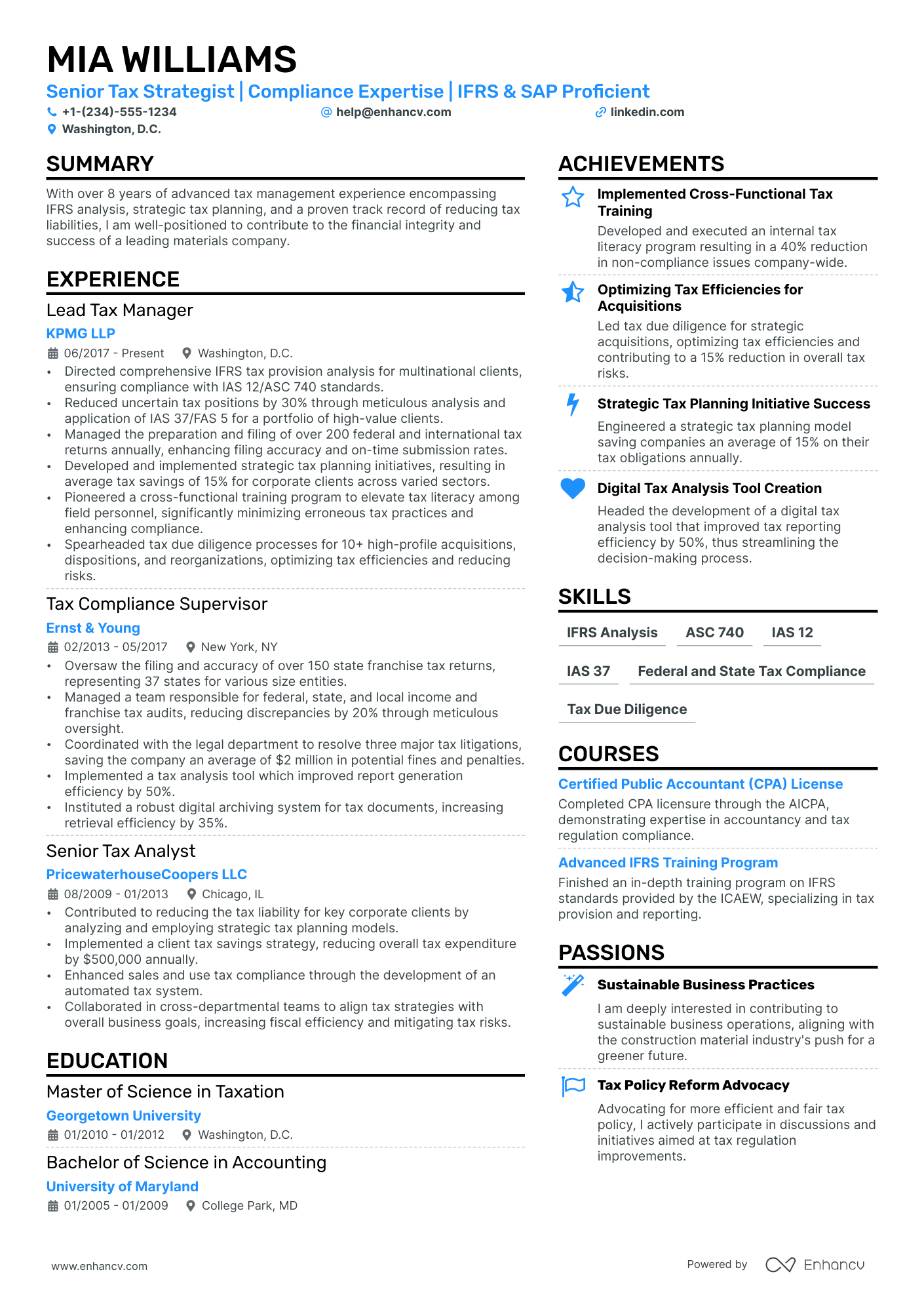

Designing your tax director resume format to catch recruiters' eyes

Your tax director resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your tax director resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your tax director resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

Adjust your resume layout based on the market – Canadian resumes, for example, may follow a unique format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

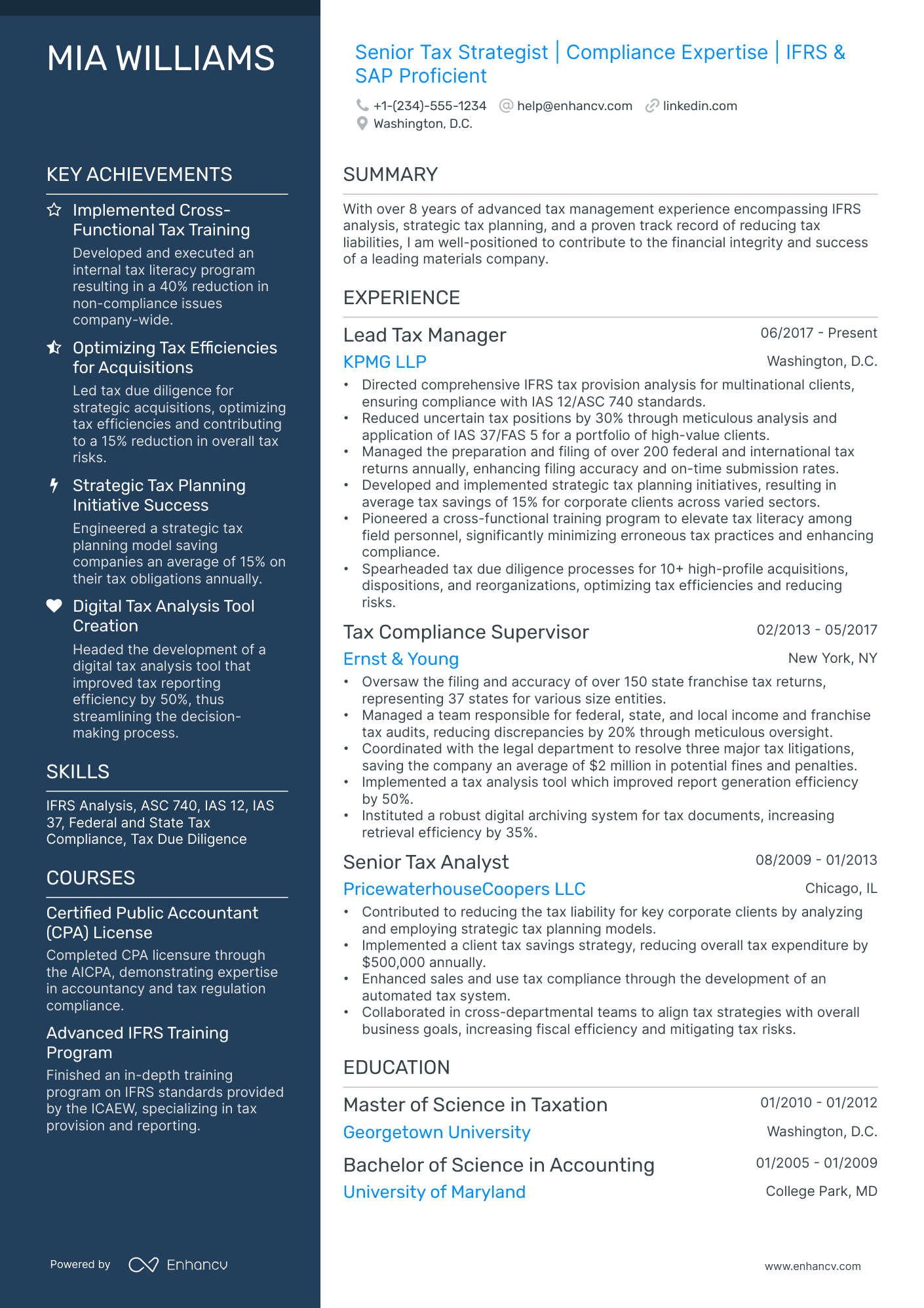

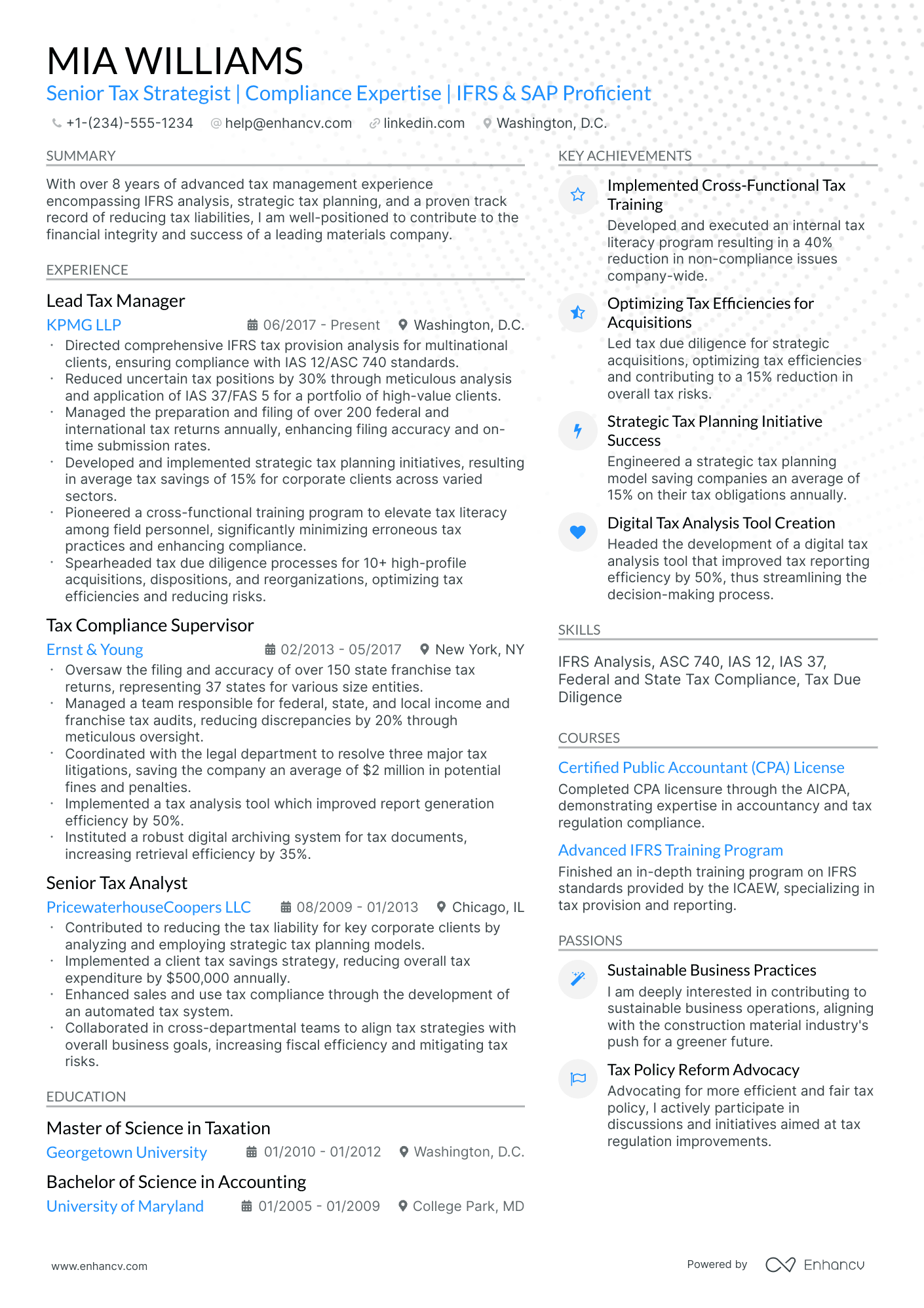

The six in-demand sections for your tax director resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Proven experience with tax strategy development and implementation for multinational corporations.

- Detailed knowledge of federal, state, and international tax laws, including upcoming legislation and compliance regulations.

- Strong leadership skills with experience managing a tax department and cross-functional relationships with finance, legal, and business units.

- Demonstrable track record of identifying and executing tax savings opportunities while mitigating risks.

- Expertise in tax software and technologies used for tax return preparation, tax research, and financial planning analysis.

Advice for your tax director resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

Take a look at how real-life tax director professionals have presented their resume experience section - always aiming to demonstrate their success.

- Led a team of 20 tax professionals in the preparation and filing of federal, state, and local tax returns for a multinational corporation, improving compliance accuracy by 35%.

- Developed and implemented a tax strategy that optimized the use of tax credits and deductions, resulting in a 20% reduction in the company's effective tax rate.

- Managed cross-functional projects with the finance and legal teams to restructure business operations and minimize the global tax burden, saving the company over $10 million annually.

- Orchestrated the integration of tax planning and compliance efforts post-merger, ensuring seamless continuity and identifying synergies that saved $5 million in the first year.

- Spearheaded the adoption of innovative tax software that automated key compliance processes, cutting down the preparation time by 40% and reducing human error.

- Collaborated with international teams to address transfer pricing issues, aligning with OECD guidelines and mitigating risk of adjustment by authorities.

- Negotiated with tax authorities to resolve disputes involving over $50 million of assessed taxes, ultimately reducing liabilities by 60% after successful appeals.

- Initiated a company-wide tax risk assessment program that identified potential tax exposures and saved the company from significant penalties by proactively addressing issues.

- Facilitated quarterly tax training workshops for internal staff, enhancing their understanding of tax laws and reducing dependency on external consultants.

- Oversaw tax compliance for over 15,000 employees, ensuring timely and accurate W-2 and 1099 reporting and preventing any non-compliance penalties.

- Conducted thorough research on complex tax matters that influenced high-level business decisions, supporting the company's long-term strategic goals.

- Improved the tax provision process by leveraging technology for data management, reducing the quarterly tax provision preparation time by 25%.

- Revamped the company's approach to dealing with sales and use tax issues, establishing a robust system that decreased audit exposures by over 30%.

- Influenced policy by participating in industry groups and coalitions to address tax legislation, leading to a more favorable tax environment for the company's operations.

- Provided expert advice on tax implications of international expansion projects, ensuring compliance with local jurisdictions and maximizing tax efficiency.

- Assumed leadership during a critical IRS audit, which involved direct negotiation with auditors and reduced proposed adjustments by over $8 million.

- Implemented a strategic tax forecasting model which provided accurate predictions of cash taxes, assisting the CFO with effective cash management.

- Cultivated a team culture focused on continuous improvement, resulting in the tax department being recognized as the most improved department in operational efficiency.

- Led the successful defense of a complex tax position during litigation, which had a favorable outcome and prevented a potential financial hit of $12 million.

- Instituted a robust tax control framework that ensured adherence to Sarbanes-Oxley (SOX) requirements and enhanced the internal reporting process.

- Initiated and maintained constructive relationships with external tax advisors and service providers to ensure the company benefited from the latest tax-saving strategies.

- Directed all aspects of the tax due diligence process for a series of acquisitions, identifying key tax risks and avoiding over $7 million in potential liabilities.

- Collaborated with the executive team to define and articulate the impact of new tax legislation on the company's financial performance and long-term strategic initiatives.

- Effectuated a comprehensive tax training program for junior staff and new hires, improving departmental productivity and reducing onboarding time by 15%.

- Championed a digital transformation initiative within the tax department, introducing cloud-based tax solutions that increased data accessibility and facilitated remote work.

- Deployed strategic tax planning to capitalize on the Tax Cuts and Jobs Act, achieving a considerable cost-saving that strategically reinvested into R&D efforts.

- Masterminded the tax component of a corporate debt restructuring, ensuring favorable tax treatment and contributing to a stronger balance sheet.

- Guided the company through a critical tax reform transition period, effectively managing changes in tax rates, interest deduction limitations, and the shift to a territorial system.

- Drove a company-wide initiative to centralize and streamline international tax operations, resulting in enhanced global reporting and a 10% cost reduction.

- Launched a tax savings initiative focused on R&D tax credits, which boosted the company's bottom line by identifying and capturing $3 million in additional credits.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for tax director professionals.

Top Responsibilities for Tax Director:

- Establish and maintain relationships with individual or business customers or provide assistance with problems these customers may encounter.

- Oversee the flow of cash or financial instruments.

- Plan, direct, or coordinate the activities of workers in branches, offices, or departments of establishments, such as branch banks, brokerage firms, risk and insurance departments, or credit departments.

- Recruit staff members.

- Evaluate data pertaining to costs to plan budgets.

- Oversee training programs.

- Establish procedures for custody or control of assets, records, loan collateral, or securities to ensure safekeeping.

- Communicate with stockholders or other investors to provide information or to raise capital.

- Develop or analyze information to assess the current or future financial status of firms.

- Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans.

Quantifying impact on your resume

- Detail the percentage by which you reduced the company's effective tax rate through strategic planning and initiatives.

- Quantify the dollar amount of tax savings achieved for your company through restructuring, tax credits, or deductions.

- List the volume of tax returns or filings overseen annually to demonstrate the scale of responsibilities managed.

- Specify the monetary value of any tax-related risks mitigated due to due diligence and compliance efforts.

- Include the size of the team you manage to reflect leadership skills and the ability to handle complex organizational structures.

- Highlight the amount of tax provision and accruals calculated accurately to showcase attention to detail and precision.

- Mention the percentage improvement in tax reporting timelines due to process optimization or technology implementations.

- State the number of jurisdictions for which you've managed tax matters to indicate experience with various tax laws and regulations.

Action verbs for your tax director resume

Guide for tax director professionals kicking off their career

Who says you can't get that tax director job, even though you may not have that much or any experience? Hiring managers have a tendency to hire the out-of-the-blue candidate if they see role alignment. You can show them why you're the best candidate out there by:

- Selecting the functional skill-based or hybrid formats to spotlight your unique value as a professional

- Tailoring your tax director resume to always include the most important requirements, found towards the top of the job ad

- Substituting the lack of experience with other relevant sections like achievements, projects, and research

- Pinpoint both achievements and how you see yourself within this specific role in the tax director resume objective.

Recommended reads:

PRO TIP

Listing your relevant degrees or certificates on your tax director resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Shining a light on your tax director hard skills and soft skills

To win recruiters over, you must really have a breadth of skill set presented and supported within your tax director resume.

On hiring managers' checklists, you'd initially discover hard or technical skills. Those are the technology (and software) that help you perform on the job. Hard skills are easy to quantify via your education, certificates, and on-the-job success.

Another main criterion recruiters are always assessing your tax director resume on is soft skills. That is your ability to communicate, adapt, and grow in new environments. Soft skills are a bit harder to measure, as they are gained both thanks to your personal and professional experience.

Showcase you have the ideal skill set for the role by:

- Dedicating both a skills box (for your technical capabilities) and an achievements or strengths section (to detail your personal skills).

- When listing your skills, be specific about your hard skills (name the precise technology you're able to use) and soft skills (aim to always demonstrate what the outcomes were).

- Avoid listing overused cliches in the skills section (e.g. Microsoft Office and Communication), unless they're otherwise specified as prominent for the role.

- Select up to ten skills which should be defined via various sections in your resume skills sidebar (e.g. a technical skills box, industry expertise box with sliders, strengths section with bullets).

Spice up your resume with leading technical and people skills, that'd help you get noticed by recruiters.

Top skills for your tax director resume:

Tax Compliance Software

ERP Systems (e.g., SAP, Oracle)

Tax Research Tools (e.g., CCH, Thomson Reuters)

Data Analytics Tools (e.g., Tableau, Power BI)

Excel Advanced Functions

Financial Modeling

Tax Provision Software (e.g., OneSource, Corptax)

Accounting Software (e.g., QuickBooks, Xero)

International Tax Regulations

Transfer Pricing Documentation

Leadership

Strategic Thinking

Communication

Problem Solving

Attention to Detail

Negotiation

Team Collaboration

Adaptability

Time Management

Decision Making

Next, you will find information on the top technologies for tax director professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Tax Director’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Microsoft SQL Server

- Yardi software

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Qualifying your relevant certifications and education on your tax director resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your tax director resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants

- Enrolled Agent (EA) - Internal Revenue Service

- Certified Tax Coach (CTC) - American Institute of Certified Tax Coaches

- Chartered Tax Professional (CTP) - The Income Tax School

- Accredited Tax Advisor (ATA) - Accreditation Council for Accountancy and Taxation

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for tax director professionals.

Top US associations for a Tax Director professional

- AICPA and CIMA

- American Bankers Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

Listing your relevant degrees or certificates on your tax director resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Recommended reads:

Professional summary or objective for your tax director resume

tax director candidates sometimes get confused between the difference of a resume summary and a resume objective.

Which one should you be using?

Remember that the:

- Resume objective has more to do with your dreams and goals for your career. Within it, you have the opportunity to showcase to recruiters why your application is an important one and, at the same time, help them imagine what your impact on the role, team, and company would be.

- Resume summary should recount key achievements, tailored for the role, through your career. Allowing recruiters to quickly scan and understand the breadth of your tax director expertise.

The resume objectives are always an excellent choice for candidates starting off their career, while the resume summary is more fitting for experienced candidates.

No matter if you chose a summary or objective, get some extra inspiration from real-world professional tax director resumes:

Resume summaries for a tax director job

- With a rich 15-year history leading tax departments for multinational corporations, I bring a depth of experience in international tax law compliance and strategy. My proudest moment was spearheading the restructure of global tax operations resulting in a 20% reduction in overhead, showcasing my commitment to efficient and ethical financial stewardship.

- Accomplished Certified Public Accountant with a decade of progressively responsible roles, I excelled in delivering accurate tax reporting and effective planning for a Fortune 500 company. My technical prowess in tax software, coupled with a successful track record of navigating audits, culminates in my reputation for excellence and reliability in financial leadership.

- As a seasoned finance professional with 22 years outside the tax specialty, my expertise spans comprehensive budget management and strategic financial analysis. Eager to transition into tax leadership, I am committed to bringing my analytical acumen and proven record of maximizing revenue to navigate the complexities of corporate taxation.

- Adept at orchestrating operational transformations in healthcare finance, with a tenure of 18 years, I am now poised to pivot to tax directorship. Leveraging my intricate knowledge of financial regulations and cost control, I am looking to apply my strategic planning talents to lead a dynamic tax department with a forward-thinking approach.

- Eager to apply my strong foundation in economics and a passion for analytical problem-solving to a career in tax management. As a master's graduate in finance with internships at leading accounting firms, I am ready to combine my academic knowledge with practical insights to contribute to effective tax strategies and compliance.

- Transitioning from business consultancy to tax management, I bring a unique perspective fostered over 12 years. My objective is to craft innovative tax solutions, leveraging my keen insight into business operations, cost-saving methods, and performance improvement to drive the financial well-being of an ambitious tax department.

Average salary info by state in the US for tax director professionals

Local salary info for Tax Director.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Other tax director resume sections to support your expertise and skills

Recruiters are always on the lookout for that tax director candidate who brings about even more value to the role.

This can be either via their personality or additional accreditations they have across the industry.

Add to your resume any of the four sections that fit your profile:

- Projects for your most impressive, cutting-edge work;

- Awards or recognitions that matter the most;

- Publications further building up your professional portfolio and accreditations;

- Hobbies and interests to feature the literature you read, how you spend your time outside of work, and other personality traits you deem may help you stand out .

Key takeaways

- All aspects of your resume should be selected to support your bid for being the perfect candidate for the role;

- Be intentional about listing your skill set to be balanced with both technical and people capabilities, while aligning with the job;

- Include any experience items that are relevant to the role and ensure you feature the outcomes of your responsibilities;

- Use the summary or objective as a screenshot of your best experience highlights;

- Curate various resume sections to showcase personal, transferable skills.