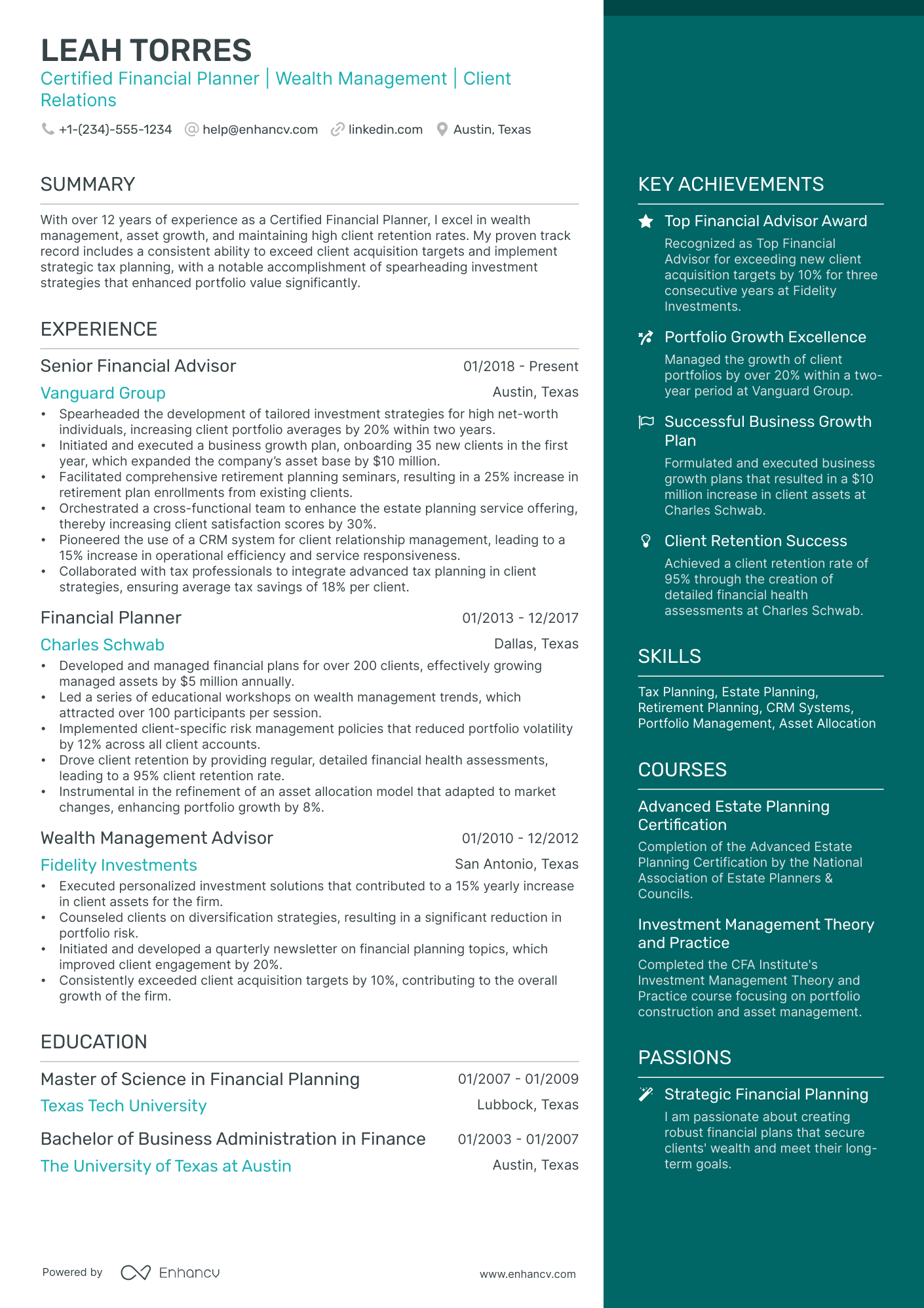

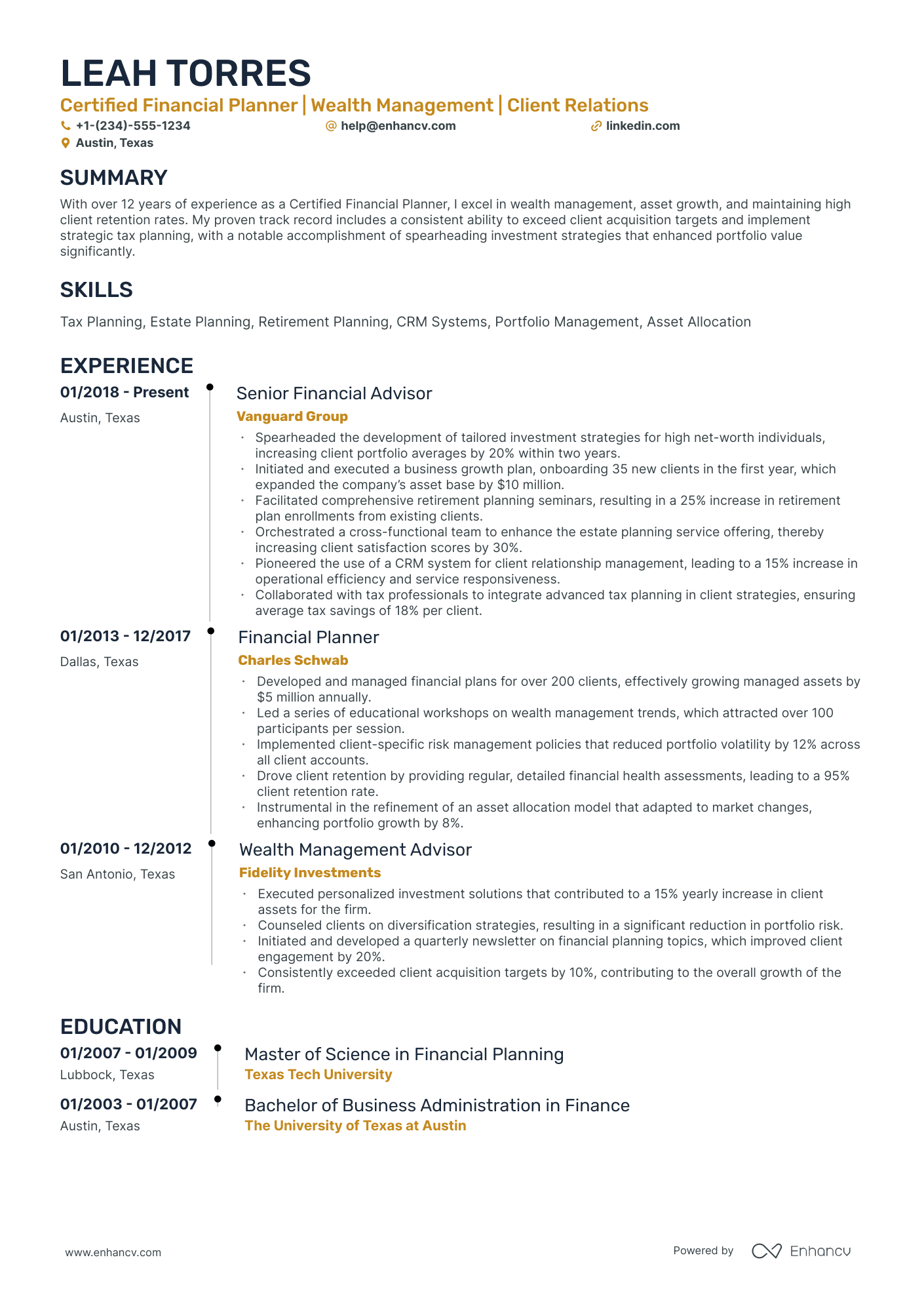

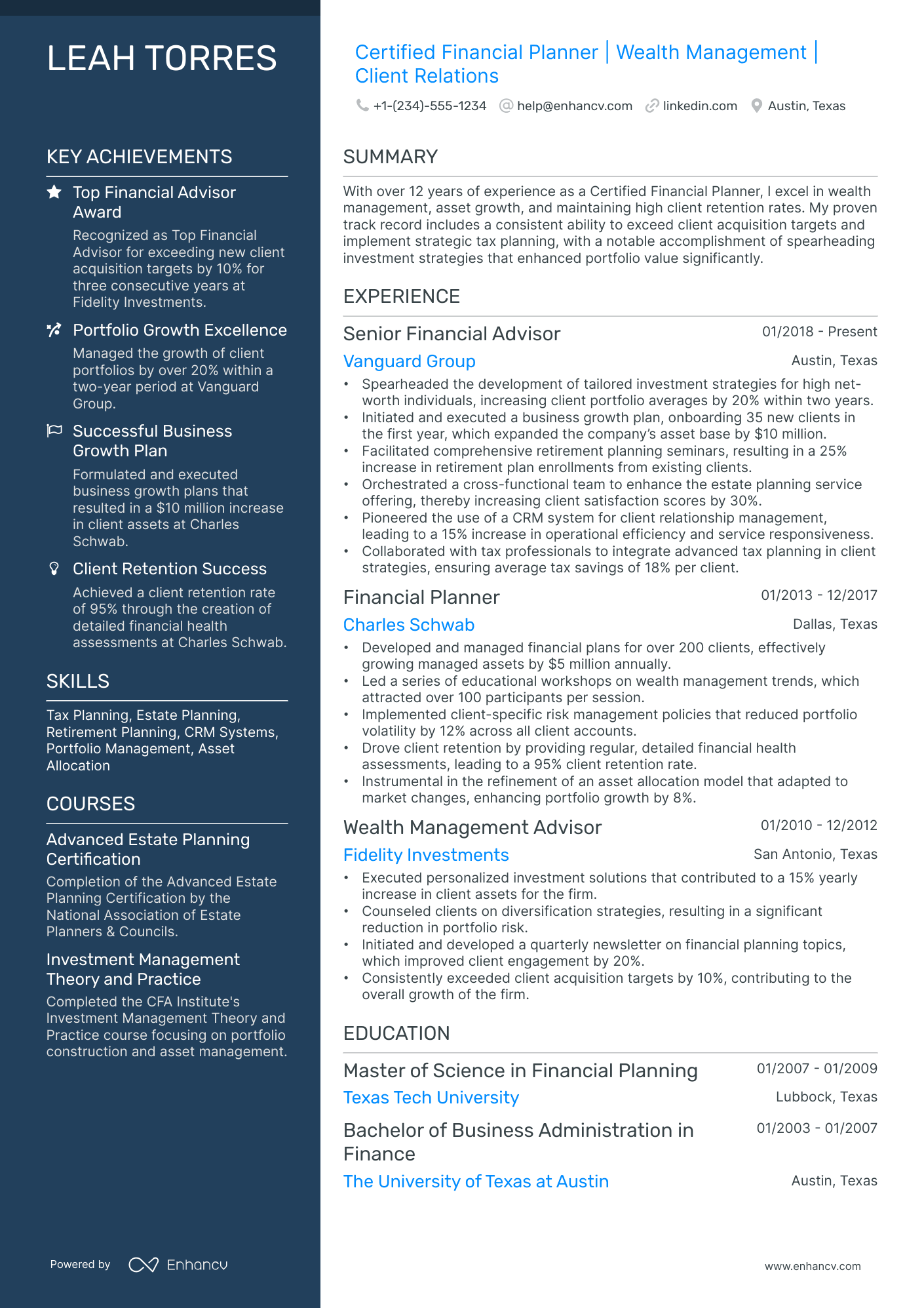

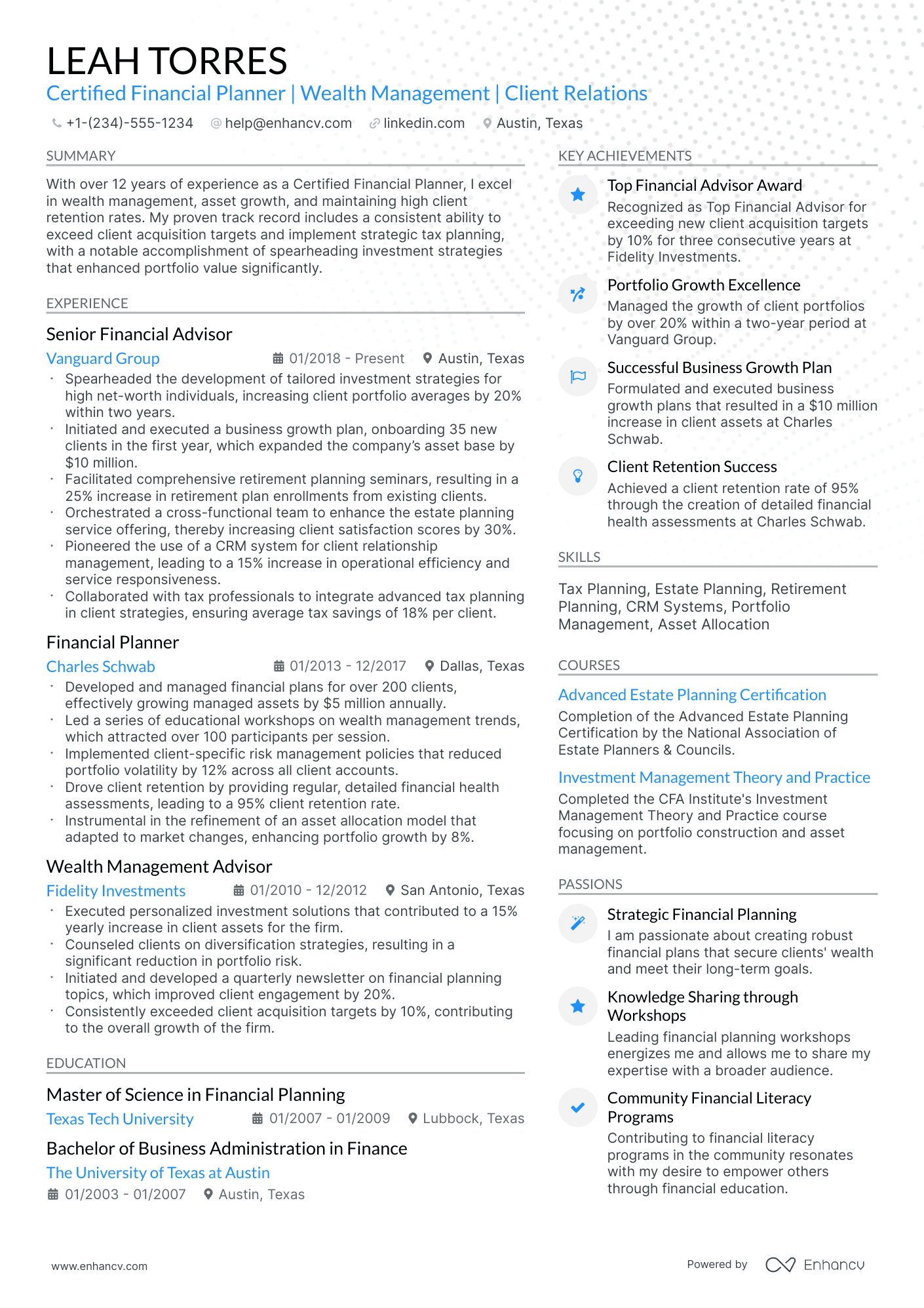

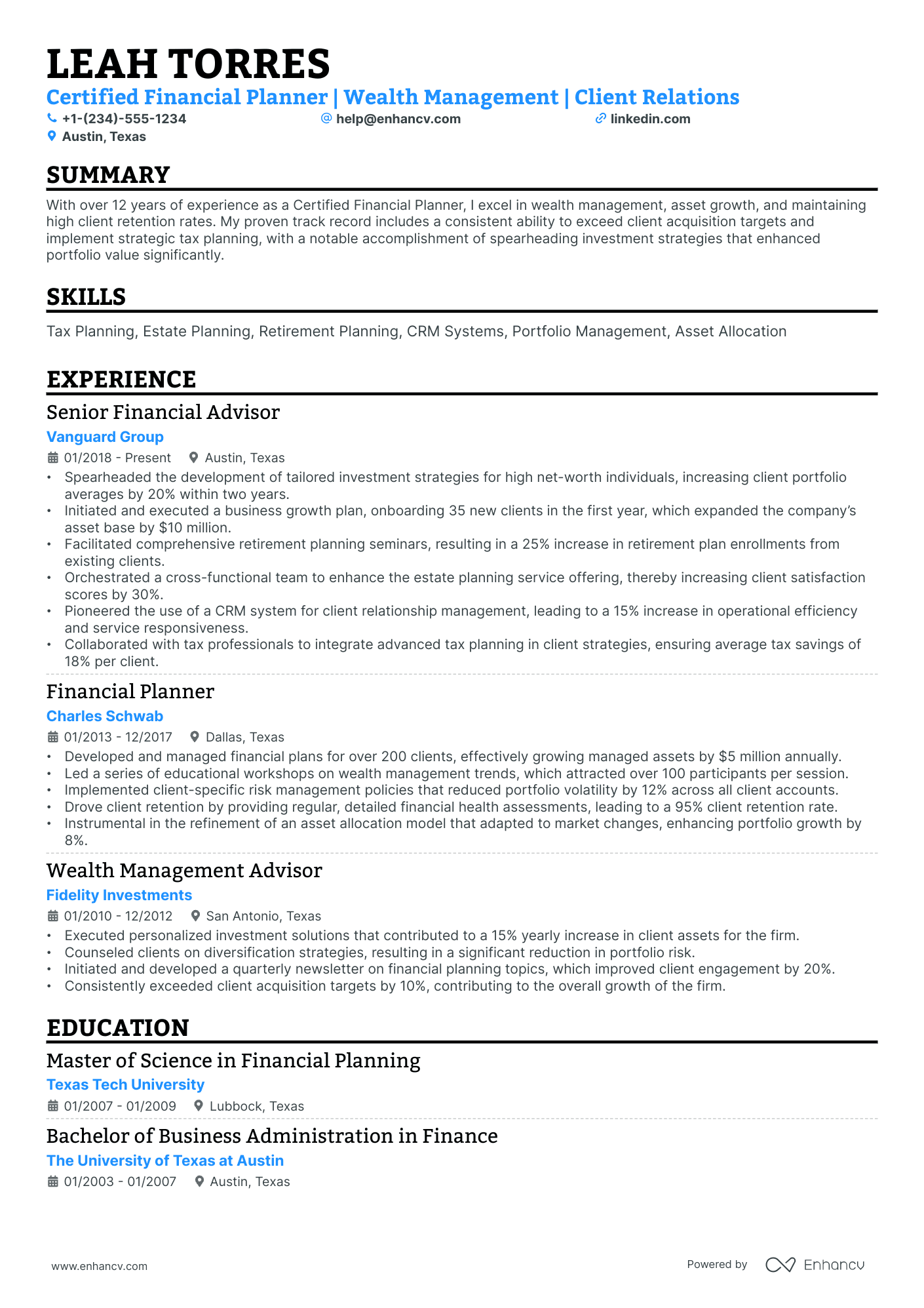

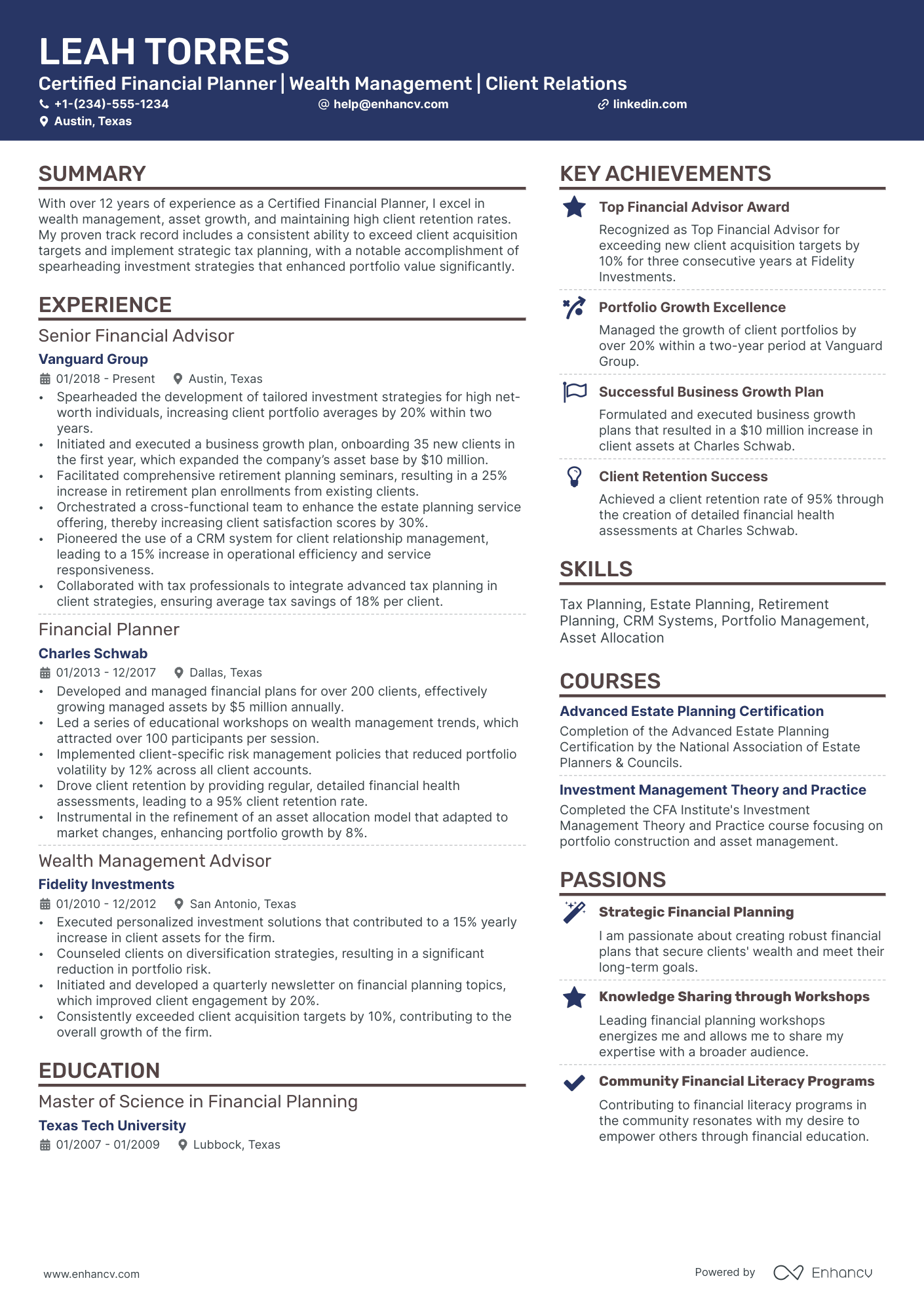

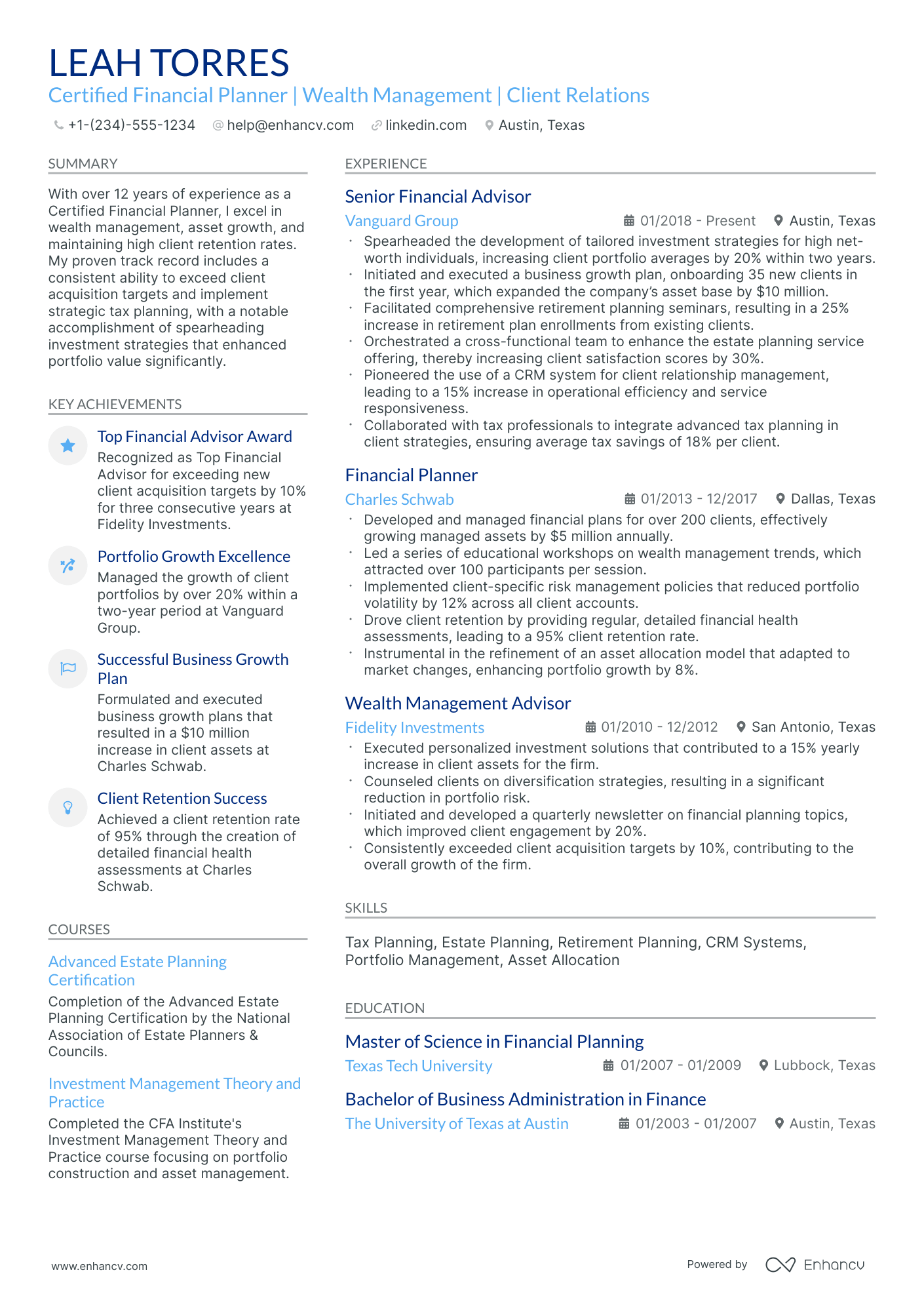

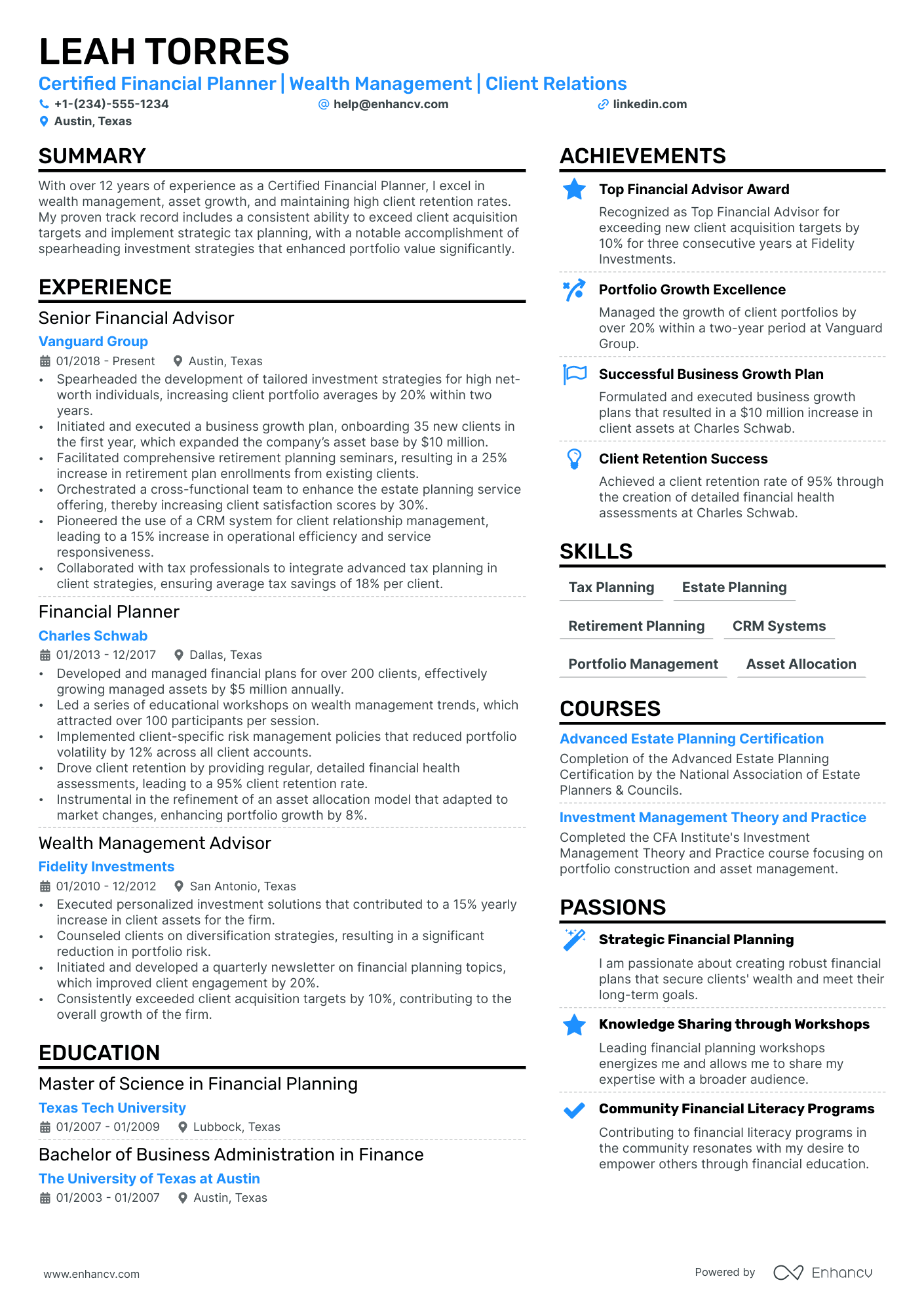

As a certified financial planner, articulating the complexity of your financial expertise and experience on your resume can be a daunting challenge. Our guide provides clear strategies and examples to help you effectively communicate your skills and achievements, ensuring your resume stands out to potential employers.

- Get inspired from our certified financial planner resume samples with industry-leading skills, certifications, and more.

- Show how you can impact the organization with your resume summary and experience.

- Introducing your unique certified financial planner expertise with a focus on tangible results and achievements.

If the certified financial planner resume isn't the right one for you, take a look at other related guides we have:

- Financial Data Analyst Resume Example

- Director of Accounting Resume Example

- Internal Audit Manager Resume Example

- Hotel Accounting Resume Example

- Assistant Finance Manager Resume Example

- Finance Business Analyst Resume Example

- Finance Clerk Resume Example

- Tax Director Resume Example

- Business Analyst Accounting Resume Example

- Accounting Supervisor Resume Example

Best practices for the look and feel of your certified financial planner resume

Before you even start writing your certified financial planner resume, first you need to consider its layout and format.

What's important to keep in mind is:

- The reverse-chronological resume is the most widely used format to present your experience, starting with your latest job.

- Your certified financial planner resume header needs to include your correct, professional contact details. If you happen to have a professional portfolio or an updated LinkedIn profile, include a link to it.

- Ensure your resume is no longer than two pages - you don't have to include irelevant experience on your resume just to make it look longer.

- Unless specified otherwise, submit your resume in the most popular format, the PDF one, as this will ensure your certified financial planner resume isn't altered.

Think about the market’s preferences – a Canadian resume, for instance, could have a different layout.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Don't forget to include these six sections on your certified financial planner resume:

- Header and summary for your contact details and to highlight your alignment with the certified financial planner job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Demonstrated experience with financial planning and wealth management software (e.g., MoneyGuidePro, Emoney, or similar).

- Proven track record of developing personalized financial plans based on individual client goals and risk tolerance.

- Strong knowledge of tax planning, estate planning, retirement planning and investment strategies.

- Active certified financial planner (CFP) certification or equivalent professional designation evidencing qualification and commitment to ethical standards.

- Experience with client acquisition and retention, showcasing excellent relationship management and communication skills.

Defining your professional expertise in your certified financial planner resume work experience section

The work experience section, often the most detailed part of your resume, is where you discuss your past roles and achievements. To effectively list your experience, consider these four key tips:

- Align your expertise with the job requirements. It's vital to integrate keywords matching the job criteria to pass initial assessments;

- Show, don’t just tell. Quantify your responsibilities by stating your actual achievements in previous roles;

- Include measurable metrics. For instance, how did your performance impact the annual ROI?

- Highlight crucial industry skills. Mention both technological knowledge and interpersonal skills in this section.

These guidelines will help you craft an impressive certified financial planner resume work experience section that is bound to catch recruiters' attention.

- Developed comprehensive financial plans for a diverse client base, consistently growing the clientele by 20% annually through referrals and marketing strategies.

- Spearheaded a financial literacy workshop series which improved client investment knowledge and engagement, leading to a 15% increase in investment portfolio sizes.

- Leveraged advanced knowledge of tax planning to optimize clients' financial scenarios, saving an average of $10,000 annually in taxes per client.

- Implemented tailor-made investment strategies that contributed to a median return of 8% per annum, outperforming the market benchmark.

- Conducted quarterly reviews and adjustments of financial plans to ensure client goals were on track, resulting in 95% client retention rate.

- Collaborated with estate lawyers to design and implement estate plans, preventing an average of $5 million in assets from undergoing probate annually.

- Orchestrated the transition to a holistic financial planning model which increased the company's assets under management (AUM) by 25% in two years.

- Analyzed market trends and adjusted investment portfolios accordingly, which led to an average risk reduction of 10% across all client accounts.

- Facilitated the integration of sustainable and ESG investing principles, attracting a new demographic of eco-conscious investors.

- Pioneered a digital-first approach to financial planning, enhancing the reach to tech-savvy millennials which now make up 30% of the client base.

- Collaborated cross-functionally to develop a proprietary financial planning software, resulting in a 40% increase in planning efficiency.

- Mastered regulatory compliances to secure clients’ assets and led educational seminars to increase awareness of financial risks and asset protection strategies.

- Directed a team of financial planners in managing high-net-worth accounts, increasing managed wealth by $50 million through strategic portfolio diversification.

- Negotiated with insurance providers to include higher-value policies in our offers, significantly reducing premiums for clients while bolstering coverage.

- Conducted in-depth retirement planning sessions to align clients' financial goals with investment strategies, ensuring a smooth transition into retirement.

- Forensically reviewed and restructured underperforming investment portfolios, achieving an average annual increase of portfolio value by 12%.

- Initiated client-centric service model changes that emphasized personalized communication, which successfully improved client satisfaction scores by 18%.

- Executed educational initiatives focused on risk management which enhanced client understanding of insurance products as integral components of financial planning.

- Optimized investment strategies by integrating robo-advisory services with traditional human advice, achieving a blend that appealed to both traditional and modern clients.

- Provided expert testimony on financial planning practices during legal disputes, upholding the firm's reputation and securing client assets.

- Championed the adaptation of the latest financial planning software, improving data analysis and plan accuracy across the firm's client base.

- Devised and executed a niche marketing strategy targeting small business owners, which accounted for an increase in AUM by over $30 million from this demographic.

- Developed a robust risk assessment framework that resulted in a 20% decrease in client portfolio volatility during market downturns.

- Mentored junior financial planners, enhancing the team's overall expertise and productivity in developing financial plans and wealth management strategies.

Quantifying impact on your resume

- Detail the total assets under management you have been responsible for to showcase your ability to handle substantial financial portfolios.

- Quantify the number of client portfolios you’ve successfully managed to demonstrate experience and reliability.

- Highlight specific percentage increases in client wealth due to your investment strategies to exhibit your skill in asset growth.

- Include the number of financial plans you have developed to reflect your expertise in creating tailored financial strategies.

- Specify the percentage by which you've helped clients reduce their tax liabilities to show your competence in tax planning.

- Mention the exact number of compliance standards you have adhered to, emphasizing your knowledge of regulations and ethical practices.

- State the number of successful audits you have completed to convey your attention to detail and accuracy in financial reporting.

- Point out any quantifiable improvements you’ve made in client satisfaction scores to underline your commitment to customer service.

Action verbs for your certified financial planner resume

Guide for certified financial planner professionals kicking off their career

Who says you can't get that certified financial planner job, even though you may not have that much or any experience? Hiring managers have a tendency to hire the out-of-the-blue candidate if they see role alignment. You can show them why you're the best candidate out there by:

- Selecting the functional skill-based or hybrid formats to spotlight your unique value as a professional

- Tailoring your certified financial planner resume to always include the most important requirements, found towards the top of the job ad

- Substituting the lack of experience with other relevant sections like achievements, projects, and research

- Pinpoint both achievements and how you see yourself within this specific role in the certified financial planner resume objective.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Defining your unique certified financial planner skill set with hard skills and soft skills

In any job advertisement, a blend of specific technologies and interpersonal communication skills is typically sought after. Hard skills represent your technical expertise and indicate your job performance capacity. Soft skills, on the other hand, demonstrate how well you would integrate within the company culture.

Incorporating a balanced mix of both skill types in your certified financial planner resume is crucial. Here's how you can do it:

- In your resume summary or objective, incorporate up to three hard and/or soft skills. Make sure to quantify these skills with relevant or impressive achievements; less

- The skills section should list your technical know-how.

- The strengths section is an ideal place to quantify your competencies by focusing on the achievements facilitated by these skills.

Top skills for your certified financial planner resume:

Financial Planning Software (e.g., eMoney, MoneyGuidePro)

Investment Analysis Tools

Retirement Planning Tools

Tax Preparation Software

CRM Software (e.g., Salesforce, Redtail)

Portfolio Management Systems

Excel for Financial Modeling

Risk Assessment Tools

Estate Planning Software

Budgeting Tools

Communication Skills

Analytical Thinking

Problem-Solving

Interpersonal Skills

Attention to Detail

Time Management

Empathy

Adaptability

Negotiation Skills

Ethical Judgment

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Discover the perfect certification and education to list on your certified financial planner resume

Value the insights your resume education section offers. It can shed light on various proficiencies and experiences tailored for the job.

- Add only college or university degrees, stating the institution and duration.

- If you're nearing the end of your degree, note your graduation date.

- Weigh the pros and cons of including unrelated degrees - it might not be your best choice with so little space on your resume.

- Talk about your educational achievements if they amplify your relevant experience.

There are so many certificates you can list on your resume.

Just which ones should make the cut?

- List your prominent higher education degree in a separate box, alongside the name of the institute you've obtained it from and your graduation dates

- Curate only relevant certificates that support your expertise, hard skills, and soft skills

- Certificates that are more niche (and rare) within the industry could be listed closer to the top. Also, this space could be dedicated to more recent certifications you've attained

- Add a description to your certificates or education, only if you deem this could further enhance your chances of showcasing your unique skill set

When listing your certificates, remember that it isn't a case of "the more, the merrier", but rather "the more applicable they are to the industry, the better".

Recruiters have hinted that these are some of the most in-demand certificates for certified financial planner roles across the industry:

The top 5 certifications for your certified financial planner resume:

- Certified financial planner (CFP) - certified financial planner Board of Standards, Inc.

- Chartered Financial Consultant (ChFC) - The American College of Financial Services

- Personal Financial Specialist (PFS) - American Institute of Certified Public Accountants

- Certified Investment Management Analyst (CIMA) - Investments & Wealth Institute

- Chartered Financial Analyst (CFA) - CFA Institute

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Recommended reads:

Deciding between a resume summary or objective for your certified financial planner role

Understanding the distinction between a resume summary and an objective is crucial for your certified financial planner resume.

A resume summary, typically three to five sentences long, offers a concise overview of your career. This is the place to showcase your most pertinent experience, key accomplishments, and skills. It's particularly well-suited for those with professional experience relevant to the job requirements.

In contrast, a resume objective focuses on how you can add value to potential employers. It addresses why they should hire you and outlines your career expectations and learning goals. Therefore, it's ideal for candidates with less experience.

In the following section of our guide, explore how resume summaries and objectives differ through some exemplary industry-specific examples.

Resume summaries for a certified financial planner job

- Seasoned certified financial planner with over 12 years of experience crafting personalized financial plans for high-net-worth individuals at a top-tier wealth management firm in New York. Skilled in retirement planning, tax strategies, and estate planning, and have successfully grown client portfolios by an average of 20% year-over-year.

- Detail-oriented financial expert with a 15-year tenure in corporate finance at a Fortune 500 company, now seeking to transition to a certified financial planner role. Holds an MBA in Finance and has a proven record of developing strategic financial models that have increased corporate revenue by 35%.

- As a former senior software developer with a decade of experience building financial applications for a leading tech firm, I am poised to bring a unique tech-driven perspective to financial planning. With recent CFP certification and keen data analytics skills, I aim to optimize financial strategies in a dynamic planning environment.

- With an eye for innovation in financial services, this aerospace engineer turned certified financial planner brings a blend of analytical prowess and 8 years of experience in risk assessment from a leading defense contractor to tailor robust investment portfolios for individuals and small businesses.

- Eager to leverage my deep-rooted passion for finance and recent graduation from a top-tier business school, I am committed to achieving certification as a Financial Planner. My objective is to contribute fresh insights from my extensive coursework in investment management and financial analysis to create impactful financial solutions.

- Dedicated professional with a background in education and community service, aspiring to become a certified financial planner. My goal is to use my strong interpersonal skills and commitment to lifelong learning to assist clients in achieving their financial goals while I work towards CFP certification.

More relevant sections for your certified financial planner resume

Perhaps you feel that your current resume could make use of a few more details that could put your expertise and personality in the spotlight.

We recommend you add some of these sections for a memorable first impression on recruiters:

- Projects - you could also feature noteworthy ones you've done in your free time;

- Awards - showcasing the impact and recognition your work has across the industry;

- Volunteering - the social causes you care the most about and the soft skills they've helped you sustain and grow;

- Personality resume section - hobbies, interests, favorite quote/books, etc. could help recruiters gain an even better understanding of who you are.

Key takeaways

- Your certified financial planner resume is formatted professionally and creates an easy-to-read (and -understand) experience for recruiters;

- You have included all pertinent sections (header, summary/objective, experience, skills, certifications) within your certified financial planner resume;

- Instead of just listing your responsibilities, you've qualified them with skills and the results of your actions;

- Within your certified financial planner resume, you've taken the time to align specific job requirements with your unique expertise, showcasing the value you can provide as a professional;

- Technologies and personal skills are featured across different sections of your certified financial planner resume to achieve the perfect balance.