Crafting a resume for a commercial banking position can be daunting due to the necessity of quantifying your financial impact and showcasing complex deal experiences. Our guide offers you targeted advice to turn this challenge into an opportunity by teaching you how to effectively communicate your accomplishments and the value you can bring to a team.

- Find different commercial banking resume examples to serve as inspiration to your professional presentation.

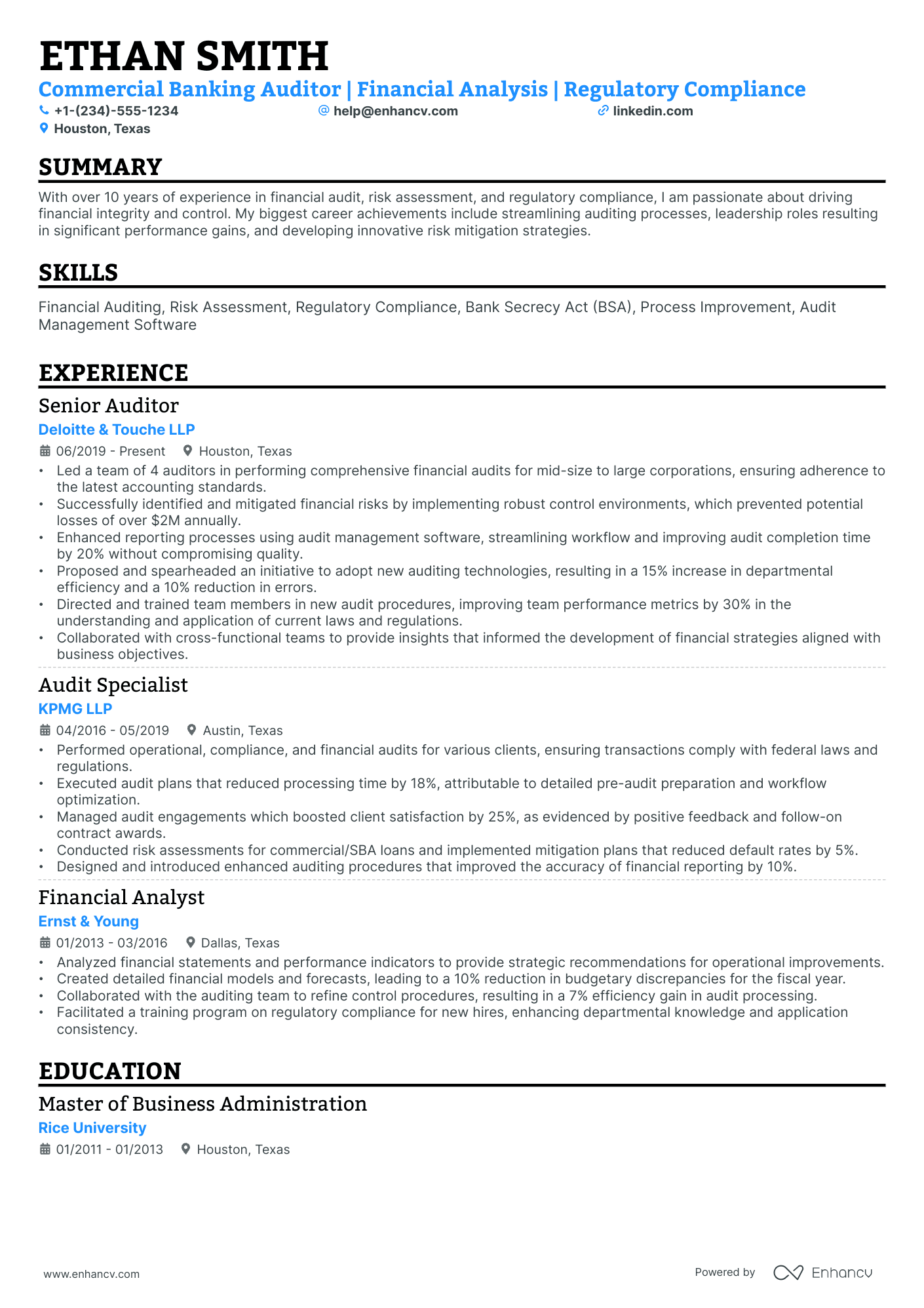

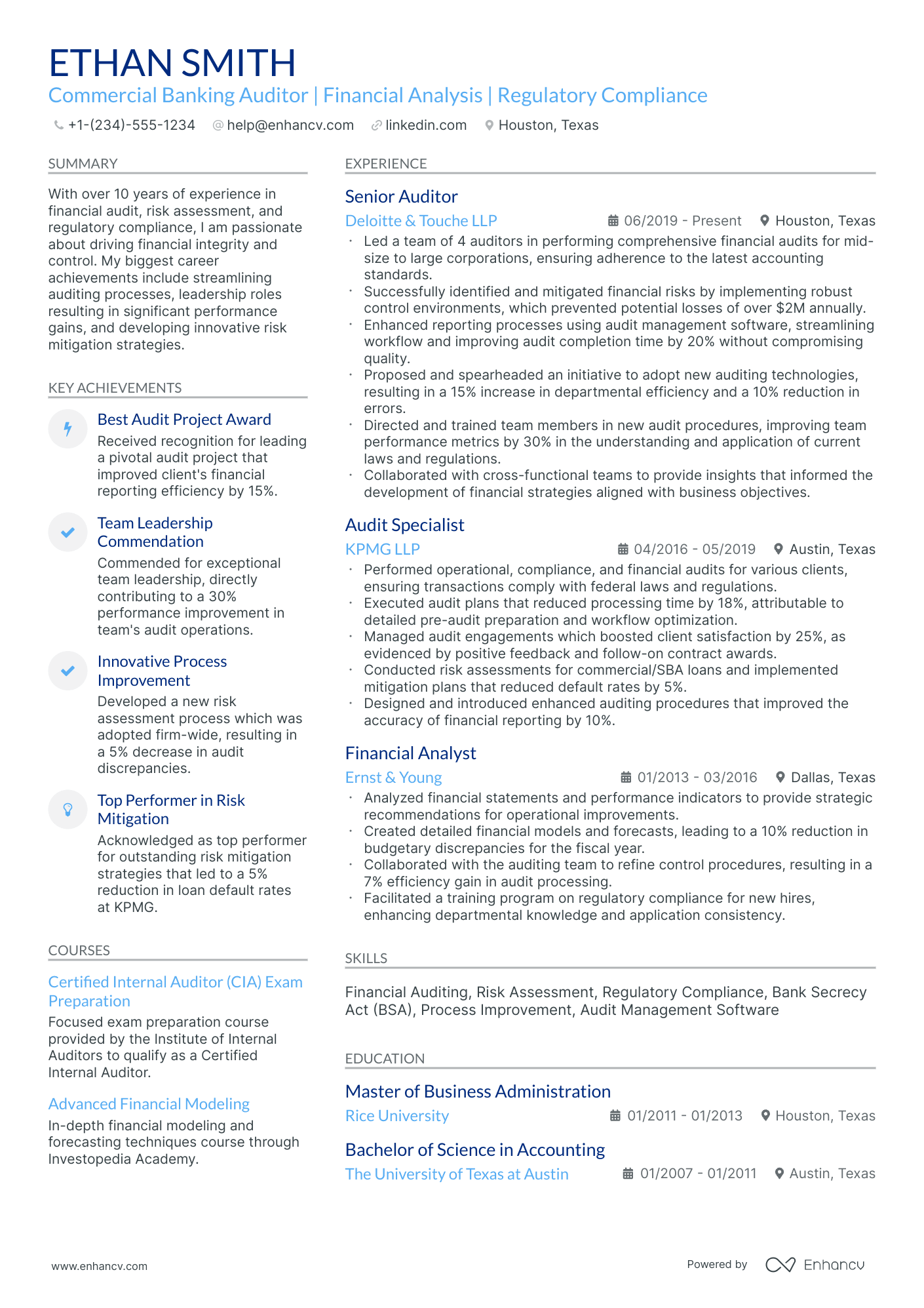

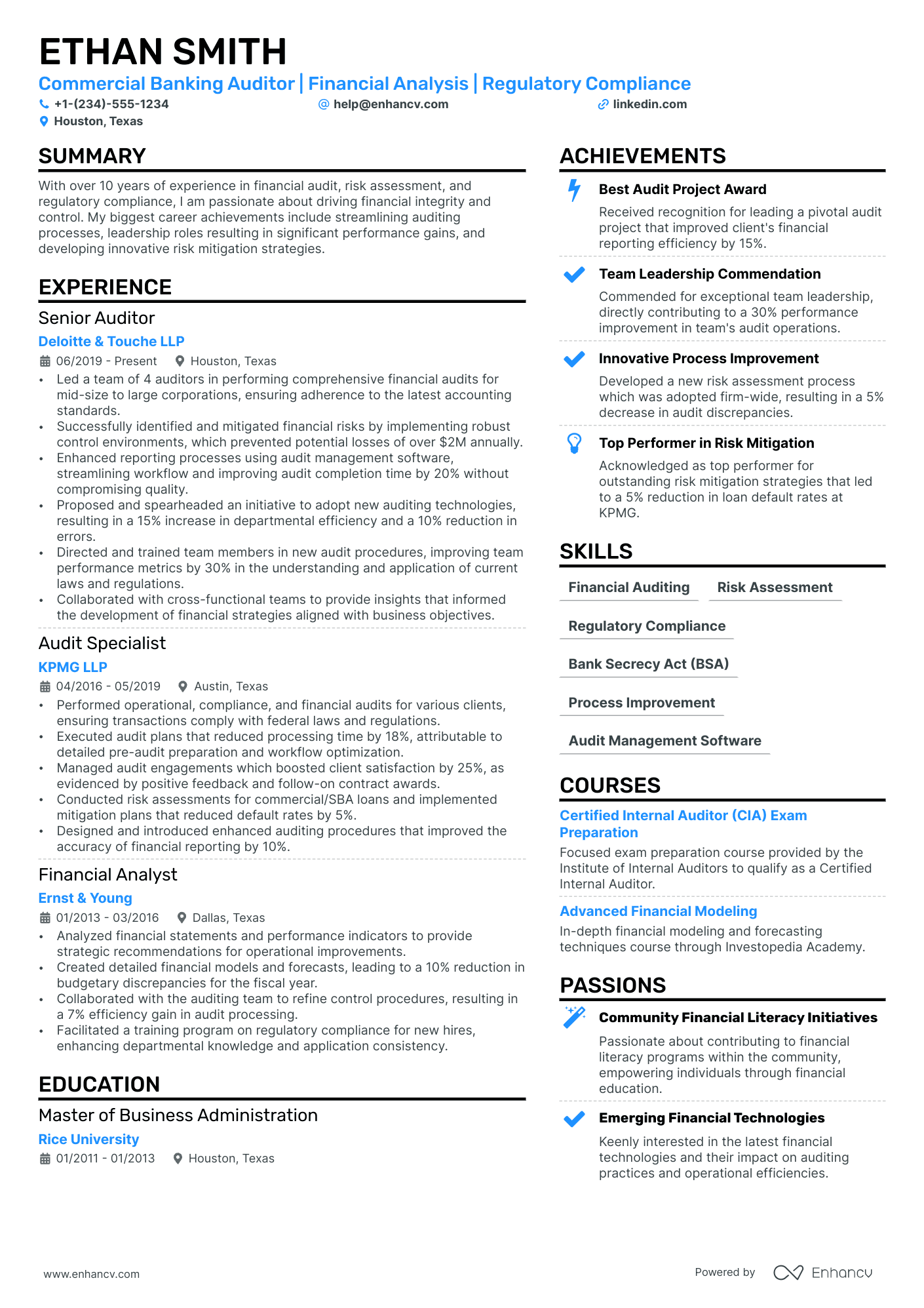

- How to use the summary or objective to highlight your career achievements.

- How to create the experience section to tell your story.

- Must have certificates and what to include in the education section of your resume.

If the commercial banking resume isn't the right one for you, take a look at other related guides we have:

- Accounting Supervisor Resume Example

- Corporate Banking Resume Example

- Audit Manager Resume Example

- Financial Risk Analyst Resume Example

- Financial Counselor Resume Example

- Financial Representative Resume Example

- Corporate Accounting Resume Example

- Forensic Accounting Resume Example

- Financial Assistant Resume Example

- External Auditor Resume Example

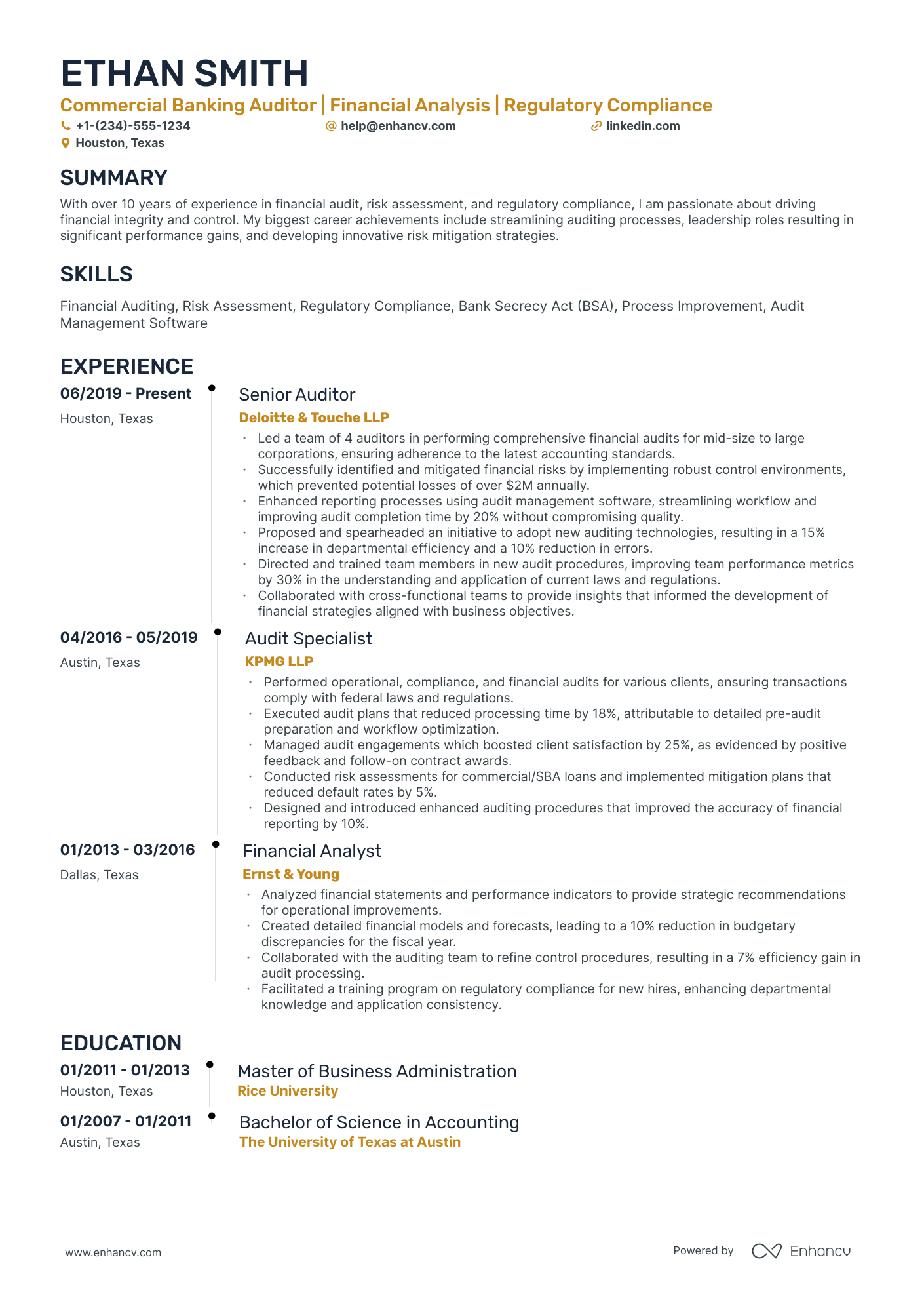

The ultimate formula for your commercial banking resume format

Our best advice on how to style your commercial banking resume is this - first, take the time to study the job advert requirements.

The resume format you select should ultimately help you better align how your experience matches the specific role.

There are four crucial elements you need to thus take into consideration:

- How you present your experience. If you happen to have plenty of relevant expertise, select the reverse-chronological resume format to organize your experience by dates, starting with the latest.

- Don't go over the top with writing your resume. Instead, stick with a maximum of two-page format to feature what matters most about your profile.

- Headers aren't just for "decoration". The header of your resume helps recruiters allocate your contact details, portfolio, and so much more.

- The PDF format rules. It's the most common practice to submit your commercial banking resume as a PDF so that your resume doesn't lose its layout. However, make sure the read the job well - in some instances, they might require a doc file.

Be mindful of regional differences in resume formats – a Canadian layout, for instance, might vary.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

The key to your commercial banking job-winning resume - present your expertise with these sections:

- A header to make your resume more scannable

- Snapshot of who you are as a professional with your resume soft skills, achievements, and summary or objective

- Job advert keywords in the skills section of your resume

- Resume experience quantifying your past job successes with metrics

- A relevant education, certification, and technical sills section to provide background to your technological/software capabilities

What recruiters want to see on your resume:

- Experience with financial analysis and credit risk assessment

- Knowledge of commercial banking products and regulations

- Proven track record in business development and client relationship management

- Strong analytical and problem-solving skills

- Demonstrated ability in using banking software and financial modeling tools

Quick formula for writing your commercial banking resume experience section

Have you ever wondered why recruiters care about your commercial banking expertise?

For starters, your past roles show that you've obtained the relevant on-the job training and expertise that'd be useful for the role.

What is more, the resume work experience section isn't just your work history , but:

- shows what you're capable of achieving based on your past success;

- proves your skills with (oftentimes, tangible) achievements;

- highlights the unique value of what it's like to work with you.

To ensure your resume work experience section is as effective as possible, follow this formula:

- start each bullet with a powerful, action verb , followed up by your responsibilities, and your workplace success.

The more details you can include - that are relevant to the job and linked with your skill set - the more likely you are to catch recruiters' attention.

Additionally, you can also scan the job advert for key requirements or buzzwords , which you can quantify across your experience section.

Not sure what we mean by this? Take inspiration from the commercial banking resume experience sections below:

- Managed a commercial loan portfolio exceeding $30 million, continually assessing risk and proactively addressing potential issues.

- Led the negotiation and structuring of complex loan agreements for mid-sized businesses, resulting in a 20% growth in the client base within the first year.

- Improved loan processing efficiency by implementing a new CRM system, reducing average approval times by 30%.

- Spearheaded the development of a fintech partnership program which enhanced the bank's commercial lending capabilities and attracted tech-savvy clients.

- Achieved a record-high customer satisfaction rate of 95% through personalized financial consulting and tailored banking solutions for commercial clients.

- Facilitated cross-departmental training on commercial product offerings, increasing overall sales team knowledge and boosting cross-selling by 25%.

- Developed and maintained a portfolio of approximately 75 high-value commercial clients with an emphasis on long-term relationship building.

- Directed a strategic initiative to focus on underserved markets, capturing a 15% market share in previously untapped sectors within two years.

- Collaborated with risk management to refine credit analysis procedures, reducing non-performing assets by 18%.

- Pioneered a data-driven approach to evaluate commercial lending opportunities, increasing the prediction accuracy of loan defaults by 22%.

- Managed a team of 8 banking professionals, fostering a collaborative environment that improved team productivity by 15%.

- Coordinated the integration of a new regulatory compliance framework, ensuring 100% adherence to industry standards and minimizing potential legal exposures.

- Implemented a relationship-based approach to portfolio management, significantly enhancing client retention rates by 30% within the span of 8 months.

- Authored insightful quarterly market trend reports that became a key decision-making tool for the bank's strategic planning committee.

- Personally managed and expanded key accounts, adding a cumulative business value of $20 million to the portfolio.

- Conducted detailed financial analyses for over 50 commercial clients, providing robust investment and loan advice tailored to their specific industry conditions.

- Orchestrated a comprehensive training program on commercial banking services, equipping more than 100 staff members with advanced sales and service skills.

- Championed the adoption of sustainable banking practices among commercial clients, resulting in a 10% increase in the bank's eco-friendly loan products.

- Managed the successful turnaround of a portfolio of distressed commercial loans, implementing recovery strategies that saved the bank an estimated $7 million in potential losses.

- Collaborated with the credit team to revamp underwriting guidelines, resulting in a 12% reduction in delinquency rates.

- Played a pivotal role in securing a $50 million line of credit for a major commercial client, which supported their expansion plans and strengthened the bank’s market presence.

- Oversaw digital transformation projects for commercial banking services, including the launch of a mobile banking app that saw 100,000 downloads in the first six months.

- Cultivated a diverse client base by designing inclusive financing programs that catered to minority-owned businesses, increasing the client portfolio by 40%.

- Led the commercial team in securing a $200 million syndicated loan deal for a major infrastructure project, amplifying the bank's reputation in the industry.

Quantifying impact on your resume

- Highlight the volume of cash handled on a daily or monthly basis to show your capability in managing significant transactions.

- Include the number of client accounts managed to demonstrate customer service skills and account maintenance proficiency.

- Mention the percentage increase of customer satisfaction or net promoter score to illustrate your commitment to client happiness and service quality.

- Quantify the reduction in transaction processing time you achieved to display efficiency improvements and workflow management.

- Specify the amount of cross-sold financial products to reflect your sales acumen and contribution to business growth.

- Detail the value of loans or lines of credit you have successfully negotiated or approved to exhibit your financial assessment skills and risk management.

- Report any cost-saving initiatives you've implemented in dollar terms to show your ability to positively impact the bottom line.

- Document the size of the teams or projects you've led to indicate leadership abilities and operational responsibilities.

Action verbs for your commercial banking resume

Making the most of your little to none professional experience

If you're hesitant to apply for your dream job due to limited professional experience, remember that recruiters also value the unique contributions you can offer.

Next time you doubt applying, consider this step-by-step approach for your resume's experience section:

- Rather than the standard reverse chronological order, opt for a functional-based format. This shifts the focus from your work history to your achievements and strengths;

- Include relevant internships, volunteer work, or other non-standard experiences in your commercial banking resume's experience section;

- Utilize your education, qualifications, and certifications to bridge gaps in your commercial banking resume experience;

- Emphasize your interpersonal skills and transferable skills from various industries. Often, recruiters seek a personality match, giving you an advantage over other candidates.

Recommended reads:

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Key hard skills and soft skills for your commercial banking resume

At the top of any recruiter commercial banking checklist, you'd discover a list of technical competencies, balanced with personal skills.

Hard or technical skills are your opportunity to show how you meet the essential responsibilities of the role. The ability to use a particular job-crucial technology or software would also hint to recruiters whether you'd need a prolonged period of on-the-job training - or you'd fit right in the job.

But to land your dream role, you'd also need to demonstrate a variety of soft or people resume skills . Employers care about soft skills as they show how each candidate would fit into the team and company culture.

Both types of skills are specific and to best curate them on your resume, you'd need to:

- Create a skill section within which you showcase your hard and soft skills and present how they help you succeed.

- List specific examples of projects, tasks, or competitions, within which your skill set has assisted your results.

- Soft skills are harder to measure, so think about situations in which they've helped you thrive. Describe those situations concisely, focusing on how the outcome has helped you grow as a professional.

- Metrics of success - like positive ROI or optimized workplace processes - are the best way to prove your technical and people skills.

Take a look at some of commercial banking industry leaders' favorite hard skills and soft skills, as listed on their resumes.

Top skills for your commercial banking resume:

Financial Analysis

Risk Management

Credit Assessment

Loan Underwriting

Financial Modeling

Regulatory Compliance

Banking Software (e.g., FIS, Jack Henry)

Data Analysis Tools (e.g., Excel, SQL)

Portfolio Management

Market Research

Communication

Negotiation

Problem Solving

Customer Service

Attention to Detail

Time Management

Team Collaboration

Analytical Thinking

Adaptability

Interpersonal Skills

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

What are the best certificates to add to your commercial banking resume + how to curate your education section

The education and certification resume sections are the underdogs of your commercial banking resume.

They showcase to recruiters that you've invested plenty of time to gain valuable and specific know-how, vital for growth.

As far as the resume education section is concerned:

- Detail only advanced education, specifying the institution and timeframe.

- Indicate your forthcoming graduation date if you're in the midst of your studies.

- Consider omitting degrees that don't align with the job's requirements.

- Offer a description of your academic journey if it underscores your notable achievements.

When curating your degrees and certificates on your commercial banking resume:

- Select only accreditation that matters to the role

- Niche knowledge that could help you stand out as a candidate (as is within the past few years), should be listed towards the top of your resume

- Include any pertinent data for credibility (e.g. institute name, graduation dates, etc.)

- Irrelevant degrees and certifications shouldn't make it on your resume. Those include your high school diploma and any specializations that have nothing to do with the technical or soft skills that are required for the job

As a final note, if you feel tempted to exclude your education or certification from your resume, don't.

These two sections could help you have a better competitive edge over other candidates - hinting that your professional journey in the industry may be for a longer period of time.

Recruiters find all of these commercial banking credentials impressive:

The top 5 certifications for your commercial banking resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Public Accountant (CPA) - American Institute of CPAs

- Certified Financial Services Auditor (CFSA) - The Institute of Internal Auditors

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Certified Bank Auditor (CBA) - Bank Administration Institute

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Recommended reads:

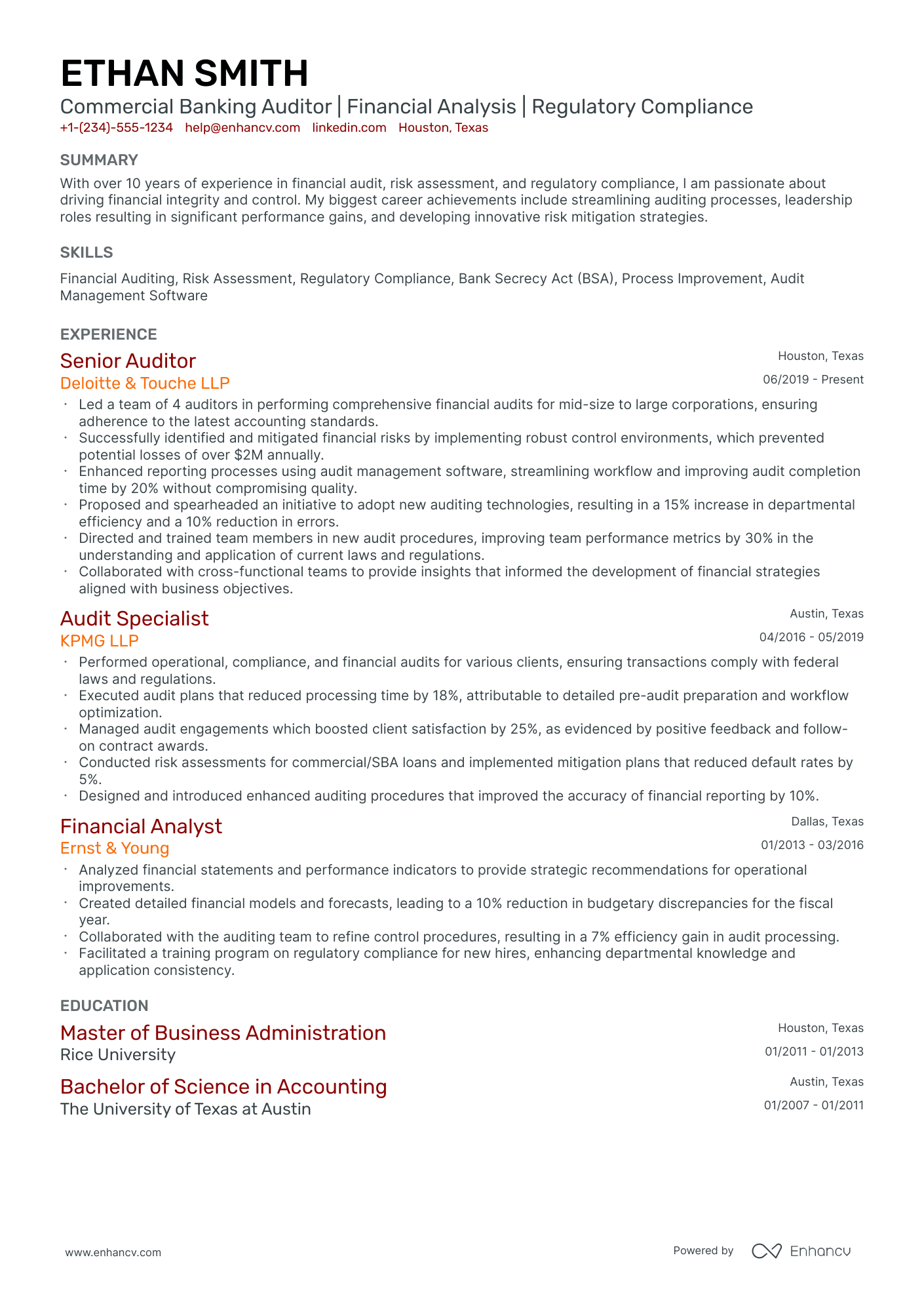

Writing the commercial banking resume summary or objective: achievements, keywords, dreams, and more

Deciding on whether to include a resume summary or resume objective should entirely depend on your career situation.

If you have:

- Plenty of relevant achievements you'd like to bring recruiters' focus to, make use of the resume summary. Ensure each of your achievements is quantified with concrete proof (e.g. % of cases solved).

- Less applicable experience, utilize the resume objective. Within the objective include a few noteworthy, past successes, followed up by your professional dreams.

As a bonus, you could define in either your commercial banking resume summary or objective what makes you the perfect candidate for the role.

Think about your unique hard and soft skills that would make your expertise even more important to the job.

These commercial banking professionals have completely covered the formula for the ideal resume introduction:

Resume summaries for a commercial banking job

- With over 10 years of robust experience in commercial banking, I have mastered the complexities of financial analysis and client relationship management at Citibank. My career highlight includes pioneering a cross-departmental workflow optimization that led to a 20% increase in operational efficiency within the corporate lending sector.

- A dedicated professional with 8 years of history in retail management, eager to leverage my strategic planning and customer-centric approach in transitioning to a commercial banking career. Successfully scaled a small retail chain to become a notable regional brand through innovative financial restructuring and critical budget decisions.

- Gifted with a forward-thinking analytical mind, and fueled by 5 years of experience in software development, I now aspire to reshape financial services by applying my technical expertise to commercial banking. I have led the implementation of an award-winning fintech application that revolutionized online transactions for over a million users.

- Seasoned Chartered Financial Analyst with 15 years of diverse experience, I transformed the fiscal strategies of several mid-size firms, culminating in my recent success in increasing portfolio returns by 35% year-over-year at JPMorgan Chase. My skill set encompasses risk management, investment advisory, and regulatory compliance.

- Eager to embark on a commercial banking career, I bring a fresh perspective and a strong foundation in business economics from my recent summa cum laude graduation. My drive is fueled by a passion for financial markets and an unwavering commitment to achieving excellence in client service and strategic advisement.

- As a recent MBA graduate with a specialization in Finance, I am excited about the prospects of applying my academic prowess and passion for economic strategies to the dynamic world of commercial banking. My objective is to contribute innovative solutions, cutting-edge financial analysis, and dedicated teamwork to drive client success and portfolio growth.

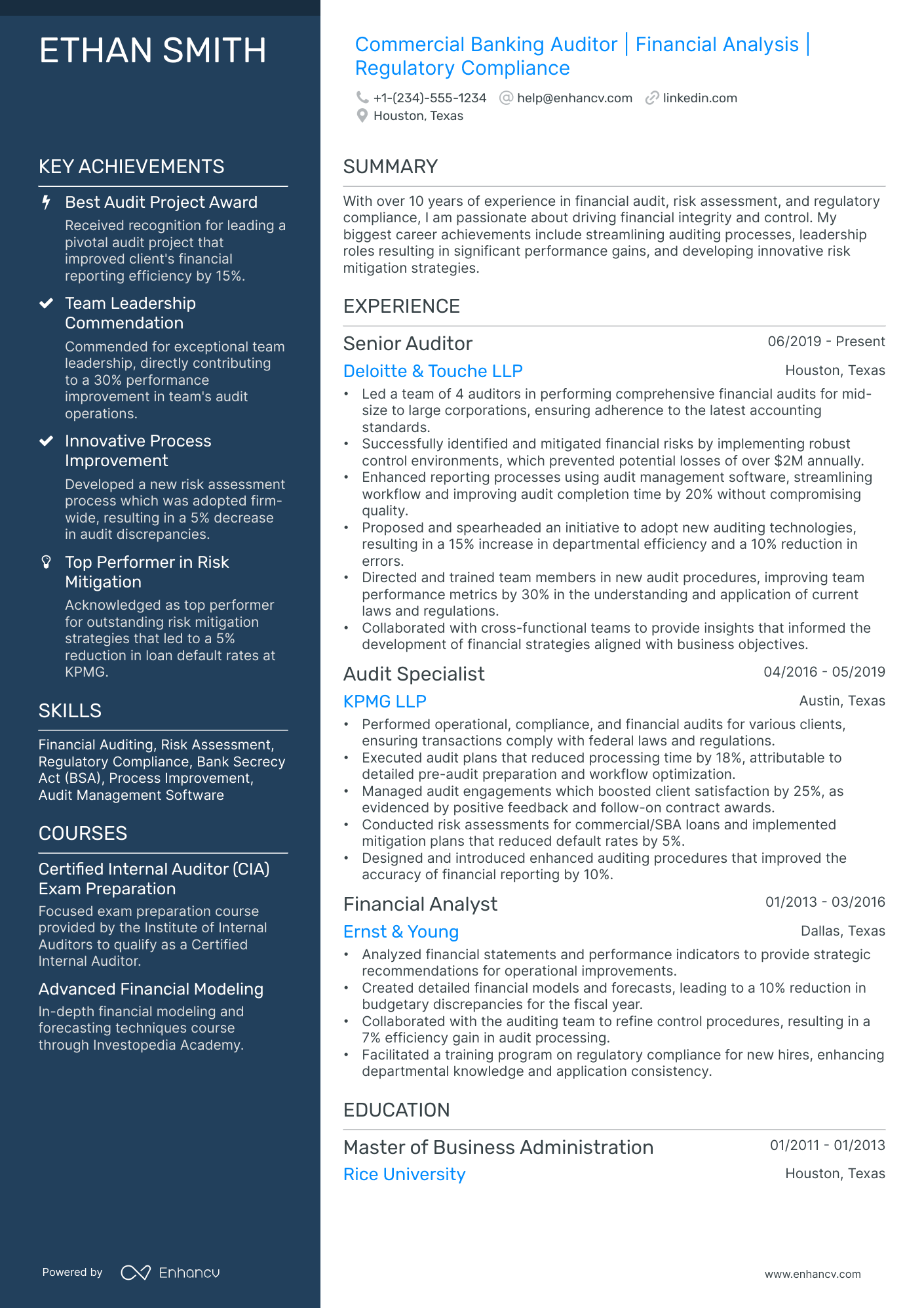

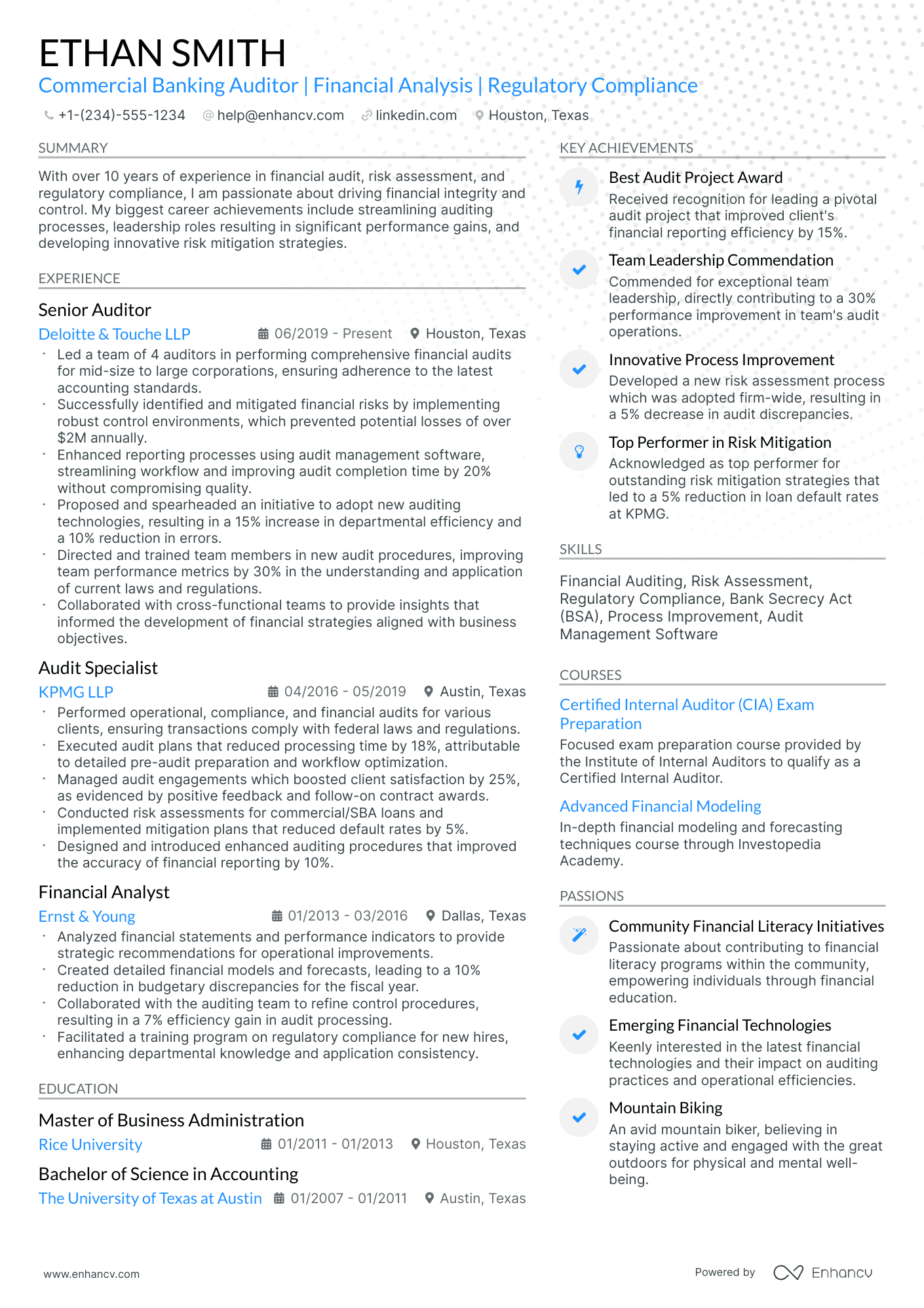

More sections to ensure your commercial banking resume stands out

If you're looking for additional ways to ensure your commercial banking application gets noticed, then invest in supplementing your resume with extra sections, like:

These supplementary resume sections show your technical aptitude (with particular technologies and software) and your people skills (gained even outside of work).

Key takeaways

Securing your ideal job starts with crafting a compelling commercial banking resume. It should not only highlight your professional strengths but also reflect your personality. Key aspects to remember include:

- Choose a clear, easily editable format, allowing more time to focus on the content of your resume;

- Emphasize experience relevant to the job, focusing on your impact on the team;

- Opt for a resume summary if you have extensive professional experience, and a resume objective if you're just starting out;

- Include technical skills in the skills section and interpersonal skills in the achievements section;

- Recognize the importance of various resume sections (e.g., My Time, Projects) in showcasing both your professional abilities and personal traits.