Senior tax accountants often struggle with effectively conveying their extensive knowledge and hands-on experience in various complex tax regulations on a resume. Our guide can assist by providing robust examples and templates that will help them highlight their expertise in tax accounting, compliance, and advisory services, thereby making their resumes stand out to potential employers.

Dive into our comprehensive guide to crafting a standout senior tax accountant resume:

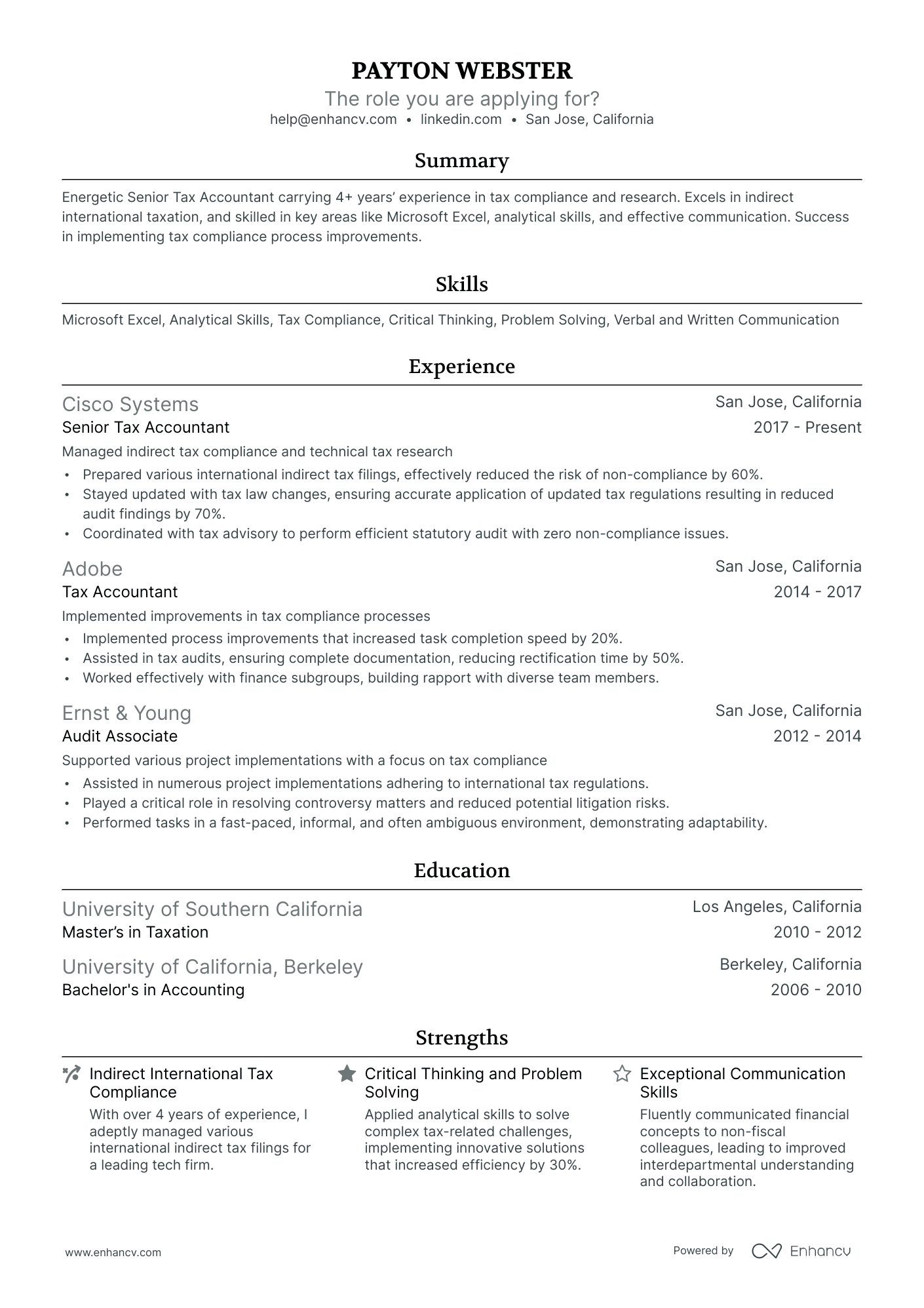

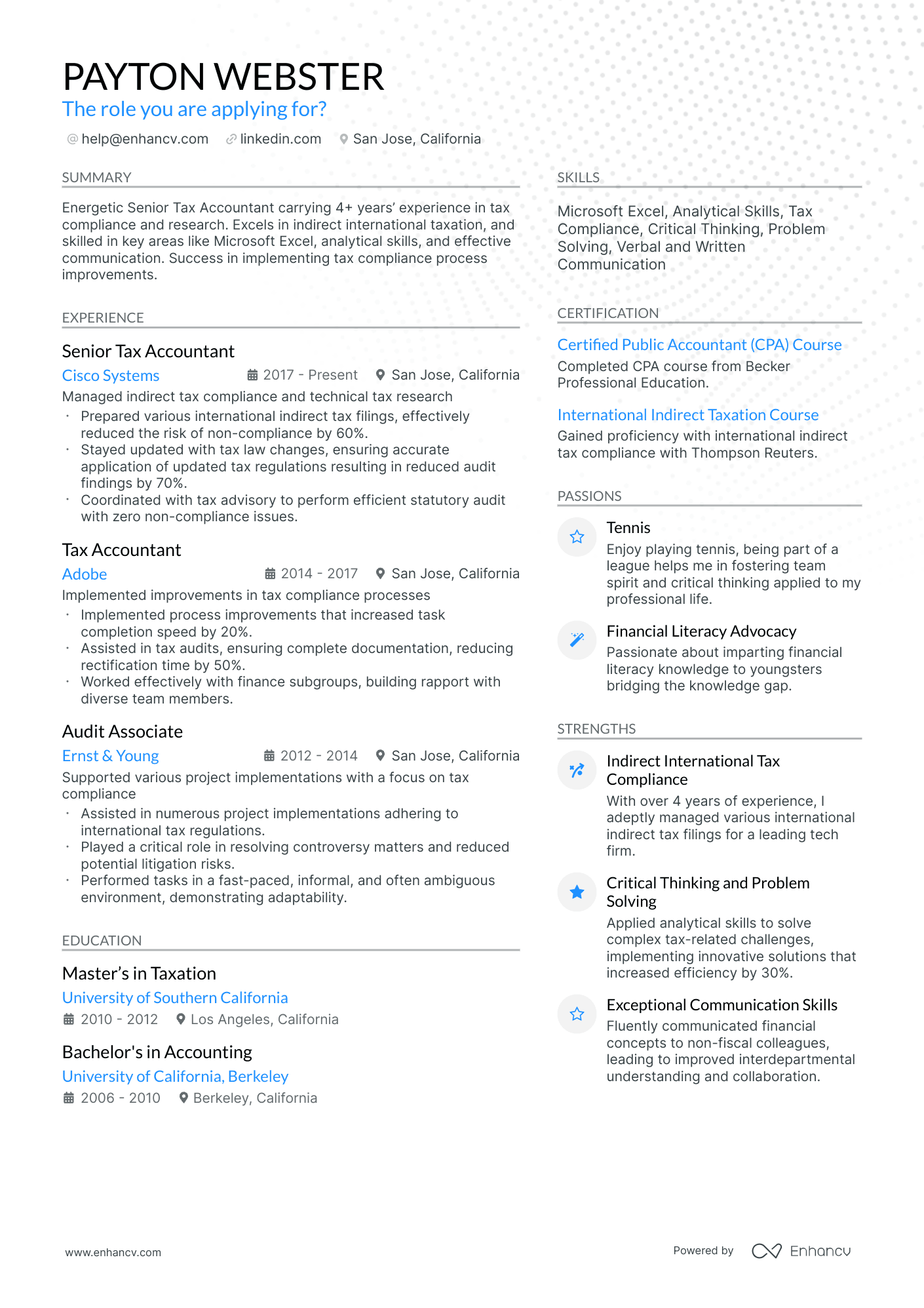

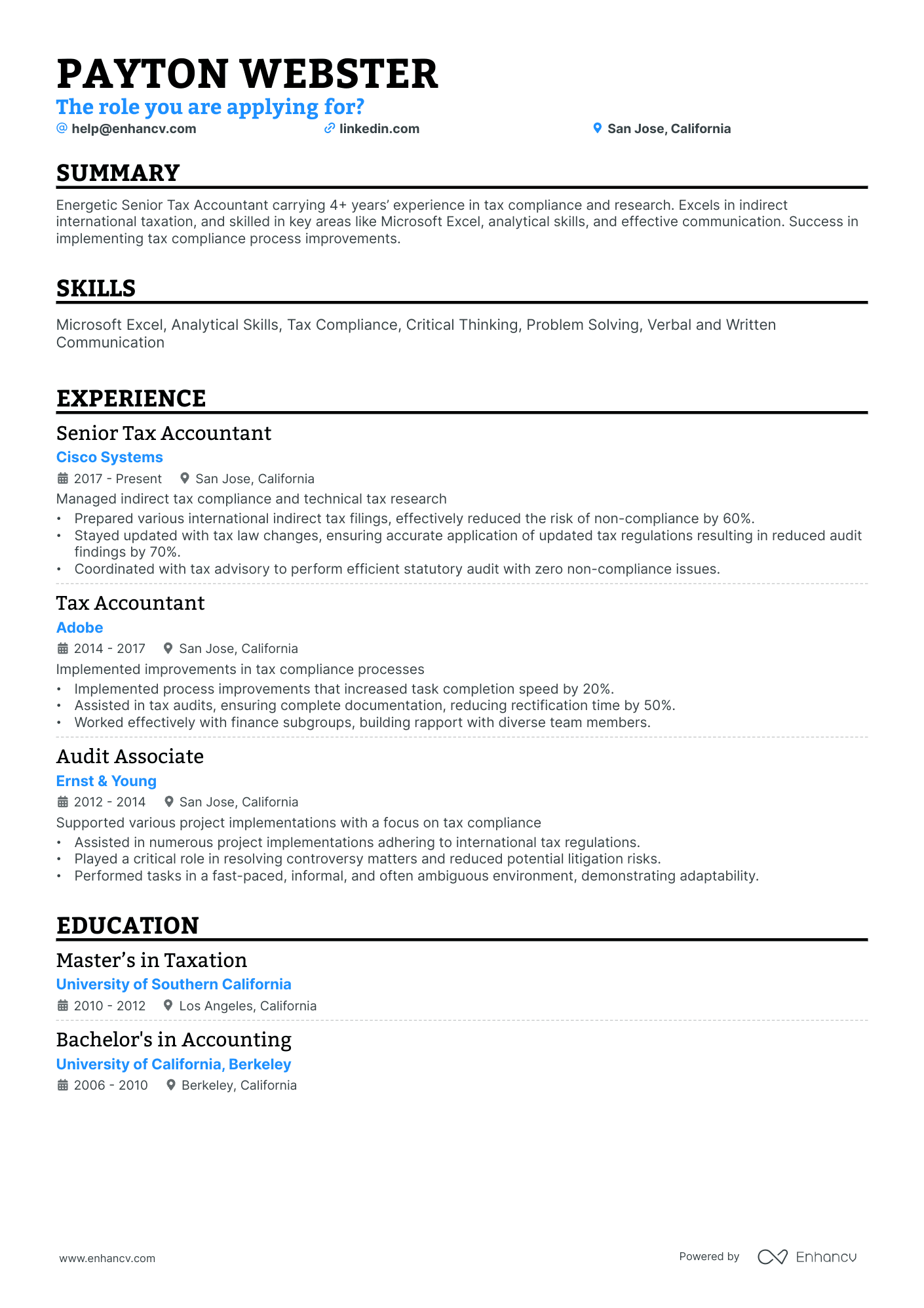

- Discover senior tax accountant resume samples that have secured positions at top-tier companies.

- Master the aesthetics of your resume layout for maximum impact.

- Strategically present your achievements and skills across various resume sections.

- Convey to recruiters why you're the perfect fit for the job.

Recommended reads:

Designing your senior tax accountant resume: best practices

Before penning down your senior tax accountant resume, consider its structure and format. Here's what you should remember:

- Employ the reverse-chronological format to present your experience, starting with your most recent role.

- Your resume's header should feature accurate, professional contact details. If you maintain a professional portfolio or LinkedIn profile, include its link.

- Keep your resume concise, ideally within two pages. Prioritize relevance over length.

- Unless directed otherwise, save your resume as a PDF to preserve its design.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Your resume will likely be processed by an Applicant Tracking System (ATS). Ensure your header, summary, or objective incorporates essential skills required for the role.

Must-have sections on a senior tax accountant resume:

- A header to list your job title and contact information

- A resume summary or objective which highlights your top career achievements

- A detailed experience section where you emphasize the breadth of your expertise

- A skills box to put the spotlight on your social talents and technical strengths

- An education and certifications section which features your qualifications

What recruiters want to see on your resume:

- Experience with tax preparation and consulting: This can include experiences in income tax, sales tax, property tax, and other forms of taxation relevant to the business.

- Proficiency in tax accounting software: Knowledge of software like TurboTax, H&R Block, or other industry-specific tools is often crucial for efficient work.

- Understanding tax laws and regulations: A robust understanding of state, federal, and international tax laws is necessary, including staying updated on any changes to these laws.

- Strong interpersonal skills: The ability to work in a team, communicate effectively with clients, and explain complex tax concepts in simple terms can distinguish you from others.

- Certifications and qualifications: These can include Certified Public Accountant (CPA) status, Master's degree in Taxation, or other relevant certifications.

Recommended reads:

Optimizing your senior tax accountant resume experience section

Your resume's experience section should resonate with your accomplishments while aligning with the job's demands. Here's how:

- Highlight significant career moments, and back them up with relevant skills.

- Analyze the job description to address both basic and advanced requirements.

- If you have unrelated roles, consider a separate section, but emphasize transferable skills.

- Avoid listing roles from over a decade ago unless they showcase your trajectory, especially for senior roles.

- Illustrate how your contributions enhanced the team or company, linking challenges to solutions.

Review how seasoned senior tax accountant professionals have crafted their experience sections, emphasizing their contributions.

- Managed tax compliance for a portfolio of high-net-worth individuals, resulting in a 15% increase in overall tax savings.

- Led the implementation of automated tax software, streamlining processes and reducing filing errors by 25%.

- Performed detailed analysis of complex tax scenarios, ensuring accurate preparation and filing of federal and state tax returns.

- Collaborated with cross-functional teams to develop tax planning strategies that minimized client liabilities while maximizing benefits.

- Provided guidance and support to junior accountants, facilitating their professional development and enhancing team productivity.

- Prepared and reviewed corporate tax returns for multinational corporations, ensuring compliance with international tax laws.

- Conducted extensive research on tax legislation changes, resulting in the identification of cost-saving opportunities for clients.

- Assisted in resolving complex tax issues, including IRS audits and inquiries, leading to successful resolutions and minimal penalties.

- Implemented an efficient tax workflow system, reducing turnaround time for tax return preparation by 20%.

- Collaborated with external auditors to reconcile financial statements and ensure accurate tax provision calculations.

- Managed tax compliance for a diverse client base, including partnerships, LLCs, and high-growth startups.

- Developed and implemented tax planning strategies that minimized clients' effective tax rates by an average of 12%.

- Prepared and reviewed complex individual, corporate, and partnership tax returns, ensuring accuracy and compliance.

- Provided guidance on tax implications of business transactions, resulting in significant tax savings for clients.

- Led a team in conducting research on state and local tax laws, optimizing clients' multi-state tax positions.

- Managed the tax department's day-to-day operations, overseeing a team of tax accountants and coordinating workload assignments.

- Collaborated with clients to identify tax planning opportunities and implemented strategies resulting in $500,000 in annual tax savings.

- Led the implementation of tax software solutions, increasing efficiency and reducing processing time by 30%.

- Developed and delivered training programs on tax law updates and best practices, enhancing staff knowledge and accuracy.

- Conducted internal audits to ensure compliance with tax regulations and identified areas for process improvement.

- Performed tax due diligence for mergers and acquisitions, identifying potential risks and tax savings opportunities.

- Collaborated with legal teams to structure transactions in a tax-efficient manner, resulting in $2 million in tax savings for clients.

- Advised clients on international tax planning, including transfer pricing strategies, leading to enhanced global tax efficiency.

- Managed IRS audits and represented clients in tax controversy matters, resulting in successful resolutions and minimized penalties.

- Developed and delivered tax training programs for clients, improving their understanding of complex tax matters.

- Prepared and reviewed federal and state tax returns for high-net-worth individuals, ensuring accuracy and compliance.

- Collaborated with financial advisors to implement tax-efficient investment strategies, resulting in increased after-tax returns for clients.

- Researched and analyzed tax laws and regulations, providing guidance on tax implications of various financial transactions.

- Assisted clients with tax planning and estimated tax calculations, resulting in improved cash flow management and reduced penalties.

- Worked closely with the audit team to reconcile tax provisions and resolve tax-related audit queries.

- Managed international tax compliance for a multinational corporation, ensuring adherence to local tax laws across multiple jurisdictions.

- Led the implementation of transfer pricing policies, resulting in a $1 million reduction in intercompany transfer pricing adjustments.

- Provided guidance on tax-efficient structuring of cross-border transactions, minimizing tax exposure and optimizing global tax positions.

- Performed tax research and analysis on country-specific tax issues, guiding business decisions and mitigating tax risks.

- Collaborated with external tax advisors to optimize the company's tax structure and ensure compliance with global tax regulations.

- Prepared and reviewed federal, state, and local tax returns for individuals, partnerships, and corporations.

- Provided tax planning advice to clients, resulting in $250,000 in annual tax savings.

- Researched complex tax issues and provided guidance on tax implications of business transactions and investment decisions.

- Assisted in IRS audits and responded to inquiries, ensuring compliance with tax laws and minimizing penalties.

- Collaborated with clients' legal teams to structure transactions in a tax-efficient manner.

- Provide comprehensive tax planning and compliance services for high-net-worth individuals and their related entities.

- Develop and implement tax strategies to minimize tax liabilities and maximize wealth preservation.

- Review complex individual and entity tax returns for accuracy and compliance with tax laws.

- Conduct tax research and analysis to identify tax-saving opportunities and ensure adherence to changing tax regulations.

- Collaborate with clients' financial advisors and attorneys to optimize tax outcomes and support overall financial goals.

- Managed tax compliance for a diverse client base, including small businesses, nonprofits, and high-net-worth individuals.

- Prepared and reviewed federal, state, and local tax returns, ensuring accurate reporting and compliance.

- Identified tax credits and deductions for clients, resulting in $100,000 in annual tax savings.

- Assisted clients in resolving tax notices and inquiries from tax authorities, minimizing penalties and interest charges.

- Developed and implemented tax planning strategies tailored to clients' specific needs.

Quantifying impact on your resume

<ul>

Crafting the experience section for novice senior tax accountant candidates

Lack of extensive experience doesn't equate to an empty resume. Here's how you can enrich your experience section:

- Volunteer Roles: Community involvement often equips you with valuable interpersonal skills, and sometimes even technical ones, relevant to the job.

- Academic Projects: Highlight significant university projects that contributed to the field, showcasing your hands-on experience.

- Internships: Even short-term internships can be invaluable. If they're pertinent to the role, they deserve a spot on your resume.

- Past Jobs: Even if unrelated to the senior tax accountant, these roles can demonstrate transferable skills that are beneficial for the position.

Recommended reads:

Pro tip

Use the SOAR (Situation - Action - Results) method for each of your senior tax accountant experience bullets. Reflect on specific challenges you've addressed, the actions you took, and the outcomes. This approach also preps you for potential interview questions.

Senior tax accountant resume skills: showcasing both hard and soft skills

Your senior tax accountant resume should show recruiters your range of skills. List the tools and software you use (hard skills) and how they fit into your daily tasks. But don't stop there. Share the personal traits (soft skills) you've gained from your experiences. Here's how:

- Showcase three top career achievements.

- For each achievement, mention a hard and a soft skill you used.

- Highlight unique skills that set you apart.

- Discuss how your skills improved the workplace or team culture.

Check our list for popular hard and soft skills in the industry.

Top skills for your senior tax accountant resume:

Tax Compliance Software (e.g., Intuit ProConnect, Drake Tax)

Microsoft Excel

IRS Regulations and Tax Codes

Accounting Software (e.g., QuickBooks, SAP)

Financial Reporting

Tax Preparation and Planning

Data Analysis Tools (e.g., Tableau, Power BI)

Document Management Systems

Tax Research Tools (e.g., CCH IntelliConnect, Thomson Reuters)

E-filing Systems

Attention to Detail

Analytical Thinking

Problem Solving

Time Management

Communication Skills

Team Collaboration

Adaptability

Critical Thinking

Client Relationship Management

Ethical Judgment

Pro tip

Don't go all over the place with your skills section by listing all keywords/ buzzwords you see within the ad. Curate both hard and soft skills that are specific to your professional experience and help you stand out.

Highlighting education and certification on your senior tax accountant resume

Your education section is a testament to your foundational knowledge and expertise.

Consider:

- Detailing your academic qualifications, including the institution and duration.

- If you're still studying, mention your anticipated graduation date.

- Omit degrees that aren't pertinent to the job.

- Highlight academic experiences that underscore significant milestones.

For senior tax accountant roles, relevant education and certifications can set you apart.

To effectively showcase your qualifications:

- List all pertinent degrees and certifications in line with the job requirements.

- Include additional certifications if they bolster your application.

- Provide concise details: certification name, institution, and dates.

- If you're pursuing a relevant certification, indicate your expected completion date.

Your education and certification sections validate both your foundational and advanced knowledge in the industry.

Best certifications to list on your resume

Pro tip

If you have plenty of certifications, prioritize the most relevant and industry-recognized ones. Arrange them based on their relevance to the job at hand.

Recommended reads:

Crafting the senior tax accountant resume summary or objective: a blend of achievements, aspirations, and uniqueness

Whether you opt for a resume summary or objective depends on your career trajectory.

- If you have a rich tapestry of relevant achievements, a resume summary can spotlight these accomplishments.

- If you're relatively new or transitioning, a resume objective can articulate your aspirations and how they align with the role.

Regardless of your choice, this section should encapsulate your unique value proposition, blending your technical and interpersonal strengths.

Resume summary and objective examples for a senior tax accountant resume

Seasoned tax professional with over 15 years of experience specializing in federal and state tax accounting. Proficient in the latest tax software, boasting an expertise in optimizing company profits through strategic tax planning and compliance. Awarded 'Accountant of the Year' for implementing significant tax-saving strategies at a Fortune 500 company.

Experienced financial analyst pivoting into tax accounting with a strong foundation in finance, budgeting, and forecasting. Leverages a Master's degree in Taxation and familiarity with tax laws. Led a project resulting in a 20% cost reduction for a multi-million dollar firm.

Highly organized CPA bringing 12 years of tax accounting experience. Skillful in GAAP and tax law, adept at processing complex transactions and corporate tax returns. Instrumental in reducing audit findings by 30% at a global tech company.

Certified auditor transitioning into a senior tax accountant role. Combines analytic prowess with strong knowledge of regulatory standards and tax laws. Recognized for improving operational efficiency by restructuring the auditing process of a Big Four firm.

Aiming to utilize my CPA certification and Master's degree in Taxation to deliver precise tax computations and ensure regulatory compliance. Keen to apply this knowledge towards identifying cost-saving opportunities in the field of tax accounting.

Aspiring to leverage my Bachelor’s in Accounting and understanding of tax software to help corporations maintain tax compliance and optimize their tax position. Passionate about solving complex tax-related issues and eager to learn from industry leaders.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Extra sections to include in your senior tax accountant resume

What should you do if you happen to have some space left on your resume, and want to highlight other aspects of your profile that you deem are relevant to the role?

Add to your senior tax accountant resume some of these personal and professional sections:

- Passions/Interests - to detail how you spend both your personal and professional time, invested in various hobbies;

- Awards - to present those niche accolades that make your experience unique;

- Publications - an excellent choice for professionals, who have just graduated from university or are used to a more academic setting;

- < a href="https://enhancv.com/blog/volunteering-on-resume/"> Volunteering - your footprint within your local (or national/ international) community.

Key takeaways

- A clear resume layout helps present your info well.

- Use all main resume sections to show how you fit the job.

- Detail specific skills or tasks and their impact.

- Show your personality through interests or hobbies.

- List certifications to back up your technical skills.