As a loan processor, articulating the complexity of your financial analysis and customer service skills in a resume can be challenging. Our guide provides clear examples and tailored language to effectively showcase your expertise in these areas, ensuring your resume stands out to potential employers.

- Defining the highlights of your loan processor career through your resume summary, objective, and experience.

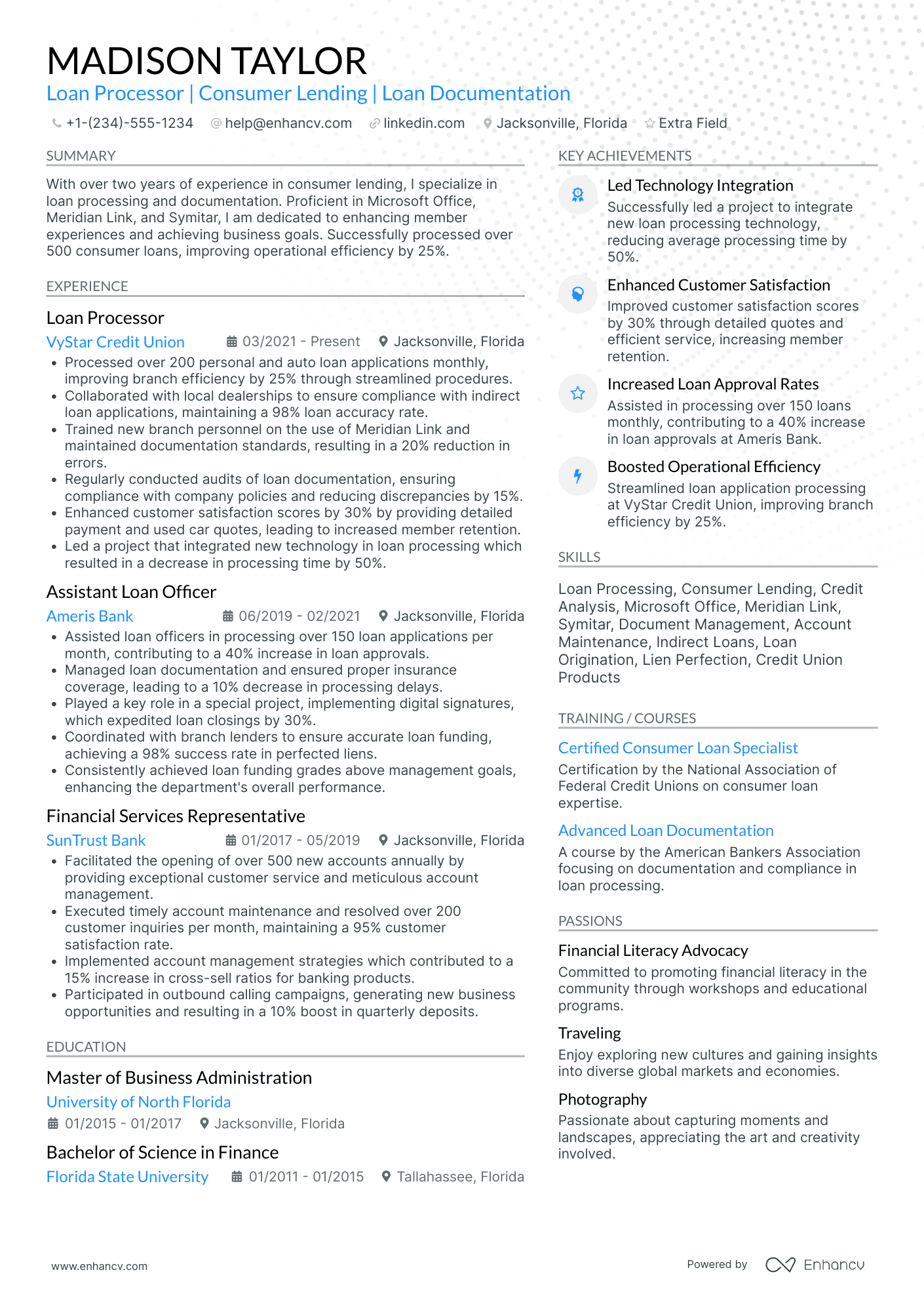

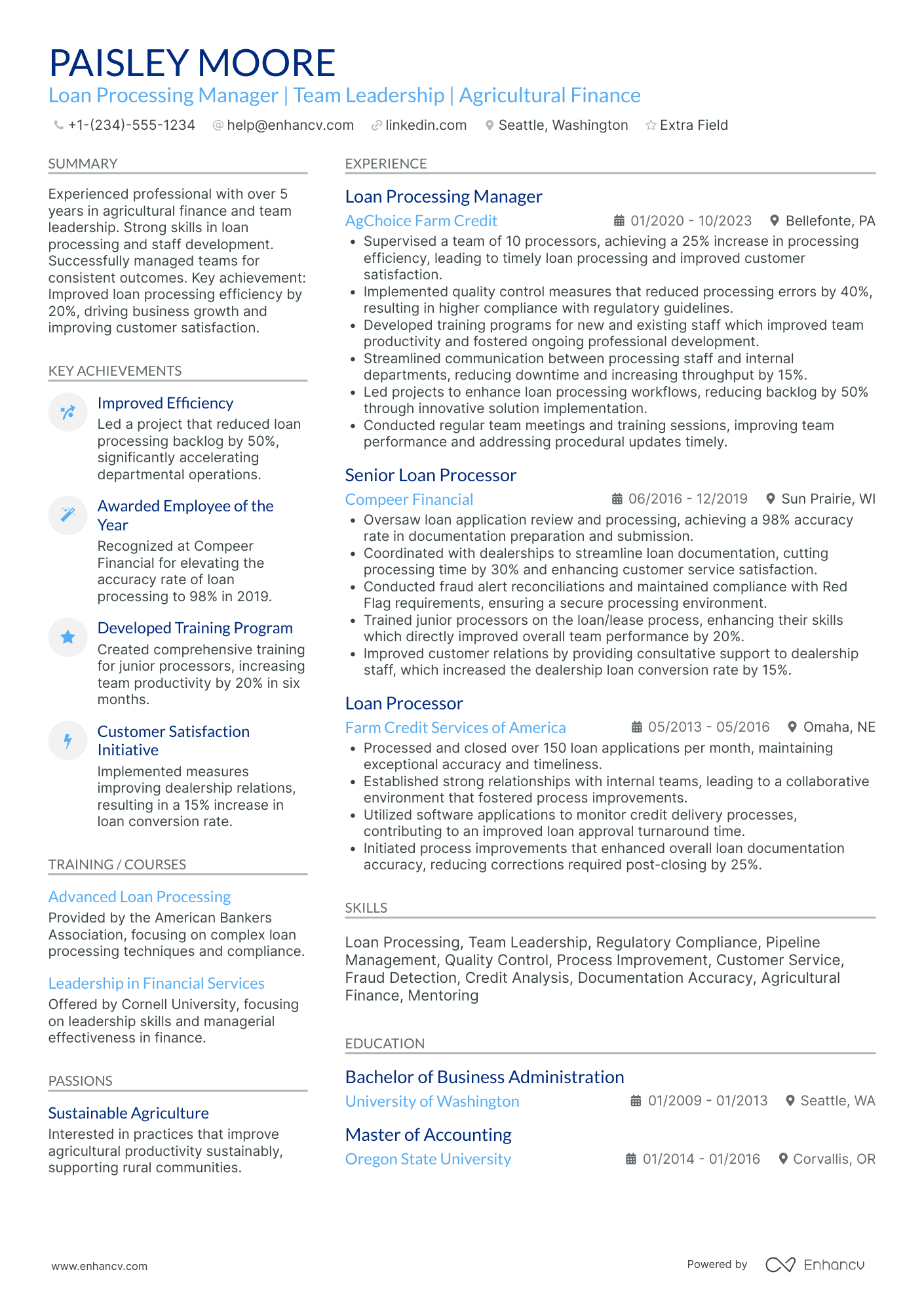

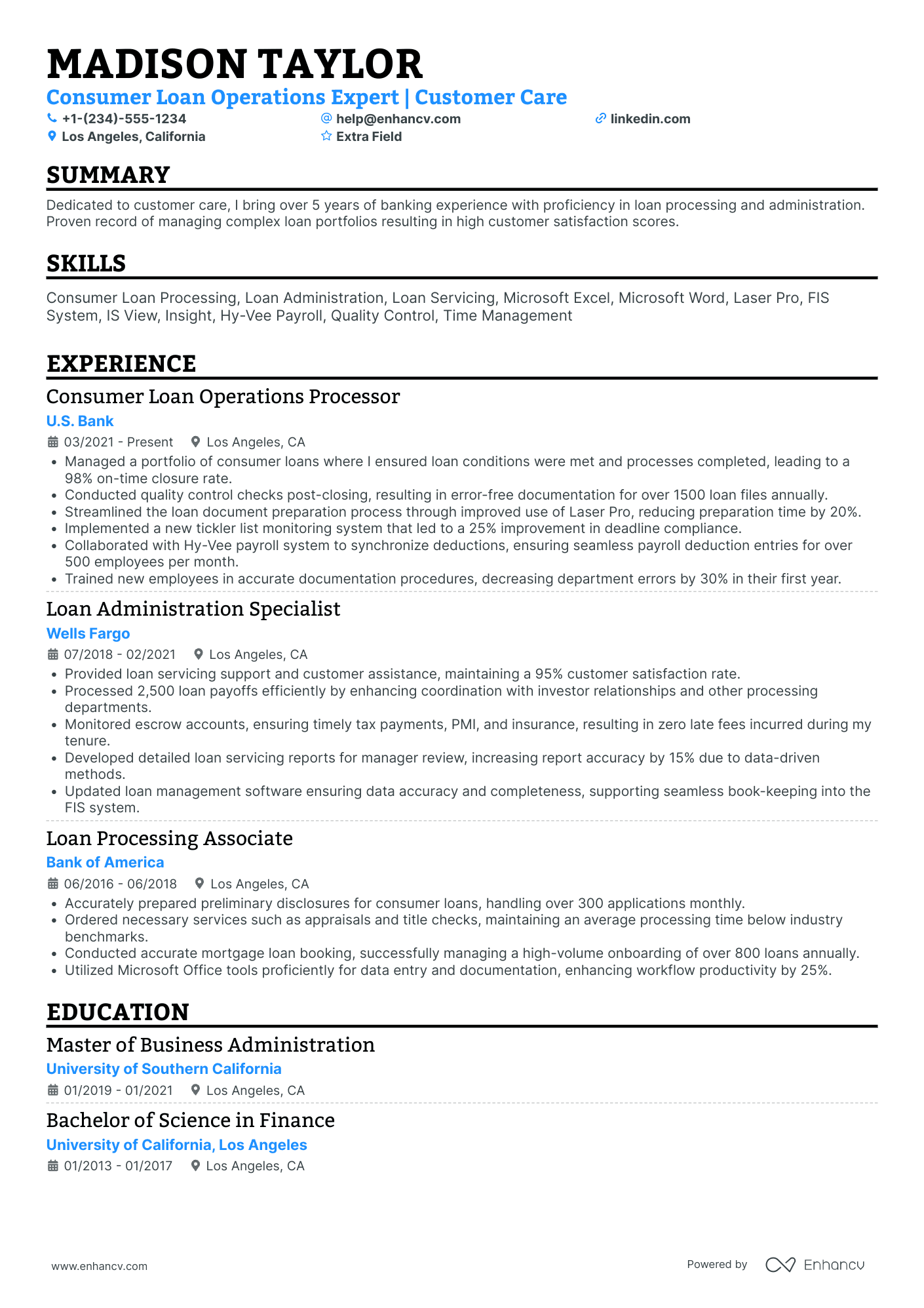

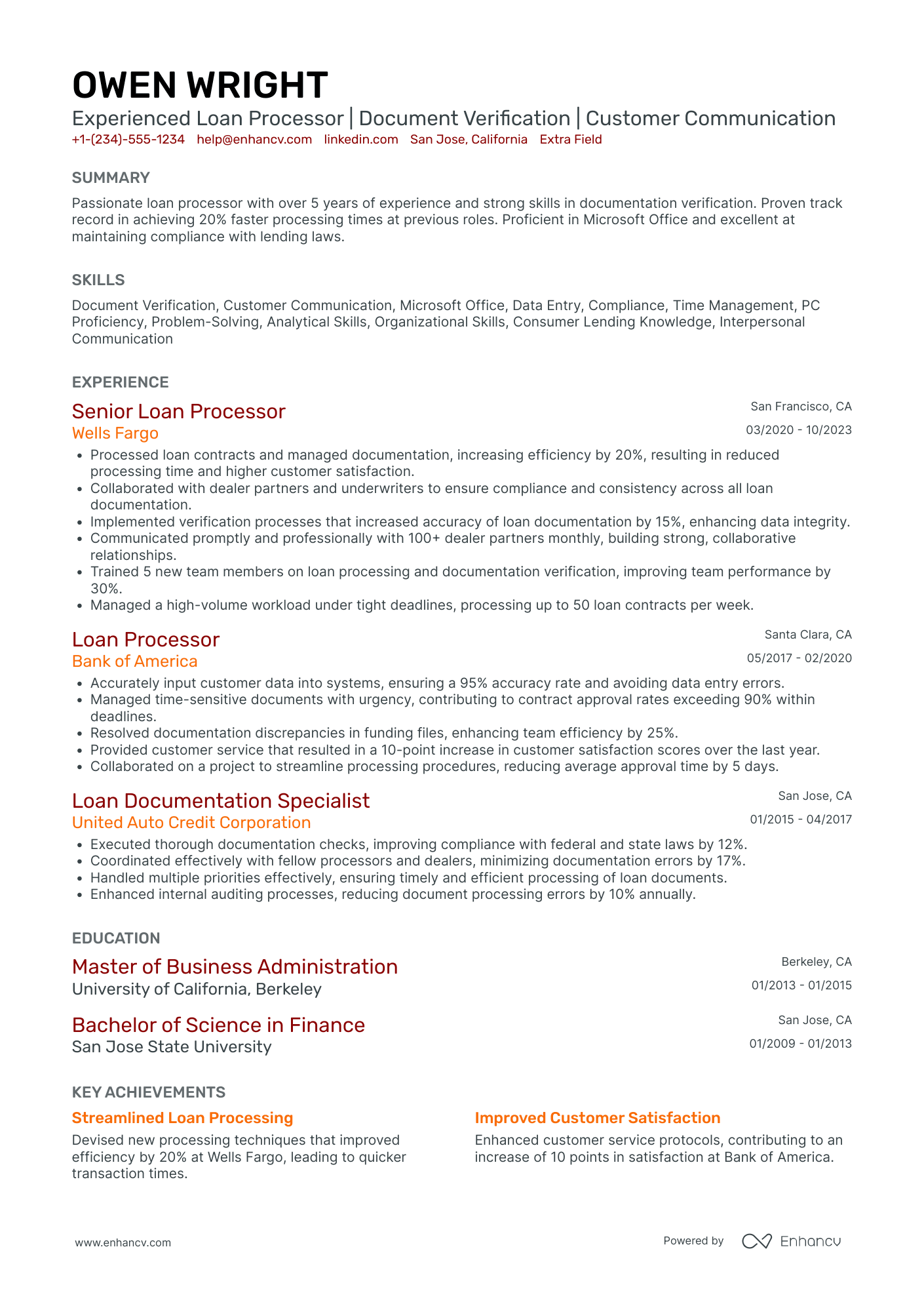

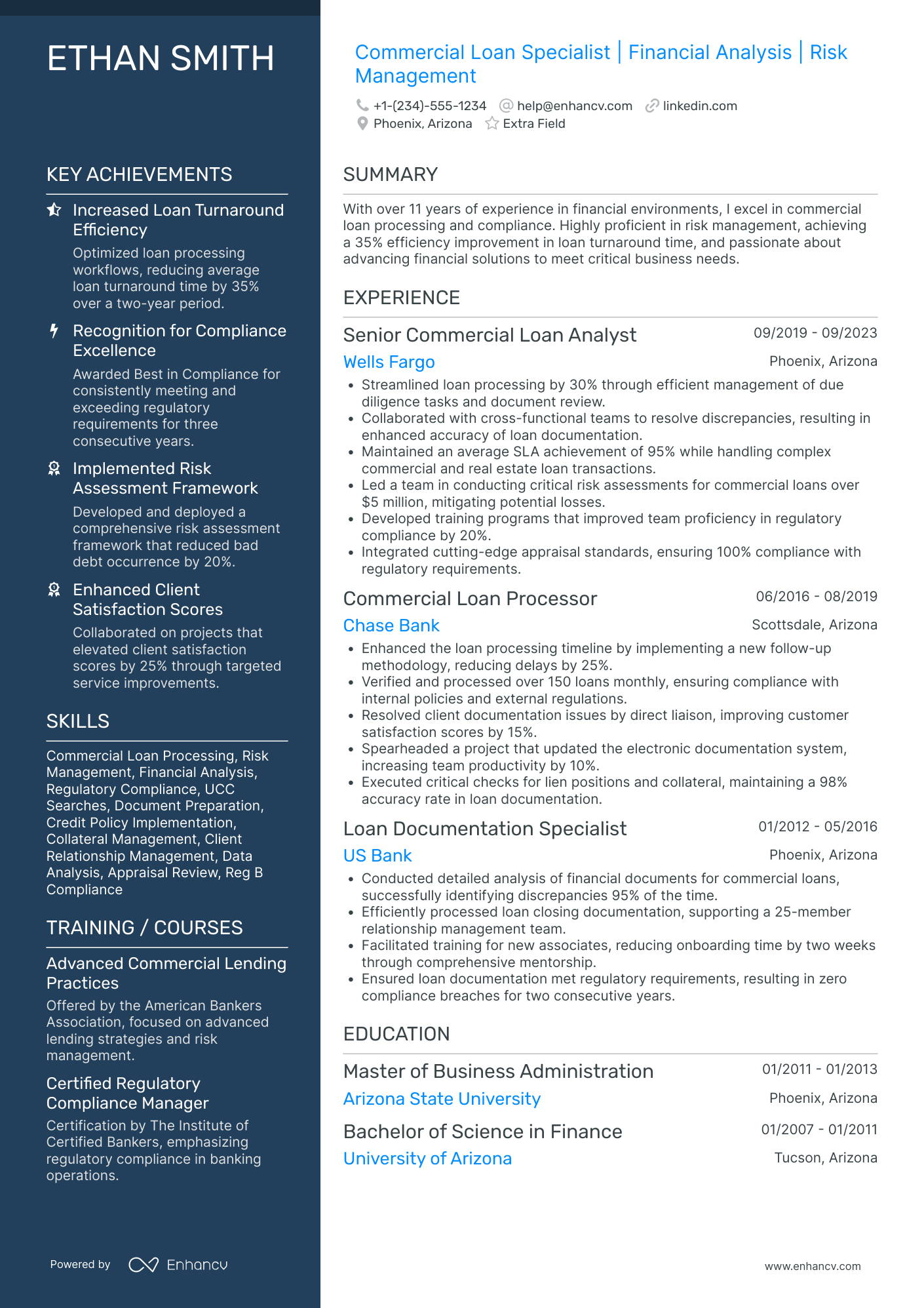

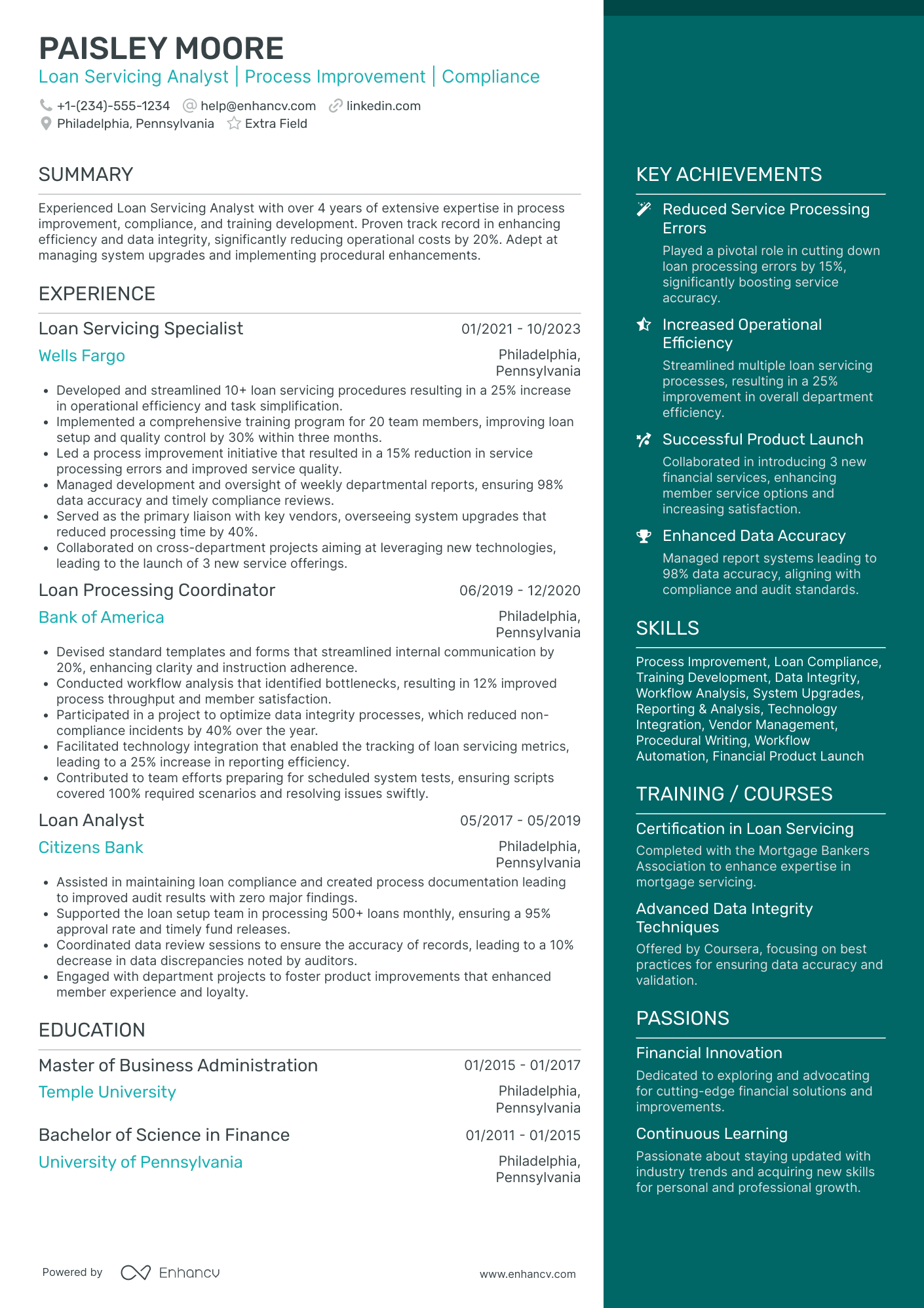

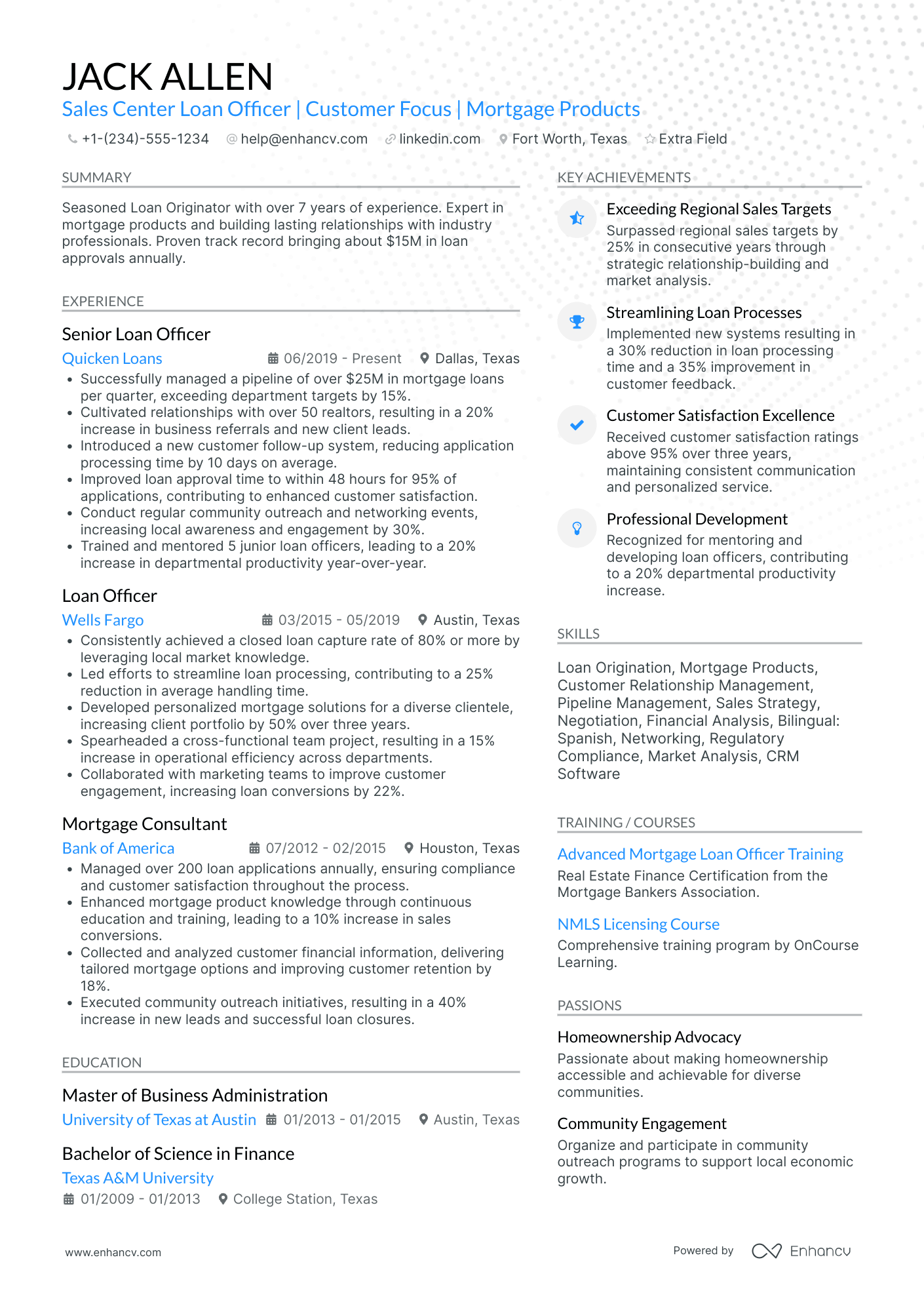

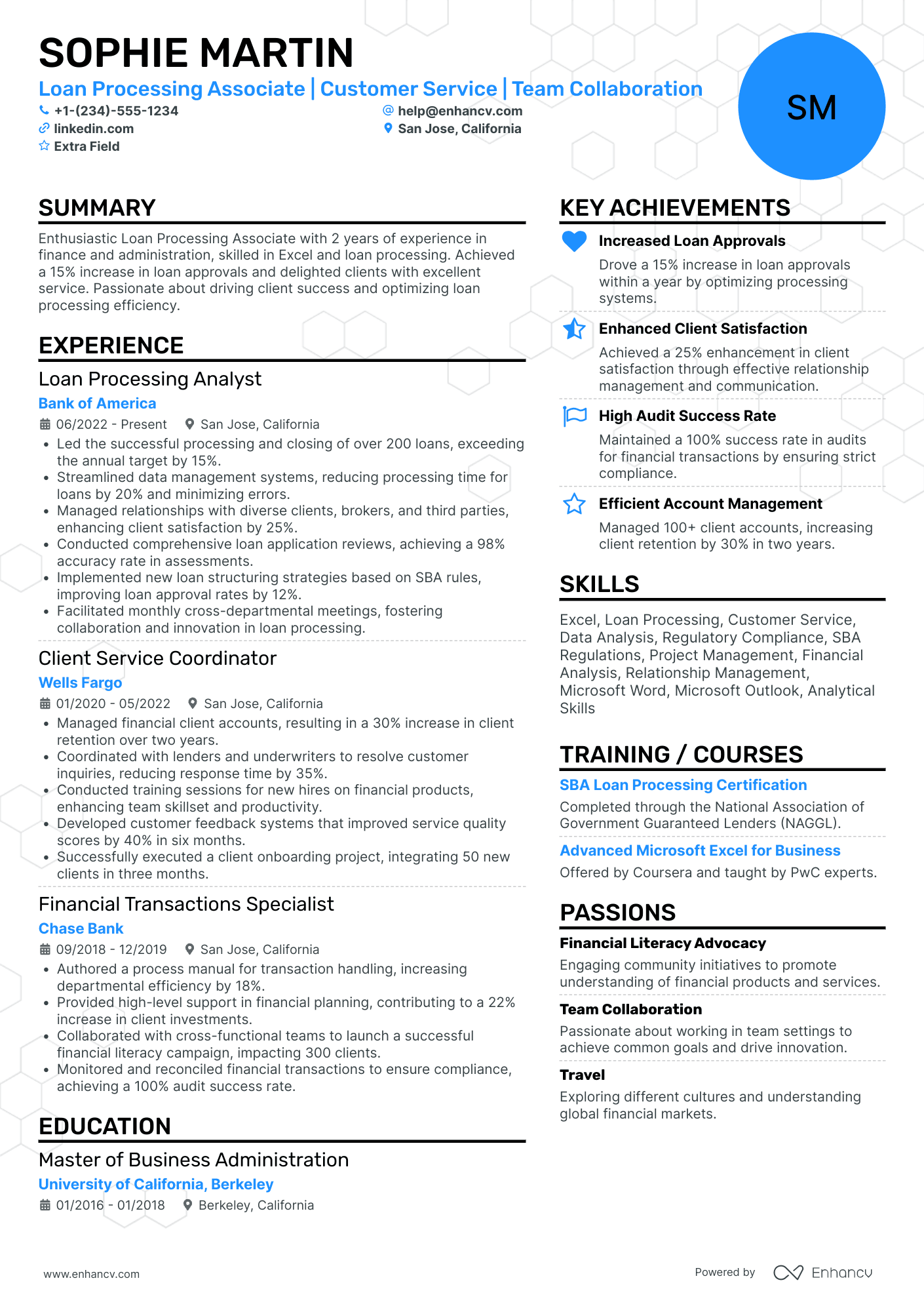

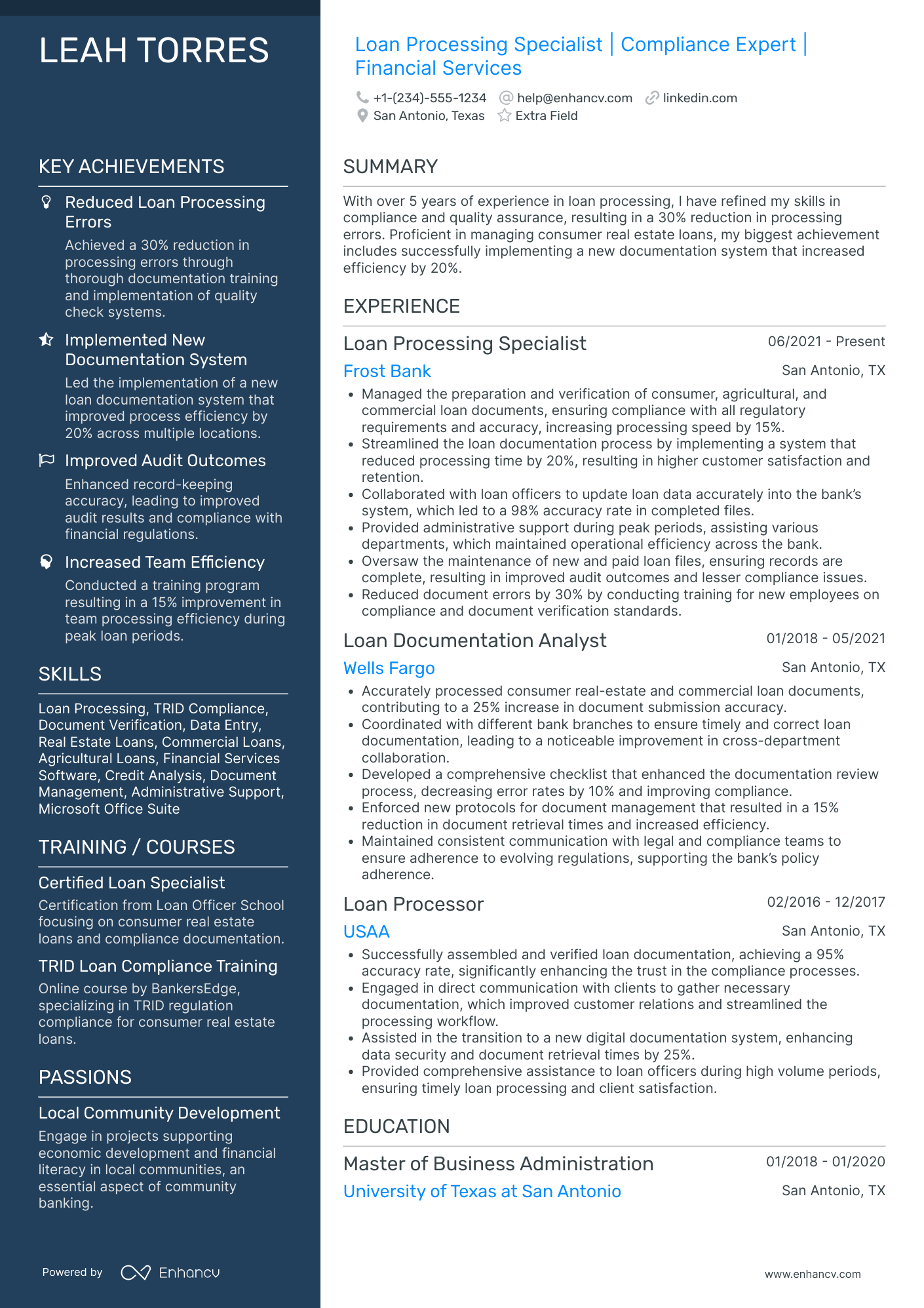

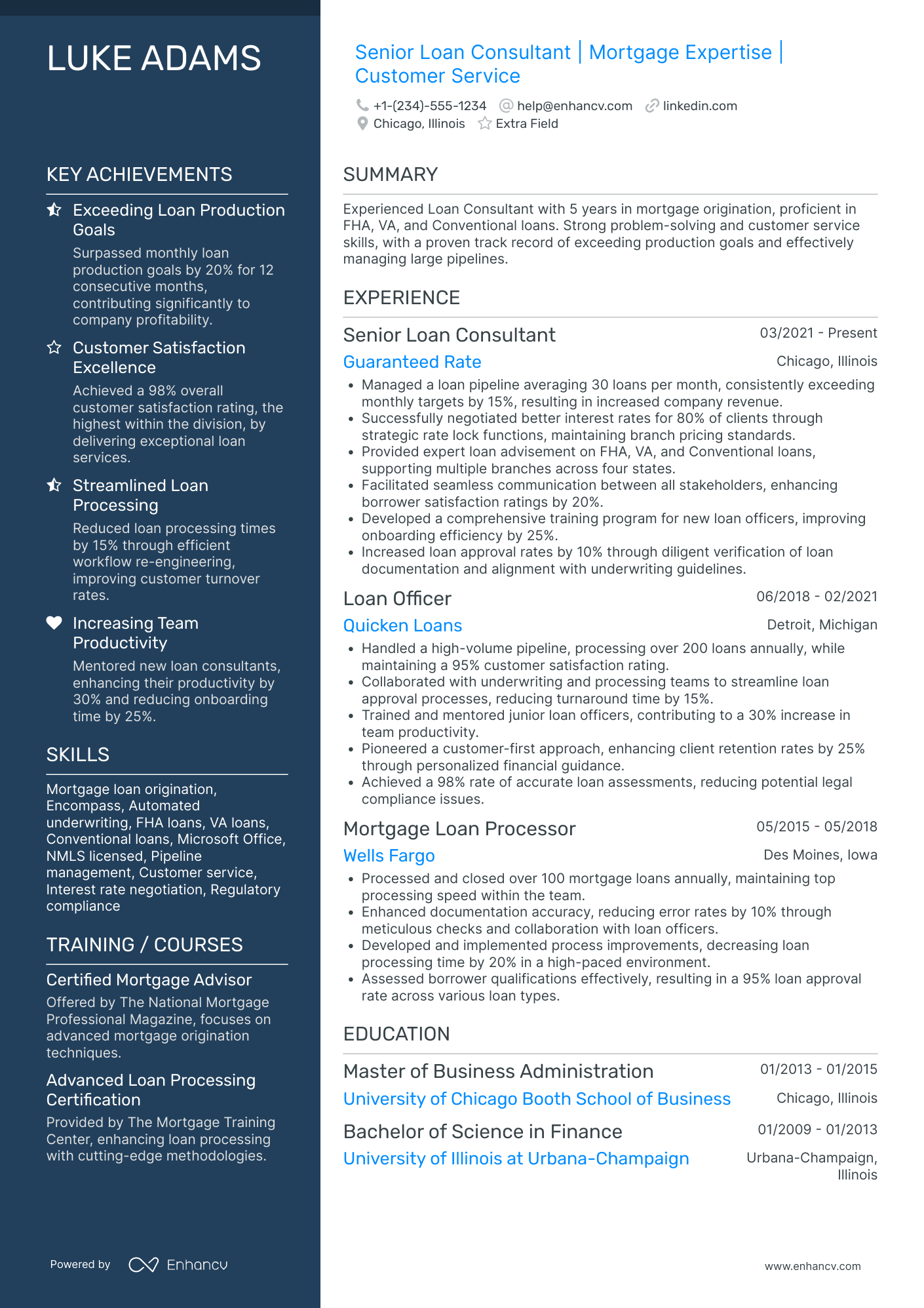

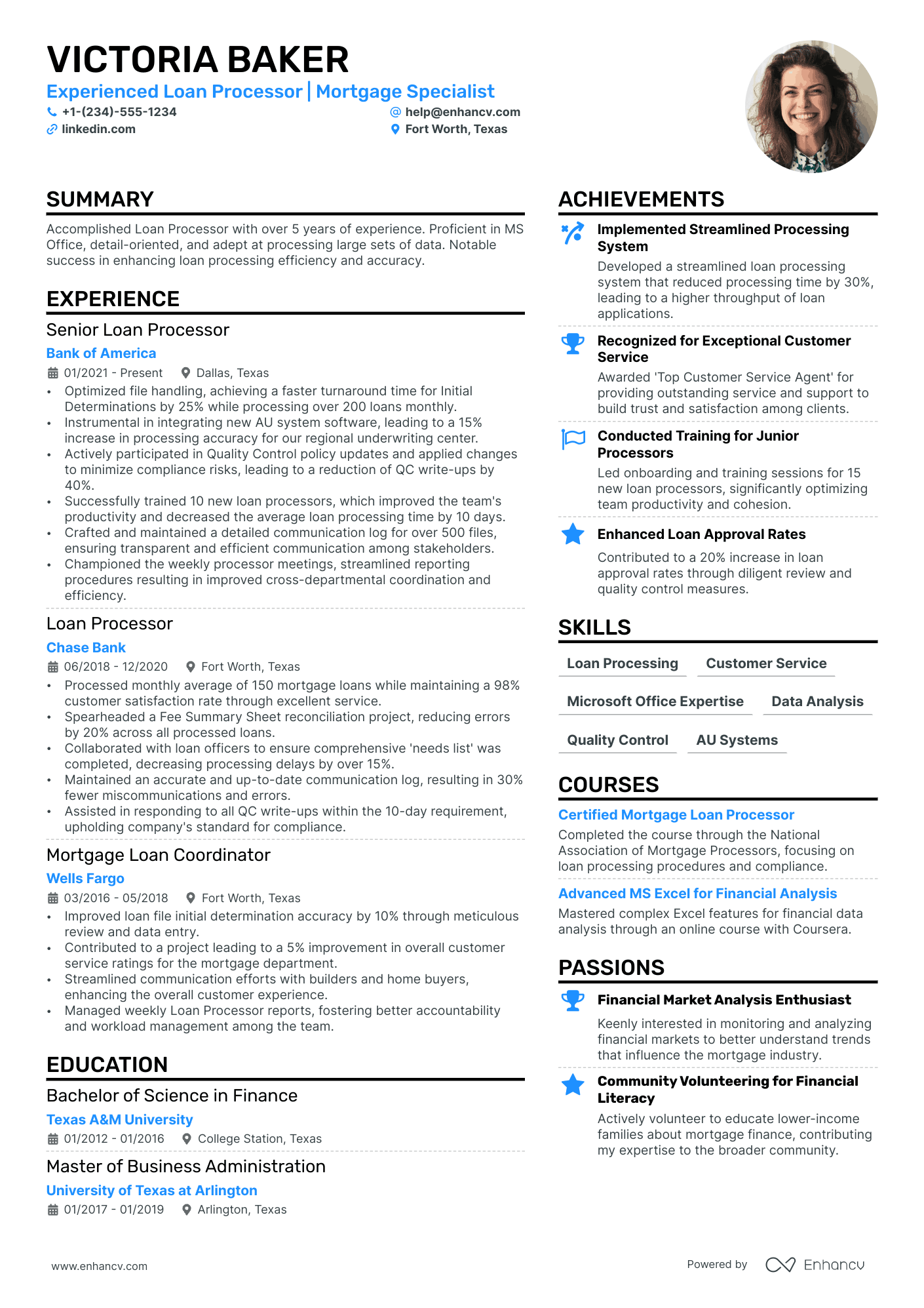

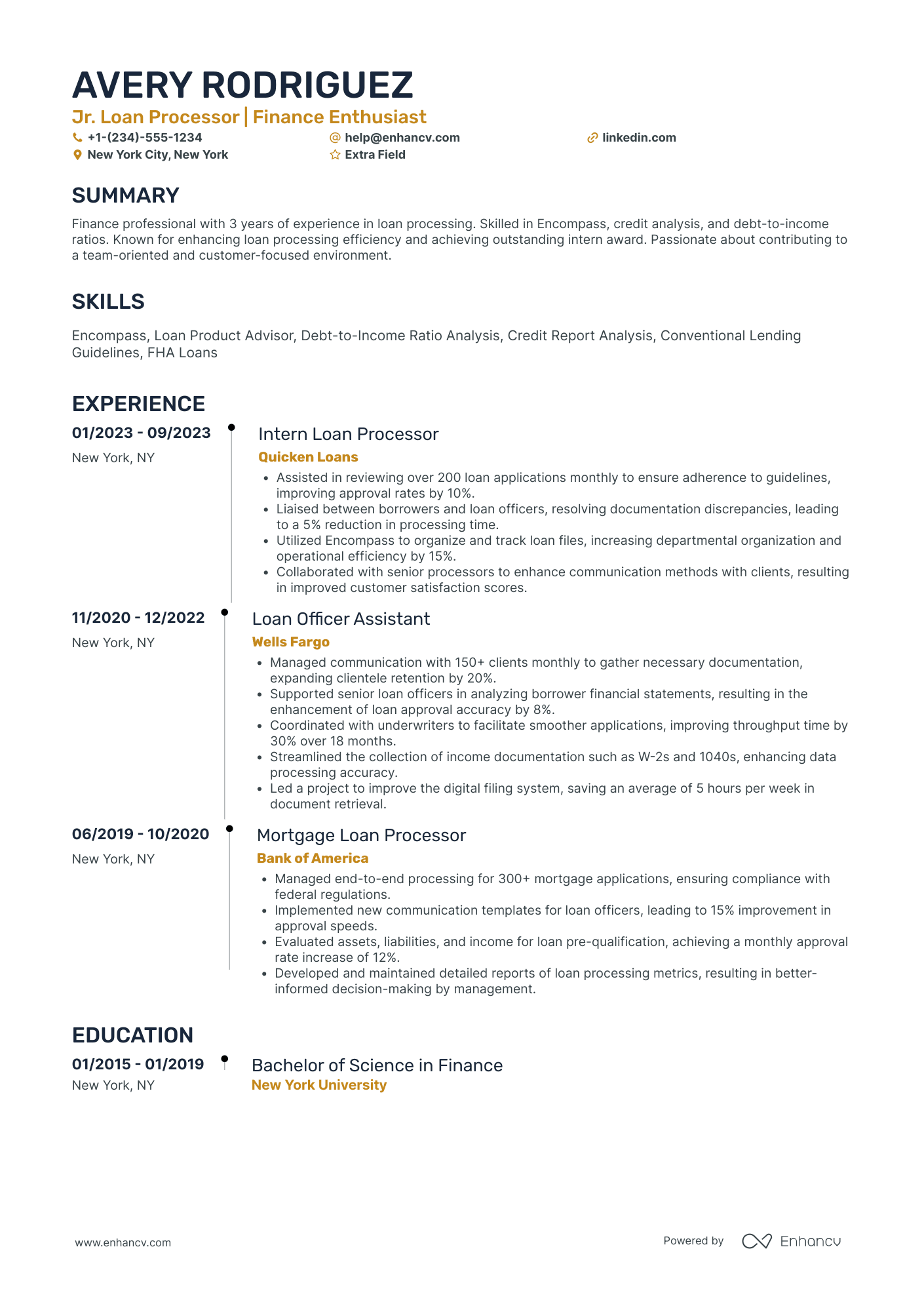

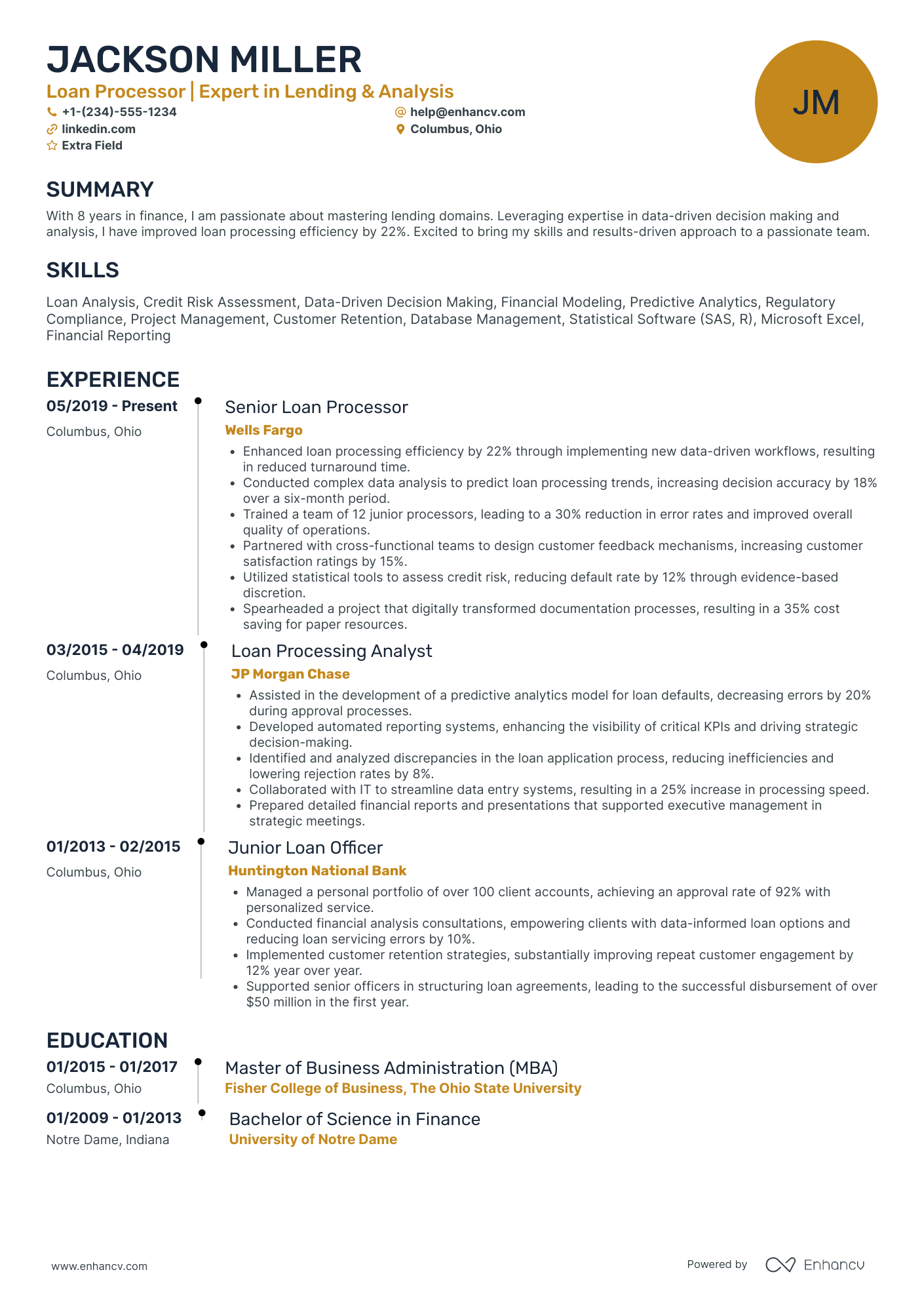

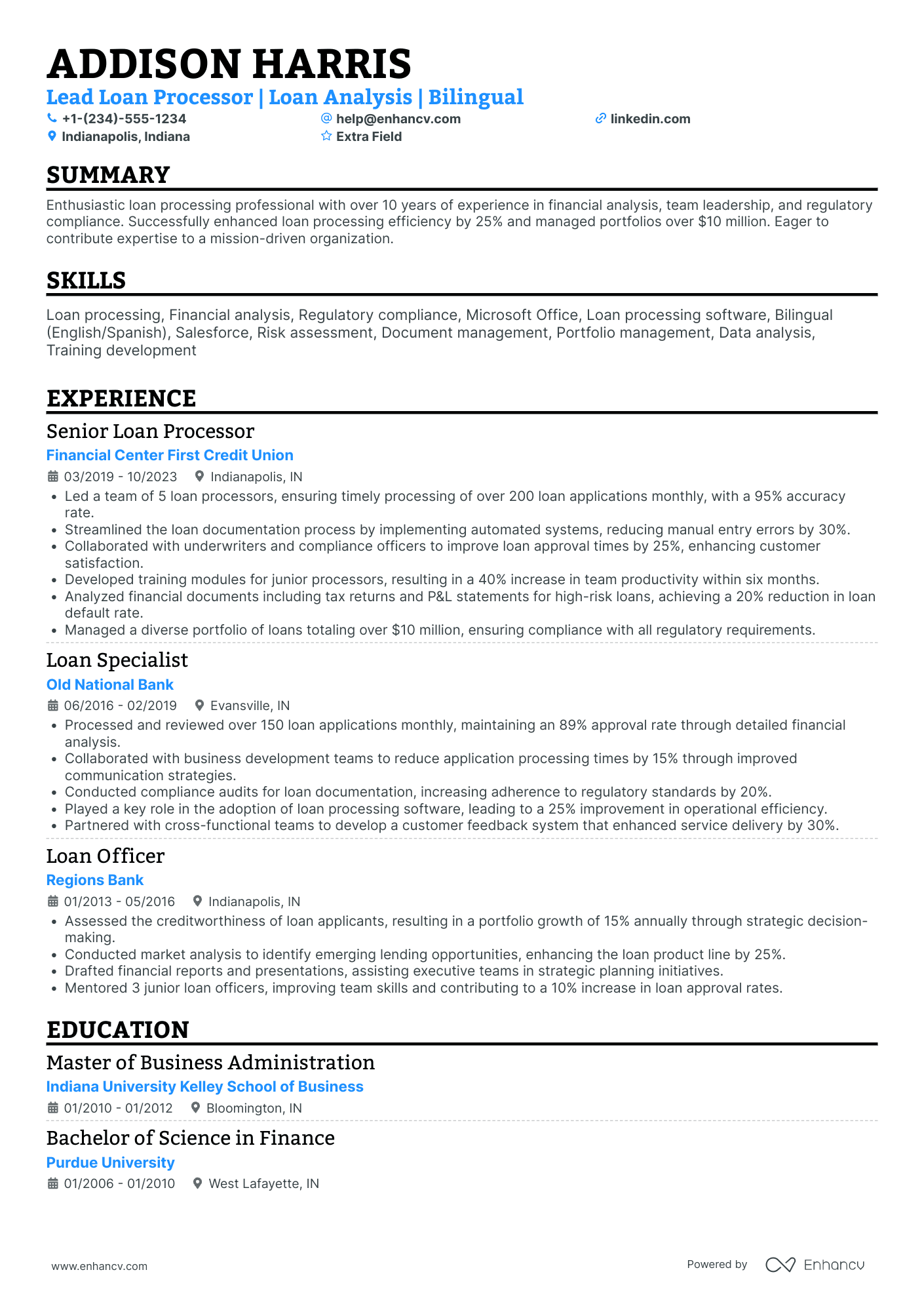

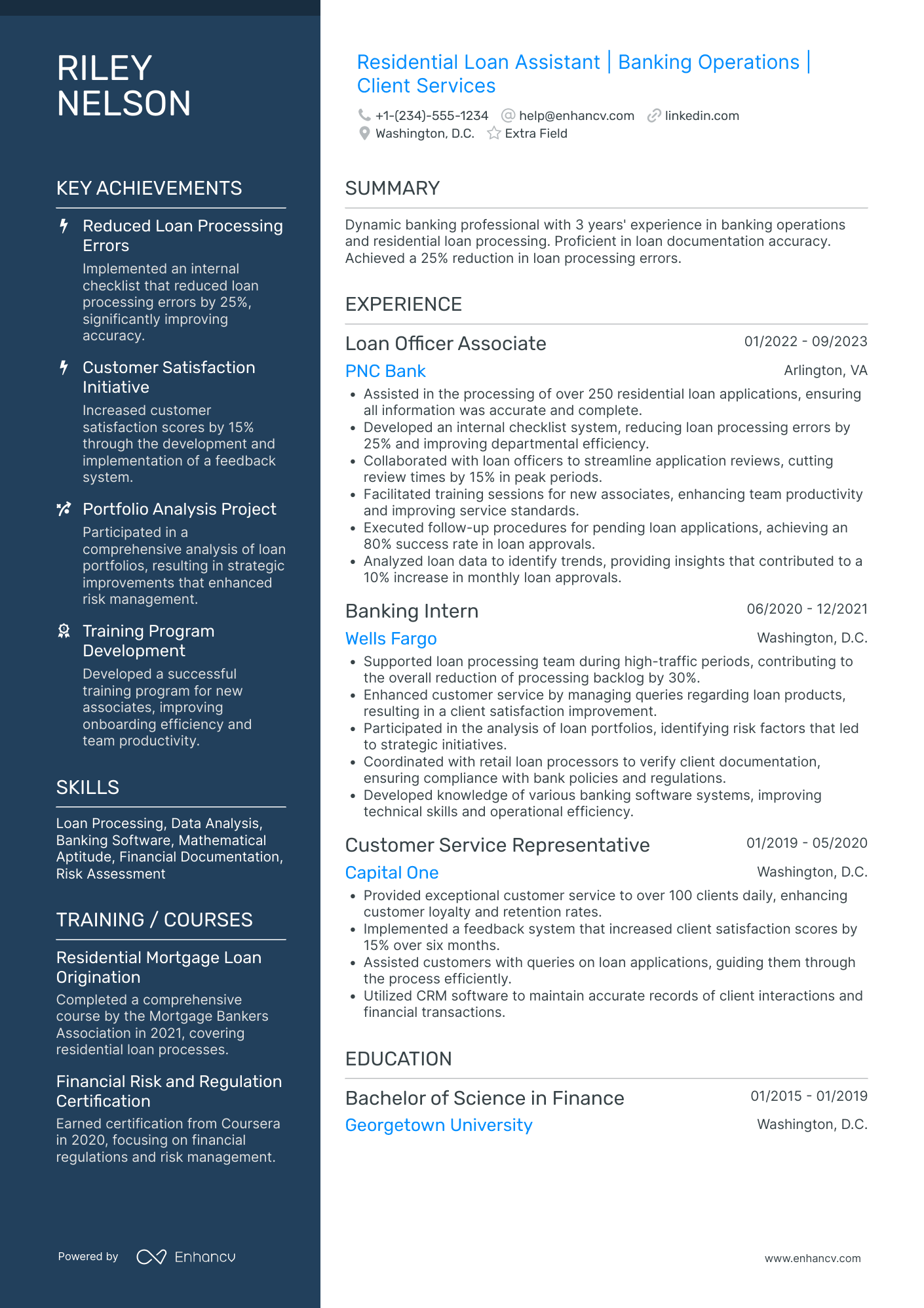

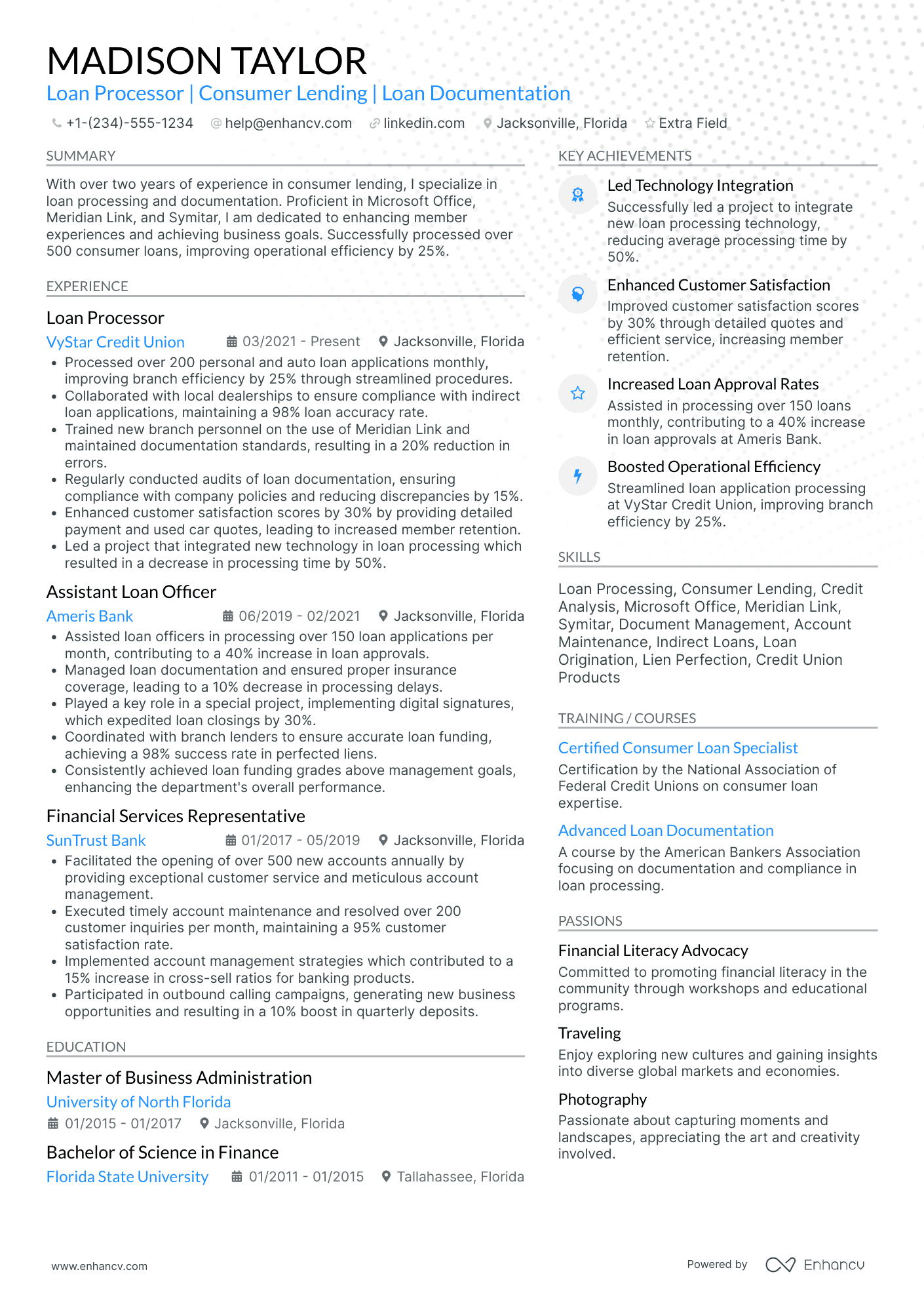

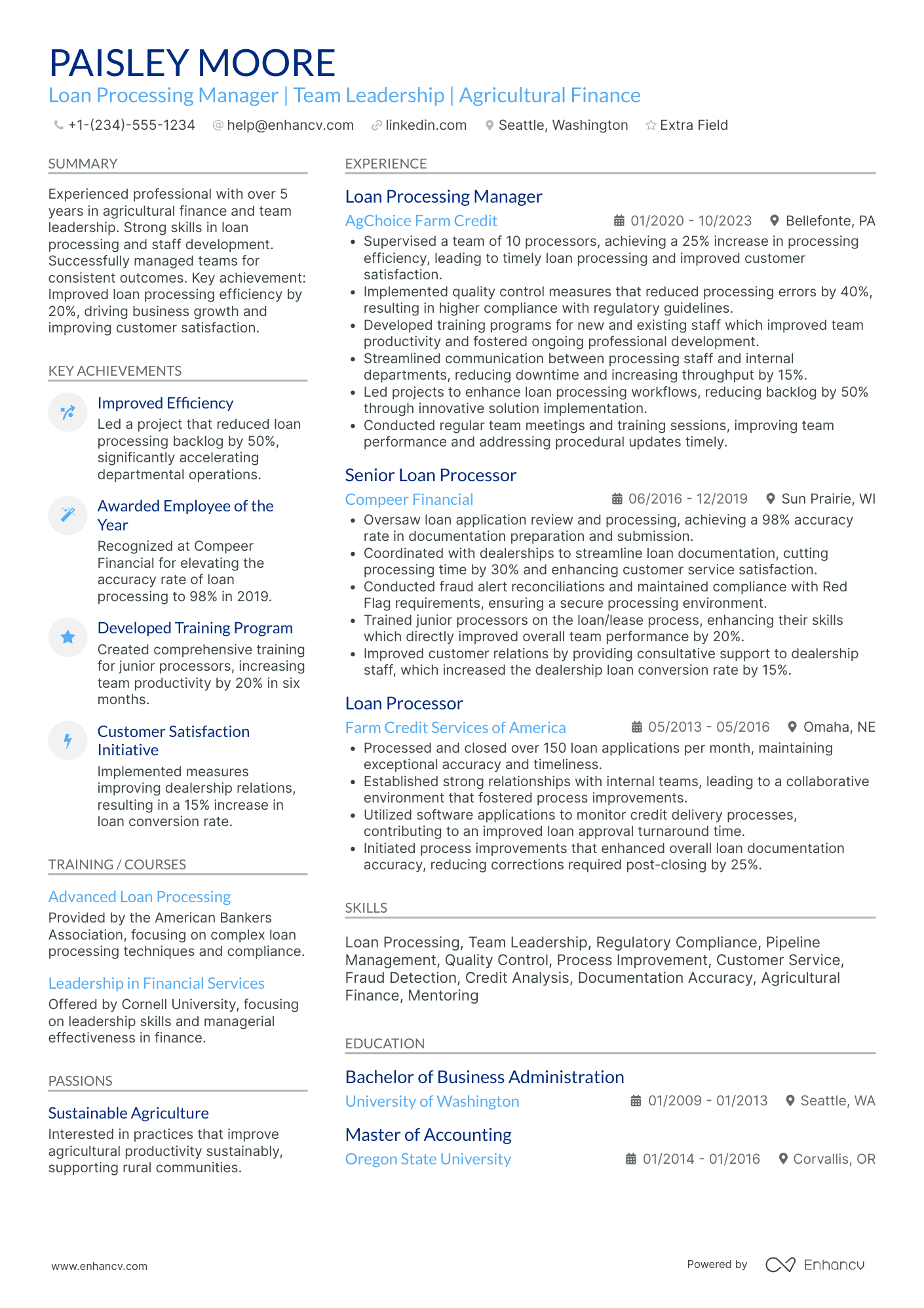

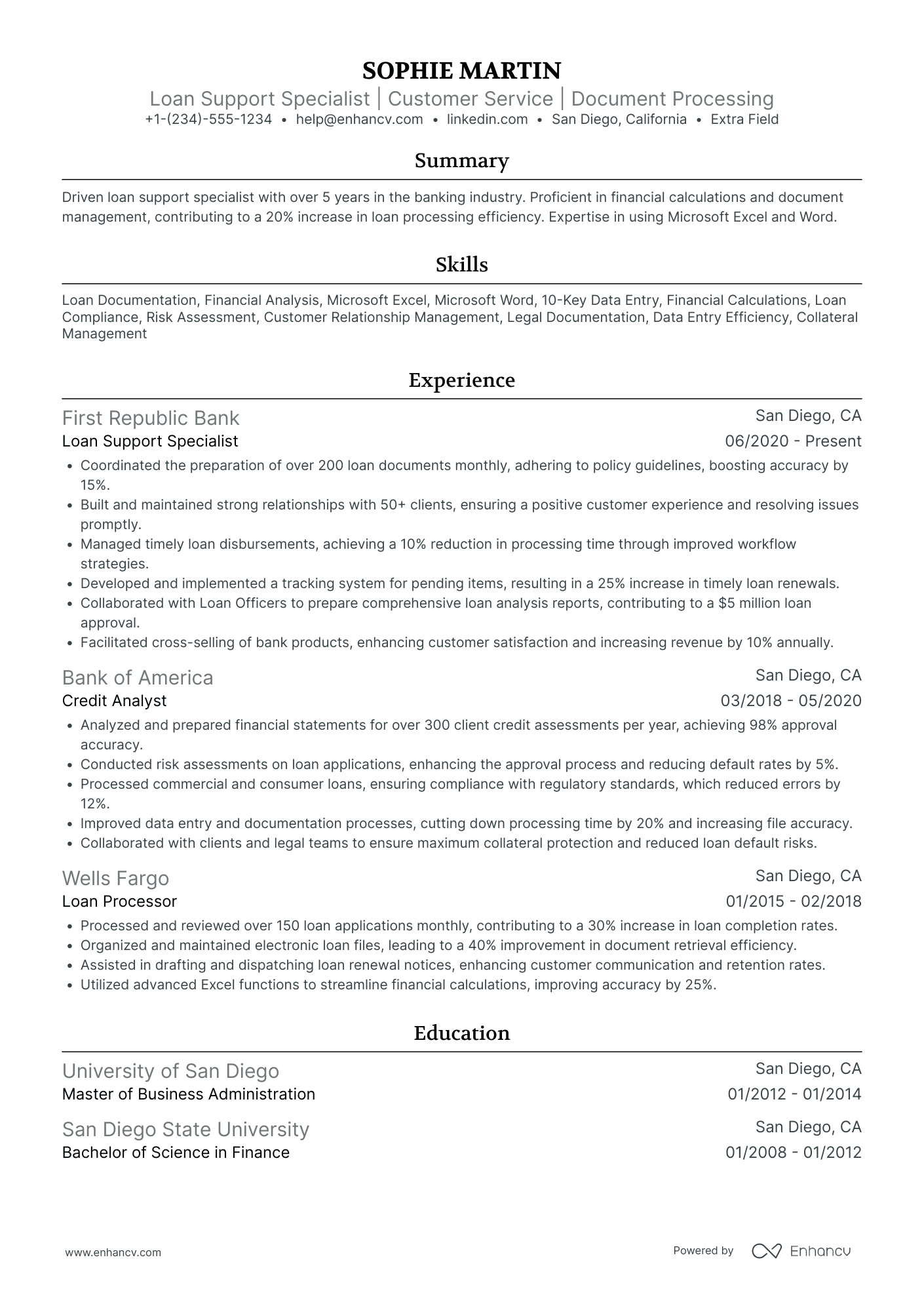

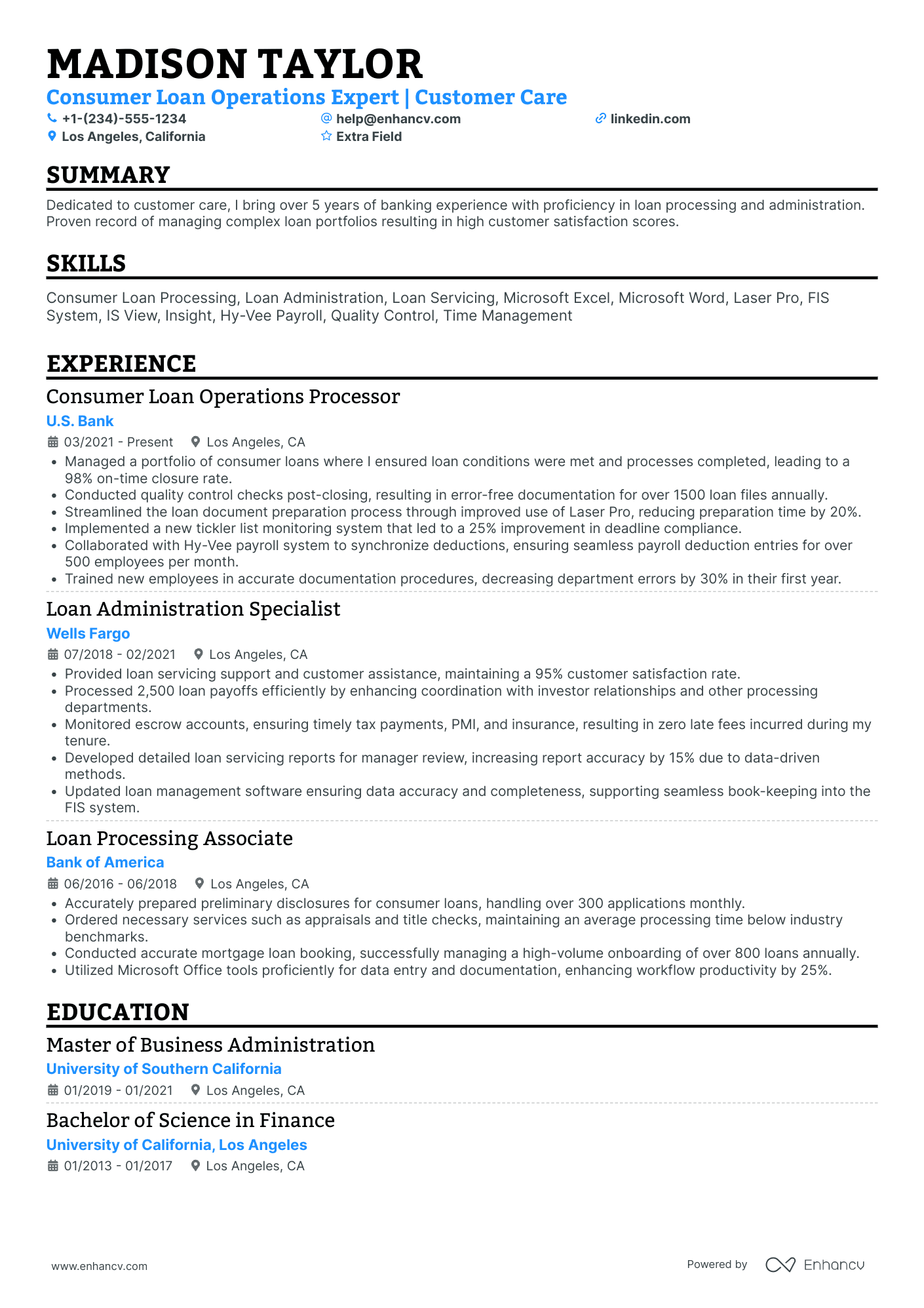

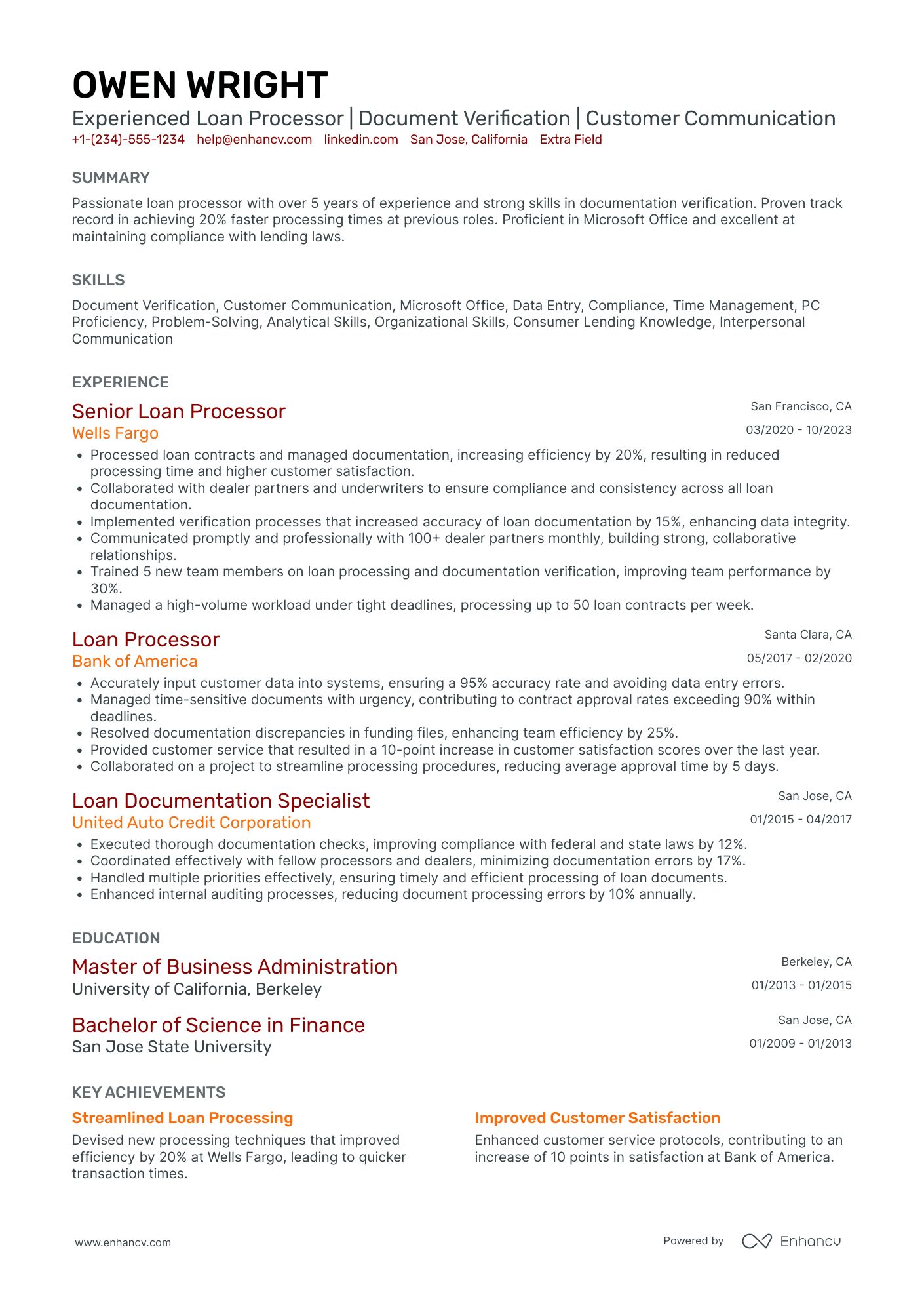

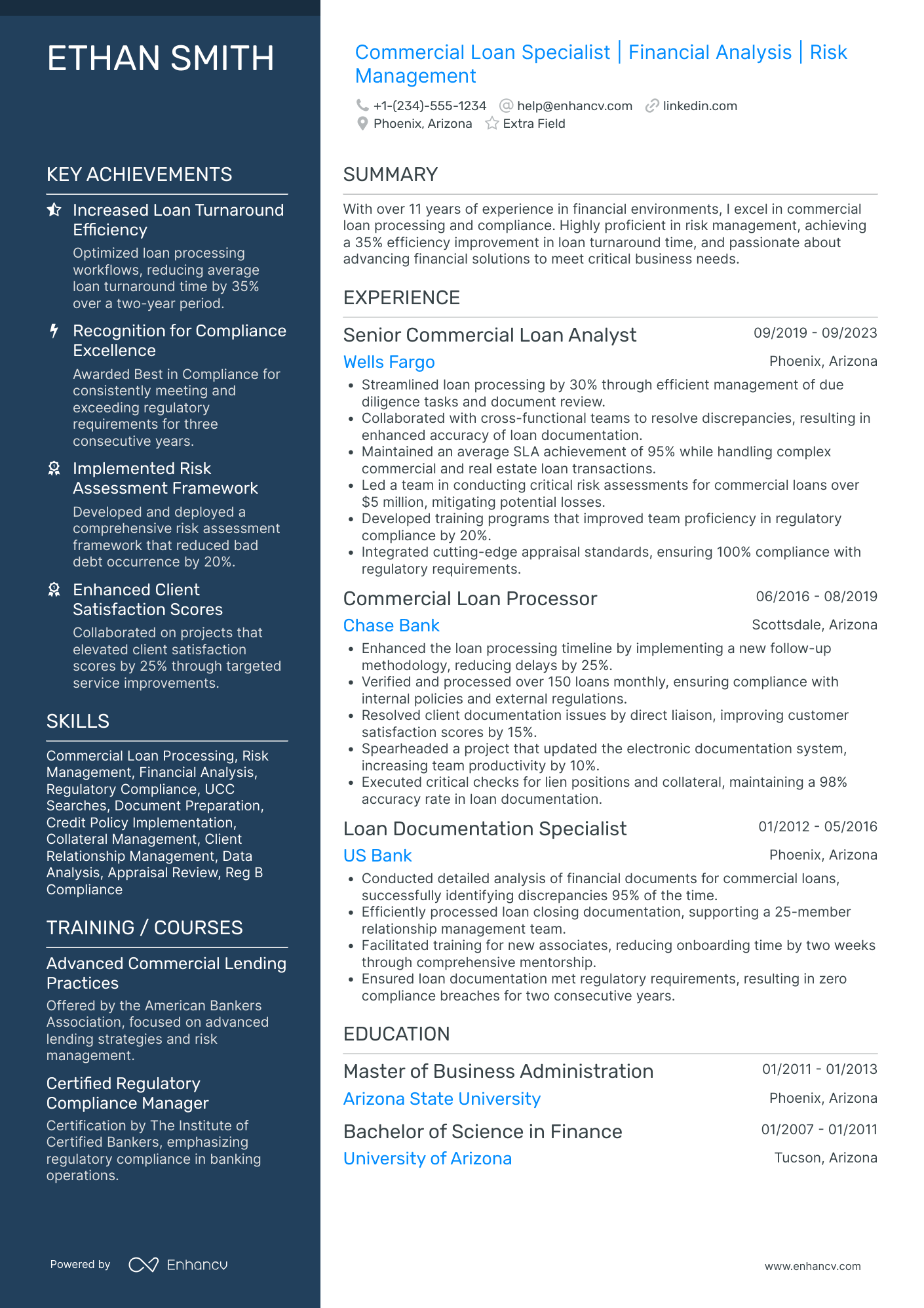

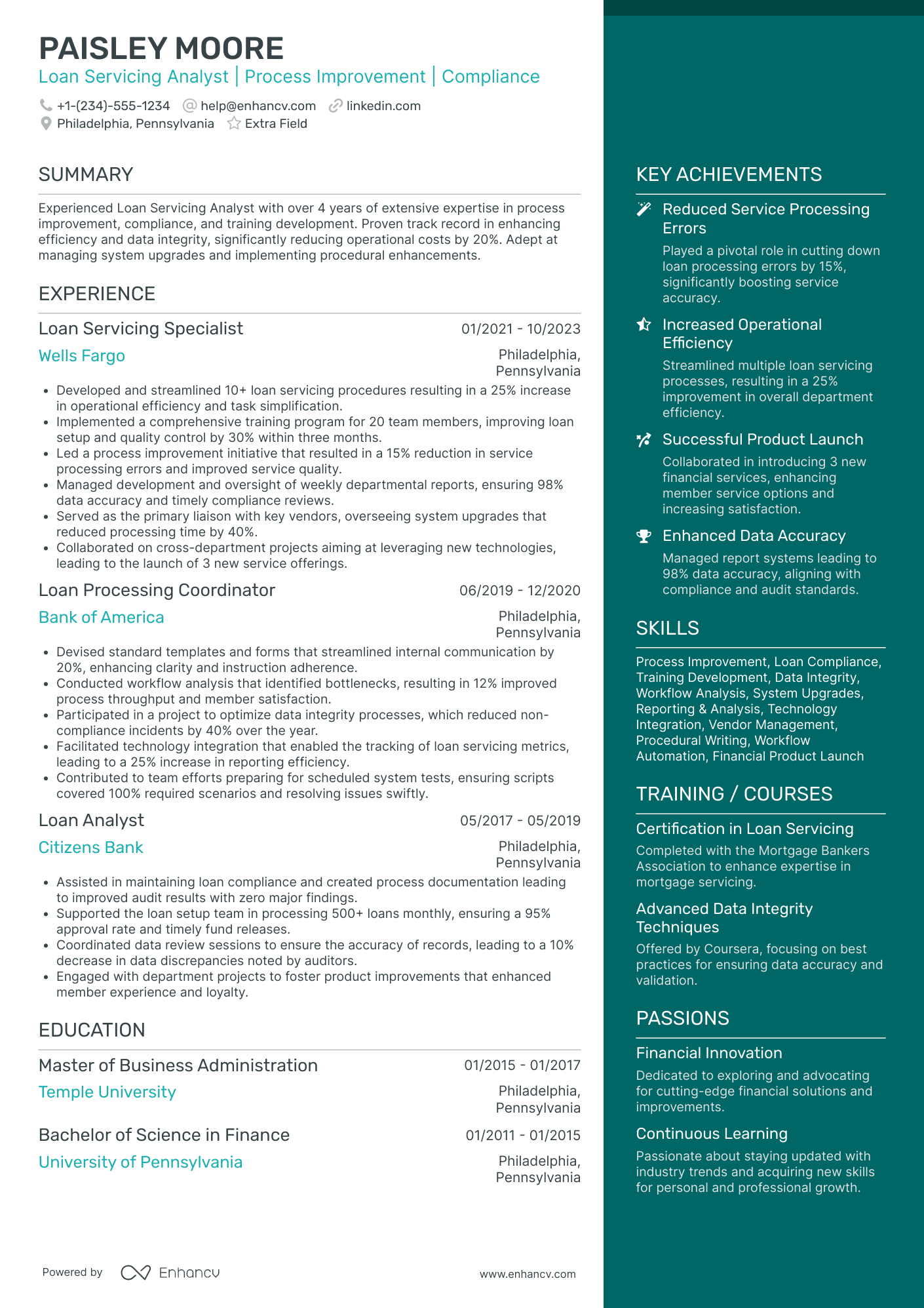

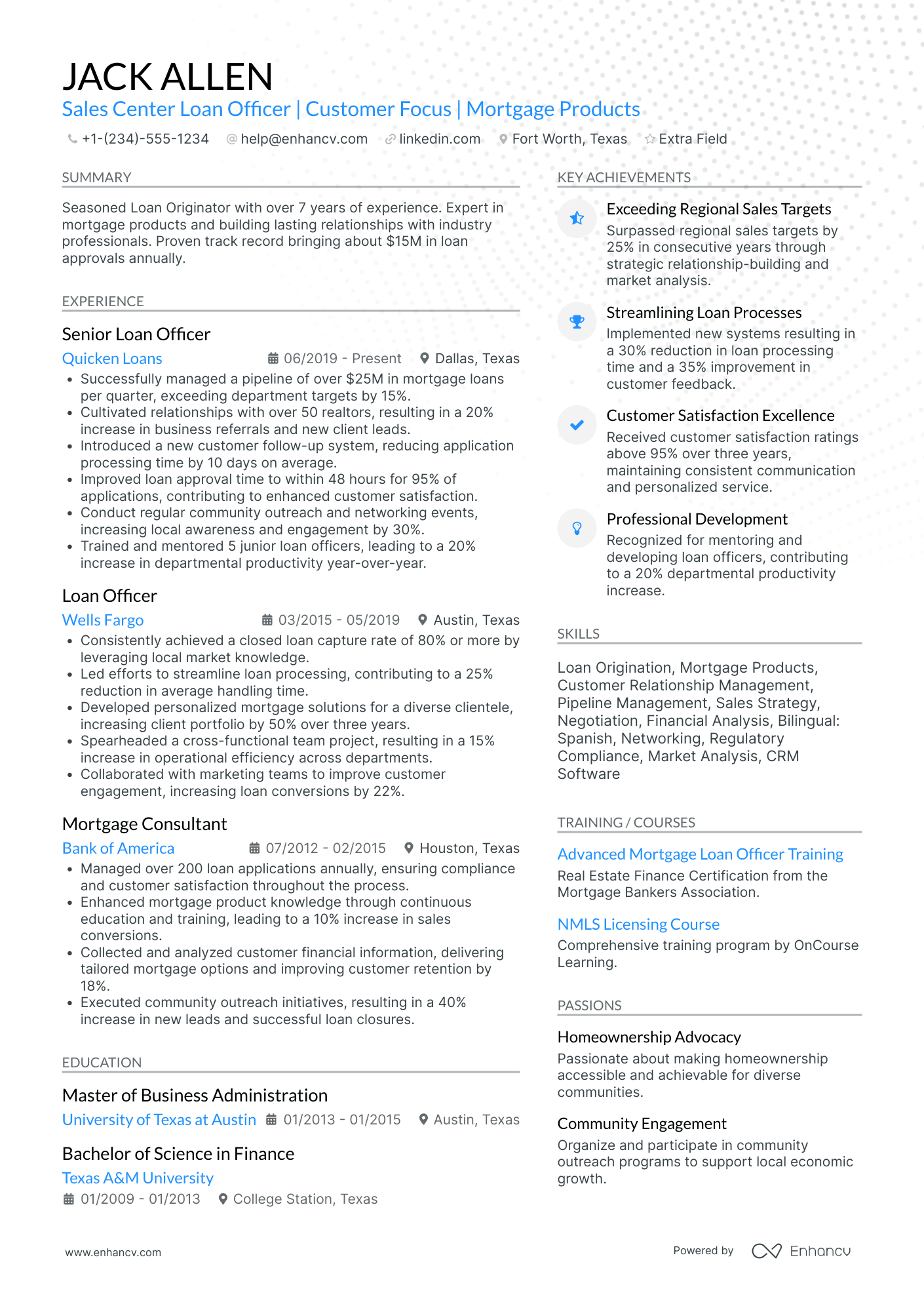

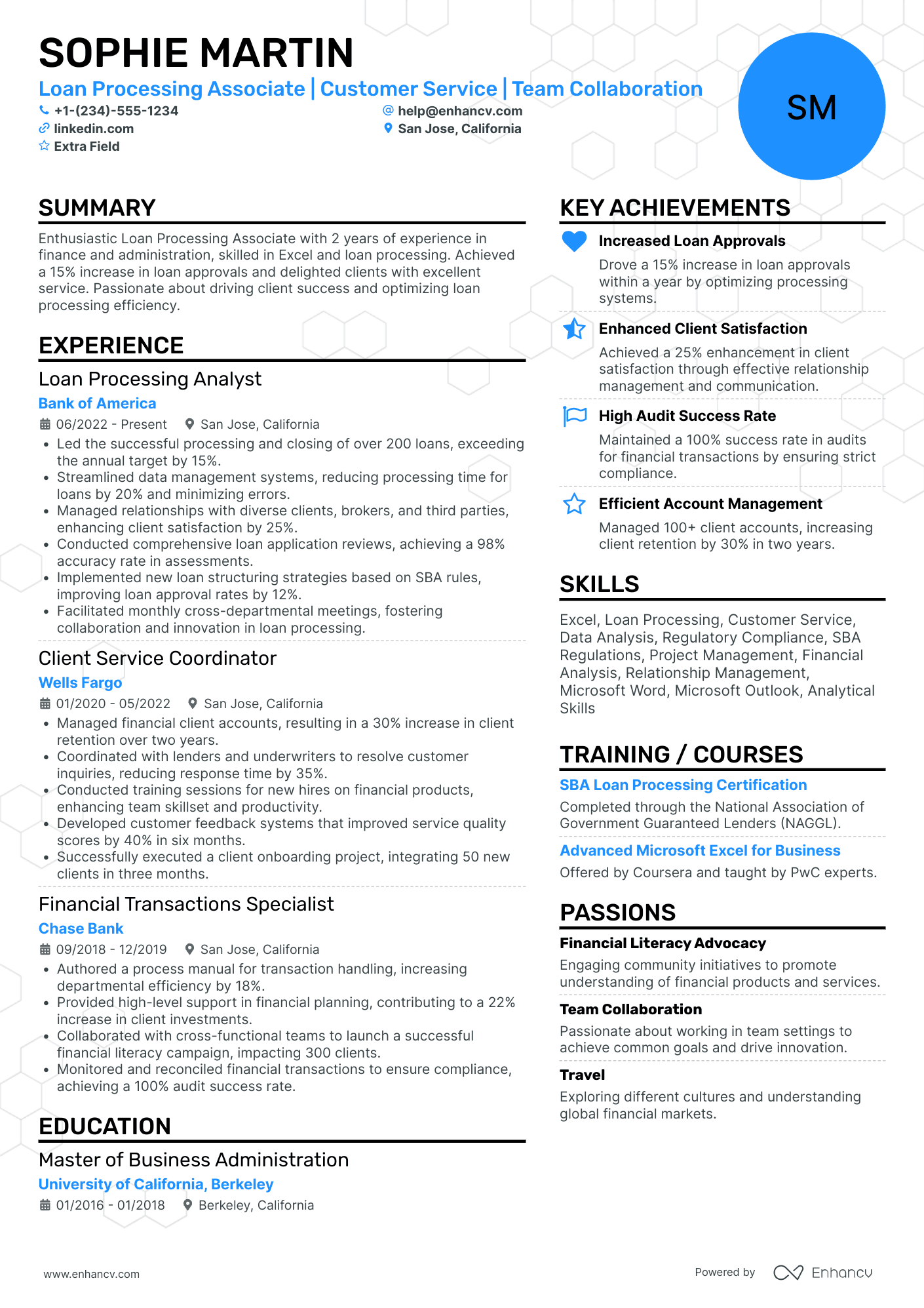

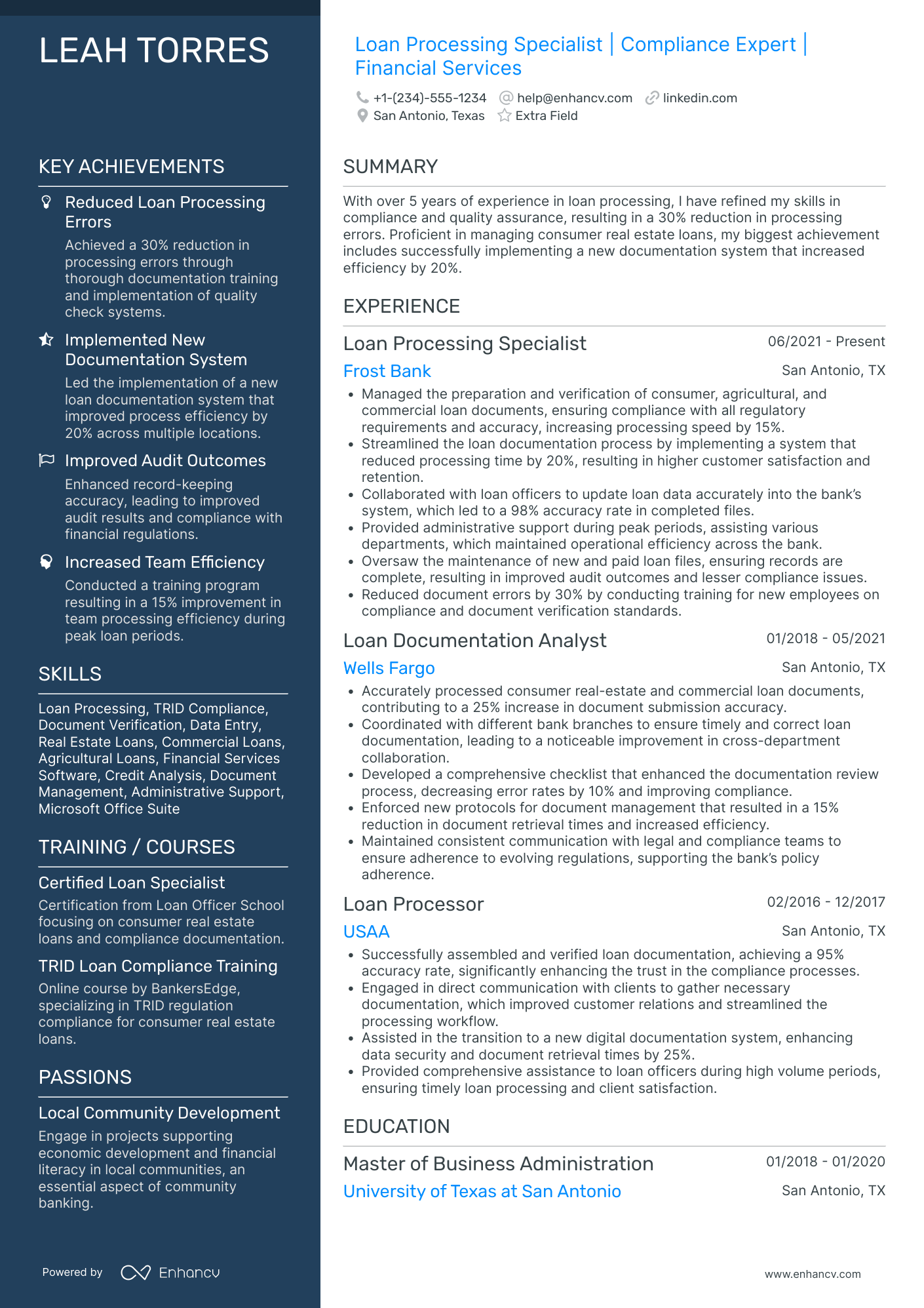

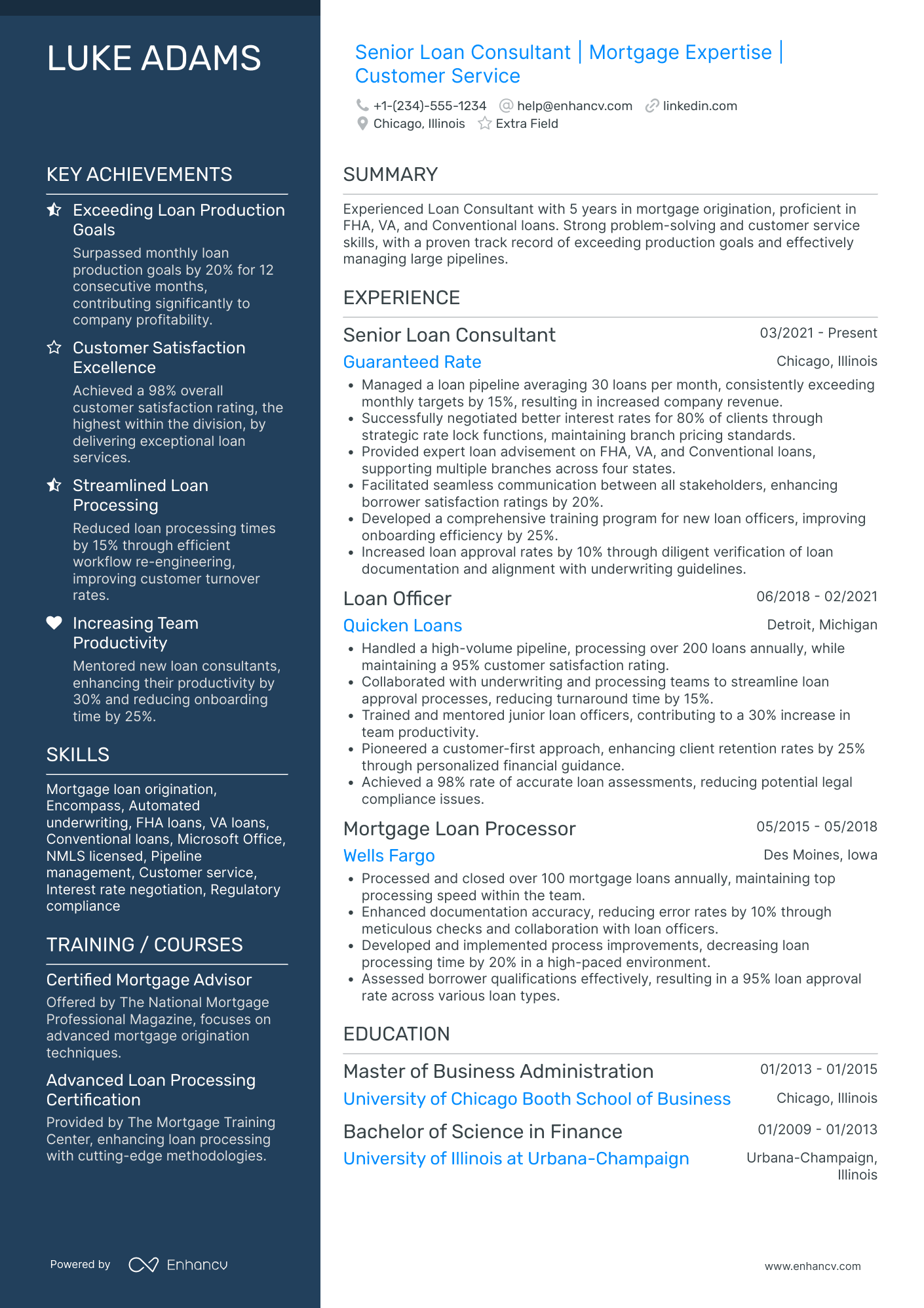

- Real-world loan processor resume samples with best practices on how to stand out amongst the endless pile of candidate resumes.

- Most in-demand loan processor resume skills and certifications across the industry.

- Standardizing your resume layout, while maintaining your creativity and individuality.

If the loan processor resume isn't the right one for you, take a look at other related guides we have:

- Accounts Payable Resume Example

- Corporate Accounting Resume Example

- Finance Business Analyst Resume Example

- Risk Manager Resume Example

- Financial Assistant Resume Example

- General Ledger Accounting Resume Example

- External Auditor Resume Example

- Corporate Banking Resume Example

- Financial Representative Resume Example

- Night Auditor Resume Example

Best practices for the look and feel of your loan processor resume

Before you even start writing your loan processor resume, first you need to consider its layout and format.

What's important to keep in mind is:

- The reverse-chronological resume is the most widely used format to present your experience, starting with your latest job.

- Your loan processor resume header needs to include your correct, professional contact details. If you happen to have a professional portfolio or an updated LinkedIn profile, include a link to it.

- Ensure your resume is no longer than two pages - you don't have to include irelevant experience on your resume just to make it look longer.

- Unless specified otherwise, submit your resume in the most popular format, the PDF one, as this will ensure your loan processor resume isn't altered.

Different markets have specific resume styles – a Canadian resume, for instance, may require a different approach.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Fundamental sections for your loan processor resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Familiarity with loan underwriting and processing software

- Knowledge of federal and state lending regulations

- Experience in preparing and reviewing loan documents

- Strong attention to detail and accuracy in handling financial information

- Proven ability to manage multiple loan files and meet deadlines

Five dos for building your loan processor resume experience section

The best strategic approach to your loan processor resume experience section is to support your particular responsibilities with actions and achievements.

For example, you could list:

- Up to six responsibilities in your day-to-day work, supported by why they're important for your role, department, or organization;

- Experience items that have helped you sustain and enhance your technical knowledge within the field, or, perhaps, have helped you grow as a professional;

- Any metrics that pinpoint your success within your past roles;

- How you've solved specific problems in your day-to-day work;

- Strategies and solutions you've implemented for growth - and how that growth was measured.

The loan processor resume experience is your best shot at making a good first impression on recruiters. That's why we've included some real-world professional examples to get you thinking about how you present your experience:

- Efficiently processed an average of 30 loans per month, ensuring all regulatory compliances were met and maintaining a 98% customer satisfaction rate.

- Designed and implemented a streamlined pre-qualification system that reduced processing time by 20%, allowing loan officers to focus on customer acquisition.

- Collaborated with a team of underwriters and lenders, facilitating rapid communication and leading to a 15% increase in successful loan closures.

- Led the integration of a new loan processing software that decreased paperwork processing time by 35% through automation.

- Trained and mentored 10 new loan processors, ensuring they were proficient in both company standards and federal regulations.

- Played a key role in a project that involved restructuring the loan application workflow, which resulted in a 40% increase in efficiency.

- Managed a portfolio of over 100 high-value loans and consistently ensured timely processing within a 45-day window.

- Spearheaded a compliance audit preparation initiative that led to a flawless regulatory audit with zero defects or violations noted.

- Initiated a cross-training program that allowed processors to understand the underwriting criteria, leading to a 25% drop in application return rate.

- Regularly collaborated with loan officers to tailor lending packages to clients' needs, improving loan conversion by 18%.

- Successfully managed end-to-end loan processing for over 20 commercial clients each quarter, maintaining a track record of accuracy.

- Executed quality control protocols that brought the error rate on documentation submissions down from 5% to less than 1%.

- Processed loans and lines of credit for a portfolio exceeding $50 million in value with strict adherence to internal and regulatory standards.

- Introduced an effective liaison strategy between borrowers and loan officers that cut down response time for document queries by 30%.

- Demonstrated accurate risk assessment resulting in a low default rate of under 2% for processed loans during fiscal years 2012 and 2013.

- Spearheaded a client education campaign on loan application documentation, which contributed to a 50% reduction in incomplete applications.

- Created and leveraged complex financial models to accurately assess borrower creditworthiness and minimize risk exposures.

- Orchestrated a successful pilot program for a new loan origination platform, leading to its full-scale adoption company-wide.

- Honed expertise in government-backed loans including FHA and VA, resulting in a 20% growth in this loan category.

- Played a pivotal role in resolving application discrepancies, which led to a reduction in processing time by 15 days on average.

- Originated and developed best practice guidelines that are now used department-wide, enhancing overall processing efficiency and borrower experience.

- Utilized bilingual skills to expand the reach of the loan processing department to a broader demographic, increasing loans processed from this segment by 25%.

- Engineered an inter-department communication protocol that increased the speed of loan approval decisions by 20%.

- Impeccably managed risk analysis for over $75 million in loans, effectively keeping default rates below industry averages.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for loan processor professionals.

Top Responsibilities for Loan Processor:

- Keep records of customers' charges and payments.

- Compile and analyze credit information gathered by investigation.

- Obtain information about potential creditors from banks, credit bureaus, and other credit services, and provide reciprocal information if requested.

- Interview credit applicants by telephone or in person to obtain personal and financial data needed to complete credit report.

- Evaluate customers' computerized credit records and payment histories to decide whether to approve new credit, based on predetermined standards.

- File sales slips in customers' ledgers for billing purposes.

- Receive charge slips or credit applications by mail, or receive information from salespeople or merchants by telephone.

- Mail charge statements to customers.

- Examine city directories and public records to verify residence property ownership, bankruptcies, liens, arrest record, or unpaid taxes of applicants.

- Relay credit report information to subscribers by mail or by telephone.

Quantifying impact on your resume

- Include the total dollar amount of loans processed to demonstrate your ability to handle significant financial transactions.

- List the number of loan applications reviewed per day or month to showcase your efficiency and throughput capabilities.

- Specify your error rate percentage to reflect your attention to detail and accuracy in processing loans.

- Mention the percentage of approved loans that you processed to highlight your success rate and expertise in selecting viable candidates.

- Detail any process improvements you implemented, quantifying the time saved or the increase in processing capacity.

- State the number of regulatory compliance standards you've consistently met or exceeded to show your knowledge and adherence to industry rules.

- Quantify the number of cross-functional teams you've collaborated with to emphasize your teamwork and communication skills.

- Include customer satisfaction scores or percentage of positive feedback received to indicate your commitment to service excellence.

Action verbs for your loan processor resume

Guide for loan processor professionals kicking off their career

Who says you can't get that loan processor job, even though you may not have that much or any experience? Hiring managers have a tendency to hire the out-of-the-blue candidate if they see role alignment. You can show them why you're the best candidate out there by:

- Selecting the functional skill-based or hybrid formats to spotlight your unique value as a professional

- Tailoring your loan processor resume to always include the most important requirements, found towards the top of the job ad

- Substituting the lack of experience with other relevant sections like achievements, projects, and research

- Pinpoint both achievements and how you see yourself within this specific role in the loan processor resume objective.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Shining a light on your loan processor hard skills and soft skills

To win recruiters over, you must really have a breadth of skill set presented and supported within your loan processor resume.

On hiring managers' checklists, you'd initially discover hard or technical skills. Those are the technology (and software) that help you perform on the job. Hard skills are easy to quantify via your education, certificates, and on-the-job success.

Another main criterion recruiters are always assessing your loan processor resume on is soft skills. That is your ability to communicate, adapt, and grow in new environments. Soft skills are a bit harder to measure, as they are gained both thanks to your personal and professional experience.

Showcase you have the ideal skill set for the role by:

- Dedicating both a skills box (for your technical capabilities) and an achievements or strengths section (to detail your personal skills).

- When listing your skills, be specific about your hard skills (name the precise technology you're able to use) and soft skills (aim to always demonstrate what the outcomes were).

- Avoid listing overused cliches in the skills section (e.g. Microsoft Office and Communication), unless they're otherwise specified as prominent for the role.

- Select up to ten skills which should be defined via various sections in your resume skills sidebar (e.g. a technical skills box, industry expertise box with sliders, strengths section with bullets).

Spice up your resume with leading technical and people skills, that'd help you get noticed by recruiters.

Top skills for your loan processor resume:

Loan origination software

Credit analysis tools

Document management systems

Data entry software

Mortgage processing software

Compliance management systems

Automated underwriting systems

Electronic signature platforms

Spreadsheet software (e.g., Microsoft Excel)

Customer relationship management (CRM) software

Attention to detail

Time management

Communication skills

Problem-solving

Customer service orientation

Organizational skills

Analytical thinking

Teamwork

Adaptability

Stress management

Next, you will find information on the top technologies for loan processor professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Loan Processor’s resume:

- Microsoft Excel

- Spreadsheet programs

- Microsoft PowerPoint

- Email software

- Microsoft Outlook

PRO TIP

If you happen to have some basic certificates, don't invest too much of your loan processor resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Maximizing your loan processor resume: education and certification sections

To effectively showcase your industry knowledge in your loan processor resume, it's important to properly list your education and certifications.

For the education section, ensure you include:

- Higher education degrees pertinent to the industry or those at a postgraduate level;

- The start and end dates of your education, along with the name of the institution you graduated from;

- Your GPA and relevant coursework, but only if they are impressive and applicable to the role.

Additionally, create a separate certifications section to spotlight your most notable recognitions. Another excellent place to feature a leading industry certificate is in your resume header, right after your name.

Below is a list of key industry certifications that are often sought after by recruiters

The top 5 certifications for your loan processor resume:

- Certified Mortgage loan processor (CMLP) - National Association of Mortgage Processors (NAMP)

- Certified Purple Processor (CPP) - National Association of Mortgage Processors (NAMP)

- National Association of Mortgage Underwriters (NAMU) - Certified Master loan processor (CMLP)

- Mortgage Bankers Association (MBA) - Certified Mortgage Processor (CMP)

- American Bankers Association (ABA) - Residential Mortgage Lender Certificate (RMLC)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for loan processor professionals.

Top US associations for a Loan Processor professional

- American Bankers Association

- Mortgage Bankers Association

- National Association of Credit Management

- National Association of Federally-Insured Credit Unions

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Recommended reads:

Deciding between a resume summary or objective for your loan processor role

Understanding the distinction between a resume summary and an objective is crucial for your loan processor resume.

A resume summary, typically three to five sentences long, offers a concise overview of your career. This is the place to showcase your most pertinent experience, key accomplishments, and skills. It's particularly well-suited for those with professional experience relevant to the job requirements.

In contrast, a resume objective focuses on how you can add value to potential employers. It addresses why they should hire you and outlines your career expectations and learning goals. Therefore, it's ideal for candidates with less experience.

In the following section of our guide, explore how resume summaries and objectives differ through some exemplary industry-specific examples.

Resume summaries for a loan processor job

- With over 8 years of dedicated experience in financial servicing at HighMark Bank, I have honed a deep understanding of loan processing, underwriting guidelines, and regulatory compliance. My expertise in processing residential mortgages has contributed to a 20% increase in customer satisfaction through efficient loan closings.

- An accomplished finance professional pivoting to loan processing with a background in account management at Fortune 500 companies. My robust quantitative analysis skills and adeptness in customer relations have shaped a career marked by consistently surpassing sales targets by 30% each quarter.

- As an adept multitasker with a 5-year tenure in a fast-paced legal office, my skills transfer seamlessly to the structured and detail-oriented realm of loan processing. My proven track record in complex documentation management and prowess in client negotiation ensure smooth financial transactions, streamlining client experiences.

- Ambitious, with a Bachelor's degree in Business Administration, I'm eager to apply my academic knowledge in a practical setting by joining the loan processing team. My academic achievements include developing a comprehensive financial analysis project that was recognized as the best in class.

- Recently certified in Loan Processing with a solid foundation in financial principles from coursework and internships. Eager to bring to bear a fresh perspective rooted in academic excellence and a commitment to upholding stringent accuracy standards in financial documentation.

- Eager to pivot into the financial sector, my project management experience and superior attention to detail developed over 7 years at a top-tier tech firm equip me to excel in loan processing. Acclaimed for improving project delivery times by 25%, I aim to drive similarly impactful results in financial operations.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for loan processor professionals

Local salary info for Loan Processor.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $48,000 |

| California (CA) | $44,280 |

| Texas (TX) | $57,990 |

| Florida (FL) | $48,830 |

| New York (NY) | $49,560 |

| Pennsylvania (PA) | $47,900 |

| Illinois (IL) | $62,800 |

| Ohio (OH) | $49,430 |

| Georgia (GA) | $34,240 |

| North Carolina (NC) | $48,790 |

| Michigan (MI) | $47,990 |

Bonus sections for your loan processor resume

Looking to show more personality on your loan processor resume? Then consider including a couple of extra sections.

They'd benefit your application by highlighting your most prominent:

Key takeaways

Writing your loan processor resume can be a structured and simple experience, once you better understand the organization's requirements for the role you're applying to. To sum up, we'd like to remind you to:

- Always select which experiences, skills, and achievements to feature on your resume based on relevancy to the role;

- In your resume summary, ensure you've cherry-picked your top achievements and matched them with the job ad's skills;

- Submit your loan processor resume as a one or two-page long document at the most, in a PDF format;

- Select industry leading certifications and list your higher education to highlight you have the basis for technical know-how;

- Quantify your people's skills through various resume sections (e.g. Strengths, Hobbies and interests, etc.) to show recruiters how your profile aligns with the organizational culture.

Loan Processor resume examples

By Experience

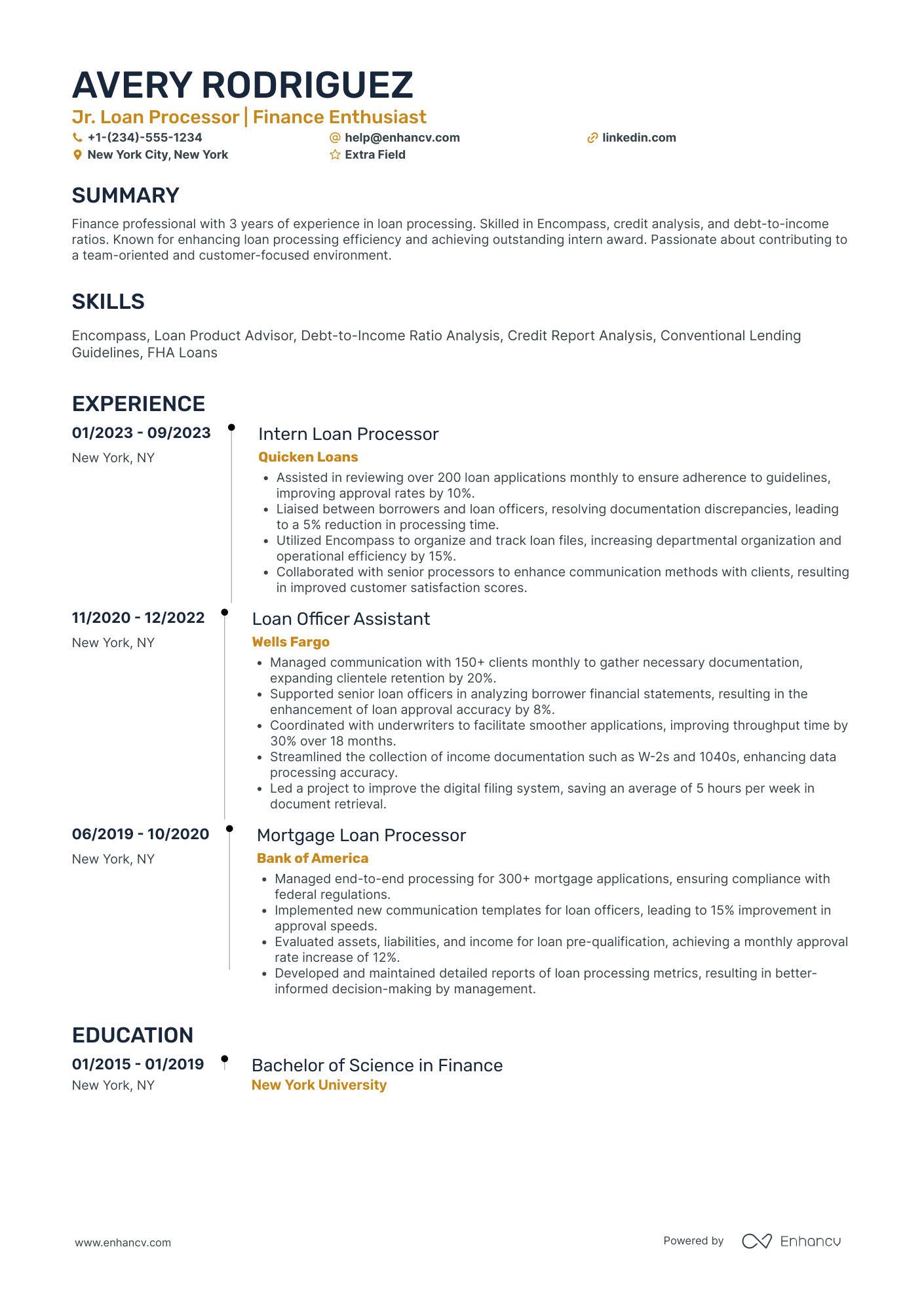

Junior Loan Processor

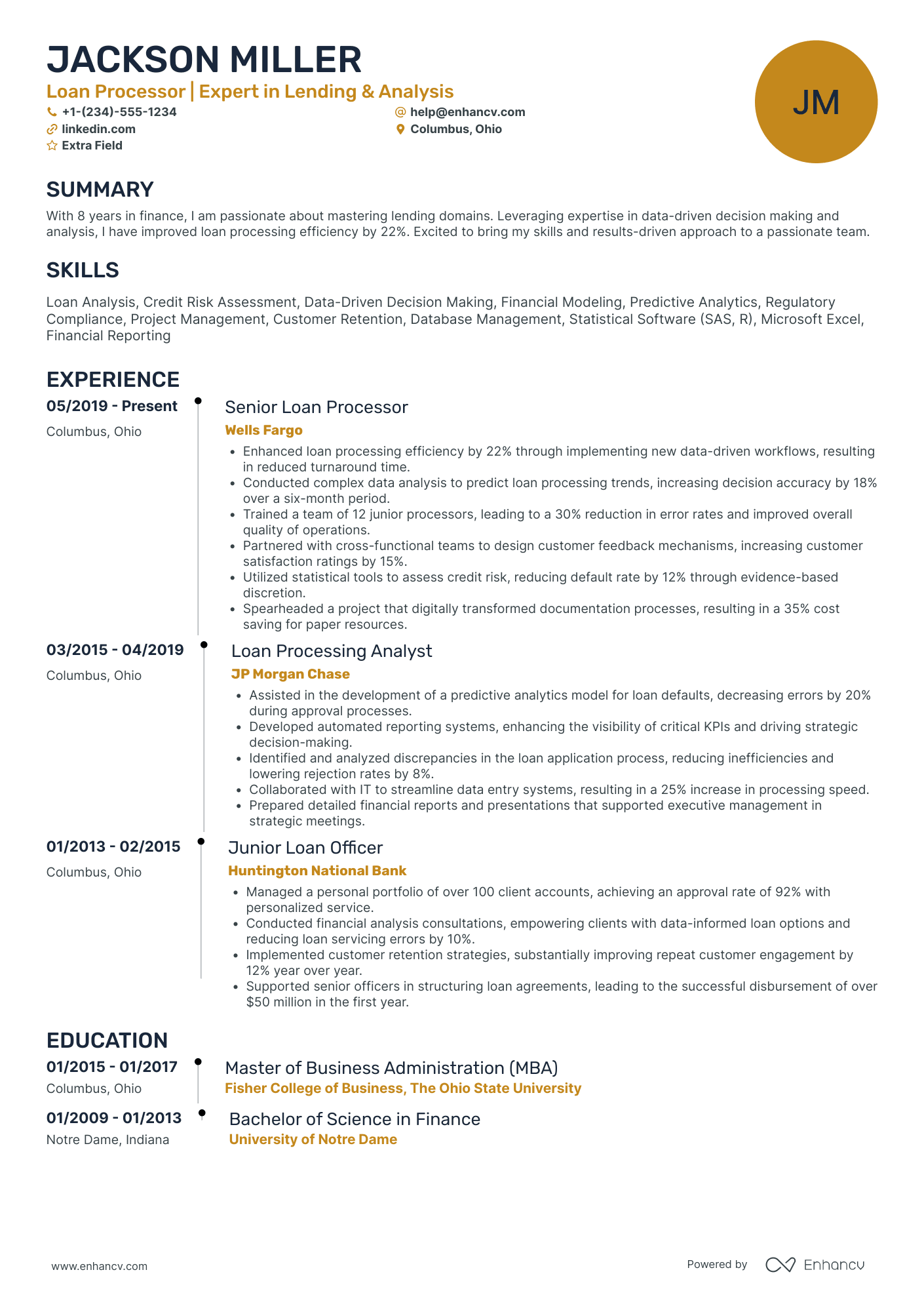

Senior Loan Processor

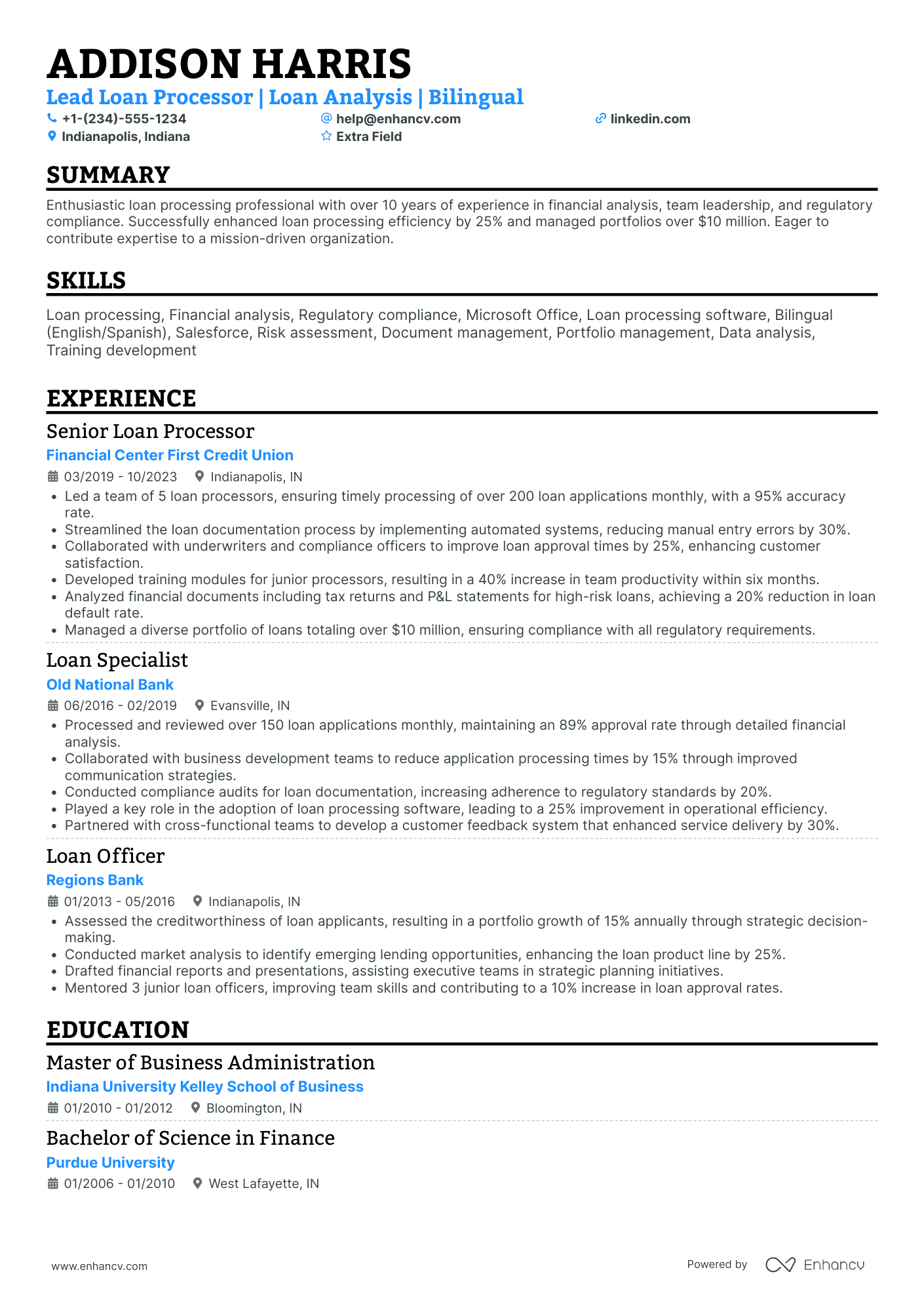

Lead Loan Processor

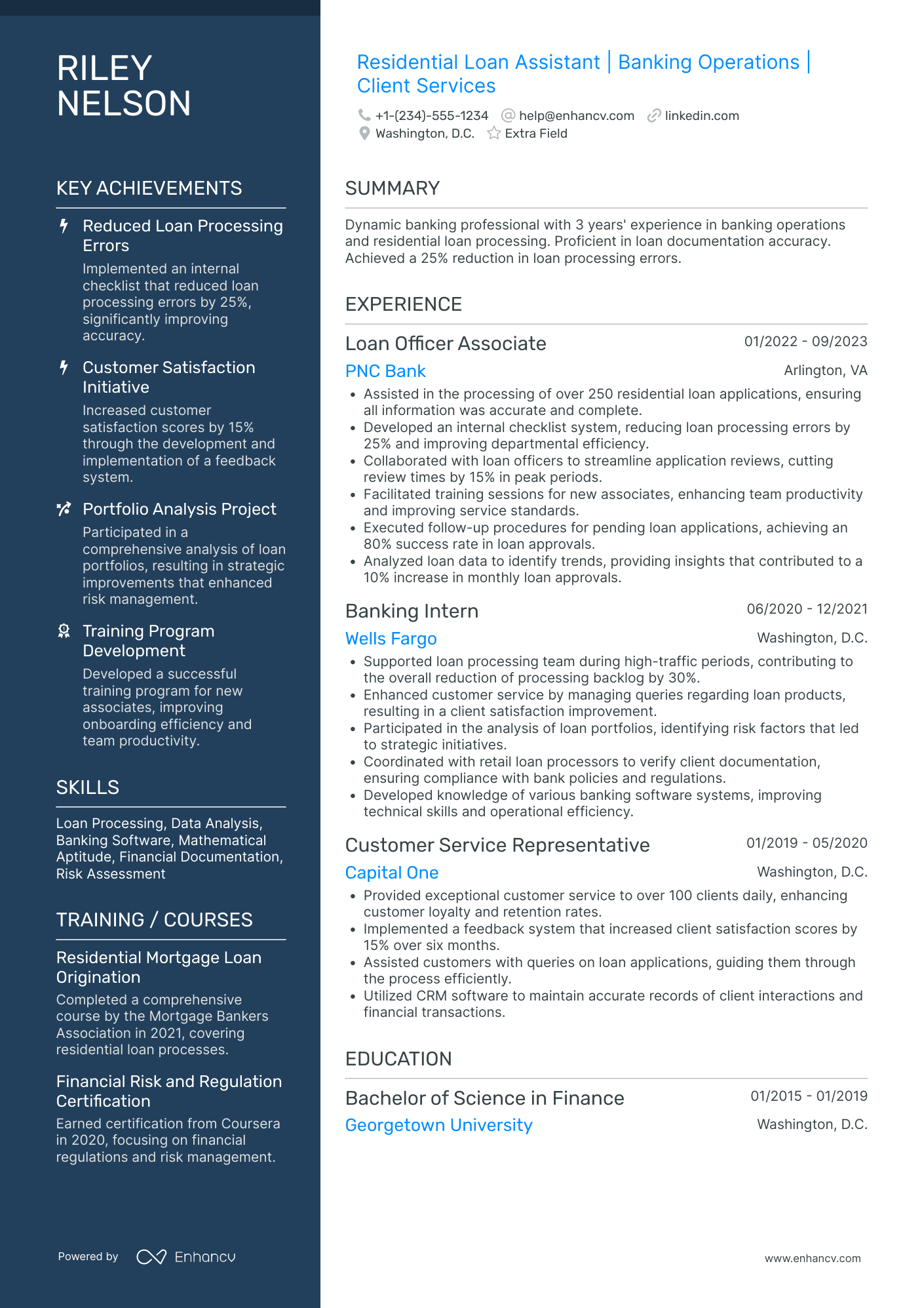

Loan Processor Assistant

Loan Processor Trainee

Loan Processor Team Lead

By Role