Actuaries often struggle to effectively communicate their complex analytical skills and technical expertise on a resume. Our resume examples demonstrate how to concisely showcase these skills in a compelling and understandable way. Dive into the examples section to see how you can enhance your own resume.

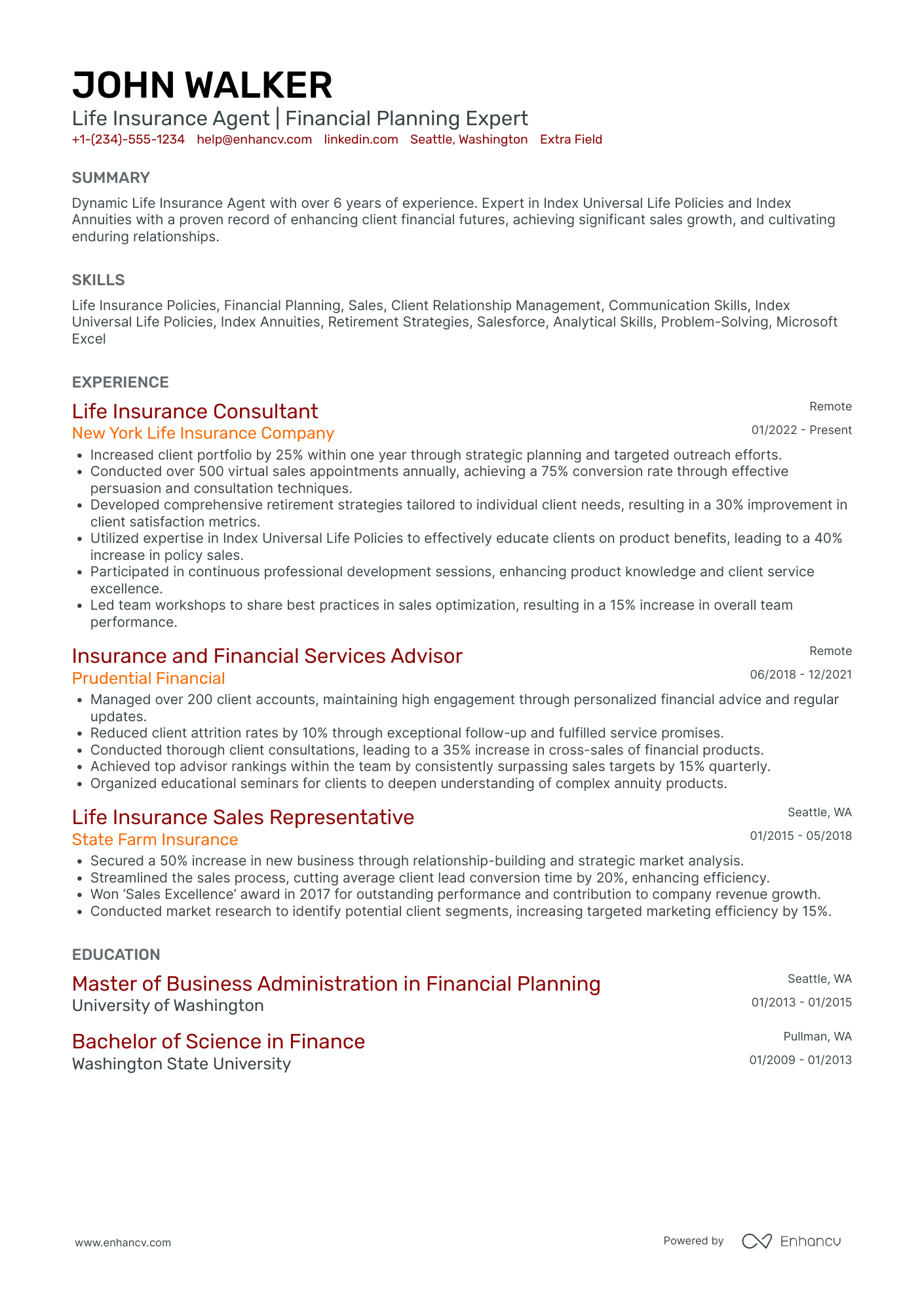

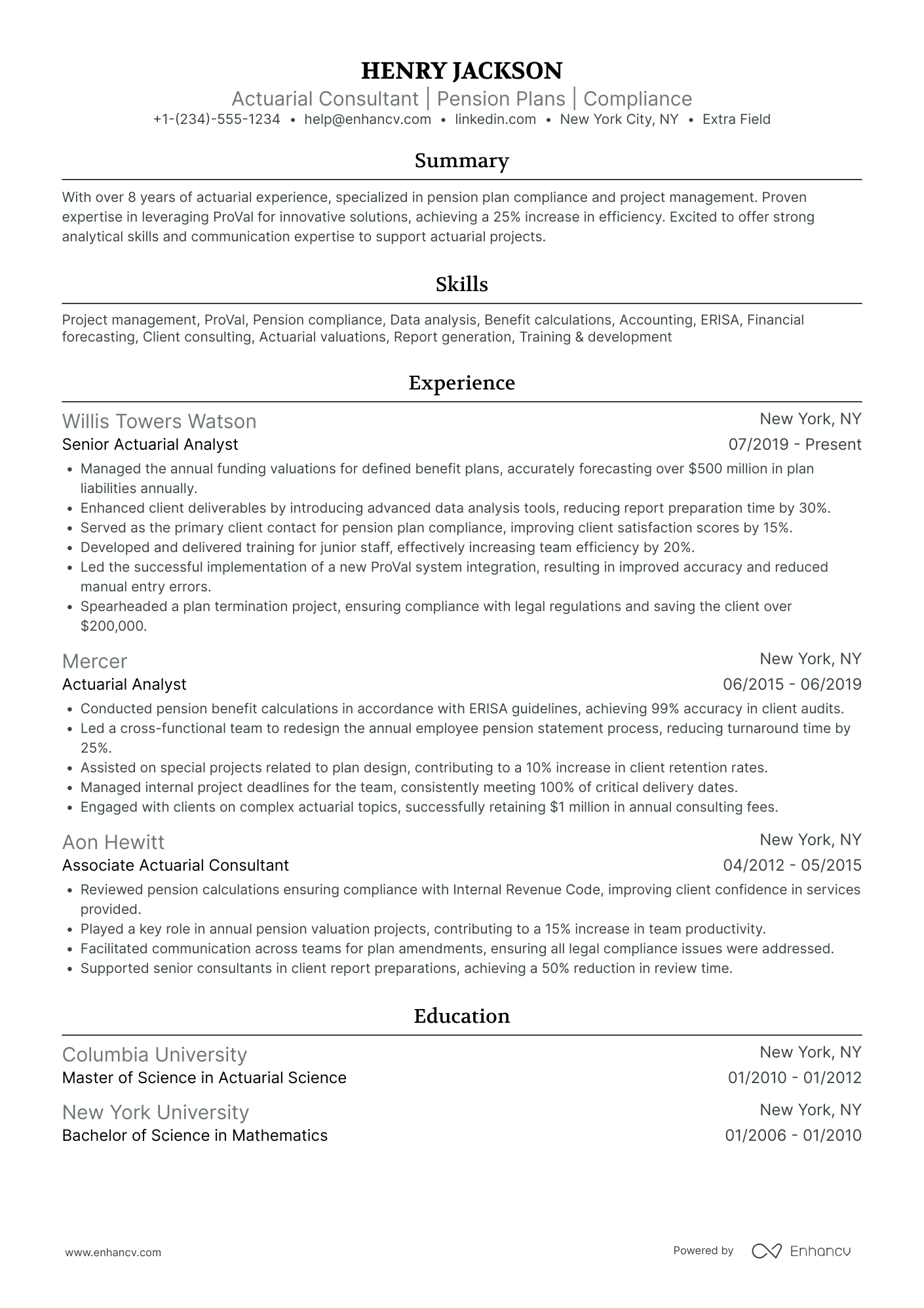

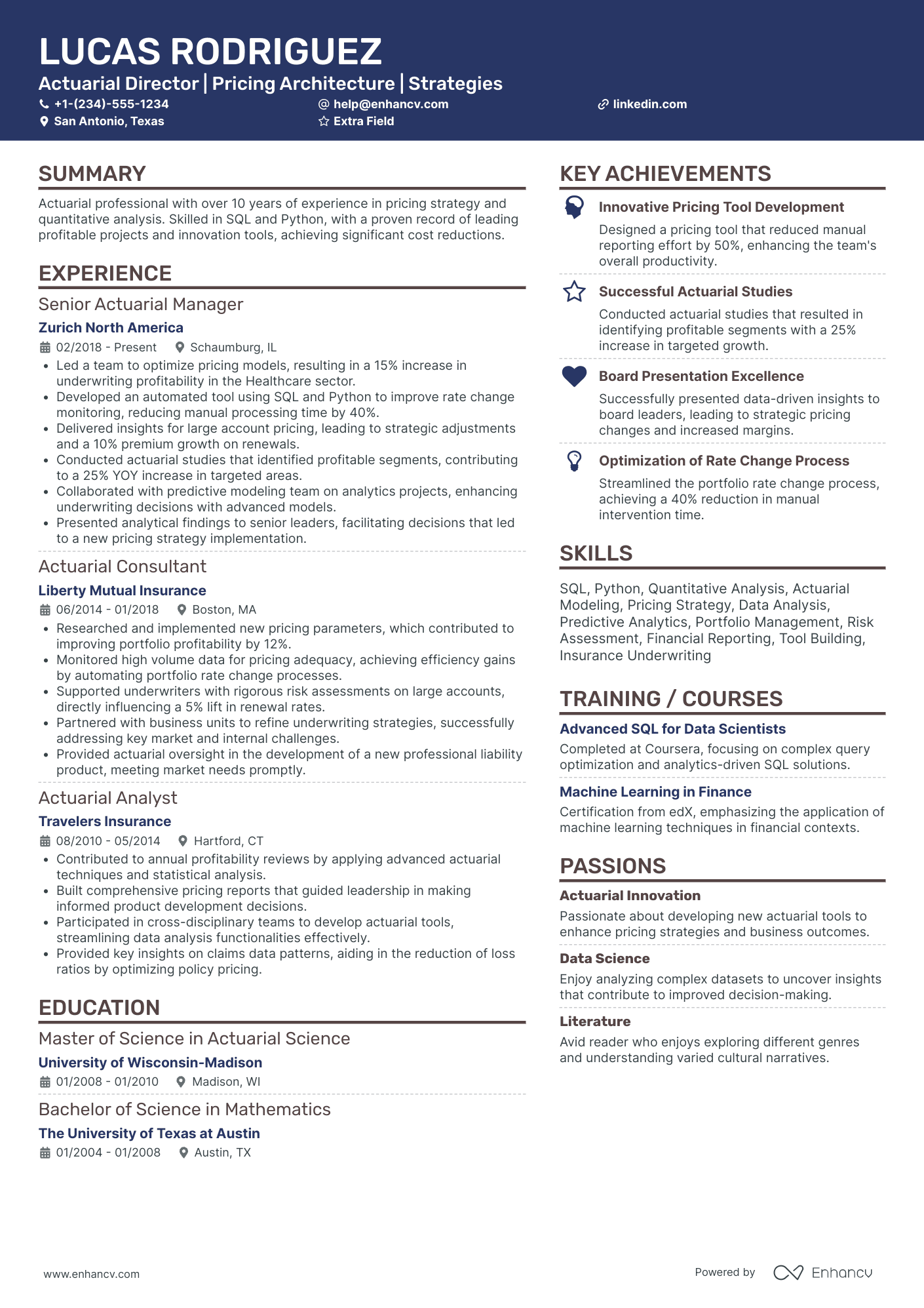

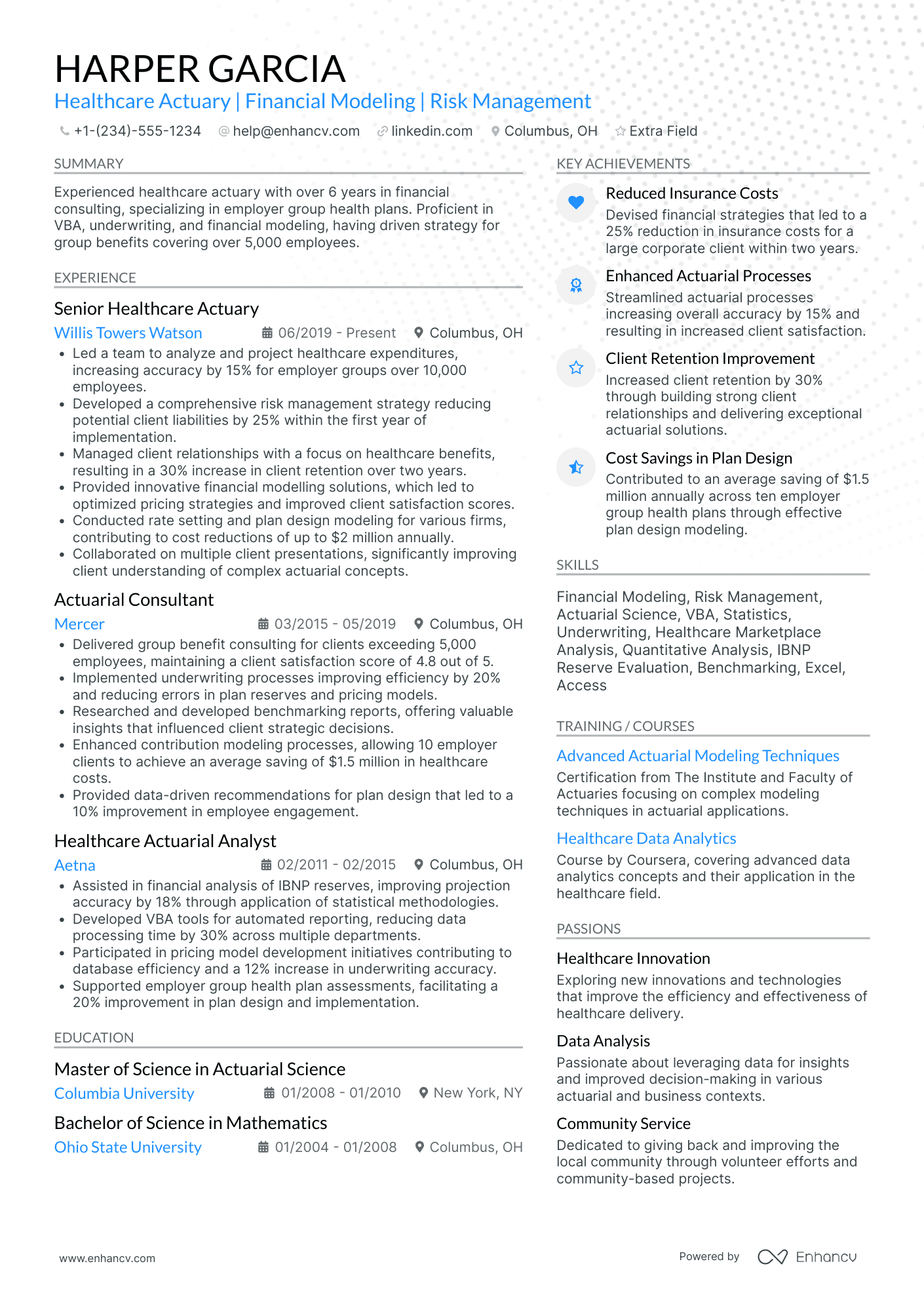

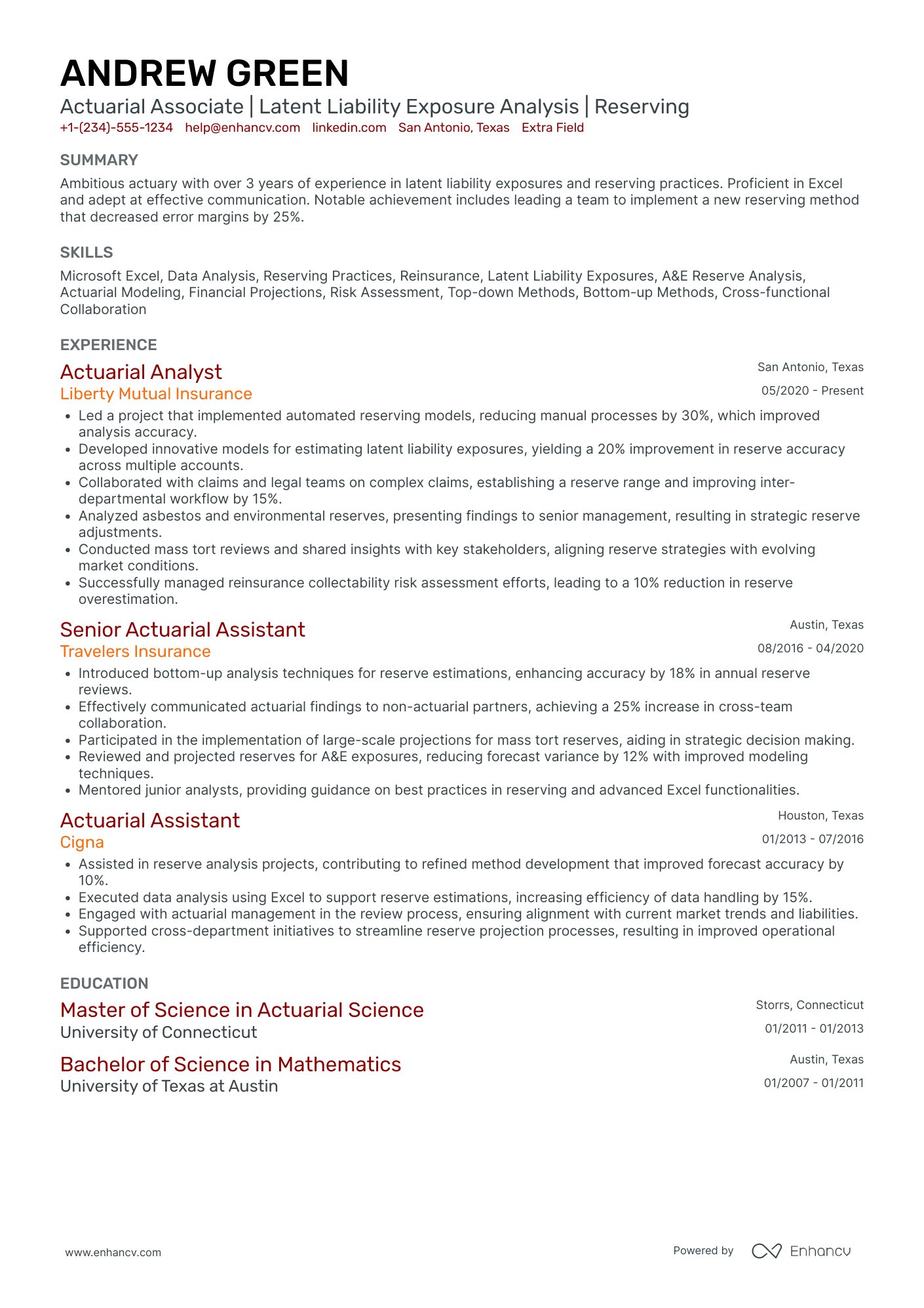

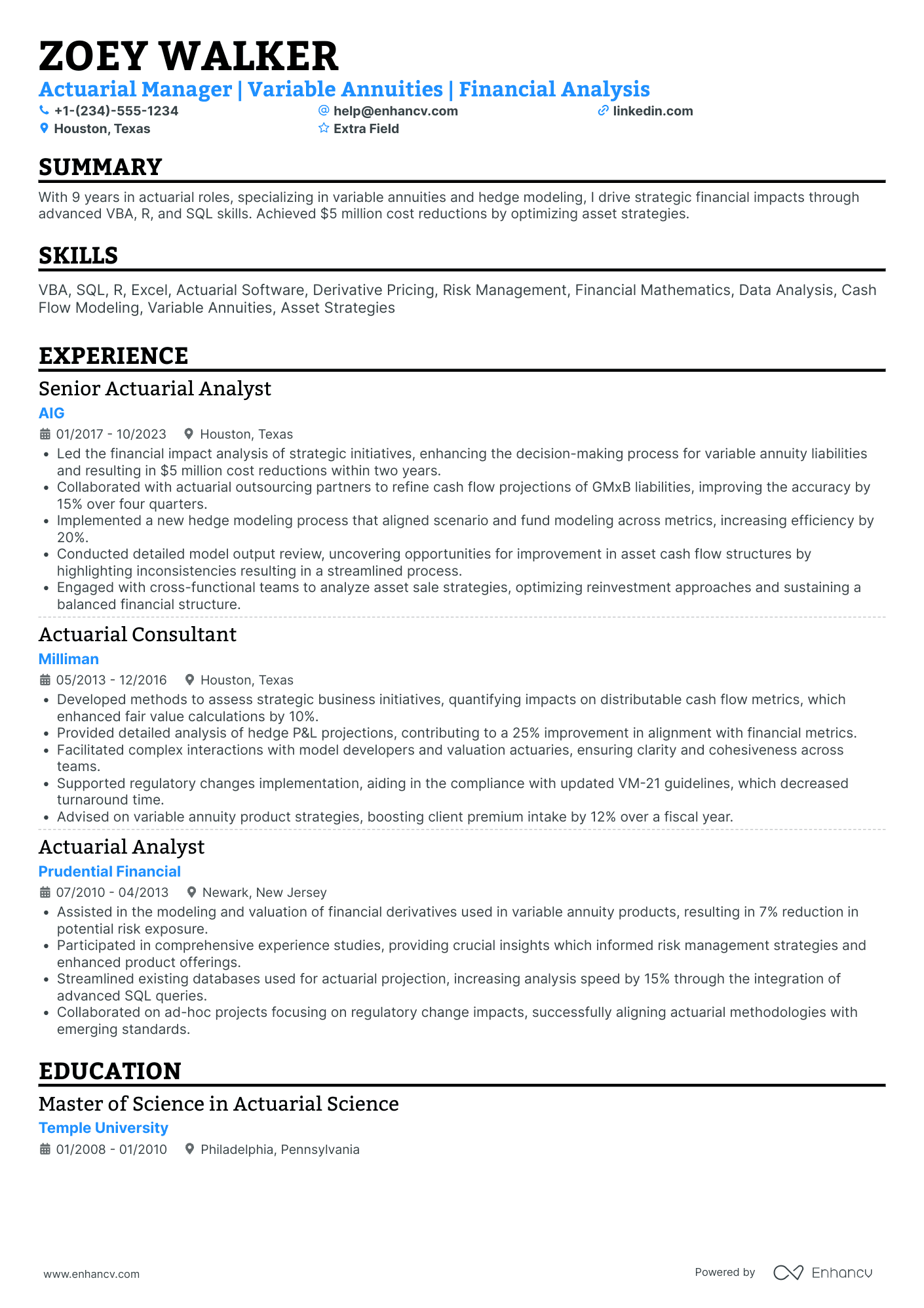

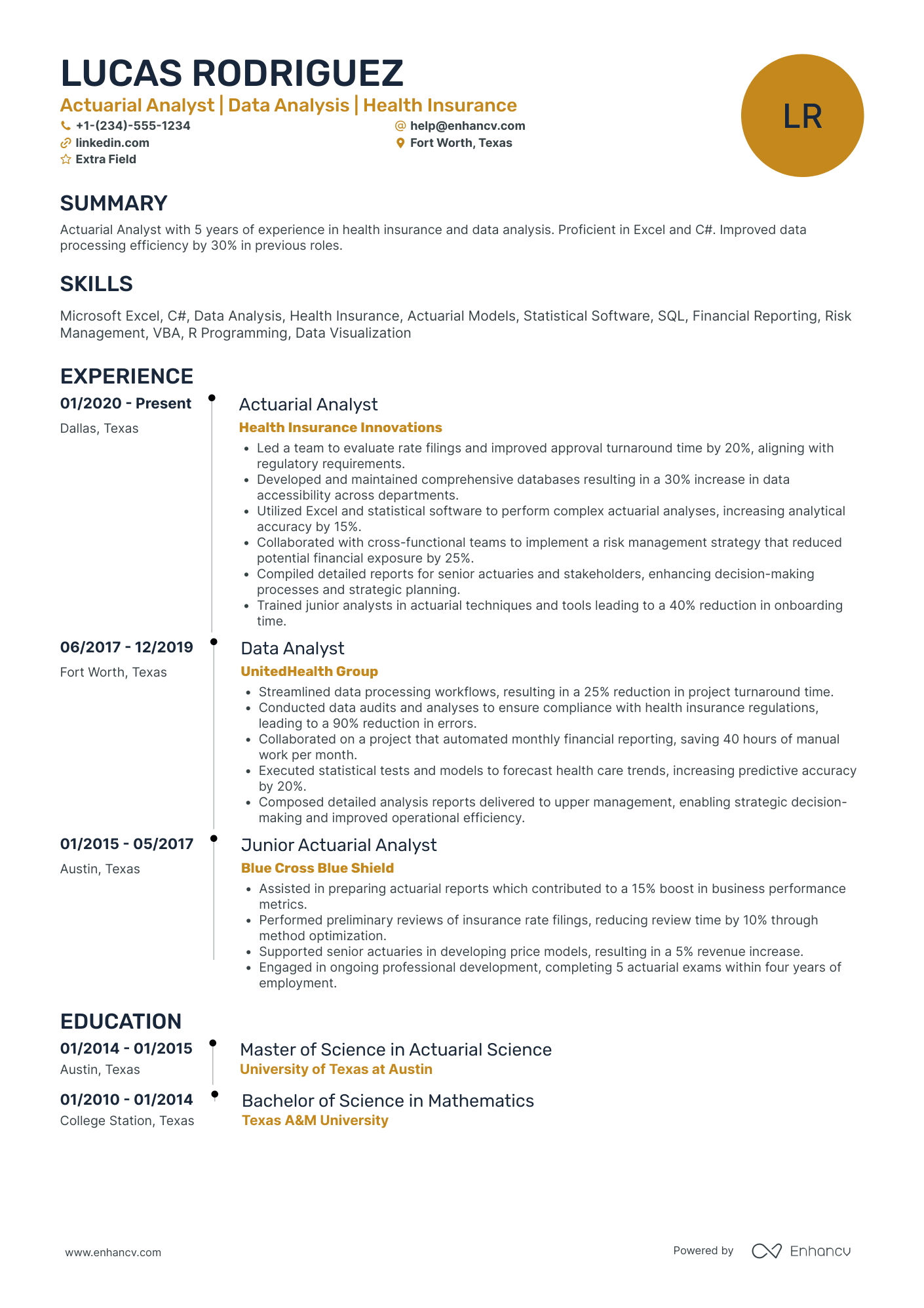

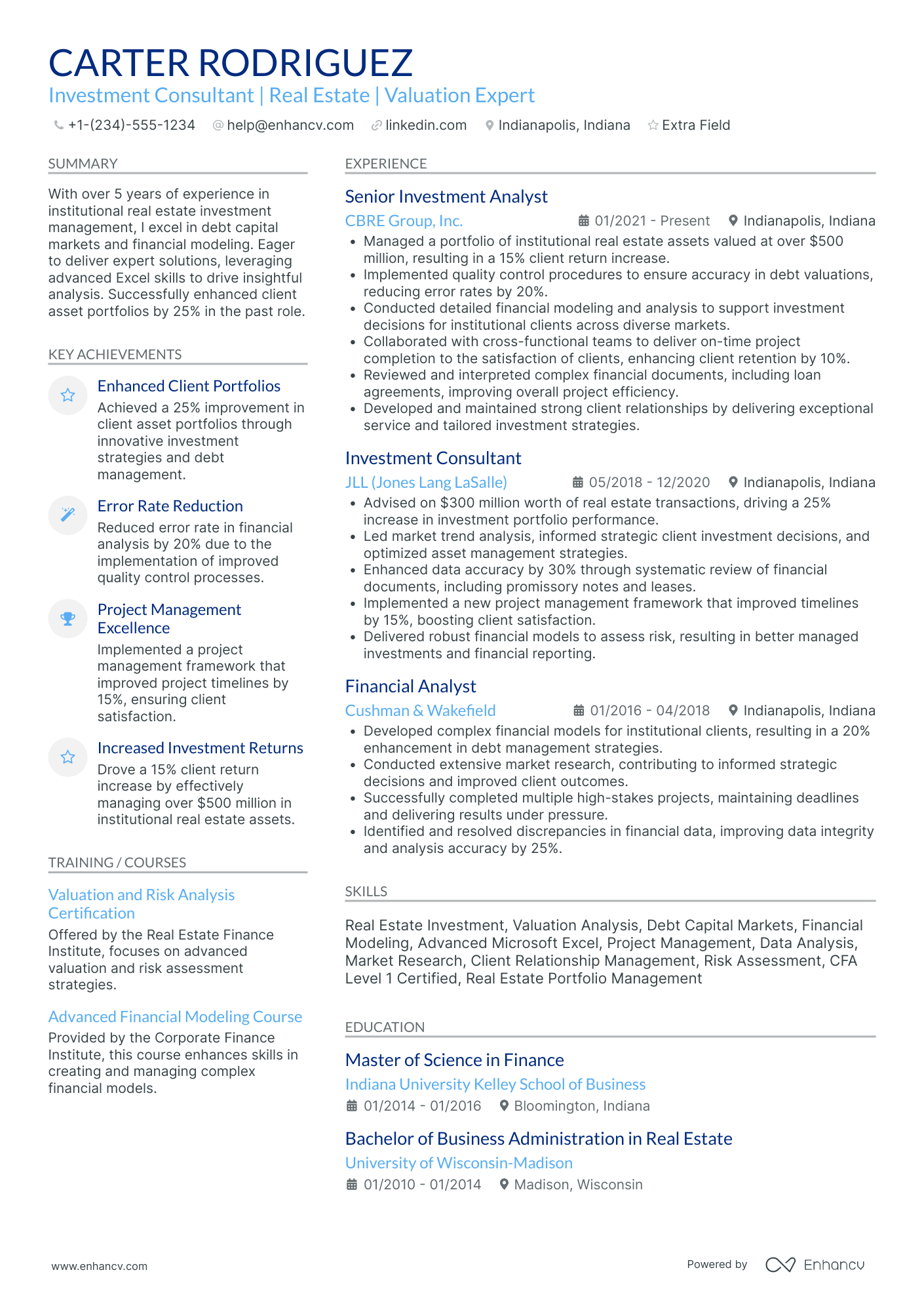

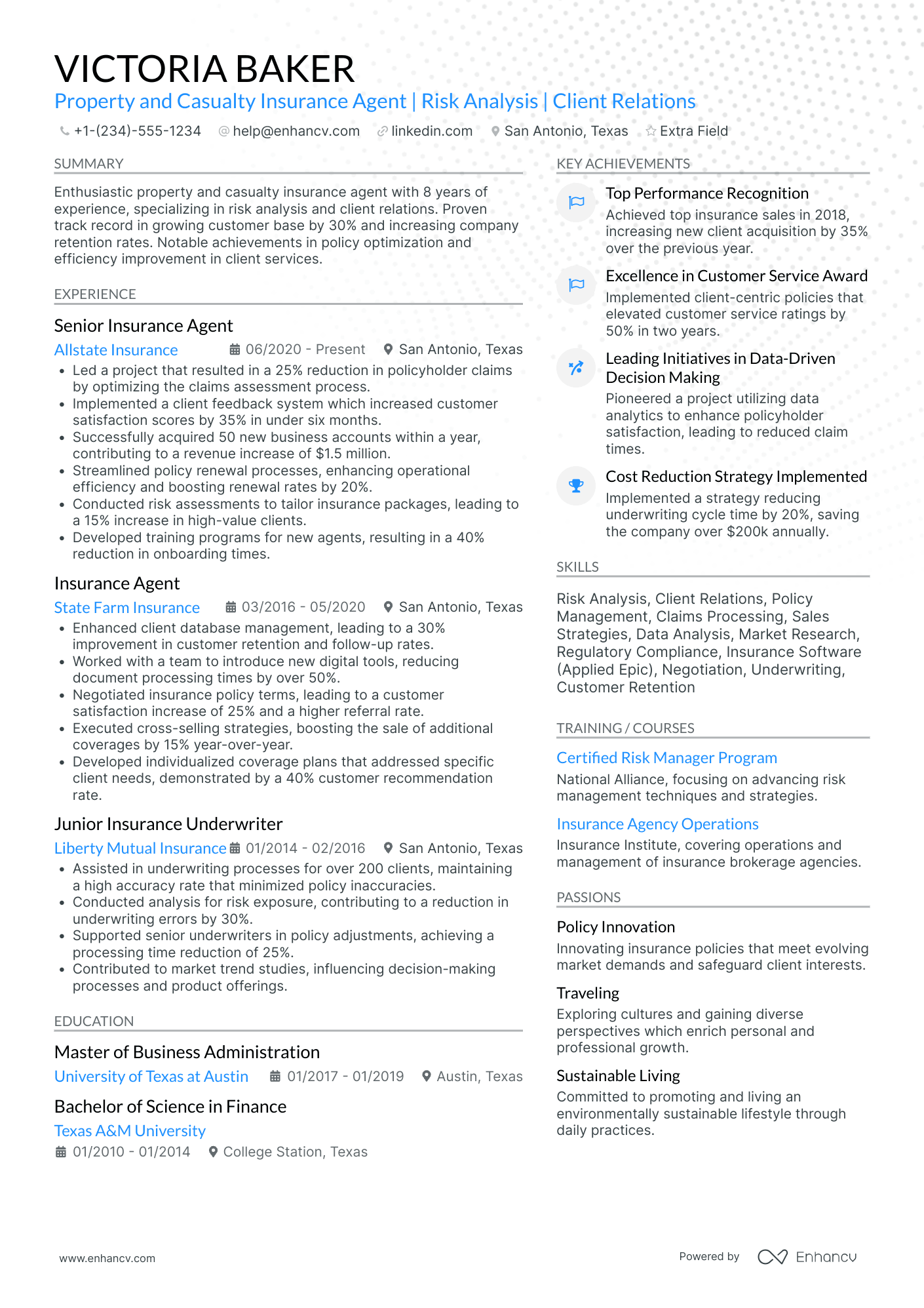

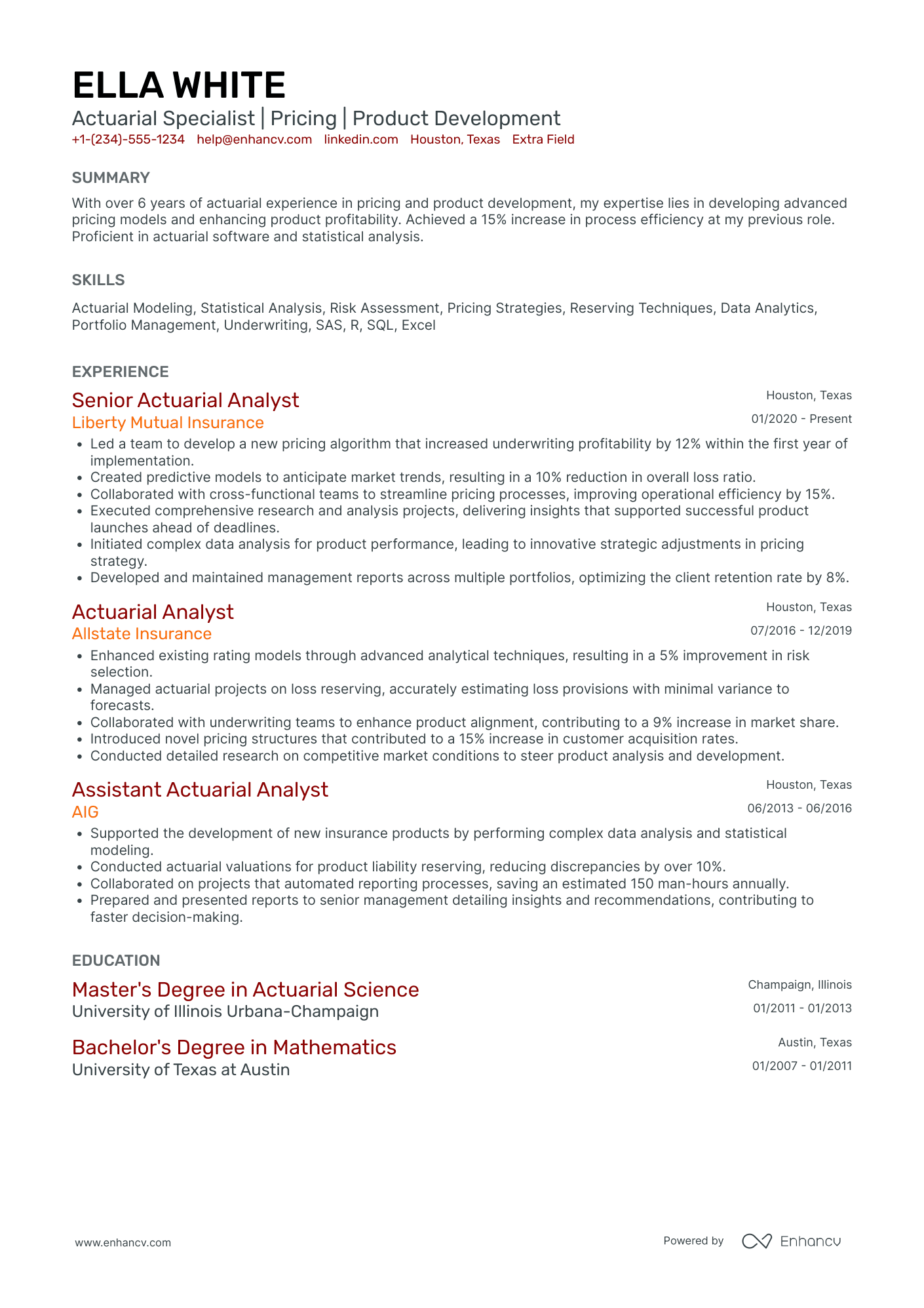

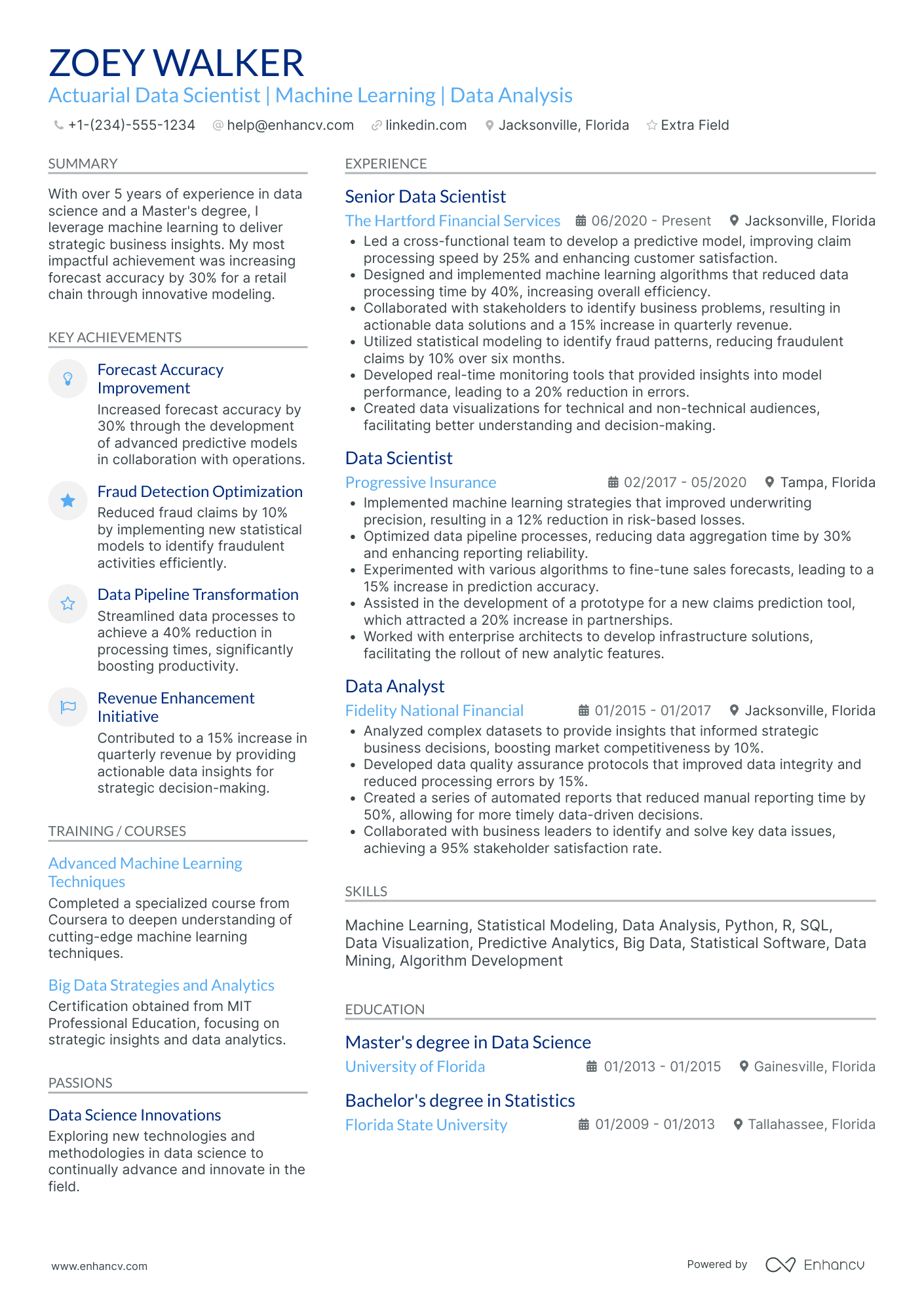

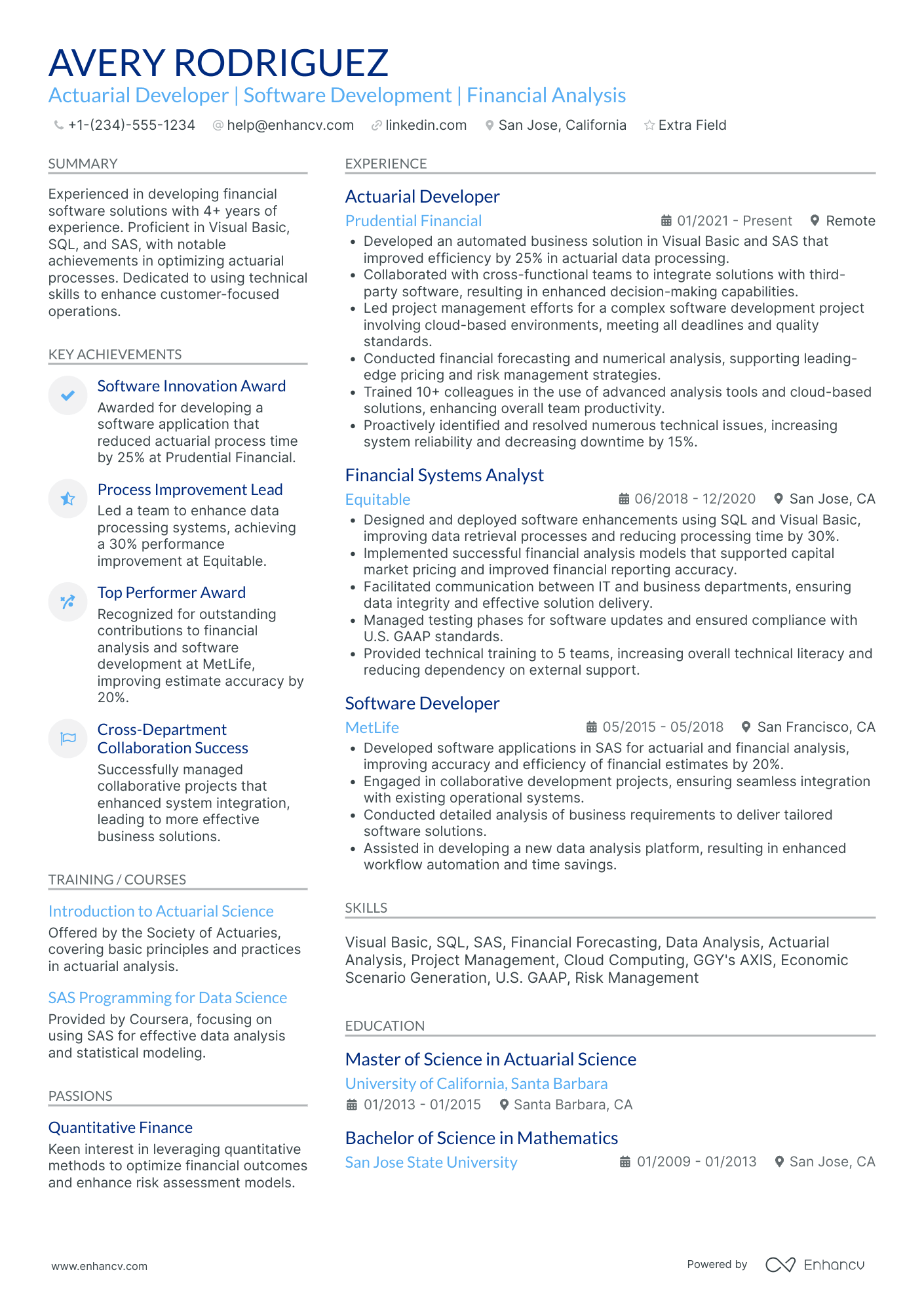

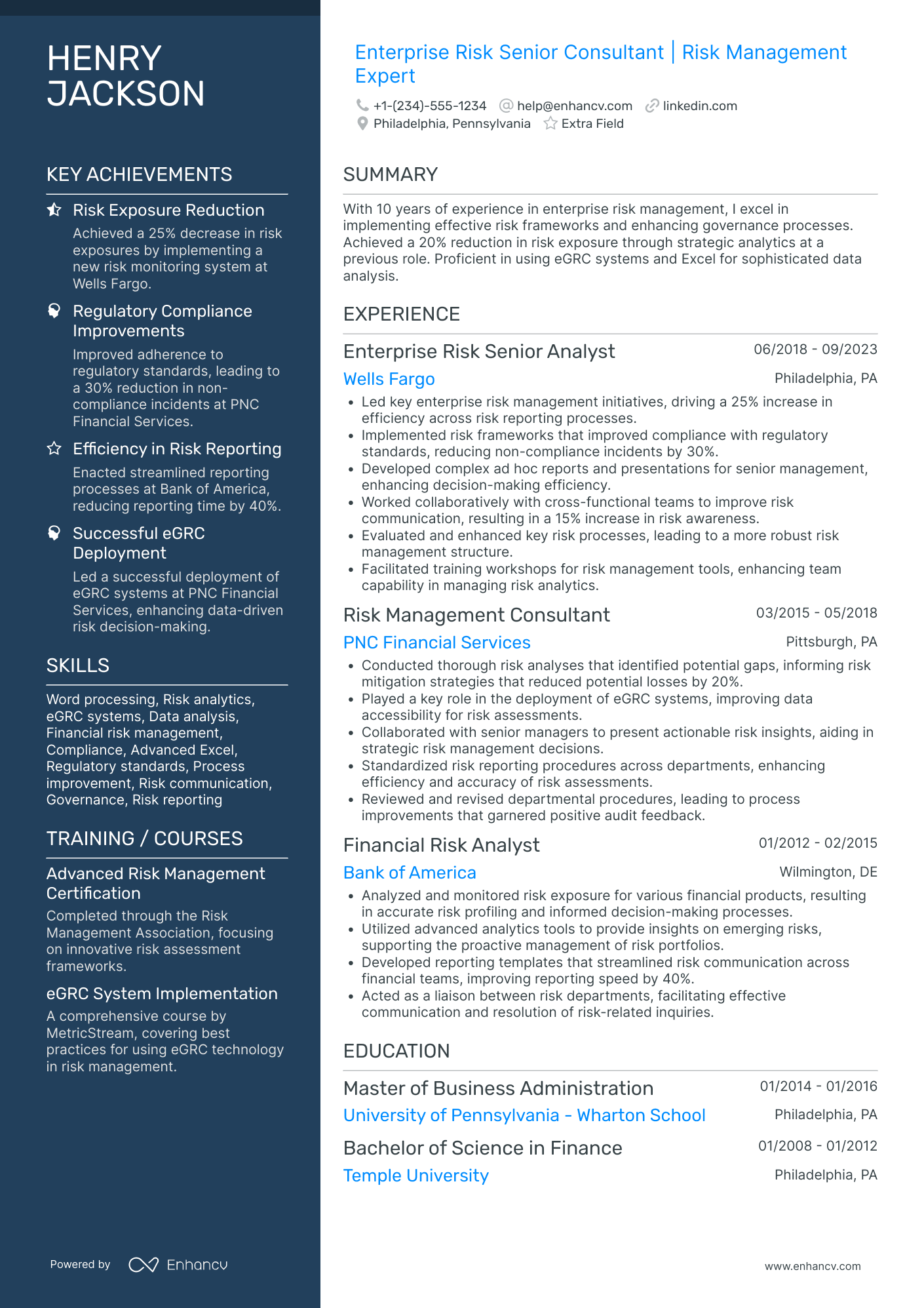

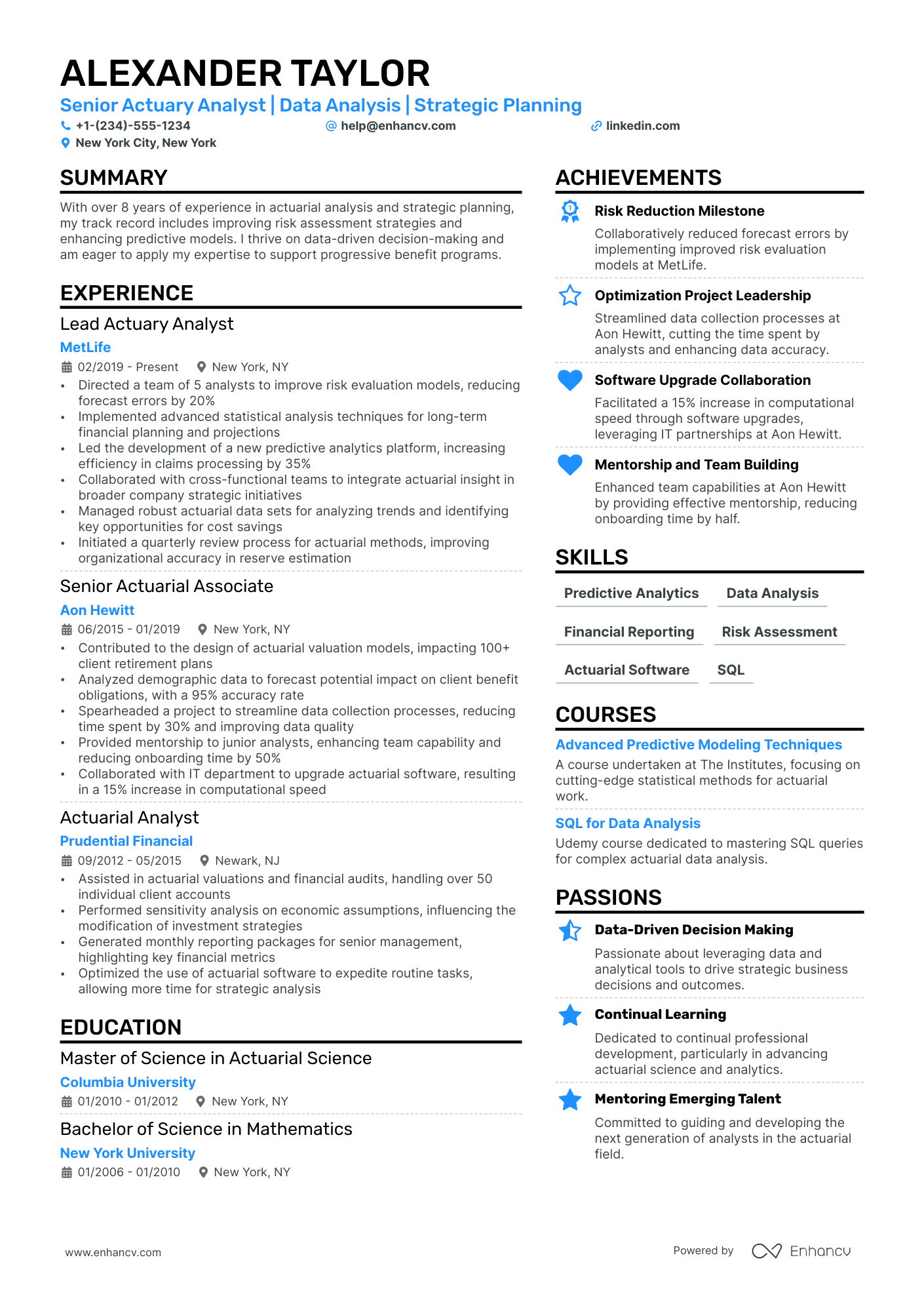

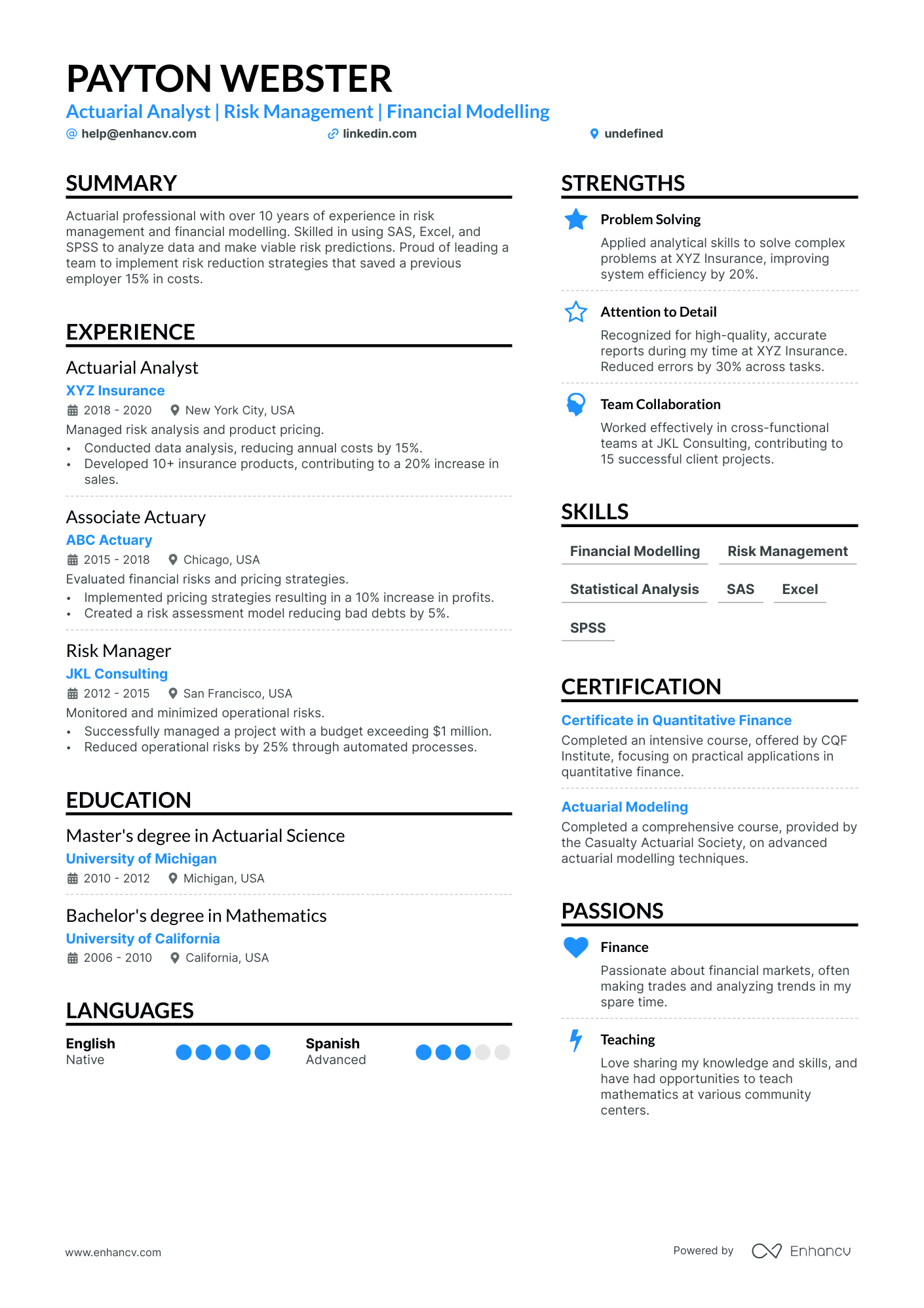

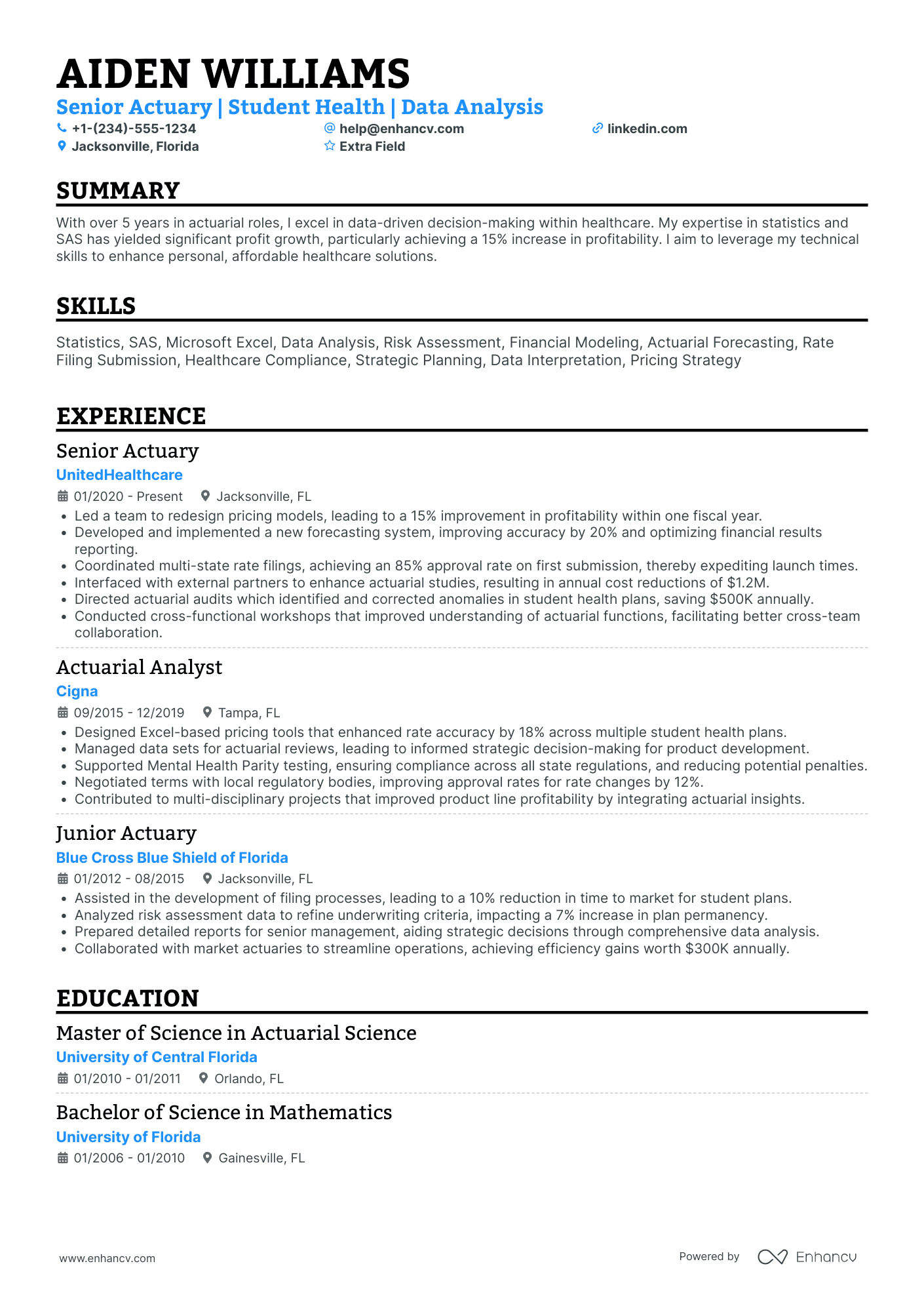

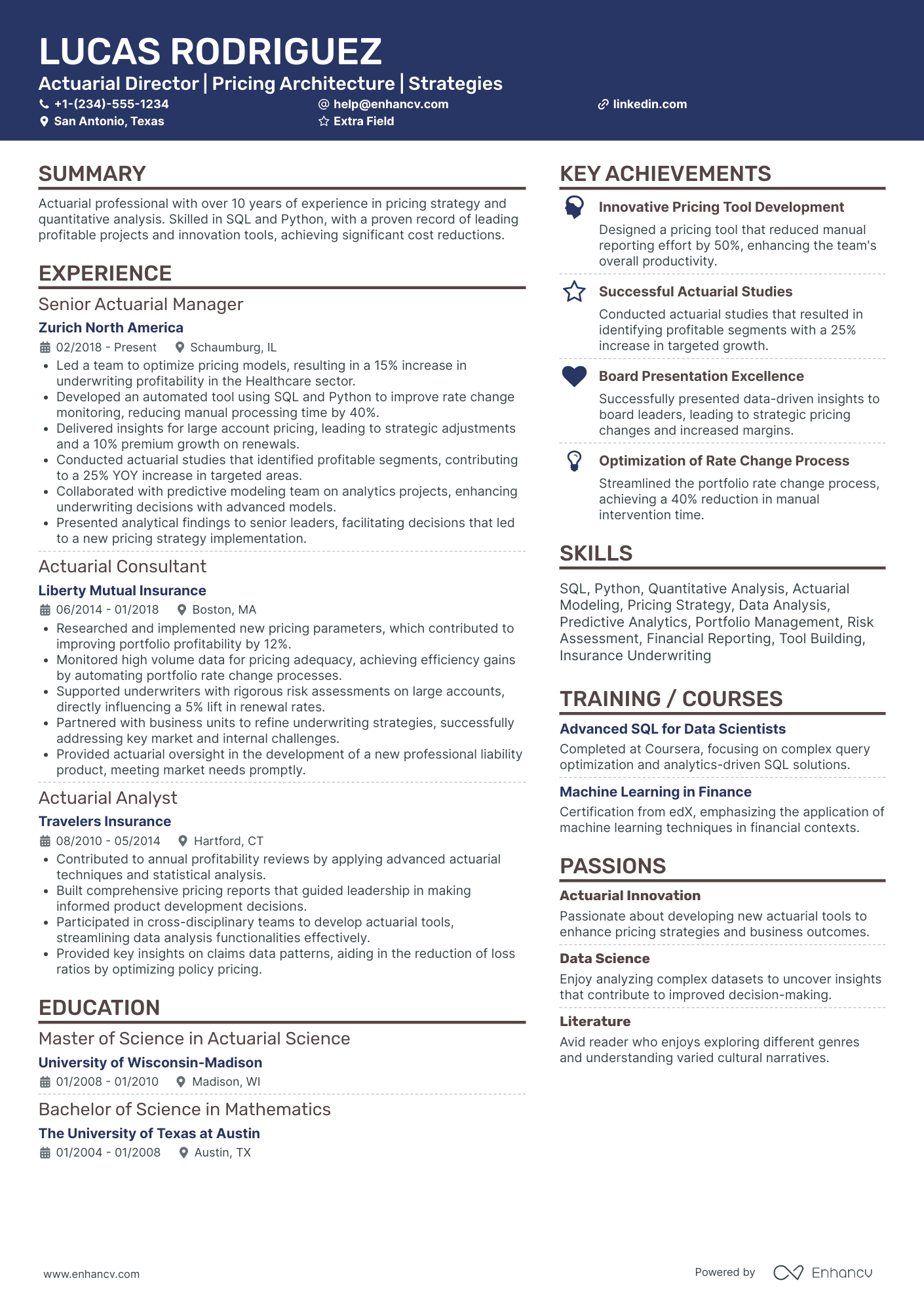

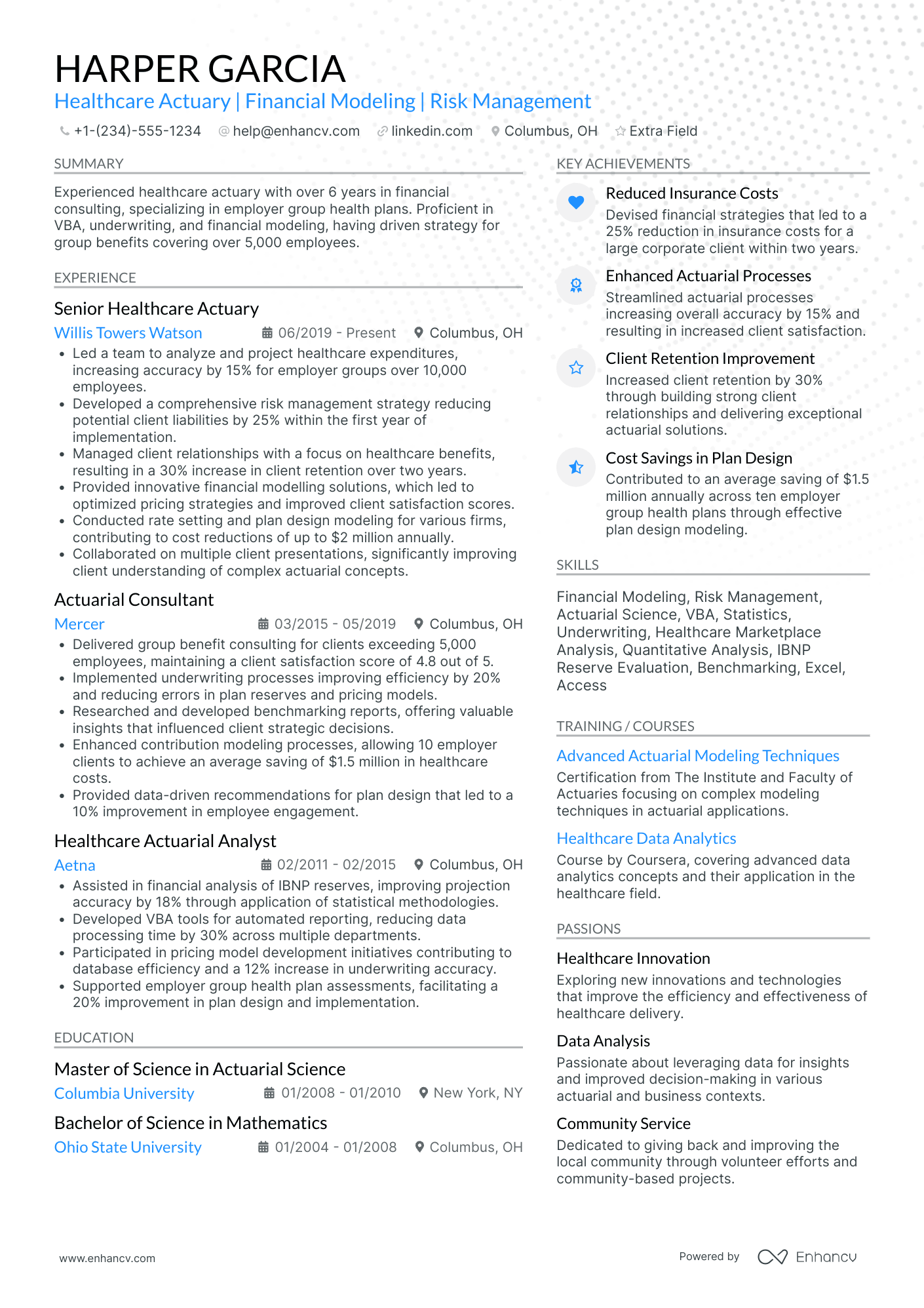

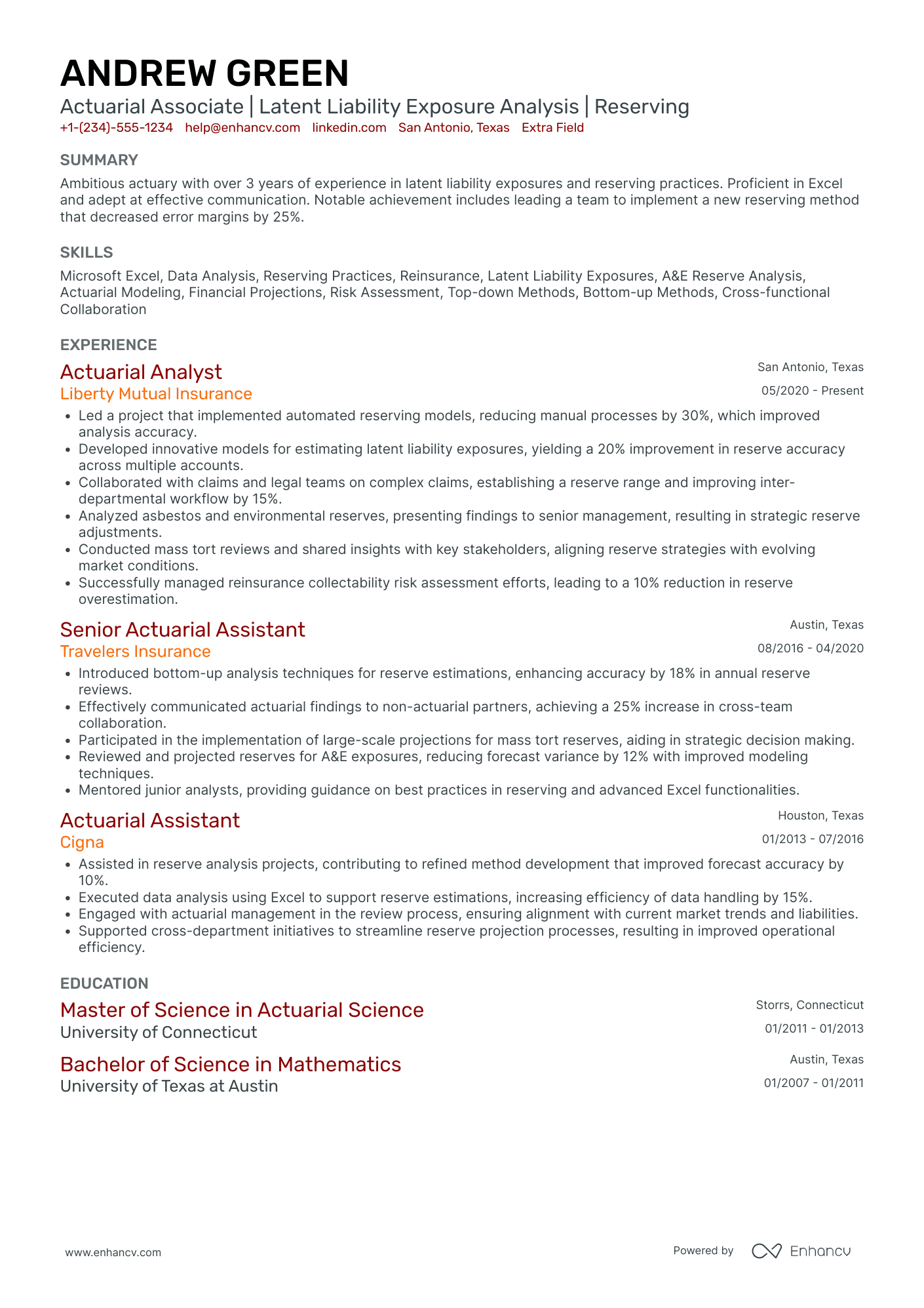

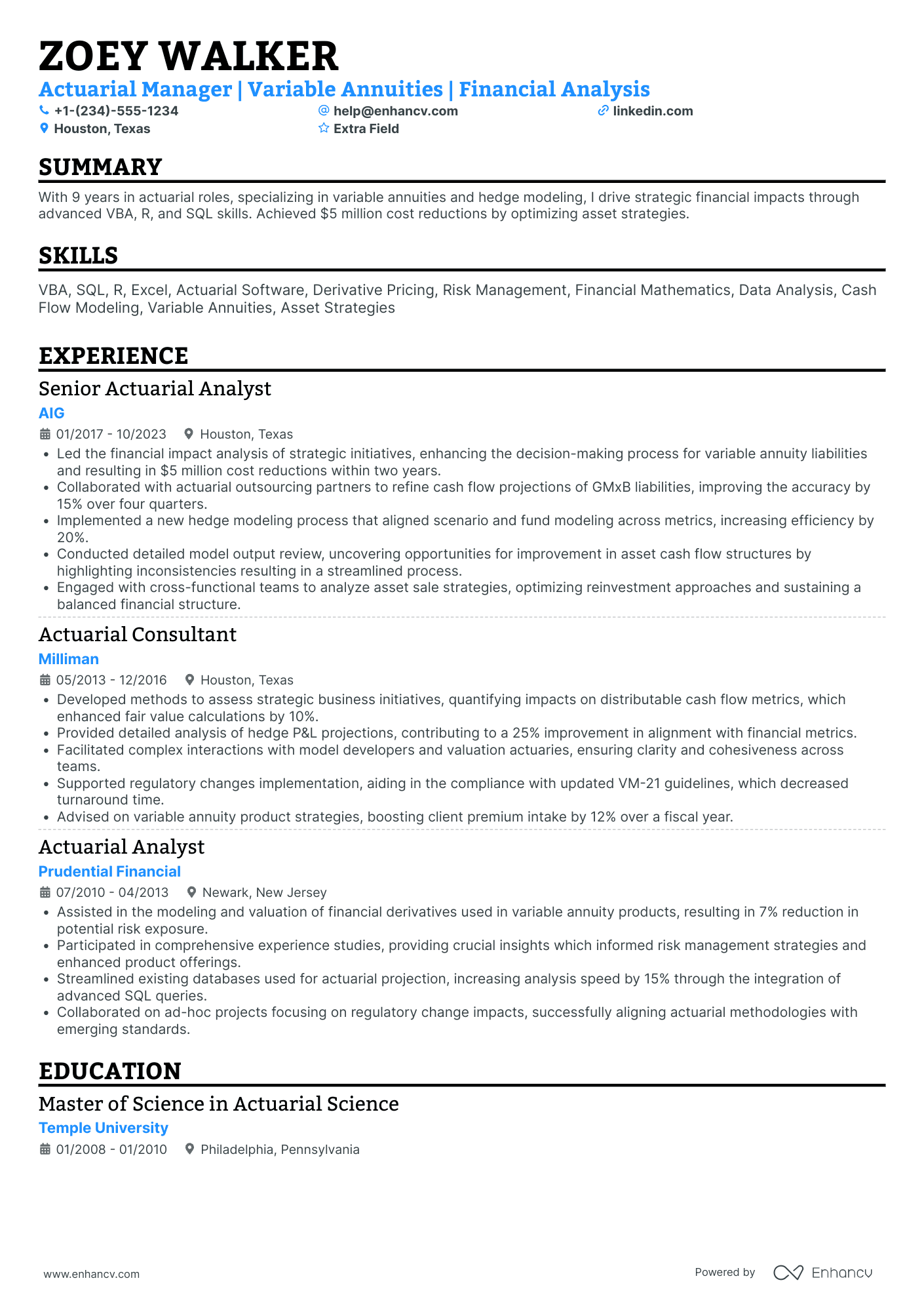

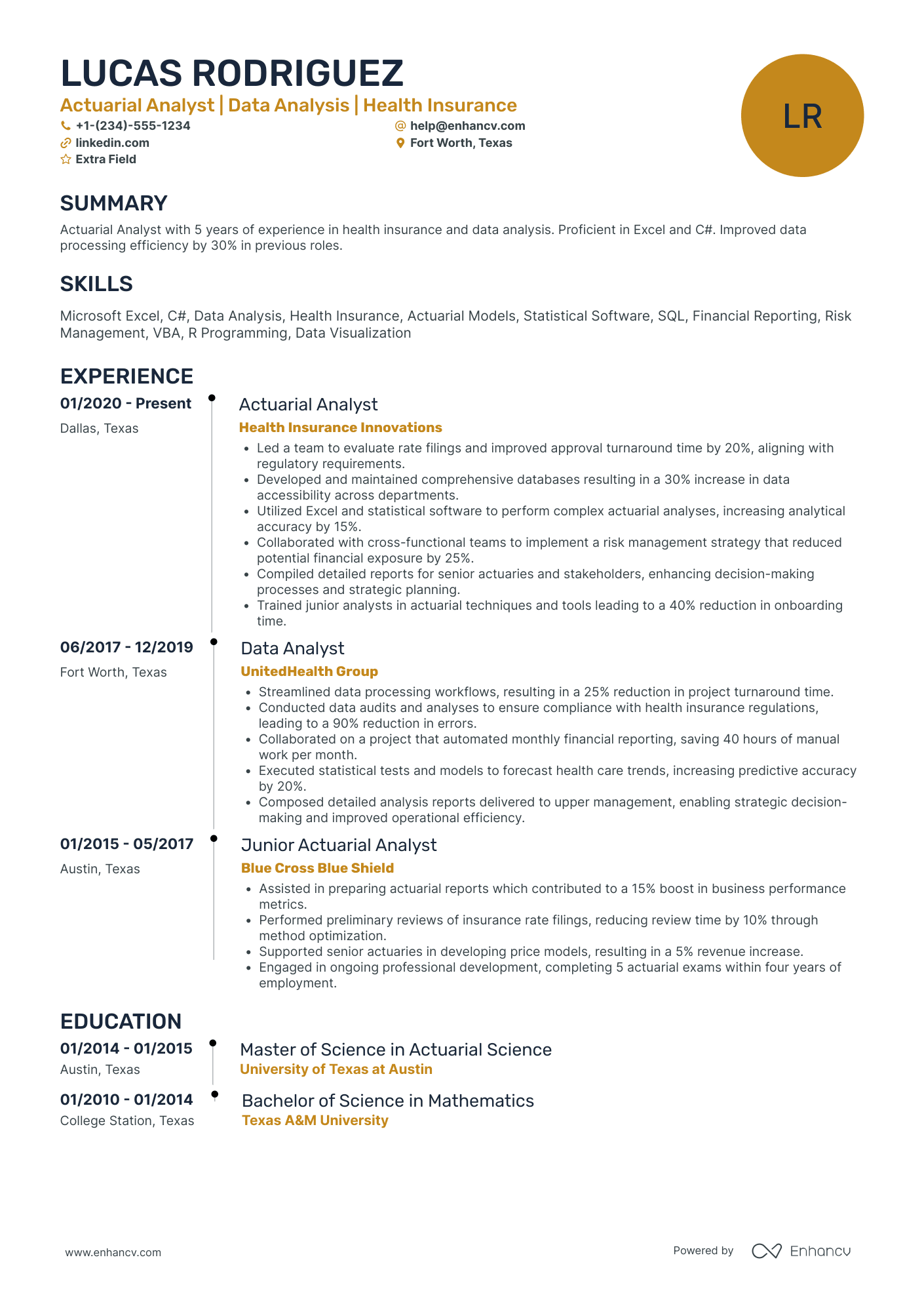

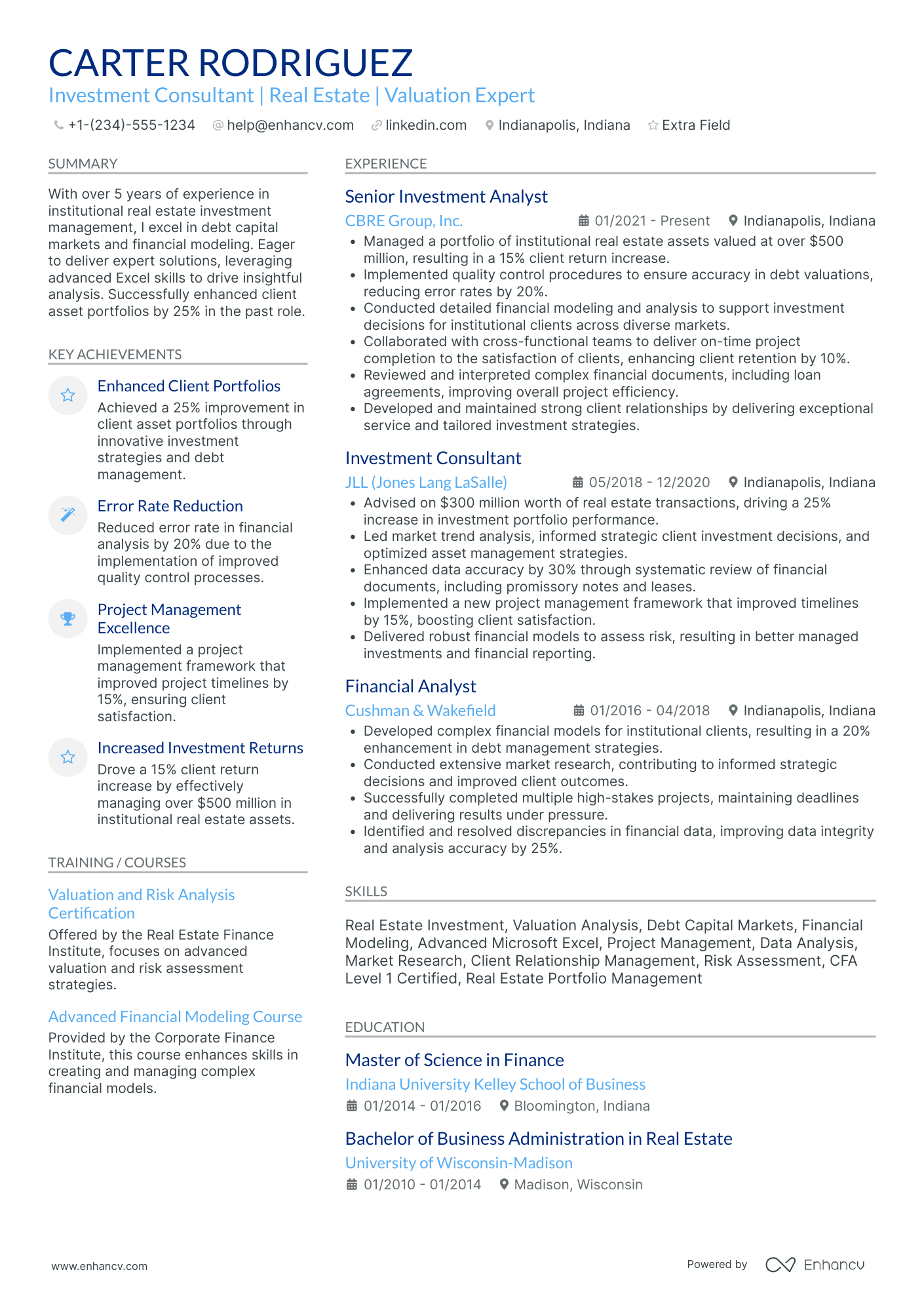

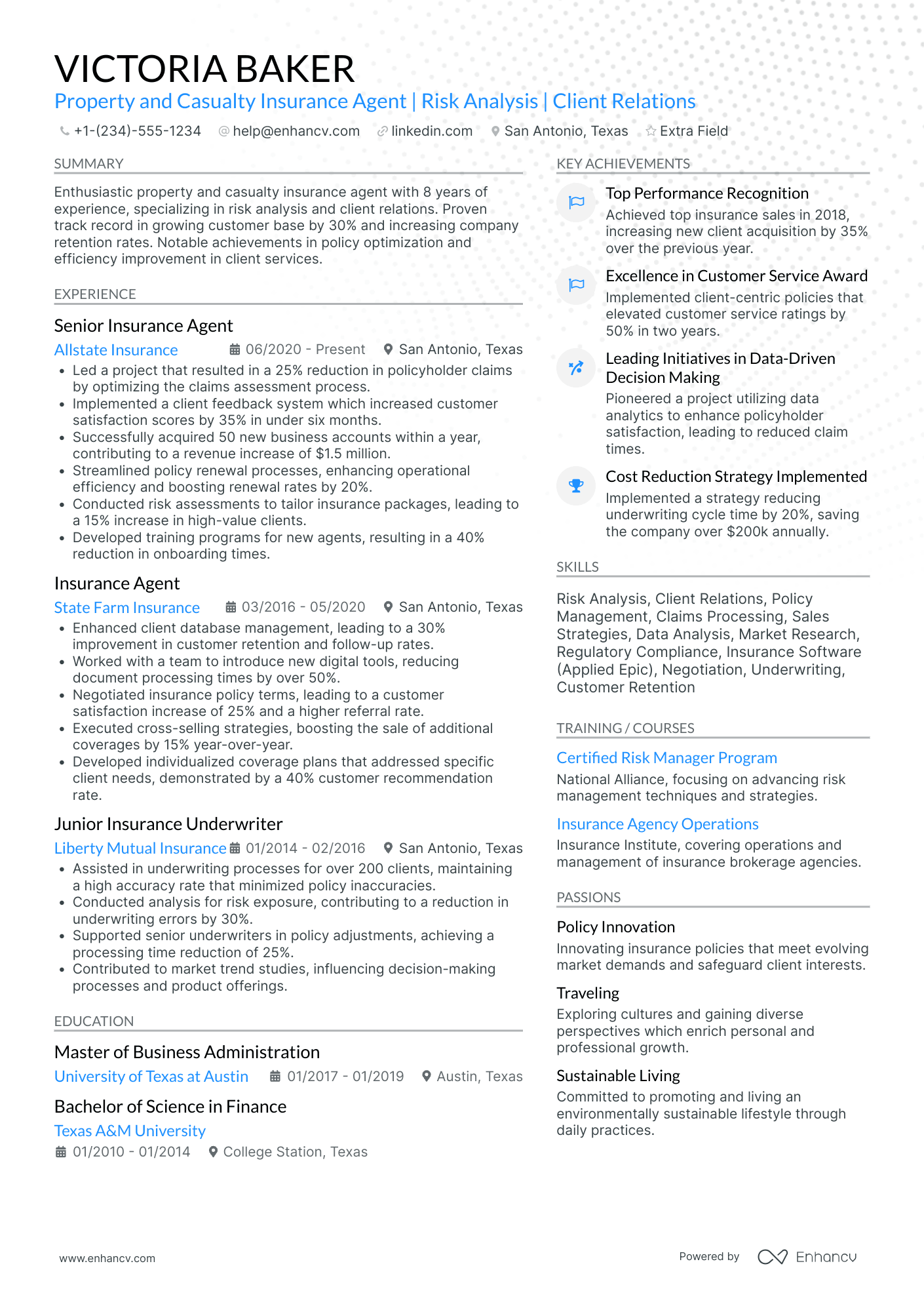

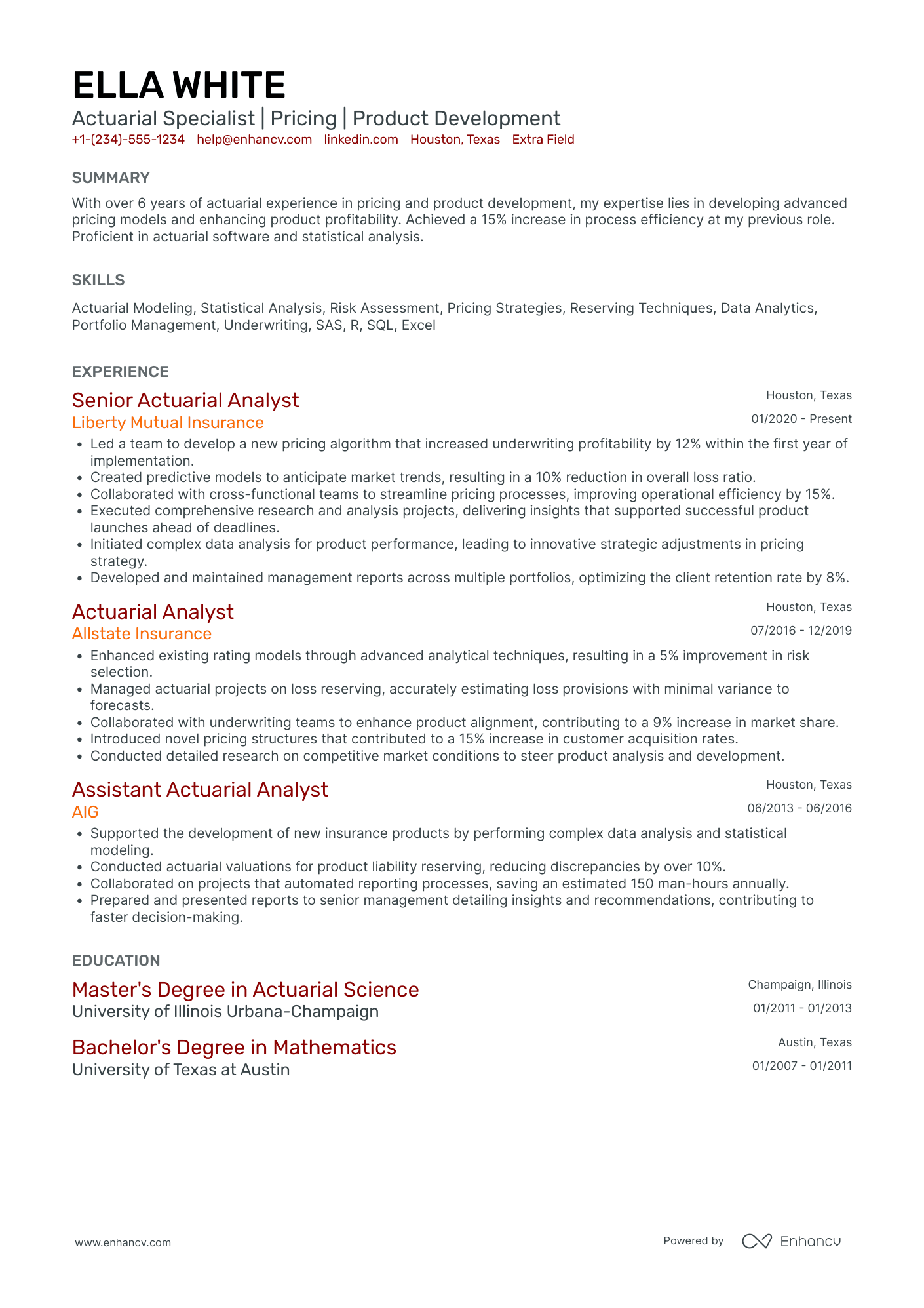

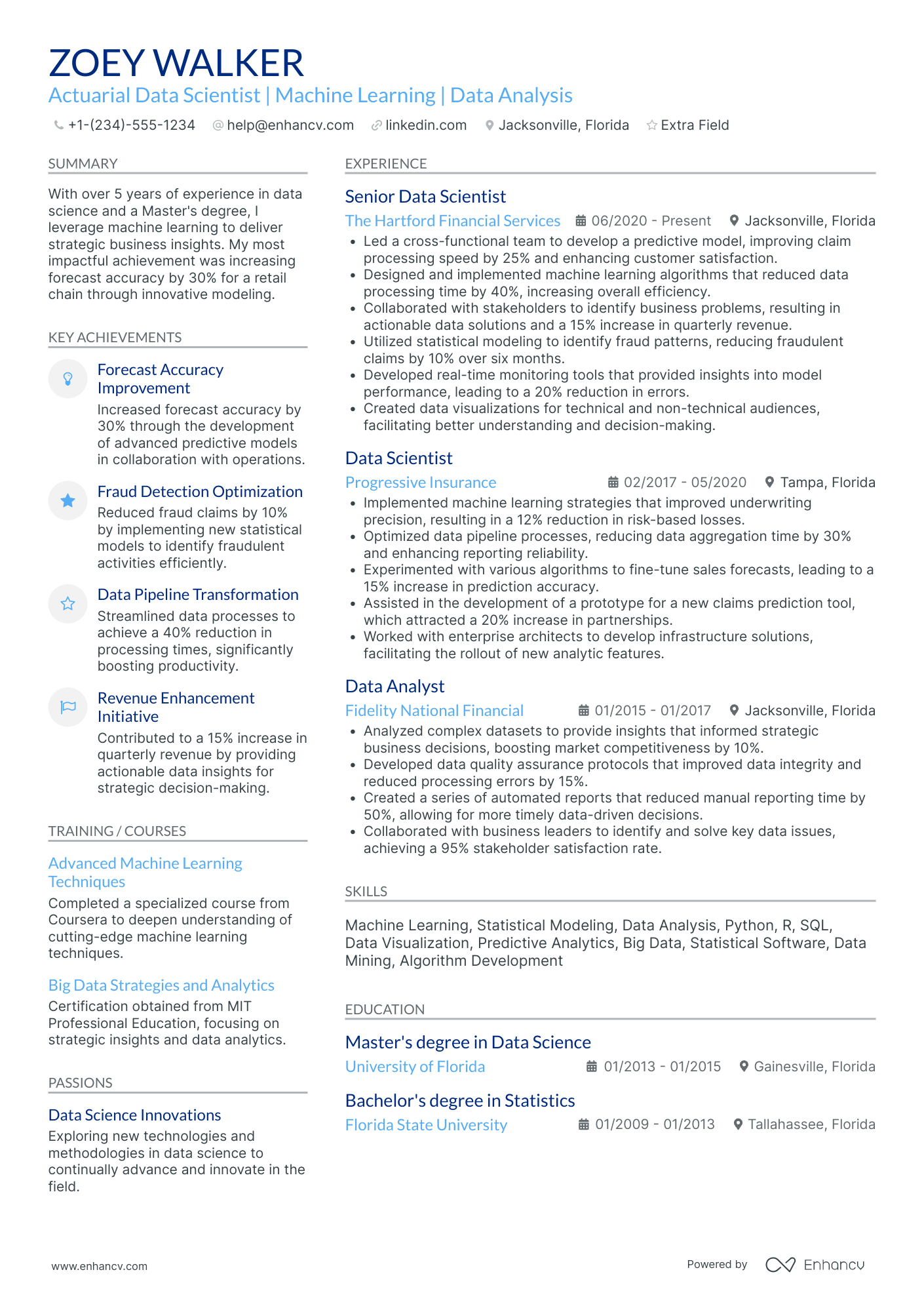

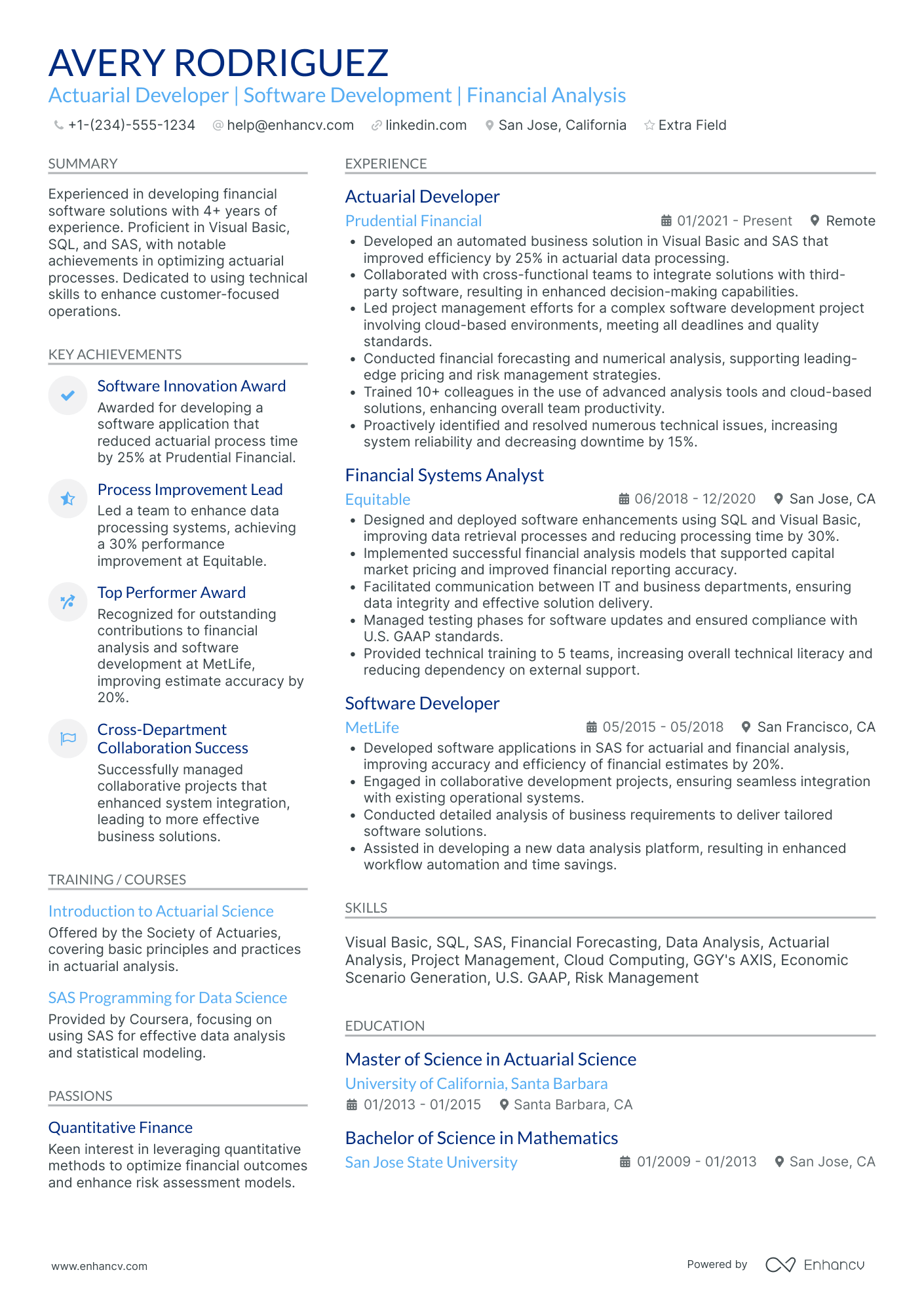

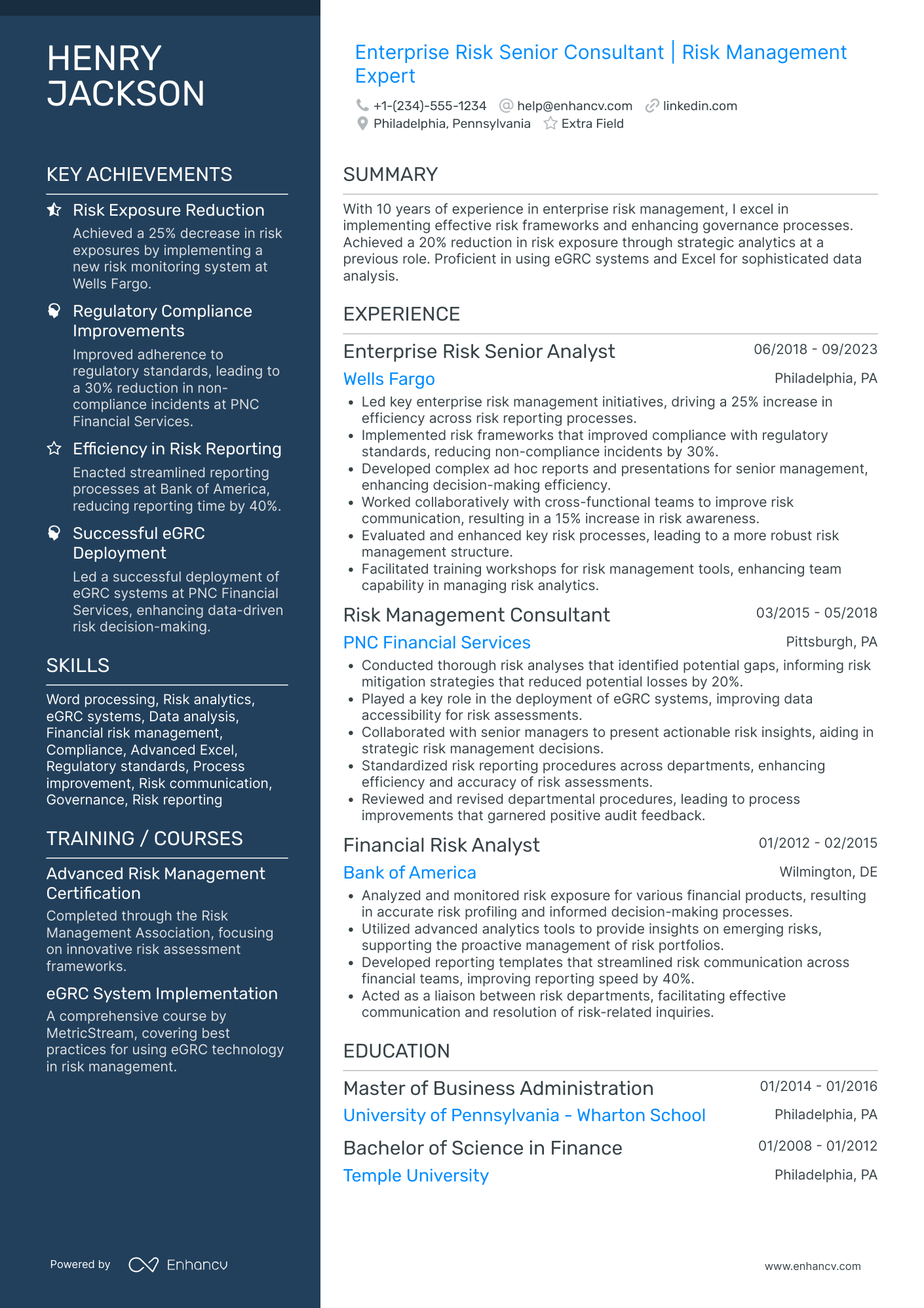

Actuary resume examples

By Experience

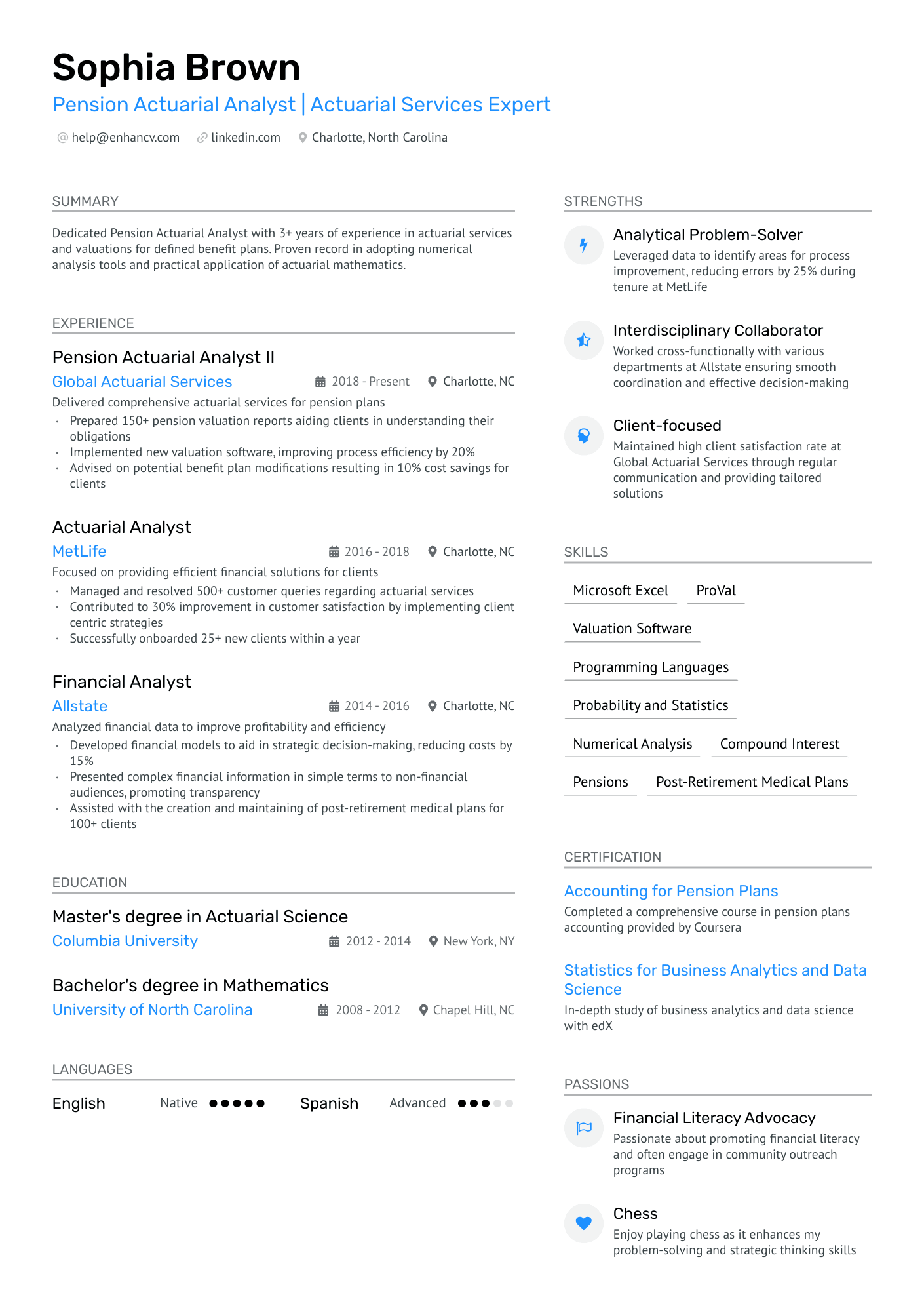

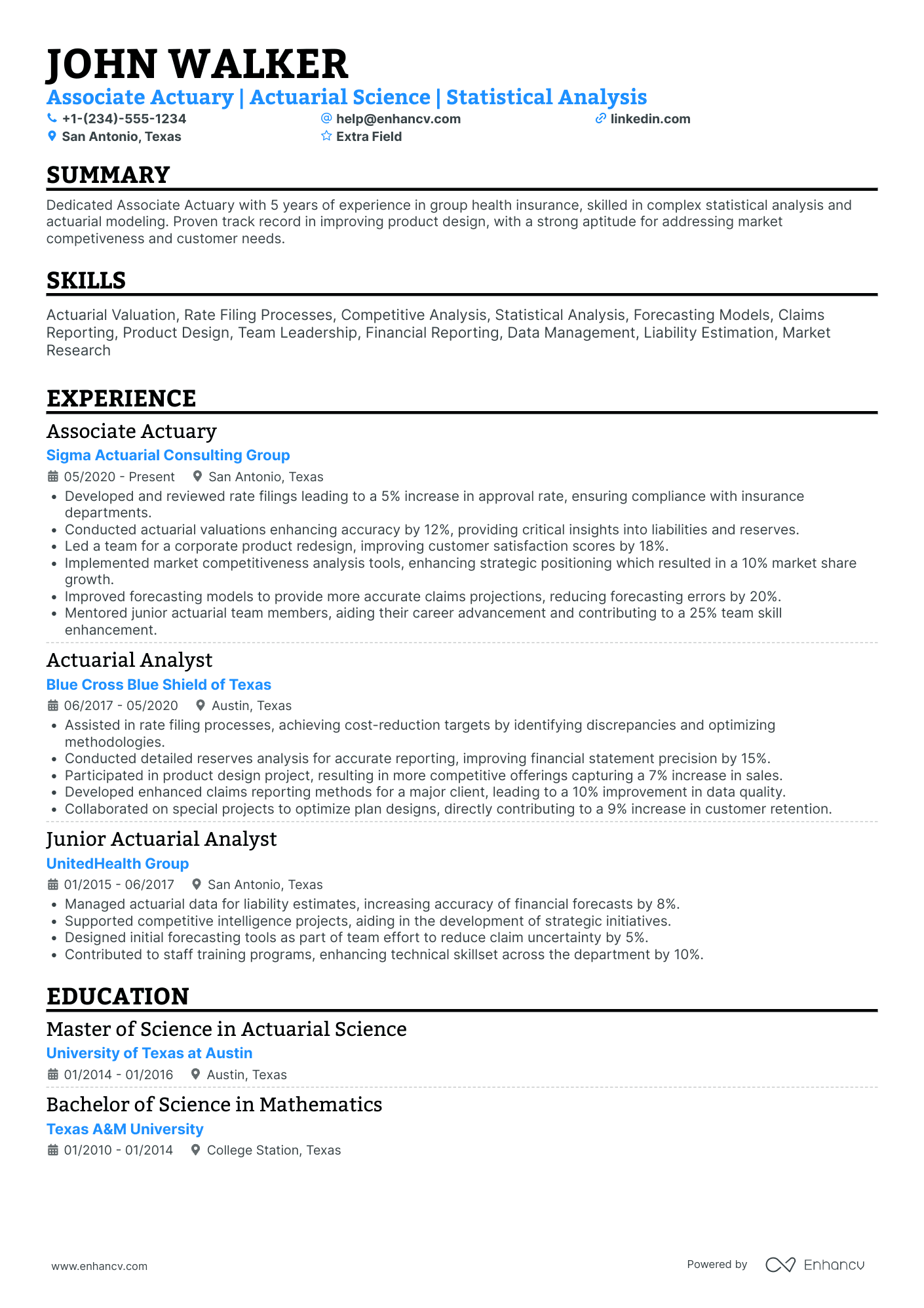

Entry Level Actuary

Actuary Internship

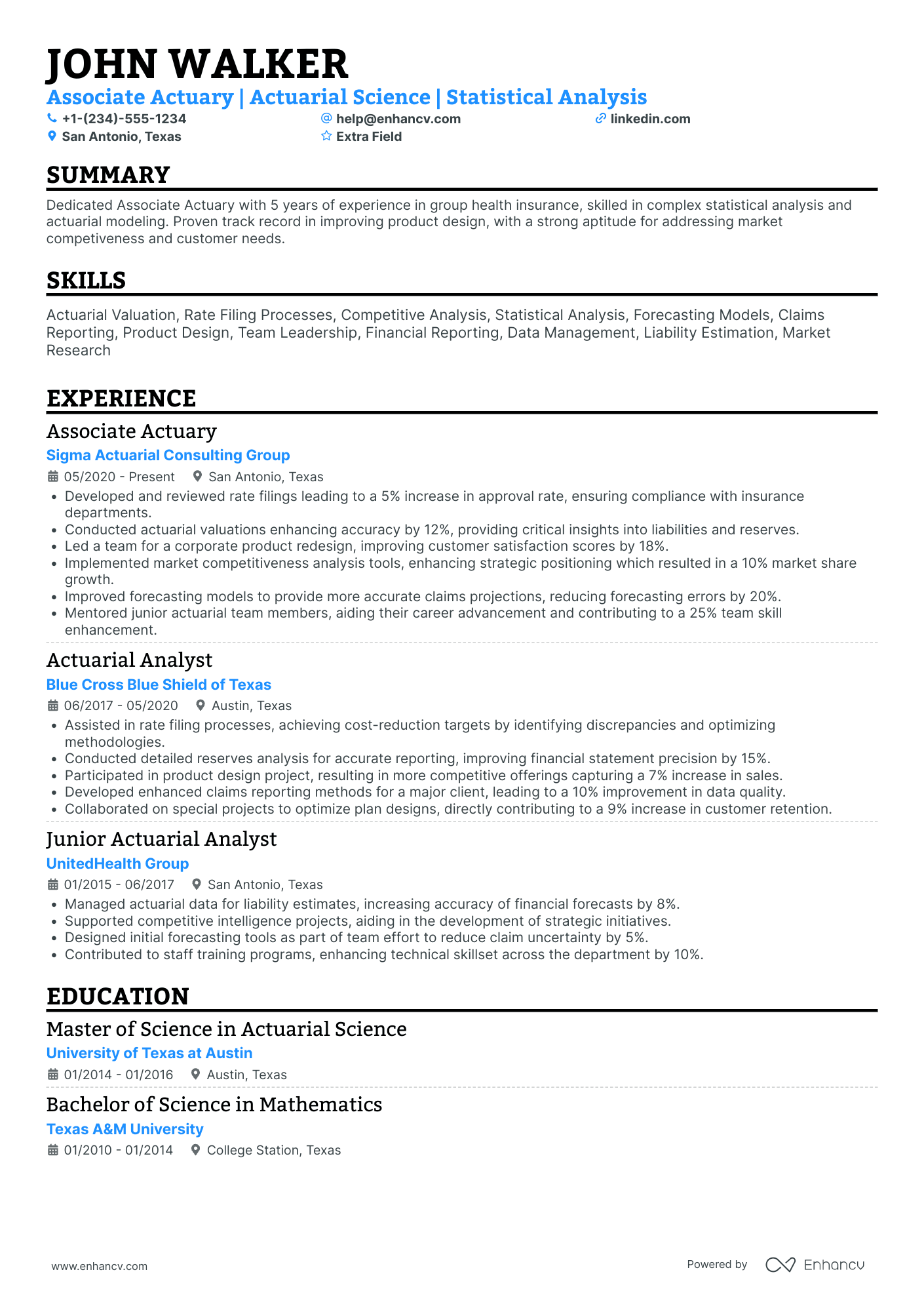

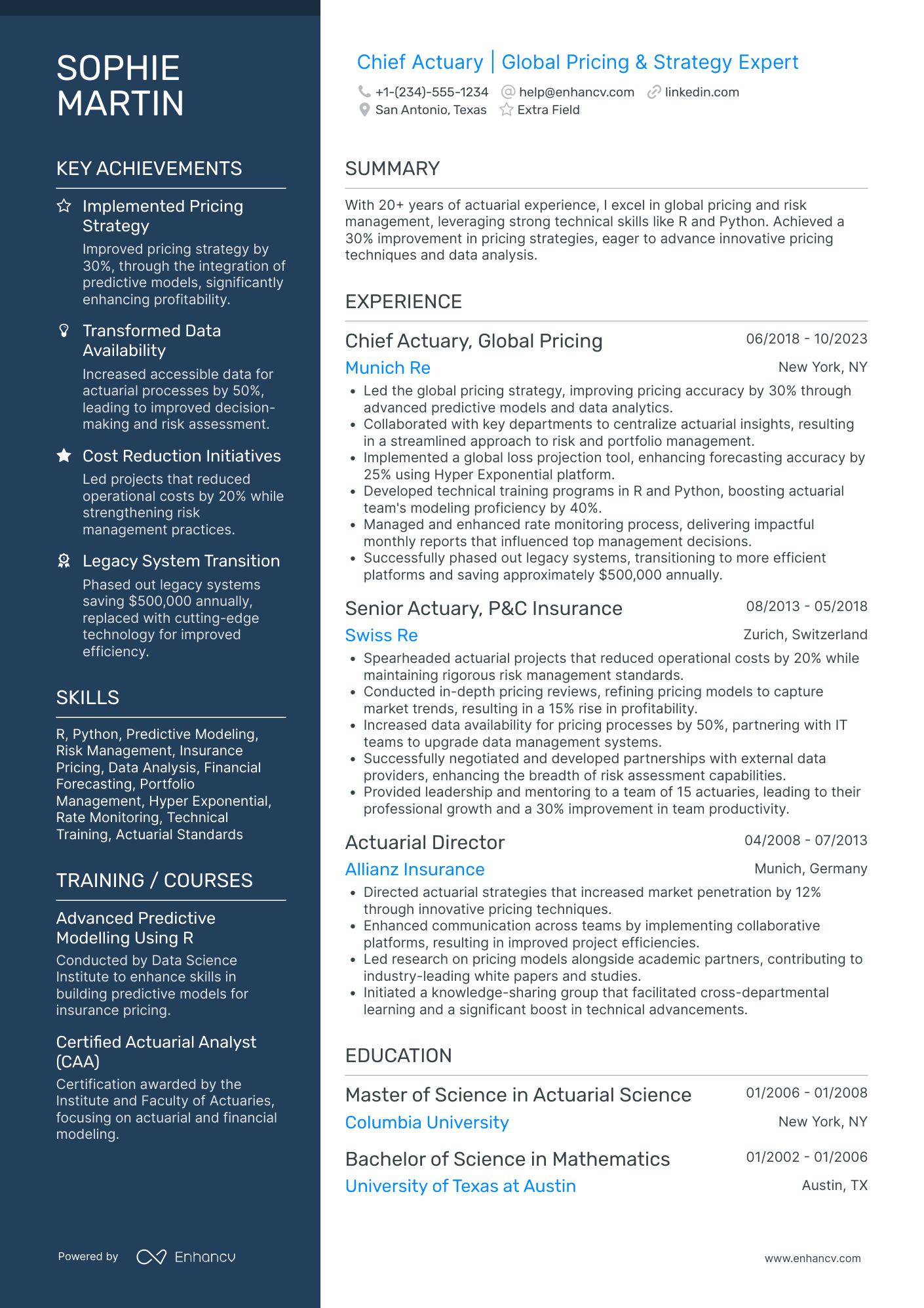

Experienced Actuary

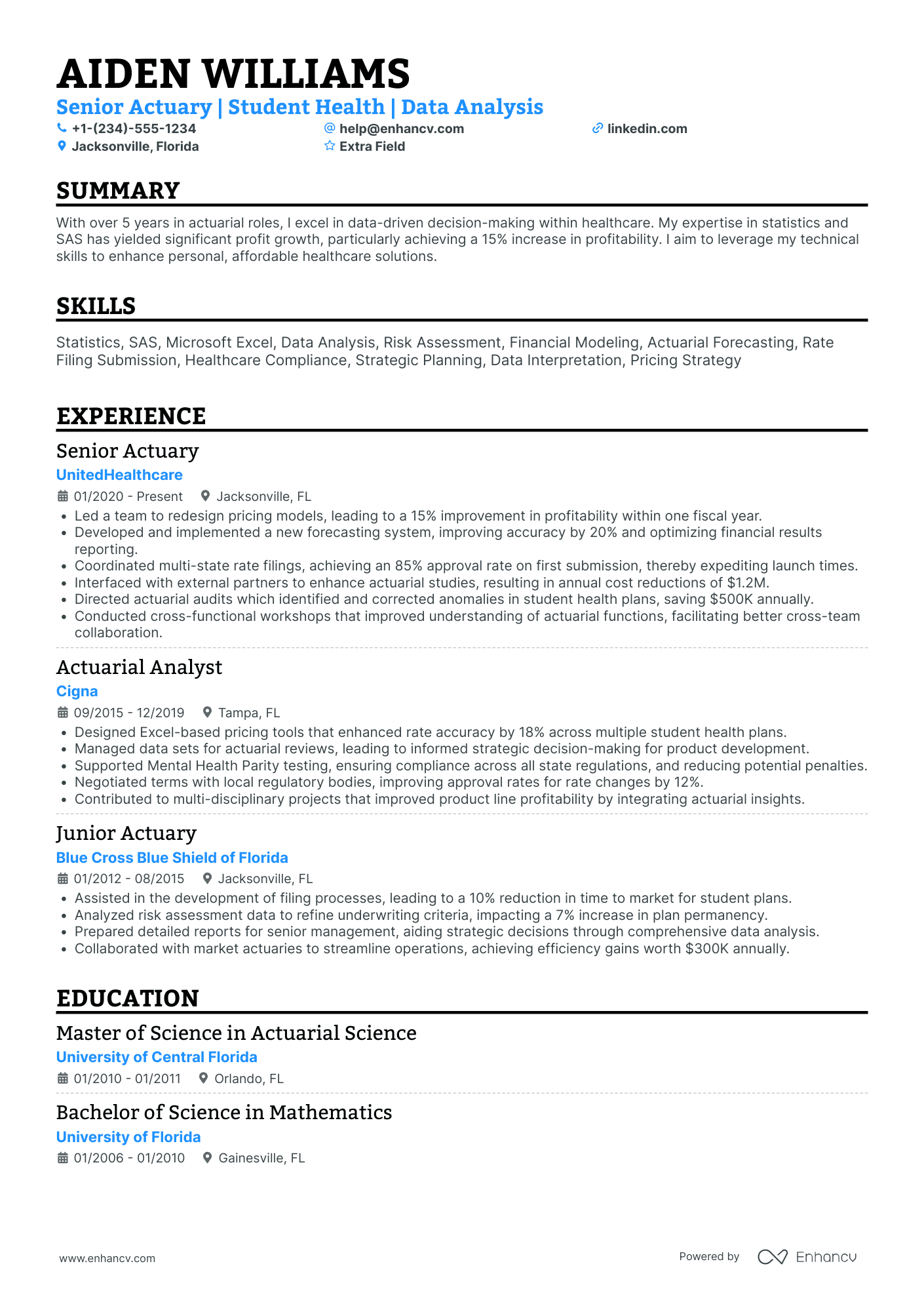

Senior Actuary

Entry-Level Actuary

Junior Actuary

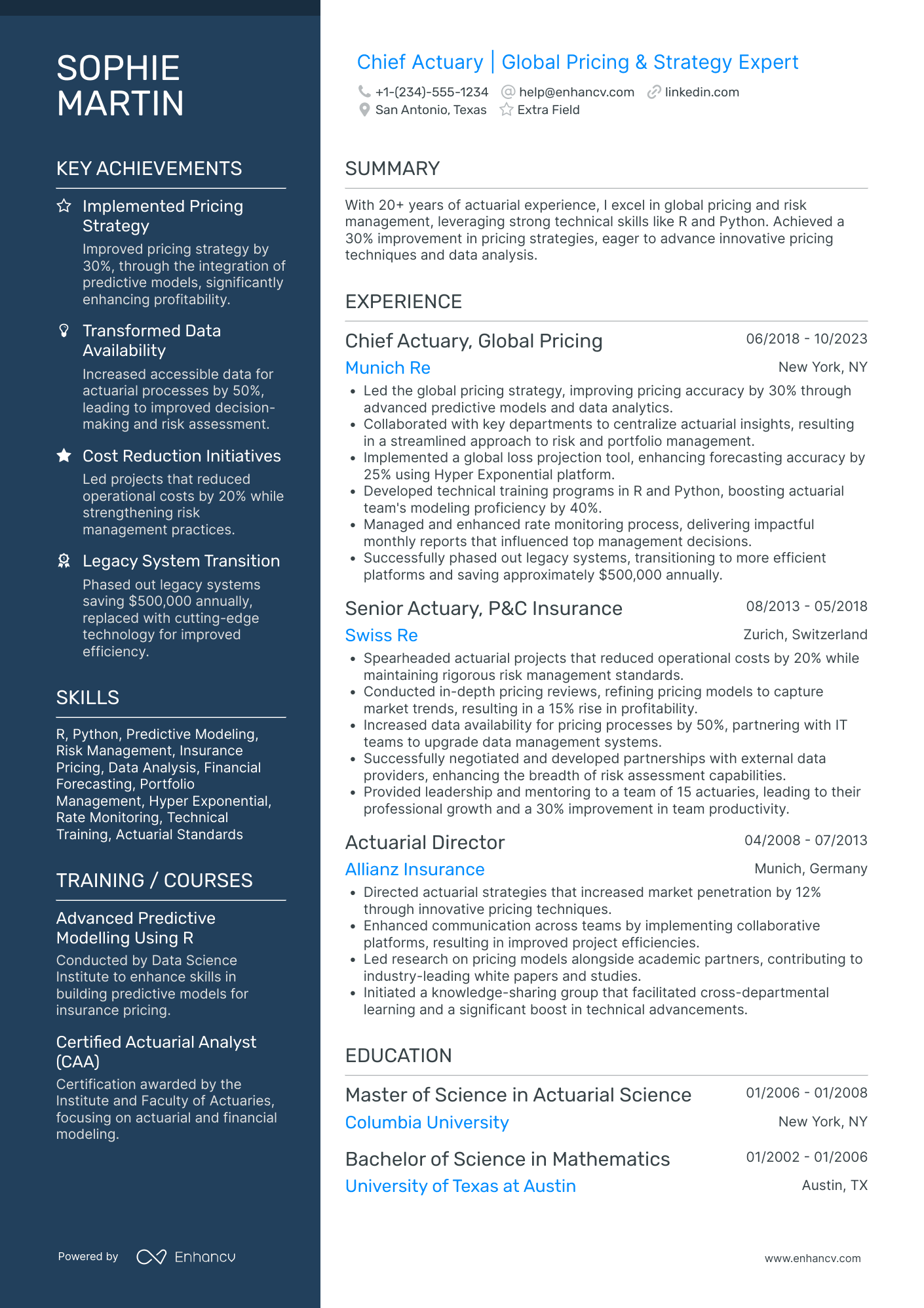

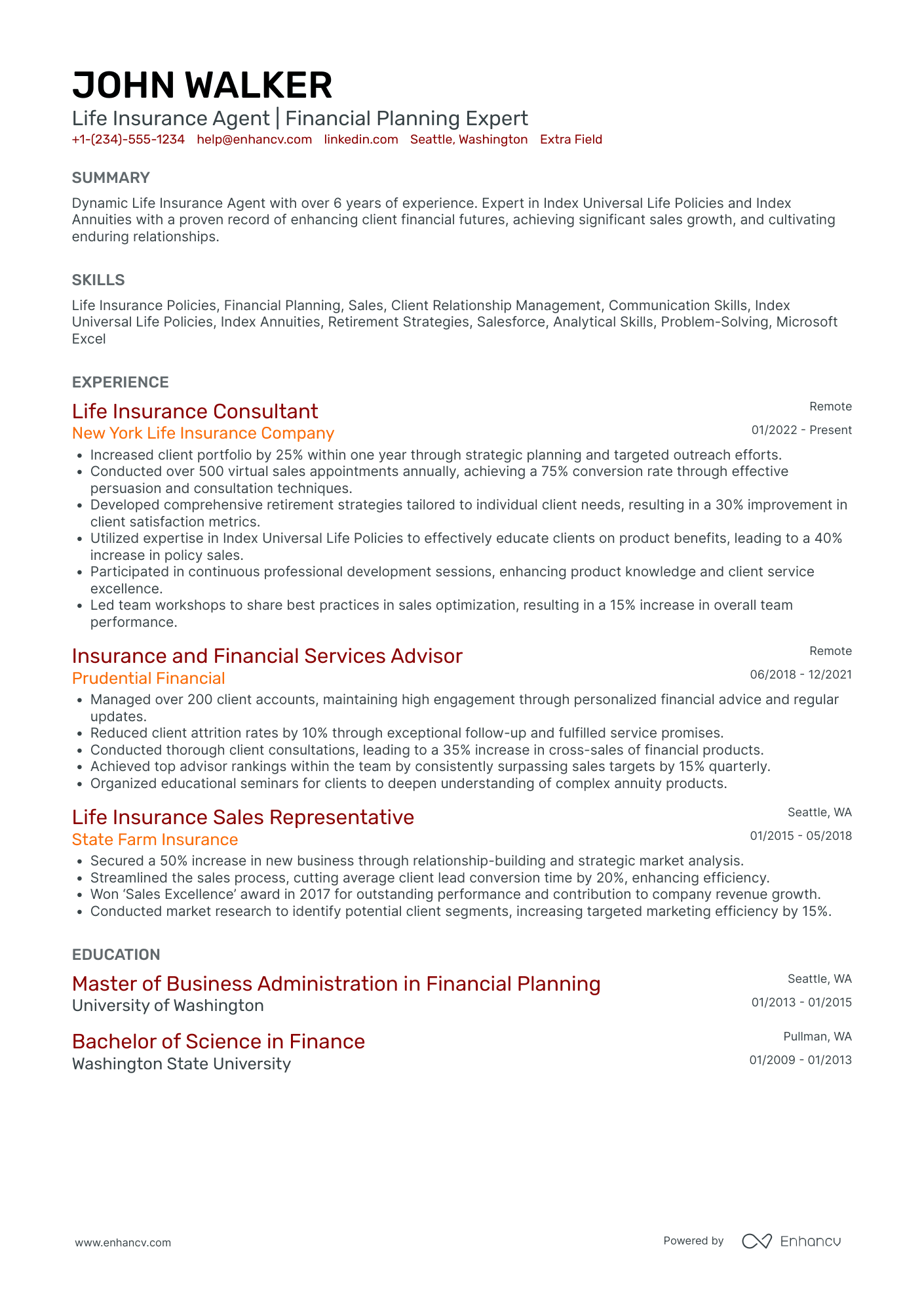

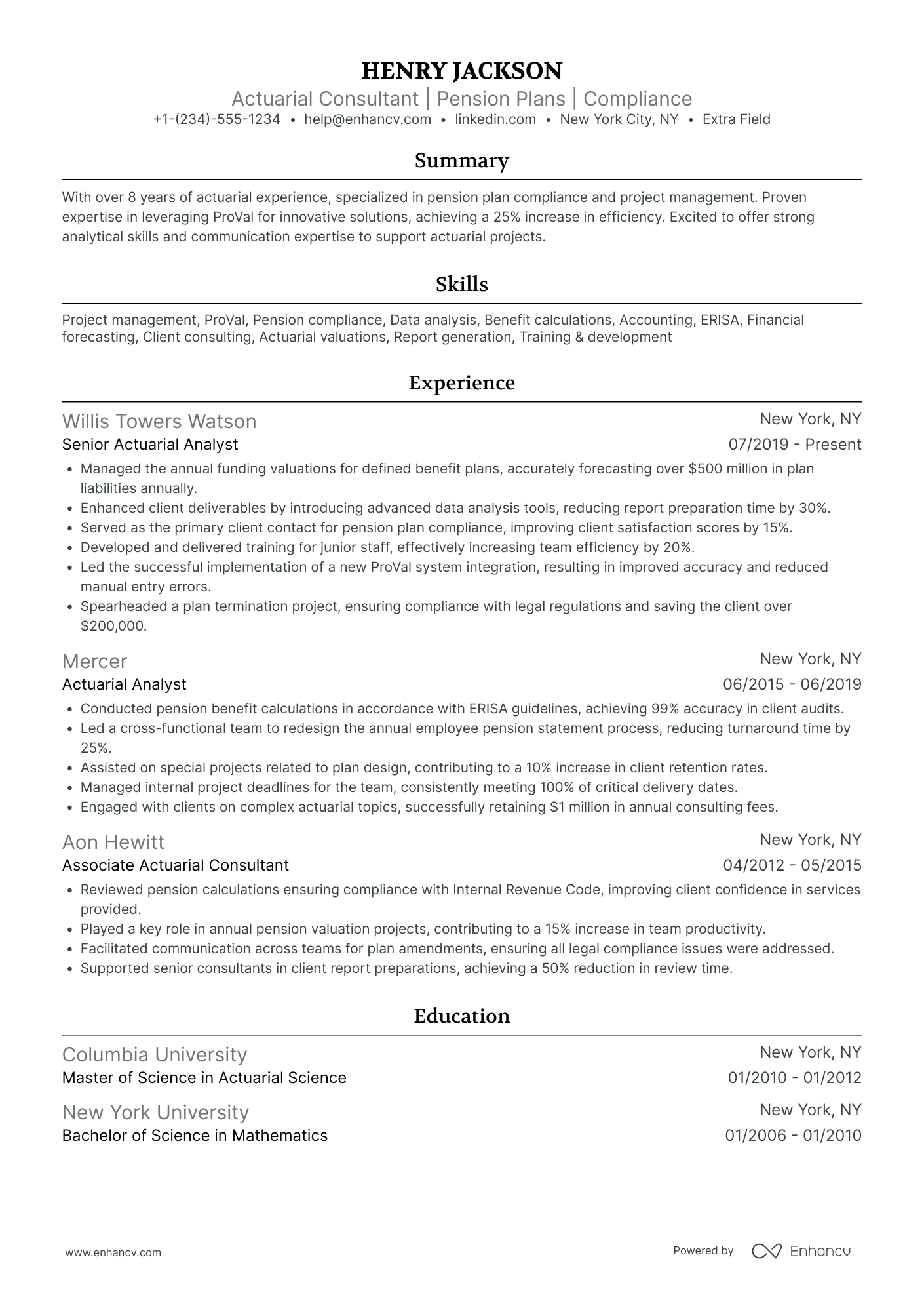

By Role