One significant resume challenge you as a finance executive might encounter is effectively showcasing your strategic leadership abilities in a succinct yet impactful manner. Our guide provides tailored strategies and language designed to highlight your top-tier financial expertise, ensuring that your resume stands out to potential employers by clearly communicating the value you bring to the table.

- Incorporate finance executive job advert keywords into key sections of your resume, such as the summary, header, and experience sections;

- Quantify your experience using achievements, certificates, and more in various finance executive resume sections;

- Apply practical insights from real-life finance executive resume examples to enhance your own profile;

- Choose the most effective finance executive resume format to succeed in any evaluation process.

- Construction Accounting Resume Example

- Financial Project Manager Resume Example

- Tax Manager Resume Example

- Financial Management Specialist Resume Example

- Functional Accounting Resume Example

- IT Auditor Resume Example

- Financial Data Analyst Resume Example

- Finance Officer Resume Example

- Government Accounting Resume Example

- Financial Planning Analyst Resume Example

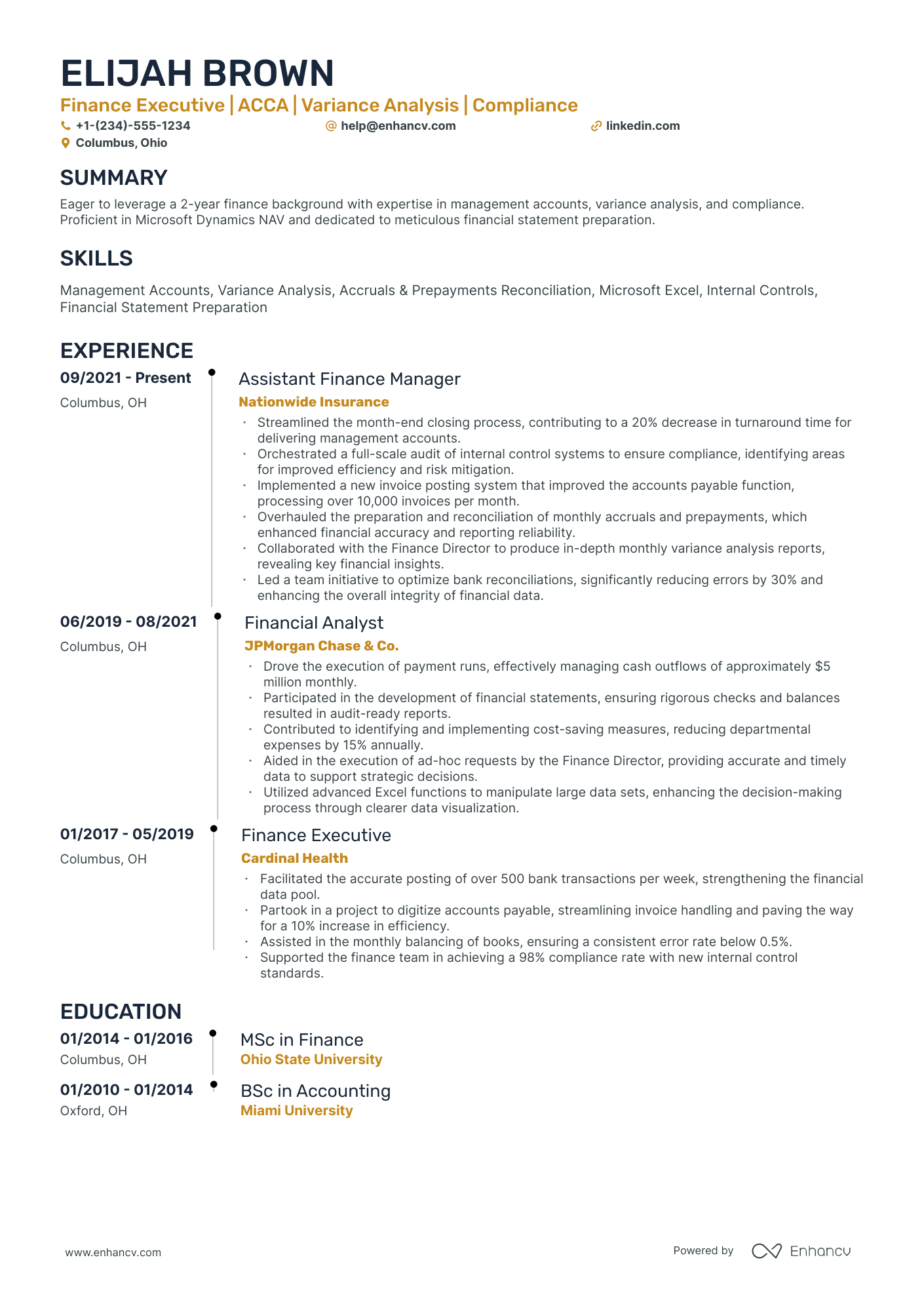

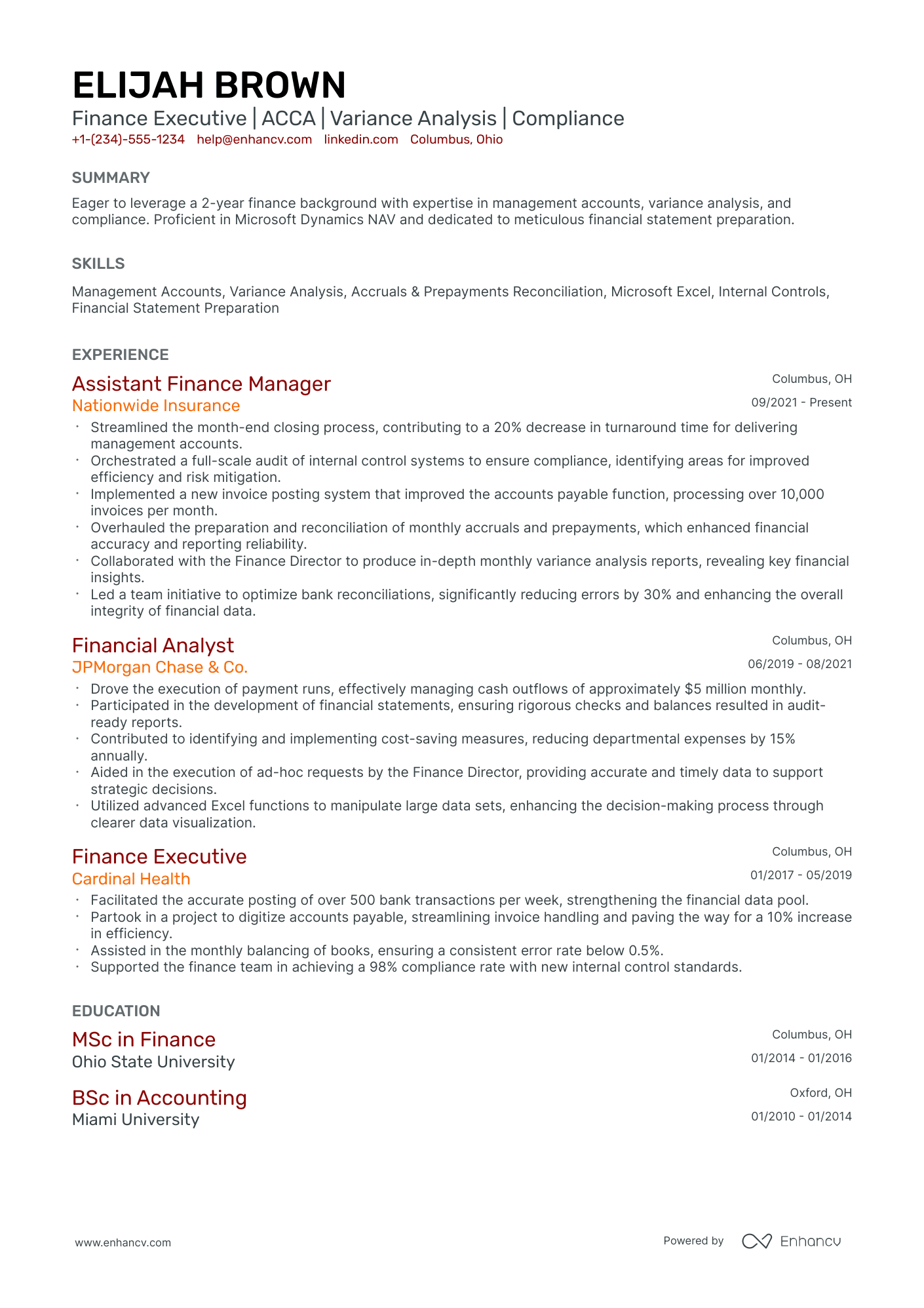

Best practices for the look and feel of your finance executive resume

Before you even start writing your finance executive resume, first you need to consider its layout and format.

What's important to keep in mind is:

- The reverse-chronological resume is the most widely used format to present your experience, starting with your latest job.

- Your finance executive resume header needs to include your correct, professional contact details. If you happen to have a professional portfolio or an updated LinkedIn profile, include a link to it.

- Ensure your resume is no longer than two pages - you don't have to include irelevant experience on your resume just to make it look longer.

- Unless specified otherwise, submit your resume in the most popular format, the PDF one, as this will ensure your finance executive resume isn't altered.

Be mindful of regional differences in resume formats – a Canadian layout, for instance, might vary.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Essential sections that should make up your finance executive resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the finance executive role

What recruiters want to see on your resume:

- Proven experience with financial management, budgeting, and forecasting

- Strong understanding of compliance and risk management principles, along with knowledge of financial regulations

- Demonstrated ability in strategic planning and financial analysis to drive business growth

- Expertise in financial reporting systems, accounting principles, and the ability to manage complex financial operations

- Exceptional leadership qualities with experience in managing finance teams and inter-departmental collaboration

Adding your relevant experience to your finance executive resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your finance executive resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the finance executive advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

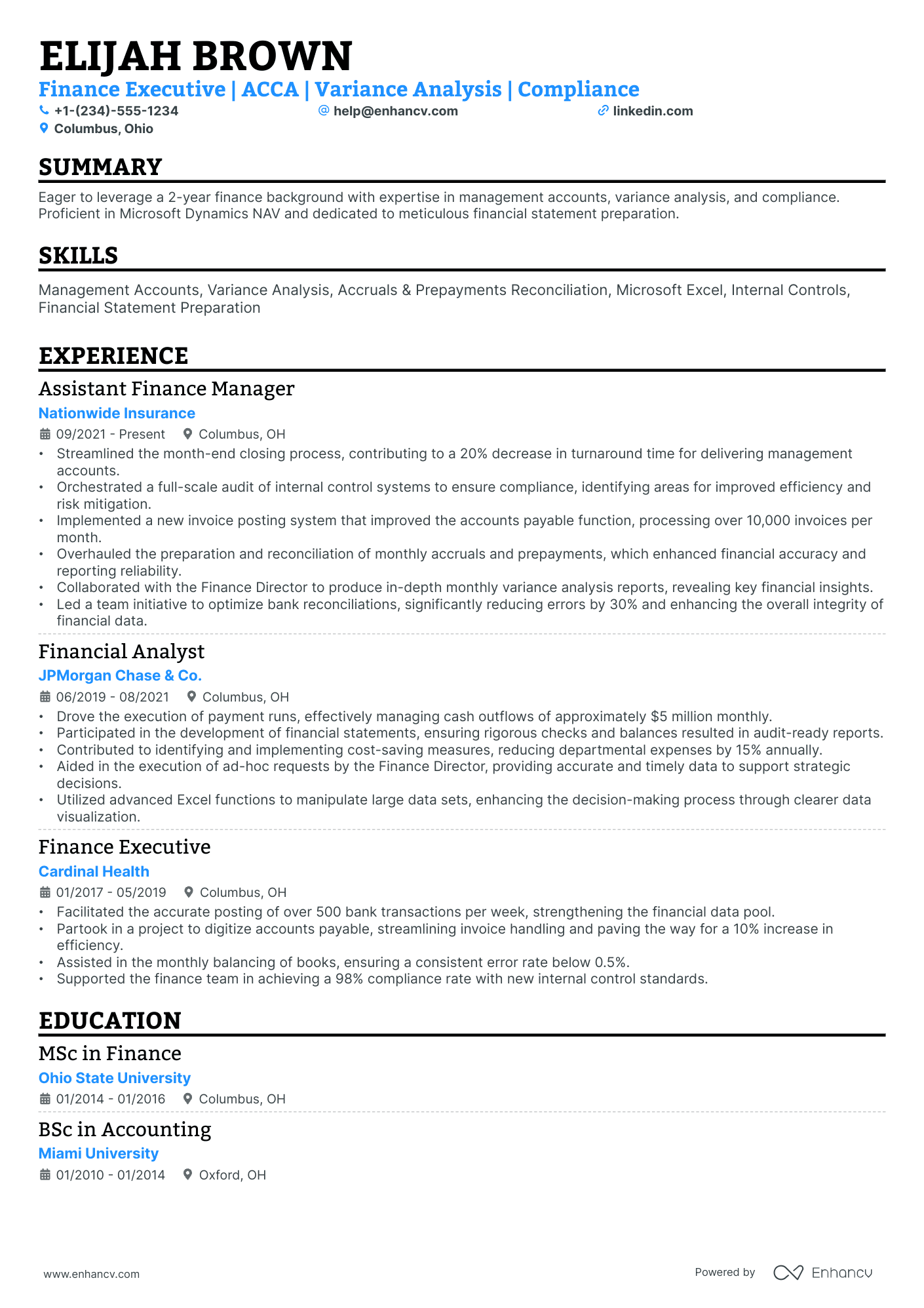

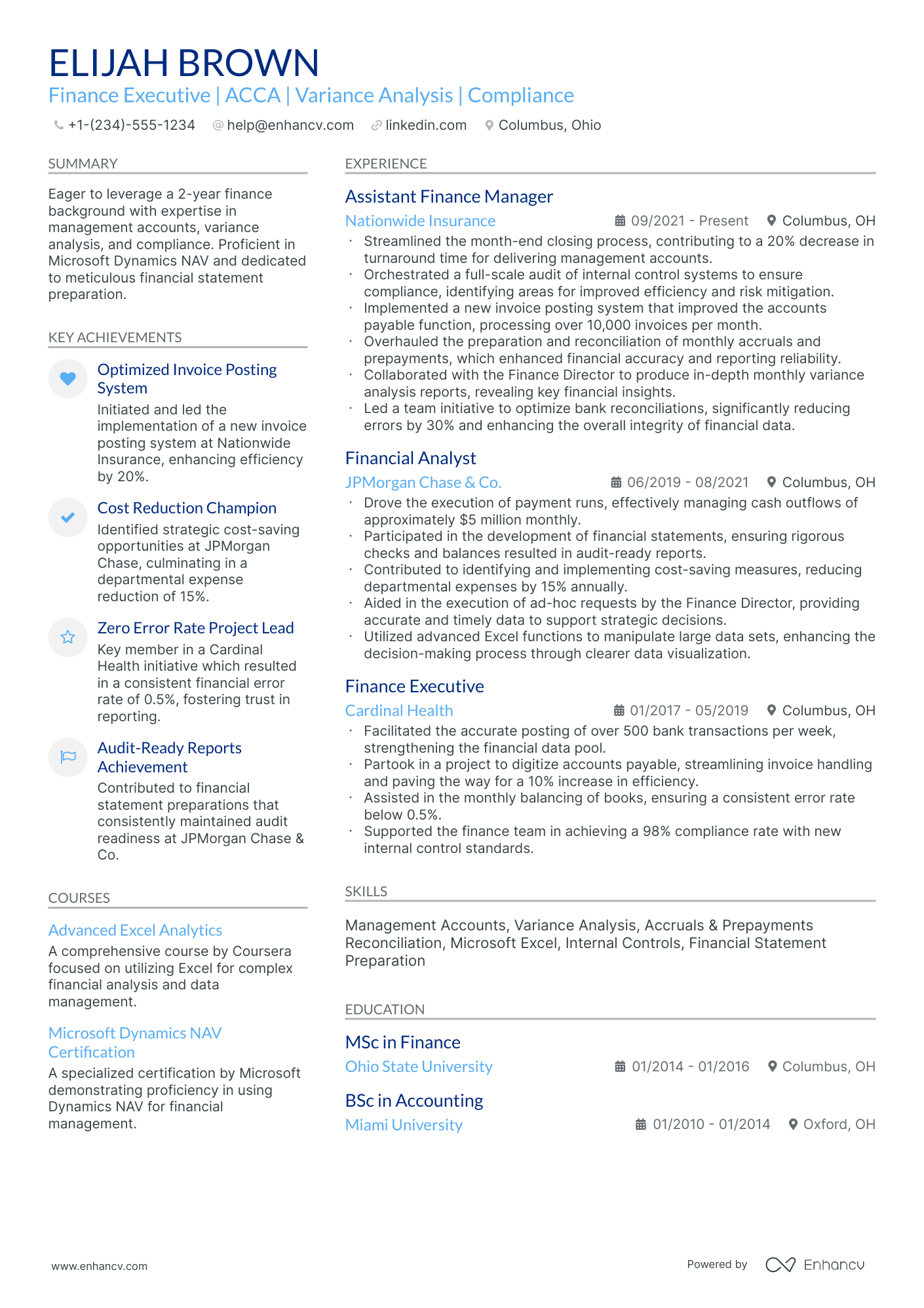

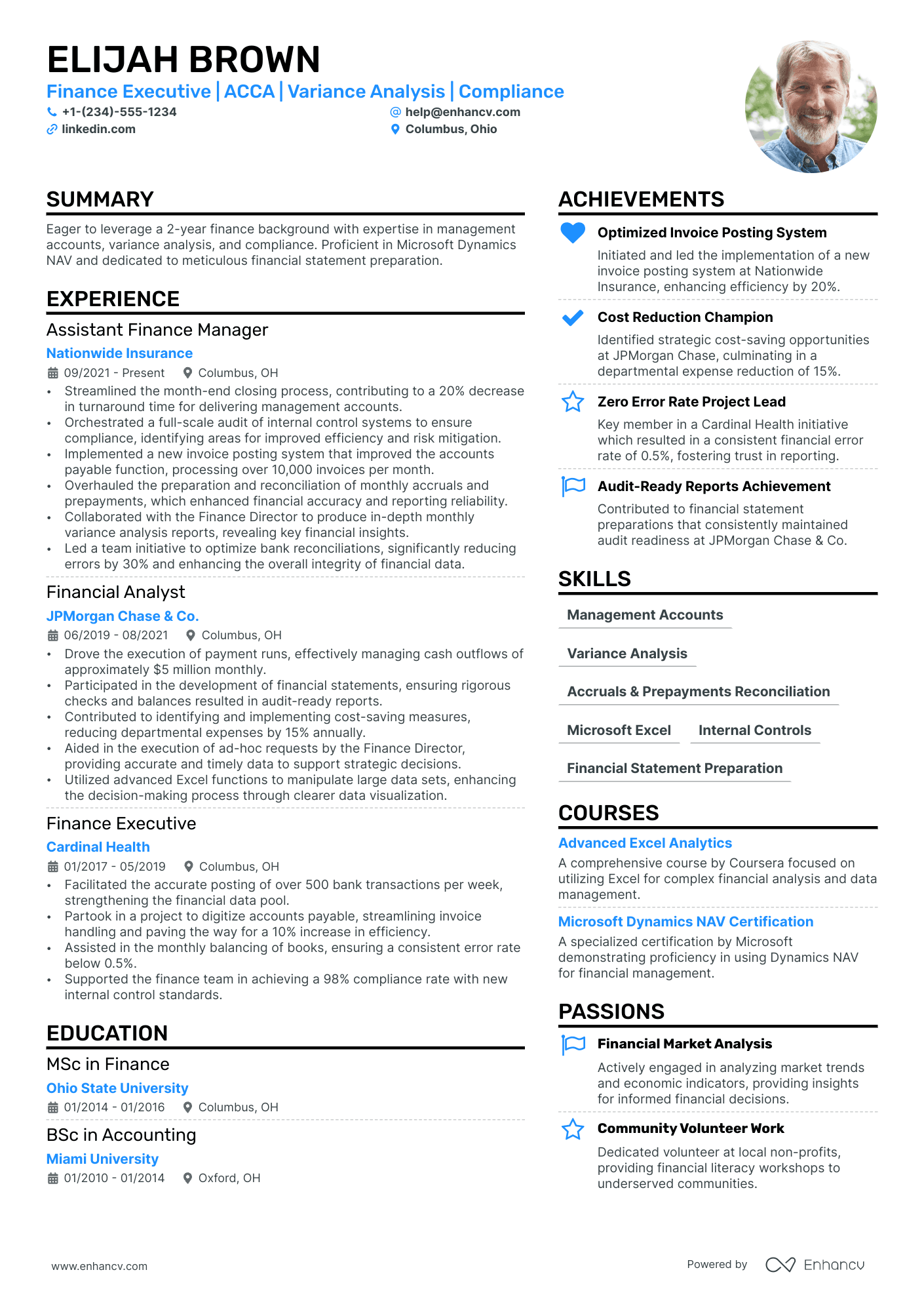

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample finance executive resumes on how to best create your resume experience section.

- Led a financial team to lower annual expenses by 15%, focusing on cost-effective strategies and negotiation with suppliers.

- Managed and reported on a portfolio of $50M, optimizing investment strategies which led to a 10% growth year over year.

- Directed the implementation of a new financial software system to streamline accounting processes, reducing reporting times by 30%.

- Oversaw the development and management of the regional budget, achieving a year-end variance within 2% of the forecasted figures.

- Facilitated a cross-departmental collaboration that resulted in the reduction of quarterly financial closing times by 25%.

- Introduced and managed a new risk assessment framework that decreased financial discrepancies by 40%.

- Played a pivotal role in a capital raise of $80M through a series of private and public equity offerings.

- Optimized cash flow management procedures which increased cash availability by 35%, enhancing the company's liquidity position.

- Conducted comprehensive financial analysis for merger and acquisition opportunities, advising executive leadership on three major deals.

- Developed quarterly financial forecasts, identifying trends that informed business strategy and resource allocation.

- Enhanced financial reporting systems, allowing for real-time P&L analysis and better strategic decision-making.

- Negotiated and secured a $25M credit facility with major banks, significantly reducing financing costs and improving cash position.

- Instrumental in the design and roll-out of company-wide budgeting tools that effectively handle a budget of over $100M.

- Improved forecast accuracy by implementing advanced analytical techniques, culminating in a 20% increase in efficiency.

- Acted as a key financial advisor during strategic pivot to digital platforms, assisting in tripling online revenue streams over a two-year period.

- Pioneered a sustainability initiative that cut costs by $5M annually while enhancing the company's green investments.

- Coordinated and executed a company-wide audit, identifying tax savings of over $3M without compromising compliance standards.

- Engaged in high-level negotiations with new software vendors, securing a long-term contract that saved the company $500K over five years.

- Implemented a new equity management program that increased employee participation by 40% and aligned staff incentives with corporate goals.

- Streamlined reporting processes through the adoption of BI tools, reducing time needed for monthly financial presentation preparations by 50%.

- Initiated a successful refinancing strategy for corporate debt, reducing interest expenses by $2M annually.

- Conducted an international expansion analysis which contributed to a 25% increase in global market presence.

- Developed and maintained financial models that projected long-term growth and valuation that directly influenced strategic planning.

- Lead a cross-functional finance and IT team to automate financial processes, saving over 500 man-hours annually.

- Managed the financial due diligence for a $150M acquisition, identifying key financial risks and potential synergies.

- Implemented a cost reduction program across the company’s supply chain, resulting in a 20% reduction in logistics expenses.

- Established a robust set of financial controls that enhanced accuracy in financial reporting and strengthened compliance with regulatory standards.

- Developed a dynamic three-statement financial model that contributed to a strategic pivot, doubling EBITDA margins within 18 months.

- Played a central role in negotiating a joint venture agreement, enhancing the company's competitive position in the Asian market.

- Implemented a sophisticated cash flow forecasting tool that minimized working capital requirements and supported a 12% reduction in credit line interest rates.

Quantifying impact on your resume

- Highlight the total assets under your management, demonstrating your ability to handle significant financial responsibilities.

- Include the percentage by which you increased revenue or reduced costs, showcasing your direct contribution to the company's bottom line.

- Quantify the size of budgets you have managed, illustrating your competency in handling large-scale financial projects.

- Detail the number of financial reports or presentations you've developed, showing your expertise in financial analysis and communication.

- Specify the number of compliance or audit processes you've overseen, indicating your commitment to maintaining financial integrity and standards.

- Mention the number of investment strategies you've devised or contributed to, revealing your strategic thinking and impact on growth.

- State the percentage of financial accuracy you maintained in your reports, underscoring your attention to detail and precision.

- Report the dollar value of debt or expenses you've successfully reduced, highlighting your proactive measures to improve financial health.

Action verbs for your finance executive resume

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, finance executive resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

In-demand hard skills and soft skills for your finance executive resume

A vital element for any finance executive resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your finance executive skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "finance executive skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your finance executive resume:

Financial Modeling

Advanced Excel

SAP ERP

Oracle Financial Services

QuickBooks

Financial Analysis Software

Data Visualization Tools (e.g., Tableau, Power BI)

Risk Management Tools

Budgeting Software

Compliance Management Systems

Leadership

Strategic Thinking

Communication

Analytical Thinking

Problem Solving

Negotiation

Attention to Detail

Team Collaboration

Time Management

Adaptability

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

The importance of your certifications and education on your finance executive resume

Pay attention to the resume education section . It can offer clues about your skills and experiences that align with the job.

- List only tertiary education details, including the institution and dates.

- Mention your expected graduation date if you're currently studying.

- Exclude degrees unrelated to the job or field.

- Describe your education if it allows you to highlight your achievements further.

Your professional qualifications: certificates and education play a crucial role in your finance executive application. They showcase your dedication to gaining the best expertise and know-how in the field. Include any diplomas and certificates that are:

- Listed within the job requirements or could make your application stand out

- Niche to your industry and require plenty of effort to obtain

- Helping you prepare for professional growth with forward-facing know-how

- Relevant to the finance executive job - make sure to include the name of the certificate, institution you've obtained it at, and dates

Both your certificates and education section need to add further value to your application. That's why we've dedicated this next list just for you - check out some of the most popular finance executive certificates to include on your resume:

The top 5 certifications for your finance executive resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Recommended reads:

Practical guide to your finance executive resume summary or objective

First off, should you include a summary or objective on your finance executive resume?

We definitely recommend you choose the:

- Resume summary to match job requirements with most noteworthy accomplishments.

- Resume objective as a snapshot of career dreams

Both the resume summary and objective should set expectations for recruiters as to what your career highlights are.

These introductory paragraphs (that are no more than five sentences long) should help you answer why you're the best candidate for the job.

Industry-wide best practices pinpoint that the finance executive resume summaries and objectives follow the structures of these samples:

Resume summaries for a finance executive job

- Finance executive with over 10 years of experience specializing in corporate finance within the technology sector. Renowned for driving profitable growth and implementing strategic financial plans at companies like TechGlobal Inc., leading to a 25% increase in annual revenue. Expertise in financial modeling, budgeting, and M&A activities.

- Seasoned finance professional with 15 years of experience managing multi-million-dollar portfolios for Fortune 500 companies. Proven track record in reducing costs by 30% through strategic sourcing and process optimization. Skillful in capital market analysis, investment strategies, and improving operational efficiencies for financial gain.

- With an extensive background in management consulting and operational strategy, for the past 8 years, this adept leader is transitioning into finance executive roles. Successfully spearheaded a $50M business transformation project, resulting in a 40% efficiency increase. Pursuing to leverage analytical prowess and strategic insight in financial oversight and planning.

- Dynamic professional transitioning from a successful 12-year marketing director career to finance management, bringing profound expertise in strategic planning and budget administration. Instrumental in scaling a startup to a market leader, achieving annual growth of 20%. Eager to apply a deep understanding of market trends and financial acumen in financial strategy formulation.

- Motivated graduate with a Master's Degree in Finance, eager to apply academic knowledge and analytical skills in a dynamic financial environment. Passionate about leveraging data-driven solutions to optimize financial processes, and committed to a lifelong career in financial management and strategy implementation.

- Recent MBA graduate with a finance concentration, aiming to apply cutting-edge financial theories and models in real-world settings. Dedicated to mastering financial analysis, risk assessment, and strategic decision-making to contribute to the financial success of a forward-thinking organization.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

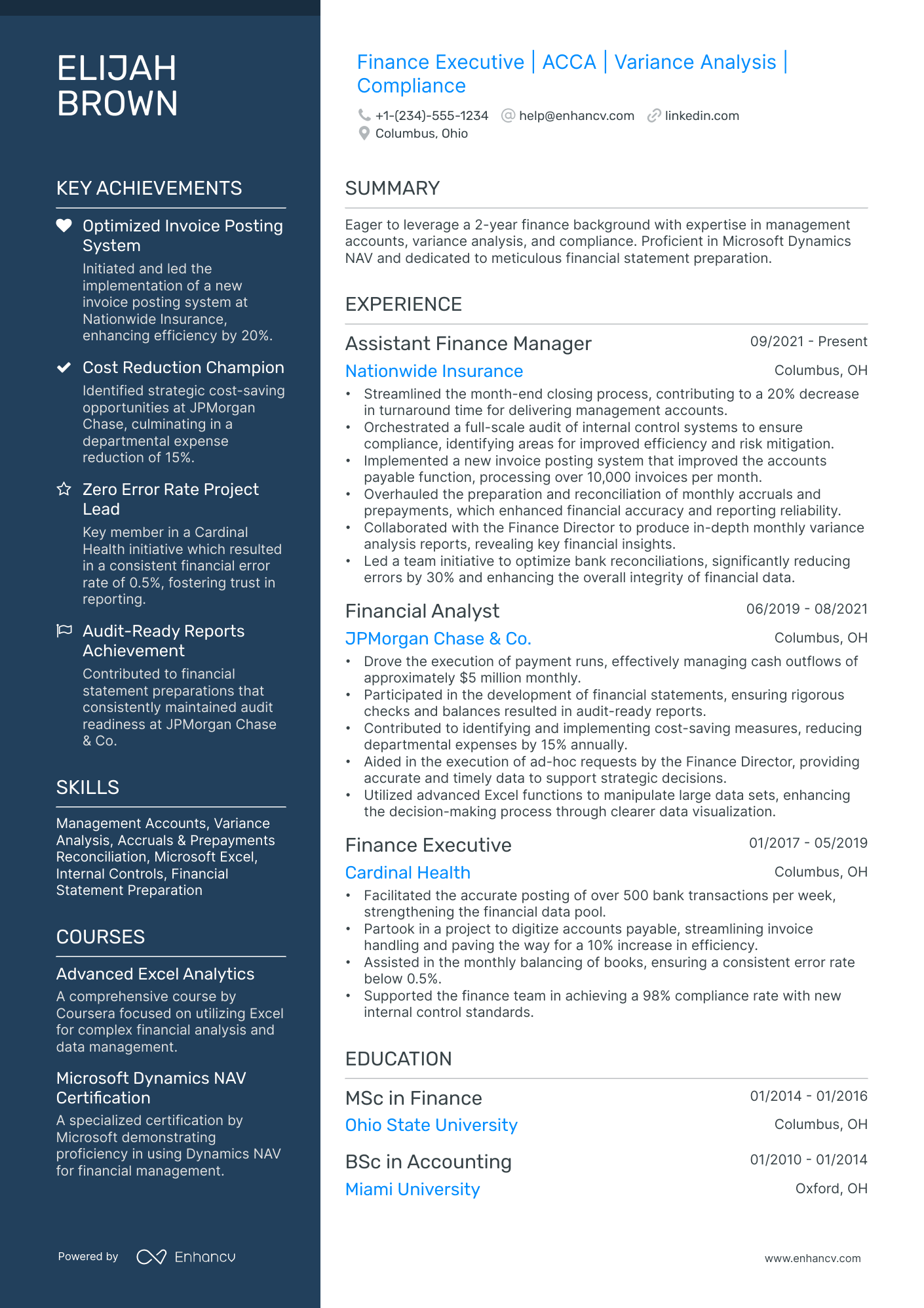

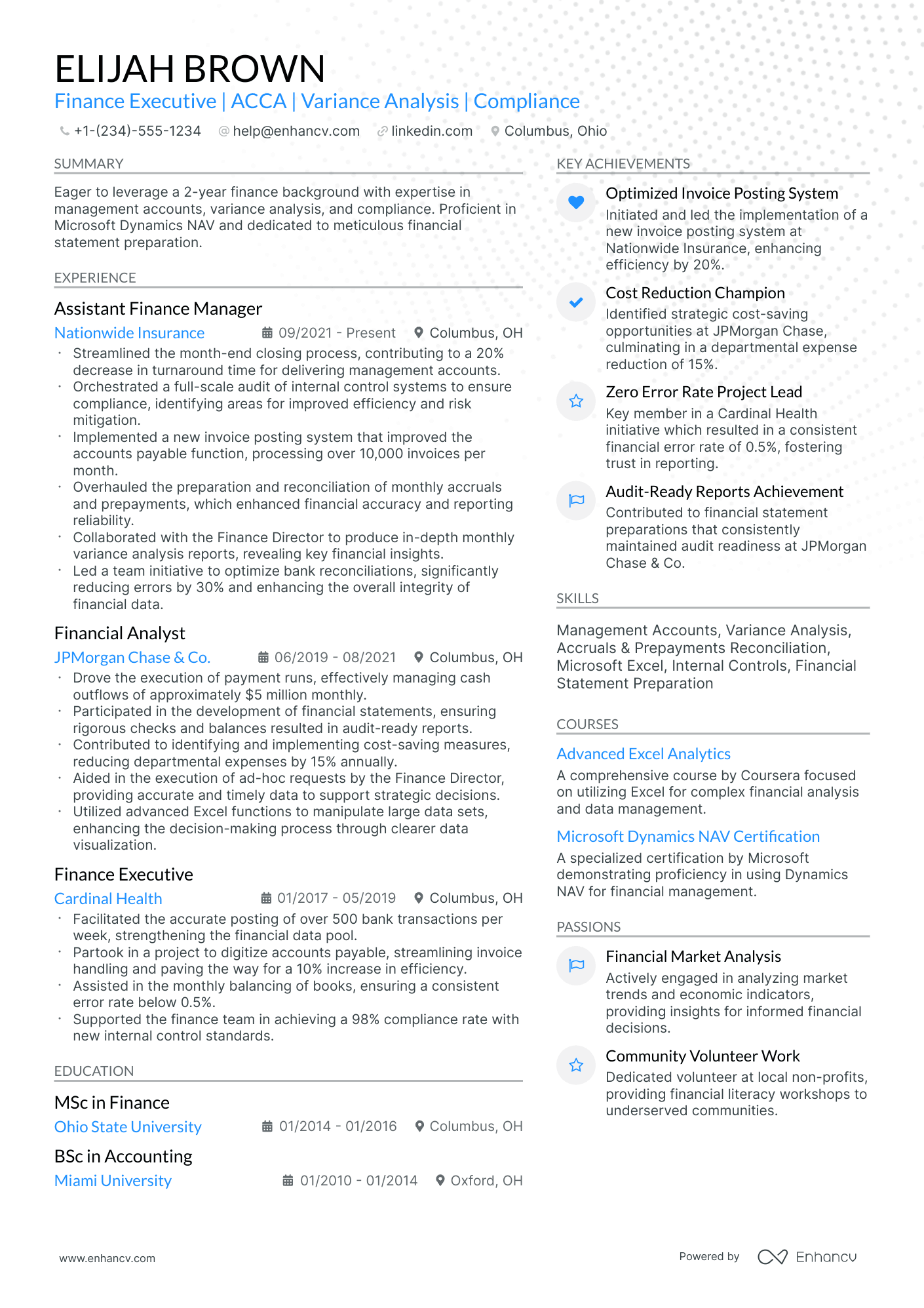

Extra sections to include in your finance executive resume

What should you do if you happen to have some space left on your resume, and want to highlight other aspects of your profile that you deem are relevant to the role? Add to your finance executive resume some of these personal and professional sections:

- Passions/Interests - to detail how you spend both your personal and professional time, invested in various hobbies;

- Awards - to present those niche accolades that make your experience unique;

- Publications - an excellent choice for professionals, who have just graduated from university or are used to a more academic setting;

- Volunteering - your footprint within your local (or national/international) community.

Key takeaways

- Ensure your finance executive resume uses a simple, easy-to-read format that reflects upon your experience and aligns with the role;

- Be specific within the top one-third of your resume (header and summary or objective) to pinpoint what makes you the ideal candidate for the finance executive role;

- Curate information that is tailored to the job by detailing skills, achievements, and actual outcomes of your efforts;

- List your certifications and technical capabilities to demonstrate your aptitude with specific software and technologies;

- The sections you decide on including on your finance executive should pinpoint your professional expertise and personality.