One significant challenge credit analysts face when crafting their resumes is the effective communication of complex financial analysis skills and experiences to potential employers. Our comprehensive guide assists by providing industry-specific keywords, action verbs and structured examples that are designed to help credit analysts accurately showcase their competencies and achievements in a readable and appealing way.

Dive into our concise guide to learn how to:

- Show your credit analyst career's brightest moments through your resume's summary, objective, and experience sections.

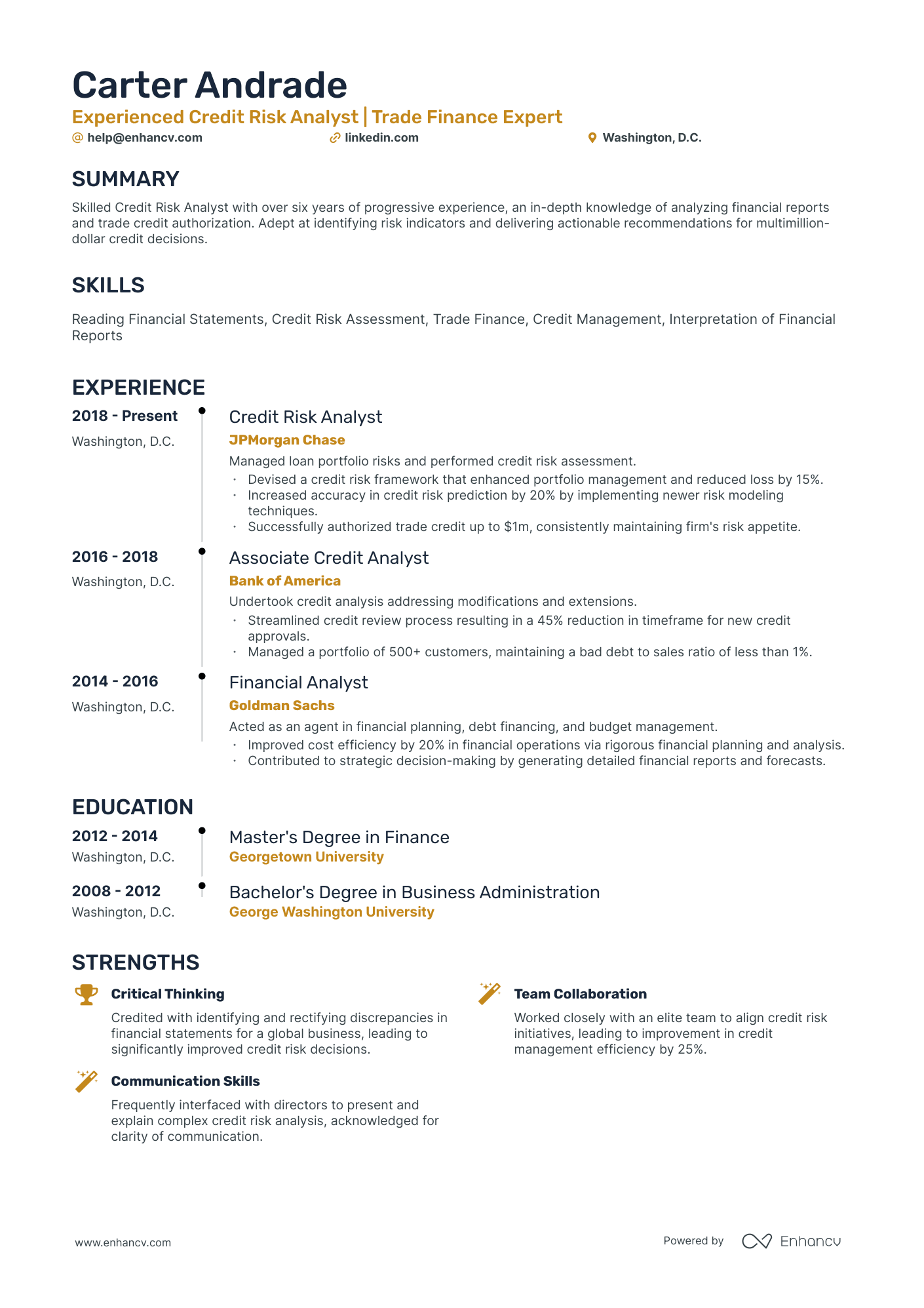

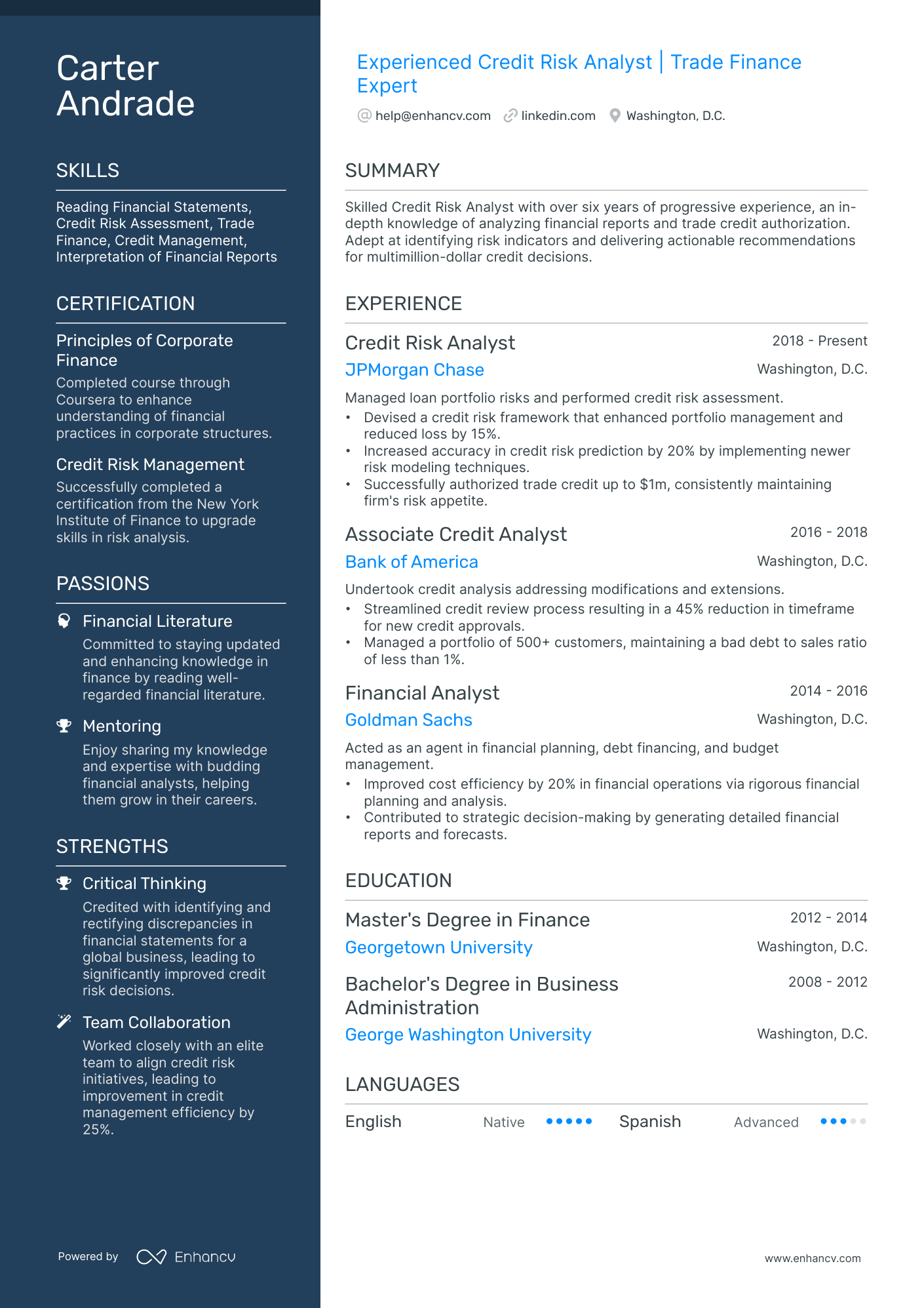

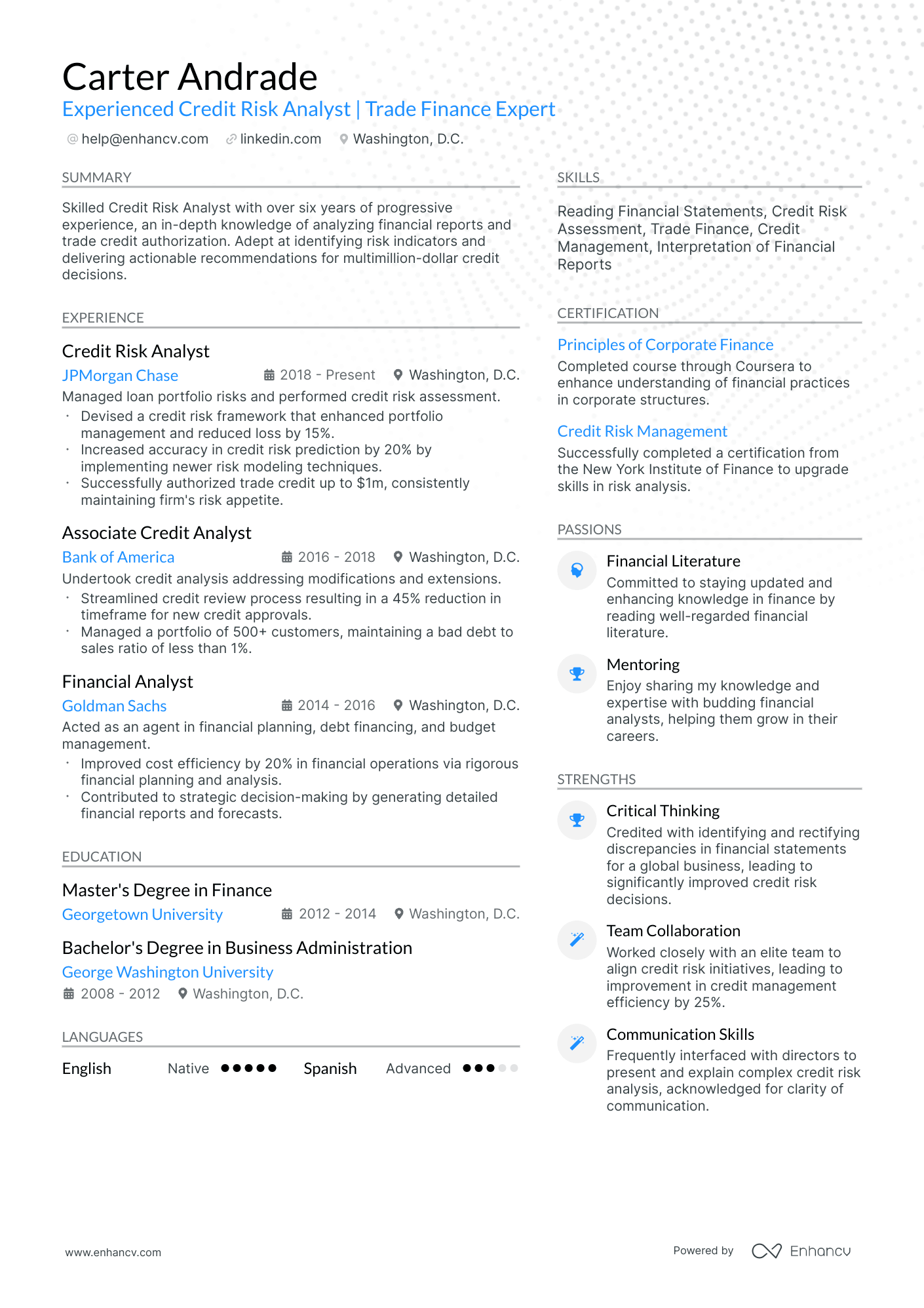

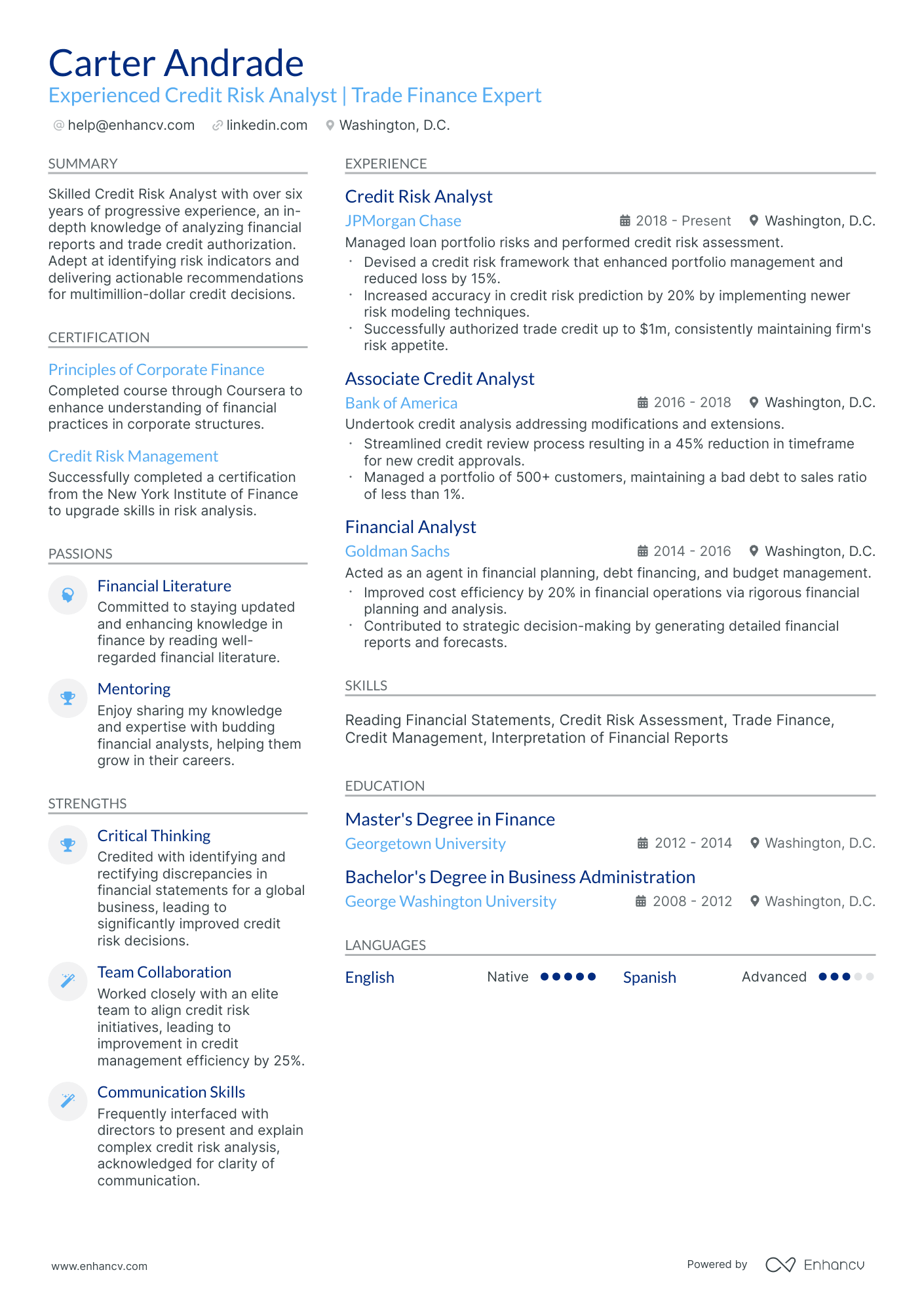

- Explore top-notch credit analyst resume examples to understand how to distinguish yourself from other candidates.

- Identify the most sought-after credit analyst skills and certifications in the industry.

- Design a structured yet unique resume layout.

Recommended reads:

Designing your credit analyst resume: best practices

Before penning down your credit analyst resume, consider its structure and format. Here's what you should remember:

- Employ the reverse-chronological format to present your experience, starting with your most recent role.

- Your resume's header should feature accurate, professional contact details. If you maintain a professional portfolio or LinkedIn profile, include its link.

- Keep your resume concise, ideally within two pages. Prioritize relevance over length.

- Unless directed otherwise, save your resume as a PDF to preserve its design.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Prioritize clarity and organization in your credit analyst resume. Use ample white space, choose readable fonts, and clearly delineate each section.

Must-have sections on a devsecops engineer resume:

- A header to list your job title and contact information

- A resume summary or objective which highlights your top career achievements

- A detailed experience section where you emphasize the breadth of your expertise

- A skills box to put the spotlight on your social talents and technical strengths

- An education and certifications section which features your qualifications

What recruiters want to see on your resume:

- Credit Risk Analysis Skills: Demonstrated experience in assessing credit risk by analyzing financial statements and credit data.

- Knowledge of Financial Regulations: Understanding of applicable laws and regulations that govern lending activities.

- Financial Modeling Proficiency: Ability to build and interpret complex financial models, with knowledge of tools such as Excel, SAS, or Python.

- Industry Expertise: Specific knowledge about the industry of operation (e.g., corporate, retail, real estate, etc.) is highly valued.

- Communication Skills: Excellent written and verbal communication for explaining complex credit information clearly to stakeholders.

Recommended reads:

Writing your credit analyst resume experience

Here are some quick tips on how to curate your credit analyst professional experience:

- Always ensure that you quantify your achievements by implementing the Situation-Task-Action-Result framework;

- When writing each experience bullet, make sure you're using active voice;

- Stand out by including personal skills you've grown while at the job;

- Be specific about your professional experience - it's not enough to say you have great communication skills, but rather explain what your communication track record led to?

Wondering how other professionals in the industry are presenting their job-winning experience? Check out how these credit analyst professionals put some of these best practices into action:

- Conducted detailed financial analysis on client portfolios, assessing creditworthiness and providing risk recommendations.

- Managed a portfolio of corporate clients, analyzing their financial statements and assessing credit risk exposure.

- Developed financial models to forecast cash flows and assess the viability of potential lending opportunities.

- Collaborated with cross-functional teams to evaluate credit proposals and structure financing solutions.

- Identified and monitored key risk indicators, ensuring compliance with regulatory requirements.

- Prepared comprehensive credit reports summarizing findings and presenting recommendations to senior management.

- Analyzed financial statements, industry trends, and economic data to evaluate creditworthiness.

- Assessed the risk of loan default by conducting thorough company and industry-specific research.

- Performed financial ratio analyses to determine liquidity, solvency, and profitability of borrowers.

- Participated in due diligence procedures, including site visits and interviews with potential borrowers.

- Collaborated with loan officers to structure credit facilities and negotiate terms with clients.

- Managed a portfolio of existing loans, monitoring repayment schedules and identifying early warning signs.

- Assessed creditworthiness of small business loan applicants through financial statement analysis.

- Analyzed collateral values and conducted market research to determine loan-to-value ratios.

- Evaluated historical financial performance and identified areas for improvement to mitigate risk.

- Collaborated with loan officers and legal counsel to negotiate loan terms and conditions.

- Managed a portfolio of small business loans, ensuring timely repayment and resolving delinquencies.

- Developed and implemented credit policies and procedures to streamline the lending process.

- Conducted credit investigations and analyzed financial statements to evaluate creditworthiness.

- Assisted in underwriting commercial loans, including reviewing loan applications and supporting documentation.

- Performed risk assessments on existing loans and recommended appropriate risk mitigation strategies.

- Collaborated with loan officers to structure loan transactions and ensure compliance with regulations.

- Monitored borrower accounts for payment delinquencies and implemented necessary collection procedures.

- Participated in credit committee meetings, providing input on loan proposals and risk management.

- Analyzed customer credit data to assess creditworthiness and determine credit limits.

- Evaluated financial statements, payment histories, and industry trends to identify potential risks.

- Assisted in developing scoring models to automate the credit evaluation process.

- Collaborated with sales teams to evaluate customer credit requests and negotiate credit terms.

- Monitored customer accounts for overdue payments and initiated collection actions as necessary.

- Provided recommendations to senior management on credit policy improvements and risk mitigation.

- Conducted credit analysis on a diverse portfolio of retail clients, including individual creditworthiness assessment.

- Developed and implemented credit risk models to enhance accuracy and efficiency in the decision-making process.

- Collaborated with sales teams to structure financing solutions, resulting in increased loan origination volume.

- Performed stress testing and scenario analysis to evaluate portfolio resilience under adverse economic conditions.

- Provided regular reports on credit quality indicators, identifying trends and potential risks.

- Participated in cross-functional projects to improve credit risk management processes and systems.

- Conducted in-depth credit analysis on commercial real estate loan applications.

- Evaluated property cash flows, market trends, and borrower financials to assess repayment capacity.

- Performed site visits and inspections to verify property condition and evaluate collateral value.

- Worked closely with internal and external stakeholders to coordinate due diligence efforts.

- Collaborated with loan officers to structure complex financing transactions for high-value properties.

- Managed a portfolio of commercial real estate loans, monitoring performance and assessing risk exposure.

- Conducted credit reviews of individual consumers, evaluating creditworthiness and repayment history.

- Analyzed credit reports, income documentation, and debt-to-income ratios to determine risk profiles.

- Collaborated with loan officers to approve or recommend modifications to consumer loan applications.

- Provided support in managing delinquent accounts, negotiating repayment plans with customers.

- Assisted in developing and implementing fraud detection strategies to minimize credit losses.

- Maintained accurate records of credit decisions and customer interactions for regulatory compliance.

- Conducted credit assessments on small business loan applicants, evaluating financial statements and business plans.

- Analyzed borrower cash flows, profitability, and industry trends to assess repayment capacity.

- Collaborated with loan officers to structure loan terms and conditions, ensuring alignment with risk appetite.

- Managed a portfolio of small business loans, monitoring repayment performance and conducting reviews.

- Provided recommendations on credit policy enhancements and risk mitigation strategies.

- Assisted in training new credit analysis team members on credit evaluation procedures.

- Conduct comprehensive credit analysis on corporate clients, assessing their creditworthiness and risk exposure.

- Evaluate financial statements, industry data, and economic indicators to make informed credit decisions.

- Develop financial models and perform scenario analyses to assess potential risks and opportunities.

- Collaborate with cross-functional teams to structure financing solutions and negotiate credit terms.

- Monitor credit portfolios, identifying early warning signs and recommending appropriate risk mitigation strategies.

- Prepare detailed credit reports and presentations for senior management and stakeholders.

Quantifying impact on your resume

<ul>

Addressing a lack of relevant credit analyst experience

Even if you lack direct credit analyst experience, you can still craft a compelling resume. Here's how:

- Highlight projects or publications that demonstrate your relevant skills or knowledge.

- Emphasize transferable skills, showcasing your adaptability and eagerness to learn.

- In your objective, outline your career aspirations and how they align with the company's goals.

- Consider a functional or hybrid resume format, focusing on skills over chronological experience.

Recommended reads:

Pro tip

If your experience section doesn't directly address the job's requirements, think laterally. Highlight industry-relevant awards or positive feedback to underscore your potential.

Highlighting essential hard and soft skills for your credit analyst resume

Your skill set is a cornerstone of your credit analyst resume.

Recruiters keenly evaluate:

- Your hard skills, gauging your proficiency with specific tools and technologies.

- Your soft skills, assessing your interpersonal abilities and adaptability.

A well-rounded candidate showcases a harmonious blend of both hard and soft skills, especially in a dedicated skills section.

When crafting your credit analyst skills section:

- List up to six skills that resonate with the job requirements and highlight your expertise.

- Feature a soft skill that encapsulates your professional persona, drawing from past feedback or personal reflections.

- Consider organizing your skills into distinct categories, such as "Technical Skills" or "Soft Skills."

- If you possess pivotal industry certifications, spotlight them within this section.

Crafting a comprehensive skills section can be daunting. To assist, we've curated lists of both hard and soft skills to streamline your resume-building process.

Top skills for your credit analyst resume:

Financial Analysis

Credit Risk Assessment

Excel

SQL

Financial Modeling

Statistical Analysis Software

Data Visualization Tools

Credit Scoring Systems

Accounting Software

Risk Management Tools

Analytical Thinking

Attention to Detail

Communication Skills

Problem Solving

Time Management

Team Collaboration

Adaptability

Critical Thinking

Interpersonal Skills

Decision Making

Pro tip

Double-check the spelling of all skills and tools on your resume. Remember, software like the Applicant Tracker System (ATS) scans for these details.

Choosing the right certifications and education for your credit analyst resume

Your education section can highlight skills and experiences perfect for the job.

- List college or university degrees with the school name and dates.

- If you're still studying, mention your expected graduation date.

- Think twice before adding unrelated degrees. Space on your resume is precious.

- Discuss educational achievements if they boost your job relevance.

There are many certifications out there. Which ones should you include?

- List your main degree in a separate section with the school name and dates.

- Only add certifications that highlight your skills and experience.

- Place unique or recent certifications near the top.

- Add a brief description to certifications if it helps show your skills.

Remember, it's not about quantity but relevance.

Best certifications to list on your resume

Pro tip

If you're in the process of obtaining a certification listed in the job requirements but haven't completed it yet, be transparent. Mention your ongoing training and the expected completion date. Honesty is always the best policy on a resume.

Recommended reads:

Summary or objective: maximizing the impact of the top third of your resume

The top third of your credit analyst resume is crucial. It's often the first thing recruiters see and can set the tone for the rest of your application.

Whether you choose a resume summary or a resume objective, make it count. The former is great for showcasing career highlights, while the latter balances your achievements with your future aspirations.

Both should be tailored to the role, as there's no universal approach to crafting the perfect credit analyst summary or objective. Use the examples below as a starting point.

Resume summary and objective examples for a credit analyst resume

- Detail-oriented credit analyst with over 6 years of experience in the banking industry, known for precise risk analysis and interpretation of complex financial data. Demonstrated expertise in credit underwriting, financial statement analysis, and portfolio management. Achieved a 20% reduction in bad debt losses through effective credit assessment strategies.

- Accomplished Financial Analyst transitioning into Credit Analysis, bringing forth 7 years of experience in the finance sector. Holds a strong understanding of budgeting, forecasting, and financial modeling. Proficient in SQL, Excel, and SAS. Successfully led a team to increase operational efficiency by 15%.

- Dedicated Data Analyst keen on bringing 5 years of experience in data-driven environments towards a career in Credit Analysis. Skilled at using Python and R for predictive modeling and data visualization. Notable achievement of increasing data accuracy by 25% in previous role.

- A seasoned Accounting Professional shifting gears to Credit Analysis, backed by a solid 8 years of experience in finance. Expertise lies in GAAP compliance, auditing, and tax preparation. Distinguished for improving financial reporting processes leading to time savings of 30%.

- Eager to leverage my Bachelor's degree in Finance and strong analytical skills to embark on a career as a credit analyst. Committed to applying learned theories and concepts to accurately assess creditworthiness and mitigate potential risks.

- Graduate in Business Administration with a specialization in Finance seeking an entry-level credit analyst role. Aspires to utilize strong quantitative and problem-solving skills to contribute effectively to risk assessment processes and enhance organizational profitability.

Additional sections to elevate your credit analyst resume

Recruiters often seek candidates who offer more than just the basics.

To stand out, consider adding:

- Interests: Share hobbies or activities that reveal your personality and transferable skills.

- Projects: Highlight innovative work that showcases your expertise.

- Languages: If communication is vital for the role, showcase your linguistic abilities.

- Awards: Feature significant recognitions that underscore your expertise.

Key takeaways

- Effective credit analyst resumes are well-structured, weaving a compelling career narrative.

- Choose between a resume summary or objective based on your experience and the impression you aim to create.

- If lacking in direct experience, leverage other roles, such as internships or contract positions, to demonstrate alignment with the credit analyst role.

- Be discerning in listing hard and soft skills, ensuring relevance and showcasing outcomes.

- Always tailor your resume for each credit analyst application, ensuring alignment with job requirements.