As a credit manager, articulating your complex risk analysis and decision-making experiences on your resume can be challenging. Our guide is designed to help you distill these intricate responsibilities into clear, impactful bullet points that will catch an employer's eye.

- Credit manager resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out credit manager skills that should make your resume.

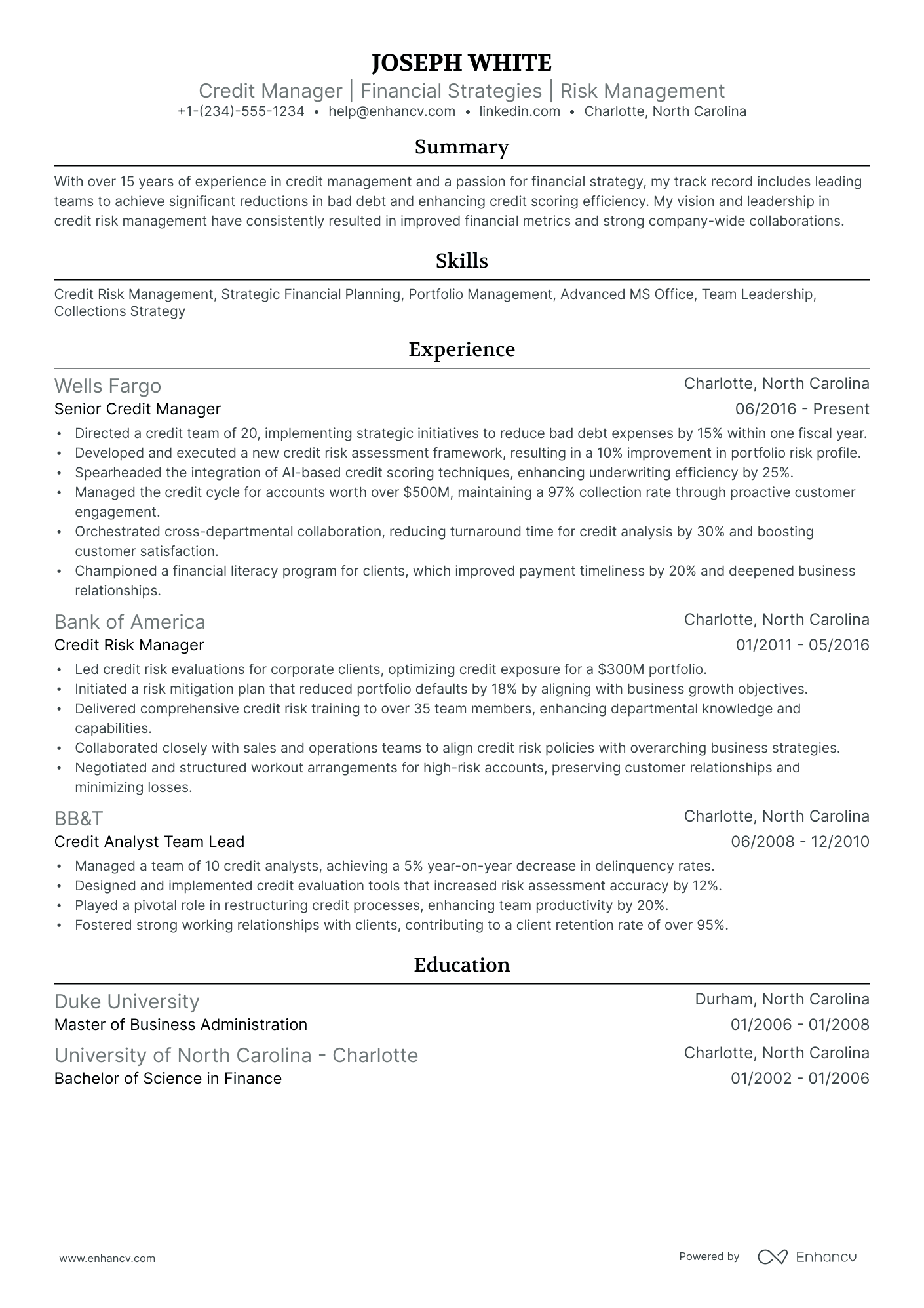

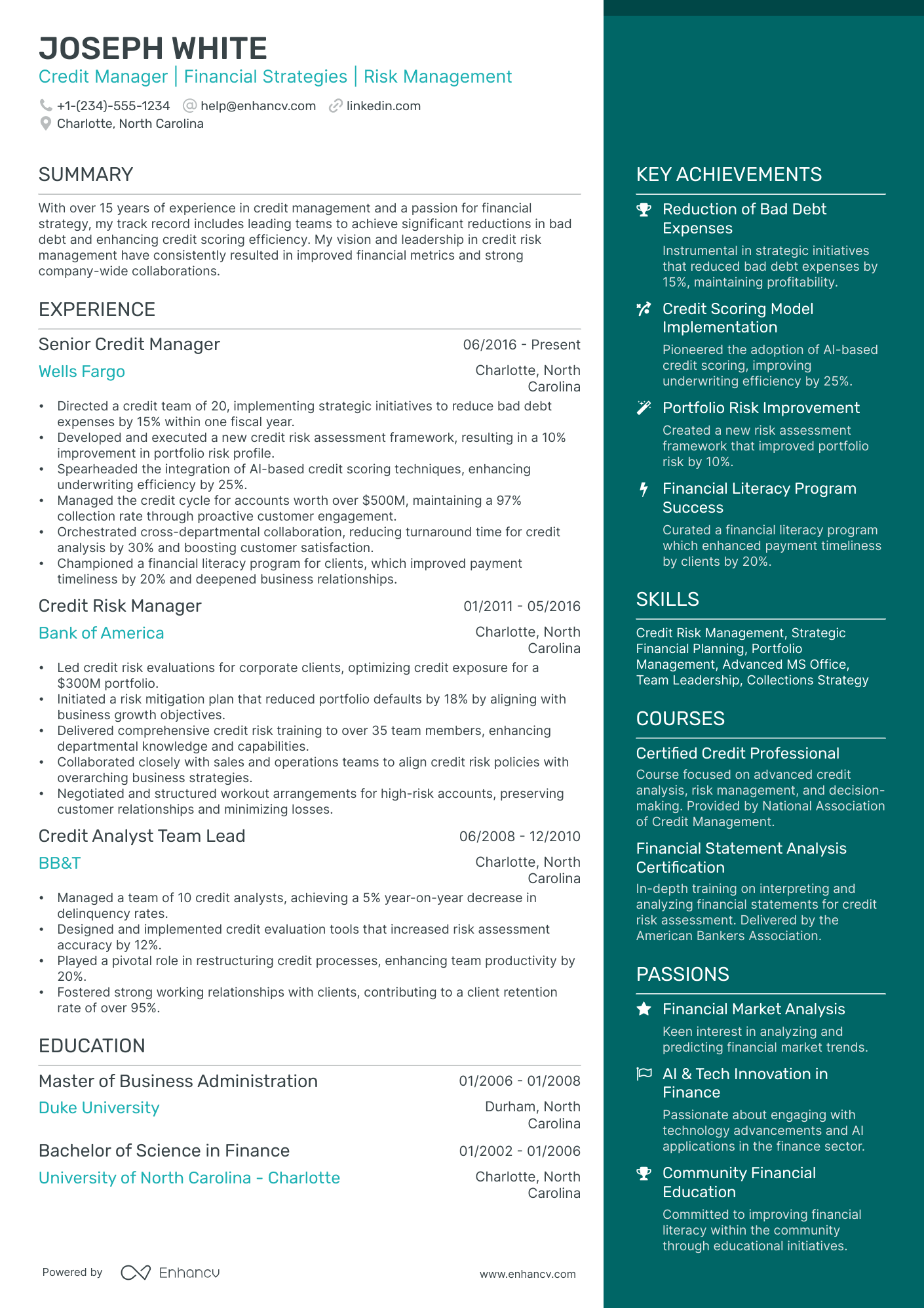

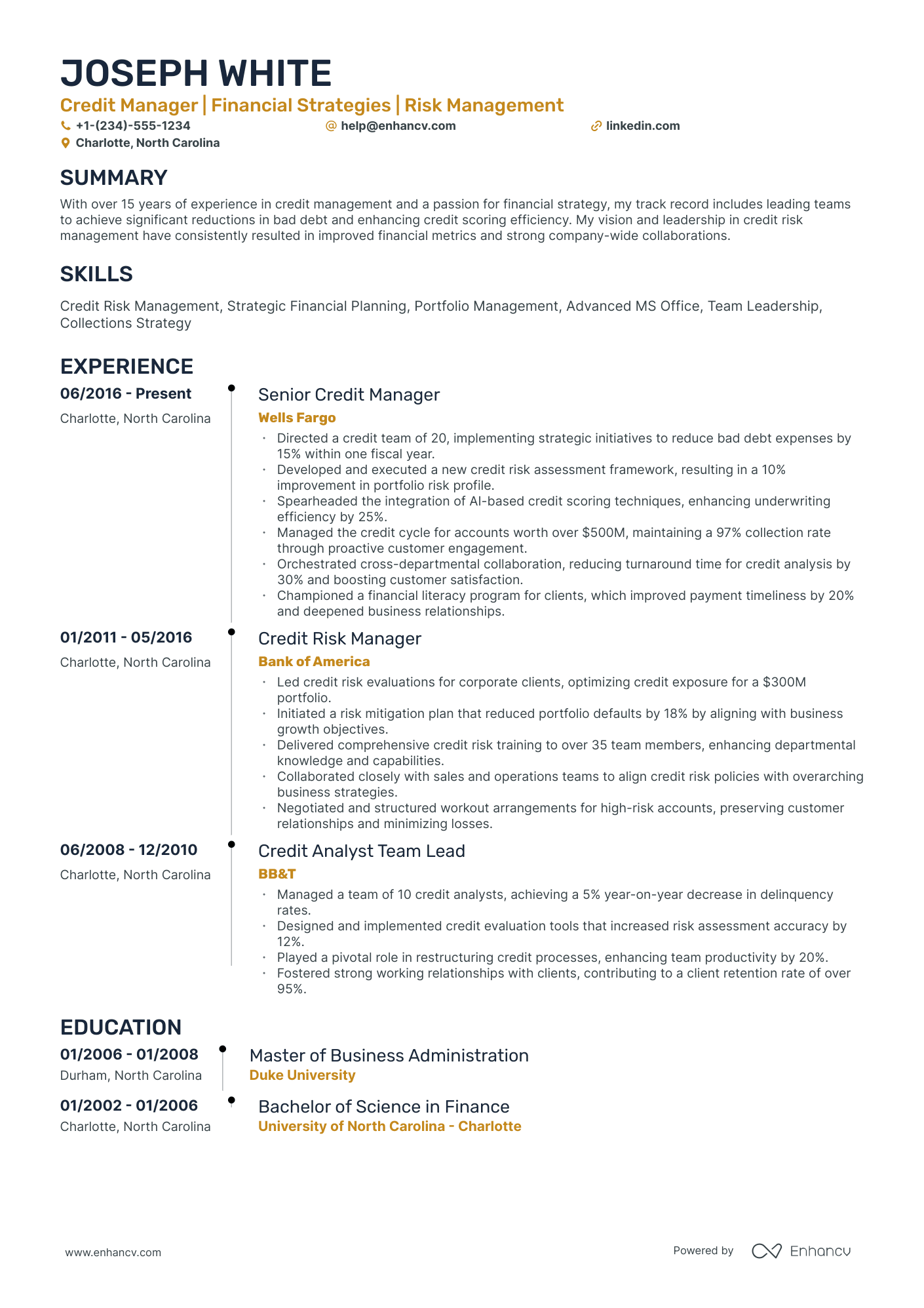

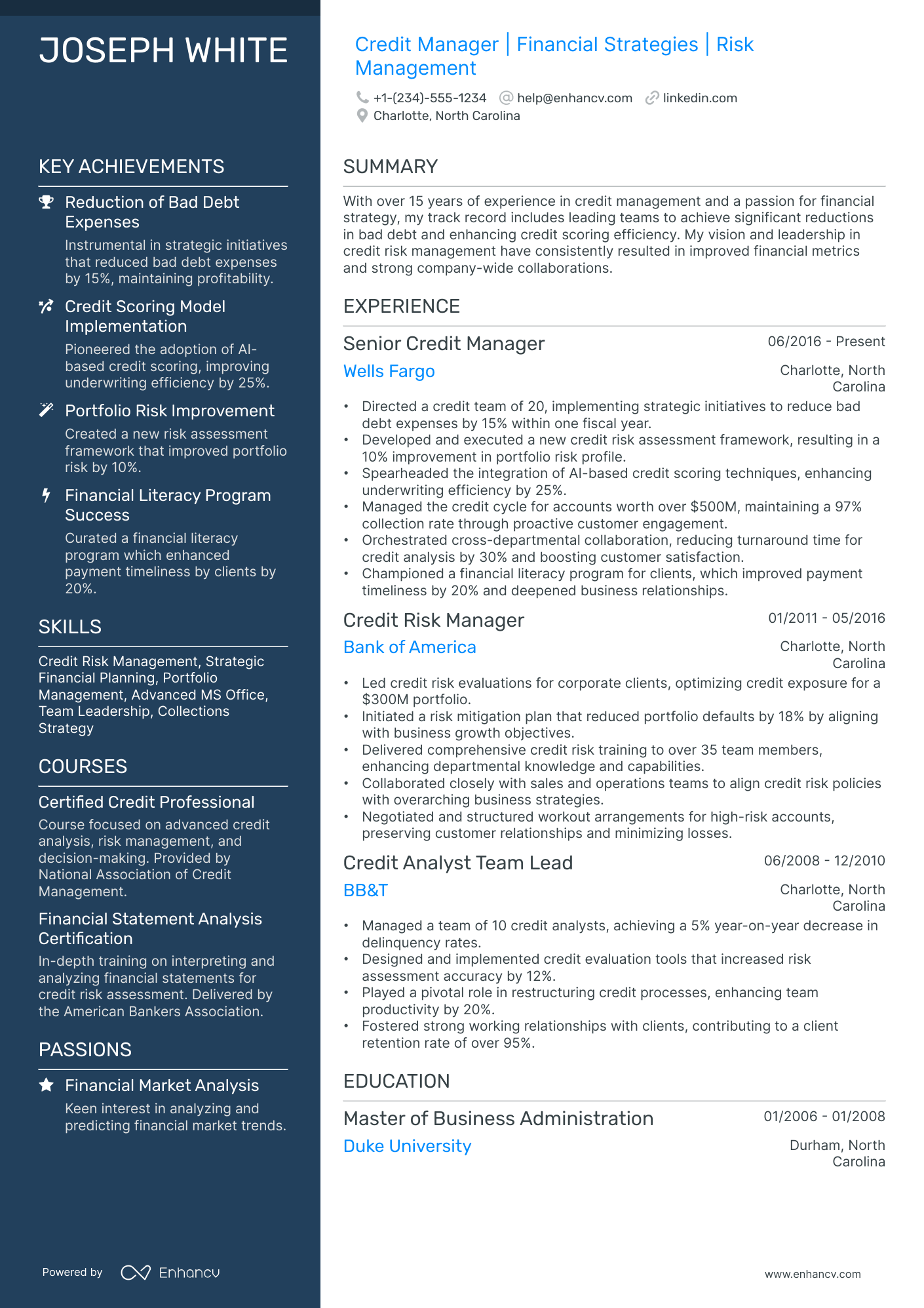

- Styling the layout of your professional resume: take a page from credit manager resume examples.

How to write about your credit manager achievements in various resume sections (e.g. summary, experience, and education).

- Junior Financial Analyst Resume Example

- Assistant Finance Manager Resume Example

- Fund Accountant Resume Example

- Hotel Night Auditor Resume Example

- IT Auditor Resume Example

- Management Accounting Resume Example

- Construction Accounting Resume Example

- Full Cycle Accounting Resume Example

- Tax Director Resume Example

- Purchase Accounting Resume Example

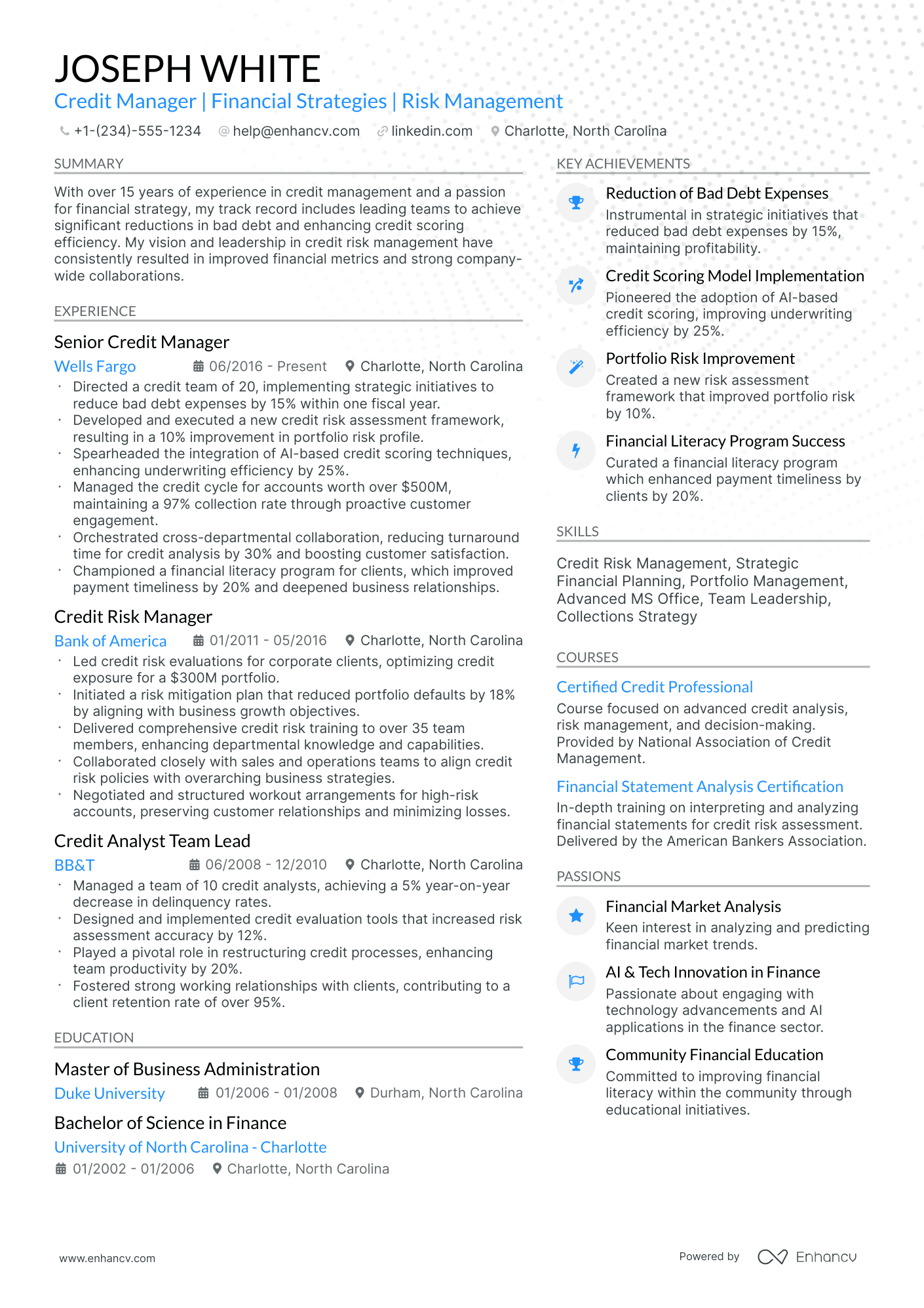

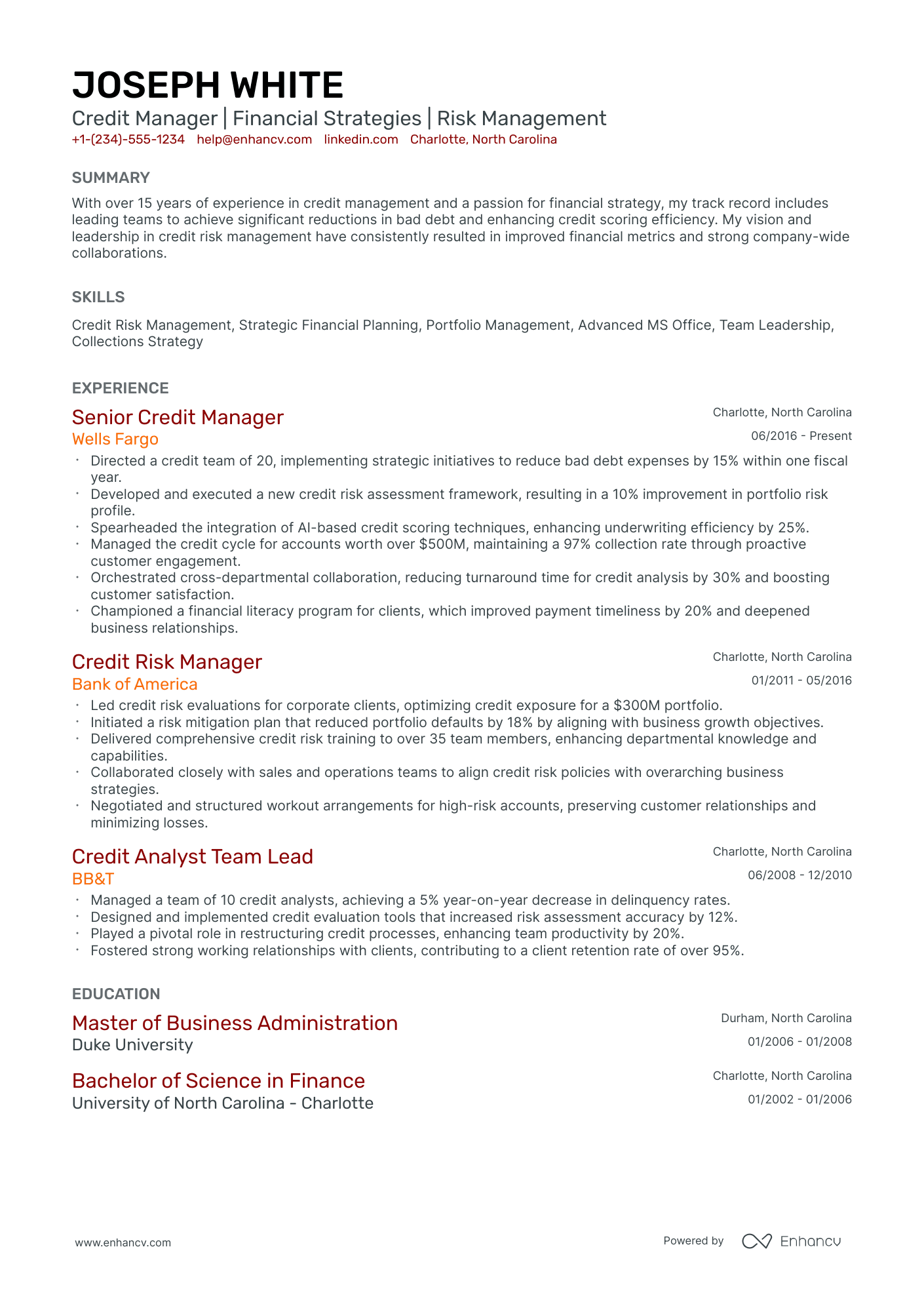

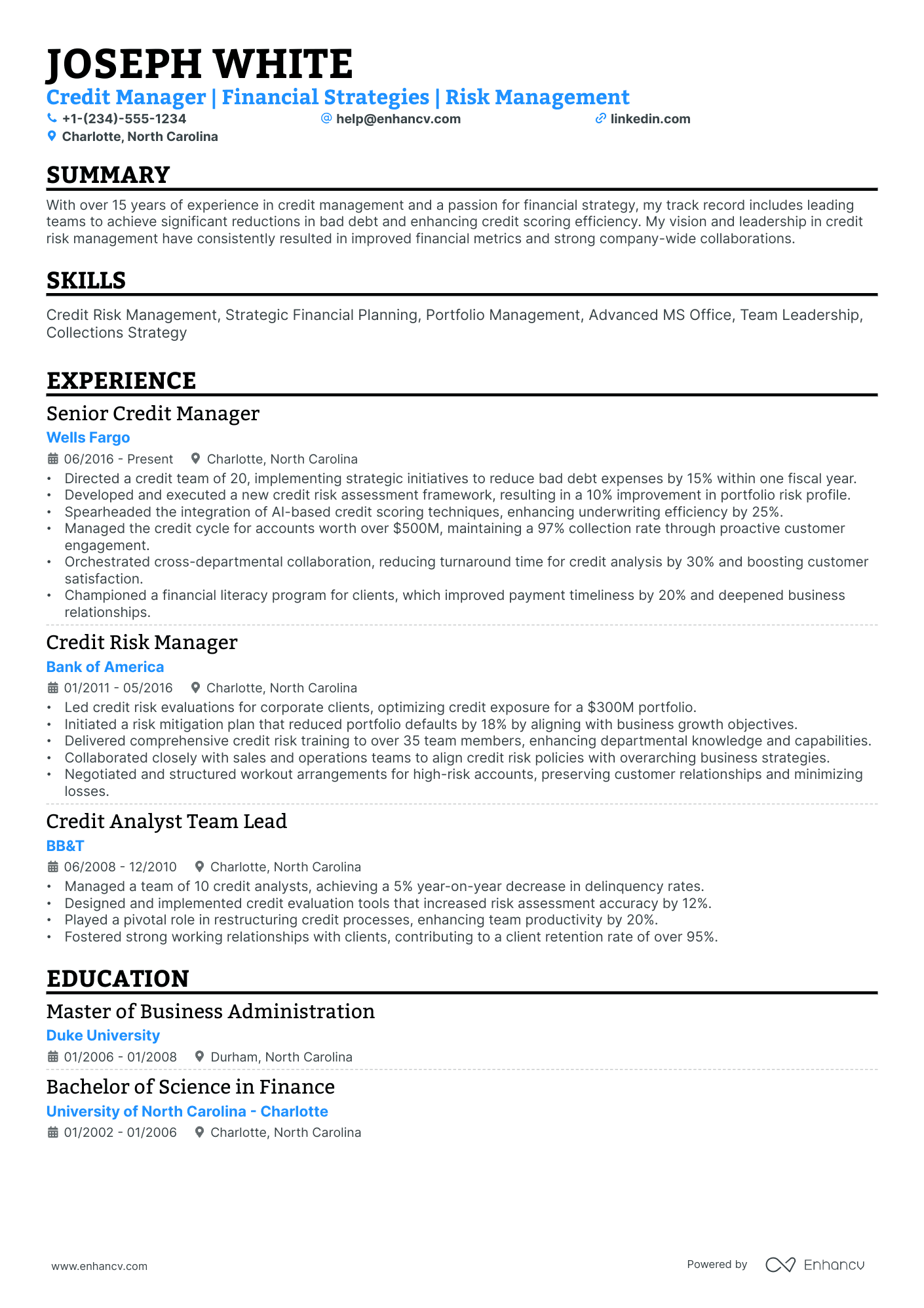

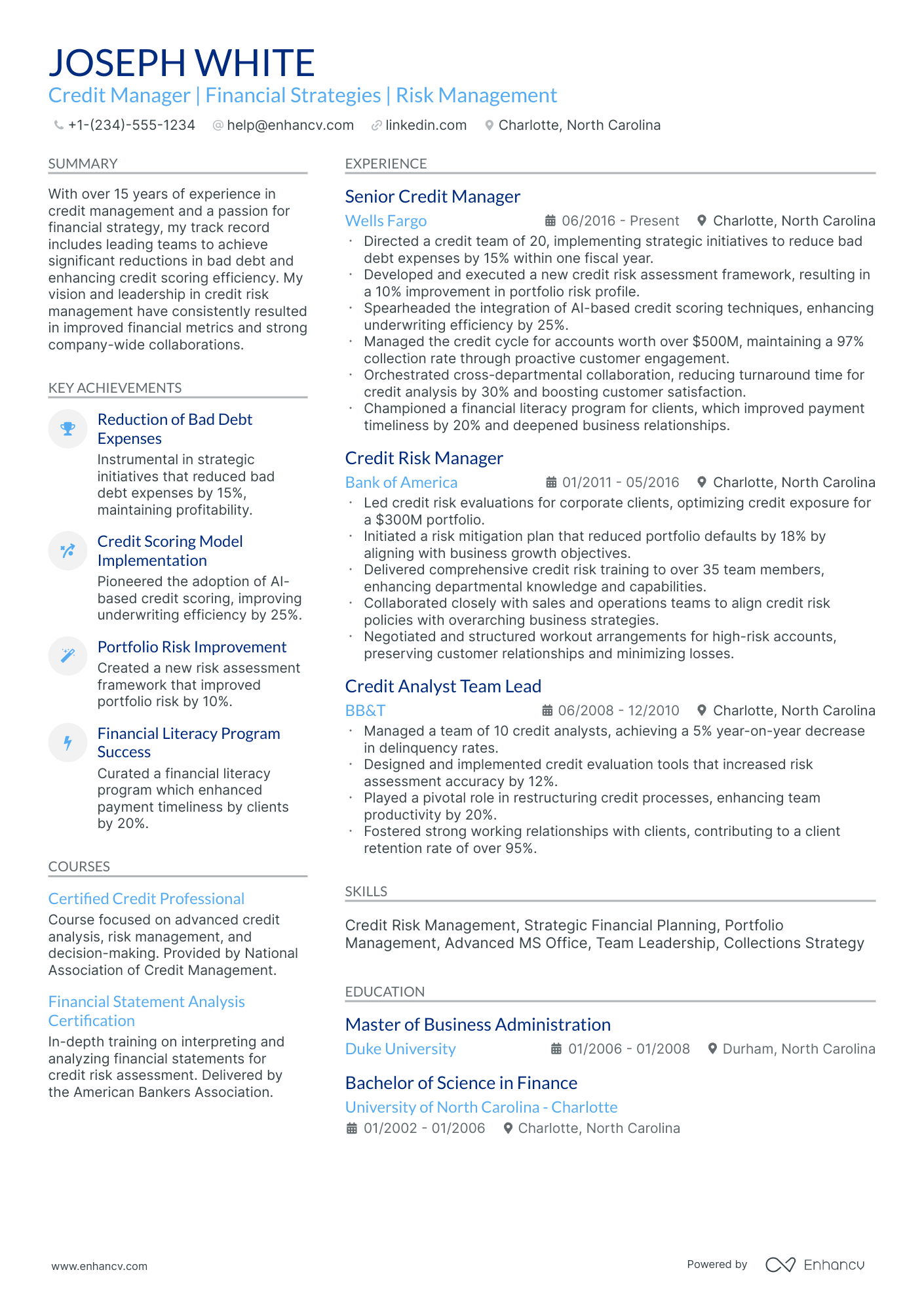

Designing your credit manager resume format to catch recruiters' eyes

Your credit manager resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your credit manager resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your credit manager resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

Align your resume with the market’s standards – Canadian resumes may have unique layout guidelines.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Fundamental sections for your credit manager resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Proven experience in credit risk analysis and decision-making.

- Capability to develop and implement credit policies and procedures.

- Proficiency with credit management software and financial analysis tools.

- Demonstrated experience managing and leading a team of credit analysts or related staff.

- Strong understanding of financial regulations and compliance as it pertains to credit and lending.

What is the resume experience section and how to write one for your past roles

The experience section in a credit manager resume is critical for your profile and overall application. It should not only display your work history, but also highlight your achievements in previous roles.

Many candidates either simply list their duties or provide excessive details about past, irrelevant jobs. A more effective approach involves first examining the job advertisement for keywords - specifically, skills essential for the role. Then, demonstrate these key requirements throughout different parts of your resume, using accomplishments from your roles.

Format each bullet point in your experience section by starting with a strong action verb. Follow this with a description of your role and its impact on the team or organization.

Aim to include three to five bullet points for each role.

Finally, gain insights into how professionals have crafted their credit manager resume experience sections by exploring some best practice examples.

- Spearheaded the restructuring of the credit evaluation process, introducing data analytics tools that improved the accuracy of credit scoring by 30%.

- Negotiated and implemented new credit terms with key vendors, improving cash flow by 20% and reducing average days sales outstanding by 15 days.

- Led a cross-functional team in a successful pilot program to automate risk assessment, which was then adopted company-wide, decreasing processing times by 40%.

- Managed a portfolio of over 500 commercial accounts, reducing delinquency rates from 7% to 4.5% within the first year.

- Developed and conducted credit management training for new team members, enhancing department expertise and reducing onboarding time by 25%.

- Established and led quarterly credit review meetings that contributed to strategic planning, resulting in a 20% reduction in credit losses.

- Implemented an innovative credit scoring model using predictive analytics that led to a 12% improvement in loan performance.

- Collaborated with IT to launch a new credit reporting system, improving reporting efficiency and cutting errors by 25%.

- Drove company policy changes that aligned credit risk objectives with overall business strategy, improving risk-adjusted returns on the portfolio.

- Oversaw a team that successfully reduced credit card fraud by 40% through implementing advanced fraud detection systems.

- Played a key role in the negotiation of a multimillion-dollar loan syndication transaction that expanded the company’s market presence.

- Initiated and managed a comprehensive debt recovery program that increased recoveries on impaired loans by 35%.

- Optimized credit line increases, reducing churn by 18% and simultaneously maintaining a healthy risk profile for the credit portfolio.

- Developed a standardized credit risk reporting framework that enhanced visibility for executive decision-making and was later adopted across regional offices.

- Championed a client retention program that incorporated credit incentives, resulting in the retention of key accounts and an increase in profitability by 10%.

- Re-engineered underwriting policies for SMB lending, leading to a portfolio growth of $100M while maintaining loss rates below industry average.

- Orchestrated the transition to a new credit monitoring platform that increased operational efficiency by streamlining credit reviews and approvals.

- Drove international credit expansion initiatives, successfully penetrating new markets in Europe and Asia, resulting in a 15% portfolio growth in those regions.

- Designed a comprehensive risk assessment model tailored for SMEs that improved credit decision turnaround times by 30%.

- Directed the successful integration of a newly acquired company's credit processes, maintaining service levels throughout the transition.

- Achieved a 20% efficiency gain in the collections process through the implementation of a new CRM system, enhancing customer payment behaviors.

- Enhanced credit risk assessment for high-net-worth individuals, increasing the portfolio under management by $50 million with an improved risk profile.

- Contributed to interdepartmental teams that developed new financial products which aligned with emerging market demands and credit trends.

- Aligned credit approval processes with regulatory requirements, ensuring 100% compliance with local and federal financial regulations.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for credit manager professionals.

Top Responsibilities for Credit Manager:

- Establish and maintain relationships with individual or business customers or provide assistance with problems these customers may encounter.

- Oversee the flow of cash or financial instruments.

- Plan, direct, or coordinate the activities of workers in branches, offices, or departments of establishments, such as branch banks, brokerage firms, risk and insurance departments, or credit departments.

- Recruit staff members.

- Evaluate data pertaining to costs to plan budgets.

- Oversee training programs.

- Establish procedures for custody or control of assets, records, loan collateral, or securities to ensure safekeeping.

- Communicate with stockholders or other investors to provide information or to raise capital.

- Develop or analyze information to assess the current or future financial status of firms.

- Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans.

Quantifying impact on your resume

- Include the total value of receivables managed to showcase financial stewardship.

- Specify the percentage reduction in bad debt achieved through credit policies to demonstrate risk mitigation effectiveness.

- Highlight the number of credit analysis reports produced to show analytical productivity.

- Mention the dollar amount of loans or credit lines approved to convey the scale of credit authority.

- State the percentage of credit limit increases granted to illustrate strategic account growth support.

- List the number of clients managed to reflect customer relationship and portfolio management skills.

- Provide the frequency of financial reviews conducted to emphasize due diligence and ongoing creditworthiness assessment.

- Detail any process improvements made in terms of reduced processing time or increased efficiency, using percentages or time saved to demonstrate operational enhancements.

Action verbs for your credit manager resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

In-demand hard skills and soft skills for your credit manager resume

A vital element for any credit manager resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your credit manager skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "credit manager skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your credit manager resume:

Credit Risk Assessment

Financial Analysis

Credit Scoring Models

Excel for Financial Modeling

Credit Management Software (e.g., FICO, Experian)

Data Analysis Tools (e.g., SQL, Tableau)

Regulatory Compliance Knowledge

Debt Recovery Techniques

Accounting Software (e.g., QuickBooks, SAP)

Financial Reporting

Communication

Negotiation

Problem-Solving

Attention to Detail

Analytical Thinking

Time Management

Decision-Making

Leadership

Interpersonal Skills

Adaptability

Next, you will find information on the top technologies for credit manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Credit Manager’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Microsoft SQL Server

- Yardi software

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Credit manager-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular credit manager certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your credit manager resume:

- Certified Credit Executive (CCE) - National Association of Credit Management (NACM)

- Credit Business Associate (CBA) - National Association of Credit Management (NACM)

- Credit Business Fellow (CBF) - National Association of Credit Management (NACM)

- Certified Manager of Credit (CMC) - The Credit Management Association (CMA)

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for credit manager professionals.

Top US associations for a Credit Manager professional

- AICPA and CIMA

- American Bankers Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Recommended reads:

Deciding between a resume summary or objective for your credit manager role

Understanding the distinction between a resume summary and an objective is crucial for your credit manager resume.

A resume summary, typically three to five sentences long, offers a concise overview of your career. This is the place to showcase your most pertinent experience, key accomplishments, and skills. It's particularly well-suited for those with professional experience relevant to the job requirements.

In contrast, a resume objective focuses on how you can add value to potential employers. It addresses why they should hire you and outlines your career expectations and learning goals. Therefore, it's ideal for candidates with less experience.

In the following section of our guide, explore how resume summaries and objectives differ through some exemplary industry-specific examples.

Resume summaries for a credit manager job

- Seasoned credit manager with over 10 years of experience in high-volume finance environments, skilled in developing credit policies that reduce delinquency rates. Expert in SAP and advanced risk assessment techniques, I've spearheaded the reduction of bad debt by 30% within a Fortune 500 company, resulting in a significant boost to the bottom line.

- With a robust history spanning 15 years as a Senior Credit Analyst, I moved into managing credit operations, fostering a team-driven environment that reduced credit processing times by 25%. My proficiency in Oracle Financials, combined with a strong track record in optimizing credit controls, has consistently enhanced departmental efficiencies.

- Former Financial Analyst transitioning to Credit Management, bringing a fresh perspective on data-driven risk analysis and an impressive background in utilizing statistical software for financial forecasting. Eager to leverage my advanced Excel skills and my achievement in reducing forecasting errors by 20% to excel in managing credit risk and policy formation.

- Dedicated Operations Manager with a decade of experience in managing supply chains looking to pivot into Credit Management. My knack for strategic planning and keen analytical skills, honed through managing multi-million dollar inventories, will be instrumental in devising comprehensive credit strategies and maintaining fiscal health.

- Aspiring to build a career in Credit Management, I am eager to apply my recent master's degree in Finance and my profound enthusiasm for quantitative analysis. My objective is to harness cutting-edge financial tools and a data-centric approach to contribute to prudent credit decision-making and support sustainable financial growth.

- Graduate with a Bachelors in Business Administration, enthusiastic to begin a career in Credit Management. Determined to use my academic knowledge of financial reporting and creditworthiness assessment, coupled with an internship experience focusing on debtor analysis, to bring a detail-oriented and fresh approach to credit operations.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for credit manager professionals

Local salary info for Credit Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Other relevant sections for your credit manager resume

Apart from the standard credit manager resume sections listed in this guide, you have the opportunity to get creative with building your profile. Select additional resume sections that you deem align with the role, department, or company culture. Good choices for your credit manager resume include:

- Language skills - always ensure that you have qualified each language you speak according to relevant frameworks;

- Hobbies - you could share more about your favorite books, how you spend your time, etc. ;

- Volunteering - to highlight the causes you care about;

- Awards - for your most prominent credit manager professional accolades and achievements.

Make sure that these sections don't take too much away from your experience, but instead build up your credit manager professional profile.

Key takeaways

Securing your ideal job starts with crafting a compelling credit manager resume. It should not only highlight your professional strengths but also reflect your personality. Key aspects to remember include:

- Choose a clear, easily editable format, allowing more time to focus on the content of your resume;

- Emphasize experience relevant to the job, focusing on your impact on the team;

- Opt for a resume summary if you have extensive professional experience, and a resume objective if you're just starting out;

- Include technical skills in the skills section and interpersonal skills in the achievements section;

- Recognize the importance of various resume sections (e.g., My Time, Projects) in showcasing both your professional abilities and personal traits.