Ensuring your CV stands out in the highly competitive field of actuarial science is a significant challenge you might encounter. By following our guide, you'll learn to effectively highlight your analytical skills and industry experience, thus enhancing your chances of securing the desired role.

- Answer job requirements with your actuary CV and experience;

- Curate your academic background and certificates, following industry-leading CV examples;

- Select from +10 niche skills to match the ideal candidate profile

- Write a more succinct experience section that consists of all the right details.

Do you need more specific insights into writing your actuary CV? Our guides focus on unique insights for each individual role:

Resume examples for actuary

By Experience

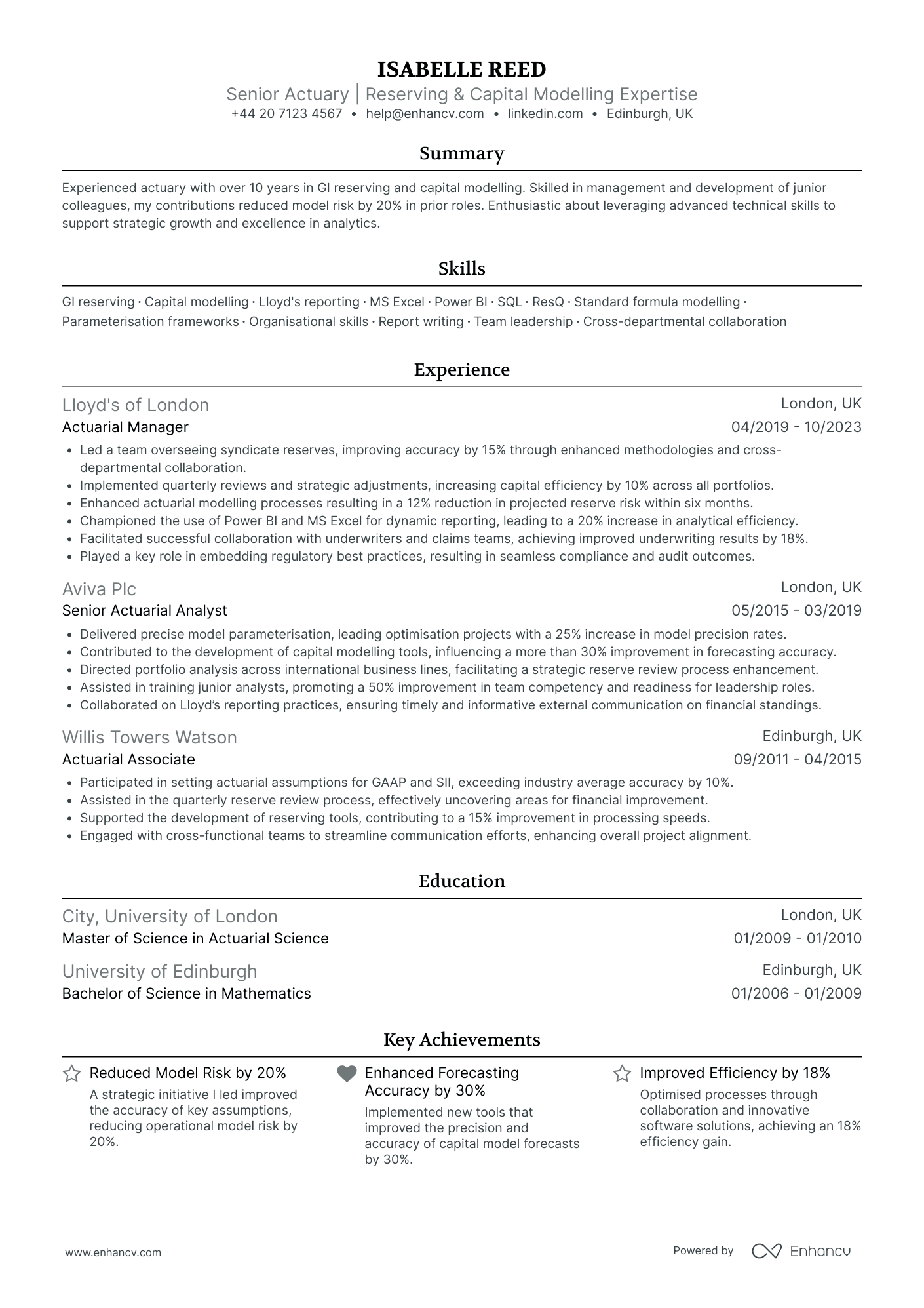

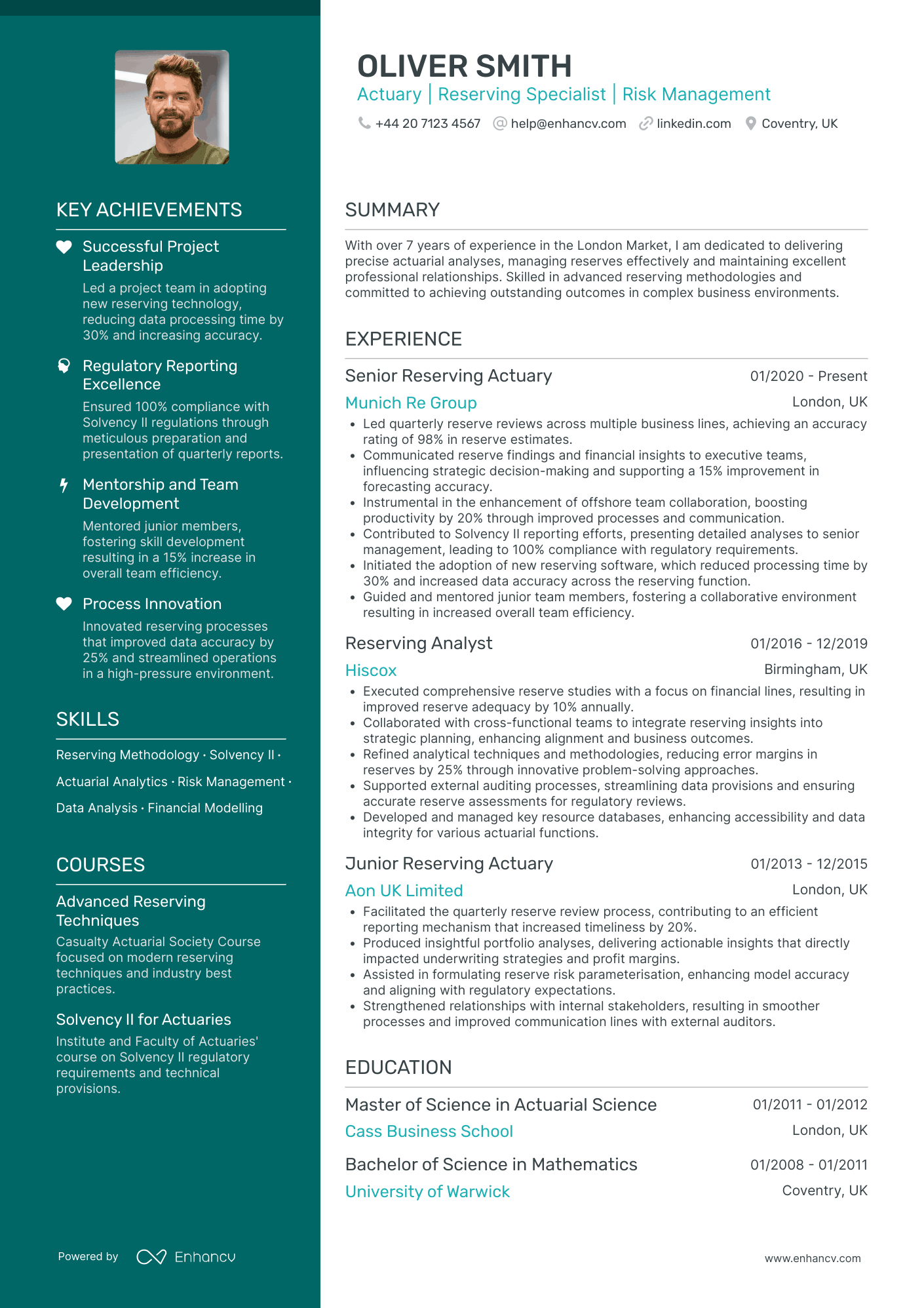

Senior Actuary

- Structured clarity with comprehensive details - Isabelle Reed's CV is well-structured with clear sections that systematically highlight her qualifications, experience, and expertise in actuarial science. Each section is concise yet comprehensive, providing a thorough understanding of her career path and skill set, which is essential for senior-level roles.

- Progressive career trajectory in actuarial roles - Isabelle's career progression from Actuarial Associate to Senior Actuarial Analyst, and finally to Actuarial Manager, illustrates a clear upward trajectory within prominent companies like Lloyd's of London and Aviva Plc. This progression demonstrates her capability for leadership and increasing responsibility, reflecting her growth and commitment to the actuarial profession.

- Industry-specific technical proficiency - The CV showcases Isabelle's proficiency with industry-specific tools such as ResQ, Power BI, and MS Excel, as well as methodologies like GAAP and SII that are critical for capital modelling and reserving. Her experience with these tools and techniques solidifies her technical expertise, crucial for delivering strategic improvements in her field.

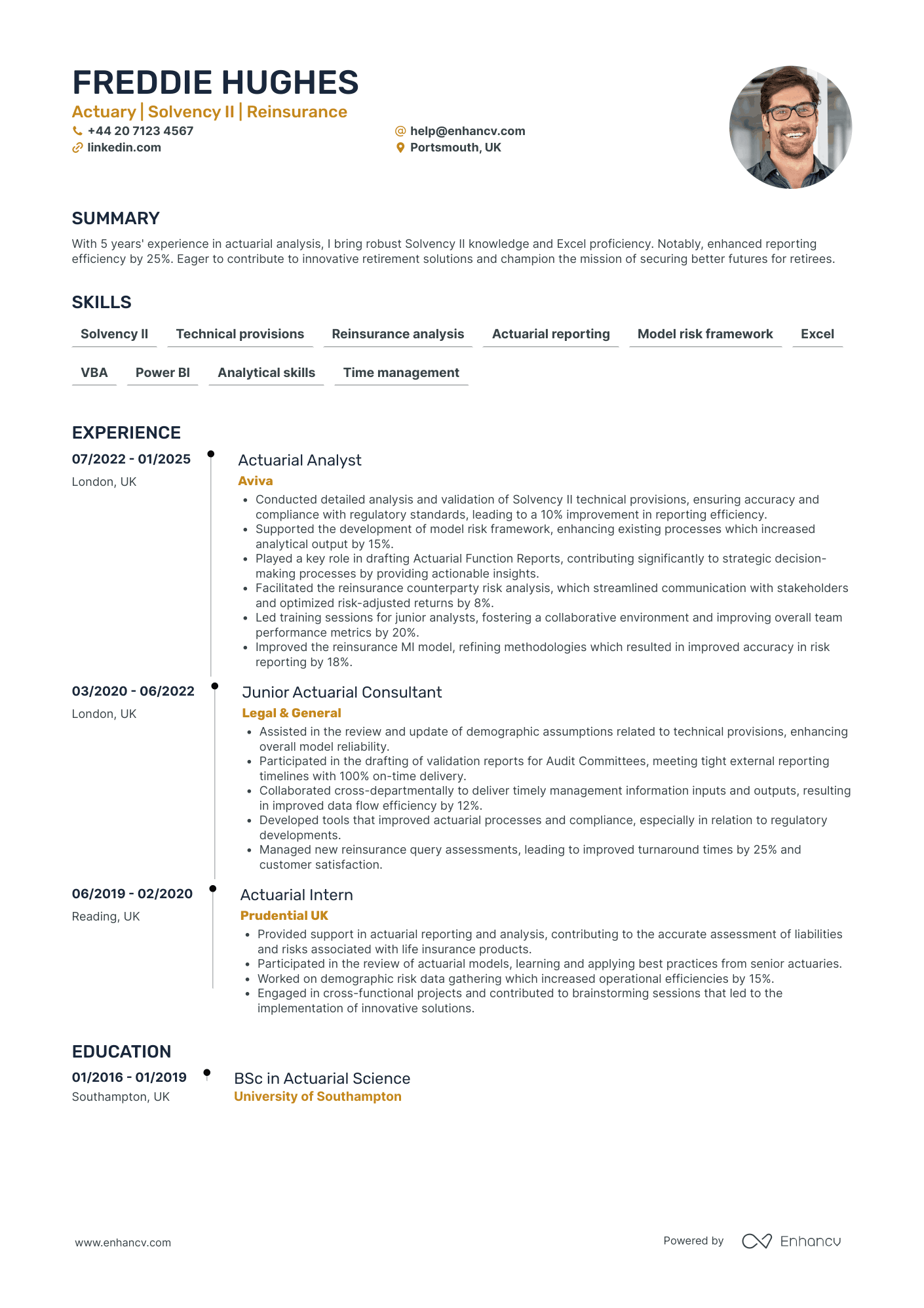

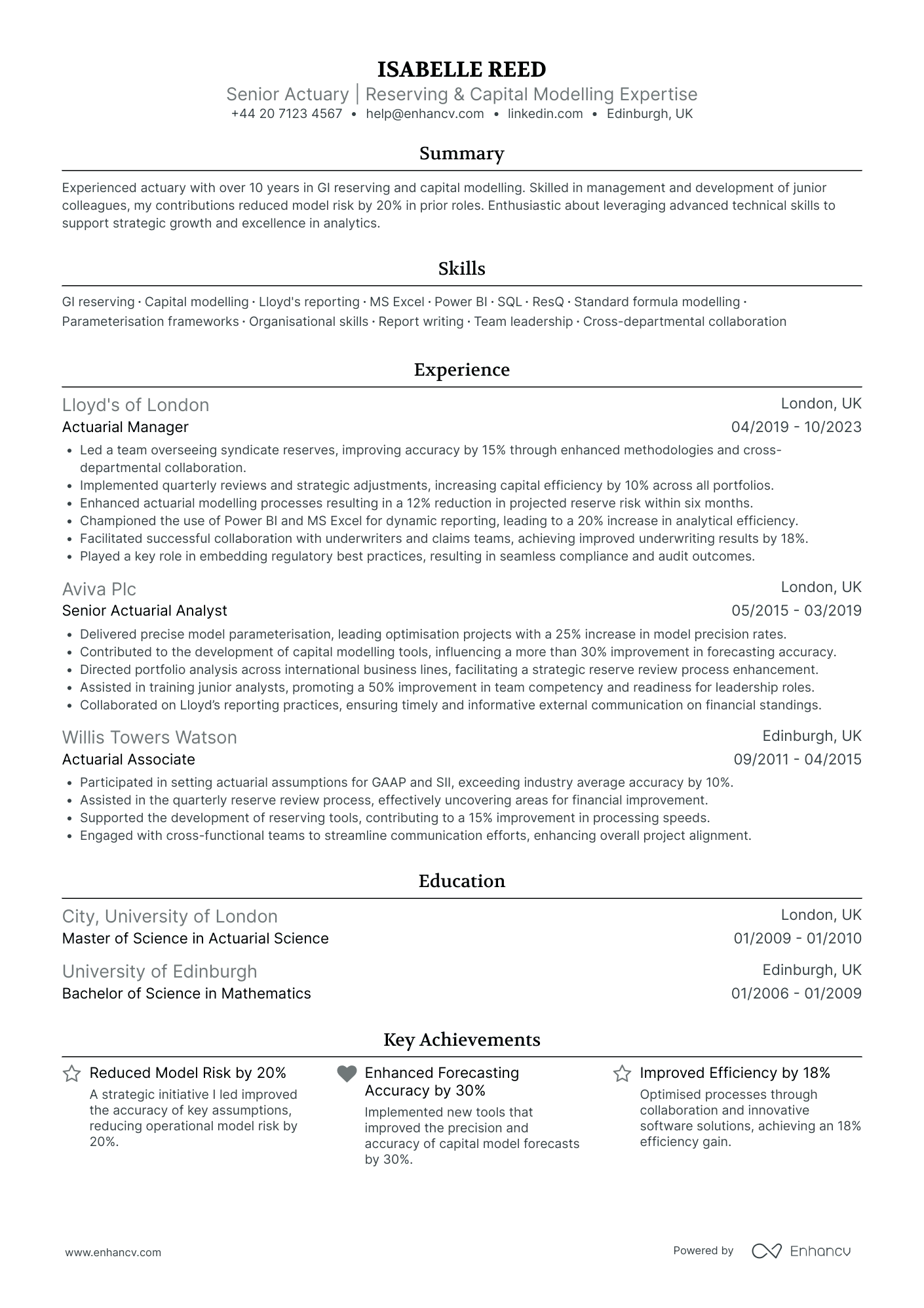

Junior Actuary

- Structured showcasing of experience and education - The CV is meticulously organized, starting with contact details and followed by a detailed account of professional experience, academic background, skills, and additional certifications. This clear structure not only makes it easy for recruiters to quickly understand the candidate's qualifications but also highlights key contributions and roles in each position held.

- Demonstrated career growth and sector specialization - Freddie Hughes' career trajectory illustrates a strong progression in the actuarial field, highlighted by roles such as Actuarial Analyst at Aviva and Junior Actuarial Consultant at Legal & General. The progression signifies an increase in responsibilities and expertise, showcasing Hughes' deepening sectorial focus on Solvency II and reinsurance, fundamental areas for actuaries.

- Impactful achievements with business significance - The CV effectively communicates achievements that have translated into substantial organizational benefits. For instance, the enhancement of reporting efficiency by 25% and improvement of analytical output and accuracy in risk reporting by significant margins reflect concrete contributions to operational excellence and strategic decision-making, underscoring Hughes' ability to deliver impactful results in the actuarial domain.

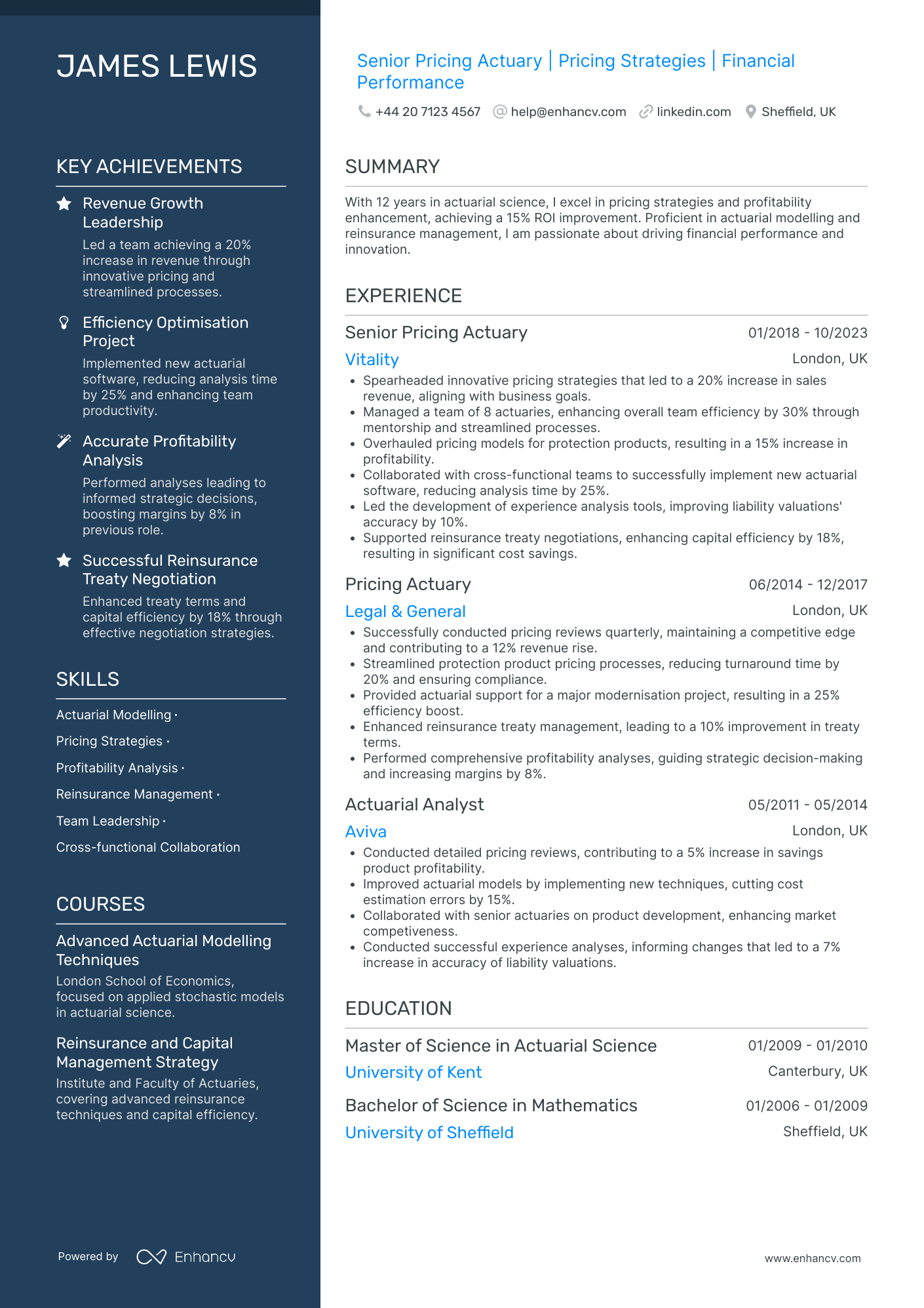

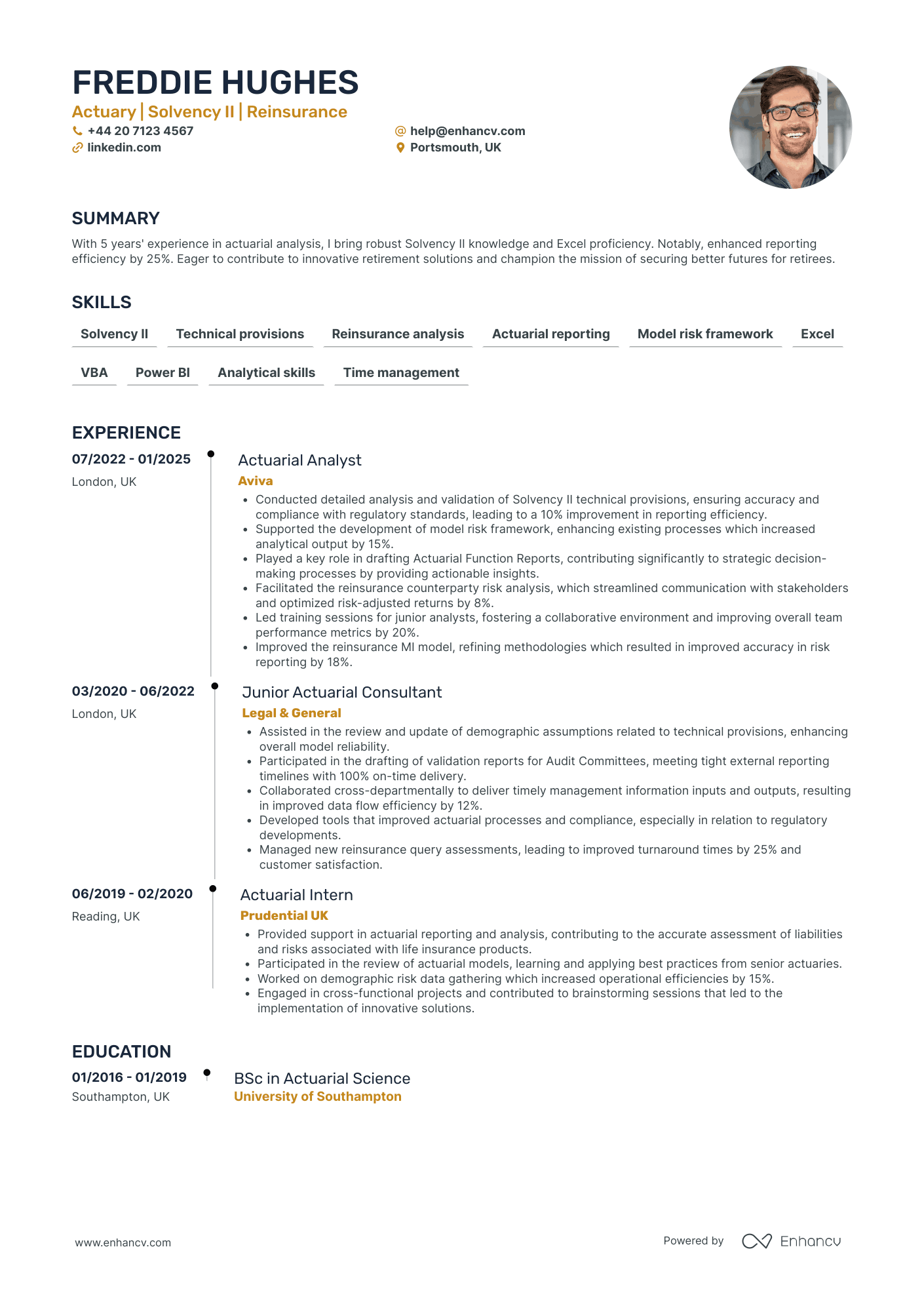

Chief Actuary

- Structured and Concise Presentation - The CV is well-organized, with clear sections for experience, education, skills, and achievements. This structure allows for easy navigation and quick identification of key information. Each section is concise, providing only relevant details without overwhelming the reader with excessive text.

- Diverse Career Trajectory in Actuarial Science - James Lewis's career progression from an Actuarial Analyst to a Senior Pricing Actuary demonstrates significant growth within the actuarial field. His promotions reflect an increasing level of responsibility and expertise, highlighting his ability to ascend through the ranks in prominent financial companies.

- Impact Through Leadership and Innovation - The CV emphasizes James's leadership skills by detailing his role in managing an actuarial team and spearheading projects that led to substantial revenue increases. His achievements, such as a 20% increase in sales revenue and enhancements in capital efficiency, underscore his capacity to significantly impact business performance through strategic initiatives.

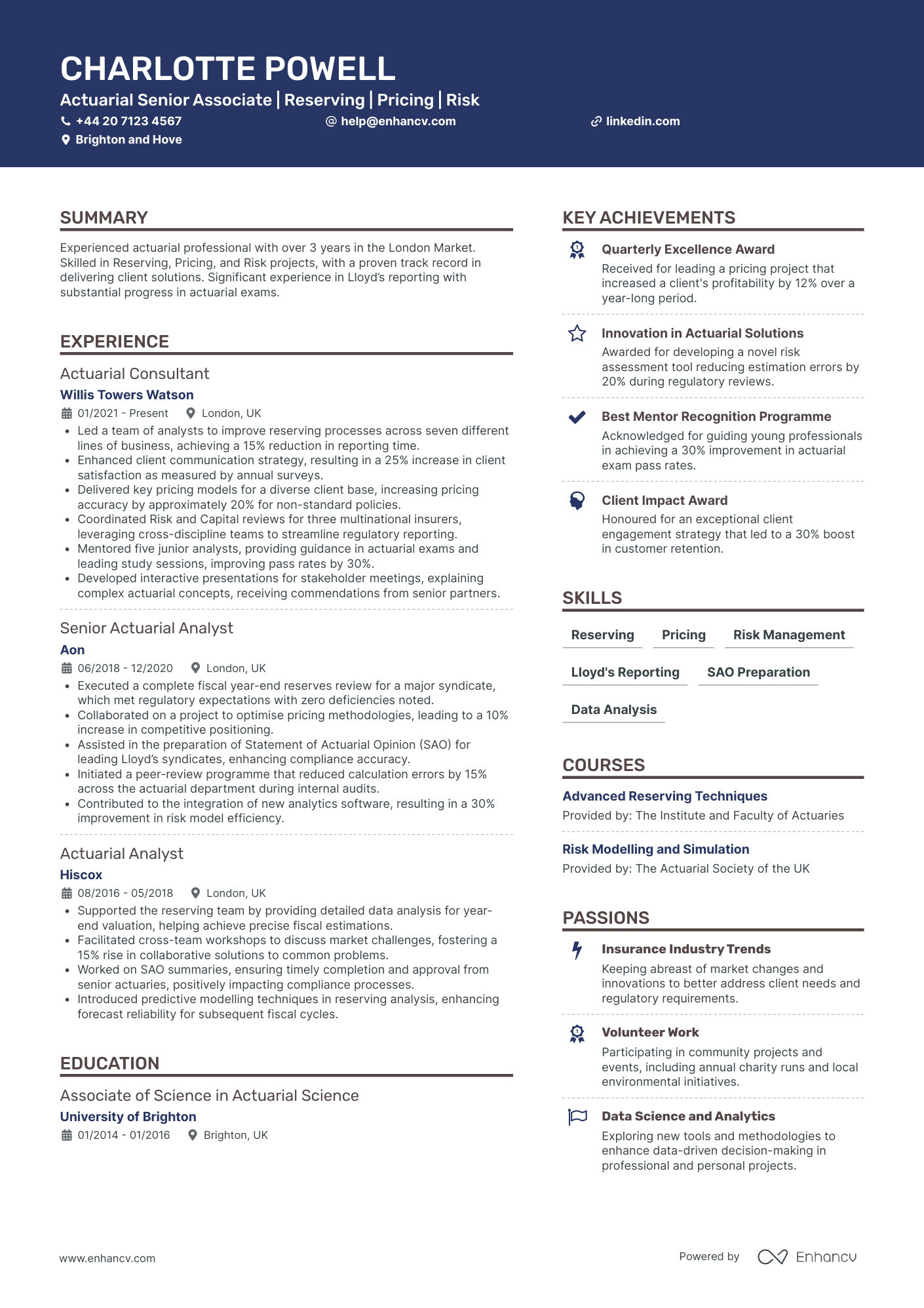

Actuary Associate

- Structured and Effective Content Presentation - The CV is organized with clarity and conciseness, effectively covering key sections such as experience, education, skills, and achievements. Each experience entry begins with the role and company, followed by structured bullet points that highlight significant responsibilities and outcomes, ensuring easy readability and comprehensive understanding.

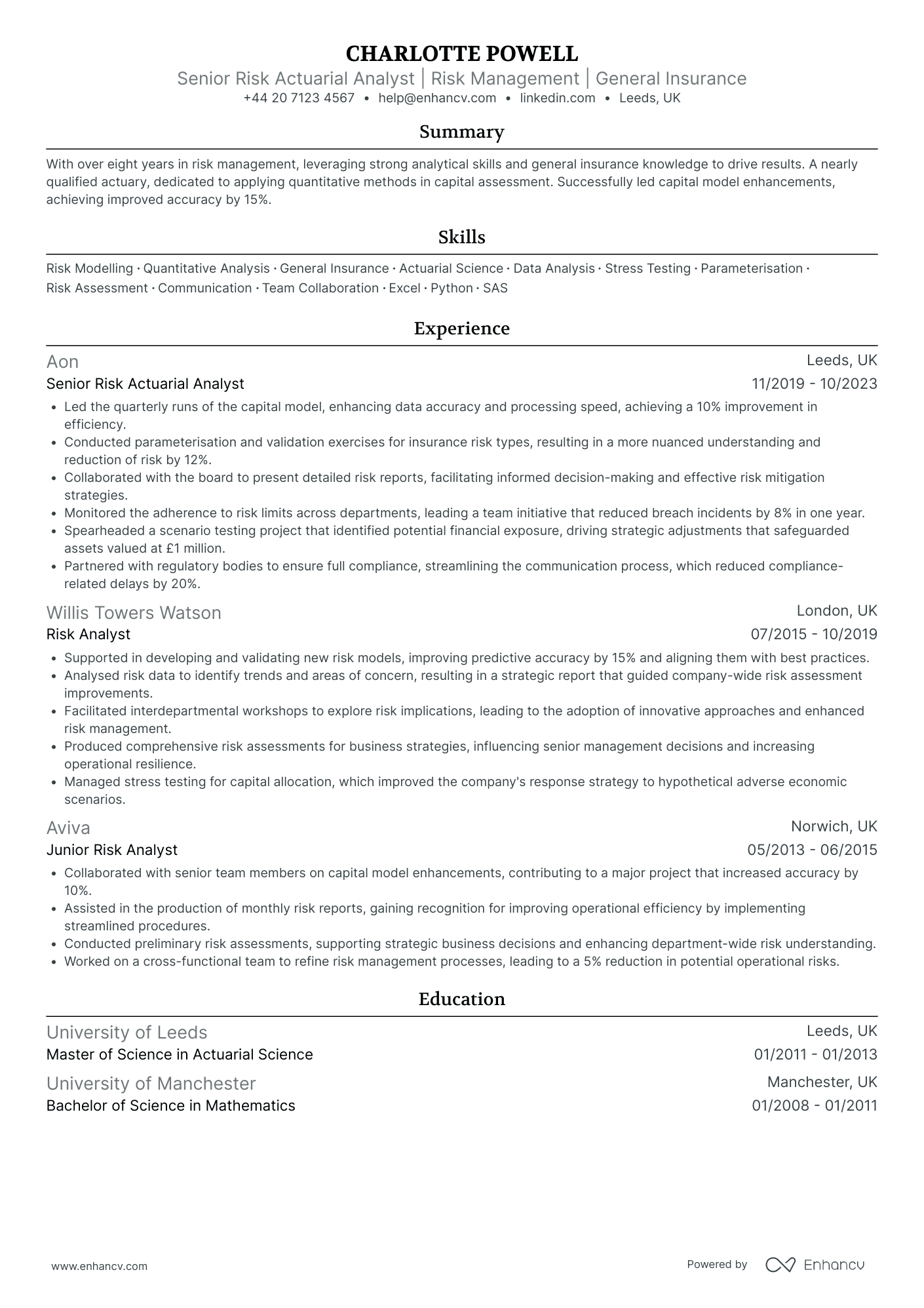

- Demonstrated Career Growth and Progression - Charlotte Powell's career trajectory reflects steady advancement in the actuarial field, moving from an analyst role to senior positions. Her progression from Hiscox to Aon and then to Willis Towers Watson marks a clear path of growing responsibility and expertise, showcasing her continuous development and adaptability in the insurance sector.

- Emphasis on Achievements and Business Impact - The CV effectively highlights achievements with clear business relevance, such as leading projects that increased profitability and improved client satisfaction. Not just focusing on numeric outcomes, it demonstrates the candidate's ability to drive business success through innovative actuarial solutions and strategic client engagements.

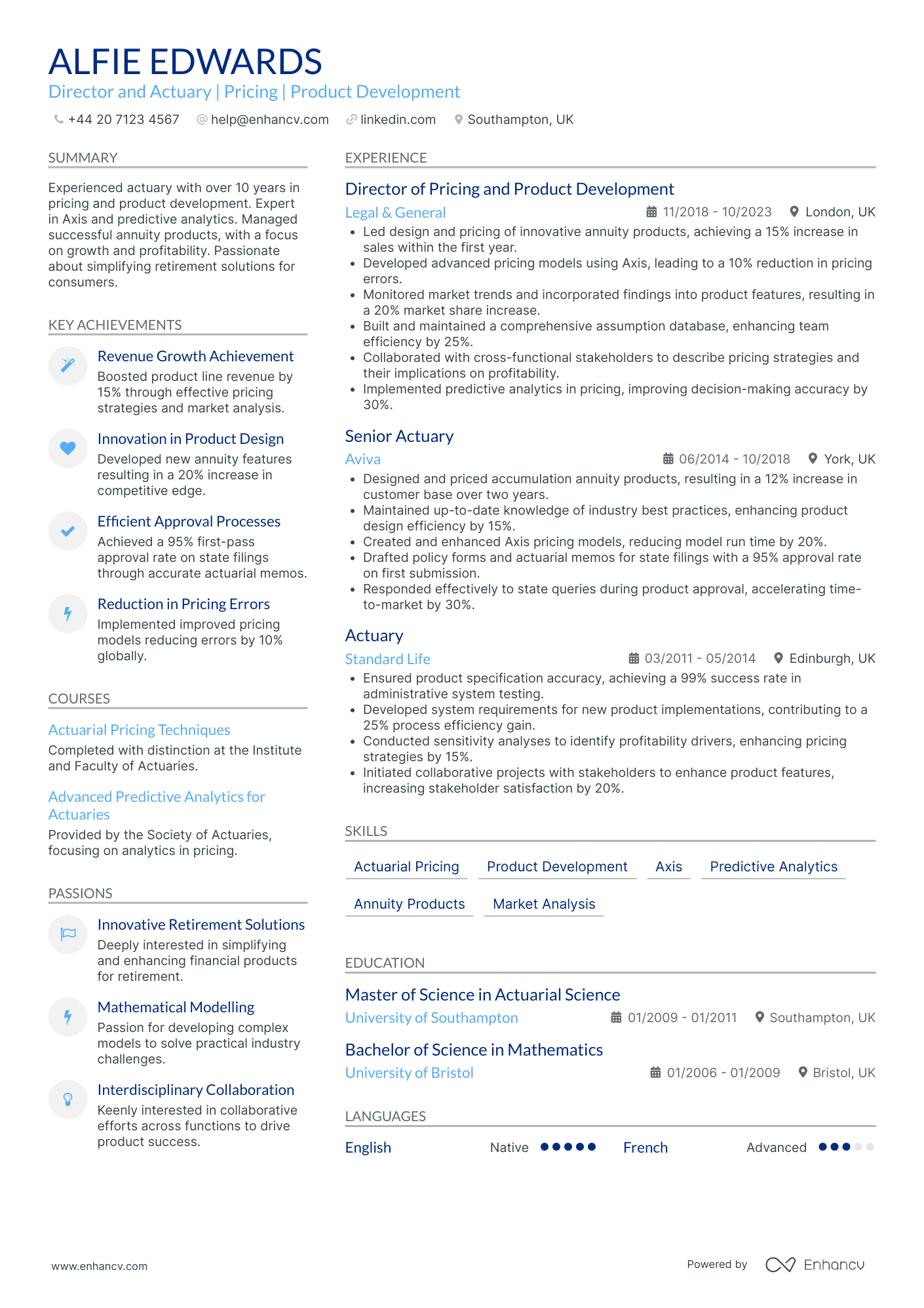

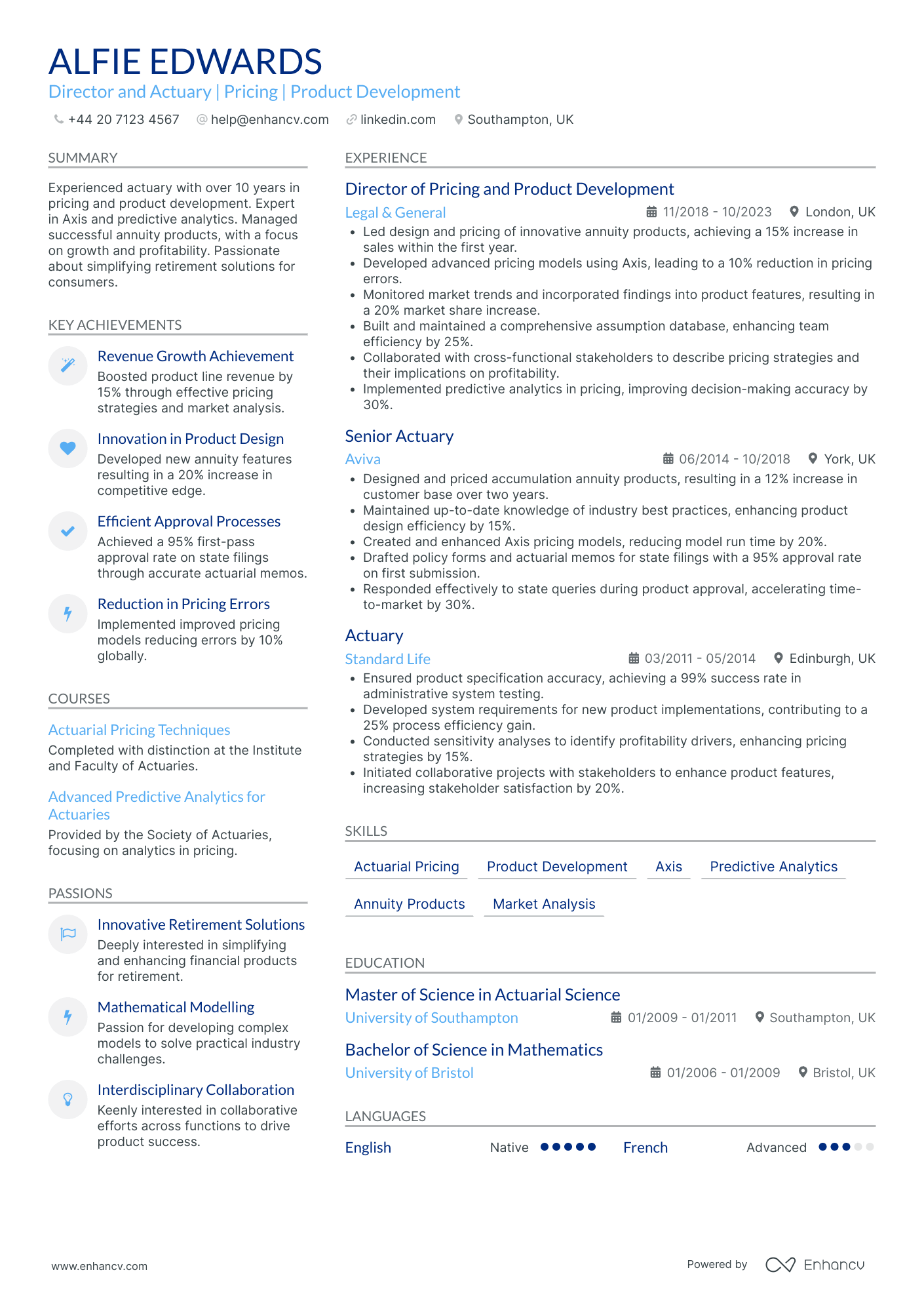

Actuary Director

- Strategic Clarity and Structure - The CV presents a clear and well-structured narrative of Alfie Edwards's professional journey. By categorizing experience, education, skills, and achievements, the CV offers a comprehensive yet concise overview, allowing the reader to quickly identify key qualifications and career highlights relevant to the director and actuary role.

- Consistent Career Growth - Alfie's career trajectory demonstrates impressive upward mobility, advancing from an Actuary at Standard Life to a Director at Legal & General. This path underscores a steady accumulation of responsibilities and expertise in pricing and product development, indicative of his growing influence and leadership in the industry.

- Technical Mastery and Industry Relevance - The CV highlights Alfie's specialization in using advanced tools like Axis and implementing predictive analytics in pricing models. These elements not only illustrate technical depth but also point to Alfie's capability to harness technology for significant improvements in efficiency and market adaptability.

By Role

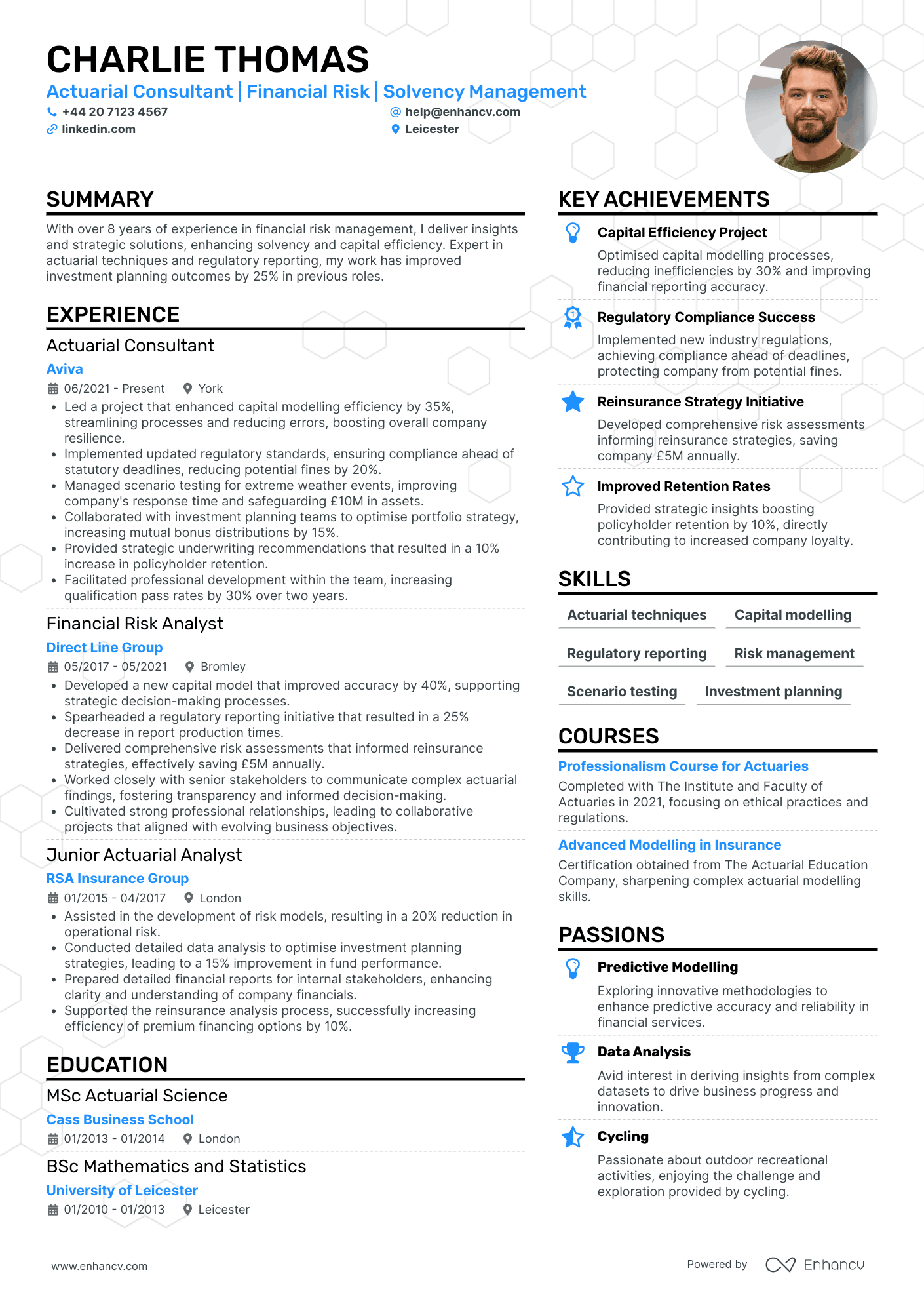

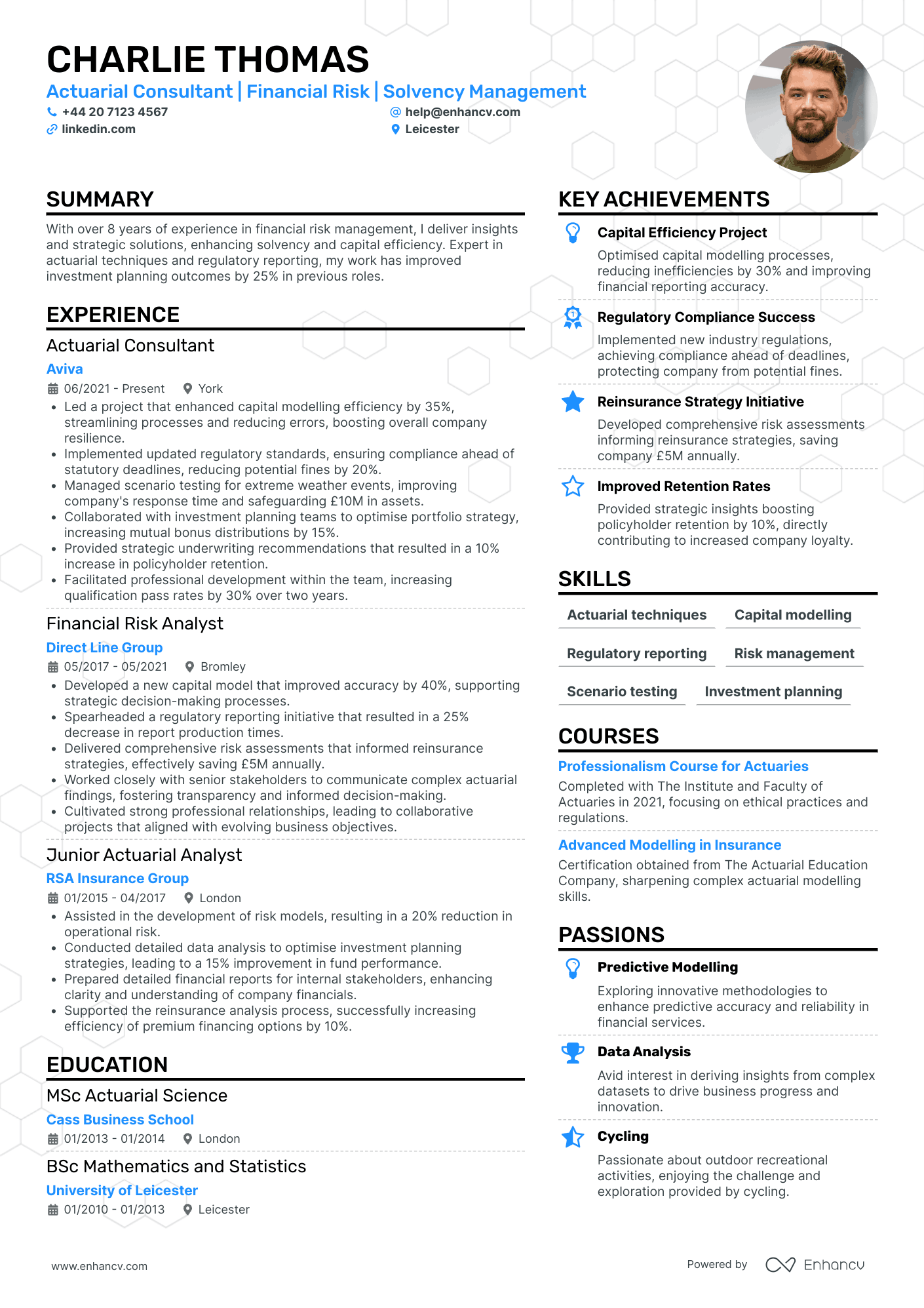

Actuary Consultant

- Strategic Clarity and Structured Presentation - The CV's presentation is highly organized, starting with a concise summary that swiftly highlights key areas of expertise, such as financial risk management and solvency. Each section is well-structured, allowing insights into career growth and achievements to be easily accessible and digestible.

- Consistent Career Advancement and Expertise Building - Charlie Thomas demonstrates a clear career progression from a Junior Actuarial Analyst to an Actuarial Consultant, consistently building expertise in financial risk and regulatory frameworks. This trajectory not only shows growth within the industry but also a deepening specialization in actuarial consultancy and financial risk management.

- Emphasis on Compliance and Technical Proficiency - The CV lists specialized achievements like leading capital efficiency initiatives and regulatory compliance projects. These reflect a strong technical prowess in capita modelling and adherence to regulatory standards, highlighting Thomas's ability to deliver business-critical solutions effectively.

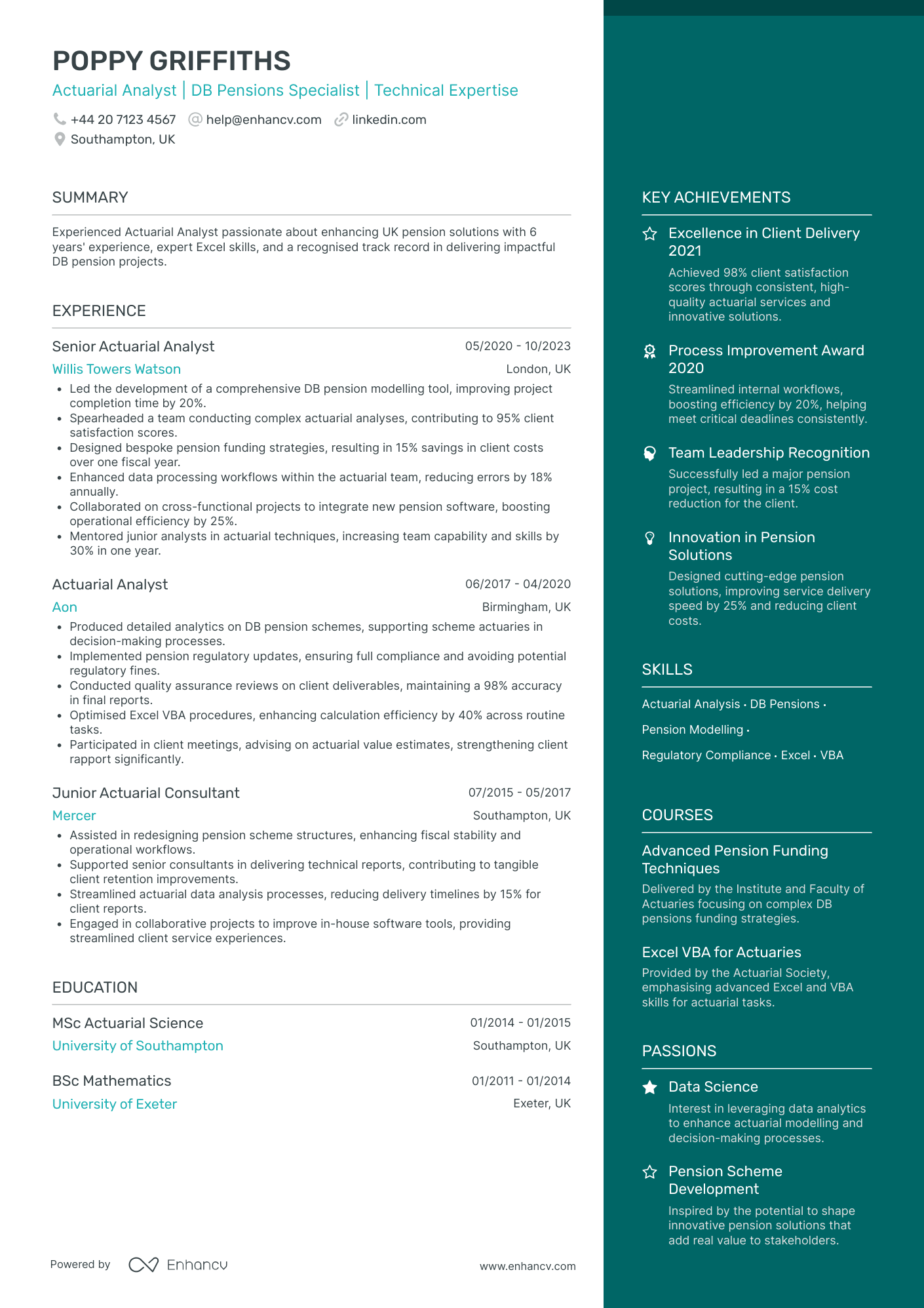

Actuary Analyst

- Comprehensive Career Growth - Poppy Griffiths demonstrates a clear upward trajectory within the actuarial field, progressing from a Junior Actuarial Consultant to a Senior Actuarial Analyst. This showcases not only her commitment to the profession but also her capacity to advance through merit and capability, as evidenced by her role changes and increasing responsibilities.

- Technical Expertise and Innovation - The CV effectively highlights Poppy's proficiency with complex actuarial tools and methodologies, such as Excel VBA and DB pension modelling. This is reinforced through achievements like developing a comprehensive modelling tool and integrating new pension software, illustrating her technical depth and innovative contributions to the industry.

- Leadership and Mentorship Skills - A significant aspect of Poppy’s profile is her leadership and mentoring capabilities, as she has successfully spearheaded teams and enhanced the skills of junior analysts. Her ability to manage complex projects and lead teams to achieve high client satisfaction rates underscores her effectiveness as a leader in the actuarial domain.

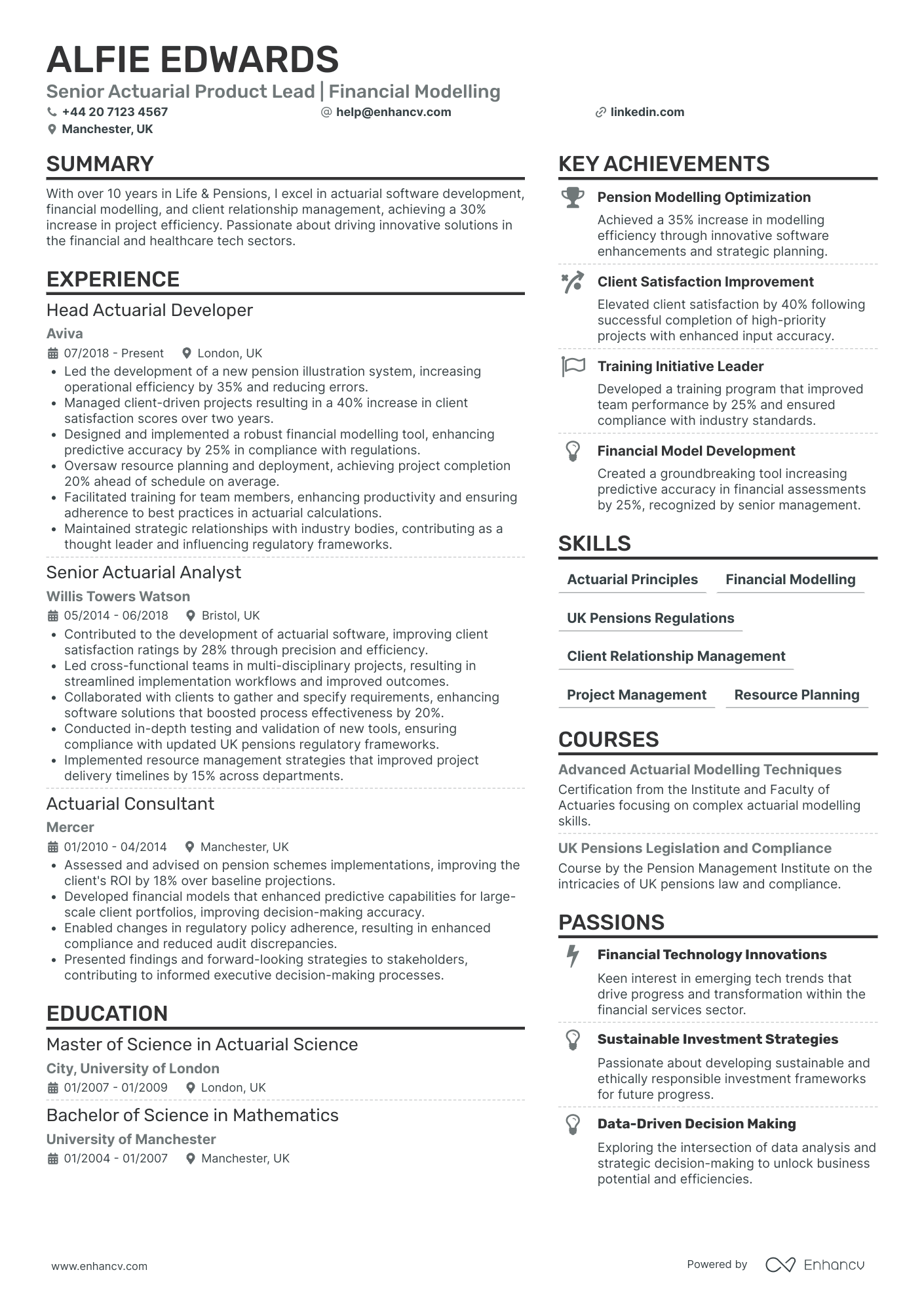

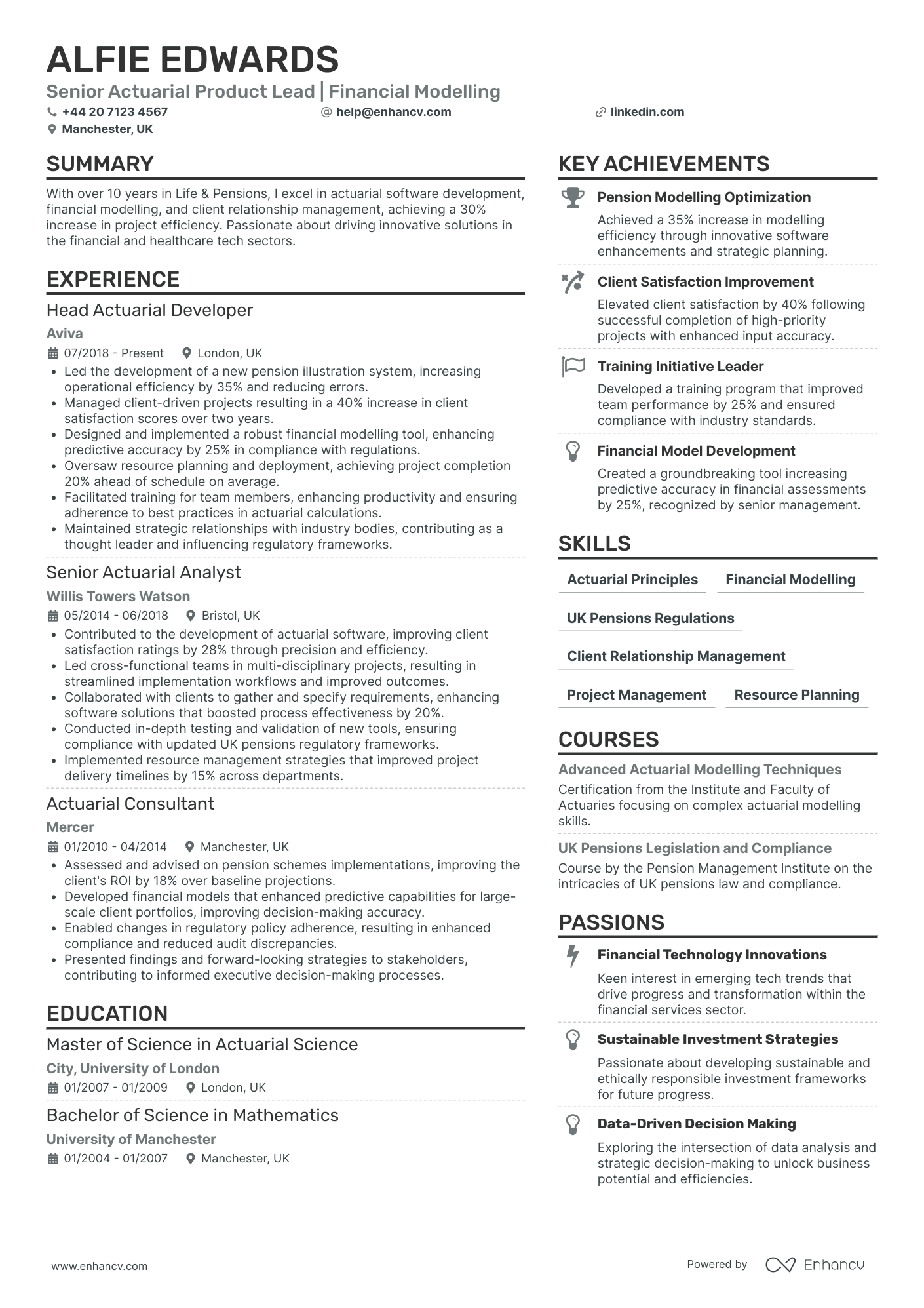

Actuary Manager

- Clear structure and logical flow - The CV is crafted with a coherent structure that begins with personal information and a succinct summary, followed by sections on experience, education, skills, and additional qualifications. Each element is presented in a clear and concise manner, facilitating easy comprehension of Alfie's career trajectory and skillset.

- Steady career growth in actuarial roles - Alfie's career demonstrates a progressive journey from an Actuarial Consultant to a Senior Actuarial Product Lead. This advancement highlights his aptitude in the field and his ability to take on higher levels of responsibility, showcasing a natural progression within the actuarial and financial modelling sectors.

- Strong emphasis on client relationship management - The CV places considerable emphasis on Alfie's strengths in client relationship management, with multiple roles highlighting improvements in client satisfaction. This underscores his ability to transpose technical skills into tangible business benefits, fostering enduring client partnerships.

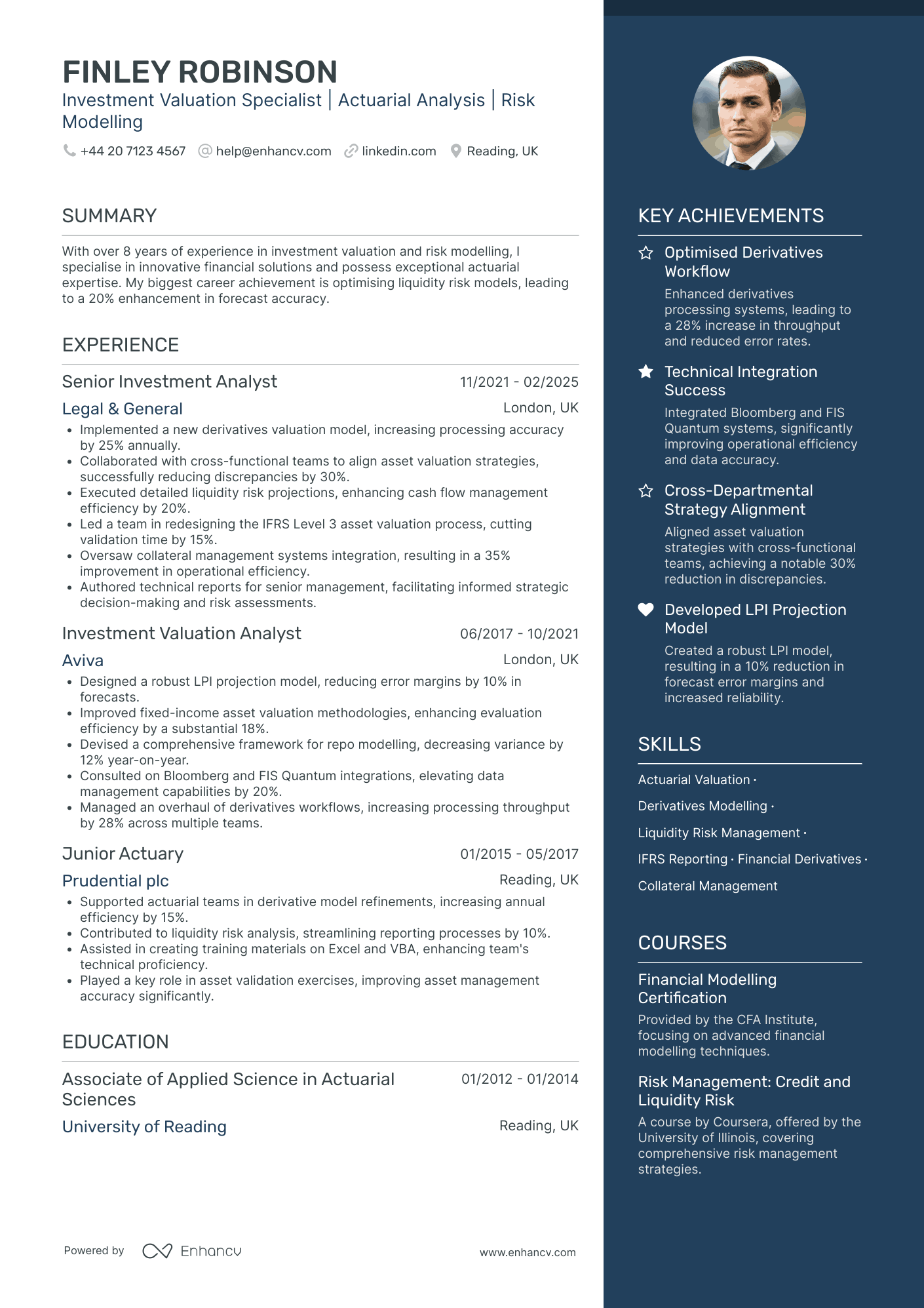

Actuary Specialist

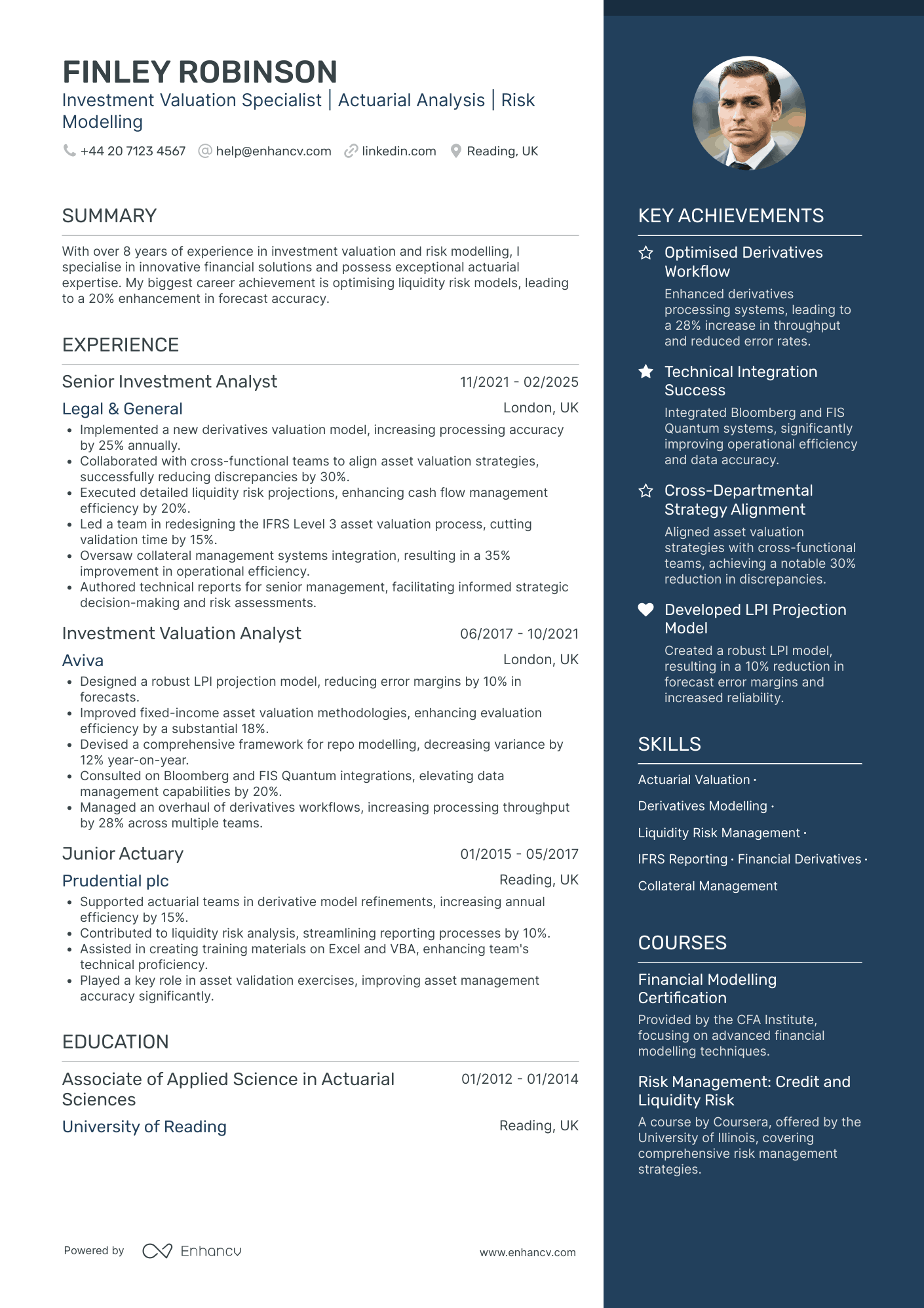

- Strong Content Presentation - The CV stands out due to its structured and concise format. Each section is clearly defined, allowing easy navigation through Finley Robinson's career history, achievements, and skills. The bullet points succinctly highlight key contributions and accomplishments, making it straightforward for the reader to grasp the candidate's strengths and expertise quickly.

- Impressive Career Trajectory - Finley Robinson's career progression showcases a steady advancement within the investment and actuarial fields. Starting as a Junior Actuary and advancing to a Senior Investment Analyst, the CV reflects a clear path of development and increasing responsibility. This trajectory not only indicates growth within specific roles but also demonstrates adaptability within various financial environments.

- Industry-Specific Expertise - The CV highlights unique industry skills, such as dealing with IFRS Level 3 asset valuation and integrating FIS Quantum for data management. These specialized abilities show deep technical knowledge essential for succeeding in finance and actuarial analysis. By mentioning specific tools and methodologies utilized, the CV establishes the candidate's credibility and technical depth within the financial sector.

Healthcare Actuary

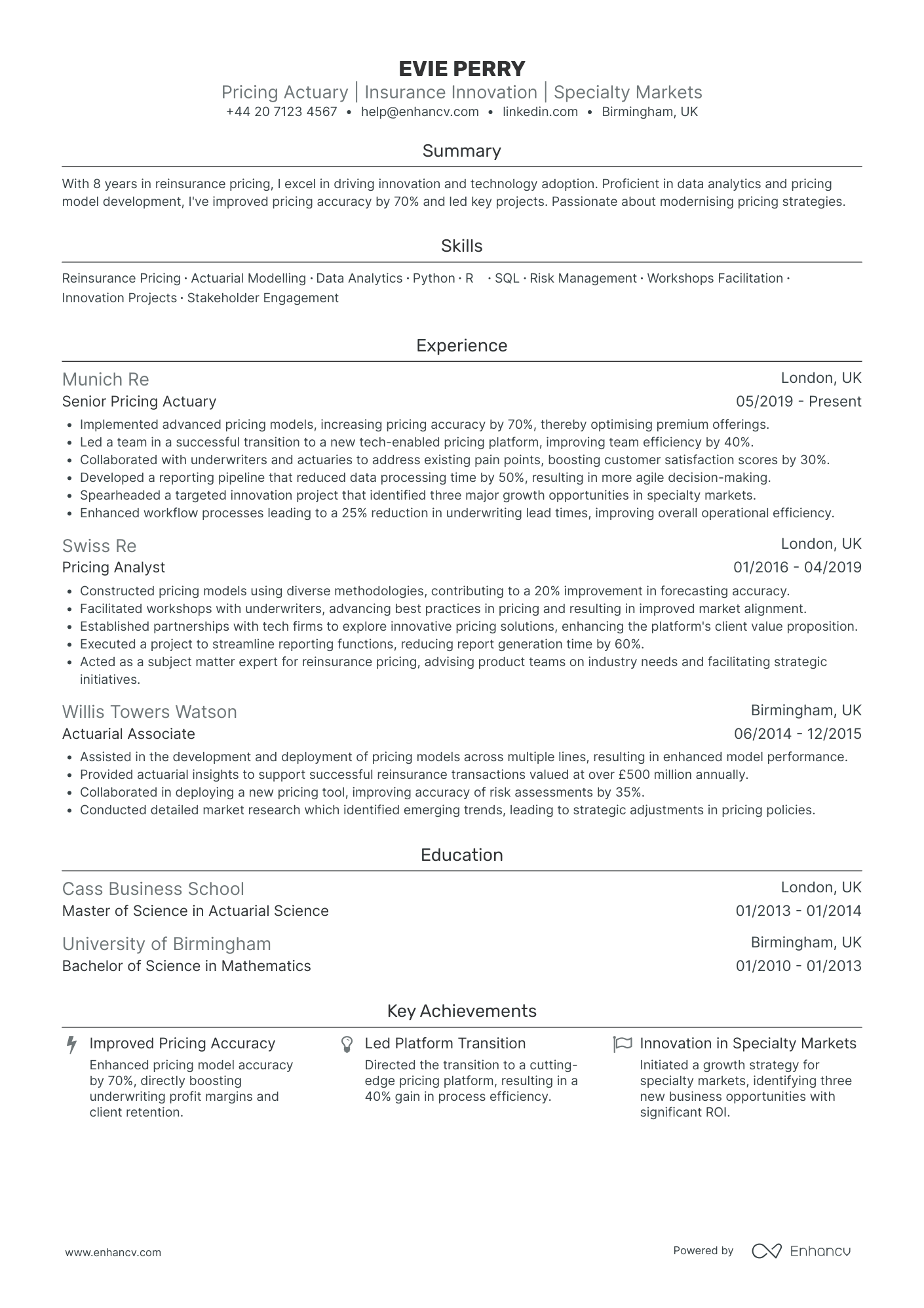

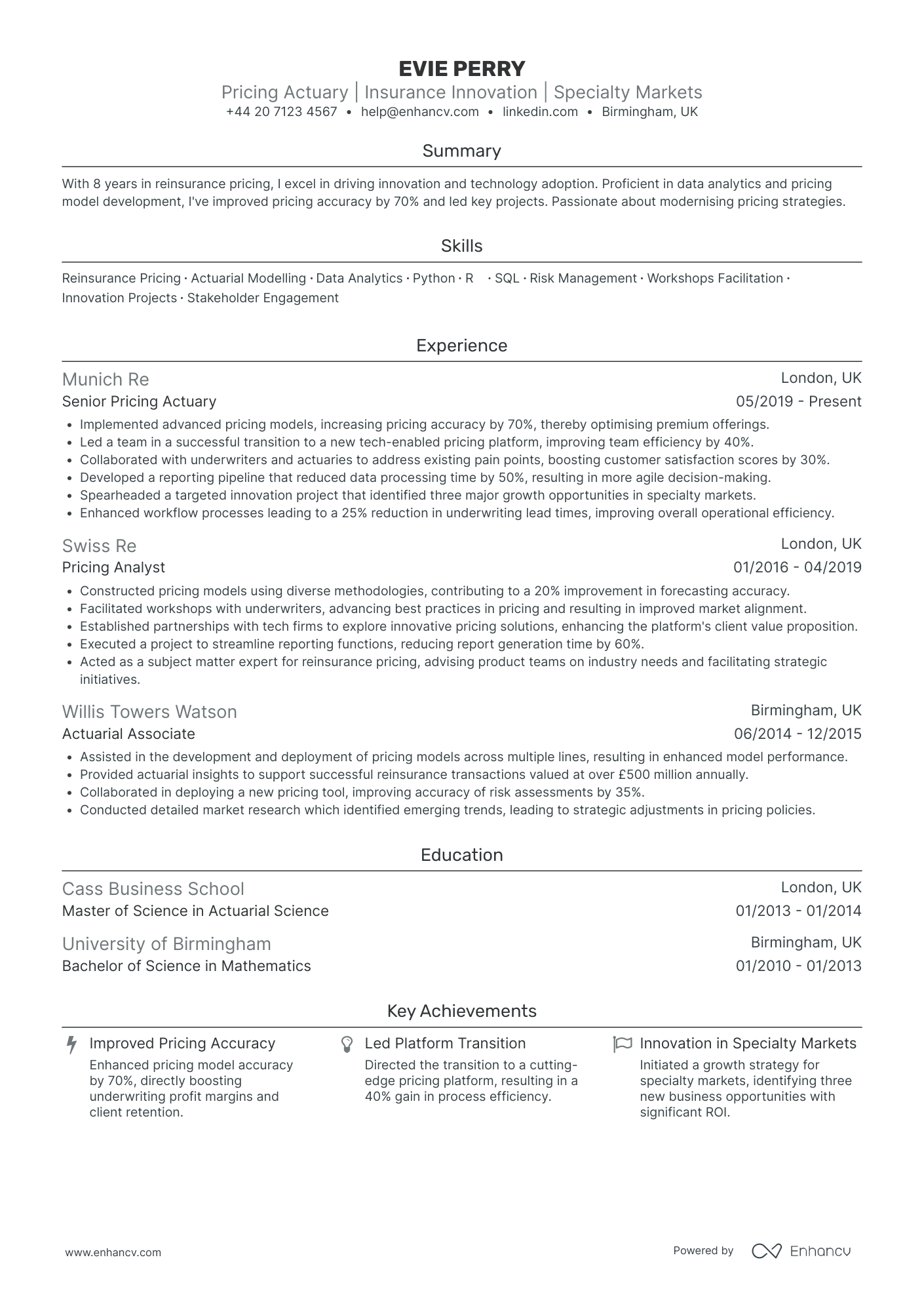

- Clear and Structured Presentation - The CV is well-organized with clear sections dedicated to each aspect of Evie's career, making it easy for readers to follow her professional journey. Each employment entry includes concise bullet points outlining key responsibilities and achievements, allowing for quick comprehension of her expertise and impact in the industry.

- Rapid Career Advancement - Evie's career trajectory demonstrates significant growth, progressing from an Actuarial Associate to a Senior Pricing Actuary. This advancement within prestigious companies such as Munich Re and Swiss Re highlights her professional development and increasing responsibilities over time, reflecting her dedication and capability in the field of actuarial science and insurance.

- Industry-Specific Expertise in Innovative Practices - The CV emphasizes Evie's use of advanced actuarial tools and methodologies, including pricing model development, data analytics, and risk management. Her experience with transitioning to tech-enabled platforms and strategic partnerships with tech firms suggests a forward-thinking approach, showcasing her contribution to modernizing pricing strategies in the insurance sector.

Pensions Actuary

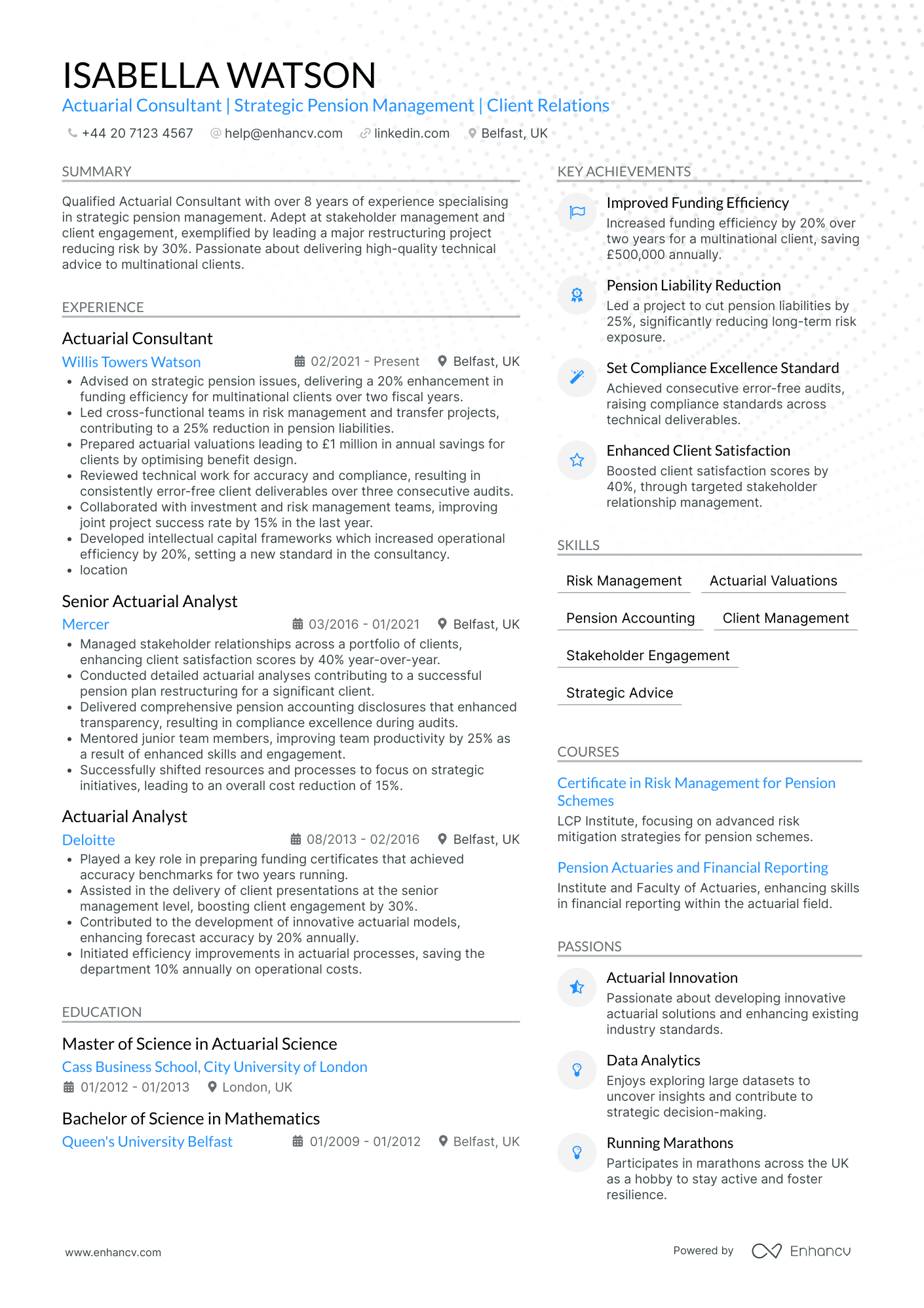

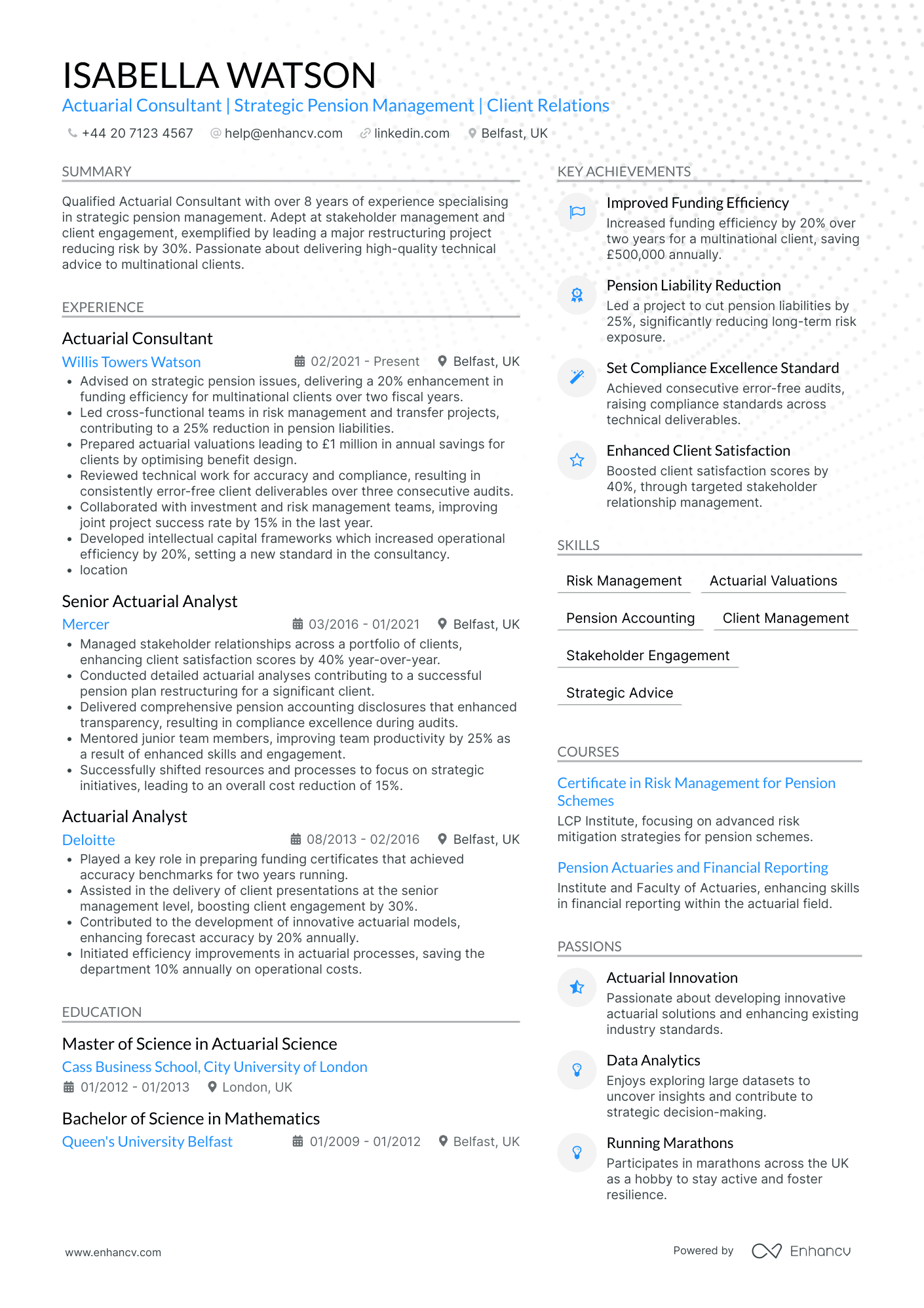

- Structured Career Progression - The CV showcases a clear upward trajectory in Isabella Watson's career, moving from an Actuarial Analyst to a Consultant position. This progression is supported by her consistent advancements in roles, highlighting her growing expertise and leadership in strategic pension management within top firms like Willis Towers Watson and Mercer.

- Strong Emphasis on Achievements - Each role listed in Isabella's experience section is accompanied by specific, quantifiable achievements that emphasize her ability to drive meaningful business impact for her clients. For instance, delivering a 20% enhancement in funding efficiency and achieving a 25% reduction in pension liabilities underscore her proficiency in transforming client objectives into tangible results.

- Diverse Skill Set and Cross-functional Collaboration - Isabella has demonstrated adaptability and a knack for cross-functional collaboration through her participation in cross-departmental projects that improved project success rates. Her skills in risk management, client relations, and technical review are further complemented by her ability to mentor junior members, illustrating her holistic approach to professional development.

Life Insurance Actuary

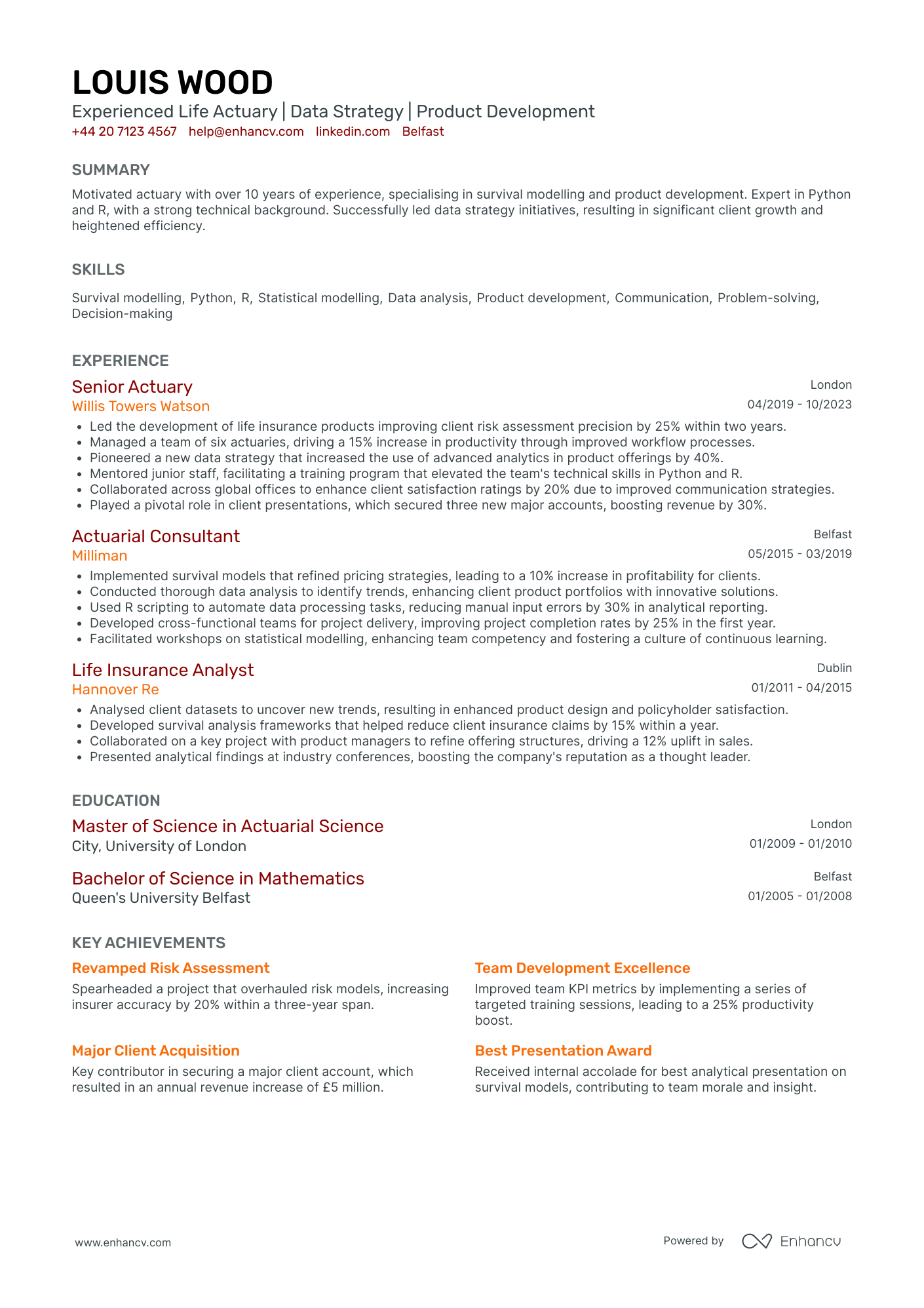

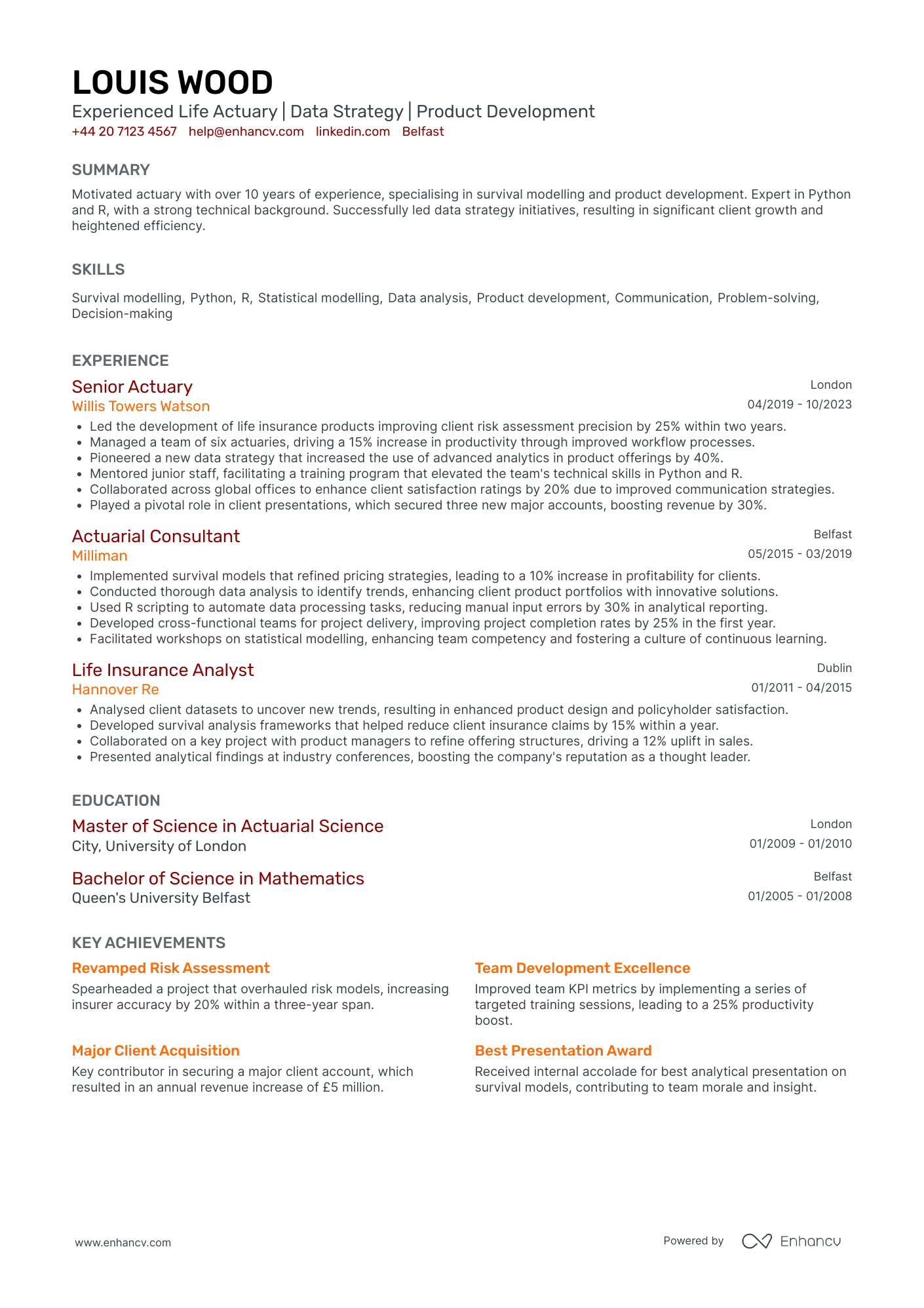

- Clear and structured content presentation - Louis Wood's CV is presented in a clear and structured manner, adhering to a logical flow that aids readability. This organization ensures that key points are easily accessible, facilitating quick review by potential employers. Conciseness is maintained throughout, ensuring that every word adds value without unnecessary detail.

- Diverse career trajectory with evident growth - The CV reflects a robust career trajectory, beginning from a Life Insurance Analyst position and advancing to a Senior Actuary role. This progression indicates a deepening of expertise and growing responsibilities, while the shift from Dublin to London showcases geographical adaptability and ambition for career advancement.

- Emphasis on achievements and their strategic impact - Louis Wood's career accomplishments are presented with an emphasis on their strategic business impact, rather than merely listing numbers. For instance, his contribution to increasing client satisfaction by 20% and securing major accounts demonstrates a clear linkage between his efforts and business growth and success, painting him as a results-driven professional.

Actuary Data Scientist

- Structured Presentation with Clear Segmentation - The CV is thoughtfully organized, presenting each section with clarity and purpose. This ensures that each component, from career experience to education and skills, is easily accessible and digestible to recruiters, allowing for a quick assessment of qualifications and expertise.

- Strong Career Progression and Senior Roles - The documentation of career trajectory highlights a clear path of progression, moving from a Junior Actuarial Consultant to a Senior Pricing Actuary. This advancement underlines the candidate's capability to take on increasing responsibilities and illustrates their growth within the actuarial field, showcasing their commitment and professional development.

- In-depth Knowledge of Actuarial Tools and Regulatory Standards - The CV demonstrates a deep understanding of industry-specific methodologies and tools such as Emblem, Radar, and Solvency II compliance. This technical depth not only showcases the candidate's expertise in actuarial modeling but also assures potential employers of their ability to meet industry standards and drive innovative pricing strategies.

Property and Casualty Actuary

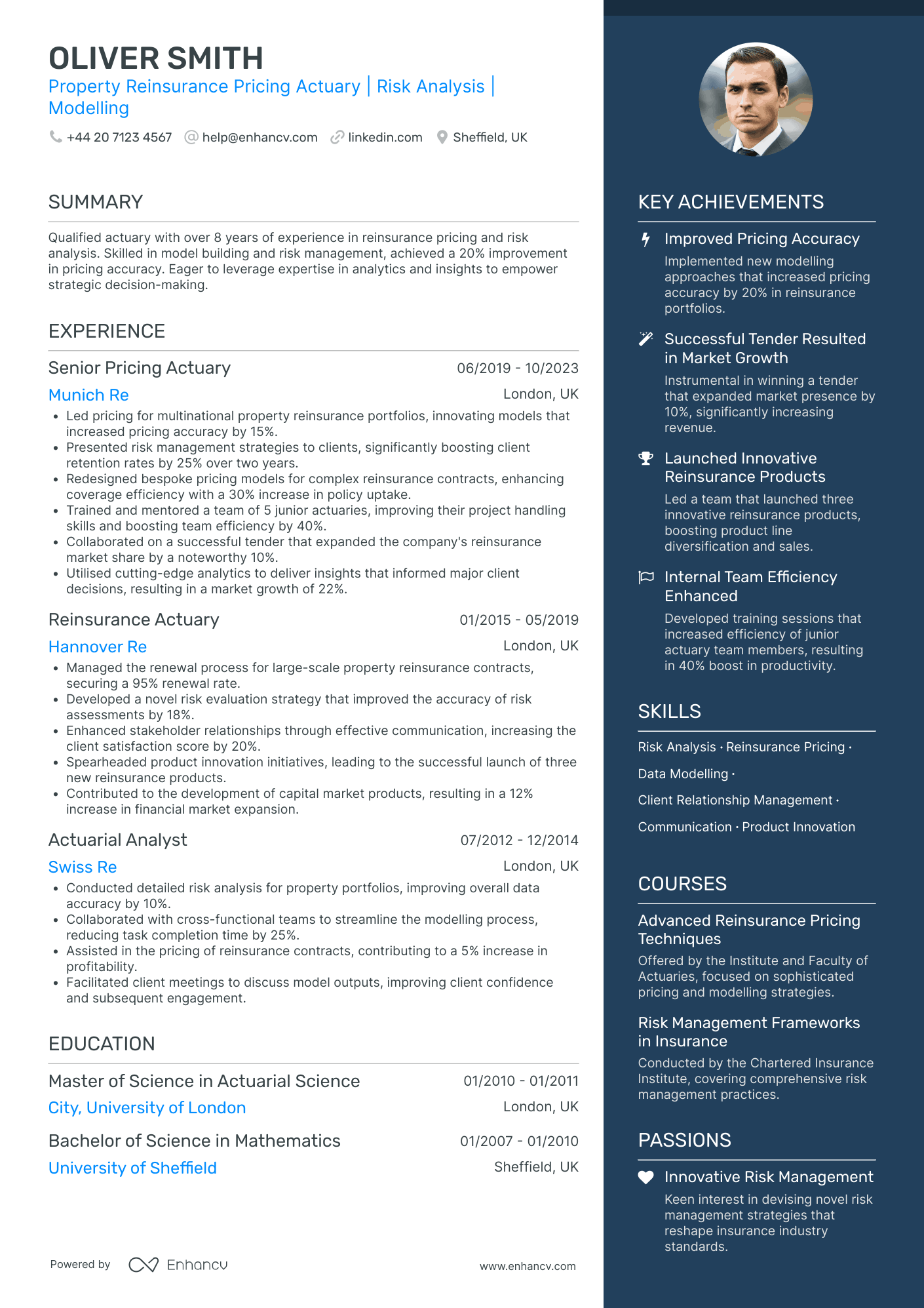

- Structured and Cohesive Content - Oliver's CV is well-organized, beginning with essential personal details, followed by a concise summary and neatly sectioned experience and education details. This clear layout allows for easy navigation while maintaining conciseness, providing a coherent overview of qualifications and experiences pertinent to the role in question.

- Demonstrated Career Growth and Leadership - The trajectory reflected in Oliver's CV showcases a steady climb from an Actuarial Analyst to a Senior Pricing Actuary. This progression highlights the increasing scope of responsibilities and leadership capabilities, as seen by his role in mentoring a team, driving performance improvements, and spearheading market expansion initiatives.

- Strong Focus on Industry-Specific Achievements - The CV stands out by detailing Oliver’s contributions to significant increases in pricing accuracy and market share through innovative model development and strategic initiatives. This evidences his strong technical expertise and impactful results in reinsurance, a critical component for decision-makers seeking to enhance their company's competitive edge.

Enterprise Risk Actuary

- Structured presentation with detailed content - The CV provides a clear and organized presentation of the candidate’s experience and qualifications. Each section is well-defined and succinct, allowing for easy navigation through the candidate's career history and accomplishments.

- Illustrates a clear career progression - Charlotte's career trajectory shows a consistent growth path in risk management and actuarial analysis. From a Junior Risk Analyst to a Senior Risk Actuarial Analyst at prominent companies, her steady advancement is marked by increased responsibilities and leadership roles.

- Emphasizes industry-specific expertise - The CV highlights Charlotte's technical depth in risk modelling, capital assessment, and quantitative analysis. This expertise is supported by her education in actuarial science and further training, demonstrating her proficiency with industry-specific methodologies and tools like Excel, Python, and SAS.

Investment Actuary

- Clear and Structured Presentation - The CV is well-organized, with a clear structure that effectively communicates the candidate’s career history and skills. It uses concise bullet points in the experience section, making it easy for readers to quickly assess key achievements and responsibilities, ensuring clarity and a professional presentation.

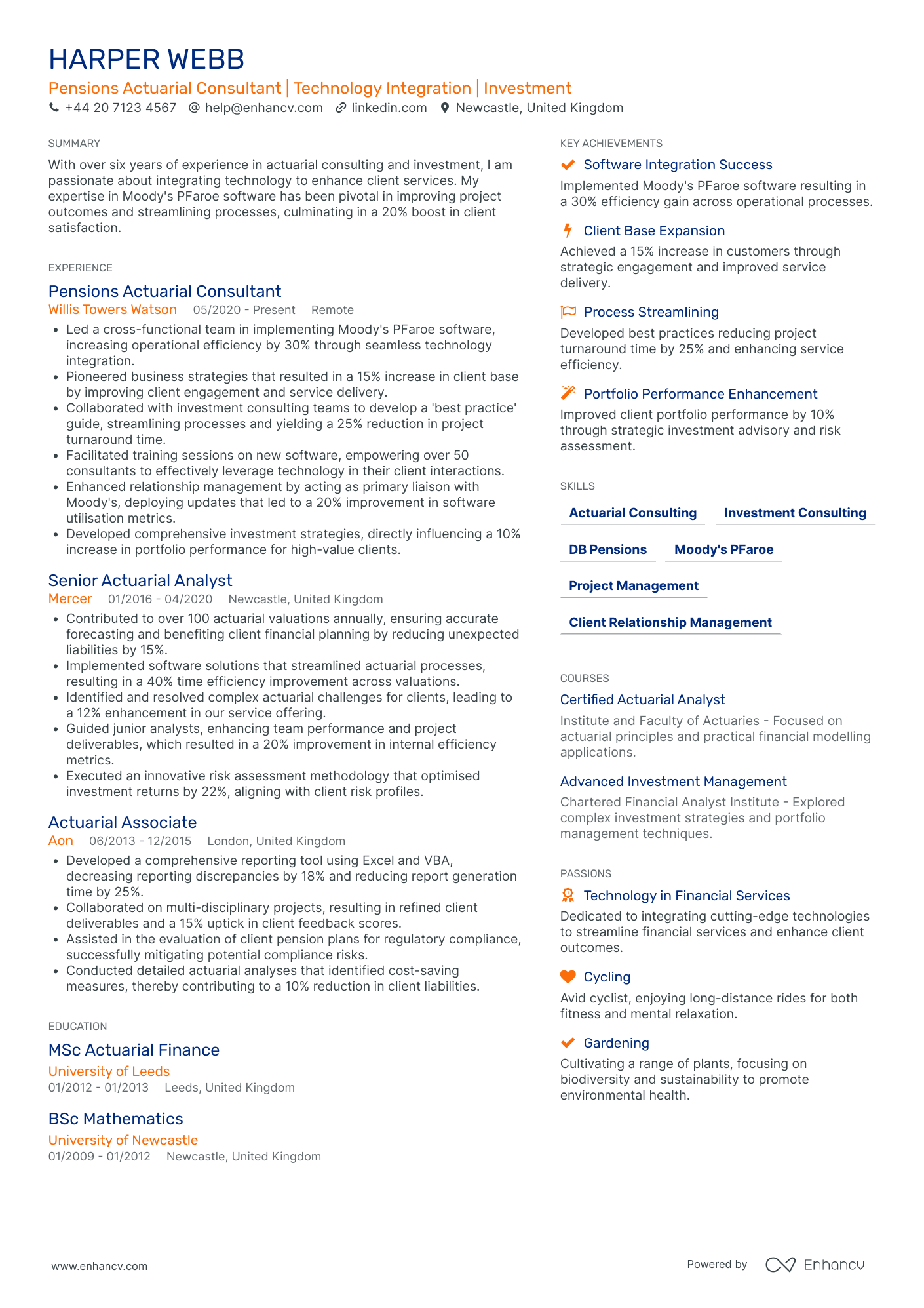

- Diverse Career Trajectory - Harper Webb’s career shows a consistent upward trajectory from an Actuarial Associate to a Pensions Actuarial Consultant, indicating strong professional growth. The transition from a specialist at Aon to leading cross-functional teams at Willis Towers Watson highlights an ongoing development in responsibilities and leadership roles within the actuarial and investment fields.

- Impressive Business Impact - The CV is rich with demonstrable achievements, such as a 30% increase in operational efficiency and a 25% reduction in project turnaround time. These metrics not only illustrate the candidate’s effectiveness in implementing technological innovations but also underscore their direct positive impact on business operations and client satisfaction.

Actuary Statistician

- Clear and effective structure - The CV is structured clearly with distinct sections for each aspect of the professional background, such as experience, education, and skills. This organization aids in easy navigation, allowing potential employers to quickly ascertain qualifications and accomplishments relevant to the actuarial consulting role.

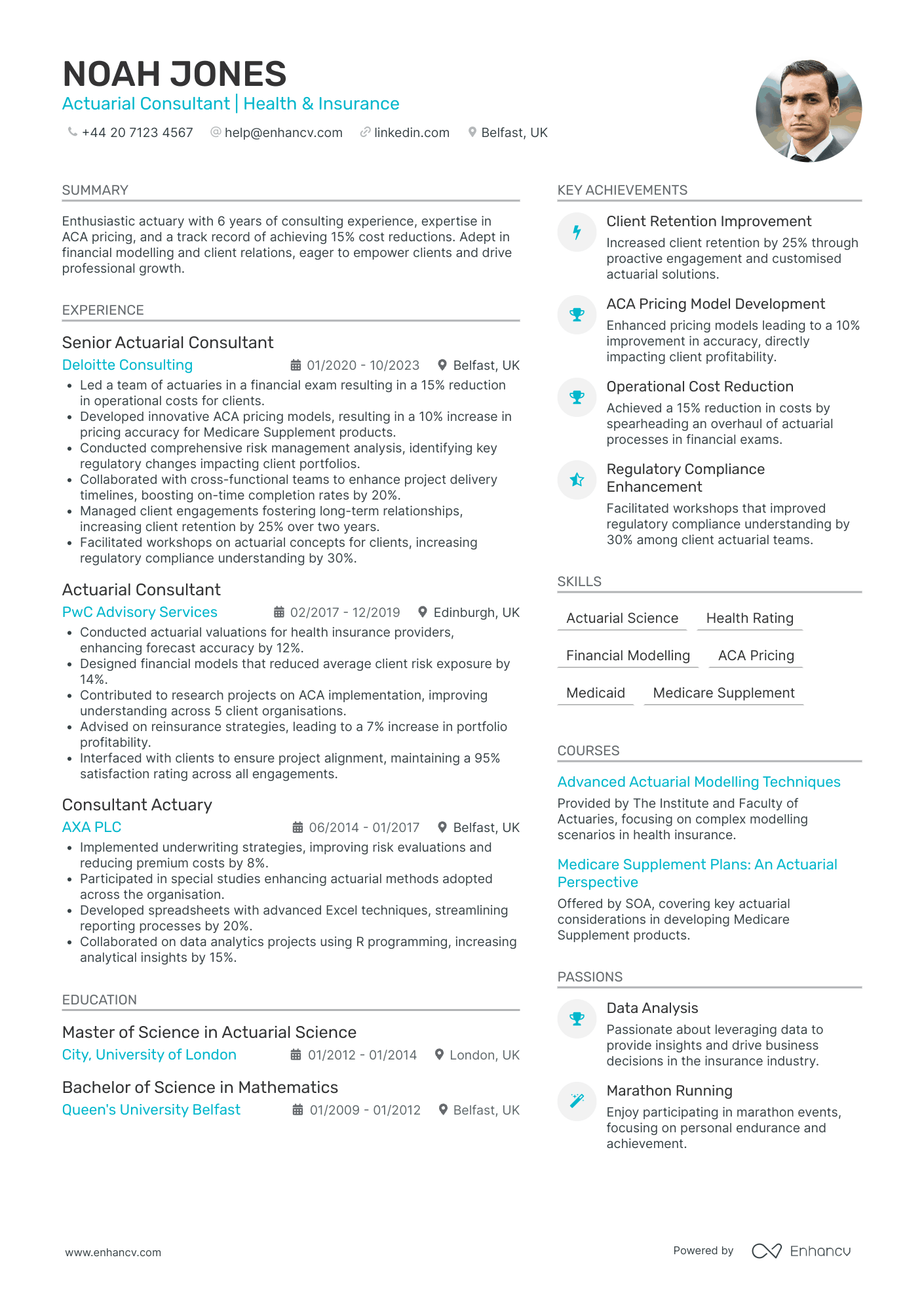

- Progressive career growth - The career trajectory of Noah Jones highlights a steady ascent from a Consultant Actuary at AXA PLC to a Senior Actuarial Consultant at Deloitte Consulting. This progression not only shows professional growth but also indicates increasing responsibilities and leadership roles within the field of health and insurance actuarial consulting.

- Industry-specific expertise - The detailed experience in ACA pricing and Medicare Supplement product accuracy both underline valuable, niche knowledge in health insurance actuarial science. The use of specific tools like R Programming and financial modeling further demonstrates technical proficiency that is particularly relevant to the actuarial consulting industry.

Actuary Risk Manager

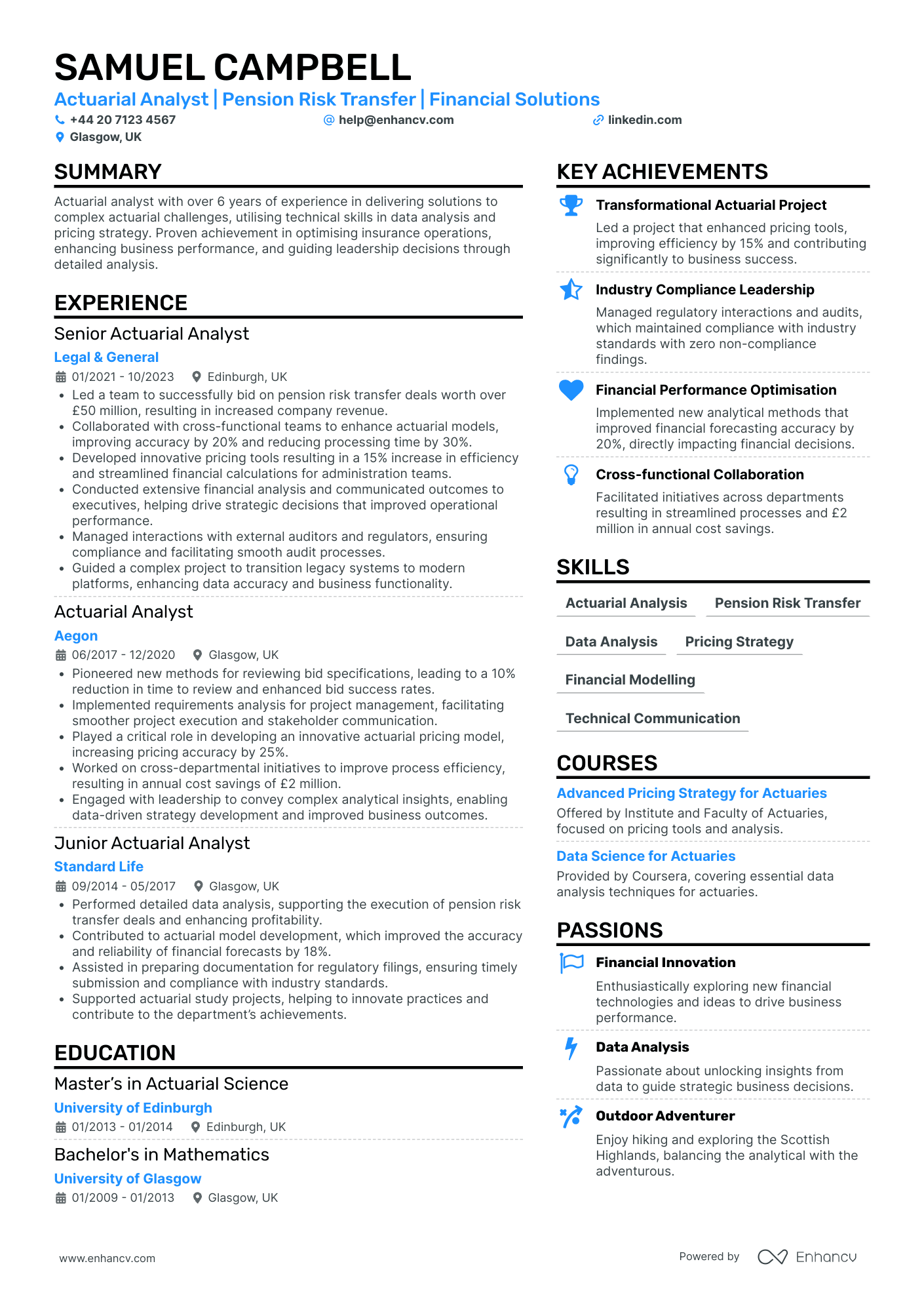

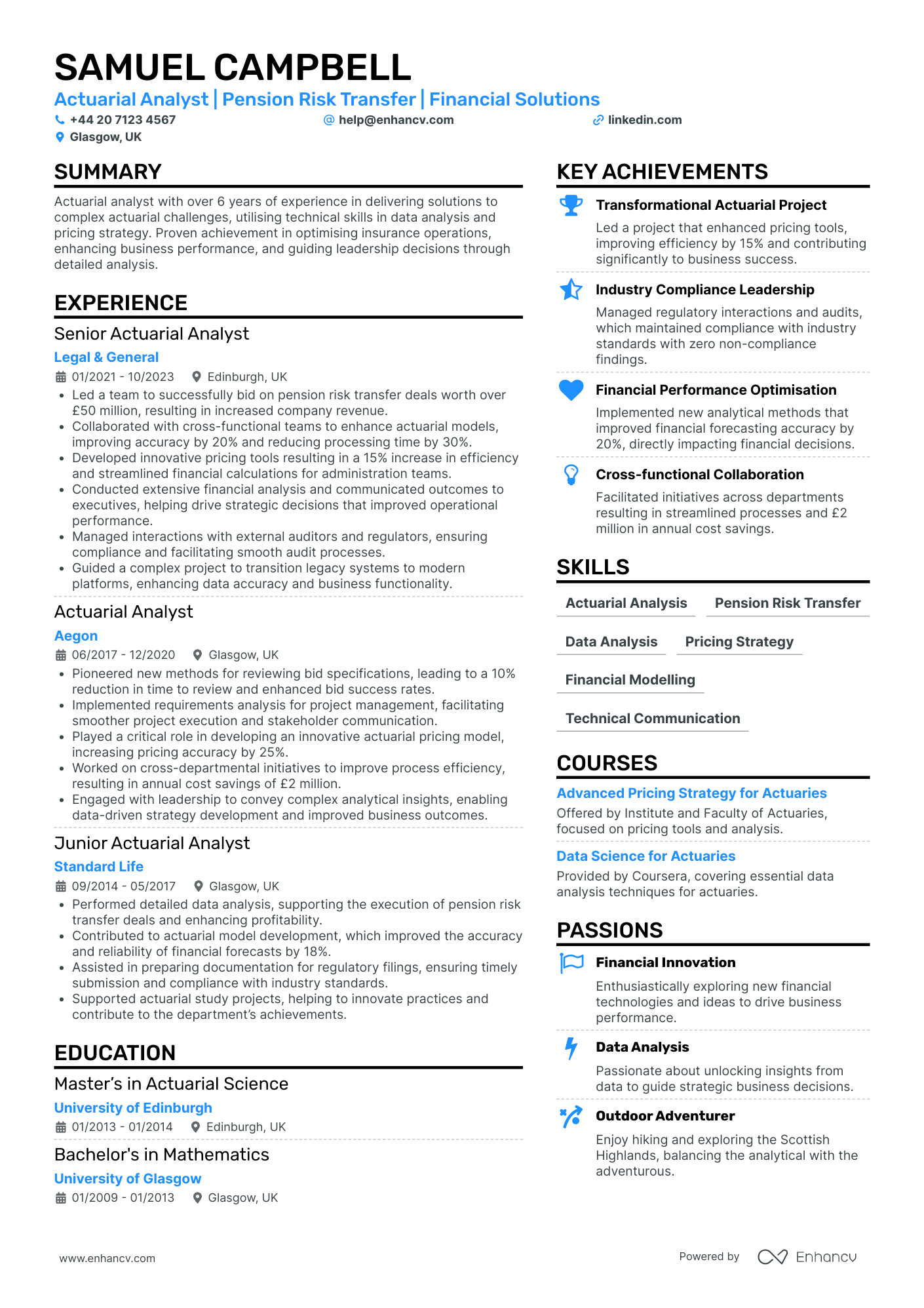

- Impressive Career Growth - Samuel Campbell's CV illustrates a clear and consistent upward trajectory in his actuarial career. Starting as a Junior Actuarial Analyst, he progressed to Senior Analyst roles at reputable companies, demonstrating his ability to take on increased responsibilities and contribute significantly to pension risk transfer projects.

- Diverse and Relevant Skill Set - The CV highlights a range of industry-specific skills like actuarial analysis, pension risk transfer, and financial modeling. It is evident that Samuel excels in technical communication and pricing strategy, which are critical in guiding leadership decisions and optimizing operations within the insurance sector.

- Quantifiable Achievements Fueled by Leadership - Throughout his roles, Samuel has consistently delivered substantial business results. Leading initiatives such as a £50 million pension risk transfer deal and improving process efficiencies underscores his capacity for leadership and delivering impactful solutions. These achievements emphasize his ability to translate analytical expertise into strategic business outcomes.

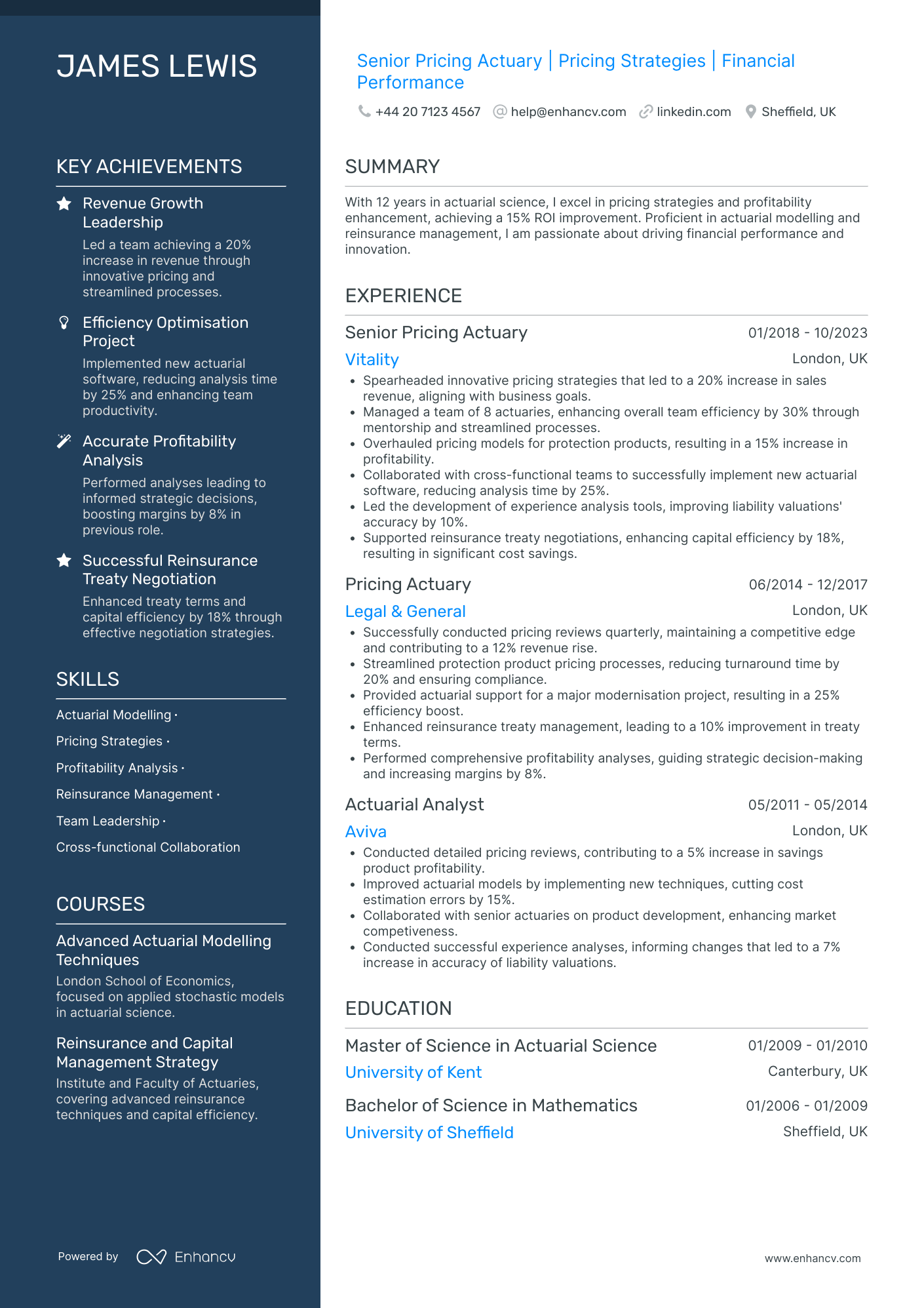

Actuary Auditor

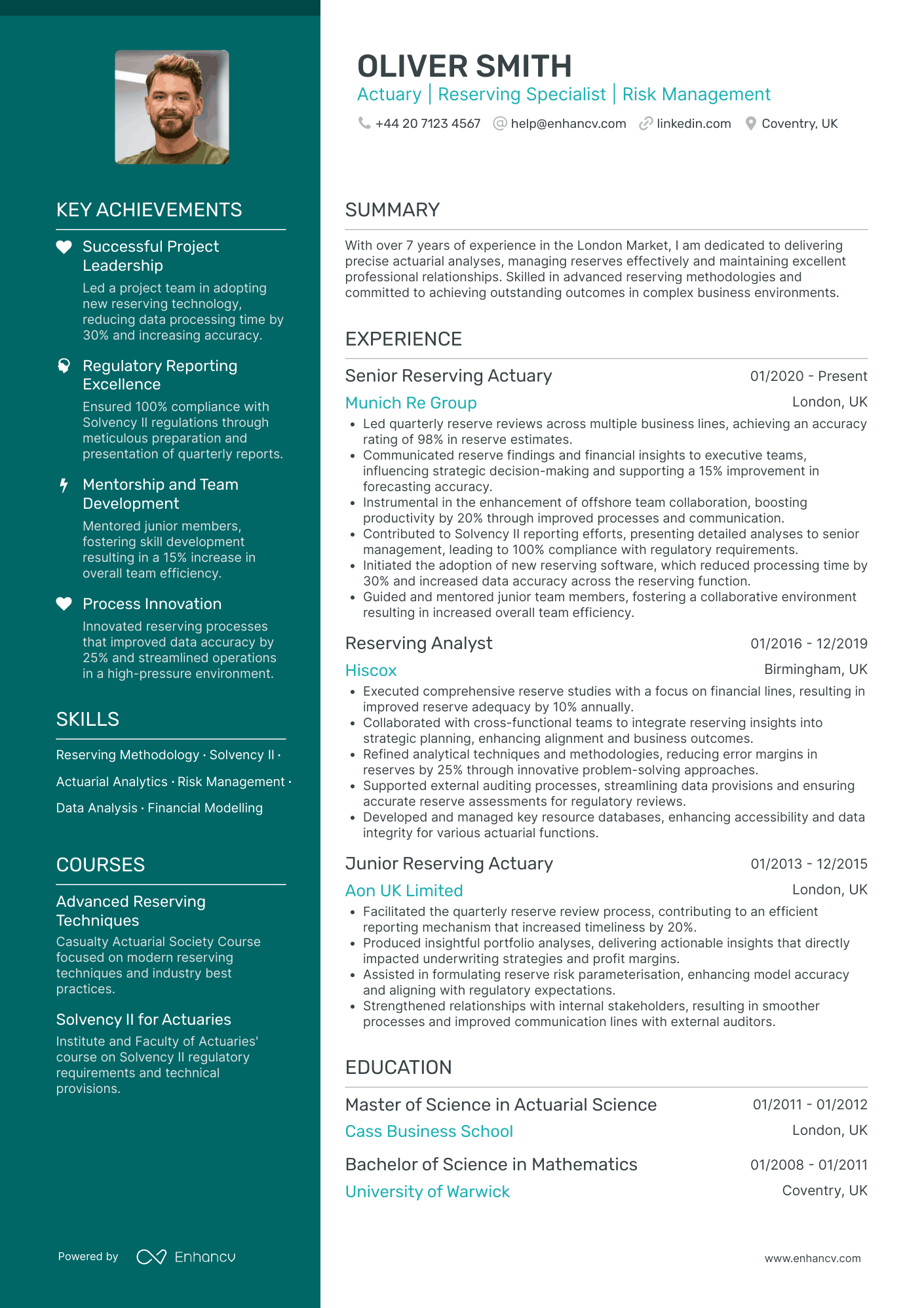

- Structured and Comprehensive Content Presentation - The CV is well-organized with clear sections for each element of Oliver's profile, ensuring that information is meticulously laid out for easy readability. The bullet points in the job experience section succinctly summarize achievements, making each contribution straightforward to assess at a glance.

- Demonstrated Career Growth and Leadership - Oliver shows a clear trajectory of professional growth from a Junior Reserving Actuary to a Senior position, highlighting promotions within the insurance sector. His experience across renowned insurance firms reflects a strategic and focused career pathway, underscoring his leadership abilities in enhancing team performance and mentoring junior colleagues.

- In-Depth Industry-Specific Knowledge - Oliver’s CV highlights his proficiency in advanced actuarial techniques and methodologies, pivotal to effective reserving and risk management. His capabilities are reinforced by his involvement in software adoption and Solvency II compliance, which are crucial to the insurance industry, demonstrating his technical depth and practical implementation skills.

Actuary Underwriter

- Strategic Career Progression - Charlie Thomas's CV clearly delineates a successful career progression within the actuarial field, starting from a Pricing Analyst to a Senior Actuarial Analyst. The roles reflect not only increased responsibility but also growth in skills and expertise in reinsurance and pricing strategies, demonstrating a robust career trajectory intimately aligned with his educational background and professional development.

- Unique Technical Proficiency - The CV highlights distinctive industry-specific elements like natural catastrophe modeling and advanced reinsurance pricing techniques. This technical depth showcases Charlie's adeptness at employing specialized tools and methodologies that are critical in the property reinsurance domain, setting him apart as an expert capable of addressing complex industry challenges.

- Impactful Leadership and Mentorship - Through specific achievements, the CV illustrates Charlie's leadership and mentoring qualities. Notably, the mentoring of junior team members who advanced to senior roles under his guidance underscores his ability to foster talent and lead teams effectively. This, coupled with initiatives that enhanced decision-making and stakeholder engagement, portrays a leader who prioritizes team development and optimized business performance.

How to ensure your profile stands out with your actuary CV format

It's sort of a Catch 22. You want your actuary CV to stand out amongst a pile of candidate profiles, yet you don't want it to be too over the top that it's unreadable. Where is the perfect balance between your CV format simple, while using it to shift the focus to what matters most. That is - your expertise. When creating your actuary CV:

- list your experience in the reverse chronological order - starting with your latest roles;

- include a header with your professional contact information and - optionally - your photograph;

- organise vital and relevant CV sections - e.g. your experience, skills, summary/ objective, education - closer to the top;

- use no more than two pages to illustrate your professional expertise;

- format your information using plenty of white space and standard (2.54 cm) margins, with colours to accent key information.

Once you've completed your information, export your actuary CV in PDF, as this format is more likely to stay intact when read by the Applicant Tracker System or the ATS. A few words of advice about the ATS - or the software used to assess your profile:

- Generic fonts, e.g. Arial and Times New Roman, are ATS-compliant, yet many candidates stick with these safe choices. Ensure your CV stands out by using a more modern, and simple, fonts like Lato, Exo 2, Volkhov;

- All serif and sans-serif fonts are ATS-friendly. Avoid the likes of fancy decorative or script typography, as this may render your information to be illegible;

- Both single- and double-column formatted CVs could be assessed by the ATS;

- Integrating simple infographics, icons, and charts across your CV won't hurt your chances during the ATS assessment.

PRO TIP

Use font size and style strategically to create a visual hierarchy, drawing the reader's eye to the most important information first (like your name and most recent job title).

The top sections on a actuary CV

- Professional Experience showcases past roles and actuarial projects.

- Educational Background lists relevant degrees and actuarial science education.

- Technical Skills are crucial for actuaries to analyse data and model risk.

- Certifications and Memberships highlight actuarial credentials and professional bodies.

- Actuarial Exams Passed shows progress in the actuarial qualification process.

What recruiters value on your CV:

- Highlight your proficiency with statistical software and data analysis tools, as actuaries rely heavily on these for modelling and risk assessment.

- Detail your progress in the actuarial examination system by including passed exams and professional designations such as FIA or associate (AIA), since this is a standard benchmark in the actuarial profession.

- Emphasise your experience with regulatory frameworks and actuarial standards, as understanding the legal and professional environment is critical for actuaries.

- Include any experience with specific actuarial fields such as life insurance, pensions, health care, investments, or general insurance, to demonstrate your specialty or broad knowledge in the profession.

- Showcase your ability to communicate complex actuarial concepts to non-specialists, as actuaries must often explain their findings to stakeholders without a technical background.

Recommended reads:

Tips and tricks on writing a job-winning actuary CV header

The CV header is the space which most recruiters would be referring most often to, in the beginning and end of your application. That is as the CV header includes your contact details, but also a headline and a professional photo. When writing your CV header:

- Double-check your contact details for spelling errors or if you've missed any digits. Also, ensure you've provided your personal details, and not your current work email or telephone number;

- Include your location in the form of the city and country you live in. If you want to be more detailed, you can list your full address to show proximity to your potential work place;

- Don't include your CV photo, if you're applying for roles in the UK or US, as this may bias initial recruiters' assessments;

- Write a professional headline that either integrates the job title, some relevant industry keywords, or your most noteworthy achievement.

In the next part of our guide, we'll provide you with professional CVs that showcase some of the best practices when it comes to writing your headline.

Examples of good CV headlines for actuary:

- Associate Actuary | Pension Risk Management | CERA Certified | 5 Years' Experience

- Senior Actuarial Analyst | Health Insurance Sector | Product Development | FIA Qualified | 8+ Years

- Actuarial Consultant | Life & Annuities | Asset-Liability Modelling | Near FSA Completion | 7 Years' Expertise

- Chief Actuary | General Insurance | Solvency II Specialist | With Over 15 Years Professional Practice

- Junior Actuarial Associate | Investment Strategies | Actuarial Science Graduate | Seeking Challenging Opportunities

- Actuarial Manager | Corporate Finance Advisory | MAAA Designation | 10 Years' Progressive Experience

Your actuary CV introduction: selecting between a summary and an objective

actuary candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you actuary CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a actuary job:

- Highly analytical Actuary with over 10 years of experience in life insurance, specialising in predictive modelling and risk assessment. Expert in applying statistical analysis and financial theory to solve complex business problems. Proud of designing a risk management strategy that reduced claims costs by 20% over 2 years for a major insurance provider.

- Seasoned Actuary with a focus on property and casualty insurance, bringing 15 years of robust experience. Excelled in leveraging data analytics to forecast financial outcomes and implement solutions yielding a 30% improvement in operational efficiency. Spearheaded a comprehensive overhaul of valuation models, significantly increasing the accuracy of premium pricing.

- Former Financial Analyst making a transition into the actuarial field, armed with 8 years of high-level experience in portfolio management and economic strategy formulation. Proven track record in data interpretation, statistical analysis, and delivering insights that have driven business strategy and profitability. Keen to leverage my quantitative skills to contribute to sophisticated risk assessment initiatives.

- Experienced Data Scientist with a PhD in Statistics looking to pivot to an Actuarial career, bringing 7 years of experience in big data, machine learning algorithms, and model development. Instrumental in deploying analytical solutions that increased data processing efficiency by 40% within a tech startup environment. Excited about applying robust analytical expertise in a new context to drive informed decision-making in risk management.

- Recent mathematics graduate eager to launch an actuarial career, demonstrating strong proficiency in statistical analysis, data interpretation, and financial modelling. Solid theoretical foundation gained through academic projects, including a predictive model for credit default risks. Aims to develop expertise in risk analysis and contribute to high-level strategic decisions.

- Ambitious graduate with a dual degree in Statistics and Economics intent on pursuing an actuarial career. Passion for quantitative analysis and problem-solving with the objective of applying my academic knowledge to practical scenarios in risk management. Keen to develop professional actuarial skills and make meaningful contributions to financial forecasting and strategic planning.

Best practices for writing your actuary CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Analysed historical data and utilised actuarial models to estimate risk and calculate premiums for a portfolio of Health Insurance products, achieving a 15% reduction in claims cost.

- Collaborated with multidisciplinary teams to design and optimise pension schemes, ensuring compliance with current regulations and enhancing retirement outcomes for clients.

- Led a quarterly review of the company’s reserving process, incorporating the latest actuarial techniques to maintain adequate reserves and satisfy financial solvency requirements.

- Managed the implementation of predictive analytics using advanced statistics and machine learning to inform underwriting decisions, resulting in a 10% increase in profitability.

- Developed and presented comprehensive risk management strategies to senior stakeholders, significantly reducing potential financial exposure in the company’s investment portfolio.

- Employed asset-liability matching approaches to minimise risks in managing insurance and pension fund investments, consistently achieving targeted returns above benchmarks.

- Documented and communicated complex actuarial concepts to non-technical audiences, enhancing understanding and decision-making in product development discussions.

- Conducted due diligence in M&A activities, providing essential actuarial valuation input and post-merger integration support for successful acquisition projects.

- Played a key role in regulatory reporting and compliance by preparing accurate actuarial reports and liaising with regulatory bodies to meet filing deadlines and requirements.

- Developed and implemented actuarial models for property and casualty insurance, resulting in a 15% improvement in risk assessment accuracy.

- Led a team of junior actuaries in the creation of statistical analysis reports, which guided the strategic decision-making process for upper management.

- Collaborated with the underwriting department to enhance pricing strategies for new insurance products, increasing profitability by 10% within the first year.

- Managed the financial risk analysis project for a major product line, providing insightful guidance that led to a reduction in loss reserves by 5%.

- Presented analysis on potential regulatory changes to the finance committee, significantly influencing the company's approach to compliance planning.

- Performed detailed data analyses for life insurance products, boosting prediction accuracy of life expectancy estimates by 20%.

- Modernized actuarial valuation processes through the adoption of new software tools, slashing calculation time by 30%.

- Designed and executed actuarial studies to evaluate the effectiveness of business strategies in the annuities division.

- Initiated and directed a cross-functional effort to align actuarial practices with updated industry standards, ensuring full regulatory compliance.

- Spearheaded the development of custom actuarial reporting templates that reduced reporting errors by 95%.

- Oversaw reserving process for auto insurance lines, identifying trends that led to a reserve adjustment of $2M in Q2 2018.

- Mentored and developed a group of actuarial associates, resulting in a 50% increase in departmental productivity.

- Automated parts of the quarterly actuarial reporting workflow, allowing the team to meet all deadlines without errors.

- Impactfully communicated complex actuarial concepts during stakeholder meetings, which facilitated better-informed business decisions.

- Engaged in product development lifecycle, providing actuarial insights that were vital in launching two new insurance products.

- Performed actuarial analysis on workers' compensation to improve pricing accuracy by identifying underlying cost drivers and trends.

- Successfully completed actuarial exams and projects ahead of schedule, contributing to an accelerated professional growth in the field.

- Contributed to a 10% reduction in claim costs through the application of advanced predictive analytics techniques.

- Actively participated in enterprise risk management initiatives, thereby strengthening the company's overall risk mitigation strategies.

- Assisted in the recalibration of the economic capital model which improved risk sensitivity and business planning.

- Tasked with quarterly solvency testing, my analyses provided critical input that ensured the organization maintained a robust financial position.

- Collaborated intensively on a major Medicare part D pricing project, which contributed to the organization securing a 10% market share increase.

- Initiated a data quality improvement plan that reduced input data errors by 40%, enhancing overall model reliability.

- Developed a comprehensive dashboard to monitor KPIs for senior executives, promoting greater transparency across business units.

- Played a key role in rate filing processes, achieving a 100% approval rate from state insurance regulators.

- Led critical analysis on reinsurance treaty terms, resulting in renegotiated contracts that saved the company $5 million annually.

- Laid the foundation for a new actuarial database system that improved data retrieval times by 40%, enhancing team performance.

- Directed the evaluation of financial implications of alternative risk transfer mechanisms, influencing the company's strategic risk decisions.

- Instituted a bi-annual actuarial seminar within the company to bolster continuous learning and professional development.

- Assisted in the formation and execution of company-wide risk management policies that adhered to evolving industry standards.

- Pioneered the use of machine learning in actuarial predictions for life insurance underwriting, which decreased prediction errors by 25% over traditional methods.

- Supervised a portfolio risk assessment project, identifying diversification opportunities that improved portfolio resilience to market volatility.

- Crafted a dynamic financial analysis framework that enabled proactive responses to changing economic conditions, protecting the company against potential financial downturns.

- Provided expert actuarial advice for M&A activities, influencing valuation and due diligence processes that were crucial for informed investment decisions.

- Facilitated the transition to an enterprise risk management system, significantly improving the company's ability to identify and manage risks early.

- Optimized health insurance rate structures, creating models that accounted for new healthcare regulations and saved the company $1.2 million in potential fines.

- Participated in the deployment of a new actuarial software, reducing calculation errors in critical reporting by ensuring the availability of real-time data.

- Contributed analysis during the transition to the Affordable Care Act regulations, seamlessly adapting the company's offerings to meet new standards.

- Provided essential actuarial support for a high-profile corporate restructuring initiative, enabling the consolidation of product lines without increases in premiums.

- Delivered key improvements in the projection of long-term care claim liabilities, better aligning with the actual experience and reducing volatility in financial statements.

- Enabled sharper pricing strategies for commercial lines insurance through the integration of geographical data analytics, improving market competitiveness.

- Crafted an actuarial toolset to assist in pension plan risk assessment, vital in the retention and acquisition of large corporate clients.

- Provided quantitative support that underpinned a corporate-level divestiture, ensuring optimal financial outcomes for the company's pension obligations.

- Accelerated the financial reporting process by automating actuarial tasks that formerly required manual intervention, cutting report generation time by 50%.

- Played an instrumental role in a long-term forecasting project that adjusted the company's strategic focus in alignment with emerging demographic trends.

- Oversaw the integration of a new stochastic modeling platform for life contingencies, enhancing the depth of our risk scenarios and model accuracy.

- Orchestrated the actuarial due diligence for a $200M acquisition, laying the groundwork for seamless integration of the new asset into the company's financial framework.

- Developed training programs for junior actuaries, emphasizing practical applications of actuarial sciences, resulting in a stronger talent pool within the department.

- Evaluated the fiscal impact of potential legislations for product pricing, shaping the company’s lobbying efforts on key insurance matters.

- Rendered expert actuarial testimony during regulatory hearings, effectively communicating complex financial assumptions and defending company's rate change proposals.

What to add in your actuary CV experience section with no professional experience

If you don't have the standard nine-to-five professional experience, yet are still keen on applying for the job, here's what you can do:

- List any internships, part-time roles, volunteer experience, or basically any work you've done that meets the job requirements and is in the same industry;

- Showcase any project you've done in your free time (even if you completed them with family and friends) that will hint at your experience and skill set;

- Replace the standard, CV experience section with a strengths or achievements one. This will help you spotlight your transferrable skills that apply to the role.

Recommended reads:

PRO TIP

Include examples of how you adapted to new tools, environments, or work cultures, showing your flexibility.

Key actuary CV skills: what are hard skills and soft skills

Let's kick off with the basics. You know that you have to include key job requirements or skills across your CV. For starters, take individual skills from the job description and copy-paste them into your CV, when relevant. Doing so, you'll ensure you have the correct skill spelling and also pass the Applicant Tracker System (ATS) assessment. There are two types of skills you'll need to include on your CV:

- Hard skills - technical abilities that are best defined by your certificates, education, and experience. You could also use the dedicated skills section to list between ten and twelve technologies you're apt at using that match the job requirements.

- Soft skills - your personal traits and interpersonal communication skills that are a bit harder to quantify. Use various CV sections, e.g. summary, strengths, experience, to shine a spotlight on your workspace achievements, thanks to using particular soft skills.

Remember that your job-winning CV should balance both your hard and soft skills to prove your technical background, while spotlighting your personality.

Top skills for your actuary CV:

Statistical Analysis

Probability Theory

Risk Assessment

Data Analysis

Actuarial Science

Financial Modelling

Technical Writing

Database Management

Solvency II

Pricing Strategies

Problem-Solving

Analytical Thinking

Communication Skills

Attention to Detail

Teamwork

Time Management

Continuous Professional Development

Adaptability

Client Relationship Management

Leadership

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Education and more professional qualifications to include in your actuary CV

If you want to showcase to recruiters that you're further qualified for the role, ensure you've included your relevant university diplomas. Within your education section:

- Describe your degree with your university name(-s) and start-graduation dates;

- List any awards you've received, if you deem they would be impressive or are relevant to the industry;

- Include your projects and publications, if you need to further showcase how you've used your technical know-how;

- Avoid listing your A-level marks, as your potential employers care to learn more about your university background.

Apart from your higher education, ensure that you've curated your relevant certificates or courses by listing the:

- name of the certificate or course;

- name of the institution within which you received your training;

- the date(-s) when you obtained your accreditation.

In the next section, discover some of the most relevant certificates for your actuary CV:

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Recommended reads:

Key takeaways

Impressing recruiters with your experience, skill set, and values starts with your professional actuary CV. Write concisely and always aim to answer job requirements with what you've achieved; furthermore:

- Select a simple design that complements your experience and ensures your profile is presentable;

- Include an opening statement that either spotlights your key achievements (summary) or showcases your career ambitions (objective);

- Curate your experience bullets, so that each one commences with a strong, action verb and is followed up by your skill and accomplishment;

- List your hard and soft skills all across different sections of your CV to ensure your application meets the requirements;

- Dedicate space to your relevant higher education diplomas and your certificates to show recruiters you have the necessary industry background.