As a financial counselor, articulating your diverse experience in debt management and investment strategies in a concise resume can be a daunting challenge. Our guide provides targeted advice to help you distill your expertise into an impactful resume that resonates with prospective employers.

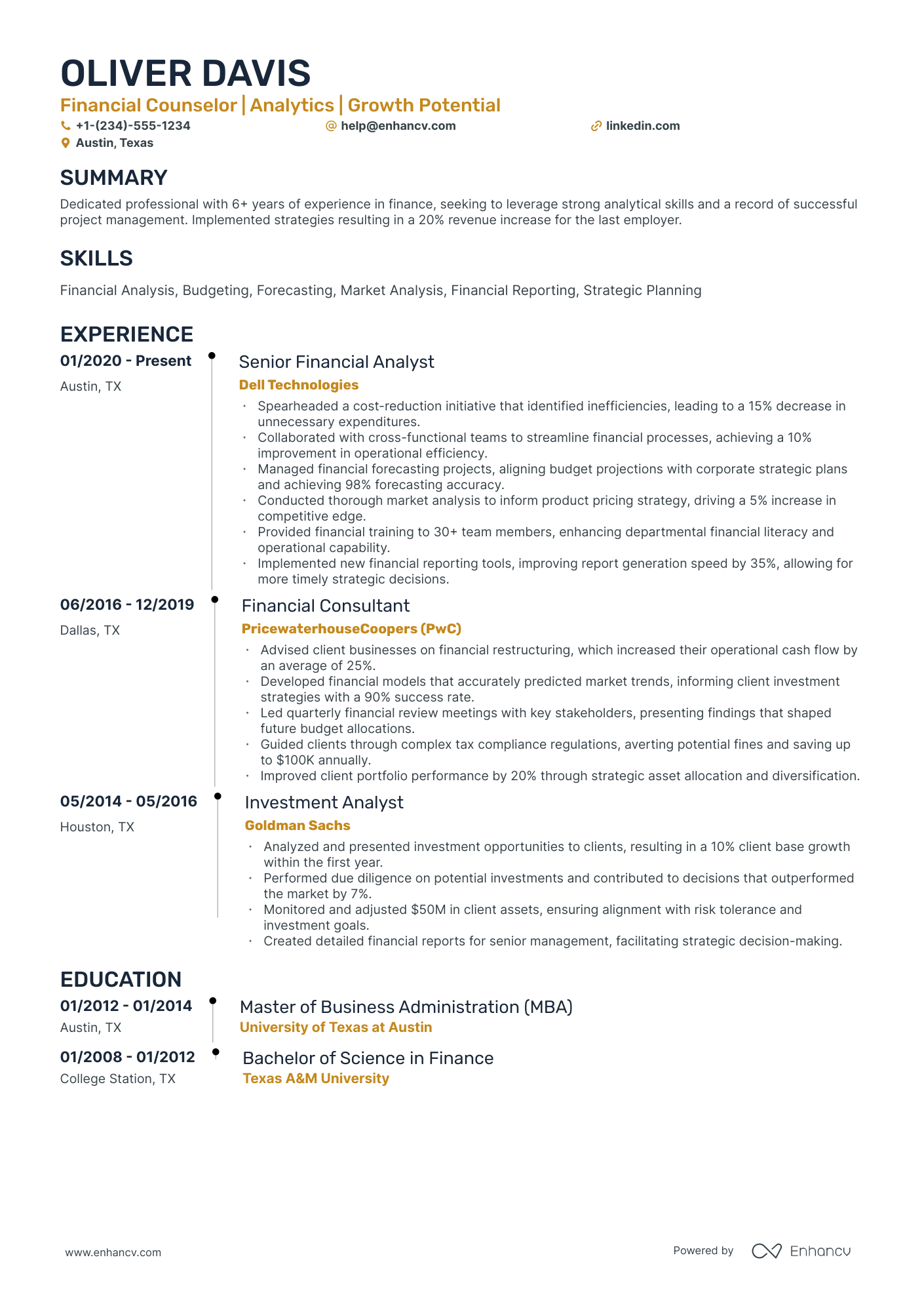

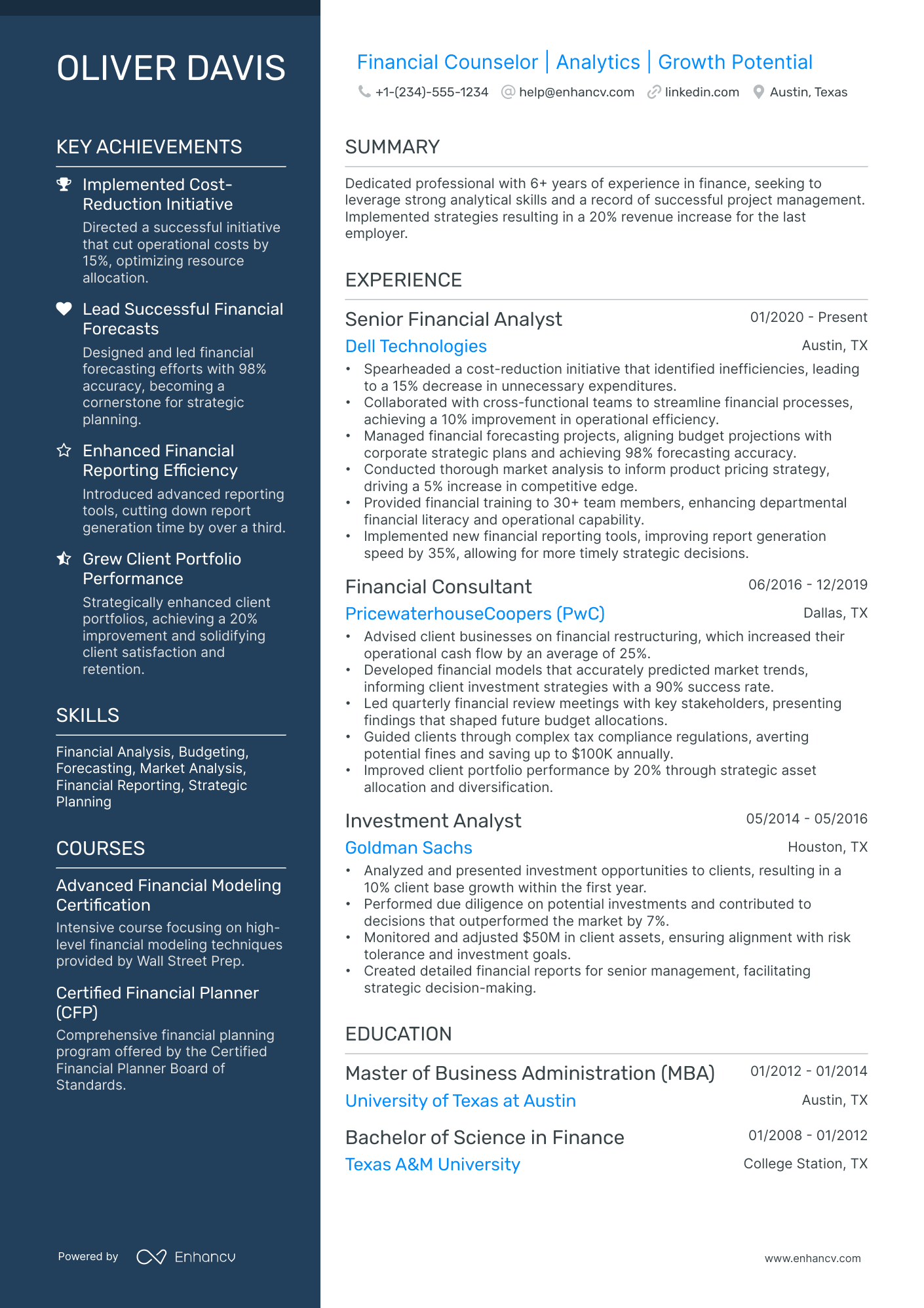

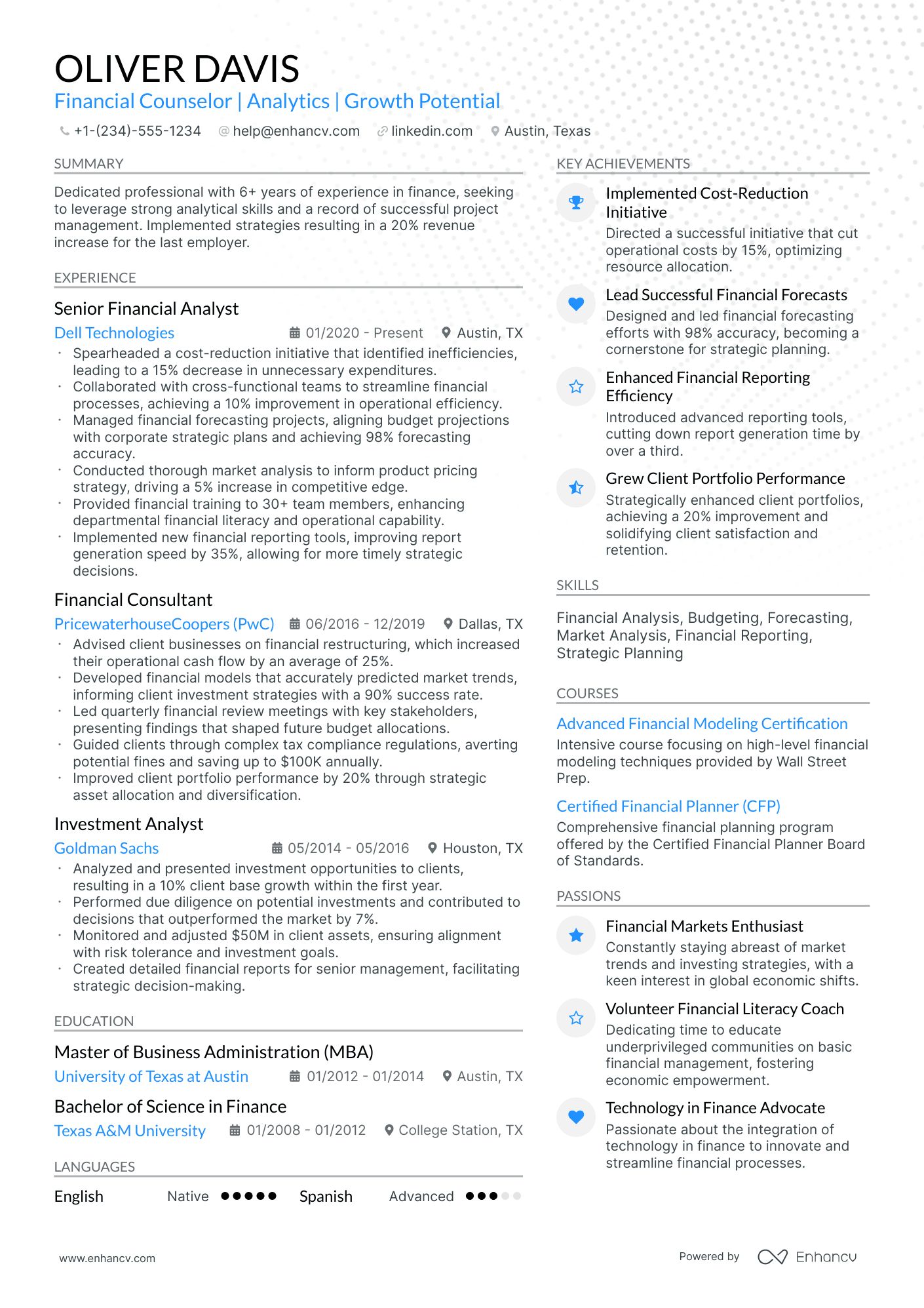

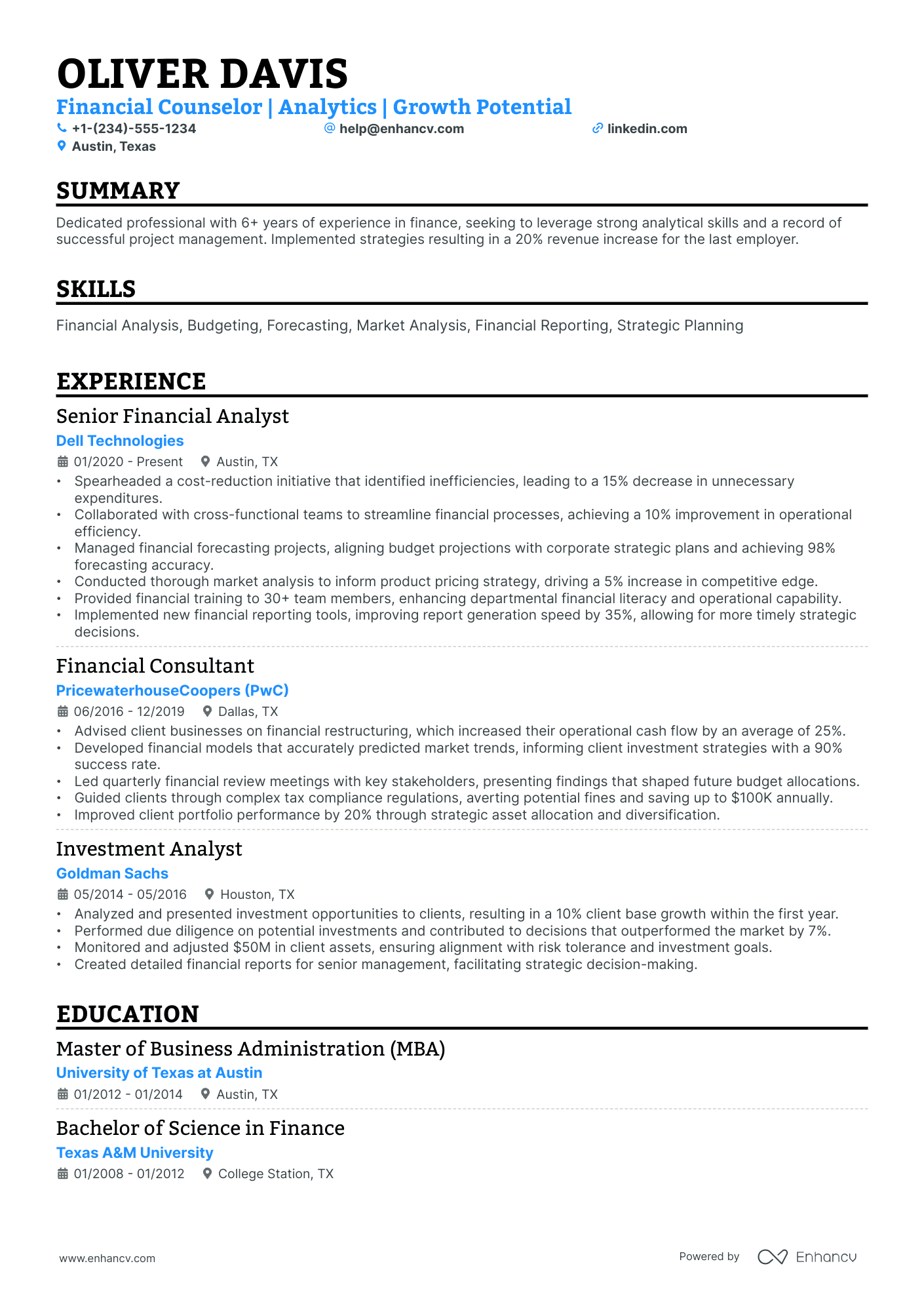

- Find different financial counselor resume examples to serve as inspiration to your professional presentation.

- How to use the summary or objective to highlight your career achievements.

- How to create the experience section to tell your story.

- Must have certificates and what to include in the education section of your resume.

If the financial counselor resume isn't the right one for you, take a look at other related guides we have:

- Management Accounting Resume Example

- Account Executive Resume Example

- Financial Management Specialist Resume Example

- Portfolio Manager Resume Example

- Financial Consultant Resume Example

- Construction Accounting Resume Example

- Loan Processor Resume Example

- Internal Audit Manager Resume Example

- Big 4 Auditor Resume Example

- Accounts Receivable Resume Example

Enhancing your financial counselor resume: format and layout tips

"Less is more" - this principle is key for your financial counselor resume design. It emphasizes the importance of focusing on why you're the ideal candidate. Simultaneously, it's crucial to select a resume design that is both clear and simple, ensuring your qualifications are easily readable.

Four popular formatting rules (and an additional tip) are here to optimize your financial counselor resume:

- Listing experience in reverse chronological order - start with your most recent job experiences. This layout helps recruiters see your career progression and emphasizes your most relevant roles.

- Including contact details in the header - make sure your contact information is easily accessible at the top of your resume. In the header, you might also include a professional photo.

- Aligning your expertise with the job requirements - this involves adding essential sections such as experience, skills, and education that match the job you're applying for.

- Curating your expertise on a single page - if your experience spans over a decade, a two-page resume is also acceptable.

Bonus tip: Ensure your financial counselor resume is in PDF format when submitting. This format maintains the integrity of images, icons, and layout, making your resume easier to share.

Finally, concerning your resume format and the Applicant Tracker System (ATS):

- Use simple yet modern fonts like Rubik, Lato, Montserrat, etc.

- All serif and sans-serif fonts are friendly to ATS systems. Avoid script fonts that look like handwriting, however.

- Fonts such as Ariel and Times New Roman are suitable, though commonly used.

- Both single and double-column resumes can perform well with the ATS.

Think about the location of your application – Canadian resumes, for instance, might follow a different structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Listing your relevant degrees or certificates on your financial counselor resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Traditional sections, appreciated by recruiters, for your financial counselor resume:

- Clear and concise header with relevant links and contact details

- Summary or objective with precise snapshot of our career highlights and why you're a suitable candidate for the financial counselor role

- Experience that goes into the nuts and bolts of your professional qualifications and success

- Skills section(-s) for more in-depth talent-alignment between job keywords and your own profile

- Education and certifications sections to further show your commitment for growth in the specific niche

What recruiters want to see on your resume:

- Demonstrated experience in financial planning and analysis, including budgeting, forecasting, and investment strategies.

- Strong knowledge of financial regulations and compliance standards, to ensure adherence to laws and ethical practices.

- Exceptional client service skills, showcasing an ability to build trust and maintain long-term client relationships.

- Proficiency in using financial counseling software and tools for account management, tax preparation, and financial reporting.

- Evidence of relevant certifications such as Certified Financial Planner (CFP) or Accredited financial counselor (AFC).

What to include in the experience section of your financial counselor resume

The resume experience section is perhaps the most important element in your application as it needs to showcase how your current profile matches the job.

While it may take some time to perfect your financial counselor experience section, here are five tips to keep in mind when writing yours:

- Assess the advert to make a list of key requirements and look back on how each of your past jobs answers those;

- Don't just showcase you know a particular skill, instead, you need proof in the form of tangible results (e.g. numbers, percent, etc.);

- It's perfectly fine to leave off experience items that don't bring anything extra to your skill set or application;

- Recruiters want to understand what the particular value is of working with you, so instead of solely featuring technologies, think about including at least one bullet that's focused on your soft skills;

- Take care with wording each bullet to demonstrate what you've achieved, using a particular skill, and an action verb.

The below financial counselor resume examples can help guide you to curate your professional experience, following industry-leading tips and advice.

- Developed and implemented tailored financial plans for over 150 clients, increasing their investment portfolios by an average of 35% within the first year.

- Counseled clients on debt management and consolidation, resulting in a 20% average reduction of their debt load within 24 months.

- Led financial literacy workshops for 300+ individuals, enhancing community financial awareness and fostering a 15% uptake in the company's financial products.

- Orchestrated the restructuring of financial strategies for high-net-worth clients, contributing to a 25% growth in asset under management for the firm.

- Spearheaded an automation initiative for reporting procedures that saved the team approximately 200 hours annually in manual data entry.

- Collaborated with cross-functional teams to develop a comprehensive financial education platform, which became a key differentiator in service offerings.

- Managed a portfolio of 100+ clients, securing on average a 10% annual return on investments during a period of economic volatility.

- Advised on tax optimization strategies for clients, saving them an estimated total of $500,000 in potential tax liabilities over the course of four years.

- Facilitated the transition of client portfolios during a major merger, ensuring zero downtime and maintained client satisfaction.

- Pioneered a budget management tool tailored for middle-income families, which was adopted by 700+ households within the first year.

- Provided crisis management counseling post-2008 financial crisis, assisting clients with asset reallocation and risk assessment.

- Negotiated with creditors on behalf of clients to lower interest rates, successfully reducing payments by up to 30% for the majority of cases.

- Implemented a robust financial tracking system for clients that increased their on-time bill payments from 70% to 95% in under a year.

- Conducted in-depth market analysis to provide informed investment advice, which led to an average 18% return on equity investments for clients.

- Partnered with estate planners to offer comprehensive financial plans, encompassing retirement, education, and legacy planning, broadening the firm's service portfolio.

- Crafted custom financial strategies for small business owners that improved their business cash flow by up to 40%.

- Initiated a digital transformation in client financial tracking, which enhanced data accuracy and improved investment decision-making processes.

- Directed a successful campaign that educated young professionals about the importance of early retirement planning, increasing the firm's clientele by 20% in this demographic.

- Led the redesign of risk assessment models for wealth management clients, aligning investment portfolios more closely with their risk tolerance and life stage.

- Engaged in proactive debt management strategies that helped reduce clients' overall debt obligations by an average of $10,000 within two fiscal years.

- Cultivated a partnership with a software provider to develop an app for real-time financial tracking, greatly enhancing client engagement and satisfaction.

- Oversaw a team of 5 junior financial counselors, mentoring them in effective client communication and portfolio management techniques.

- Facilitated workshops to aid clients in understanding complex investment products, thereby empowering them to make more informed financial decisions.

- Played a key role in the development and launch of an eco-friendly investment fund, attracting over $50 million in investments within two years.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial counselor professionals.

Top Responsibilities for Financial Counselor:

- Interview clients to determine their current income, expenses, insurance coverage, tax status, financial objectives, risk tolerance, or other information needed to develop a financial plan.

- Analyze financial information obtained from clients to determine strategies for meeting clients' financial objectives.

- Answer clients' questions about the purposes and details of financial plans and strategies.

- Review clients' accounts and plans regularly to determine whether life changes, economic changes, environmental concerns, or financial performance indicate a need for plan reassessment.

- Manage client portfolios, keeping client plans up-to-date.

- Recommend to clients strategies in cash management, insurance coverage, investment planning, or other areas to help them achieve their financial goals.

- Recommend financial products, such as stocks, bonds, mutual funds, or insurance.

- Implement financial planning recommendations, or refer clients to someone who can assist them with plan implementation.

- Contact clients periodically to determine any changes in their financial status.

- Prepare or interpret for clients information, such as investment performance reports, financial document summaries, or income projections.

Quantifying impact on your resume

- Highlight the amount of assets under management (AUM) to showcase your ability to handle significant financial responsibilities.

- Include specific percentages by which you've grown client portfolios to demonstrate investment success and strategy effectiveness.

- Detail the number of client accounts you have managed to reflect your experience with diverse financial needs and portfolio sizes.

- Mention quantifiable cost savings from negotiated financial products or services to show your skill in reducing expenses for clients.

- Specify the sizes of budgets you have overseen to highlight your competence in managing large-scale financial operations.

- Reference the number of financial plans or reports you’ve developed to emphasize your role in strategic financial decision-making.

- Illustrate the growth in client retention rates under your counsel to prove your effectiveness in maintaining client satisfaction.

- Document any quantitative improvements in a business's financial health for which you provided guidance to validate your impact on organizational success.

Action verbs for your financial counselor resume

No experience, no problem: writing your financial counselor resume

You're quite set on the financial counselor role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

The heart and soul of your financial counselor resume: hard skills and soft skills

If you read between the lines of the financial counselor role you're applying for, you'll discover that all requirements are linked with candidates' hard skills and soft skills.

What do those skills have to do with your application?

Hard or technical skills are the ones that hint at your aptitude with particular technologies. They are easy to quantify via your professional experience or various certifications.

Meanwhile, your soft skills are more difficult to assess as they are personality traits, you've gained thanks to working in different environments/teams/organizations.

Your financial counselor resume skills section is the perfect opportunity to shine a light on both types of skills by:

- Dedicating a technical skills section to list up to six technologies you're apt at.

- Focusing a strengths section on your achievements, thanks to using particular people skills or technologies.

- Including a healthy balance of hard and soft skills in the skills section to answer key job requirements.

- Creating a language skills section with your proficiency level - to hint at an abundance of soft skills you've obtained, thanks to your dedication to learning a particular language.

Within the next section of this guide, stay tuned for some of the most trending hard skills and soft skills across the industry.

Top skills for your financial counselor resume:

Financial Planning Software

Budgeting Tools

Investment Analysis Software

Accounting Software (e.g., QuickBooks)

Spreadsheet Applications (e.g., Microsoft Excel)

Debt Management Tools

CRM Software

Data Analysis Software

Tax Preparation Software

Financial Modeling Tools

Communication

Empathy

Problem-Solving

Active Listening

Analytical Thinking

Negotiation

Time Management

Interpersonal Skills

Adaptability

Conflict Resolution

Next, you will find information on the top technologies for financial counselor professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Counselor’s resume:

- Microsoft Business Contact Manager

- Salesforce software

- Financial planning presentation software

- Microsoft PowerPoint

- Oracle E-Business Suite Financials

- WealthTec Foundations

PRO TIP

Listing your relevant degrees or certificates on your financial counselor resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

What are the best certificates to add to your financial counselor resume + how to curate your education section

The education and certification resume sections are the underdogs of your financial counselor resume.

They showcase to recruiters that you've invested plenty of time to gain valuable and specific know-how, vital for growth.

As far as the resume education section is concerned:

- Detail only advanced education, specifying the institution and timeframe.

- Indicate your forthcoming graduation date if you're in the midst of your studies.

- Consider omitting degrees that don't align with the job's requirements.

- Offer a description of your academic journey if it underscores your notable achievements.

When curating your degrees and certificates on your financial counselor resume:

- Select only accreditation that matters to the role

- Niche knowledge that could help you stand out as a candidate (as is within the past few years), should be listed towards the top of your resume

- Include any pertinent data for credibility (e.g. institute name, graduation dates, etc.)

- Irrelevant degrees and certifications shouldn't make it on your resume. Those include your high school diploma and any specializations that have nothing to do with the technical or soft skills that are required for the job

As a final note, if you feel tempted to exclude your education or certification from your resume, don't.

These two sections could help you have a better competitive edge over other candidates - hinting that your professional journey in the industry may be for a longer period of time.

Recruiters find all of these financial counselor credentials impressive:

The top 5 certifications for your financial counselor resume:

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Financial Consultant (ChFC) - The American College of Financial Services

- Accredited financial counselor (AFC) - Association for Financial Counseling & Planning Education

- Certified Credit Counselor (CCC) - National Association of Certified Credit Counselors

- Financial Fitness Coach (FFC) - Association for Financial Counseling & Planning Education

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial counselor professionals.

Top US associations for a Financial Counselor professional

- National Association of Personal Financial Advisors

- AICPA and CIMA

- American Bar Association

- Certified Financial Planner Board of Standards

- CFA Institute

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Recommended reads:

Financial counselor resume summaries or objectives: real-world samples for best industry practices

Grasp recruiters' attention from the get-go of your application with a professional financial counselor resume summary or objective.

It's wise to select the:

- Resume objective , if you don't happen to have much experience alignment and would like to more prominently feature your dreams and personality.

- Resume summary , if you'd like to have a more standard approach to your application and feature up to five career highlights to help you stand out.

Writing your resume summary or objective should be tailored to each role you apply for.

Think about what would impress the recruiters and go from there.

But, if you need further help with this introductory section, check out some real-world samples in the next part of this guide:

Resume summaries for a financial counselor job

- Seasoned financial counselor with over a decade of experience in debt management and investment advising. Skills include comprehensive budget analysis, strategic financial planning, and a record of successful debt reduction strategies that led to a 40% average client debt decrease within two years.

- Dynamic former retail bank manager transitioning into financial counseling, boasting 8 years of experience in personal banking, exceptional customer service, and development of tailor-made financial products that resulted in a 30% growth in customer portfolio year-over-year.

- Accomplished educator with 15 years of teaching economics and personal finance, now pivoting to a career as a financial counselor. Fuses pedagogical expertise with a passion for financial literacy, delivering tools that empower individuals to achieve financial stability and growth.

- Marketing executive with 20 years in the corporate sector, now seeking to apply a wealth of experience in consumer behavior analysis towards fostering financial wellness as a financial counselor. Expert at interpreting market trends that translate into actionable financial advice for diverse client bases.

- Eager to apply a strong foundation in finance theory, acquired through a master's degree in finance, to help individuals navigate their financial journey. Committed to utilizing analytical skills and a detail-oriented approach to develop personalized financial plans that promote long-term security and prosperity.

- Aspiring financial counselor, driven by a keen interest in the intersections of technology and personal finance, ready to leverage a recently awarded Bachelor’s degree in Financial Technology. Looking forward to applying cutting-edge digital solutions to traditional financial counseling, optimizing client outcomes through innovation and efficiency.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for financial counselor professionals

Local salary info for Financial Counselor.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $99,580 |

| California (CA) | $103,330 |

| Texas (TX) | $81,660 |

| Florida (FL) | $92,770 |

| New York (NY) | $161,760 |

| Pennsylvania (PA) | $100,370 |

| Illinois (IL) | $95,870 |

| Ohio (OH) | $82,030 |

| Georgia (GA) | $98,330 |

| North Carolina (NC) | $102,920 |

| Michigan (MI) | $70,390 |

Taking your financial counselor resume to the next level with these four additional resume sections

Your financial counselor resume can feature a variety of skills (both hard and soft) in diverse sections. Choose those that align best with the job requirements and reflect your suitability for the company culture.

Consider these four additional resume sections recommended by our experts:

- Languages - State any languages you are proficient in and your level of proficiency. This demonstrates your commitment to communication and potential for international growth.

- Projects - Highlight up to three significant projects you've completed outside of work, showcasing skill development. Include a link to your project portfolio in the financial counselor resume header, if applicable.

- My Time - How you allocate your time outside work can indicate your organizational skills and cultural fit within the company.

- Volunteering - Detail causes you're passionate about, roles you've held, and achievements in volunteering. Such experiences likely have honed a range of soft skills crucial for your dream job.

Key takeaways

- Ensure your financial counselor resume uses a simple, easy-to-read format that reflects upon your experience and aligns with the role;

- Be specific within the top one-third of your resume (header and summary or objective) to pinpoint what makes you the ideal candidate for the financial counselor role;

- Curate information that is tailored to the job by detailing skills, achievements, and actual outcomes of your efforts;

- List your certifications and technical capabilities to demonstrate your aptitude with specific software and technologies;

- The sections you decide on including on your financial counselor should pinpoint your professional expertise and personality.