Crafting a resume that effectively highlights your analytical skills and deal-making experience can be daunting in the competitive field of private equity. Our guide offers step-by-step insights to ensure your resume stands out, demonstrating your value through quantifiable achievements and tailored content that speaks directly to the needs of private equity firms.

- Aligning the top one-third of your private equity resume with the role you're applying for.

- Curating your specific private equity experience to get the attention of recruiters.

- How to list your relevant education to impress hiring managers recruiting for the private equity role.

Discover more private equity professional examples to help you write a job-winning resume.

- Finance Business Analyst Resume Example

- Government Accounting Resume Example

- CPA Resume Example

- Finance Specialist Resume Example

- Accounts Receivable Resume Example

- Staff Auditor Resume Example

- Financial Risk Analyst Resume Example

- Business Analyst Accounting Resume Example

- Director of Accounting Resume Example

- Finance Coordinator Resume Example

Creating the best private equity resume format: four simple steps

The most appropriate private equity resume format is defined by precision and a systematic approach. What is more, it should reflect upon how your application will be assessed by recruiters. That is why we've gathered four of the most vital elements to keep in mind when designing your resume:

- It's all about presenting how your experience or skills align with the job. Use the reverse-chronological resume format , if your expertise is relevant to the private equity role. Otherwise, select the functional skill-based resume format or the hybrid resume format to shift the focus to your skill set.

- Resume header - make sure you've filled out all relevant (and correct) information, like your contact details and link to your portfolio.

- Resume length - unless you've over a decade of applicable expertise in the field, stick with a one-page resume format. If you'd like to present more of your professional experience, go up to two pages.

- Resume file - submit your private equity resume in a PDF format to ensure all information stays in the same place.

Think about the market’s preferences – a Canadian resume, for instance, could have a different layout.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Recruiters' preferred private equity resume sections:

- A header with relevant contact information and headline, listing your current job title

- A resume summary or objective pinpointing what is most impressive about your expertise (that aligns with the role)

- An experience section highlighting the specifics of your responsibilities and achievements

- A skills sidebar to intertwine job advert keywords with your unique talents

- An education and certifications sections to serve as further accreditation to your professional experience

What recruiters want to see on your resume:

- Deal Experience: Details of acquisition, growth equity, and leveraged buyout transactions you've been involved with, including the sizes and outcomes.

- Financial Modeling Expertise: Demonstrated ability to build complex LBO, DCF, and accretion/dilution models from scratch.

- Industry Knowledge: Insight into specific sectors you've worked in and understanding of market trends, key players, and industry dynamics.

- Portfolio Management: Experience in overseeing portfolio companies, implementing operational improvements, and tracking performance metrics.

- Fundraising Skills: Participation in the fundraising process, including drafting of PPMs, investor roadshows, and LP engagements.

Writing your private equity resume experience

Within the body of your private equity resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your private equity professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

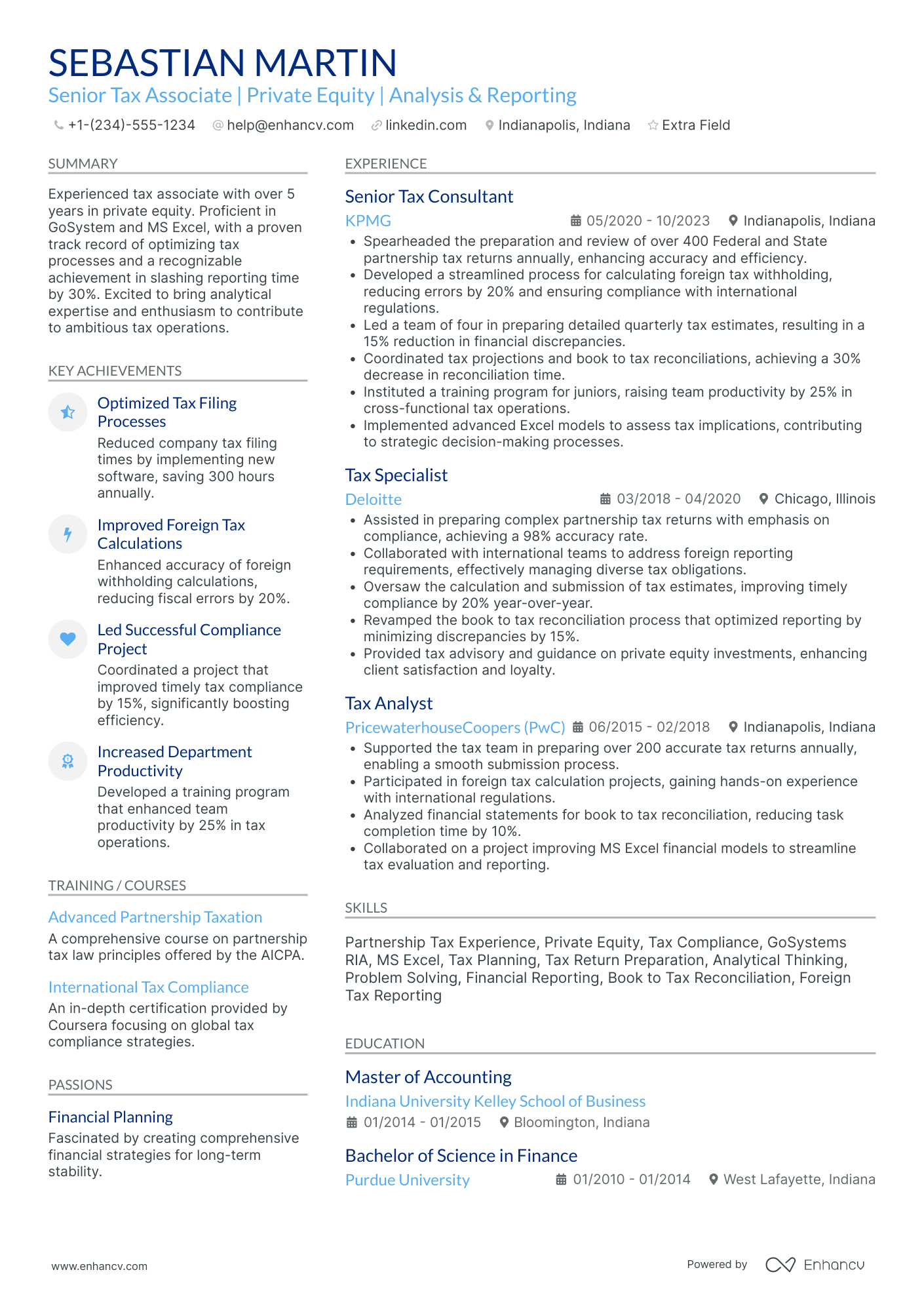

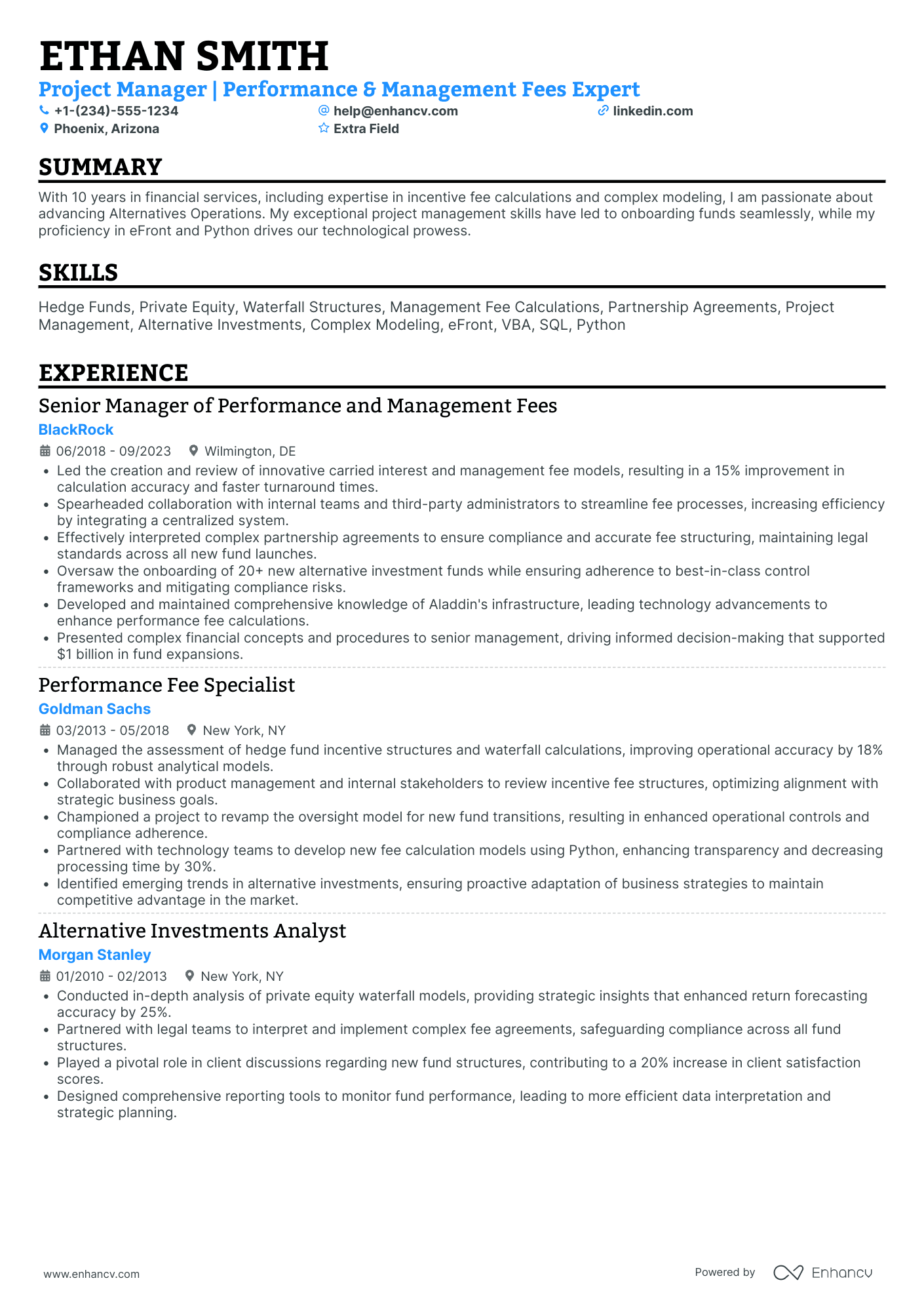

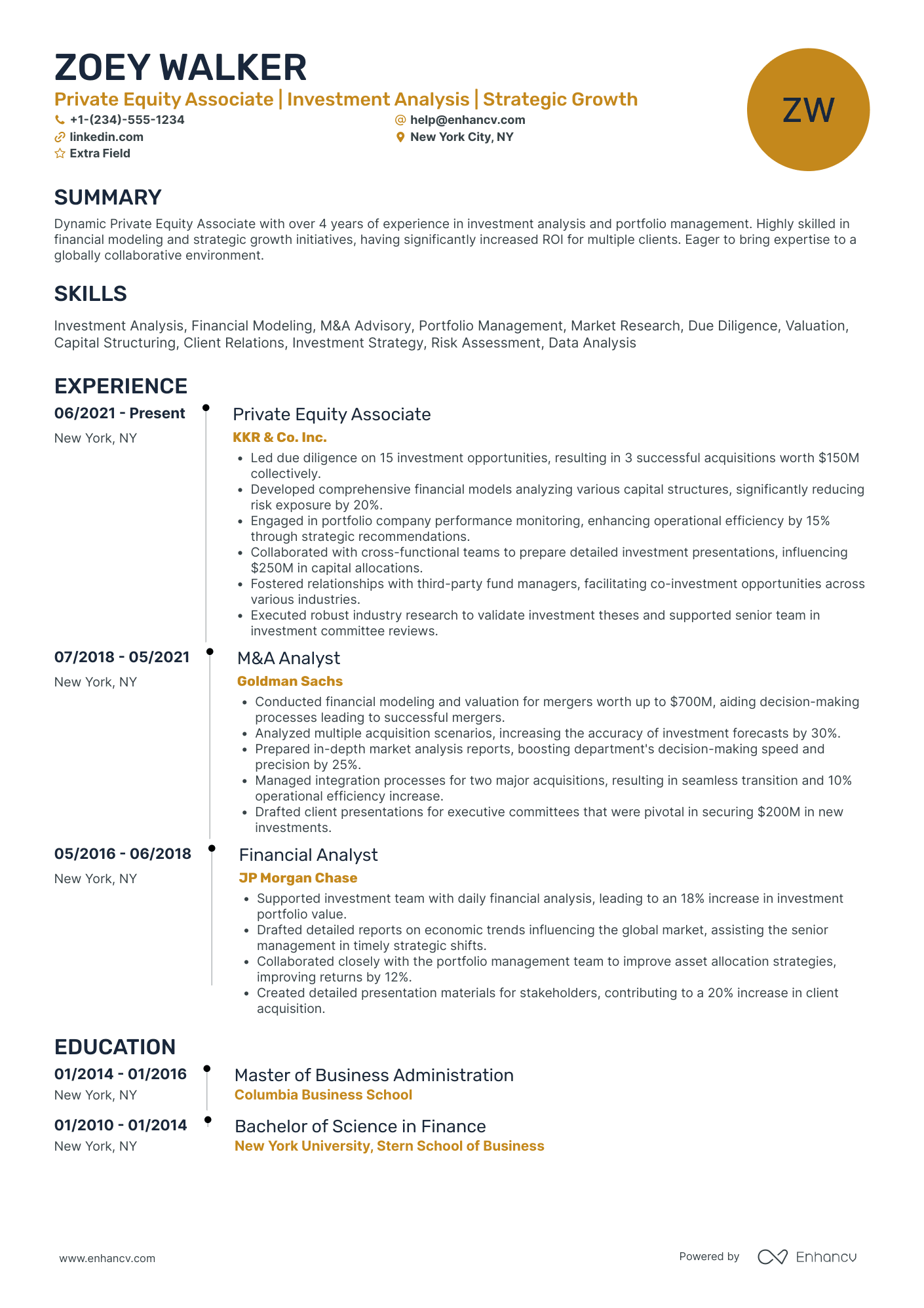

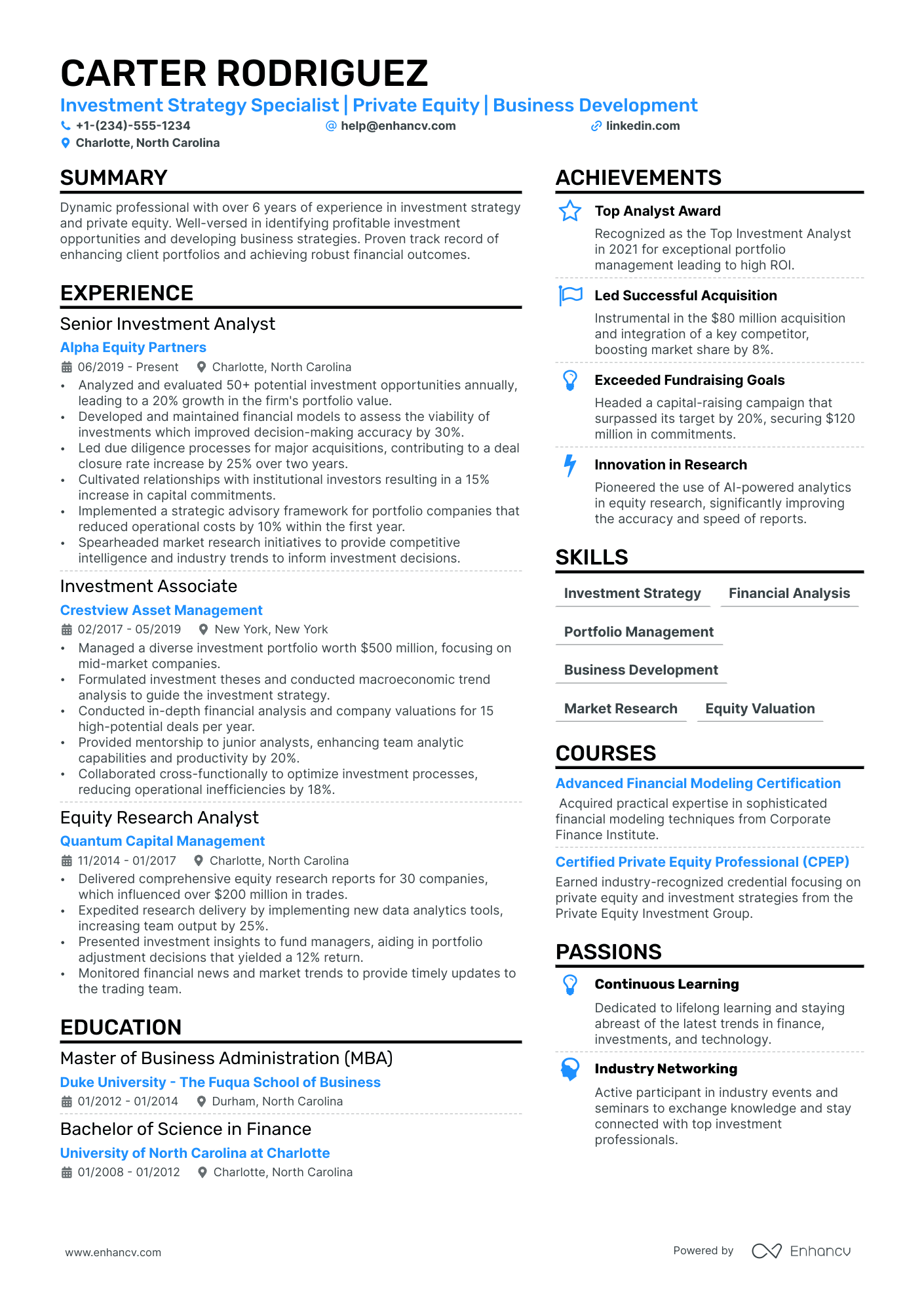

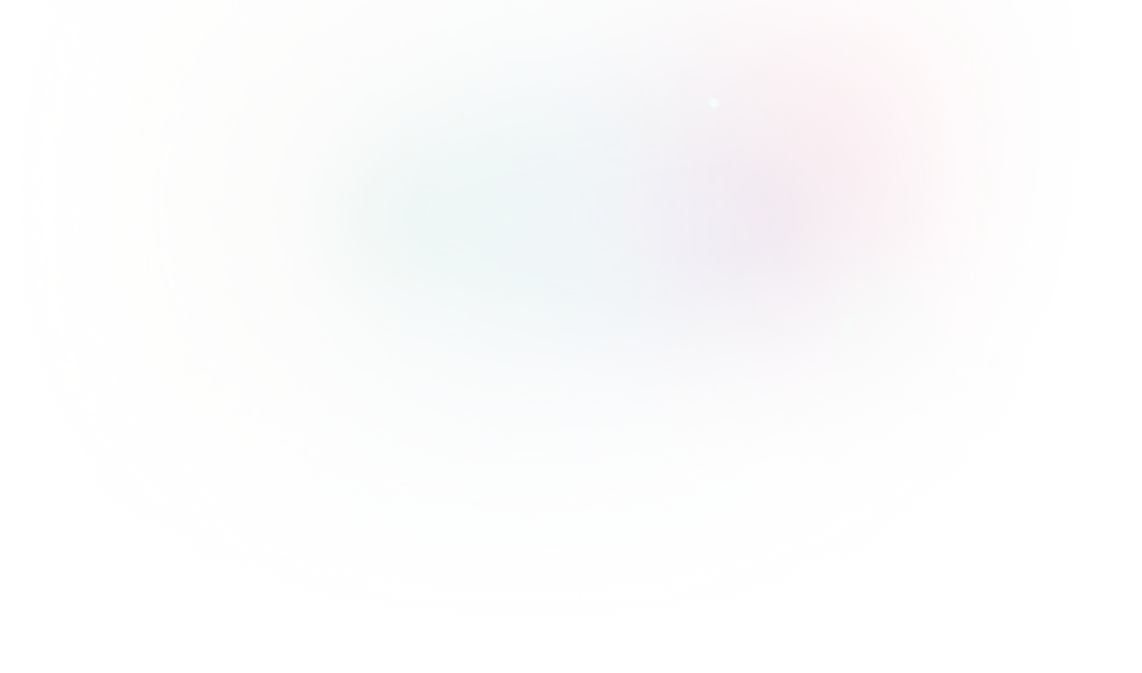

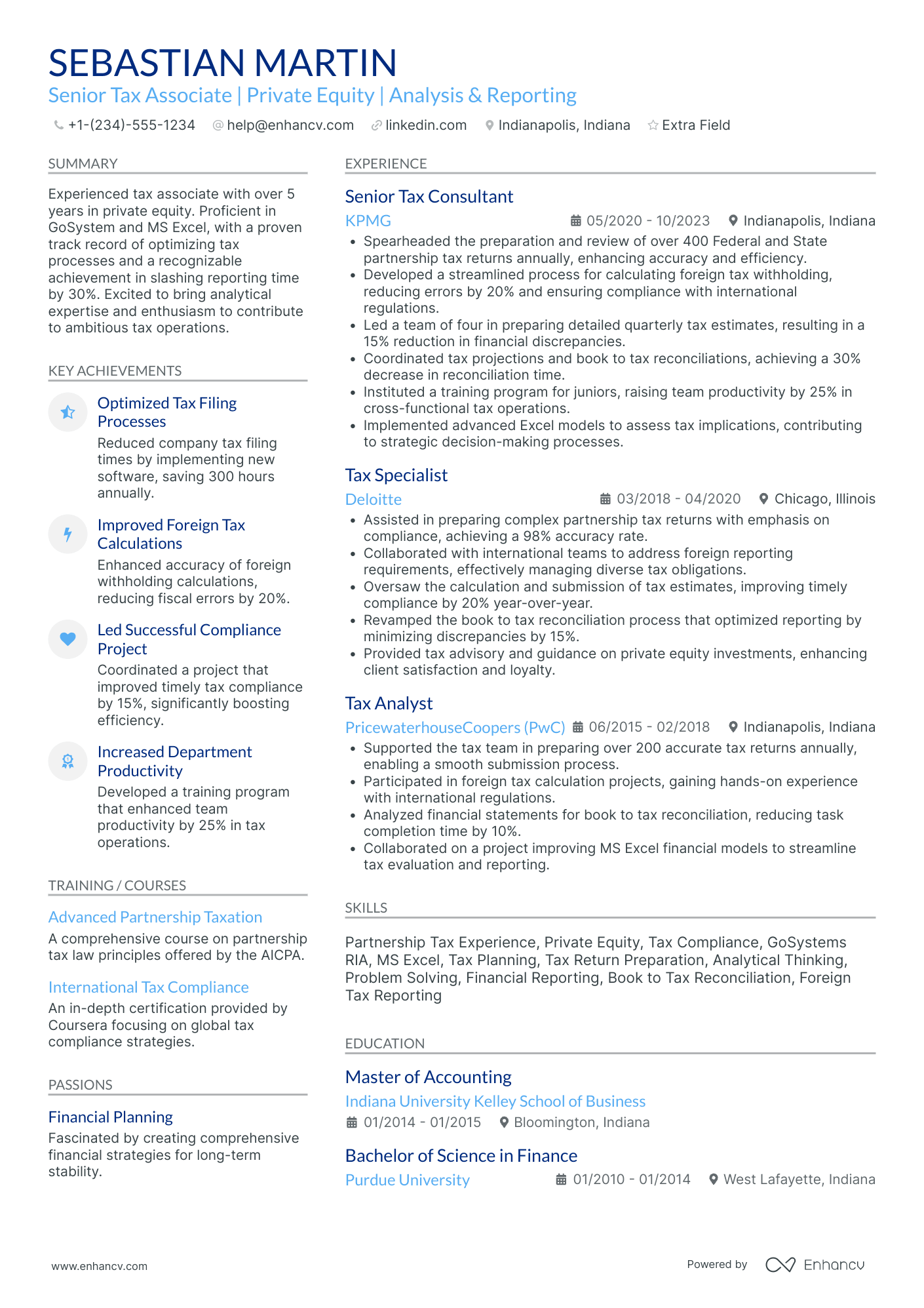

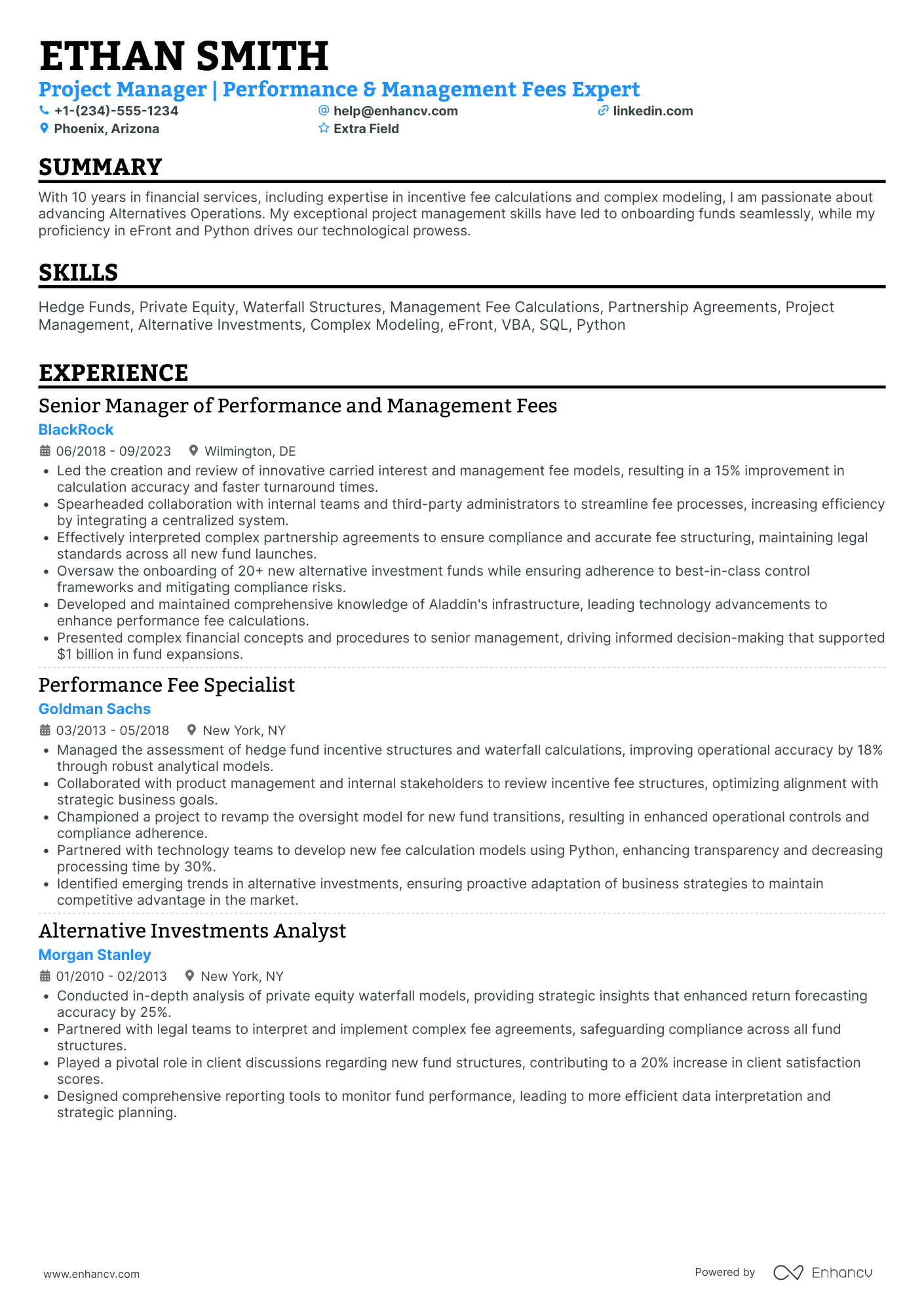

Wondering how other professionals in the industry are presenting their job-winning private equity resumes? Check out how these private equity professionals put some of our best practices into action:

- Led a successful acquisition of a $50M revenue software firm, performing comprehensive due diligence and negotiating terms favorable to a 20% EBITDA margin increase within the first year.

- Spearheaded the post-acquisition integration process, resulting in a seamless transition and retention of key personnel, and ultimately delivering a 15% growth in productivity.

- Implemented strategic cost-cutting measures across portfolio companies, which led to an average of 12% overhead reduction while maintaining operational performance.

- Managed a diverse private equity portfolio, achieving a 25% average annual return on investments across various industry verticals by identifying high-growth opportunities.

- Coordinated the restructuring of two underperforming portfolio companies, guiding them to profitability with a combined 18% margin improvement over 24 months.

- Directed a cross-border investment initiative that expanded the firm's footprint into emerging markets, recognizing a 30% increase in international investment deals.

- Masterminded the leveraged buyout of a mid-sized manufacturing company for $200 million, increasing its market share by 10% over a three-year period through strategic capital investments.

- Fostered partnerships with leading industry players to co-invest in high-potential startups, contributing to a $100M growth capital fund that yielded multiple successful exits.

- Initiated a value-add program for portfolio companies, leveraging data analytics to drive decision-making and optimize performance metrics across the board.

- Increased the profitability of portfolio acquisitions by systematically identifying and executing on operational efficiencies, leading to a 15% average EBITDA uplift.

- Conducted rigorous industry analysis and market research to originate a pipeline of potential acquisition targets with combined revenue potentials exceeding $300 million.

- Facilitated a series of executive-level strategic planning sessions with portfolio company leadership teams, aligning business objectives with broader market opportunities.

- Drove a detailed financial analysis process that informed the acquisition of three enterprise-level healthcare companies, each surpassing post-acquisition revenue targets by at least 20%.

- Cultivated a network of industry experts to provide insights on potential market disruptions, allowing the firm to pivot investment strategies ahead of the curve.

- Developed and executed a capital allocation strategy that optimized the deployment of $500M in funds across various asset classes, mitigating risk while maximizing returns.

- Pioneered the firm's expansion into sustainable investments, raising a dedicated $250M green energy fund that focuses on renewably-driven growth initiatives.

- Deployed cutting-edge financial modeling to assess risk and project the long-term value of private investments, helping to secure a deal flow increase of 20% year over year.

- Crafted and implemented rigorous ESG compliance criteria for all portfolio companies, ensuring adherence to sustainable business practices and a 10% improvement in social governance scoring.

- Oversaw a series of transformative equity investments in technology startups, with a focus on blockchain and AI, contributing to a 50% increase in the tech portfolio's performance index.

- Collaborated with management of acquired entities to digitize operations, leading to an average cost reduction of 18% across five major projects.

- Orchestrated the exit of a legacy retail investment through a strategic IPO, effectively doubling the firm's initial investment and capturing a significant market cap uplift.

- Developed and executed financial strategies for middle-market LBOs, creating an aggregate value creation plan that translated into a 30% compounded annual growth rate for investment profits.

- Leveraged industry expertise to identify and close on investments in high-growth sectors, resulting in doubling the firm's assets under management during tenure.

- Cultivated a culture of performance and accountability within the PE team, mentoring junior analysts and associates, which led to a 40% improvement in deal sourcing efficiency.

Quantifying impact on your resume

- Highlight the total amount of funds raised for various investment rounds, indicating your ability to secure financial support and build investor confidence.

- Specify the number of portfolio companies you’ve managed or provided strategic guidance to, showcasing your hands-on experience.

- Detail the percentage increase in revenue or profits you’ve achieved for portfolio companies through your strategic initiatives.

- Enumerate the number of successful exits you've facilitated, such as through sales or IPOs, affirming your exit strategy expertise.

- Quantify cost savings achieved through operational improvements or restructuring plans you’ve implemented in portfolio companies.

- Mention the size of the investments you’ve led or been a part of, reflecting your competence in deal-making and fund allocation.

- Present the amount by which you've grown assets under management during your tenure, evidencing your expertise in portfolio growth.

- Detail the number of deals you’ve sourced and closed, providing concrete evidence of your networking and negotiation skills.

Action verbs for your private equity resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Key hard skills and soft skills for your private equity resume

At the top of any recruiter private equity checklist, you'd discover a list of technical competencies, balanced with personal skills.

Hard or technical skills are your opportunity to show how you meet the essential responsibilities of the role. The ability to use a particular job-crucial technology or software would also hint to recruiters whether you'd need a prolonged period of on-the-job training - or you'd fit right in the job.

But to land your dream role, you'd also need to demonstrate a variety of soft or people resume skills . Employers care about soft skills as they show how each candidate would fit into the team and company culture.

Both types of skills are specific and to best curate them on your resume, you'd need to:

- Create a skill section within which you showcase your hard and soft skills and present how they help you succeed.

- List specific examples of projects, tasks, or competitions, within which your skill set has assisted your results.

- Soft skills are harder to measure, so think about situations in which they've helped you thrive. Describe those situations concisely, focusing on how the outcome has helped you grow as a professional.

- Metrics of success - like positive ROI or optimized workplace processes - are the best way to prove your technical and people skills.

Take a look at some of private equity industry leaders' favorite hard skills and soft skills, as listed on their resumes.

Top skills for your private equity resume:

Financial Modeling

Due Diligence

Valuation Techniques

Excel

PowerPoint

LBO Modeling

VBA

Data Analysis Tools

CRM Software

Market Research Tools

Analytical Thinking

Communication

Negotiation

Problem Solving

Teamwork

Attention to Detail

Time Management

Adaptability

Interpersonal Skills

Strategic Thinking

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Qualifying your relevant certifications and education on your private equity resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your private equity resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified private equity Professional (CPEP) - private equity Investment Group

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

- Certified Merger & Acquisition Advisor (CM&AA) - Alliance of Merger & Acquisition Advisors

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

PRO TIP

Always remember that your private equity certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Recommended reads:

Adding a summary or objective to your private equity resume

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

- Either a resume summary - your career highlights at a glance. Select the summary if you have plenty of relevant experience (and achievements), you'd like recruiters to remember about your application.

- Or, a resume objective - to showcase your determination for growth. The perfect choice for candidates with less experience, who are looking to grow their career in the field.

If you want to go above and beyond with your private equity resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life private equity professionals, whose resumes have helped them land their dream jobs:

Resume summaries for a private equity job

- Seasoned finance professional with over a decade of experience in managing multi-million-dollar portfolios and spearheading strategic acquisitions. Boasting a robust background in financial analysis, due diligence, and market assessments, my journey includes a pivotal role in growing an asset portfolio by 200% within five years at a leading investment firm.

- With a strong foundation as a senior investment analyst and six years of progressive experience at a top-tier investment bank, I have honed expert-level skills in financial modeling, equity research, and complex deal structures. My career highlight includes leading a transaction that saved the firm $30 million through strategic restructuring.

- Highly successful tech entrepreneur aiming to leverage an eight-year track record of founding and scaling a $50M software company to pivot into private equity. Equipped with deep industry insights, financial acumen, and a passion for driving business growth, poised to deliver exceptional results in venture capital initiatives.

- Eager to transition from a successful five-year tenure in management consulting to private equity, bringing analytical prowess and experience with Fortune 500 client strategies. Expertise in operational efficiency and revenue growth strategies, I contribute a fresh perspective on value creation for portfolio companies.

- Ambitious finance graduate intent on applying academic learning and internship experience to contribute to successful private equity transactions. Eager to develop expertise in leveraged buyouts and growth equity deals, driven by a commitment to excel in asset management and investment analysis.

- Dynamic MBA candidate with a passion for finance and a solid foundation in accounting, seeking to apply a unique blend of leadership and analytical skills to the field of private equity. Aspiring to grow in a challenging environment while mastering investment strategies and portfolio management.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Showcasing your personality with these four private equity resume sections

Enhance your private equity expertise with additional resume sections that spotlight both your professional skills and personal traits. Choose options that not only present you in a professional light but also reveal why colleagues enjoy working with you:

- My time - a pie chart infographic detailing your daily personal and professional priorities, showcasing a blend of hard and soft skills;

- Hobbies and interests - share your engagement in sports, fandoms, or other interests, whether in your local community or during personal time;

- Quotes - what motivates and inspires you as a professional;

- Books - indicating your reading and comprehension skills, a definite plus for employers, particularly when your reading interests align with your professional field.

Key takeaways

Writing your private equity resume can be a structured and simple experience, once you better understand the organization's requirements for the role you're applying to. To sum up, we'd like to remind you to:

- Always select which experiences, skills, and achievements to feature on your resume based on relevancy to the role;

- In your resume summary, ensure you've cherry-picked your top achievements and matched them with the job ad's skills;

- Submit your private equity resume as a one or two-page long document at the most, in a PDF format;

- Select industry leading certifications and list your higher education to highlight you have the basis for technical know-how;

- Quantify your people's skills through various resume sections (e.g. Strengths, Hobbies and interests, etc.) to show recruiters how your profile aligns with the organizational culture.

Private Equity resume examples

By Experience

Senior Private Equity Associate

By Role