As a financial representative, you may struggle with effectively showcasing your complex portfolio of financial products and client relations skills on your resume. Our guide will provide you with tailored strategies to concisely articulate your financial expertise and interpersonal accomplishments, ensuring your resume stands out to potential employers.

- Incorporate financial representative job advert keywords into key sections of your resume, such as the summary, header, and experience sections;

- Quantify your experience using achievements, certificates, and more in various financial representative resume sections;

- Apply practical insights from real-life financial representative resume examples to enhance your own profile;

- Choose the most effective financial representative resume format to succeed in any evaluation process.

- Accounts Clerk Resume Example

- General Ledger Accounting Resume Example

- Collector Resume Example

- Financial Reporting Analyst Resume Example

- Treasury Manager Resume Example

- Certified Financial Planner Resume Example

- Financial Management Specialist Resume Example

- Accounts Payable Resume Example

- Phone Banking Resume Example

- Finance Intern Resume Example

Simple guide to your financial representative resume format and layout

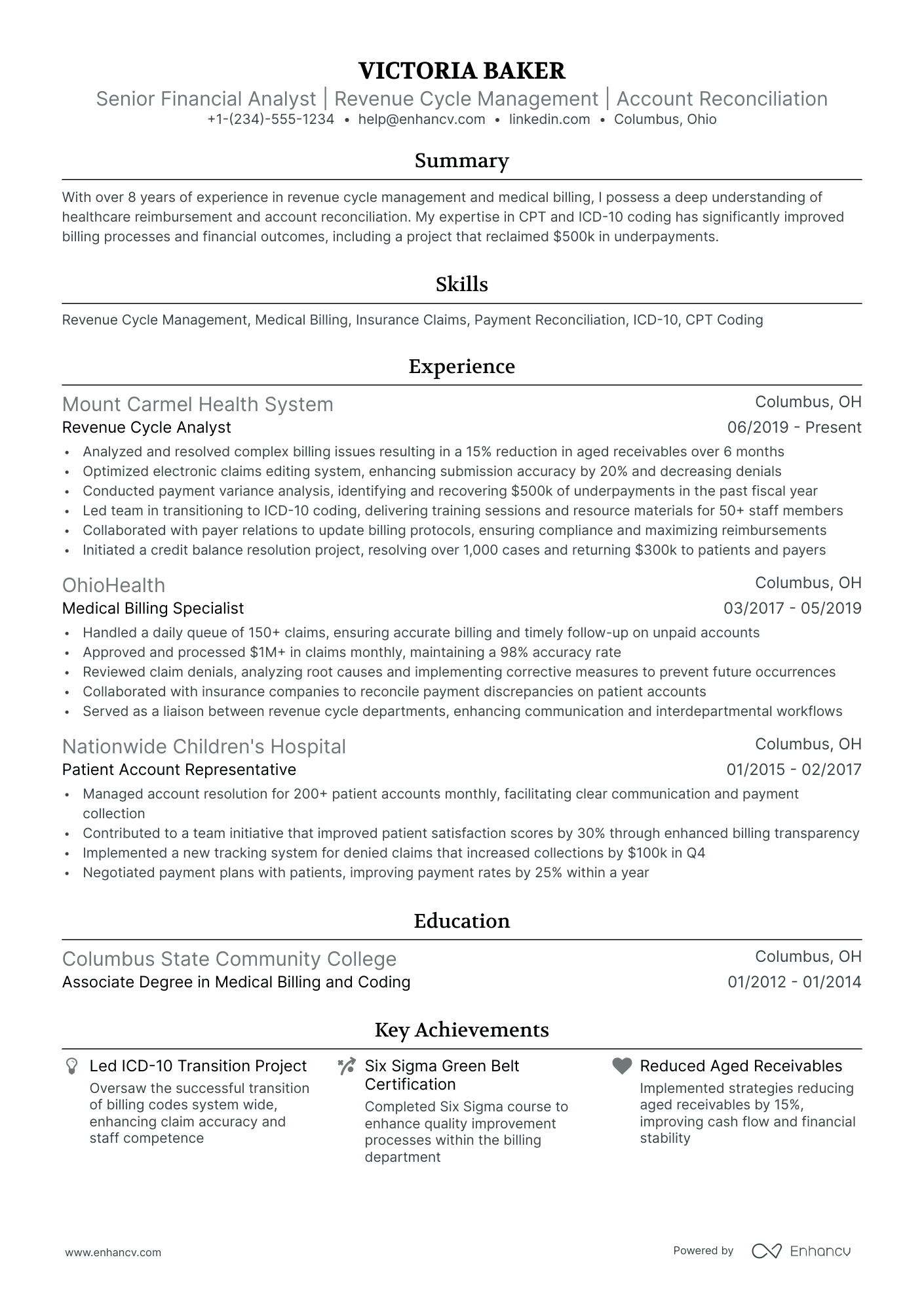

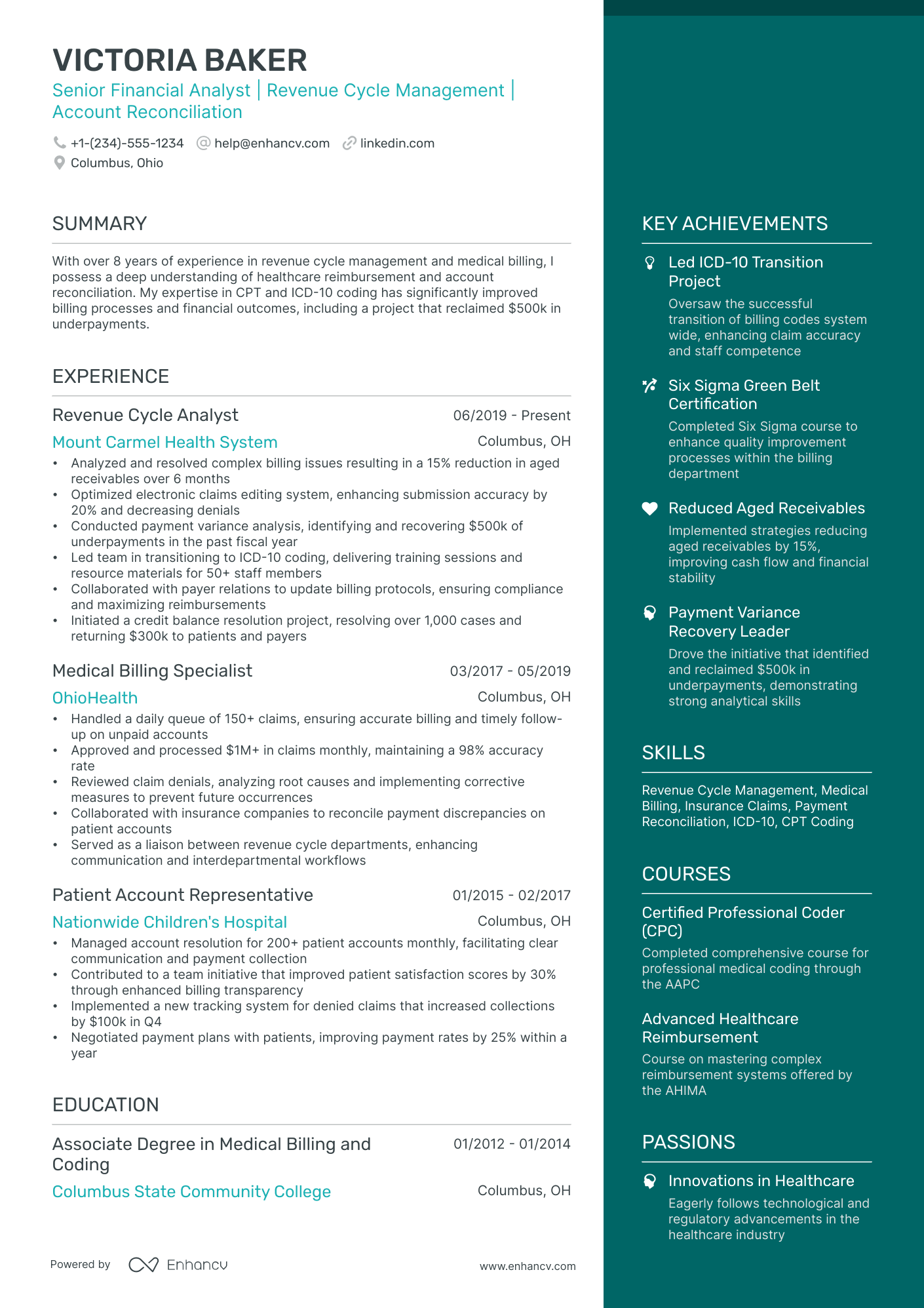

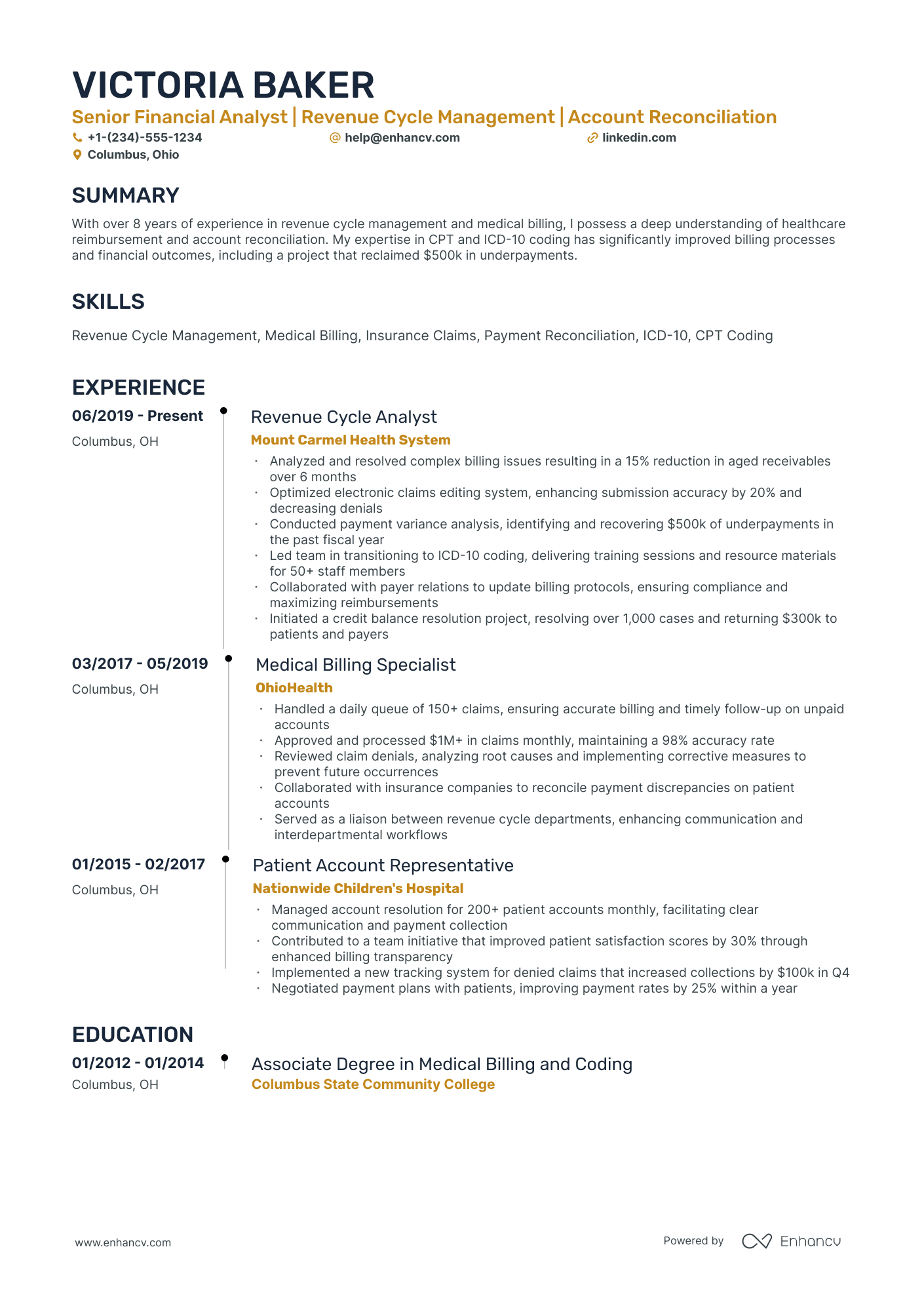

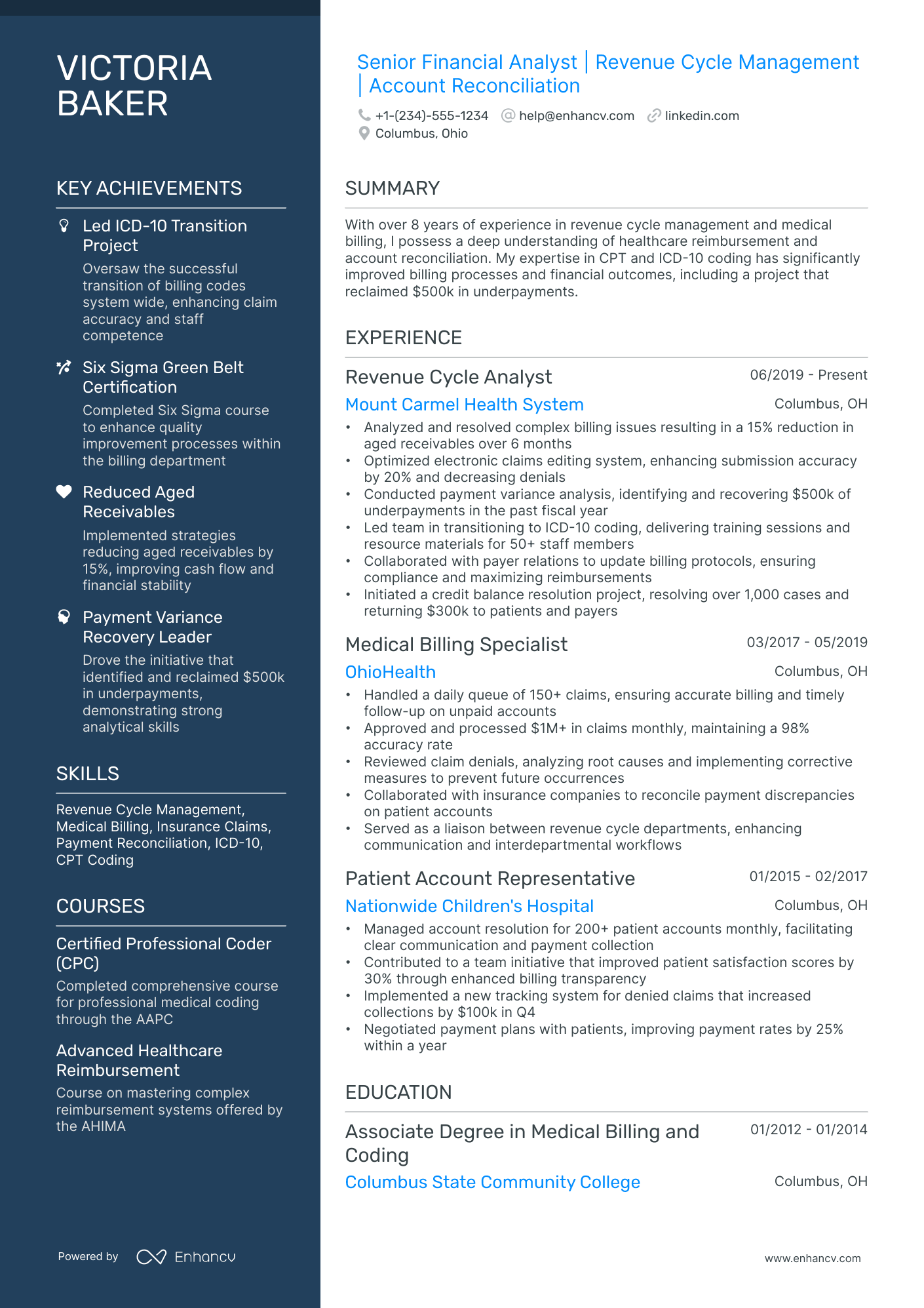

Successful financial representative resumes all have one specific characteristic - candidates have invested in a simple resume layout . One that is easy to read, makes a good first impression, and is adapted to their professional experience. There are three distinct resume formats to help you focus on your:

- professional experience - use the reverse-chronological resume format;

- skills and achievements - via the functional skill-based resume format;

- both experience and skills - with a hybrid resume format .

What is more, keep in mind that your resume may be initially assessed by the ATS (Applicant Tracker System) (or the software used by companies in the hiring process). The financial representative resumes that suit the ATS:

- have a header that includes either a role keyword or the job you're applying for;

- should be no longer than two pages;

- be submitted as PDF, unless specified otherwise.

Consider your target market – resumes in Canada, for example, follow different layout conventions.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

The five (plus) definite sections your resume for a financial representative job should include are:

- Header with your headline, contact details, and/or a preview of your work

- Summary (or objective) to pinpoint how your success aligns with the role

- Experience with bullets of your most relevant achievements in the field

- Skills to integrate vital job requirements (both technical and personal)

- Your further dedication to the field, showcased via relevant higher education and/or certifications

What recruiters want to see on your resume:

- Proven sales track record and ability to meet financial targets

- Strong knowledge of investment products, financial planning and market trends

- Exceptional client service skills and experience in managing client portfolios

- Relevant certifications and licenses (e.g., Series 7, Series 66, or CFP®)

- Experience with financial software and CRM systems (e.g., Salesforce, Financial Planning tools)

Writing your financial representative resume experience

Within the body of your financial representative resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your financial representative professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

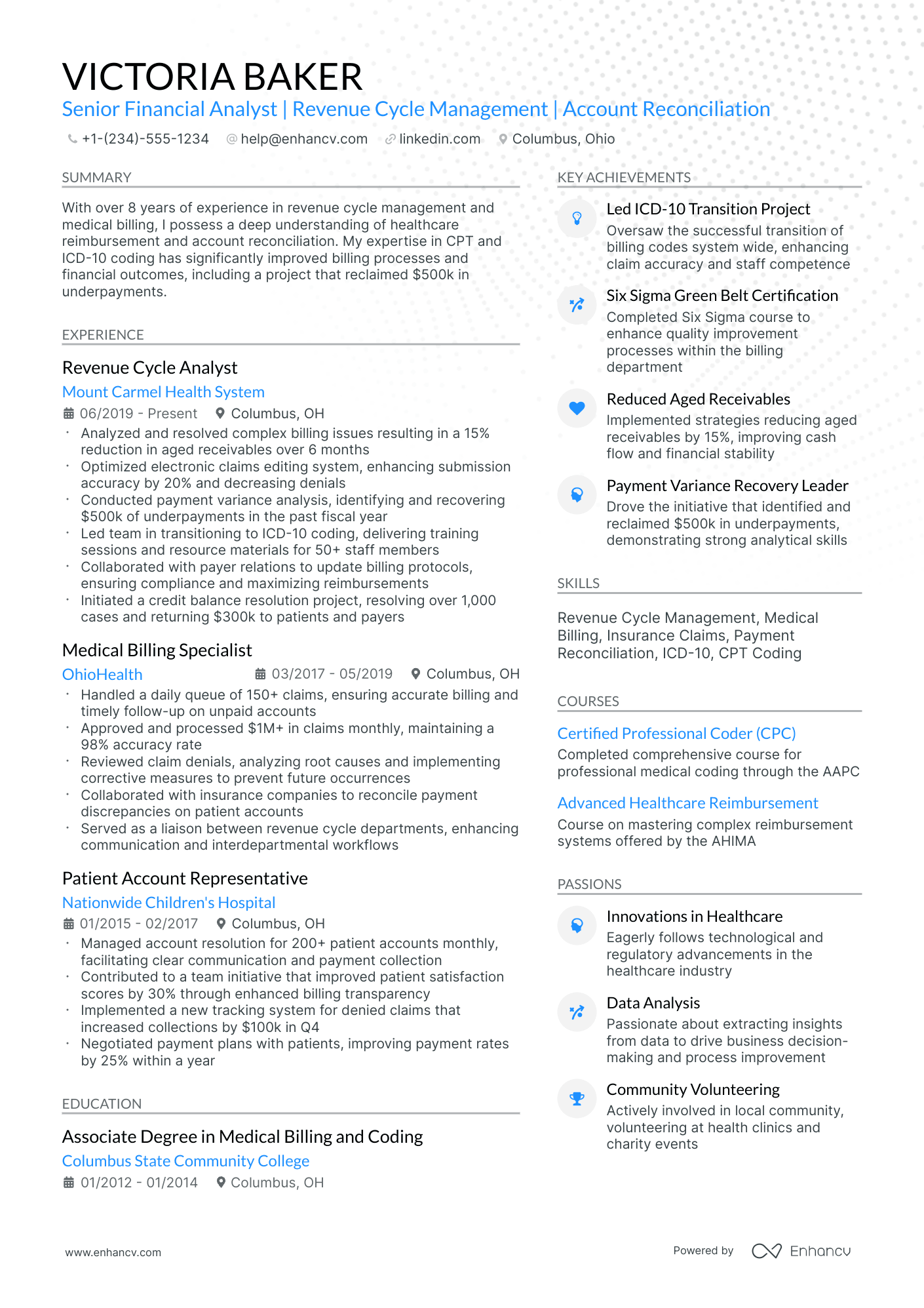

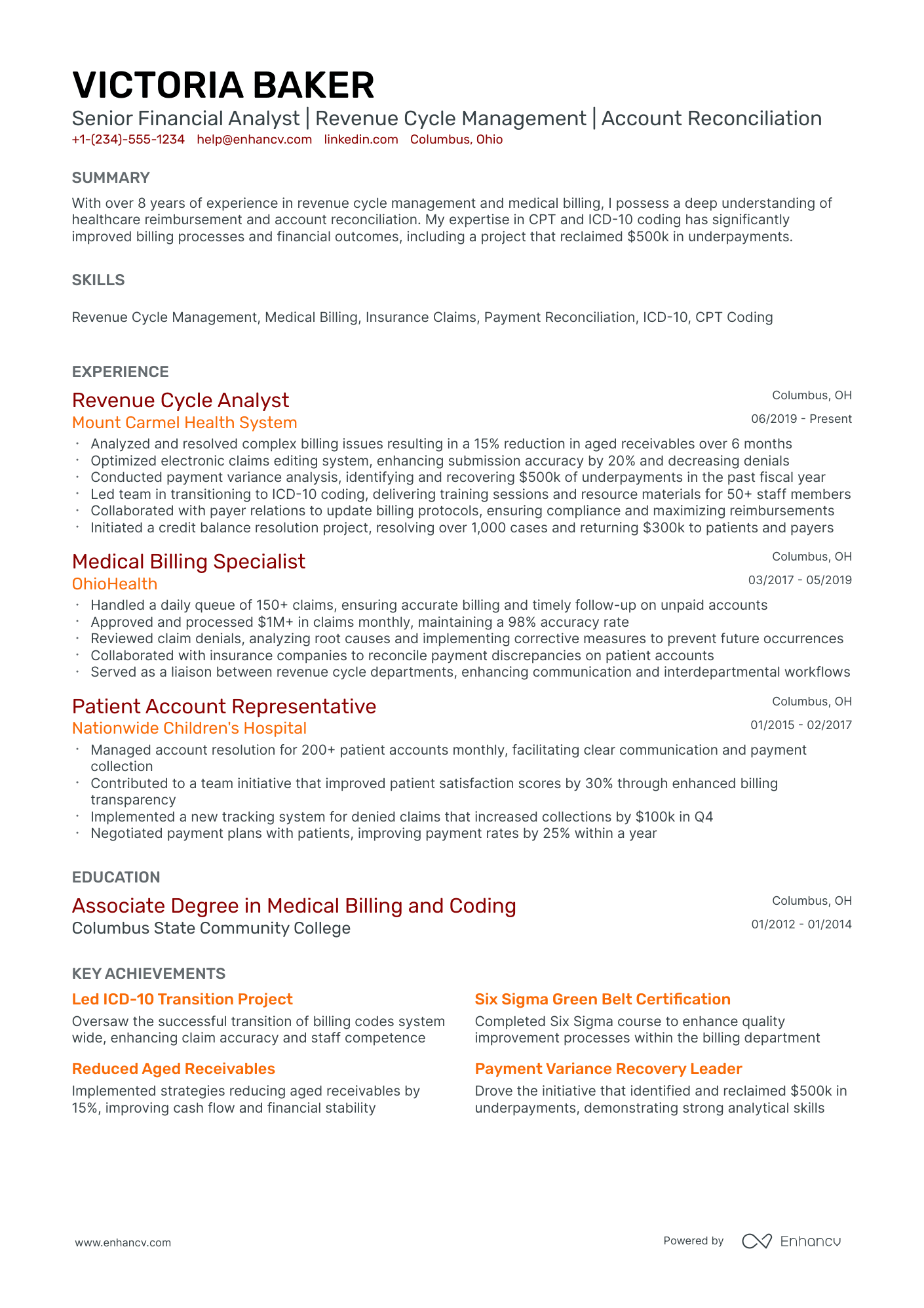

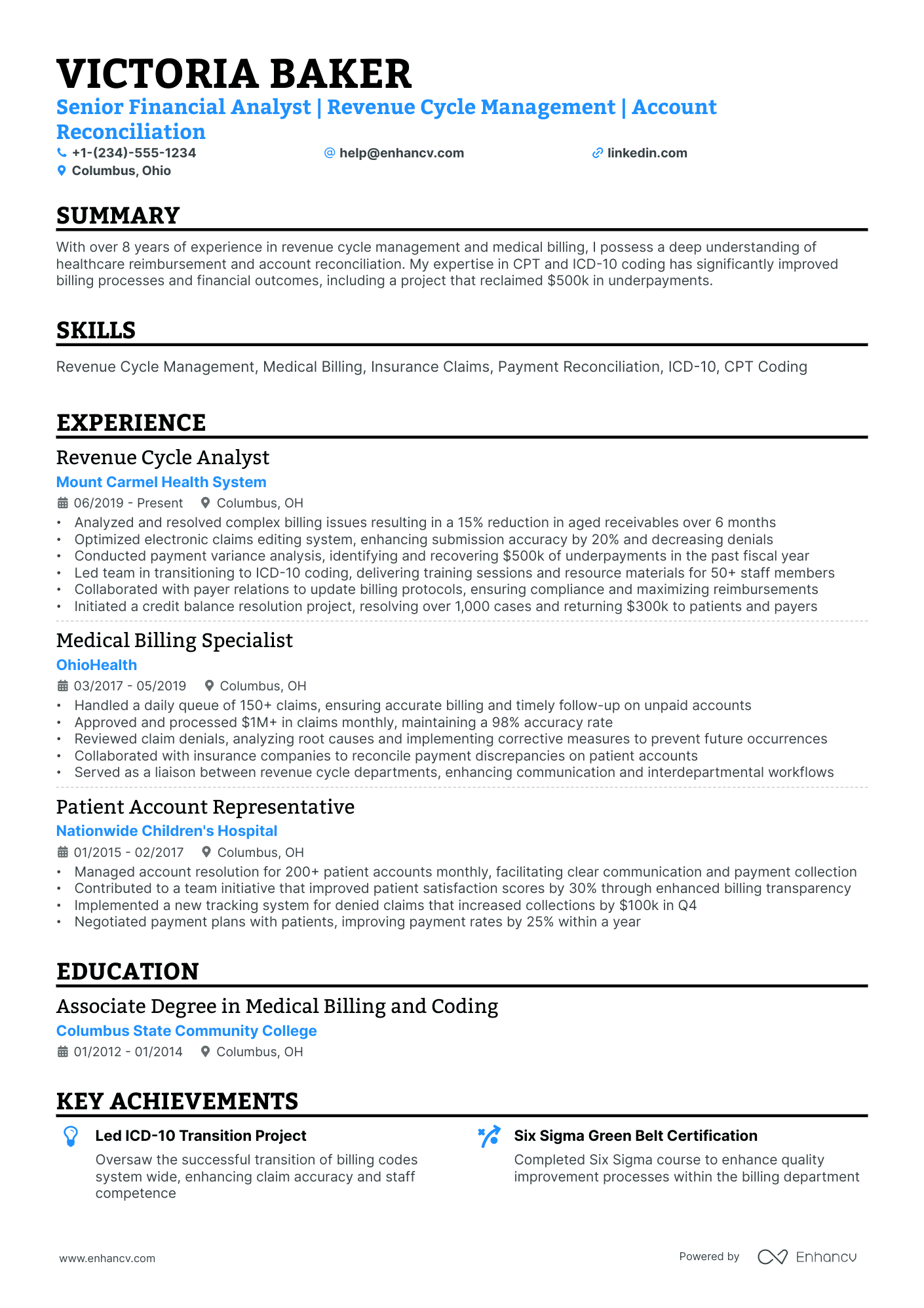

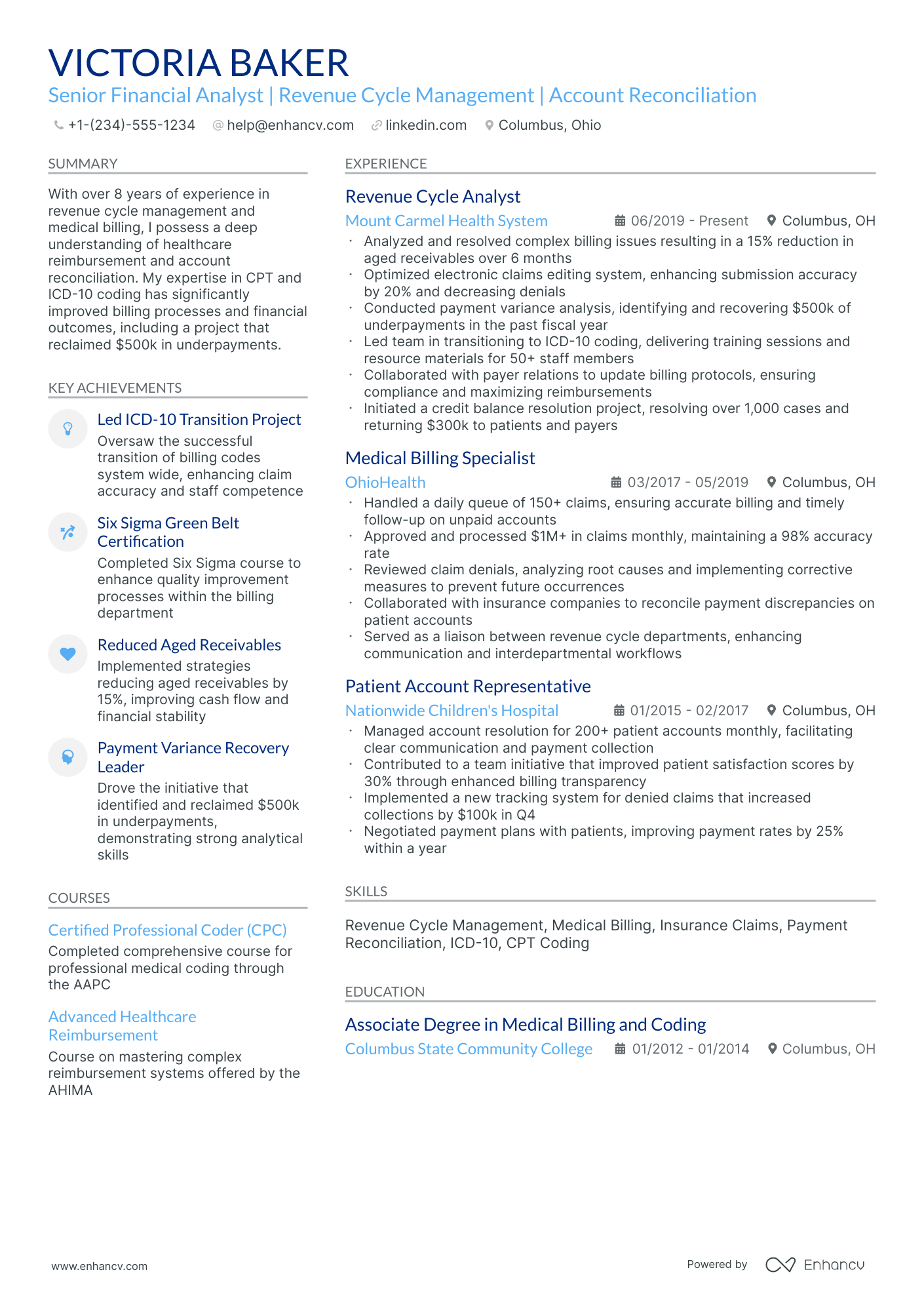

Wondering how other professionals in the industry are presenting their job-winning financial representative resumes? Check out how these financial representative professionals put some of our best practices into action:

- Generated portfolio reviews for over 150 clients, leading to a 20% increase in portfolio optimization and client satisfaction.

- Spearheaded a cross-functional team to develop a new financial advising tool tailored for young investors, which captured a 15% growth in the under-30 client segment within the first year.

- Conducted in-depth market analysis to identify trends, resulting in the development of a sector-specific investment strategy that outperformed the S&P 500 by 12%.

- Collaborated with over 200 clients to establish comprehensive financial plans, ensuring alignment with their long-term goals and risk tolerances.

- Facilitated weekly financial literacy workshops for clients, improving customer retention by 25% over a 3-year period.

- Oversaw a portfolio restructuring for high-net-worth individuals that led to an average return of 10% above the market benchmark.

- Implemented a customized asset allocation strategy that increased client investment performance by an average of 8% annually.

- Negotiated with financial institutions to offer exclusive investment products to our clients, broadening our portfolio options and attracting 30 new high-value accounts.

- Pioneered a digital transformation initiative for client reporting, enhancing report accuracy and reducing delivery time by 50%.

- Managed a financial campaign focused on retirement planning, capturing over $10M in new retirement assets from 100+ households.

- Conducted quarterly performance analysis for client portfolios, adjusting strategies to mitigate risks and capitalizing on market opportunities.

- Streamlined the new client onboarding process, reducing time required by 30% and improving client satisfaction scores by 20%.

- Developed a proprietary risk assessment tool that reduced portfolio volatility and was adopted by the firm as the standard for all client assessments.

- Enhanced client acquisition by implementing targeted digital marketing strategies, resulting in a 40% increase in lead generation over two years.

- Initiated sustainability-focused investment options, which attracted $5M in investments from environmentally conscious clients within the first six months.

- Played a pivotal role in developing the company's international investment strategy, facilitating an average annual growth rate of 15% in international portfolios.

- Optimized tax strategies for clients' investment portfolios, saving on average 5% in potential tax liabilities annually for our client base.

- Launched a mentorship program for new financial representatives, increasing team productivity by 35% and reducing turnover by 25%.

- Orchestrated a debt consolidation and restructuring plan for clients with high debt profiles, resulting in an average debt reduction of 20% per client.

- Led the introduction of a new annuity product line that accounted for 25% of the total sales revenue within the first year of launch.

- Customized financial educational content for clients, enhancing understanding and empowering clients to make informed financial decisions.

- Exceeded the regional target for life insurance upselling by 30%, contributing significantly to the firm's revenue stream.

- Established key partnerships with local businesses to provide exclusive financial planning services, increasing local market penetration by 20%.

- Designed and implemented a cash flow management system for small business clients, leading to an average of 10% reduction in unnecessary expenses.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial representative professionals.

Top Responsibilities for Financial Representative:

- Make bids or offers to buy or sell securities.

- Monitor markets or positions.

- Agree on buying or selling prices at optimal levels for clients.

- Keep accurate records of transactions.

- Buy or sell stocks, bonds, commodity futures, foreign currencies, or other securities on behalf of investment dealers.

- Complete sales order tickets and submit for processing of client-requested transactions.

- Report all positions or trading results.

- Interview clients to determine clients' assets, liabilities, cash flow, insurance coverage, tax status, or financial objectives.

- Discuss financial options with clients and keep them informed about transactions.

- Identify opportunities or develop channels for purchase or sale of securities or commodities.

Quantifying impact on your resume

- Highlight the dollar amounts of the investment portfolios you managed to showcase your responsibility level and trustworthiness.

- Include the number of client accounts you have successfully managed to demonstrate your capability in handling multiple responsibilities.

- Mention the percentage increase of client portfolio returns under your management to show your successful investment strategies.

- Specify the exact number of financial strategies you have developed to emphasize your expertise in creating customized solutions.

- Indicate the percentage reduction in costs or expenses for clients or your firm to display your ability to improve financial efficiency.

- List how many cross-selling opportunities you have identified and capitalized on to highlight your business development skills.

- State the number of regulatory compliance checks you completed to underscore your dedication to legal and ethical standards.

- Detail the number of financial plans or reports you have prepared to convey your analytical abilities and attention to detail.

Action verbs for your financial representative resume

No experience, no problem: writing your financial representative resume

You're quite set on the financial representative role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

The heart and soul of your financial representative resume: hard skills and soft skills

If you read between the lines of the financial representative role you're applying for, you'll discover that all requirements are linked with candidates' hard skills and soft skills.

What do those skills have to do with your application?

Hard or technical skills are the ones that hint at your aptitude with particular technologies. They are easy to quantify via your professional experience or various certifications.

Meanwhile, your soft skills are more difficult to assess as they are personality traits, you've gained thanks to working in different environments/teams/organizations.

Your financial representative resume skills section is the perfect opportunity to shine a light on both types of skills by:

- Dedicating a technical skills section to list up to six technologies you're apt at.

- Focusing a strengths section on your achievements, thanks to using particular people skills or technologies.

- Including a healthy balance of hard and soft skills in the skills section to answer key job requirements.

- Creating a language skills section with your proficiency level - to hint at an abundance of soft skills you've obtained, thanks to your dedication to learning a particular language.

Within the next section of this guide, stay tuned for some of the most trending hard skills and soft skills across the industry.

Top skills for your financial representative resume:

Financial Analysis

Investment Strategies

Financial Planning Software

CRM Software

Microsoft Excel

Data Analysis Tools

Tax Preparation Software

Accounting Software

Risk Assessment Tools

Portfolio Management Tools

Communication

Customer Service

Problem Solving

Time Management

Analytical Thinking

Negotiation

Attention to Detail

Interpersonal Skills

Adaptability

Emotional Intelligence

Next, you will find information on the top technologies for financial representative professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Representative’s resume:

- Oracle PeopleSoft

- SAP software

- Microsoft PowerPoint

- Oracle E-Business Suite Financials

- Web-based trading systems

PRO TIP

If you happen to have some basic certificates, don't invest too much of your financial representative resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Your academic background: should you include your education and certifications on your financial representative resume?

Adding relevant education and certifications to your financial representative resume is beneficial, whether you're an experienced candidate or just starting in the field.

Featuring your higher education degree that aligns with the role demonstrates your commitment to the industry. On your financial representative resume, include the start and graduation dates, followed by the name of the institution that awarded your degree.

Regarding certifications, it's wise to list those most relevant to the role or that have contributed to your array of crucial technical or personal traits. Be sure to include the name of the certificate and the awarding institution.

If uncertain about which certifications to feature prominently on your financial representative resume, refer to our compiled list of the most in-demand ones for guidance.

The top 5 certifications for your financial representative resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Financial Planner (CFP) - CFP Board

- Financial Industry Regulatory Authority (Series 7) - FINRA

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Chartered Financial Consultant (ChFC) - The American College

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial representative professionals.

Top US associations for a Financial Representative professional

- AICPA and CIMA

- Association for Financial Professionals

- Certified Financial Planner Board of Standards

- CFA Institute

- Financial Industry Regulatory Authority

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Recommended reads:

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your financial representative resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world financial representative professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a financial representative job

- Accomplished financial advisor with 10 years of experience in providing customized investment solutions and wealth management strategies to a diverse clientele. Expertise in tax planning and portfolio analysis complemented by a proven track record of surpassing client expectations and expanding customer base through referrals.

- Diligent accounting professional transitioning into the financial services industry, armed with a decade of experience in corporate financial analysis. Demonstrates a strong command of market trends, fiscal policy, and strategic investment approaches geared towards maximizing client asset growth.

- Charismatic sales leader with extensive experience in tech sales, pivoting to financial consulting, brings a fresh approach to driving customer investment strategies. Highly skilled in interpersonal communication, persuasive negotiation, and cultivating lucrative relationships, seeking to leverage these strengths in a new financial milieu.

- Energetic finance graduate eager to start as a financial representative, emphasizes a strong educational grounding in economics and statistics. Passionate about contributing a fresh perspective to financial planning and investment strategies while rapidly acquiring industry-specific expertise and certification.

- Former healthcare manager with strong analytical abilities and a keen interest in financial markets aims to apply meticulous financial oversight and strategic planning skills to the realm of personal and corporate finance, aspiring for continuous growth and contribution through diligent efforts and ongoing professional development.

- Recent MBA graduate, equipped with knowledge in strategic management and investment theory, is enthused to embark on a career in financial services. With robust analytical skills and commitment to learning, the objective is to provide exceptional advice and foster enduring customer relationships.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for financial representative professionals

Local salary info for Financial Representative.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $76,900 |

| California (CA) | $76,230 |

| Texas (TX) | $71,400 |

| Florida (FL) | $60,510 |

| New York (NY) | $163,640 |

| Pennsylvania (PA) | $61,850 |

| Illinois (IL) | $80,250 |

| Ohio (OH) | $59,190 |

| Georgia (GA) | $63,050 |

| North Carolina (NC) | $65,910 |

| Michigan (MI) | $74,260 |

Beyond your financial representative resume basics - extra sections

Ensure your financial representative resume stands out from the crowd by spicing it up with a couple of supplementary sections that showcase your:

- Prizes - as a special nod to what matters most in the field;

- Projects - ones that would really further support your application;

- Hobbies - include only if you think they'd further your chances at landing the role with personality

- Community impact - to hint at the causes you care about.

Key takeaways

- Ensure your financial representative resume uses a simple, easy-to-read format that reflects upon your experience and aligns with the role;

- Be specific within the top one-third of your resume (header and summary or objective) to pinpoint what makes you the ideal candidate for the financial representative role;

- Curate information that is tailored to the job by detailing skills, achievements, and actual outcomes of your efforts;

- List your certifications and technical capabilities to demonstrate your aptitude with specific software and technologies;

- The sections you decide on including on your financial representative should pinpoint your professional expertise and personality.