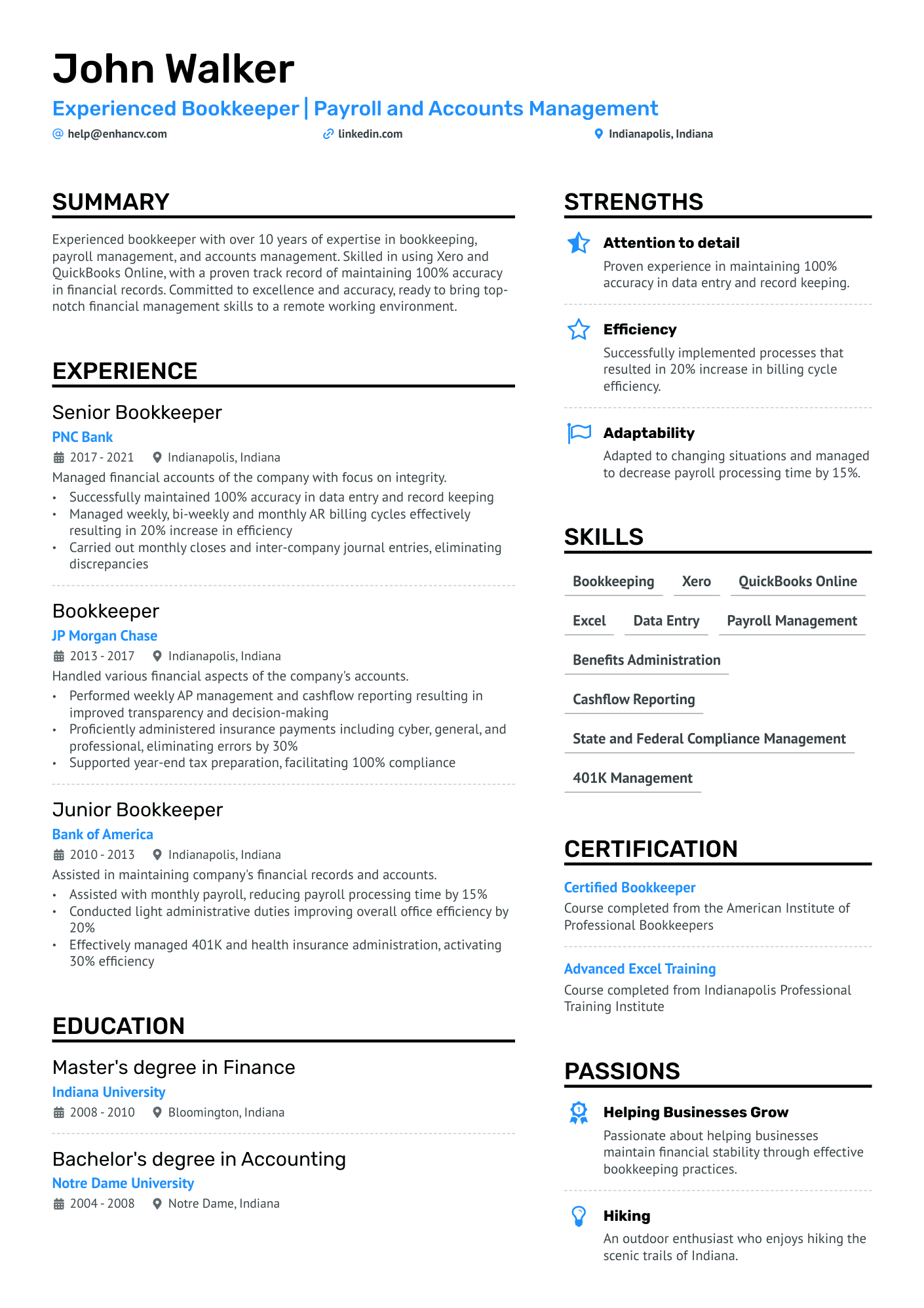

A lot of people think they can skip hiring a bookkeeper because QuickBooks ads make it sound so easy. Unfortunately, this often leads to years of disorganized financial records. Eventually, even those who were skeptical came to realize that AI can't fully replace the human touch needed in bookkeeping. It's a detail-intensive job. While some routine tasks can be automated, the role of bookkeepers remains vital for thorough analysis and strategic decision-making.

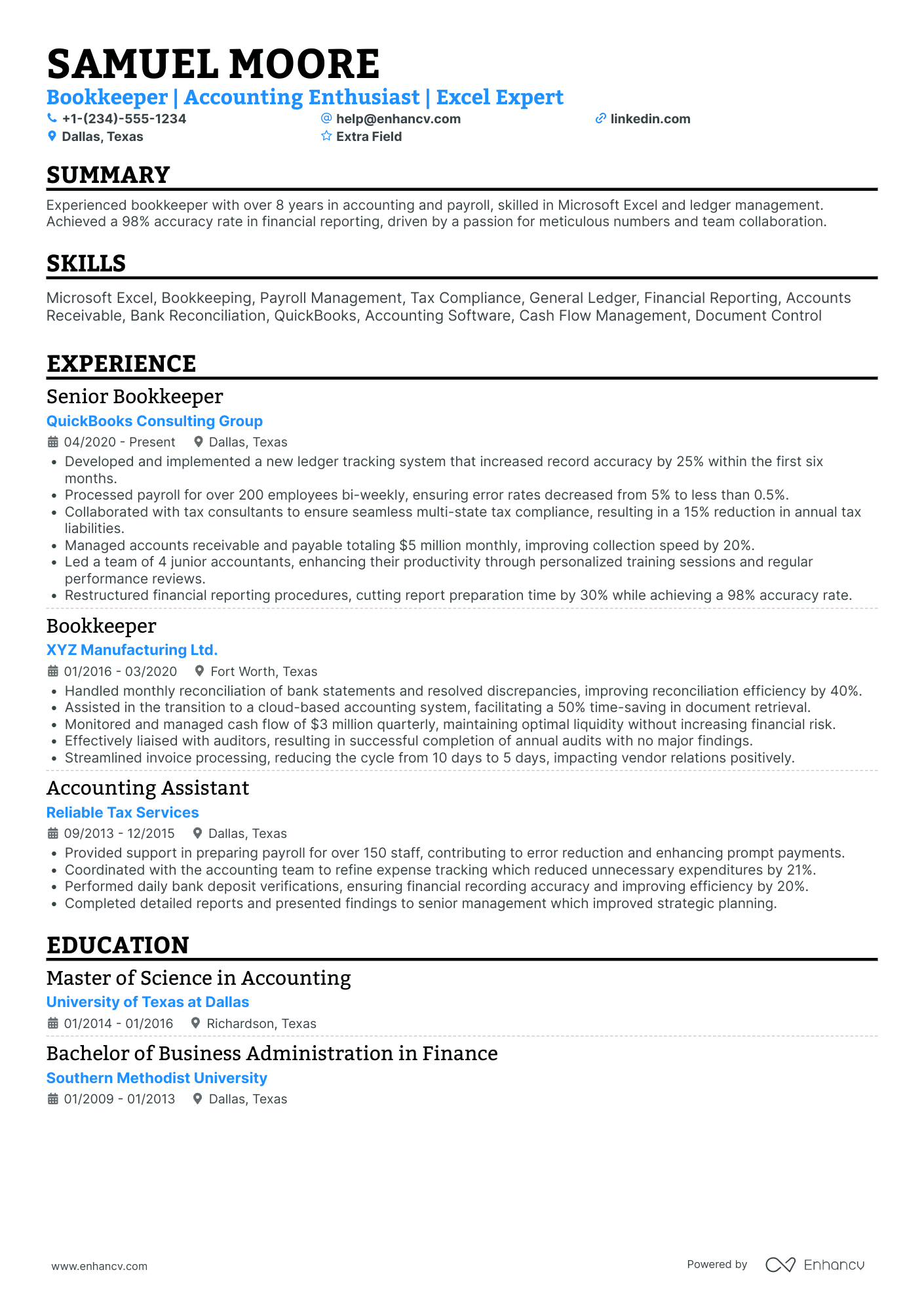

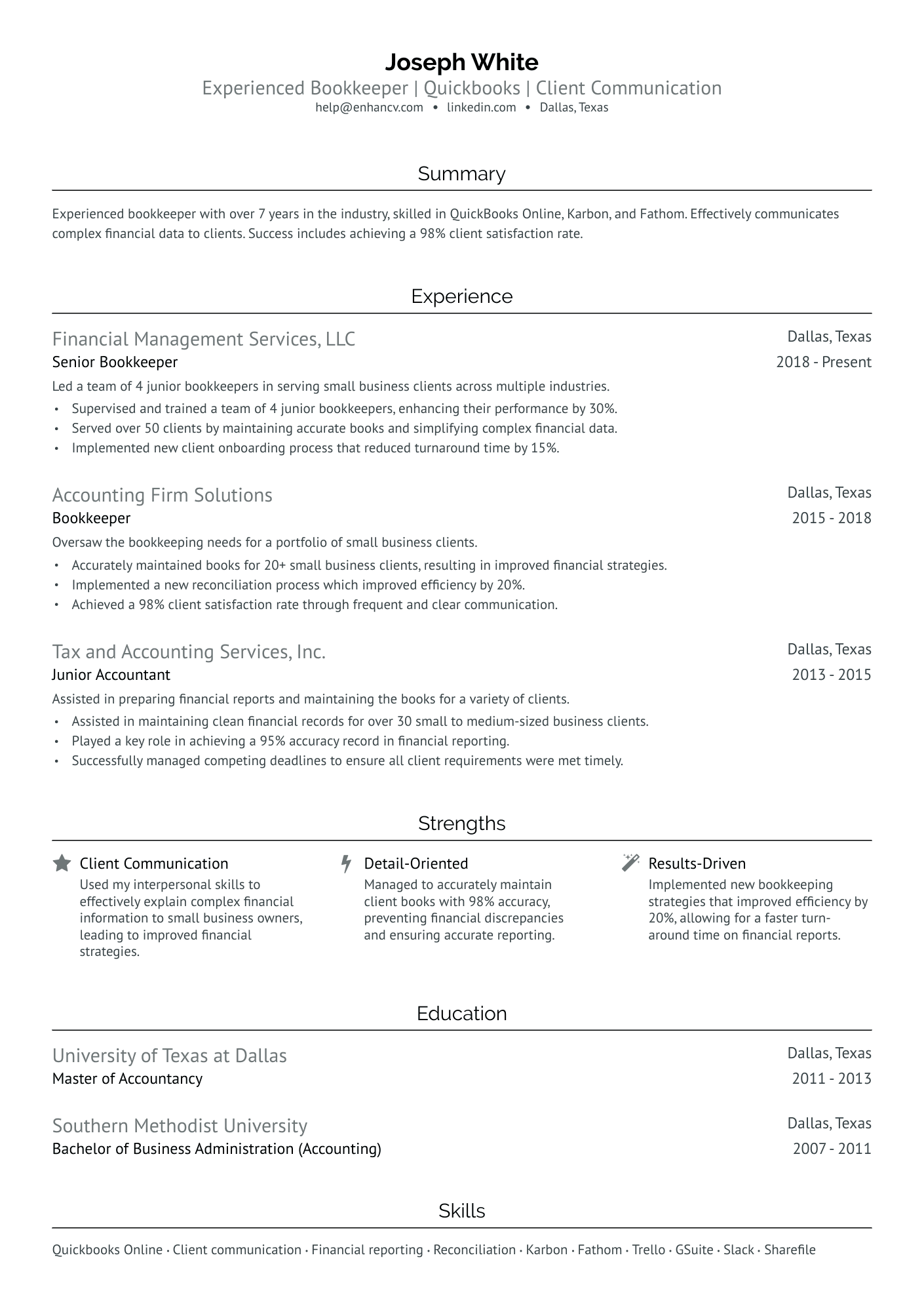

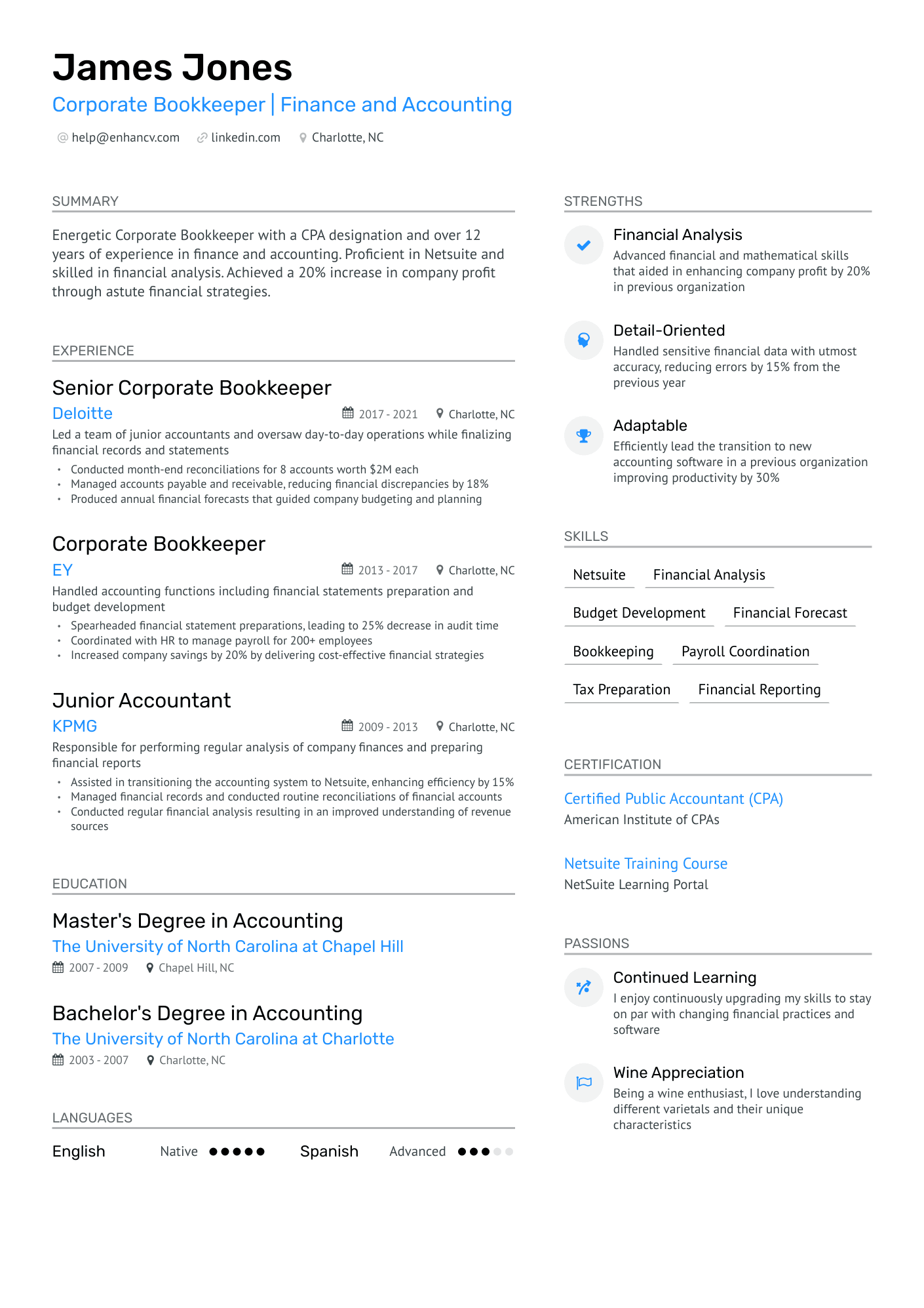

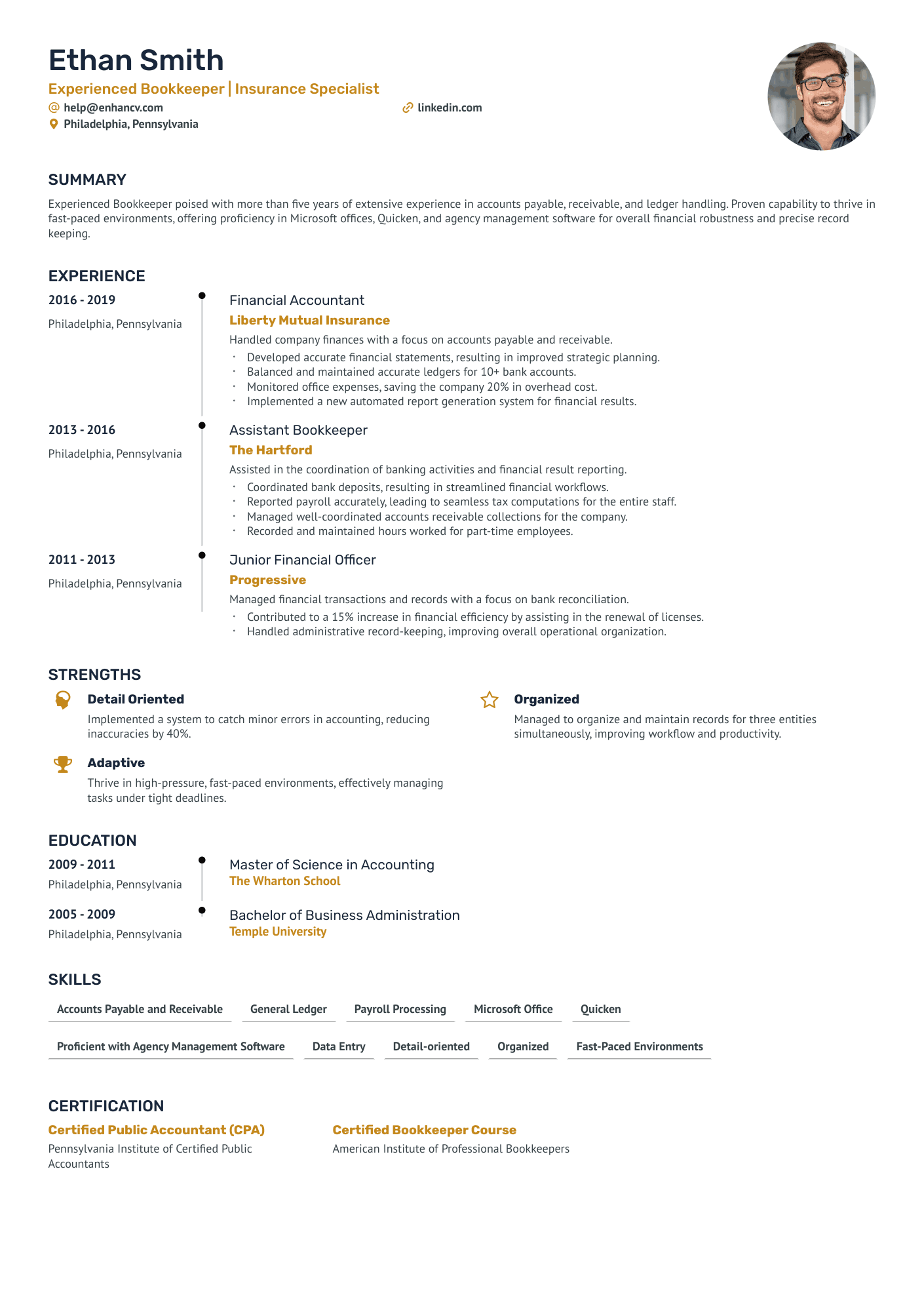

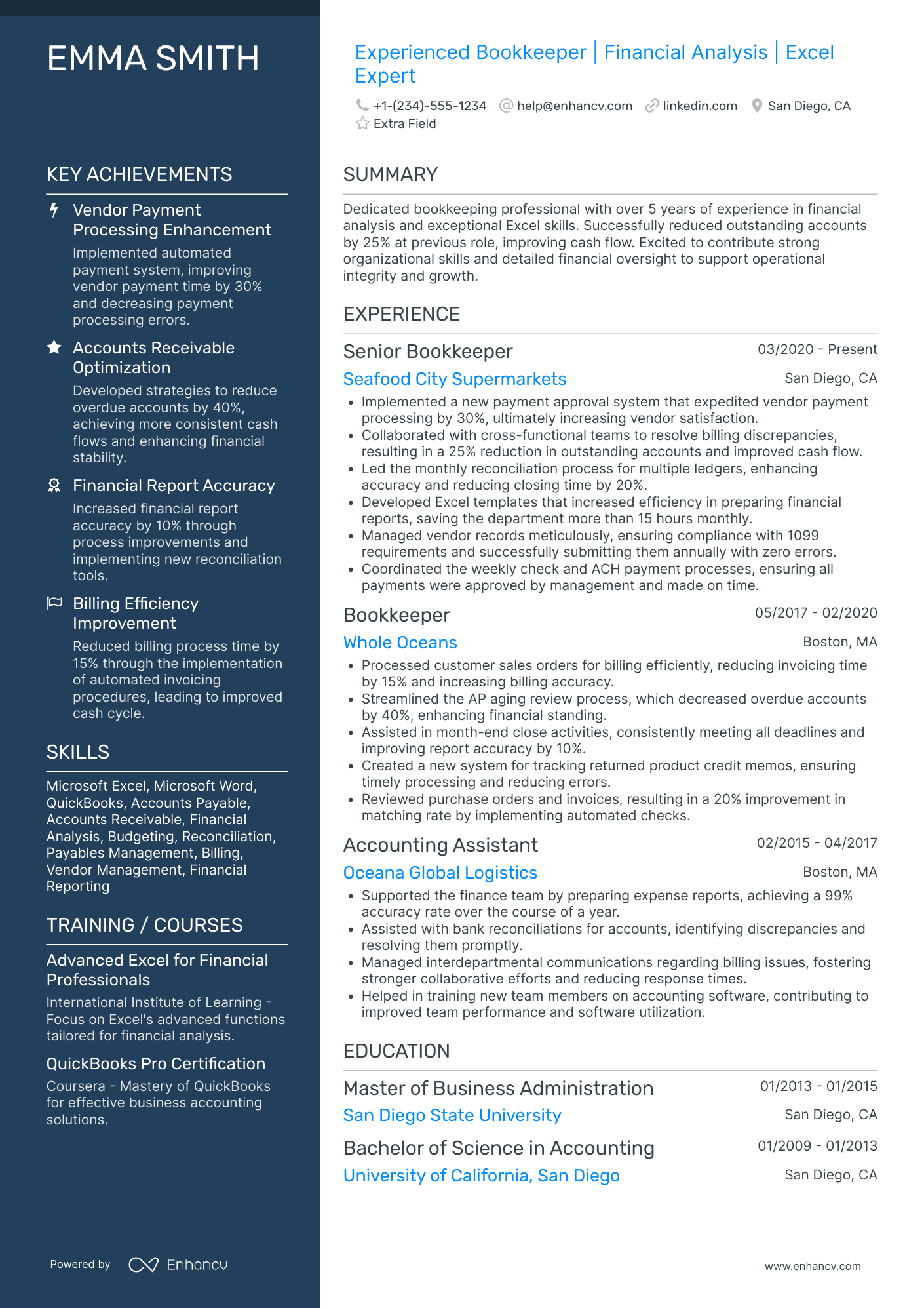

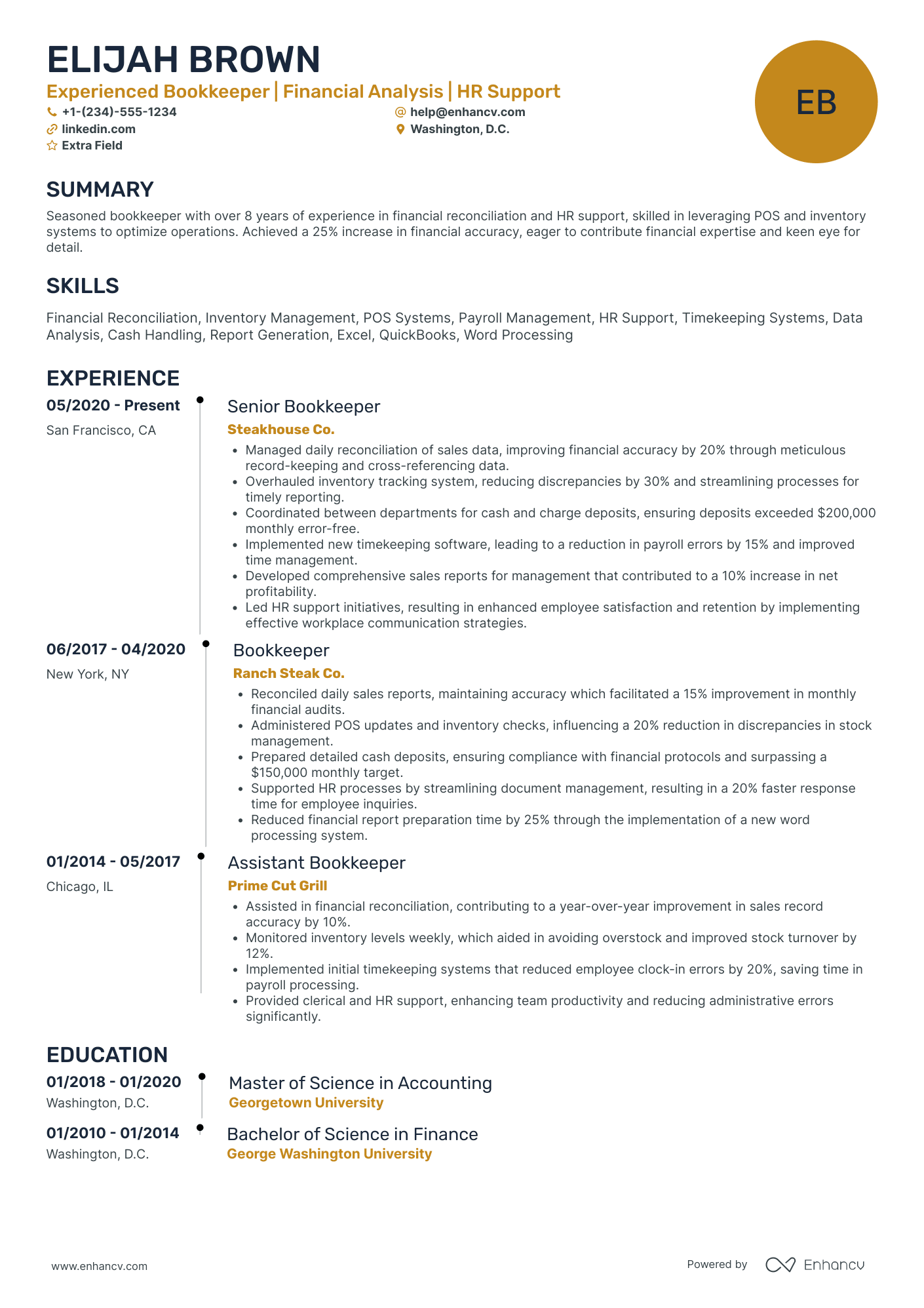

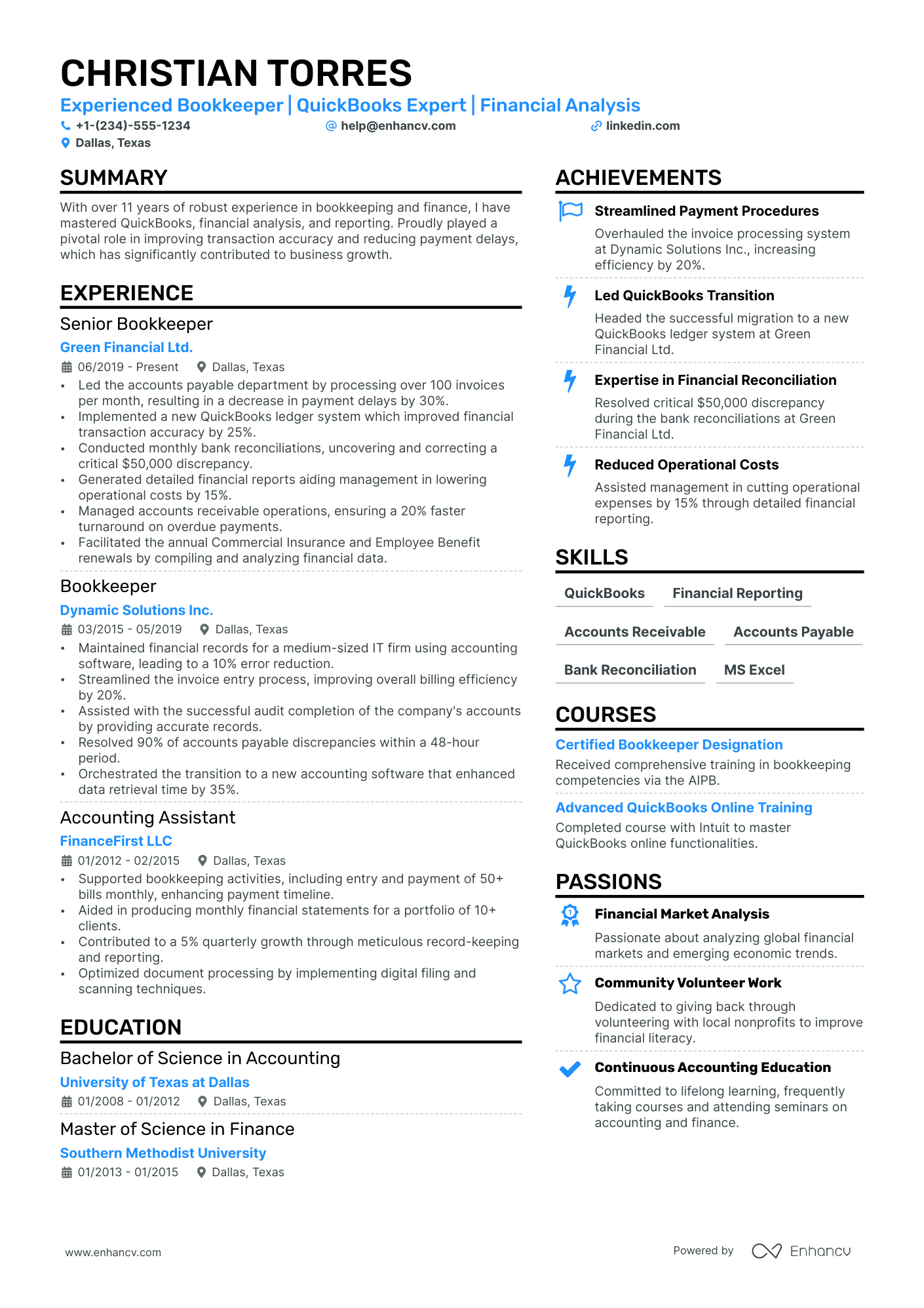

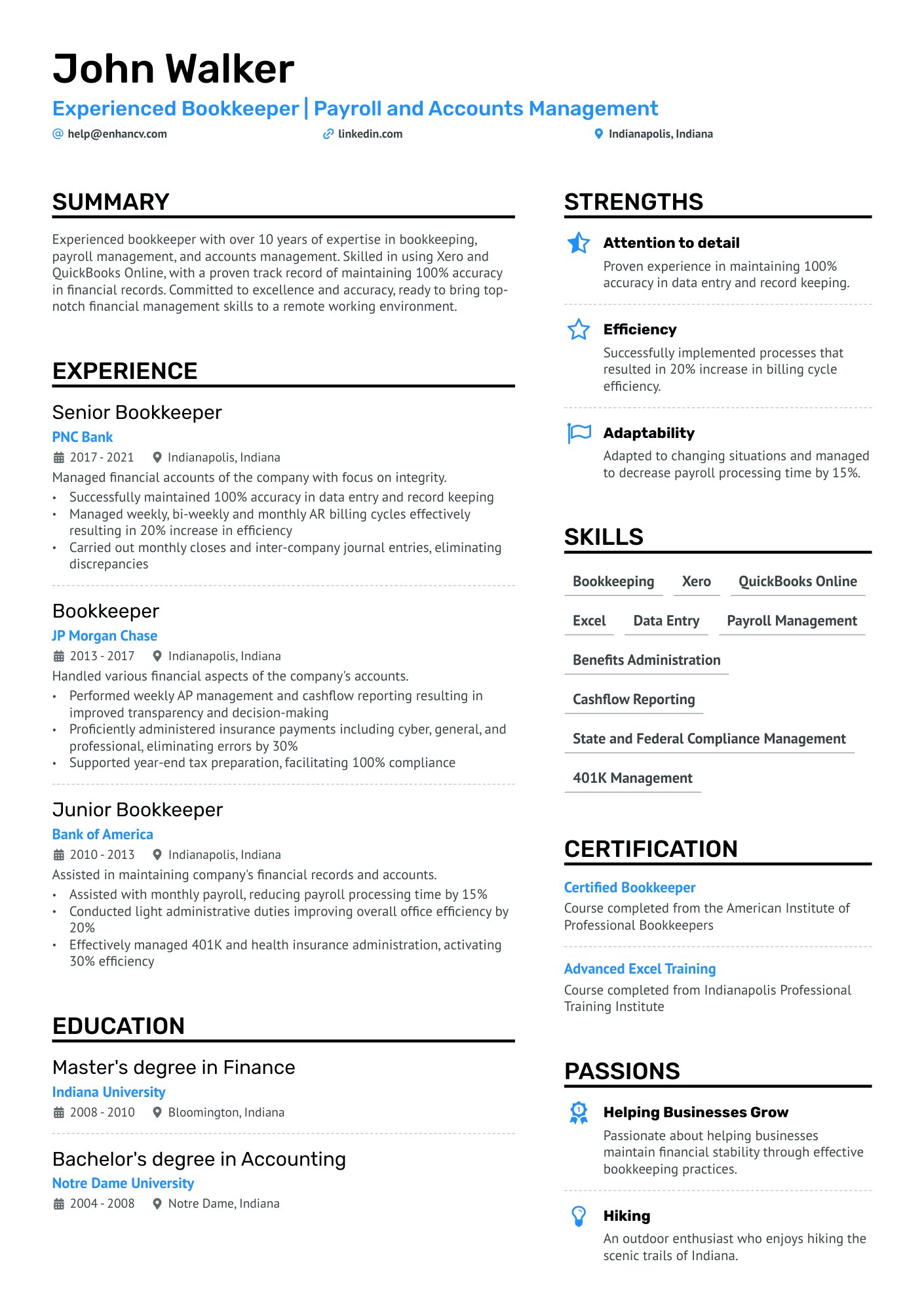

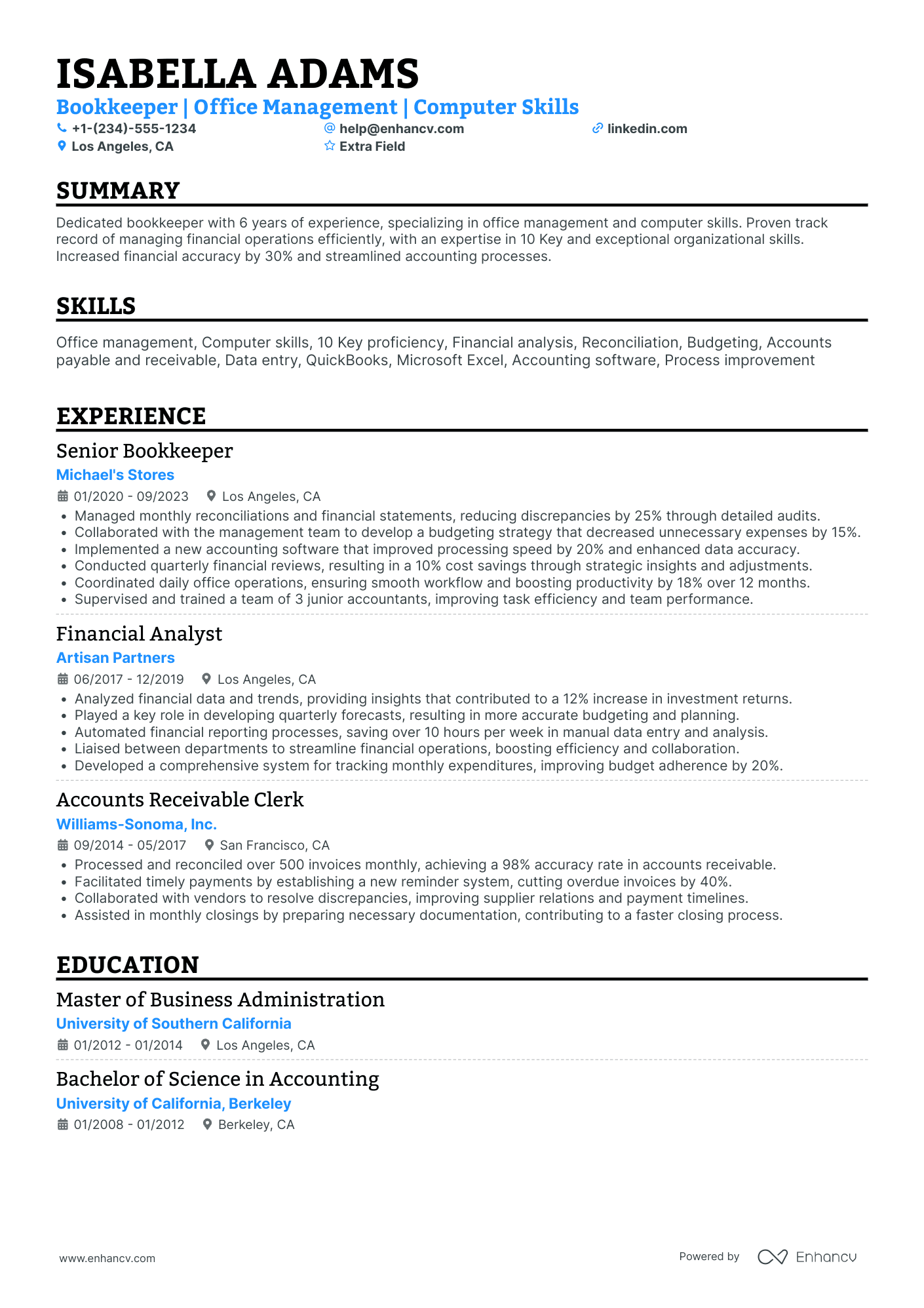

So, if you're hunting for a job in this industry, you really need to nail your resume. It’s the key to showing off your ability to handle the intricate challenges that software simply can’t.

Want recruiters to call you? Here's how to do it:

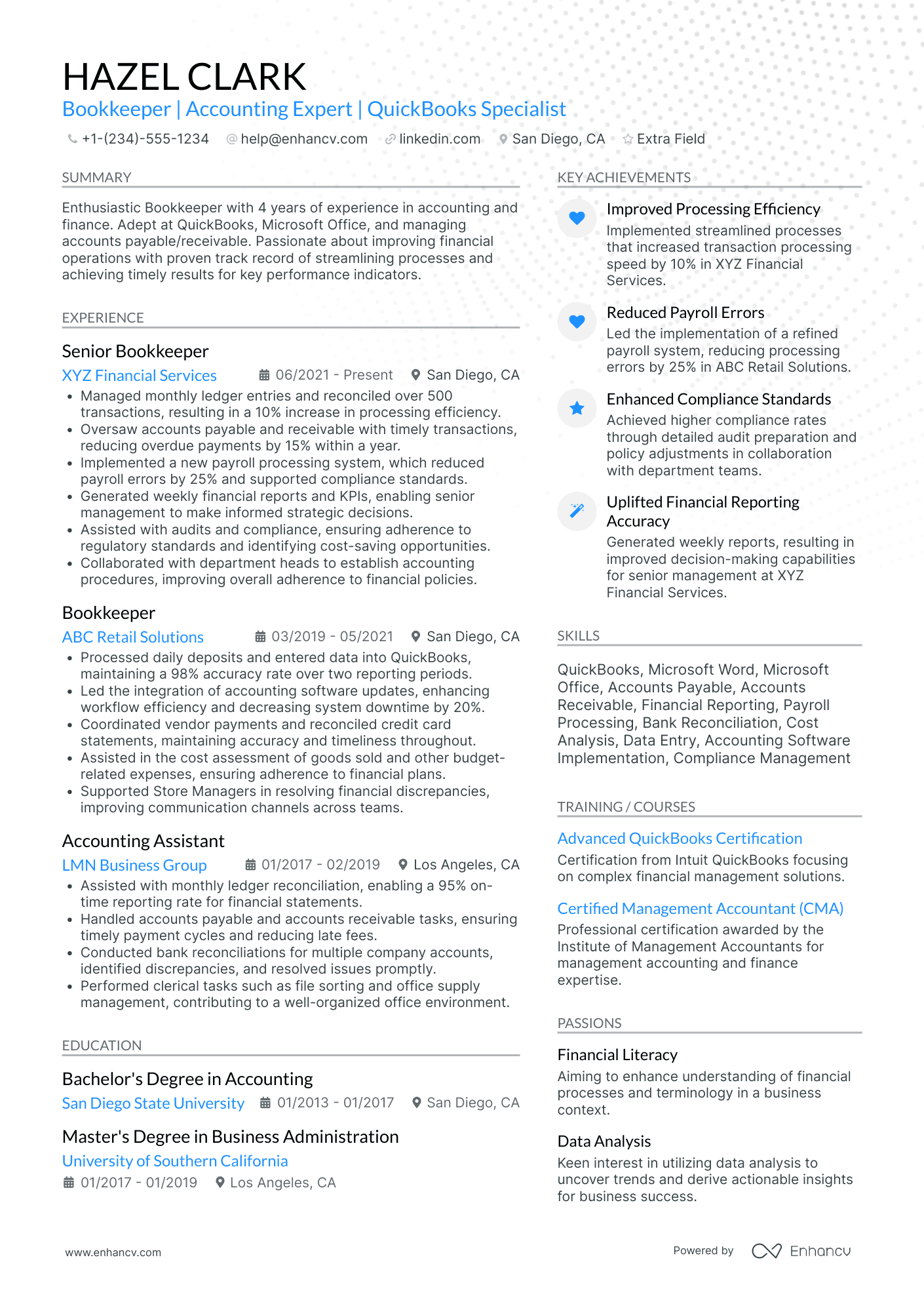

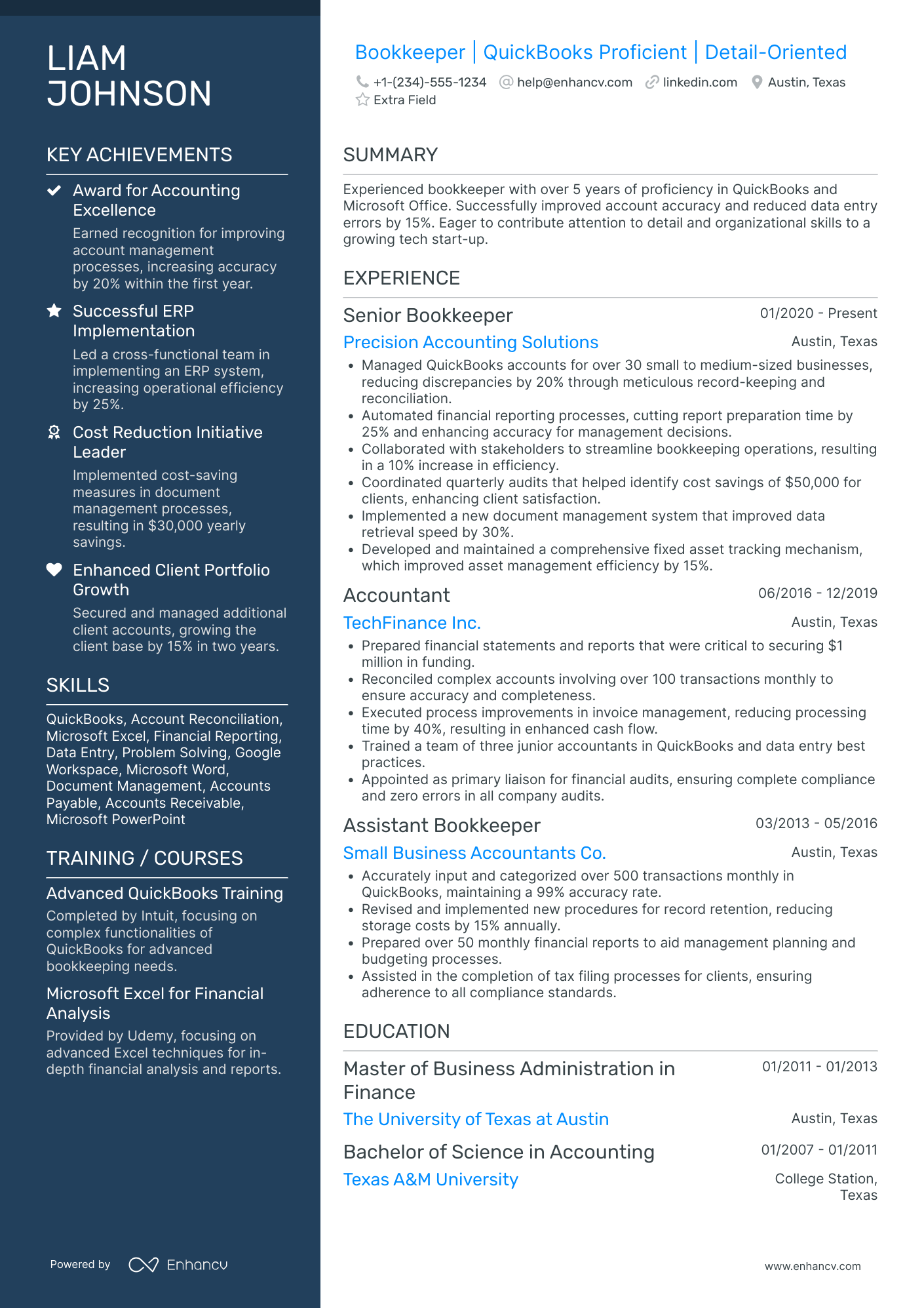

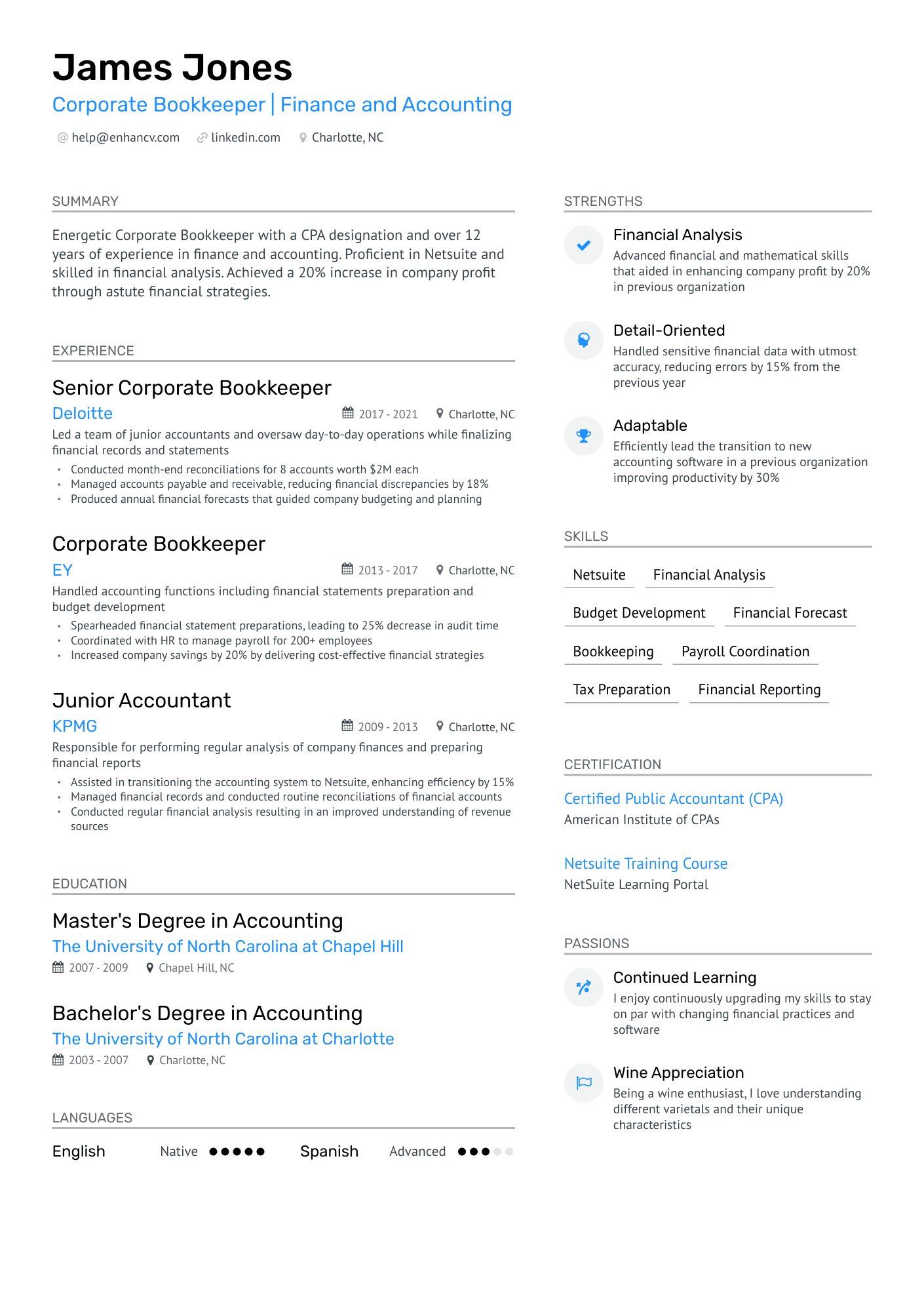

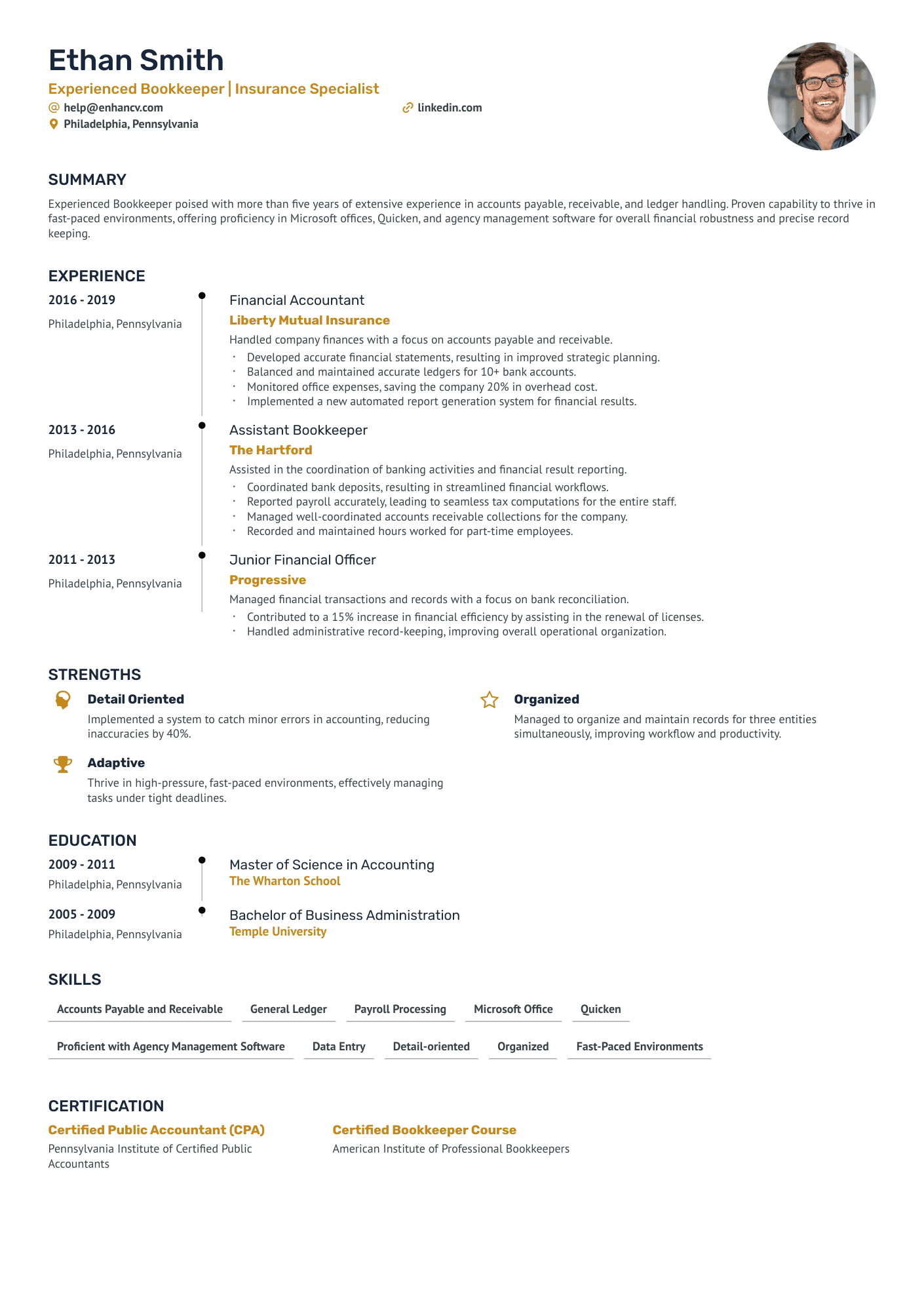

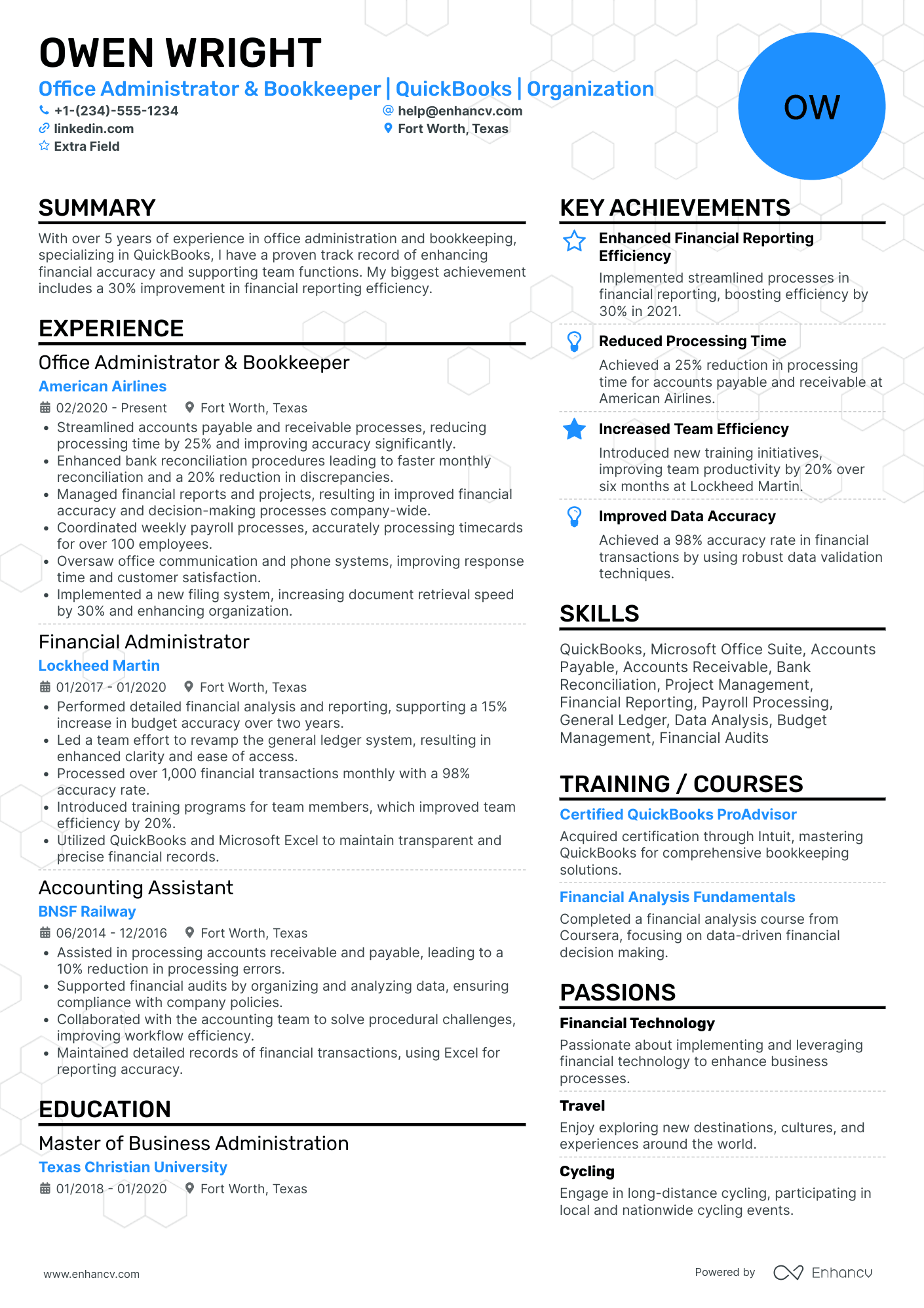

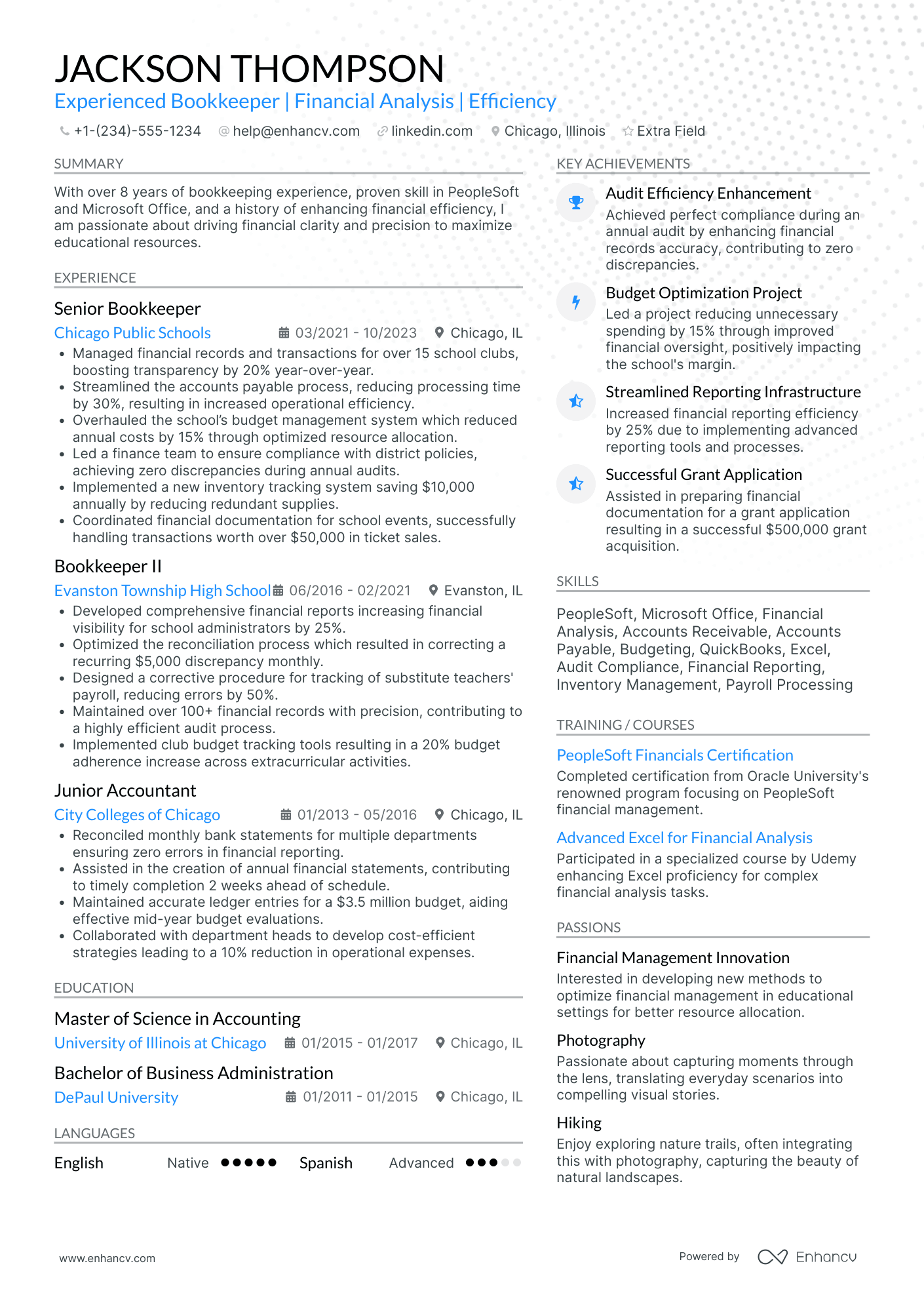

- Select a resume template that shows your bookkeeping skills.

- Organize your resume's main sections for the best display of your expertise.

- Underline your experience with key bookkeeping practices and software.

- Describe your key achievements and their impact on financial management.

- Match your skills to the job description to align with employer expectations.

- List your relevant educational qualifications, focusing on bookkeeping-related certifications or degrees.

Interested in expanding your career in accounting and bookkeeping? Explore these resume examples to discover more job opportunities.

- Purchase Manager Resume Example

- Payroll Director Resume Example

- Financial Operations Manager Resume Example

- Public Accounting Resume Example

- Financial Data Analyst Resume Example

How to format a bookkeeper resume

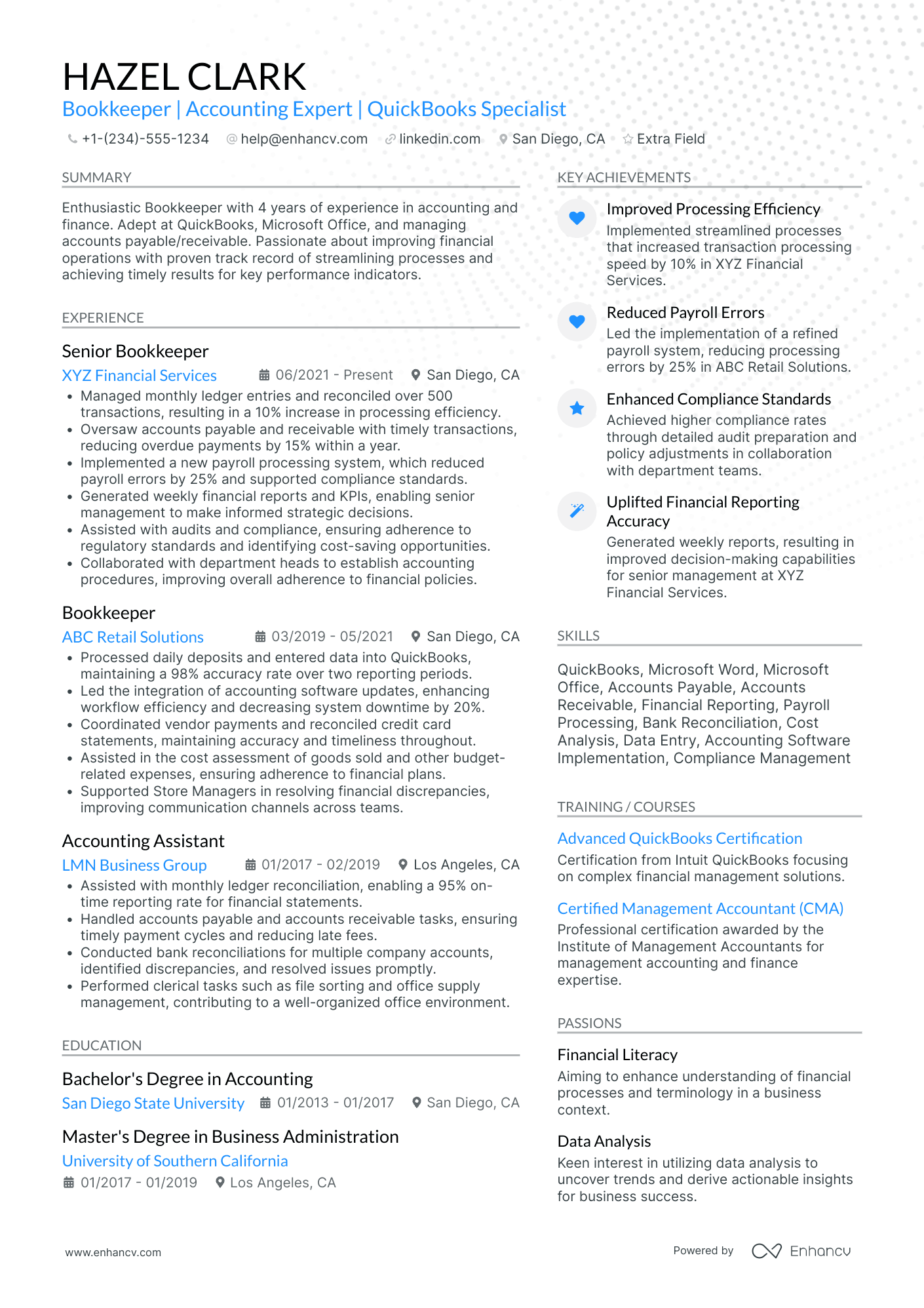

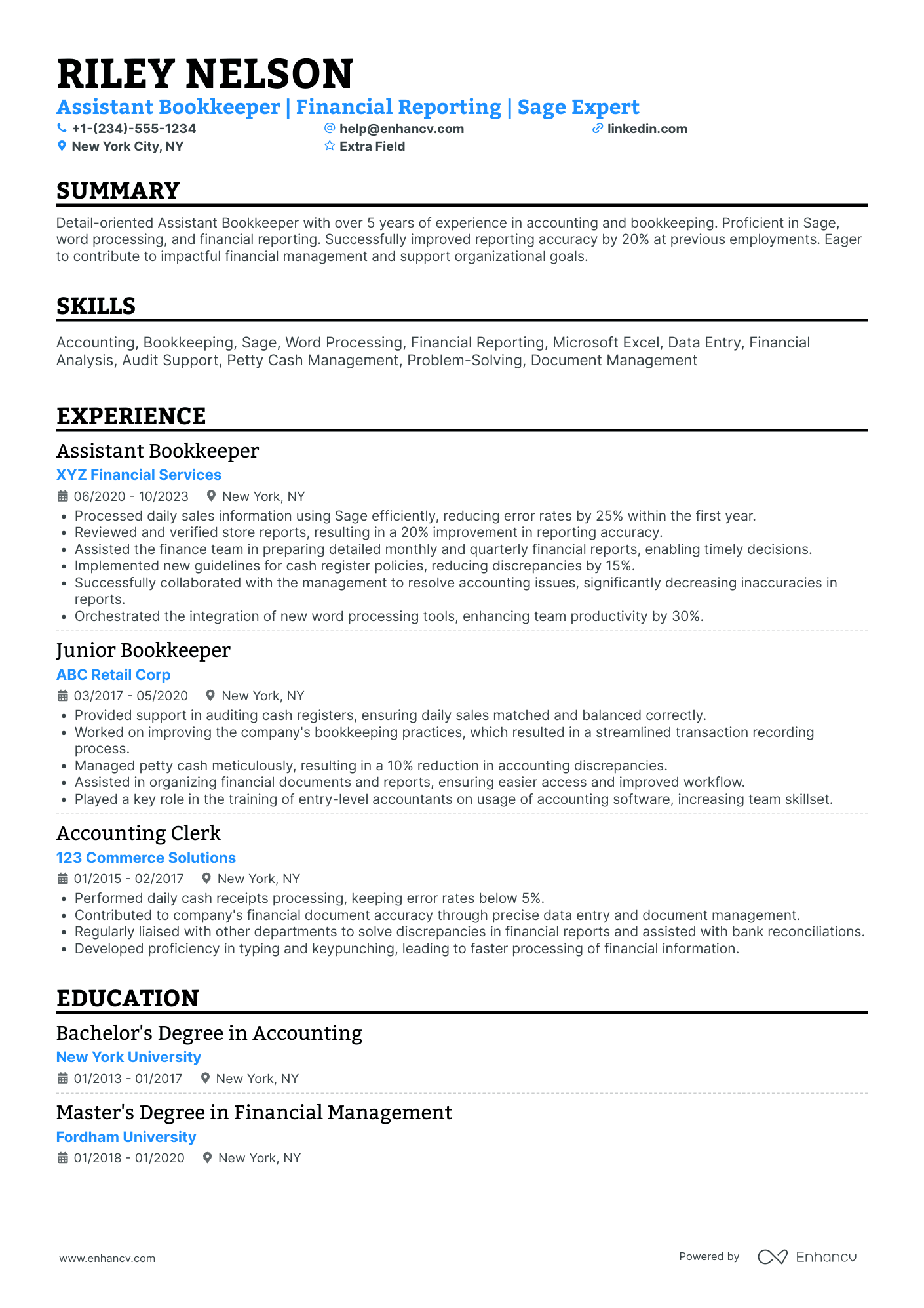

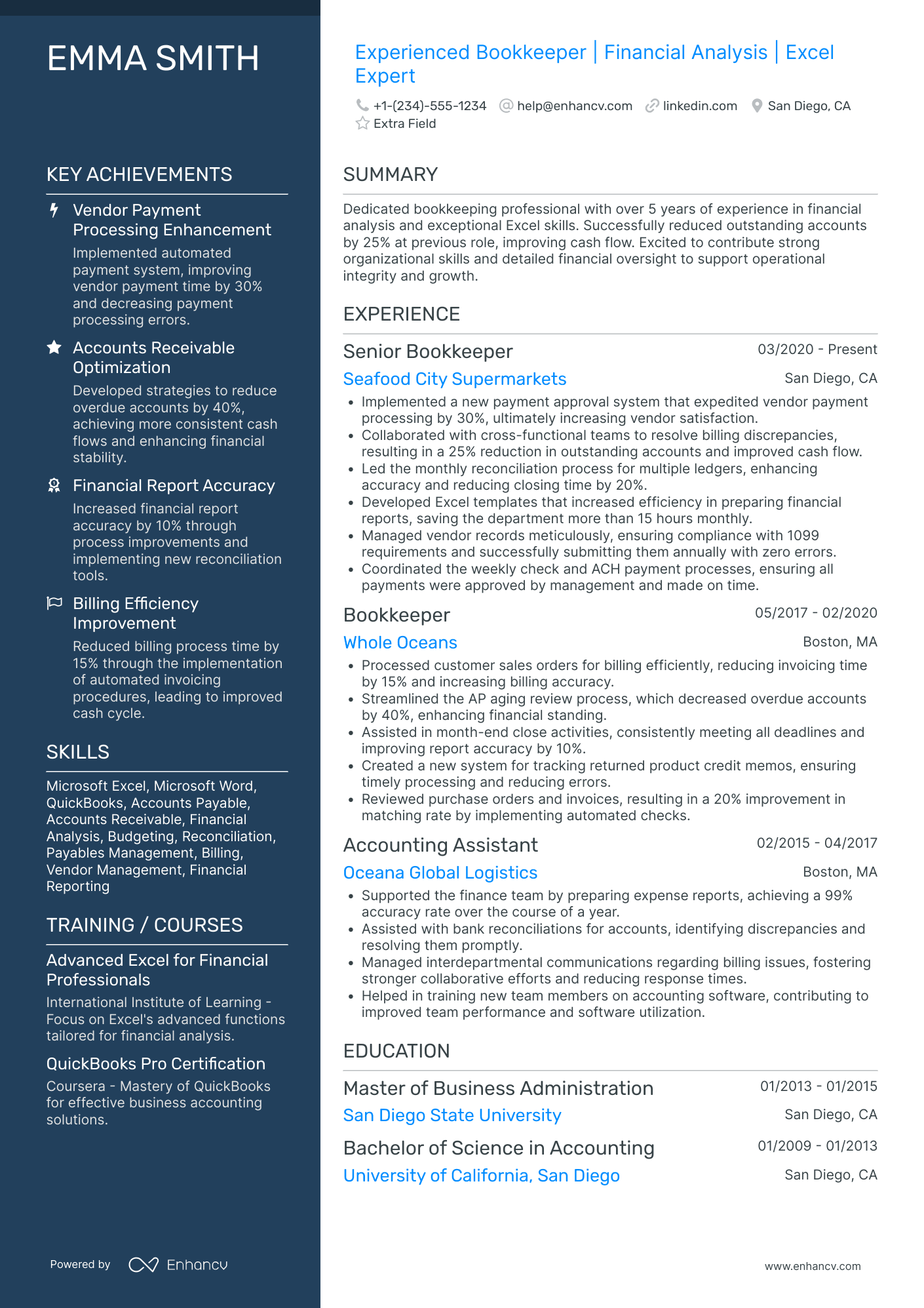

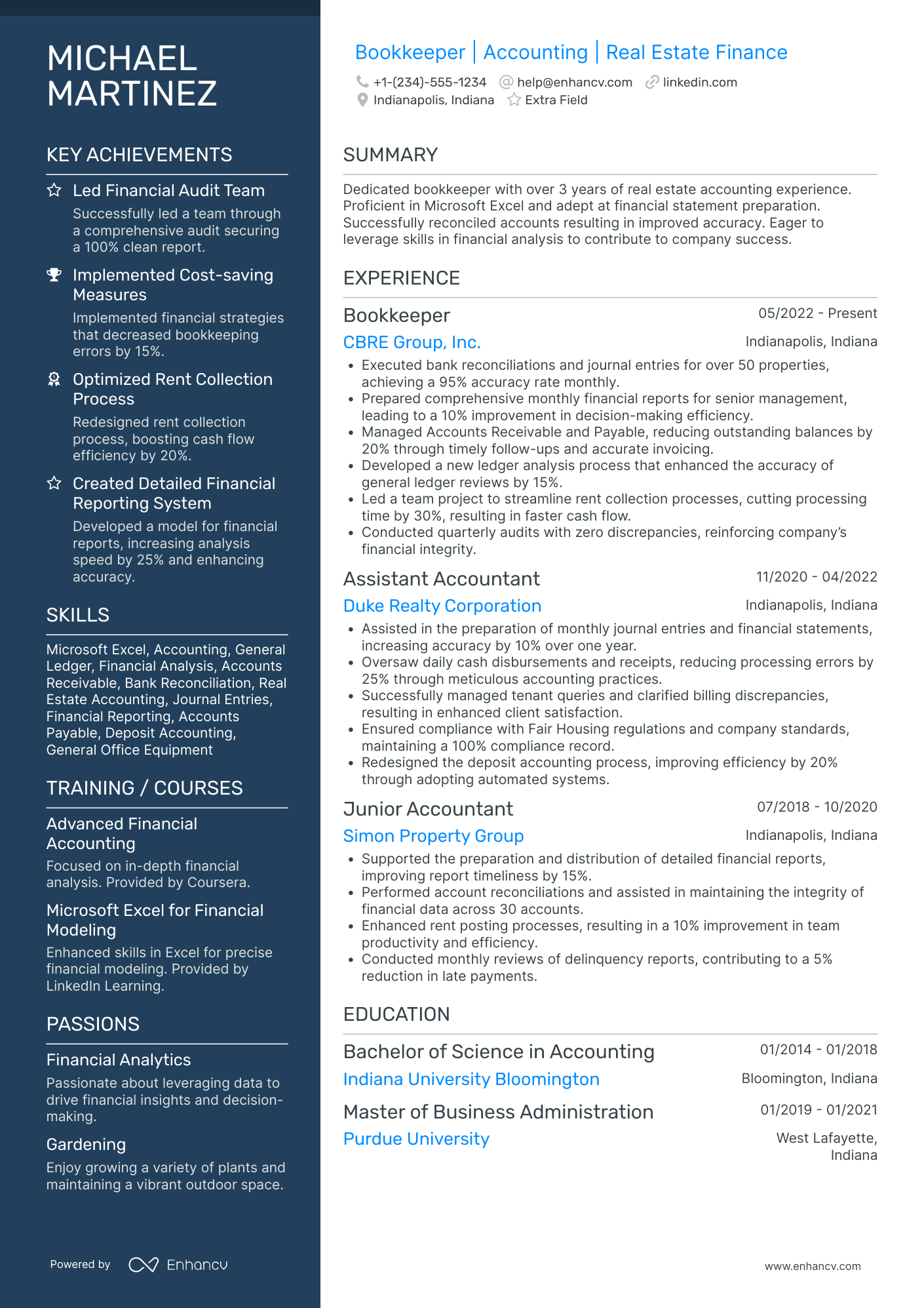

Selecting the appropriate resume format is key to making a great impression as a bookkeeper. Here are three formats to consider:

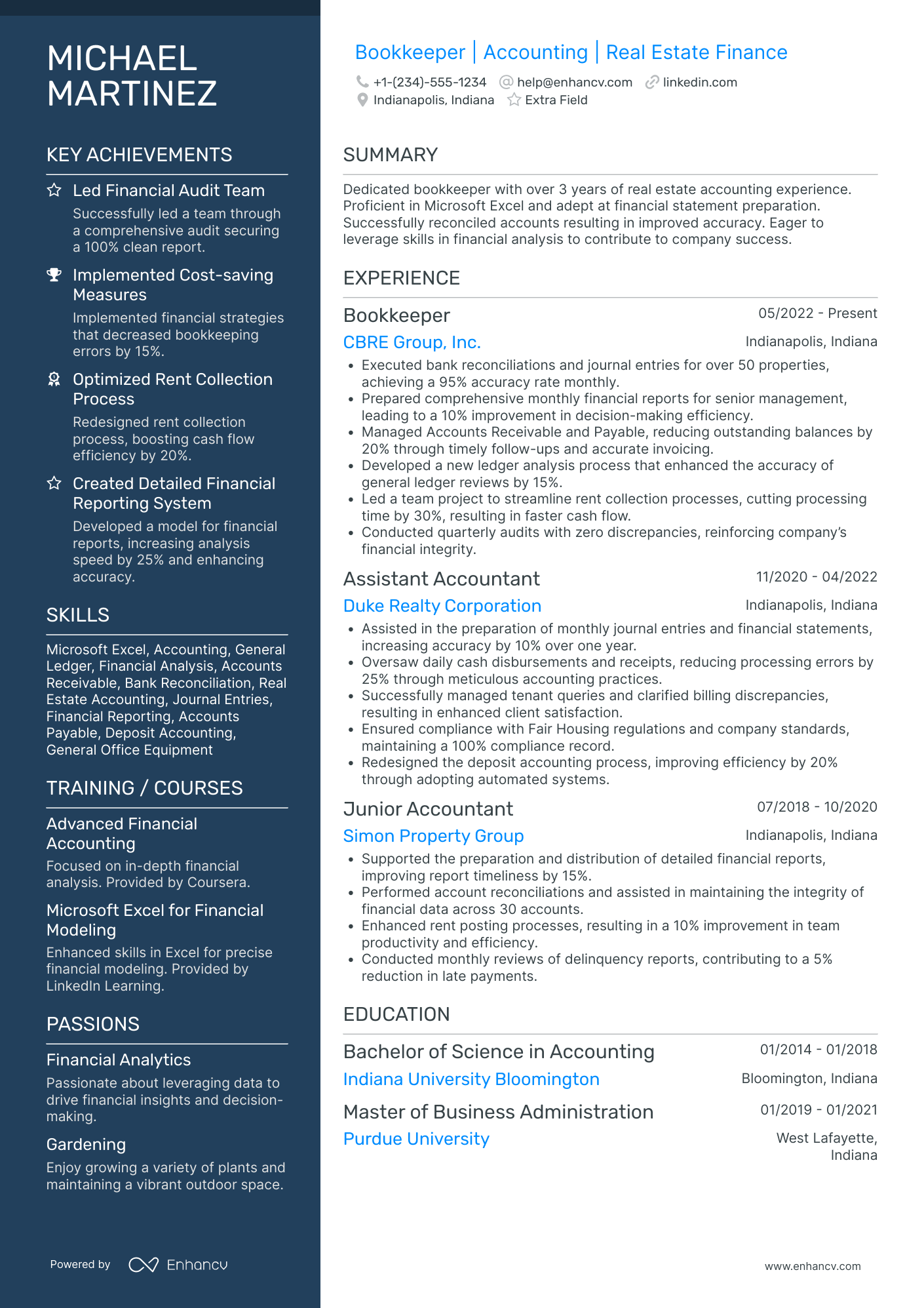

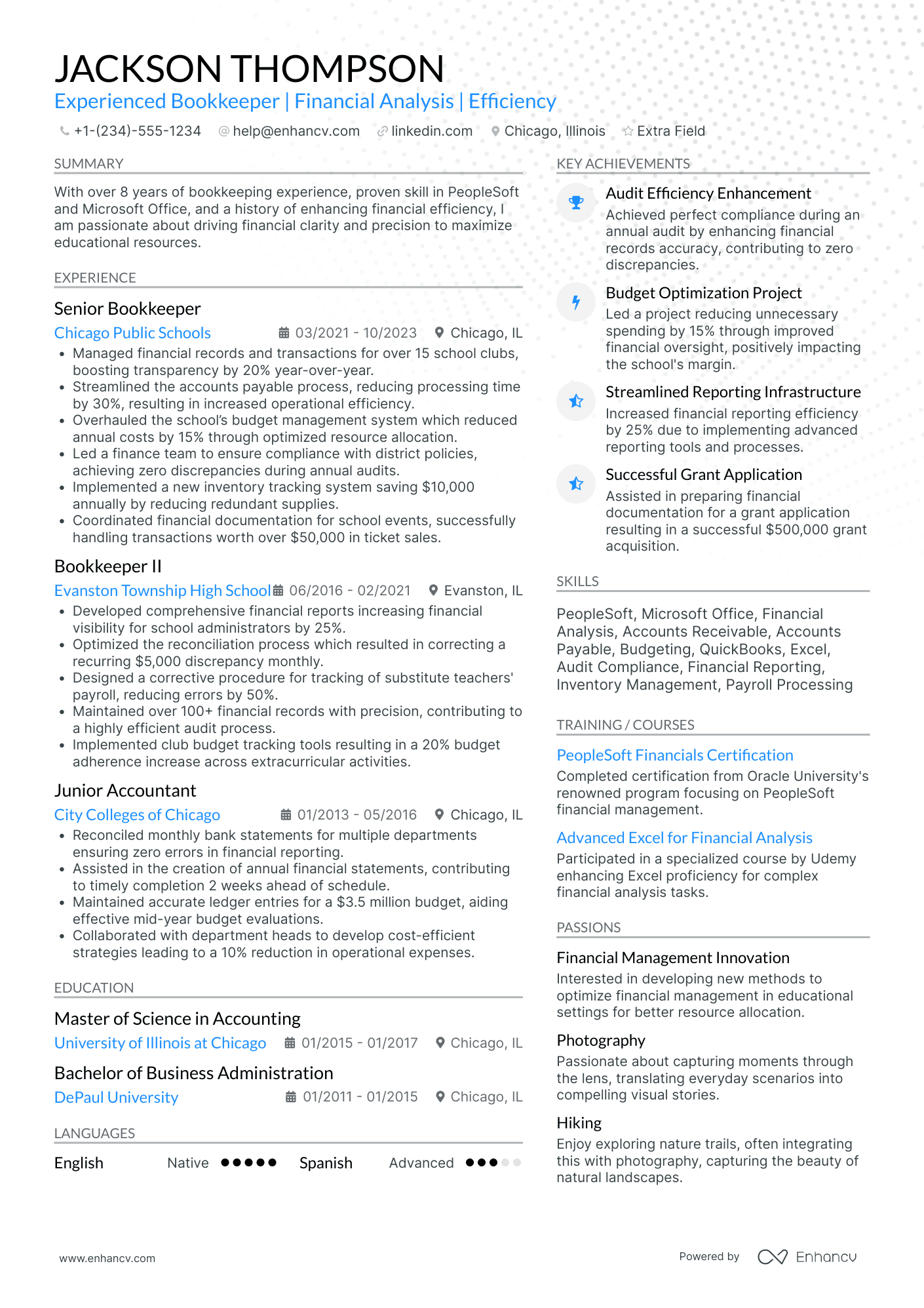

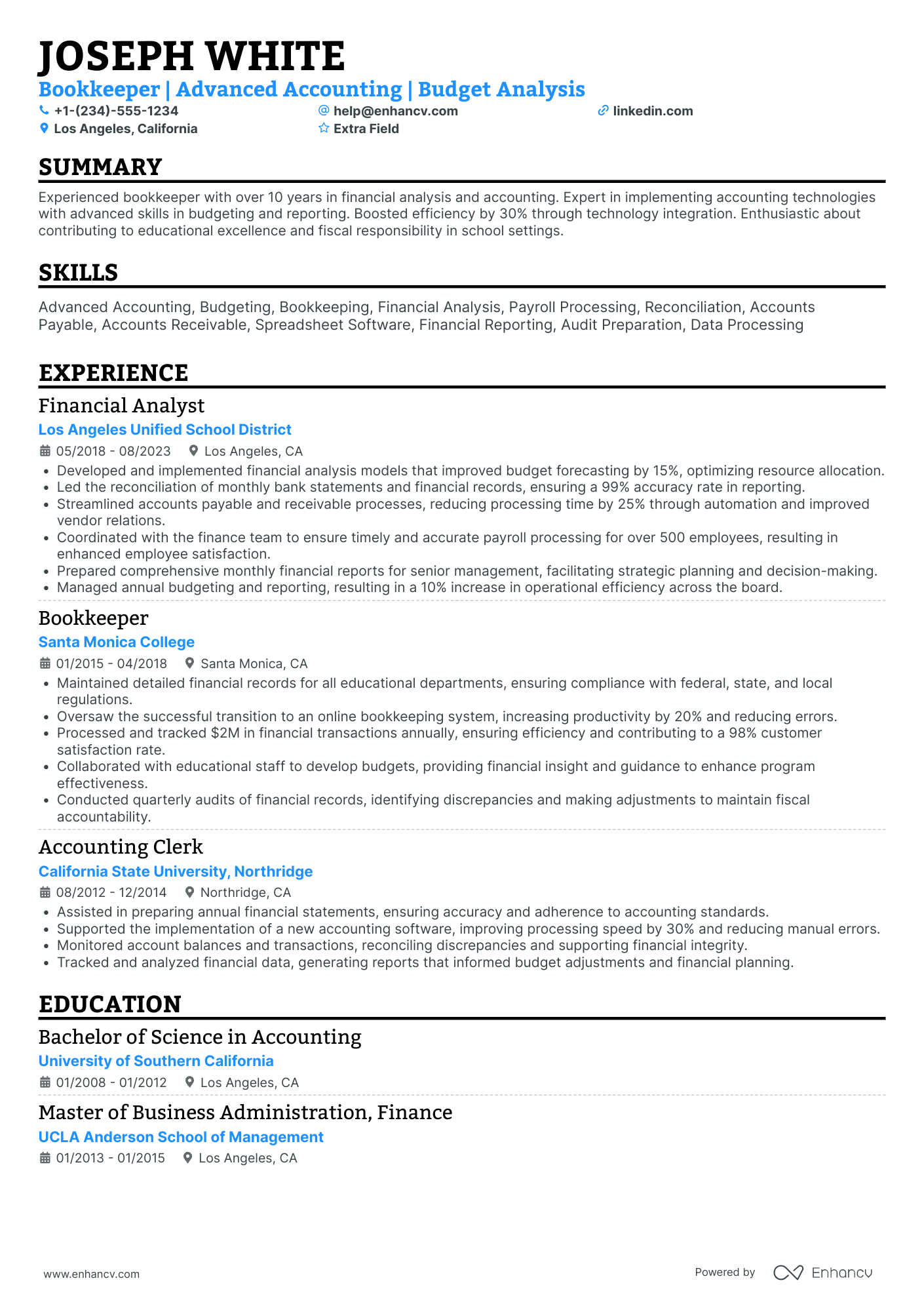

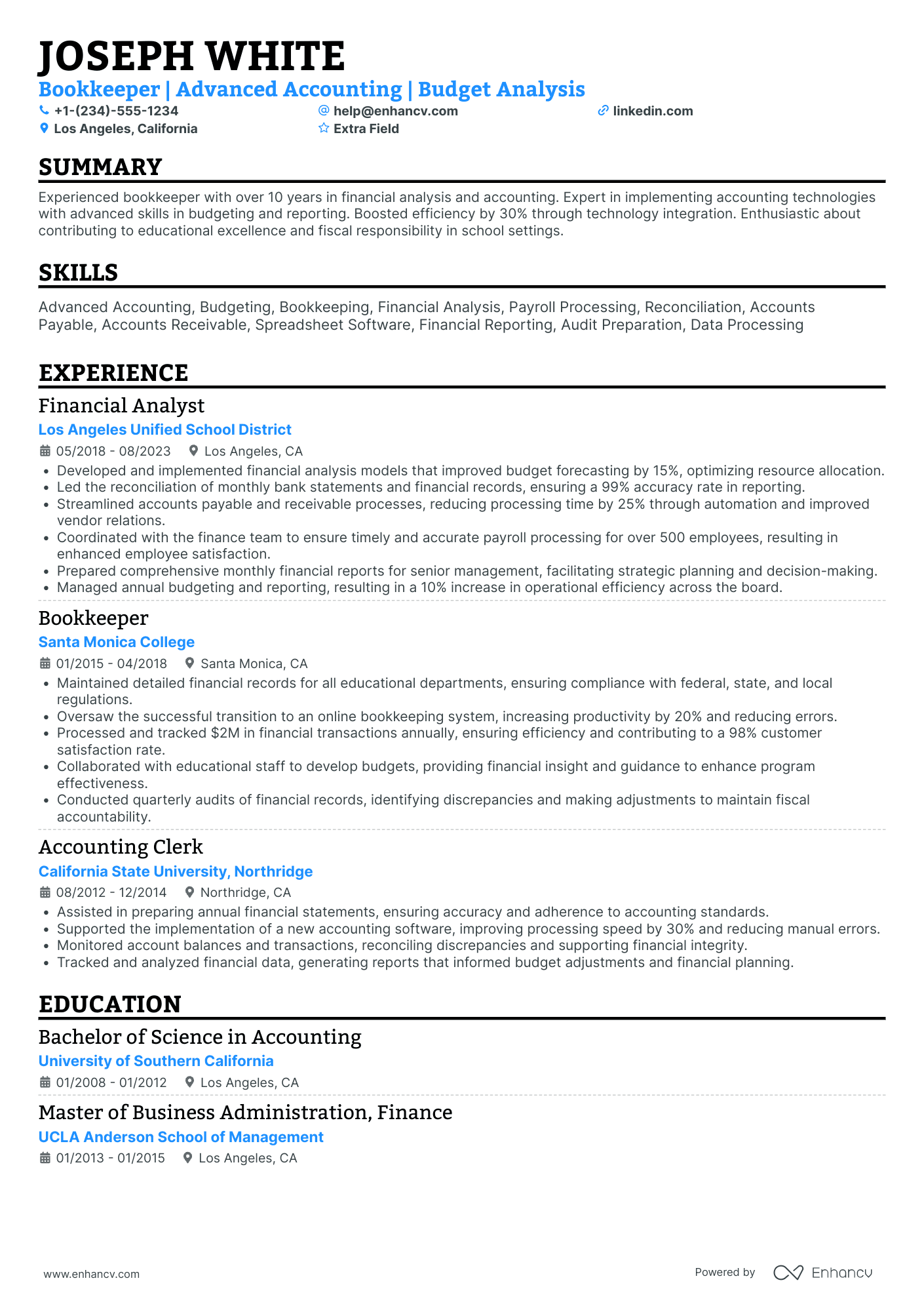

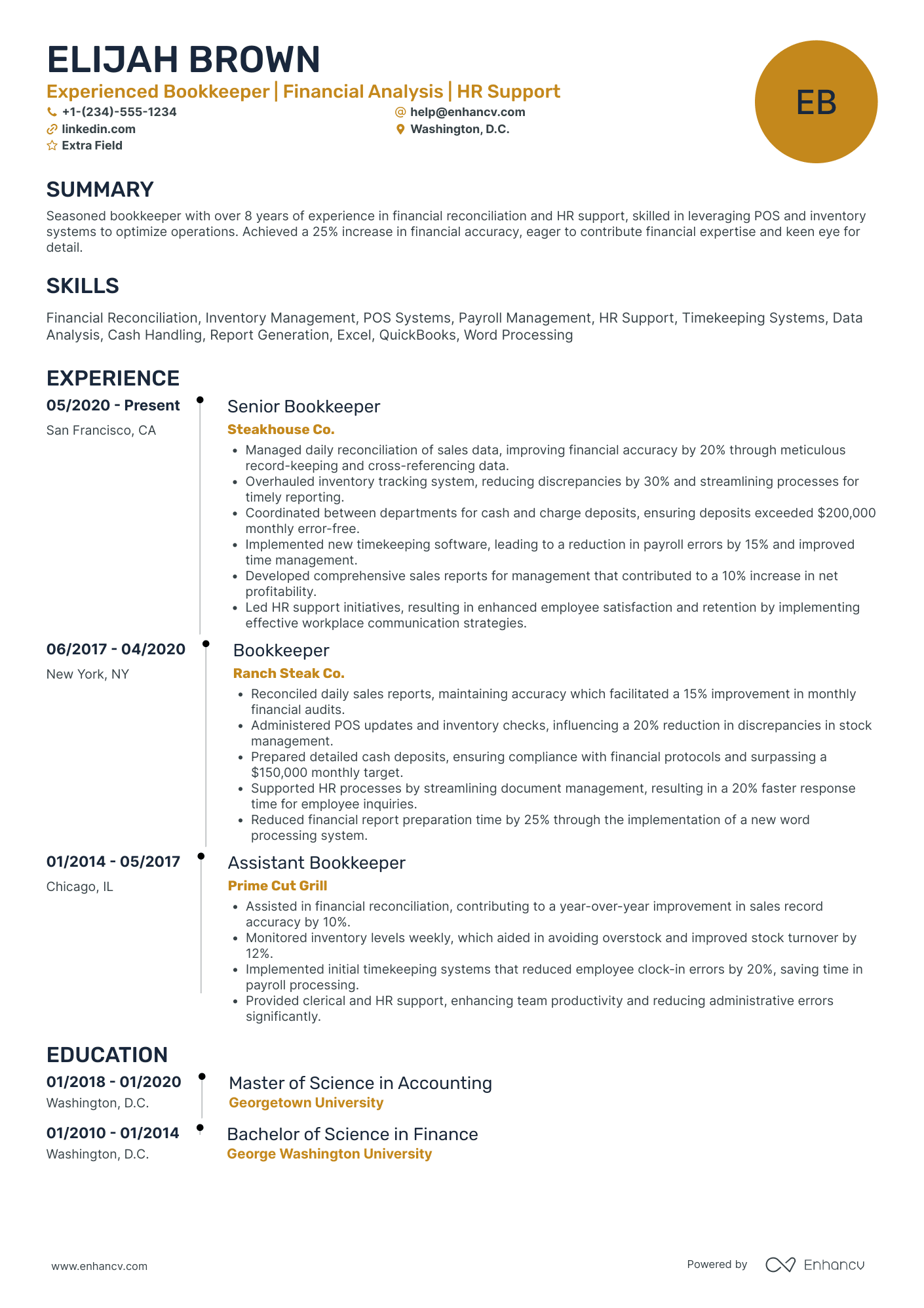

- Reverse chronological resume: This format is ideal for candidates with steady work experience, as it lists your jobs starting with the latest one. You can use reverse chronological resume templates to show off a consistent job history and your career growth, which is what employers look for in experienced bookkeepers.

- Functional resume: If you're new to bookkeeping, changing careers, or have gaps in your work history, consider a skills-based resume template. This format focuses on your skills and qualifications instead of your job history, helping you underline your bookkeeping abilities and certifications without drawing attention to employment gaps.

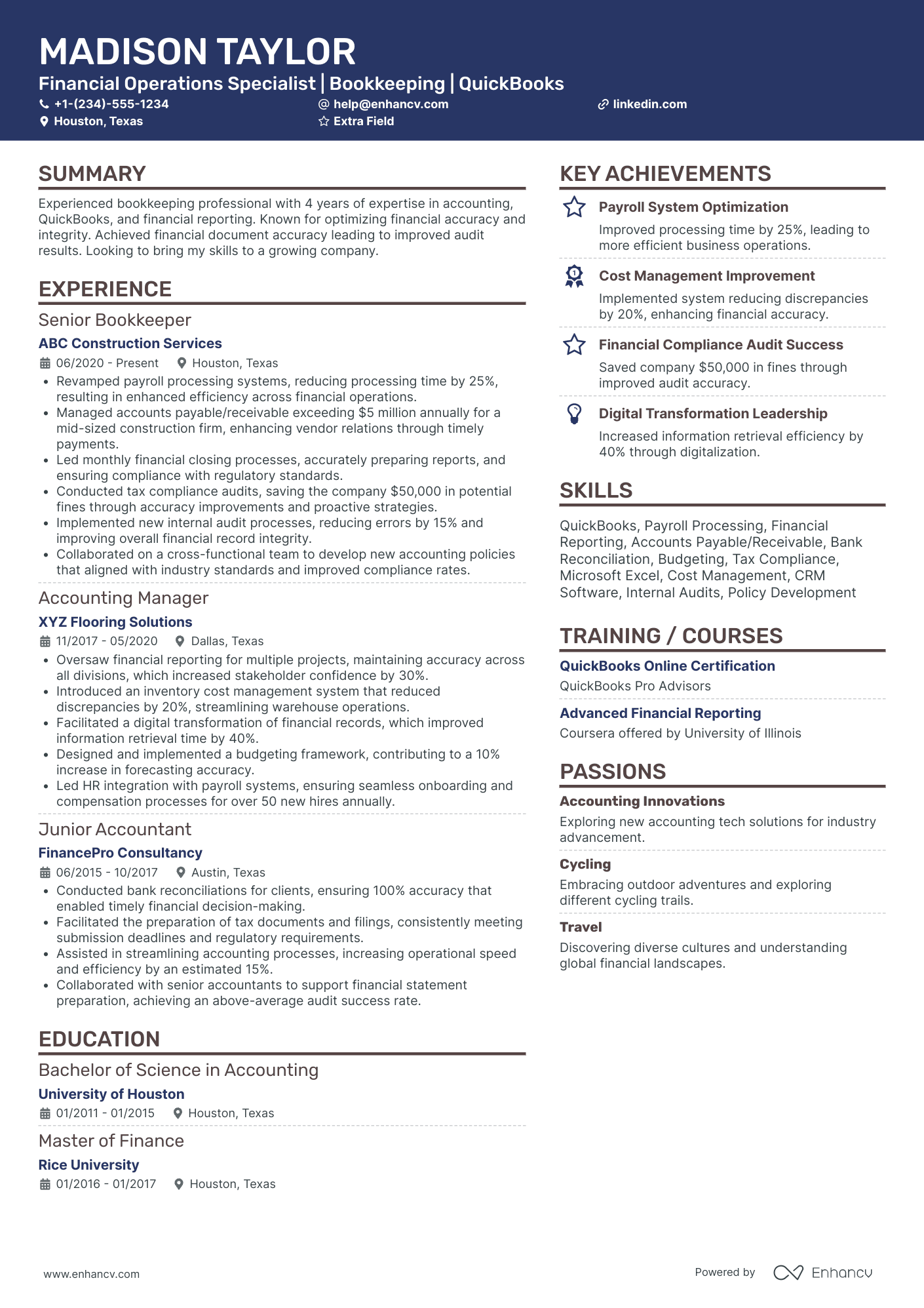

- Hybrid resume: These combination resume templates are great for bookkeepers with both solid experience and relevant skills. They allow you to showcase your skills and work history together. This versatile approach is ideal for highlighting your abilities and showing a steady job progression, making it suitable for different bookkeeping roles, from junior to senior levels.

Here are some effective strategies to enhance your bookkeeper resume:

- Opt for a clean, modern template that keeps the layout uncluttered. This helps your achievements stand out without any visual distractions.

- Select simple fonts like Rubik, Lato, or Times New Roman, and keep font size between 10 and 12 points to ensure your resume is easy to read.

- If you're early in your career or at mid-level, limit your resume to one page. If you're more experienced, a two-page resume can be appropriate.

- Use consistent margins of about 1 inch to create a tidy, organized look.

- Include your name, phone number, location, and professional email address in the header of your resume.

- Insert a link to your LinkedIn profile if it's up-to-date and relevant.

- Only add a photo if the job advertisement specifically asks for one.

- Always save your resume as a PDF to keep the format consistent across different platforms.

Focus on your precision in managing financial records and the positive outcomes of your projects. Incorporate keywords from the job description to help your resume get past Applicant Tracking Systems that many employers use.

Different markets have specific resume formats – a Canadian resume could vary in layout.

Take advantage of our intuitive AI resume checker to get a detailed 16-point evaluation and improve your resume for free.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

After picking out the right structure, we'll craft a bookkeeper resume that catches the eye. Here are the key sections we'll focus on.

The top sections on a bookkeeper resume:

- Summary or objective: It gives a glimpse of your career goals and key qualifications that may align with the bookkeeping role.

- Skills: Include this section to highlight your proficiency in bookkeeping software, financial analysis, and other relevant abilities mandatory for a bookkeeping job.

- Work experience: This is necessary because it showcases your experience in handling financial records which is directly relevant to a bookkeeper's role.

- Certifications: This section should exhibit additional qualifications specific to bookkeeping, like Certified Public bookkeeper or Certified Internal Auditor.

- Education: Include this section since positions in bookkeeping often require specific educational backgrounds in accounting or finance.

We'll review what recruiters are looking for in these sections of your resume and how they assess your qualifications.

What recruiters want to see on your resume:

- Proficiency in bookkeeping software: Recruiters focus on this because it ensures efficient and accurate handling of financial data.

- Knowledge of general accounting principles: This is essential because bookkeepers are often tasked with the core accounting responsibilities.

- Attention to detail: Being precise in managing financial records is critical, and recruiters prioritize this.

- Relevant work experience: This catches the recruiter's attention as direct experience in bookkeeping indicates you can hit the ground running.

- Certification like Certified Public bookkeeper: Recruiters prioritize this as it shows dedication to the profession and can translate to better quality work.

According to SCORE, 82% of all small businesses fail due to cash flow problems, which highlights the importance of good bookkeeping.

No matter which resume format you choose, the experience section is typically at the forefront. We'll assist you in customizing it for a bookkeeper role.

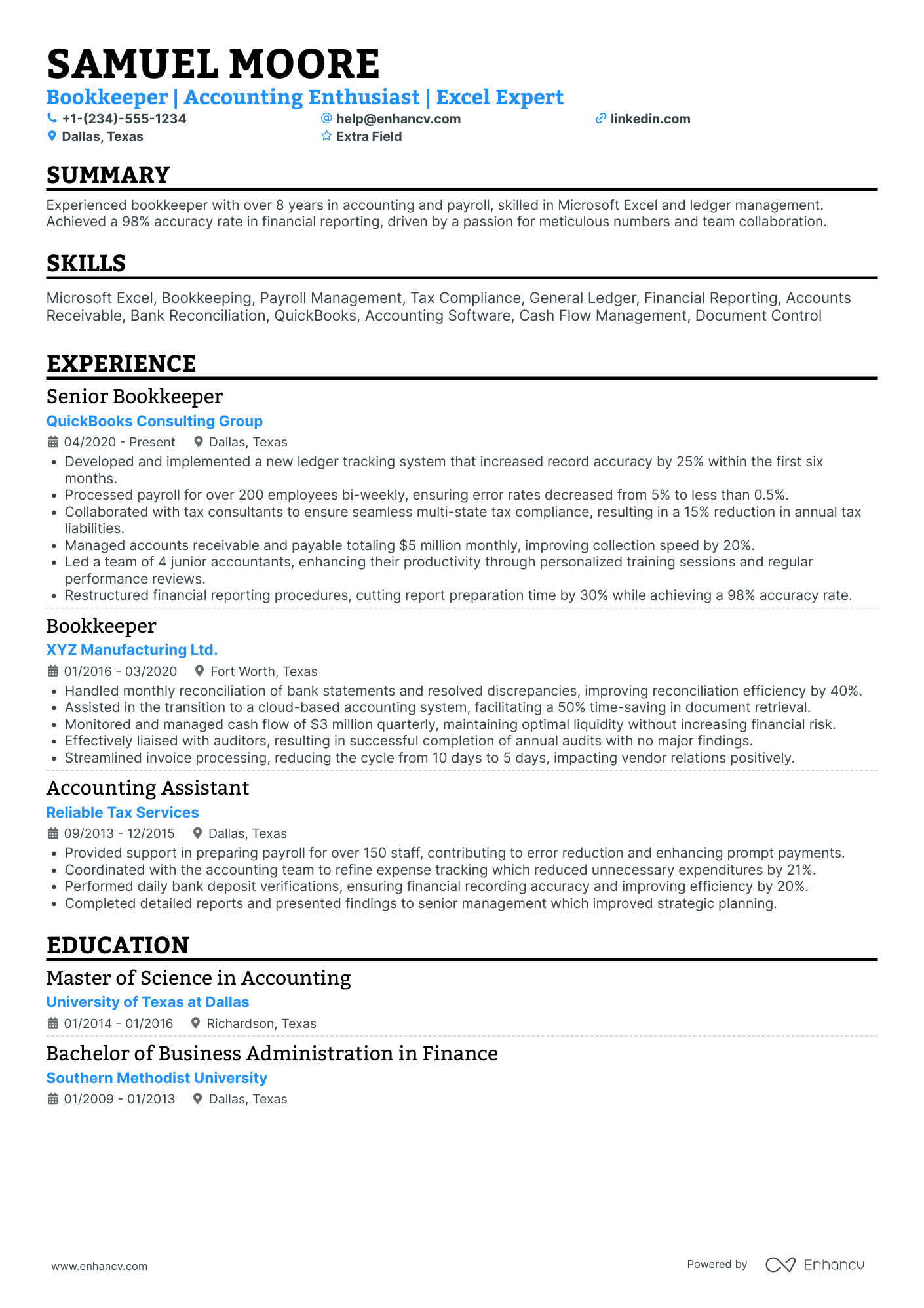

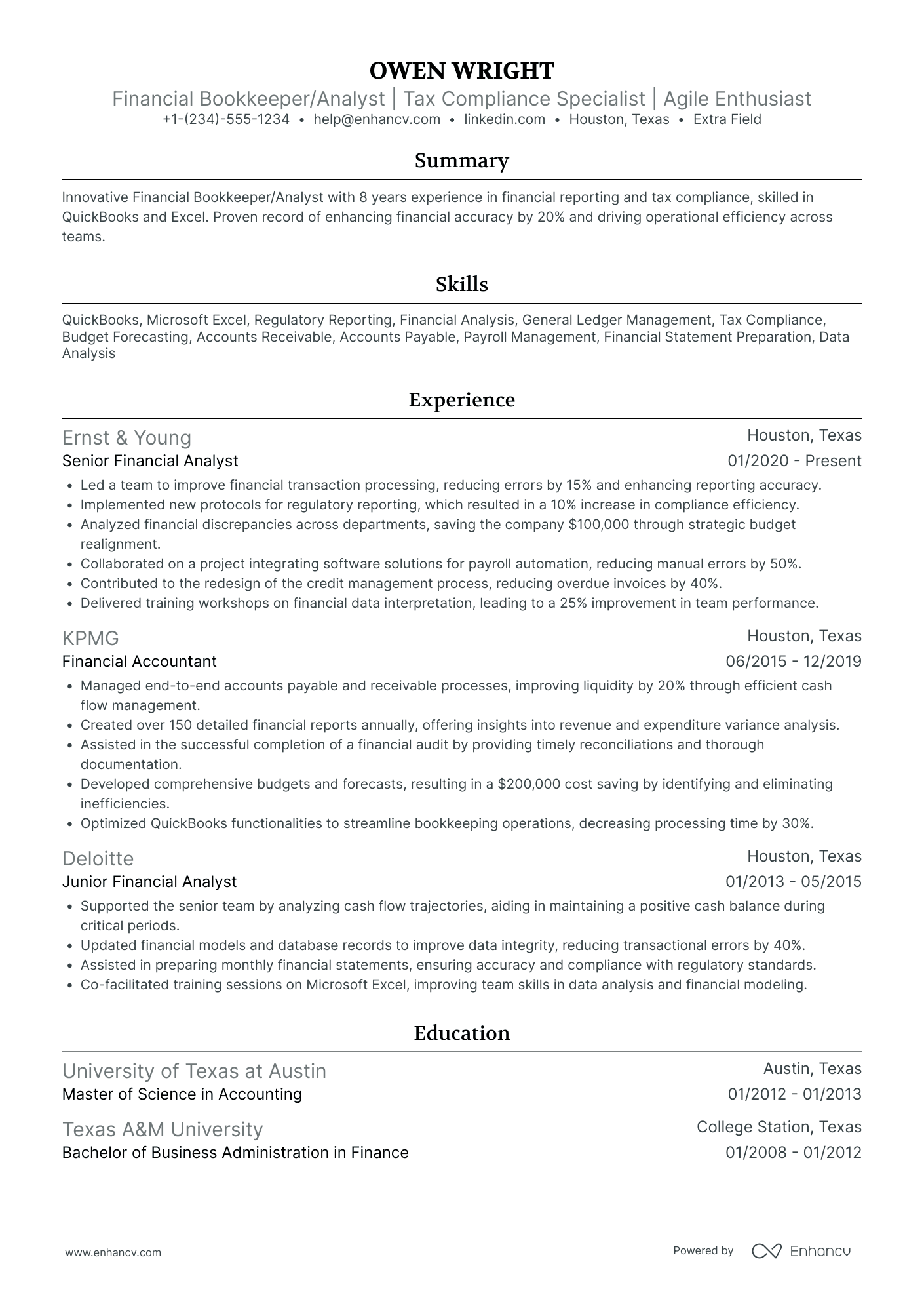

How to write your bookkeeper resume experience

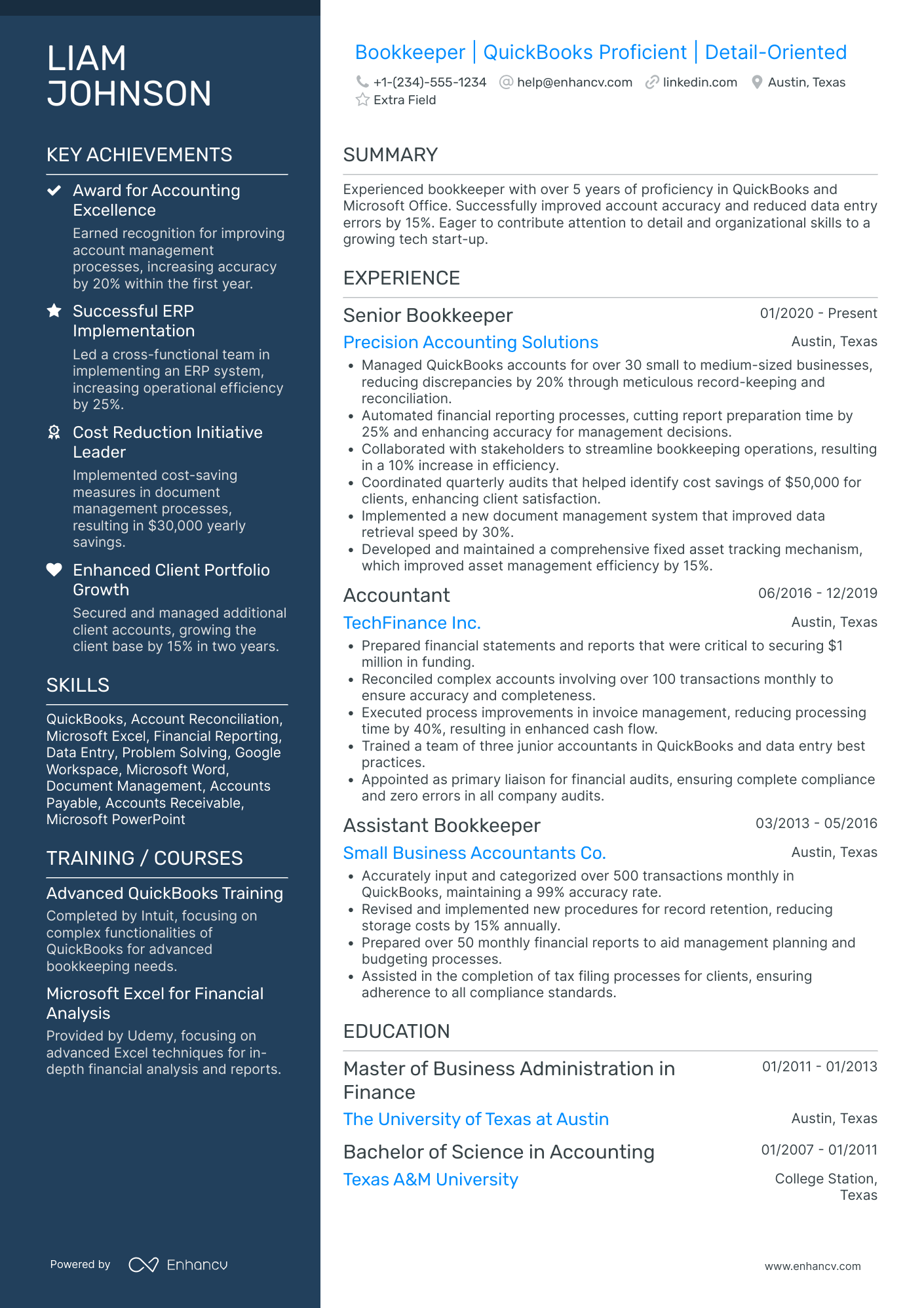

The experience section of your resume is where you share your professional story as a bookkeeper. To make it truly stand out, consider these tips:

- Select only the experience relevant to bookkeeping and include the company name, a brief description, and the dates, followed by up to six bullet points per job.

- Underscore the concrete results of your work in each position, using numbers or percentages to prove your effectiveness.

- Use action verbs to describe your responsibilities clearly and dynamically.

- Summarize your most significant and relevant achievements within each job's description.

Now, let's examine a specific bookkeeper job description to tailor your experience entries effectively.

Job title - Bookkeeper

As a Bookkeeper you will work with the AP/AR Supervisors to:

- Work with any or all the following: cash receipts and disbursements, allocations and distributions, accounts receivable, accounts payable.

- Responsible for data entries, account analysis, preparation of schedules, and bank reconciliation.

- Adhere to reporting requirements and deadlines.

- Generate monthly, quarterly, or annual reports as needed.

- Protect an organization's value by keeping information confidential.

- Maintain financial data security by following internal controls, policies, and procedures.

- Perform other job responsibilities and projects as assigned.

Required qualifications:

- College Degree required; Accounting Degree preferred.

- Minimum of one year accounting or bookkeeping experience.

- Comprehensive knowledge of accounting procedures.

- Proficient in Microsoft Office applications especially with Excel, Word, and Outlook.

- Have good knowledge working with other accounting programs.

- Good communication skills.

First, check out this poorly crafted experience entry.

- •Handled various client accounts and maintained financial records.

- •Prepared financial documents and ensured regulatory compliance.

- •Reviewed financial transactions for accuracy.

- •Used software tools for financial management tasks.

This experience section is too vague and lacks the specific details that make a resume interesting to recruiters. It doesn't clearly convey the impact or scope of the candidate's responsibilities in bookkeeping. Merely stating tasks like "maintained financial records" or "prepared financial documents" doesn't provide insight into the candidate's effectiveness or the complexity of their work.

Now, let's review an enhanced version of the same experience entry that better showcases the candidate's capabilities and achievements.

- •Managed 300+ client accounts, improving financial accuracy by handling cash operations and account transactions.

- •Completed over 150 bank reconciliations yearly, ensuring financial consistency.

- •Produced 50+ financial reports each year, meeting all reporting deadlines to aid in strategic planning.

- •Enhanced financial security, reducing data breaches by implementing effective security measures.

The revised experience section is particularly effective for the following reasons:

- Quantified achievements: The bullet points include specific, measurable results such as 'managed 300+ client accounts improving financial accuracy,' 'completed over 150 bank reconciliations yearly,' and 'reduced data breaches by implementing security measures.' This quantification clearly demonstrates the candidate's contributions and effectiveness.

- Action verbs: The use of dynamic verbs like 'managed,' 'completed,' 'produced,' and 'enhanced' portrays each task as proactive and impactful.

- Demonstrated soft skills: The description implies critical skills for the job. For example, managing numerous accounts and maintaining financial records highlight exceptional organizational skills. Additionally, meeting all reporting deadlines and enhancing security measures demonstrates reliability and a strong ethical stance.

Overall, this updated entry really does a great job of showing off what the candidate can do. It customizes the work history to fit exactly what's needed for the bookkeeping role. It’s a well-targeted resume that addresses specific job requirements and showcases relevant achievements.

How to quantify impact on your resume

Using specific numbers and percentages can really paint a picture of how your bookkeeping efforts have boosted company finances. This method helps highlight your actual effectiveness, like cutting costs or improving audit outcomes.

Below are some examples to underline your achievements in past bookkeeping positions.

- Include specific efficiency improvements: Showing how you improved efficiency, such as reducing the time taken for data entry by a certain percentage, demonstrates your effectiveness to recruiters.

- Quantify cost reductions: Detailing instances where you’ve decreased costs by a significant percentage showcases your ability to contribute positively to the company's bottom line.

- Express revenue increases: Provide instances where your accurate bookkeeping led to noticeable profit increases, which proves you understand the impact of your role on a company's finances.

- Share error reductions: Detailing how you lessened errors in financial records during your tenure presents you as a figure of dependability.

- Underscore auditing instances: If you've participated in audits, provide the number of times along with the outcomes, indicating your proficiency in compliance and regulatory standards.

- Specify savings in tax payments: If you've saved the company money by identifying valid tax deductions, this emphasizes your knowledge and direct influence on the company's financial well-being.

- Give numerical representation of reports prepared: State the type and number of financial reports you've prepared, revealing your capability to handle diverse financial documentation.

- Indicate the size of budgets you've managed: This demonstrates your ability to handle financial responsibilities of varied scales effectively.

How do I write a bookkeeper resume with no experience

To secure an entry-level bookkeeping job, start by earning a certification such as the Certified bookkeeper (CB) from the American Institute of Professional bookkeepers or a similar credential. Build your skills with essential software like QuickBooks and Excel, and get hands-on experience through internships or by volunteering in financial roles, whether in small local businesses or nonprofits.

If you're just entering the field without specific work experience, it's beneficial to focus on your transferable skills, educational achievements, and hobbies that involve careful attention to detail, such as analyzing numbers or budgeting.

When applying for an entry-level bookkeeping job, tailor your resume accordingly:

- Highlight any personal or freelance projects in the bookkeeping field.

- Include participation in finance workshops or related seminars, noting any awards or recognitions received.

- Detail your involvement in online communities focused on finance or accounting.

- List references from educators or mentors, or note that they are available upon request.

- Start your resume with a clear objective statement that reflects your passion for bookkeeping and any relevant experiences, keeping it concise within 3 or 4 sentences.

These steps will demonstrate your initiative and skills, which are crucial for a career in bookkeeping.

PRO TIP

Be honest on your resume. Any lies might be caught in the interview and hurt your chances.

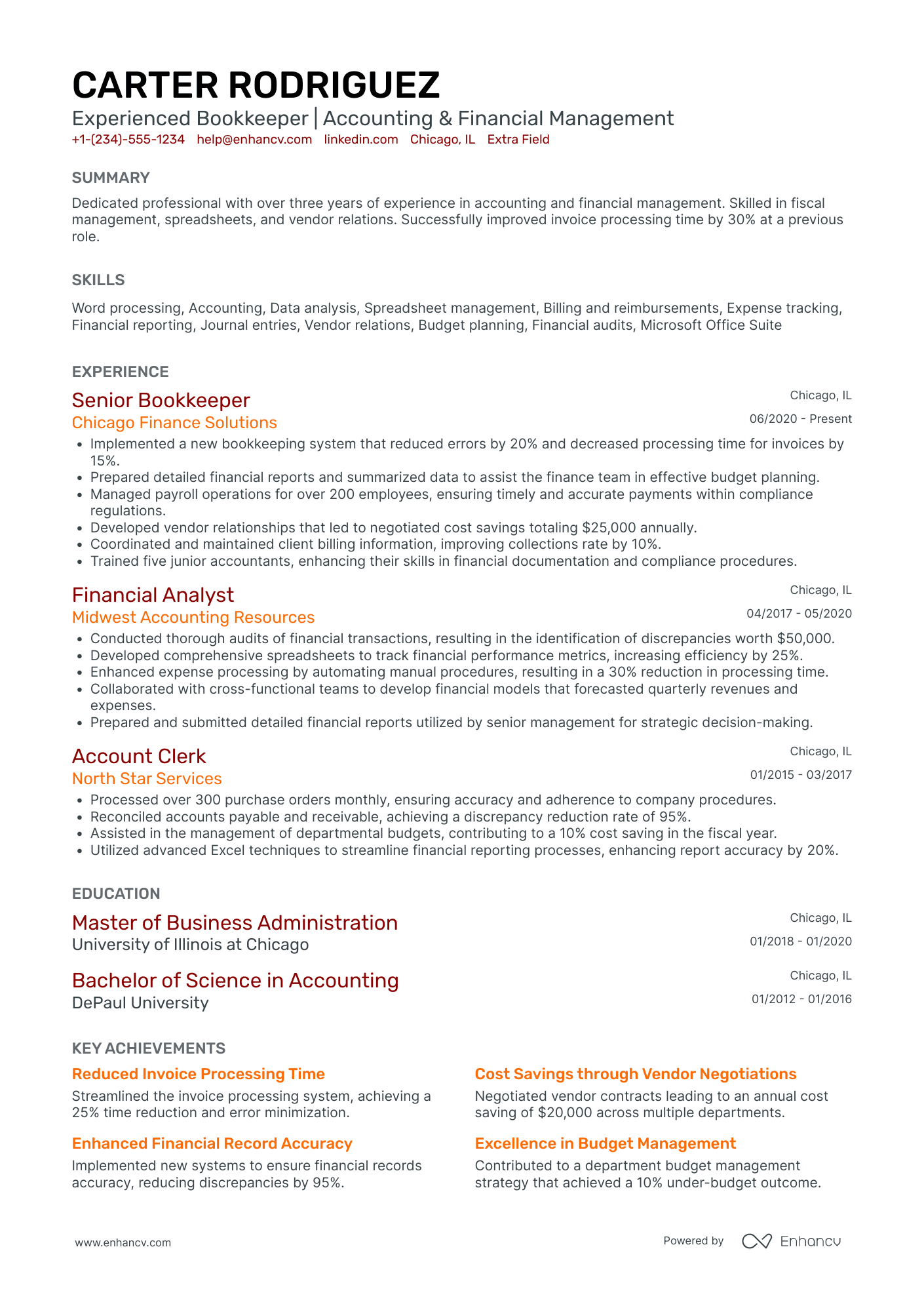

How to list your hard and soft skills on your resume

Including skills on your resume is vital as it showcases your qualifications and capabilities. This lets recruiters quickly assess your fit for a bookkeeping position. It also matches your skills with the job's demands. Additionally, it improves your resume's visibility in Applicant Tracking Systems and demonstrates your worth to prospective employers.

Let’s focus on hard skills for bookkeeping.

Hard skills

Including hard skills on a bookkeeper's resume demonstrates your expertise in specific accounting software and financial practices necessary for bookkeeping positions.

Create a distinct section on your resume labeled "Hard skills," ideally placed near the top or right after the work experience section. Specify and prioritize skills such as particular software, tools, and accounting methodologies you’re proficient in.

Tailor these skills to the position you’re targeting. If you possess a wide range of hard skills, consider categorizing them under headings like "Accounting Software," "Financial Reporting," and "Tax Preparation" for clearer presentation.

Below are 20 key skills that would significantly enhance your application:

Best hard skills for your bookkeeper resume

- QuickBooks proficiency

- Financial analysis

- Data entry

- Accounts payable and receivable

- Payroll management

- Bank reconciliation

- Xero expertise

- Sage 50 Accounting

- Budget preparation

- Tax filing

- Financial reporting

- Invoice processing

- Credit management

- Microsoft Excel

- Cash flow management

- Cost accounting

- MYOB experience

- ACCPAC competence

- General ledger accounting

- Knowledge of GAAP standards

Let's now shift to soft skills.

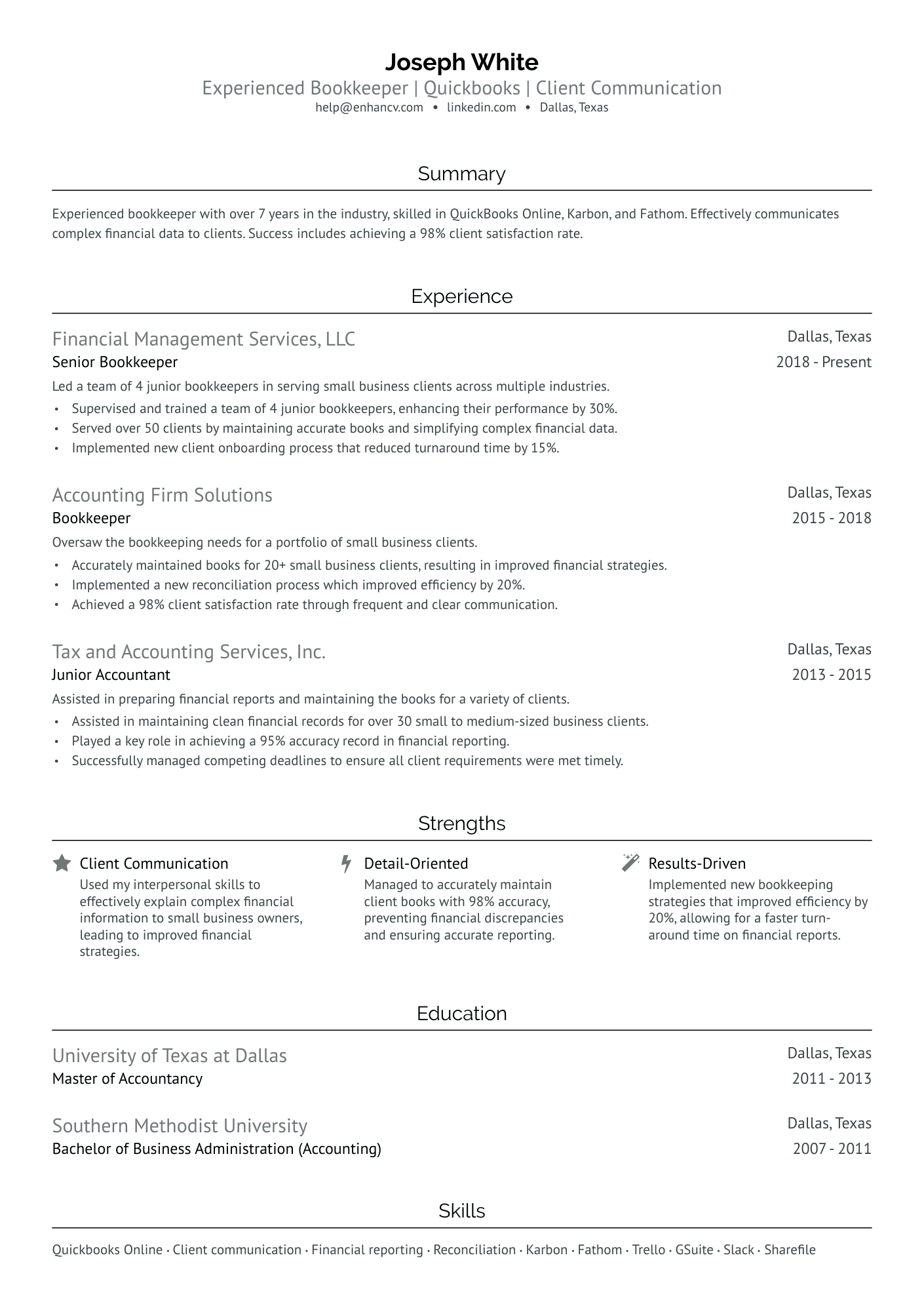

Soft skills

Soft skills are crucial for your bookkeeping resume as they show your ability to collaborate and adapt in the workplace. Instead of isolating these skills in a separate section, integrate them throughout your resume.

In your summary or objective, highlight essential soft skills and give specific examples of how you've used them in practical situations, like improving client relationships or resolving financial issues.

Also, underline relevant soft skills in your work experience and education sections, demonstrating teamwork and leadership in a financial context. Ensure these skills match the job description keywords and balance them with your technical abilities to present a well-rounded profile. Always be honest about your skill levels, as inaccuracies can be easily exposed in interviews.

Here are some commonly valued soft skills in bookkeeping that our research has identified:

Best soft skills for your bookkeeper resume

- Detail-oriented

- Adaptability

- Problem-solving

- Teamwork

- Organization

- Dependability

- Time management

- Confidentiality

- Work ethics

- Communication

- Analytical thinking

- Decision making

- Self-motivation

- Patience

- Stress management

- Initiative

- Business acumen

- Critical thinking

- Learning agility

- Multitasking

Next up, we'll craft education sections that bring attention to your academic accomplishments and qualifications.

How to list your education and certifications on your resume

bookkeepers typically only need a high school diploma to start, but the role requires competencies often not covered in high school education.

To acquire additional skills, new bookkeepers may receive about six months of on-the-job training to become proficient in bookkeeping software, databases, and spreadsheets.

While a college degree is not mandatory, obtaining one can lead to higher wages. So, if you’ve got one, let’s make sure it stands out.

Here’s how to lay out the education section on your bookkeeping resume:

- Degree title: List the degree you earned related to bookkeeping or accounting.

- Institution name: Provide the name of the educational institution you attended.

- Graduation year: Indicate the year you graduated or expect to graduate.

- Major: Underline your field of study, such as accounting or business administration, which are pertinent to bookkeeping roles.

- Relevant certifications: Include any bookkeeping-specific certifications you hold, like Certified bookkeeper (CB) or Certified Public bookkeeper (CPB).

- Additional training: Mention any additional courses or workshops you completed that enhance your bookkeeping skills, such as advanced Excel or QuickBooks.

- GPA: If your Grade Point Average is above 3.5, consider adding it to showcase your academic excellence.

PRO TIP

When applying for entry-level positions, be sure to emphasize your educational background and relevant coursework to demonstrate your readiness for the tech industry.

Here's a simple way to structure this part of your resume.

- •Focused on accounting principles and financial regulations.

- •Completed a capstone project on streamlining financial reporting processes.

- •Graduated with honors.

- •Conducted a senior project on budget management and financial tracking for student organizations.

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Employers often prefer bookkeepers who have completed some postsecondary education. As an alternative to a full degree, many bookkeepers opt for certificate programs in bookkeeping to enhance their qualifications.

Displaying your bookkeeping license and certifications on your resume emphasizes your commitment to ongoing learning. Be sure to:

- List each certification you have received.

- Include the name of the certifying body.

- Mention the expiration date, if any.

Consider these respected bookkeeping certifications:

Best certifications for your bookkeeper resume

Now that we've covered that, let's shift our focus to writing engaging resume summaries and objective statements to catch the eye of potential employers.

How to write your bookkeeper resume summary or objective

For bookkeepers, that summary at the top of your resume is super important. It’s your chance to quickly show off your precision and how well you handle the numbers. This section should underscore your skills with financial software, any relevant certifications, and key achievements.

You want this part to grab attention and make a strong first impression. Want to see what not to do? Here's an example.

This summary is so generic that it can frustrate recruiters. It's too vague, lacks specific achievements, and fails to show unique skills or experiences relevant to bookkeeping.

But don't worry, here’s the improved version.

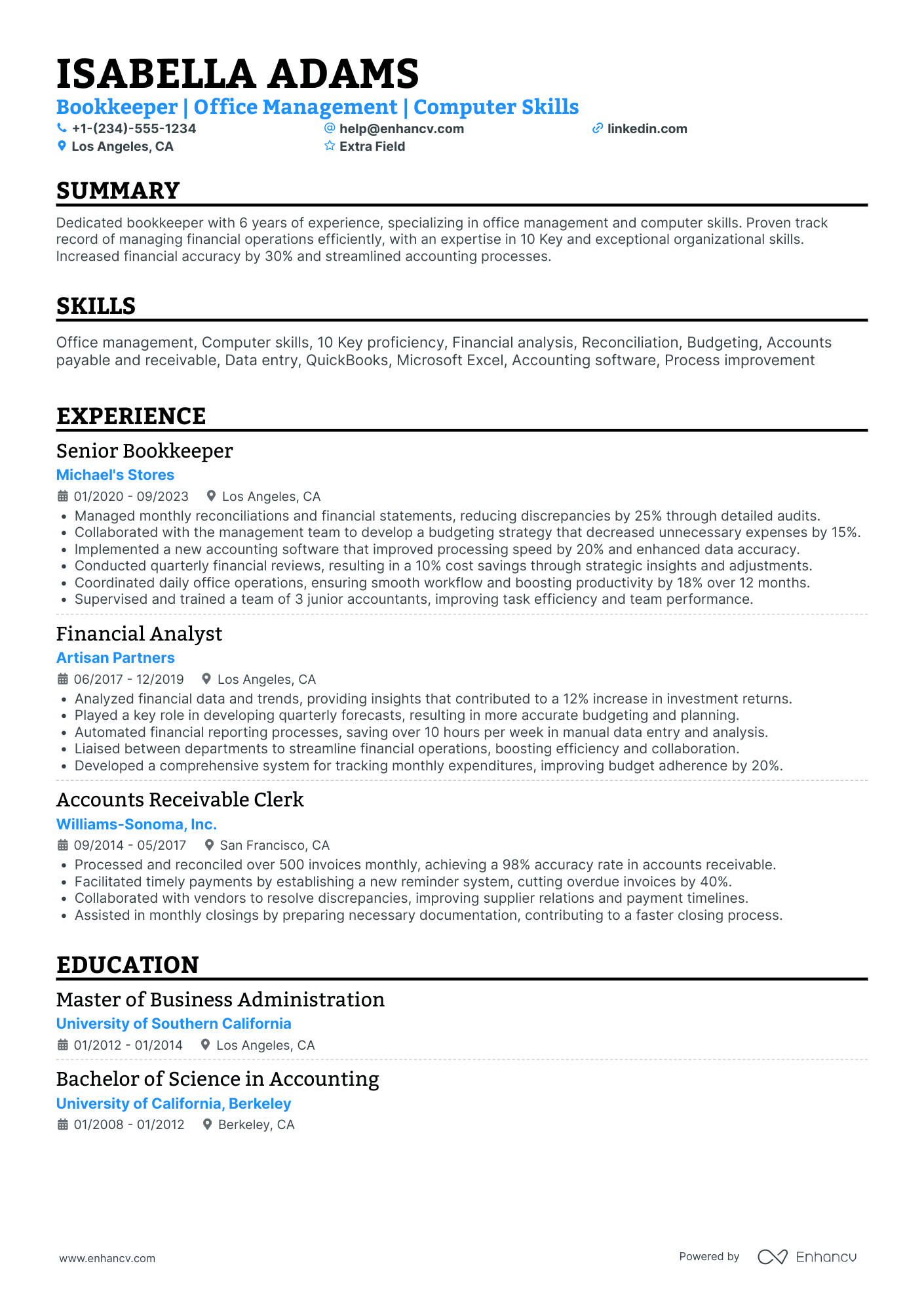

This concise summary is a winning approach. It effectively grabs the attention of hiring managers and highlights the candidate's suitability for the role. Here’s why:

- Relevant experience: Shows 6 years of experience in bookkeeping along with a degree in accounting.

- Measurable successes: Demonstrates a track record of enhancing accounting processes and boosting operational efficiency.

- Technical proficiency: Underlines skills in Microsoft Office applications, including Excel, Word, and Outlook, and familiarity with various accounting software.

- Acknowledged strengths: Recognized for outstanding communication and problem-solving abilities, reflecting a history of professional excellence.

PRO TIP

Construct the resume summary or objective avoiding a first-person narrative style.

Resume objectives are particularly useful for those entering the workforce or changing career paths. Unlike a summary, an objective centers on your professional goals and core values, making up for a limited direct experience.

Take a look at this bookkeeper resume objective, which you can modify for your own use:

Now that we've tackled the main sections of your resume, consider adding a bonus section. These extra bits offer a fuller picture of your skills and potentially elevate your resume above others.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Additional sections for a bookkeeper resume

For bookkeeper positions, it's essential to showcase your skills and accomplishments clearly. Consider including these sections in your resume:

- Awards: Draws attention to your awarded achievements, emphasizing your proficiency in bookkeeping.

- Passions: Share your interests outside of work cooking, blogging, or doing sports. This shows that you're a well-rounded individual with a genuine enthusiasm for activities beyond your professional life.

- Volunteer work: If you have volunteer experience, particularly in roles that involve financial management or consulting for non-profits, include this. It demonstrates your commitment to using your skills for community betterment and shows a broader application of your abilities.

- Language skills: If you are proficient in languages other than English, mention this. Being multilingual can be advantageous in diverse business environments and when dealing with international clients.

Key takeaways

Now that you've covered the fundamentals, let's summarize the key points for your bookkeeper resume:

- Choose a resume template that highlights your bookkeeping skills clearly and professionally.

- Strategically organize your resume to best display your bookkeeping expertise, making it easy for recruiters to assess your capabilities.

- Outline your experience with key bookkeeping practices and software to demonstrate your proficiency and familiarity with essential tools.

- Where possible, use numbers and percentages to quantify your achievements and demonstrate the tangible impact of your work.

- Match your skills with the specific requirements of the job description to show that you are a perfect fit for the role.

- Include your educational qualifications, especially any bookkeeping-related certifications or degrees, to underline your formal training.

Bookkeeper resume examples

By Experience

By Role