An accounts payable specialist often encounters the challenge of effectively highlighting their analytical skills and attention to detail, which are critical for managing accounts, spotting discrepancies, and ensuring timely payments. Our guide assists in addressing this challenge by providing industry-specific examples and proven strategies to showcase these skills, thus ensuring your resume stands out to hiring managers.

Dive into this guide to learn how to craft a accounts payable specialist resume that offers recruiters a clear view of your career journey:

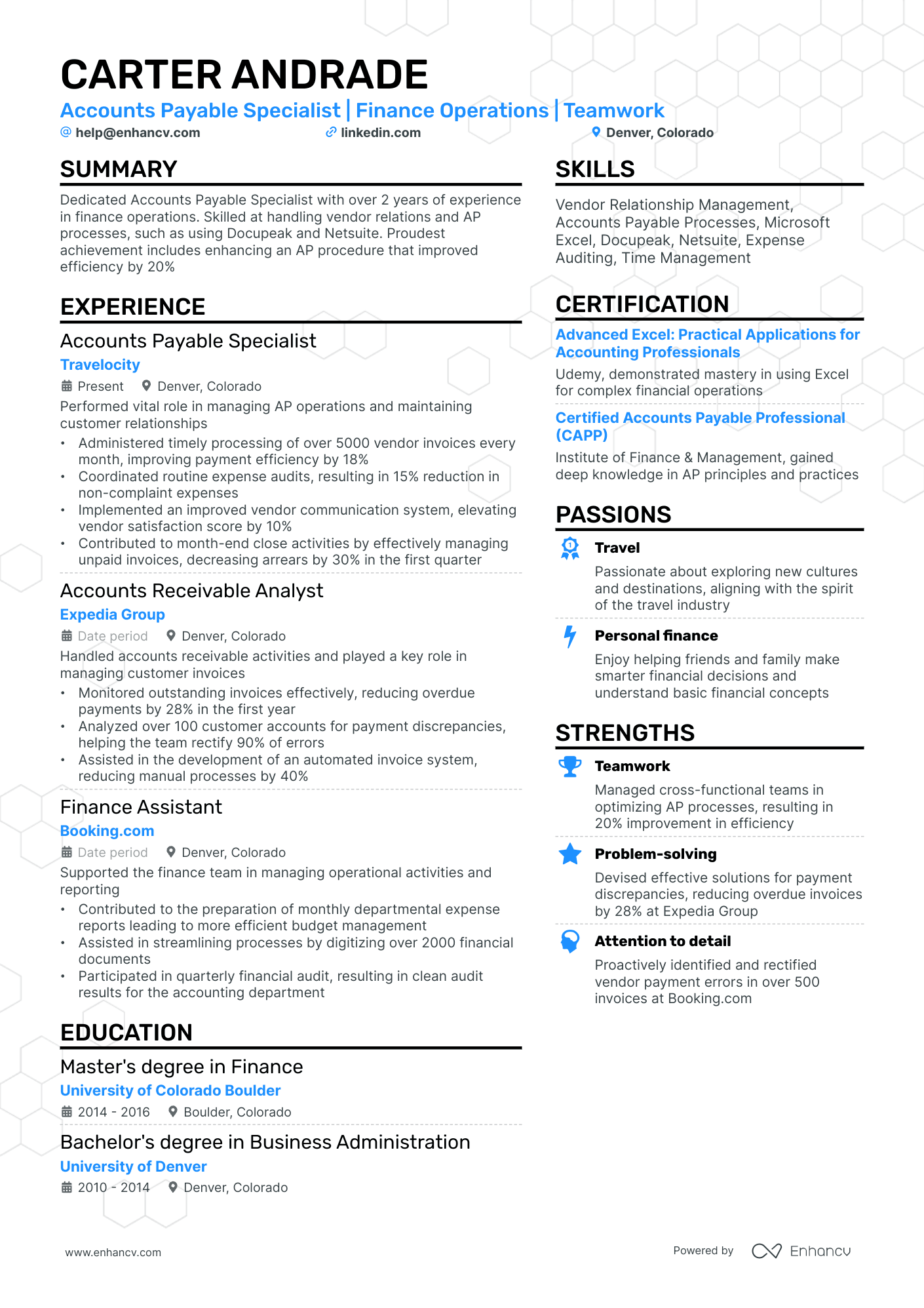

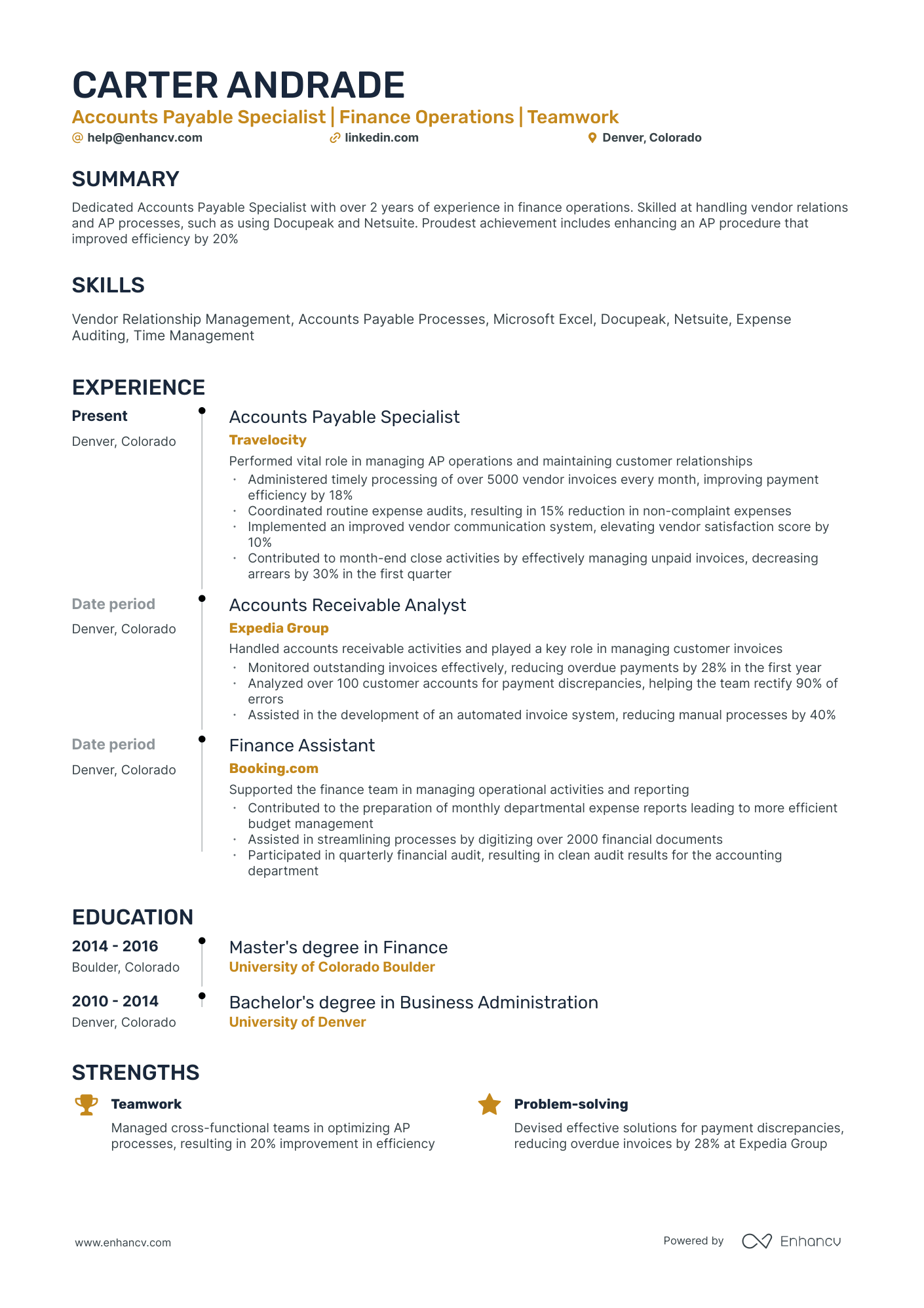

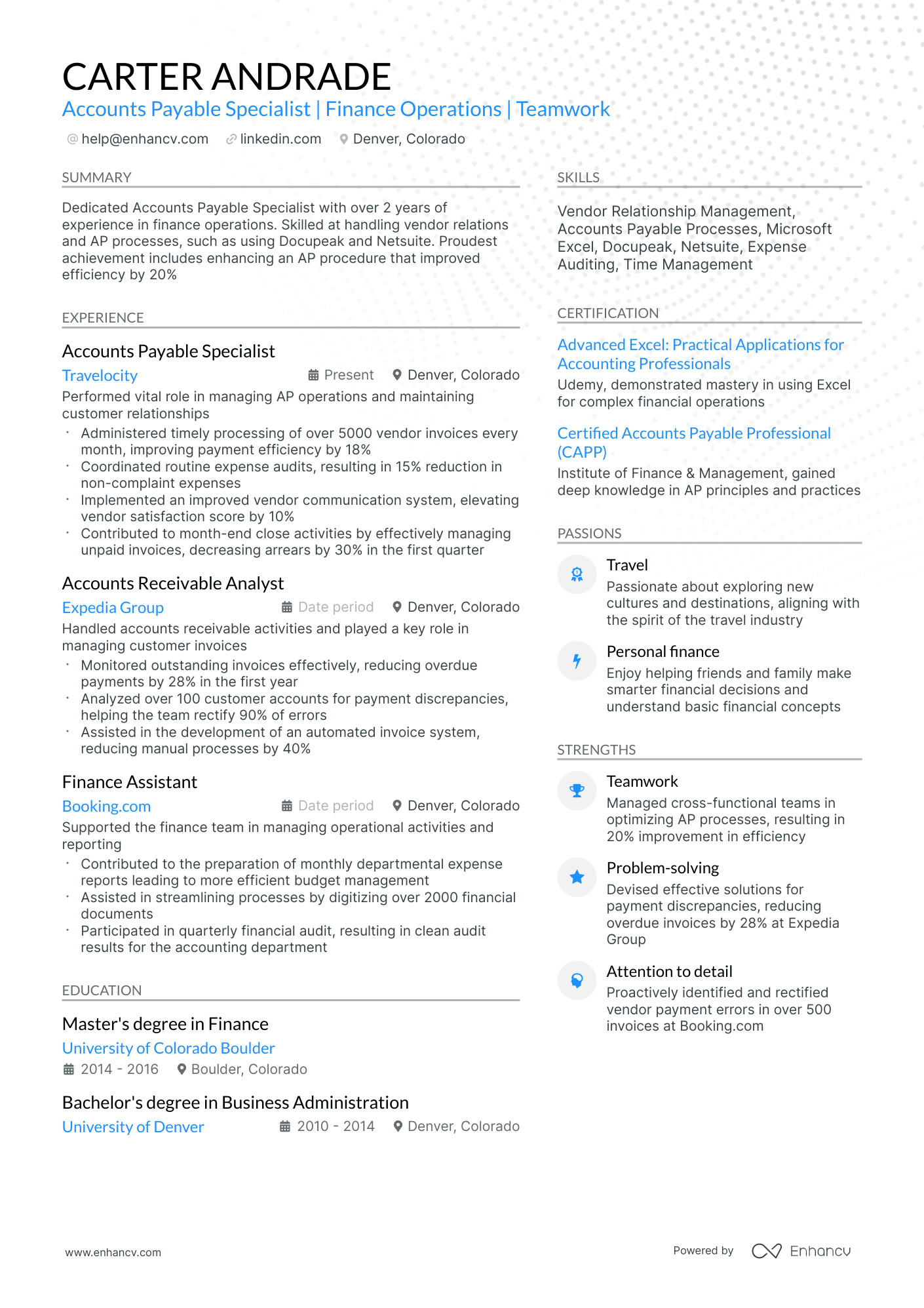

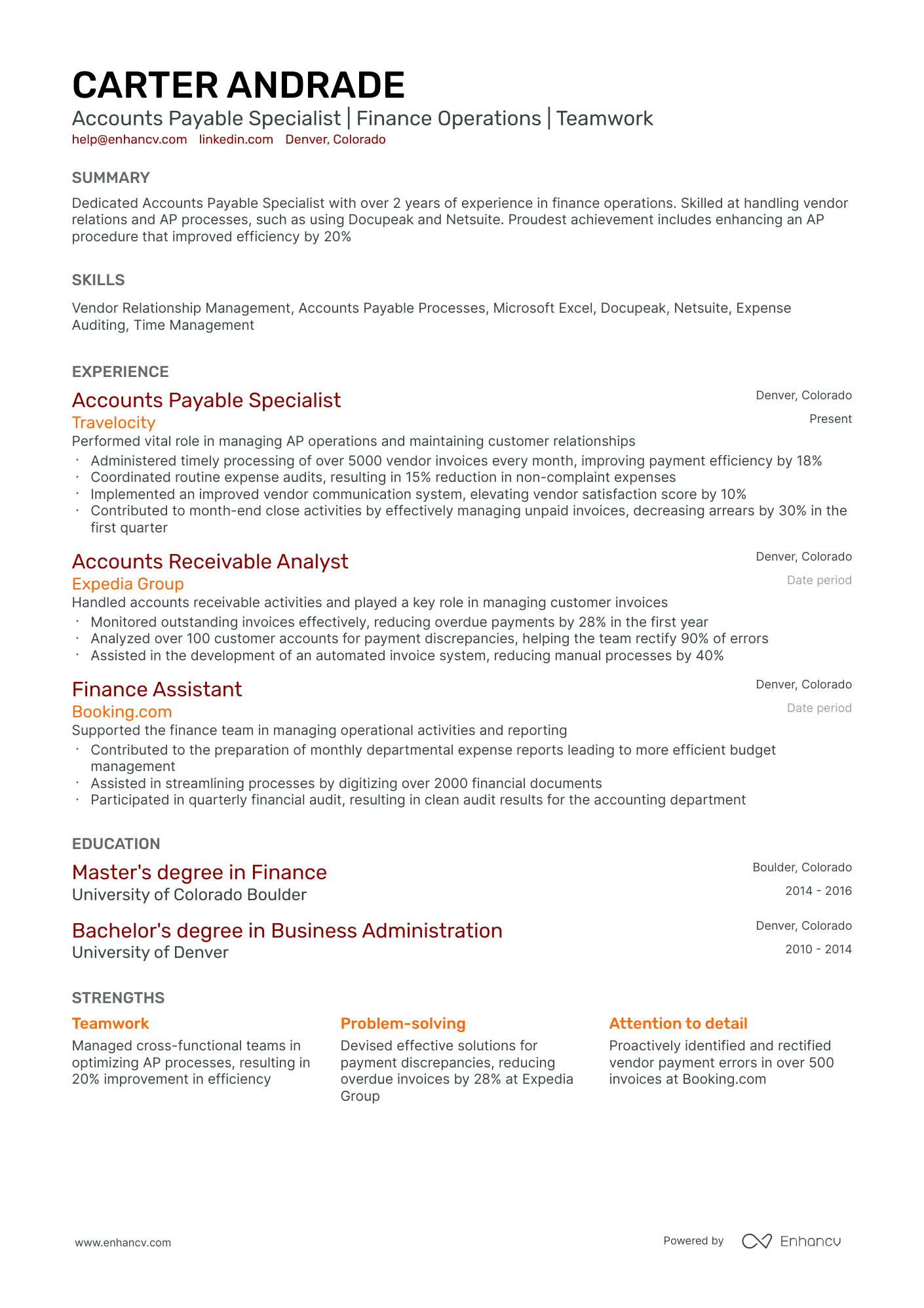

- Draw from our accounts payable specialist resume samples, highlighting top skills, certifications, and more.

- Illuminate the potential impact you can bring to an organization through your resume summary and experience.

- Spotlight your unique accounts payable specialist expertise, emphasizing tangible results and standout achievements.

Recommended reads:

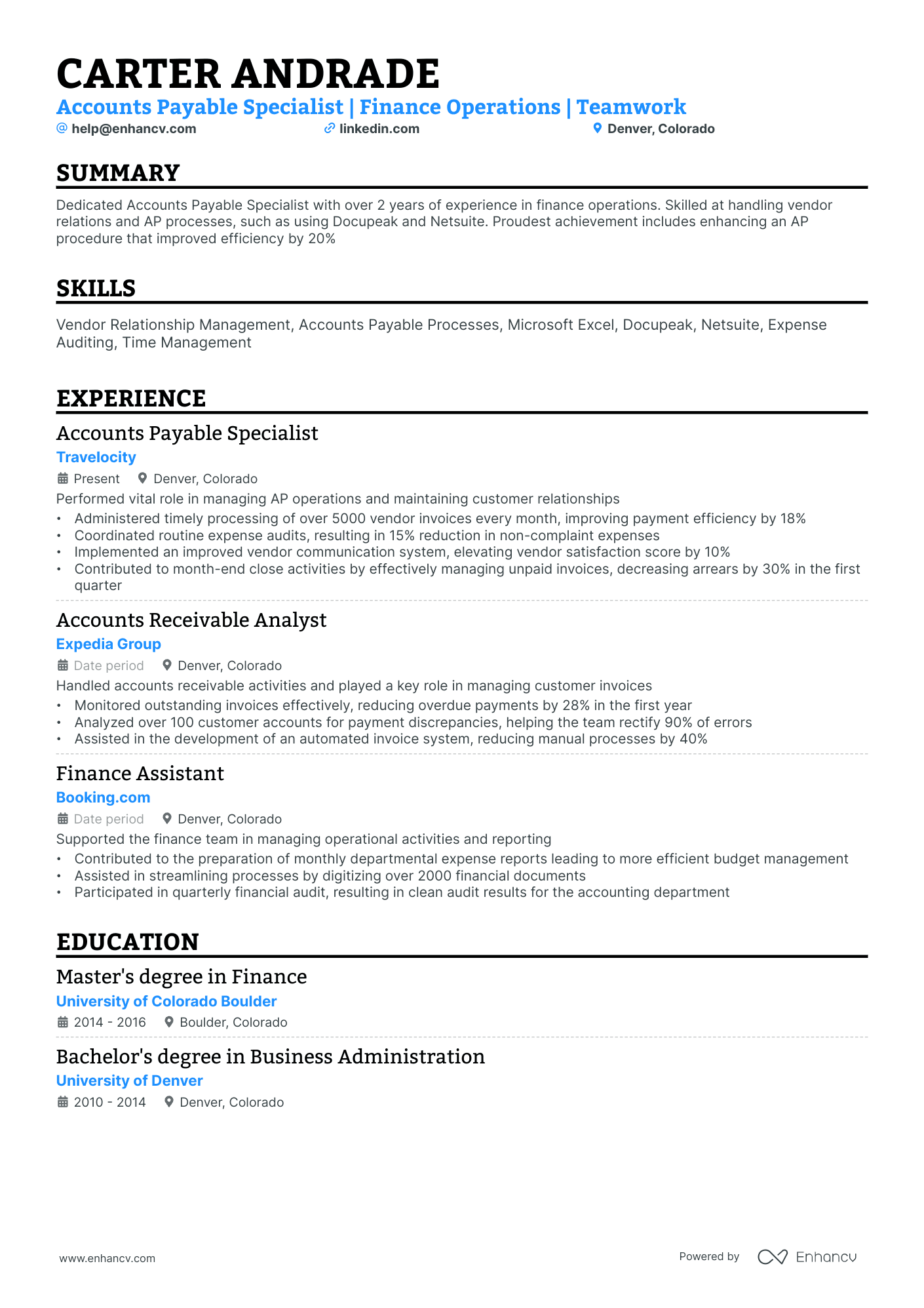

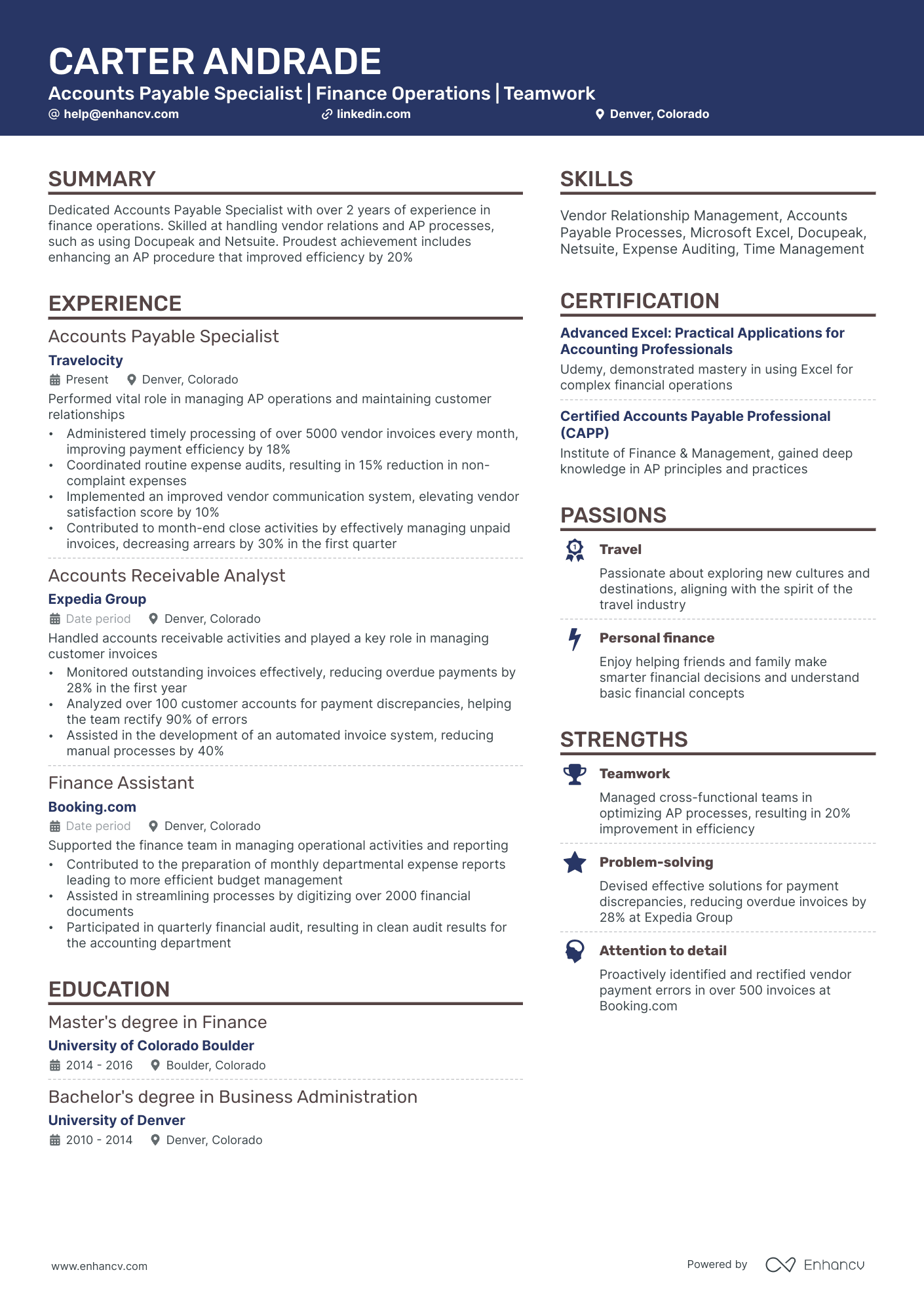

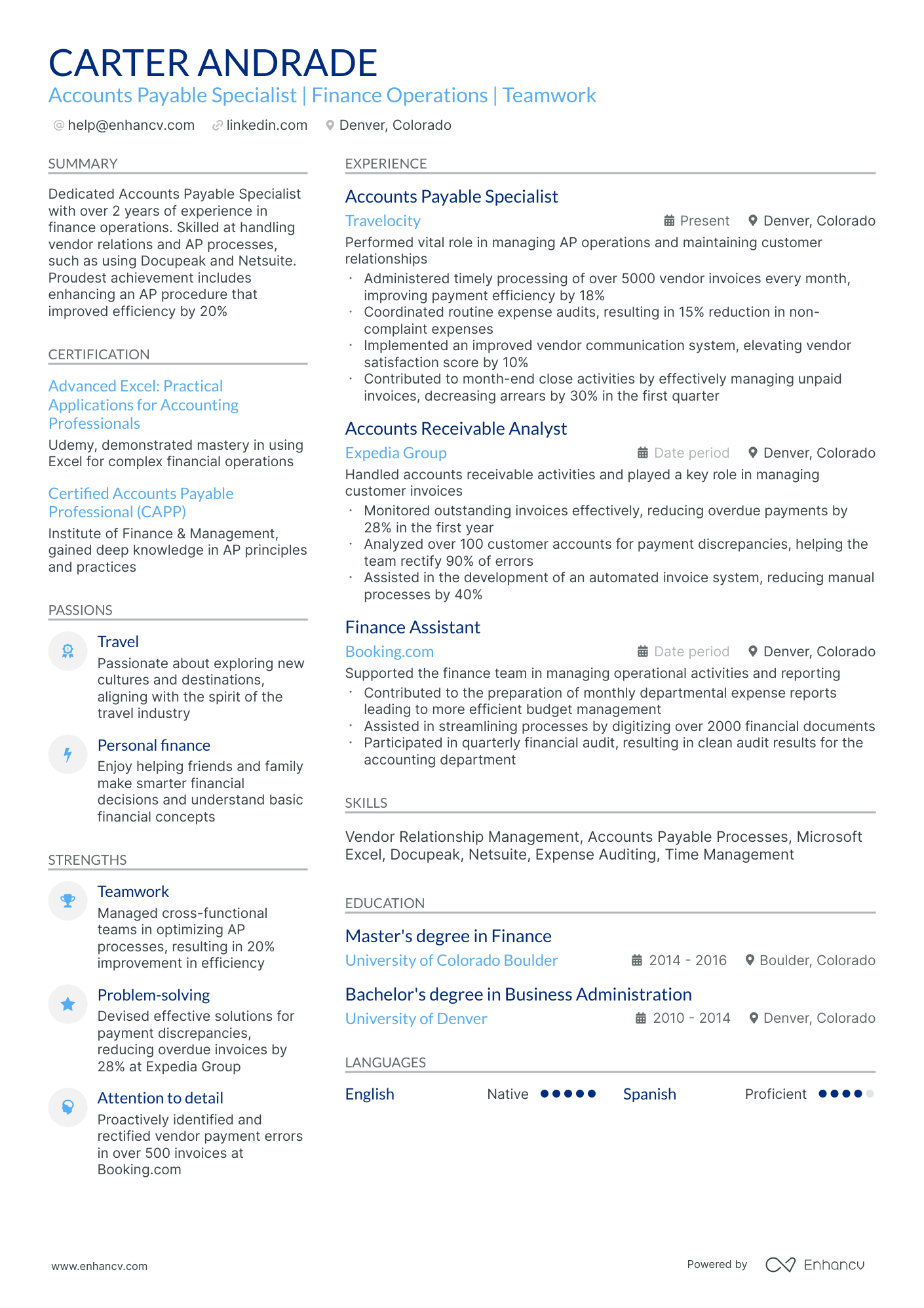

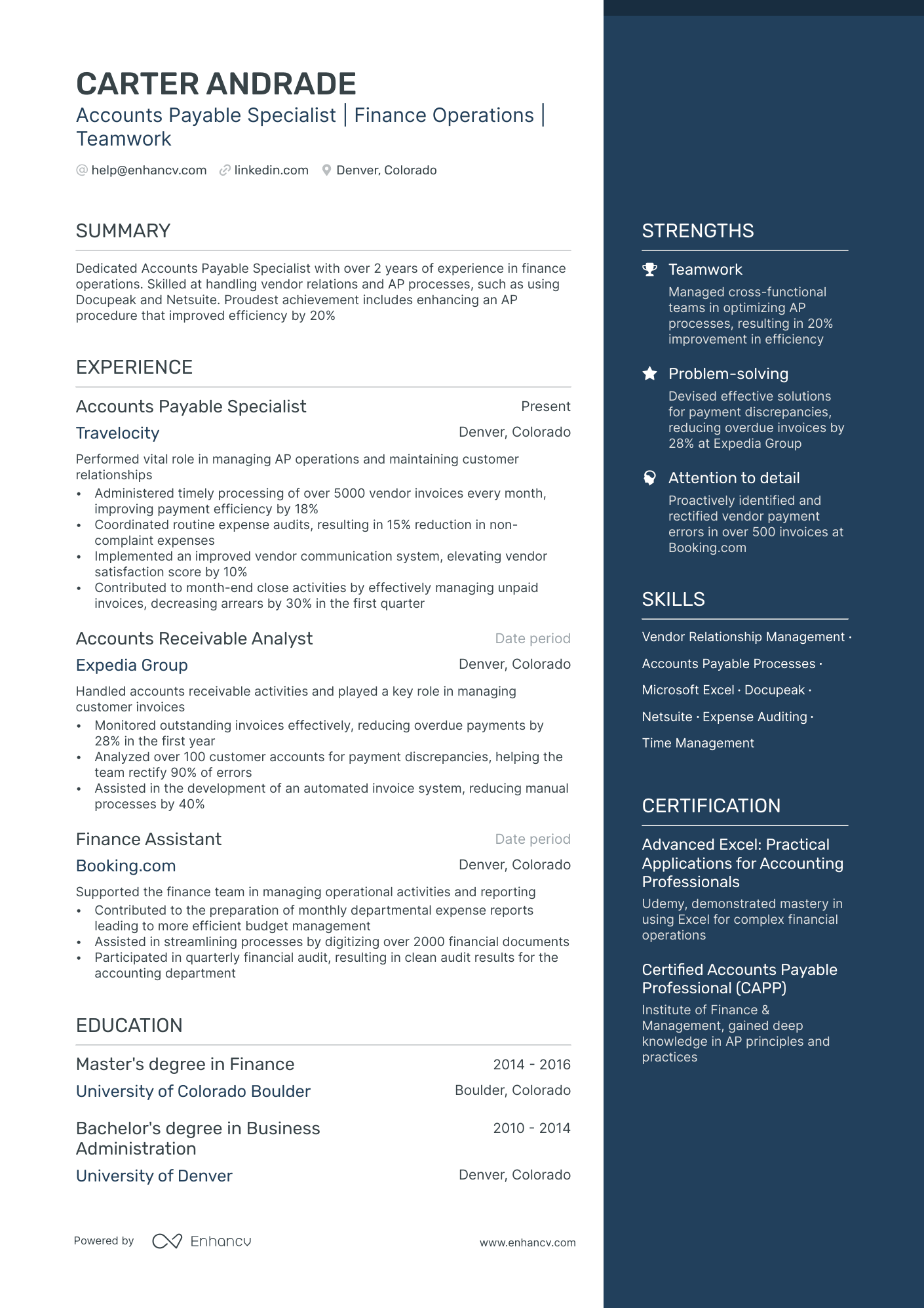

crafting a stellar accounts payable specialist resume format

Navigating the maze of resume formatting can be challenging. But understanding what recruiters prioritize can make the process smoother.

Wondering about the optimal format, the importance of certain sections, or how to detail your experience? Here's a blueprint for a polished resume:

- Adopt the reverse-chronological resume format. By spotlighting your latest roles upfront, you offer recruiters a snapshot of your career trajectory and recent accomplishments.

- Your header isn't just a formality. Beyond basic contact information, consider adding a link to your portfolio and a headline that encapsulates a significant achievement or your current role.

- Distill your content to the most pertinent details, ideally fitting within a two-page limit. Every line should reinforce your candidacy for the accounts payable specialist role.

- To preserve your resume's layout across different devices and platforms, save it as a PDF.

Different markets have specific resume styles – a Canadian resume, for instance, may require a different approach.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Your resume will likely be processed by an Applicant Tracking System (ATS). Ensure your header, summary, or objective incorporates essential skills required for the role.

Don't forget to include these six sections on your accounts payable specialist resume:

- A header for your contact details and a summary that highlight your alignment with the accounts payable specialist job you're applying for

- An experience section that explains how you apply your technical and personal skills to deliver successful results

- A skills section that further highlights how your profile matches the job requirements

- An education section that provides your academic background

- An achievements' section that mentions any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Accounts Payable Experience: Evidence of previous experience managing accounts payable, including processing invoices, maintaining vendor relationships, and general ledger reconciliation.

- Software Proficiency: Familiarity with accounting software (like QuickBooks, SAP) and proficiency in Microsoft Excel for handling large data sets, creating spreadsheets, and generating reports.

- Attention to Detail: Ability to accurately process high volumes of invoices and payments while minimizing errors, demonstrating strong organizational and detail-oriented skills.

- Communication Skills: Capabilities to effectively liaise with both internal stakeholders and external vendors, resolving any disputes or discrepancies promptly and professionally.

- Understanding of Regulatory Compliance: Knowledge of applicable financial regulations and standards, understanding the importance of confidentiality and adherence to data protection guidelines.

Recommended reads:

The experience section of your accounts payable specialist resume: your professional journey

The experience section is your platform to narrate your professional story. Recruiters scrutinize this section to gauge your unique value proposition.

Here are five steps to craft a compelling experience section:

- Highlight relevant roles, including the company, role description, and tenure, supported by up to six bullet points per role.

- Emphasize tangible outcomes of your contributions, using quantifiable metrics where possible.

- Integrate positive feedback or endorsements to bolster your claims.

- Ensure verb tense consistency when detailing responsibilities.

- Summarize significant achievements relevant to each role.

Explore how seasoned accounts payable specialist professionals have crafted their experience sections to secure roles at industry-leading firms.

- Managed accounts payable processes for a high-volume manufacturing company, processing an average of 500 invoices per week.

- Implemented an automated invoice approval system, resulting in a 30% reduction in processing time and improved accuracy.

- Collaborated with vendors to resolve payment discrepancies, ensuring timely and accurate payments.

- Generated weekly aging reports and implemented proactive measures to minimize delinquent payments.

- Assisted in the preparation of financial statements, providing accurate and reliable data for analysis and reporting.

- Processed and reconciled invoices, purchase orders, and expense reports, ensuring compliance with company policies and procedures.

- Created and maintained vendor records, including accurate contact information and payment terms.

- Collaborated with cross-functional teams to resolve billing discrepancies and address vendor inquiries.

- Assisted in the implementation of a new accounts payable system, resulting in streamlined processes and increased efficiency.

- Performed monthly closing activities, including accruals and account reconciliation.

- Processed and coded invoices, verified supporting documentation, and obtained proper approvals before payment.

- Managed the accounts payable email inbox, responding to vendor inquiries and resolving issues promptly.

- Assisted in the migration of the accounts payable system to a cloud-based platform, resulting in improved accessibility and data security.

- Conducted periodic audits to ensure compliance with internal controls and identify areas for process improvement.

- Collaborated with the procurement team to negotiate favorable payment terms and discounts with vendors.

- Processed and matched invoices with purchase orders and receiving documents, ensuring accurate and timely payments.

- Reconciled vendor statements and resolved discrepancies to maintain positive relationships.

- Managed the petty cash fund and prepared expense reports for reimbursement.

- Assisted in the implementation of electronic payment methods, reducing processing time and improving efficiency.

- Participated in cross-functional projects to streamline accounts payable processes and reduce manual tasks.

- Verified and entered invoices into the accounting system, ensuring accuracy and proper coding.

- Prepared monthly reports on outstanding payables and aging analysis for management review.

- Assisted in the annual audit by providing supporting documentation and explanations for accounts payable transactions.

- Maintained organized filing systems, both physical and digital, to facilitate easy retrieval of documents.

- Collaborated with the purchasing department to resolve pricing and quantity discrepancies with suppliers.

- Manage the full-cycle accounts payable process, including invoice processing, vendor communication, and payment disbursement.

- Implemented a digital document management system, reducing paper usage by 50% and improving efficiency.

- Developed and maintained strong relationships with vendors, negotiating favorable payment terms and resolving issues promptly.

- Collaborated with the finance team to streamline the month-end closing process, resulting in faster financial reporting.

- Assisted in the implementation of an automated expense tracking system, improving accuracy and reducing processing time.

- Processed a high volume of invoices on a daily basis, ensuring accuracy and adherence to company policies.

- Assisted with the implementation of a new accounts payable software, providing training to other team members.

- Collaborated with cross-functional teams to identify cost-saving opportunities and improve vendor relationships.

- Conducted regular audits to ensure compliance with internal controls and government regulations.

- Participated in process improvement initiatives, resulting in streamlined workflows and increased productivity.

- Processed and coded invoices, verified accuracy, and resolved discrepancies with vendors.

- Maintained accurate records of accounts payable transactions and ensured proper filing for audit purposes.

- Assisted in the preparation of annual budgets and forecasts, providing valuable insights into cash flow projections.

- Collaborated with the finance team to reconcile accounts payable-related general ledger accounts.

- Provided support during the implementation of a new ERP system, assisting with data migration and testing.

- Processed and audited high-volume invoices, purchase orders, and expense reports with a focus on accuracy and timeliness.

- Reviewed and resolved vendor inquiries regarding outstanding payments resulting in improved vendor relationships.

- Implemented process improvements to streamline accounts payable procedures and reduce payment errors.

- Contributed to month-end closing activities, including accruals and account reconciliation.

- Assisted in the preparation of financial reports and analysis for management review.

- Managed the full-cycle accounts payable process, ensuring accuracy and adherence to company policies.

- Streamlined the vendor onboarding process, resulting in reduced setup time and improved efficiency.

- Collaborated with cross-functional teams to resolve payment discrepancies and address vendor inquiries promptly.

- Implemented a vendor performance evaluation system, resulting in improved supplier selection and cost management.

- Led a project to digitize accounts payable records, improving accessibility and reducing storage costs.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for accounts payable specialist professionals.

Top Responsibilities for Accounts Payable Specialist:

- Operate computers programmed with accounting software to record, store, and analyze information.

- Check figures, postings, and documents for correct entry, mathematical accuracy, and proper codes.

- Comply with federal, state, and company policies, procedures, and regulations.

- Operate 10-key calculators, typewriters, and copy machines to perform calculations and produce documents.

- Receive, record, and bank cash, checks, and vouchers.

- Code documents according to company procedures.

- Perform financial calculations, such as amounts due, interest charges, balances, discounts, equity, and principal.

- Reconcile or note and report discrepancies found in records.

- Perform general office duties, such as filing, answering telephones, and handling routine correspondence.

- Access computerized financial information to answer general questions as well as those related to specific accounts.

Quantifying impact on your resume

<ul>

Building a accounts payable specialist resume when experience is sparse

If you're light on relevant experience, consider highlighting:

- Short-term roles or internships undertaken during your academic years.

- Contractual roles, emphasizing their relevance and the outcomes achieved.

- Alternative resume formats, such as functional or hybrid, that spotlight your skills.

- Research roles, especially if they involved significant projects or if your contribution was pivotal to the project's success.

Recommended reads:

Pro tip

Boost your resume by focusing on the practical aspects of each job requirement. While it's good to have job-related keywords on your resume, ensure they're backed by action verbs and quantifiable data. This gives recruiters a clear picture of your accounts payable specialist professional journey.

Essential accounts payable specialist resume skills

When recruiters review accounts payable specialist resumes, they're looking for a mix of technical know-how and personal attributes.

Technical skills demonstrate your proficiency in specific tools or tasks. They indicate if you're ready to jump into the role or if you'll need extensive training.

On the other hand, soft skills reflect your interpersonal abilities. They show how you'll fit into a team or company culture.

To effectively present these skills on your resume:

- Design a skills section that highlights both your technical and interpersonal strengths.

- Provide examples where you've applied these skills, such as projects or tasks.

- For soft skills, describe situations where they've been crucial to your success.

- Use metrics, like improved efficiency or positive feedback, to validate your skills.

For inspiration, explore the preferred skills of leading accounts payable specialist professionals.

Top skills for your accounts payable specialist resume:

Accounts Payable Software (e.g., SAP, Oracle, QuickBooks)

Excel (Advanced Functions and Formulas)

Data Entry and Management

Invoice Processing

Financial Reporting

Expense Management Systems

Tax Compliance Knowledge

General Ledger Reconciliation

Electronic Payment Processing

Document Management Systems

Attention to Detail

Time Management

Problem-Solving

Communication Skills

Team Collaboration

Organizational Skills

Adaptability

Analytical Thinking

Customer Service Orientation

Conflict Resolution

Next, you will find information on the top technologies for accounts payable specialist professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Accounts Payable Specialist’s resume:

- Intuit QuickBooks

- Sage 50 Accounting

- Dropbox

- Microsoft SharePoint

- Microsoft Dynamics

- SAP software

Pro tip

Sometimes, basic skills mentioned in the job ad can be important. Include them in your resume, but don't give them too much space.

Choosing the right certifications and education for your accounts payable specialist resume

Your education section can highlight skills and experiences perfect for the job.

- List college or university degrees with the school name and dates.

- If you're still studying, mention your expected graduation date.

- Think twice before adding unrelated degrees. Space on your resume is precious.

- Discuss educational achievements if they boost your job relevance.

There are many certifications out there. Which ones should you include?

- List your main degree in a separate section with the school name and dates.

- Only add certifications that highlight your skills and experience.

- Place unique or recent certifications near the top.

- Add a brief description to certifications if it helps show your skills.

Remember, it's not about quantity but relevance.

Best certifications to list on your resume

Pro tip

List your degrees in reverse order, starting with the newest. A recent PhD or unique field could set you apart.

Recommended reads:

Choosing between a resume summary or objective

Many accounts payable specialist candidates ponder whether to include a resume summary or objective.

Here's a breakdown:

- A Resume objective outlines your career aspirations. It tells recruiters why you're applying and the value you can bring.

- A Resume summary offers a snapshot of your significant achievements, giving a quick overview of your expertise.

New professionals might lean towards an objective, while seasoned experts might prefer a summary. Whichever you choose, ensure it's tailored to the role.

For inspiration, review examples from established accounts payable specialist professionals.

Resume summary and objective examples for a accounts payable specialist resume

- Seasoned finance professional with 10 years of experience managing accounts payable operations for Fortune 500 corporations. Demonstrates a keen understanding of accounting principles and proficiency in software such as SAP and Oracle. Increased efficiency by 20% through process improvements.

- Highly meticulous professional with over 15 years of experience, including 8 years in accounts payable management within retail sector. Notable expertise in QuickBooks and Excel, coupled with a proven track record of implementing cost-saving measures, reducing discrepancies by 30%.

- Highly organized individual transitioning from an administrative background, bringing excellent communication skills and attention to detail. Holds a Bachelor's degree in Finance and has completed coursework in account reconciliation and financial reporting. Seeking to leverage these skills to manage accounts payable operations.

- Dynamic professional making a career switch from project management to accounts payable, armed with an MBA and strong analytical skills. Acquired proficient knowledge in accounting software during studies and seeks to apply these skills in managing invoices and payments.

- Recent graduate with a B.Com degree and a major in Finance aiming to start a career in accounts payable. Strong emphasis on detail-oriented tasks and mathematical accuracy during education. Eager to apply academic knowledge to real-world financial scenarios at a growth-oriented firm.

- Aspiring accounts payable specialist with internship experience in the finance sector. Possesses an Academic Excellence award in Accountancy and adept knowledge of MS Office Suite. Desires to utilize this knowledge base and enthusiasm to contribute effectively to a dynamic business environment.

Enhancing your accounts payable specialist resume with additional sections

Make your accounts payable specialist resume truly distinctive by adding supplementary sections that showcase:

- Awards that underscore your industry recognition.

- Projects that bolster your application's relevance.

- Hobbies, if they can further your candidacy by revealing facets of your personality.

- Community involvement to highlight causes you champion.

Key takeaways

- Structure your resume to spotlight career highlights and relevance to the role.

- Keep your resume concise, prioritizing relevant experiences.

- Detail specific achievements that showcase your suitability for the role.

- Both technical and interpersonal skills should be evident throughout your accounts payable specialist application.