A significant challenge faced by revenue accountants when crafting their resumes is demonstrating their technical skills in revenue recognition, financial reporting, and data analysis in a concise yet compelling manner. Our guide provides specific language tips and templates, tailored for revenue accountants, that effectively highlight these key skills, making your resume stand out to potential employers.

Here's what you'll read within our professional resume guide:

- Revenue accountant resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out revenue accountant skills that should make your resume.

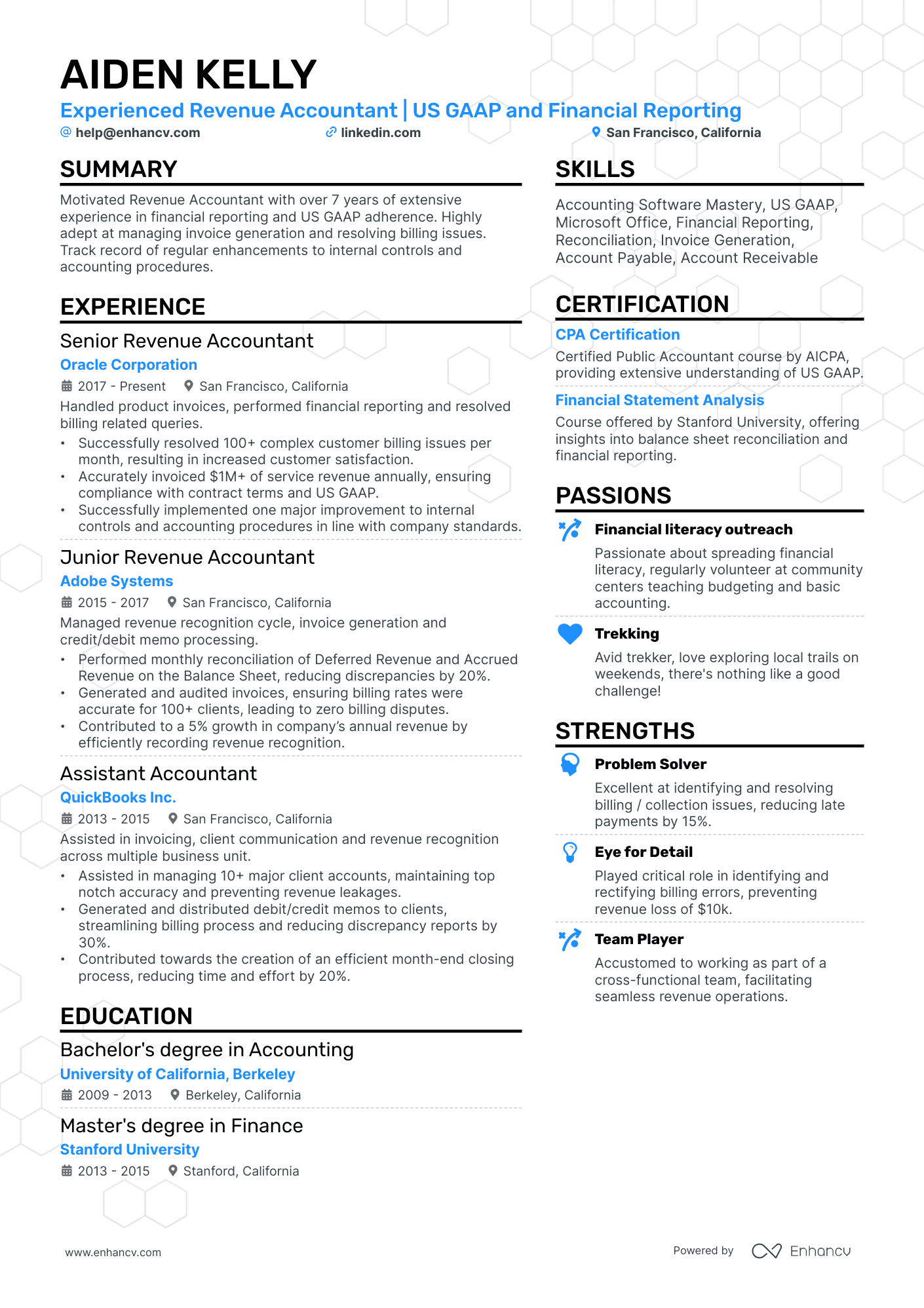

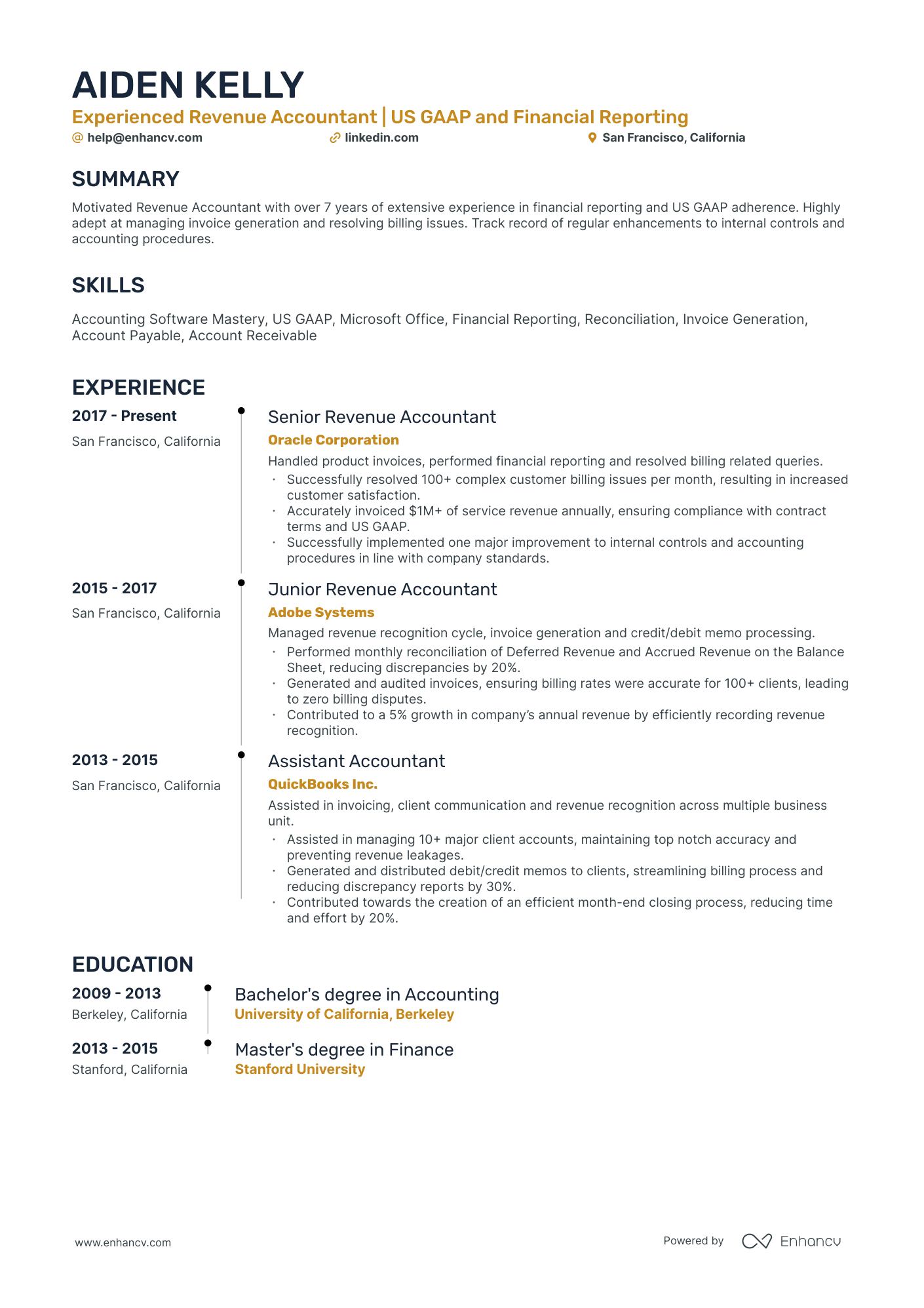

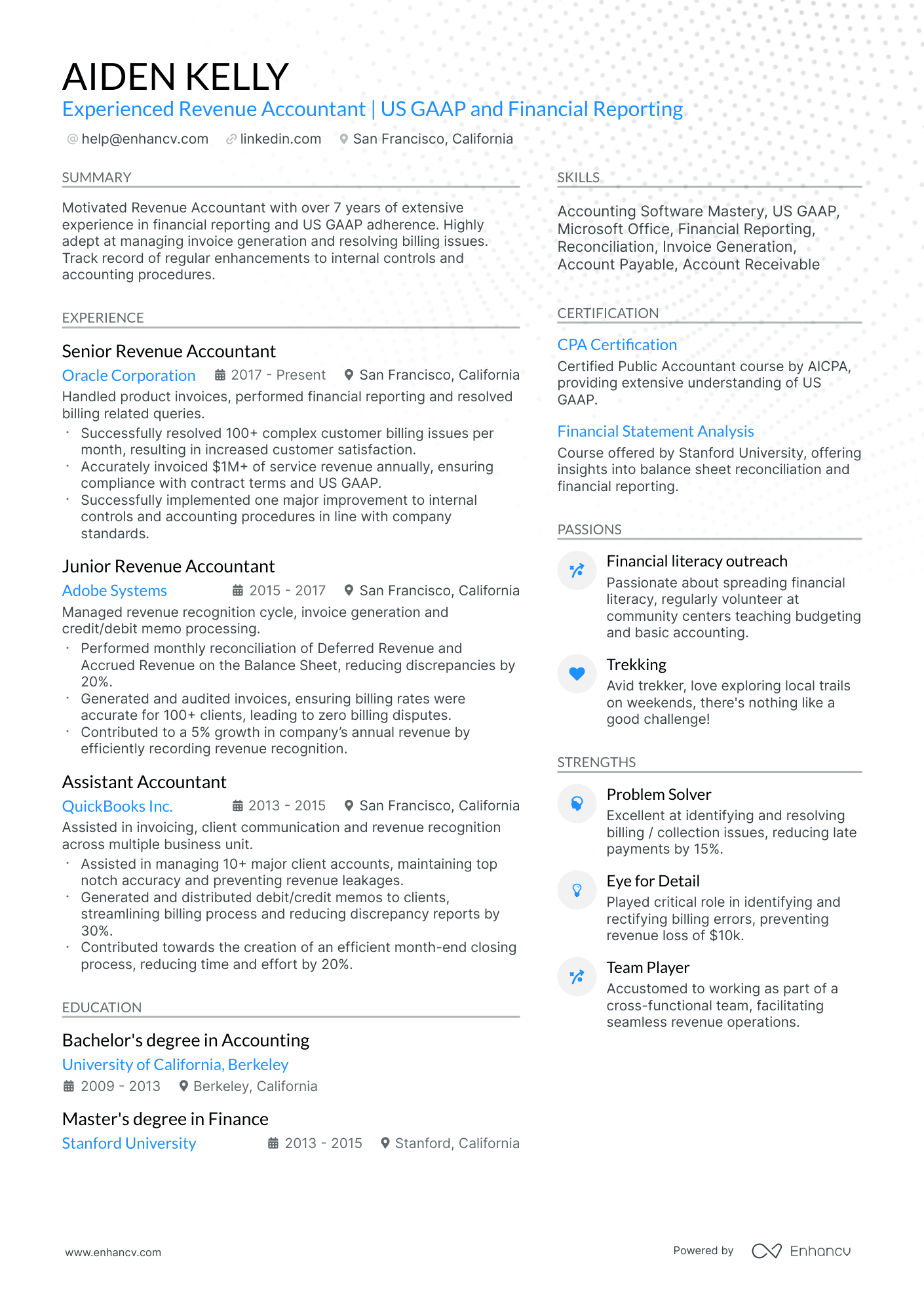

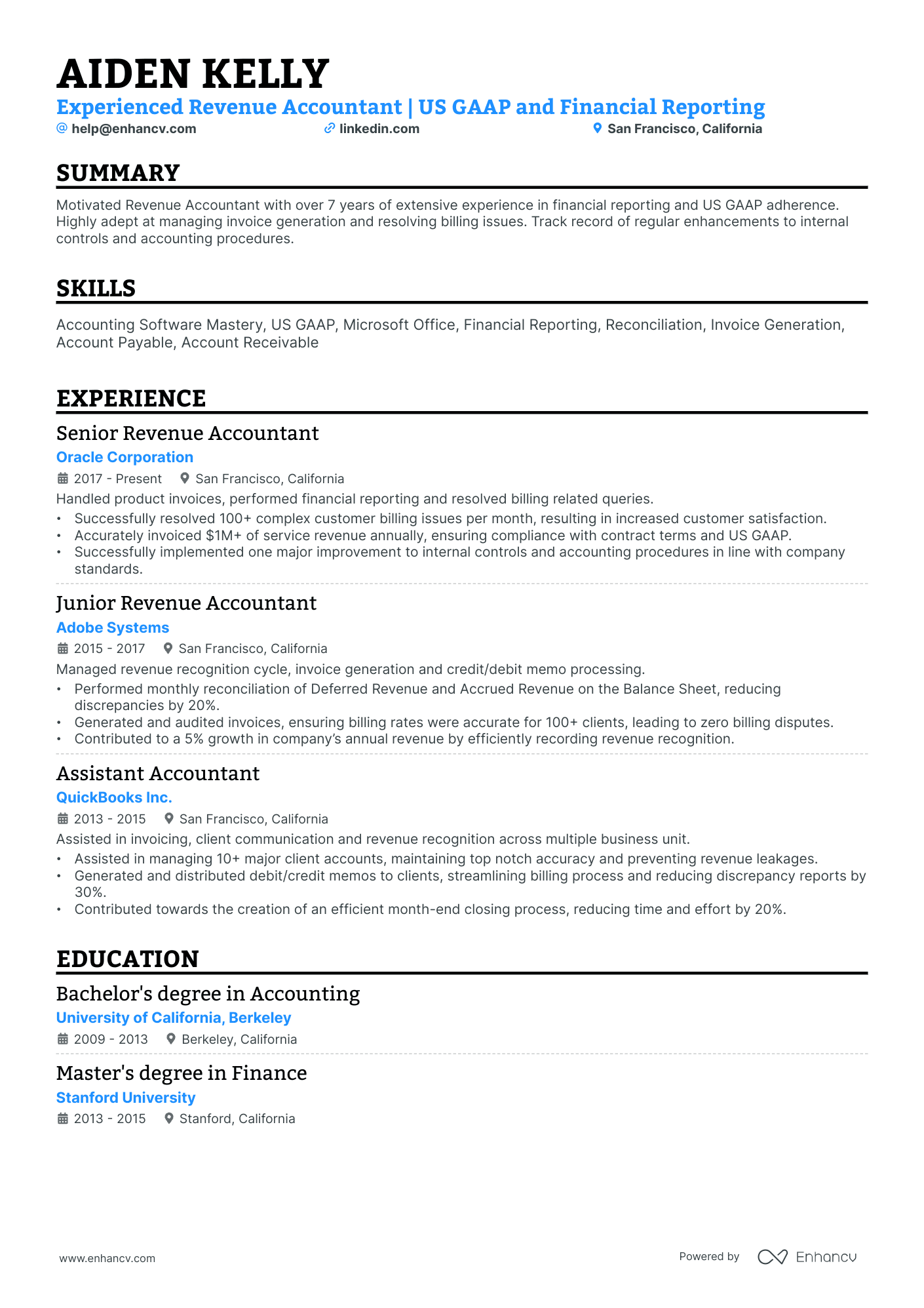

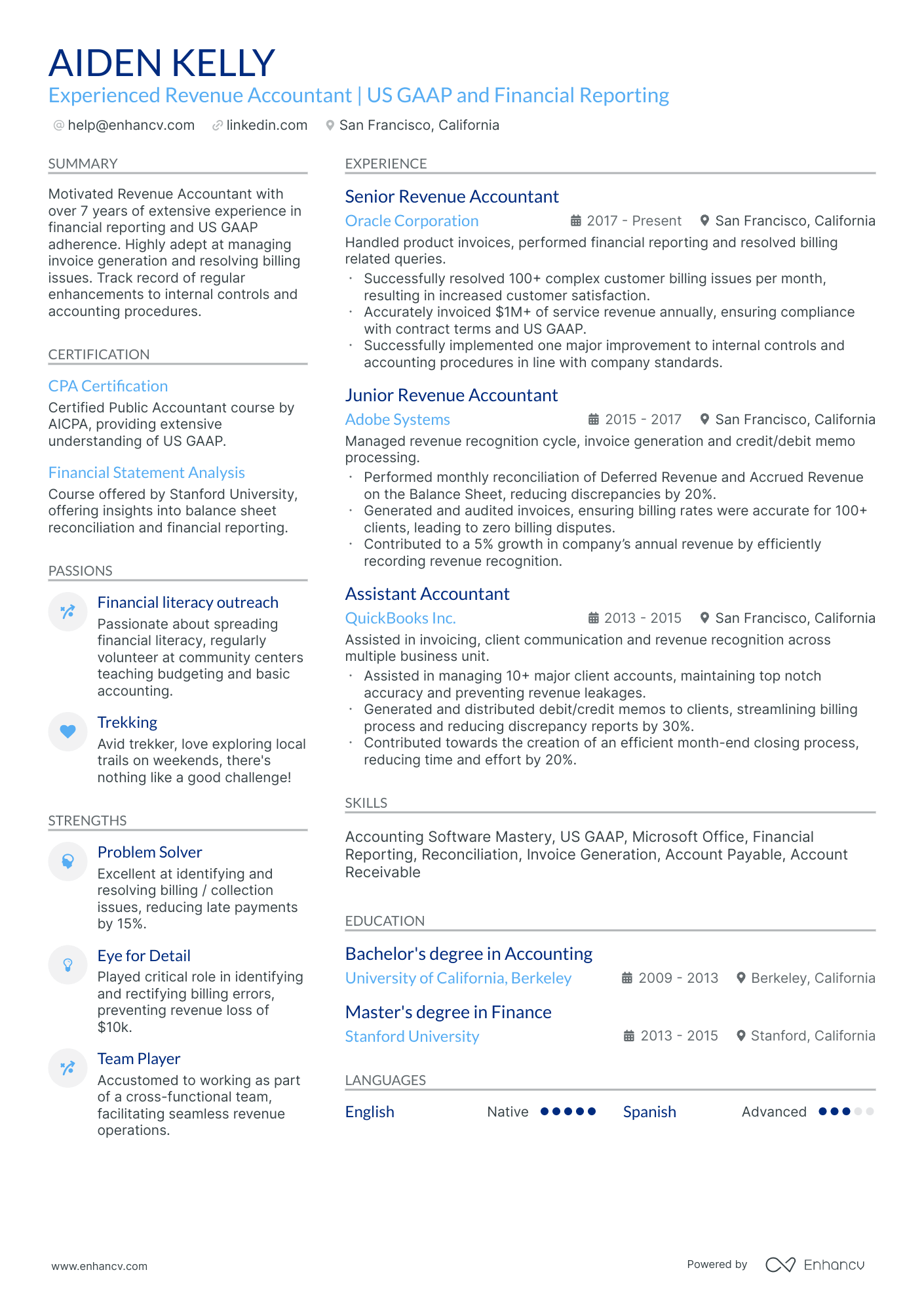

- Styling the layout of your professional resume: take a page from revenue accountant resume examples.

- How to write about your revenue accountant achievements in various resume sections (e.g. summary, experience, and education).

Recommended reads:

crafting a stellar revenue accountant resume format

Navigating the maze of resume formatting can be challenging. But understanding what recruiters prioritize can make the process smoother.

Wondering about the optimal format, the importance of certain sections, or how to detail your experience? Here's a blueprint for a polished resume:

- Adopt the reverse-chronological resume format. By spotlighting your latest roles upfront, you offer recruiters a snapshot of your career trajectory and recent accomplishments.

- Your header isn't just a formality. Beyond basic contact information, consider adding a link to your portfolio and a headline that encapsulates a significant achievement or your current role.

- Distill your content to the most pertinent details, ideally fitting within a two-page limit. Every line should reinforce your candidacy for the revenue accountant role.

- To preserve your resume's layout across different devices and platforms, save it as a PDF.

Your resume should match the market – Canadian applications, for instance, may use a different layout.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Consider incorporating design elements like icons or charts to enhance your resume's visual appeal and readability. But remember, the key is subtlety; don't let design overshadow content.

The five (plus) definite sections your resume for a revenue accountant job should include are:

- Header with your headline, contact details, and/or a preview of your work

- Summary (or objective) to pinpoint how your success aligns with the role

- Experience with bullets of your most relevant achievements in the field

- Skills to integrate vital job requirements (both technical and personal)

- Your further dedication to the field, showcased via relevant higher education and/or certifications

What recruiters want to see on your resume:

- Knowledge of Revenue Recognition: Demonstrating familiarity with ASC 606 and IFRS 15, which are crucial revenue recognition accounting standards.

- Experience with Relevant Software: Proficiency in software like QuickBooks, Oracle, SAP or other ERP systems specific to accounting and finance is highly valued.

- Analytical Skills: Ability to use data and reports to identify trends, discrepancies, and opportunities for improvement in revenue processes.

- Detail-Oriented: Evidence of careful attention to detail in order to ensure compliance with regulations and accuracy in financial reporting.

- Certifications: Credentials such as the Certified Public Accountant (CPA) designation can demonstrate commitment to the field and technical expertise.

Recommended reads:

The experience section of your revenue accountant resume: your professional journey

The experience section is your platform to narrate your professional story. Recruiters scrutinize this section to gauge your unique value proposition.

Here are five steps to craft a compelling experience section:

- Highlight relevant roles, including the company, role description, and tenure, supported by up to six bullet points per role.

- Emphasize tangible outcomes of your contributions, using quantifiable metrics where possible.

- Integrate positive feedback or endorsements to bolster your claims.

- Ensure verb tense consistency when detailing responsibilities.

- Summarize significant achievements relevant to each role.

Explore how seasoned revenue accountant professionals have crafted their experience sections to secure roles at industry-leading firms.

- Managed revenue recognition process, ensuring compliance with accounting standards and company policies.

- Collaborated with cross-functional teams to implement revenue accounting system enhancements, resulting in improved efficiency and accuracy.

- Prepared and analyzed monthly revenue reports, identifying trends and variances for management review.

- Assisted in the preparation of financial statements and supporting schedules for external audits.

- Led a project to streamline revenue processes, reducing processing time by 20%.

- Performed revenue reconciliations between general ledger and subledger systems, resolving discrepancies and ensuring accurate financial reporting.

- Reviewed contracts and sales agreements to determine proper revenue recognition treatment.

- Collaborated with sales team to develop pricing models and sales strategies, resulting in a 15% increase in overall revenue.

- Prepared and reviewed revenue forecasts and budget analysis, providing insights for decision-making.

- Implemented a revenue tracking system to monitor billing and collections, improving cash flow management.

- Conducted internal training sessions on revenue recognition policies and procedures for finance and sales teams.

- Assisted in the implementation of ERP system upgrades, ensuring accurate recording of revenue transactions.

- Analyzed complex revenue arrangements and documented accounting treatment according to ASC guidelines.

- Collaborated with legal team to review and negotiate revenue-related contract terms.

- Developed revenue recognition policies and procedures, ensuring compliance with GAAP and regulatory requirements.

- Participated in cross-functional projects to improve revenue recognition processes, resulting in a 30% reduction in errors.

- Assisted in the implementation of a new revenue accounting software system, training staff on its use.

- Prepared revenue-related disclosures for quarterly and annual financial filings.

- Performed detailed analysis of revenue contracts, identifying potential risks and recommending appropriate actions.

- Assisted in the preparation of revenue-related audit schedules, supporting external auditors during quarterly reviews and year-end audits.

- Collaborated with sales and operations teams to resolve billing discrepancies and ensure accurate revenue recognition.

- Implemented process improvements in revenue controls, reducing the occurrence of billing errors by 25%.

- Supported the finance team in ad hoc financial analysis and reporting.

- Participated in cross-functional initiatives to enhance internal controls related to revenue recognition.

- Responsible for analyzing revenue streams and identifying areas for optimization and increased profitability.

- Collaborate with sales and marketing teams to develop pricing strategies and promotional campaigns.

- Conduct regular revenue forecasting and budgeting activities, providing insights for strategic decision-making.

- Implement process automation initiatives to streamline revenue accounting procedures, resulting in a 15% reduction in processing time.

- Perform revenue reconciliations, ensuring accurate and timely recognition of revenue.

- Participate in system implementations and upgrades to enhance revenue accounting systems and controls.

- Performed detailed analysis of revenue contracts, identifying potential risks and recommending appropriate actions.

- Collaborated with cross-functional teams to develop revenue recognition policies and procedures.

- Conducted training sessions on revenue recognition guidelines for internal stakeholders.

- Led the implementation of a new revenue management system, resulting in improved accuracy and efficiency.

- Analyzed revenue performance and identified revenue optimization opportunities.

- Prepared revenue-related reports for management and external stakeholders.

- Reviewed revenue contracts to ensure compliance with company policies and accounting standards.

- Assisted in the development and documentation of revenue recognition policies and procedures.

- Performed monthly revenue reconciliations, investigating and resolving discrepancies.

- Collaborated with sales and finance teams to resolve revenue-related issues and inquiries.

- Assisted in the preparation of revenue forecasts and budgets.

- Contributed to internal process improvement initiatives to enhance revenue accounting controls.

- Assisted in the review and analysis of revenue contracts and agreements.

- Updated revenue recognition schedules and performed related journal entries.

- Prepared supporting documentation for revenue-related audits and reviews.

- Collaborated with cross-functional teams to resolve billing and revenue discrepancies.

- Assisted in the implementation of a new revenue accounting system.

- Provided general support to the revenue accounting team.

- Reviewed and analyzed revenue contracts, ensuring compliance with accounting standards and company policies.

- Collaborated with sales and legal teams to negotiate revenue-related contract terms.

- Prepared revenue forecasts and budget analysis, providing insights for financial planning.

- Implemented process improvements to streamline revenue recognition procedures, resulting in a 20% reduction in turnaround time.

- Conducted revenue reconciliations and resolved discrepancies between systems.

- Assisted in the preparation of revenue-related disclosures for external financial reporting.

- Performed detailed review of revenue contracts and agreements for proper revenue recognition.

- Collaborated with cross-functional teams to develop and implement revenue recognition policies.

- Prepared revenue analytics reports, identifying trends and deviations for management review.

- Assisted in the development of revenue forecasting models, improving accuracy by 10%.

- Coordinated with auditors during quarterly and year-end audits, providing necessary documentation.

- Participated in the integration of a new revenue accounting software, facilitating efficient revenue tracking.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for revenue accountant professionals.

Top Responsibilities for Revenue Accountant:

- Prepare detailed reports on audit findings.

- Report to management about asset utilization and audit results, and recommend changes in operations and financial activities.

- Collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies.

- Inspect account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

- Supervise auditing of establishments, and determine scope of investigation required.

- Confer with company officials about financial and regulatory matters.

- Examine and evaluate financial and information systems, recommending controls to ensure system reliability and data integrity.

- Inspect cash on hand, notes receivable and payable, negotiable securities, and canceled checks to confirm records are accurate.

- Examine records and interview workers to ensure recording of transactions and compliance with laws and regulations.

- Prepare, examine, or analyze accounting records, financial statements, or other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards.

Quantifying impact on your resume

<ul>

Tips for revenue accountant newcomers launching their careers

Lacking extensive experience for that revenue accountant role? No worries.

Sometimes, hiring managers go for the unexpected candidate when they see potential.

Here's how to convince them you're the right fit:

- Opt for the functional skill-based or hybrid formats to highlight your unique professional value.

- Always tailor your revenue accountant resume to emphasize the most critical requirements, usually listed at the top of the job ad.

- Compensate for limited experience with other relevant sections like achievements, projects, and research.

- In your revenue accountant resume objective, pinpoint both your achievements and how you envision your role in the position.

Recommended reads:

Pro tip

Remember, the experience section isn't just about traditional roles. It's a space to highlight all professional learning, whether from internships, contract roles, research projects, or other relevant experiences. If it's added value to your skill set for the revenue accountant role, it deserves a mention.

Highlighting essential hard and soft skills for your revenue accountant resume

Your skill set is a cornerstone of your revenue accountant resume.

Recruiters keenly evaluate:

- Your hard skills, gauging your proficiency with specific tools and technologies.

- Your soft skills, assessing your interpersonal abilities and adaptability.

A well-rounded candidate showcases a harmonious blend of both hard and soft skills, especially in a dedicated skills section.

When crafting your revenue accountant skills section:

- List up to six skills that resonate with the job requirements and highlight your expertise.

- Feature a soft skill that encapsulates your professional persona, drawing from past feedback or personal reflections.

- Consider organizing your skills into distinct categories, such as "Technical Skills" or "Soft Skills."

- If you possess pivotal industry certifications, spotlight them within this section.

Crafting a comprehensive skills section can be daunting. To assist, we've curated lists of both hard and soft skills to streamline your resume-building process.

Top skills for your revenue accountant resume:

Accounting Software (e.g., QuickBooks, SAP)

Revenue Recognition Standards (e.g., ASC 606)

Excel (Advanced Functions and Formulas)

Financial Reporting

Data Analysis Tools (e.g., Tableau, Power BI)

General Ledger Management

Tax Compliance and Reporting

Budgeting and Forecasting

Accounts Receivable Management

Financial Auditing

Attention to Detail

Analytical Thinking

Problem-Solving

Communication Skills

Time Management

Team Collaboration

Adaptability

Critical Thinking

Organizational Skills

Integrity

Next, you will find information on the top technologies for revenue accountant professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Revenue Accountant’s resume:

- Intuit QuickBooks

- Sage 50 Accounting

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Tropics workers' compensation software

Pro tip

Sometimes, basic skills mentioned in the job ad can be important. Include them in your resume, but don't give them too much space.

Optimizing the education and certification sections of your revenue accountant resume

Your education and certification sections can be game-changers on your revenue accountant resume, showcasing your commitment to professional growth.

For the education section:

- Highlight advanced education, noting the institution and duration.

- If you're currently studying, mention your expected graduation date.

- Exclude degrees that don't align with the job's requirements.

- If relevant, delve into your academic journey, spotlighting significant achievements.

When listing degrees and certifications:

- Feature those directly relevant to the role.

- Highlight recent and significant knowledge or certifications at the top of your resume.

- Provide essential details like the issuing institution and dates for credibility.

- Avoid listing irrelevant degrees or certifications, such as your high school diploma or unrelated specializations.

Remember, even if you're tempted to omit your education or certifications, they can offer a competitive edge, signaling a long-term commitment to the industry.

Best certifications to list on your resume

Pro tip

The reputation of the institution or organization granting your certification or degree can bolster your credibility. Prioritize recognized and respected credentials.

Recommended reads:

Should you add a summary or objective to your revenue accountant resume?

Choose between:

- Resume summary to match job needs with your top wins.

- Resume objective to share your career goals.

Both should tell recruiters about your best moments. Keep them short, around five sentences. Check out our sample structures for guidance.

Resume summary and objective examples for a revenue accountant resume

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Extra sections to include in your revenue accountant resume

What should you do if you happen to have some space left on your resume, and want to highlight other aspects of your profile that you deem are relevant to the role?

Add to your revenue accountant resume some of these personal and professional sections:

- Passions/Interests - to detail how you spend both your personal and professional time, invested in various hobbies;

- Awards - to present those niche accolades that make your experience unique;

- Publications - an excellent choice for professionals, who have just graduated from university or are used to a more academic setting;

- < a href="https://enhancv.com/blog/volunteering-on-resume/"> Volunteering - your footprint within your local (or national/ international) community.

Key takeaways

- Structure your resume to spotlight career highlights and relevance to the role.

- Keep your resume concise, prioritizing relevant experiences.

- Detail specific achievements that showcase your suitability for the role.

- Both technical and interpersonal skills should be evident throughout your revenue accountant application.