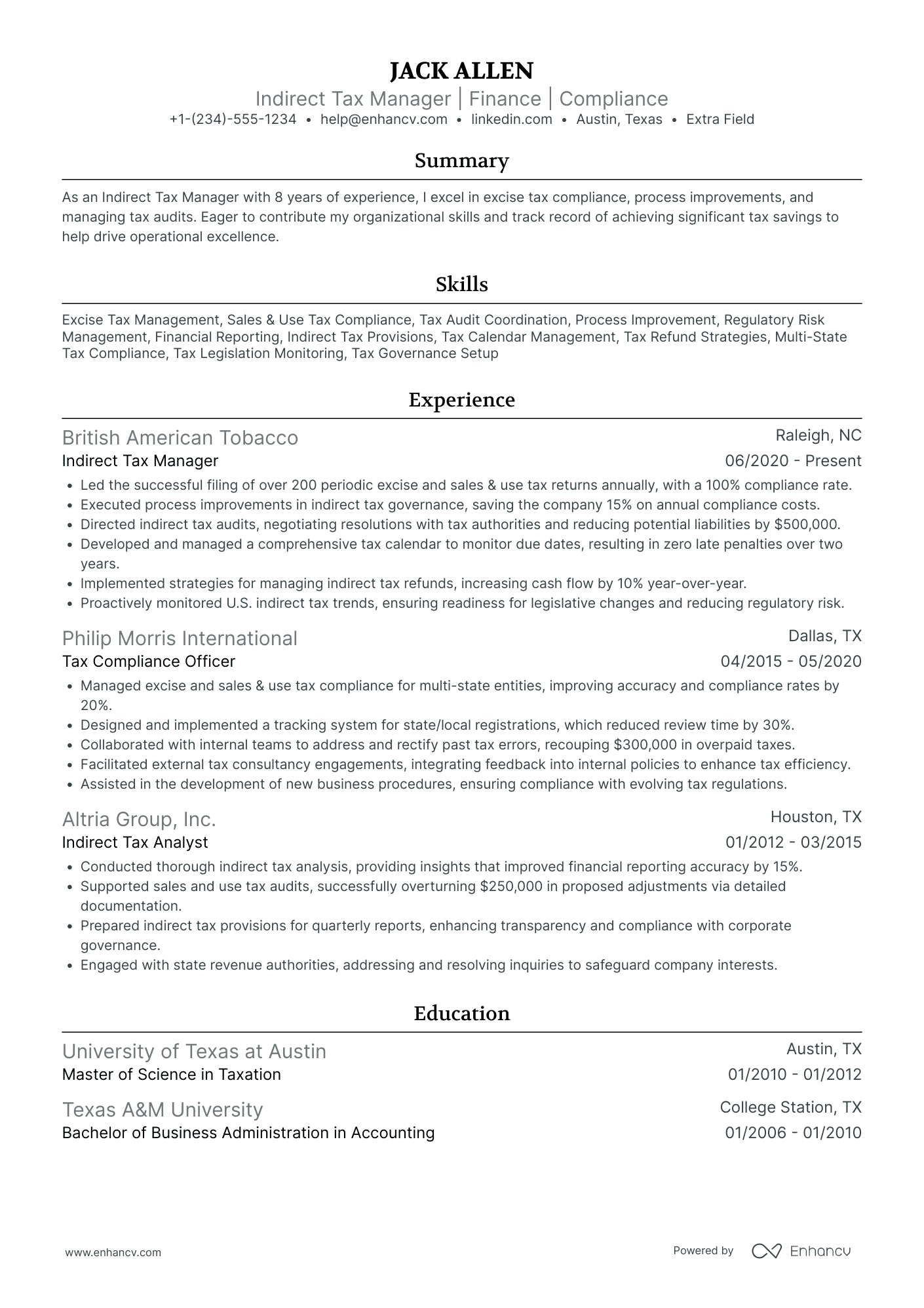

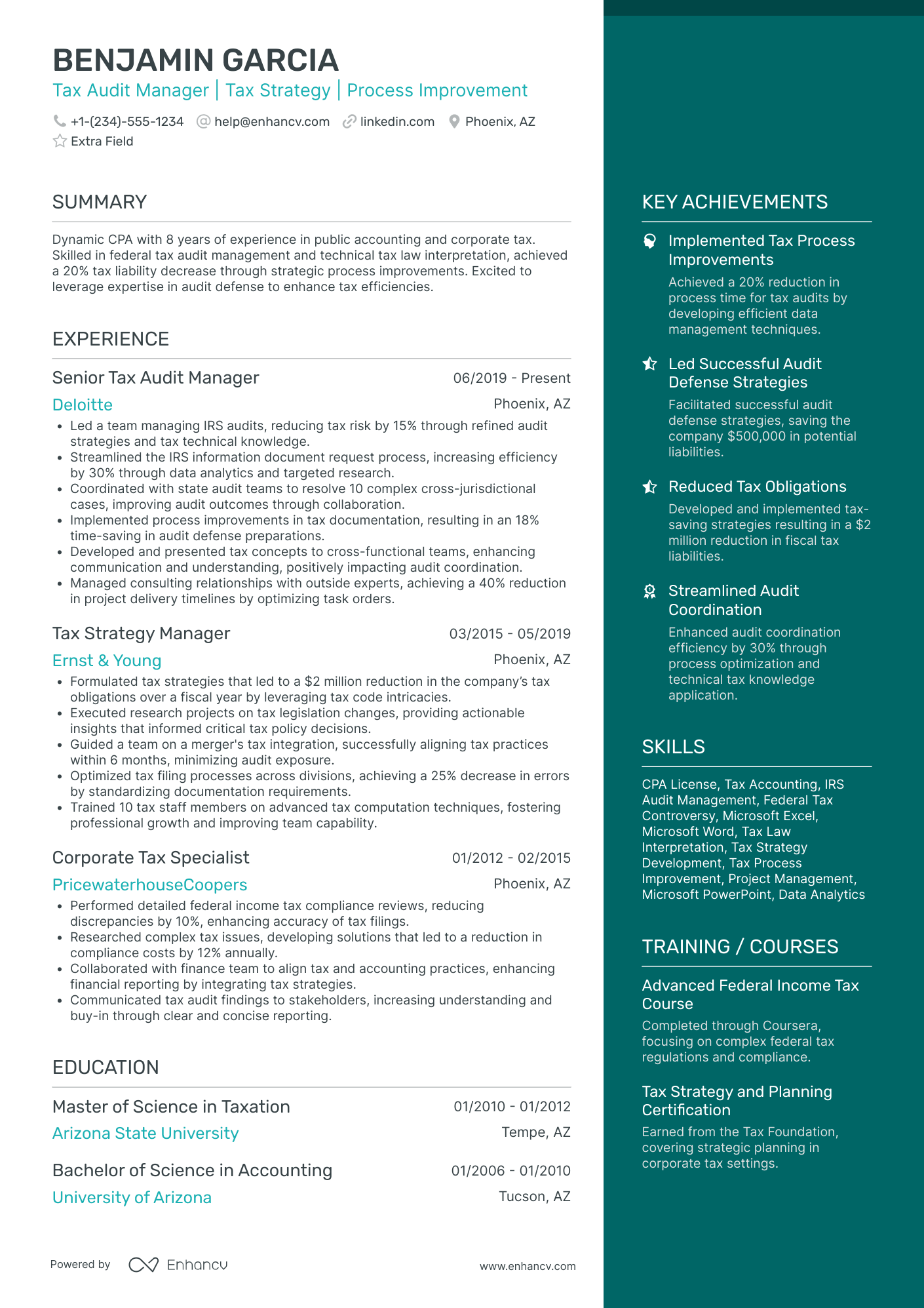

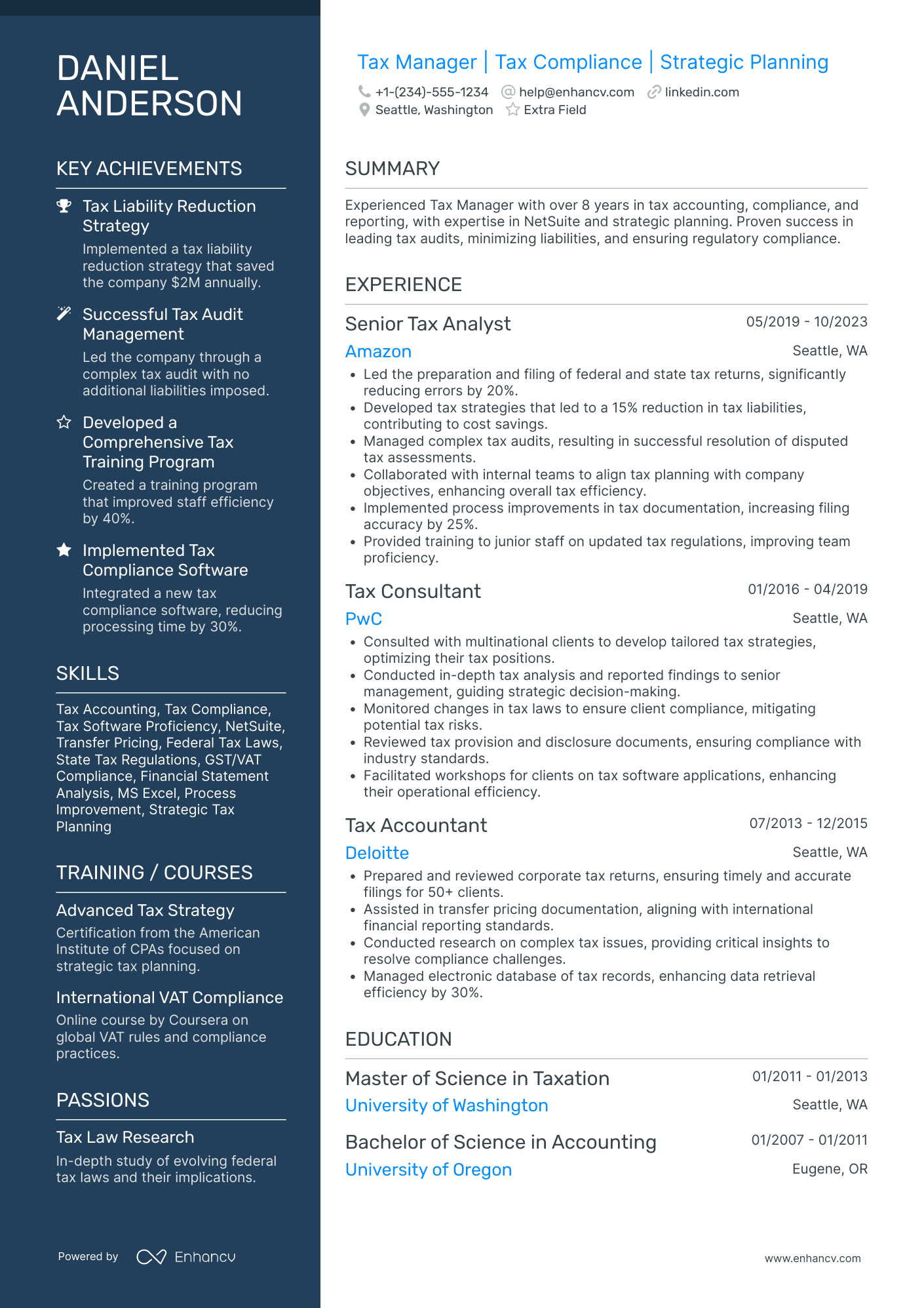

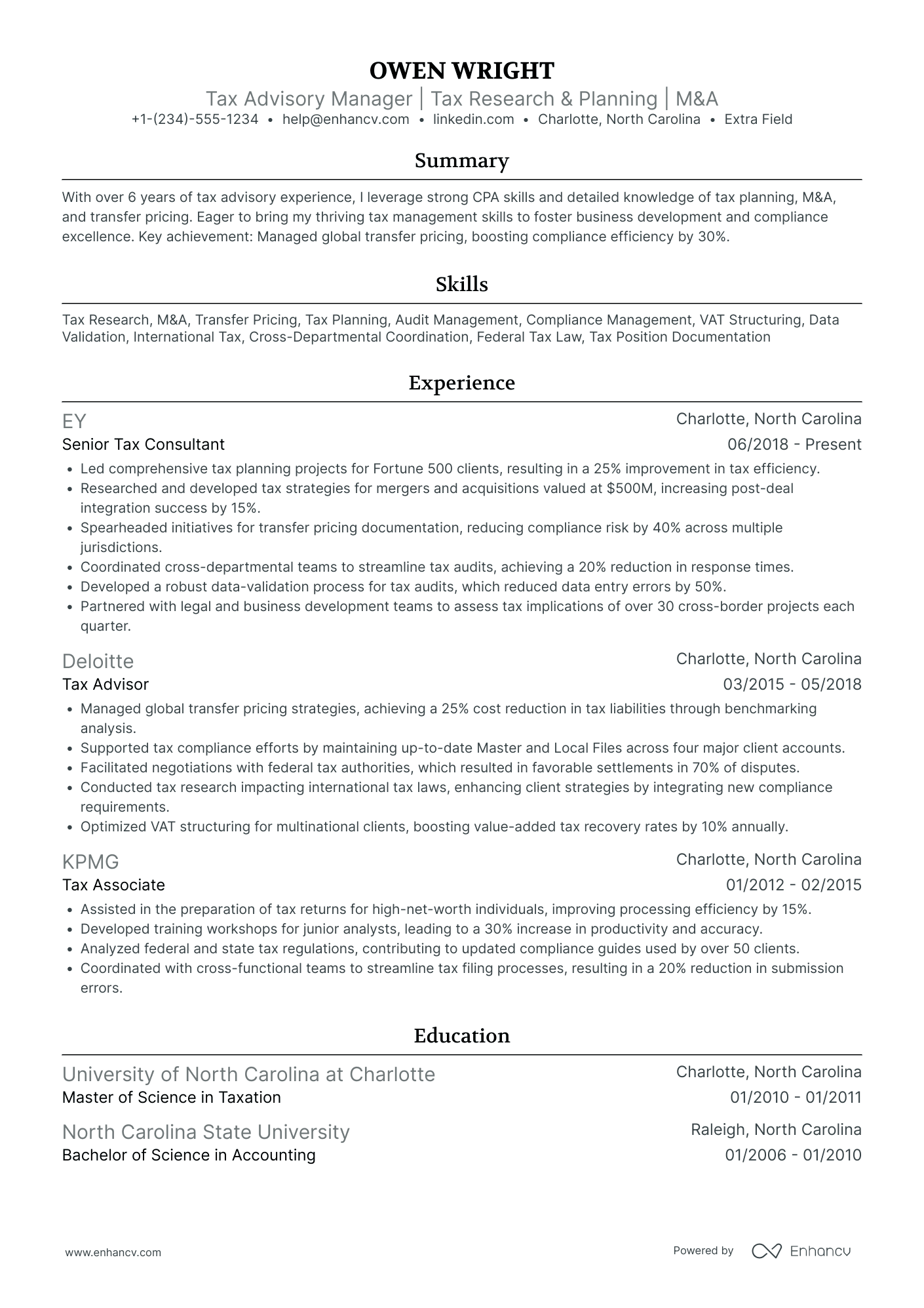

Tax Managers often grapple with effectively showcasing their ability to handle complex tax regulations on their resumes. Our resume examples can guide you in highlighting these skills to impress potential employers. Dive into the examples below to craft a standout resume.

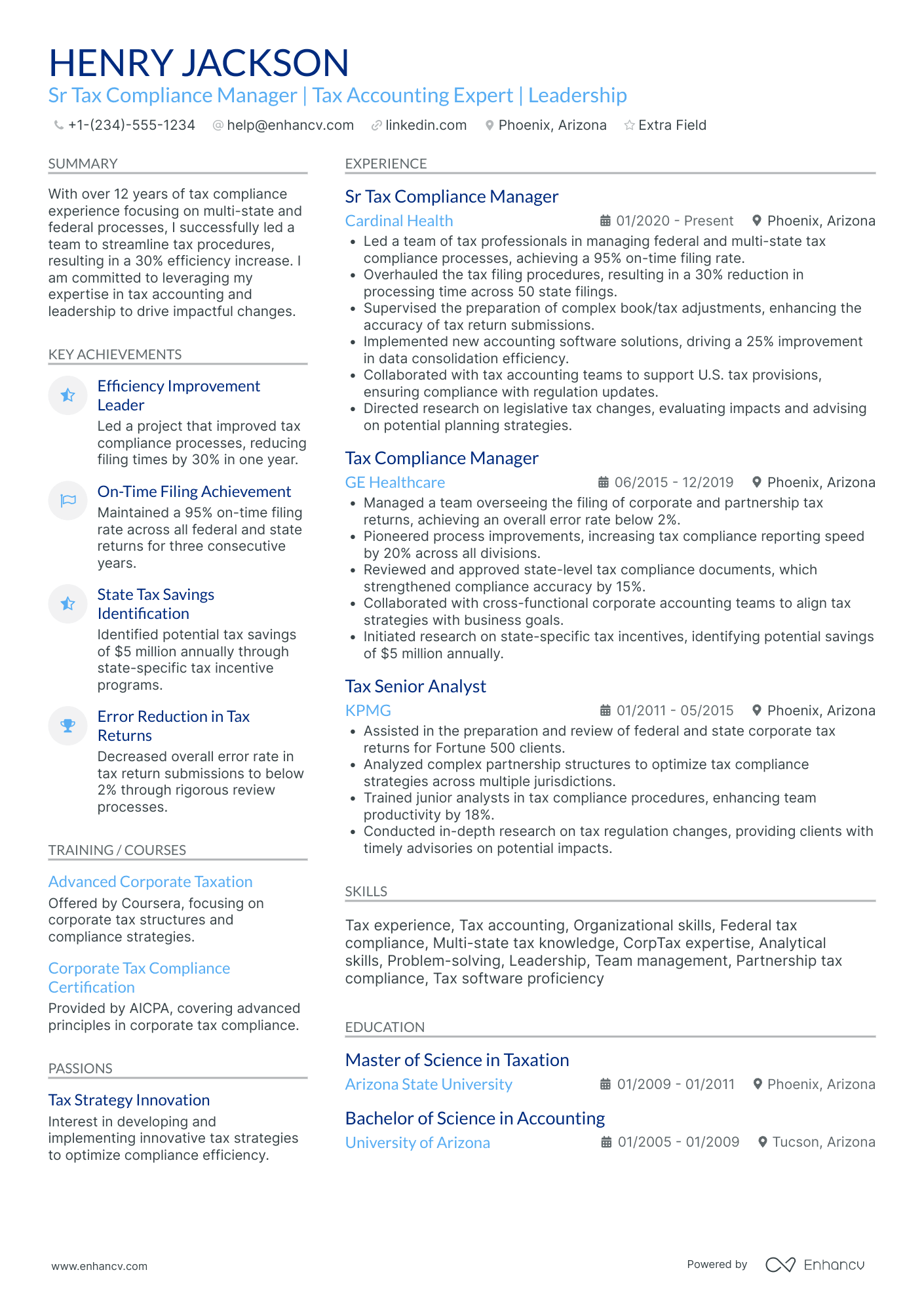

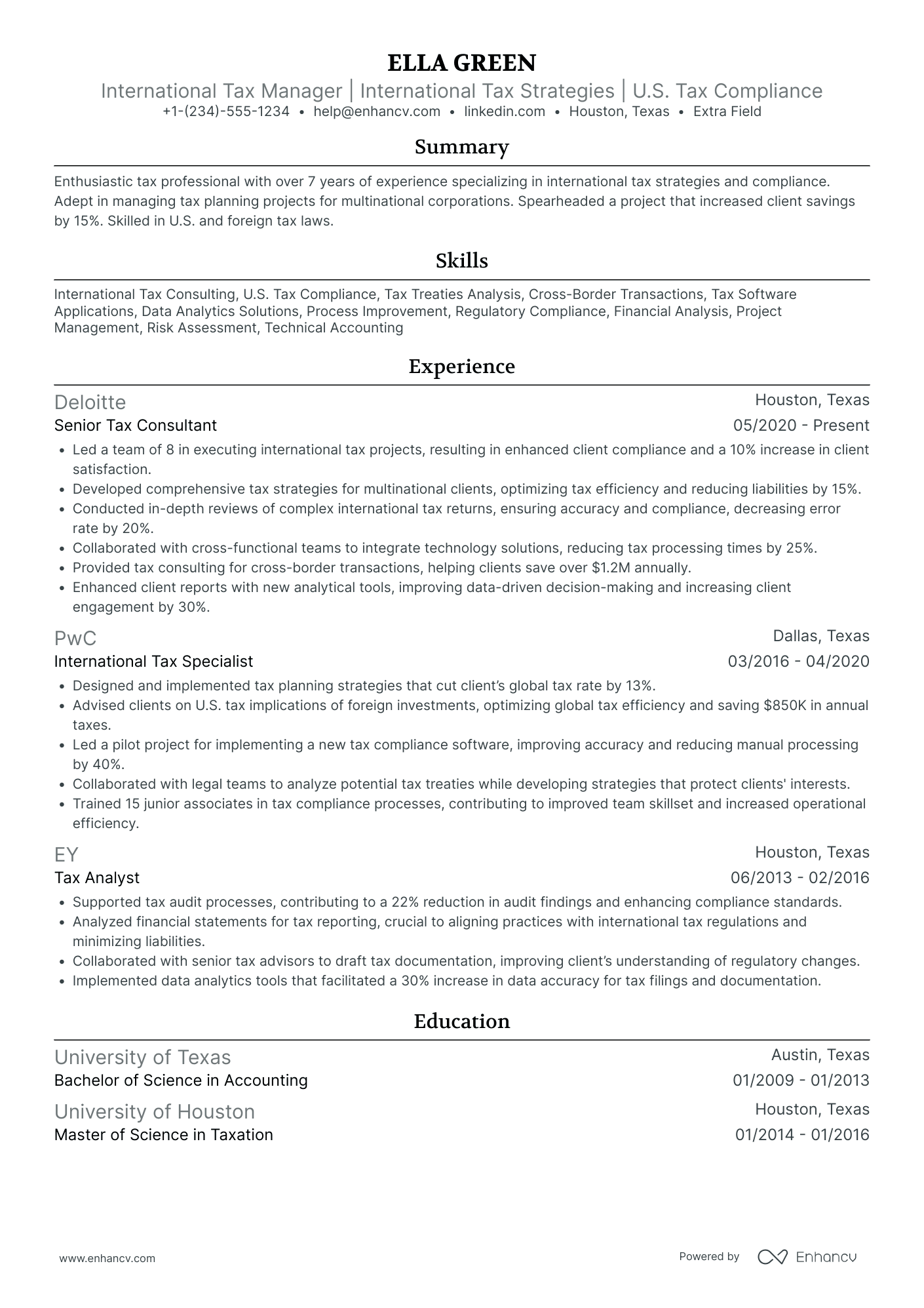

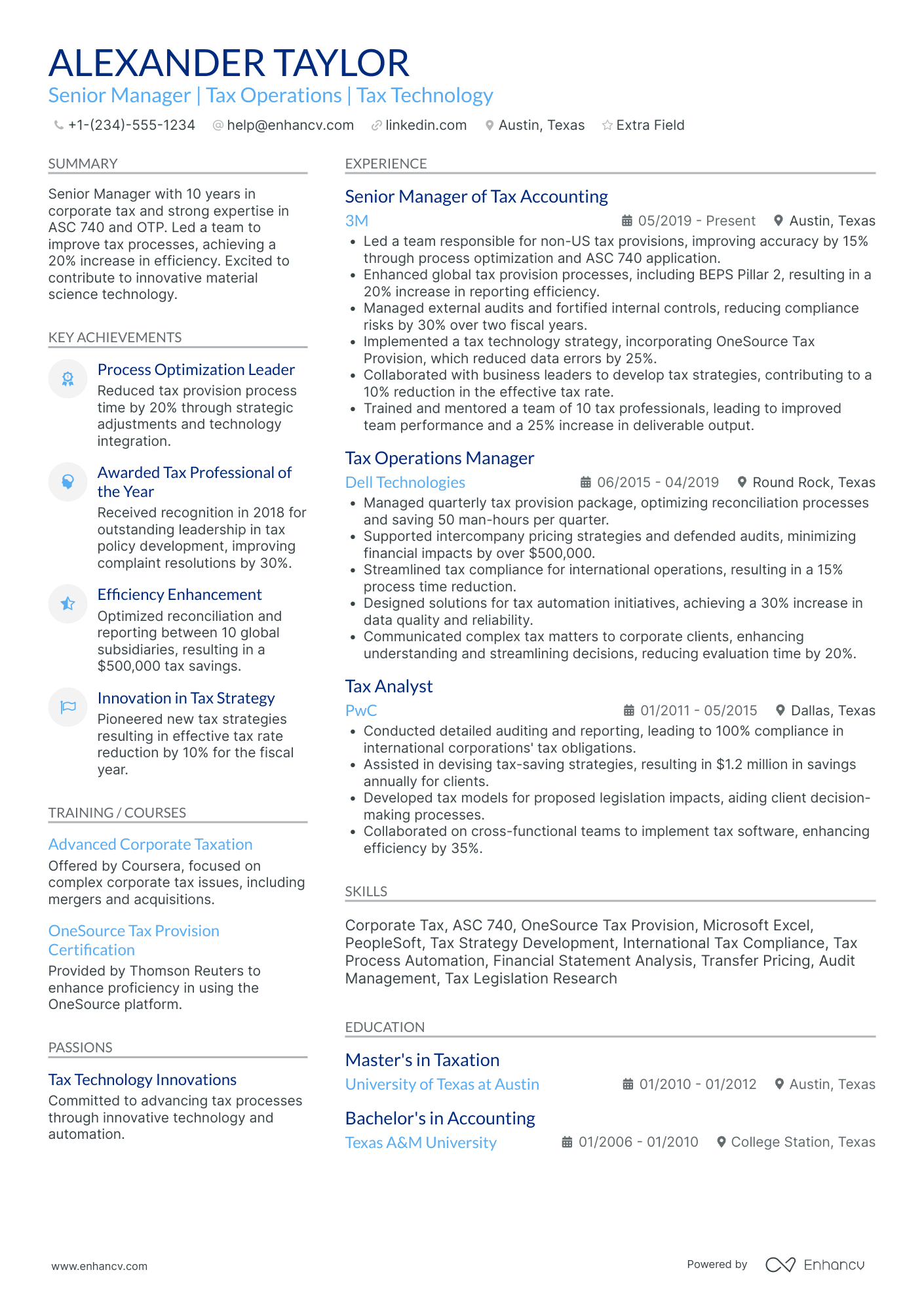

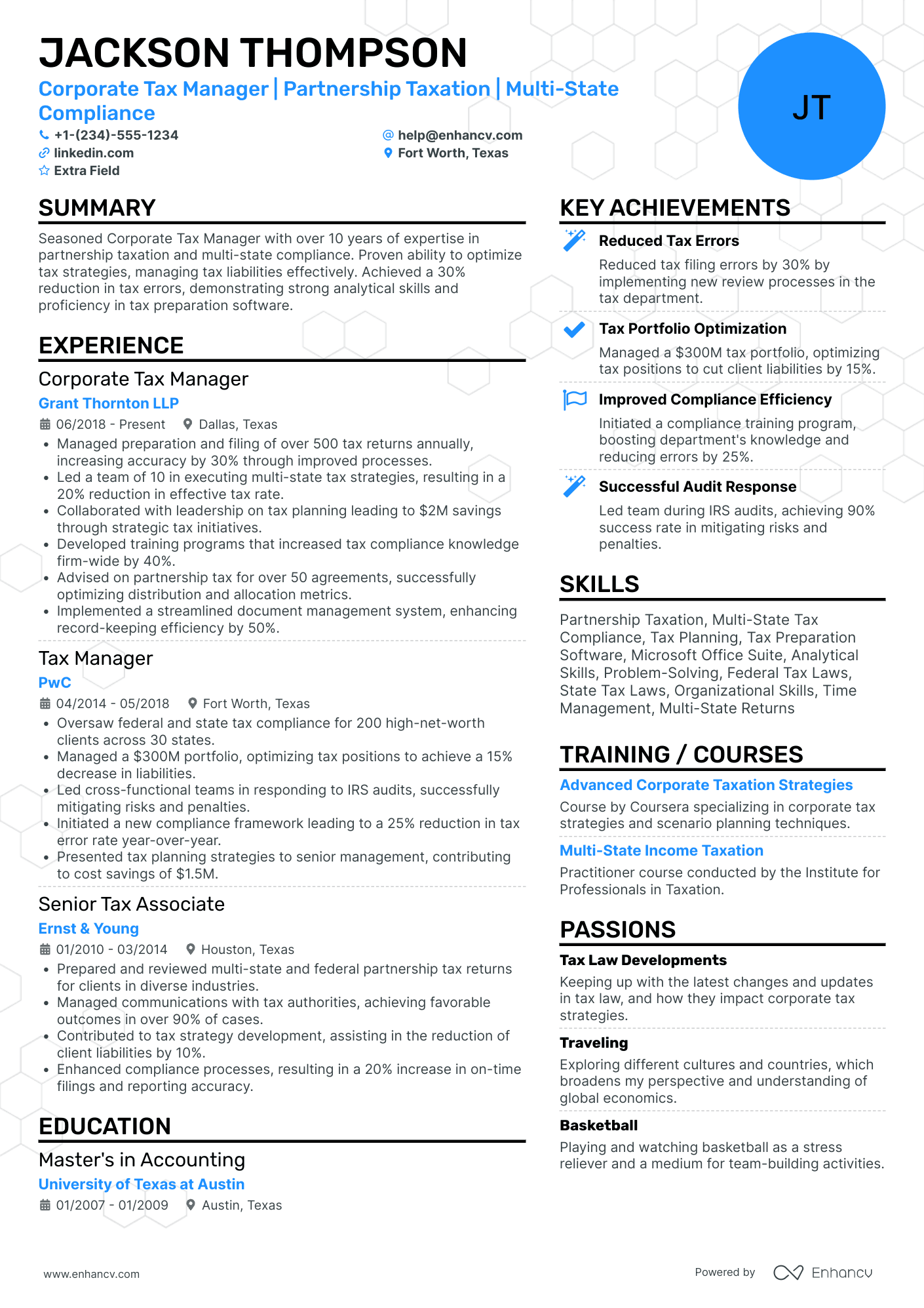

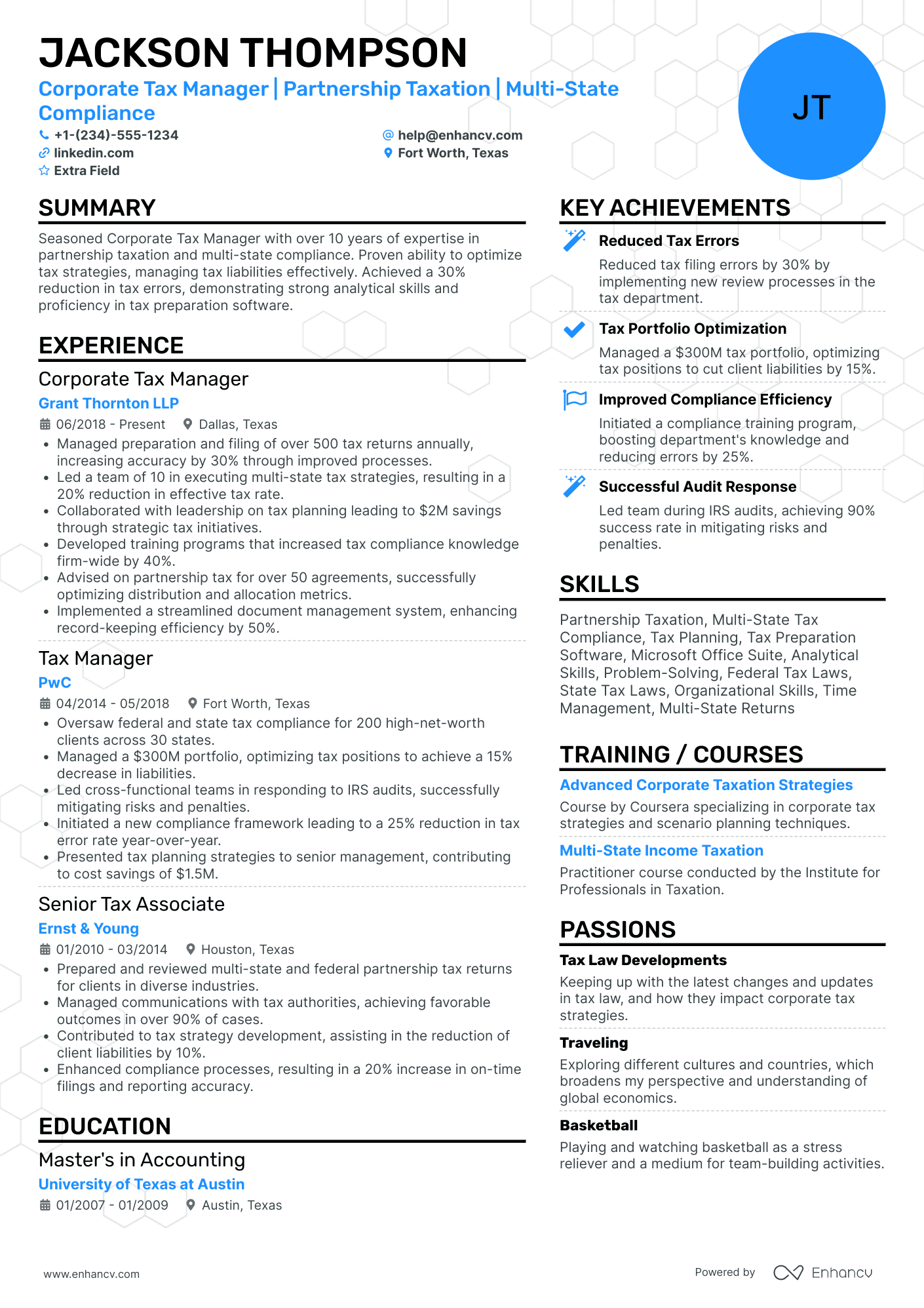

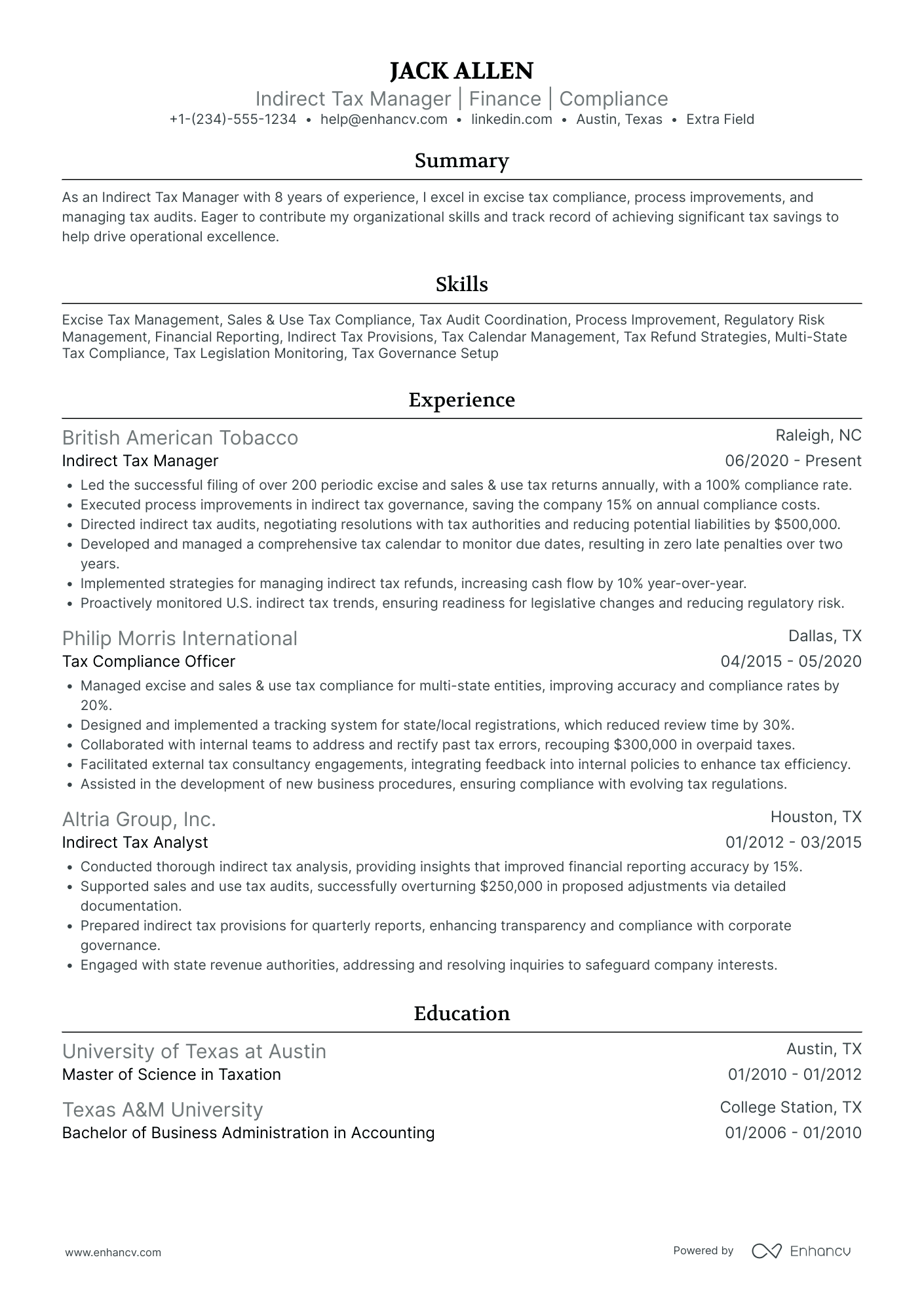

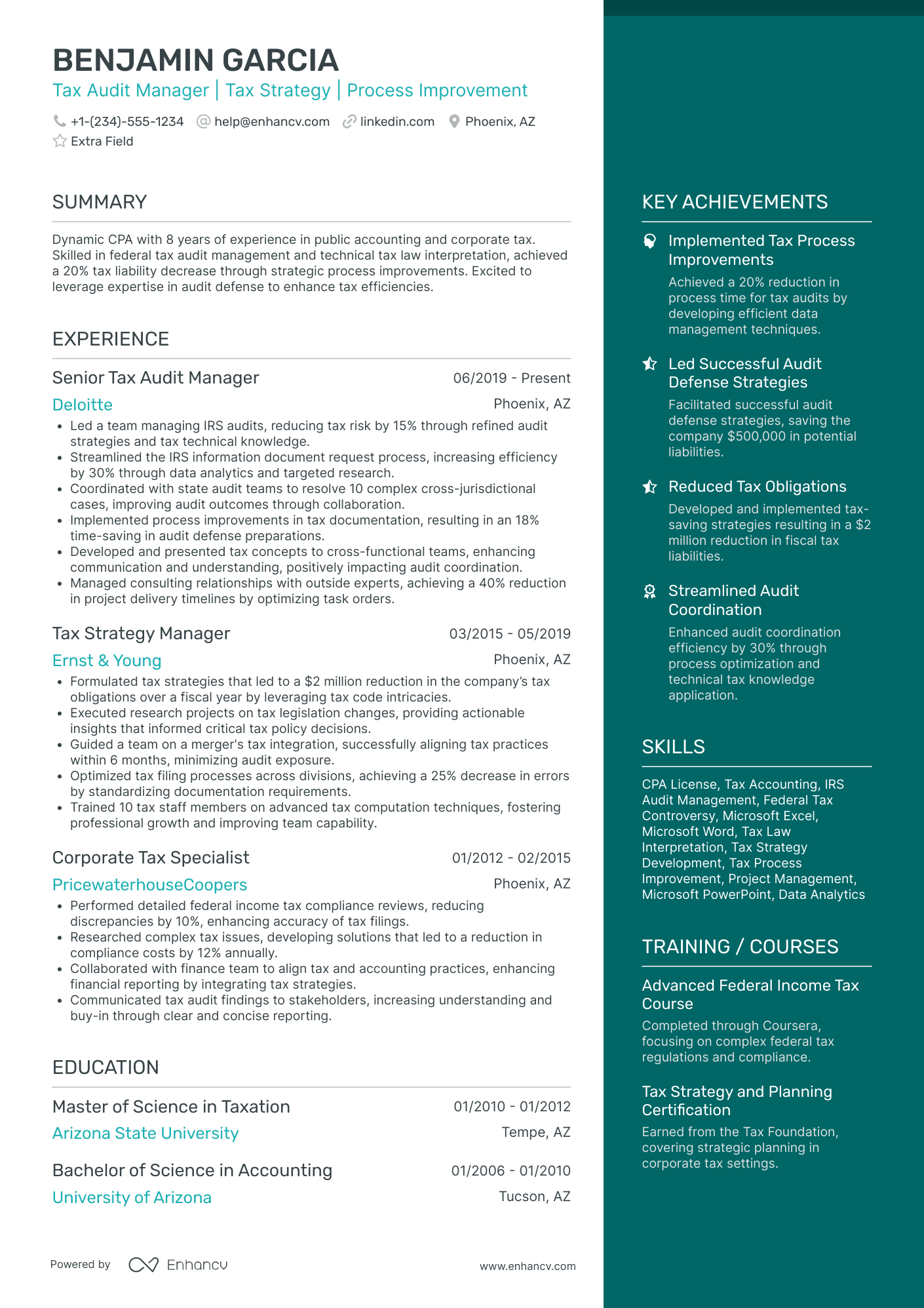

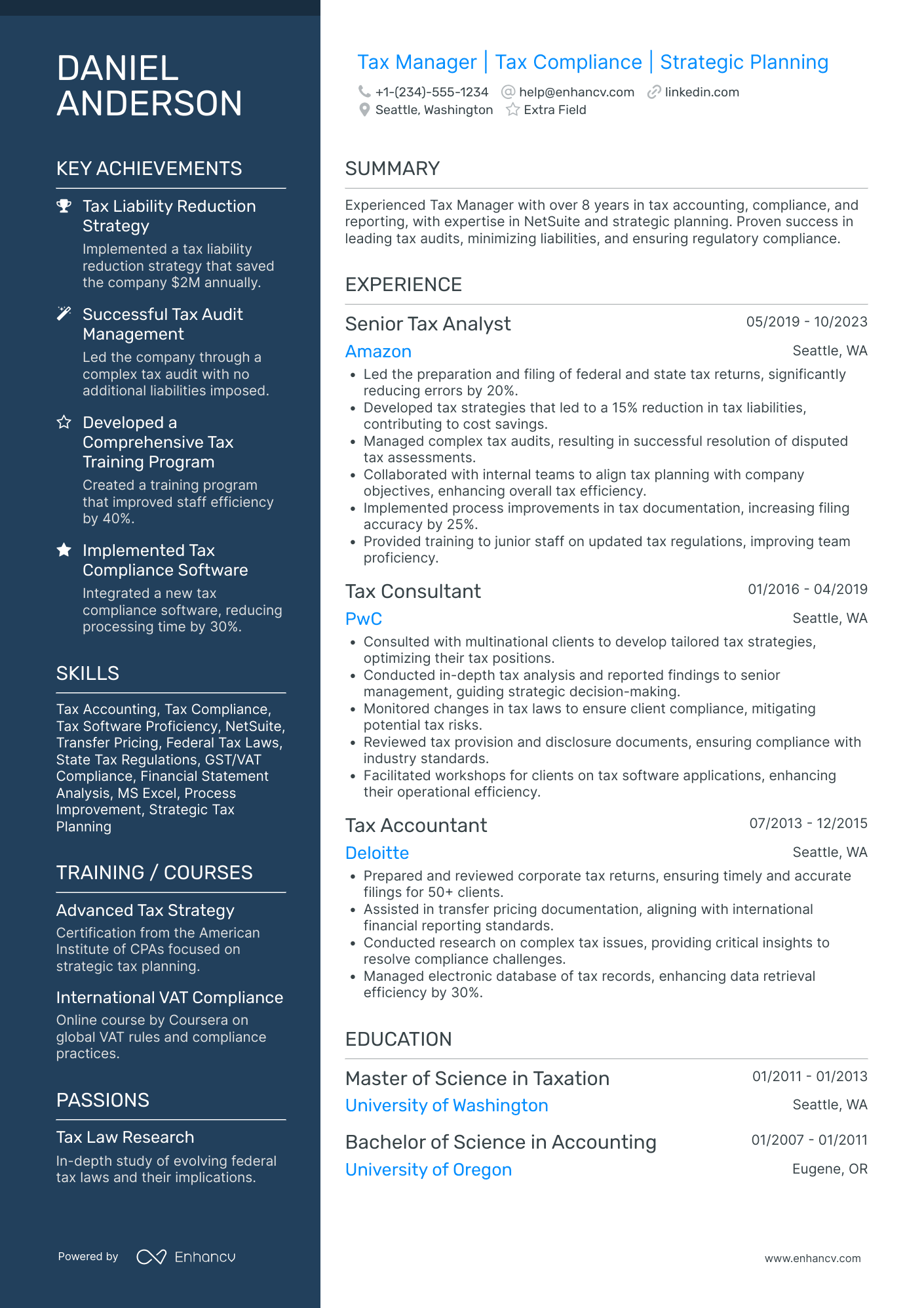

Tax Manager resume examples

By Experience

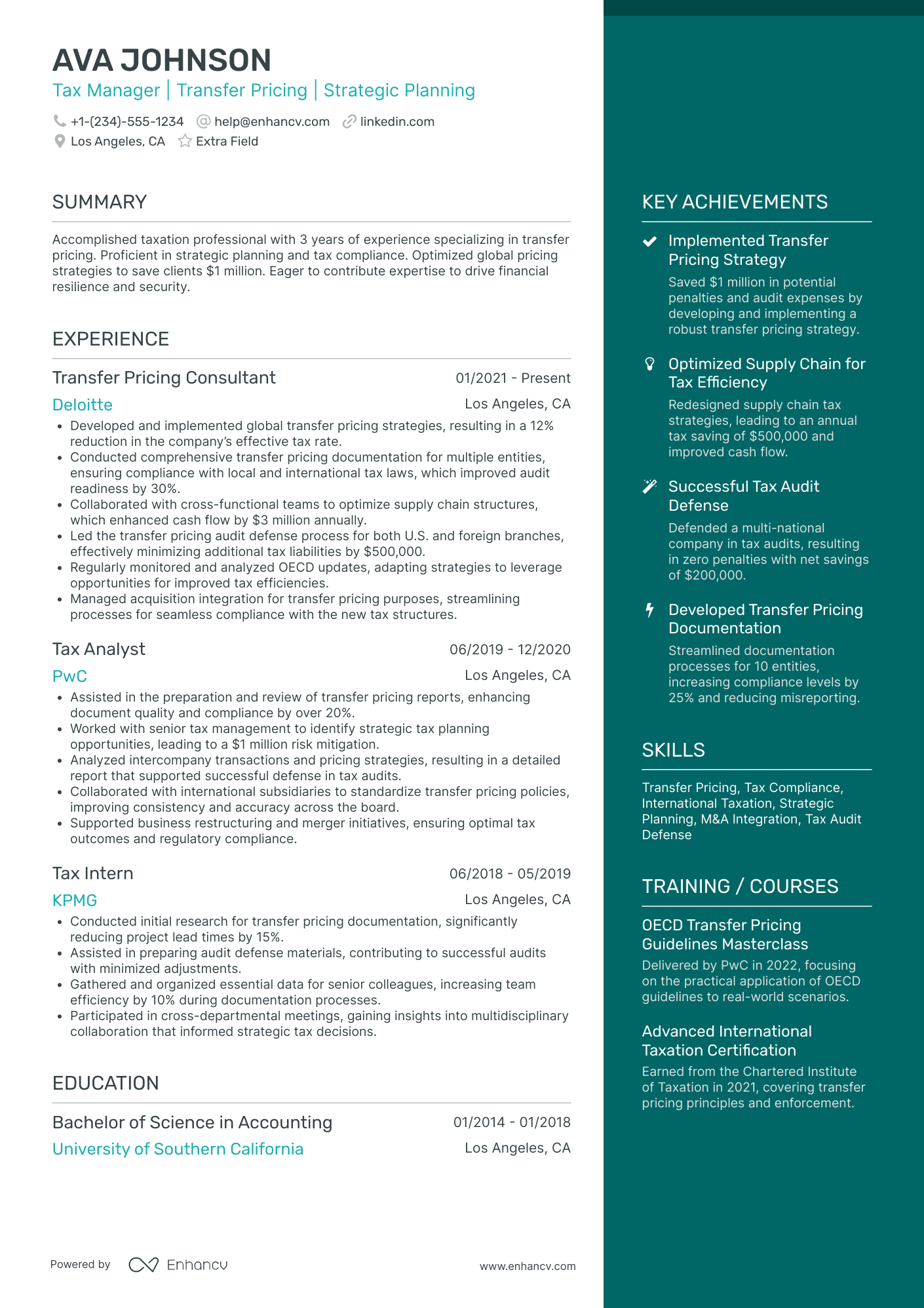

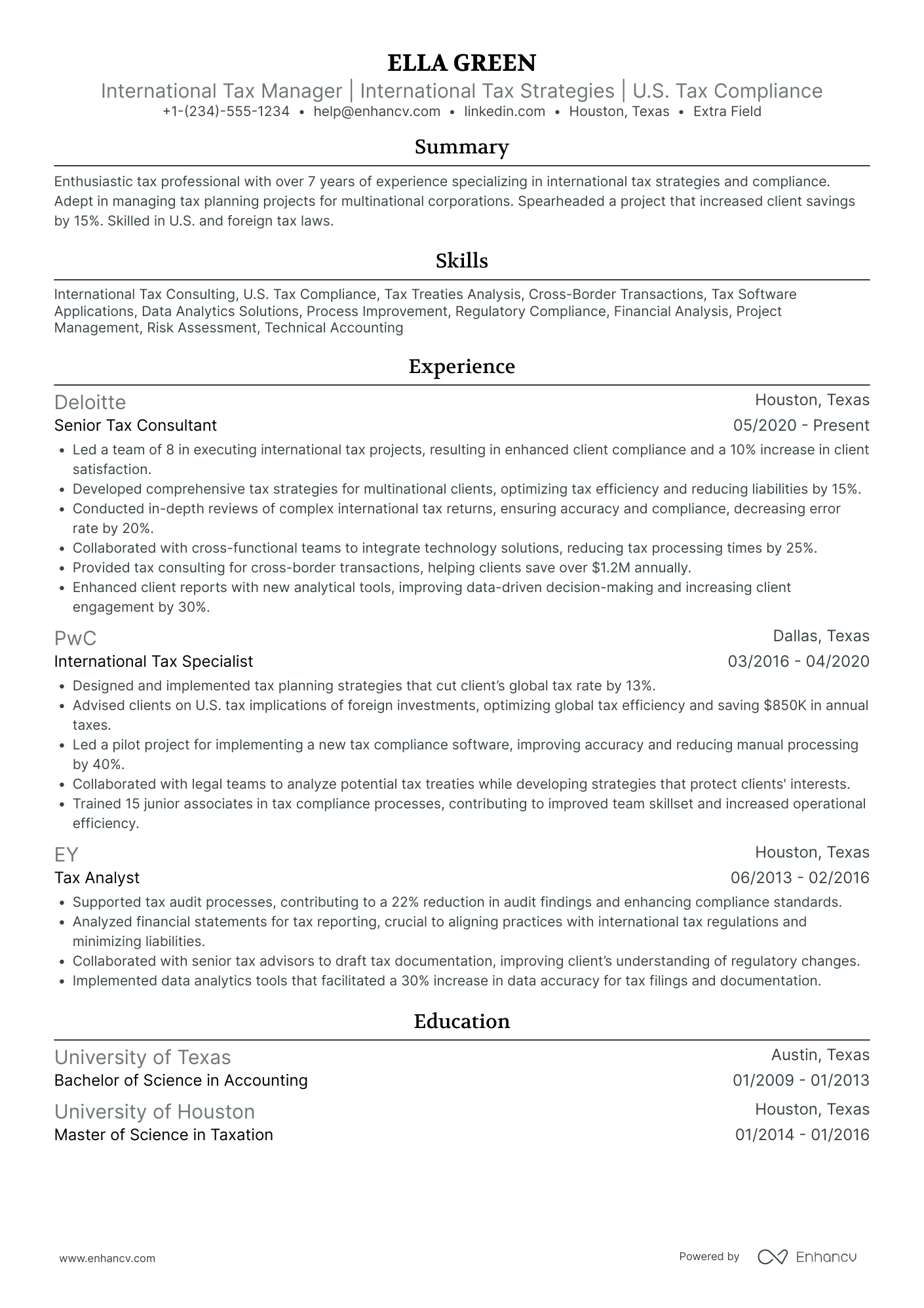

Junior Tax Manager

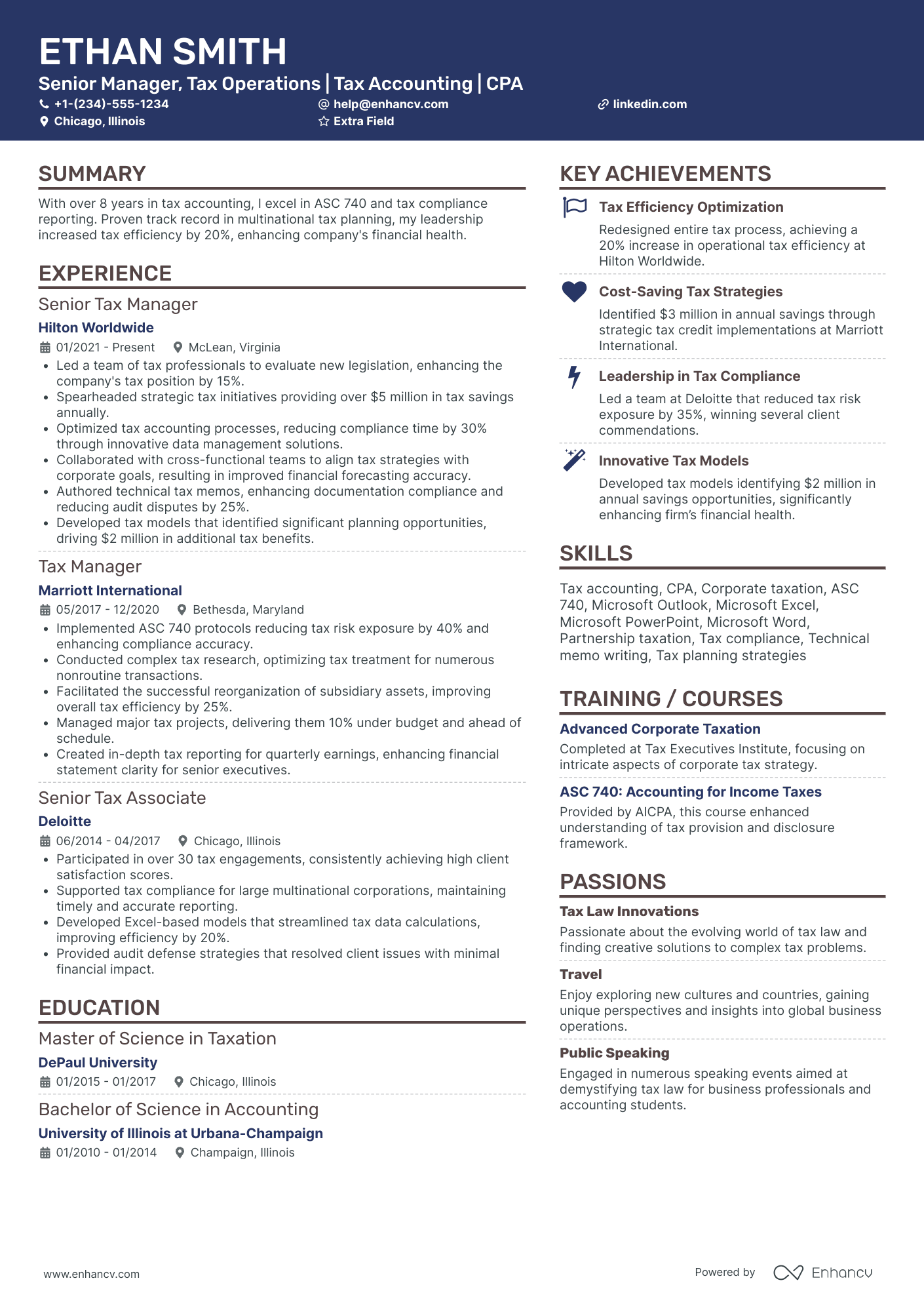

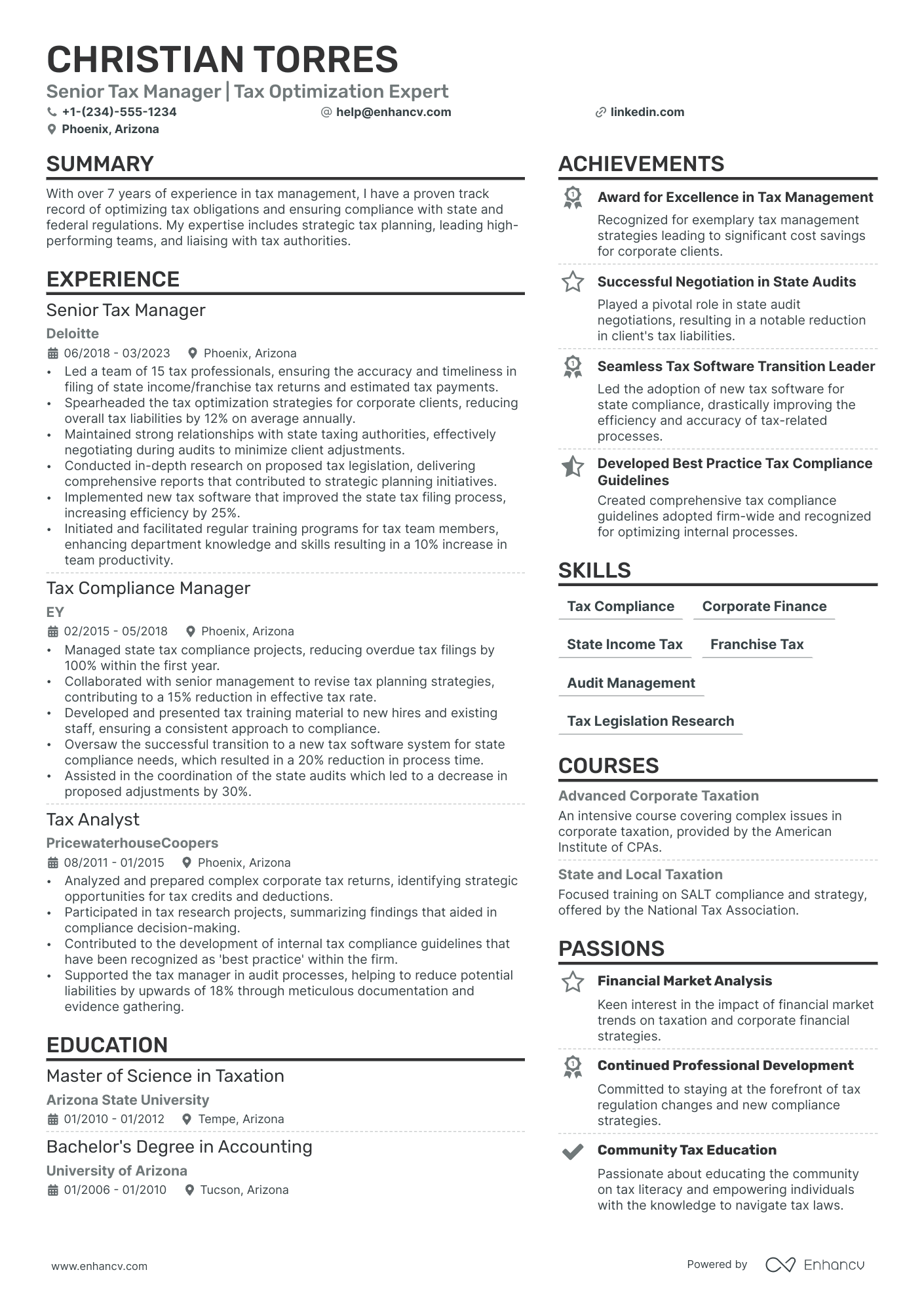

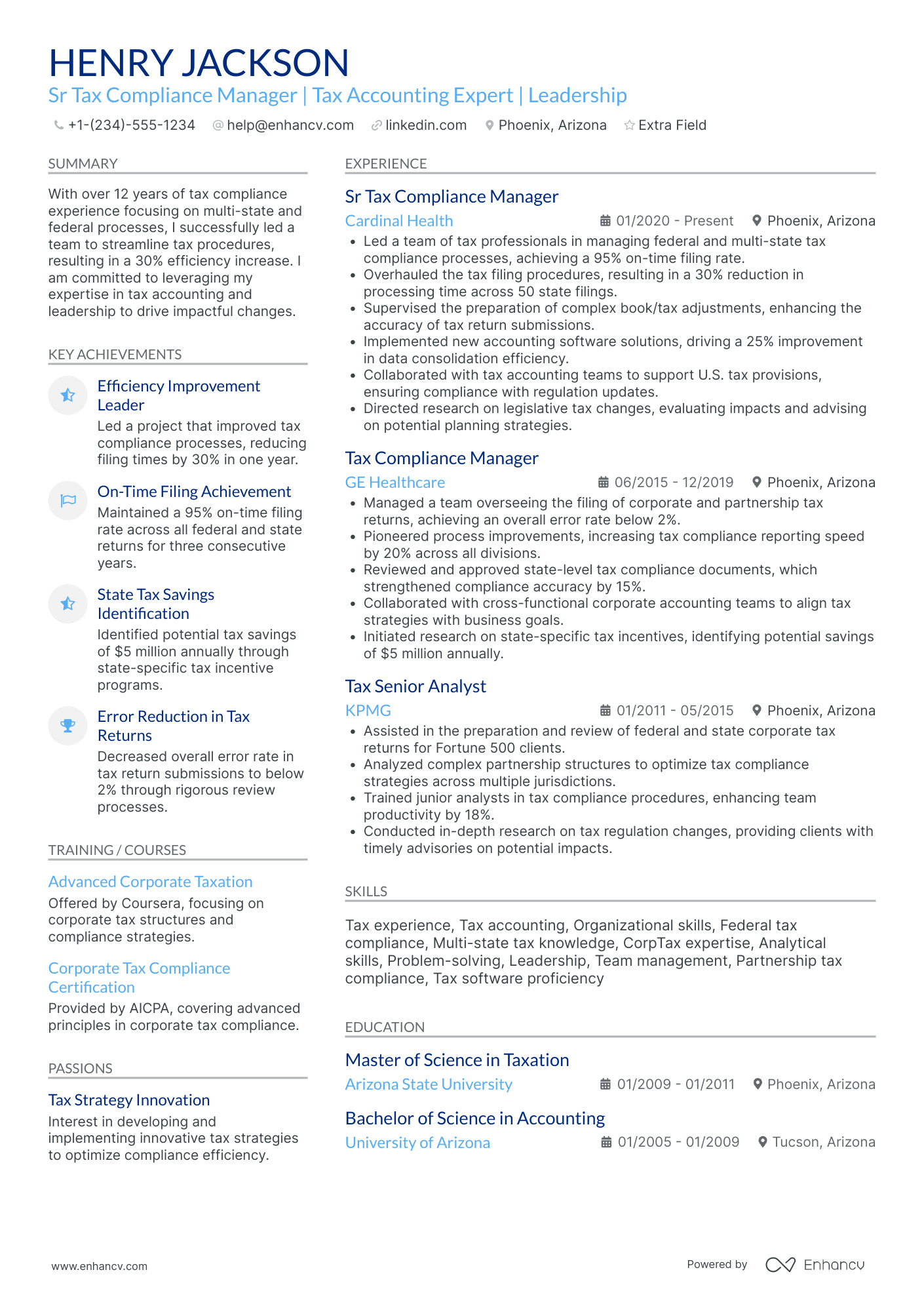

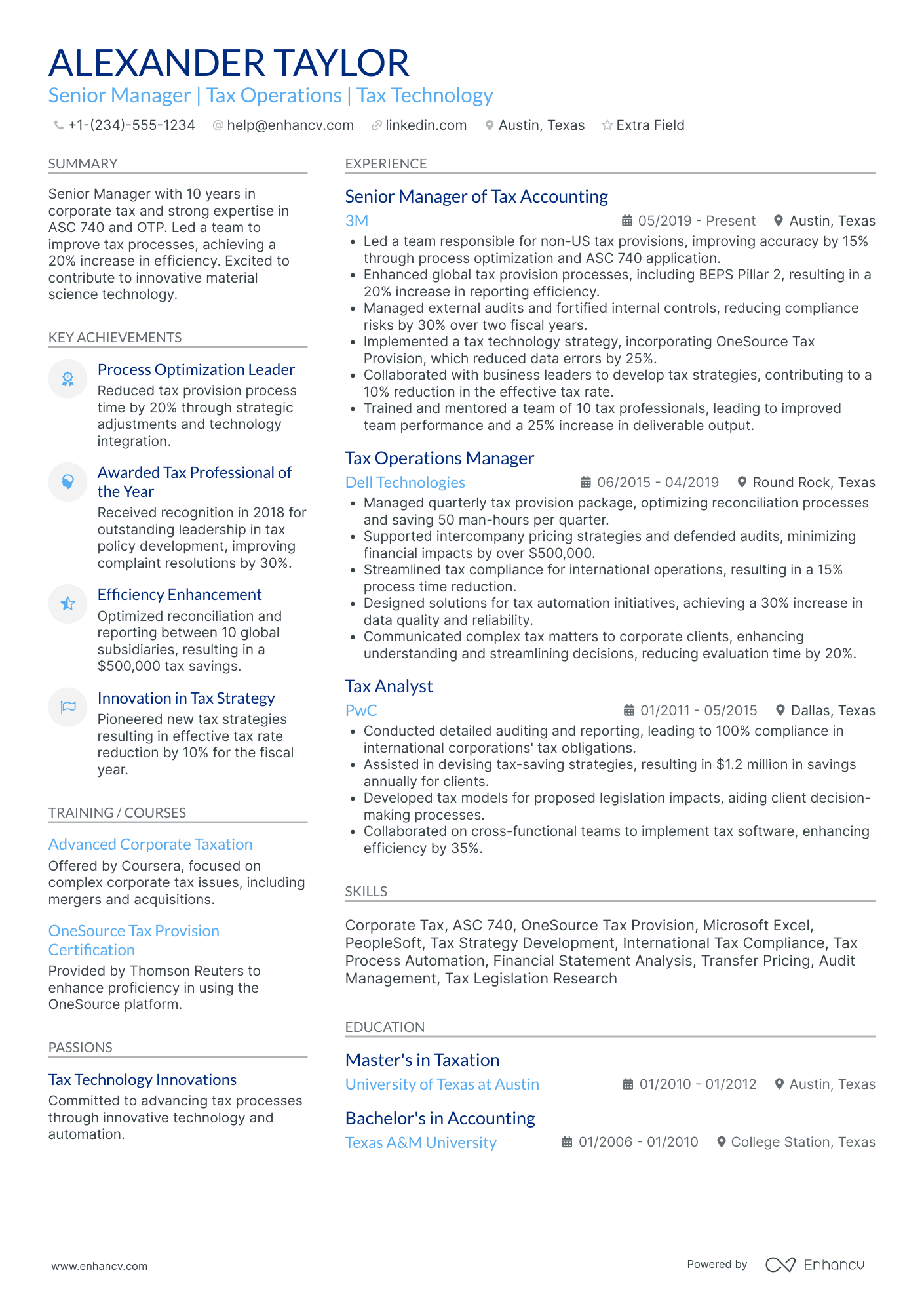

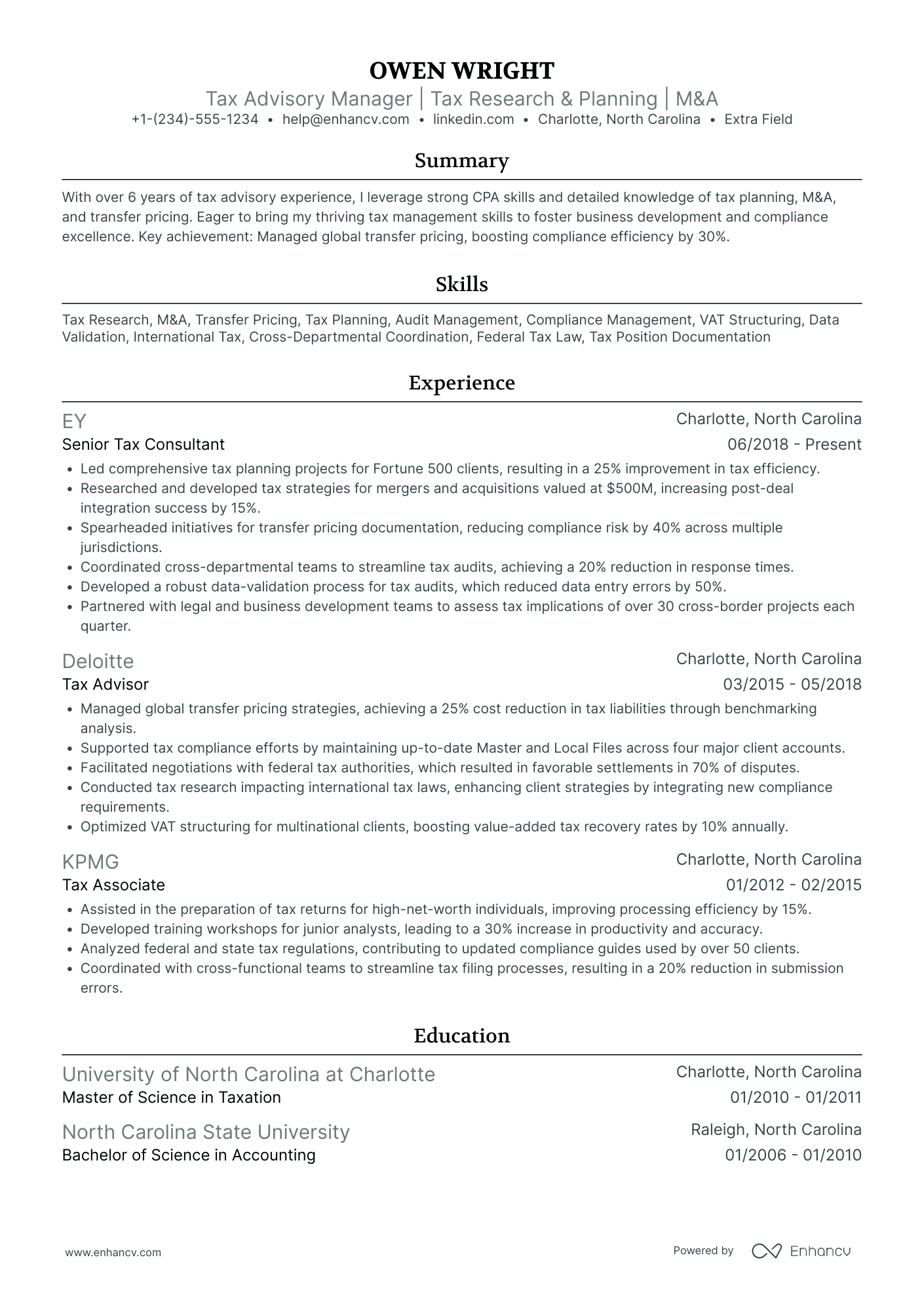

Senior Tax Manager

By Role

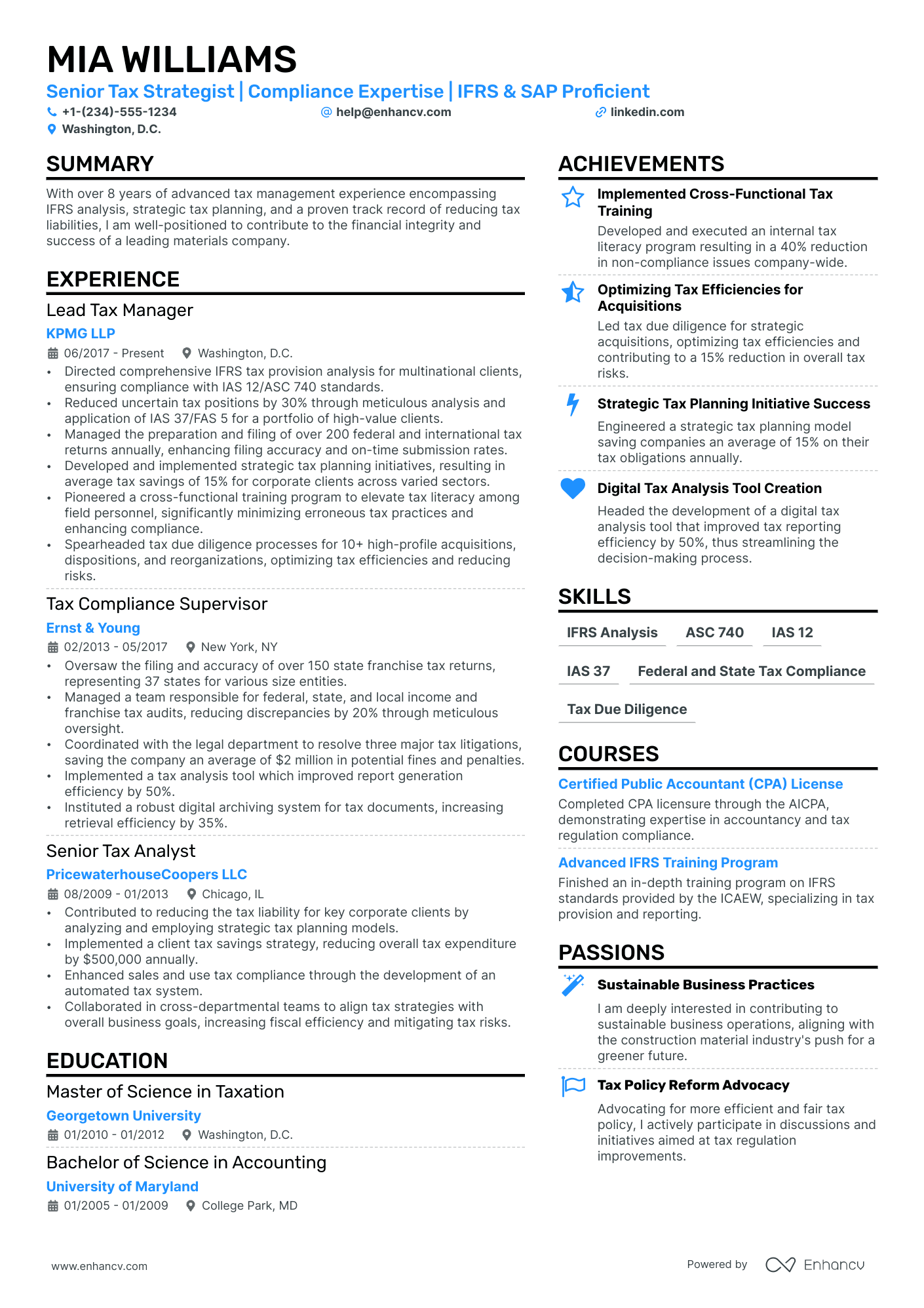

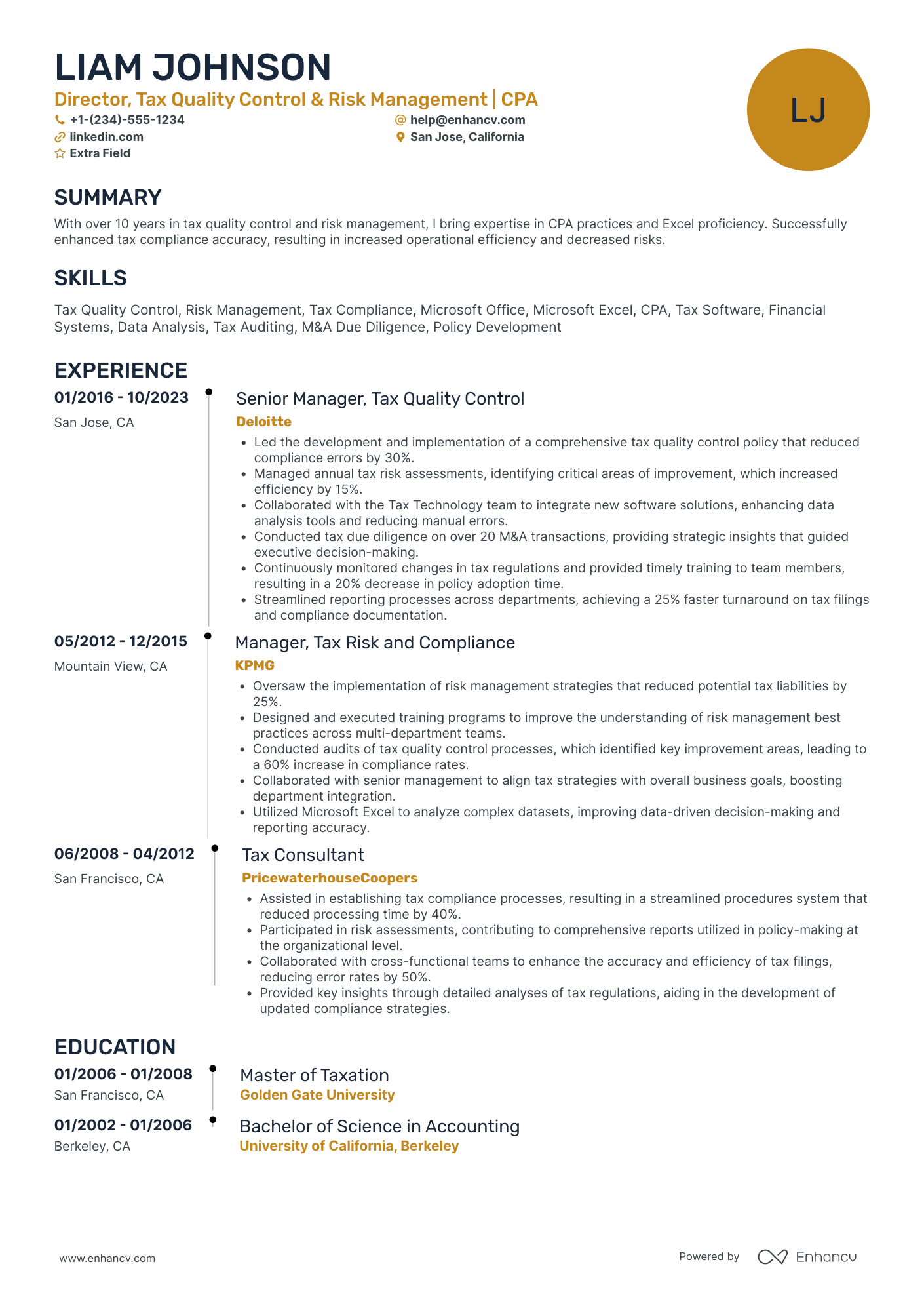

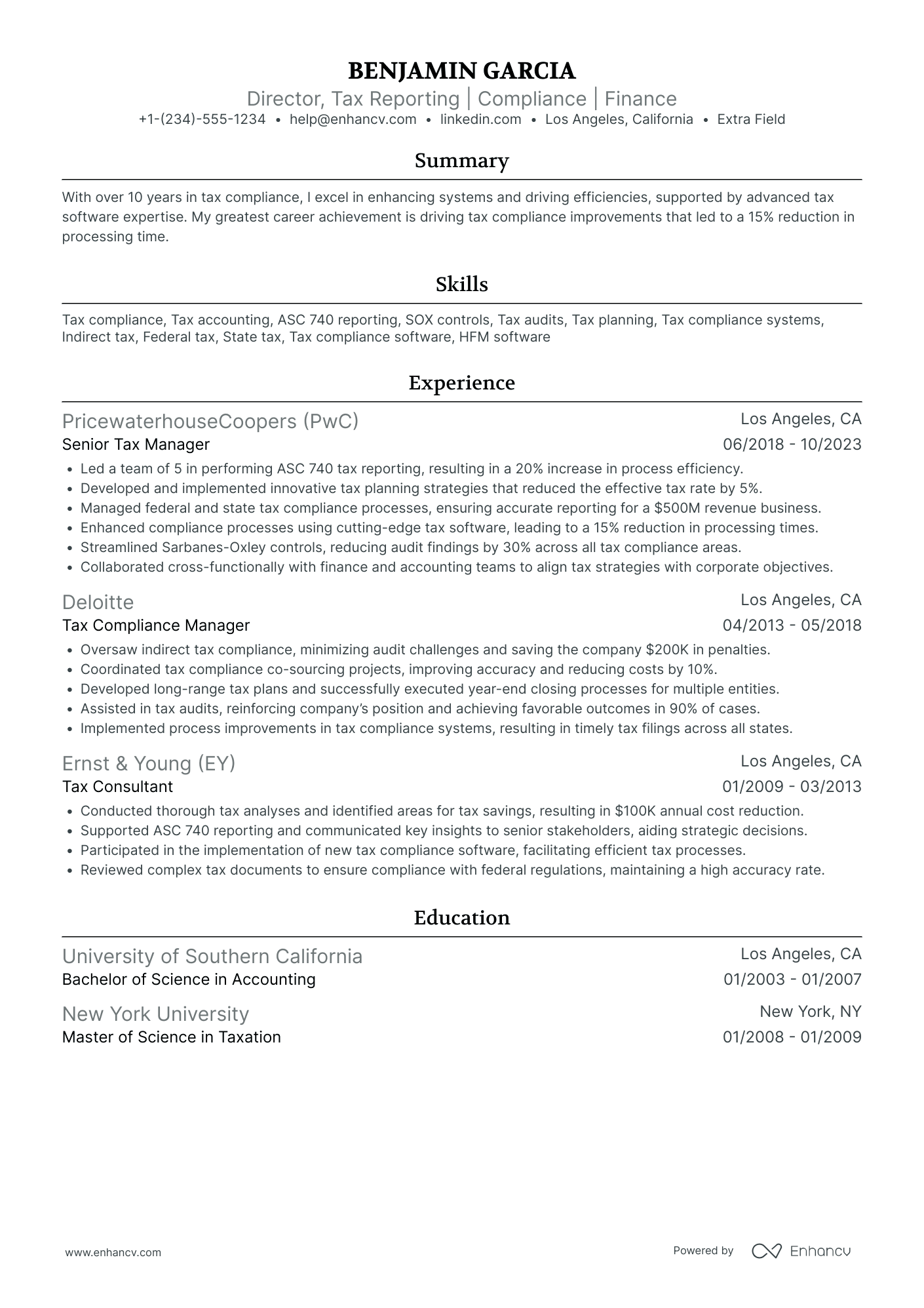

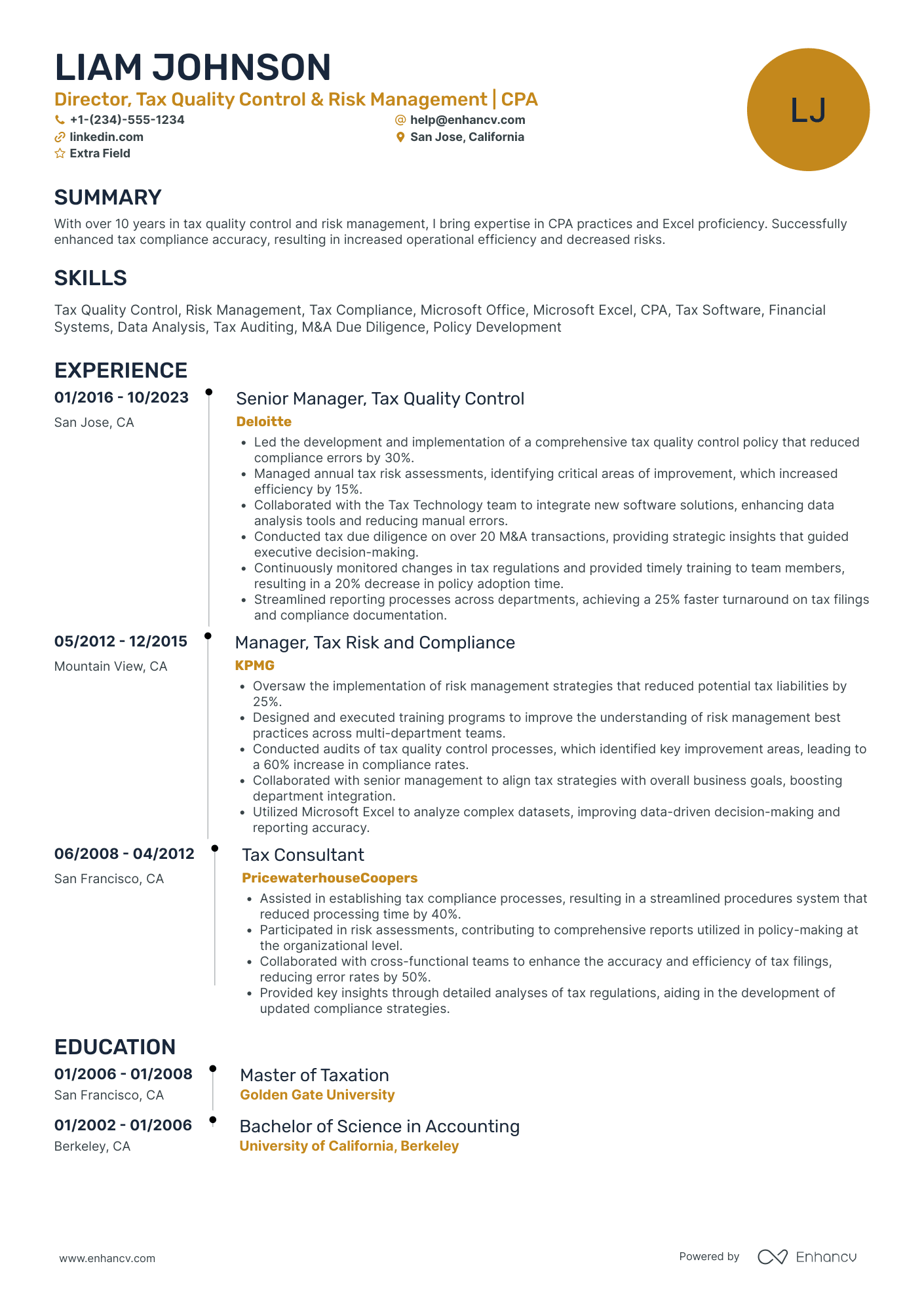

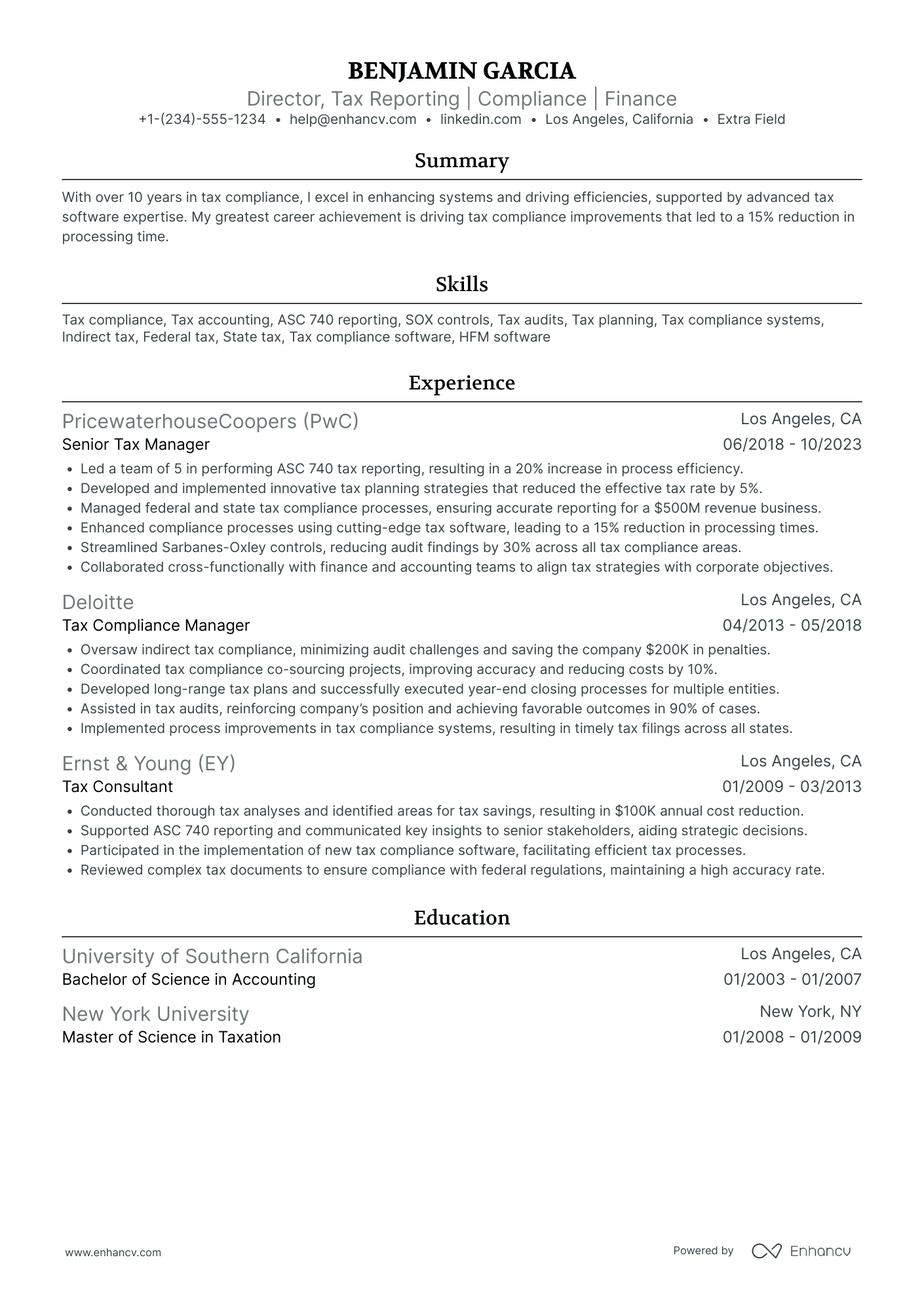

Tax Director

The role of a Tax Director is incredibly strategic and often born from years of experience in handling the financial and tax structures of companies. The following points can be useful in applying to a Tax Director role:

- Forefront your strategic experience with financial planning and tax strategy implementation.

- Specify your understanding of tax laws and how you've applied them to benefit the company, following a 'knowledge-action-result' pattern.

- Certainly, highlight your team management abilities - as a Tax Director, you'll lead a team of tax professionals.

- Remember to list any certifications, like the CPA, and how they've contributed to your career.

- Actionable outcomes are vital in this role. Specify how your strategic plans decreased tax liability or identified cost savings, aiding the company's bottom-line.

Tax Preparer

The Tax Preparer position, although not as strategic as a Tax Director, is vital in the world of finance and tax. To successfully apply for a Tax Preparer job, consider these pointers:

- Highlight your knowledge of tax software like TurboTax or H&R Block. Instead of simply listing them, explain how they've made your work more efficient or accurate.

- Give importance to your communication skills. You'll handle client interactions on a regular basis, so interpersonal abilities matter.

- Certifications matter in this job. If you passed the IRS's Annual Filing Season Program (AFSP), emphasize it. Share how this certification helped you improve your performance or client satisfaction.

- Remember to emphasize outcomes - show how your meticulous work has resulted in error-free filings or how you've made clients' tax seasons less stressful.