As a tax preparer, you might struggle with effectively showcasing your detailed-oriented nature and extensive knowledge of tax legislation on your resume. Our guide provides targeted advice to help you highlight your expertise and precision, ensuring that potential employers recognize your valuable skill set.

- Incorporate tax preparer job advert keywords into key sections of your resume, such as the summary, header, and experience sections;

- Quantify your experience using achievements, certificates, and more in various tax preparer resume sections;

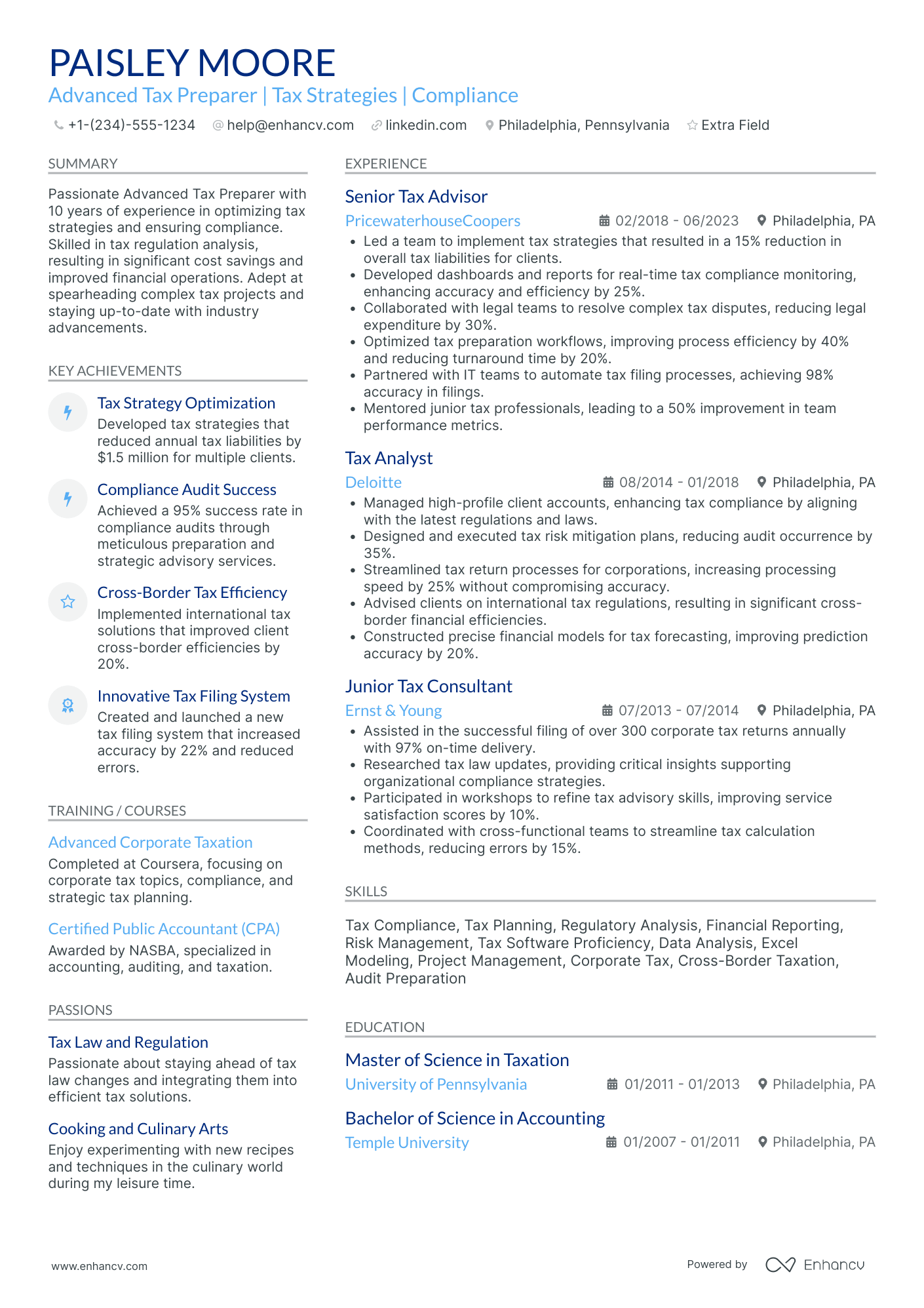

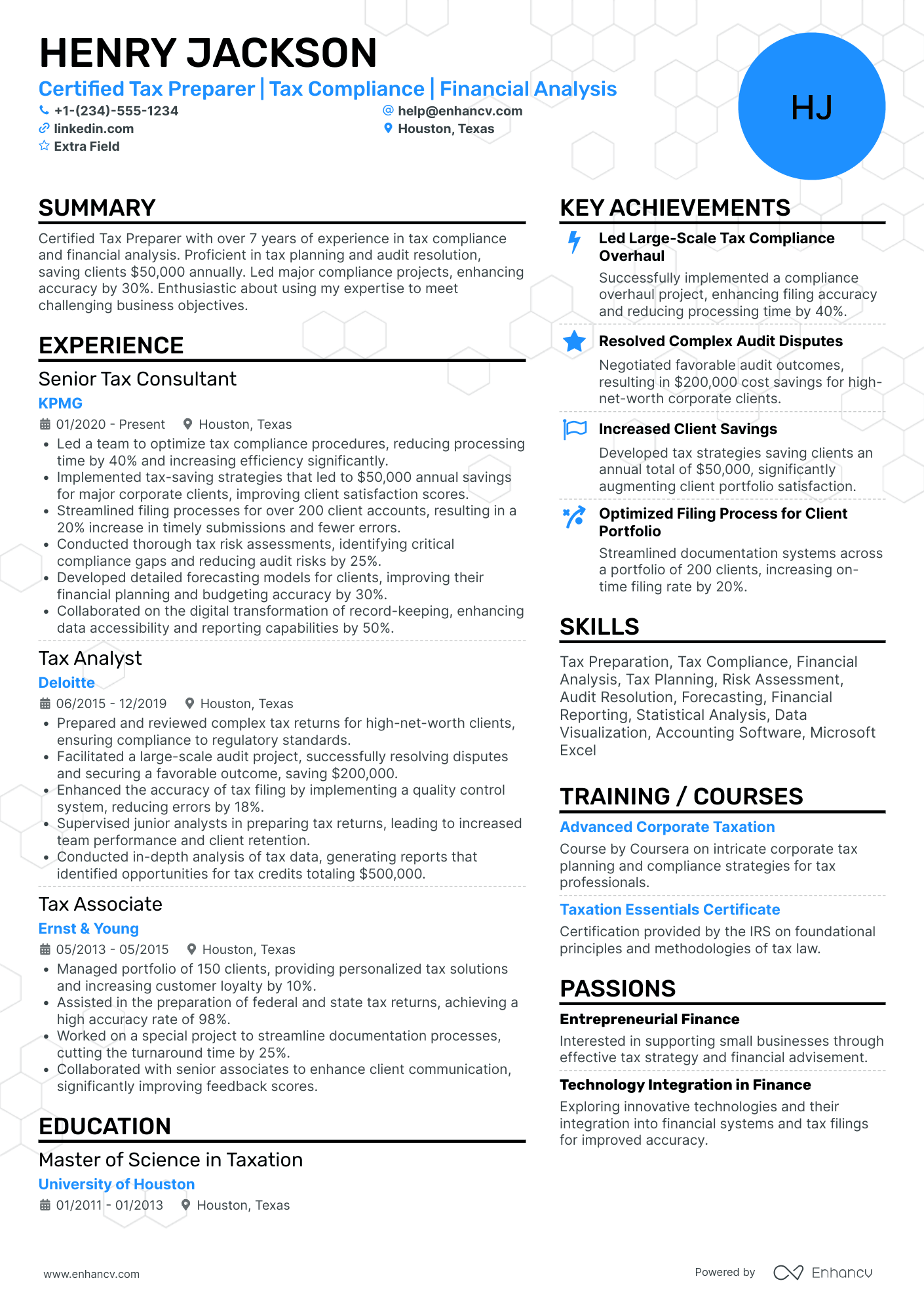

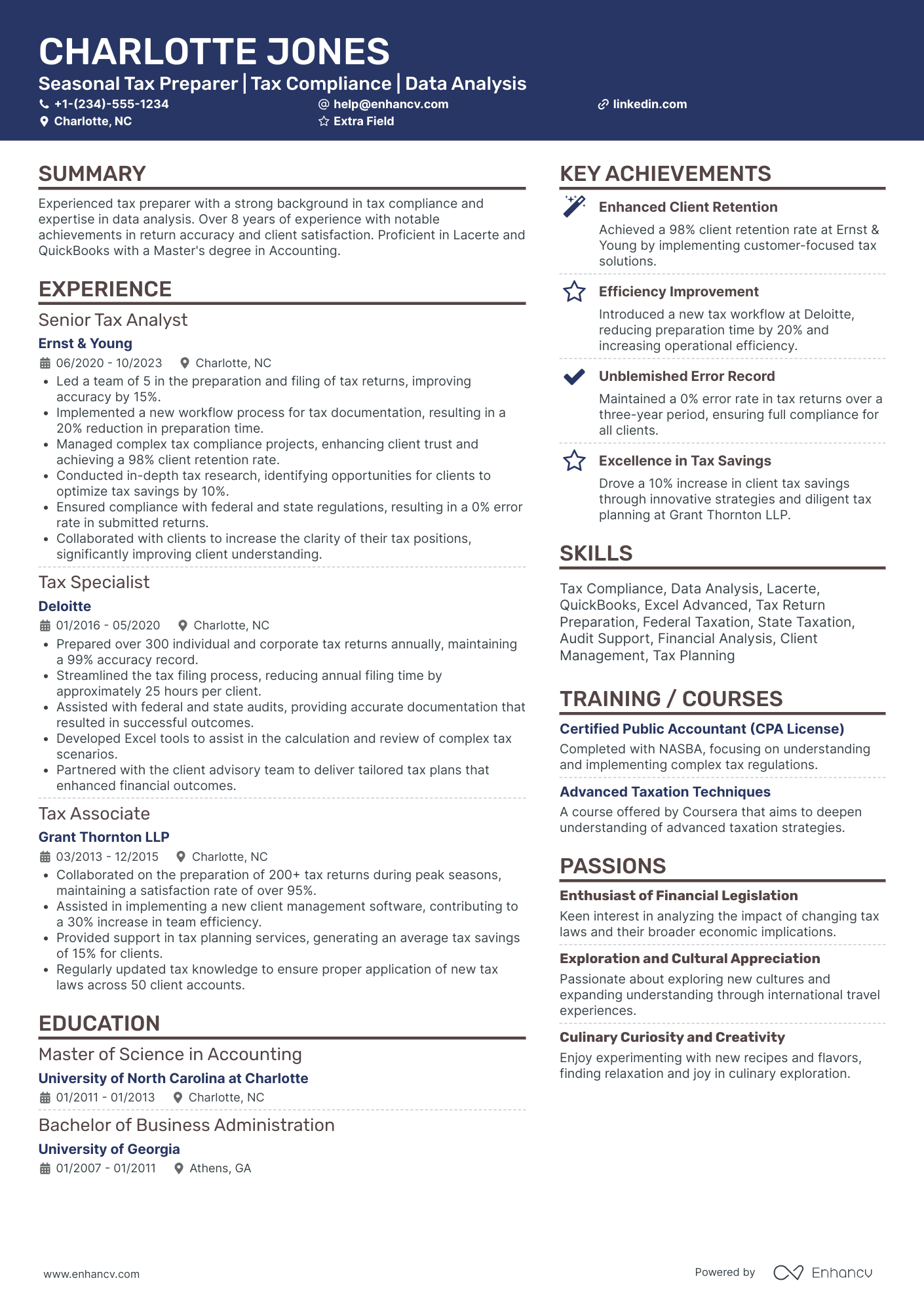

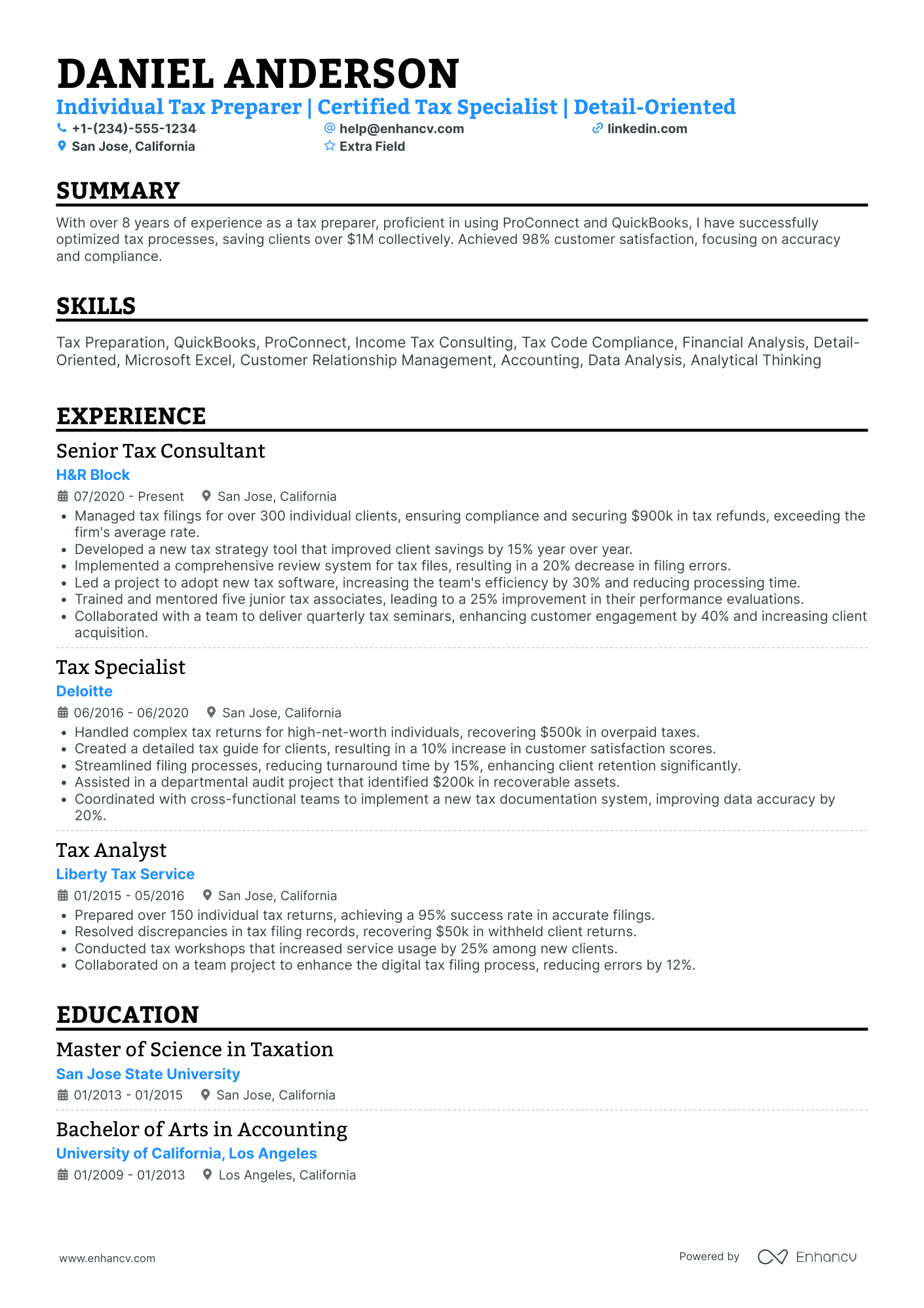

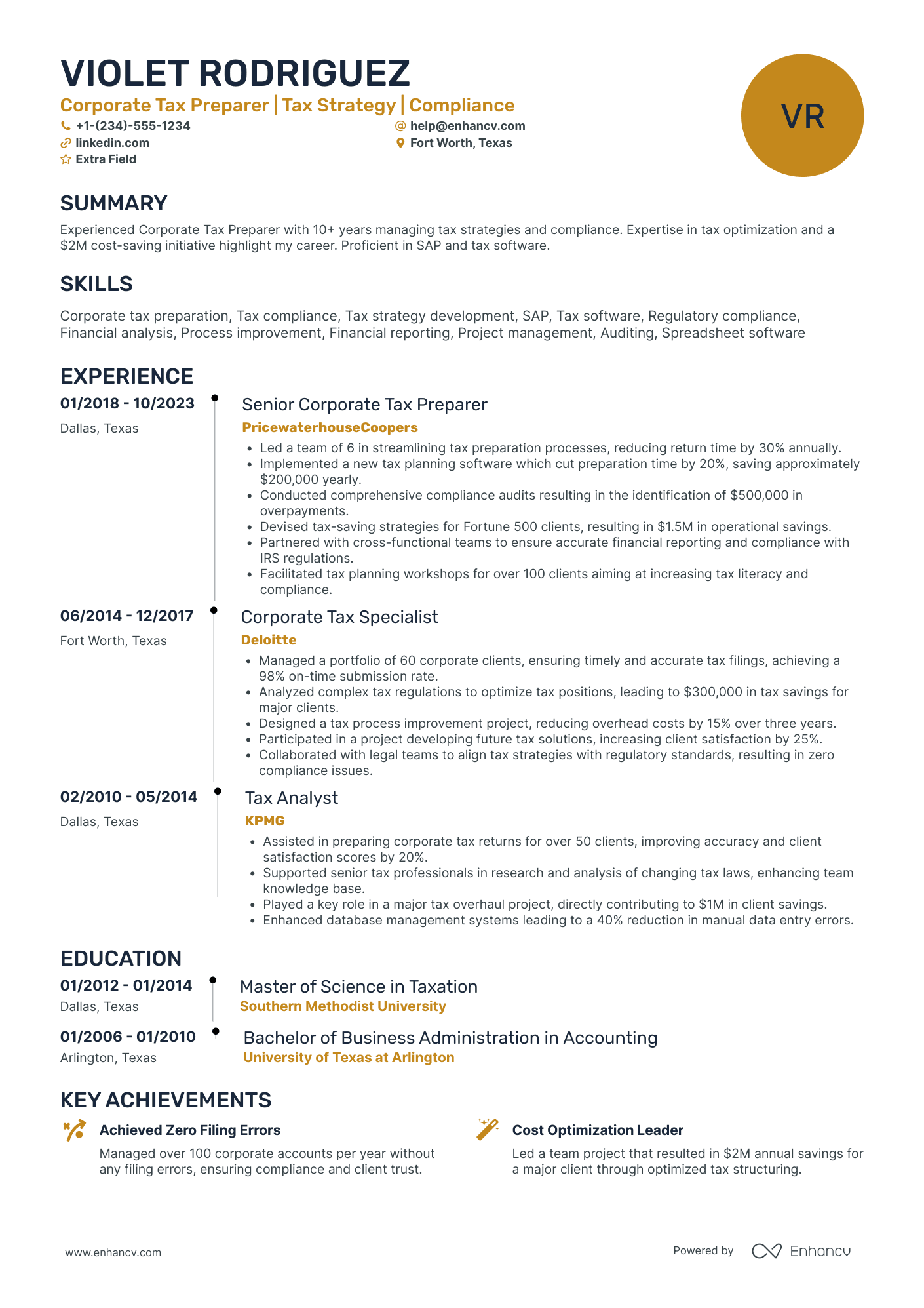

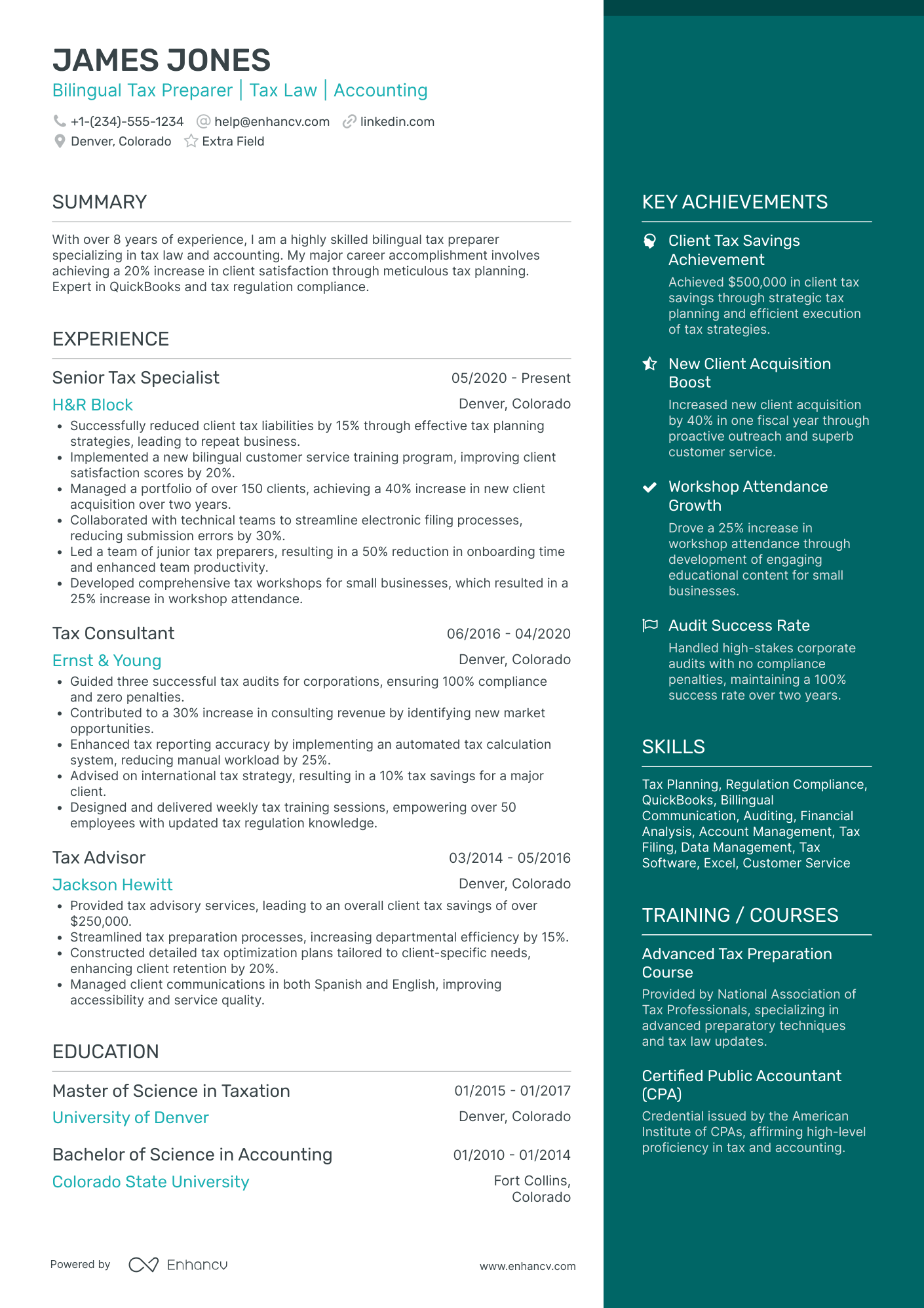

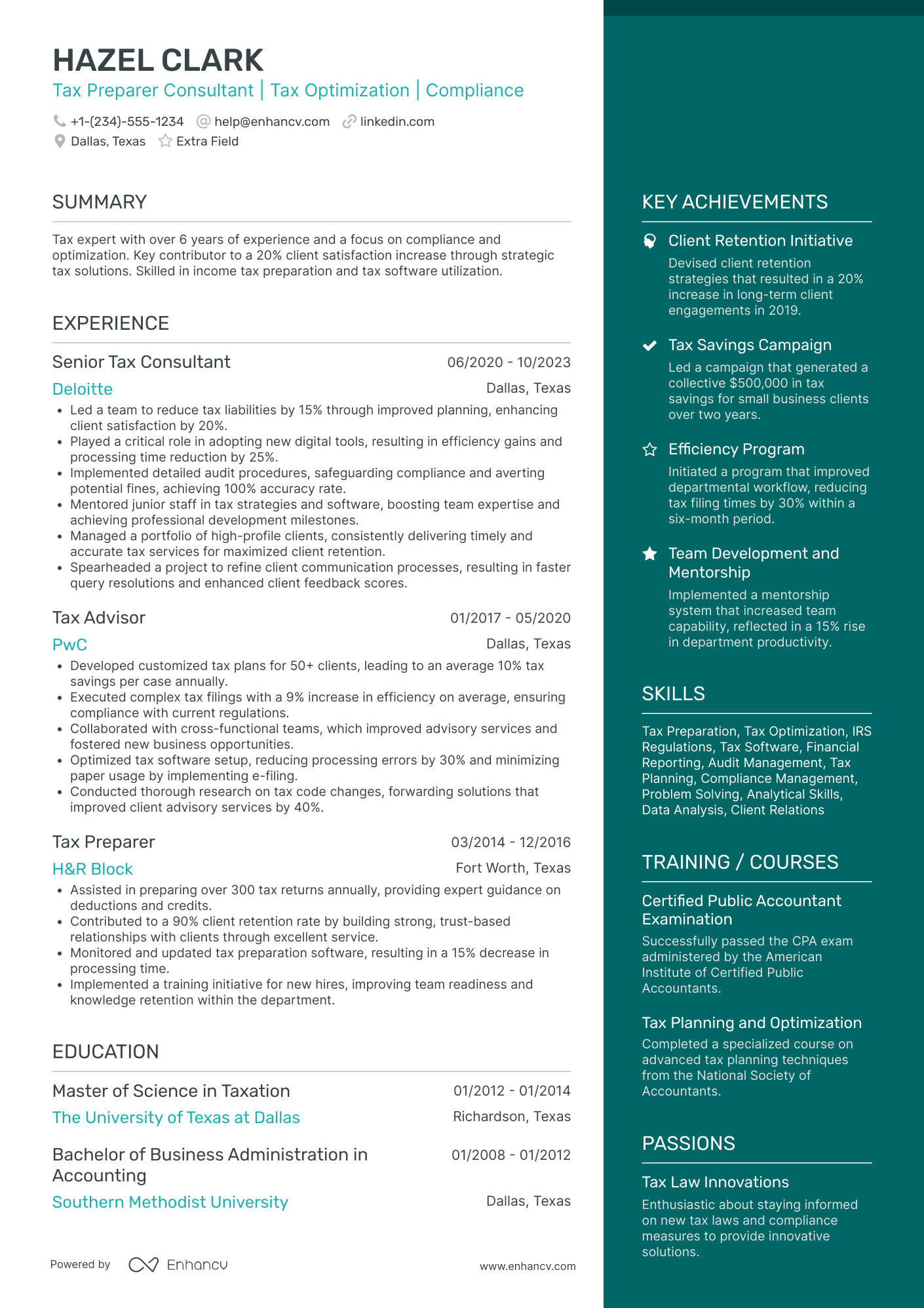

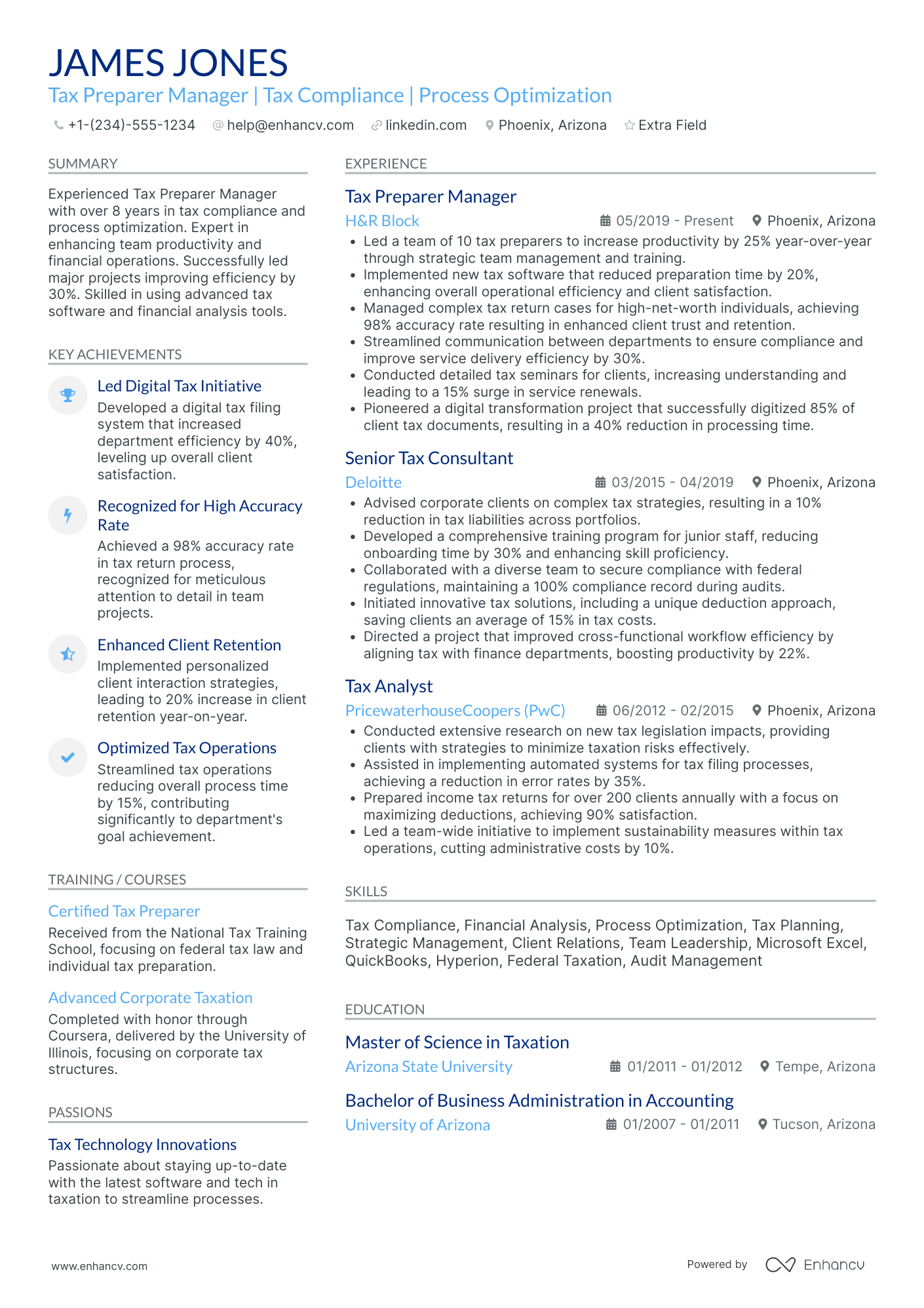

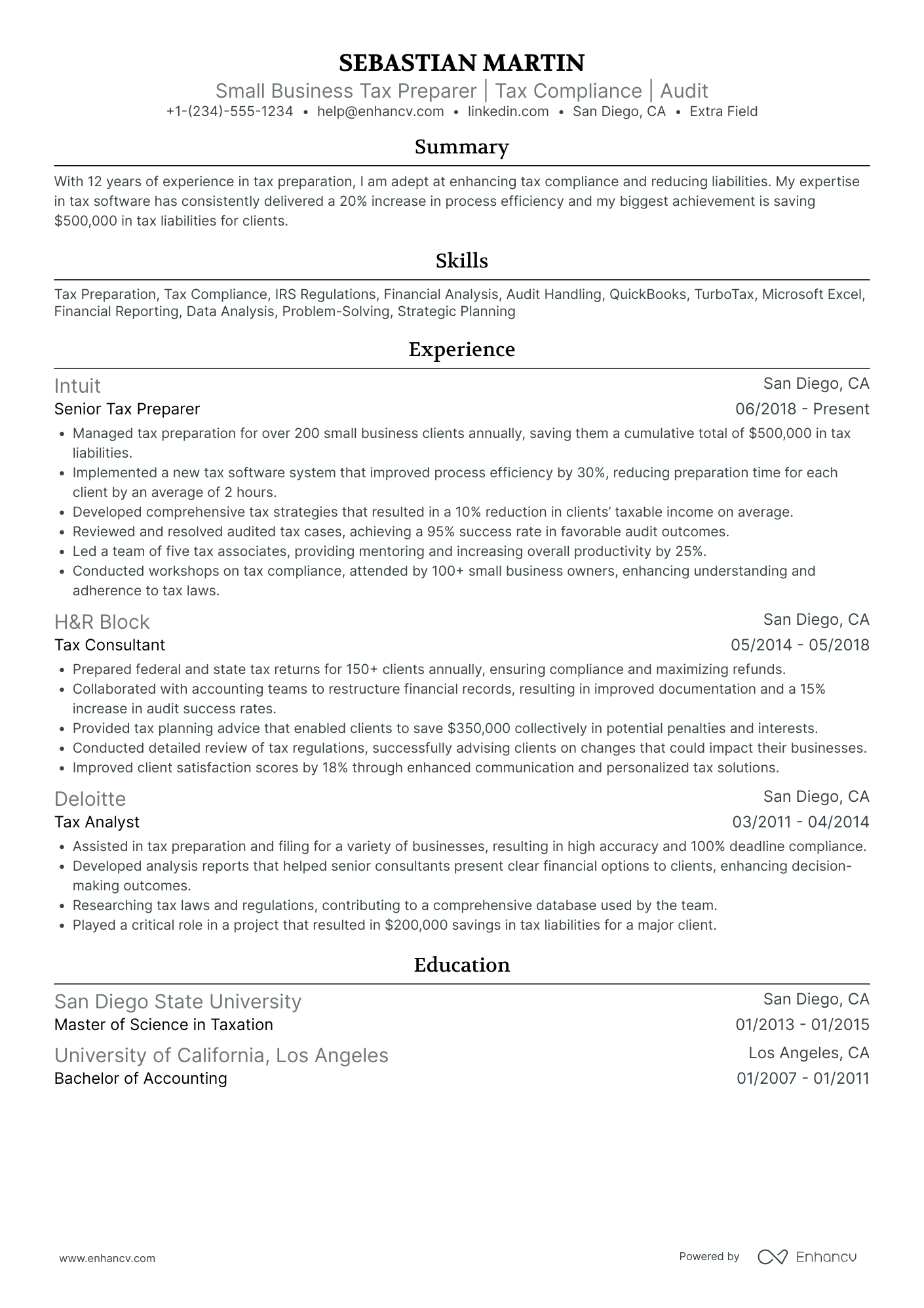

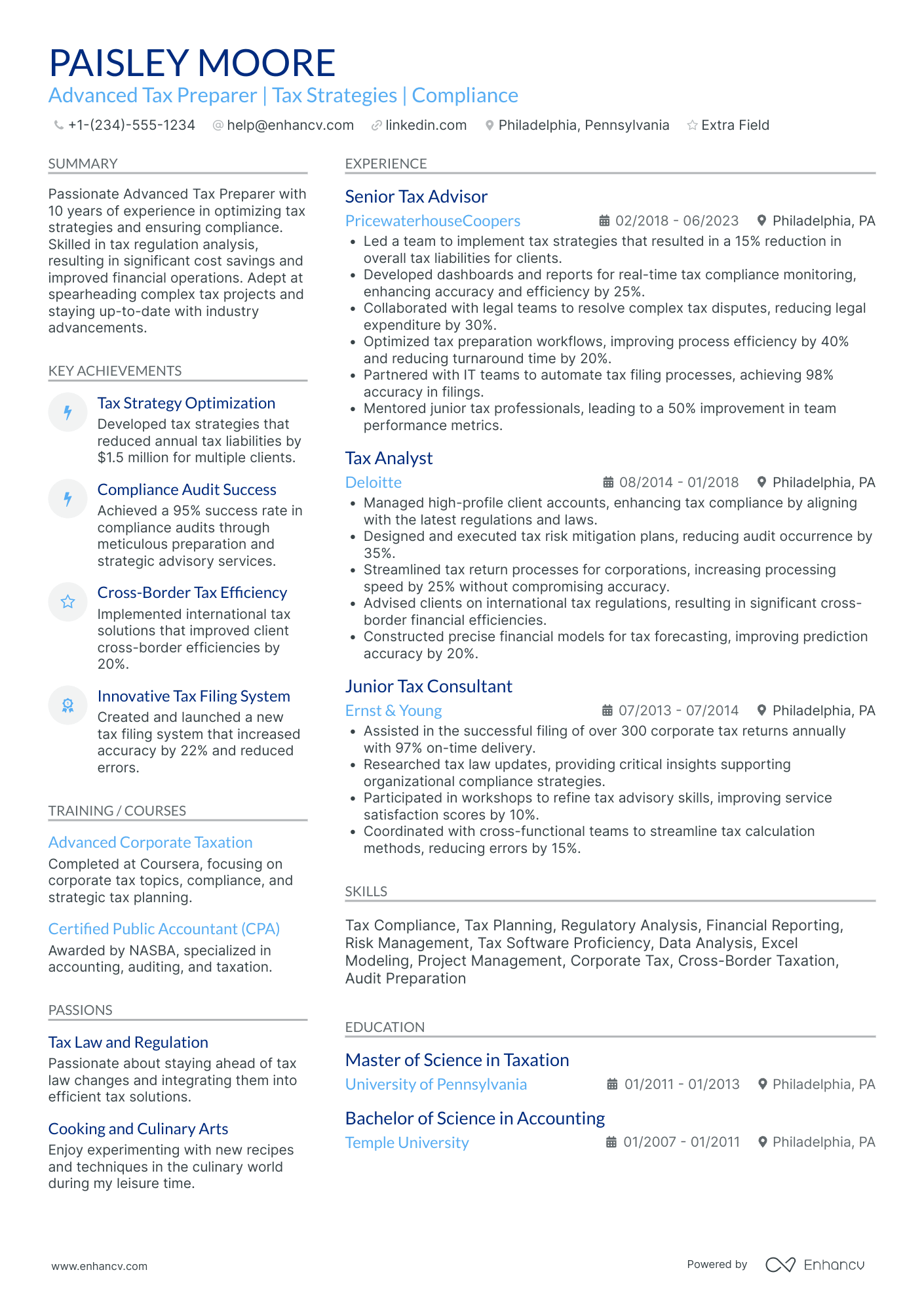

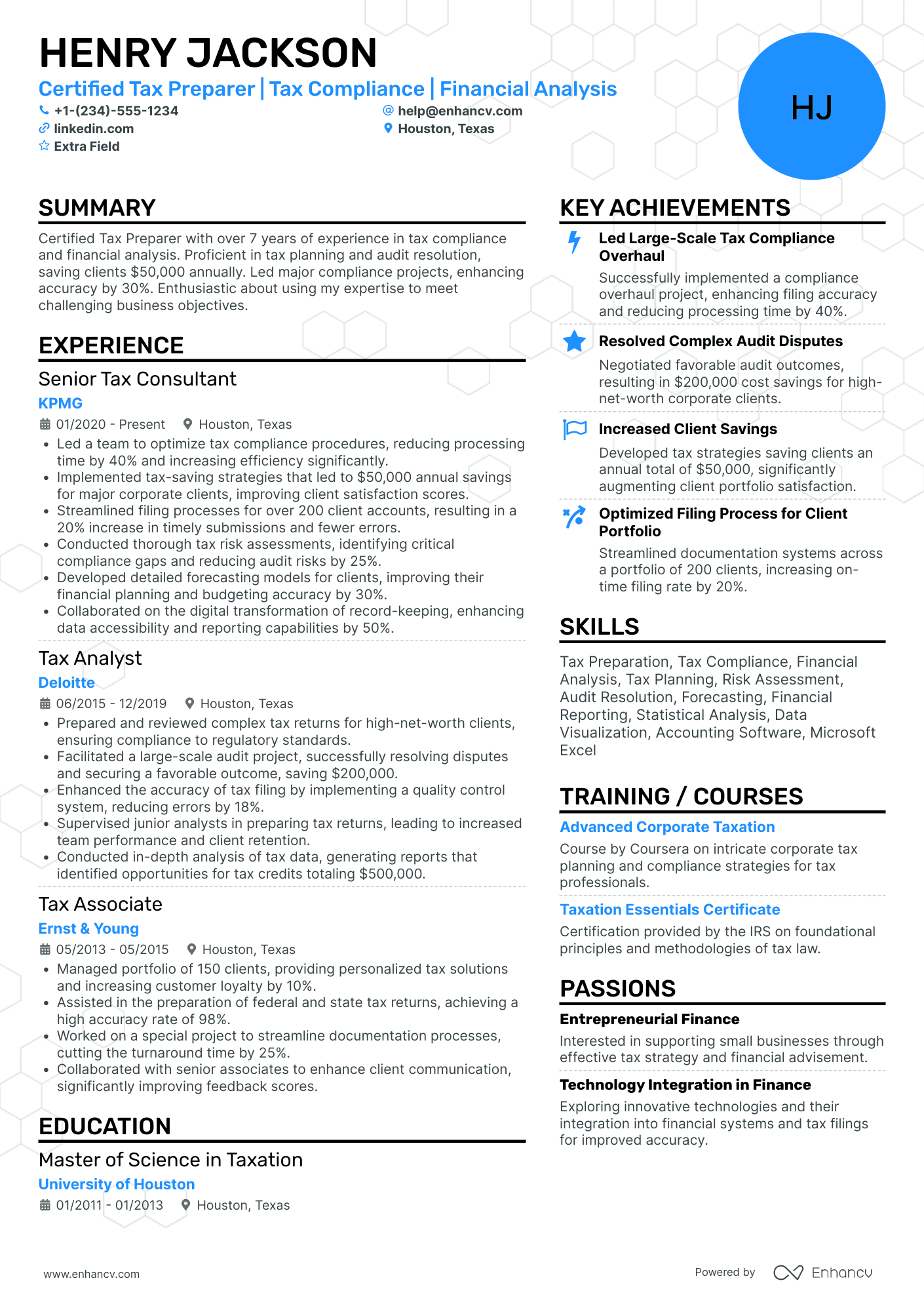

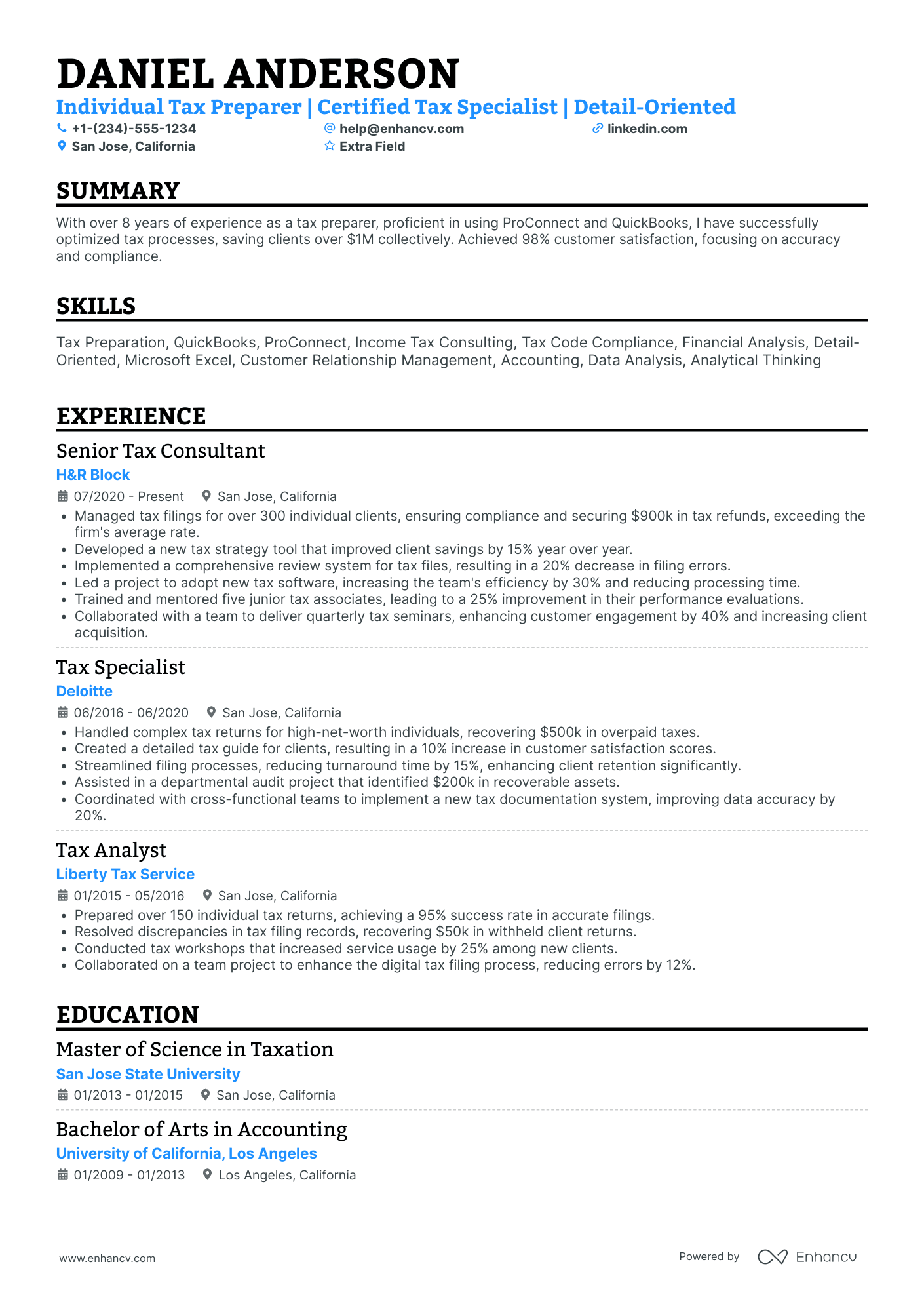

- Apply practical insights from real-life tax preparer resume examples to enhance your own profile;

- Choose the most effective tax preparer resume format to succeed in any evaluation process.

- Real Estate Administrative Assistant Resume Example

- Hotel Assistant Manager Resume Example

- Dental Office Manager Resume Example

- Temporary Administrative Assistant Resume Example

- Construction Administrative Assistant Resume Example

- Guest Services Manager Resume Example

- Front Office Manager Resume Example

- Business Office Manager Resume Example

- School Administrative Assistant Resume Example

- Records Manager Resume Example

The ultimate formula for your tax preparer resume format

Our best advice on how to style your tax preparer resume is this - first, take the time to study the job advert requirements.

The resume format you select should ultimately help you better align how your experience matches the specific role.

There are four crucial elements you need to thus take into consideration:

- How you present your experience. If you happen to have plenty of relevant expertise, select the reverse-chronological resume format to organize your experience by dates, starting with the latest.

- Don't go over the top with writing your resume. Instead, stick with a maximum of two-page format to feature what matters most about your profile.

- Headers aren't just for "decoration". The header of your resume helps recruiters allocate your contact details, portfolio, and so much more.

- The PDF format rules. It's the most common practice to submit your tax preparer resume as a PDF so that your resume doesn't lose its layout. However, make sure the read the job well - in some instances, they might require a doc file.

Consider your target market – resumes in Canada, for example, follow different layout conventions.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Listing your relevant degrees or certificates on your tax preparer resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Essential sections that should make up your tax preparer resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the tax preparer role

What recruiters want to see on your resume:

- Demonstrated knowledge of tax laws and regulations, mentioning specific tax codes or types of tax returns prepared

- Detail-oriented skills, with emphasis on accuracy and minimizing errors in tax preparation

- Proficiency with tax preparation software, such as TurboTax, H&R Block, or specific professional tax preparation tools like Drake or ProSeries

- Experience with a variety of tax situations, including complex personal returns, small business taxes, or industry-specific tax issues

- Credentials such as Certified Public Accountant (CPA) or Licensed Enrolled Agent (EA), or completion of tax-related courses and certifications

Adding your relevant experience to your tax preparer resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your tax preparer resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the tax preparer advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

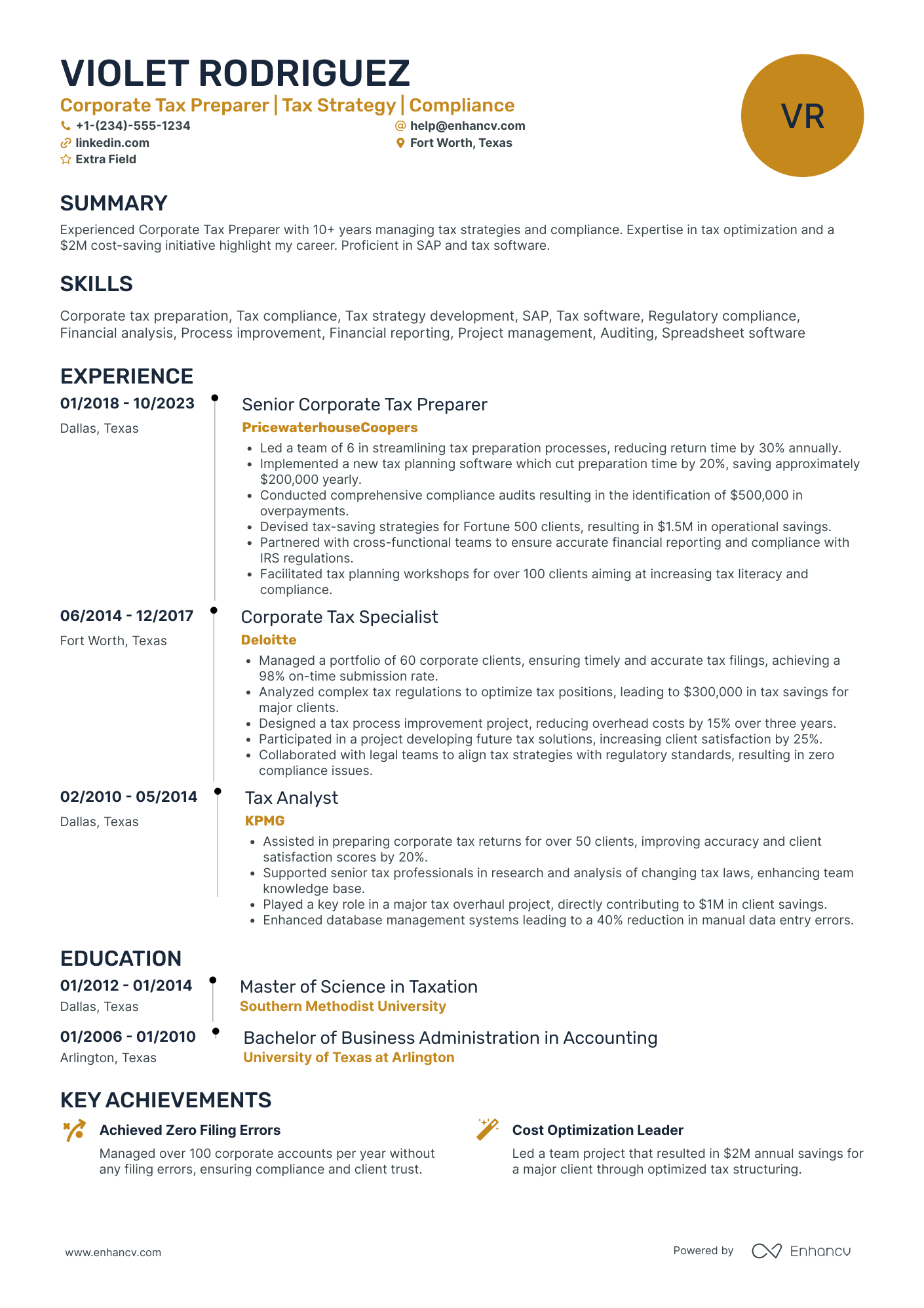

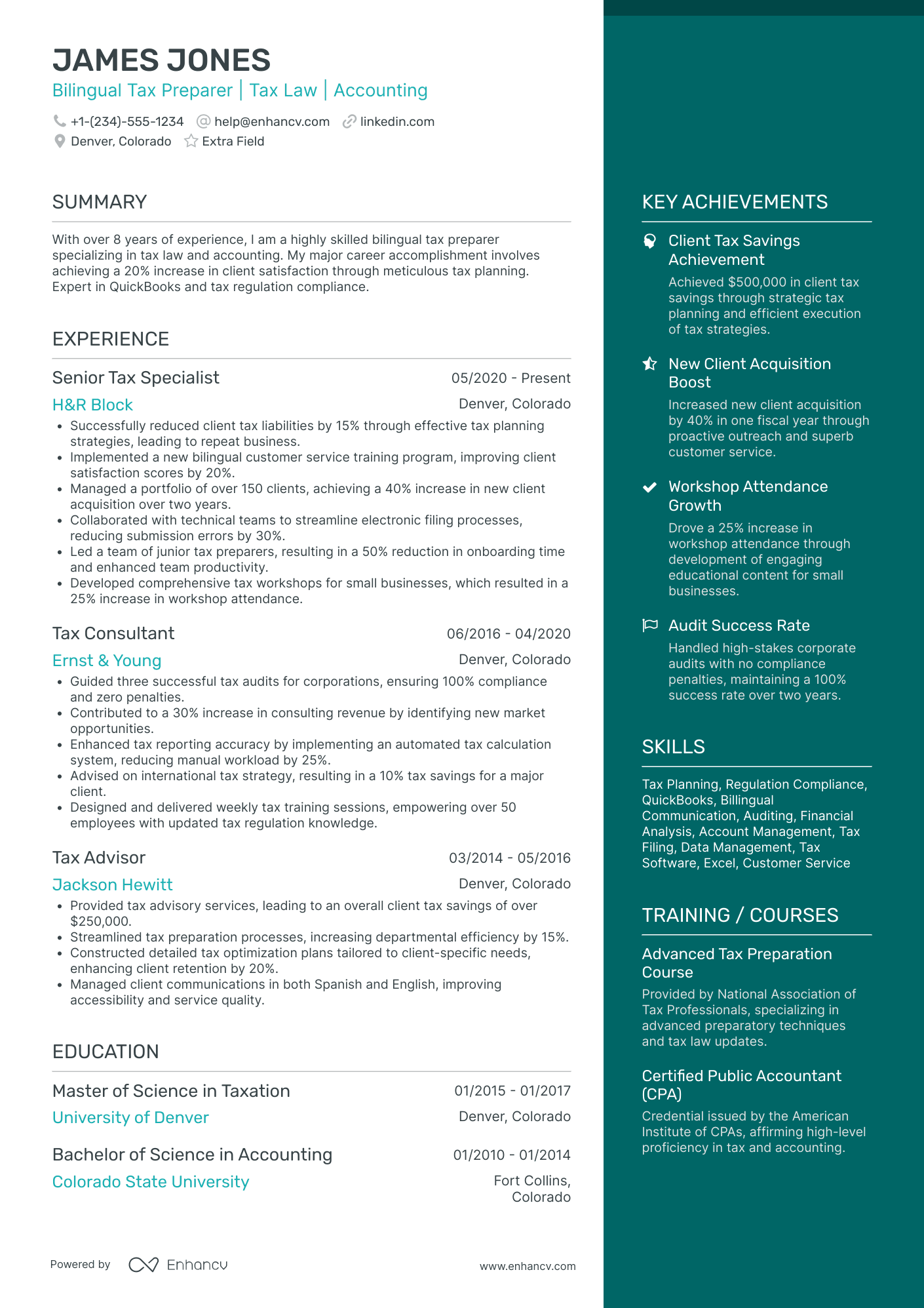

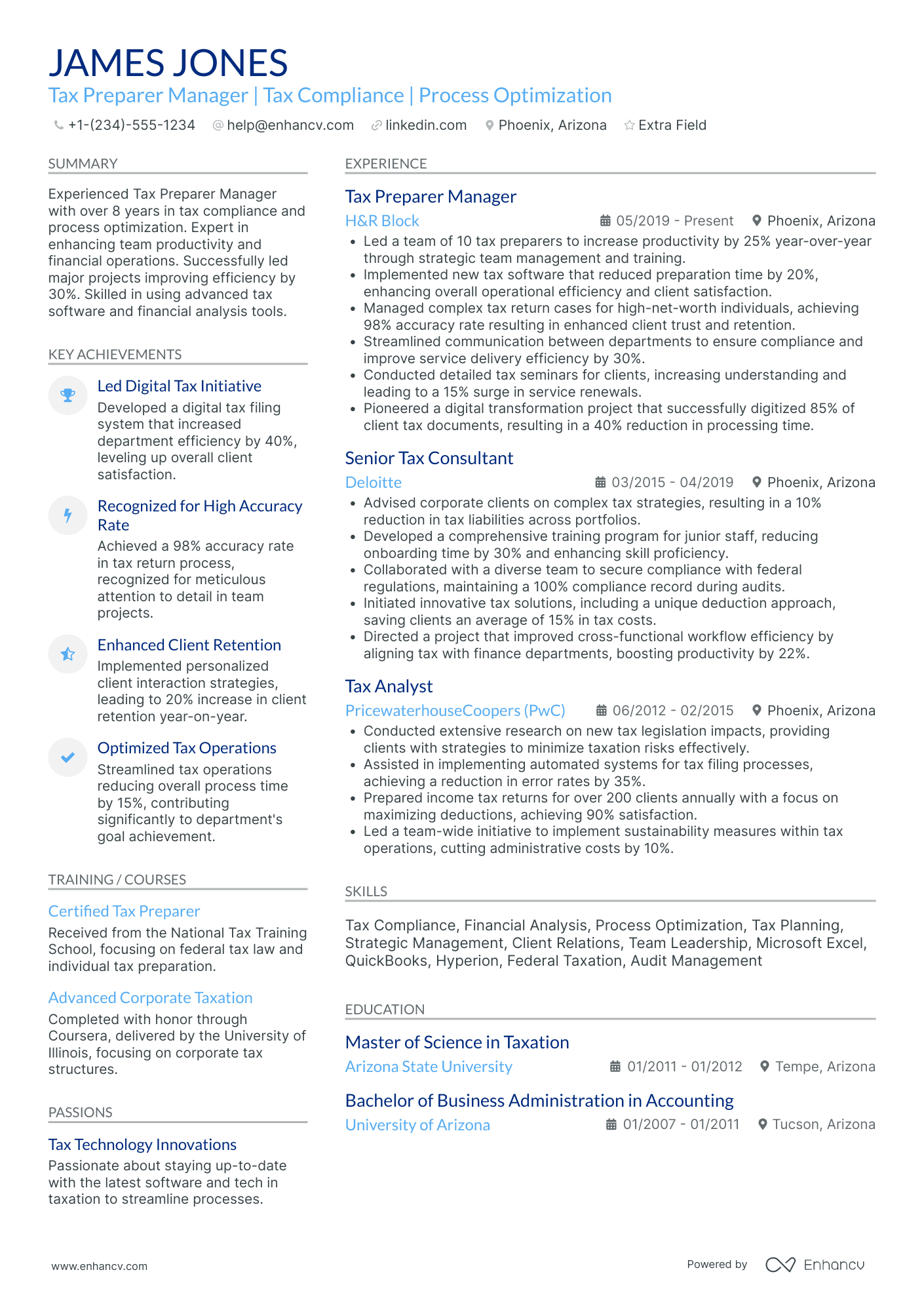

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample tax preparer resumes on how to best create your resume experience section.

- Regularly prepared over 350 tax returns each tax season with a focus on individual and small business clients, increasing client retention by 30%

- Leveraged advanced tax software to streamline the preparation process, decreasing average preparation time by 15%

- Implemented a client education program that assisted clients in understanding tax obligations and potential deductions, enhancing customer satisfaction scores by 25%

- Managed tax compliance for a diverse clientele, ensuring adherence to the latest federal and state regulations

- Facilitated quarterly training sessions for new tax associates, contributing to a 20% improvement in accuracy on first-time filings

- Negotiated with the IRS on behalf of clients, successfully reducing owed amounts by 10% on average through effective communication and reasoning

- Conducted thorough reviews of financial records and achieved a 98% accuracy rate in income tax return filings

- Pioneered a digital archiving system for client tax documents, cutting down document retrieval times by 40%

- Orchestrated a client transition to cloud-based accounting solutions, leading to a 20% reduction in document processing costs

- Specialized in tax research and analysis for complex tax issues, providing detailed reports that guided strategic decision-making

- Collaborated across departments to prepare accurate financial statements and reports for annual audits

- Assisted in the training of junior preparers in tax law changes, resulting in an increase in team efficiency by 10%

- Increased the firm's small business client base by 25% through targeted marketing and exceptional service

- Developed tax planning strategies for clients, which on average, led to a 15% decrease in their yearly tax liabilities

- Mitigated audit risks by conducting pre-emptive internal reviews and maintaining thorough documentation on tax filings

- Administered the end-to-end tax preparation process for over 200 real estate investors, ensuring optimal compliance

- Co-created a proprietary tax deduction checklist tailored to freelance professionals, increasing user engagement by 40%

- Maintained an error rate of less than 1% through meticulous attention to detail and regular training in current tax laws

- Provided expert tax advice to medium-sized businesses, leading to an improved financial performance for 85% of those clients

- Spearheaded a departmental revamp of the electronic filing system that increased operational efficiency by 35%

- Developed and maintained strong professional relationships with clients, which resulted in a 20% year-over-year growth in client base

- Advised clients on tax-saving opportunities and investment strategies, leading to an average of 22% return on investments for clients

- Handled the complex tax situations of expatriates, ensuring compliance with both US and international tax standards

- Optimized record-keeping processes for client tax information, resulting in enhanced data integrity and faster access to historical data

- Orchestrated the tax preparation process for high-net-worth individuals, customizing strategies to minimize liabilities

- Authored a monthly tax newsletter for clients, providing insights into tax law changes and planning opportunities

- Successfully represented 50+ clients in IRS audits, with a successful resolution rate of 98%

- Integrated cutting-edge tax software to optimize workflow and reduce errors in tax return processing for our clientele

- Led a cross-functional team to evaluate tax efficiency for corporate mergers and acquisitions, advising on tax impacts and opportunities

- Authored a comprehensive guide on state-specific tax credits leading to client savings of over $500,000 annually

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for tax preparer professionals.

Top Responsibilities for Tax Preparer:

- Send notices to taxpayers when accounts are delinquent.

- Confer with taxpayers or their representatives to discuss the issues, laws, and regulations involved in returns, and to resolve problems with returns.

- Notify taxpayers of any overpayment or underpayment, and either issue a refund or request further payment.

- Maintain records for each case, including contacts, telephone numbers, and actions taken.

- Contact taxpayers by mail or telephone to address discrepancies and to request supporting documentation.

- Answer questions from taxpayers and assist them in completing tax forms.

- Collect taxes from individuals or businesses according to prescribed laws and regulations.

- Determine appropriate methods of debt settlement, such as offers of compromise, wage garnishment, or seizure and sale of property.

- Check tax forms to verify that names and taxpayer identification numbers are correct, that computations have been performed correctly, or that amounts match those on supporting documentation.

- Examine and analyze tax assets and liabilities to determine resolution of delinquent tax problems.

Quantifying impact on your resume

- Detail the number of tax returns prepared annually to demonstrate volume-handling capabilities.

- Highlight the amount of money saved for clients through strategic tax planning and credits to show financial impact.

- Specify the types of clients serviced (individuals, small businesses, corporations, etc.) and quantify the client base to establish the scope of your expertise.

- Mention any increases in client satisfaction ratings or growth in client retention rates to illustrate customer service proficiency.

- Include the size of the average tax refund achieved for clients to emphasize your effectiveness in maximizing client benefits.

- Quantify the accuracy rate of tax return filing to showcase attention to detail and reliability.

- List the number of audits successfully resolved to convey your problem-solving abilities and experience.

- Provide the percentage of compliance with updated tax laws and regulations to demonstrate ongoing professional development and dedication to excellence.

Action verbs for your tax preparer resume

No relevant experience - what to feature instead

Suppose you're new to the job market or considering a switch in industry or niche. In such cases, it's common to have limited standard professional experience. However, this isn't a cause for concern. You can still craft an impressive tax preparer resume by emphasizing other sections, showing why you're a great fit for the role:

- Emphasize your educational background and extracurricular activities to demonstrate your industry knowledge;

- Replace the typical experience section with internships or temporary jobs where you've gained relevant skills and expertise;

- Highlight your unique skill set, encompassing both technological and personal abilities;

- Showcase transferable skills acquired throughout your life and work experiences so far.

Recommended reads:

PRO TIP

If you happen to have some basic certificates, don't invest too much of your tax preparer resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Popular tax preparer hard skills and soft skills for your resume

Apart from assessing your professional expertise, recruiters are on the lookout for whether your skills align with the job.

Your profile would thus be assessed in regard to your:

- Hard or technical skills - your ability to perform on the job using particular technologies or software

- Soft skills - how you adapt, communicate, and thrive in different environments.

Both types of skills - hard and soft skills - are important for your resume, so make sure to create a dedicated skills section that:

- Lists up to five or six skills that align with the job advert.

- Integrates vital keywords for the industry, but also reflects on your personal strengths.

- Builds up further your skills with an achievements section within which you explain what you've achieved thanks to using the particular skill.

- Aims to always quantify in some way how you've used the skill, as it's not enough to just list it.

What are the most sought out hard and soft skills for tax preparer roles?

Check out the industry's top choices with our two dedicated lists below:

Top skills for your tax preparer resume:

Proficiency in tax preparation software (e.g., TurboTax, H&R Block)

Knowledge of federal and state tax laws

Experience with bookkeeping and accounting principles

Ability to perform tax calculations and projections

Familiarity with IRS forms and documentation

Data entry and management skills

Proficiency in Microsoft Excel and spreadsheets

Understanding of financial statements and reporting

Knowledge of tax credits and deductions

Experience with electronic filing (e-filing)

Attention to detail

Strong analytical skills

Excellent communication skills

Time management and organizational skills

Ability to work under pressure

Problem-solving skills

Customer service orientation

Ethical judgment and integrity

Adaptability to changing regulations

Team collaboration skills

Next, you will find information on the top technologies for tax preparer professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Tax Preparer’s resume:

- Fund accounting software

- Intuit QuickBooks

- Microsoft PowerPoint

- Email software

- Microsoft Outlook

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

The tax preparer resume sections you may underestimate: certifications and education

Your education and certifications provide insight into both your technical capabilities and personal attributes, such as perseverance. When crafting your tax preparer resume, consider how you present these elements:

- For your higher education degrees, prioritize listing those most relevant to the job or indicative of your academic dedication;

- Include applicable coursework as a stand-in for relevant experience or if it might impress recruiters;

- Include incomplete higher education only if it's pertinent to meeting job requirements;

- If your degree is from a renowned university, mention how often you made the Dean's list to underline academic excellence.

Regarding certifications, it's not necessary to list all of them. Instead, match up to three of your most recent or significant certificates with the technical skills required in the job description.

Below, we've selected some of the top industry certifications that could be vital additions to your tax preparer resume.

The top 5 certifications for your tax preparer resume:

- Enrolled Agent (EA) - Internal Revenue Service (IRS)

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Annual Filing Season Program (AFSP) - Internal Revenue Service (IRS)

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Accredited Tax Advisor (ATA) - Accreditation Council for Accountancy and Taxation (ACAT)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for tax preparer professionals.

Top US associations for a Tax Preparer professional

- AICPA and CIMA

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Recommended reads:

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your tax preparer resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world tax preparer professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a tax preparer job

- With over 15 years of dedicated experience as a CPA and a proven track record of success, including reducing a firm's tax liabilities by 25%, I am an adept tax preparer skilled in complex tax filing procedures, compliance, and strategic planning, seeking to leverage meticulous attention to detail and deep knowledge of tax regulations in aiding clients to optimize their financial outcomes.

- Detail-oriented financial analyst with comprehensive experience in budgeting and strategic forecasting looking to transition into tax preparation, bringing a fresh perspective along with strong analytical skills and a commitment to accuracy in dealing with financial data and regulatory tax requirements.

- Seasoned customer service manager with a decade of experience in a fast-paced retail environment, aiming to apply exceptional organizational skills and a passion for helping others to a new career path in tax preparation, eager to learn tax laws and provide top-tier financial services.

- Former educator with 8 years of experience in facilitating learning and promoting critical thinking, now seeking to apply transferable skills such as clear communication, problem-solving, and ongoing professional development to assist clients with their tax preparation needs and navigate the complexities of tax legislation.

- As a recent finance graduate with a strong foundation in accounting principles and tax-related coursework, I am enthusiastic about beginning a career in tax preparation, aiming to utilize my strong quantitative skills and proficiency in tax software to help clients achieve financial compliance effortlessly.

- Eager to take the first step into the financial services industry, I am a highly motivated individual armed with a comprehensive understanding of tax codes from recent university studies, and I am passionate about deploying my analytical abilities and detail-oriented nature in a dynamic environment aiding clients with their tax preparation and planning strategies.

Average salary info by state in the US for tax preparer professionals

Local salary info for Tax Preparer.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $58,530 |

| California (CA) | $70,280 |

| Texas (TX) | $51,670 |

| Florida (FL) | $36,190 |

| New York (NY) | $68,600 |

| Pennsylvania (PA) | $53,100 |

| Illinois (IL) | $75,570 |

| Ohio (OH) | $68,700 |

| Georgia (GA) | $54,230 |

| North Carolina (NC) | $59,510 |

| Michigan (MI) | $60,690 |

Bonus sections for your tax preparer resume

Looking to show more personality on your tax preparer resume? Then consider including a couple of extra sections.

They'd benefit your application by highlighting your most prominent:

Key takeaways

- The layout of your resume should take into consideration your professional background while integrating vital sections and design elements;

- Highlight your most pertinent achievements for the role all through different sections;

- Be very specific when selecting your certifications, hard skills, and soft skills to showcase the best of your talents;

- Include within the top one-third of your tax preparer resume a header and summary to help recruiters understand your experience and allocate your contact details. A skills box is optional, but it will help you align your expertise with the role;

- Detail the full extent of your professional experience with specific bullets that focus on tasks, actions, and outcomes.

Tax Preparer resume examples

By Experience

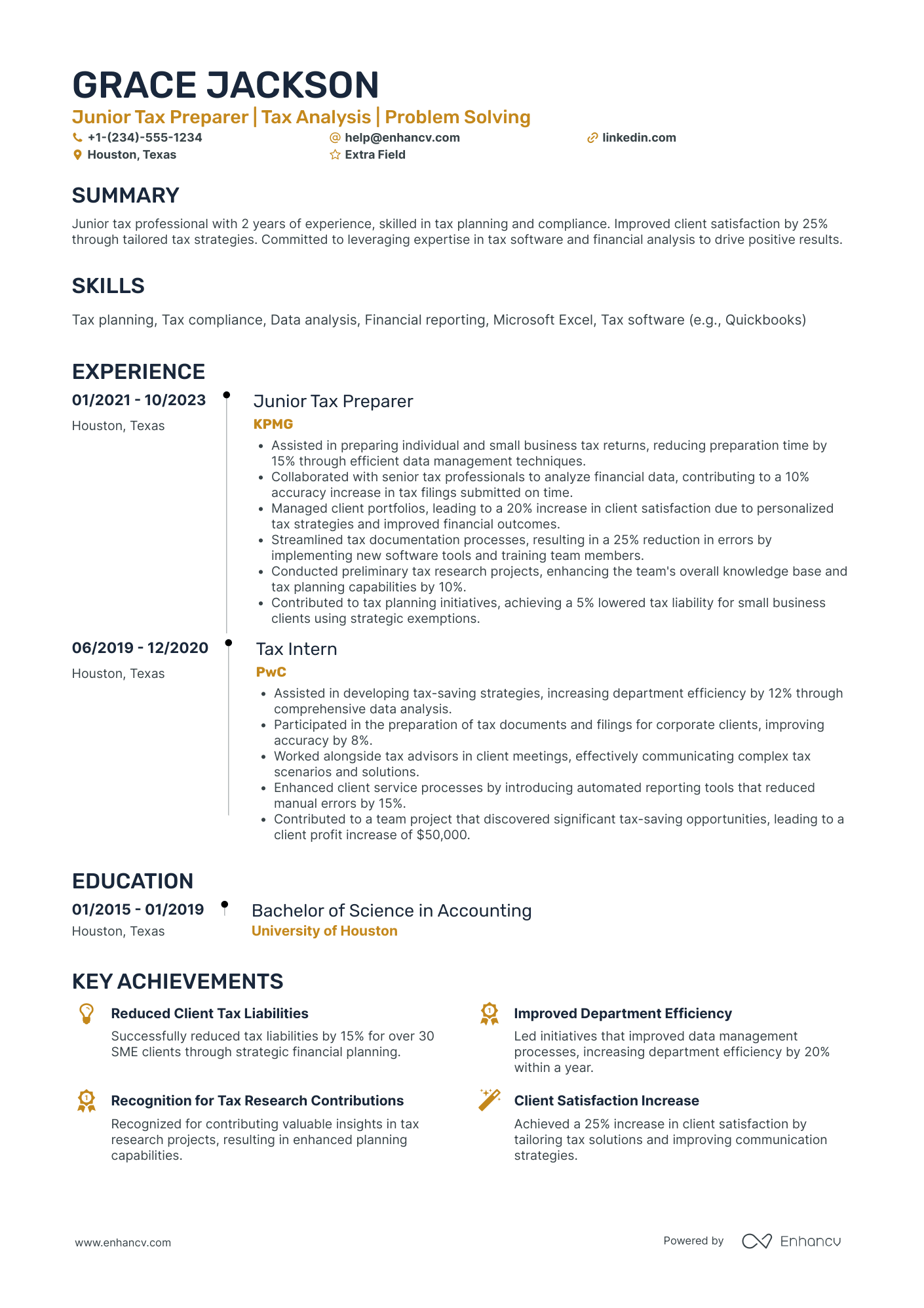

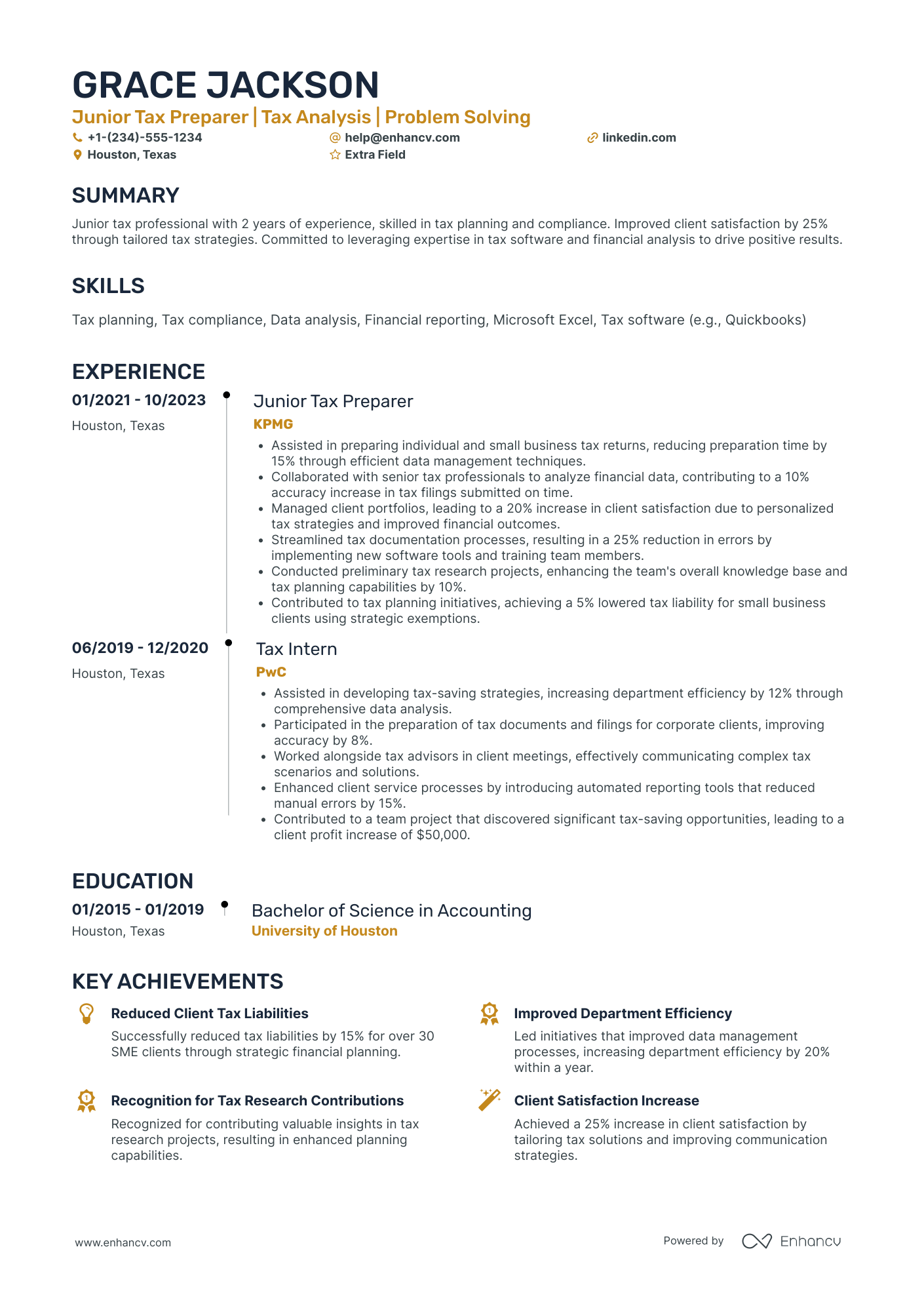

Junior Tax Preparer

Entry-Level Tax Preparer

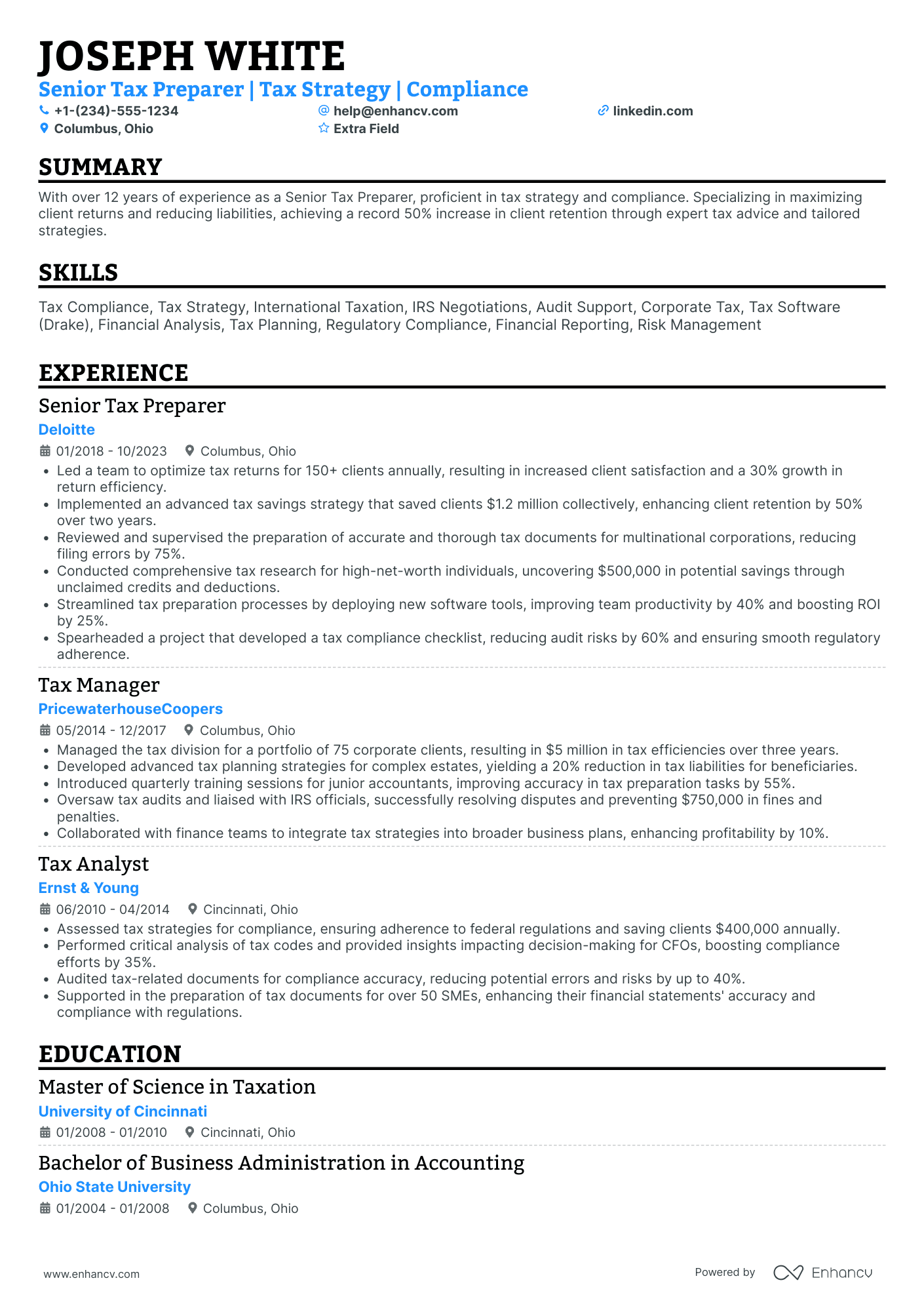

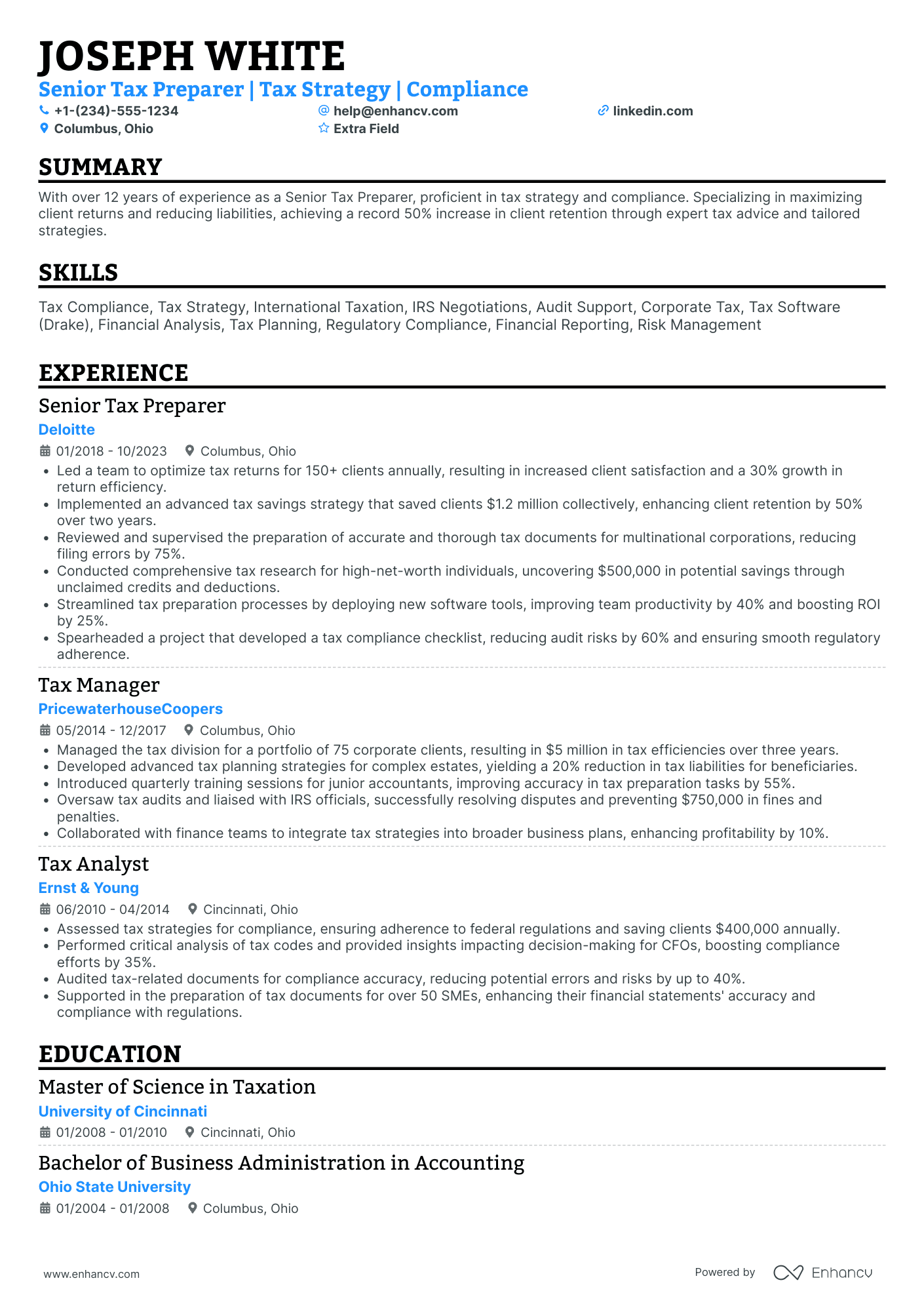

Senior Tax Preparer

Lead Tax Preparer

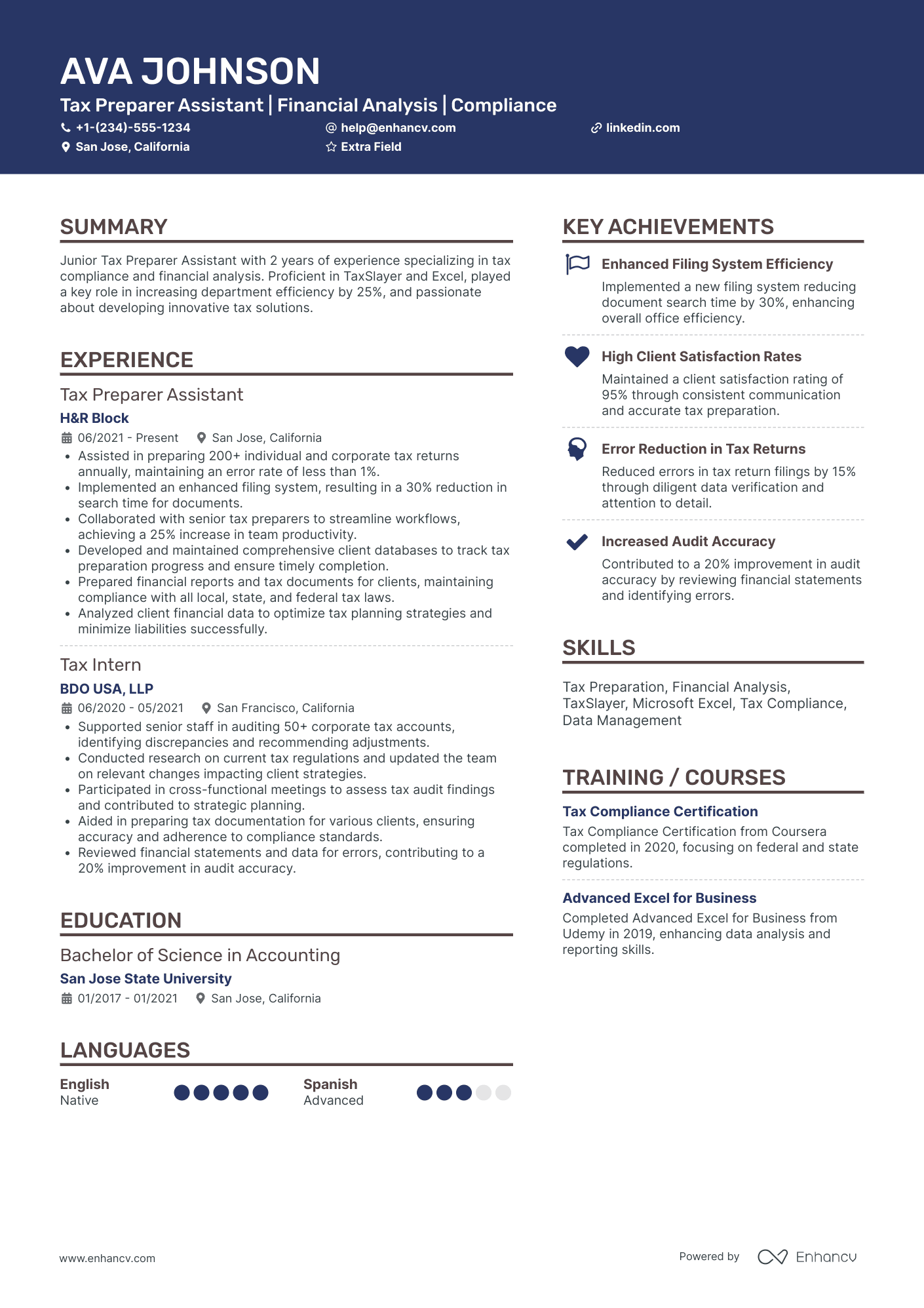

Tax Preparer Assistant

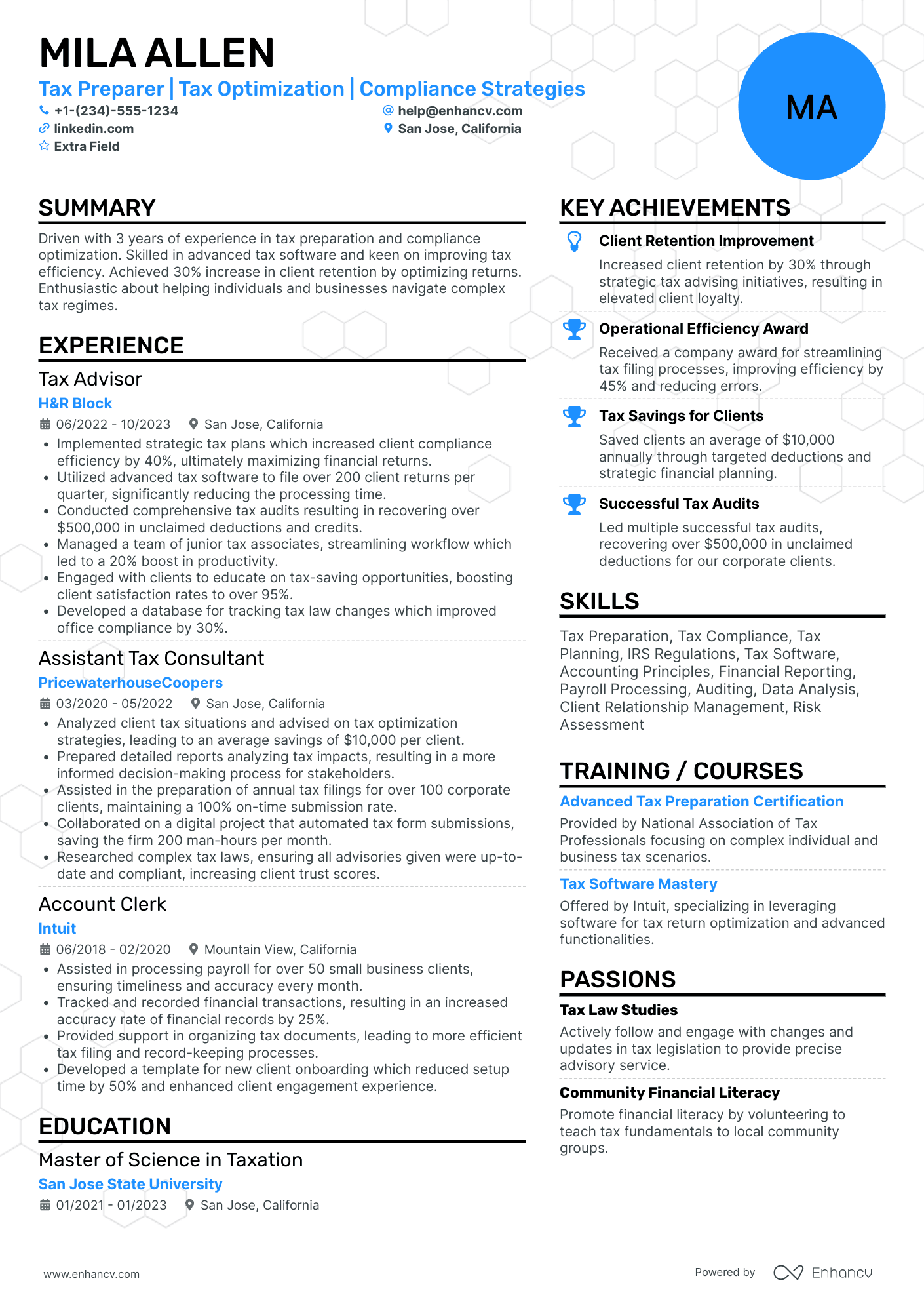

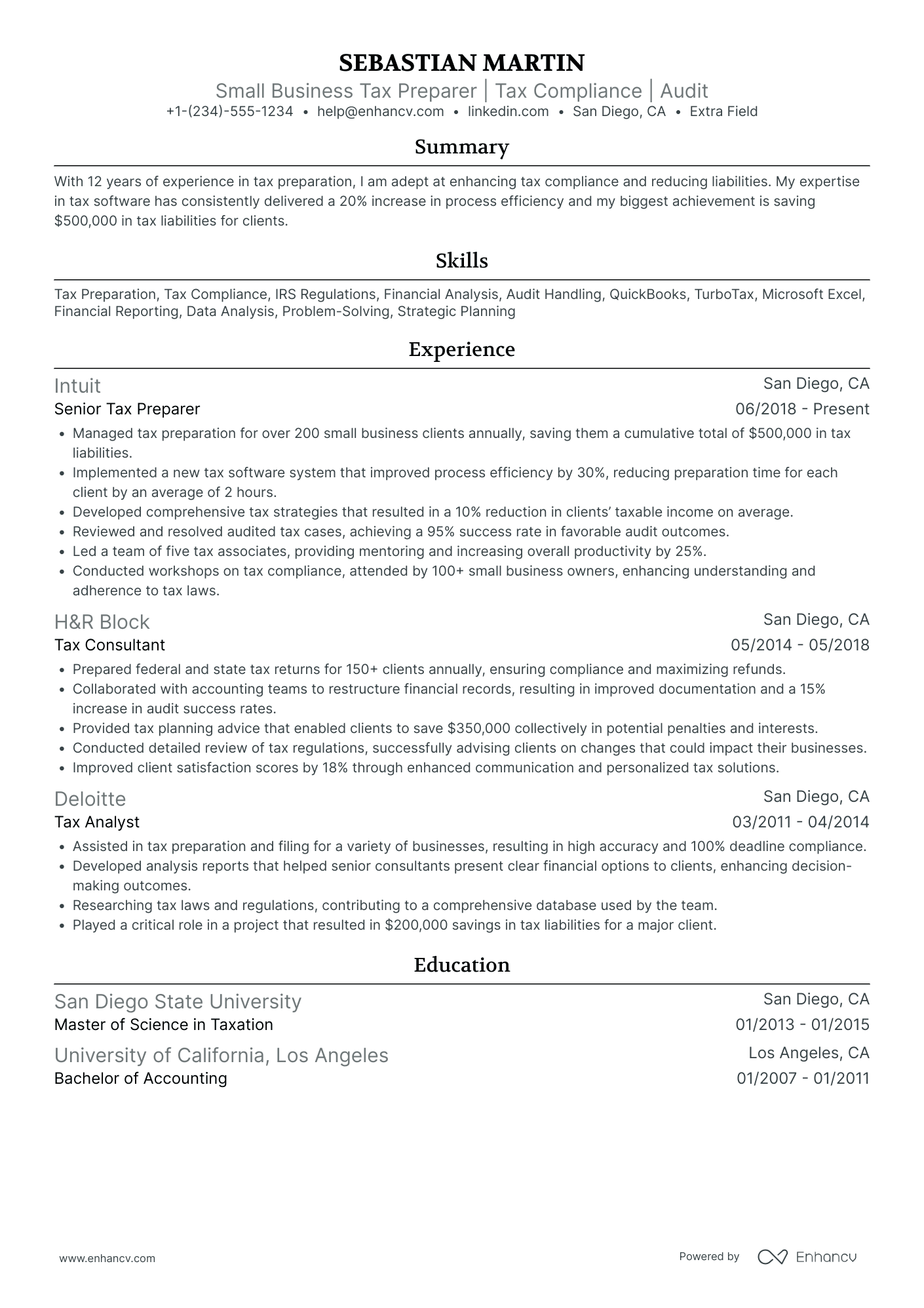

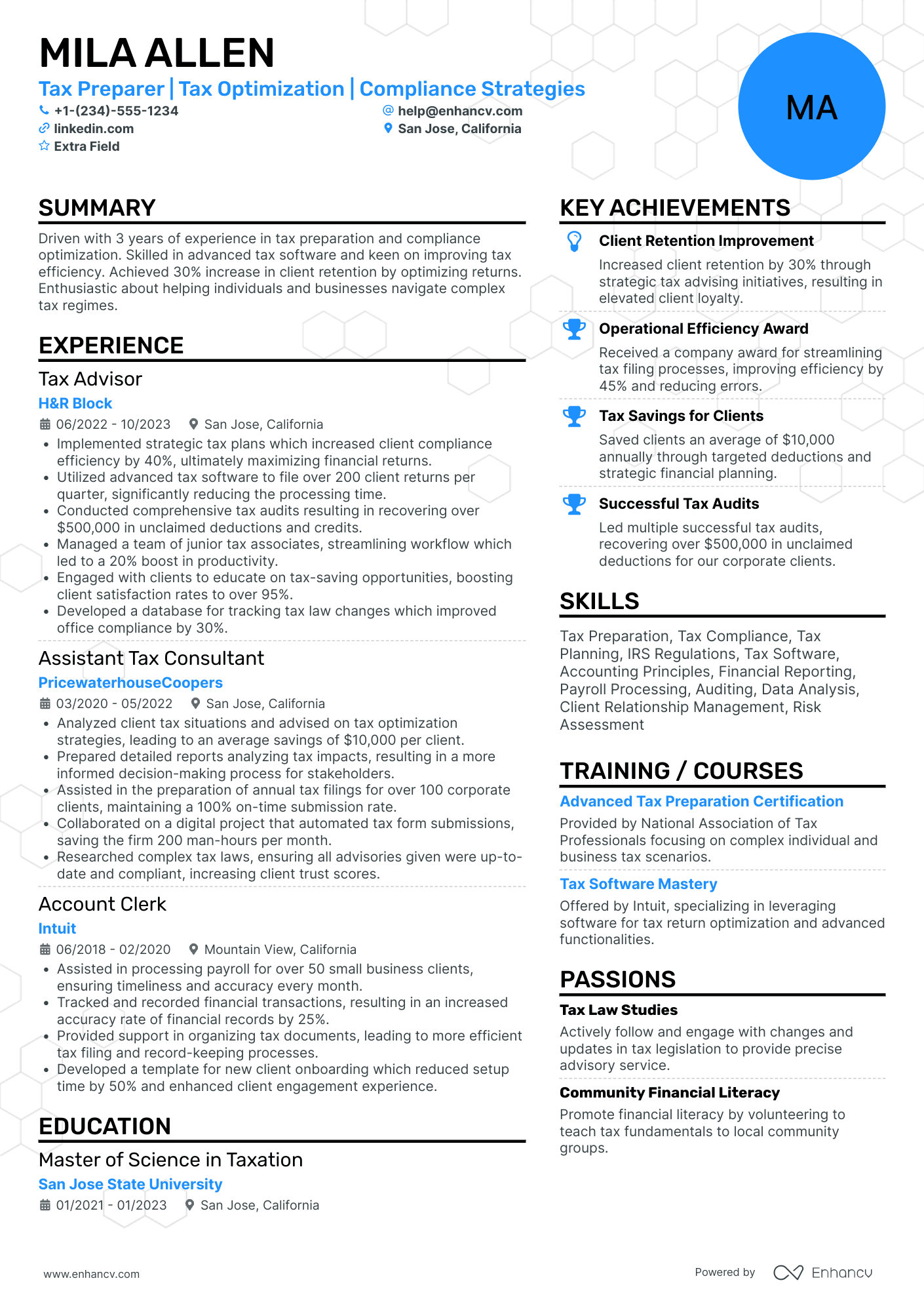

By Role