As a portfolio manager, articulating your complex investment strategies and client management successes in a resume can be a daunting challenge. Our guide provides clear examples and strategies to effectively showcase your expertise, ensuring your resume stands out to potential employers.

- Apply best practices from professional resumes to spotlight your application;

- Quantify your professional experience with achievements, career highlights, projects, and more;

- Write an eye-catching portfolio manager resume top one-third with your header, summary/objective, and skills section;

- Fill in the gaps of your experience with extracurricular, education, and more vital resume sections.

We've selected, especially for you, some of our most relevant portfolio manager resume guides. Getting you from thinking about your next career move to landing your dream job.

- Internal Audit Manager Resume Example

- Accounts Receivable Resume Example

- Accounting Assistant Resume Example

- Commercial Banking Resume Example

- Corporate Financial Analyst Resume Example

- Public Accounting Auditor Resume Example

- CPA Resume Example

- Tax Accountant Resume Example

- Oracle Project Accounting Resume Example

- Construction Accounting Resume Example

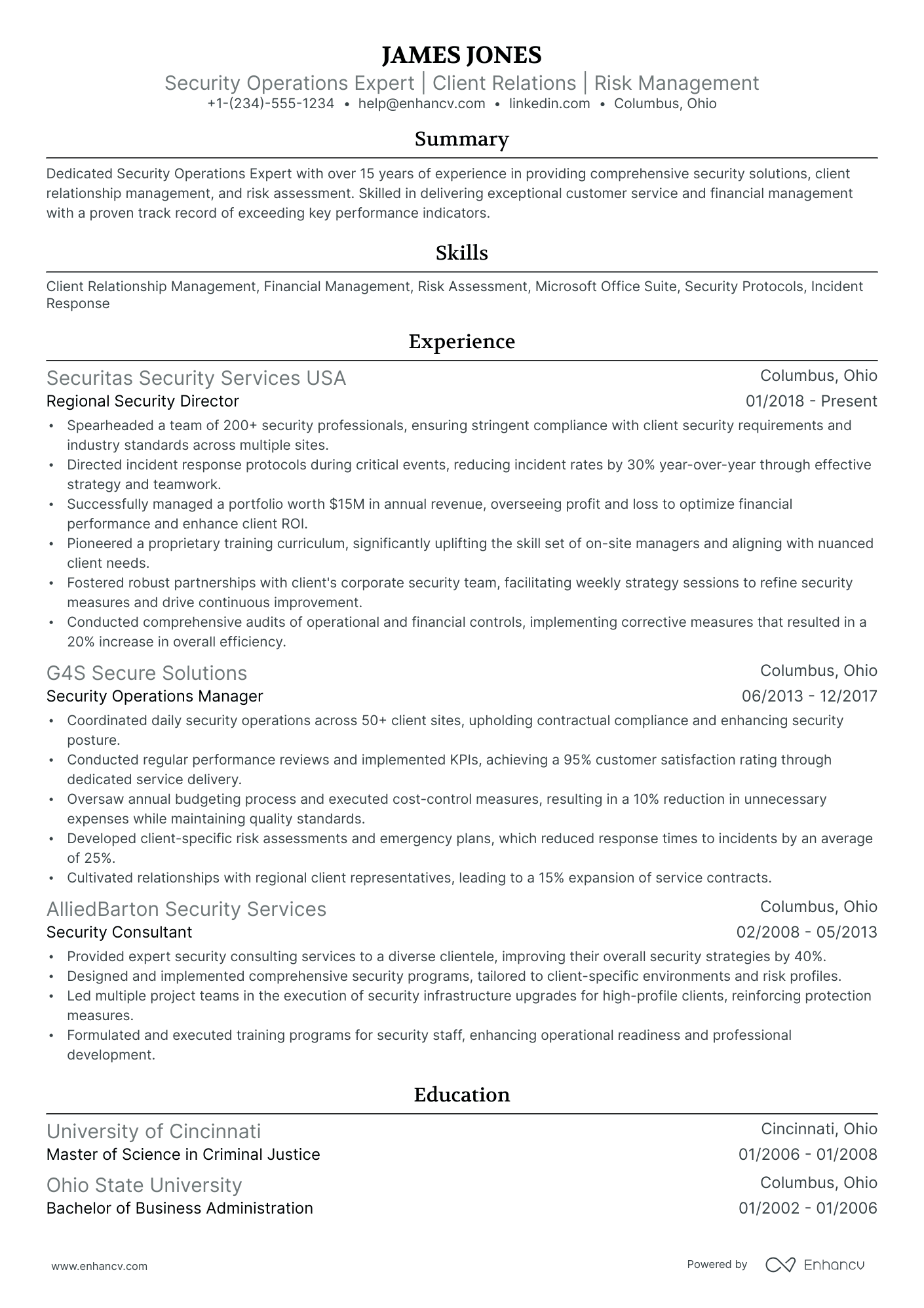

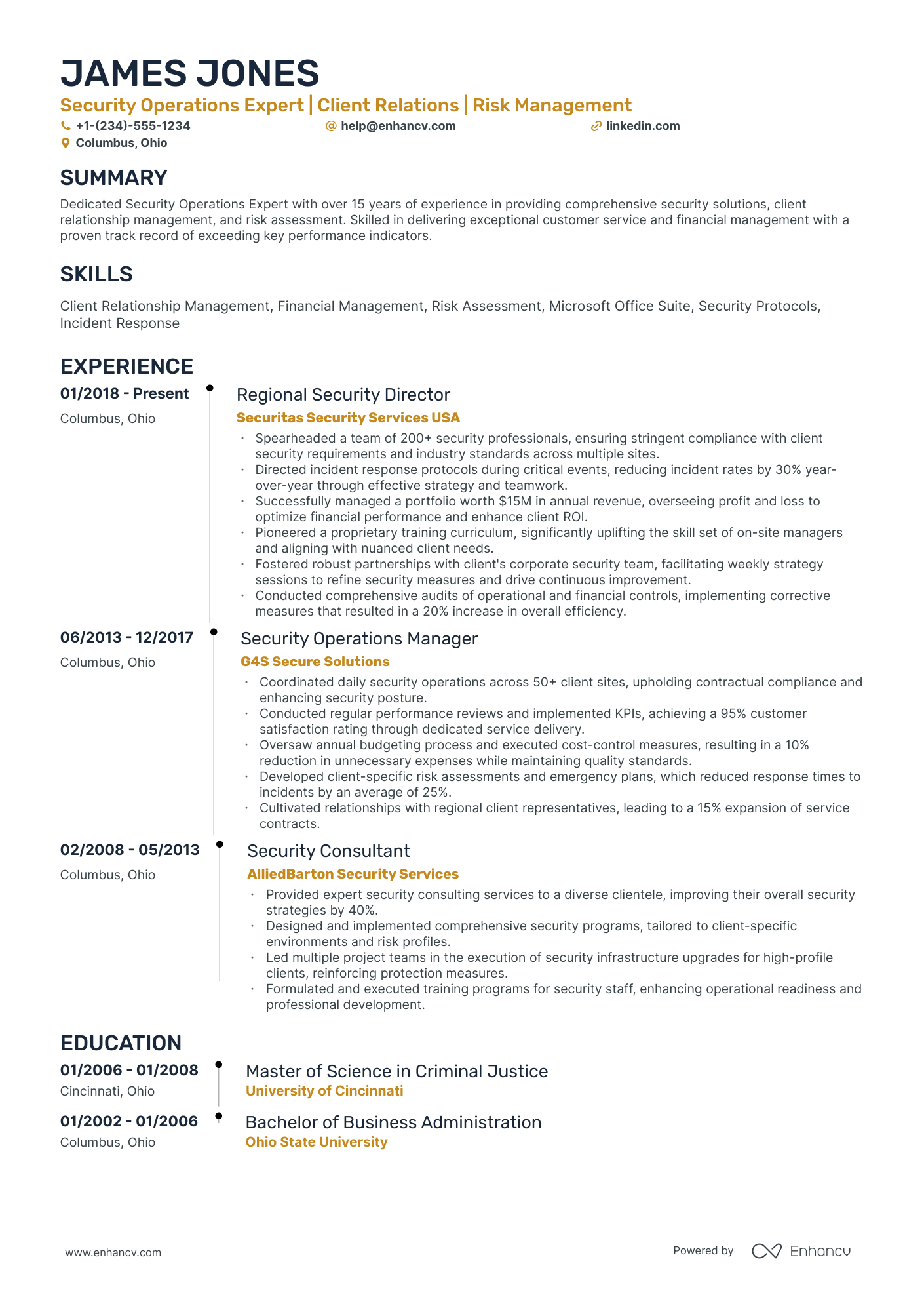

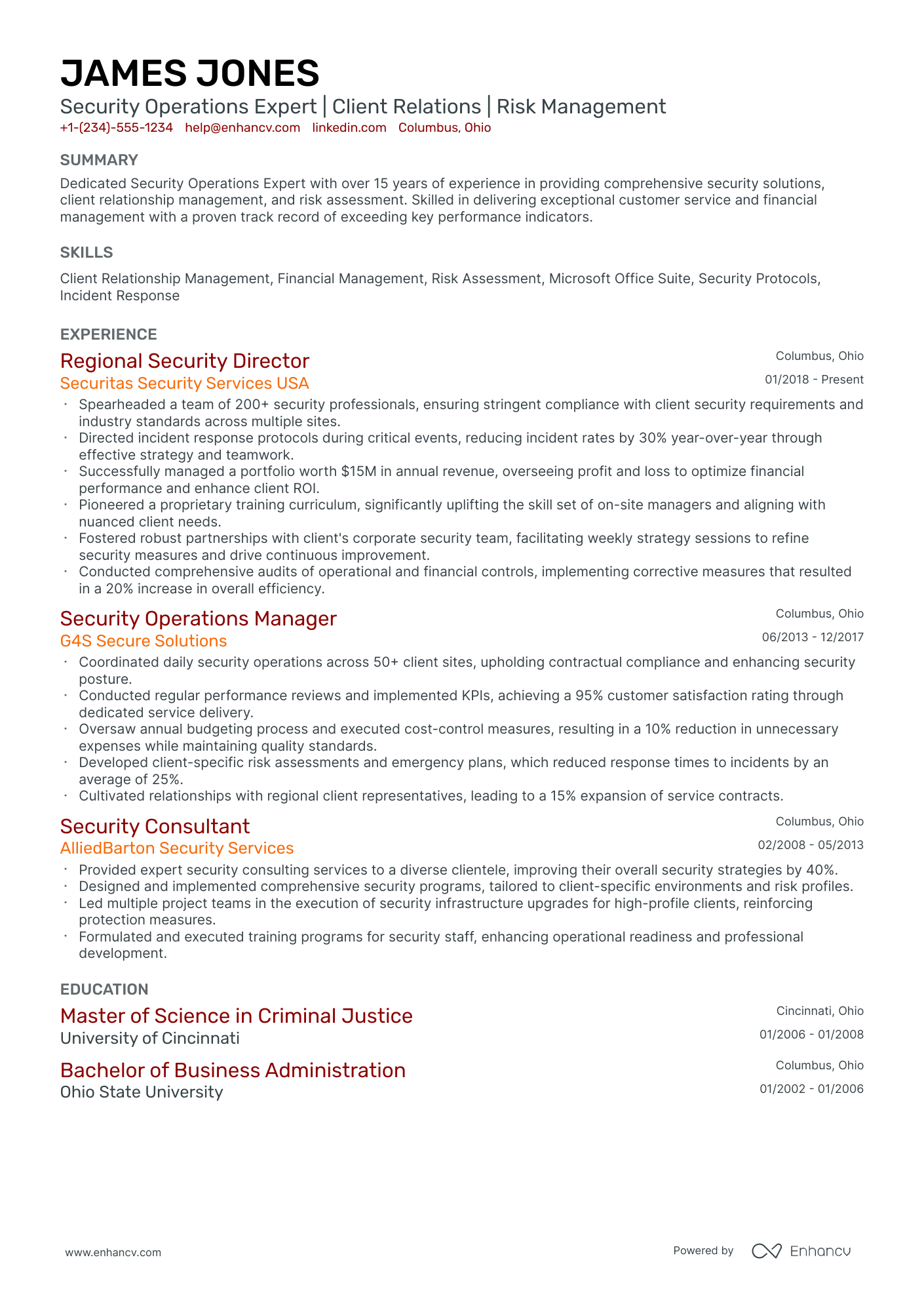

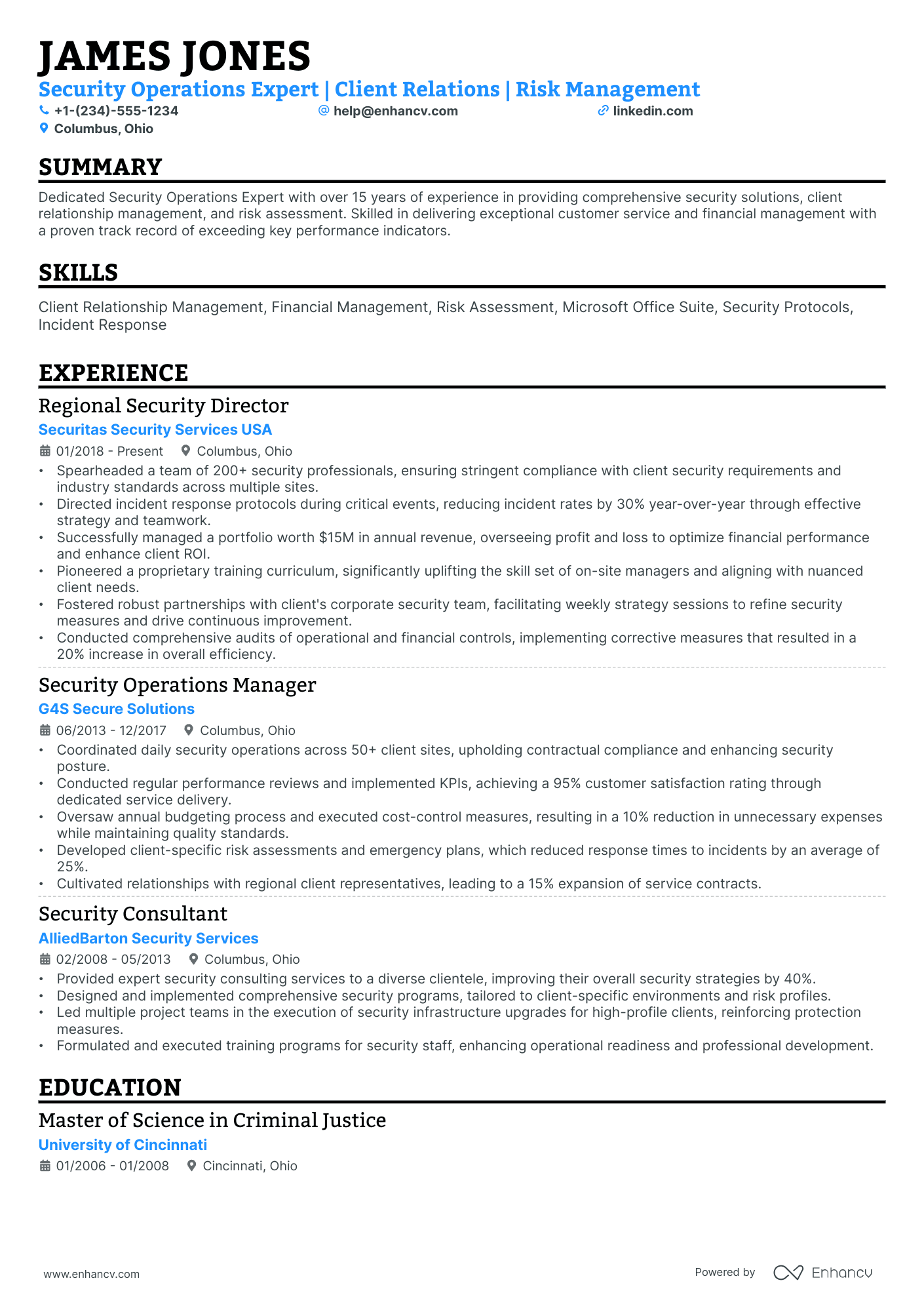

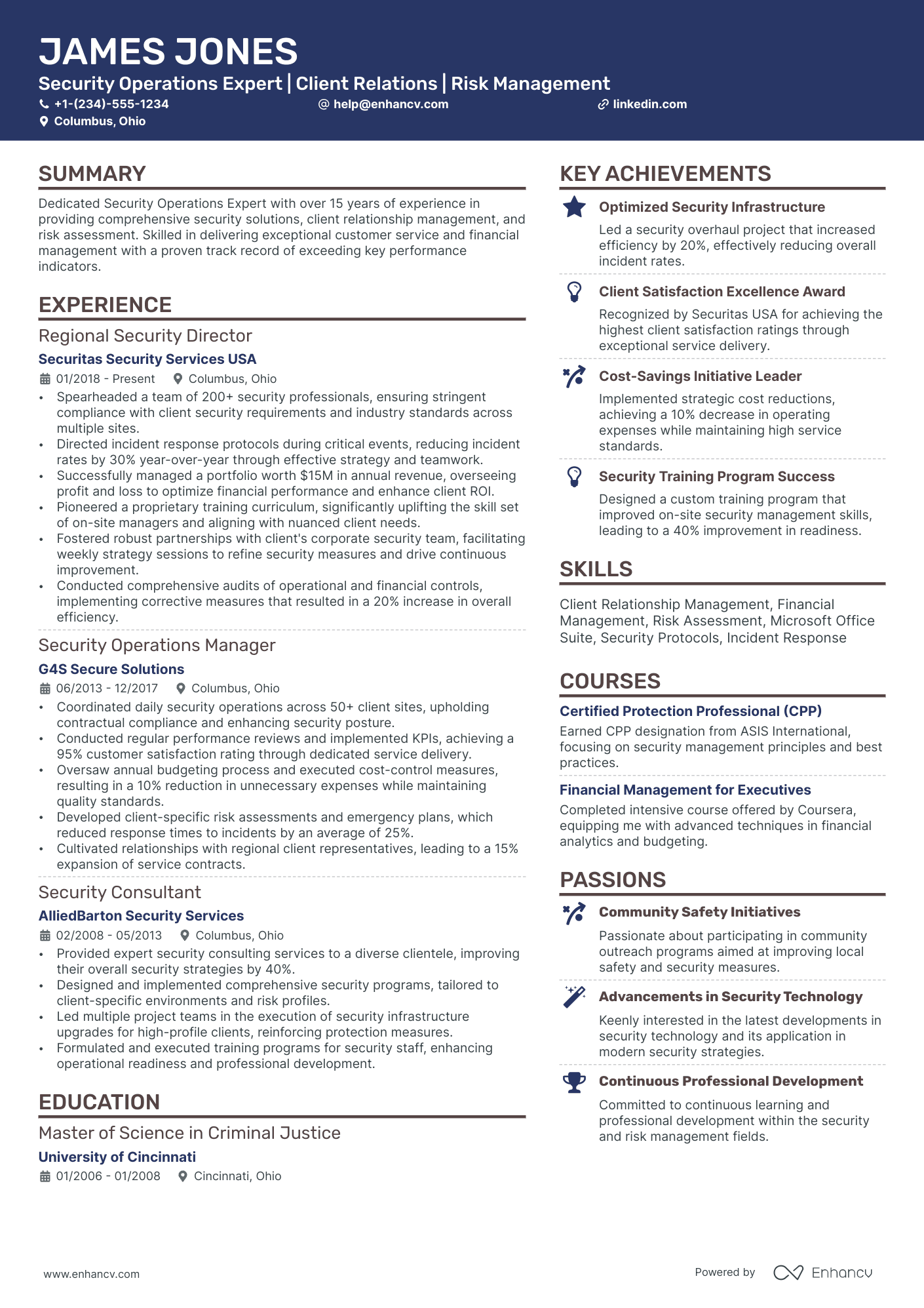

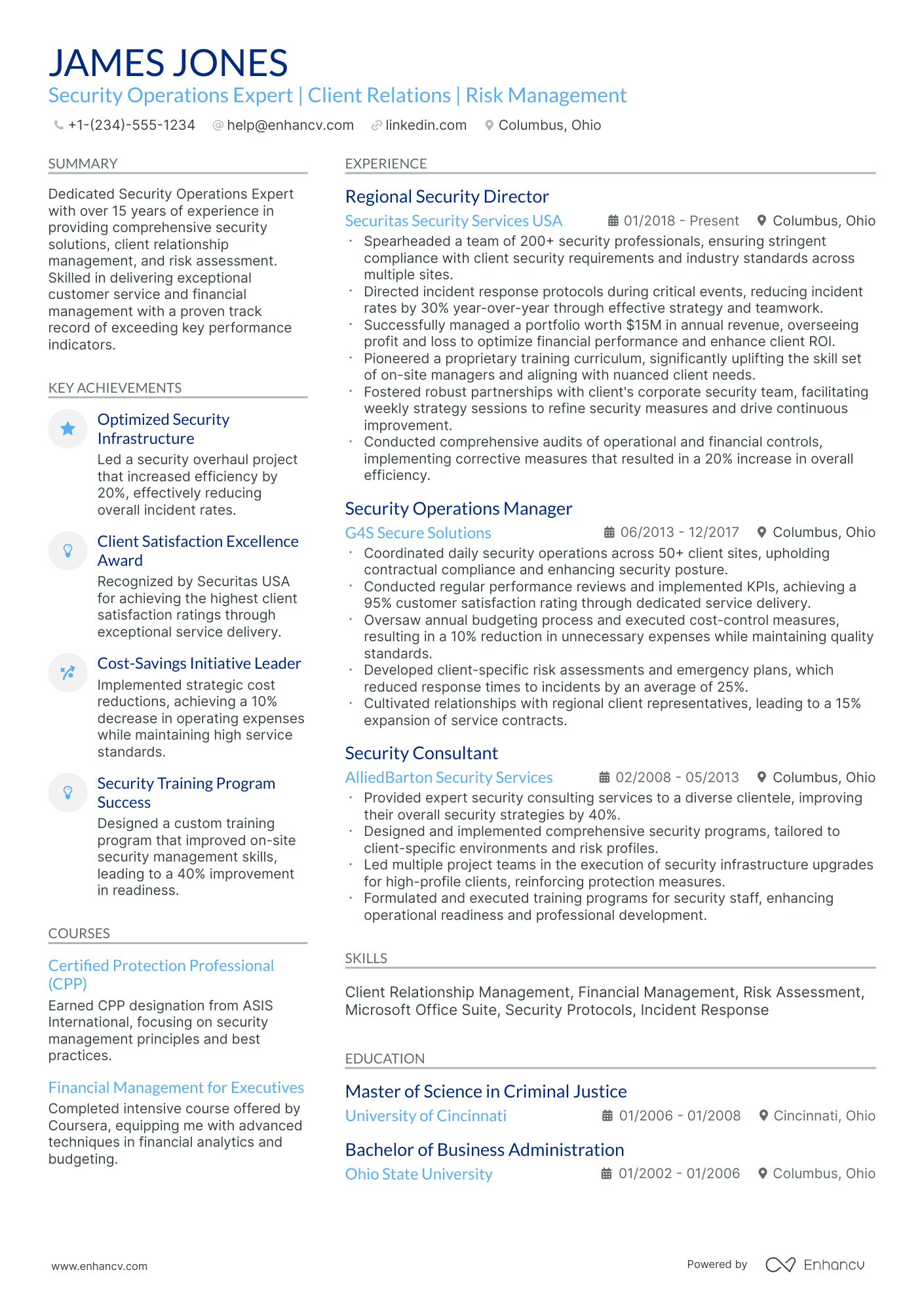

Simple guide to your portfolio manager resume format and layout

Successful portfolio manager resumes all have one specific characteristic - candidates have invested in a simple resume layout . One that is easy to read, makes a good first impression, and is adapted to their professional experience. There are three distinct resume formats to help you focus on your:

- professional experience - use the reverse-chronological resume format;

- skills and achievements - via the functional skill-based resume format;

- both experience and skills - with a hybrid resume format .

What is more, keep in mind that your resume may be initially assessed by the ATS (Applicant Tracker System) (or the software used by companies in the hiring process). The portfolio manager resumes that suit the ATS:

- have a header that includes either a role keyword or the job you're applying for;

- should be no longer than two pages;

- be submitted as PDF, unless specified otherwise.

Different markets have specific resume formats – a Canadian resume could vary in layout.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

The five (plus) definite sections your resume for a portfolio manager job should include are:

- Header with your headline, contact details, and/or a preview of your work

- Summary (or objective) to pinpoint how your success aligns with the role

- Experience with bullets of your most relevant achievements in the field

- Skills to integrate vital job requirements (both technical and personal)

- Your further dedication to the field, showcased via relevant higher education and/or certifications

What recruiters want to see on your resume:

- Proven track record of strong investment performance, including specific benchmarks or indices beaten, and the impact on fund or asset growth.

- Demonstrated expertise in asset allocation, portfolio construction, and risk management.

- Familiarity with financial laws, regulations, and the ethical standards relevant to portfolio management and trading.

- Strong quantitative and analytical skills, including experience with financial modeling and using portfolio management software.

- Effective communication skills to convey complex investment strategies to clients, stakeholders, or team members.

Creating your portfolio manager resume experience to catch recruiters' attention

Remember that for the portfolio manager role, hiring managers are looking to see how your expertise aligns with their requirements. Here's where your resume experience section can help out. Make sure you:

- Include mainly roles that are relevant to the portfolio manager job you're applying for;

- Don't go too far back in your experience - recruiters will only care what you did a decade ago if it's really important for the portfolio manager role;

- Each bullet you include should say what you did, followed by the skills you used and the actual end result of your efforts;

- Quantify each of your achievements with numbers and possibly the overall effect it had on the organization;

- Highlight transferrable skills - or personal skills you've attained thanks to past jobs - that could be applicable within your potential workplace. This would showcase your unique value as a professional.

Formatting the experience section of your resume doesn't have to be an over-the-top deep dive into your whole career. Follow the portfolio manager resume examples below to see how industry-leading professionals are presenting their experience:

- Overhauled the fixed-income investment strategy for a portfolio totaling $500 million, achieving a 20% increase in annual returns compared to previous years.

- Implemented cutting-edge quantitative analysis methods to optimize asset allocation, boosting the fund's performance above industry benchmarks by 15%.

- Spearheaded the integration of ESG criteria into the investment selection process, attracting $100 million in new capital from socially conscious investors.

- Managed a diversified equity portfolio that outperformed the S&P 500 index by 10% annually through strategic market research and precise stock selection.

- Led a team of analysts to identify high potential startups, successfully adding five new growth companies to the portfolio, each averaging 30% year-over-year revenue growth.

- Cultivated key relationships with institutional clients, resulting in a 25% growth in client base and a sustained 95% retention rate over the three-year period.

- Executed a strategic pivot towards tech and healthcare sectors amid the pandemic, achieving a robust 18% portfolio gain in a challenging economic climate.

- Initiated a proprietary risk management framework that reduced volatility by 22%, greatly appealing to risk-averse clients and expanding the high-net-worth client segment.

- Coordinated with international teams to tap into emerging markets, resulting in a successful expansion and outperformance in Asian market equities by 12%.

- Directed the transition of a $200 million portfolio towards sustainable energy, securing a 30% improvement in portfolio carbon footprint within the first year.

- Negotiated and finalized the acquisition of three environmental technology companies, enhancing the portfolio's innovation score and attracting new green investors.

- Devised a customized client reporting system that improved transparency and boosted client satisfaction scores by 20% through enhanced communication.

- Led the successful turnaround of an underperforming $350 million equity portfolio to achieve top-quartile performance within two years.

- Conducted rigorous competitor analysis to reposition growth strategies, which allowed the mid-cap segment of the portfolio to outperform peers by 14%.

- Introduced an employee mentorship program that improved the skills and productivity of junior analysts, directly contributing to the higher quality of investment research.

- Developed and managed an international equities portfolio, leveraging geopolitical insights to capitalize on market shifts and yielding an average 16% return per annum.

- Orchestrated the exit of low-performing assets and reallocated funds to secure more lucrative opportunities, notably increasing the value of the portfolio by 35%.

- Actively contributed to client acquisition strategies through educational workshops; instrumental in asset growth of 150% within the portfolio under management.

- Developed a sophisticated algorithmic trading strategy that enhanced the real-time decision-making process for a portfolio valuing $250 million.

- Pioneered a data-driven approach to market analysis, which identified undervalued securities, leading to a direct impact on the portfolio's performance with a 12% yield increase.

- Organized quarterly educational seminars for clients, which increased client engagement and led to a 40% increase in investment upsells within my portfolio.

- Masterminded a strategic portfolio realignment in response to the 2016 market downturn, preserving capital and outperforming the recovery benchmark by 9%.

- Piloted a partnership with a fintech startup to develop AI-based analytics tools, enhancing predictive capabilities and contributing to an informed investment approach.

- Enhanced portfolio yield by negotiating better terms with financial product providers, saving an average of 2% in annual fees across managed funds.

- Championed the digital transformation of portfolio management, integrating AI and machine learning to improve predictive analytics and investment decision-making.

- Executed a regional diversification strategy that fortified the portfolio against domestic market volatility, with a 15% increase in risk-adjusted return.

- Led the diligence and integration process for the merger of two high-yield bond funds totaling $600 million, maintaining performance stability throughout the transition.

- Implemented a dynamic hedging strategy that mitigated interest rate risk, contributing to the portfolio's resilience during Federal Reserve rate hikes.

- Hosted bi-annual investment strategy webinars for clients, which were highly praised for their educational content and were linked to a significant reduction in client churn.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for portfolio manager professionals.

Top Responsibilities for Portfolio Manager:

- Manage investment funds to maximize return on client investments.

- Select specific investments or investment mixes for purchase by an investment fund.

- Monitor financial or operational performance of individual investments to ensure portfolios meet risk goals.

- Select or direct the execution of trades.

- Develop or implement fund investment policies or strategies.

- Perform or evaluate research, such as detailed company or industry analyses, to inform financial forecasting, decision making, or valuation.

- Present investment information, such as product risks, fees, or fund performance statistics.

- Develop, implement, or monitor security valuation policies.

- Meet with investors to determine investment goals or to discuss investment strategies.

- Attend investment briefings or consult financial media to stay abreast of relevant investment markets.

Quantifying impact on your resume

- List the total assets under management (AUM) you have overseen to demonstrate the scale of your financial responsibilities.

- Include the percentage growth of your portfolio to showcase your investment success and decision-making abilities.

- Mention the number of investment strategies you have developed and implemented to illustrate your strategic thinking skills.

- Quantify the reduction in risk or volatility of the portfolio to highlight your risk management expertise.

- Indicate the number of clients or accounts you have managed to display your client relationship and account management capabilities.

- State the number of trades executed to show your experience with market operations and transaction management.

- Specify the percentage of outperformance compared to benchmarks to validate your competitive edge in the market.

- Present the number of team members you have supervised or mentored to emphasize your leadership and collaboration skills.

Action verbs for your portfolio manager resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Featuring your hard skills and soft skills on your portfolio manager resume

The skills section of your portfolio manager resume needs to your various capabilities that align with the job requirements. List hard skills (or technical skills) to showcase to potential employers that you're perfectly apt at dealing with technological innovations and niche software. Meanwhile, your soft skills need to detail how you'd thrive within your new, potential environment with personal skills (e.g. resilience, negotiation, organization, etc.) Your portfolio manager resume skills section needs to include both types of skills to promote how you're both technical and cultural fit. Here's how to create your bespoke portfolio manager skills section to help you stand out:

- Focus on skill requirements that are listed toward the top of the job advert.

- Include niche skills that you've worked hard to obtain.

- Select specific soft skills that match the company (or the department) culture.

- Cover some of the basic job requirements by including important skills for the portfolio manager role - ones you haven't been able to list through the rest of your resume.

Get inspired with our portfolio manager sample skill list to list some of the most prominent hard and soft skills across the field.

Top skills for your portfolio manager resume:

Financial Modeling

Portfolio Optimization Software

Risk Management Tools

Investment Analysis Platforms

Quantitative Analysis

Data Visualization Tools

Performance Measurement Systems

Asset Allocation Software

Trading Platforms

Excel Advanced Functions

Analytical Thinking

Communication Skills

Decision-Making

Negotiation Skills

Time Management

Attention to Detail

Problem-Solving

Leadership

Emotional Intelligence

Adaptability

Next, you will find information on the top technologies for portfolio manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Portfolio Manager’s resume:

- SAS

- Statistical analysis software

- Microsoft PowerPoint

- Oracle Hyperion Planning

- SunGard Financial Systems AddVantage

PRO TIP

Listing your relevant degrees or certificates on your portfolio manager resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

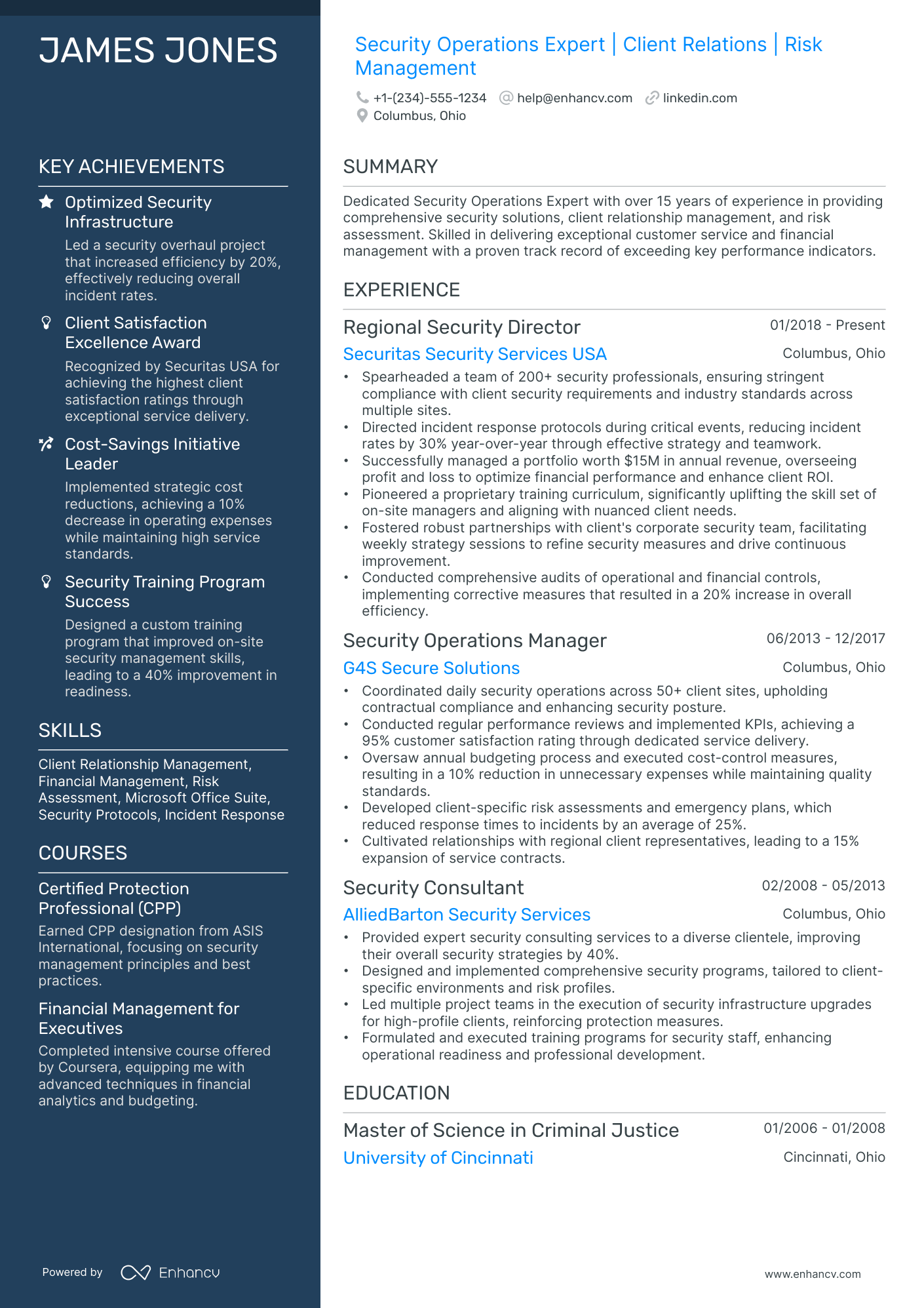

Education section and most popular portfolio manager certifications for your resume

Your resume education section is crucial. It can indicate a range of skills and experiences pertinent to the position.

- Mention only post-secondary qualifications, noting the institution and duration.

- If you're still studying, highlight your anticipated graduation date.

- Omit qualifications not pertinent to the role or sector.

- If it provides a chance to emphasize your accomplishments, describe your educational background, especially in a research-intensive setting.

Recruiters value portfolio manager candidates who have invested their personal time into their professional growth. That's why you should include both your relevant education and certification . Not only will this help you stand out amongst candidates, but showcase your dedication to the field. On your portfolio manager resume, ensure you've:

- Curated degrees and certificates that are relevant to the role

- Shown the institution you've obtained them from - for credibility

- Include the start and end dates (or if your education/certification is pending) to potentially fill in your experience gaps

- If applicable, include a couple of job advert keywords (skills or technologies) as part of the certification or degree description

If you decide to list miscellaneous certificates (that are irrelevant to the role), do so closer to the bottom of your resume. In that way, they'd come across as part of your personal interests, instead of experience. The team at Enhancv has created for you a list of the most popular portfolio manager certificates - to help you update your resume quicker:

The top 5 certifications for your portfolio manager resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Investment Management Analyst (CIMA) - Investments & Wealth Institute

- Certified Financial Planner (CFP) - CFP Board

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for portfolio manager professionals.

Top US associations for a Portfolio Manager professional

- AICPA and CIMA

- American Bar Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Recommended reads:

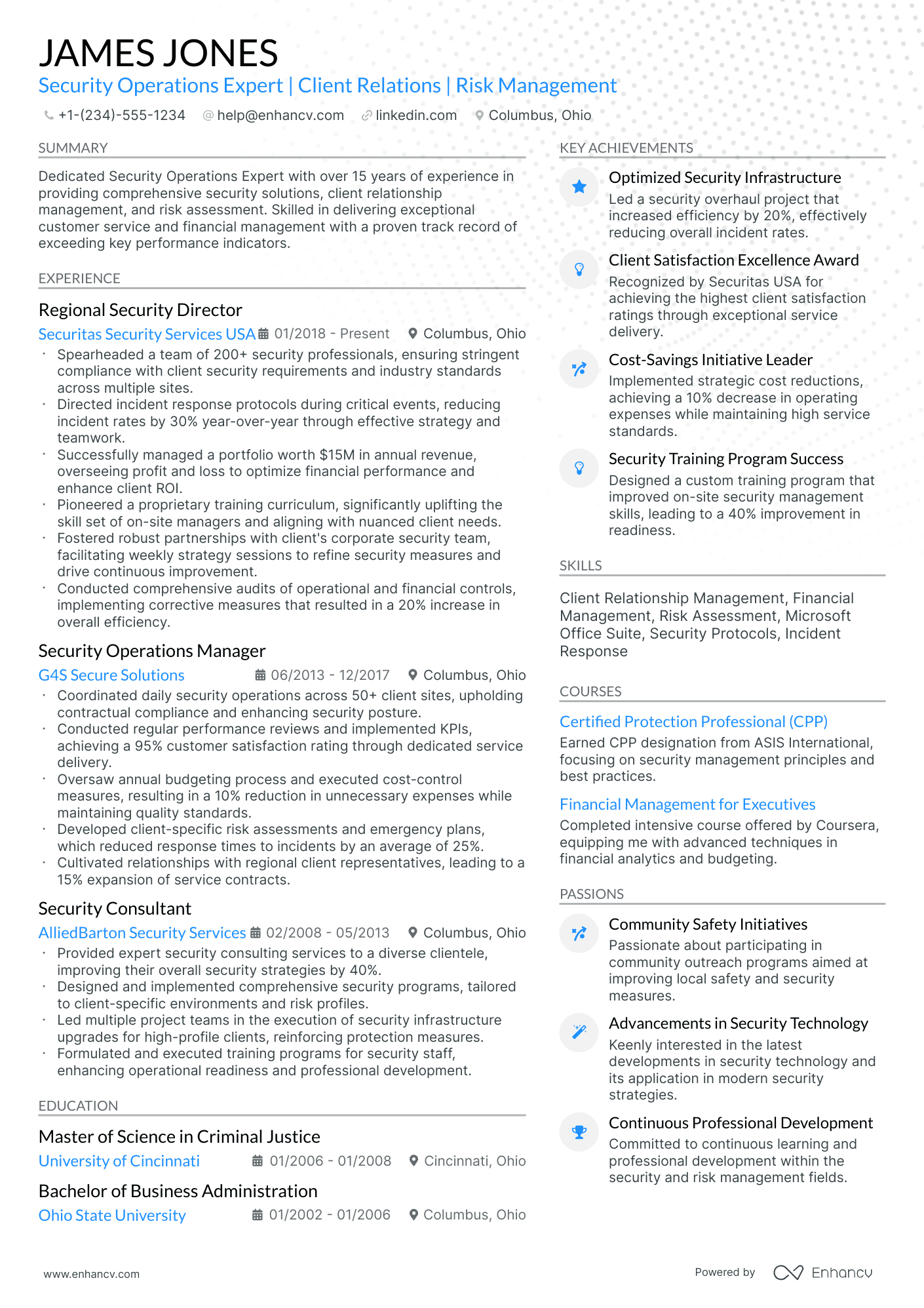

Writing the portfolio manager resume summary or objective: achievements, keywords, dreams, and more

Deciding on whether to include a resume summary or resume objective should entirely depend on your career situation.

If you have:

- Plenty of relevant achievements you'd like to bring recruiters' focus to, make use of the resume summary. Ensure each of your achievements is quantified with concrete proof (e.g. % of cases solved).

- Less applicable experience, utilize the resume objective. Within the objective include a few noteworthy, past successes, followed up by your professional dreams.

As a bonus, you could define in either your portfolio manager resume summary or objective what makes you the perfect candidate for the role.

Think about your unique hard and soft skills that would make your expertise even more important to the job.

These portfolio manager professionals have completely covered the formula for the ideal resume introduction:

Resume summaries for a portfolio manager job

- Seasoned portfolio manager with over 12 years of successful experience in managing multi-asset portfolios for a top-tier asset management firm. Proven track record of exceeding performance targets through rigorous market analysis and customized investment strategy implementation. Mastery of quantitative analytics and proficiency in Bloomberg software, awarded "portfolio manager of the Year" in 2020 for exceptional client returns.

- Dynamic finance professional and CFA charter holder transitioning from a 10-year career in corporate financial analysis to portfolio management. Demonstrated expertise in financial modeling and risk assessment, with a deep understanding of equity markets and financial instruments. Achieved a 25% year-over-year growth in previous financial advisory roles, eager to leverage analytical prowess in asset allocation and portfolio optimization.

- Accomplished portfolio manager bringing over 15 years of notable success within the hedge fund industry, specializing in algorithmic trading strategies and active portfolio rebalancing. Strong foundation in machine learning applications. Achieved a 35% increase in fund performance over a two-year period using proprietary quantitative models and led the introduction of AI-driven investment tools.

- Eager professional with a decade-long background in wealth management seeking to transfer skills to portfolio management. Expert in client relationship building and portfolio assessment, currently pursuing the CFA designation. Recognized for implementing tax-efficient strategies that resulted in a 15% client savings increase. Ready to apply a client-centric approach to portfolio management and advance investment performance.

- Ambitious MBA graduate with a strong academic background in finance and internships in investment banking. Keen interest in macroeconomic trends and asset management, with the goal of achieving CFA certification within the next two years. Determined to utilize cutting-edge financial analysis and asset valuation techniques to contribute towards optimizing portfolio returns and strategic decision-making.

- Aspiring portfolio manager with a strong foundation in economics and data analysis from a leading university. Holder of a Series 7 license with hands-on experience in stock market simulations, looking to apply my robust analytical skills and passion for financial markets. Committed to pursuing continuous learning and development opportunities in investments and financial planning to deliver top-tier portfolio performance.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for portfolio manager professionals

Local salary info for Portfolio Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Other relevant sections for your portfolio manager resume

Apart from the standard portfolio manager resume sections listed in this guide, you have the opportunity to get creative with building your profile. Select additional resume sections that you deem align with the role, department, or company culture. Good choices for your portfolio manager resume include:

- Language skills - always ensure that you have qualified each language you speak according to relevant frameworks;

- Hobbies - you could share more about your favorite books, how you spend your time, etc. ;

- Volunteering - to highlight the causes you care about;

- Awards - for your most prominent portfolio manager professional accolades and achievements.

Make sure that these sections don't take too much away from your experience, but instead build up your portfolio manager professional profile.

Key takeaways

- Your resume layout plays an important role in presenting your key information in a systematic, strategic manner;

- Use all key resume sections (summary or objective; experience; skills; education and certification) to ensure you’ve shown to recruiters just how your expertise aligns with the role and why you're the best candidate;

- Be specific about listing a particular skill or responsibility you've had by detailing how this has helped the role or organization grow;

- Your personality should shine through your resume via the interests or hobbies, and strengths or accomplishments skills sections;

- Certifications go to provide further accreditation to your technical capabilities, so make sure you've included them within your resume.