As a financial advisor, articulating your complex experience and ensuring it resonates with both industry and client-centric roles can be a significant resume challenge. Our guide provides targeted advice and examples to help you distill your expertise into a compelling narrative that appeals to diverse stakeholders in your career journey.

- Get inspired from our financial advisor resume samples with industry-leading skills, certifications, and more.

- Show how you can impact the organization with your resume summary and experience.

- Introducing your unique financial advisor expertise with a focus on tangible results and achievements.

If the financial advisor resume isn't the right one for you, take a look at other related guides we have:

- Cost Accounting Resume Example

- Finance Specialist Resume Example

- General Ledger Accounting Resume Example

- Risk Manager Resume Example

- Purchase Manager Resume Example

- Accounts Receivable Resume Example

- Financial Consultant Resume Example

- Bid Manager Resume Example

- Treasury Manager Resume Example

- Payroll Admin Resume Example

Creating the best financial advisor resume format: four simple steps

The most appropriate financial advisor resume format is defined by precision and a systematic approach. What is more, it should reflect upon how your application will be assessed by recruiters. That is why we've gathered four of the most vital elements to keep in mind when designing your resume:

- It's all about presenting how your experience or skills align with the job. Use the reverse-chronological resume format , if your expertise is relevant to the financial advisor role. Otherwise, select the functional skill-based resume format or the hybrid resume format to shift the focus to your skill set.

- Resume header - make sure you've filled out all relevant (and correct) information, like your contact details and link to your portfolio.

- Resume length - unless you've over a decade of applicable expertise in the field, stick with a one-page resume format. If you'd like to present more of your professional experience, go up to two pages.

- Resume file - submit your financial advisor resume in a PDF format to ensure all information stays in the same place.

The layout of a resume can differ by region – Canadian resumes may use a distinct format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Essential sections that should make up your financial advisor resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the financial advisor role

What recruiters want to see on your resume:

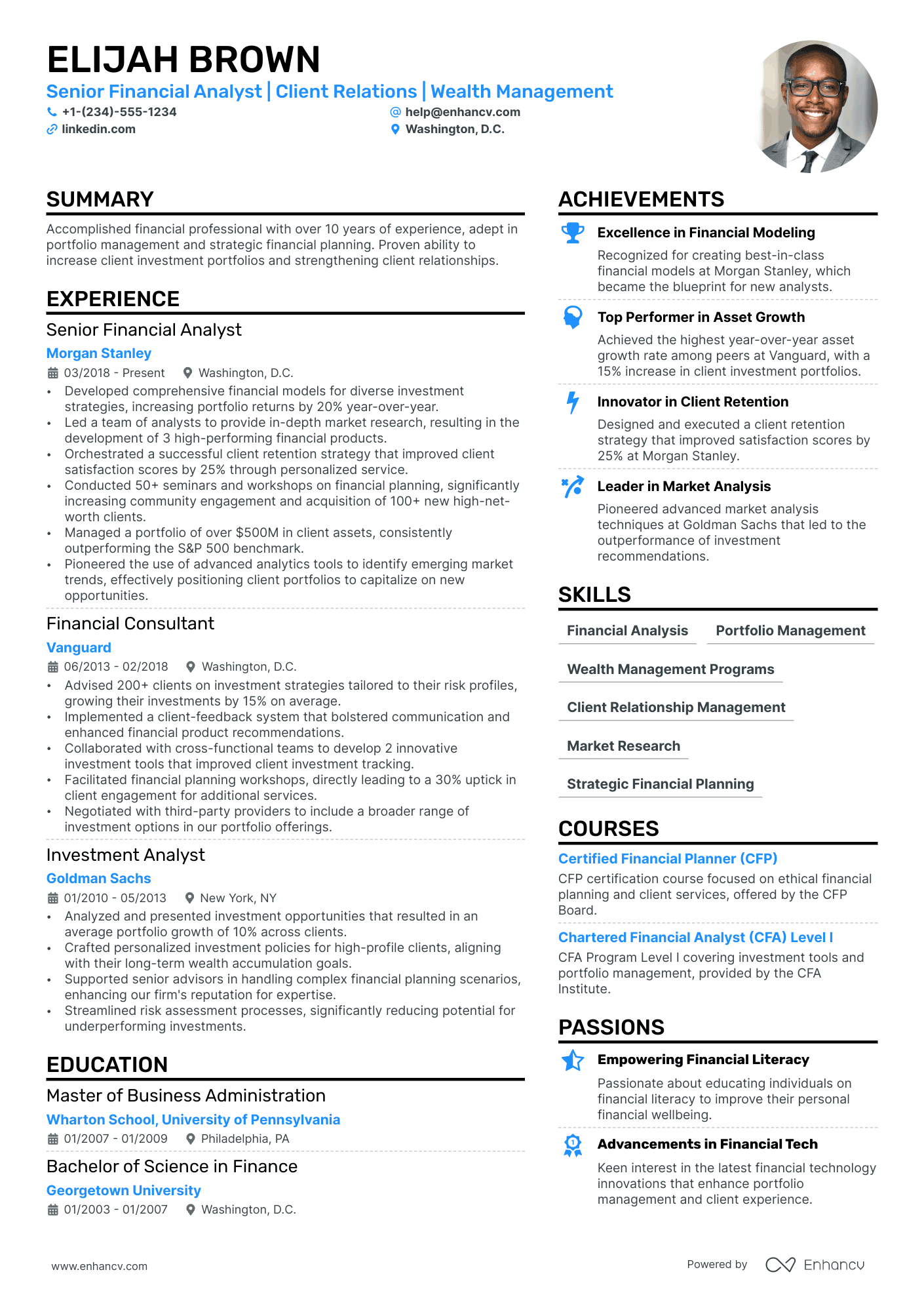

- Demonstrated success in client portfolio management and investment strategy

- Proficiency with financial planning software and platforms (e.g., Morningstar, Bloomberg, etc.)

- Relevant certifications and designations (e.g., CFP, CFA, Series 7/63 licenses)

- Experience with tax planning, estate planning, and retirement strategies

- Strong track record of business development and client retention

Writing your financial advisor resume experience

Within the body of your financial advisor resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your financial advisor professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

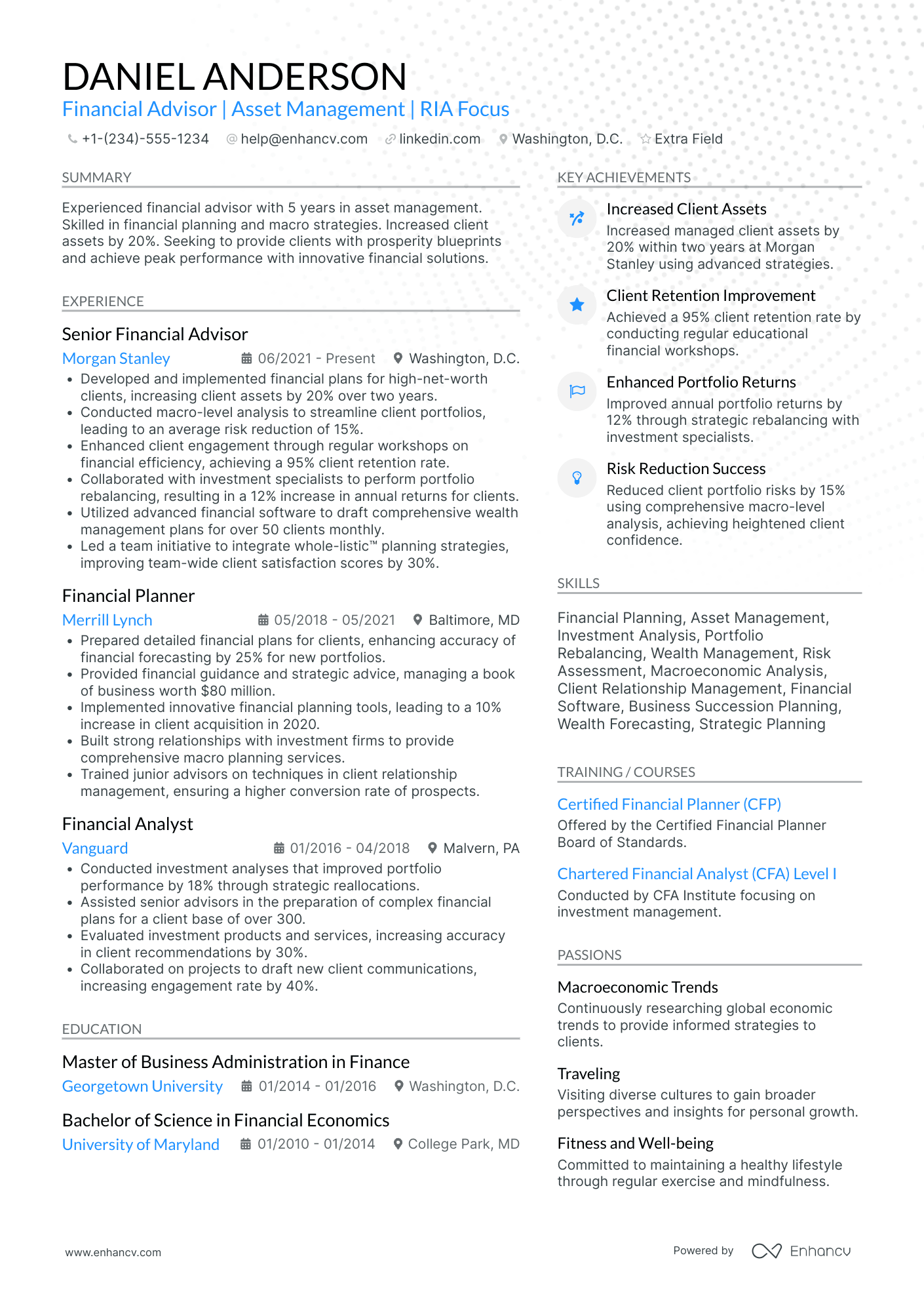

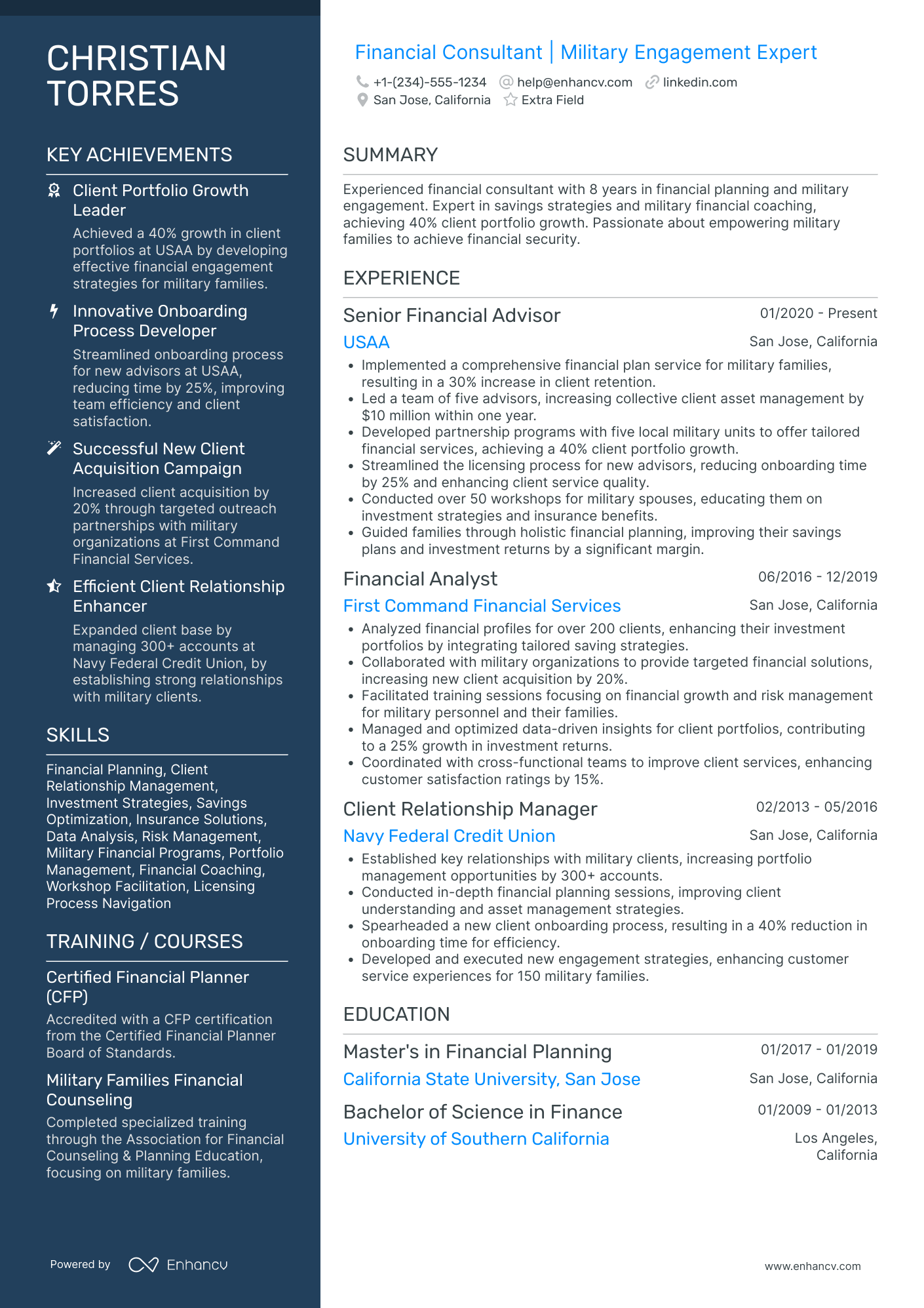

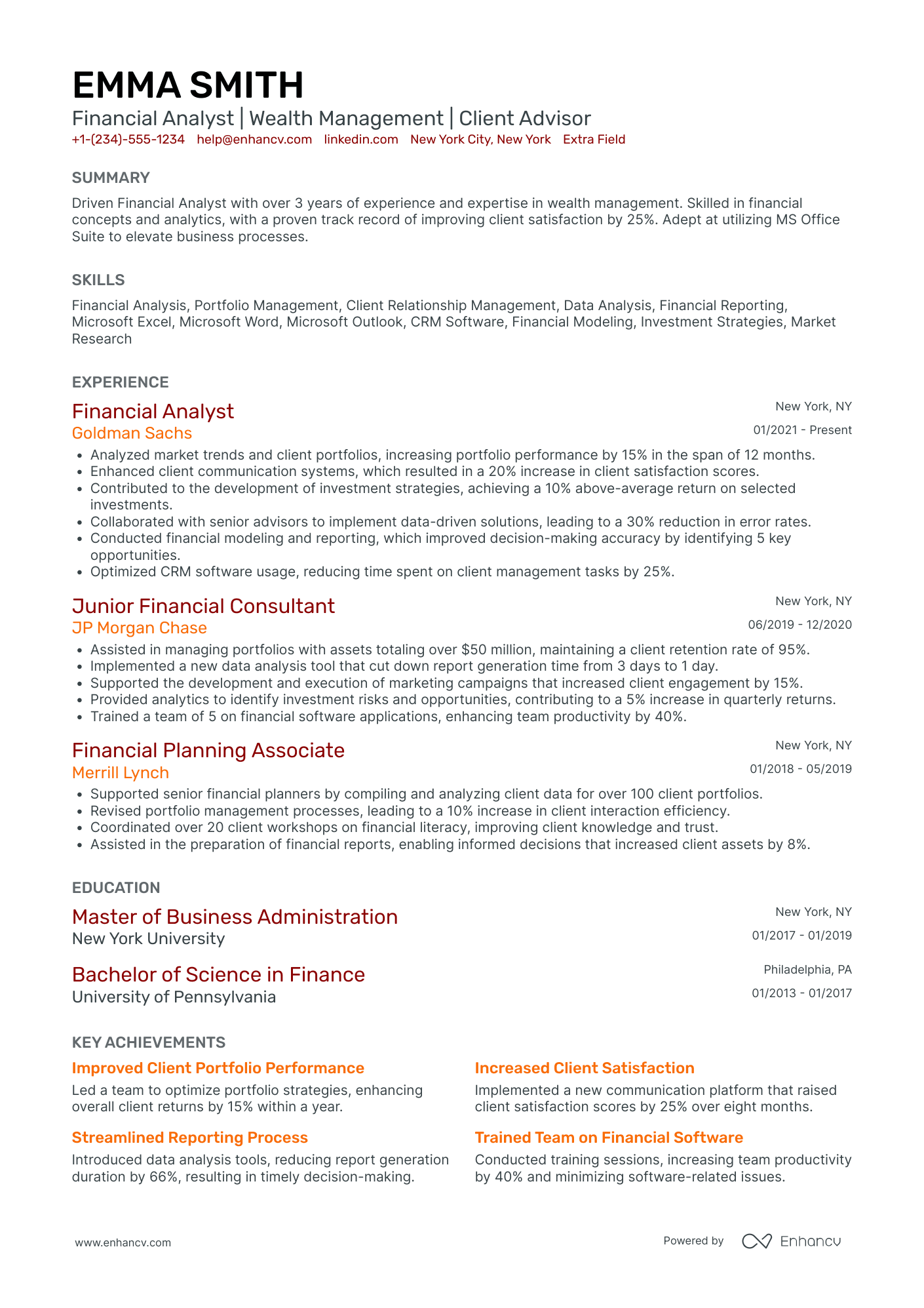

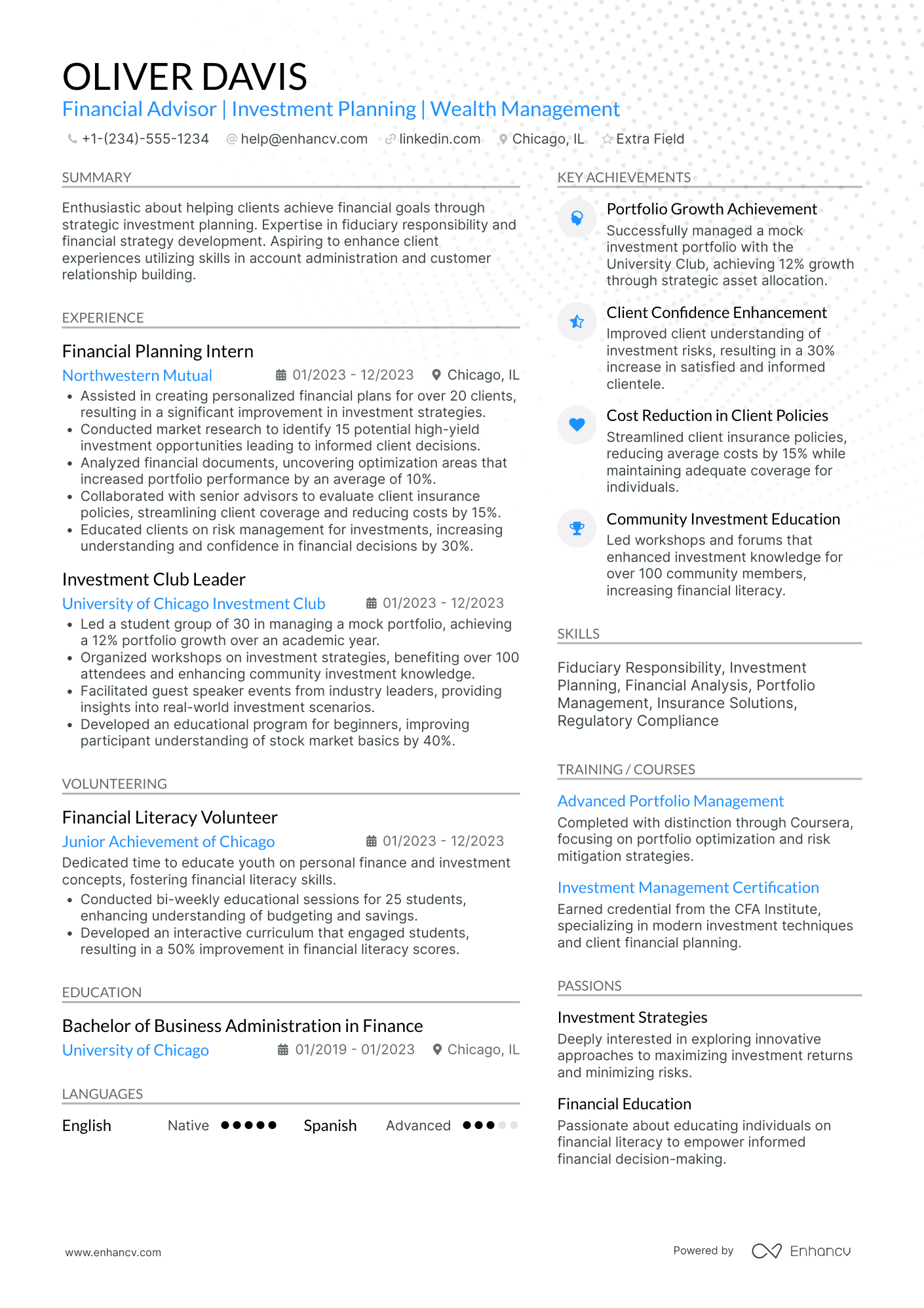

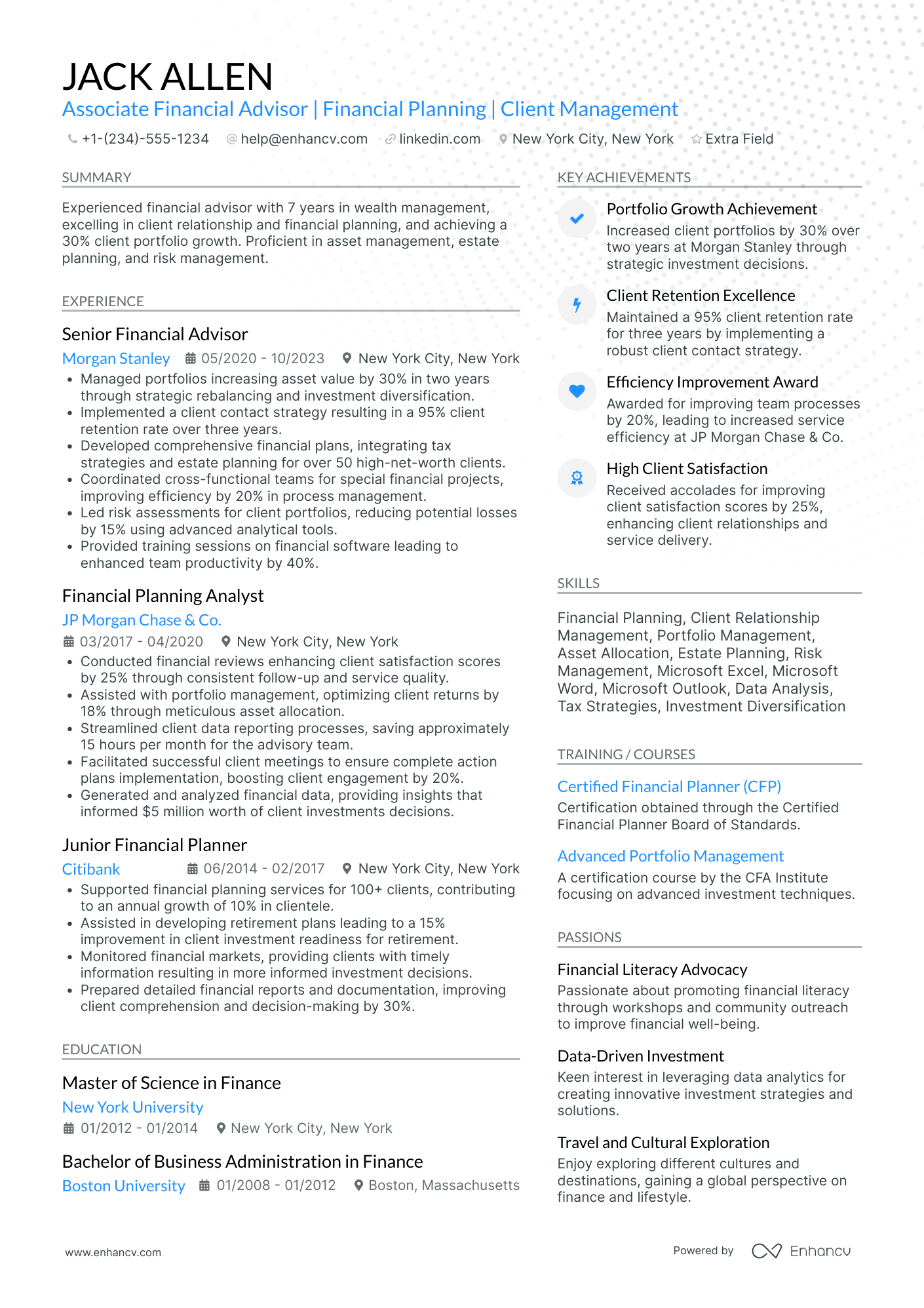

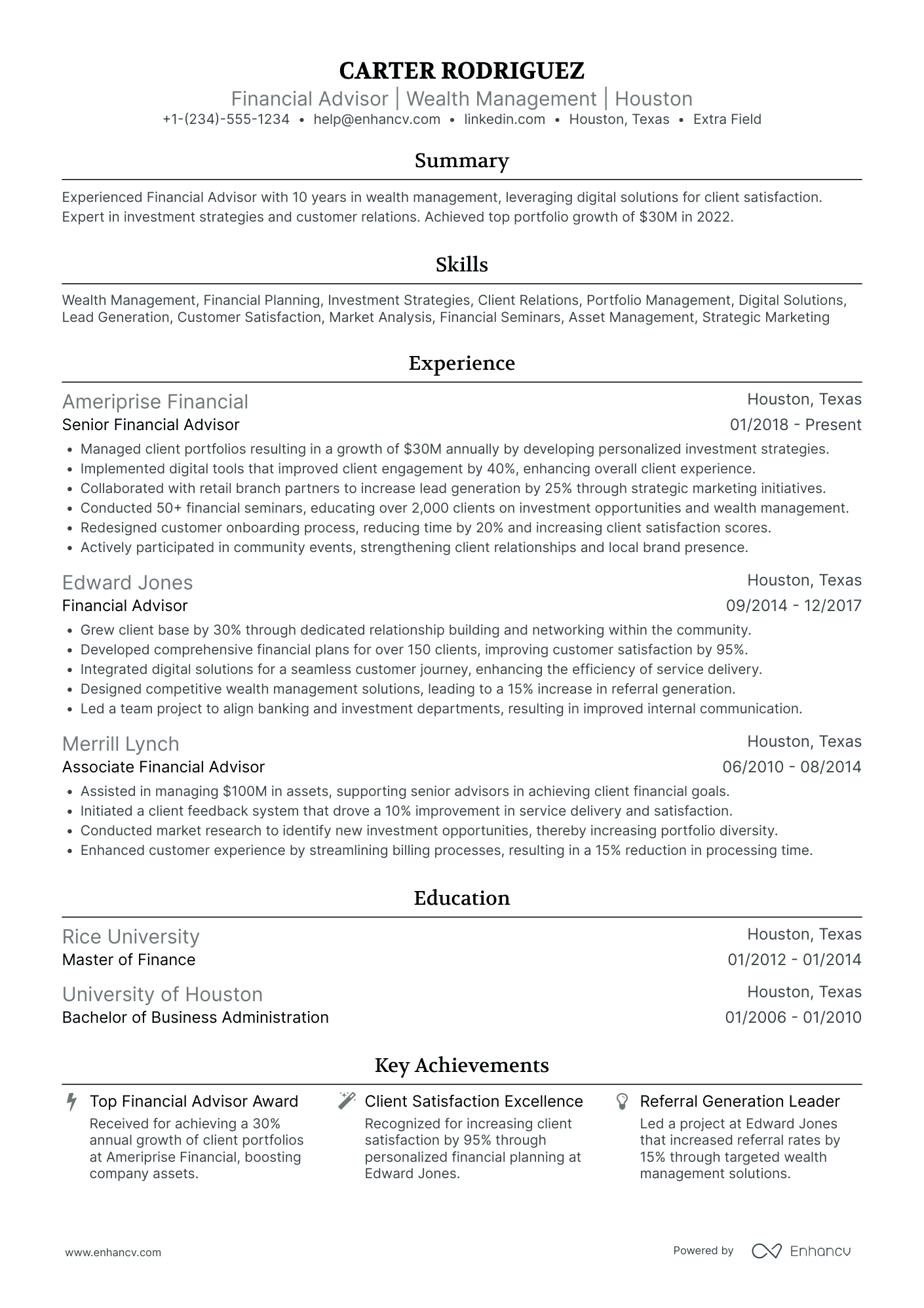

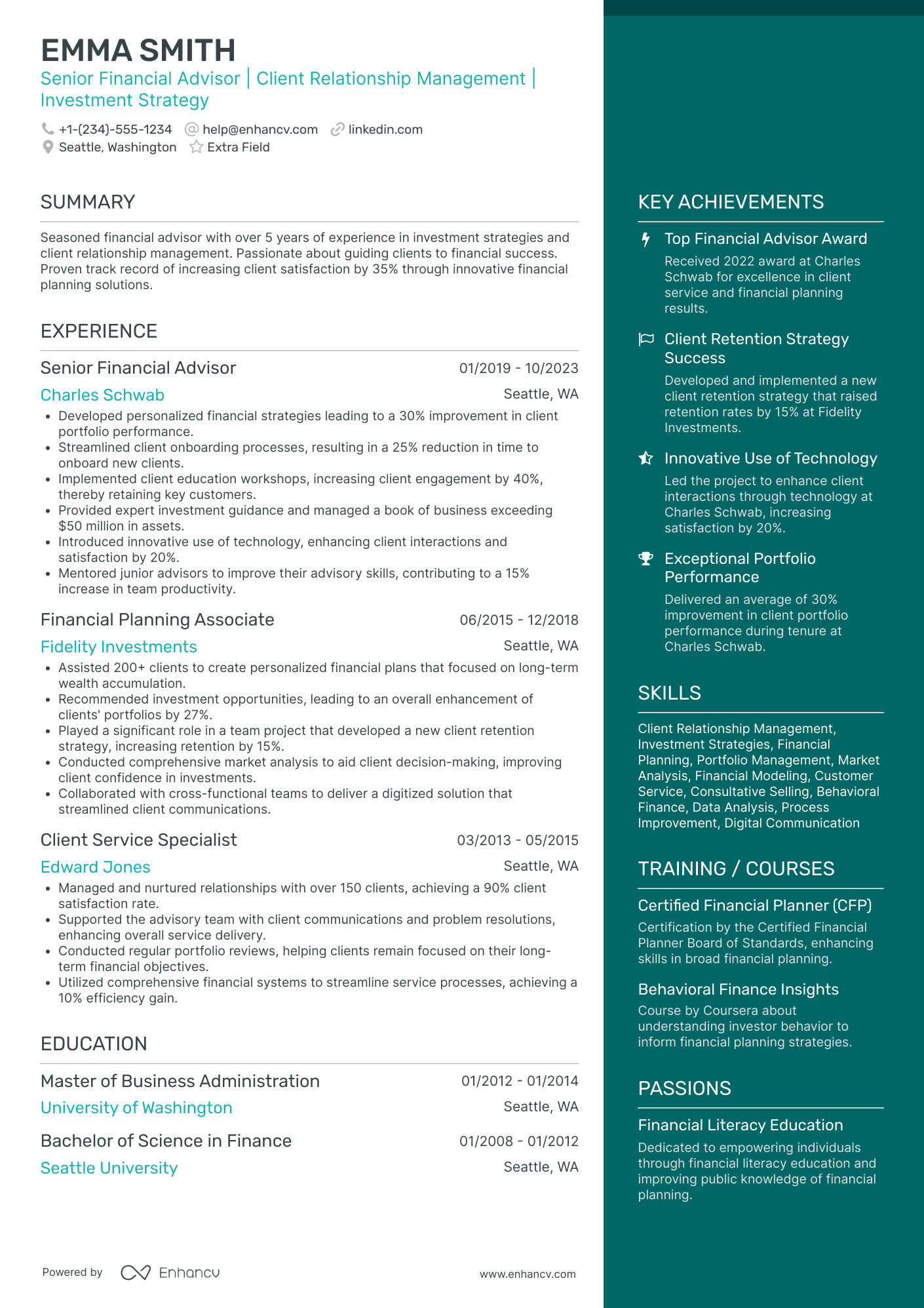

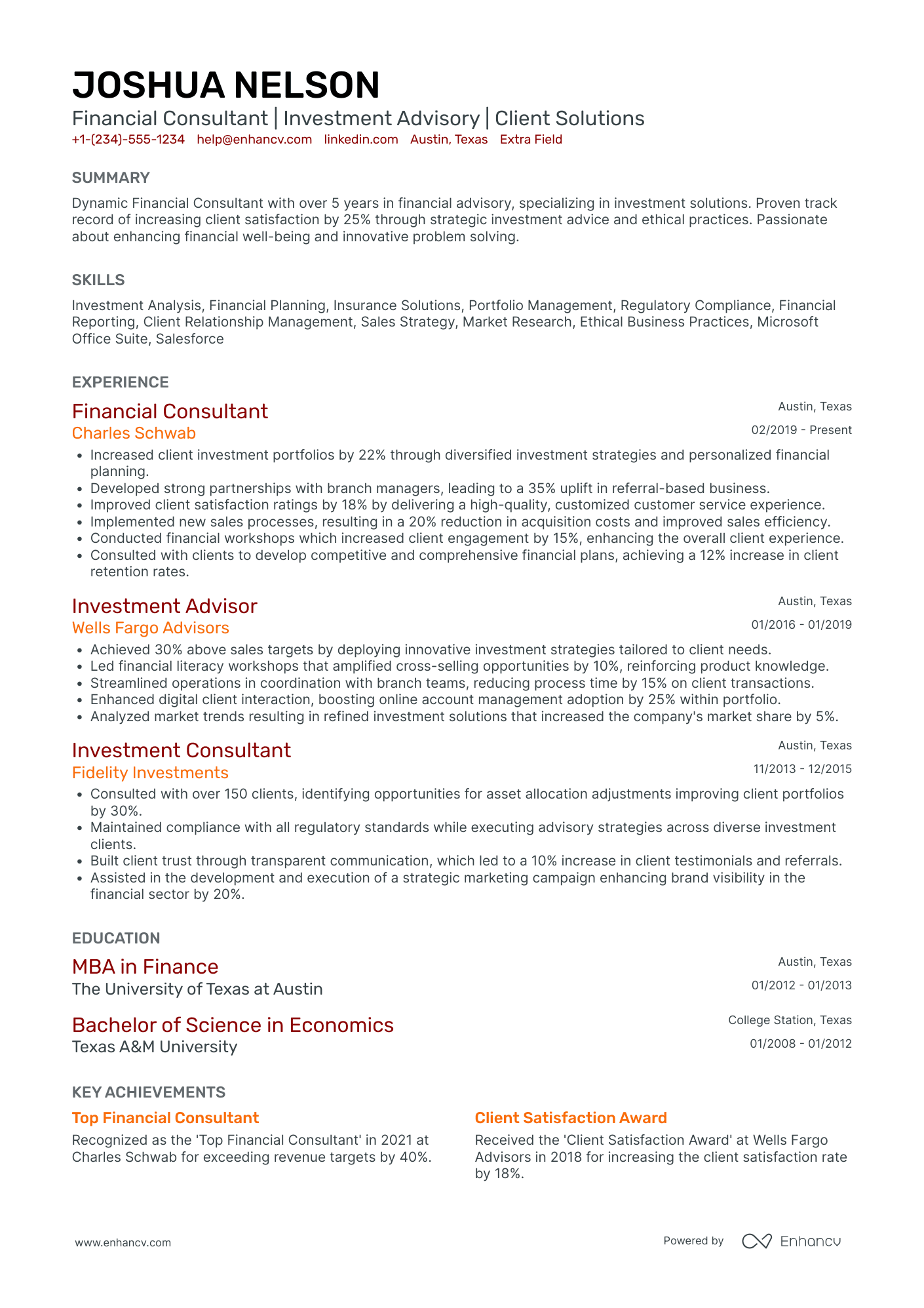

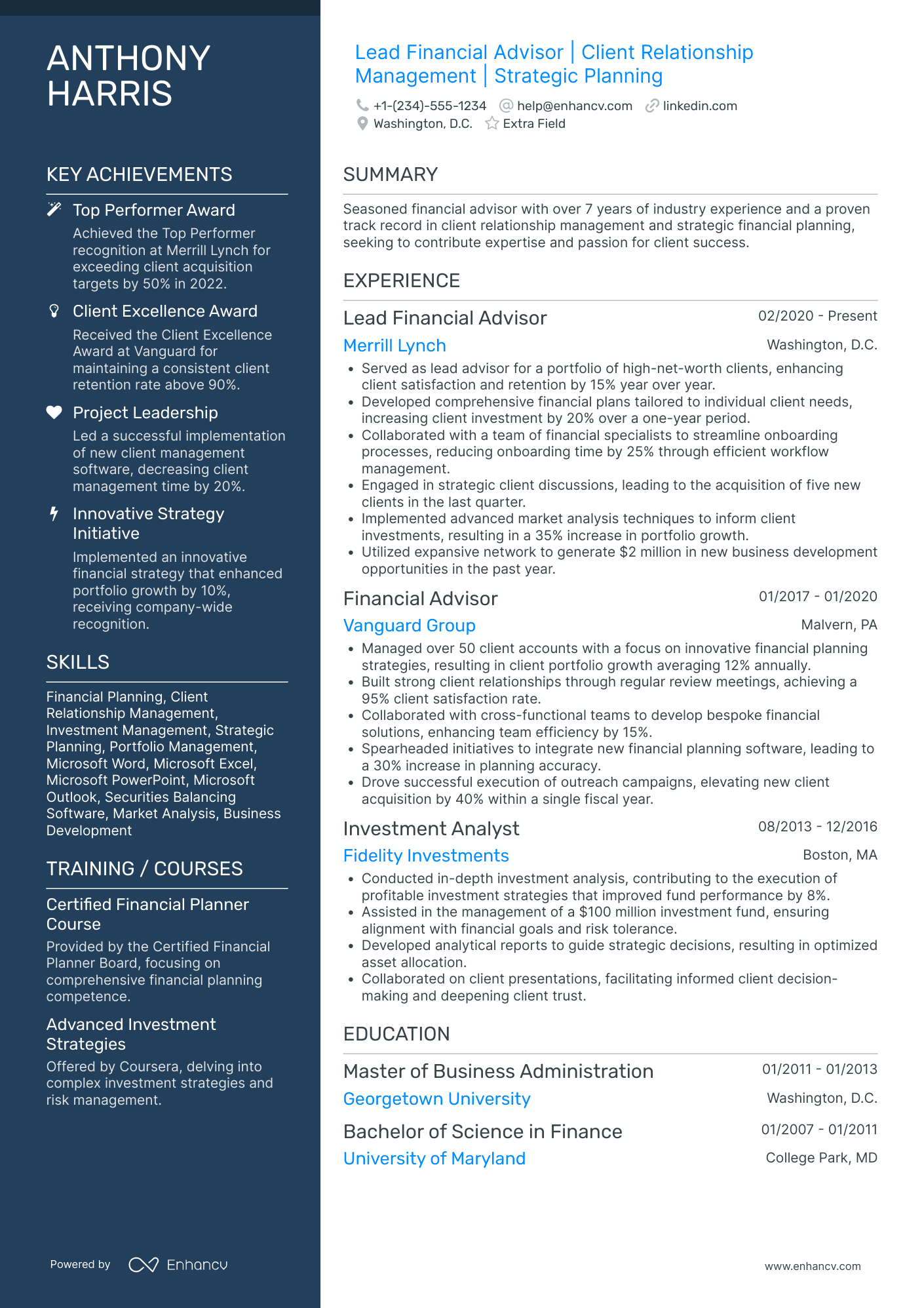

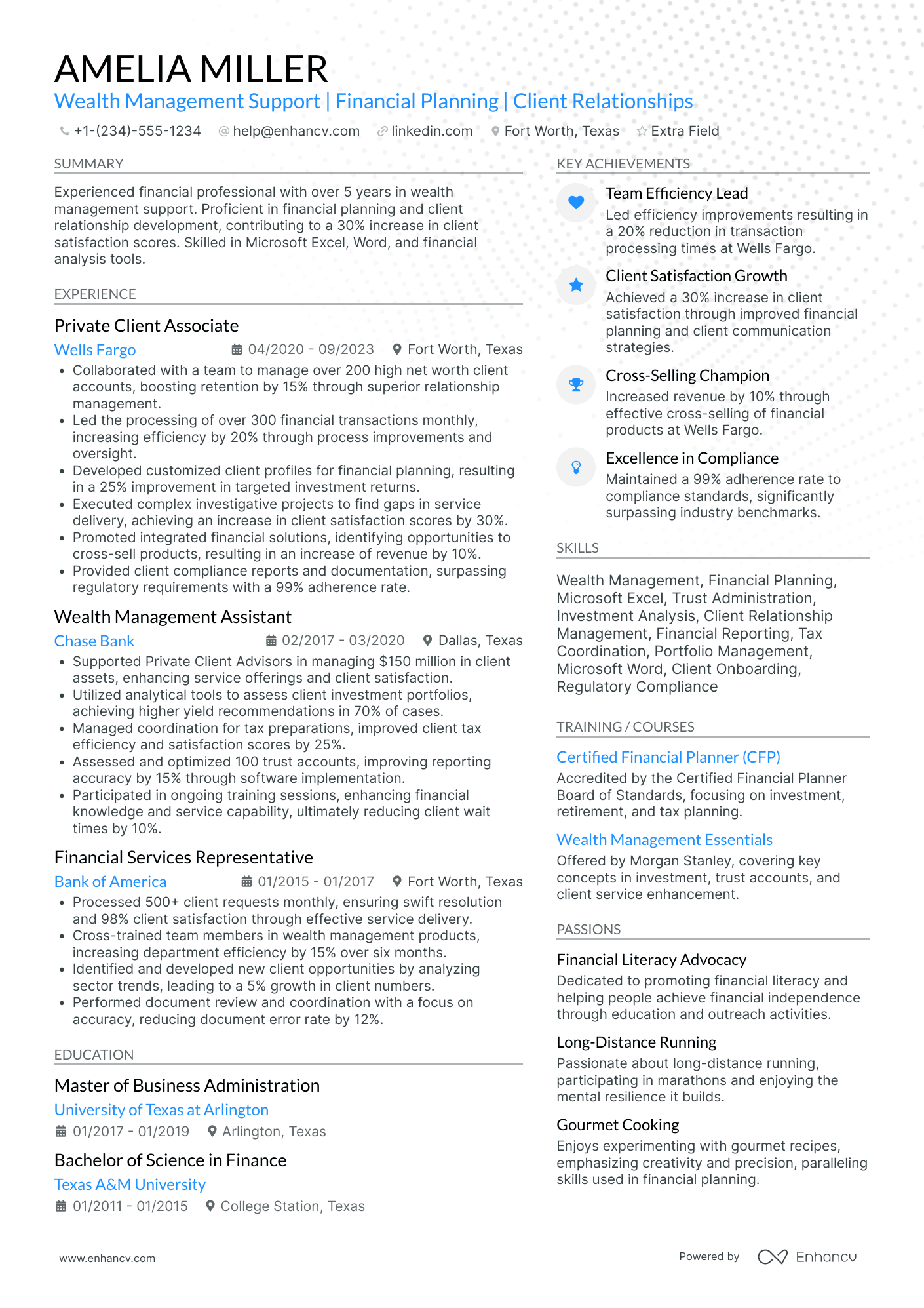

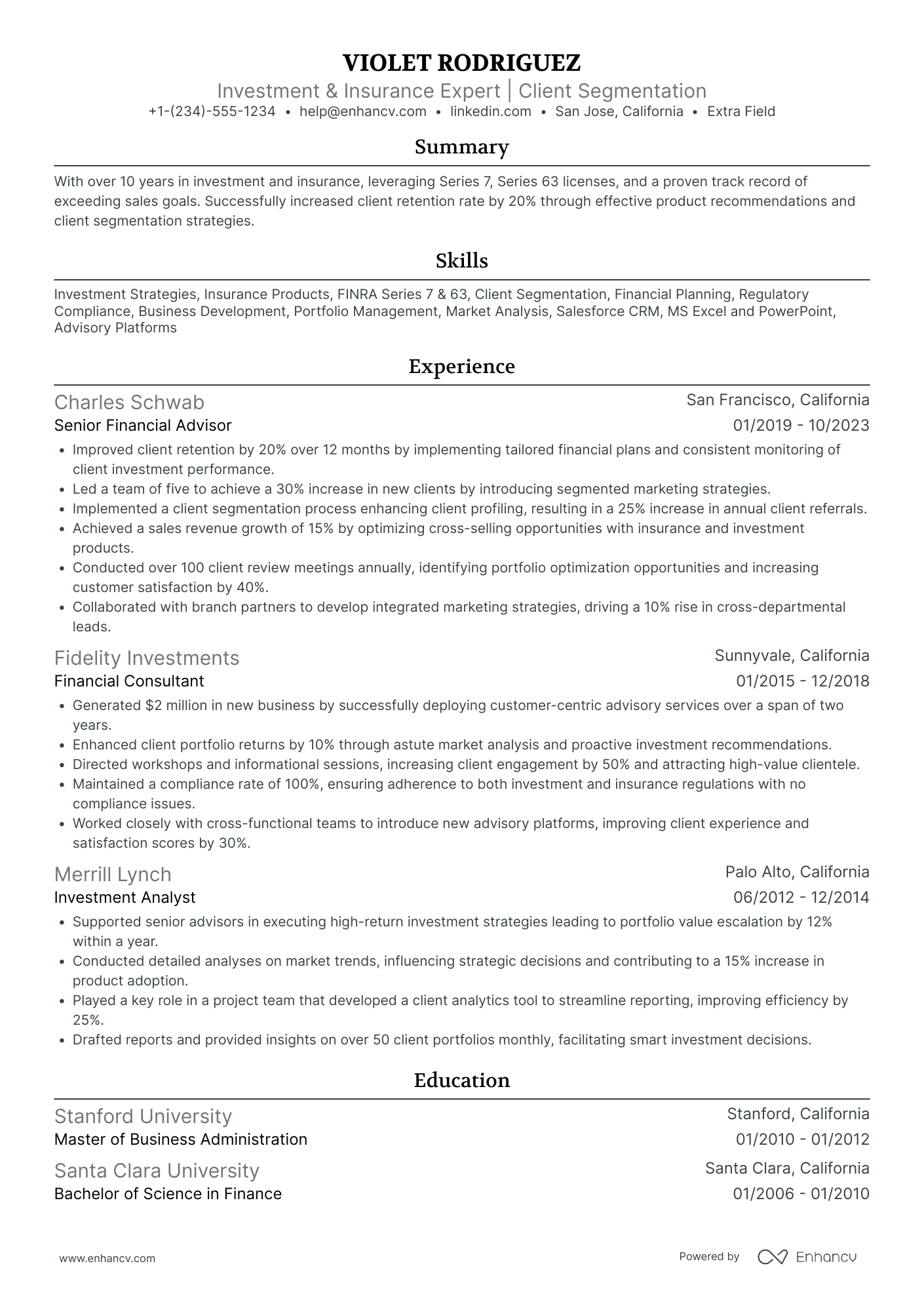

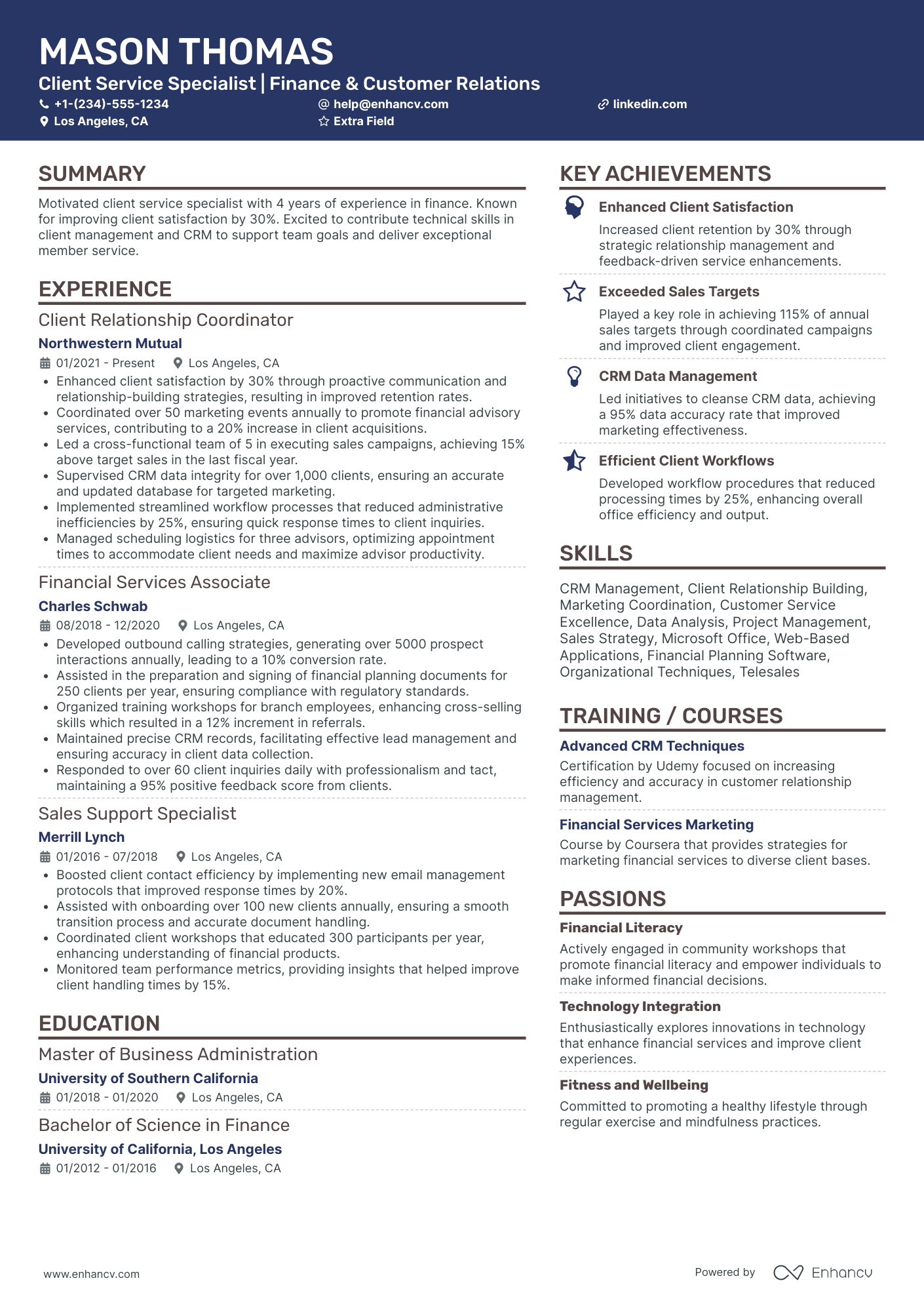

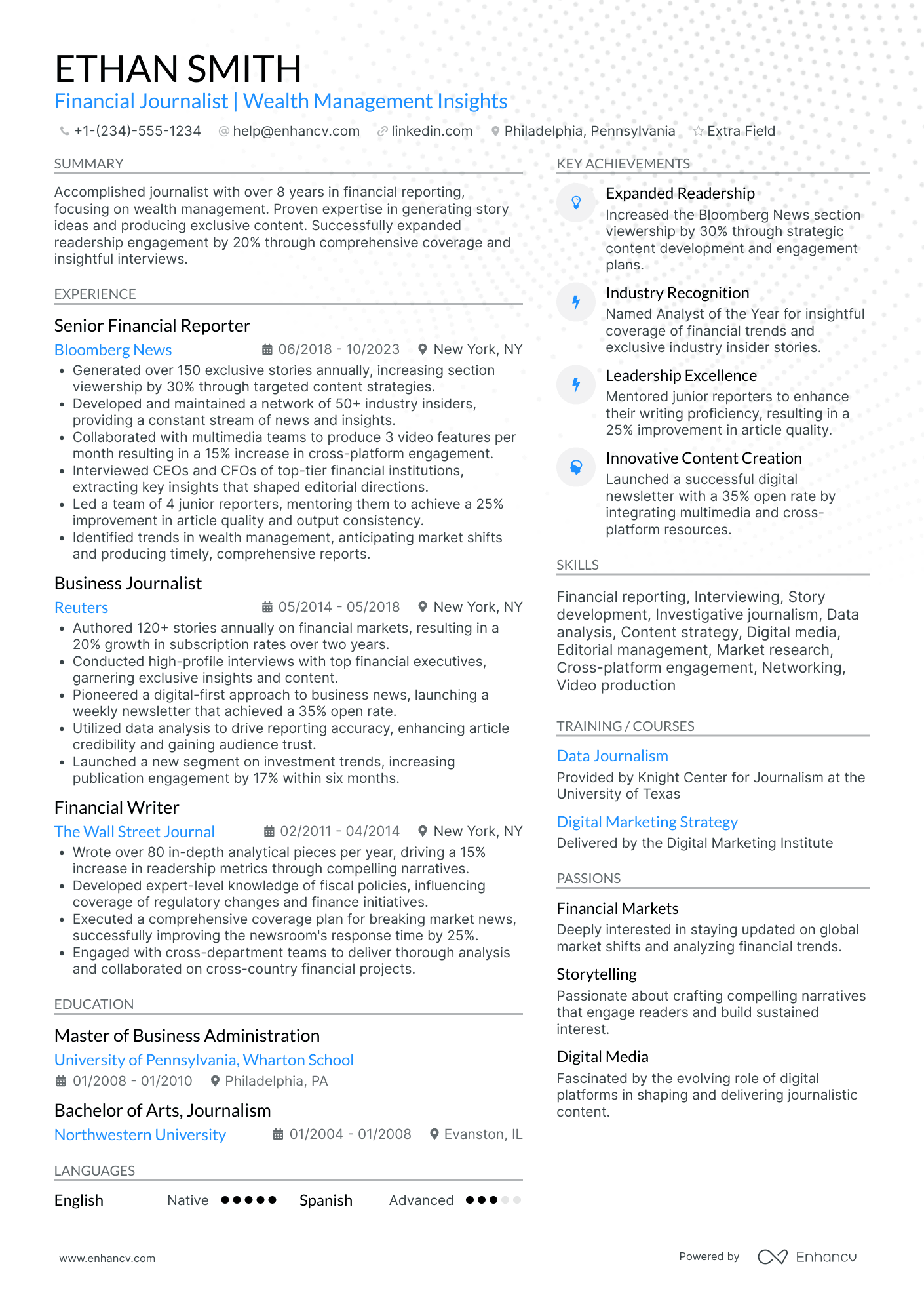

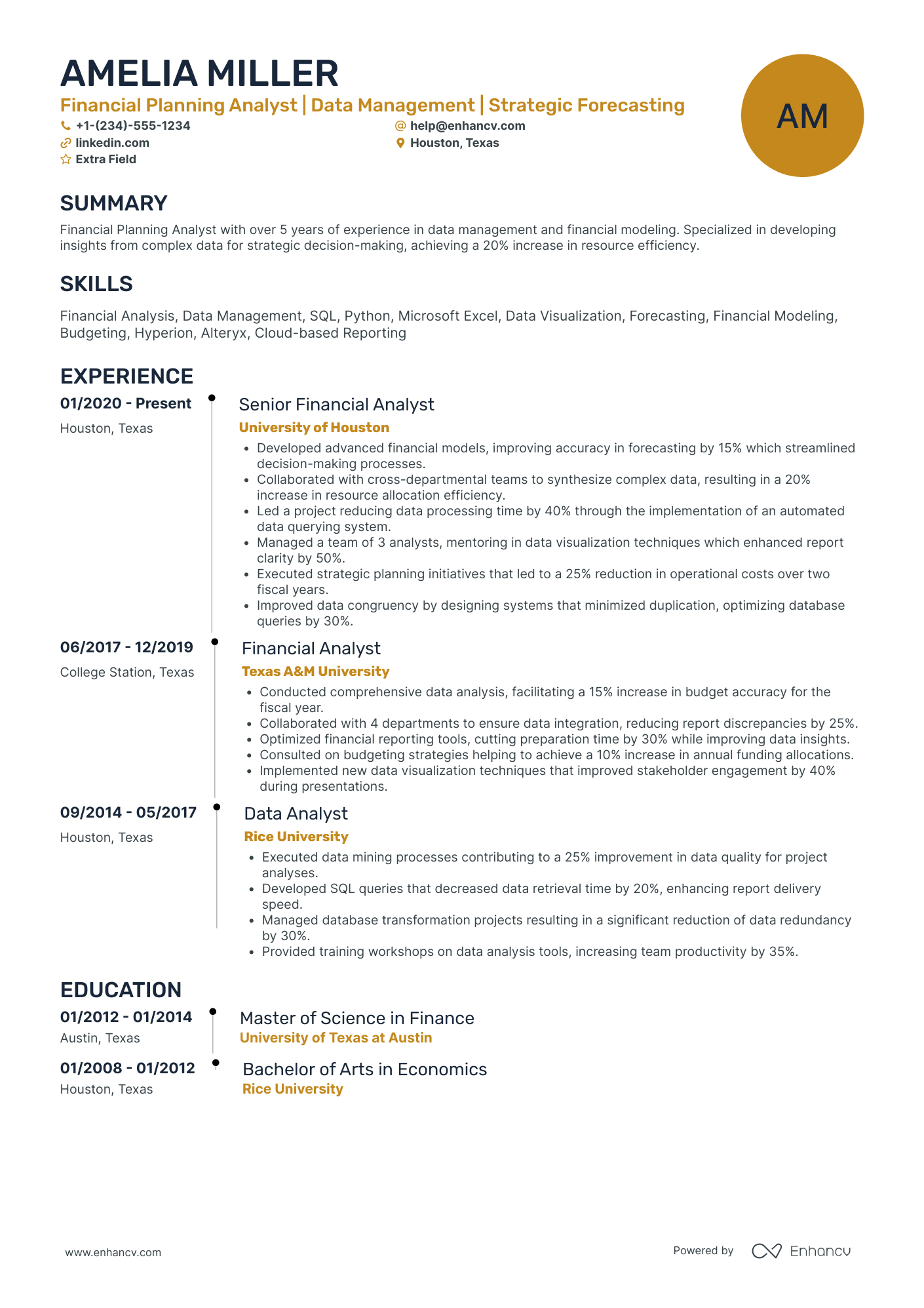

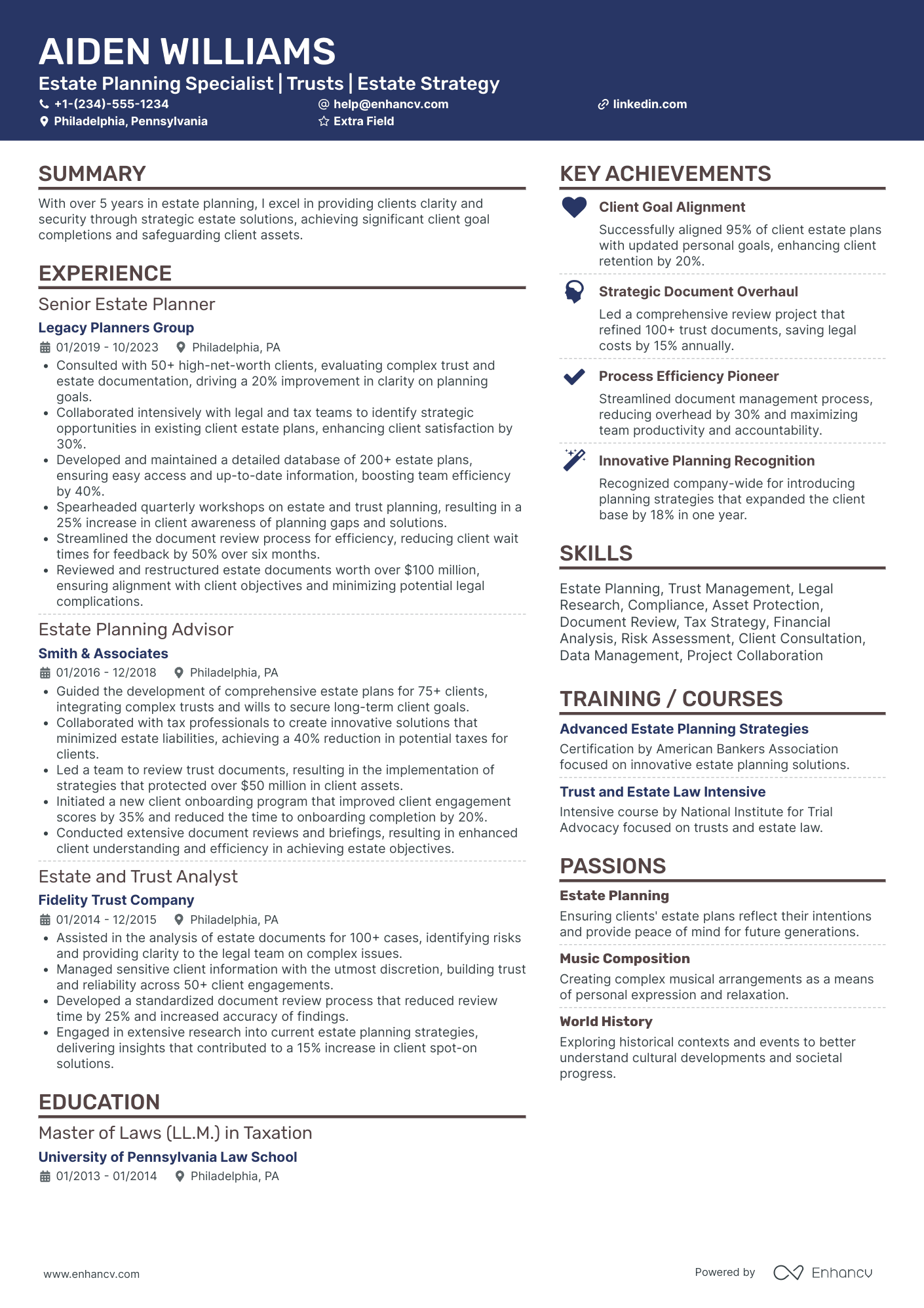

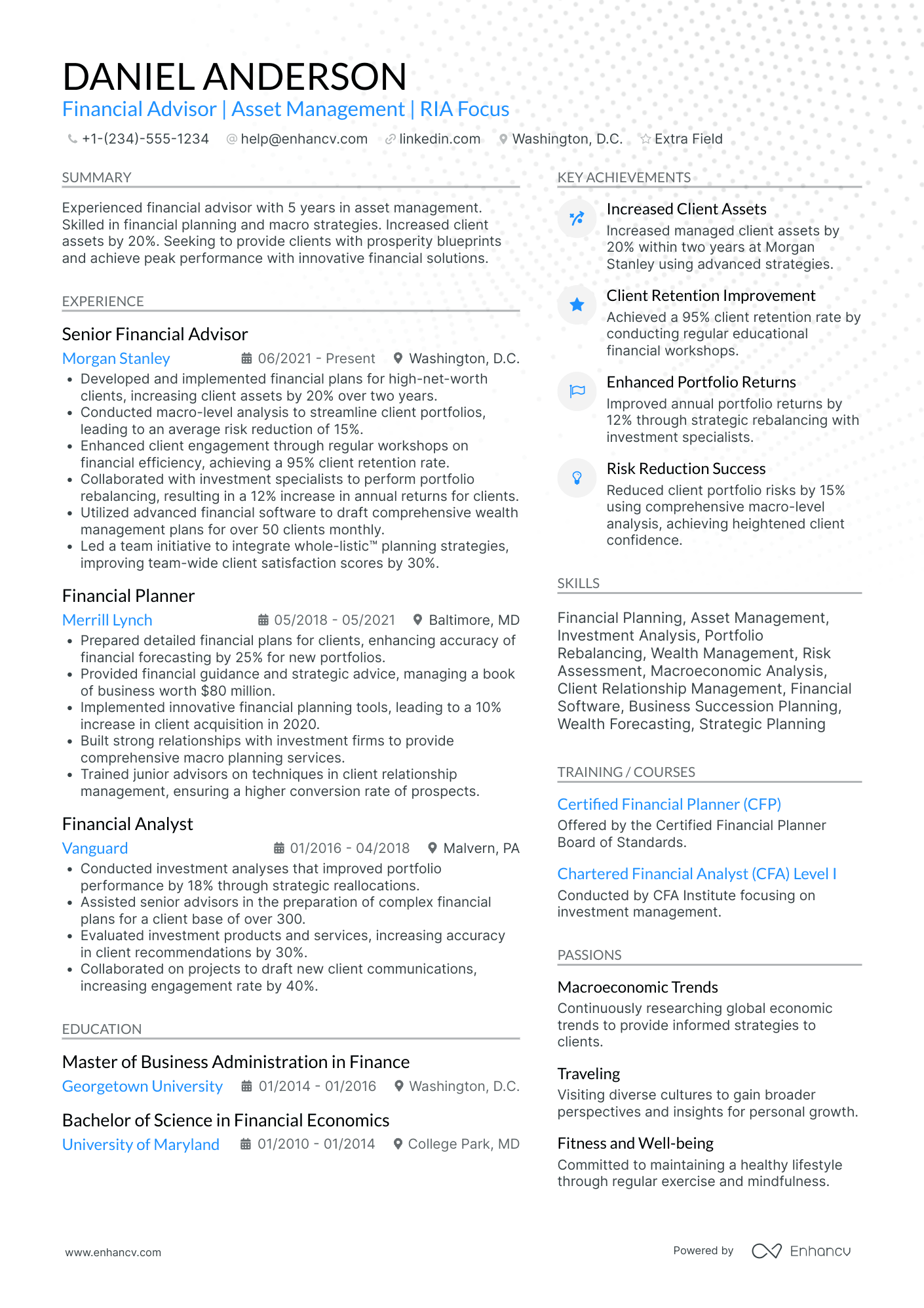

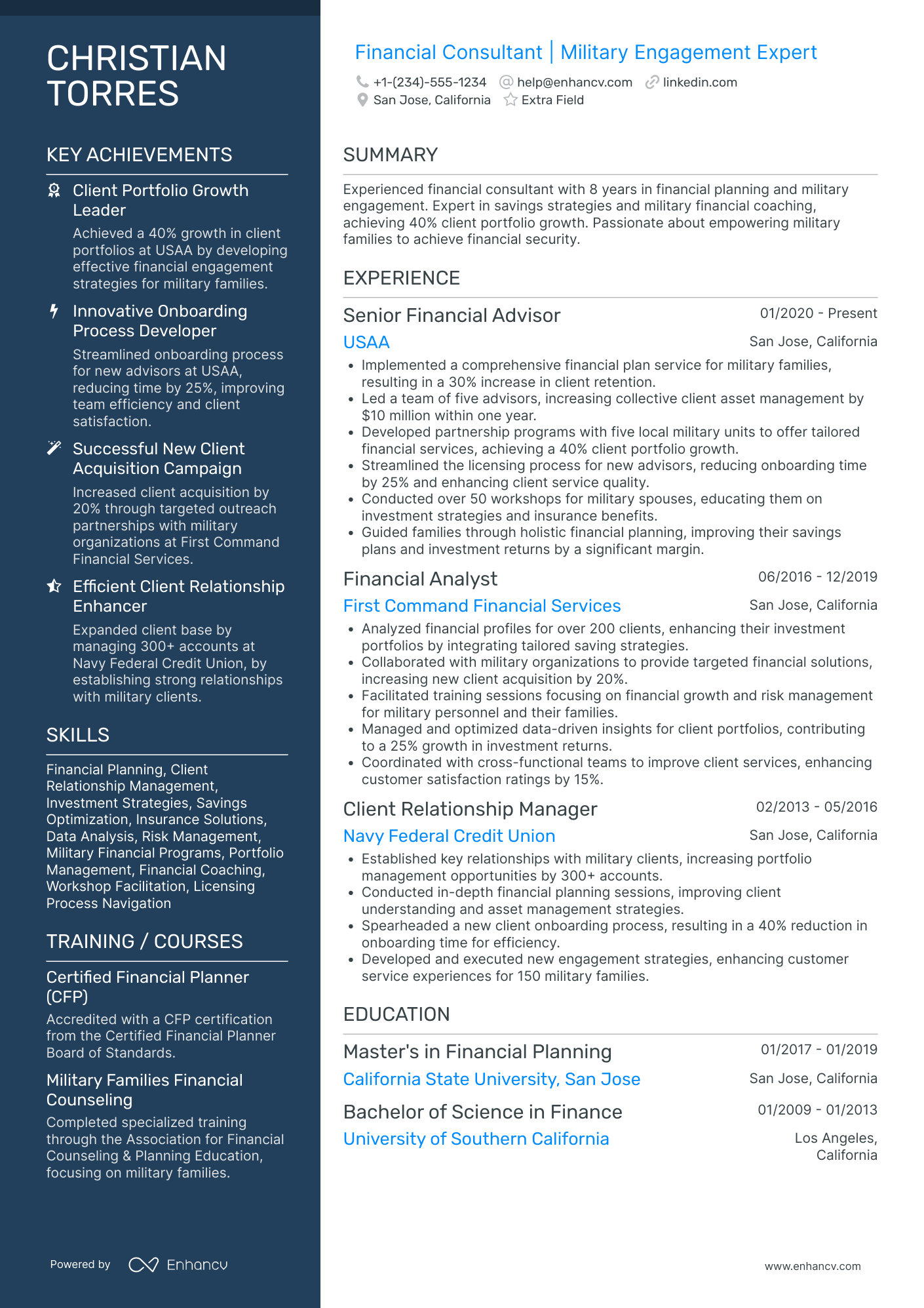

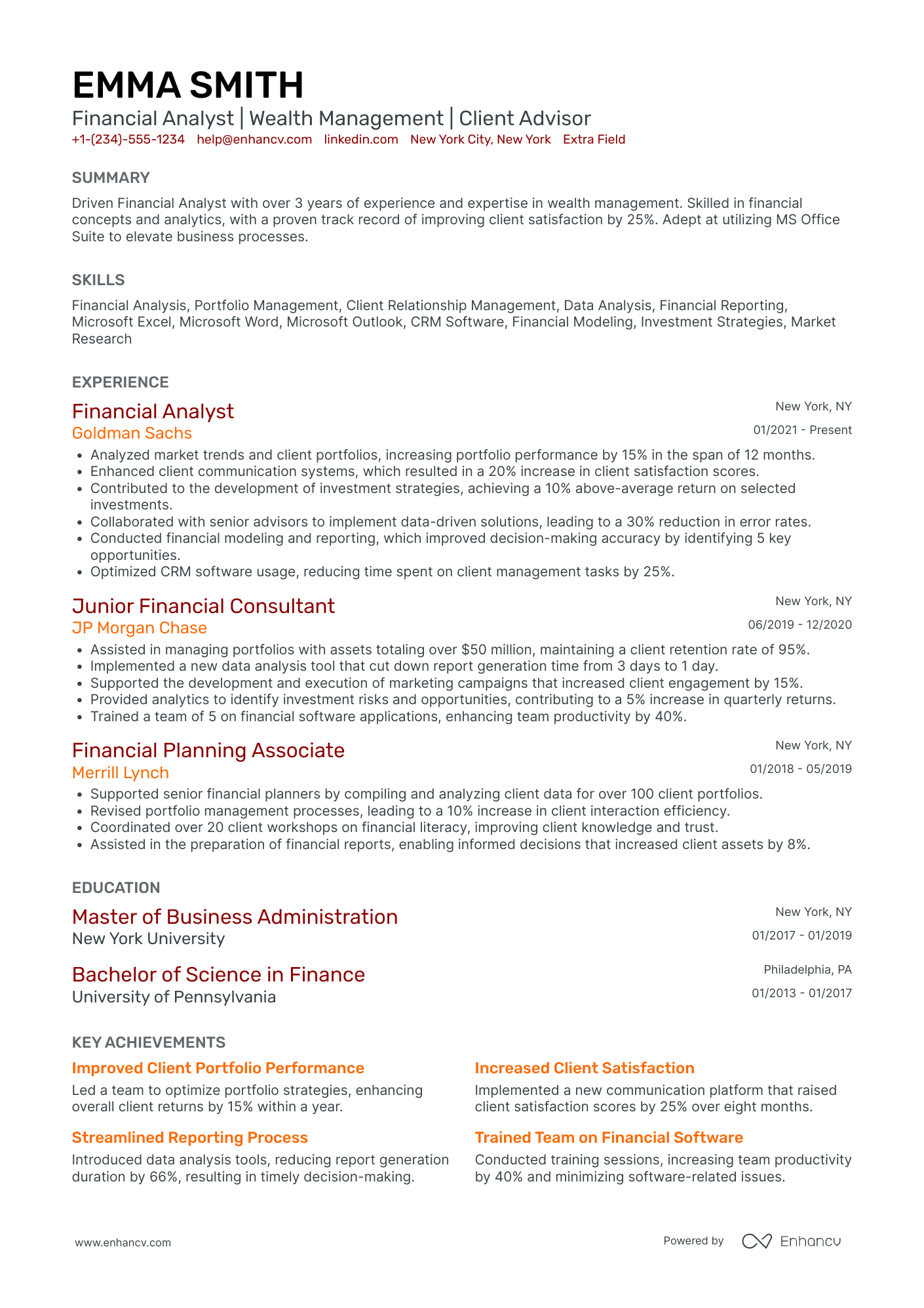

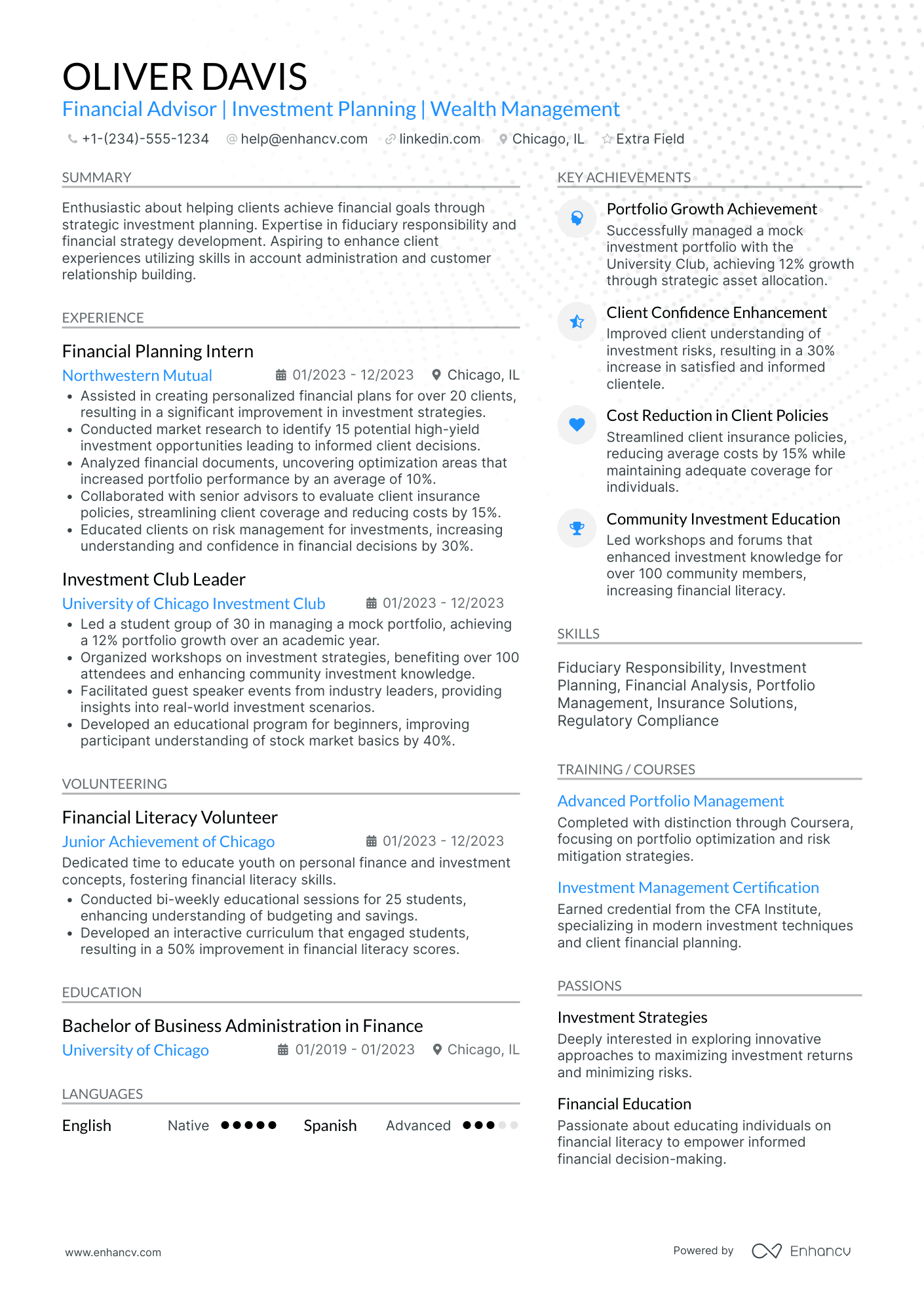

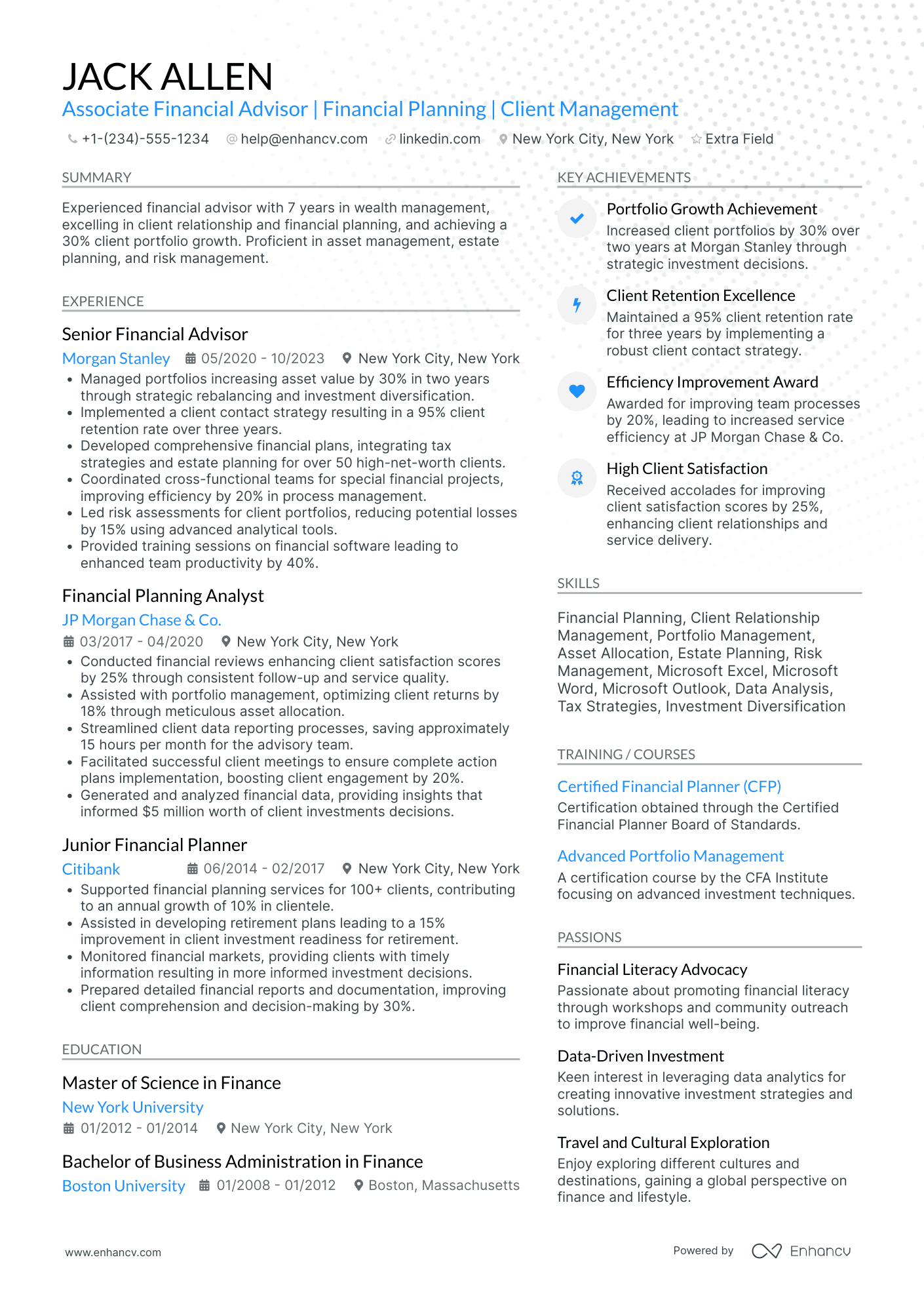

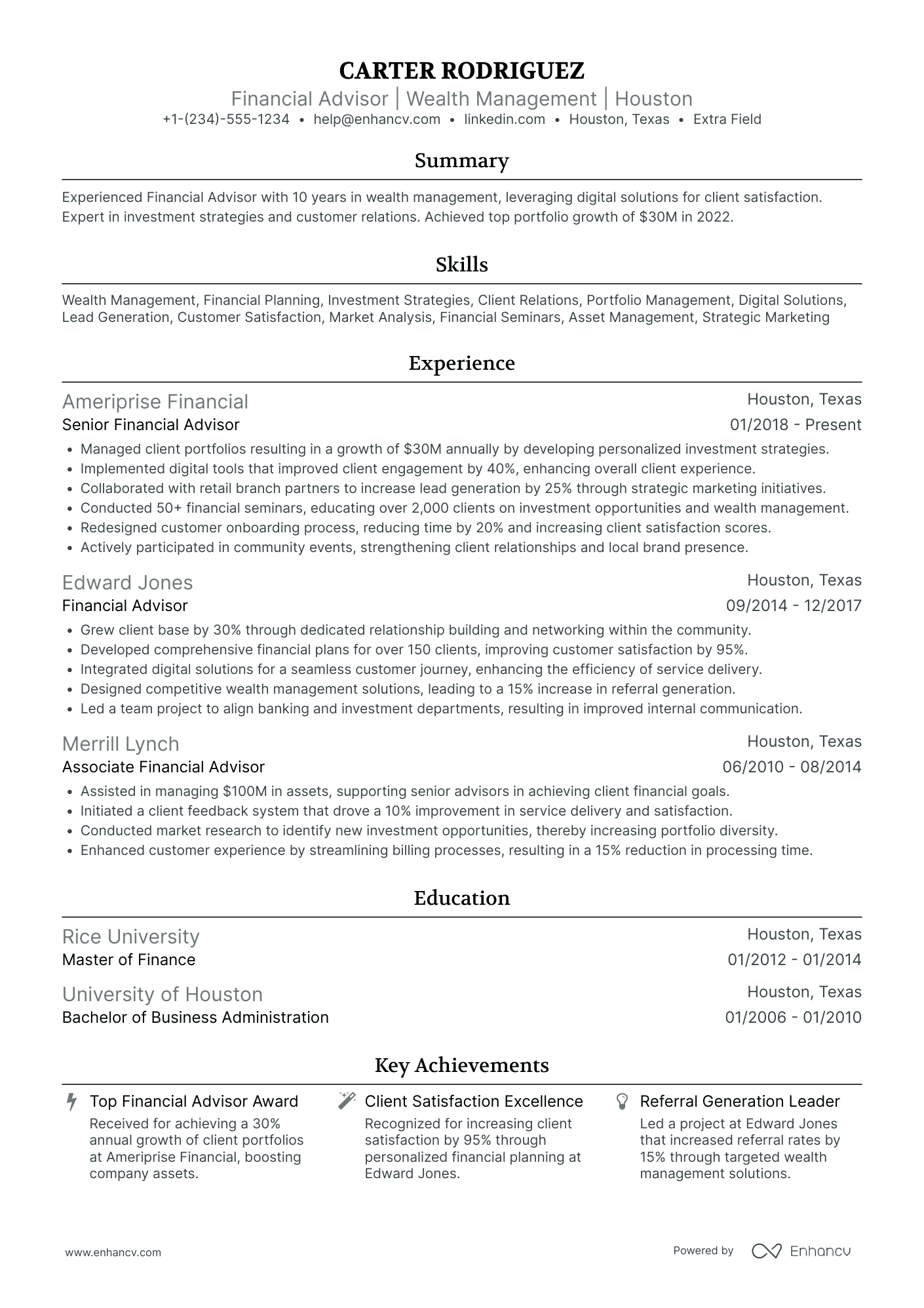

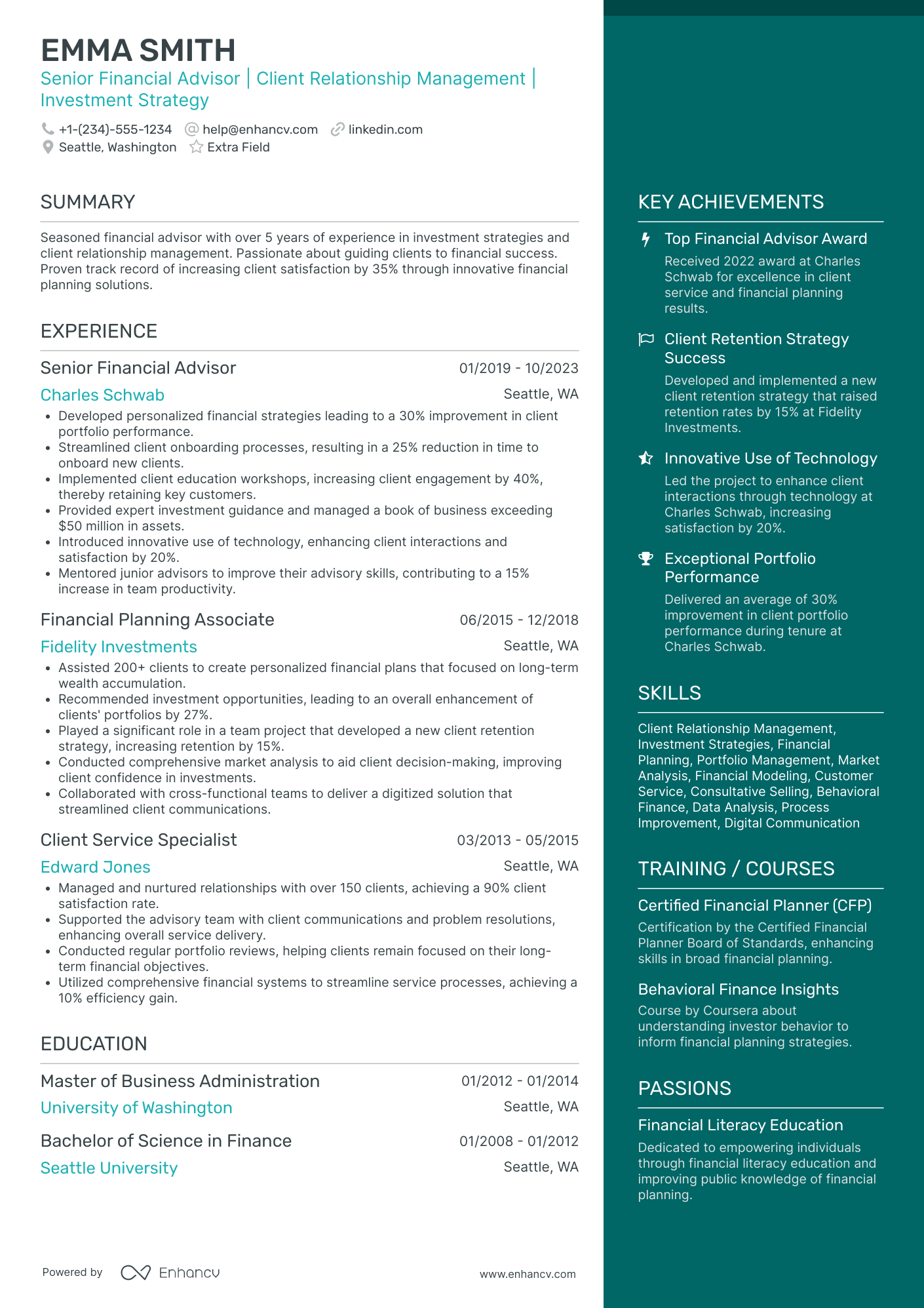

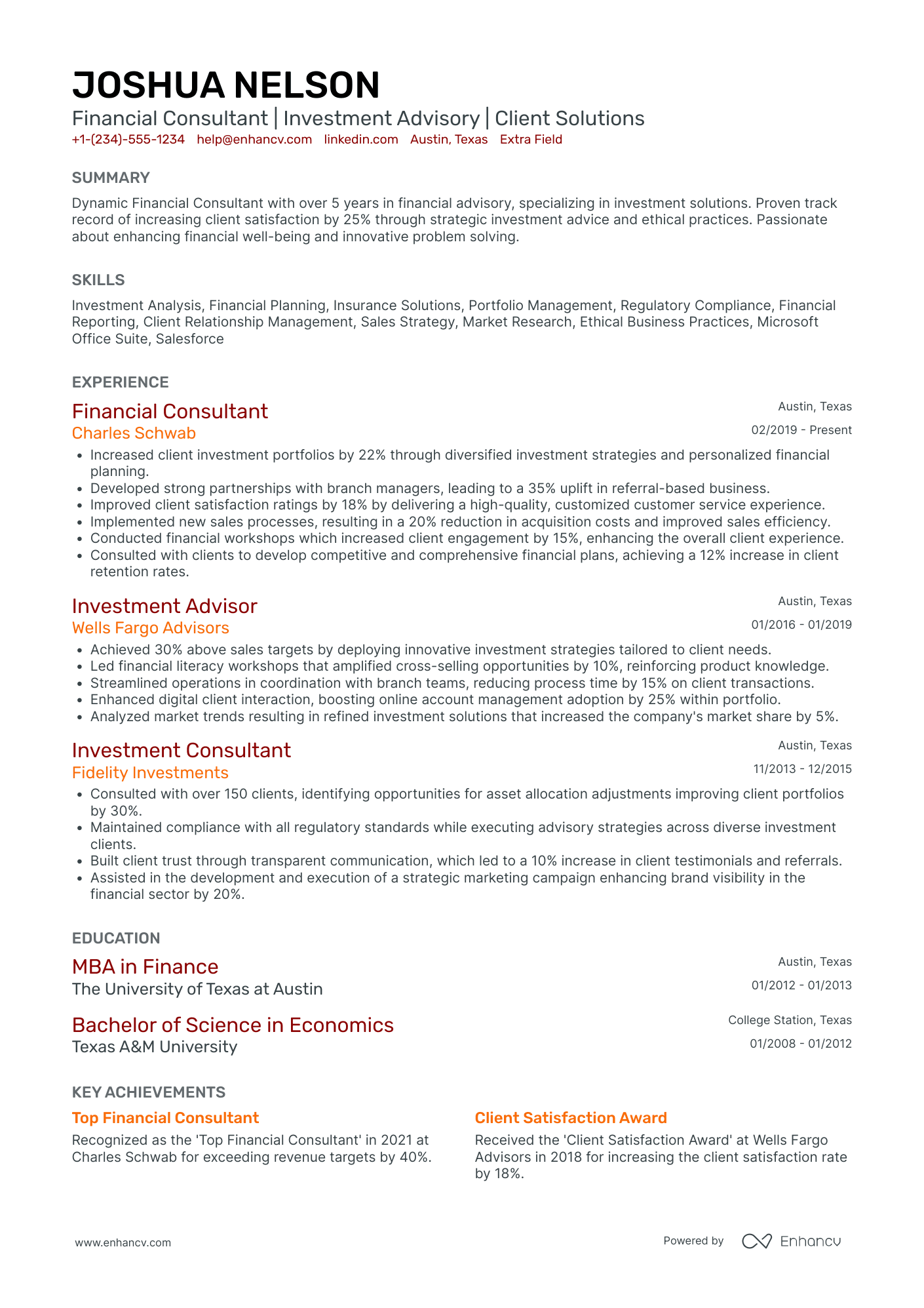

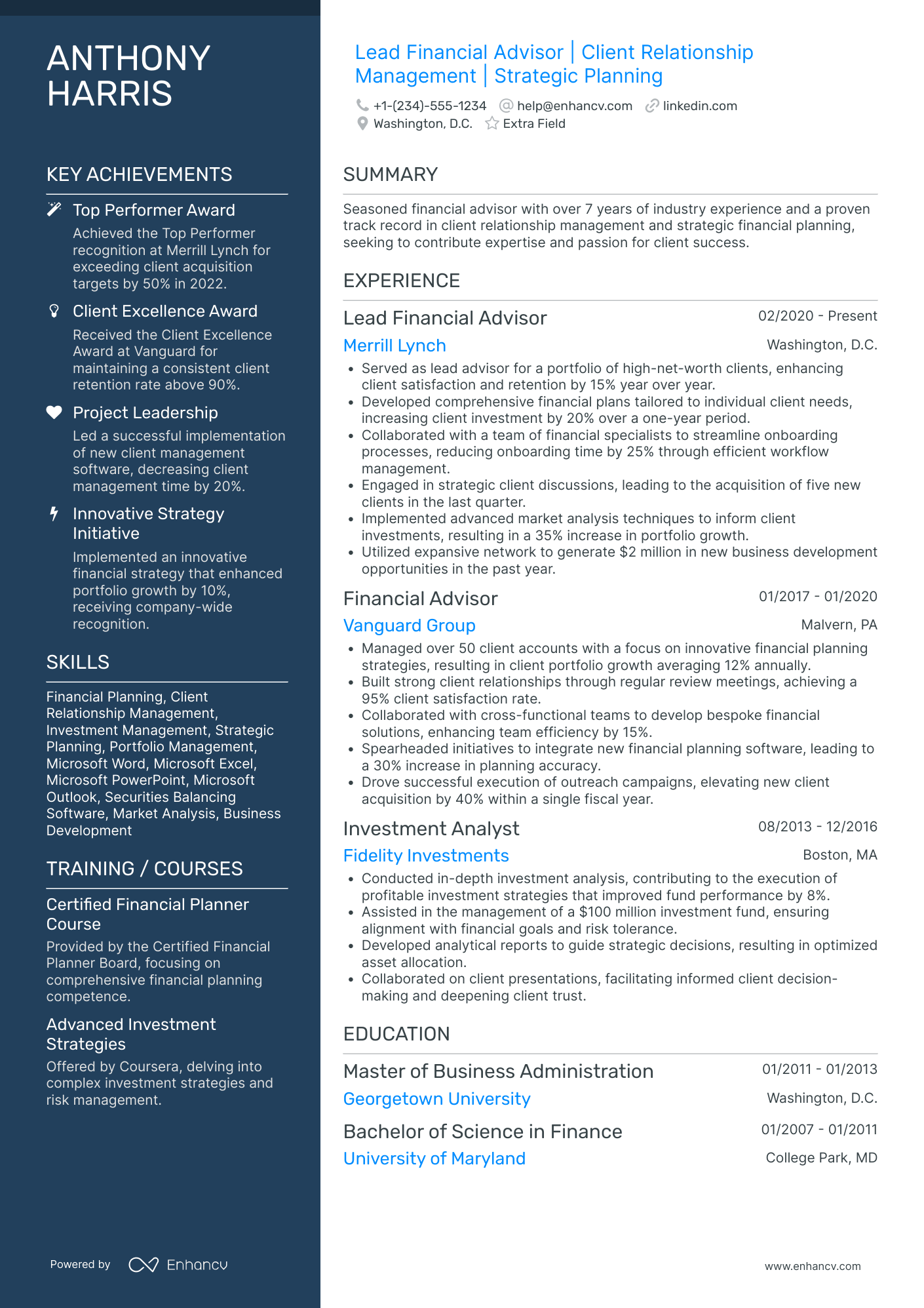

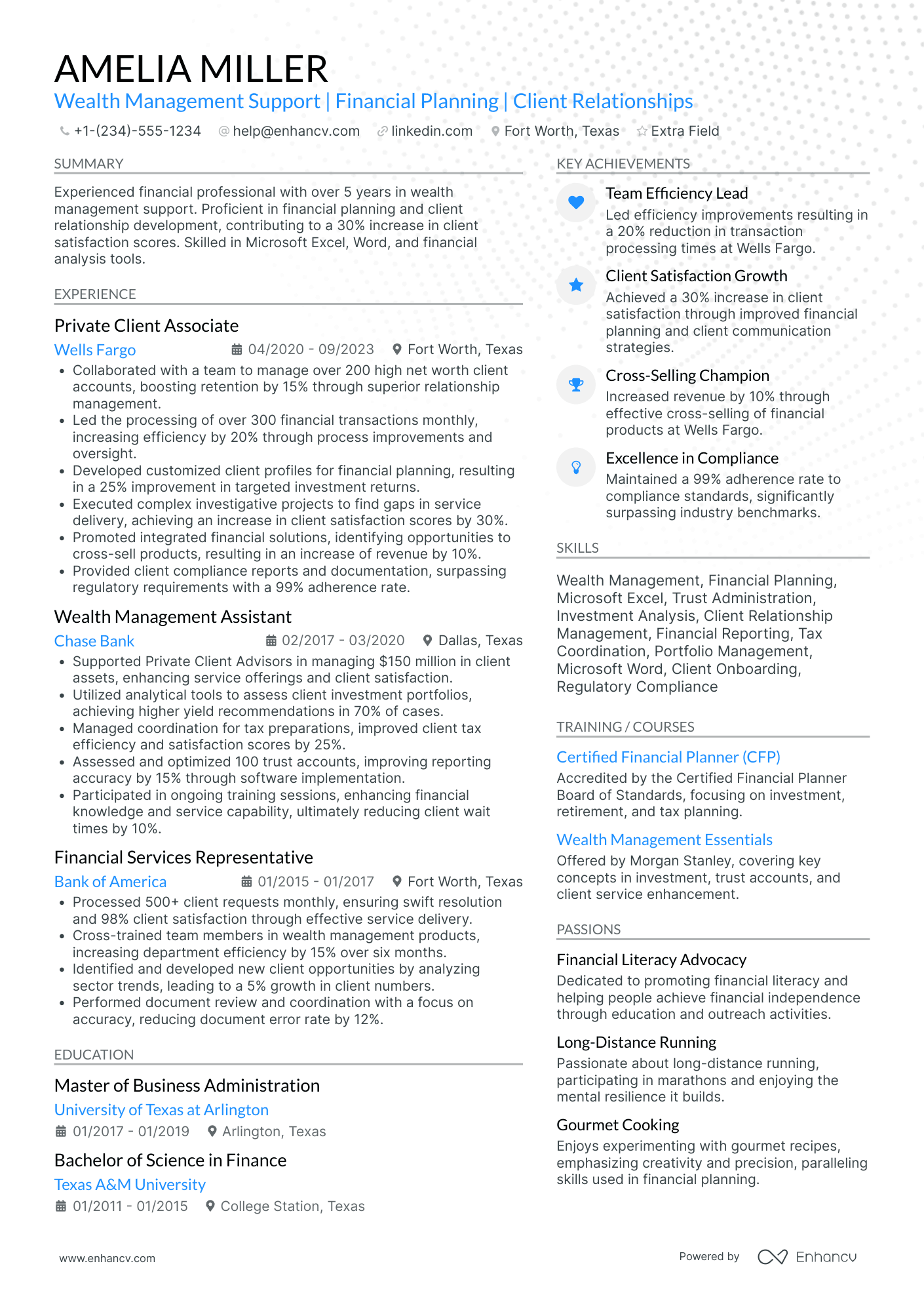

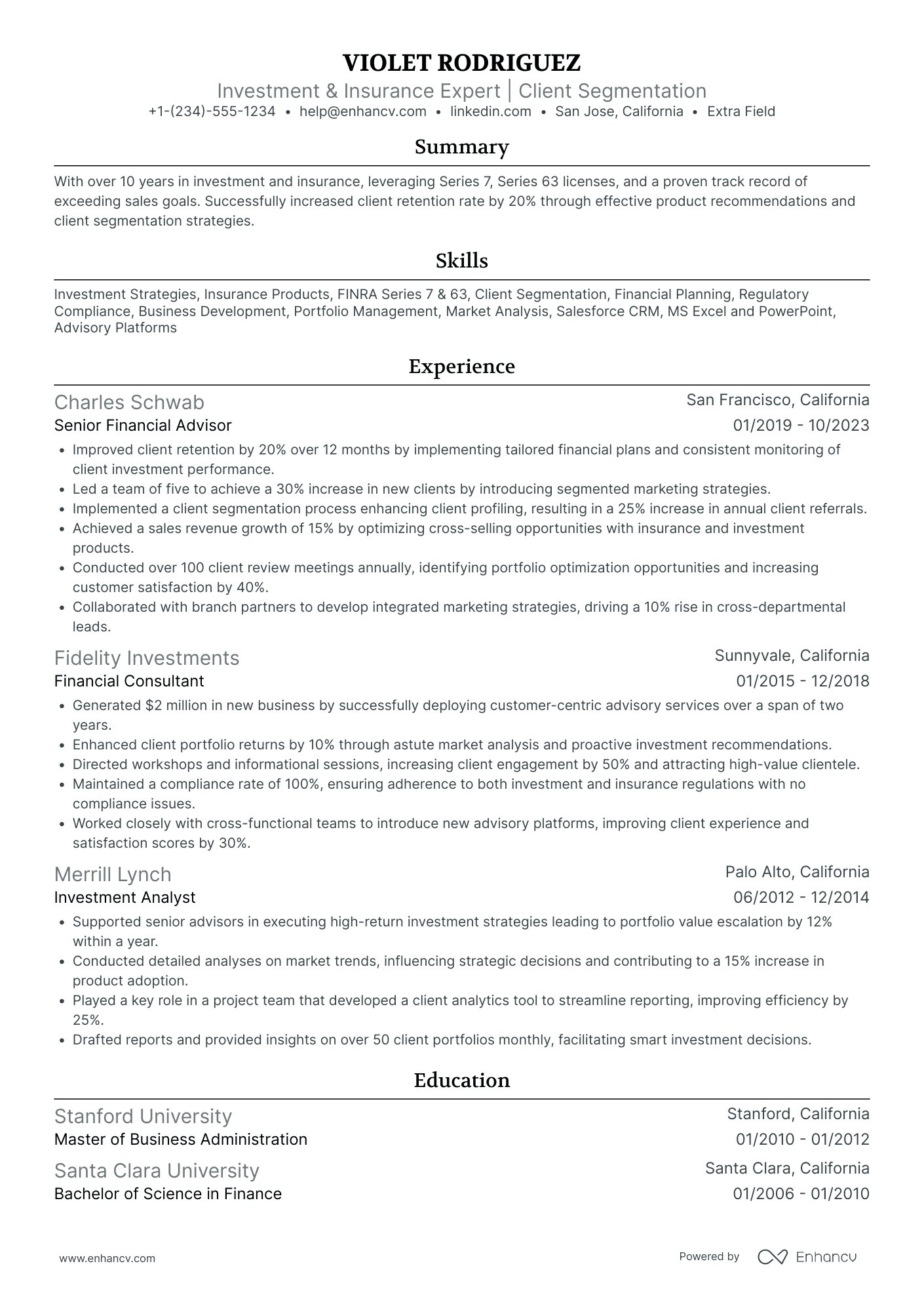

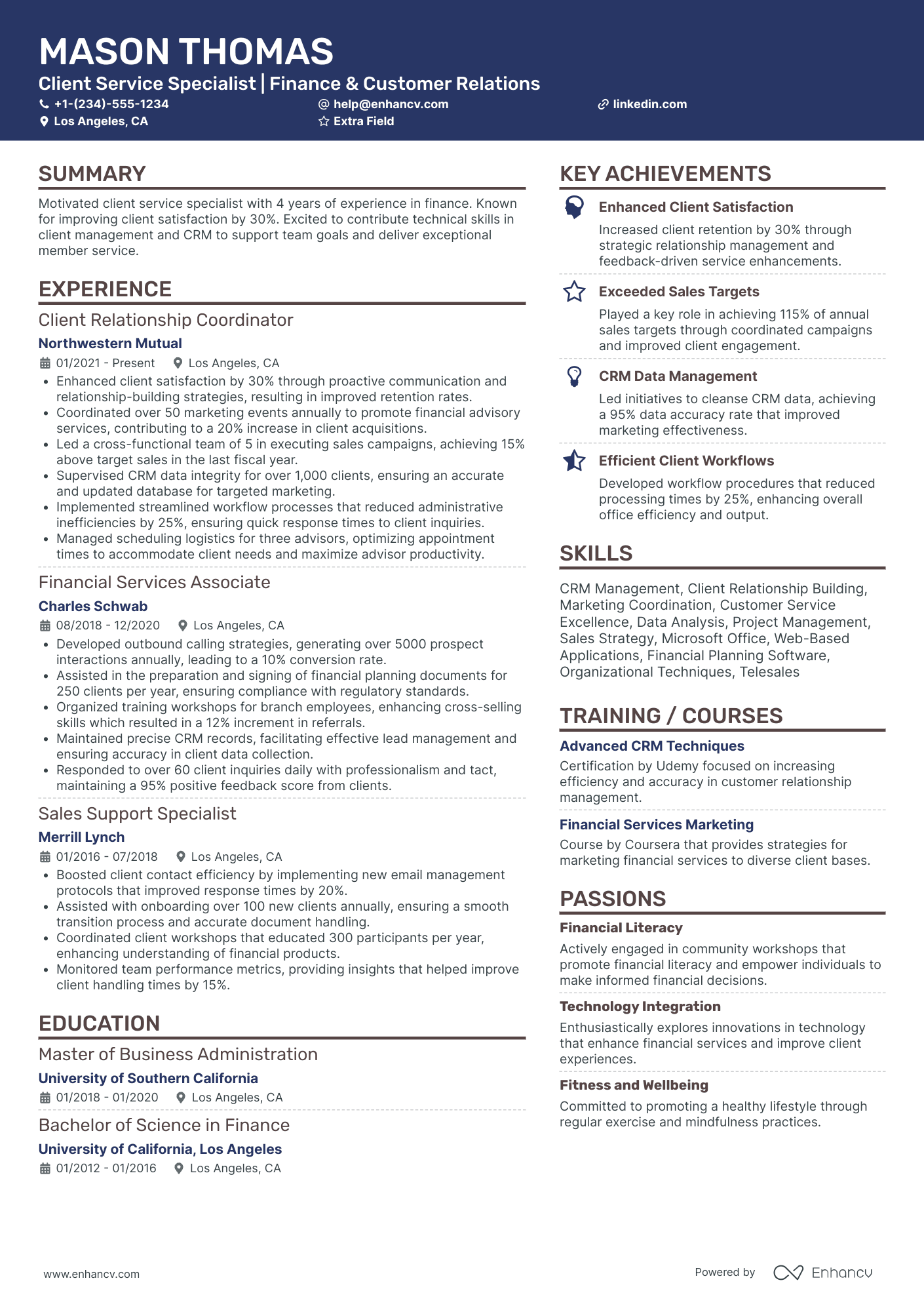

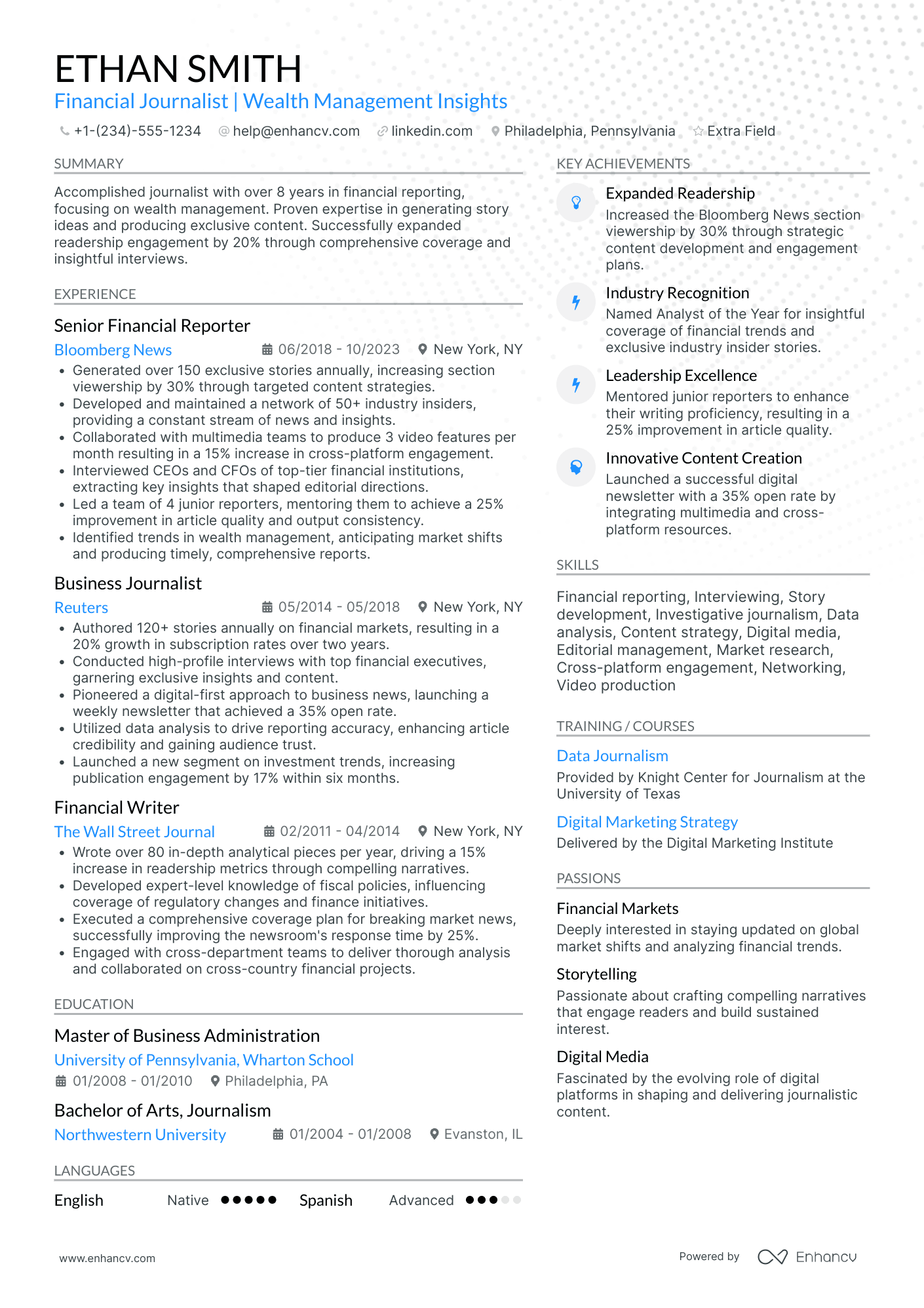

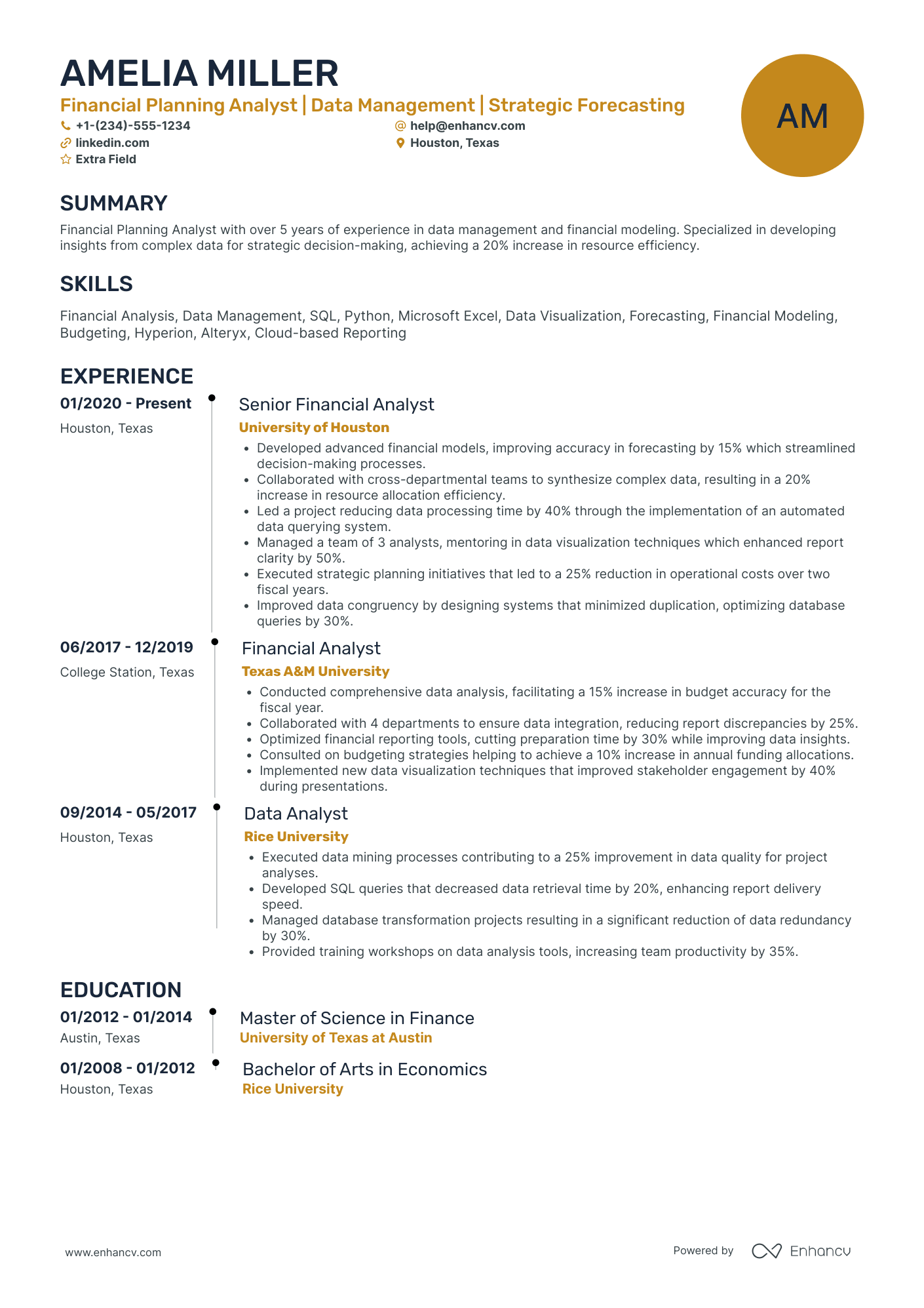

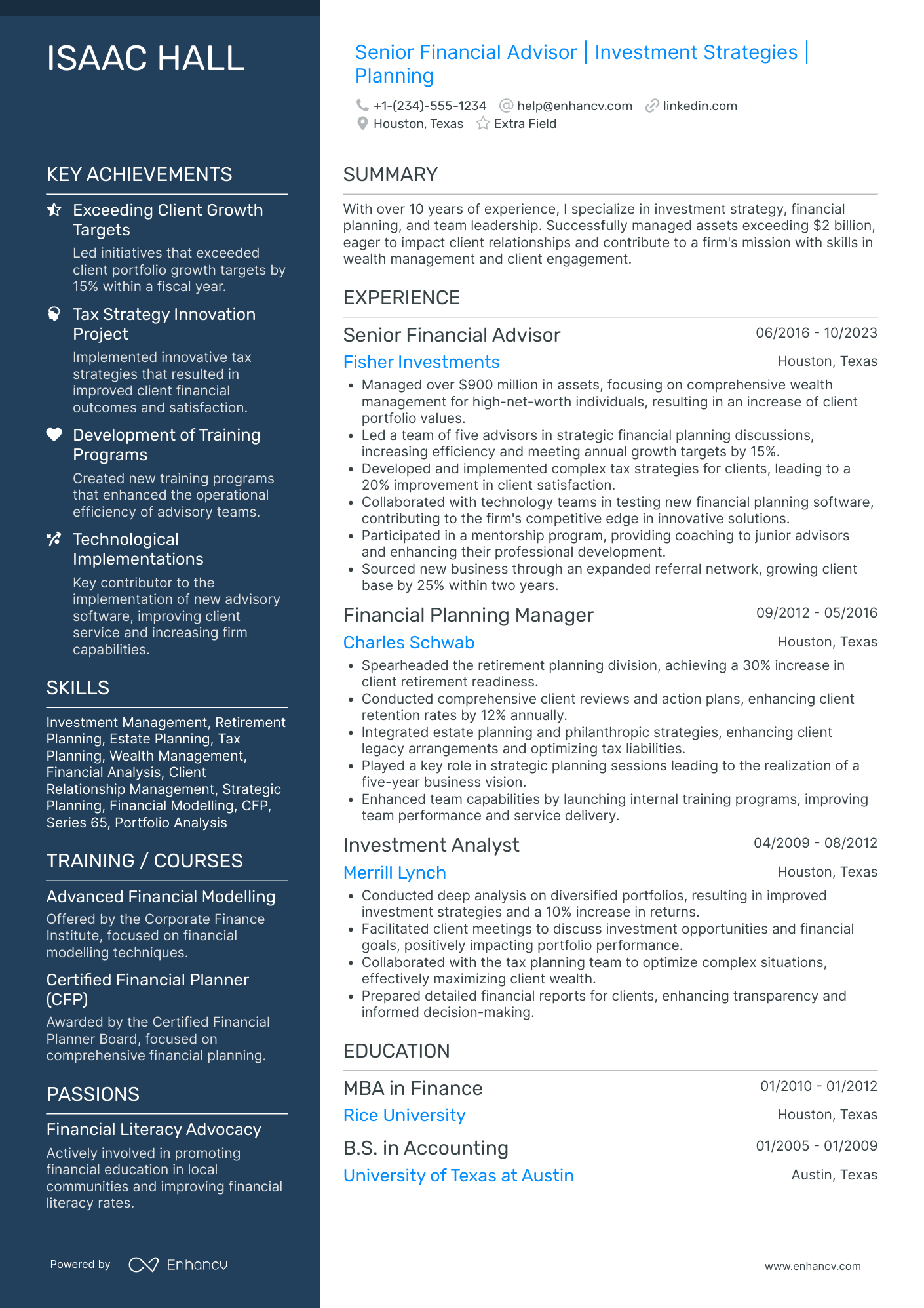

Wondering how other professionals in the industry are presenting their job-winning financial advisor resumes? Check out how these financial advisor professionals put some of our best practices into action:

- Developed and implemented comprehensive financial strategies for high-net-worth individuals, growing the clientele base by 25%.

- Cultivated strong relationships with clients by providing regular market updates and personalized investment advice, resulting in a 95% client retention rate.

- Led a team of junior financial advisors, enhancing their skills and knowledge through structured training programs, increasing team productivity by 40%.

- Managed a portfolio of $50 million in client assets, consistently outperforming the S&P 500 benchmark.

- Provided in-depth analysis and reporting on investment performance and financial planning strategies to clients on a quarterly basis.

- Executed risk management practices by diversifying investment portfolios across multiple asset classes.

- Initiated and conducted comprehensive financial planning workshops, increasing community engagement by 35%.

- Collaborated with estate planning attorneys to offer clients a full spectrum of wealth management services.

- Spearheaded the adoption of tax-efficient investment strategies that reduced client tax liabilities by an average of 15%.

- Regularly evaluated and adjusted clients' investment portfolios, ensuring compliance with their risk tolerance and financial goals.

- Facilitated financial literacy seminars for business owners, focusing on retirement planning and cash flow management.

- Oversaw the implementation of new financial planning software, streamlining the analysis process and increasing efficiency by 30%.

- Established and maintained fruitful relationships with 100+ individual and small business clients.

- Analyzed market trends and provided clients with timely investment opportunities, exceeding targeted sales goals by 20%.

- Assisted clients in setting up and managing 401(k) plans, contributing to their long-term financial security.

- Performed rigorous due diligence on investment products, contributing to a 10% decrease in overall portfolio risk.

- Designed and executed effective marketing campaigns, attracting a 15% increase in clientele within a year.

- Provided critical support to clients during the 2008 financial crisis recovery period, helping them restore portfolio balances to pre-crisis levels.

- Negotiated complex insurance and annuity products for clients, fortifying their financial safety net.

- Streamlined the firm's financial planning process with advanced analytical tools, enhancing precision in retirement planning projections.

- Championed socially responsible investing initiatives, aligning client portfolios with their values and ethical concerns.

- Conducted thorough market research to identify and capitalize on emerging investment trends, boosting portfolio growth by an average of 12% annually.

- Played a pivotal role in developing the firm’s educational content, leading to a 50% increase in financial seminar attendance.

- Optimized legacy client portfolios with contemporary asset allocation strategies, ensuring optimal performance.

- Devised and presented customized financial plans for clients, emphasizing long-term investment and tax-saving strategies.

- Acted as the key liaison between clients and tax advisors during the annual tax preparation season.

- Empowered clients by leading user training sessions on the firm’s client-facing digital investment platforms.

- Masterminded a new client onboarding process that shortened the average acquisition time by 25% without compromising service quality.

- Leveraged data analytics to refine client risk assessment models, reducing financial misalignments and improving satisfaction scores.

- Coordinated with a team of international financial advisors to manage global investment portfolios, enhancing diversification for high-net-worth clients.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial advisor professionals.

Top Responsibilities for Financial Advisor:

- Interview clients to determine their current income, expenses, insurance coverage, tax status, financial objectives, risk tolerance, or other information needed to develop a financial plan.

- Analyze financial information obtained from clients to determine strategies for meeting clients' financial objectives.

- Answer clients' questions about the purposes and details of financial plans and strategies.

- Review clients' accounts and plans regularly to determine whether life changes, economic changes, environmental concerns, or financial performance indicate a need for plan reassessment.

- Manage client portfolios, keeping client plans up-to-date.

- Recommend to clients strategies in cash management, insurance coverage, investment planning, or other areas to help them achieve their financial goals.

- Recommend financial products, such as stocks, bonds, mutual funds, or insurance.

- Implement financial planning recommendations, or refer clients to someone who can assist them with plan implementation.

- Contact clients periodically to determine any changes in their financial status.

- Prepare or interpret for clients information, such as investment performance reports, financial document summaries, or income projections.

Quantifying impact on your resume

- Include the total assets under management (AUM) you've successfully managed, demonstrating scale and trustworthiness.

- List the percentage growth of your clients' portfolios to showcase investment success and client satisfaction.

- Mention the number of clients you have advised to highlight your experience and relationship-building skills.

- Detail your client retention rate to emphasize loyalty and long-term client satisfaction.

- Quantify the revenue your advice has generated for your firm to underline your contribution to business growth.

- Specify your rank or percentile among peers in sales or client acquisition to show competitive performance.

- Report the percentage by which you've exceeded sales or performance targets to establish goal-oriented results.

- Include the number of workshops or educational seminars you've conducted to evidence thought leadership and expertise.

Action verbs for your financial advisor resume

Lacking relevant financial advisor resume experience?

Learn how to write your financial advisor resume experience in spite of having no real-world (or applicable) experience for the job.

You should:

- Feature relevant projects or publications that could impress recruiters or showcase that you have the basic skill set for the job

- Shift the focus towards your people (communication, organization, etc.) skills to demonstrate that you're a quick learner and can easily adapt to a new environment

- Use the resume objective to not only highlight your accomplishments but also map out how your career plans are perfectly aligned with the company's vision

- Select either the functional-skill-based resume format (that puts the focus on your skills) or the hybrid one (balancing expertise with skills).

Recommended reads:

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Key hard skills and soft skills for your financial advisor resume

At the top of any recruiter financial advisor checklist, you'd discover a list of technical competencies, balanced with personal skills.

Hard or technical skills are your opportunity to show how you meet the essential responsibilities of the role. The ability to use a particular job-crucial technology or software would also hint to recruiters whether you'd need a prolonged period of on-the-job training - or you'd fit right in the job.

But to land your dream role, you'd also need to demonstrate a variety of soft or people resume skills . Employers care about soft skills as they show how each candidate would fit into the team and company culture.

Both types of skills are specific and to best curate them on your resume, you'd need to:

- Create a skill section within which you showcase your hard and soft skills and present how they help you succeed.

- List specific examples of projects, tasks, or competitions, within which your skill set has assisted your results.

- Soft skills are harder to measure, so think about situations in which they've helped you thrive. Describe those situations concisely, focusing on how the outcome has helped you grow as a professional.

- Metrics of success - like positive ROI or optimized workplace processes - are the best way to prove your technical and people skills.

Take a look at some of financial advisor industry leaders' favorite hard skills and soft skills, as listed on their resumes.

Top skills for your financial advisor resume:

Financial Planning Software

Portfolio Management Tools

Excel

QuickBooks

CRM Systems

Tax Preparation Software

Investment Analysis Tools

Risk Assessment Software

Retirement Planning Software

Financial Modeling Software

Communication

Interpersonal Skills

Analytical Thinking

Problem Solving

Time Management

Sales Skills

Attention to Detail

Empathy

Negotiation

Adaptability

Next, you will find information on the top technologies for financial advisor professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Advisor’s resume:

- Microsoft Business Contact Manager

- Salesforce software

- Financial planning presentation software

- Microsoft PowerPoint

- Oracle E-Business Suite Financials

- WealthTec Foundations

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

The basics of your financial advisor resume certifications and education sections

Improve the education and certification sections of your financial advisor resume by:

- Dedicating more prominent space to certificates that are more recent and have helped you update your skill set

- Keeping all the information you list to the basics: certificate/degree name, institution, and graduation dates

- Writing supplementary information in the details of your certification or education section, only if you lack experience or want to show further skill alignment

- Including your credential or license number, only if the information is valid to your application or certification

Within financial advisor job adverts, relevant education, and certification are always listed within the key prerequisite for the role.

Ensure you meet all job requirements with some of the leading certificates in the industry:

The top 5 certifications for your financial advisor resume:

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Financial Analyst (CFA) - CFA Institute

- Chartered Financial Consultant (ChFC) - The American College of Financial Services

- Certified Investment Management Analyst (CIMA) - Investments & Wealth Institute

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial advisor professionals.

Top US associations for a Financial Advisor professional

- National Association of Personal Financial Advisors

- AICPA and CIMA

- American Bar Association

- Certified Financial Planner Board of Standards

- CFA Institute

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Recommended reads:

The summary or objective: focusing on the top one-third of your resume

It's a well-known fact that the top one-third of your financial advisor resume is the make-it-or-break-it moment of your application. The resume summary and objective could help you further build up your professional profile.

- If you have plenty of career highlights behind your back, use the resume summary . The financial advisor summary immediately focuses recruiters' attention on what matters most within your experience.

- The resume objective is the perfect choice for balancing your career achievements with your vision. Use it to state precisely how you see yourself in a couple of years' time - as part of the company you're applying for.

Both the resume summary and resume objective can be your value pitch to potential employers: answering what makes your application unique and the top choice for the financial advisor role. They both have to be specific and tailored - as there's no one-size-fits-all approach to writing your financial advisor summary or objective. Use the financial advisor examples below as a starting point:

Resume summaries for a financial advisor job

- With over 10 years of robust experience in the financial advisory landscape, I have honed a deep expertise in personalized wealth management, helping clients achieve a 20% average portfolio growth. My technical capabilities include advanced proficiency in tax planning, investment strategy formulation, and retirement planning, underscoring my commitment to fostering financial well-being for a diverse client base.

- Seasoned CPA and financial strategist seeking to transition into financial advising after eight successful years at a Big Four firm, where I spearheaded complex audits and tax mitigation strategies, resulting in a 15% average savings for clients. I bring a profound analytical acumen and a proven track record in regulatory compliance and strategic financial planning.

- Eager to transfer my 5-year tenure in corporate sales into the dynamic world of financial advisory, I offer a strong foundation in client relationship building, market analysis, and a relentless drive for excellence in customer service. My tenacity, combined with a comprehensive understanding of market trends, positions me to empower clients in realizing their financial goals.

- As a freshly minted Finance graduate, my objective is to apply my academic knowledge, passion for financial markets, and adeptness in financial modeling to deliver insightful advice and build lasting client relationships. My dedication to ongoing professional development and my eagerness to contribute fresh perspectives make me an ideal candidate for nurturing trust and achieving customer financial aspirations.

- Emerging from an extensive 12-year career in financial journalism, I bring a unique perspective to financial advising, leveraging my knack for distilling complex financial information into actionable insights. My commitment to integrity, along with a keen understanding of economic indicators, provides a solid foundation for helping clients navigate the ever-evolving financial landscape.

- Recent finance graduate aiming to embark on a career in financial advising with an eagerness to implement theoretical knowledge in practical settings. I am poised to offer contemporary financial analysis, robust economic research skills, and a vibrant enthusiasm for developing personalized strategies that align with client goals and expectations.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for financial advisor professionals

Local salary info for Financial Advisor.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $99,580 |

| California (CA) | $103,330 |

| Texas (TX) | $81,660 |

| Florida (FL) | $92,770 |

| New York (NY) | $161,760 |

| Pennsylvania (PA) | $100,370 |

| Illinois (IL) | $95,870 |

| Ohio (OH) | $82,030 |

| Georgia (GA) | $98,330 |

| North Carolina (NC) | $102,920 |

| Michigan (MI) | $70,390 |

What else can you add to your financial advisor resume

What most candidates don't realize is that their financial advisor resumes should be tailored both for the job and their own skillset and personality.

To achieve this balance between professional and personal traits, you can add various other sections across your resume.

Your potential employers may be impressed by your:

- Awards - spotlight any industry-specific achievements and recognitions that have paved your path to success;

- Languages - dedicate some space on your financial advisor resume to list your multilingual capabilities, alongside your proficiency level;

- Publications - with links and descriptions to both professional and academic ones, relevant to the role;

- Your prioritization framework - include a "My Time" pie chart, that shows how you spend your at-work and free time, would serve to further backup your organization skill set.

Key takeaways

- The format and layout of your financial advisor resume should reflect on both your career and what matters most to the job you're applying for;

- Use the resume summary and objective to hint at your most prominent accomplishments;

- Always be specific about your experience and consider what value each bullet you curate adds to your financial advisor application;

- Consider how your academic background and technical capabilities could further showcase your alignment to the role;

- Your soft skills should contribute to your overall financial advisor profile - aligning your personality with skills and results.

Financial Advisor resume examples

By Experience

Lead Financial Advisor

Junior Financial Advisor

Senior Financial Advisor

Financial Advisor Trainee

Financial Advisor Intern

By Role