As a financial administrator, articulating your broad range of complex technical skills and financial management expertise in a clear and concise manner can be a daunting resume challenge. Our comprehensive guide offers you tailored strategies to showcase your qualifications effectively, ensuring your prowess in fiscal stewardship shines through to potential employers.

- Sample industry-leading professional resumes for inspiration and financial administrator resume-writing know-how.

- Focus recruiters' attention on what matters most - your unique experience, achievements, and skills.

- Write various resume sections to ensure you meet at least 95% of all job requirements.

- Balance your financial administrator technical expertise with personality to stand out amongst candidates.

If the financial administrator resume isn't the right one for you, take a look at other related guides we have:

- External Auditor Resume Example

- Functional Accounting Resume Example

- Finance Executive Resume Example

- Hotel Accounting Resume Example

- Project Accounting Resume Example

- Financial Project Manager Resume Example

- Full Cycle Accounting Resume Example

- Audit Manager Resume Example

- Fund Accountant Resume Example

- Purchasing Director Resume Example

Enhancing your financial administrator resume: format and layout tips

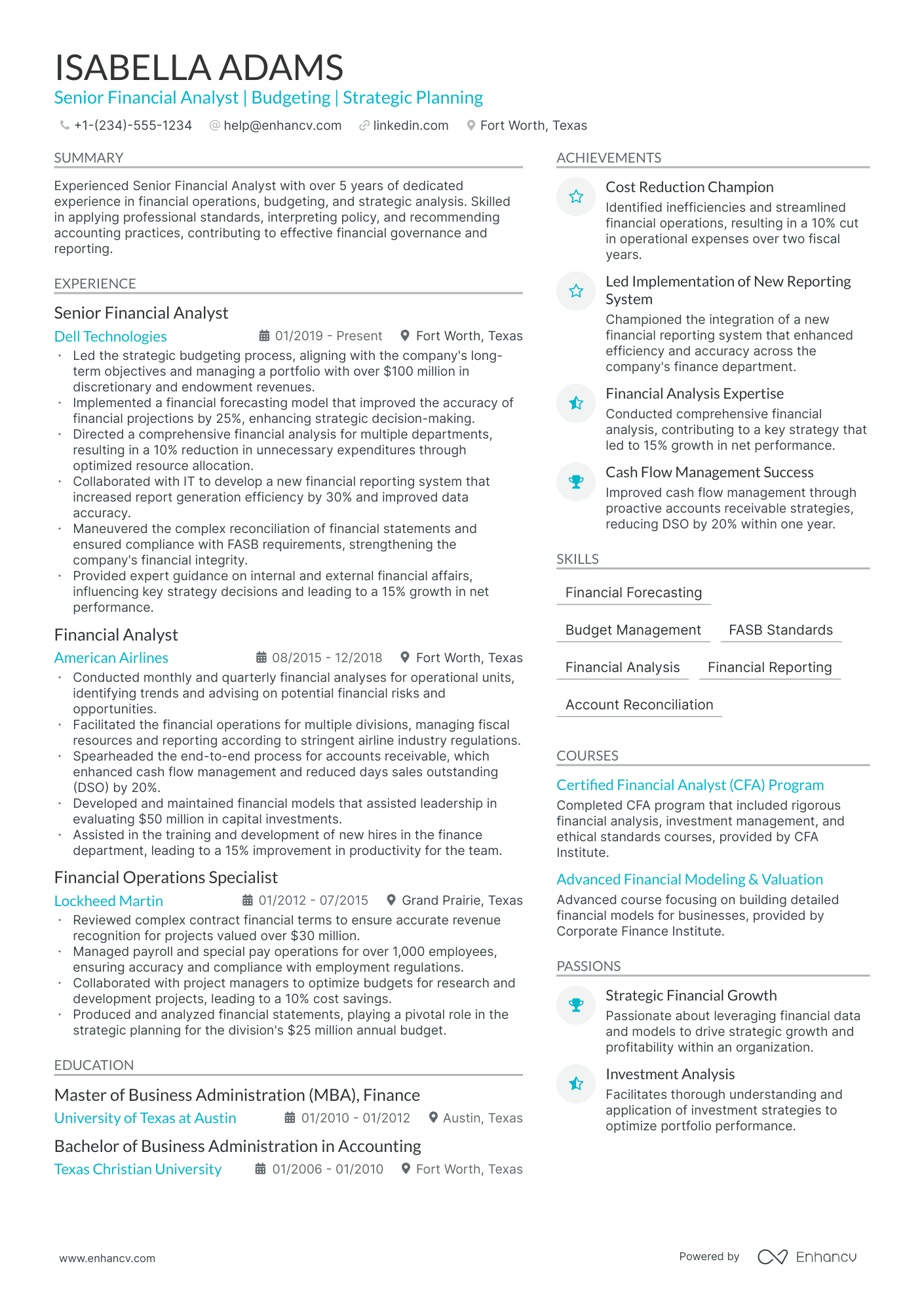

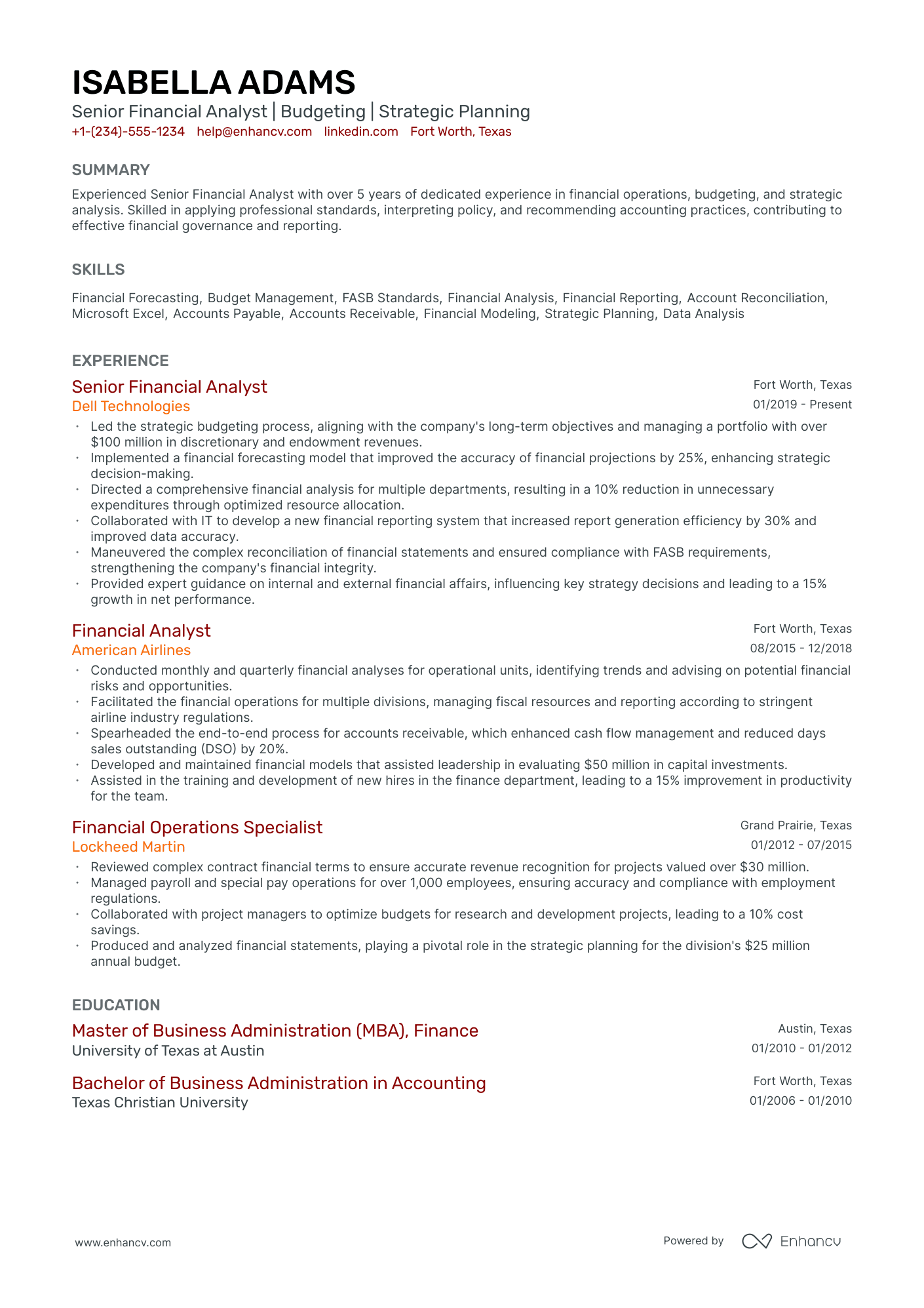

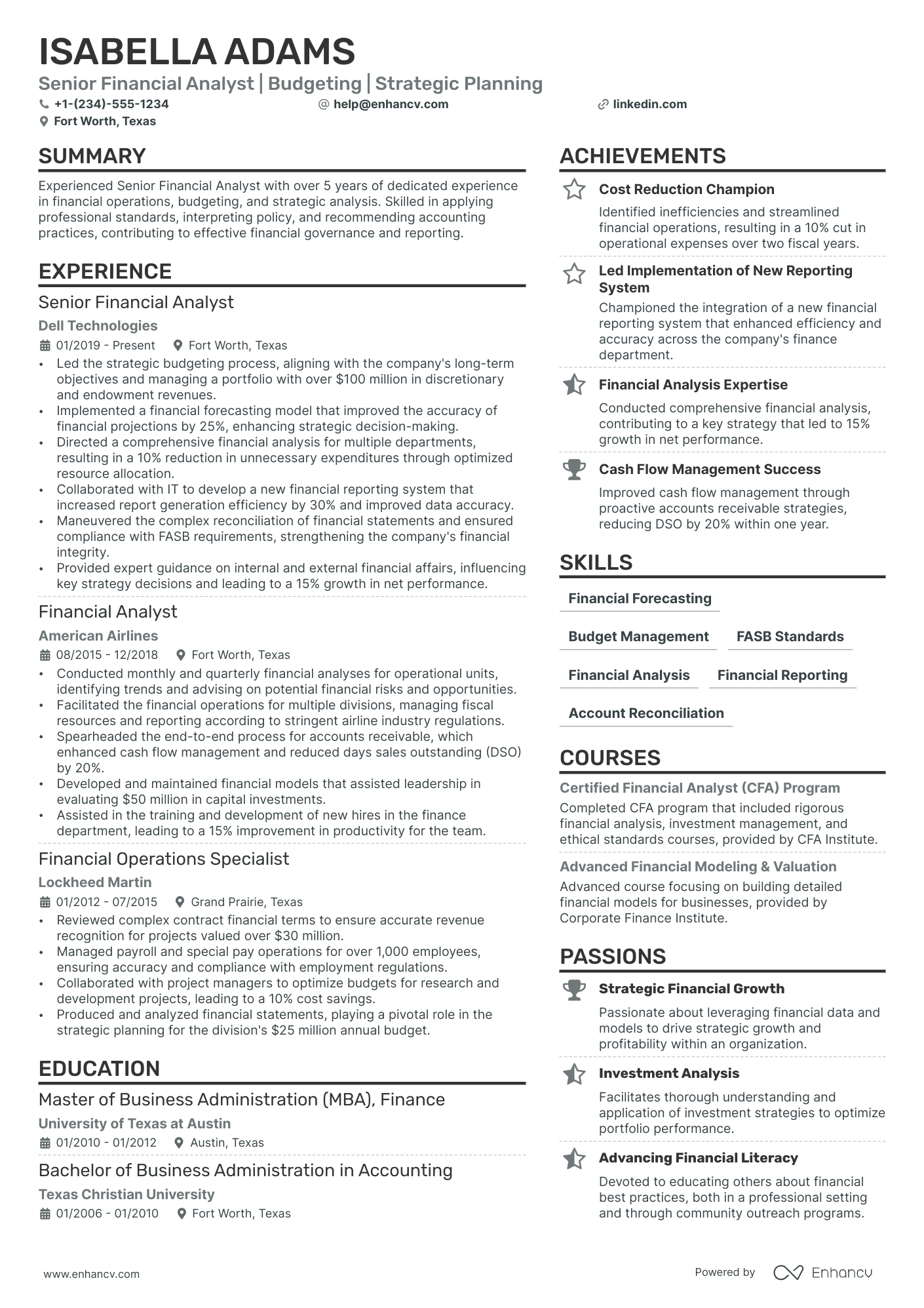

"Less is more" - this principle is key for your financial administrator resume design. It emphasizes the importance of focusing on why you're the ideal candidate. Simultaneously, it's crucial to select a resume design that is both clear and simple, ensuring your qualifications are easily readable.Four popular formatting rules (and an additional tip) are here to optimize your financial administrator resume:

- Listing experience in reverse chronological order - start with your most recent job experiences. This layout helps recruiters see your career progression and emphasizes your most relevant roles.

- Including contact details in the header - make sure your contact information is easily accessible at the top of your resume. In the header, you might also include a professional photo.

- Aligning your expertise with the job requirements - this involves adding essential sections such as experience, skills, and education that match the job you're applying for.

- Curating your expertise on a single page - if your experience spans over a decade, a two-page resume is also acceptable.

Bonus tip: Ensure your financial administrator resume is in PDF format when submitting. This format maintains the integrity of images, icons, and layout, making your resume easier to share.

Finally, concerning your resume format and the Applicant Tracker System (ATS):

- Use simple yet modern fonts like Rubik, Lato, Montserrat, etc.

- All serif and sans-serif fonts are friendly to ATS systems. Avoid script fonts that look like handwriting, however.

- Fonts such as Ariel and Times New Roman are suitable, though commonly used.

- Both single and double-column resumes can perform well with the ATS.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

Fundamental sections for your financial administrator resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Extensive experience in financial reporting, budgeting, and forecasting to showcase an ability to manage an organization's financial health.

- Proficiency in financial software and advanced Excel skills, indicating the ability to perform complex financial analyses and manage large data sets.

- Demonstrated knowledge of financial regulations and compliance standards to ensure the company meets all legal financial obligations.

- Strong leadership and team management abilities, as financial administrators often oversee finance departments and need to guide their teams effectively.

- Proven track record in implementing financial controls and processes which have led to cost savings or financial efficiencies for previous employers.

Creating your financial administrator resume experience to catch recruiters' attention

Remember that for the financial administrator role, hiring managers are looking to see how your expertise aligns with their requirements. Here's where your resume experience section can help out. Make sure you:

- Include mainly roles that are relevant to the financial administrator job you're applying for;

- Don't go too far back in your experience - recruiters will only care what you did a decade ago if it's really important for the financial administrator role;

- Each bullet you include should say what you did, followed by the skills you used and the actual end result of your efforts;

- Quantify each of your achievements with numbers and possibly the overall effect it had on the organization;

- Highlight transferrable skills - or personal skills you've attained thanks to past jobs - that could be applicable within your potential workplace. This would showcase your unique value as a professional.

Formatting the experience section of your resume doesn't have to be an over-the-top deep dive into your whole career. Follow the financial administrator resume examples below to see how industry-leading professionals are presenting their experience:

- Managed a financial portfolio for mid-sized clients averaging $10M, improving investment strategies and optimizing tax liabilities.

- Led a team of 5 junior financial analysts to monitor and report on fiscal performance indicators, enhancing data-driven decisions.

- Implemented a new risk management framework that reduced financial discrepancies by 20% over a 2-year period.

- Oversaw the reconciliation of financial accounts amounting to over $30M, ensuring accuracy in all financial reporting.

- Streamlined the monthly close process, reducing the cycle time by 30% while maintaining compliance with GAAP.

- Collaborated with cross-functional teams to roll out an enterprise-wide budgeting software, leading to a 15% reduction in budgeting errors.

- Developed and maintained financial databases and systems, ensuring data integrity and security for transactions totaling $50M annually.

- Negotiated with vendors to reduce supply costs by 12%, effectively increasing the company’s net profit margin.

- Provided strategic financial insights that helped shape the company’s expansion into new markets, resulting in a 25% revenue growth.

- Designed detailed financial models for projected company growth, directly affecting investment decisions and contributing to a 35% growth in equity valuation.

- Directed quarterly budget reviews, identifying and addressing variances, thereby strengthening financial controls and forecasting.

- Enhanced financial reporting mechanisms which improved the decision-making process for senior management on key business initiatives.

- Facilitated the processing of payroll and benefits for over 500 employees, ensuring timely and accurate salary distribution.

- Improved cash flow management by forecasting weekly, monthly, and quarterly cash requirements, aiding in effective fund allocation.

- Played a pivotal role in the year-end audit preparation, which led to a 100% compliant audit rating from the external auditors.

- Coordinated with department heads to develop a unified cost-cutting strategy that decreased operational expenses by 18% without impacting productivity.

- Automated financial reporting processes using advanced Excel functions and macros, saving the team 10 hours per week in manual data entry.

- Played a key role in a merger analysis, leading to a successful merge with a competing firm and an increase in market share.

- Executed daily financial transactions, including AP/AR, payroll, and capital expenditures, for a company with annual revenues exceeding $75M.

- Introduced robust financial control systems that slashed accounting errors by 22% and safeguarded company assets.

- Initiated a financial literacy program for all employees, improving overall financial awareness and contributing to more cost-effective decision-making.

- Administered the financial aspects of international projects totaling over $200M, while ensuring compliance with both domestic and international financial regulations.

- Partnered with IT to develop a custom financial management information system, boosting reporting efficiency by 40%.

- Spearheaded the successful acquisition and integration of a smaller firm, resulting in the expansion of the company’s service offerings and a 10% increase in annual revenue.

- Orchestrated the financial component of a corporate restructuring that reduced overhead costs by $5M annually while maintaining key employee retention.

- Championed the application of Six Sigma methodologies to the finance department, significantly improving process efficiency.

- Successfully advocated for and managed the transition to a new financial software platform, leading to more accurate financial tracking and analysis.

- Rectified a chronic budget misalignment issue by introducing a new forecasting tool, directly impacting project profitability.

- Supervised the financial integration of two newly acquired companies, ensuring a seamless transition and uninterrupted financial operations.

- Implemented a tax optimization strategy that saved $2M in tax liabilities over a 3-year period by leveraging new tax code revisions.

Quantifying impact on your resume

- Include the total amount of funds you managed or oversaw to showcase your capability in handling substantial financial responsibilities.

- Highlight any cost-saving measures you implemented and the resulting percentage decrease in expenses to demonstrate your resourcefulness and efficiency.

- Provide the exact number of financial reports you prepared and analysis projects you conducted to emphasize your experience and technical skills.

- Mention the size of the team you supervised, if applicable, to illustrate your leadership and management experience.

- Quantify any improvements you contributed to in financial processes or systems, using percentages or time saved, to show your impact on operational efficiency.

- List any achievements in revenue growth, such as percentage increase, to underscore your role in driving profitability.

- Include the number of audits you completed and any discrepancies identified to convey your attention to detail and compliance expertise.

- Specify the value of investments you managed or advised on to highlight your ability to make strategic financial decisions.

Action verbs for your financial administrator resume

What can candidates do about their resume, if they have no experience

Job requirements can sometimes be answered by other elements you could make more prominent in your financial administrator resume.

Thus, you'd be substituting your lack of experience with your relevant:

- Education with details of skills you've obtained that align with the job

- Internships and short-term jobs that are once more dedicated to putting your expertise in the spotlight

- Skills section answering basic and - potentially - more specific job qualifications

- Strengths or accomplishments to show the unique value you present, even as a candidate with less or no professional experience in the industry.

Recommended reads:

PRO TIP

Always remember that your financial administrator certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

In-demand hard skills and soft skills for your financial administrator resume

A vital element for any financial administrator resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your financial administrator skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "financial administrator skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your financial administrator resume:

Financial Reporting

Accounting

Budget Management

Financial Analysis

Cash Flow Management

General Ledger

Payroll Processing

Tax Preparation

Audit Compliance

Financial Software Proficiency

Attention to Detail

Critical Thinking

Problem-Solving

Time Management

Communication Skills

Adaptability

Leadership

Organization

Integrity

Collaboration

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Certifications and education: in-demand sections for your financial administrator resume

Your academic background in the form of certifications on your resume and your higher degree education is important to your application.

The certifications and education sections pinpoint a variety of hard and soft skills you possess, as well as your dedication to the industry.

Add relevant certificates to your financial administrator resume by:

- Add special achievements or recognitions you've received during your education or certification, only if they're really noteworthy and/or applicable to the role

- Be concise - don't list every and any certificate you've obtained through your career, but instead, select the ones that would be most impressive to the role

- Include the name of the certificate or degree, institution, graduation dates, and certificate license numbers (if possible)

- Organize your education in reverse chronological format, starting with the latest degree you have that's most applicable for the role

Think of the education and certification sections as the further credibility your financial administrator resume needs to pinpoint your success.

Now, if you're stuck on these resume sections, we've curated a list of the most popular technical certificates across the industry.

Have a look, below:

The top 5 certifications for your financial administrator resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Recommended reads:

Professional summary or objective for your financial administrator resume

financial administrator candidates sometimes get confused between the difference of a resume summary and a resume objective.

Which one should you be using?

Remember that the:

- Resume objective has more to do with your dreams and goals for your career. Within it, you have the opportunity to showcase to recruiters why your application is an important one and, at the same time, help them imagine what your impact on the role, team, and company would be.

- Resume summary should recount key achievements, tailored for the role, through your career. Allowing recruiters to quickly scan and understand the breadth of your financial administrator expertise.

The resume objectives are always an excellent choice for candidates starting off their career, while the resume summary is more fitting for experienced candidates.

No matter if you chose a summary or objective, get some extra inspiration from real-world professional financial administrator resumes:

Resume summaries for a financial administrator job

- With over 10 years of dedicated financial administration expertise, including advanced proficiency in Oracle and Excel, I excelled in managing a $30 million budget at a Fortune 500 company, significantly reducing overhead by 15% through strategic cost analysis and control measures.

- Seasoned financial professional bringing 8 years of experience in overseeing financial operations for a multinational tech firm, where I implemented streamlined accounting processes that improved reporting efficiency by 20% and played a pivotal role in a successful IPO.

- Former Senior Data Analyst seeking to leverage a strong analytical background and a Master's in Business Analytics towards a career in financial administration, aiming to apply predictive modeling skills to enhance financial decision-making and efficiency.

- As an experienced Project Manager transitioning into financial administration, I bring a robust understanding of budget management and project financing from successfully handling projects worth over $15 million, aiming to contribute exceptional organizational skills to optimize financial processes.

- Eager to embark on a career in financial administration, armed with a recent MBA with a focus on Finance and a dedicated commitment to developing comprehensive budget management and financial analysis expertise to drive successful fiscal strategies.

- Recent Finance graduate passionate about starting a career in financial administration; I am enthusiastic about applying my academic knowledge, including high-level coursework in financial modeling and investment strategies, and contributing to the financial success of dynamic organizations.

Beyond your financial administrator resume basics - extra sections

Ensure your financial administrator resume stands out from the crowd by spicing it up with a couple of supplementary sections that showcase your:

- Prizes - as a special nod to what matters most in the field;

- Projects - ones that would really further support your application;

- Hobbies - include only if you think they'd further your chances at landing the role with personality

- Community impact - to hint at the causes you care about.

Key takeaways

- Pay special attention to the tiny details that make up your financial administrator resume formatting: the more tailored your application to the role is, the better your chances at success would be;

- Select the sections you include (summary or objective, etc.) and formatting (reverse-chronological, hybrid, etc.) based on your experience level;

- Select experience items and, consequently, achievements that showcase you in the best light and are relevant to the job;

- Your profile will be assessed both based on your technical capabilities and personality skills - curate those through your resume;

- Certifications and education showcase your dedication to the particular industry.