As a financial analyst, you manage financial models, send reports, control budgets, and provide insights to management. These tasks help you become a reliable and skilled analyst, turning data into actionable insights.

Yes, the job can get a bit repetitive, but that’s exactly where your focus and attention to detail pay off. With that in mind, this guide will help you craft a resume that illustrates your achievements and shows just how effective you are in the role.

Key takeaways

- Organize your employment history and career progression as a financial analyst in reverse chronological order.

- Write a compelling resume summary that emphasizes your core qualifications, analytical mindset, and key achievements.

- Highlight your technical skills, including proficiency in financial modeling, data analysis, and financial software, along with your strong communication and problem-solving abilities.

- Prove the impact of your work by using specific metrics, such as enhanced financial forecasting accuracy or achieved cost reductions.

- Tailor your resume for each position by aligning your skills and experiences with the job's specific requirements.

- Detail your educational background and any relevant certifications to emphasize your expertise.

- If you have limited work experience, focus on internships, academic projects, and volunteer roles that showcase your financial analysis skills.

Building a strong resume for financial analysts is key. Let’s look at the best format to underline your skills and experience.

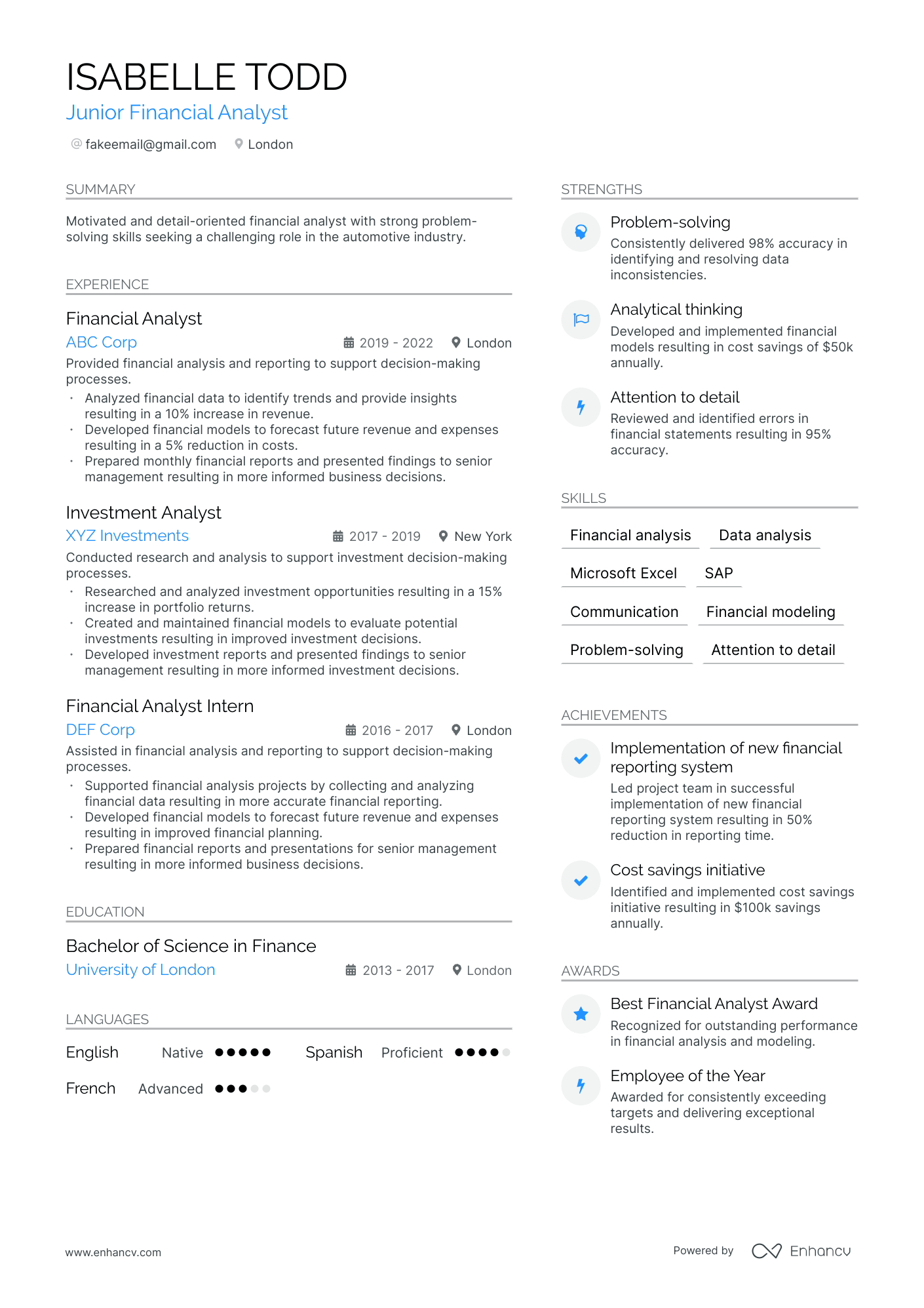

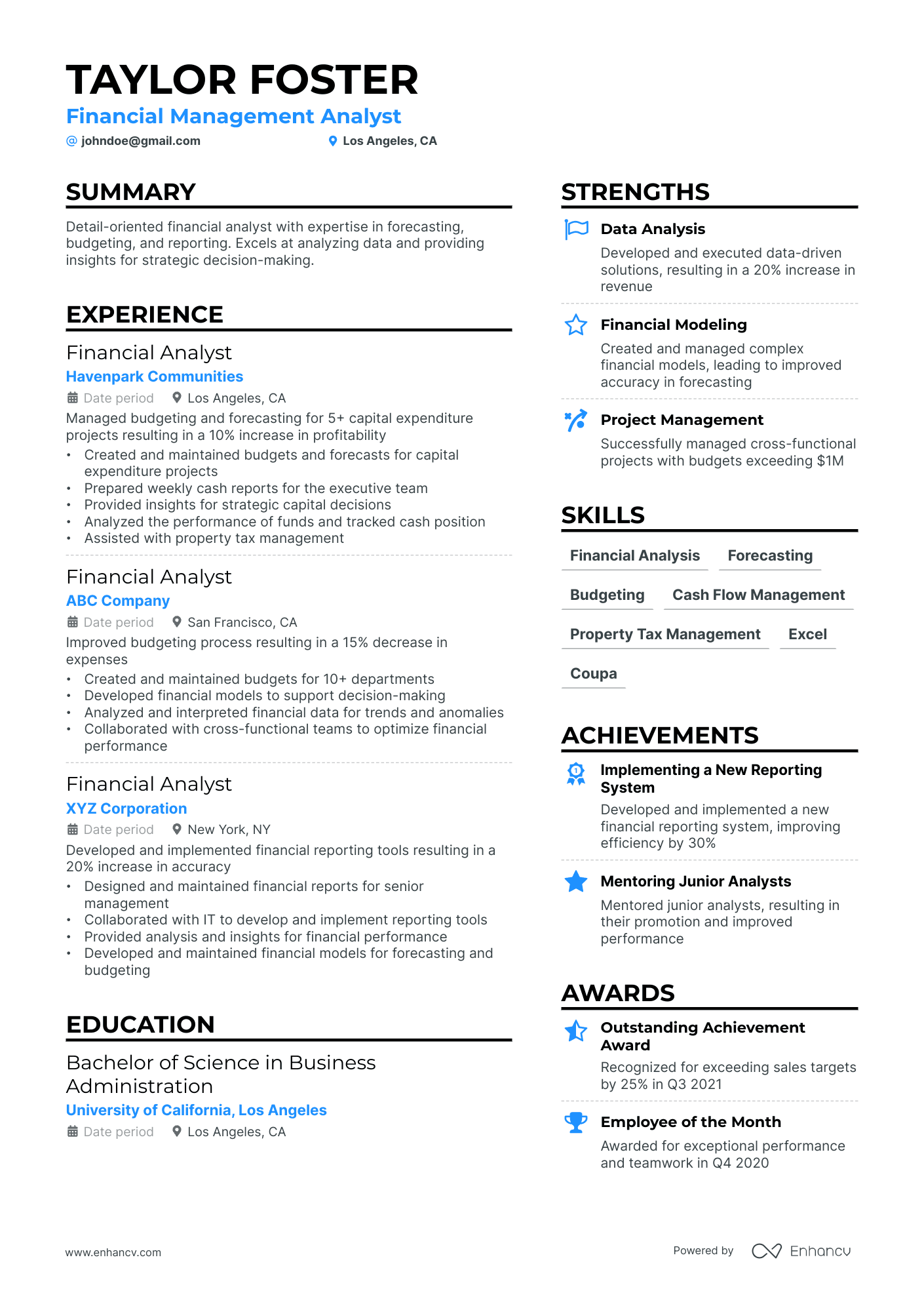

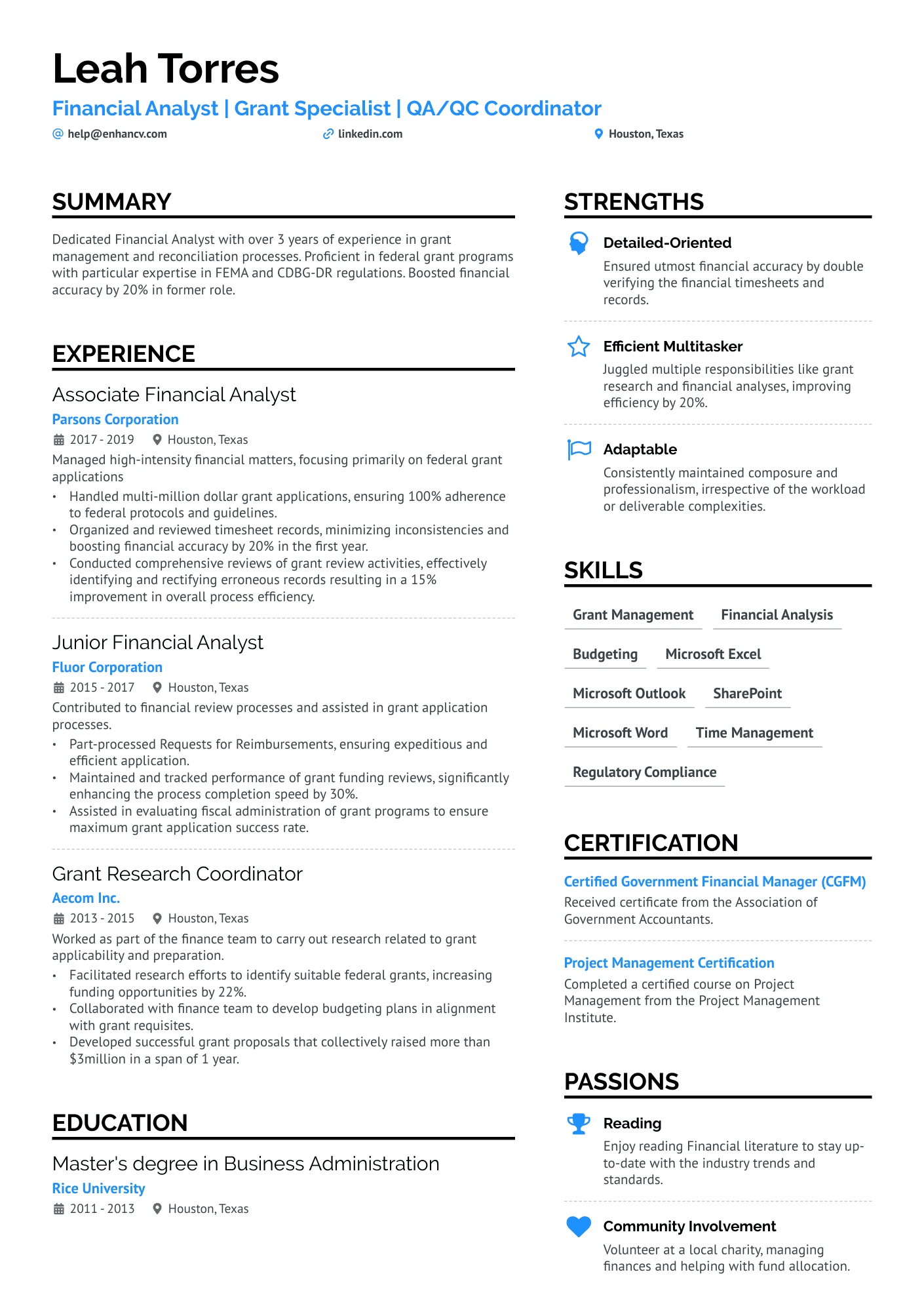

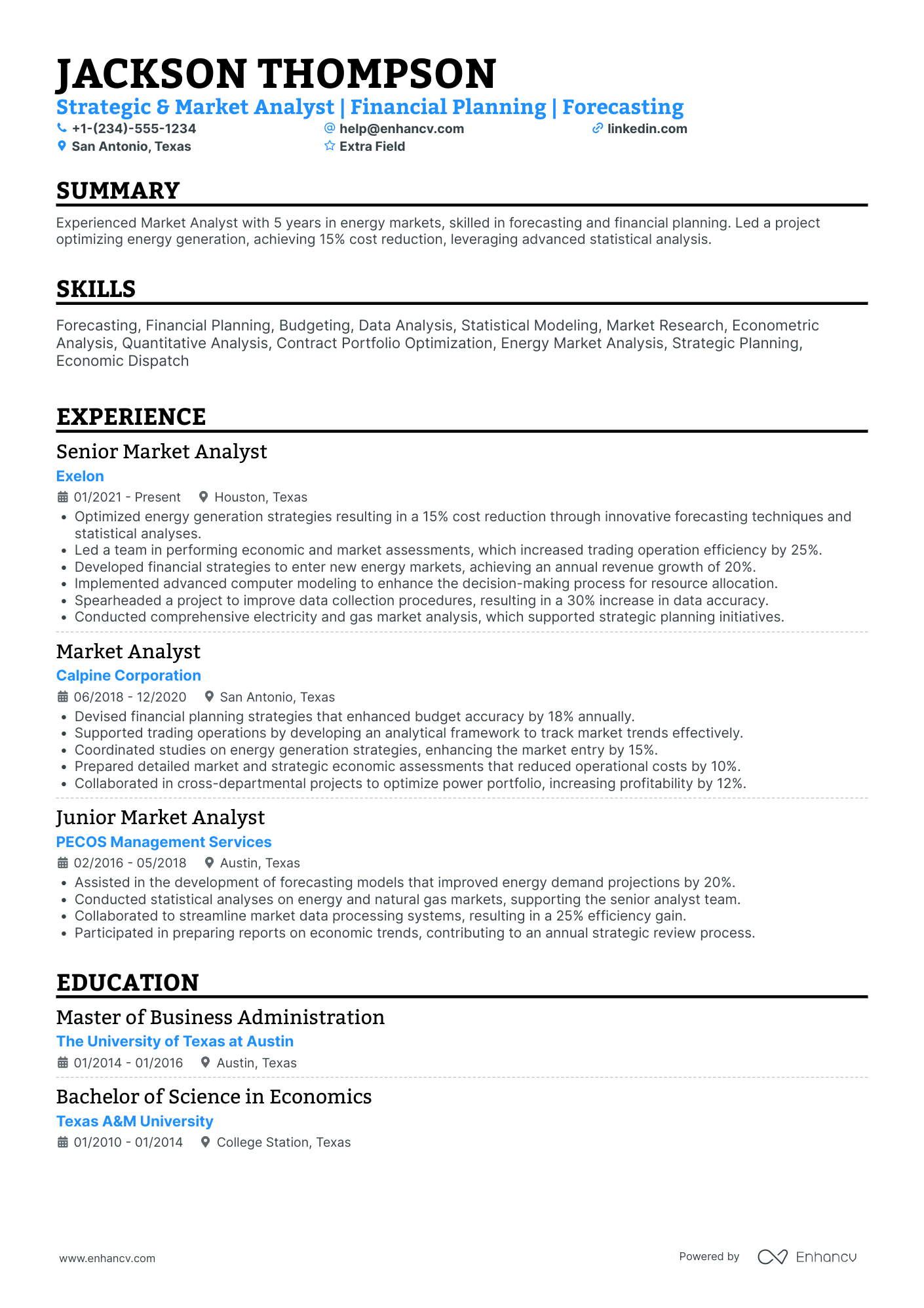

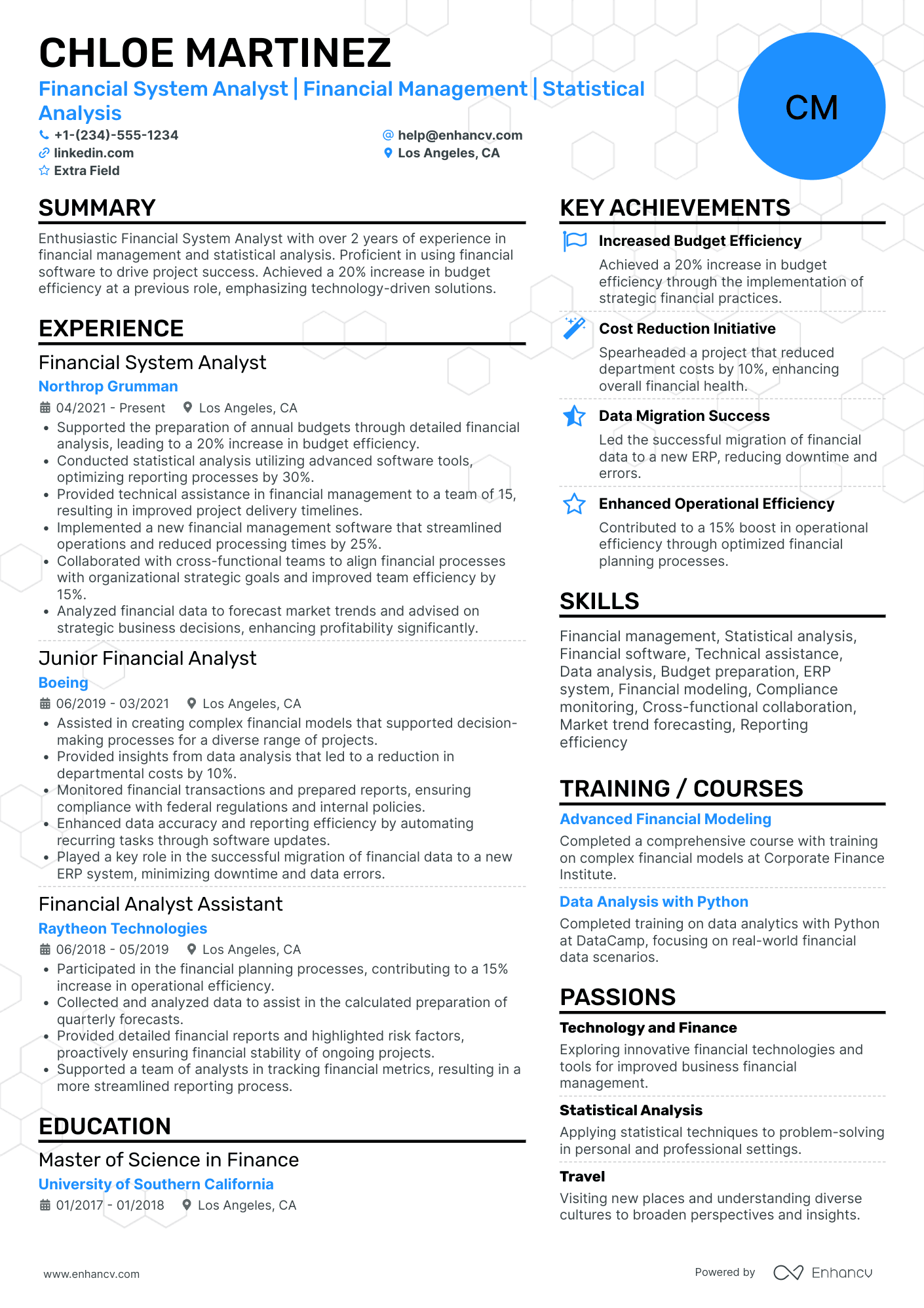

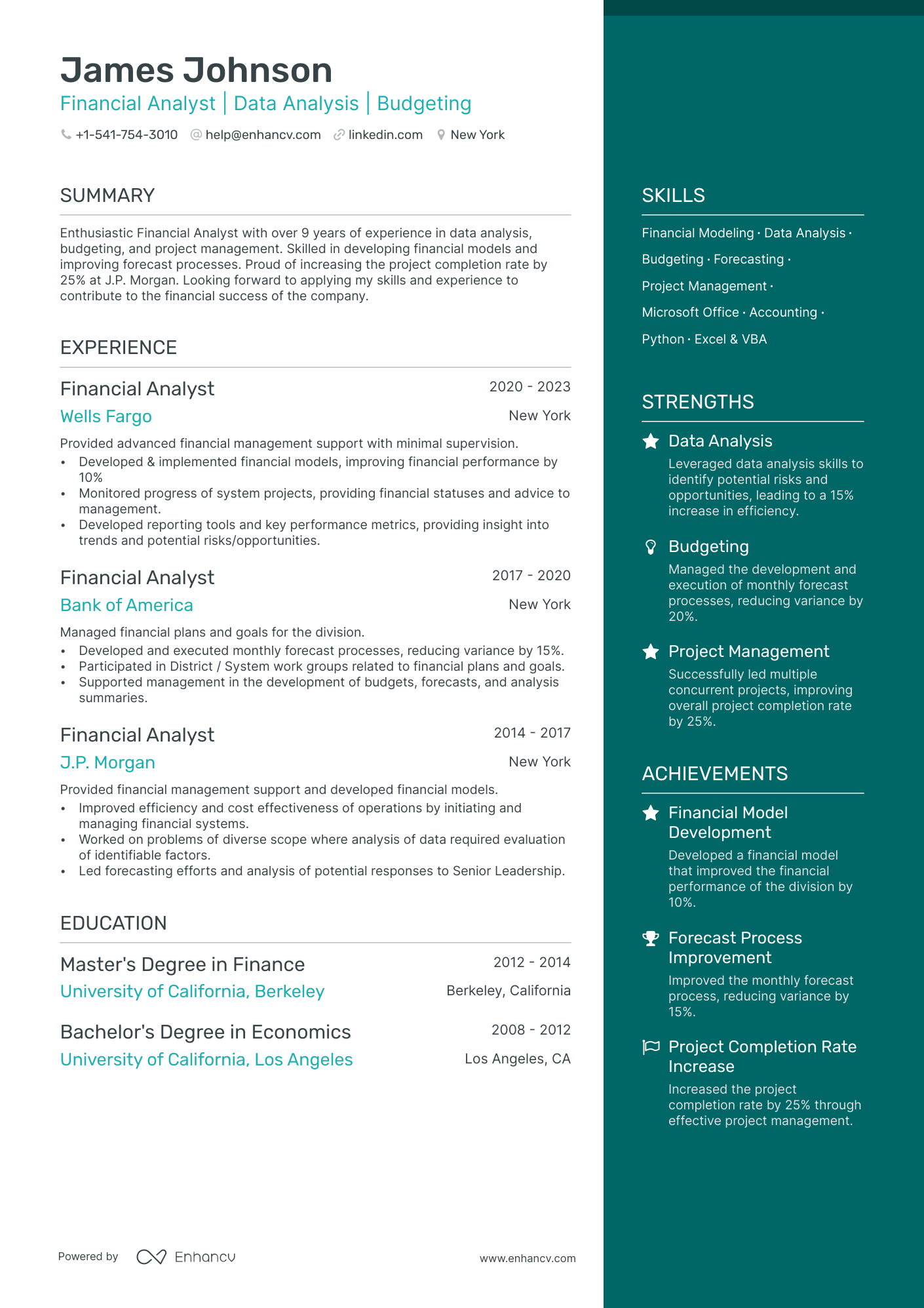

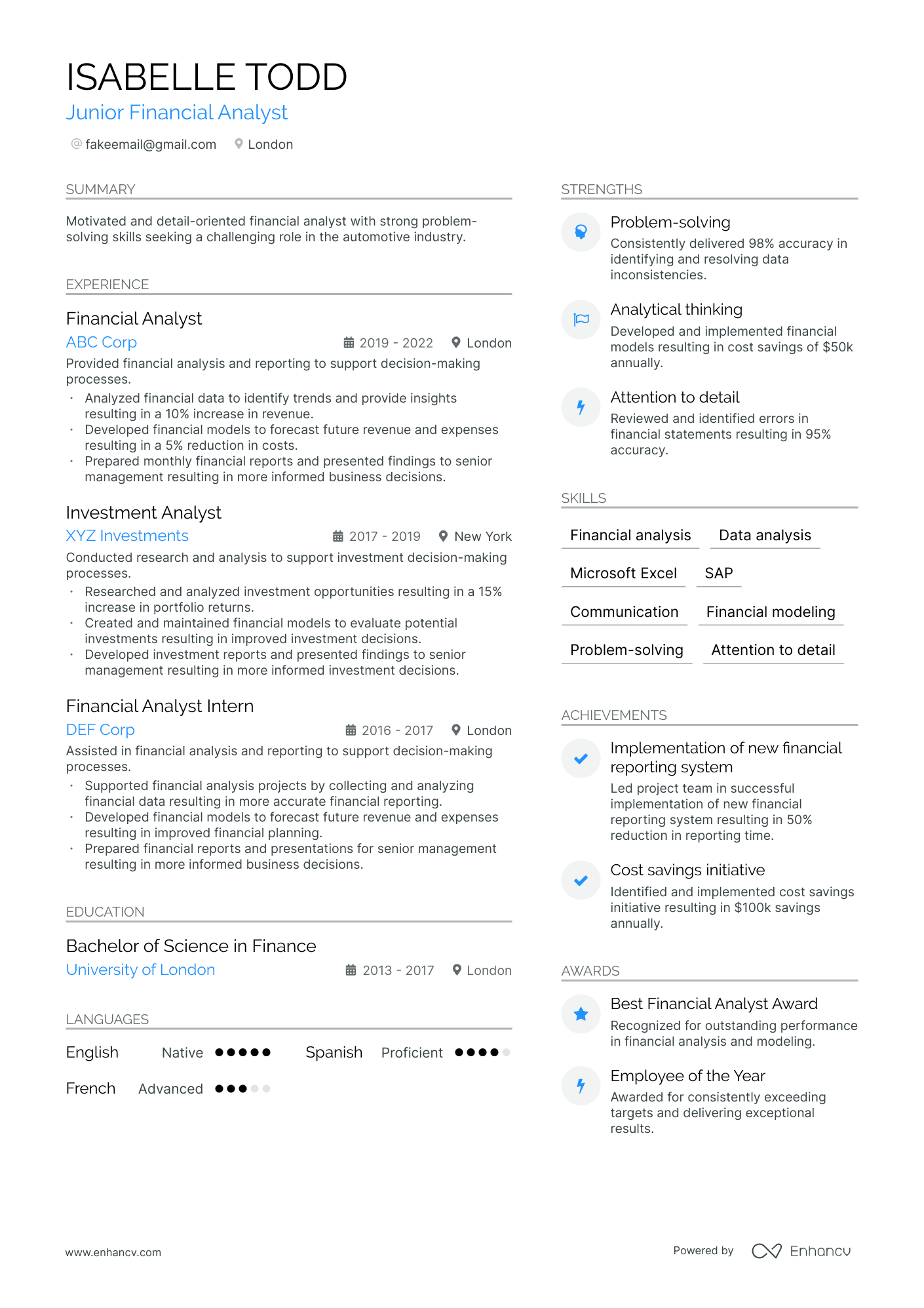

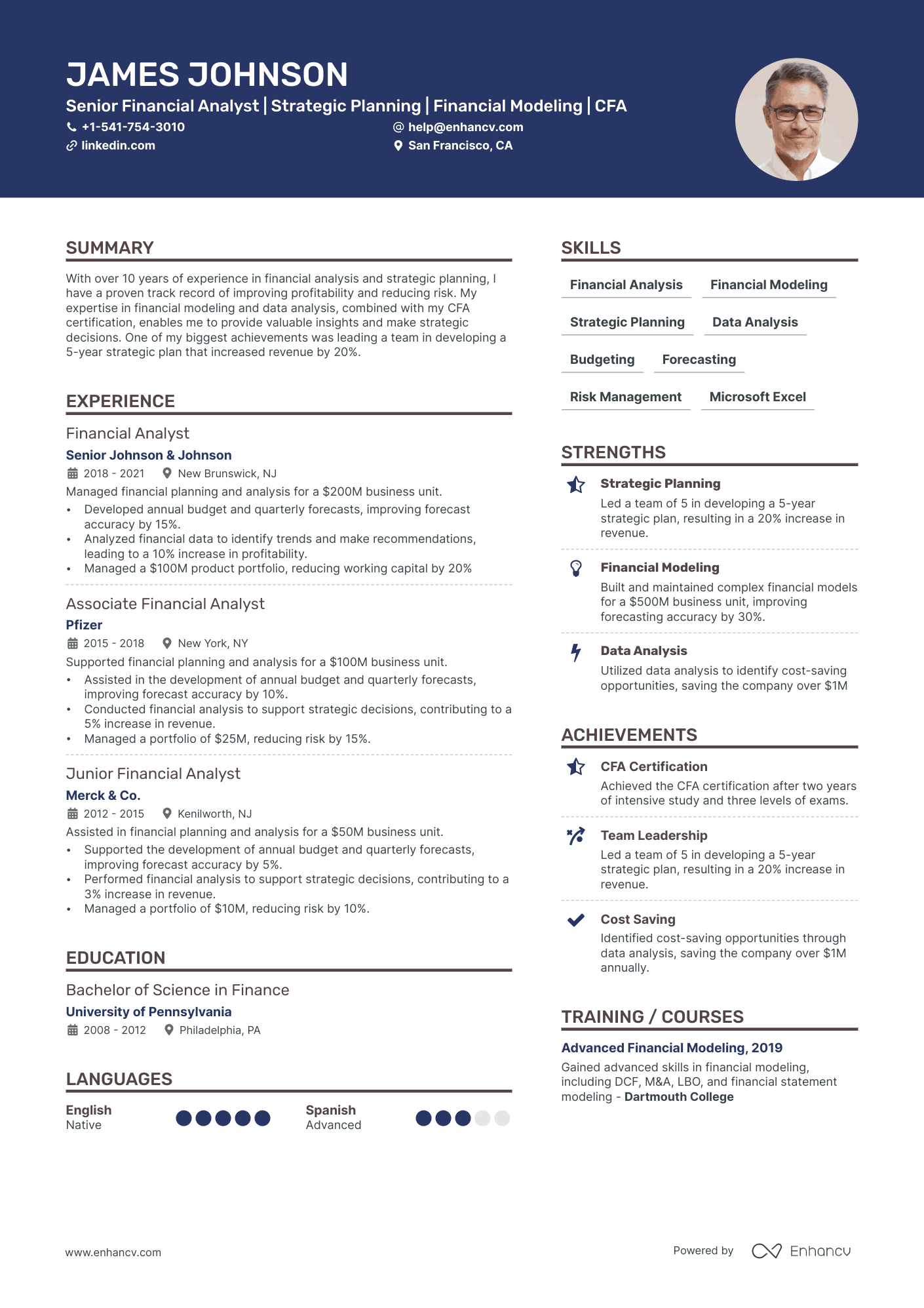

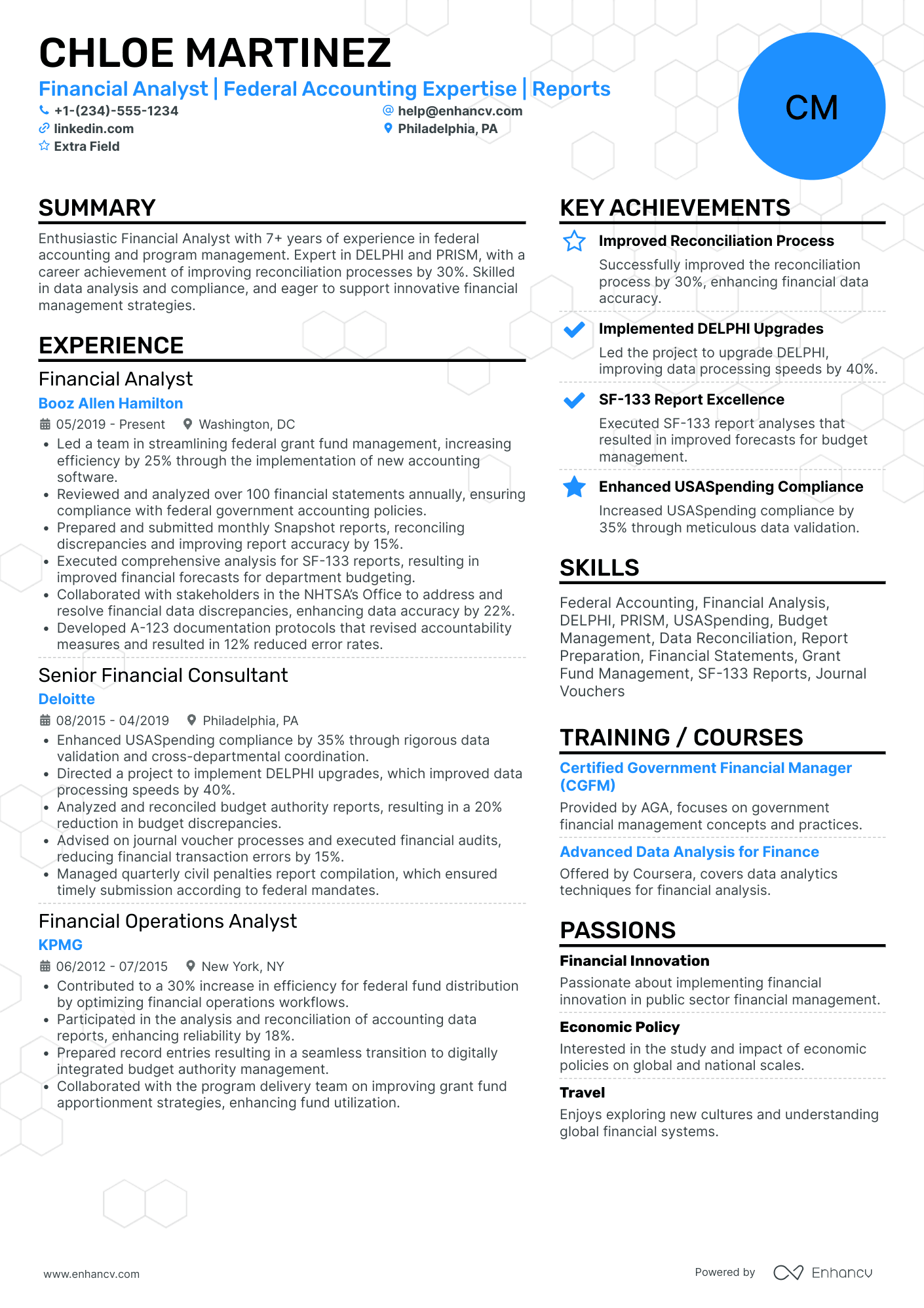

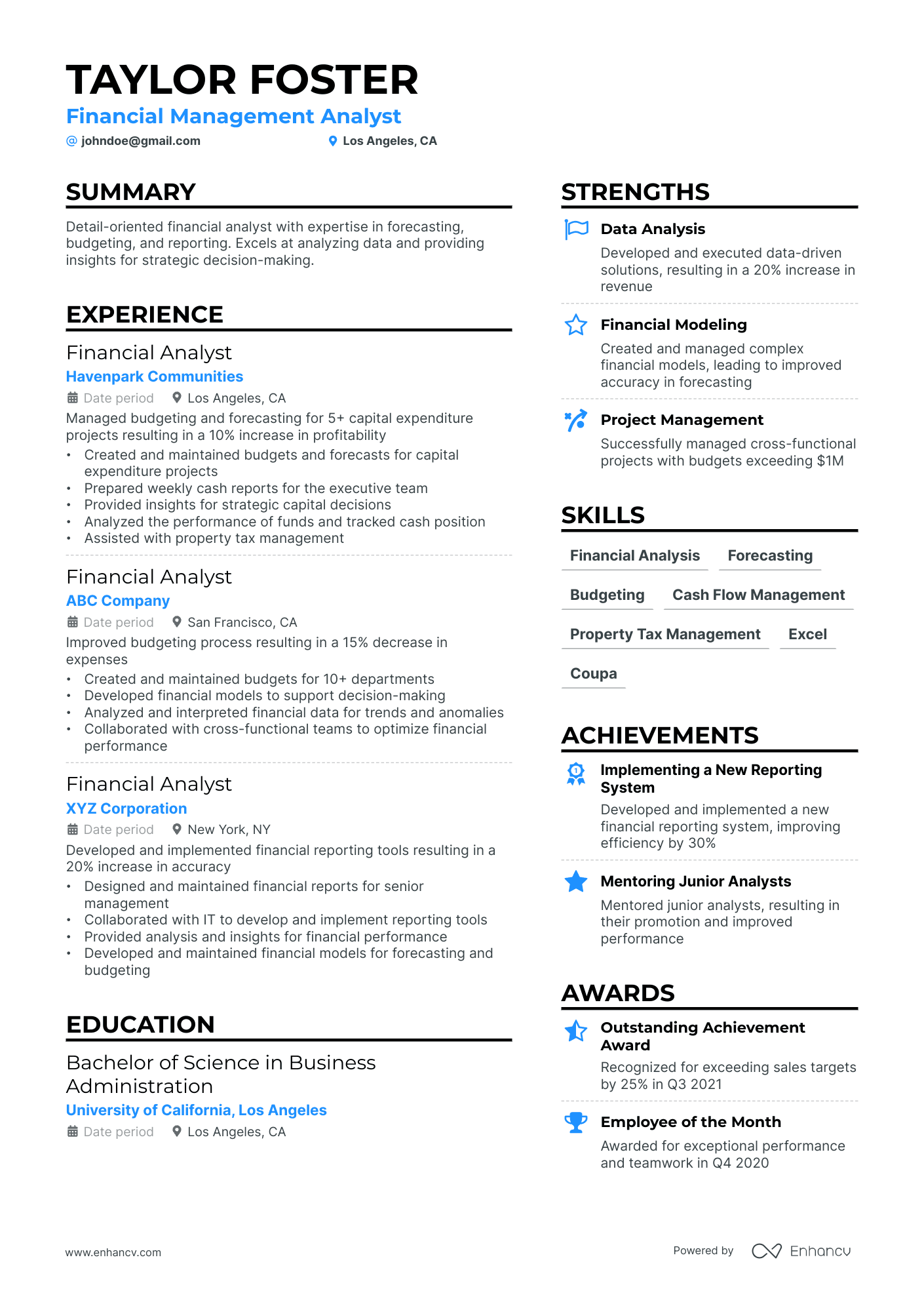

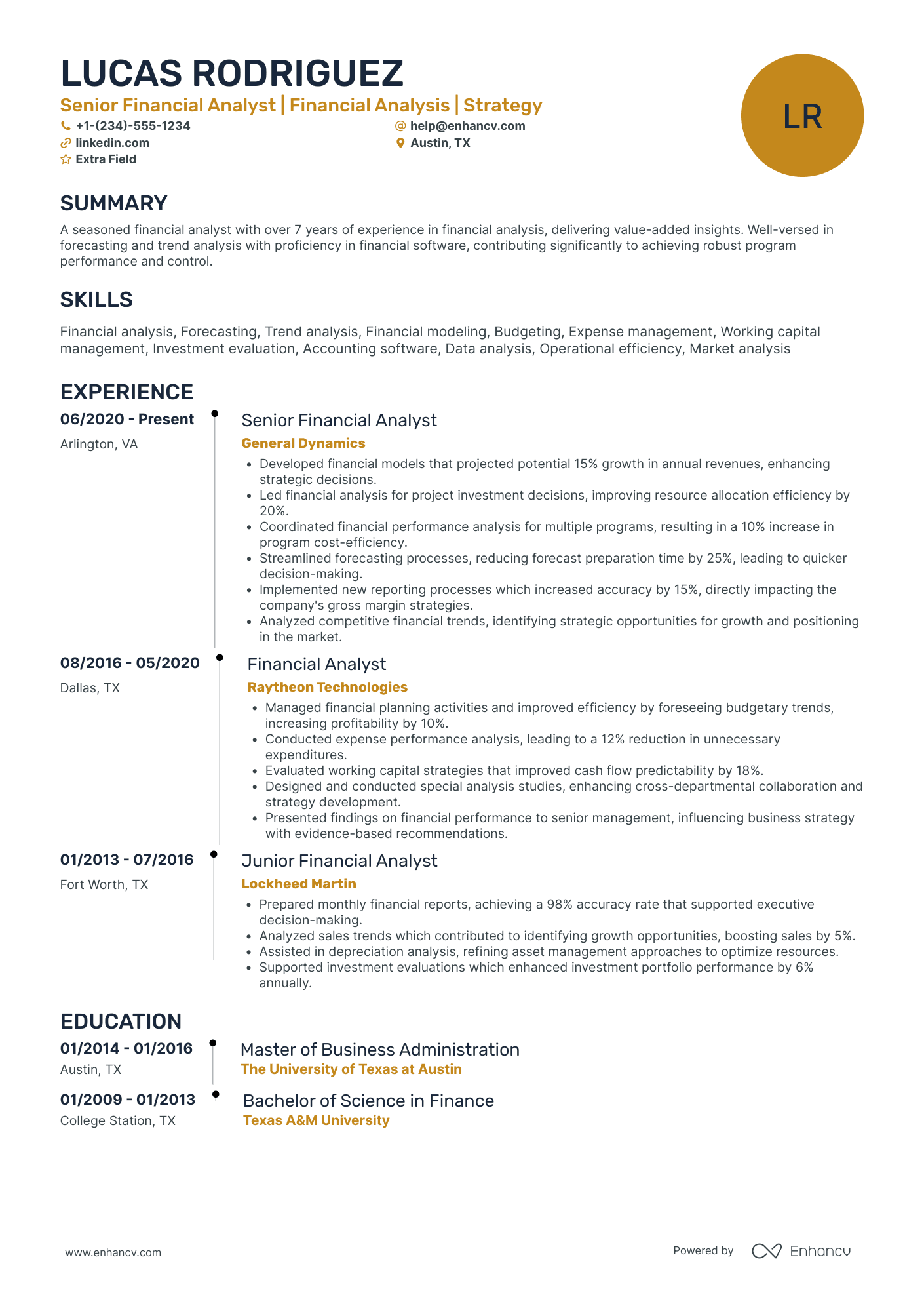

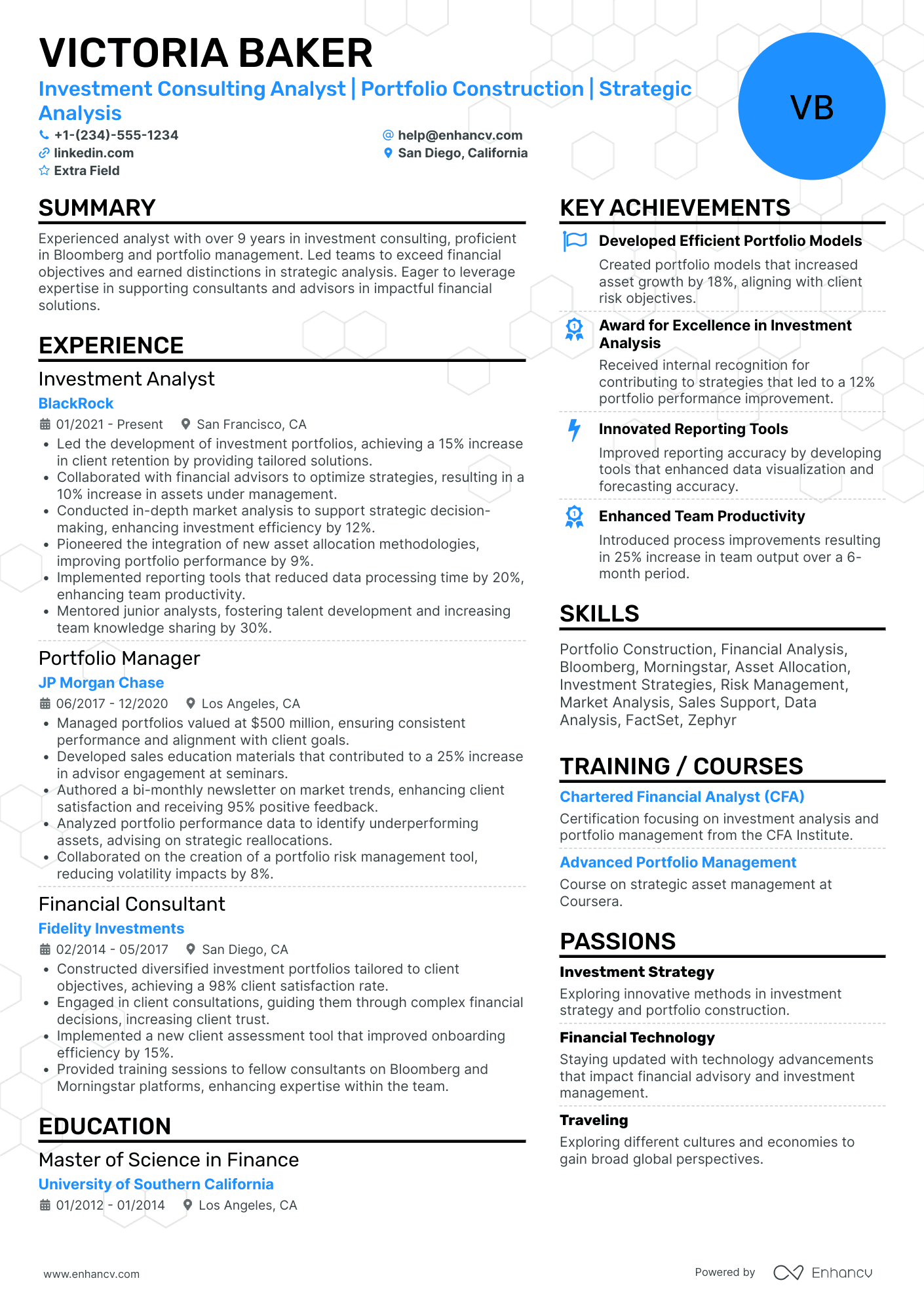

Financial analyst resume sample

Check out this financial analyst resume example for guidance.

Ethan Miller

financial analyst

help@enhancv.com | @linkedin.com | Austin, Texas

Summary

Dedicated financial analyst with over 7 years of experience in dynamic financial environments. Skilled in financial modeling, data analysis, and budget management. Known for a detail-oriented approach, strong analytical skills, and the ability to provide actionable insights. Proven track record of working effectively with cross-functional teams and senior management.

Financial analyst

Shockwave Medical (Johnson & Johnson MedTech), New Brunswick, NJ

June 2022 - Present

- Develop and maintain complex financial models, providing insights that inform strategic decisions.

- Manage budgeting and forecasting processes, improving accuracy by 15%.

- Analyze financial data to identify trends and opportunities, resulting in a 10% reduction in costs.

- Prepare detailed financial reports for senior management, enhancing decision-making processes.

- Collaborate closely with cross-functional teams to ensure alignment on financial goals and strategies.

Junior financial analyst

BBVA Compass, Birmingham, AL

November 2017 – May 2022

- Assisted in preparing financial reports and analysis, contributing to a 20% improvement in forecast accuracy.

- Managed budget tracking and variance analysis, helping reduce discrepancies by 12%.

- Supported senior analysts in conducting in-depth financial research, enhancing the quality of reports.

- Played a key role in the monthly closing process, ensuring timely and accurate financial reporting.

Education

Bachelor of Business Administration (Finance)

University of Alabama

Graduated: 2017

Relevant Coursework

- Financial Analysis: Focused on advanced financial modeling and data-driven decision-making.

Certifications

- Chartered financial analyst (CFA) Level 1, CFA Institute, 2019

- Microsoft Excel Expert, Microsoft, 2018

Skills

- Financial Modeling

- Budget Management

- Data Analysis

- Forecasting

- Financial Reporting

- Advanced Excel

Languages

- English (Fluent)

- Spanish (Intermediate)

After checking out the example, let’s dive into structuring your financial analyst resume.

How to format a financial analyst resume

For financial analysts, the reverse-chronological resume format is the most effective. It underscores your latest and most relevant experience, allowing recruiters to quickly assess your career progression and the impact you’ve made.

This format highlights your strengths, such as specific skills and quantifiable results--things financial analysis heavily relies on. Additionally, it’s easy for both Applicant tracking systems (ATS) and hiring managers to navigate.

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Our tests confirm that fonts, colors, and resume length typically don’t cause problems with ATS parsing. What’s critical are the details like date formatting and bullet point usage, as these can impact how the software reads your resume. A well-structured resume isn’t just good for ATS but it also catches the eye of hiring managers with packed schedules.

Let's dive into the specifics of resume designs.

Resume order

When building a reverse-chronological resume, organize the sections in a straightforward, easy-to-follow order:

- Header

- Summary/Objective

- Professional experience

- Education & Certifications

- Skills

- Languages

Design tips for financial analyst resumes

- Stick to standard margins of 1 inch to keep your resume clean and easy to read.

- Consider using a double-column layout to showcase your analytical skills and key accomplishments.

- Use traditional fonts in sizes 10-12 pt and add subtle color accents to maintain a professional appearance.

- Aim to keep your resume to one page, to show your ability to communicate essential information clearly. However, if you have over 10 years of experience, a two-page resume is also appropriate.

Contact information

- Position your name, phone number, and professional email at the header of your resume.

- Align your job title with the position you’re applying for, and consider adding a short headline that highlights your financial skills.

- Add a link to your LinkedIn profile to display your professional network and notable accomplishments.

- Leave out a photo to keep the focus on your qualifications and experience, minimizing the risk of bias.

File format

- Choose a simple name for your resume, such as "EthanMillerFinancialAnalystResume.pdf."

- Save your resume as a PDF unless the job posting specifies a different format.

Take advantage of our free AI resume checker to see how your existing resume will be parsed by ATS.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now, let’s take a closer look at the work experience section of your financial analyst resume.

How to write your financial analyst resume experience

It’s vital to demonstrate your professional experience on a financial analyst’s resume, as it brings attention to your practical skills, reinforces your credibility, and underlines your expertise in finance.

This helps potential employers to see your ability to manage real-world financial tasks. Concentrate on your major accomplishments, using measurable results such as enhancing the accuracy of financial forecasts, optimizing budget processes, or achieving significant cost savings.

Organize your resume clearly by using bullet points. Most importantly, tailor your resume to the job description, ensuring recruiters can easily see why you’re the best candidate for the role.

The right way to tailor your financial analyst resume to the job description

Customizing your resume to align with the job description helps your most relevant qualifications stand out, increasing your chances of impressing the hiring manager. By focusing on the skills and experiences the employer values most, you display your suitability for the position. This method is referred to as creating a targeted resume.

Here’s how to tailor an experience section to fit a real financial analyst job offer:

Financial analyst

Job description:

Abbott is a global healthcare leader that helps people live more fully at all stages of life. In the role of financial analyst you will be responsible for handling many day-to-day and month-end closing activities within the finance department with a focus on fixed asset accounting. This role will support various accounting areas including journal entries, reconciliations, process improvement, and reporting.

What you'll do:

- Perform day-to-day accounting duties including but not limited to account reconciliations, accruals, general ledger maintenance and/or other tasks as assigned.

- Perform month-end close activities, including fixed asset additions and account reconciliations, preparation of journal entries, reconciling general ledger accounts, and maintaining supporting schedules.

- Maintain detailed, supported, documented reconciliations of all assigned general ledger accounts.

- Support account inquiries and fluctuations for month-end accounting review.

- Handle all aspects of Fixed Assets and Construction in Process. Maintains the fixed asset database, including additions, disposals, and reporting. Performs physical verification of Fixed Assets.

- Monitor bank accounts daily, posting all incoming and outgoing transactions.

Core competencies:

- Action-oriented

- Collaborative

- Communicates effectively

- Financial acumen

- Optimizes work processes

- Resourcefulness

- Dealing with ambiguity

Required qualifications:

- Bachelor’s Degree (B.A) in Accounting, Finance, and/or other related technical field or equivalent combination of education and experience

- 3+ years accounting experience required

- Advanced experience in Excel and proficiency with Microsoft Office Suite (Outlook, Access, Word, PowerPoint)

- Excellent attention to detail, well-organized, and highly accountable

- Solid analytical insight, prioritization, and problem-solving skills

- Strong oral, written, and interpersonal skills

- Comfortable working in a fast-paced environment with limited guidance

- Self-motivated, action-oriented individual with the perseverance to meet deadlines

- Developed time management and priority setting skills required to work in an often ambiguous and constantly changing business environment

Here’s the customized experience section:

- •Handled daily accounting tasks, improving reconciliation accuracy by 15%.

- •Completed month-end close activities, reducing close time by 10%.

- •Maintained detailed reconciliations for 100+ general ledger accounts.

- •Supported month-end reviews, decreasing discrepancies by 12%.

- •Managed fixed assets, ensuring 100% accuracy in database and physical verifications.

- •Monitored and posted daily bank transactions, maintaining 99% accuracy.

This resume aligns well with the job ad's requirements by:

- Underscoring key financial responsibilities, such as daily accounting tasks and month-end close activities, showcasing essential financial management skills.

- Demonstrating measurable impact through metrics like improving reconciliation accuracy by 15% and reducing the month-end close time by 10%.

- Emphasizing critical skills like managing fixed assets, maintaining detailed ledger reconciliations, and ensuring accuracy in bank transaction monitoring.

- Proving a strong ability to support month-end reviews and reduce discrepancies by 12%, which is crucial for financial reporting accuracy.

- Covering the importance of detailed record-keeping and accuracy, essential for maintaining financial integrity and compliance.

PRO TIP

Start each bullet point with an action verb and include specific metrics to quantify your results.

In the upcoming section, we'll show you how to quantify your achievements.

How to quantify your experience on a resume

Understanding the story behind the numbers is what sets great financial analysts apart.

Warren Buffett

Just as metrics and KPIs are crucial in evaluating financial performance, using numbers and results on your resume illustrates your impact as a financial analyst. It’s about demonstrating how you improved financial forecasting, cut costs, or boosted budget accuracy—making your achievements tangible and quantifiable.

Here are some ideas:

- Reduced forecasting errors by 15% through improved data analysis techniques.

- Managed a $10 million budget, optimizing resource allocation to achieve a 12% cost reduction.

- Increased accuracy in financial reporting by 20% through automated processes.

- Analyzed financial trends and provided insights that led to a 25% increase in revenue.

- Implemented a new financial model that boosted profitability by 18% over six months.

Even without financial analyst experience, you can still build a strong resume. Here’s how.

How do i write a financial analyst resume with no experience

Diving into a financial analyst career can be both exciting and challenging, especially if you’re just starting out. But don’t worry! You can still create a financial analyst resume that displays your potential and helps you stand out.

Here are some tips to get you started:

- Use a functional resume format to spotlight your analytical skills and academic achievements.

- Choose a simple template to keep your resume professional, even with limited experience.

- Include coursework and academic projects that demonstrate your understanding of financial analysis and problem-solving.

- Emphasize your technical skills and familiarity with financial software, such as Excel or the Microsoft Office Suite, by highlighting your training or courses.

- Focus on transferable skills. Summer jobs or relevant internships, even if not directly related to finance, can help you develop critical skills like data analysis or report generation, so be sure to include them.

- Underline any hands-on experience with financial documents, such as forecasting or budget analysis.

- Mention volunteer work or extracurricular activities that involve financial responsibilities or collaboration.

Resume objective for entry-level financial analyst

When you create a resume for a financial analyst without work experience, an objective statement is key to showcasing your career goals and passion for entering the finance sector, even if you lack extensive experience.

To write a compelling resume objective:

- Outline your career aspirations within 2-3 sentences and customize them to the specific financial analyst position you’re targeting.

- Customize it to fit the job and company, using relevant keywords from the job posting to demonstrate your alignment with the role.

- Highlight important skills or qualifications that make you a standout candidate.

- Show how your expertise can benefit the company and drive its financial success.

Now, let’s review an example of an effective objective statement:

Now that your experience is well presented, let’s focus on building a strong skills section for your financial analyst resume.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Financial analyst hard and soft skills on your resume

financial analysts need to showcase a diverse set of skills, emphasizing both their soft and hard skills. This is essential, as the finance industry requires staying current with evolving tools and financial regulations.

To move forward in the hiring process, display your core competencies in a dedicated section. This approach allows employers to quickly recognize your suitability for the role.

Here’s a list of the top hard skills featured on financial analyst resumes:

Best hard skills for your financial analyst resume

- Microsoft Excel

- SAP

- Oracle Financials

- SQL

- Bloomberg Terminal

- Hyperion

- QuickBooks

- Tableau

- Power BI

- Microsoft Access

- SAS

- MATLAB

- R

- Python

- Essbase

- JD Edwards

- Xero

- Microsoft PowerPoint

- Workday

Recruiters also look for soft skills when assessing financial analyst candidates.

Integrate people skills into other sections of your resume, such as the summary or experience sections, where they can be demonstrated through examples. For instance, you might outline your data analysis skills with a statement like: "Improved financial forecasting accuracy by 20% through advanced data analysis techniques."

Best soft skills for your financial analyst resume

- Excellent communication

- Problem-solving

- Organizational skills

- Time management

- Attention to detail

- Critical thinking

- Team collaboration

- Decision-making

- Analytical thinking

- Multitasking

- Interpersonal skills

- Leadership

- Negotiation

- Flexibility

- Initiative

- Conflict resolution

- Stress management

We’ve gone over the crucial skills for a financial analyst, so now let’s shift to certifications and education. These are great for emphasizing your commitment and industry insight.

How to list your education and certifications on your resume

When outlining your education on your financial analyst resume, make sure to draw attention to the key analytical and technical skills you’ve acquired. Tailor this part of your resume to match the job description, just as you would with your work history. Employers will look at this section to confirm that your educational background supports the skills you’ve emphasized.

Important details to include in your education section:

- Degree and field of study

- Name of the university

- Date of graduation

- Relevant courses

- Awards and honors

- GPA (optional)

Here’s an example adjusted for the financial analyst position you’re applying for:

- •Honors: Summa Cum Laude, Dean's List (2014-2028)

- •Corporate Finance: Conducted in-depth analyses of capital structure and financing decisions, aligning with the responsibilities of a financial analyst.

- •Advanced Excel Techniques: Mastered financial functions, pivot tables, and data visualization, essential for managing and analyzing financial data.

The financial analyst education example is a good one because it:

- Presents a Bachelor's Degree in Finance with a Minor in Data Analytics, which aligns perfectly with the financial analyst role.

- Provides all necessary details, including degree, institution, location, GPA, and graduation dates, ensuring a complete overview.

- Underscore relevant coursework, such as Financial Modeling and Advanced Data Analytics, directly tied to the skills required for a financial analyst position.

- Shows honors like Summa Cum Laude and Dean's List, demonstrating academic excellence and dedication.

- Incorporates advanced skills, such as mastering Excel techniques, which are critical for managing and analyzing financial data.

This example could be further enhanced by adding a certifications section, as specific financial certifications can strengthen your resume and increase your appeal to potential employers.

Best certifications for your financial analyst resume

Now that the education section is finalized, let’s concentrate on your strongest financial analyst skills in the summary.

How to write your financial analyst resume summary

The summary section of your financial analyst resume provides a quick glance at your expertise and achievements.

Here’s how to make it impactful:

- Begin with your professional title and years of experience in financial analysis.

- Focus on your key skills and achievements, backing them up with specific examples.

- Mention your expertise with relevant financial tools and technologies, like Excel, SQL, and financial modeling software.

- Keep it concise, using 3-5 strong sentences, and use compelling adjectives to describe your accomplishments.

- Avoid using the first-person perspective.

Here’s an example summary tailored to a financial analyst role we discussed earlier in the article:

This summary highlights the candidate's relevant skills in financial modeling, data analysis, and budgeting. It includes quantifiable achievements, such as a 20% increase in financial reporting efficiency, and aligns the candidate’s expertise with Abbott's needs, making it clear they can contribute to the company’s financial success.

Additional sections for a financial analyst resume

Adding optional sections to your financial analyst resume can provide a more comprehensive view of your skills and experiences, making you more appealing to potential employers. These sections can emphasize additional strengths and qualifications. Here are some ideas:

- Professional memberships: Drawing attention to memberships in organizations like the CFA Institute or Financial Planning Association can demonstrate your commitment to ongoing professional development and active participation in the financial field.

- Passions: Including hobbies such as hiking, cooking, or reading can give employers insight into your interests outside of work, showing that you’re passionate about finance even beyond your job.

- Language skills: Mentioning any additional languages you speak can emphasize your ability to work with international clients or in global markets, which is particularly valuable for companies with a global presence.

- Projects: Detail specific projects where you enhanced financial processes, improved forecasting accuracy, or implemented digital transformation initiatives, outlining your impact in driving financial efficiency and innovation.

In conclusion

Your resume is now set to prove your financial analysis skills, but remember to keep it updated as you progress. Whether you're looking for a new role or a promotion, a sharp resume is crucial in the finance world.

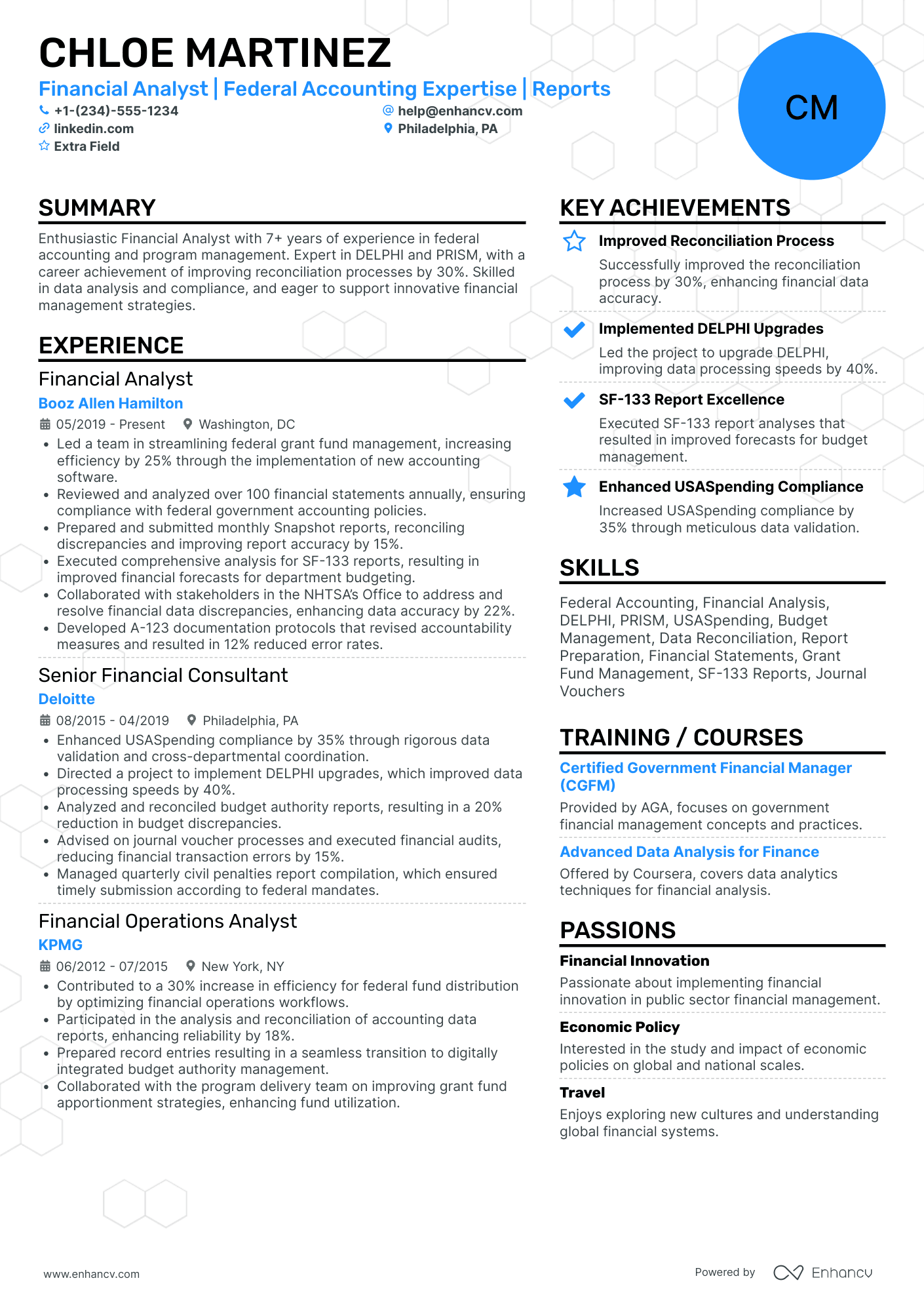

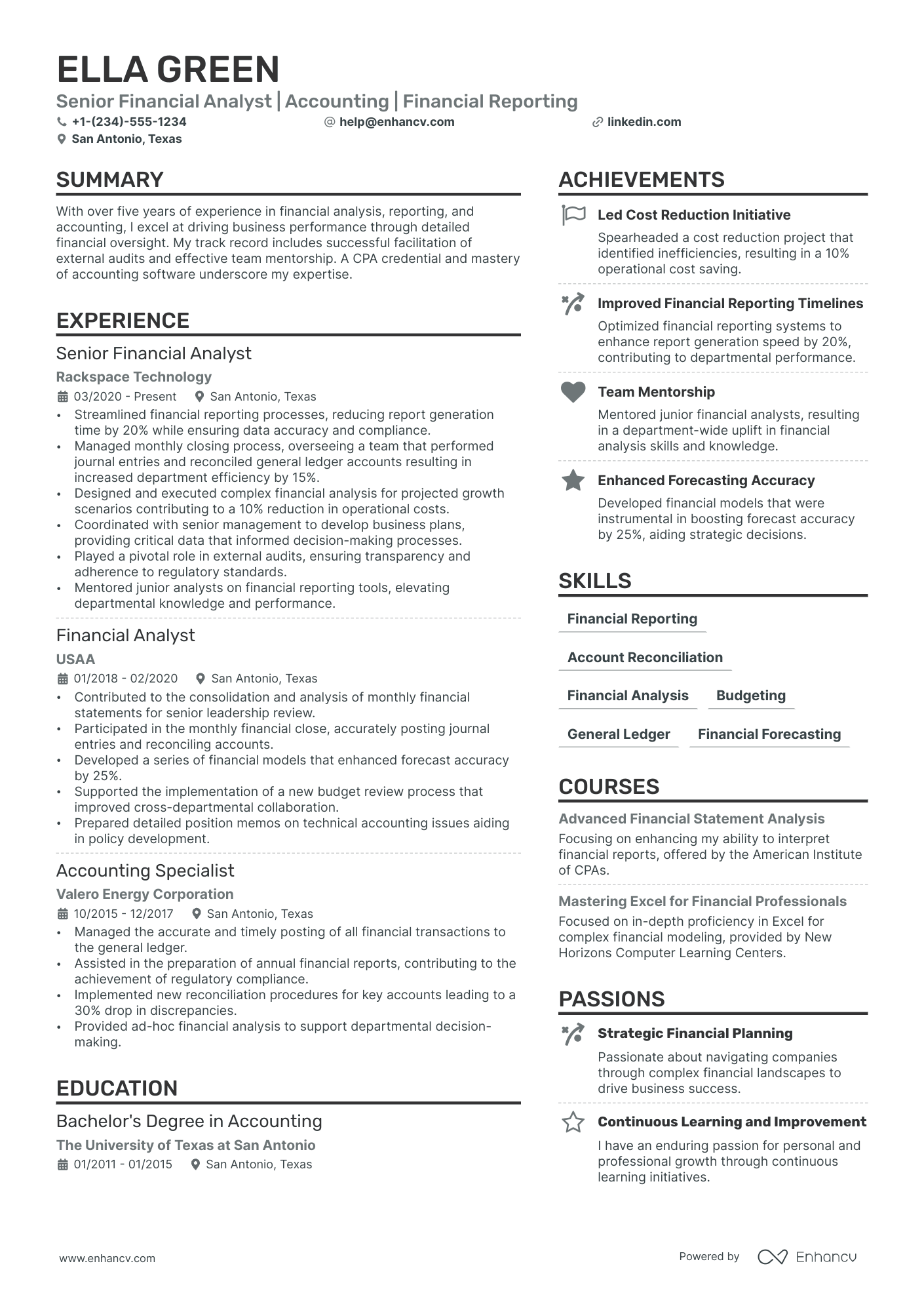

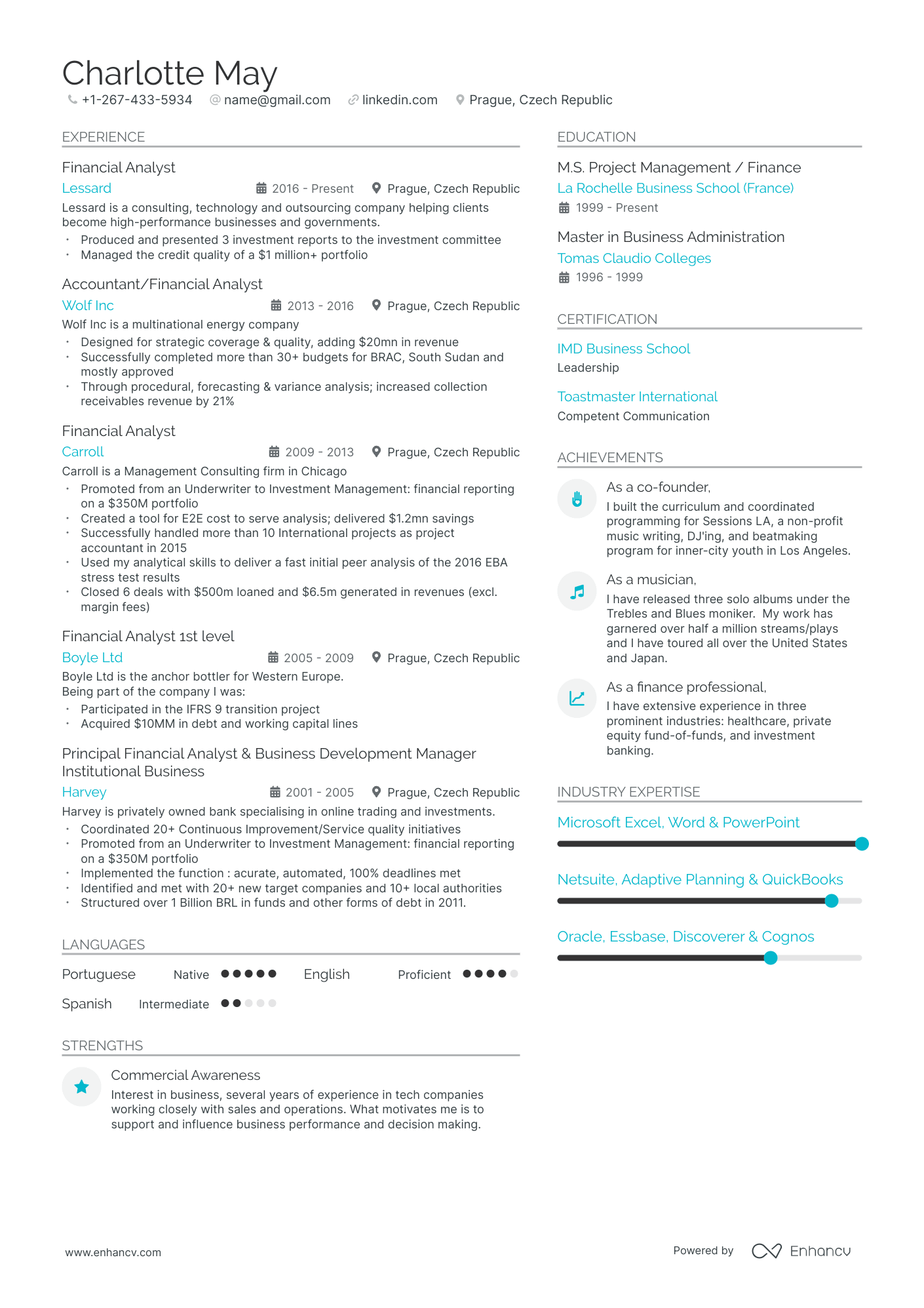

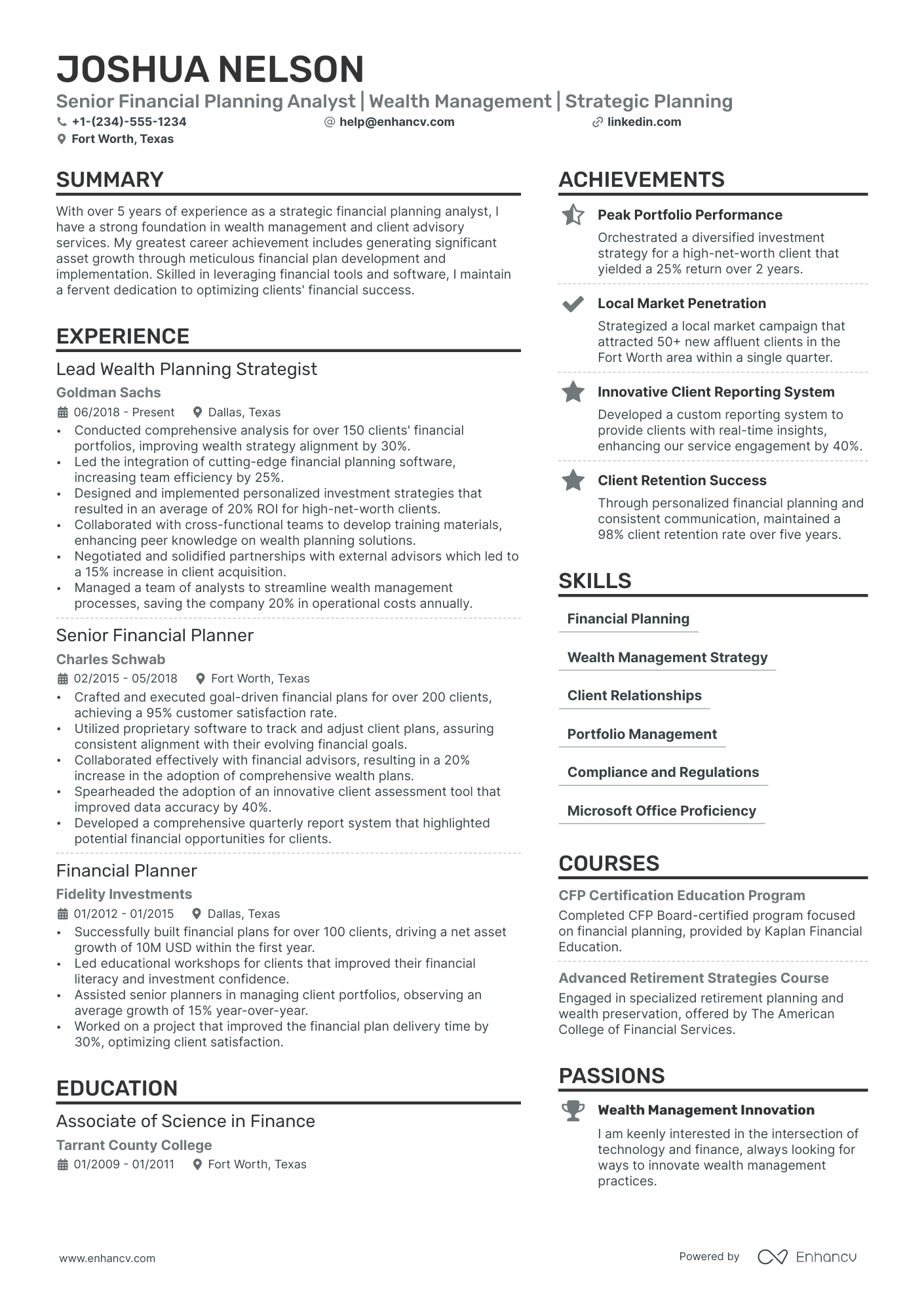

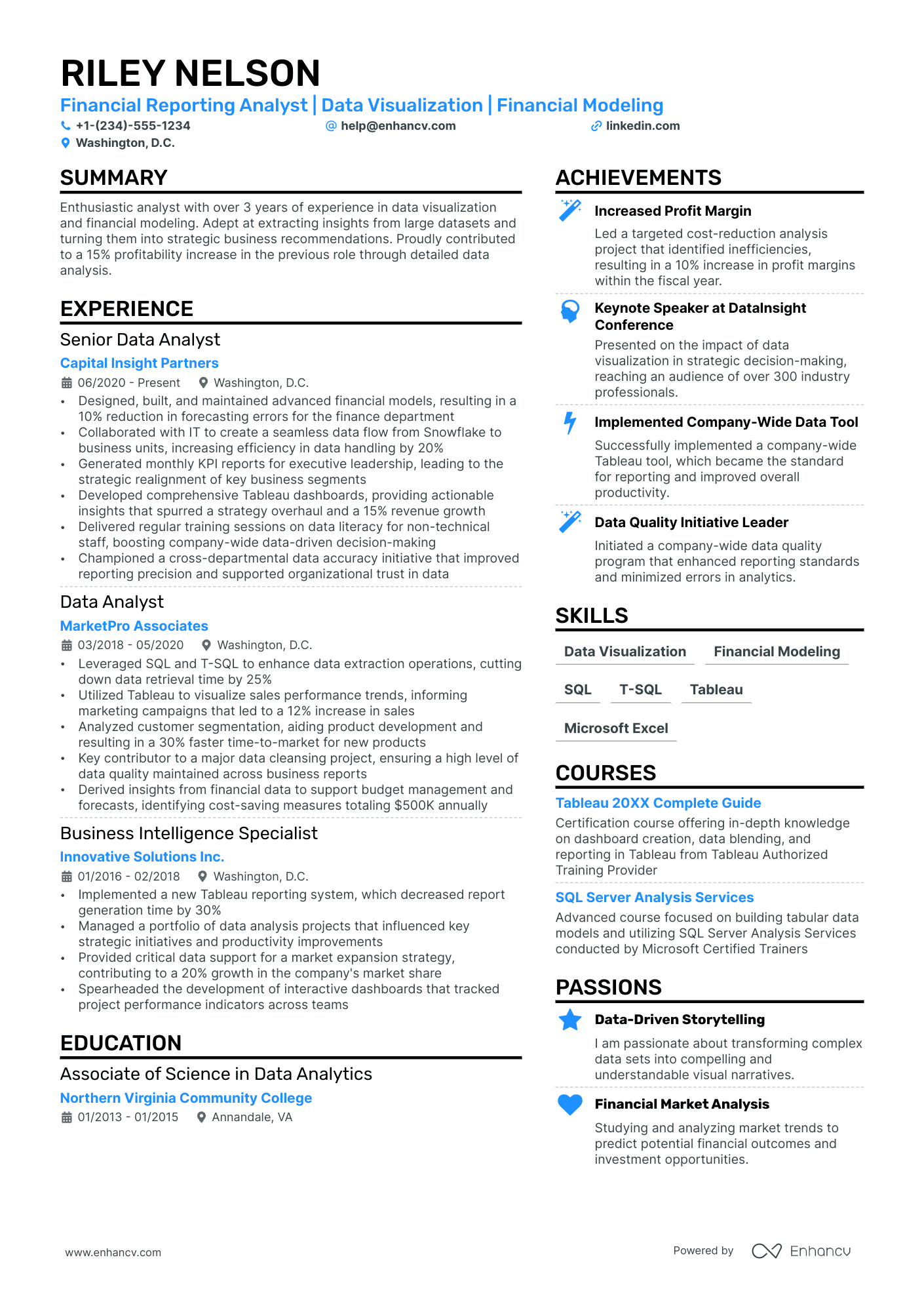

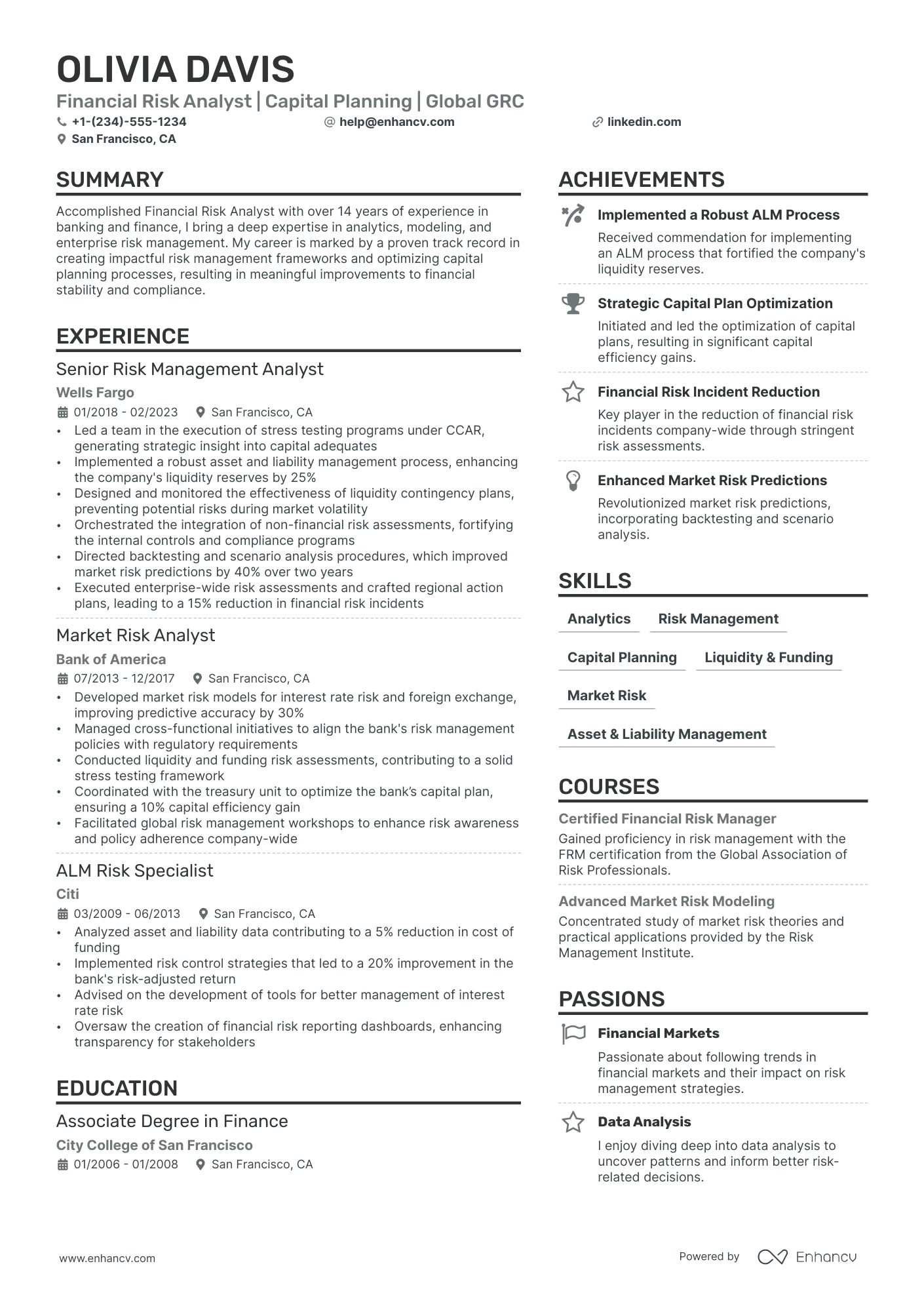

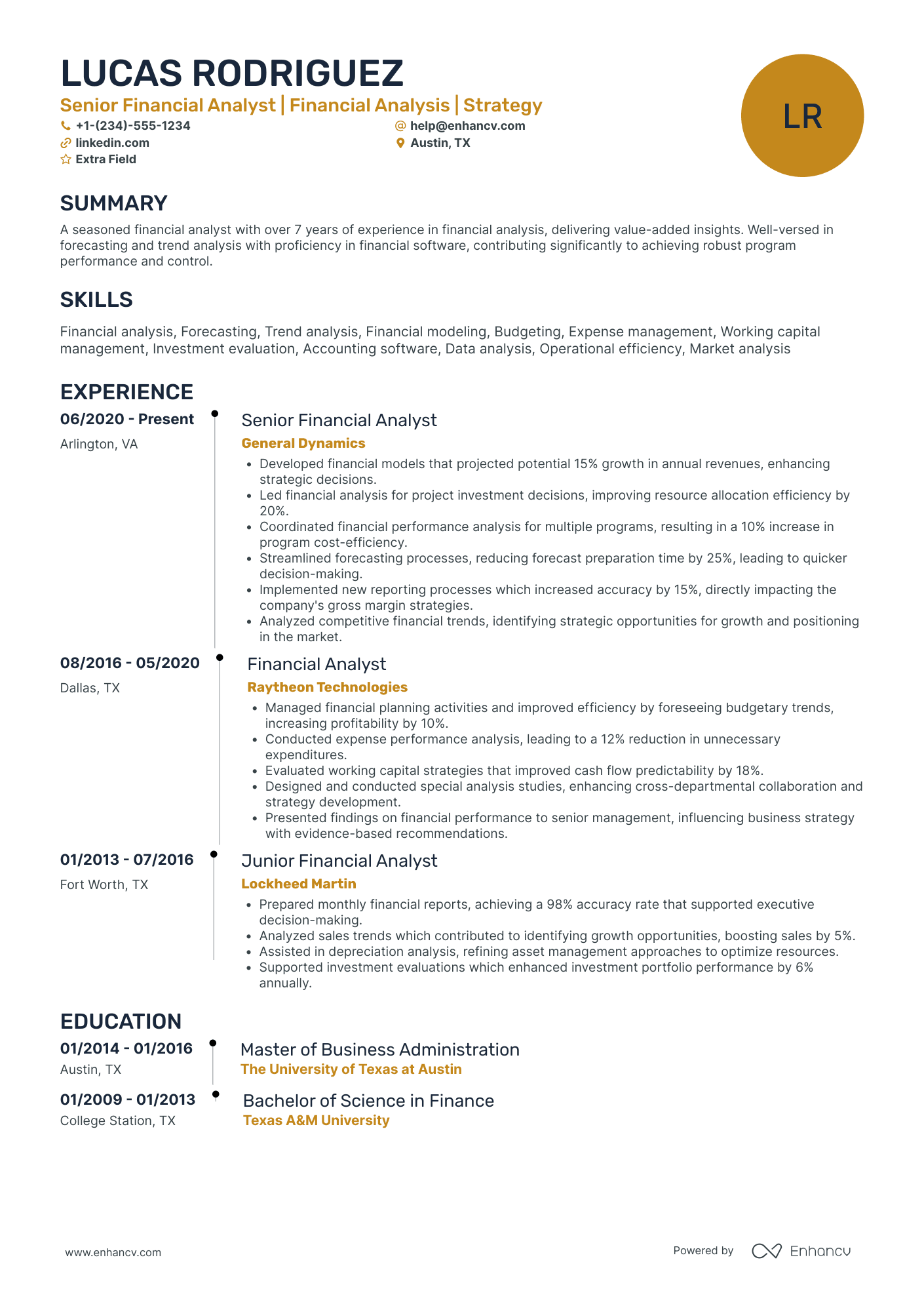

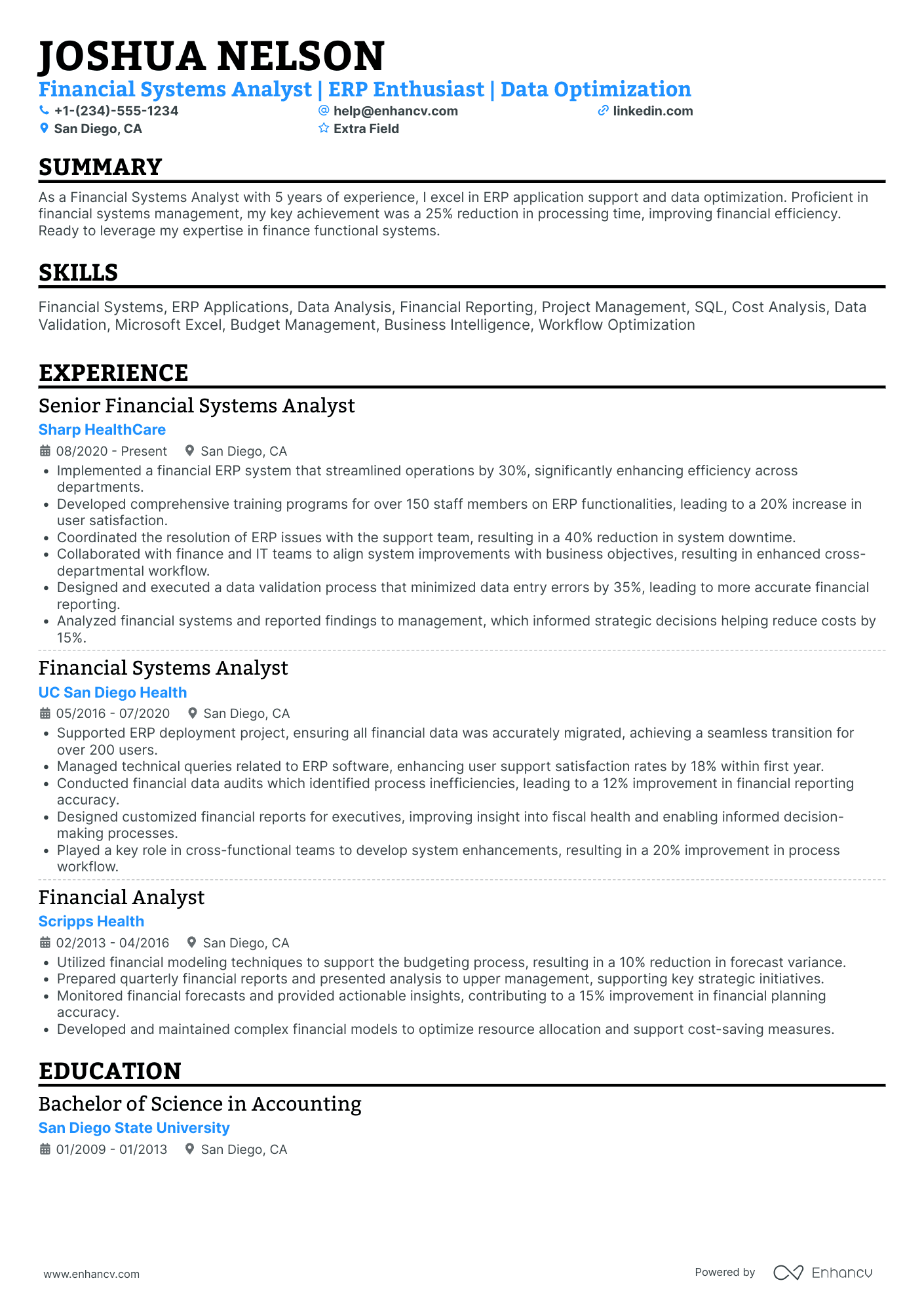

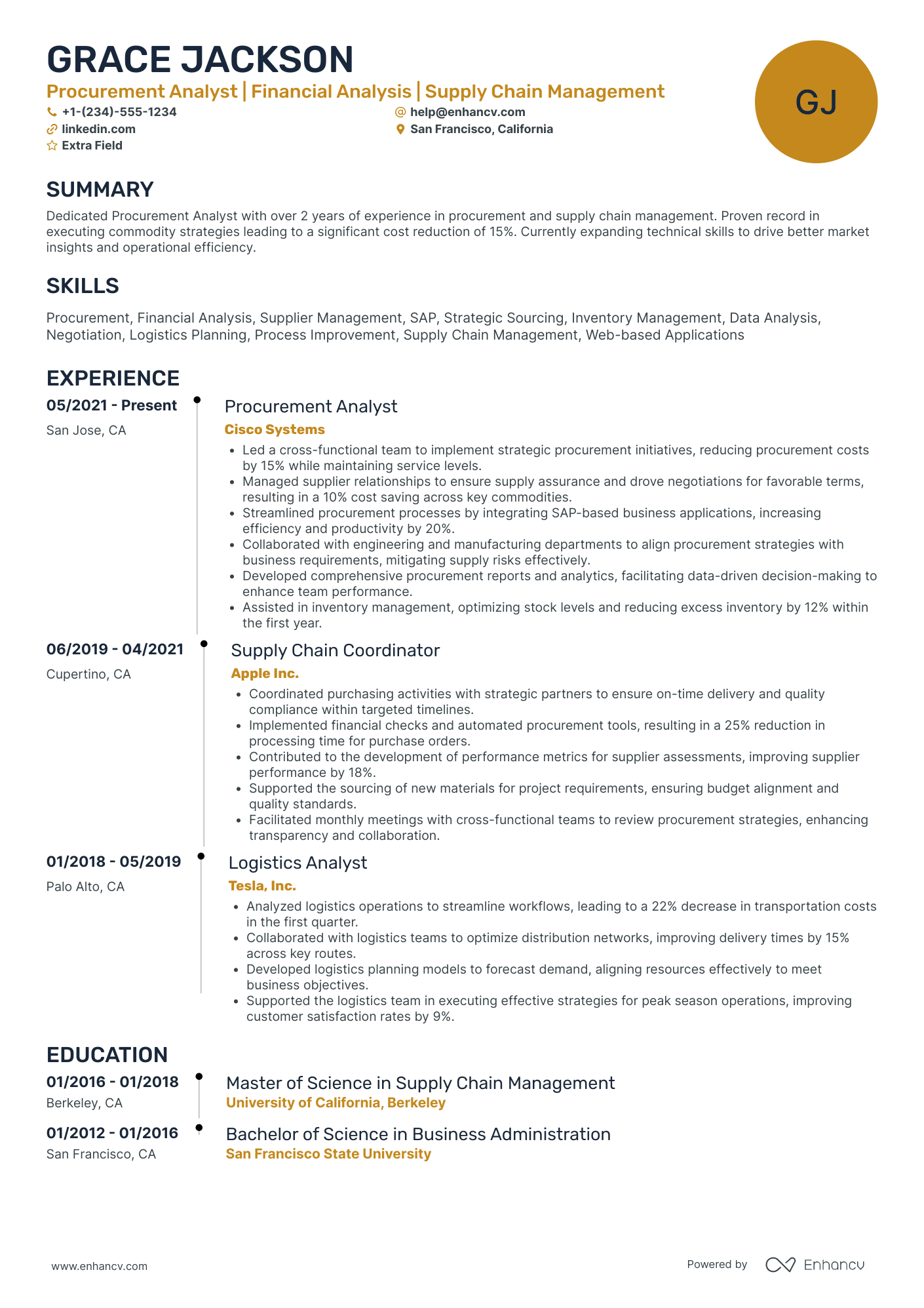

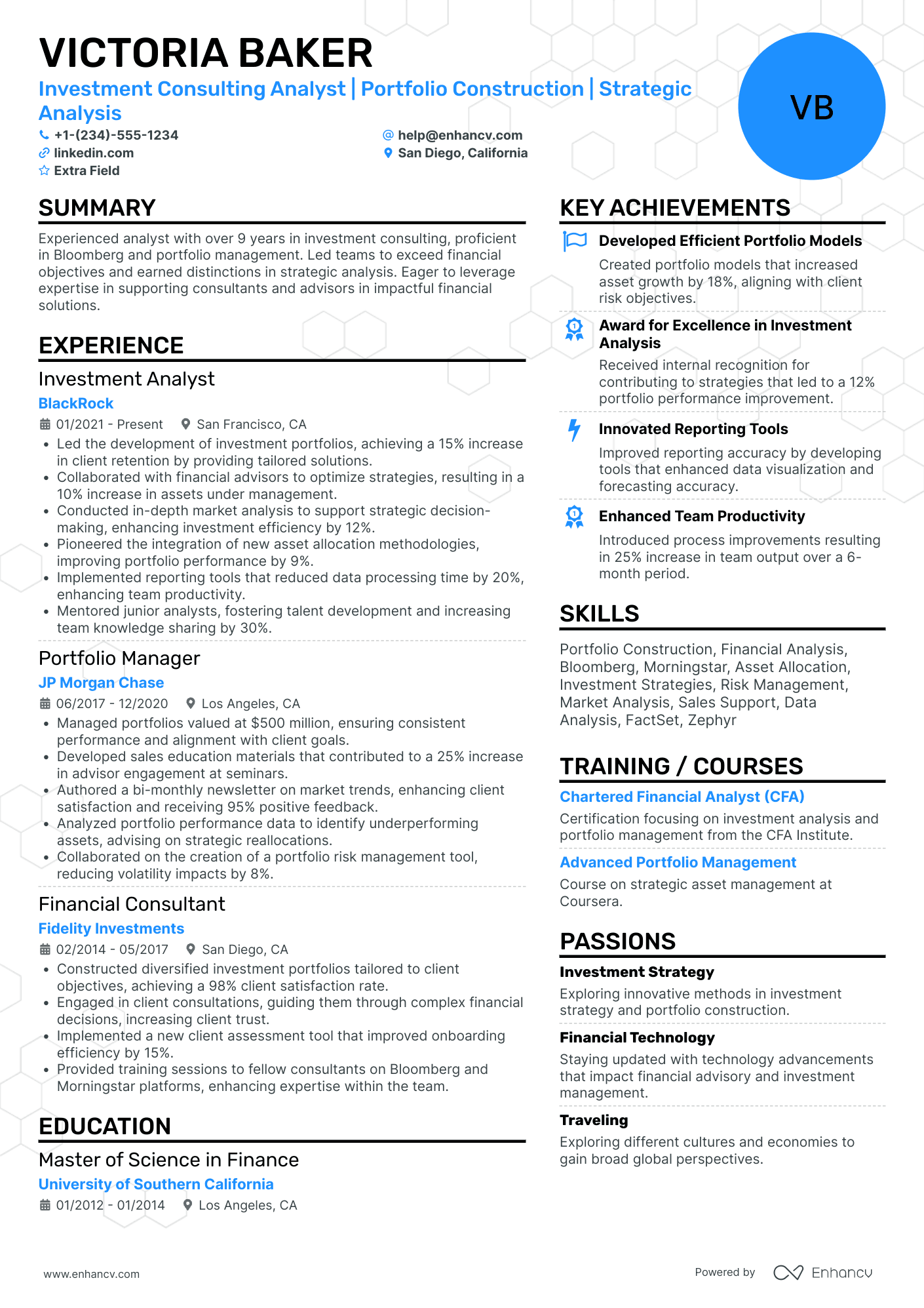

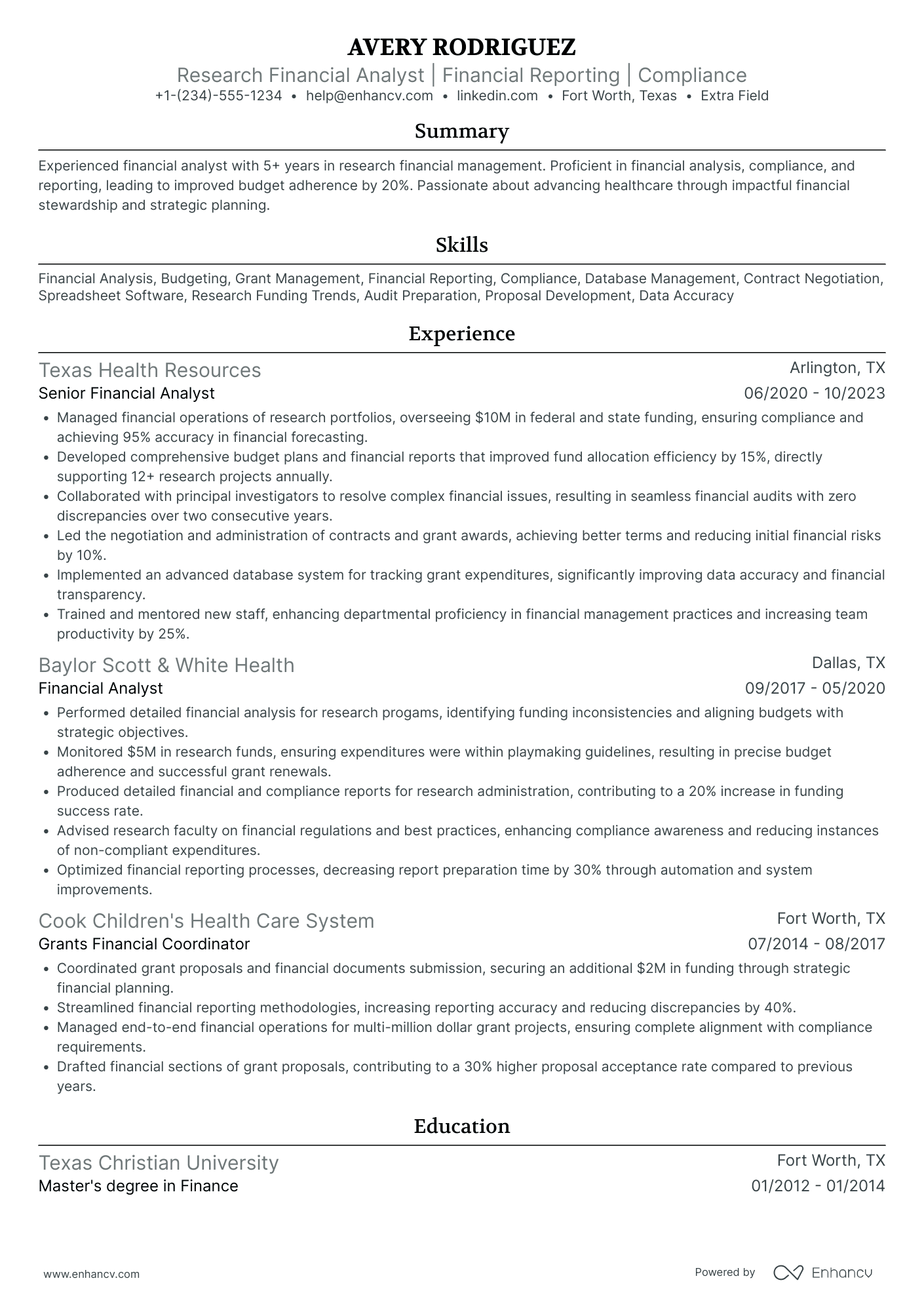

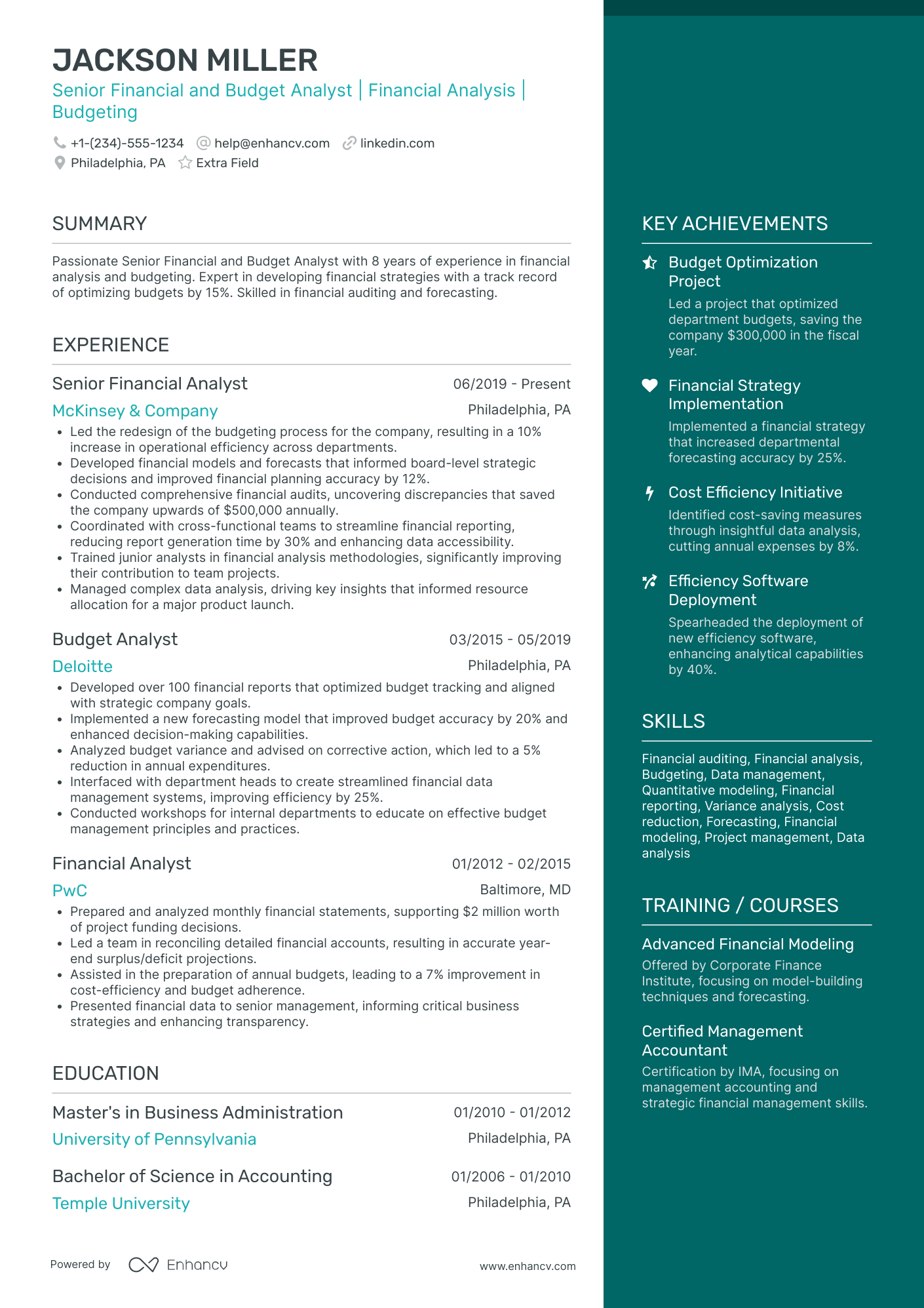

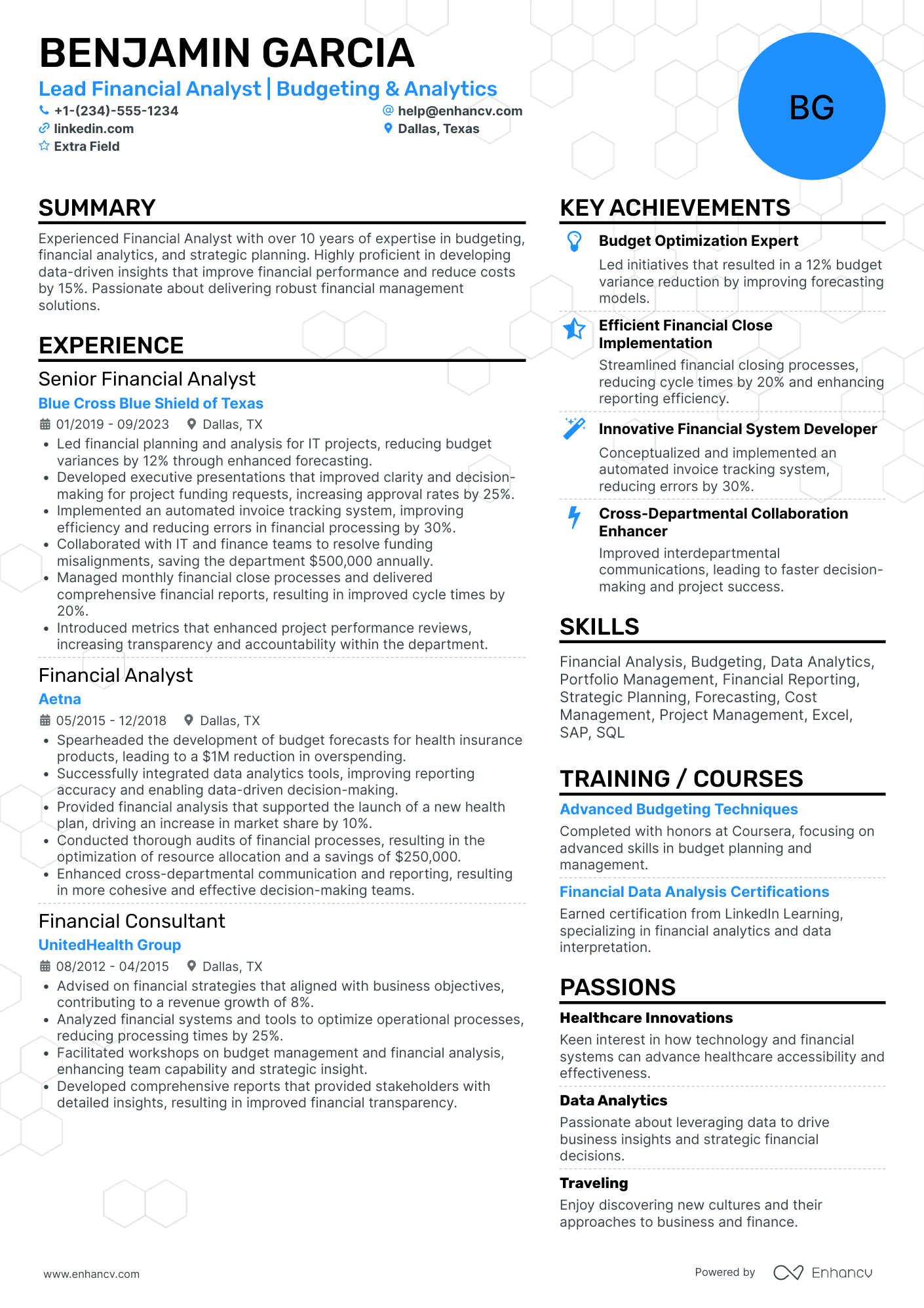

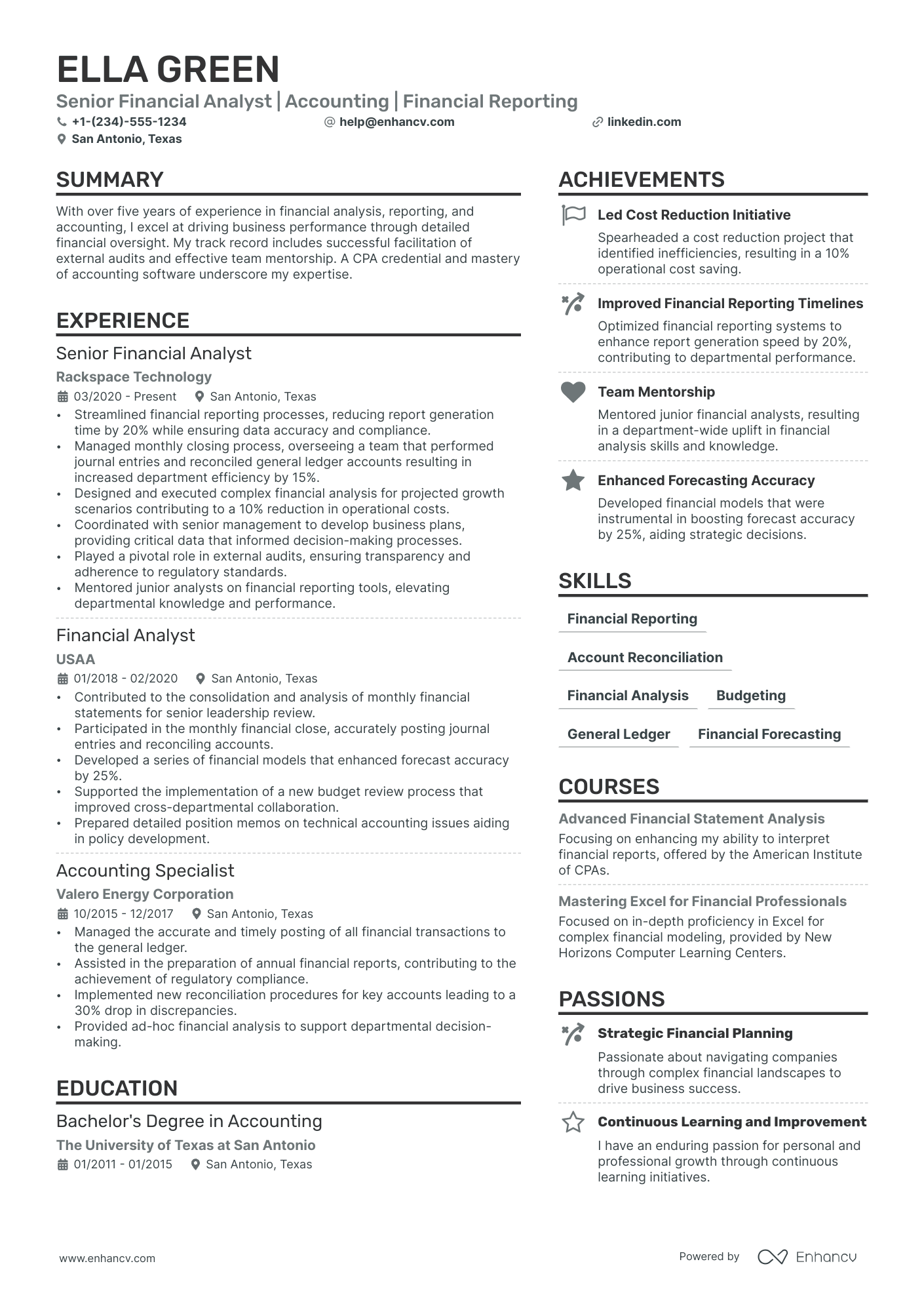

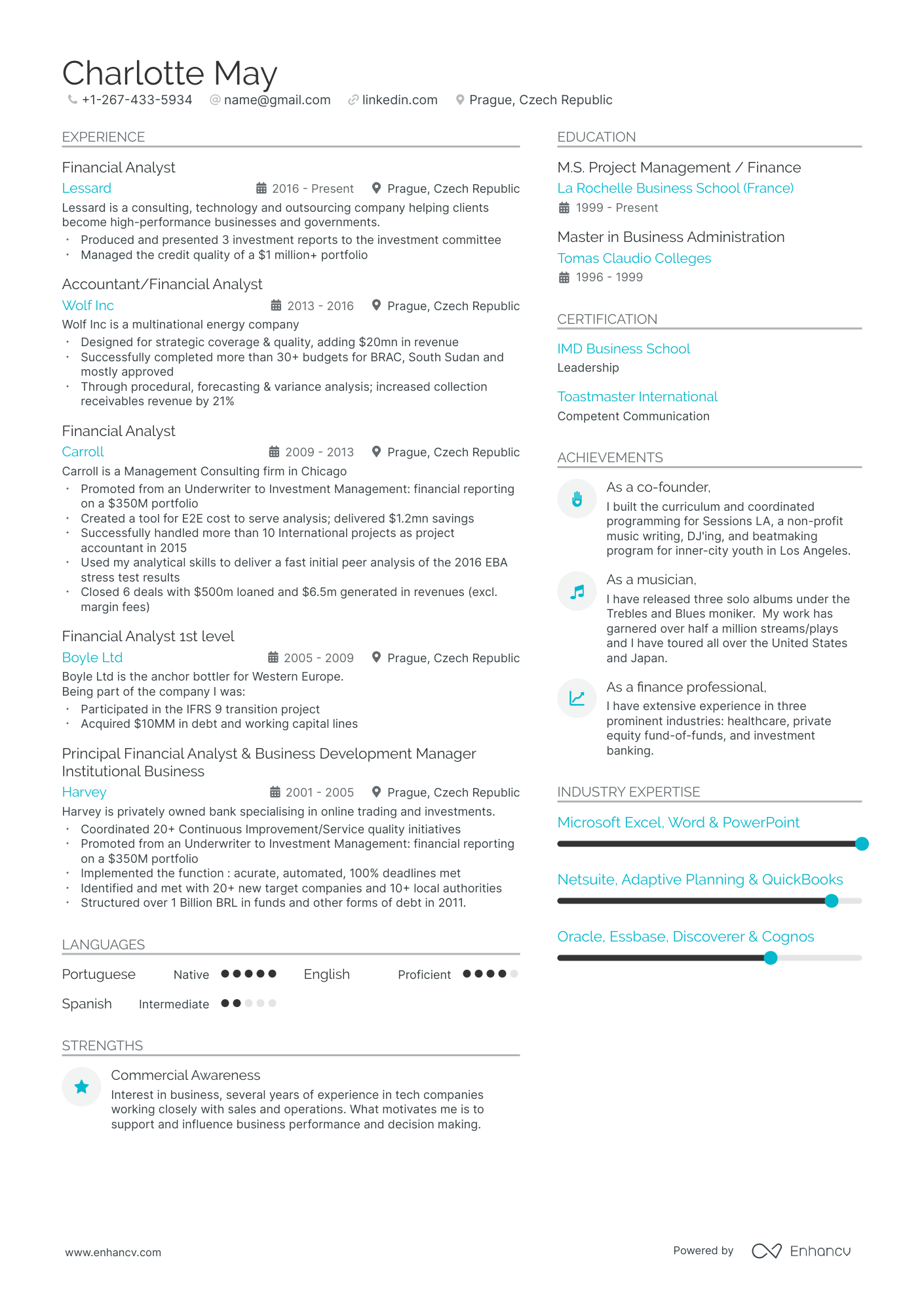

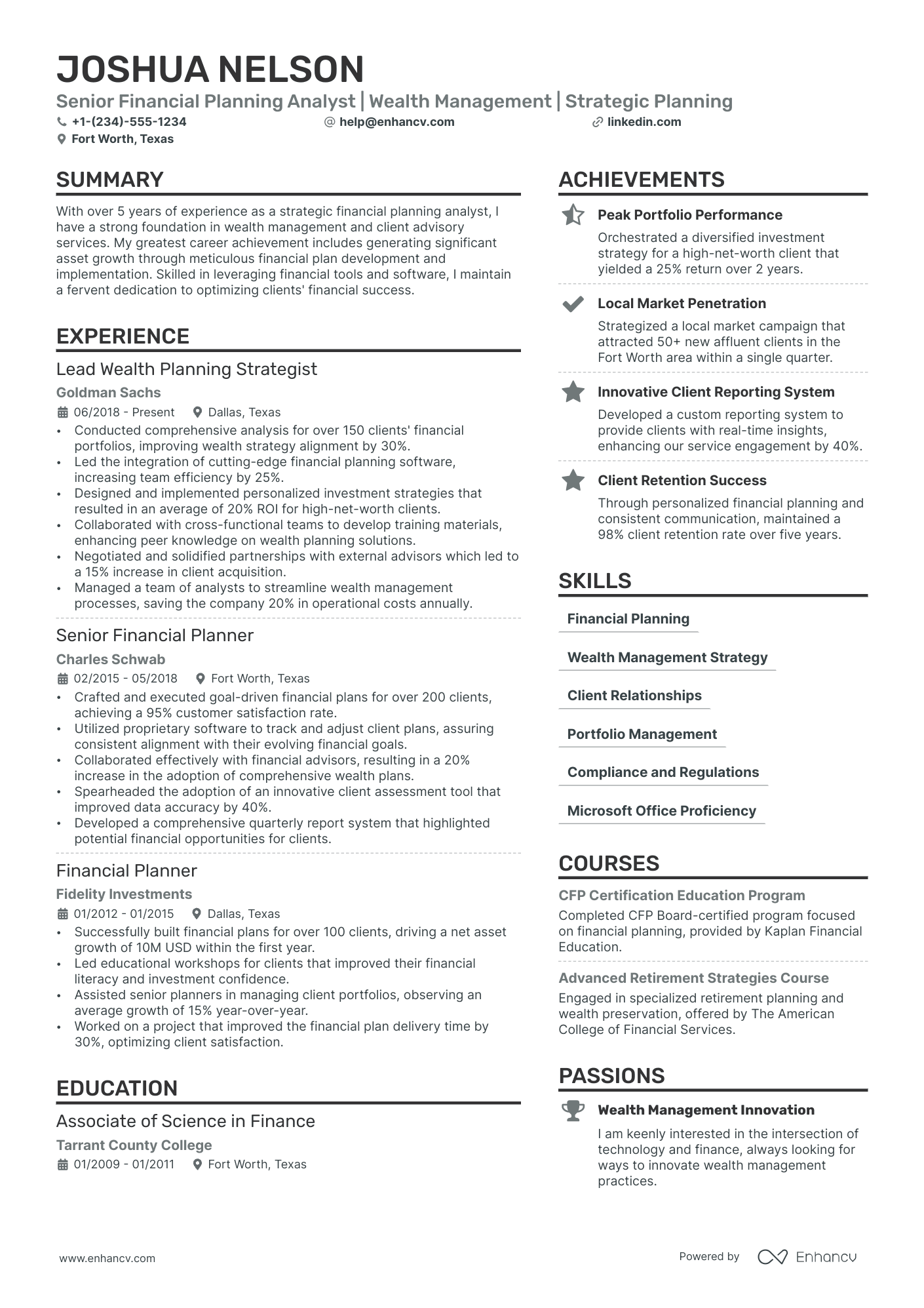

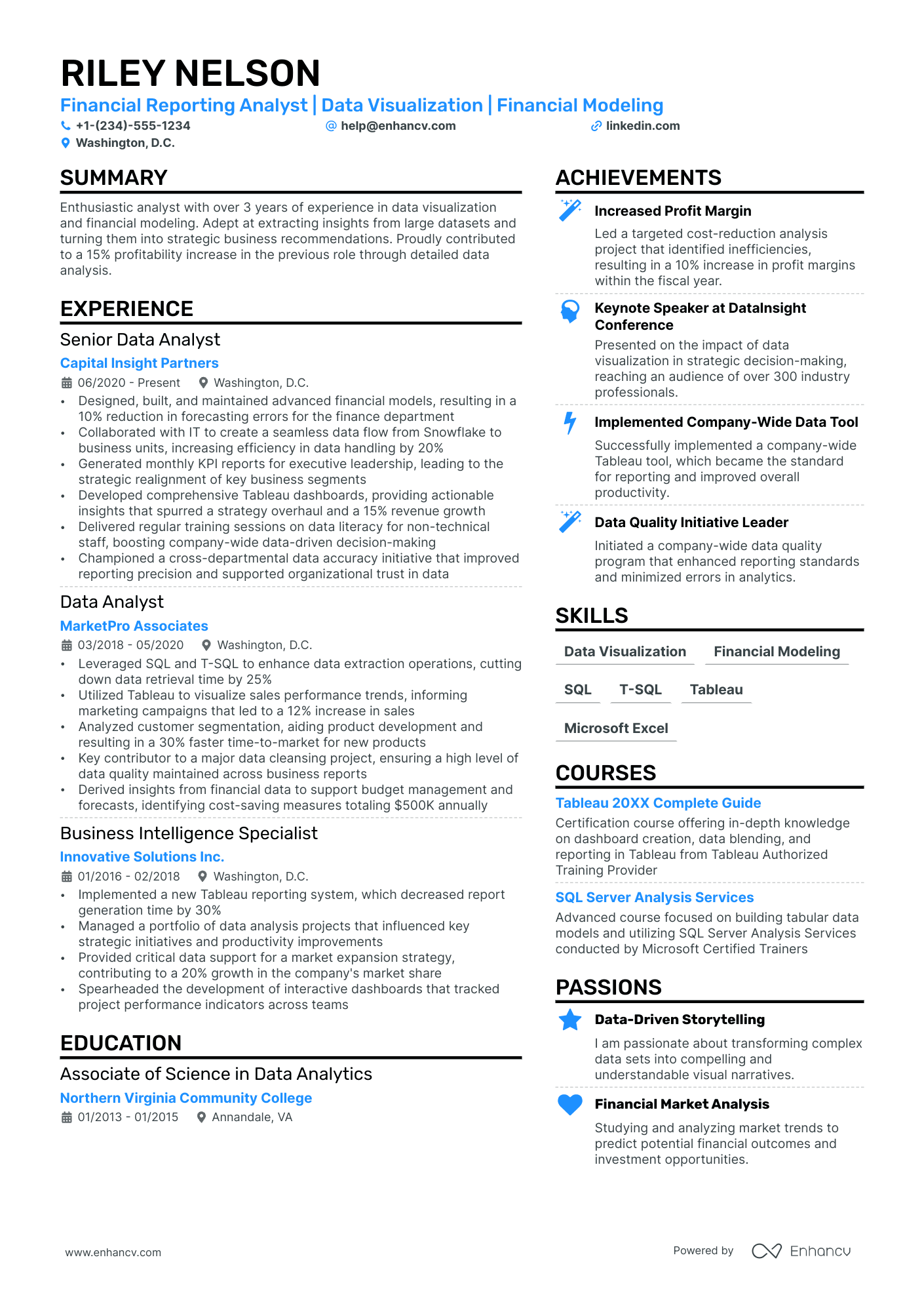

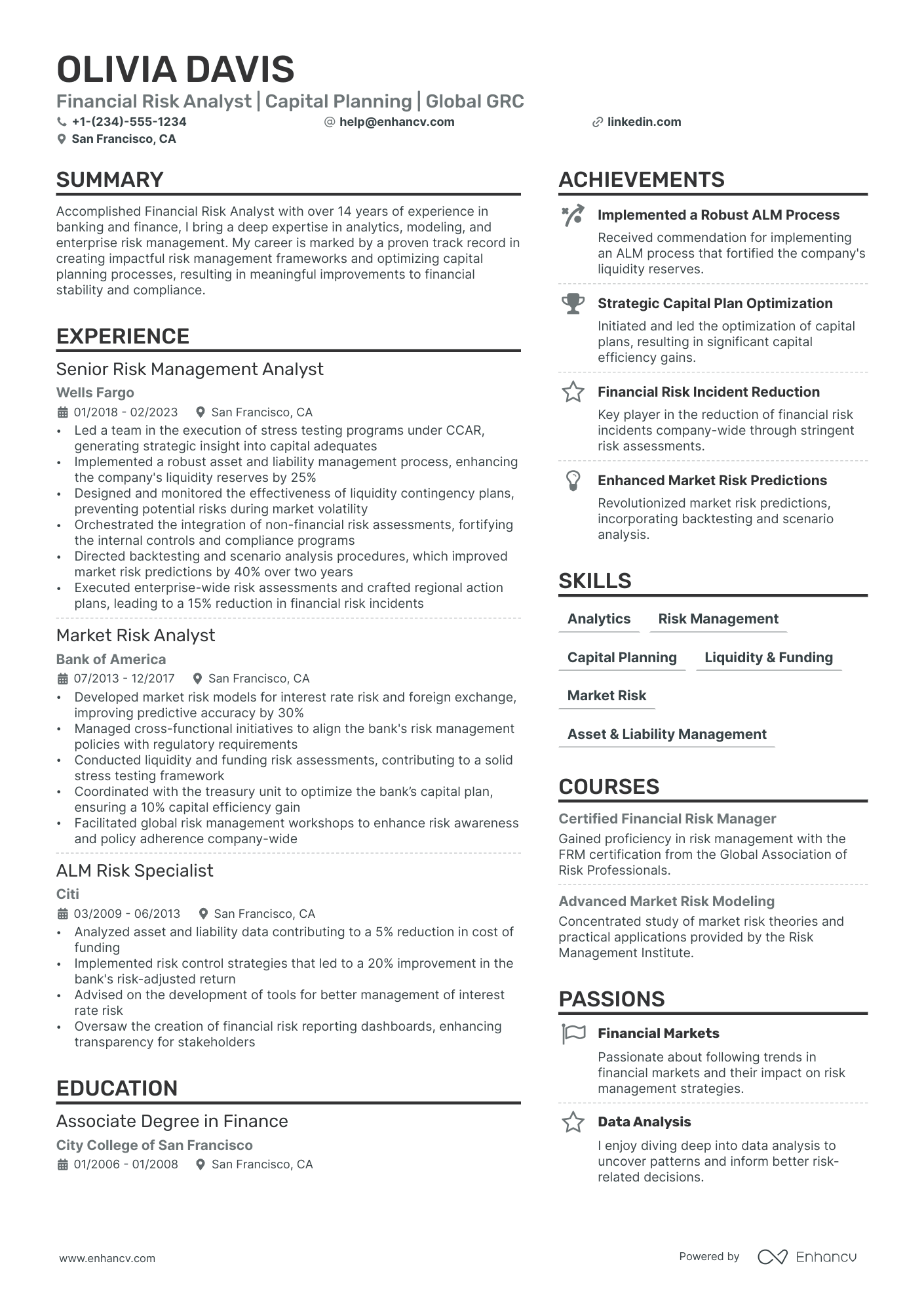

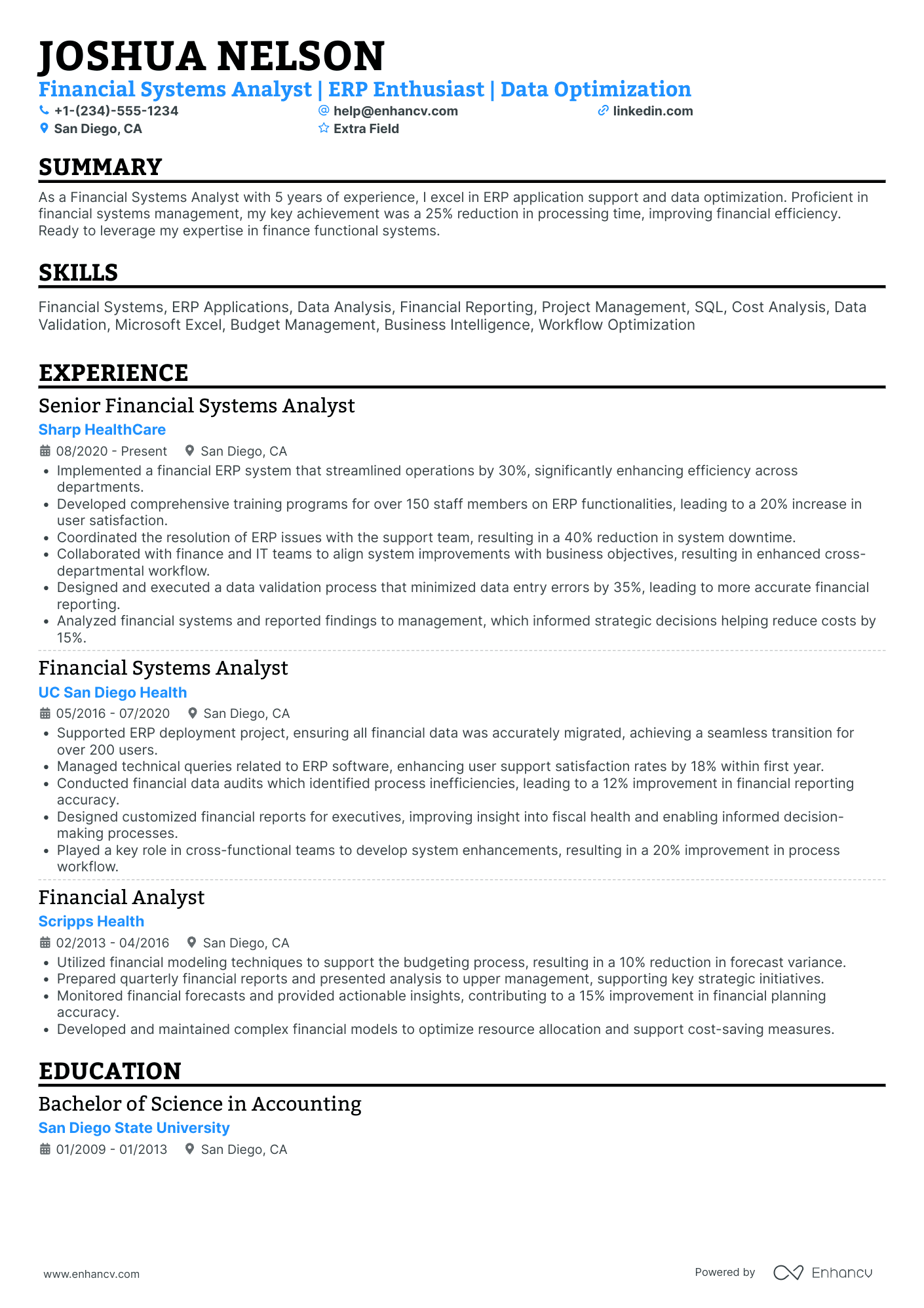

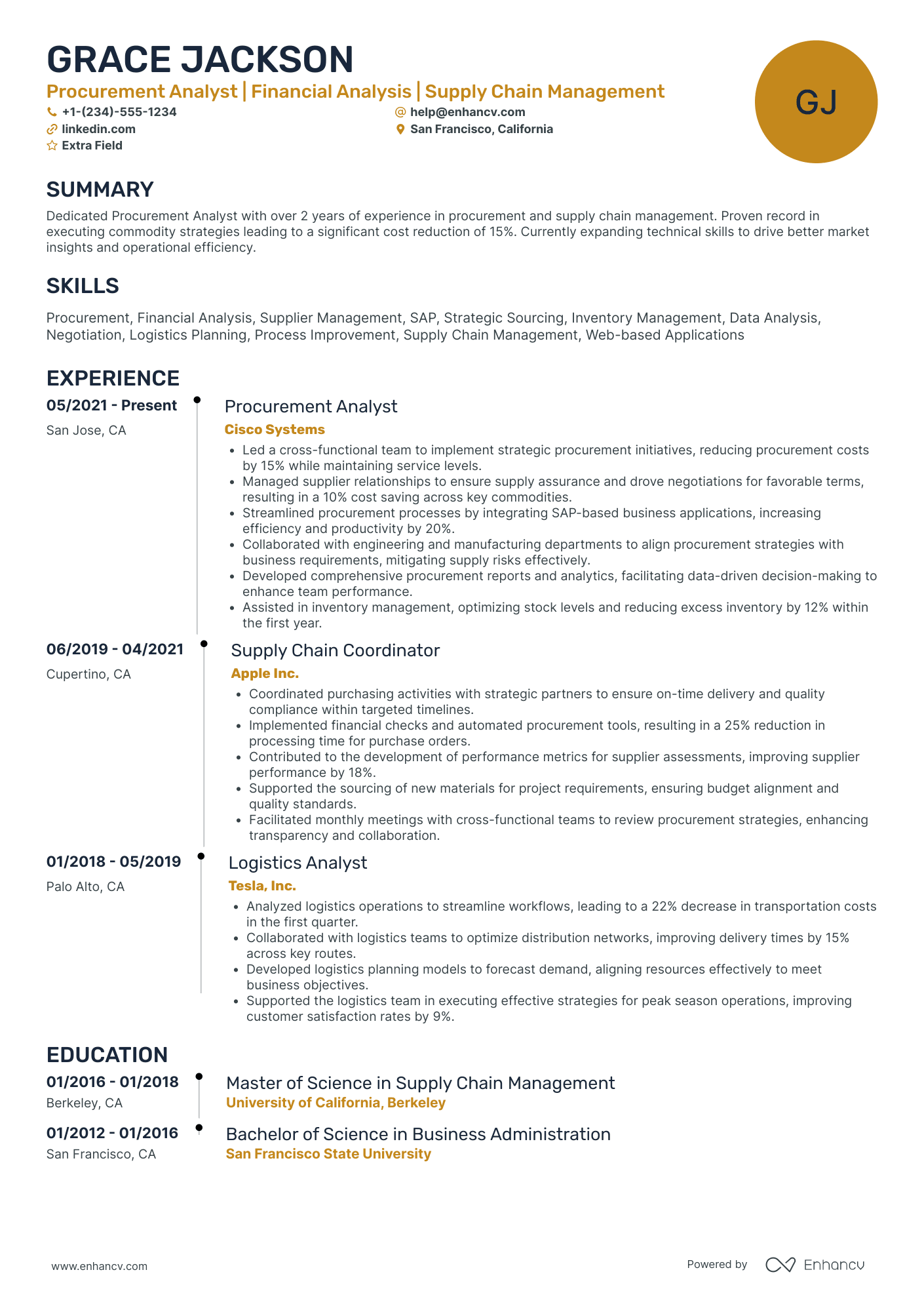

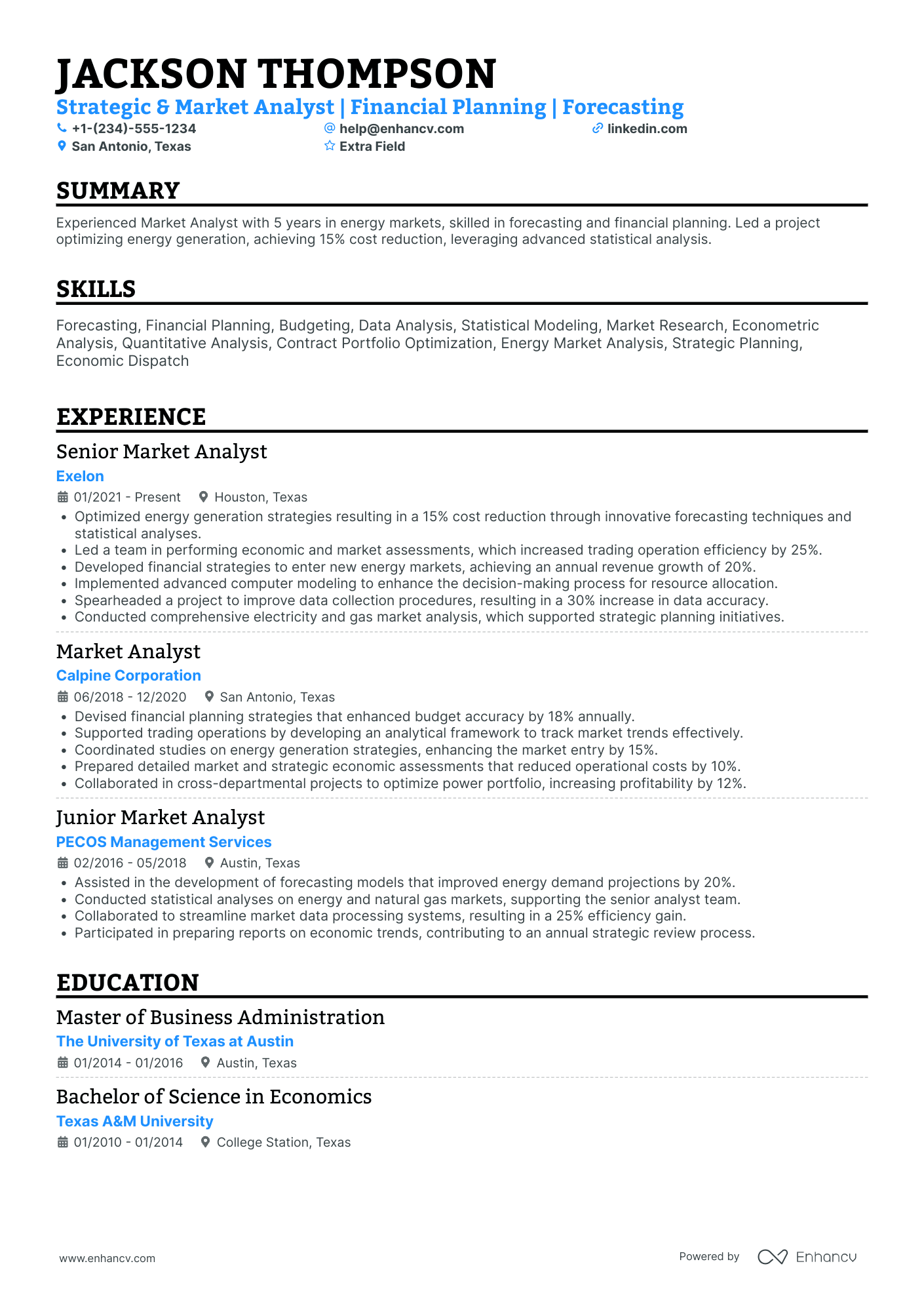

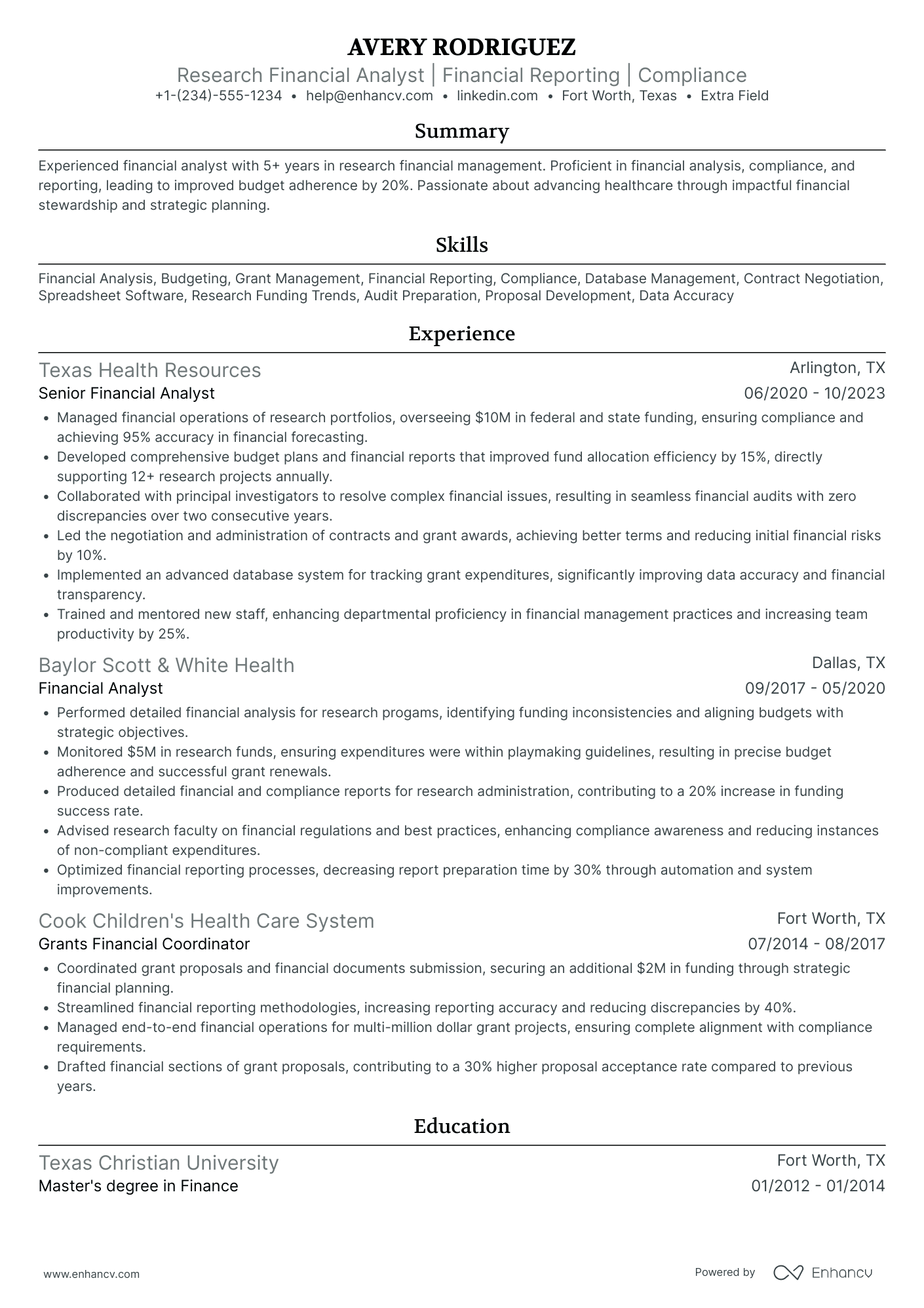

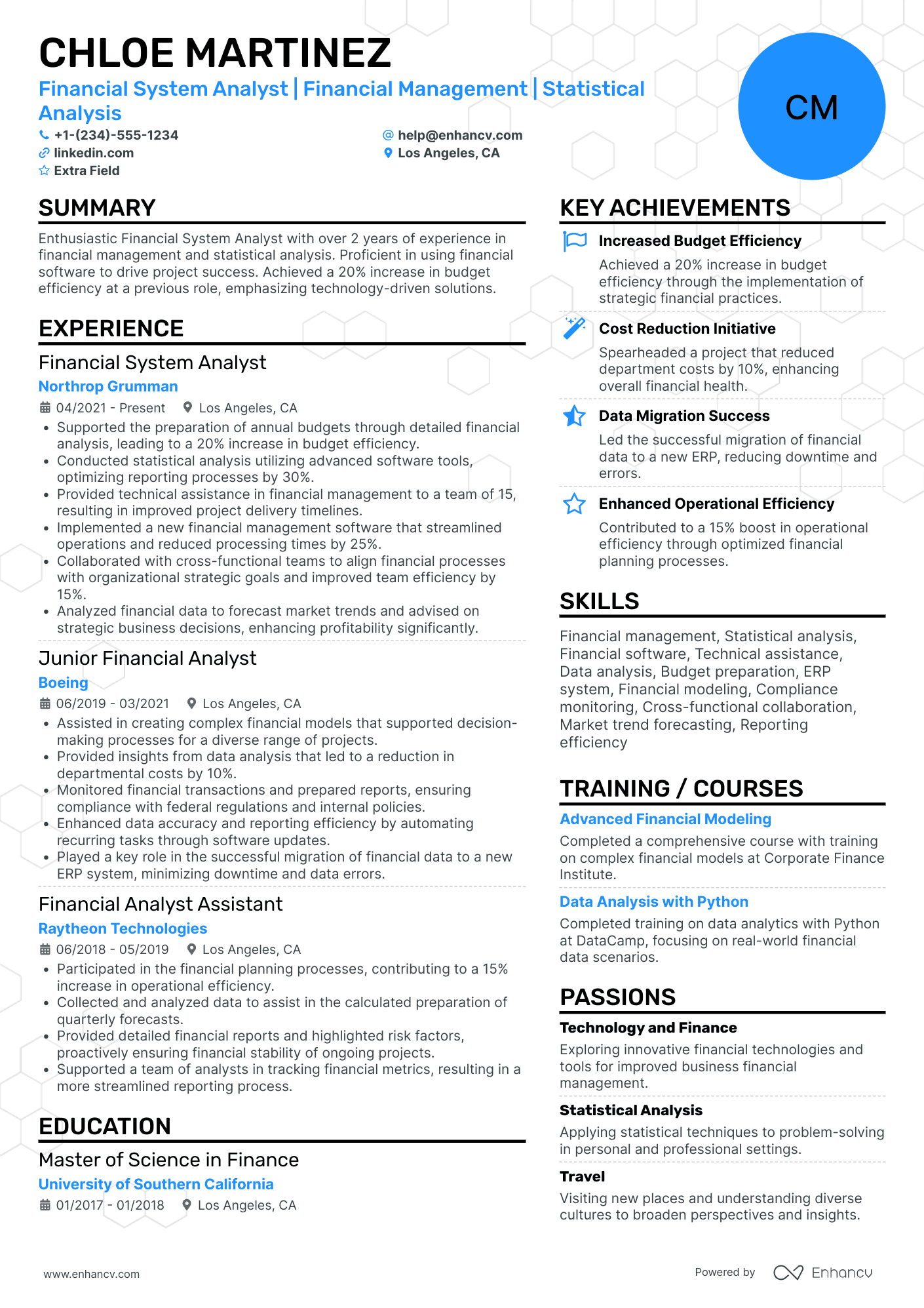

Financial Analyst resume examples

By Experience

By Role