As a loan officer, your resume may struggle to showcase your ability to build strong client relations amidst strict financial regulations. Our guide provides tailored strategies to highlight your interpersonal skills and regulatory expertise, giving you the edge in a competitive job market.

- Format your loan officer resume to ensure that it balances professionalism with creativity, and follows the best practices.

- Match the loan officer job requirements by including industry keywords on your resume.

- Use various resume sections to showcase your skills and achievements to answer why you're the best candidate for the loan officer role.

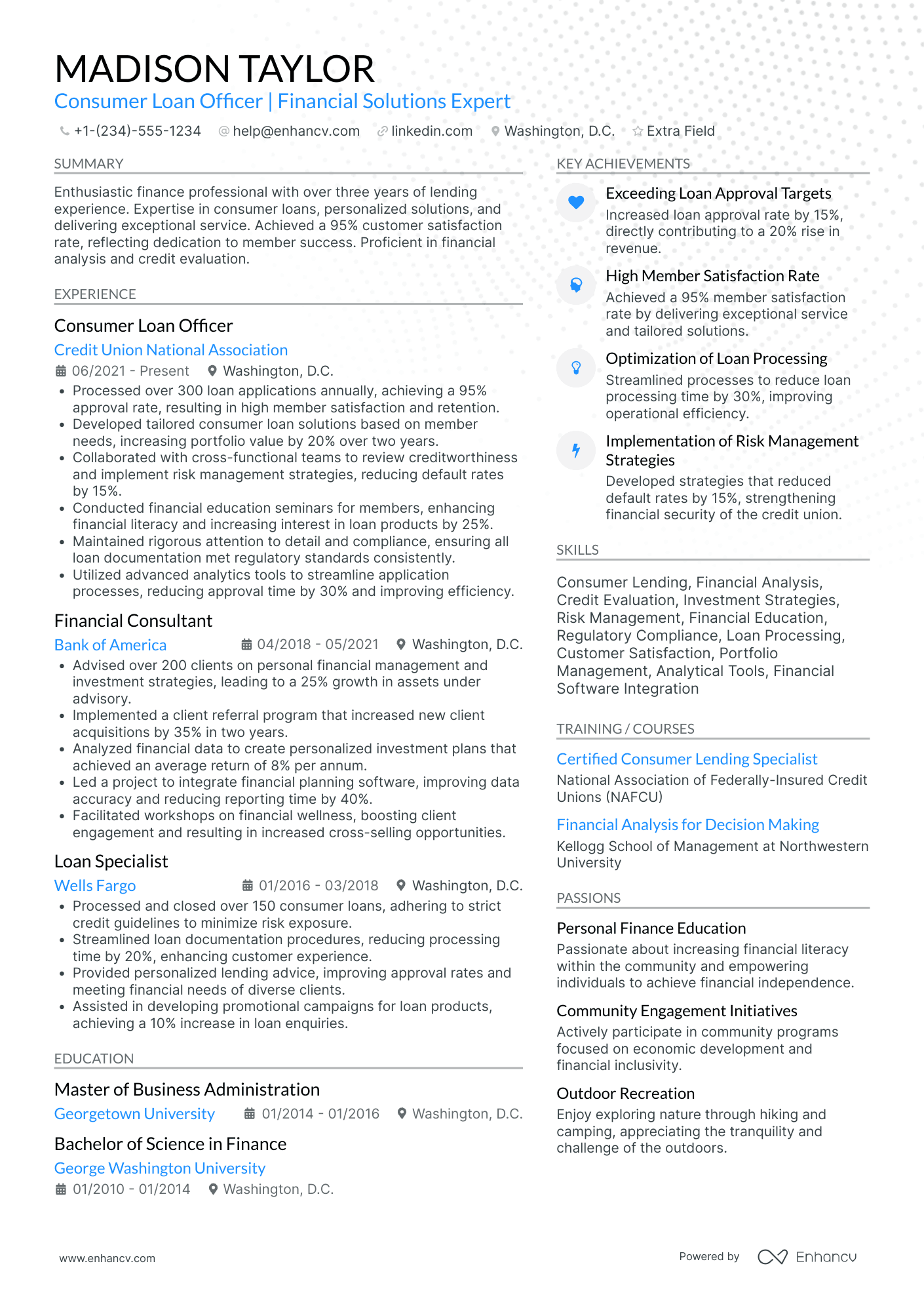

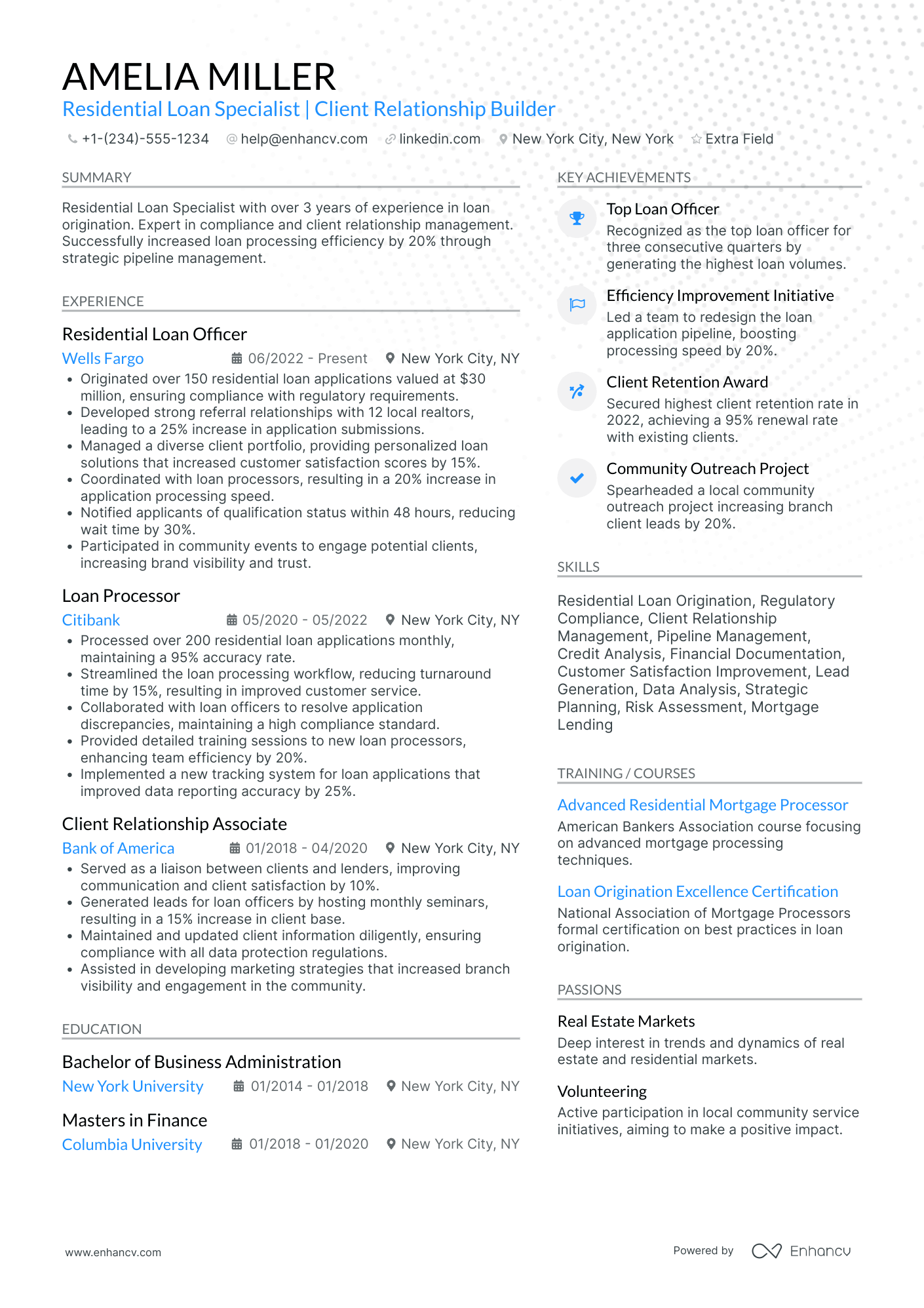

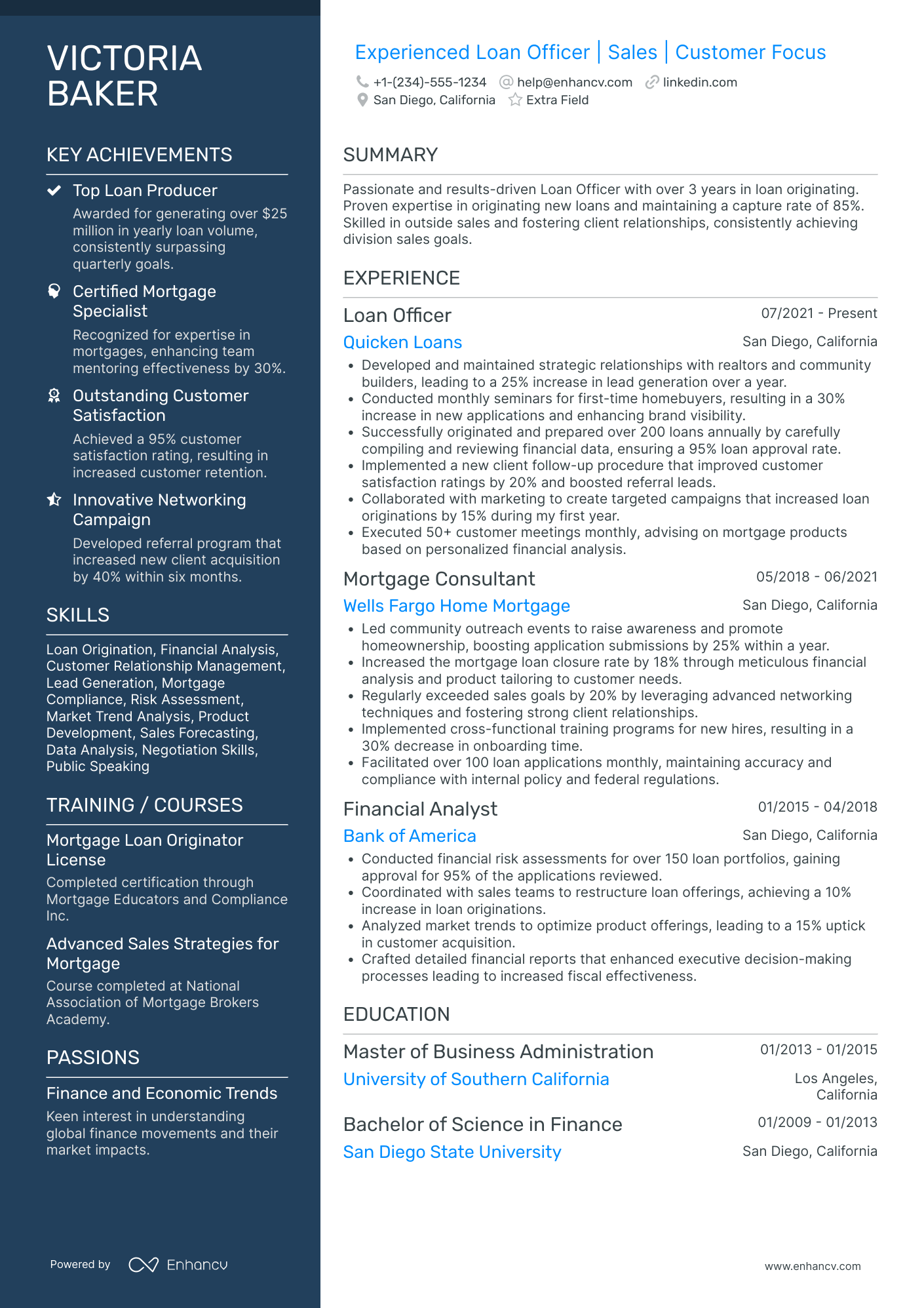

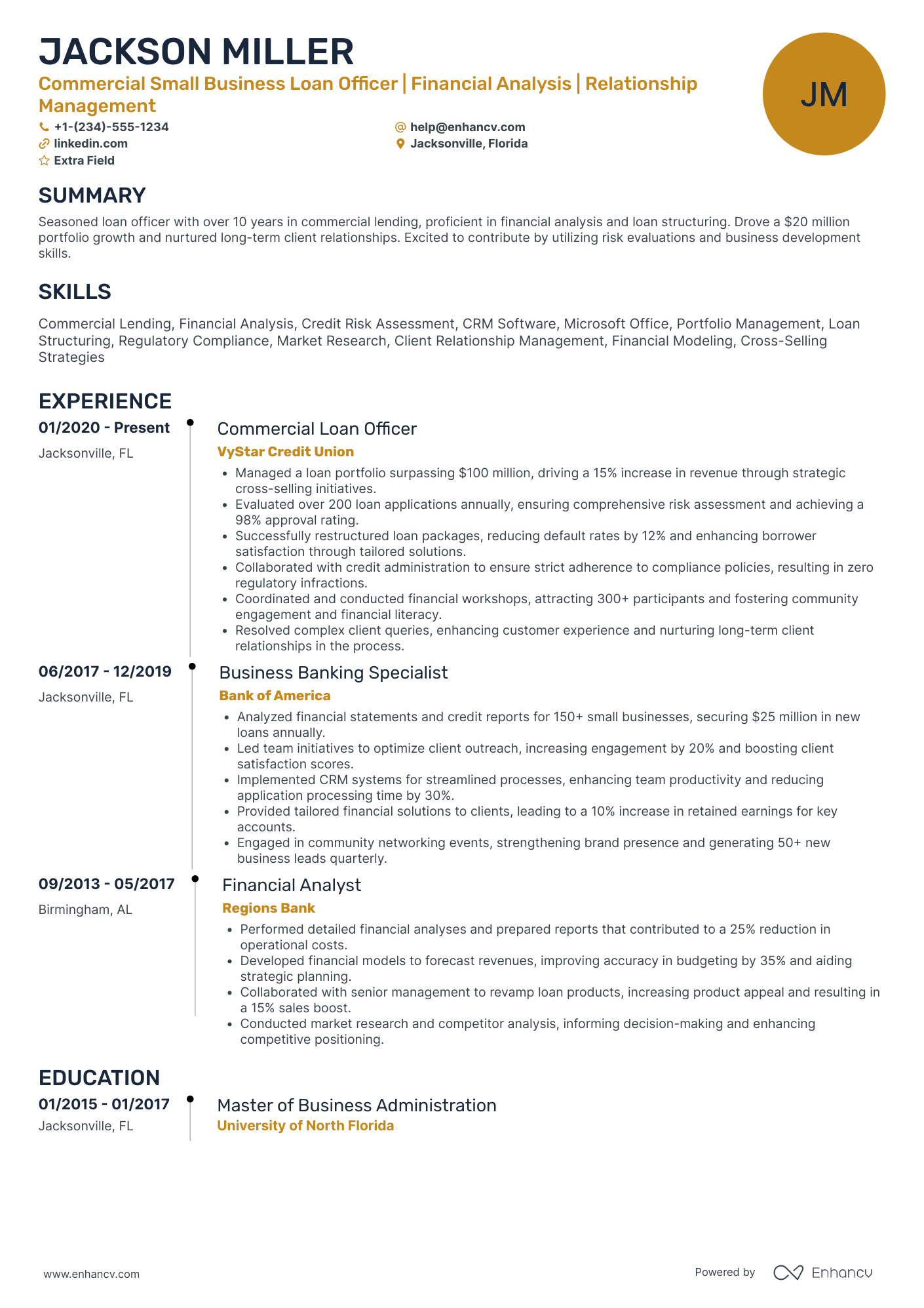

Take inspiration from leading loan officer resume examples to learn how to tailor your experience.

- Management Accounting Resume Example

- Financial Consultant Resume Example

- Actuary Resume Example

- Finance Executive Resume Example

- Payroll Director Resume Example

- Hotel Accounting Resume Example

- Finance Coordinator Resume Example

- Accounts Receivable Resume Example

- Bookkeeper Resume Example

- Corporate Financial Analyst Resume Example

Best practices for the look and feel of your loan officer resume

Before you even start writing your loan officer resume, first you need to consider its layout and format.

What's important to keep in mind is:

- The reverse-chronological resume is the most widely used format to present your experience, starting with your latest job.

- Your loan officer resume header needs to include your correct, professional contact details. If you happen to have a professional portfolio or an updated LinkedIn profile, include a link to it.

- Ensure your resume is no longer than two pages - you don't have to include irelevant experience on your resume just to make it look longer.

- Unless specified otherwise, submit your resume in the most popular format, the PDF one, as this will ensure your loan officer resume isn't altered.

Align your resume with the market’s standards – Canadian resumes may have unique layout guidelines.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Loan officer resume sections to answer recruiters' checklists:

- Header to help recruiters quickly allocate your contact details and have a glimpse over your most recent portfolio of work

- Summary or objective to provide an overview of your career highlights, dreams, and goals

- Experience to align with job requirements and showcase your measurable impact and accomplishments

- Skills section/-s to pinpoint your full breadth of expertise and talents as a candidate for the loan officer role

- Education and certifications sections to potentially fill in any gaps in your experience and show your commitment to the industry

What recruiters want to see on your resume:

- Demonstrated knowledge of lending laws and regulations

- History of achieving sales targets and cultivating client relationships

- Experience with loan underwriting, approval, and processing procedures

- Proficiency in banking software and loan servicing platforms

- Strong analytical skills and attention to detail for risk assessment

Writing your loan officer resume experience

Within the body of your loan officer resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your loan officer professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

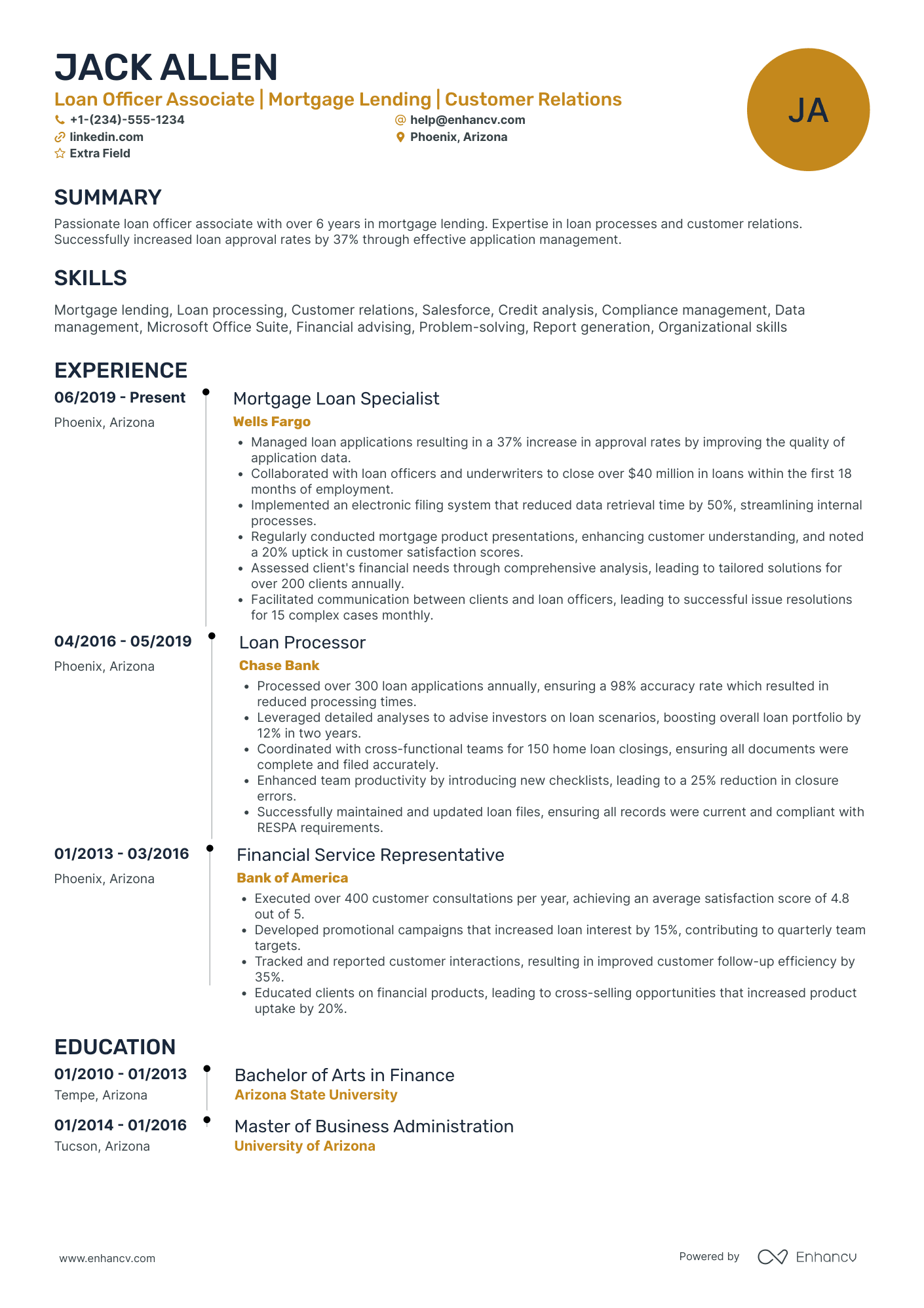

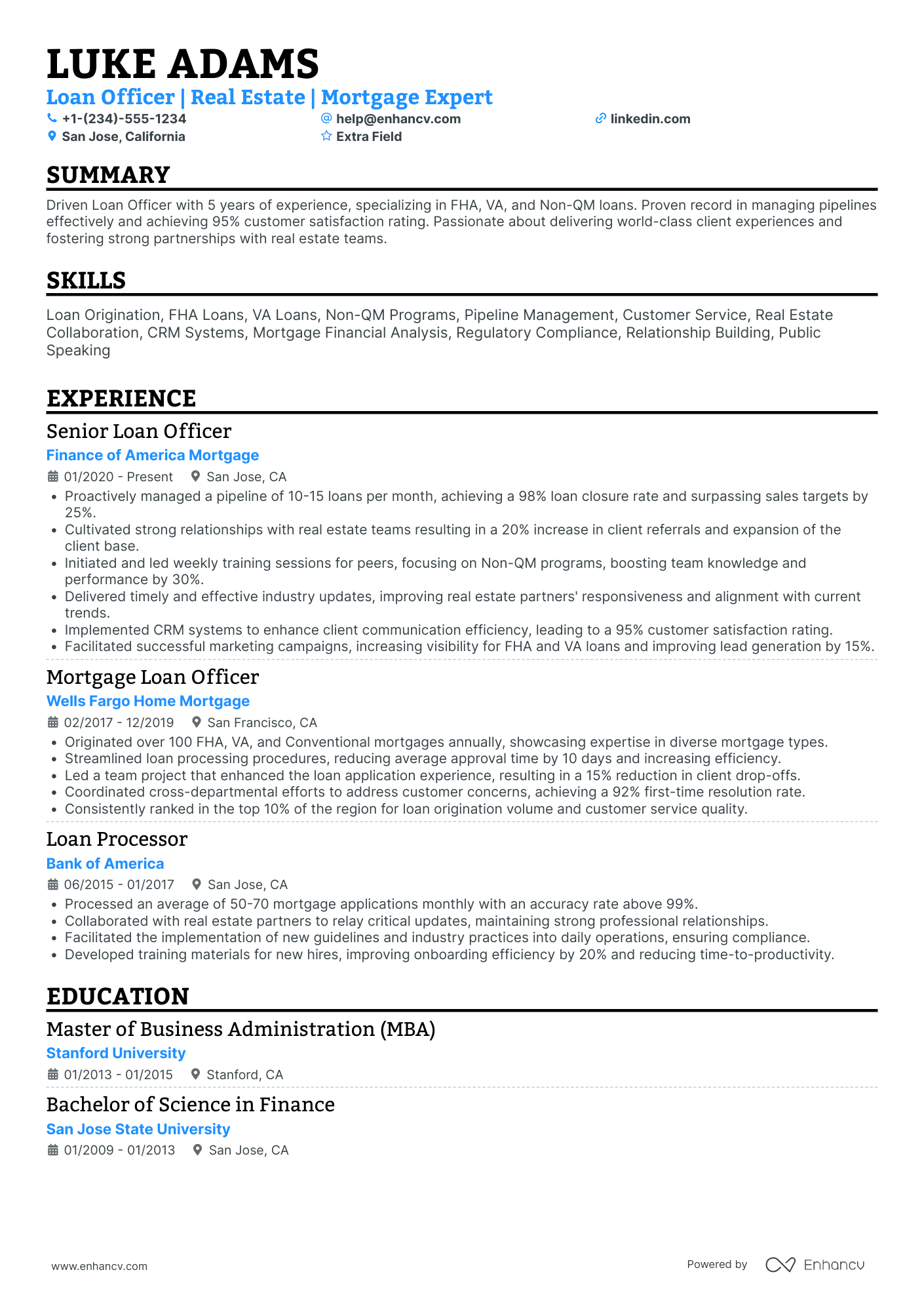

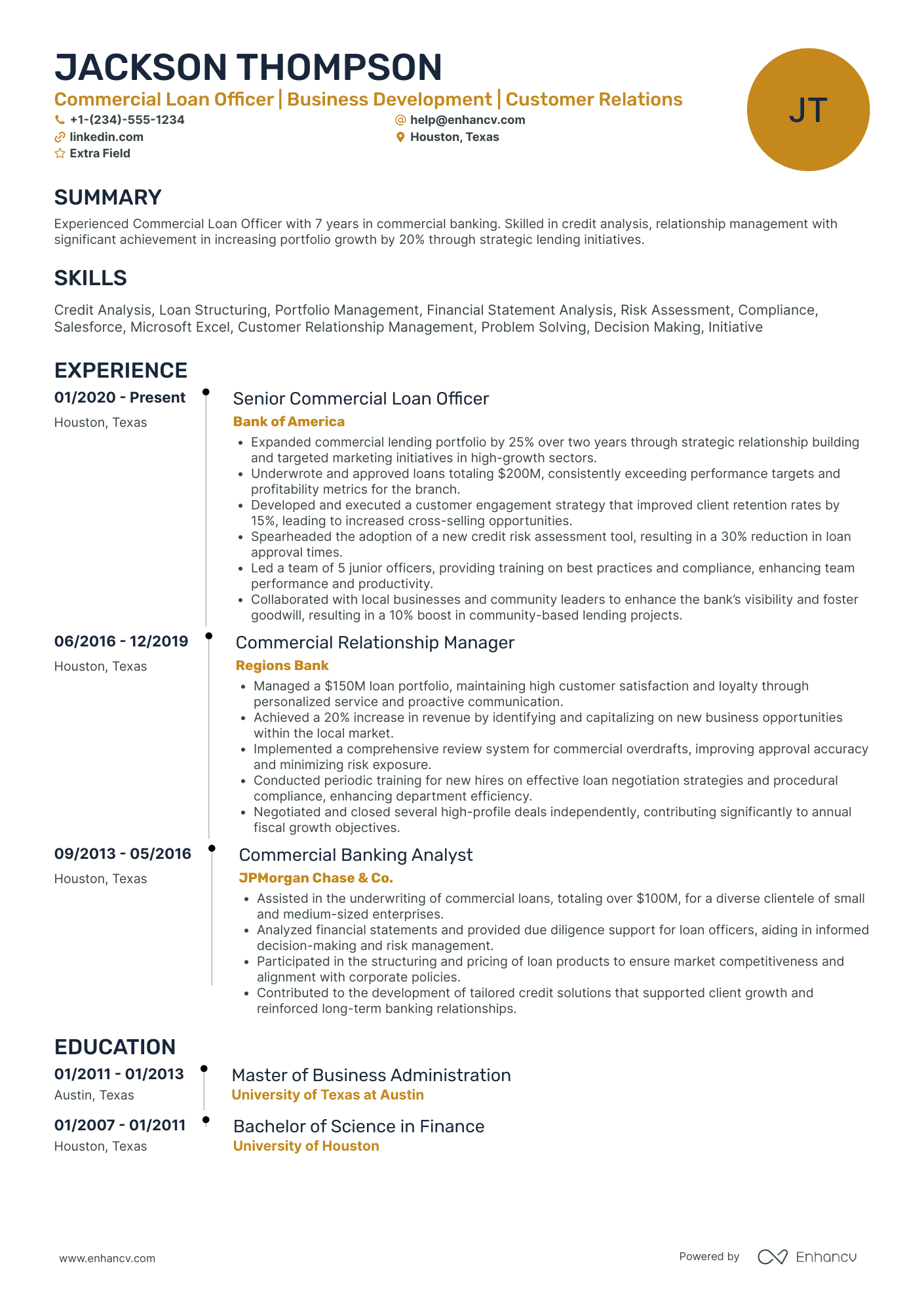

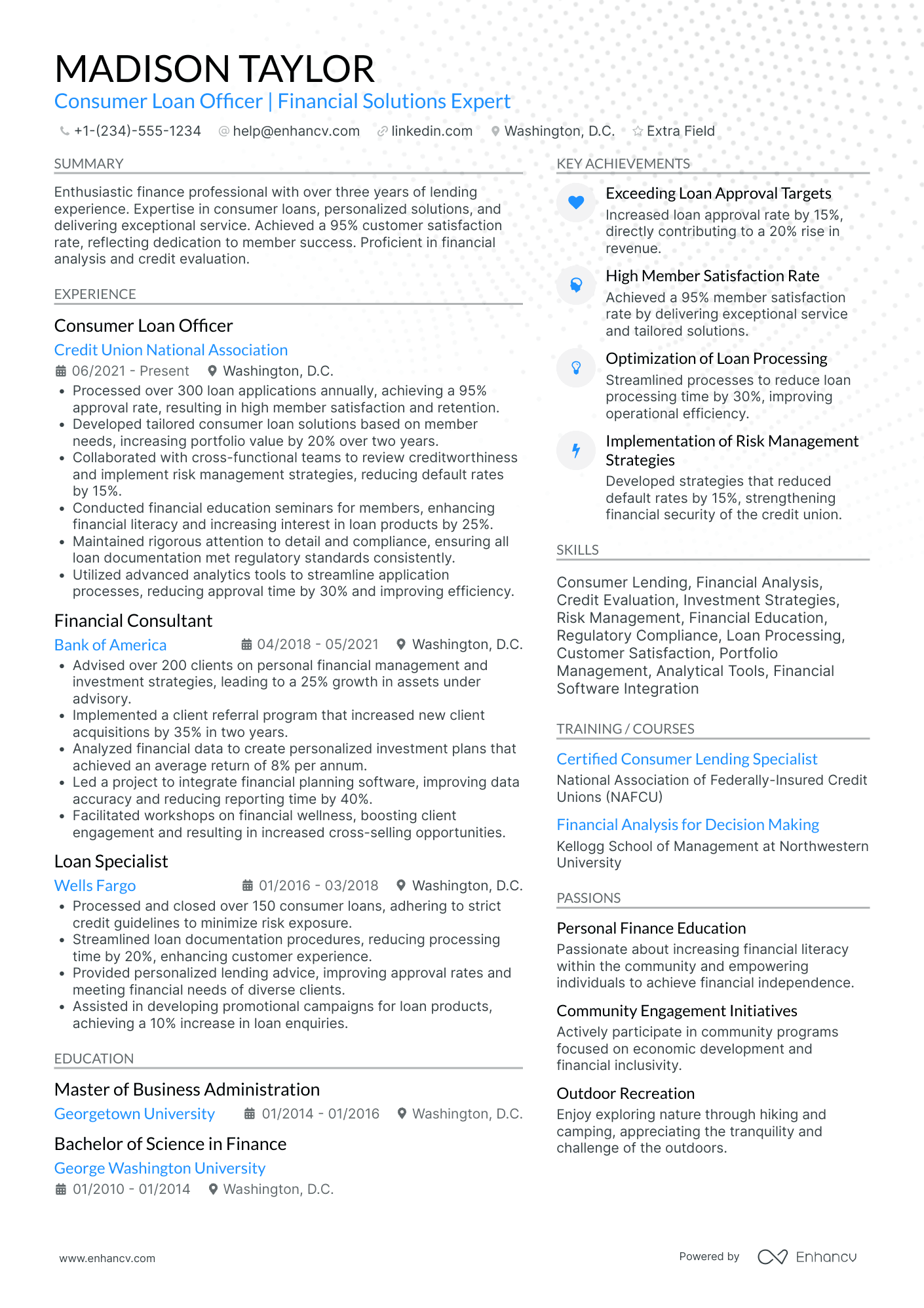

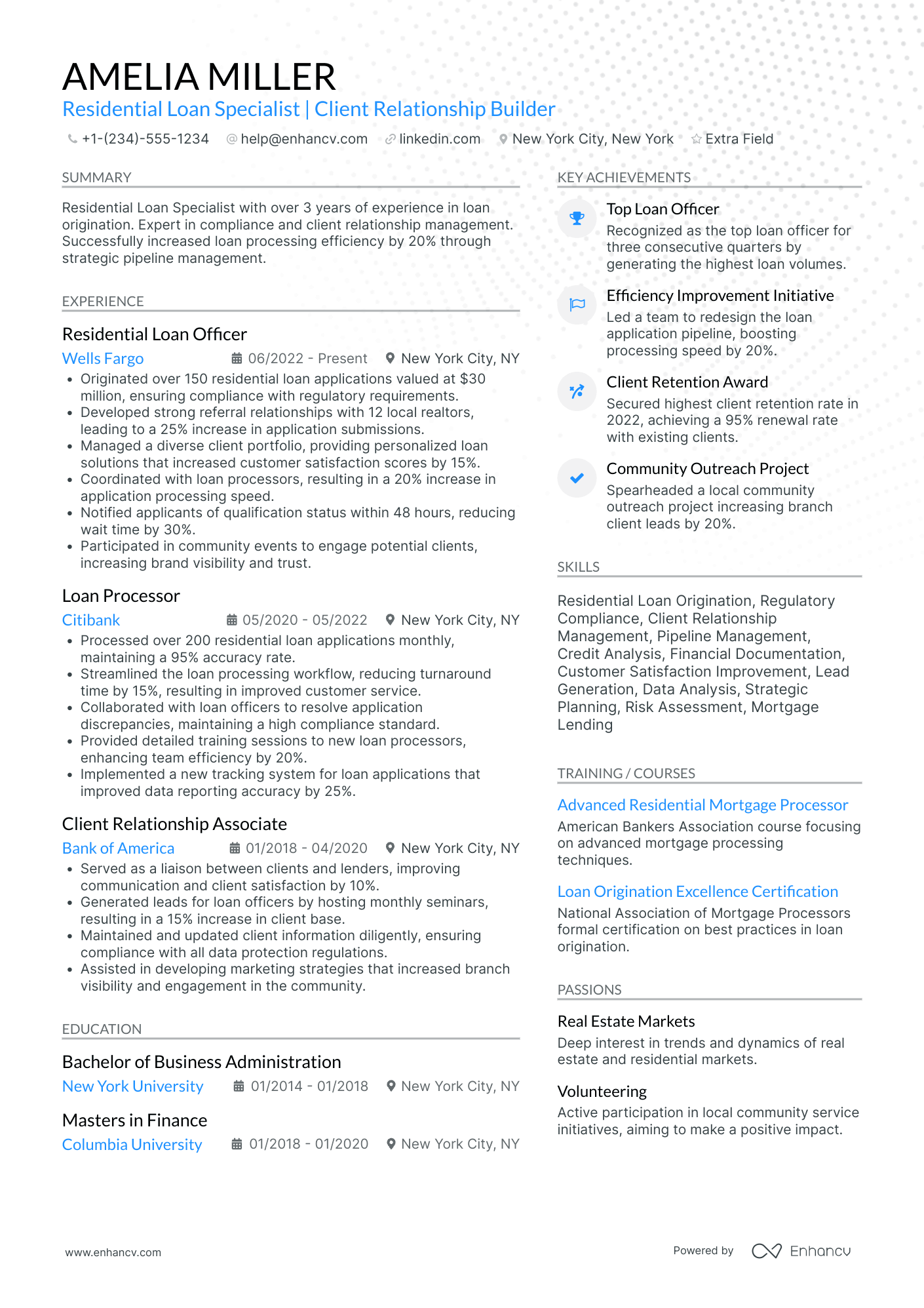

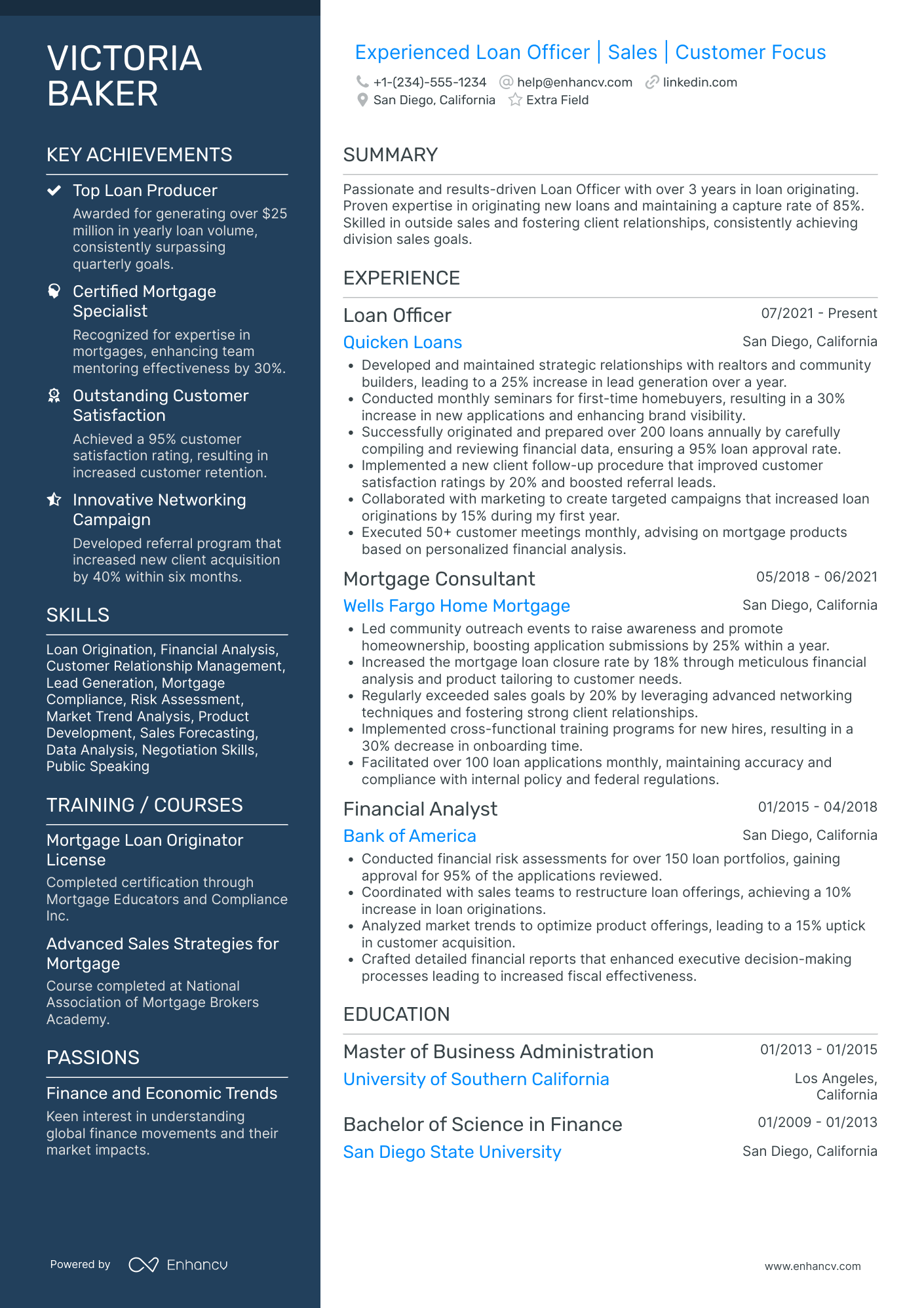

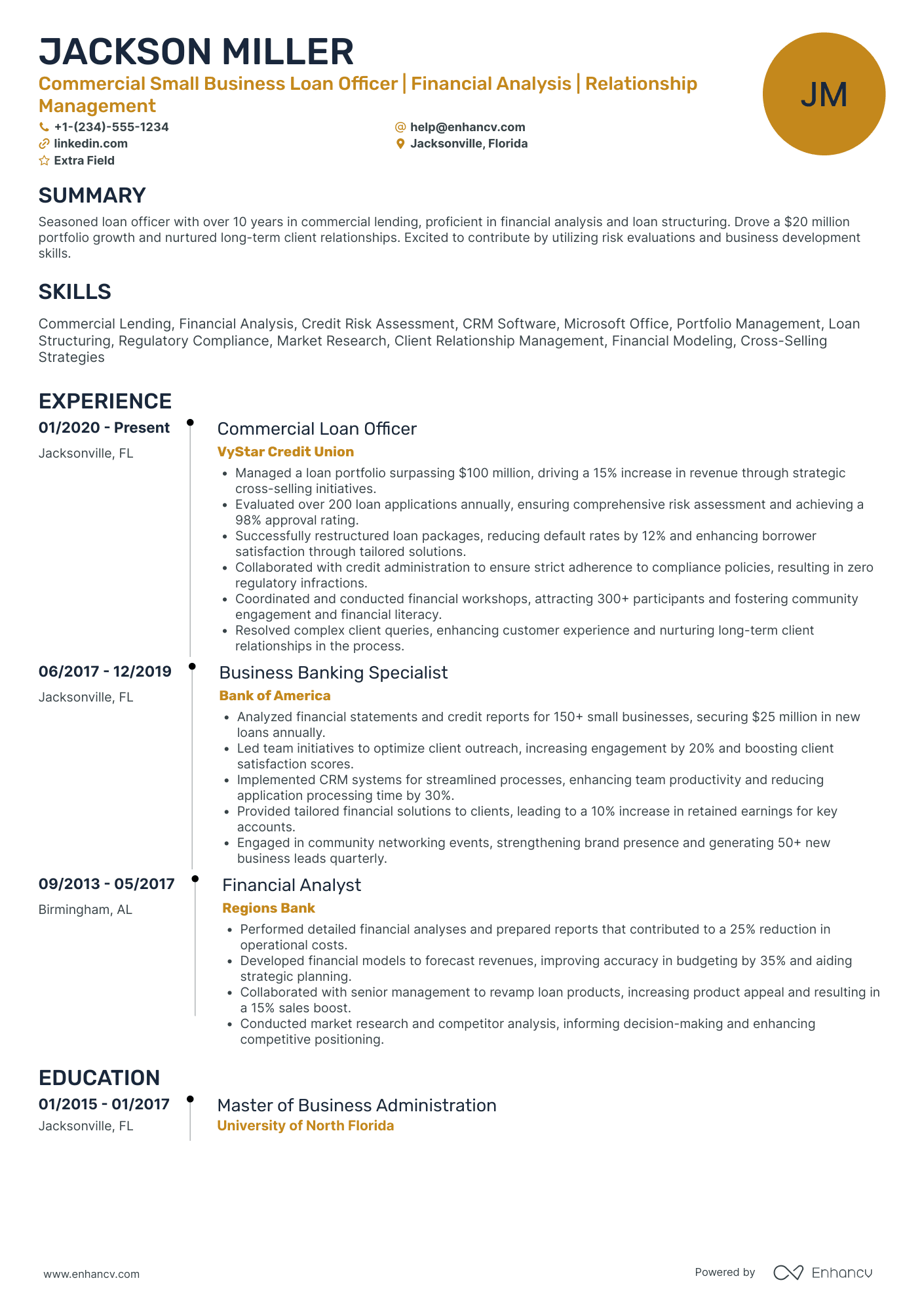

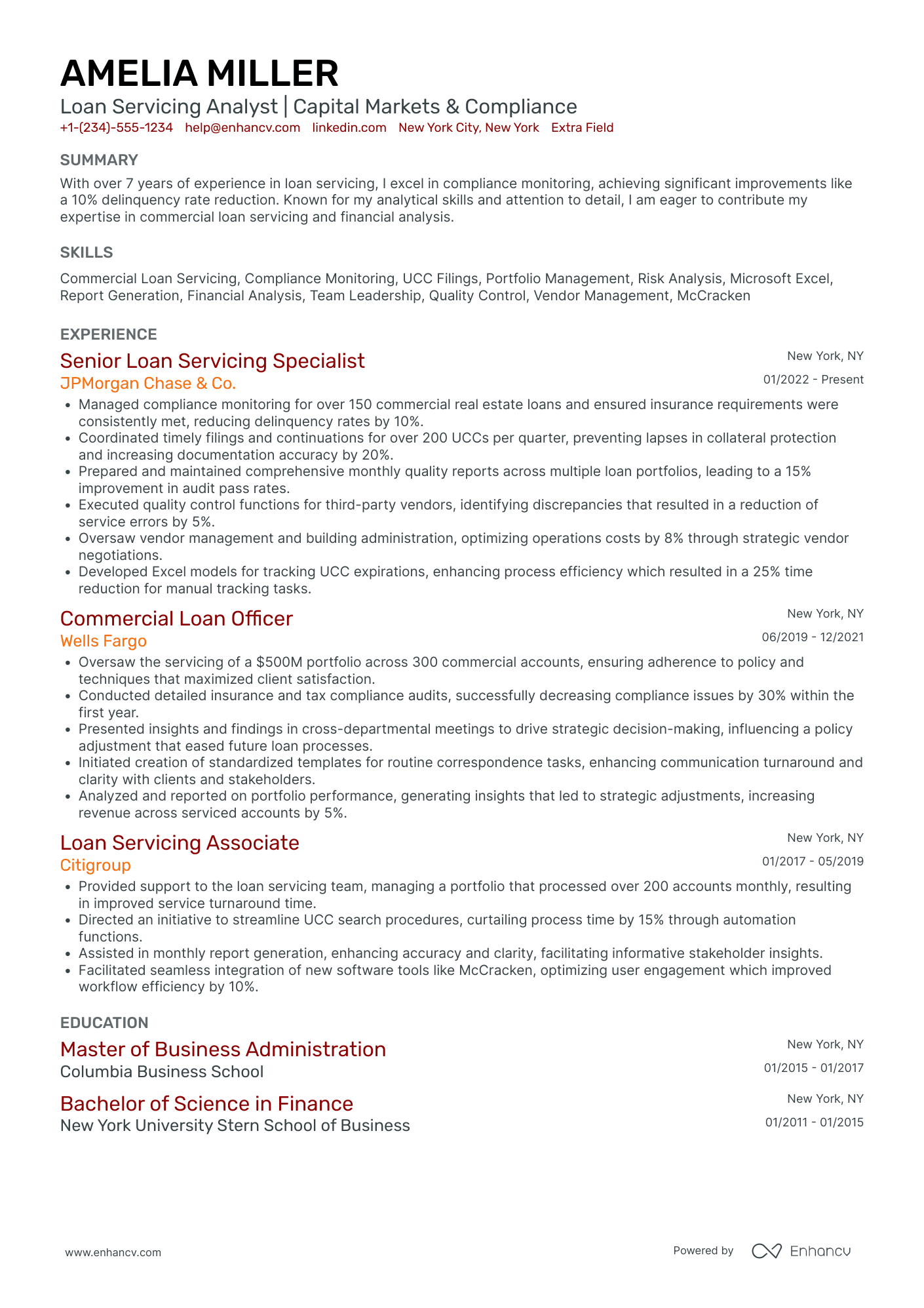

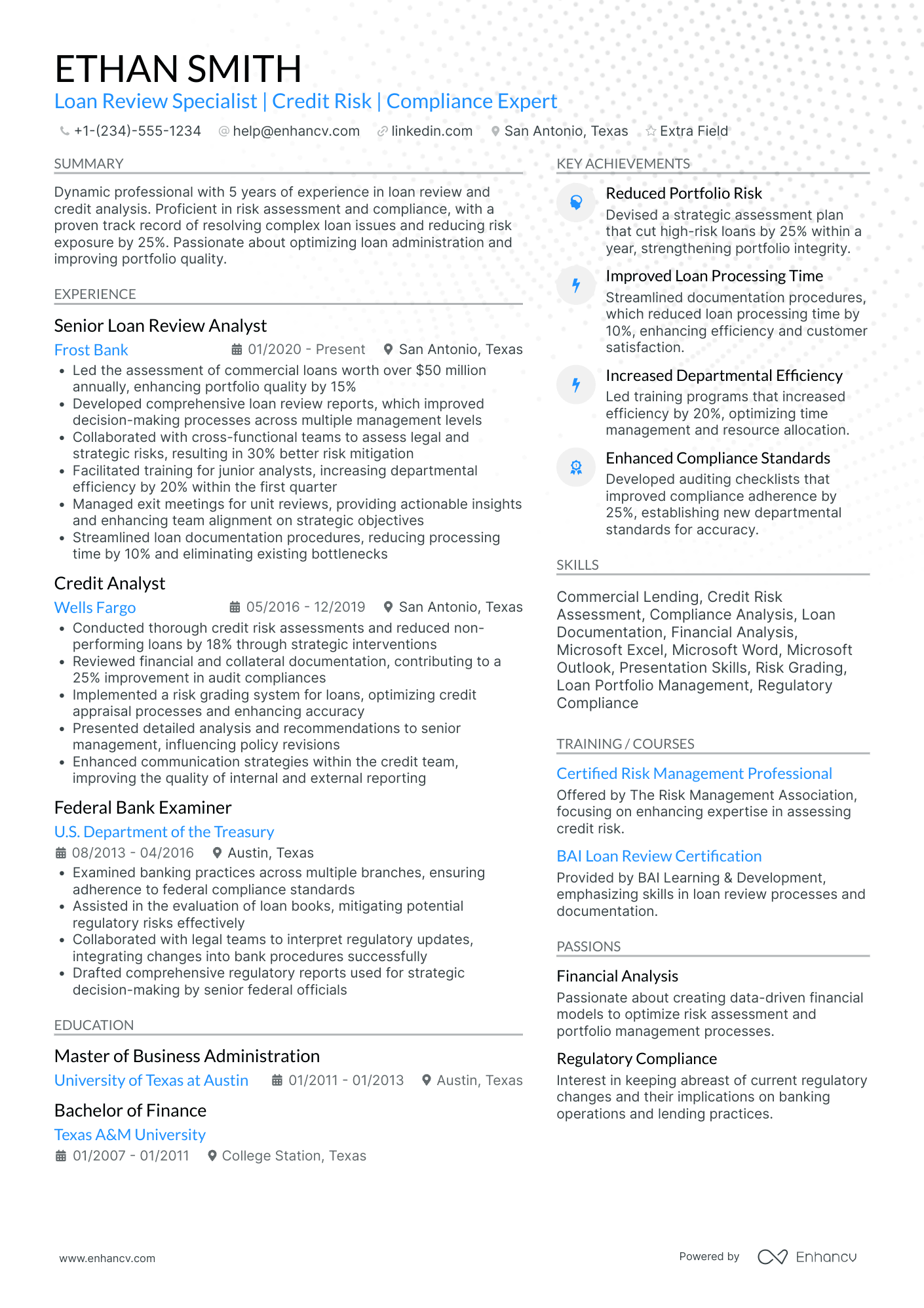

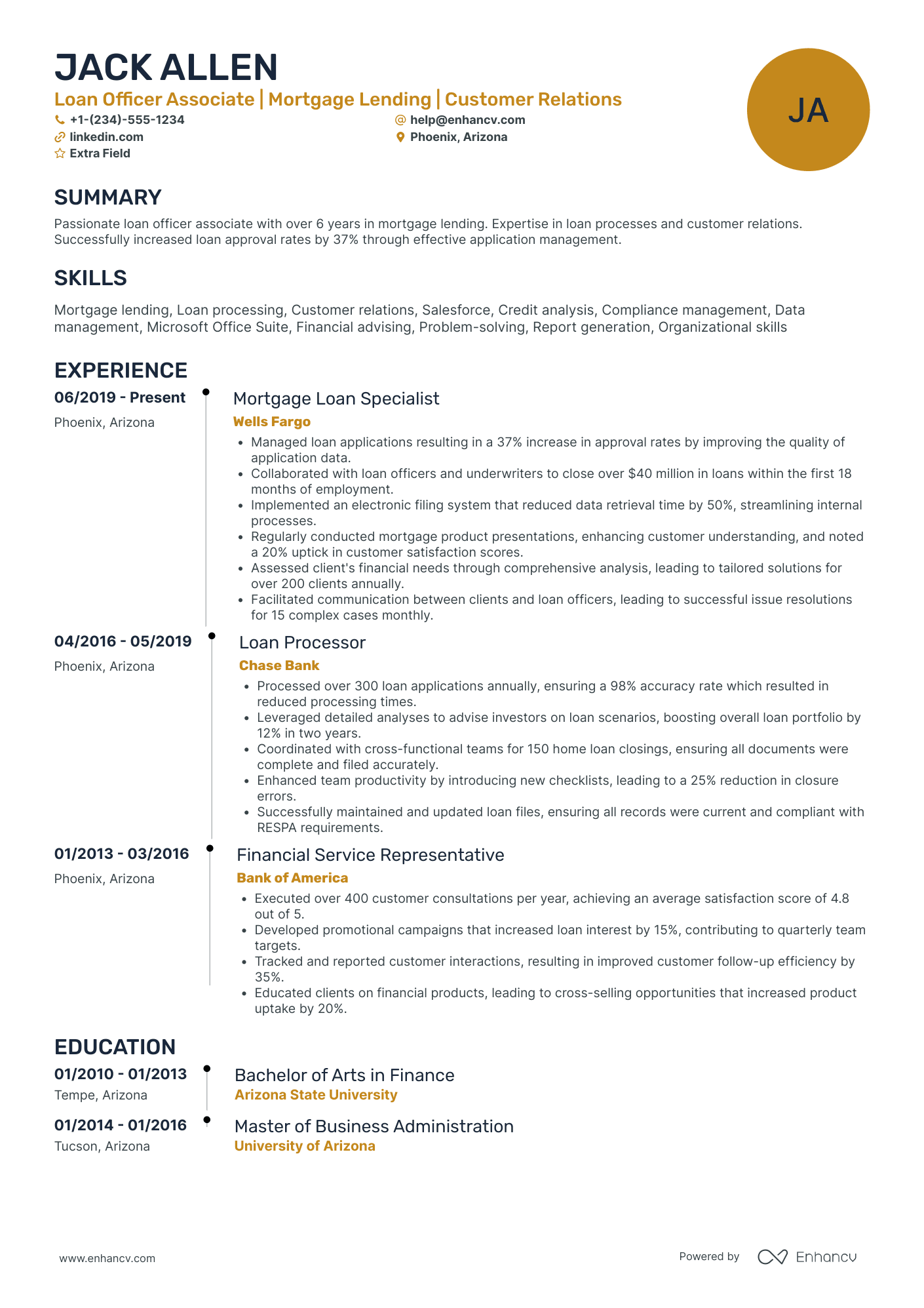

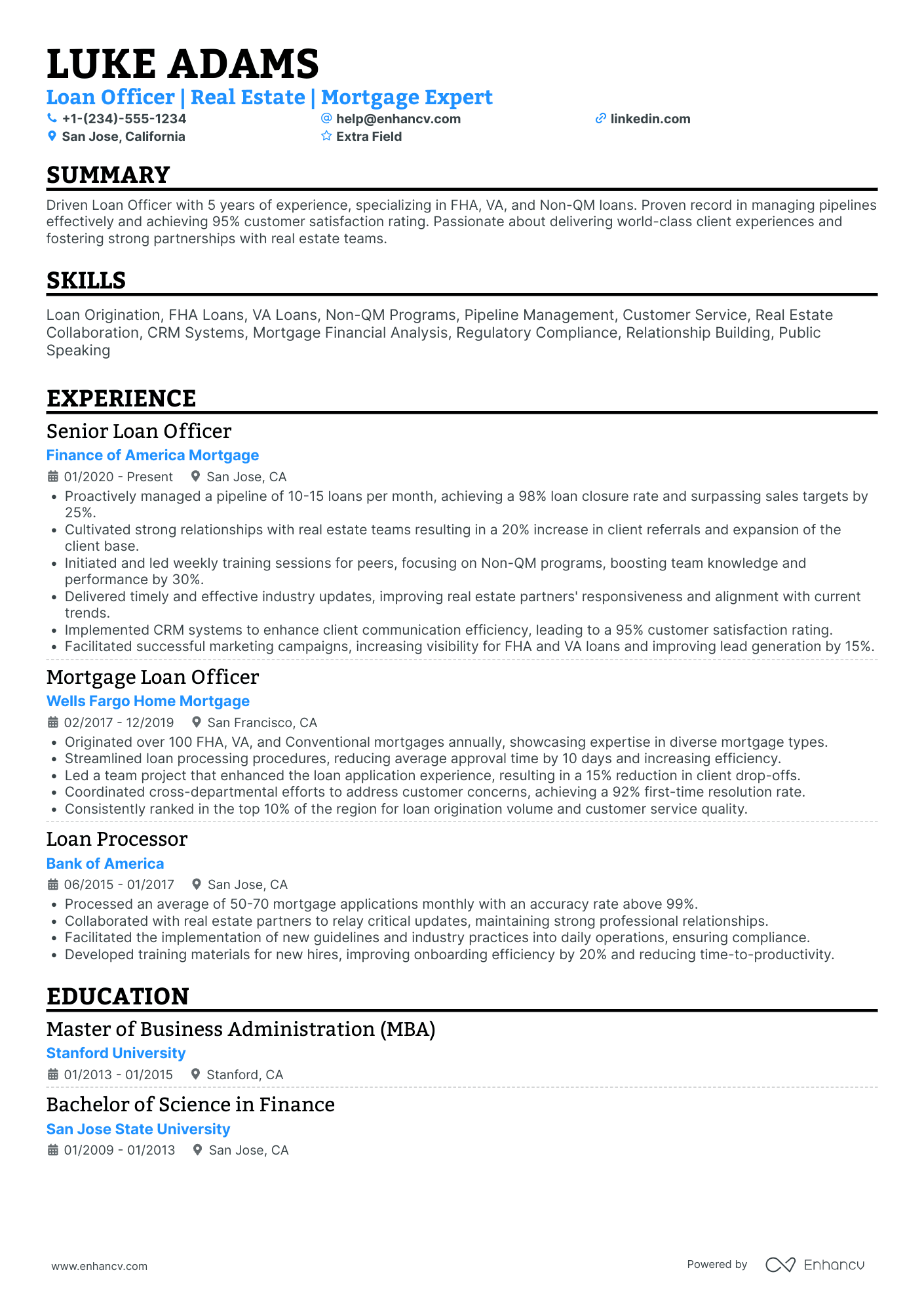

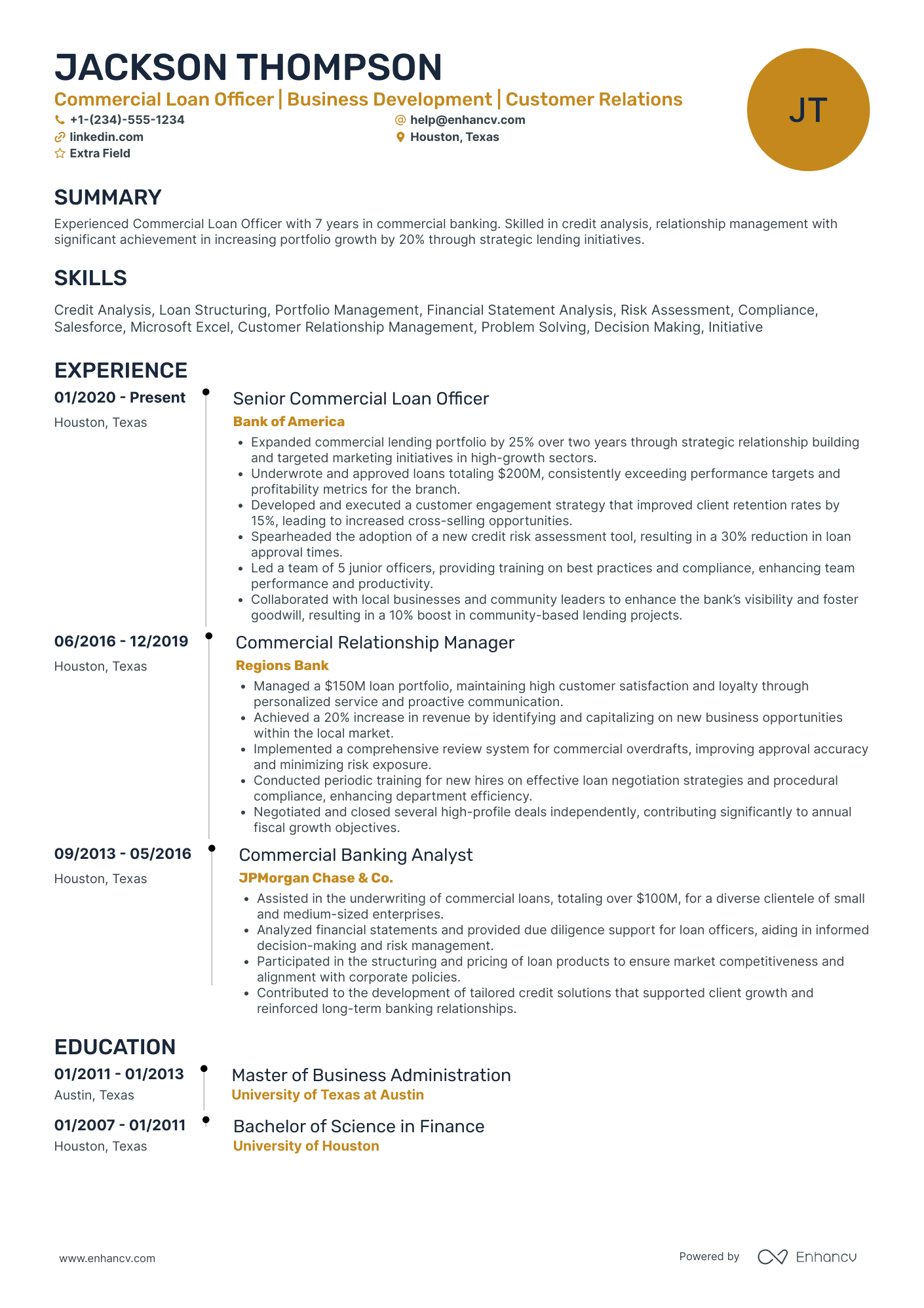

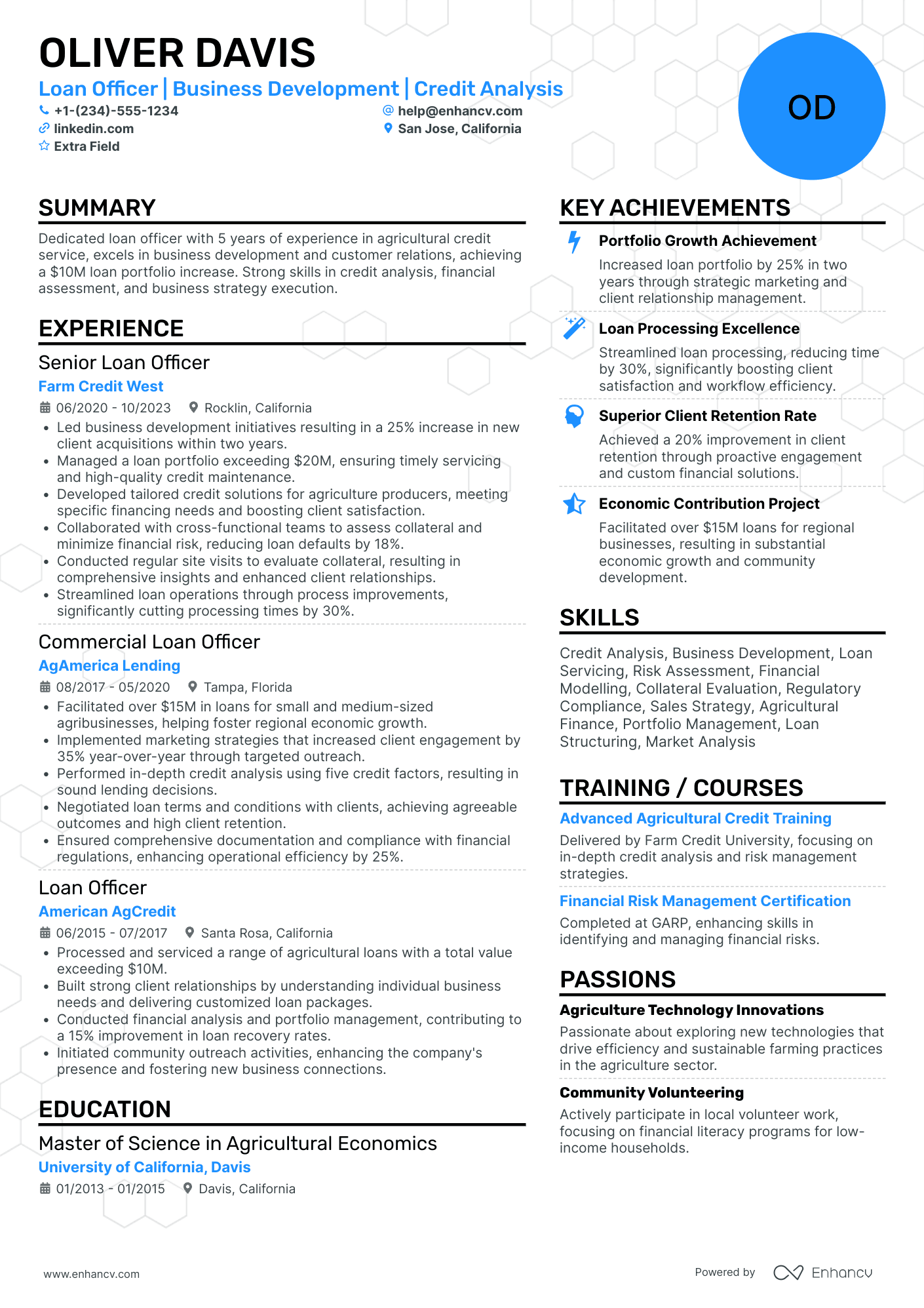

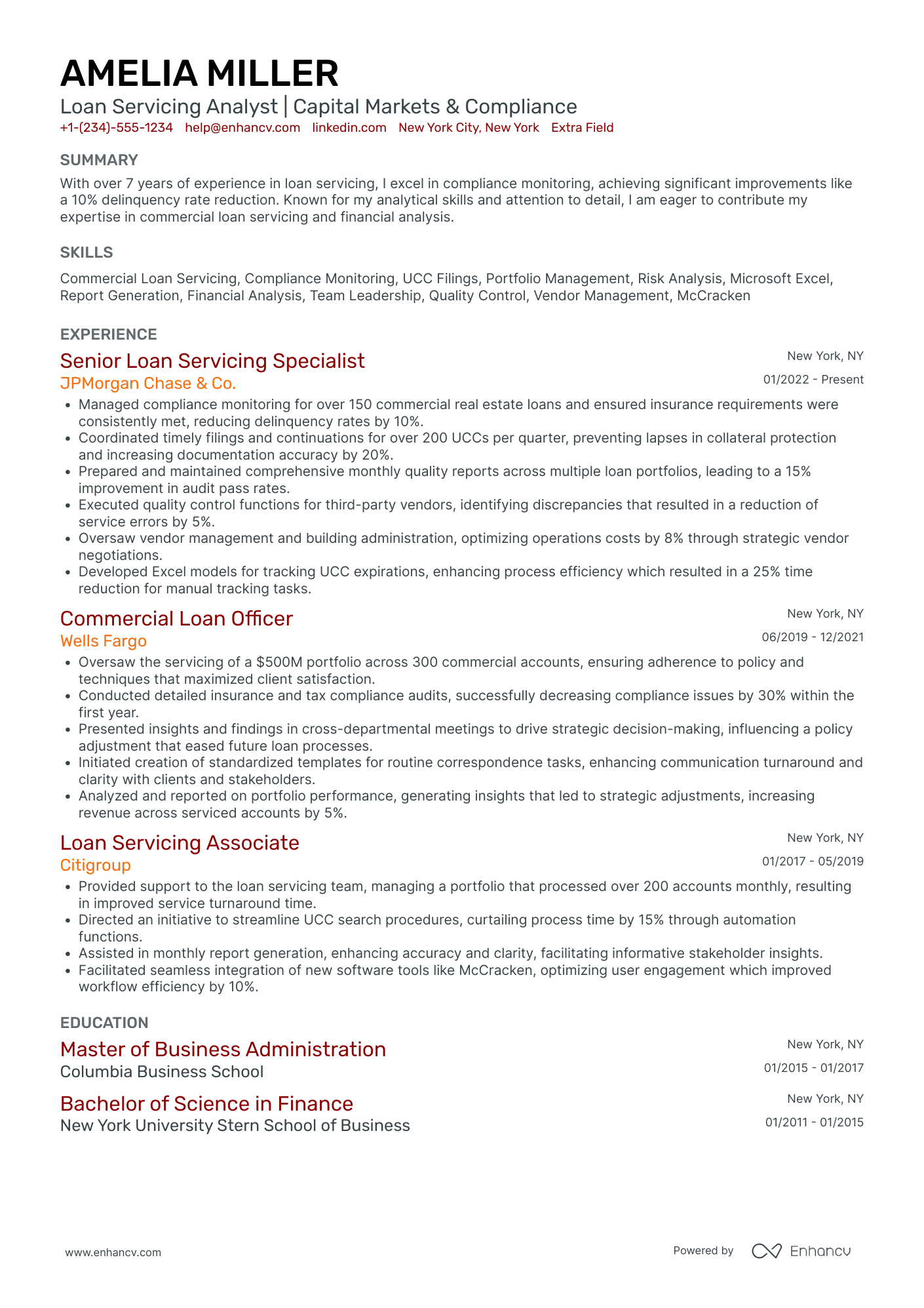

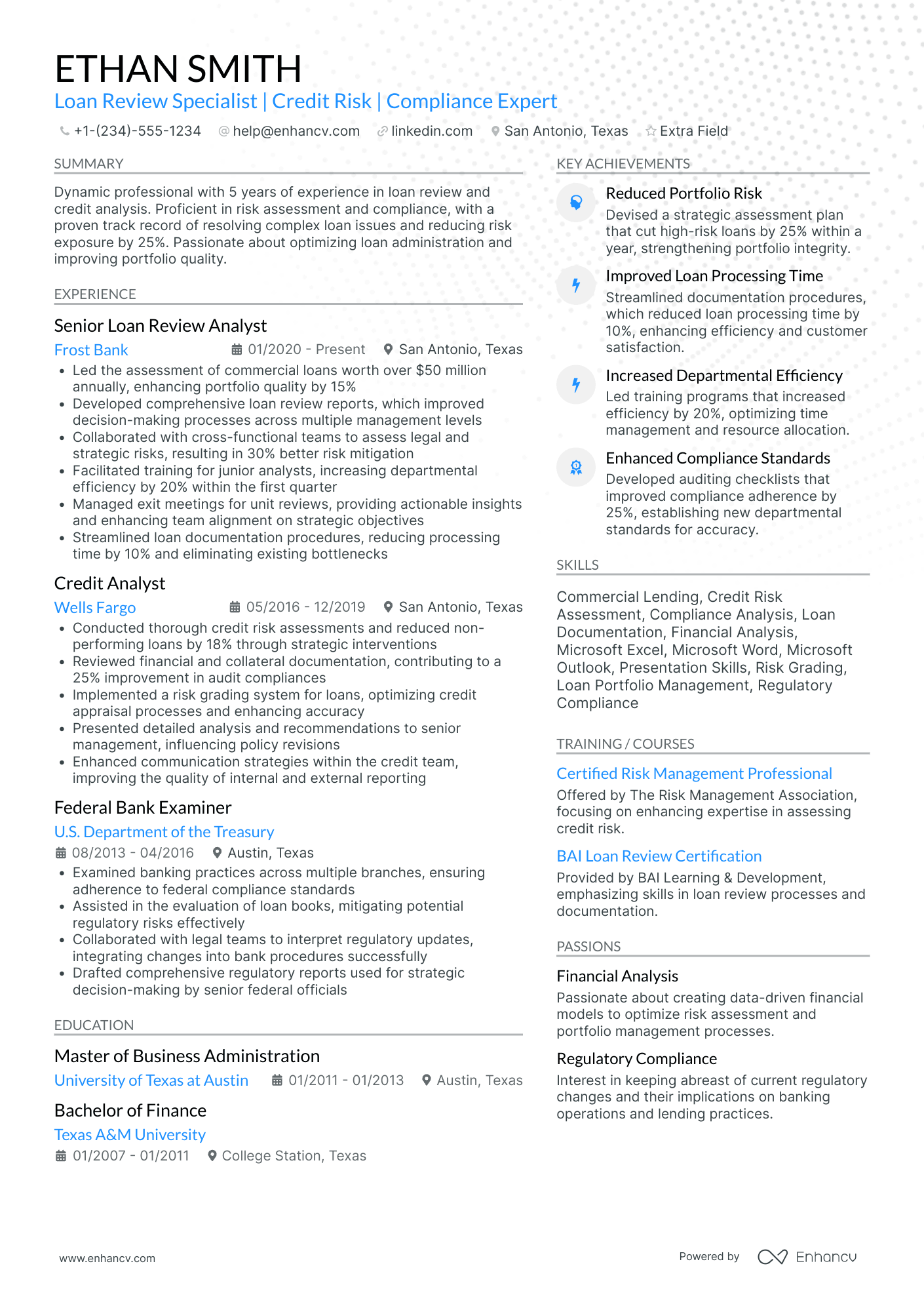

Wondering how other professionals in the industry are presenting their job-winning loan officer resumes? Check out how these loan officer professionals put some of our best practices into action:

- Managed a portfolio of over 250 mortgage loans, ensuring compliance with lending regulations and maintaining a less than 0.5% default rate.

- Developed and maintained relationships with local real estate agents, resulting in a 20% increase in referred loan applications.

- Utilized advanced mortgage loan software to streamline application processes, which improved customer satisfaction scores by 15%.

- Successfully closed an average of $50 million in residential loans annually, consistently meeting and exceeding sales targets by at least 10%.

- Mentored and trained a team of junior loan officers on client engagement strategies and loan processing efficiencies.

- Advised clients on complex loan structures, leading to securing high-value loans for premium property investments.

- Specialized in FHA and VA loans, aiding over 300 military families in obtaining affordable financing for their homes.

- Implemented a customer follow-up system which increased repeat customer rate by 30% within a 3-year period.

- Negotiated loan terms with prospective clients, effectively reducing risk for the lender while increasing approval rates by 25%.

- Orchestrated the integration of AI-driven risk assessment tools which reduced the loan processing time by 40%.

- Spearheaded a digital marketing campaign for loan products that amplified online applications by 50% within six months.

- Forge strategic partnerships with fintech companies, enhancing our technology stack and offering competitive loan products.

- Championed the launch of a new commercial loan program that delivered $100 million in loans within the first year.

- Analyzed and interpreted complex financial data to present loan opportunities to the credit committee, achieving a 90% approval rate.

- Collaborated with underwriters to tailor loans to clients' specific circumstances, thus expanding the commercial loan portfolio by 35%.

- Revamped underwriting criteria in alignment with market changes, which preserved loan quality during an economic downturn.

- Grew personal loan book of business by 50% in four years through effective networking and client satisfaction initiatives.

- Initiated a financial literacy workshop for first-time homebuyers that strengthened community relations and led to a 15% uptick in approved loans.

- Instrumental in a project that automated the appraisal review process, which cut operational costs by 20% while maintaining loan quality.

- Facilitated inter-departmental cooperation to ensure seamless loan processing, resulting in a customer satisfaction score increase from 85% to 95%.

- Oversaw a cross-selling strategy that boosted ancillary financial product sales by 40%, deepening customer relationships and retention.

- Piloted a regional initiative to promote HELOC products that grew the home equity line portfolio by $25 million.

- Conducted thorough market analysis to identify and capitalize on refinancing opportunities, leading to a 60% increase in refinance loan volume.

- Credited for designing loan structures that accommodated high-net-worth clients' unique financial needs, attracting a new segment of clientele.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for loan officer professionals.

Top Responsibilities for Loan Officer:

- Meet with applicants to obtain information for loan applications and to answer questions about the process.

- Analyze applicants' financial status, credit, and property evaluations to determine feasibility of granting loans.

- Approve loans within specified limits, and refer loan applications outside those limits to management for approval.

- Explain to customers the different types of loans and credit options that are available, as well as the terms of those services.

- Submit applications to credit analysts for verification and recommendation.

- Review loan agreements to ensure that they are complete and accurate according to policy.

- Review and update credit and loan files.

- Obtain and compile copies of loan applicants' credit histories, corporate financial statements, and other financial information.

- Work with clients to identify their financial goals and to find ways of reaching those goals.

- Handle customer complaints and take appropriate action to resolve them.

Quantifying impact on your resume

- Include the total value of loans you have managed to highlight experience with significant sums of money.

- Detail the percentage growth in loan applications or approvals year-over-year to demonstrate sales and marketing success.

- List the number of clients you've managed or advised to showcase customer service and relationship management abilities.

- Mention the reduction in processing time for loan applications you've achieved through efficiency improvements.

- Quantify the decrease in default rates under your management to prove effective risk analysis and management.

- Cite specific rankings or awards you've earned for your performance to establish a track record of excellence.

- State the number of cross-sells or up-sells you've accomplished to display your ability to contribute to business growth.

- Record the scale of the portfolios you've worked with by providing average loan sizes to underline industry expertise.

Action verbs for your loan officer resume

No relevant experience - what to feature instead

Suppose you're new to the job market or considering a switch in industry or niche. In such cases, it's common to have limited standard professional experience. However, this isn't a cause for concern. You can still craft an impressive loan officer resume by emphasizing other sections, showing why you're a great fit for the role:

- Emphasize your educational background and extracurricular activities to demonstrate your industry knowledge;

- Replace the typical experience section with internships or temporary jobs where you've gained relevant skills and expertise;

- Highlight your unique skill set, encompassing both technological and personal abilities;

- Showcase transferable skills acquired throughout your life and work experiences so far.

Recommended reads:

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Creating your loan officer resume skills section: balancing hard skills and soft skills

Recruiters hiring for loan officer roles are always keen on hiring candidates with relevant technical and people talents. Hard skills or technical ones are quite beneficial for the industry - as they refer to your competency with particular software and technologies. Meanwhile, your soft (or people) skills are quite crucial to yours and the company's professional growth as they detail how you'd cooperate and interact in your potential environment. Here's how to describe your hard and soft skill set in your loan officer resume:

- Consider what the key job requirements are and list those towards the top of your skills section.

- Think of individual, specific skills that help you stand out amongst competitors, and detail how they've helped you succeed in the past.

- Look to the future of the industry and list all software/technologies which are forward-facing.

- Create a separate, technical skills section to supplement your experience and further align with the loan officer job advert. Find the perfect balance between your resume hard and soft skills with our two lists.

Top skills for your loan officer resume:

Loan origination software

Credit analysis tools

Mortgage underwriting systems

Customer relationship management (CRM) software

Data analysis software

Financial modeling tools

Document management systems

Compliance management software

Electronic signature platforms

Accounting software

Communication skills

Negotiation skills

Attention to detail

Problem-solving skills

Time management

Customer service orientation

Interpersonal skills

Analytical thinking

Stress management

Adaptability

Next, you will find information on the top technologies for loan officer professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Loan Officer’s resume:

- FileMaker Pro

- Microsoft Access

- Zoom

- Delphi Discovery

- White Clarke North America Credit Adjudication and Lending Management

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

Showcase academic background with education and certifications' sections

Listing your education and certifications should be a rudimentary part of your resume writing.

Including your relevant academic background - in the form of your higher education degree and niche-specific certificates - will prove knowledge of the industry.

For your education section:

- Start by including your degree, followed by start and graduation dates, as well as the institution;

- You could include relevant coursework, major/minor , or GPA, only if your've just graduated from college or if this information would further support your application;

- If you have an "ongoing" degree, you can still list it in case you think your diploma can impress recruiters or it's required;

Follow a similar logic for your certifications section by listing the institution, alongside dates you've obtained the certificate. For some of the most recent and relevant industry certificates , check out the next part of our guide:

The top 5 certifications for your loan officer resume:

- Certified Mortgage Banker (CMB) – Mortgage Bankers Association (MBA)

- Residential Certified Mortgage Servicer (RCMS) – Mortgage Bankers Association (MBA)

- Certified Loan Servicing Professional (CLSP) – MBA Education

- Certified Mortgage Compliance Professional (CMCP) – MBA Education

- Certified Mortgage Lender (CML) – Mortgage Bankers Association (MBA)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for loan officer professionals.

Top US associations for a Loan Officer professional

- American Bankers Association

- BNI

- Mortgage Bankers Association

- Risk Management Association

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Recommended reads:

The summary or objective: focusing on the top one-third of your resume

It's a well-known fact that the top one-third of your loan officer resume is the make-it-or-break-it moment of your application. The resume summary and objective could help you further build up your professional profile.

- If you have plenty of career highlights behind your back, use the resume summary . The loan officer summary immediately focuses recruiters' attention on what matters most within your experience.

- The resume objective is the perfect choice for balancing your career achievements with your vision. Use it to state precisely how you see yourself in a couple of years' time - as part of the company you're applying for.

Both the resume summary and resume objective can be your value pitch to potential employers: answering what makes your application unique and the top choice for the loan officer role. They both have to be specific and tailored - as there's no one-size-fits-all approach to writing your loan officer summary or objective. Use the loan officer examples below as a starting point:

Resume summaries for a loan officer job

- With over a decade of dedicated experience in commercial lending at a top-tier bank in New York, this seasoned professional has consistently exceeded quarterly loan origination targets by 20%. Expert in risk assessment, financial analysis, and regulatory compliance, with a track record of cultivating long-term client relationships, leading to a 95% client retention rate.

- Accomplished financial advisor with 8 years of experience transitioning into the loan officer domain, bringing a wealth of knowledge in personal finance management, investment strategies, and client service excellence. Holds a CFA certification and has successfully guided 150+ clients through complex financial planning, demonstrating acute analytical skills and attention to detail.

- Esteemed secondary education teacher seeking a shift to the financial sector as a loan officer, equipped with impeccable communication and interpersonal skills developed over 7 years of shaping young minds. Brings a unique perspective in client education, having significantly improved student performance by 40% through innovative teaching methods and individualized attention.

- Guided by a passion for helping individuals achieve their financial goals, this professional leverages 5 years of client-facing experience in the retail banking industry to expertly navigate the nuances of loan processing. Known for an impressive track record of processing loan applications 30% faster than the team average, all while maintaining rigorous accuracy and compliance standards.

- Ambitious newcomer to the financial industry, eager to apply recent Finance degree and internship experience where analytical acumen, precise communication, and a dedication to upholding the highest standards of customer service were honed. Aims to leverage academic understanding of financial principles and a fresh perspective to deliver exceptional satellite service.

- Passionate about starting a career in loan management, this recent MBA graduate brings to the table advanced financial modeling expertise, a robust understanding of economic trends, and a keen ability to assess and mitigate risks. Aspires to apply strong quantitative skills and deep theoretical knowledge to ensure prudent loan portfolio management in a dynamic banking environment.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for loan officer professionals

Local salary info for Loan Officer.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $69,990 |

| California (CA) | $73,380 |

| Texas (TX) | $65,850 |

| Florida (FL) | $65,560 |

| New York (NY) | $97,300 |

| Pennsylvania (PA) | $64,230 |

| Illinois (IL) | $75,250 |

| Ohio (OH) | $63,320 |

| Georgia (GA) | $77,050 |

| North Carolina (NC) | $67,240 |

| Michigan (MI) | $73,080 |

Recruiters' favorite additional loan officer resume sections

When writing your loan officer resume, you may be thinking to yourself, " Is there anything more I can add on to stand out? ".

Include any of the below four sections you deem relevant, to ensure your loan officer resume further builds up your professional and personal profile:

Key takeaways

We've reached the end of our loan officer resume guide and hope this information has been useful. As a summary of our key points:

- Always assess the job advert for relevant requirements and integrate those buzzwords across various sections of your loan officer resume by presenting tangible metrics of success;

- Quantify your hard skills in your certificates and skills section, while your soft skills in your resume achievements section;

- Ensure you've added additional relevant experience items, such as extracurricular activities and projects you've participated in or led;

- Use both your resume experience and summary to focus on what matters the most to the role: including your technical, character, and cultural fit for the company.

Loan Officer resume examples

By Experience

Junior Loan Officer

Senior Loan Officer

Loan Officer Trainee

Lead Loan Officer

By Role