Crafting a CV that effectively showcases your prowess in risk management and strategic asset allocation is a major challenge for portfolio managers. Our guide provides tailored advice to help you articulate your unique expertise and accomplishments, ensuring your CV stands out to potential employers.

- Answer job requirements with your portfolio manager CV and experience;

- Curate your academic background and certificates, following industry-leading CV examples;

- Select from +10 niche skills to match the ideal candidate profile

- Write a more succinct experience section that consists of all the right details.

Do you need more specific insights into writing your portfolio manager CV? Our guides focus on unique insights for each individual role:

Resume examples for portfolio manager

By Experience

Senior Portfolio Manager

- Structured and Concise Presentation - The CV is organized with clear sections like Summary, Experience, Education, Skills, and Achievements, making it easy to navigate and highlighting the candidate's extensive experience in change management. Each section is concise yet comprehensive, ensuring all critical information regarding Archie Clark's career accomplishments and qualifications is easily accessible.

- Progressive Career Trajectory - Archie Clark's career path demonstrates impressive growth and progression in the area of change management and strategy. Starting as a Project Manager at Willis Towers Watson and advancing to a Senior Change Manager at Aviva represents significant career promotion, reflecting both the depth and breadth of his expertise in strategic portfolio management and transformation projects.

- Impact-Oriented Achievements - This CV highlights key achievements that emphasize the candidate's ability to drive significant business value. With accomplishments such as increasing operational efficiency by 35% at Aviva and a strategic resource realignment turning a projected loss into a 10% profit at Lloyd's, each achievement underscores not only the numbers but the real-world impact on organizational performance and strategic goals.

Junior Portfolio Manager

- Clear and Structured Presentation - This CV leverages a well-organized layout that makes it easy to navigate through various sections. Each section, such as experience, education, and skills, is distinct and clearly labeled, allowing hiring managers to quickly find vital information. The bullet points are concise yet detailed, ensuring clarity without overwhelming the reader.

- Career Trajectory and Growth - Theodore Green demonstrates significant career progression from a Testing Intern at Accenture to a Senior Test Automation Engineer at Capgemini. This upward trajectory is indicative of his growing expertise and increasing responsibilities, highlighting his career development and dedication to advancing in the field of test automation.

- Technical Proficiency and Industry-Specific Expertise - Green's CV showcases his deep industry knowledge with specializations in Java and Selenium, vital tools for test automation. His expertise extends to integrating automation into CI/CD pipelines and developing test data management strategies, emphasizing his technical depth and contributions to efficient software testing processes.

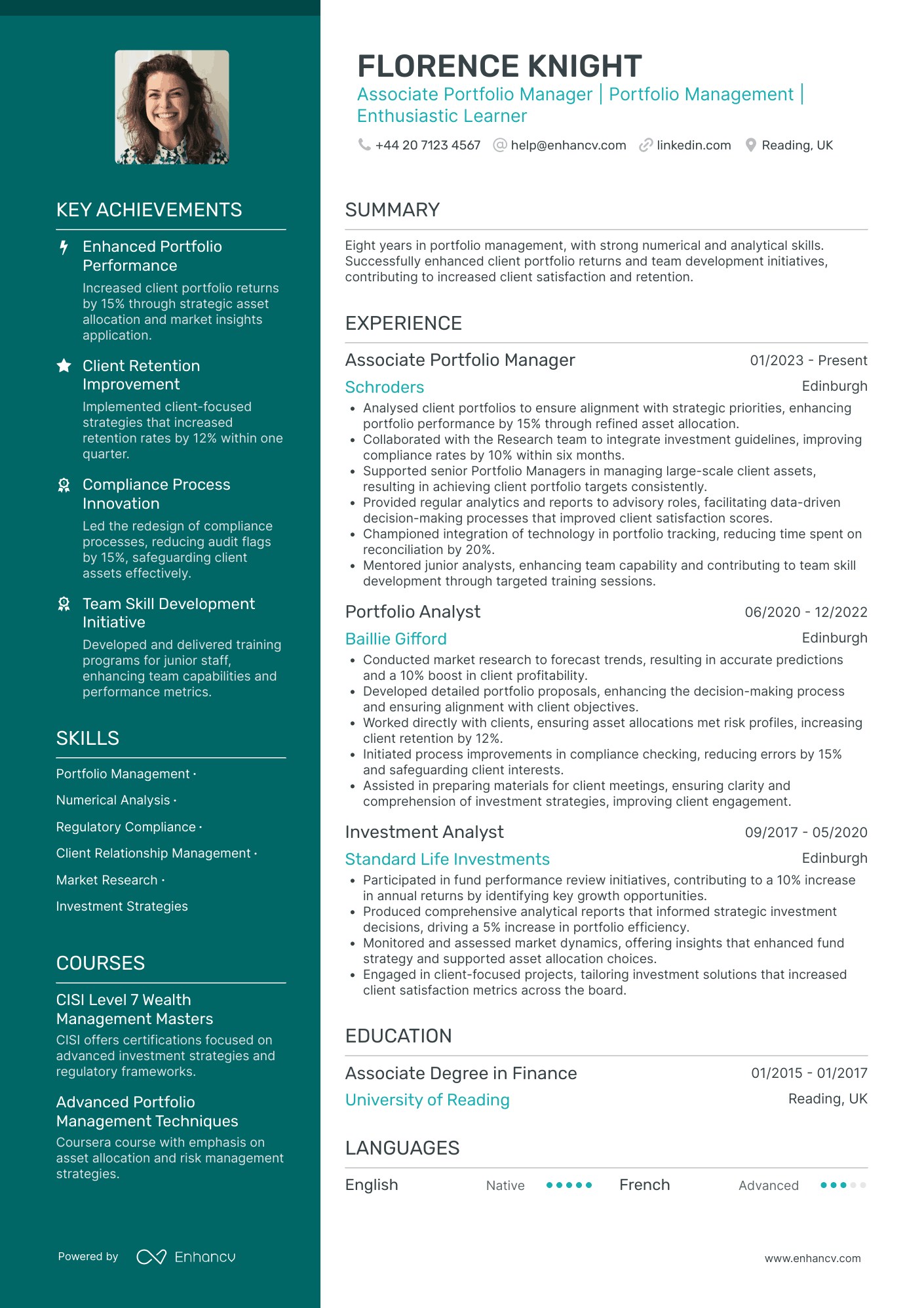

Associate Portfolio Manager

- Clear and Structured Content Presentation - The CV is well-organized, with distinct sections for experience, skills, education, and achievements. This clear structure allows for easy navigation and quickly highlights the candidate's capabilities and professional history in an understandable manner.

- Impressive Career Trajectory - Florence Knight's career reflects a progression from Investment Analyst to Associate Portfolio Manager within prominent companies. This upward trajectory showcases her growing responsibilities and consistent professional development, indicating her capability and ambition in the finance sector.

- Achievements with Business Relevance - The CV includes numerous specific accomplishments, such as enhancing portfolio performance by 15% and increasing client retention by 12%. These achievements are not just numerical; they underscore the impact she has had on business outcomes, evidencing her effectiveness in role-related tasks and her value to employers.

By Role

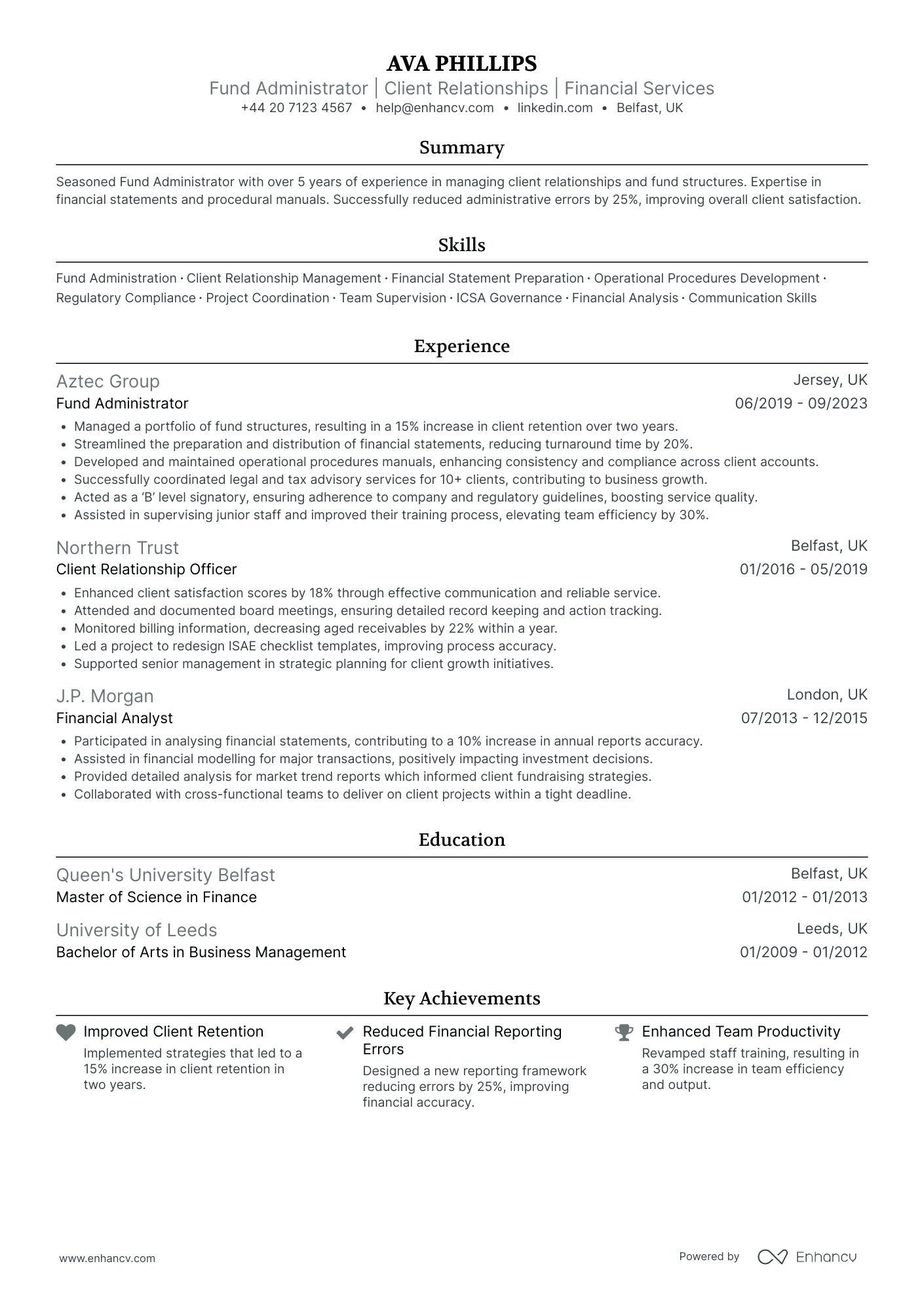

Portfolio Manager in Financial Services

- Structured and Concise Presentation - The CV is well-organized, with clearly defined sections and succinct points that ensure easy readability. Bullet points in each experience section highlight key accomplishments and responsibilities, maintaining clarity and helping the reader quickly grasp the candidate's expertise.

- Progressive Career Trajectory - Freddie's career journey shows a clear progression within the financial audit industry, continually moving up the ladder from Internal Auditor to Internal Audit Manager. This growth signifies a strong foundation in the field and an ability to handle increasing responsibilities and team leadership.

- Industry-Specific Technical Depth - The CV consistently demonstrates Freddie's comprehensive understanding of risk management and audit methodologies specific to the insurance and asset management sectors. It underscores proficiency in cutting-edge audit strategies and risk assessment models, tailored to industry needs.

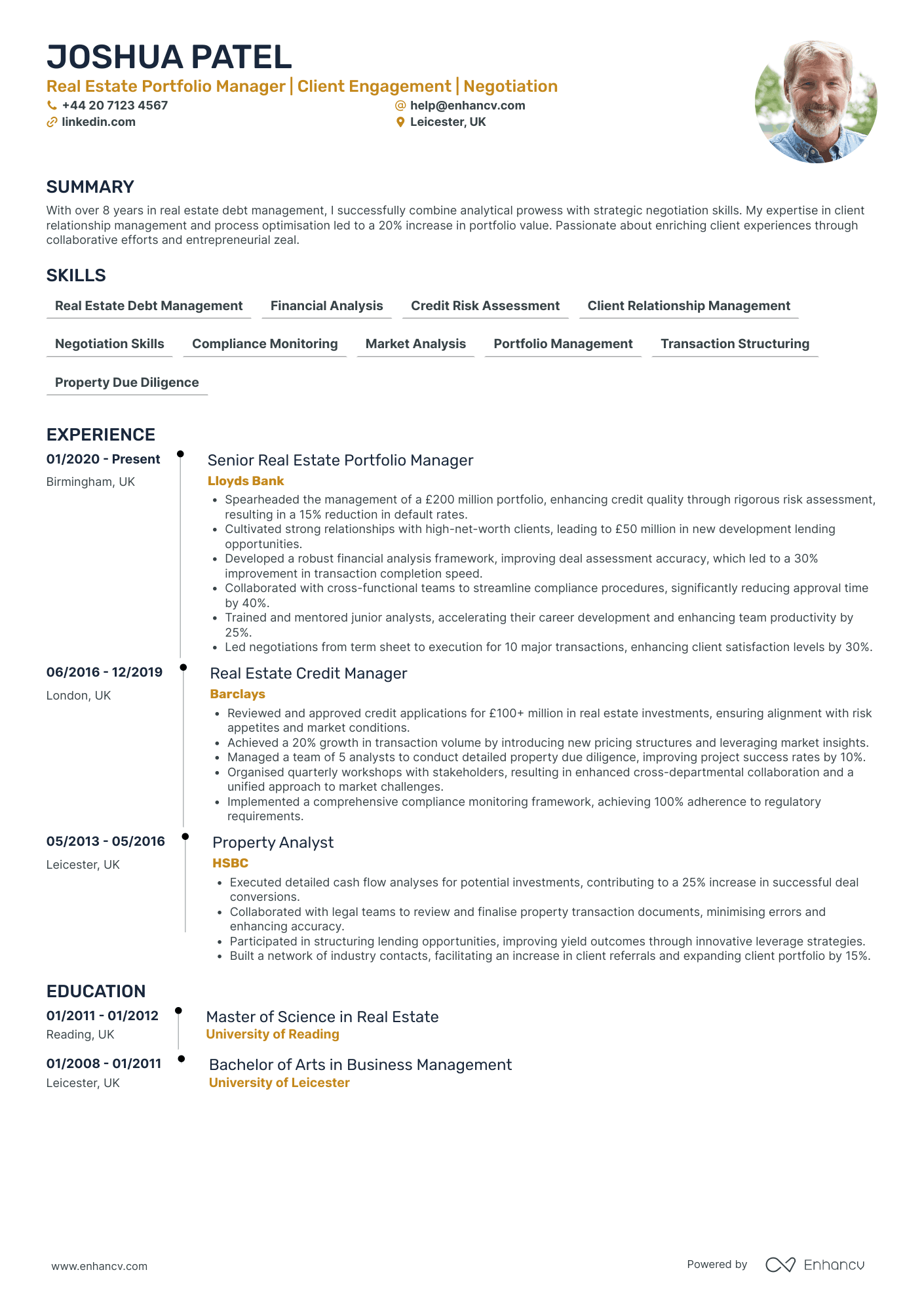

Real Estate Portfolio Manager

- Structured Content Presentation - The CV is well-organized, efficiently segmented into comprehensive sections including Summary, Experience, Education, Skills, Courses, Achievements, Languages, and Passions. This clarity aids readability and allows employers to quickly assess qualifications relevant to the real estate management role.

- Demonstrated Career Growth - Joshua Patel’s career trajectory is impressive, showcasing a steady ascent from Property Analyst at HSBC to Senior Real Estate Portfolio Manager at Lloyds Bank. This progression highlights his ability to adapt, embrace responsibility, and excel in higher-level positions within the real estate finance sector.

- Significant Achievements with Business Impact - The CV details Joshua’s notable accomplishments, such as spearheading a portfolio growth of 20% and reducing default rates by 15%, translating strategic initiatives into substantial financial improvements and demonstrating his pivotal role in value creation within the organizations he served.

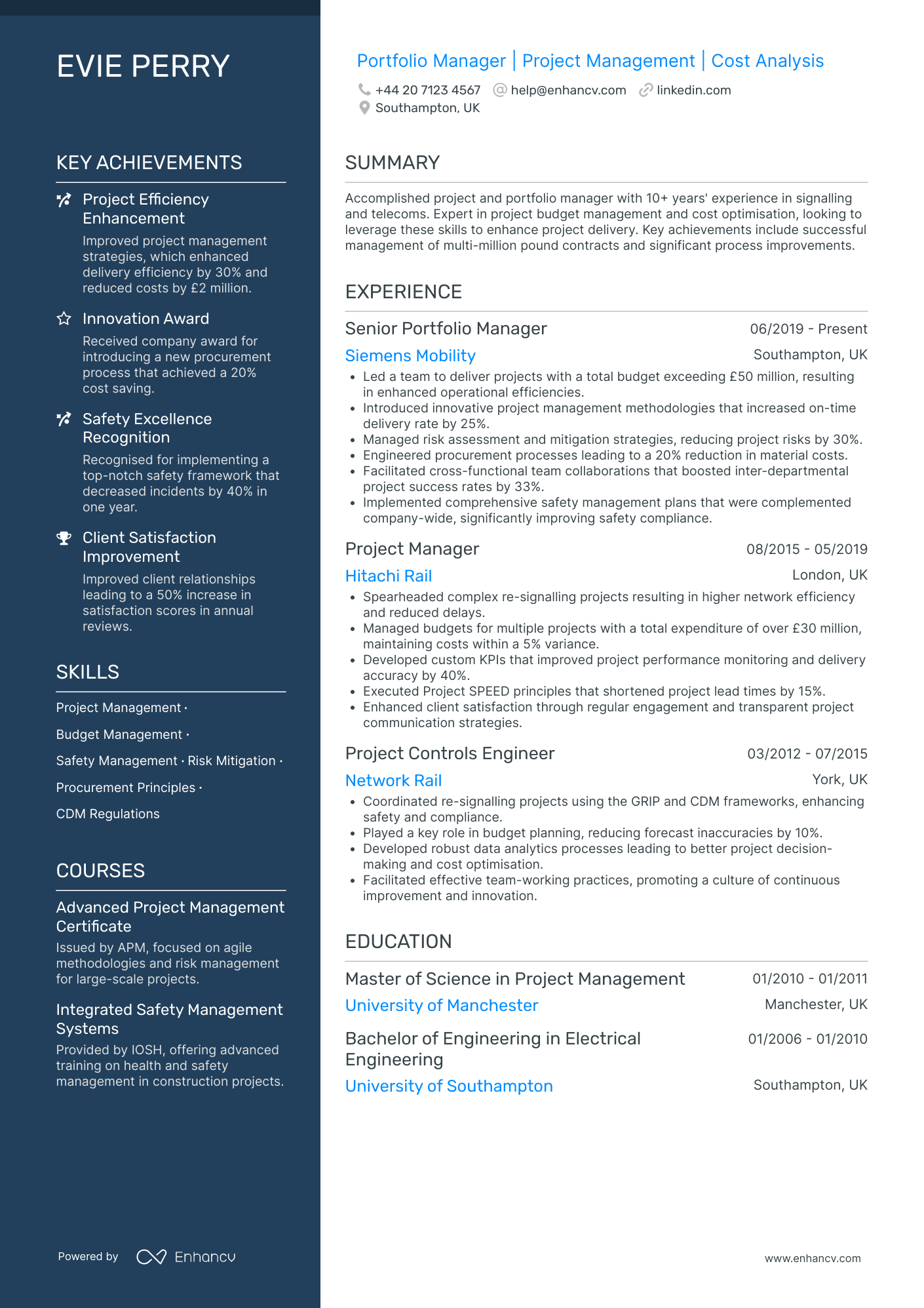

Corporate Portfolio Manager

- Comprehensive Career Progression - Evie Perry’s CV illustrates a clear and consistent upward trajectory in the field of project management, moving from roles like Project Controls Engineer to Senior Portfolio Manager over a decade. This progression highlights her adaptability and capability to handle increasing levels of responsibility within major companies like Siemens Mobility, Hitachi Rail, and Network Rail.

- Industry-Specific Methodologies and Tools - The CV’s inclusion of industry-specific frameworks and tools such as GRIP, CDM regulations, and procurement principles reflects a deep technical knowledge pertinent to the rail and telecom industry. Such specifics demonstrate Evie's proficiency in managing and optimizing projects within her niche field.

- Significant Achievements with Tangible Impact - The document effectively showcases Evie’s achievements in terms that relate directly to business outcomes, emphasizing reductions in material costs and improved safety compliance. By citing these metrics, the CV underscores her ability to enhance operational efficiency and contribute substantial value to her organizations.

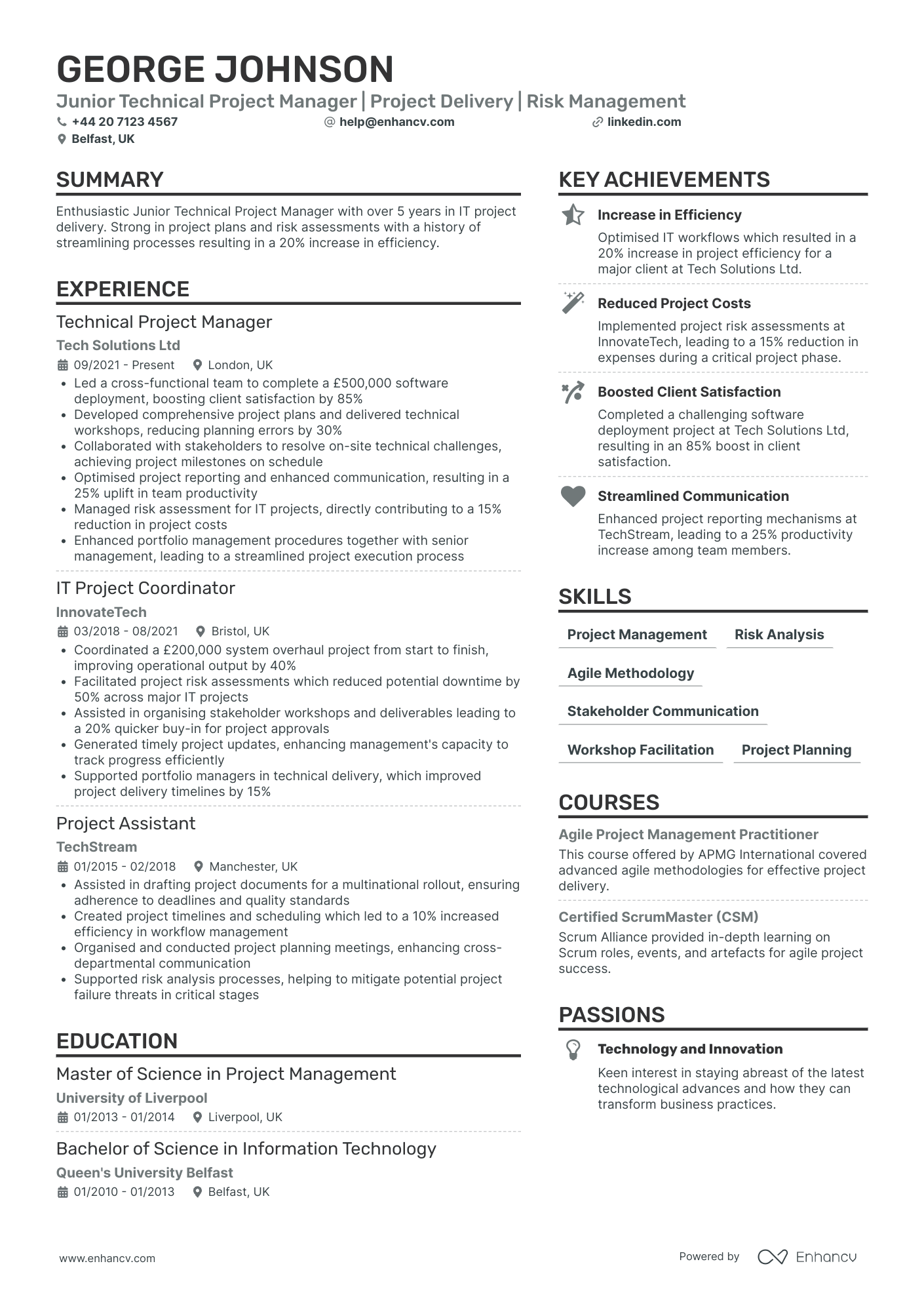

Technology Portfolio Manager

- Content Presentation and Structured Layout - The CV presents information in a clear, structured manner that ensures easy navigation and comprehension. Each section flows logically, with concise bullet points that quickly communicate the candidate's competencies and achievements without overwhelming the reader.

- Growth in Project Management Roles - George Johnson's career trajectory shows a clear path of progression from a Project Assistant to a Technical Project Manager, indicating significant professional growth. This advancement suggests a strong work ethic and an ability to take on greater responsibilities within the tech industry.

- Practical Application of Agile Methodologies - The CV highlights the candidate's in-depth knowledge of industry-specific tools and methodologies, such as Agility and Scrum, which are critical in the modern project management landscape. This technical depth ensures that Johnson is well-equipped to handle complex project environments effectively.

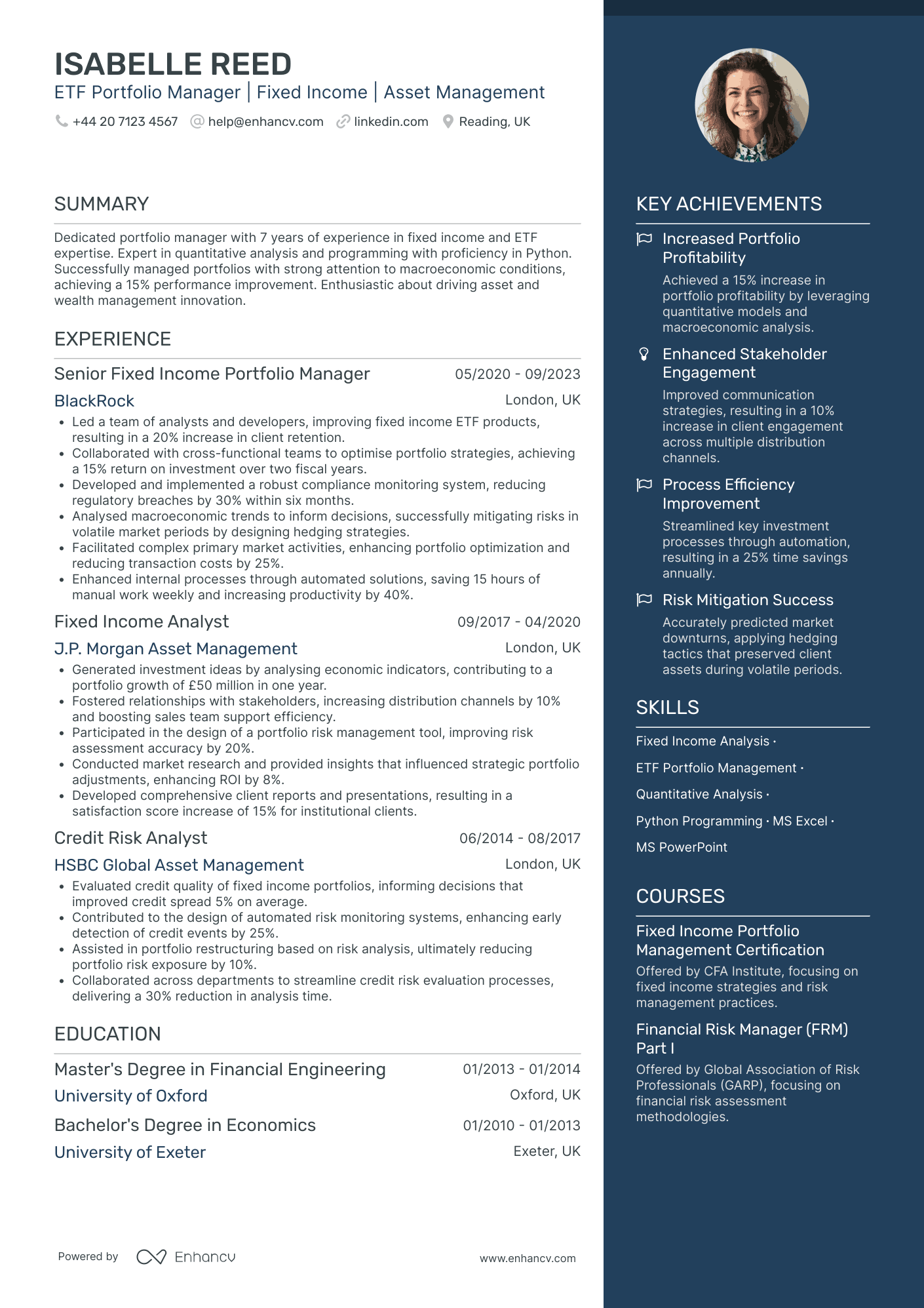

Portfolio Manager in Asset Management

- Comprehensive career progression in asset management - Isabelle Reed's CV illustrates a clear growth trajectory in the asset management industry, advancing from a Credit Risk Analyst to a Senior Fixed Income Portfolio Manager. Her career path reflects increasing responsibility and leadership within prestigious financial institutions such as BlackRock and J.P. Morgan Asset Management, demonstrating her capability to excel in high-pressure environments.

- Strong focus on technical and quantitative skills - The CV emphasizes Reed's proficiency in quantitative analysis and programming, particularly with Python, a highly relevant tool in asset management for developing financial models and automating processes. Her contributions to creating automated solutions have led to significant productivity improvements, underlining her technical depth and adaptability to industry demands.

- Impactful achievements with tangible business outcomes - Throughout her career, Isabelle has consistently delivered significant results, such as a 20% increase in client retention at BlackRock and £50 million portfolio growth at J.P. Morgan. These achievements not only reflect her strategic and analytical capabilities but also her ability to convert insights into meaningful improvements that align with business goals.

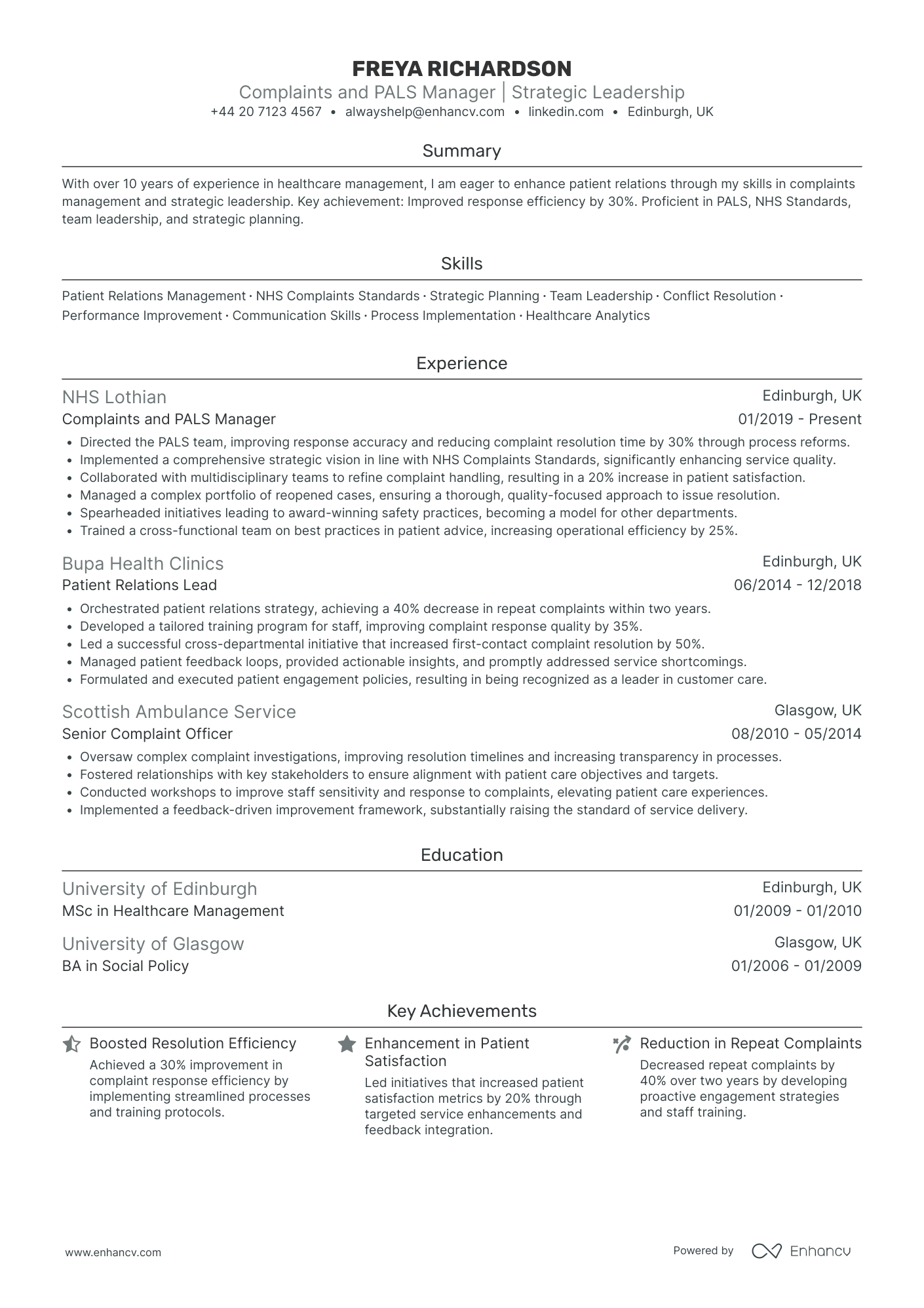

Healthcare Portfolio Manager

- Structured Career Development - Freya's CV exhibits a clear and progressive career trajectory that showcases her dedication to healthcare management. Starting from a Senior Complaint Officer to becoming a Complaints and PALS Manager, each role reflects a step up in responsibility and impact, indicating her career growth and development in leadership within the industry.

- Comprehensive Skill Set in Healthcare Management - The document highlights Freya's strong proficiency in industry-specific competencies like NHS Complaints Standards, which sets her apart in the healthcare domain. Her ability to lead strategic planning and implement performance improvements further underpins her technical depth and suitability for a managerial position.

- Leadership and Impactful Achievements - By focusing on quantifiable achievements like improving complaint response efficiency by 30% and increasing patient satisfaction by 20%, the CV underscores Freya's capacity not only for leadership but also for making significant, positive changes in her roles. This aspect demonstrates her adeptness at converting strategic initiatives into tangible results, benefiting the organizations she has worked for.

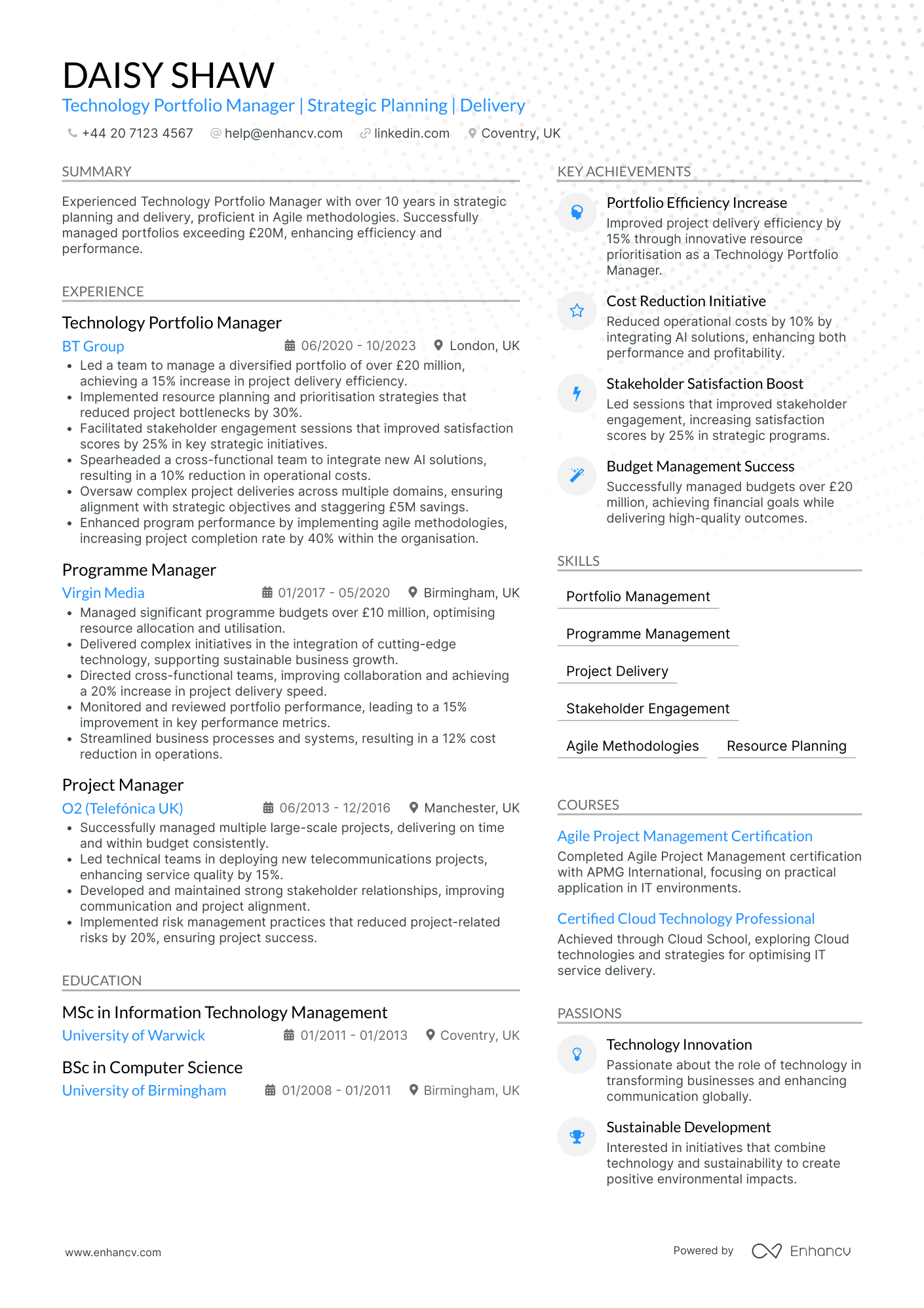

Strategic Portfolio Manager

- Strong Career Progression - Daisy Shaw's CV displays a clear path of career growth, from Project Manager to Technology Portfolio Manager, demonstrating her ability to handle increasing responsibilities and larger budgets within the telecommunications sector. Her career advancements indicate a strong performance and recognition in her field.

- Leadership in Cross-Functional Teams - The CV highlights Daisy's capability to lead and collaborate with cross-functional teams, especially through her achievements at BT Group and Virgin Media. This includes spearheading teams for AI integration, achieving operational cost reductions, and improving project delivery speed, which showcases her ability to lead diverse groups towards common goals effectively.

- Impactful Achievements with Quantifiable Outcomes - Throughout the CV, Daisy communicates her accomplishments with precise metrics, such as achieving a 15% increase in delivery efficiency and reducing project bottlenecks by 30%. These quantifiable outcomes not only illustrate her success in improving operational performance but also demonstrate her results-driven mindset and its relevance to the overarching business objectives.

Risk Management Portfolio Manager

- Career Progression Reflects Growth and Expertise - Jacob Roberts' CV illustrates a clear trajectory of career advancement in the risk management field, having gradually moved from a Risk Management Associate position at Lloyds Banking Group to a Senior Risk Analyst at HSBC, and finally into a leadership role as Agility Product Portfolio Operations Manager at Barclays. This progression highlights his ability to excel and take on increasing responsibilities in the industry.

- Effective Use of Industry-Specific Tools and Methodologies - The CV details proficiency in key tools like JIRA and JIRA Align, as well as familiarity with processes such as Agile transformation. These elements underscore his deep understanding of the technological and methodological requirements necessary for effective risk management and agility practices in financial institutions.

- Adaptability and Cross-Functional Collaboration - Jacob’s experience signals a strong adaptability to changing environments and needs, as seen in his cross-functional collaborations that enhanced communication and increased project delivery efficiency by 25%. This capability is crucial for someone in a leadership role that demands coordination across various departments and specialties.

Equity Portfolio Manager

- Structured and Effective Content Presentation - The CV is meticulously structured to enhance readability and comprehension. It includes clearly defined sections such as experience, education, skills, achievements, and passions, all of which are tailored to the role of an Equity Portfolio Manager. Bullet points within the experience section provide concise and impactful insights into the candidate’s responsibilities and successes.

- Impressive Career Trajectory in Finance - George Johnson's career reflects a trajectory of growth within prestigious financial institutions like BlackRock, JP Morgan Asset Management, and Goldman Sachs. This progression from an Equity Research Analyst to a Senior Equity Portfolio Manager demonstrates a clear path of professional development and leadership advancement in the finance industry.

- Strategic Leadership and Collaboration - The CV emphasizes the candidate's strong leadership and team collaboration skills. Johnson has effectively led teams in driving portfolio growth and developing robust risk management protocols. These initiatives not only underscore his ability to manage and motivate teams but also highlight his influence in achieving remarkable growth and stability in investment portfolios.

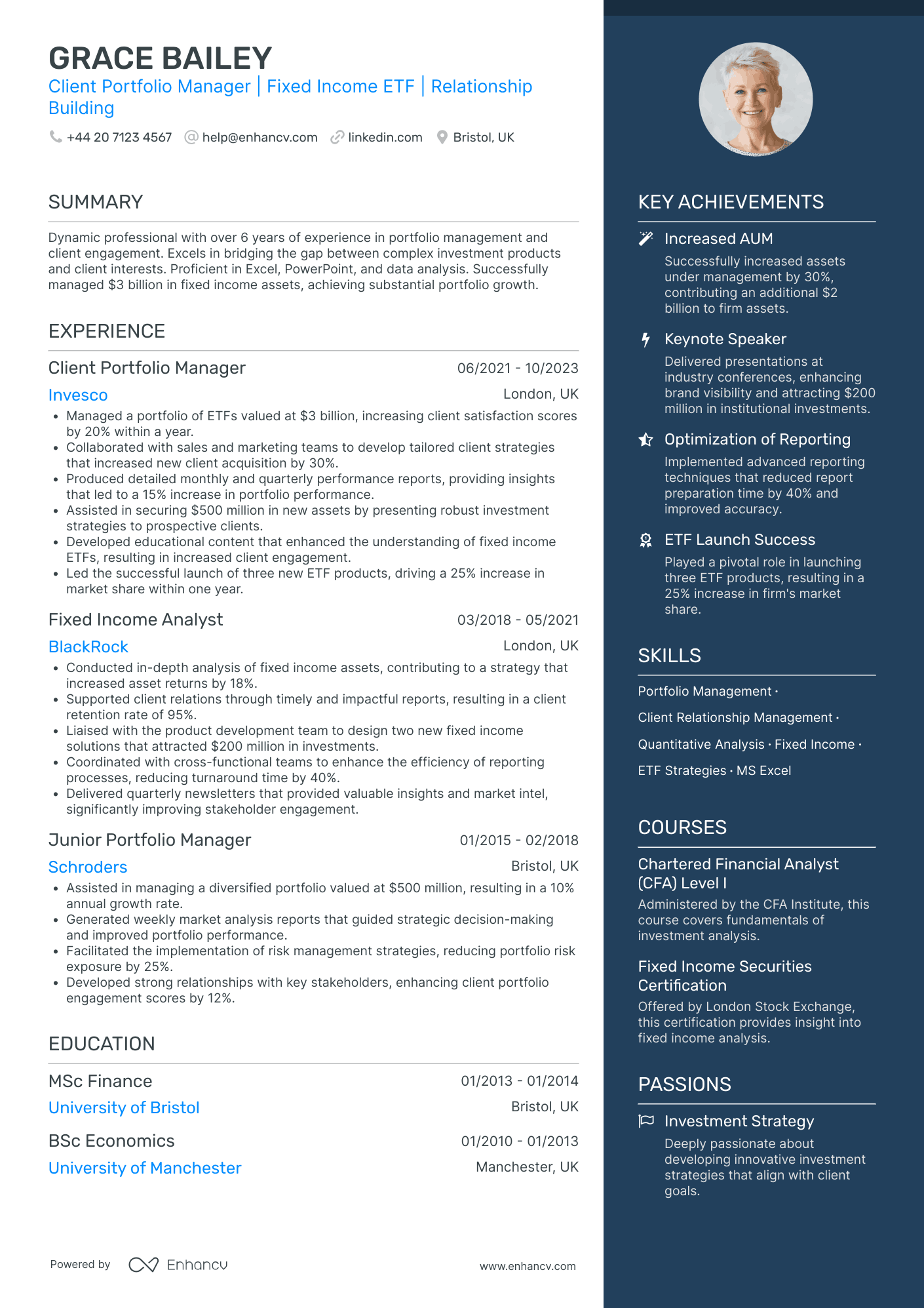

Fixed Income Portfolio Manager

- Clear and Structured Content Presentation - Grace Bailey’s CV is well-organized and concise, presenting each section with clarity and precision. The structured layout makes it easy to follow her career journey, with clearly defined categories such as experience, education, skills, and achievements that allow employers to quickly assess her qualifications and suitability for the role.

- Strong Career Trajectory and Consistent Growth - Starting as a Junior Portfolio Manager, Grace’s progression to roles like Fixed Income Analyst and Client Portfolio Manager reflects a clear upward trajectory within the industry. Her promotions demonstrate not only her expertise in fixed income and portfolio management but also her ability to adapt and excel in increasingly responsible positions.

- Industry-Specific Technical Expertise - Grace’s proficiency in tools and methodologies crucial to fixed income and ETFs, such as quantitative analysis and data-driven strategies, highlights her deep industry knowledge. Her hands-on experience with managing portfolios worth billions and successfully launching new ETF products underscores her technical depth and financial acumen.

Private Equity Portfolio Manager

- Impressive Career Trajectory - The CV outlines a well-defined career progression, showcasing steady development through roles in the technology sector. Moving from a junior software developer position to a lead developer role within five years illustrates significant professional growth and leadership qualities. Additionally, there is evidence of industry shifts that reflect adaptability, such as transitioning from traditional software development environments to more agile, cloud-based systems.

- Strong Emphasis on Adaptability and Cross-functional Experience - The candidate's CV highlights a versatile skill set by illustrating a variety of roles across different project teams, from development to project management. Experience in cross-disciplinary teams is emphasized, showcasing the ability to work effectively with departments such as marketing, sales, and customer service, which signals a capacity to navigate and unify diverse stakeholder interests.

- Unique Industry-Specific Tools and Methodologies – The CV stands out for its detailed explanation of experience with advanced tools and methodologies within the tech industry, such as proficiency in machine learning and data analytics frameworks. It also notes an in-depth understanding of software development methodologies like Agile and SCRUM, providing evidence of a robust technical background aligned with industry standards.

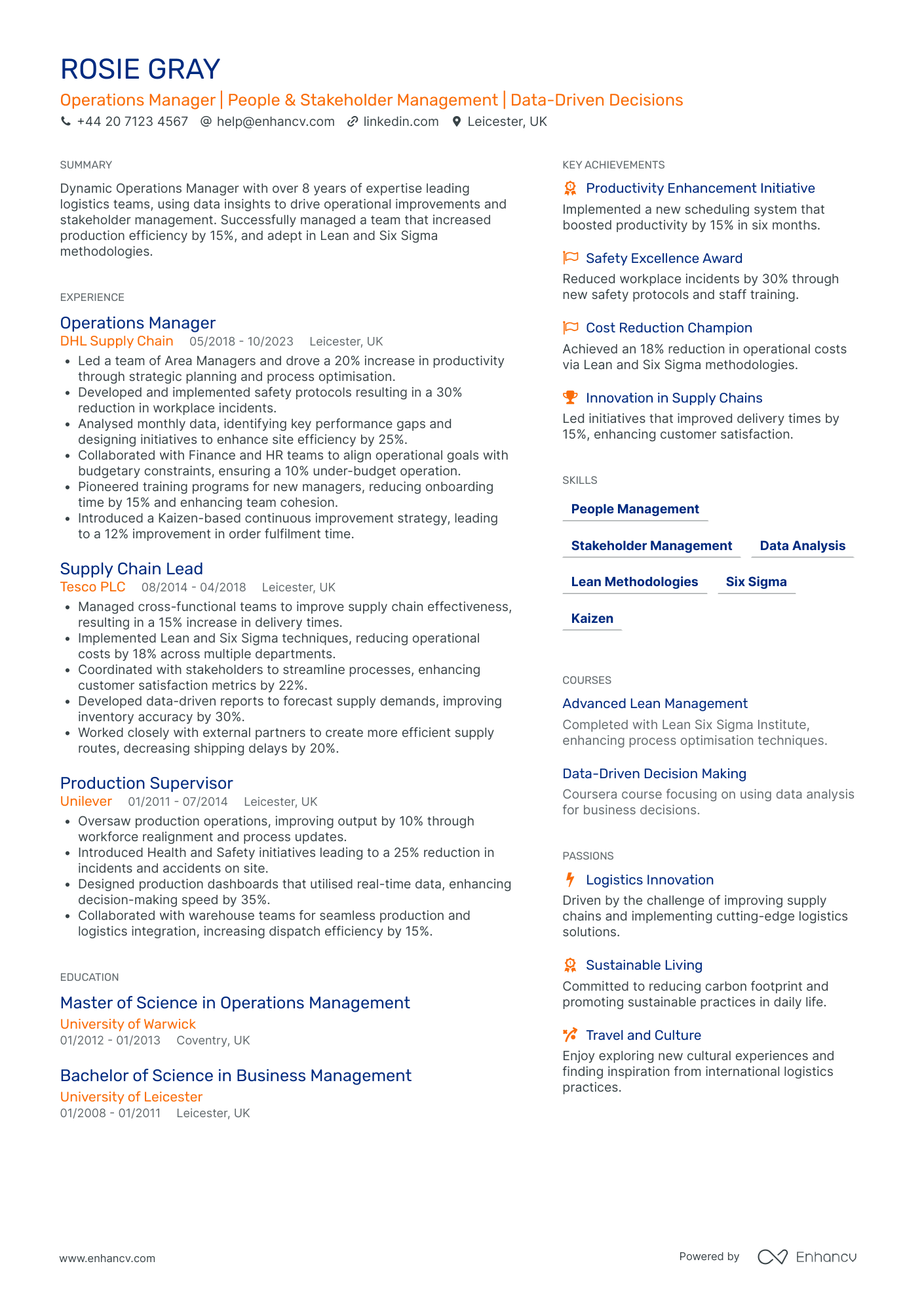

Operations Portfolio Manager

- Clear and Structured Presentation - The CV is organized with a clean structure that divides key sections like experience, education, and skills, allowing the reader to quickly and easily navigate through Rosie's professional background. Each job listing under experience is supported by concise bullet points focusing on quantifiable achievements, ensuring clarity and brevity throughout.

- Diverse Career Progression - Rosie Gray's career trajectory displays a strong upward movement from a Production Supervisor at Unilever to an Operations Manager at DHL Supply Chain. The advancement through these prominent roles within leading brands in the logistics and supply chain industry underscores her capability to manage larger teams and increase responsibilities efficiently over time.

- Emphasis on Industry-Standard Methodologies - The CV highlights Rosie's proficiency in Lean, Six Sigma, and Kaizen methodologies, demonstrating her deep technical knowledge and commitment to continual process improvement within the operational sphere. Her ability to integrate these methodologies into her daily operations is a key differentiator in the logistics management industry.

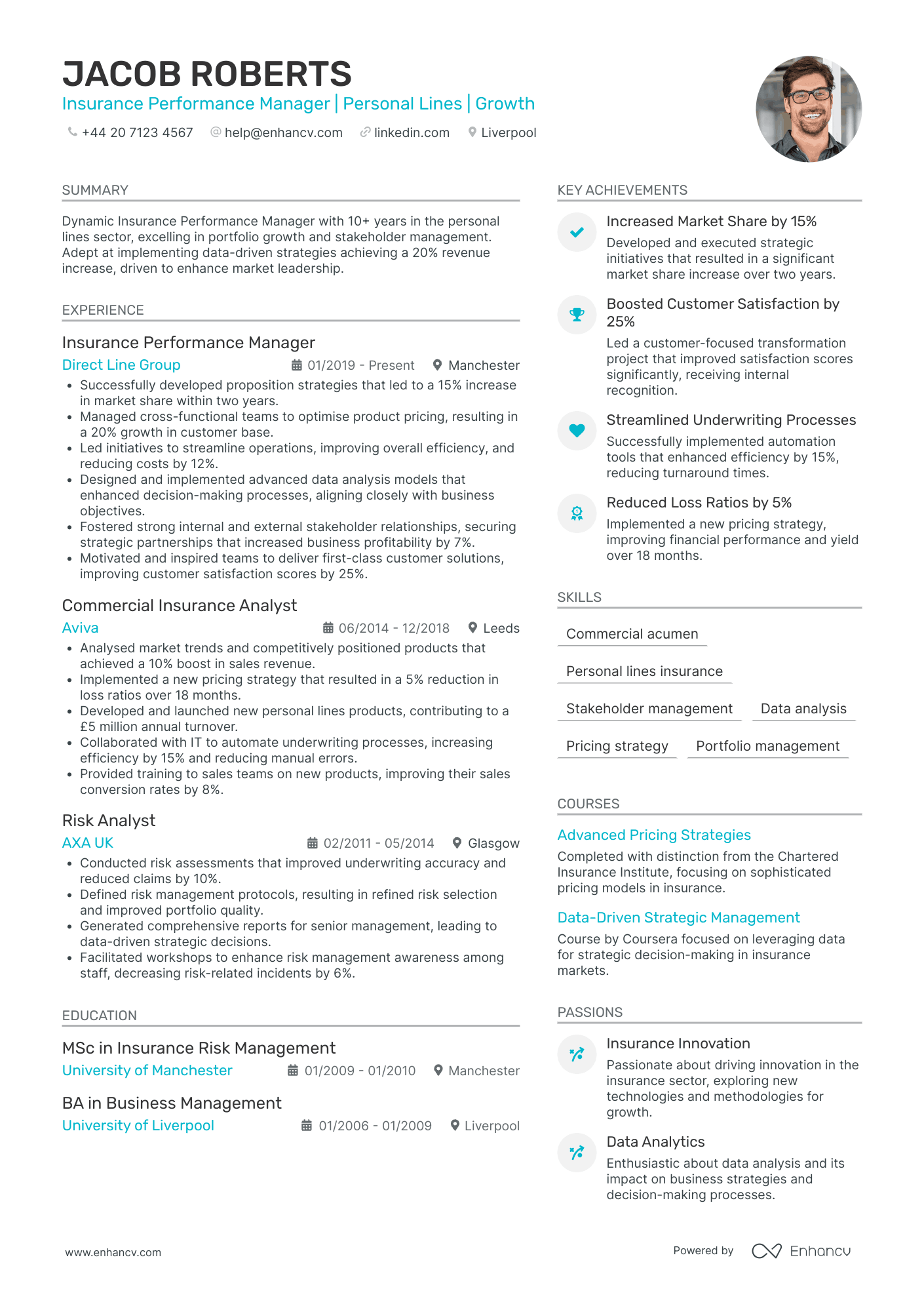

Portfolio Manager in Insurance

- Comprehensive Career Progression - The CV demonstrates a clear trajectory of advancement in the insurance industry, moving from a Risk Analyst role to a managerial position. This progression evidences the candidate's growing responsibilities, suggesting robust competence and recognition within the industry. Each role has been leveraged as a stepping stone for strategic personal and professional development, particularly in personal lines and insurance performance management.

- Industry-Specific Expertise and Methodologies - The CV highlights the candidate's expertise in leveraging data-driven strategies and implementing sophisticated pricing strategies, underpinning success in market share growth and profitability. Specific mentions of cross-functional team management and stakeholder engagement underscore a solid grasp of industry-specific methodologies, such as advanced data analysis models and automation in underwriting processes.

- Focus on Achieving Business Outcomes - The CV is impactful by articulating successes with quantifiable results, such as a 15% increase in market share and a 25% boost in customer satisfaction. This focus not only indicates the candidate's ability to drive growth and enhancement initiatives but also aligns closely with strategic business objectives like efficiency improvements and reduction in costs, making their achievements highly relevant and valuable to potential employers.

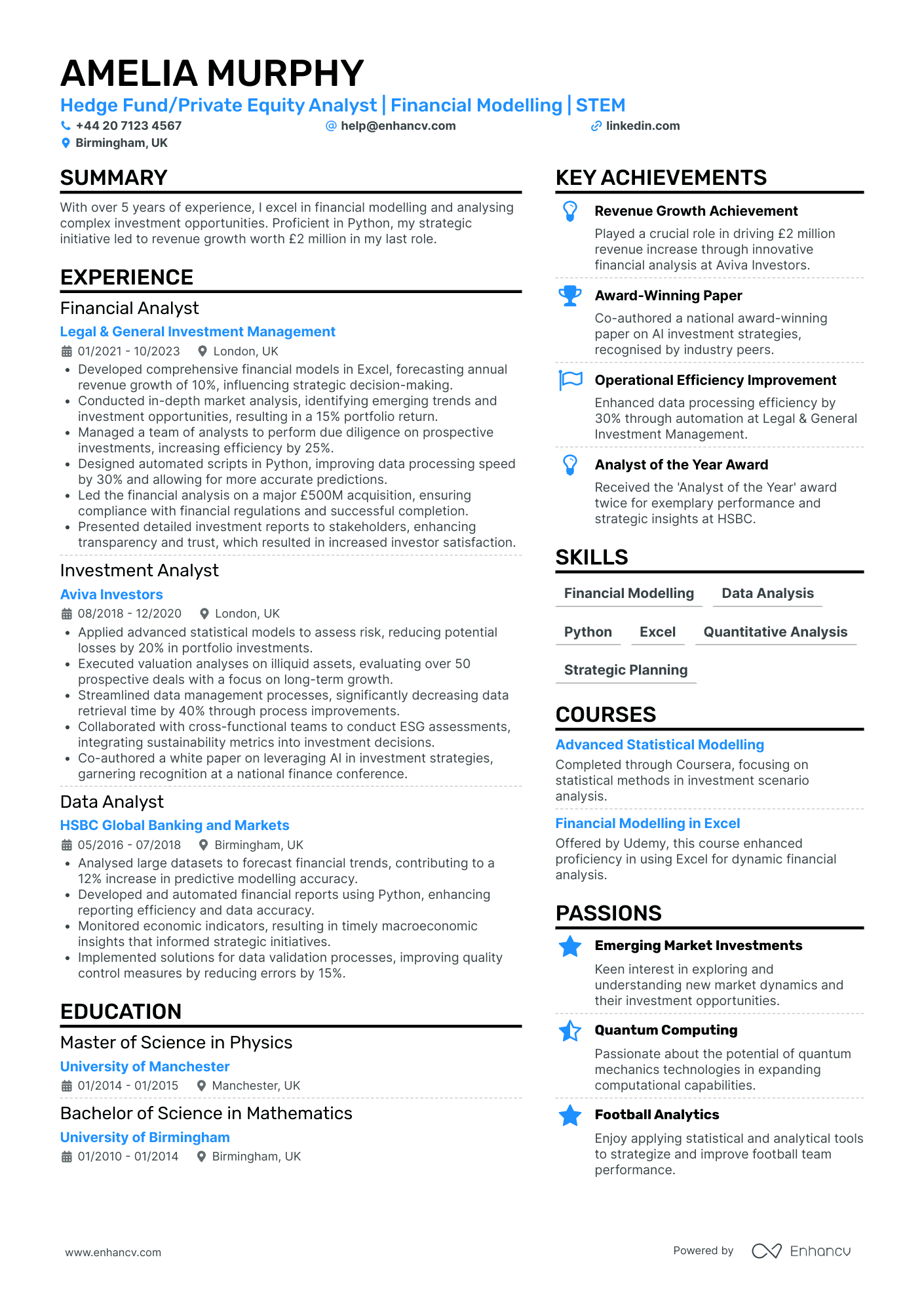

Hedge Fund Portfolio Manager

- Structured Career Progression - Amelia Murphy’s CV presents a clear career trajectory, illustrating her growth from a Data Analyst at HSBC to a Financial Analyst at Legal & General Investment Management. This upward movement is marked by increased responsibilities and leadership roles, showcasing her commitment and adaptability within the finance industry.

- Technical Proficiency and Methodologies - The CV highlights a robust command of industry-specific tools and methodologies, such as Python programming for automated financial reports and advanced statistical models for risk assessment. This technical depth is essential for a Hedge Fund/Private Equity Analyst and underscores Amelia's capability to handle complex quantitative analyses.

- Achievements and Impact - Notable accomplishments such as driving a £2 million revenue increase and enhancing data processing efficiency by 30% are featured prominently. These achievements not only quantify her impact but also demonstrate her strategic thinking and ability to deliver substantial business results, enhancing her value proposition to potential employers.

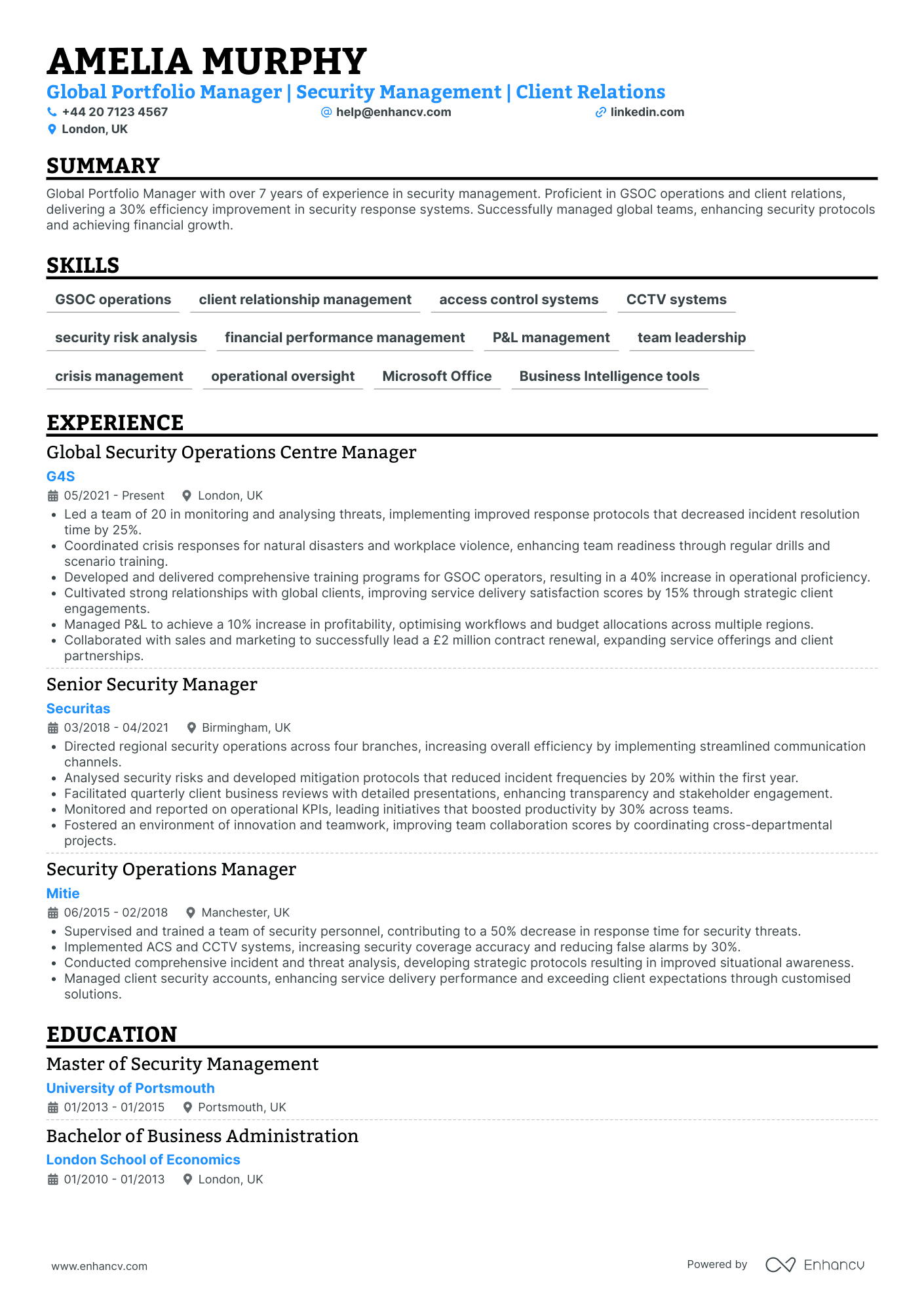

Global Portfolio Manager

- Structured Presentation with Clear Focus - The CV's layout ensures clarity and conciseness, effectively using sections to highlight key areas such as experience, education, and skills. The use of bullet points for accomplishments facilitates easy reading and helps the hiring manager quickly identify critical information, such as performance improvements and financial contributions.

- Progressive Career Path in Security Management - Amelia's career trajectory demonstrates continuous growth, from a Security Operations Manager in Manchester to a Global Security Operations Centre Manager in London. This upward progression reflects her ability to take on increasing responsibilities and her dedication to achieving excellence within the security management industry.

- Technical Prowess and Industry Expertise - The CV showcases Amelia's proficiency in advanced security management tools and methodologies, such as GSOC operations, ACS, and CCTV systems. These industry-specific skills highlight her capability to handle complex security challenges and adapt to technological advancements, making her an asset in any security management role.

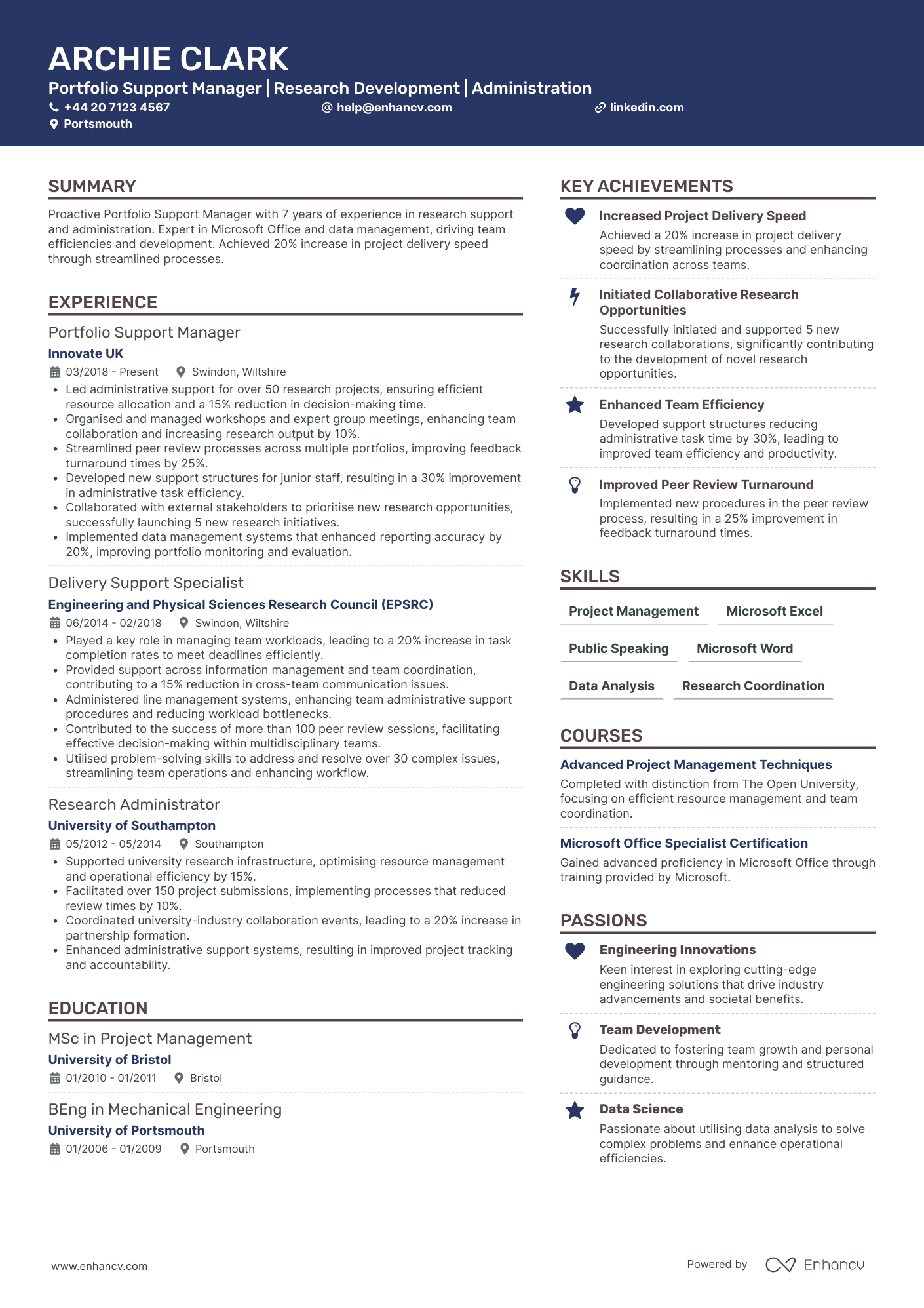

Portfolio Manager in Energy Sector

- Strategic Presentation of Achievements - The CV effectively summarizes key accomplishments in a way that highlights the real-world impact of Archie's work. Increasing project delivery speed by 20% and enhancing team efficiency through streamlined processes showcase his ability to deliver substantial business improvements, which are crucial in a Portfolio Support Manager role.

- Laser-Focused Career Growth - Archie's career trajectory shows a clear progression from a Research Administrator to a Portfolio Support Manager. This growth reflects his continuous development in managing larger responsibilities and more complex projects, illustrating his capability to adapt and excel as he advances in his career.

- Methodological Proficiency in Portfolio Management - The candidate's experience stands out with specialized skills in research coordination and administrative optimization. By implementing data management systems and improving peer review processes, Archie demonstrates his technical expertise in methodologies that significantly increase operational efficiencies within research and development environments.

Formatting your portfolio manager CV to meet the role expectations

Staring at the blank page for hours on end, you still have no idea how you should start your professional portfolio manager CV. Should you include more colours, two columns, and which sections? What you should remember about your CV format is this - ensure it's minimalistic and doesn't go over the top with fancy fonts and many colours. Instead, focus on writing consistent content that actually answers the job requirements. But, how about the design itself :

- Use the reverse chronological order to showcase your experience, starting with your most recent role;

- Include your contact details (email address, phone number, and location) - and potentially your professional photo - in the header;

- Must-have CV sections include summary or objective, experience, education, and skills: curate the ones that fit your profile;

- Your professional portfolio manager CV should be between one-to-two pages long: select the longer format if you have more experience.

A little bit more about your actual CV design, ensure you're using:

- plenty of serif or sans serif font (e.g. Montserrat, Exo 2, Volkhov) as they are Applicant Tracker System (ATS) compliant. Avoid the likes of Arial and Times New Roman because most candidates' CVs are in this typography.

When submitting your CV, are you still not sure what format it should be? Despite the myth that has been circling around, most modern ATS systems are perfectly capable of reading PDFs. This format is an excellent choice as it keeps all of your information intact.

PRO TIP

Use bold or italics sparingly to draw attention to key points, such as job titles, company names, or significant achievements. Overusing these formatting options can dilute their impact.

The top sections on a portfolio manager CV

- Investment Management Experience highlights relevant positions that showcase financial expertise.

- Significant Trades & Investments demonstrates a history of successful portfolio decisions.

- Risk Management Skills shows the ability to identify and mitigate investment risks.

- Advanced Financial Qualifications lists relevant certifications and education pertinent to portfolio management.

- Client Relationship Management emphasises experience in managing investor relations and satisfaction.

What recruiters value on your CV:

- Highlight your track record of investment performance by detailing specific funds or portfolios you have managed and the resulting returns, underscoring your hands-on experience and success in the field.

- Emphasise your expertise in risk management by mentioning strategies you've implemented to mitigate risk and protect assets, demonstrating an understanding of the balance between risk and reward.

- Point out your proficiency in quantitative and qualitative research, showing your ability to analyse financial statements, market trends, and economic indicators to inform investment decisions.

- Include examples of your leadership skills and your ability to work collaboratively with analysts, traders, and clients, proving that you can effectively manage a team and maintain strong client relationships.

- Detail your familiarity with regulatory requirements and ethical standards of the financial industry, reflecting your commitment to compliance and integrity in all transactions and decisions.

Recommended reads:

Making a good first impression with your portfolio manager CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for portfolio manager:

- Portfolio Manager | Equities & Fixed Income Specialist | CFA Charterholder | 7+ Years' Experience

- Senior Investment Strategist | Emerging Markets Focus | MSc Finance | 12 Years in Asset Management

- Junior Portfolio Manager | Sustainable Investment Enthusiast | ACCA Qualified | 3 Years' Industry Insight

- Fixed Income Portfolio Manager | Risk Management Expert | 9 Years' Industry Leadership

- Global Equity Portfolio Director | Chartered Wealth Manager | Strategic Allocation | 15+ Years' Expertise

- Lead Portfolio Manager | Multi-Asset Strategies | Fintech & Quant Analysis Advocate | 10 Years' Progressive Experience

What's the difference between a portfolio manager CV summary and objective

Why should it matter to you?

- Your portfolio manager CV summary is a showcasing your career ambitions and your unique value. Use the objective to answer why your potential employers should hire you based on goals and ambitions. The objective is the ideal choice for candidates who happen to have less professional experience, but still meet some of the job requirements.

Before you select which one will be more relevant to your experience, have a look at some industry-leading CV summaries and objectives.

CV summaries for a portfolio manager job:

- Seasoned Portfolio Manager with over 10 years of experience in spearheading robust investment strategies, managing multi-million dollar portfolios, and a proven track record of outperforming the S&P 500 index year-on-year. Expertise in quantitative analysis, risk management, and leading high-calibre teams to maximise returns and minimise risks.

- Highly analytical ex-Healthcare Professional transitioning to Portfolio Management, bringing 15 years of experience in medical data assessment, an exceptional eye for detail, and strong proficiency in statistical analysis. Recognised for developing models predicting patient health outcomes, now pursuing to apply predictive analytics in the financial sector.

- Former Software Engineer with a passion for data-driven decision-making and 7 years of coding experience, now seeking to leverage a strong background in algorithm design and machine learning in a dynamic asset management setting. Recently completed a Master’s in Finance, eager to apply technical skills to optimise portfolio performance.

- With over 20 years of deep expertise in emerging market equities, this Portfolio Manager has consistently delivered double-digit returns. Renowned for a keen understanding of geopolitical influences on market dynamics, adept in the use of advanced econometric models, and enhancing portfolio diversification.

- Aspiring to embark on a career in Portfolio Management, I bring an unwavering enthusiasm for financial markets and a commitment to learning. A recent graduate in Economics, eager to contribute fresh perspectives and to grow within a team that values pragmatic and research-driven investment strategies.

- Seeking an entry-level opportunity to apply a strong foundation in finance and a fervent interest in global markets. My objective is to leverage my internship experience in financial analysis and recent Certified Financial Analyst (CFA) designation to support the growth and success of a forward-thinking asset management firm.

Best practices for writing your portfolio manager CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Analysed and managed a diversified portfolio of equities, bonds, and alternative investments, leading to a consistent yearly outperformance of the benchmark index by 2-3%.

- Designed and executed tailored investment strategies based on clients' risk appetites, financial objectives, and market conditions, which improved client satisfaction scores by 15%.

- Engaged in thorough fundamental and technical analysis to forecast market trends and make informed investment decisions, resulting in a 20% growth in portfolio value over 5 years.

- Collaborated with analysts and economists to integrate macroeconomic insights into portfolio construction that enhanced long-term asset allocation effectiveness.

- Implemented robust risk management protocols, including stop-loss orders and position sizing, which reduced volatility and drawdowns during market downturns.

- Provided comprehensive monthly and quarterly reports detailing portfolio performance, asset allocation, and market outlook, effectively communicating complex data in an understandable format.

- Utilised cutting-edge financial software for portfolio optimisation and securities analysis, improving portfolio efficiency and reducing operational time by 30%.

- Demonstrated adaptability by swiftly adjusting investment strategies in response to the COVID-19 pandemic, which mitigated potential losses and capitalised on recovery opportunities.

- Mentored junior portfolio managers and interns, fostering a culture of continuous learning and professional growth within the team.

- Led the strategic asset allocation for a £1.2 billion investment fund, outperforming the benchmark index by 3% annually.

- Managed a diversified investment portfolio including equities, fixed income, and alternative assets, enhancing overall returns while controlling for risk.

- Initiated and developed a comprehensive risk management framework tailored for mid-sized funds, effectively reducing volatility by 20%.

- Orchestrated the turnaround of an underperforming £800 million equity portfolio by revamping investment strategies and focusing on high-growth sectors.

- Collaborated frequently with analysts and other investment team members to align investment objectives with the firm’s long-term goals.

- Directed a series of workshops on advanced portfolio construction techniques, enhancing the skills of junior portfolio managers.

- Managed a portfolio of £500 million in corporate and government bonds, achieving a consistent yield outperformance of 150 basis points relative to the benchmark.

- Forged strong relationships with institutional clients by providing insightful market analysis and tailored investment solutions, leading to a 25% growth in client funds under management.

- Spearheaded the integration of ESG factors into bond selection processes, which was instrumental in securing an industry award for responsible investing.

- Crafted and executed equity investment strategies across global markets, contributing to a portfolio growth of 15% per annum despite volatile market conditions.

- Implemented cutting-edge quantitative analysis methods to inform buy/sell decisions, improving the accuracy of market predictions by 40%.

- Drove the overhaul of technological tools used in portfolio management, leading to increased efficiency in trade execution and real-time monitoring.

- Strategically directed a global fund portfolio with assets exceeding £2.5 billion, consistently delivering top-quartile performance within the peer group.

- Pioneered the adoption of artificial intelligence in investment processes, which enhanced predictive analytics and resulted in a 10% reduction in risk-adjusted performance anomalies.

- Championed the development and implementation of a new portfolio reporting platform, which significantly improved transparency for stakeholders.

- Contributed to managing a mid-cap equity portfolio of £300 million, achieving a compound annual growth rate of 12%.

- Developed and maintained dynamic financial models to forecast company earnings, resulting in more informed and profitable investment decisions.

- Cultivated productivity improvements within the investment team through the implementation of agile project management techniques.

- Oversaw the strategic direction for a portfolio management department, resulting in a 150% increase in assets under management over 6 years.

- Launched a successful sustainable investment fund, attracting £350 million in capital commitments and delivering competitive returns above industry benchmarks.

- Cultivated a culture of continuous improvement, leading to streamlined operations and a 30% reduction in operational costs over three years.

- Devised and implemented custom portfolio strategies for high-net-worth individuals, resulting in an average account increase of 18%.

- Utilized advanced statistical modeling to enhance portfolio construction methodologies, leading to more robust risk management practices.

- Acted as the lead portfolio manager on a new emerging markets fund, surpassing target returns by 5% in the first year of inception.

Swapping your professional experience (when you have none) with skills and more

Never underestimate the importance of relevancе when it comes to your portfolio manager CV. Even if you don't happen to have much or any standard (full-time contract) professional experience, this doesn't mean you shouldn't apply for the role. Instead of a bespoke CV experience section:

- Showcase more prominently any internships, part-time roles, and volunteer experience that are applicable to the role and have taught you job-crucial skills;

- Feature a strengths or achievements section with your transferrable skills or talents you've obtained thanks to your work or life experience;

- Write an objective statement that clearly outlines your values as a candidate and defines your career ambitions;

- List your education or certificates that match the job profile closer to the top of your CV.

Recommended reads:

PRO TIP

Describe how each job helped you grow or learn something new, showing a continuous development path in your career.

Describing your unique skill set using both hard skills and soft skills

Your portfolio manager CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your portfolio manager CV:

Investment Strategies

Risk Management

Asset Allocation

Financial Analysis

Portfolio Construction

Quantitative Analysis

Market Research

Regulatory Compliance

Performance Measurement

Economic Forecasting

Decision-Making

Communication

Strategic Thinking

Problem-Solving

Leadership

Time Management

Adaptability

Negotiation

Teamwork

Attention to Detail

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Your university degree and certificates: an integral part of your portfolio manager CV

Let's take you back to your uni days and decide what information will be relevant for your portfolio manager CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Recommended reads:

Key takeaways

Here are five things you need to remember about writing your portfolio manager CV for success:

- Sort your experience based on the reverse chronological order, starting with your most recent career items, to showcase how you've grown your career;

- Include within your CV header your relevant contact details, a headline that could spotlight your unique value, and a photo - if you're applying for roles outside the UK or US;

- Decide to use the CV summary, if you happen to have more professional experience, and an objective, if you want to showcase your career goals;

- Within the experience section, write your bullets using action verbs, skills, and success, instead of just merely listing your on-the-job responsibilities;

- Prove your technical skills, using your education and certificates, and your soft skills, with your achievements and strengths sections.