Crafting a resume as a budget analyst isn’t just about listing your skills in forecasting, allocation, and financial reporting. It’s about proving you can turn raw numbers into smart decisions—and communicating that value clearly to employers.

Whether you’re applying for a role in government, healthcare, or corporate finance, your resume needs to speak the language of both data and impact. Because the truth is, recruiters don’t just want someone who manages budgets—they want someone who understands what’s at stake.

In this guide, you’ll find real-world budget analyst resume examples and expert tips to help you present your experience with purpose, clarity, and confidence.

Key takeaways

- Use a reverse-chronological format and keep your layout clean, ATS-friendly, and easy to scan.

- Tailor your resume to each job description by mirroring keywords and quantifying your achievements.

- Focus your experience section on budget ownership, analysis tools, and cost-saving impact.

- If you have no formal experience, emphasize relevant coursework, internships, and transferable skills.

- Include both hard and soft skills that reflect technical expertise and collaboration.

- Highlight your education and certifications to build credibility and show your commitment to the field.

So, what does a job-winning budget analyst resume actually look like today?

Let’s break it down.

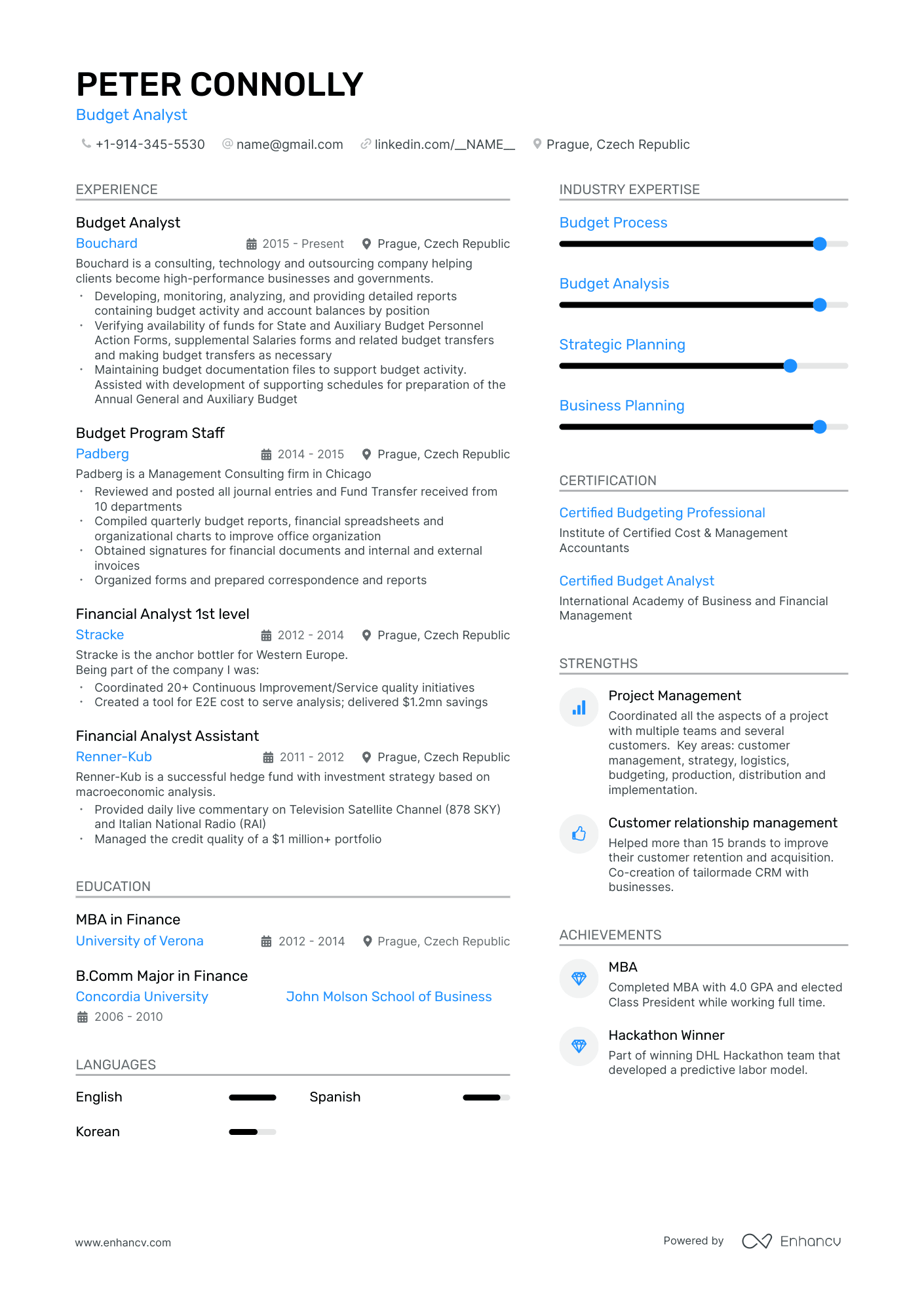

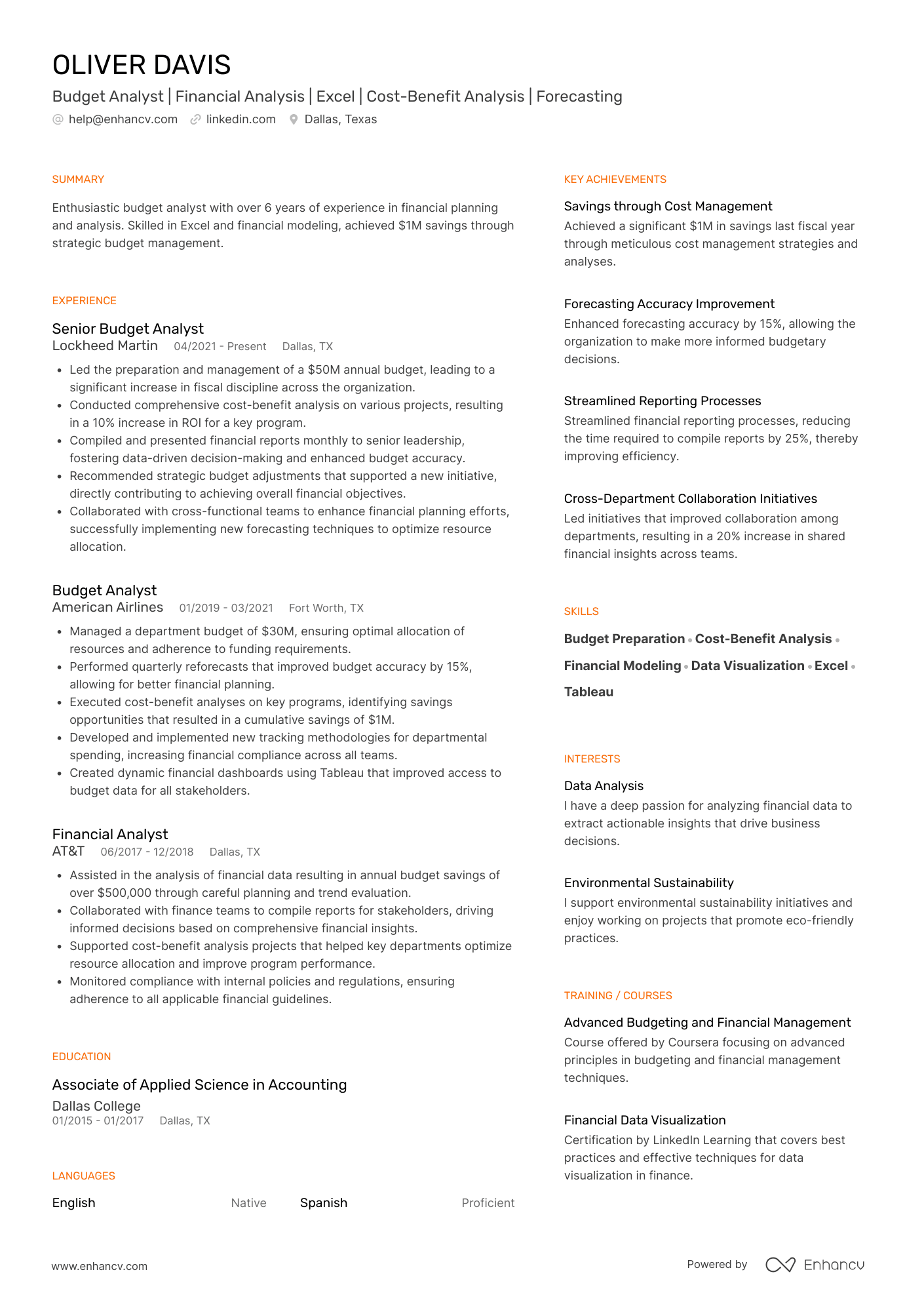

Budget analyst resume sample

Here’s a real-world example of a budget analyst resume tailored to a mid-level public sector role. This format balances professionalism with clarity, while the content speaks directly to the skills recruiters prioritize.

Johnathan Keller

Job Position

(312) 555-8XXX | john.keller@enhancv.com | @linkedin | Chicago, IL

Summary

Detail-oriented budget analyst with 3+ years of experience managing multimillion-dollar departmental budgets in the public and nonprofit sectors. Known for delivering accurate forecasts, improving budget efficiency by 15%, and turning complex financial data into actionable insights for senior leaders. Passionate about helping organizations allocate resources responsibly while achieving strategic goals.

Experience

Budget Analyst

Chicago Department of Public Health, Chicago, IL

June 2022 – May 2026

- Led development of a $12M annual budget, ensuring alignment with city and federal funding guidelines.

- Reduced administrative overhead by 10% through strategic reallocation and efficiency audits.

- Developed Excel-based forecasting models that improved planning accuracy by 18%.

- Partnered with HR and operations teams to monitor personnel costs and grant allocations.

Budget Assistant

Heartland Alliance, Chicago, IL

August 2020 – May 2022

- Assisted with quarterly budget revisions and monthly expenditure tracking for a $5M program portfolio.

- Produced variance reports and financial summaries for grant compliance reviews.

- Supported senior analysts with ad hoc financial modeling and cost-benefit analyses.

Education

Bachelor of Science in Finance

DePaul University, Chicago, IL

Graduated: 2020

- Completed advanced coursework in public finance, cost analysis, and financial reporting.

- Led a capstone project analyzing budget inefficiencies in local government operations.

- Member of the Finance Honors Program and Beta Alpha Psi.

Certifications

- Certified Government Financial Manager (CGFM) – AGA, 2023

- Financial Planning & Analysis (FP&A) Certification – AFP, 2022

Skills

Budget forecasting • Financial modeling • Cost-benefit analysis • Excel & Google Sheets • Tableau • Power BI • GAAP • Grant reporting • Strategic planning • Variance analysis

Languages

- English – Native

- Spanish – Professional proficiency

Now that you’ve seen what an effective budget analyst resume looks like, let’s explore how to format yours to stand out.

How to format a budget analyst resume

A clean, structured layout helps both hiring managers and applicant tracking systems (ATS) quickly understand your most relevant qualifications.

You don’t need a flashy design—just a layout that’s organized and easy to read.

Here’s how to do that:

The best format for budget analysts

Use the reverse-chronological format. It puts your most recent and relevant experience first—perfect for showing career progression and budget responsibility.

And these are the resume sections that matter most:

- Contact information

- Summary

- Experience

- Education

- Certifications

- Skills

- Languages

Design details that make a difference

A simple, consistent layout helps your resume pass ATS filters and make a great first impression.

Follow these rules:

- Margins: Keep them between 0.5" and 1".

- Font types: Use clear fonts like Rubik, Arial, Lato, or Helvetica.

- Font size: 11–12 pt for text and 13–16 pt for section headings.

- Colors: One accent color is fine—just use it sparingly.

- Columns: Safe to use if aligned properly and not overly dense.

- Length: One page is ideal for budget analysts.

Contact information tips (and what not to stress about)

Your resume header should include:

- Phone number

- Professional email

- LinkedIn profile

- City and state (full address not needed)

- No photos needed

Don’t stress over photos, colors, or columns. Contrary to popular belief, most ATS can handle them just fine. What really matters is using keywords from the job description and formatting bullet points and dates consistently.

File formatting and naming

Save your resume as a PDF, unless the job posting says otherwise.

Use a professional, easy-to-identify filename format, such as:

“Johnathan_Keller_Budget_Analyst_Resume.pdf”

This helps hiring managers stay organized and quickly locate your resume, especially when it's submitted alongside other documents like a cover letter.

Want to know how your current resume holds up? Use Enhancv’s tool to scan for formatting and ATS readability issues in seconds.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

We’ll break down each section of your resume next, starting with the one recruiters care most about: your experience.

How to write your budget analyst resume experience

Focus on aligning your experience with the role’s specific expectations and keywords hiring teams are actively looking for.

Here’s what to focus on:

What to include in your experience section

- Budget ownership: Size and scope of the budgets you’ve managed.

- Tools used: Excel, Power BI, Tableau, ERP systems—mention them by name.

- Decision support: How your analysis shaped policy, spending, or strategy.

- Efficiency wins: Any cost-saving measures, budget reallocations, or process improvements.

- Collaboration: Who you worked with—HR, operations, program directors, etc.

- Reporting: Type of reporting (internal, grant-related, executive-level) and outcomes.

PRO TIP

Don’t just list what you were responsible for—show what you achieved. Structure your bullet points around results.

Always adjust your tone based on the industry:

- Corporate: Keep it concise, strategic, and numbers-focused.

- Government: Highlight compliance, transparency, and attention to process.

- Nonprofit: Emphasize impact, resourcefulness, and alignment with mission-driven goals.

But even the best experience falls flat if it doesn’t feel relevant to the role.

Why tailoring matters

The strongest resumes immediately answer: Is this person a fit for this role at this company?

- Shows relevance: Directly mirrors what the job description asks for.

- Gets through ATS filters: Echoes keywords that trigger automatic resume scans.

- Saves the recruiter time: Makes it easier to say “yes” to your application.

- Positions you as intentional: You look like someone who actually wants this job, not just any job.

Below is a real-world example of a budget analyst job ad. We’ve highlighted specific phrases and responsibilities that would matter to both an ATS and a hiring manager. These are the exact terms we’ll use to shape the resume that follows.

Budget Analyst

Position overview:

As a Budget Analyst, you will be responsible for planning, analyzing, and monitoring financial resources to support departmental goals. You’ll work closely with finance and operations teams to ensure fiscal responsibility, provide budget forecasts, and deliver actionable insights to guide decision-making.

Key Responsibilities:

- Prepare and manage annual budgets, including quarterly reforecasts and variance analysis.

- Conduct cost-benefit analyses to evaluate program effectiveness.

- Compile and present financial data and reports for senior leadership.

- Monitor departmental spending to ensure compliance with funding requirements.

- Recommend budget adjustments and reallocation strategies.

- Collaborate with cross-functional teams to support financial planning efforts.

- Ensure adherence to internal policies, GAAP, and applicable federal or state regulations.

Requirements:

- Bachelor’s degree in Finance, Accounting, Public Administration, or a related field.

- 2–4 years of experience in budget analysis or financial planning.

- Proficiency in Excel, financial modeling, and data visualization tools (e.g., Tableau, Power BI).

- Strong analytical, organizational, and communication skills.

- Knowledge of government or nonprofit budgeting processes is a plus.

Here’s how we turned the key terms from that job description into a results-oriented experience section. The bullets are rewritten to match the language of the ad while staying specific, measurable, and relevant.

- •Manage a $12M departmental budget, ensuring compliance with city and federal funding requirements.

- •Develope forecasting models in Excel that improved financial planning accuracy by 18%.

- •Collaborate with HR and program teams to monitor personnel costs and grant allocations, reducing budget variance by 10%.

- •Supported financial reporting for a $5M program portfolio, ensuring timely submission of variance and compliance reports.

- •Contributed to quarterly budget reviews and recommended cost adjustments that saved over $150K annually.

- •Assisted senior analysts with cost-benefit analyses and internal audit preparation using Power BI dashboards.

How to quantify your experience on a resume

Saying you “managed a budget” is good. Saying you “managed a $12M departmental budget with 98% accuracy” is much better. Why? Because numbers build trust.

Hard data gives recruiters a clear view of your impact and builds trust in your ability to deliver results.

Here are some areas budget analysts can usually back up with real successes:

- Budget scope: Total budget managed, number of departments, or funding sources.

- Forecasting accuracy: Percentage improvements in projections vs. actuals.

- Cost savings: Annual savings, reduced overhead, or avoided penalties.

- Efficiency improvements: Time saved, process cycles shortened, or system upgrades implemented.

- Grant or compliance work: Number of grants tracked, audits passed, or reports filed on time.

- Collaboration outcomes: How your support improved outcomes across departments or teams.

Use the formula “Action + Metric + Result” to shape each bullet point. For example:

“Reduced administrative costs by 10% by implementing automated variance tracking in Excel.”

If you're not sure what to measure, start by asking:

- What tools or reports did I improve?

- Did I help save time, money, or resources?

- Did I make a process faster, more accurate, or more transparent?

Even modest improvements—like reducing reporting time by two days—can strengthen your resume.

How do I write a budget analyst resume with no experience

No budget analyst experience? No problem. Everyone starts somewhere—and your resume can still prove you have the mindset and skills to succeed in the role.

The key is to focus on transferable skills, relevant coursework, and any hands-on experience you've gained, even if it wasn’t in a formal analyst role.

What to focus on instead of work experience:

- Education: Emphasize coursework in finance, economics, statistics, or accounting.

- Projects: Class projects, simulations, or personal budgeting tools you’ve built.

- Internships: Even if it wasn’t a “budget analyst” internship, did you work with data, reports, or budgets?

- Part-time jobs: Roles where you handled money, tracked spending, or supported team planning.

- Certifications: Online courses in Excel, Power BI, financial modeling, or public budgeting.

- Skills: Show that you’re proficient in the tools and concepts analysts rely on every day.

If you're applying for your first role, a resume objective can help frame your goals and demonstrate your readiness. It’s a short, forward-looking statement that summarizes your background, intent, and what you hope to bring to the company.

Here’s an example of an objective statement that works well for someone just starting out:

Once you have some experience under your belt—even in support roles—it’s time to show how you’ve grown.

How to show career progression on a budget analyst resume

You won’t find many people applying to senior-level budget analyst roles without any relevant experience—but you will see a lot of professionals ready to step up. Whether you're aiming for a senior, lead, or even management-level position, your resume needs to show you're prepared for that next level.

Here’s how to make your growth clear:

Tips for showing progression in senior-level budget analyst roles

- Mention previous stepping-stone roles: Titles like budget assistant, junior analyst, or financial analyst show a clear path.

- Highlight increased responsibility: Show how your scope expanded—larger budgets, more departments, or strategic planning involvement.

- Demonstrate ownership: Make it clear when you moved from supporting to leading budget cycles, audits, or reforecasting initiatives.

- Include leadership elements: Note if you trained junior staff, led cross-functional planning sessions, or advised senior stakeholders.

- Show impact over time: Reflect your growing influence through cost savings, improved accuracy, or process automation.

- Mention advanced tools or compliance: Mastery of ERP systems, grant tracking tools, or GAAP protocols signals seniority.

You don’t need “Senior” in your title to show senior-level work. Use bullet points that demonstrate leadership, strategic input, and ownership of outcomes.

How to list your hard and soft skills on your resume

As a budget analyst, you’re expected to know your way around numbers—but also around people, policies, and pressure. That’s why your resume should present a balanced mix of hard and soft skills.

Hard skills reflect your technical abilities, while soft skills show how you apply them effectively on the job.

Recruiters hiring for mid-level roles typically expect proficiency in the following tools and platforms:

Best hard skills for your budget analyst resume

- Microsoft Excel

- Google Sheets

- Power BI

- Tableau

- SAP

- Oracle Financials

- Workday Adaptive Planning

- QuickBooks

- Anaplan

- Hyperion

- SAS

- SQL

- Microsoft Access

- IBM Planning Analytics (TM1)

- NetSuite

- Cognos Analytics

- JD Edwards

- Alteryx

- Smartsheet

- Zoho Analytics

These skills highlight how you operate under pressure, collaborate with teams, and contribute beyond the numbers:

Best soft skills for your budget analyst resume

Now that you’ve defined your capabilities, let’s move on to how to list your certifications and education—the credentials that give your skills credibility.

How to list your certifications and education on your resume

Your education and certifications are more than formalities—they provide proof of your qualifications and context for your skills. In budget analyst roles, where employers often require technical knowledge and regulatory awareness, this section can signal your credibility and readiness for the job.

Most hiring managers expect to see a degree in finance, accounting, or a related field. However, certifications can give you a competitive edge, especially if they reflect hands-on skills or sector-specific expertise.

What to include in your education section:

- Your degree title (e.g., Bachelor of Science in Finance)

- The name of the institution

- The graduation year. You can skip the month—just the year is sufficient and keeps things concise

- Optionally, a few bullet points highlighting coursework or achievements

Here’s an education section tailored to the mid-level budget analyst job we introduced earlier:

- •Completed advanced coursework in public finance, cost analysis, and financial reporting.

- •Led a capstone project analyzing budget inefficiencies in local government.

- •Member of the Finance Honors Program and Beta Alpha Psi.

This example works well because it lists a relevant degree, highlights key coursework and leadership through concise bullets, and maintains clean, consistent formatting.

For finance roles like budget analyst, a dedicated certifications section is especially important. These credentials not only show initiative—they often reflect deeper technical proficiency and familiarity with regulations or budgeting practices specific to the sector.

Best certifications for your budget analyst resume

Let’s focus on the first thing recruiters will read—your resume summary—and how to write one that immediately shows your value as a budget analyst.

How to write your budget analyst resume summary

Your summary is often the first—and sometimes only—section a hiring manager reads before deciding to continue. In just two to three lines, it should convey your experience level, core strengths, technical capabilities, and, if possible, quantified results.

Think of it as your value proposition: What do you bring to the table that fits this specific role?

Here’s a strong example tailored to the job description:

This summary is effective because it quickly establishes experience, mentions relevant tools and skills from the job ad, and backs it all up with a measurable achievement.

With the core sections covered, it’s time to explore additional resume sections that can give your budget analyst application an extra edge.

Additional sections for a budget analyst resume

While the core sections cover your qualifications, optional sections can add depth, personality, or specificity—especially when multiple candidates have similar experience. For budget analyst roles, these extras can help show you're more than just numbers on a page.

Best additional sections for budget analysts:

- Certifications (strongly recommended): Highlight specialized credentials like CGFM or FP&A to reinforce technical credibility.

- Projects: Useful for showcasing financial models, grant tracking systems, or reforecasting solutions you've led or contributed to.

- Awards and achievements: Ideal for measurable impact (e.g., “recognized for identifying $500K in annual savings”).

- Languages: Especially valuable for analysts in multinational or government organizations.

- Volunteer experience: Great for early-career candidates or those in mission-driven sectors like nonprofits or public service.

- Publications or speaking engagements: Useful if you’ve written on budgeting, forecasting, or financial policy—even internal presentations count.

- Professional affiliations: Listing memberships in groups like the Association for Financial Professionals (AFP) or AGA shows commitment to your field.

Conclusion

A well-crafted budget analyst resume combines technical expertise, measurable achievements, and clear formatting to make an immediate impact. With the right structure, tailored content, and supporting sections, you’ll be positioned as a standout candidate in a competitive field.