If you had to explain your accounts payable job to a 12-year-old, you'd probably describe it as being the strategist in a video game, managing resources to help your team succeed by paying bills and handling finances smartly. The same goes for your accounts payable (AP) resume. It should communicate your varied skills and achievements so clearly, that even non-specialists (and 12-year-olds) can understand it.

This guide will help you do just that. Here’s what we’ll cover:

- How to organize your resume to showcase your organizational skills, precision, and diligence.

- How to communicate your knowledge and illustrate how you’ve applied it in practical situations.

- How to ensure your technical abilities in accounts payable don't overshadow essential soft skills.

- Which certifications and financial software packages are most important to list on your accounts payable resume.

- How to create a resume that’s packed with the right keywords and make it appealing to both automated systems and human recruiters.

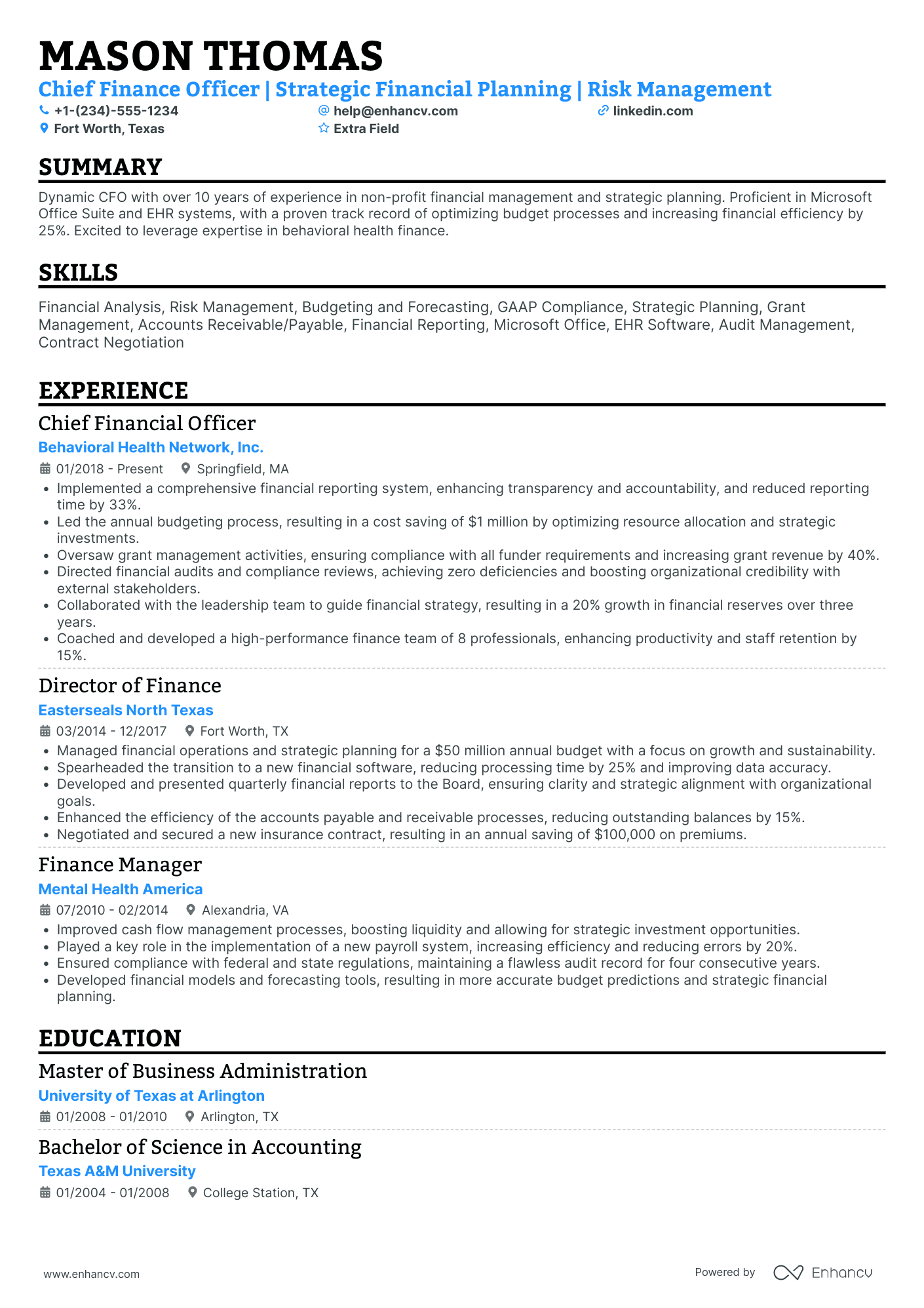

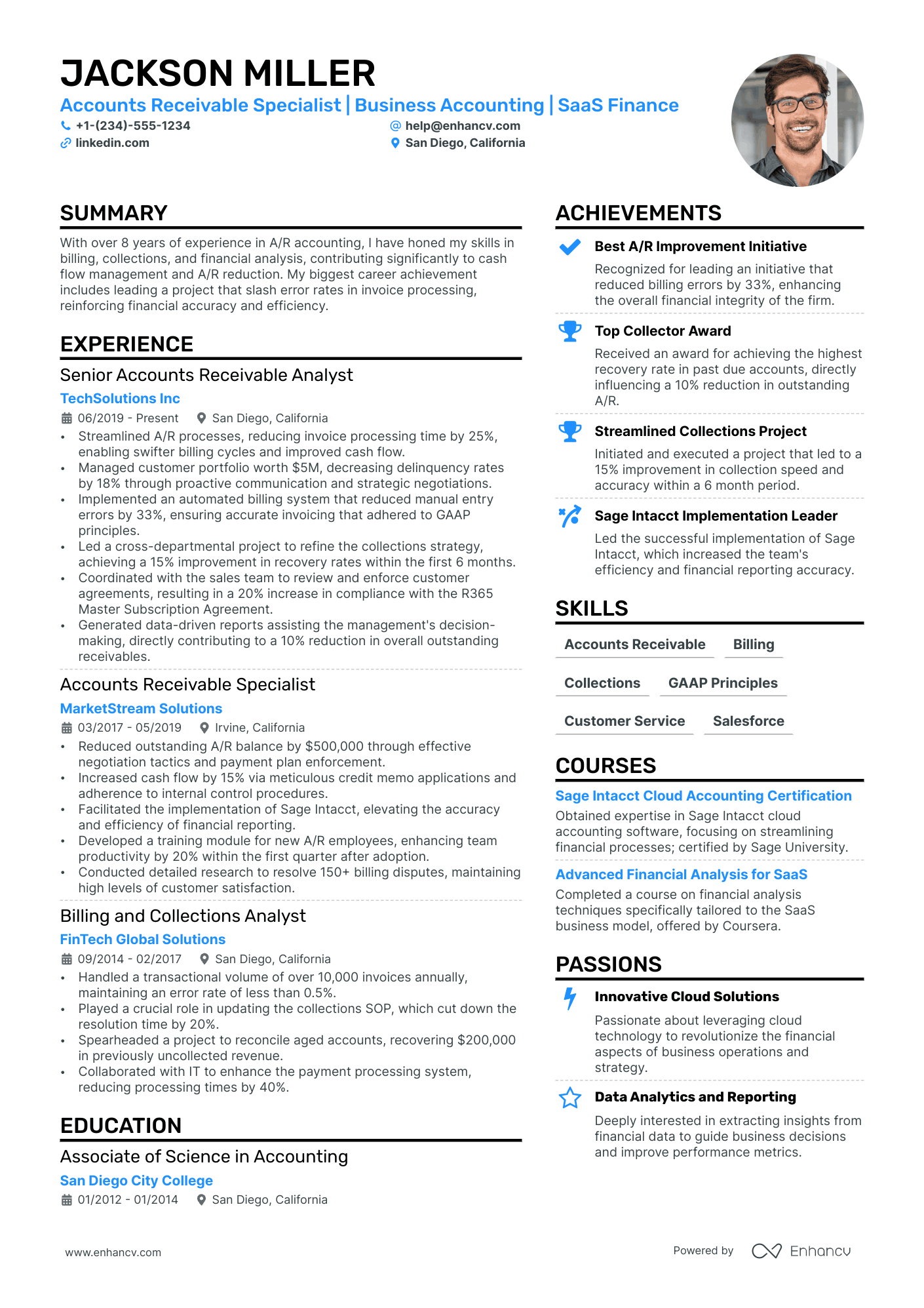

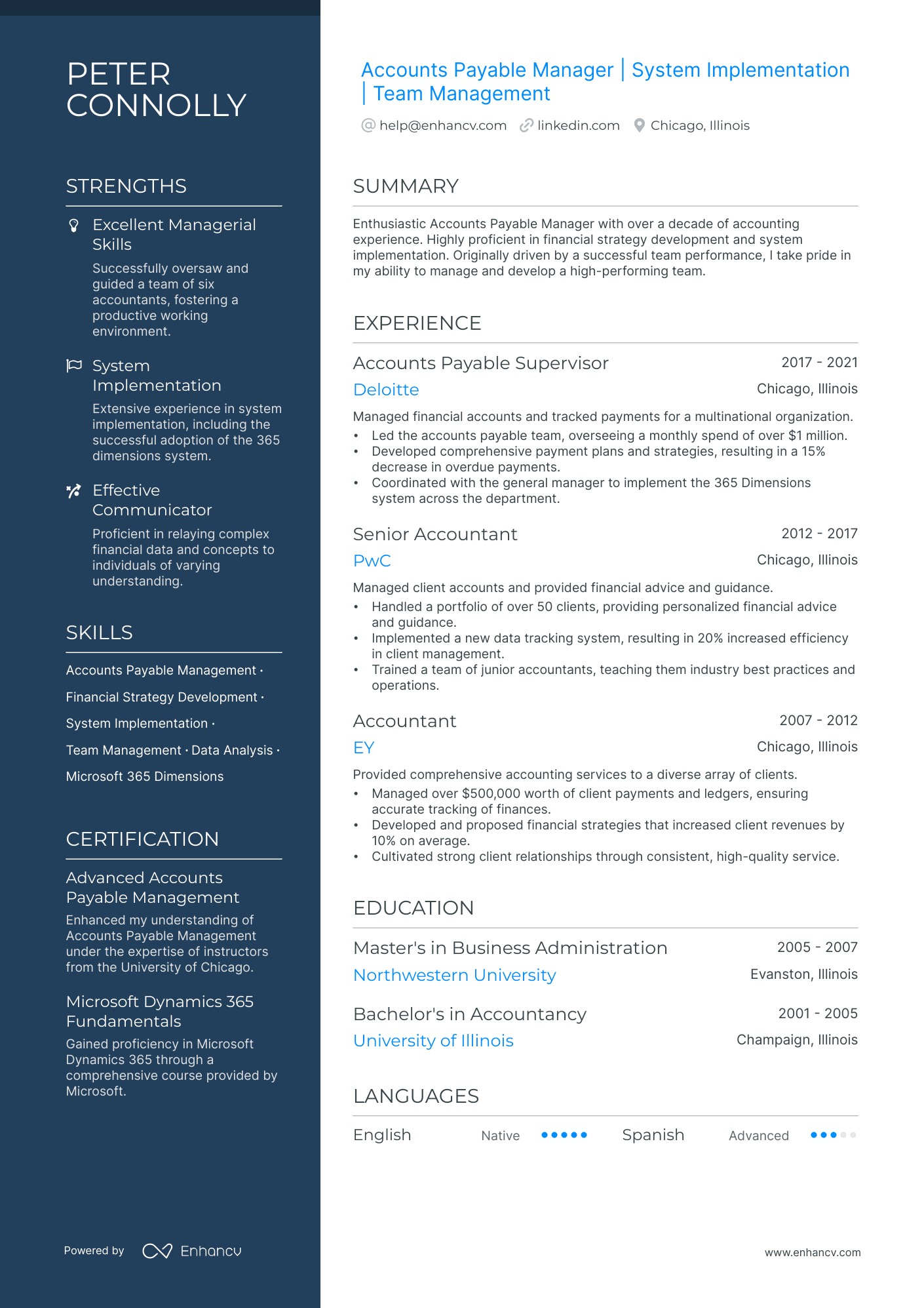

Before we dive in, have a look at some more resume examples for various accounting positions.

- Accounts Receivable Resume

- Accounts payable Manager Resume

- Bank Manager Resume

- Account Executive Resume

- Tax Accountant Resume

- CPA Resume Example

- Accounts payable Cover Letter

How to format an accounts payable resume

The accounts payable role demands a resume that balances meticulous detail with clarity and efficiency, much like the invoices and financial statements you handle daily. Here's how to shape your resume to reflect both the precision of your work and your ability to navigate the financial intricacies of business operations.

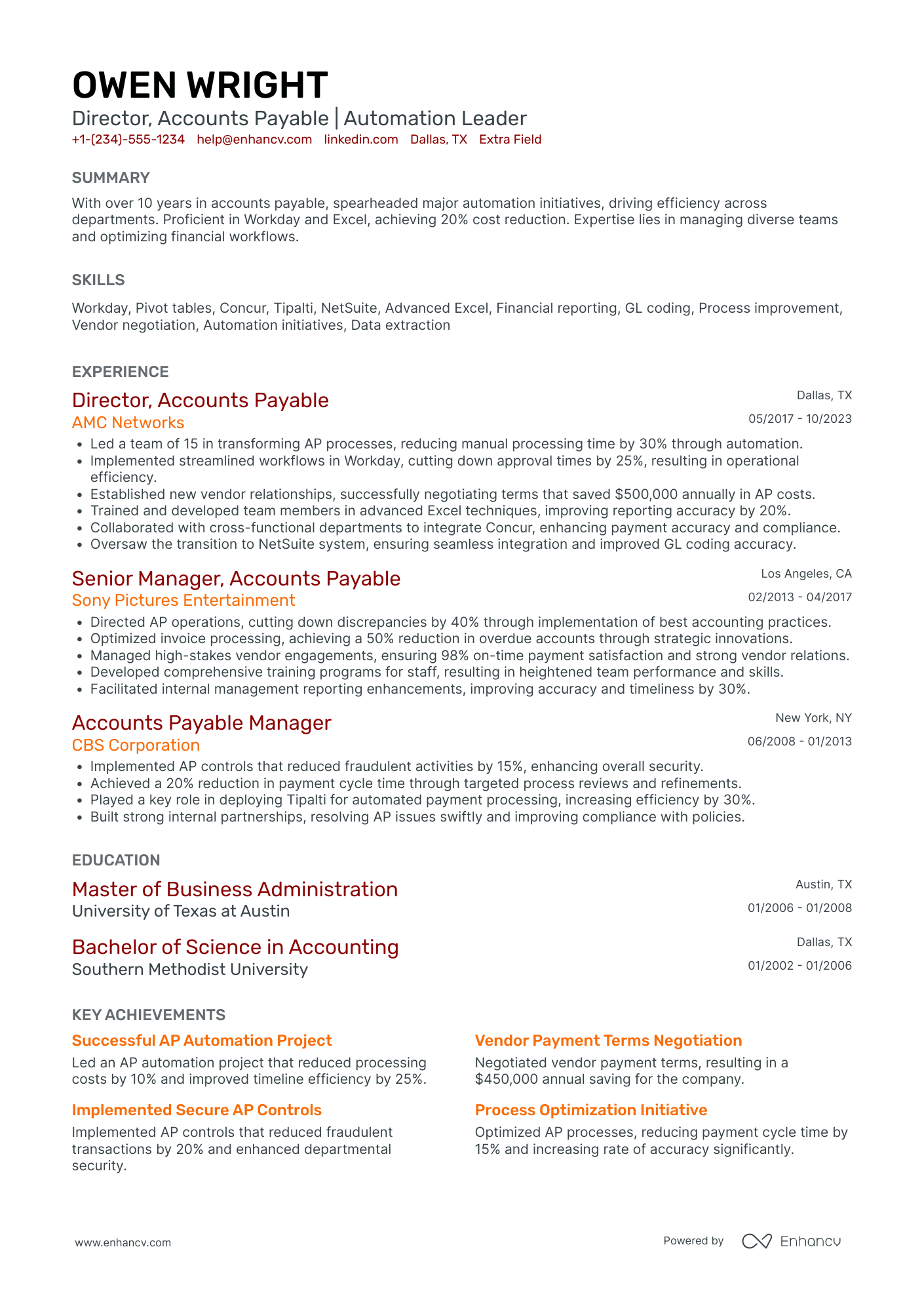

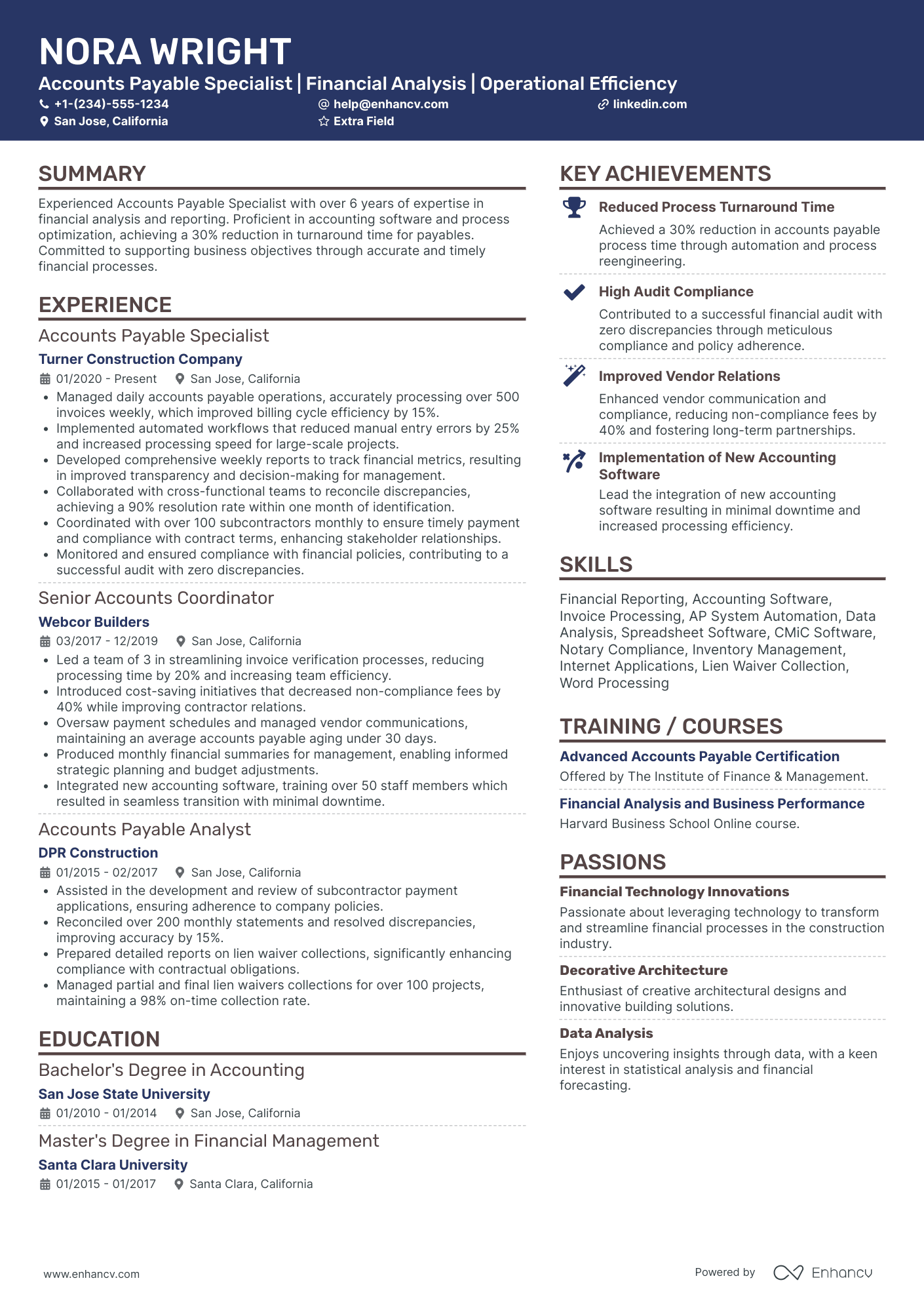

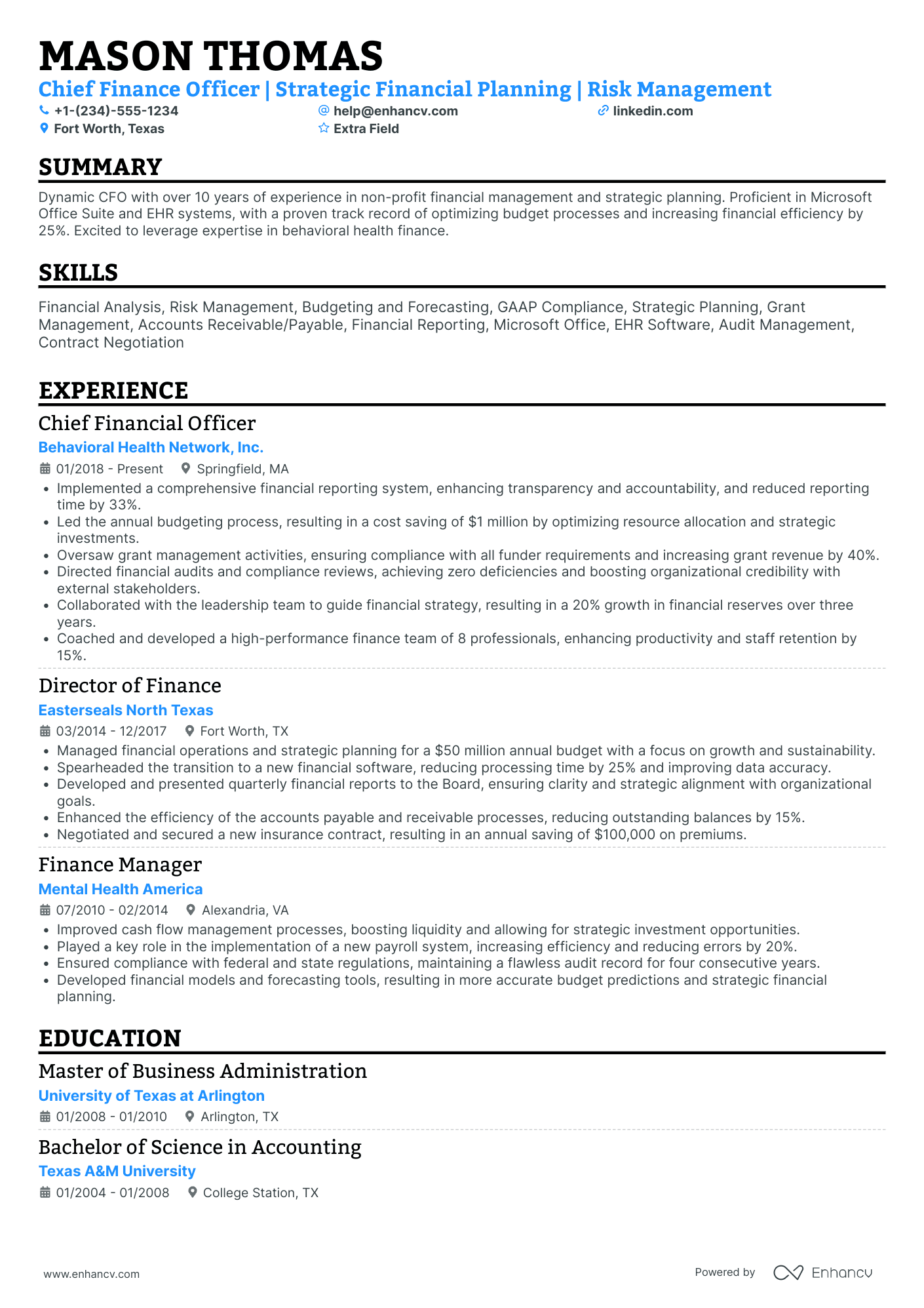

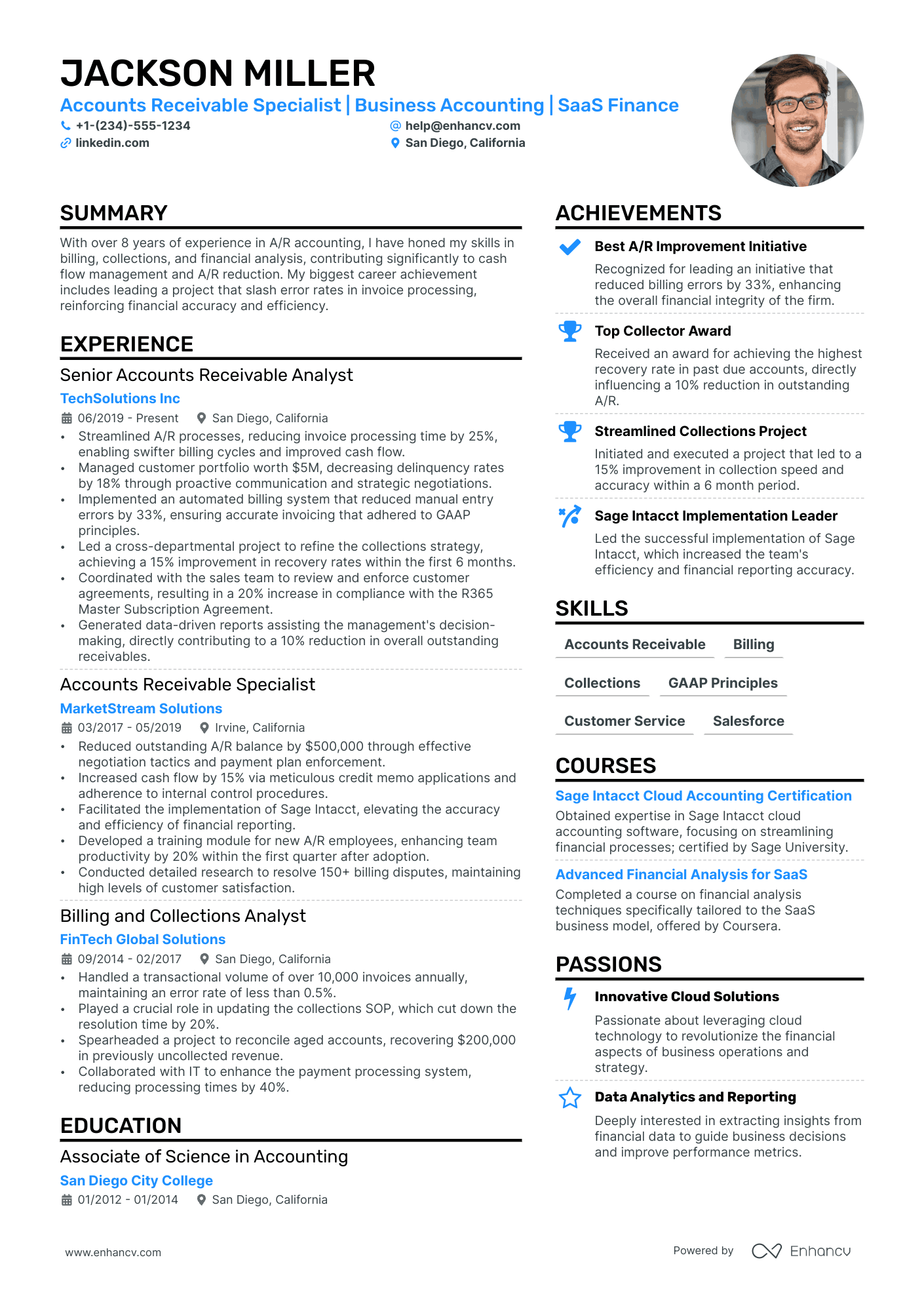

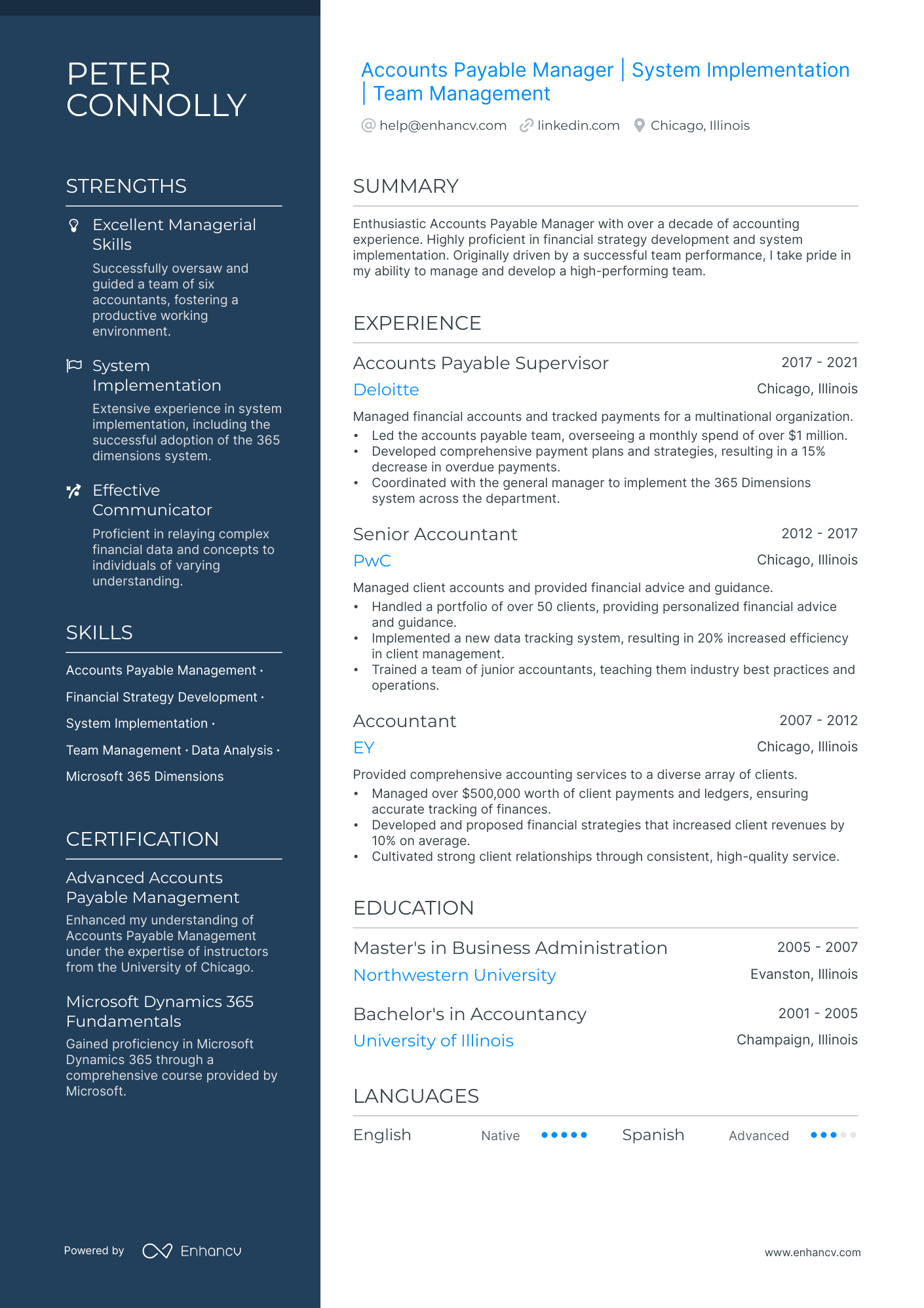

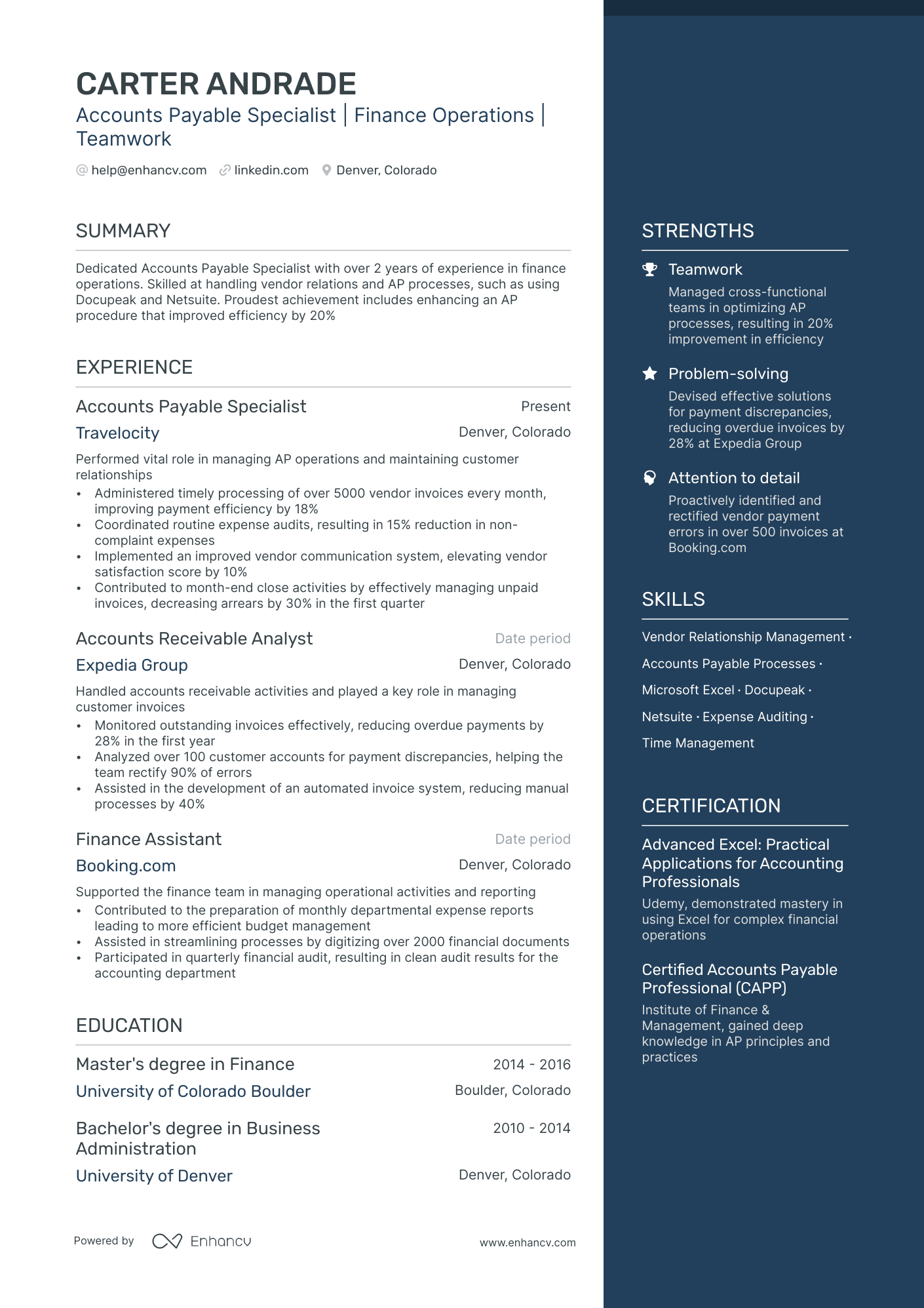

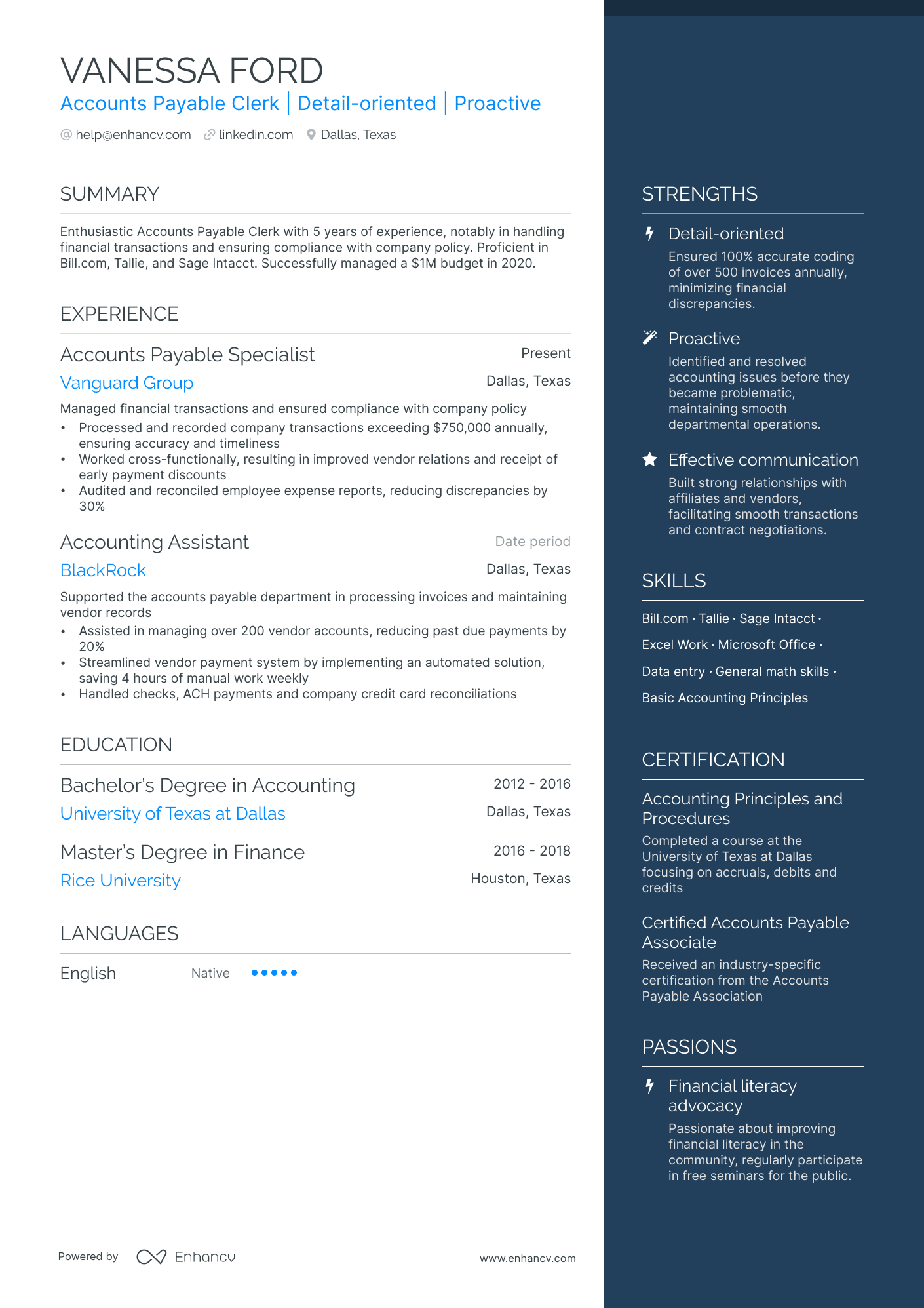

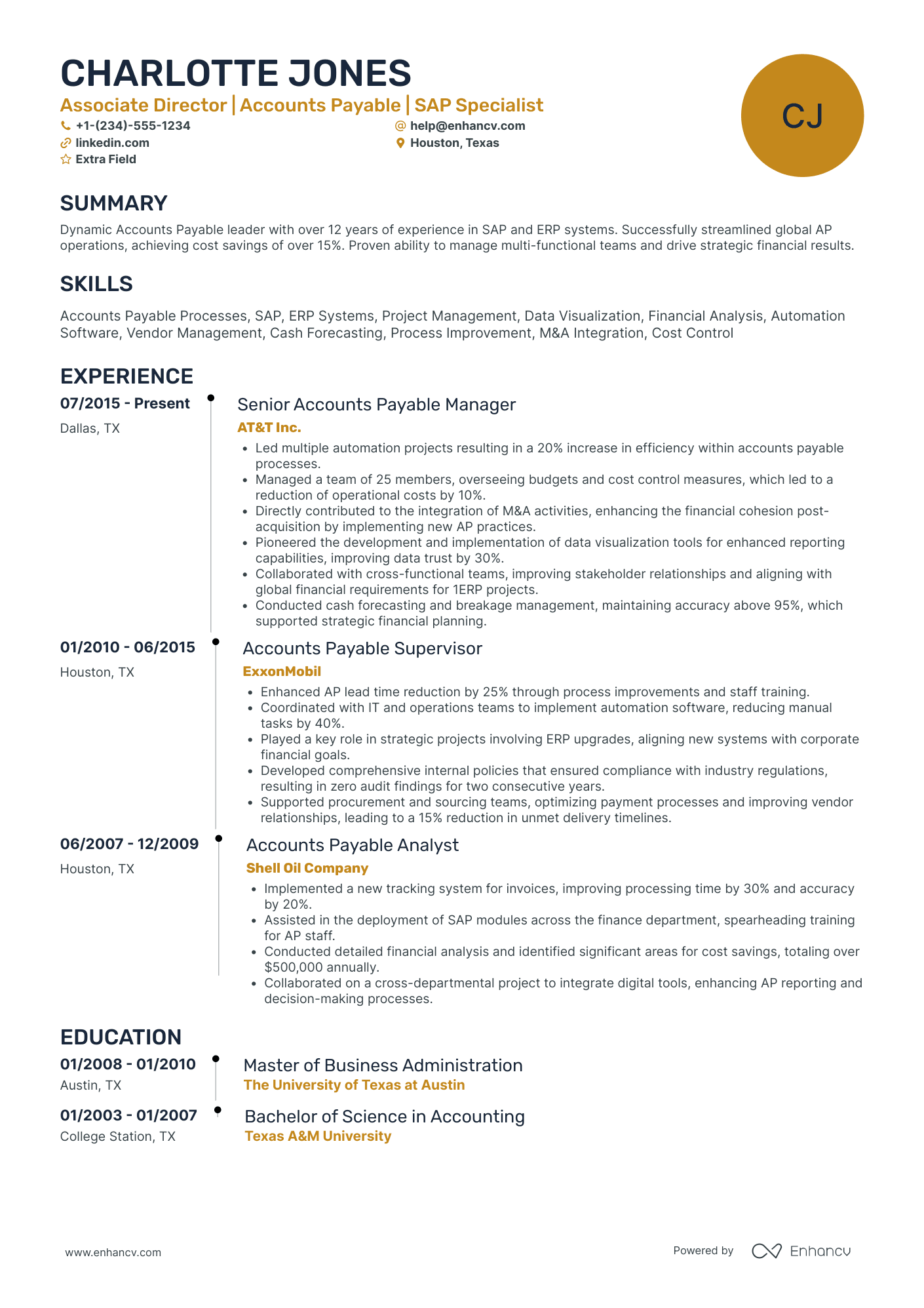

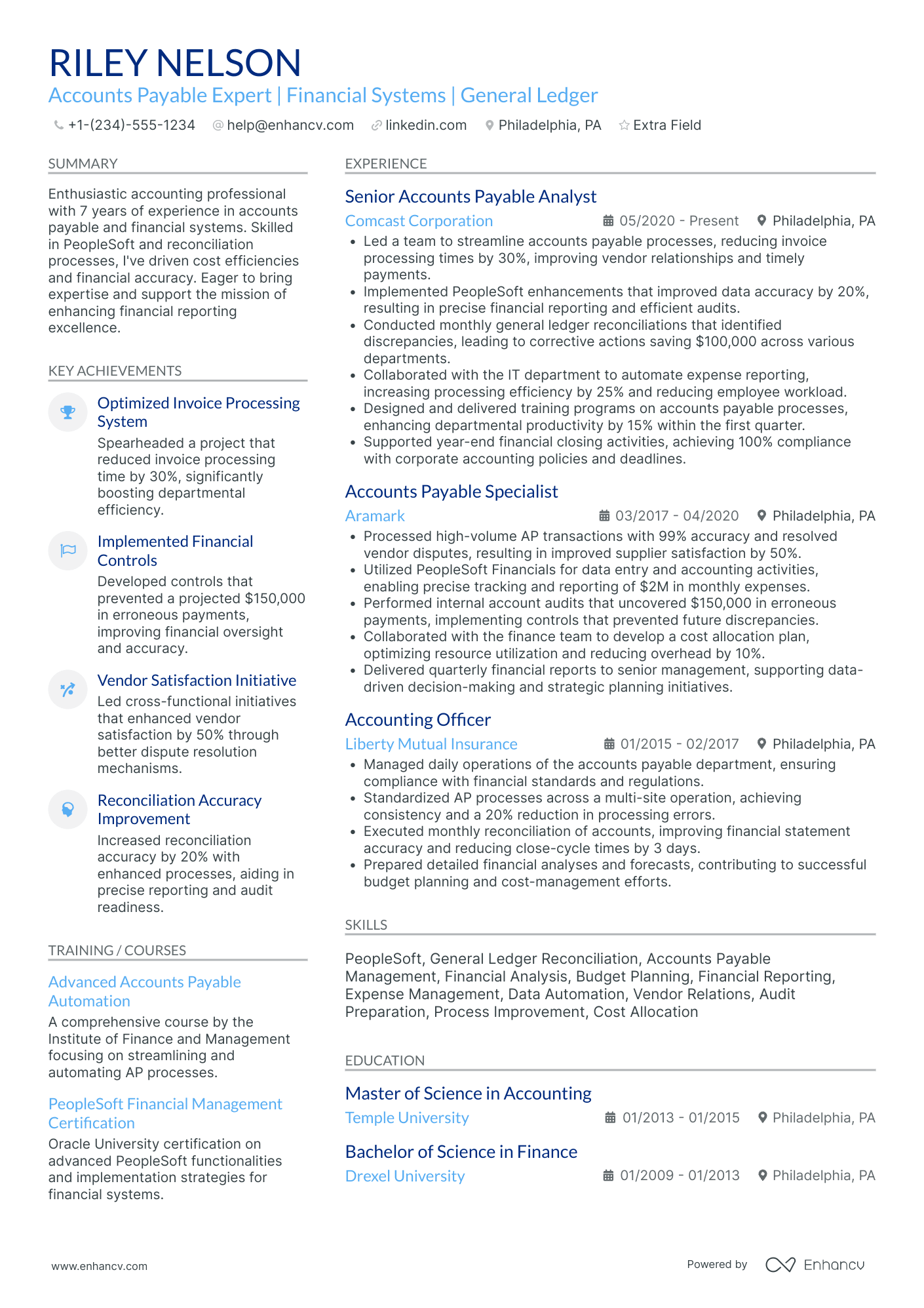

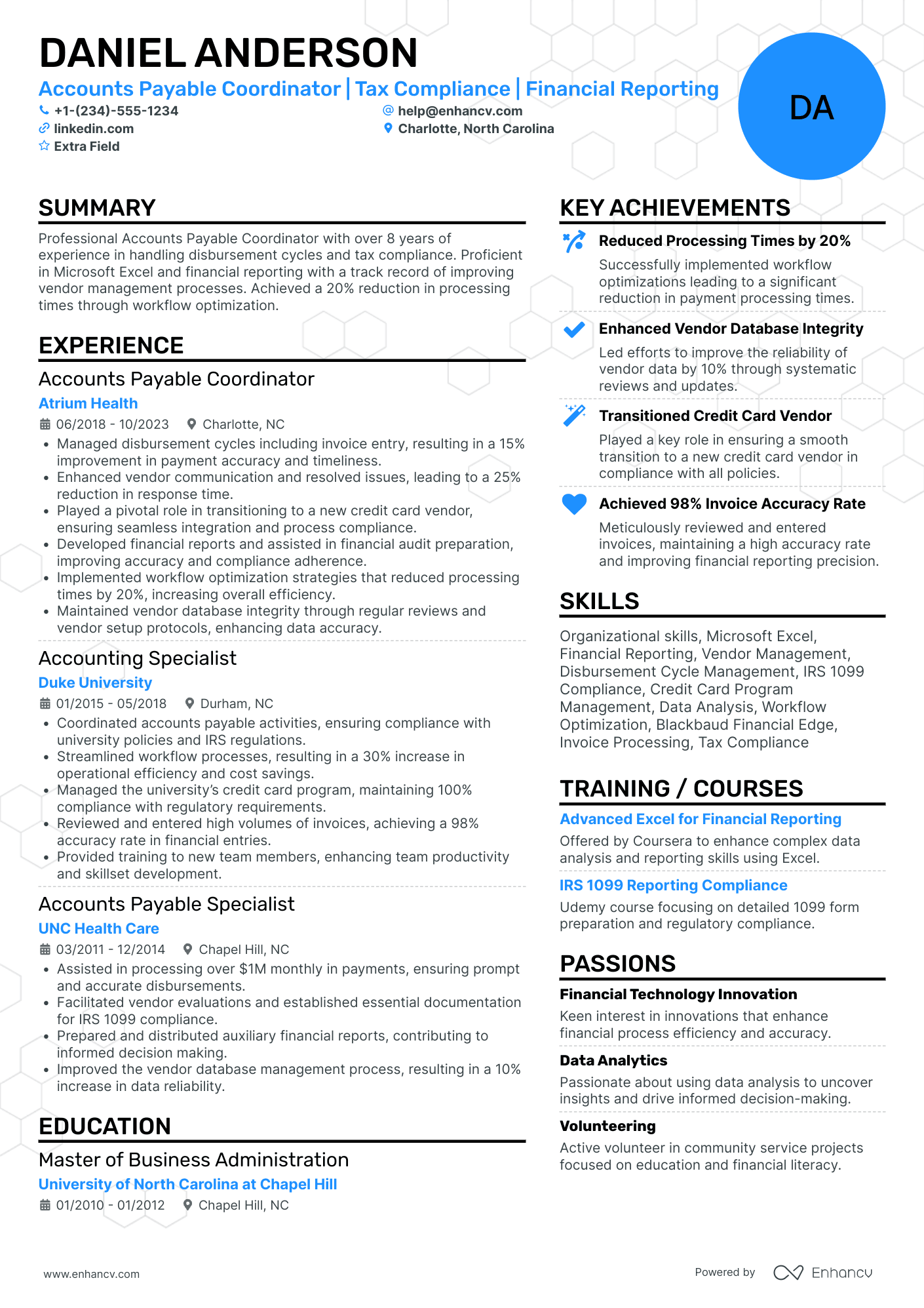

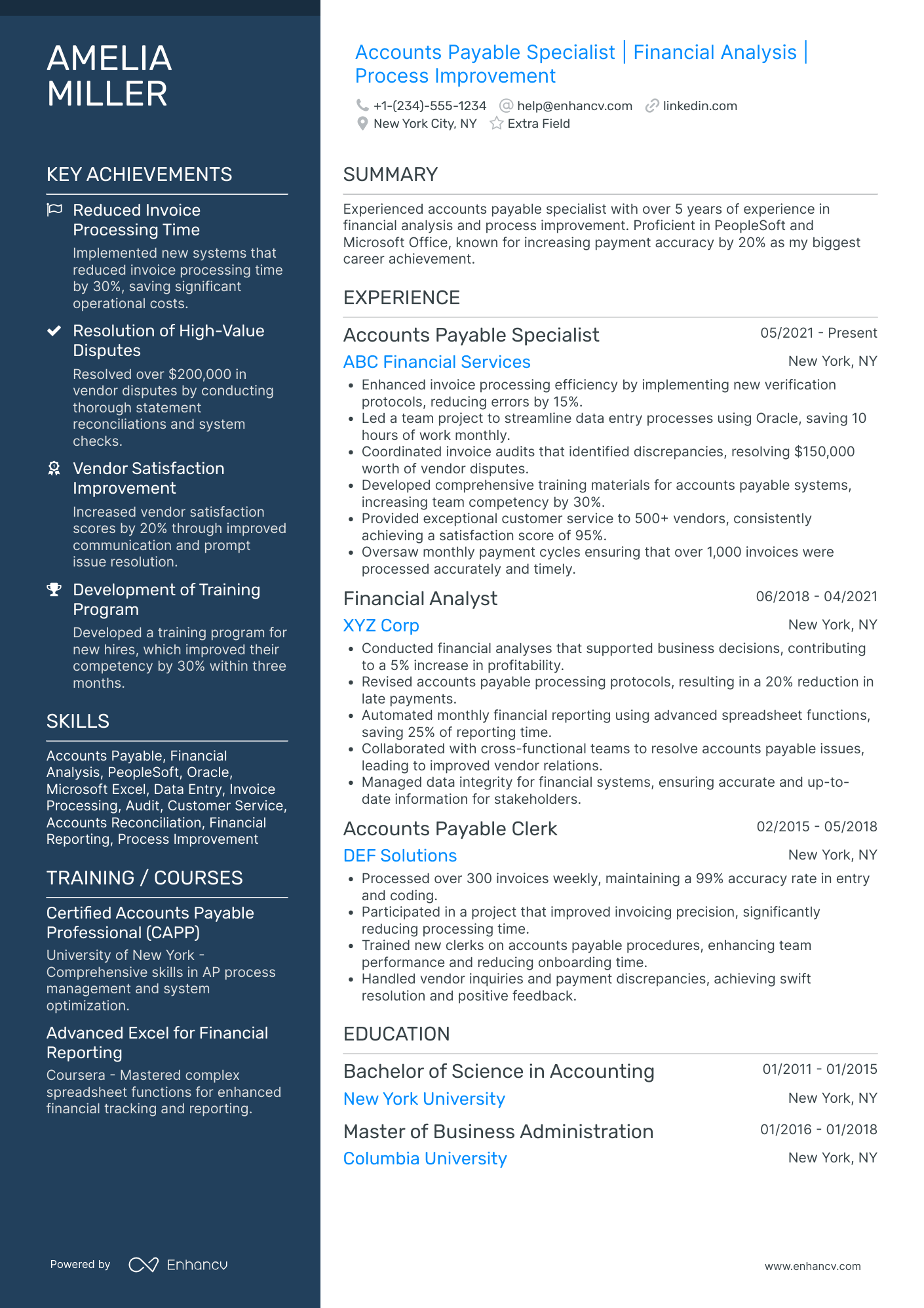

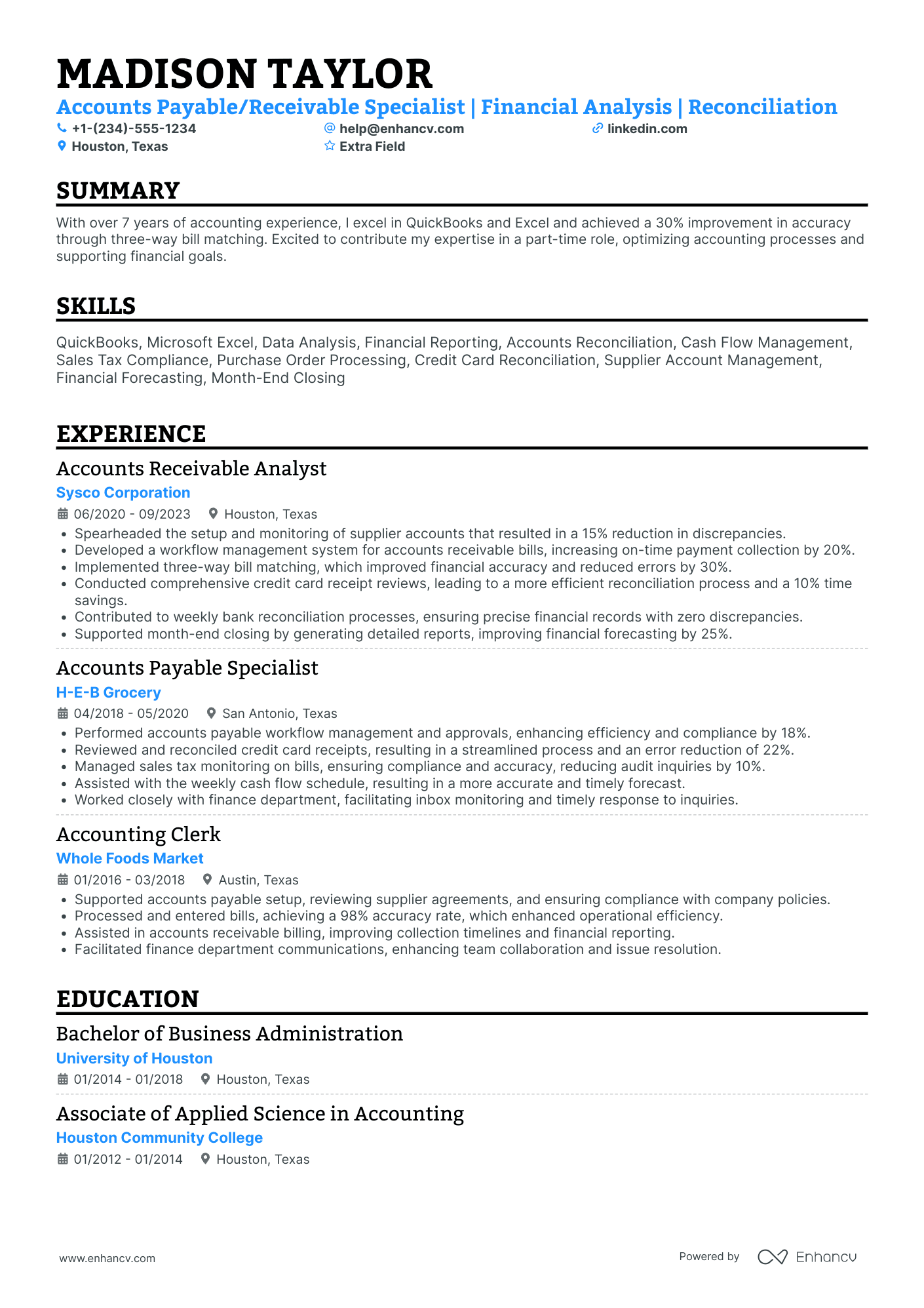

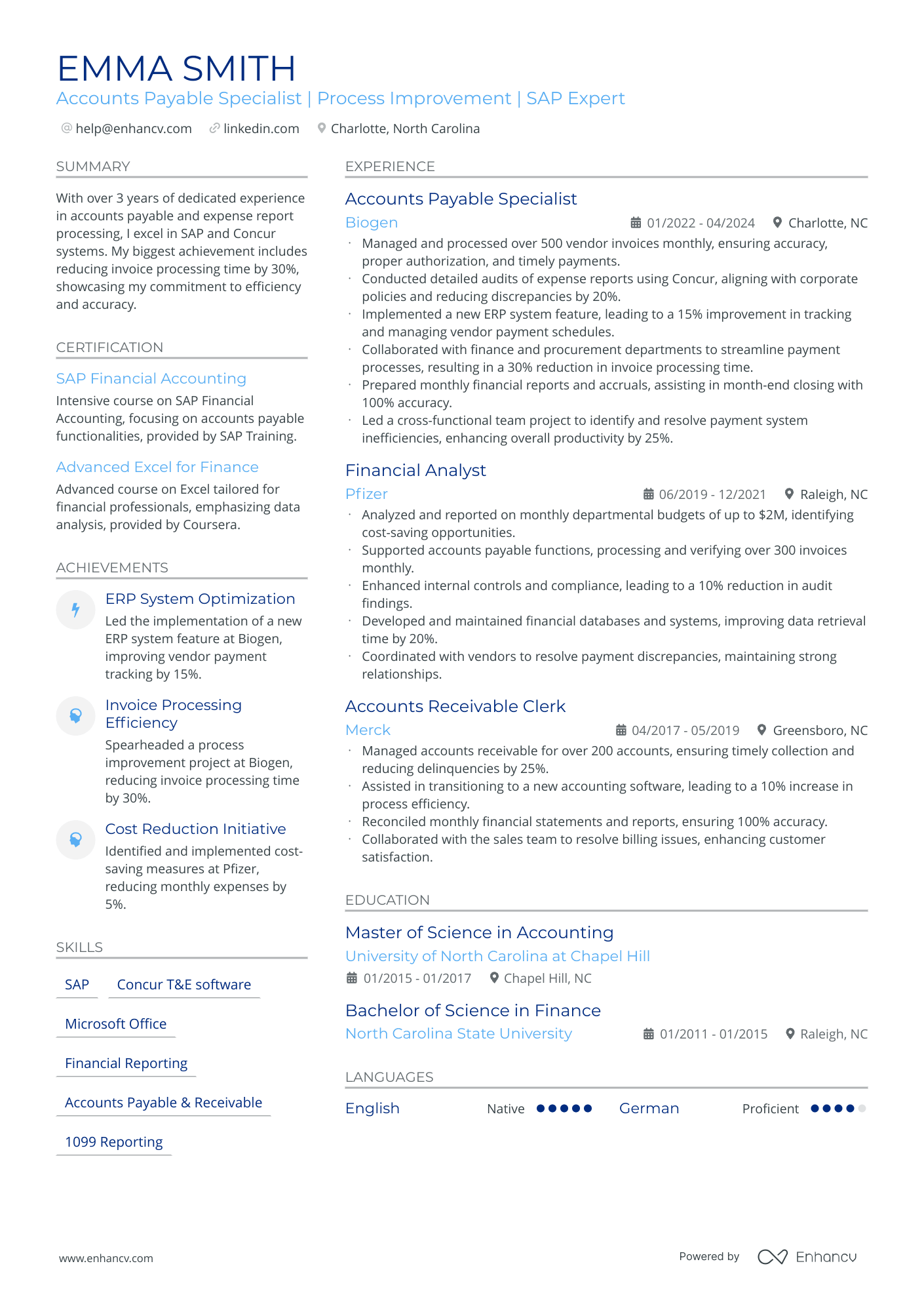

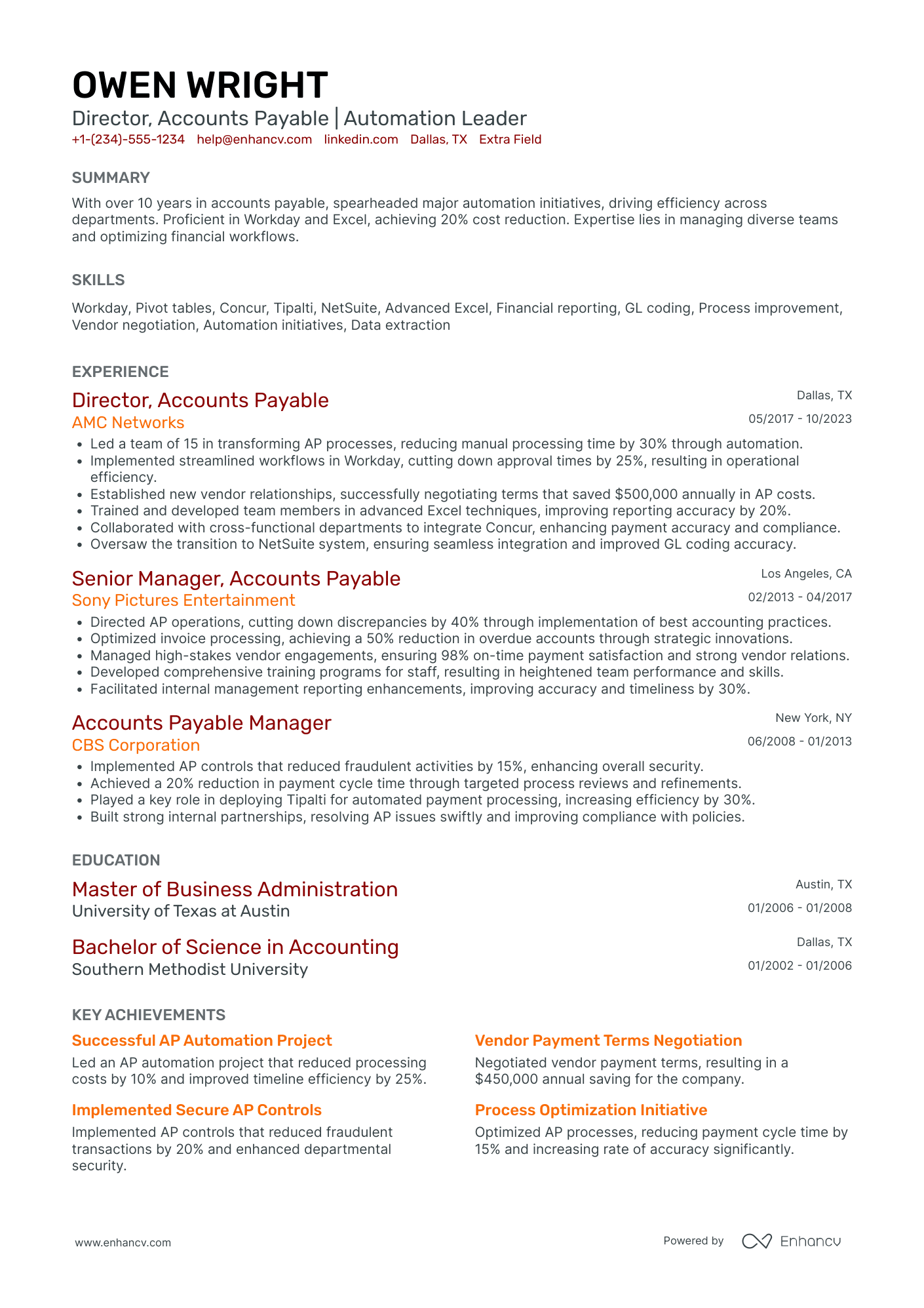

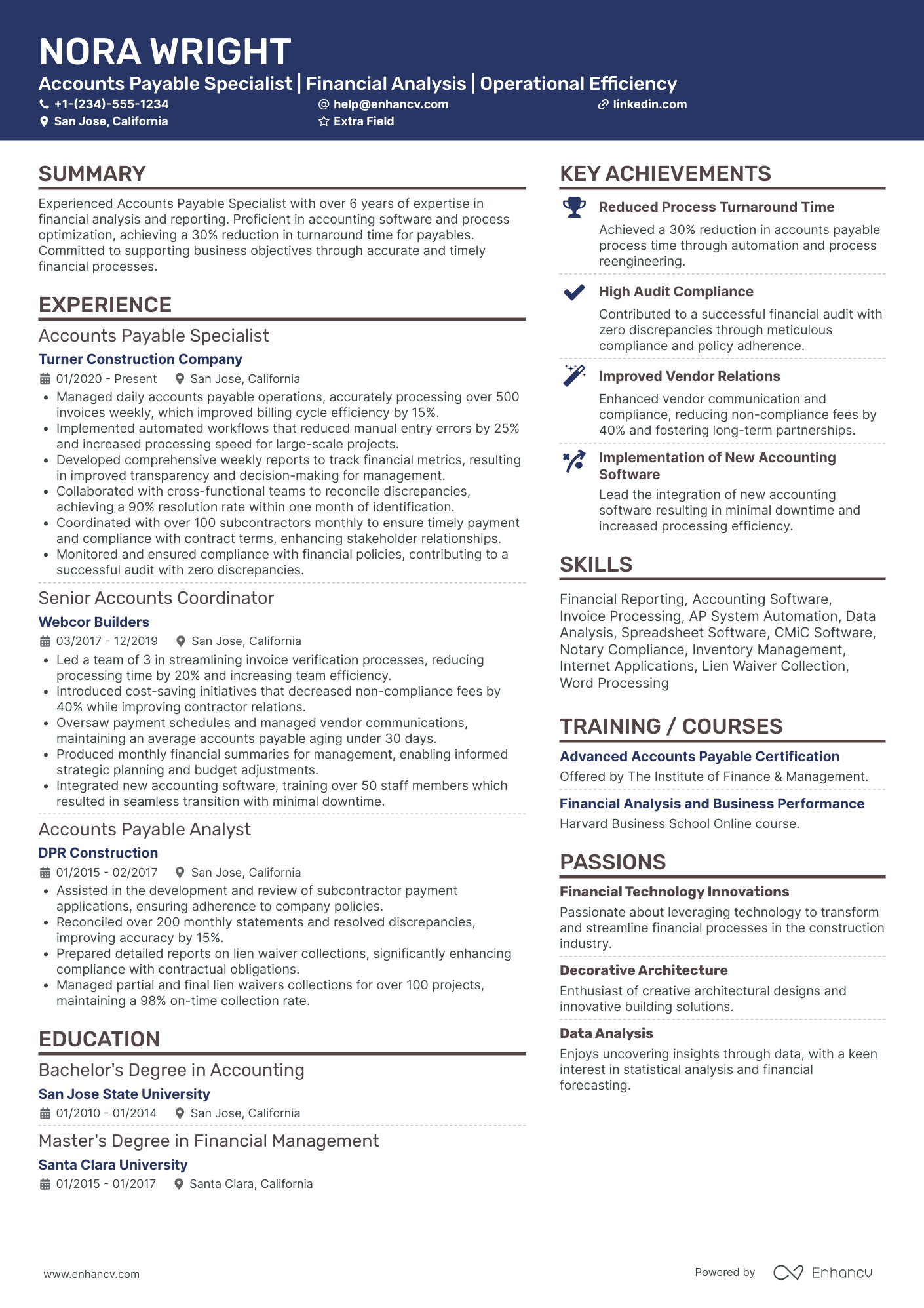

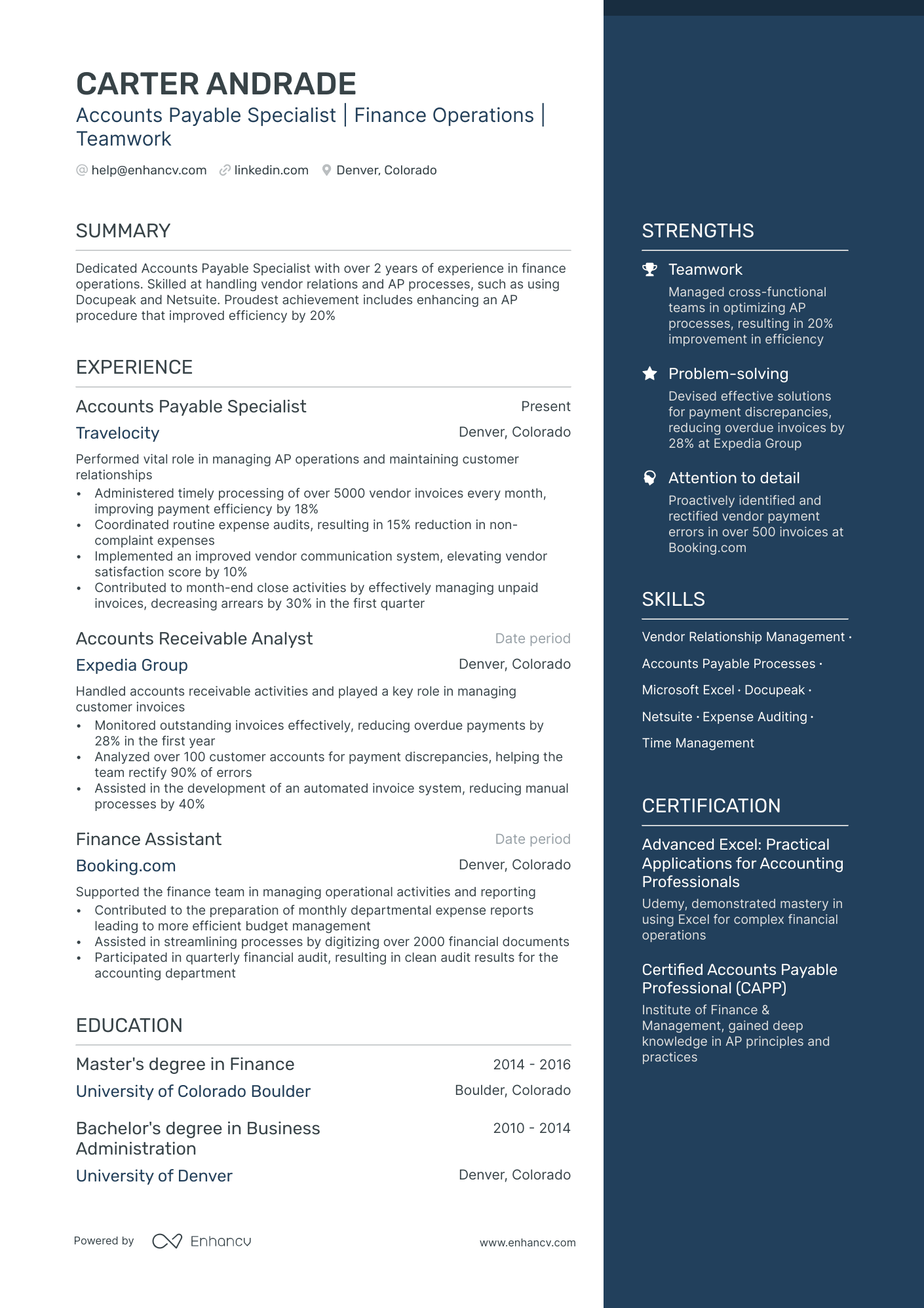

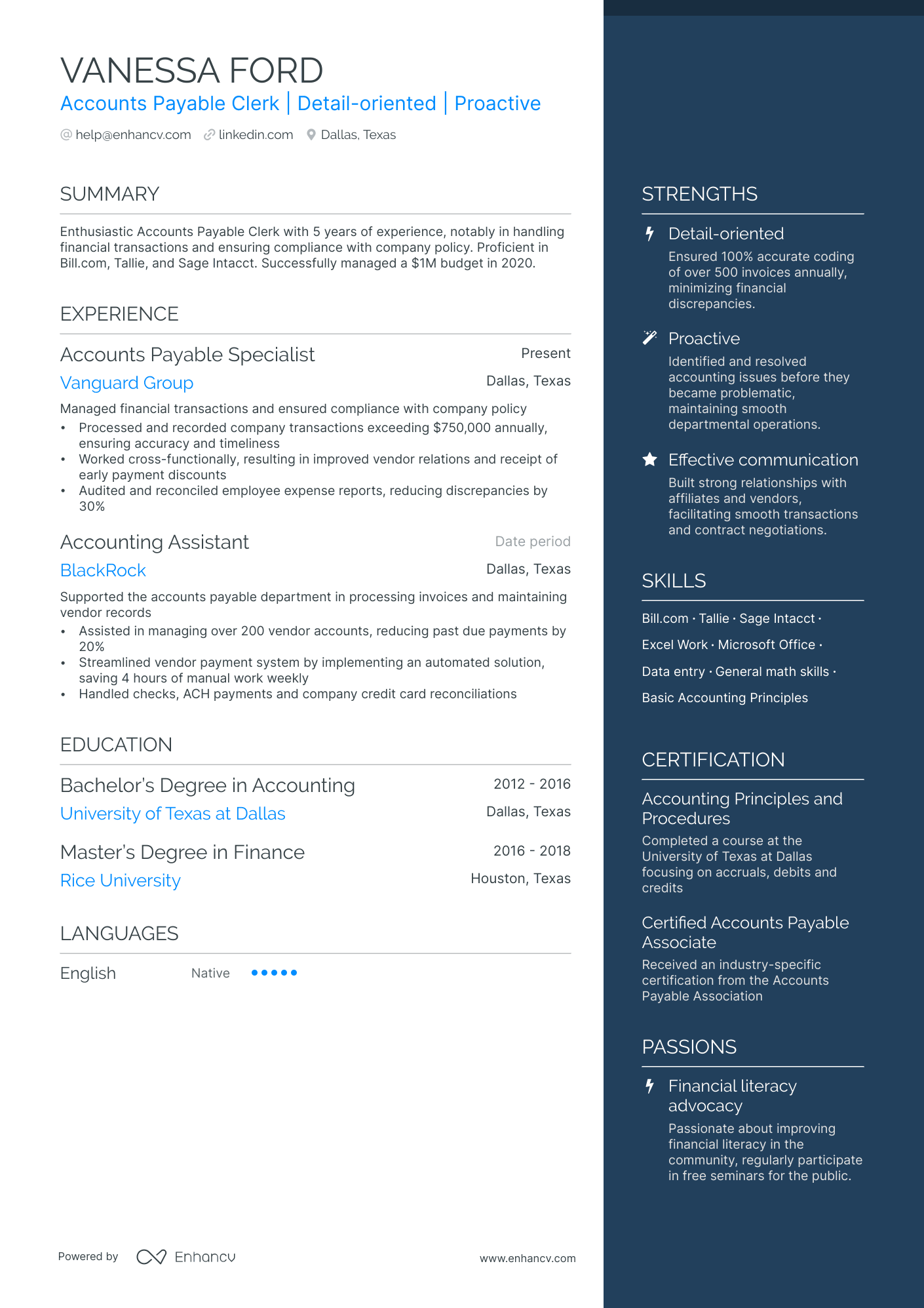

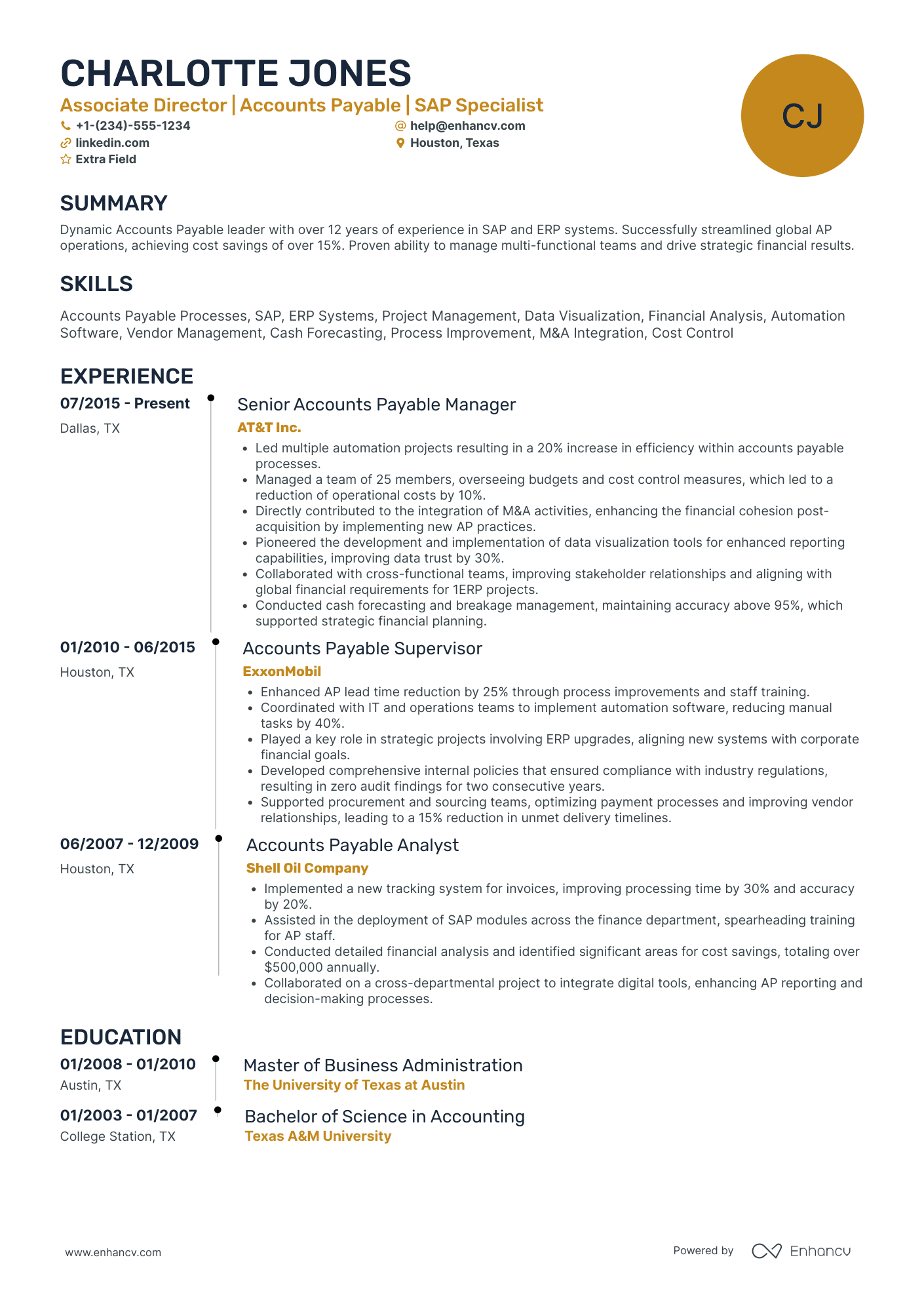

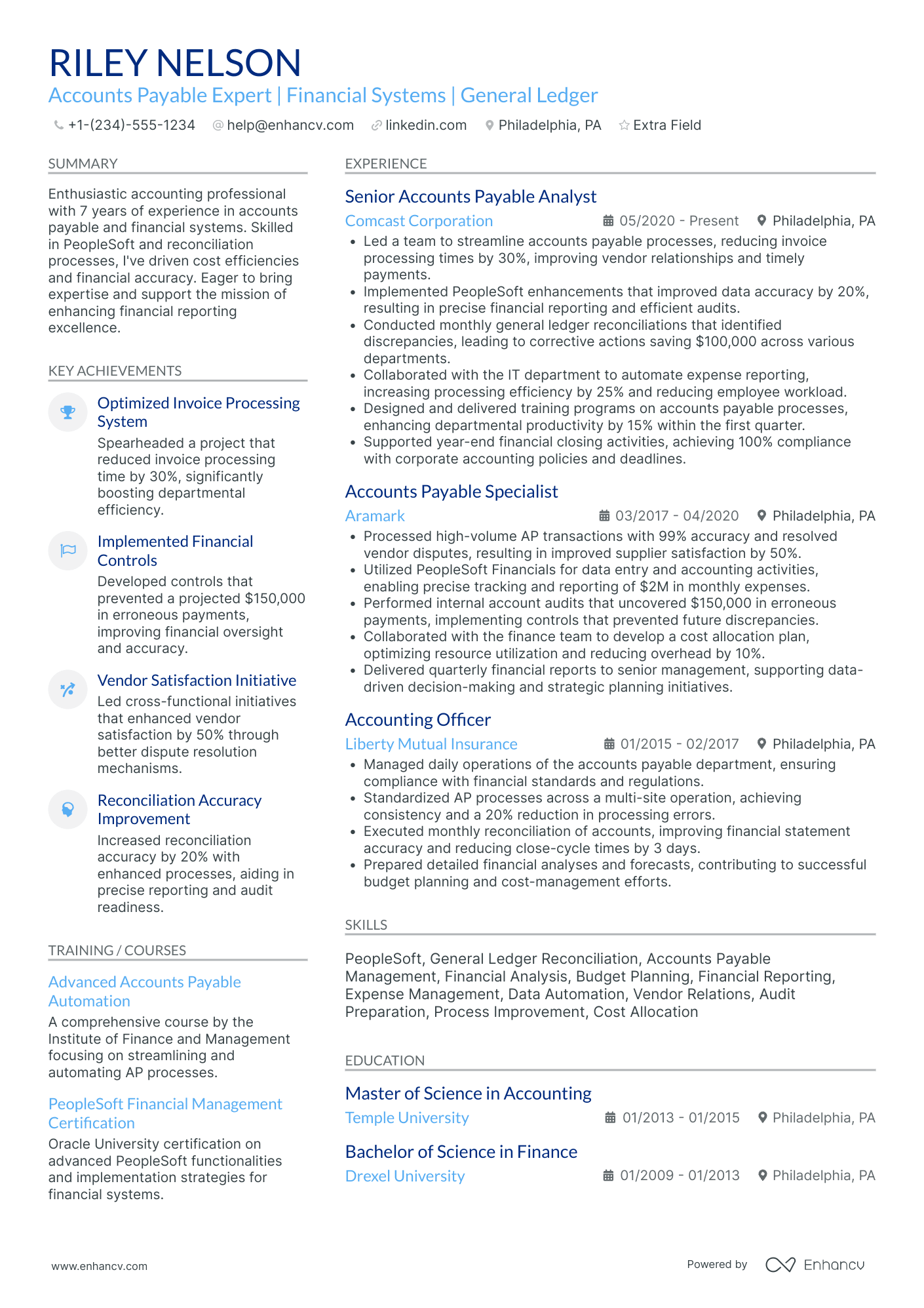

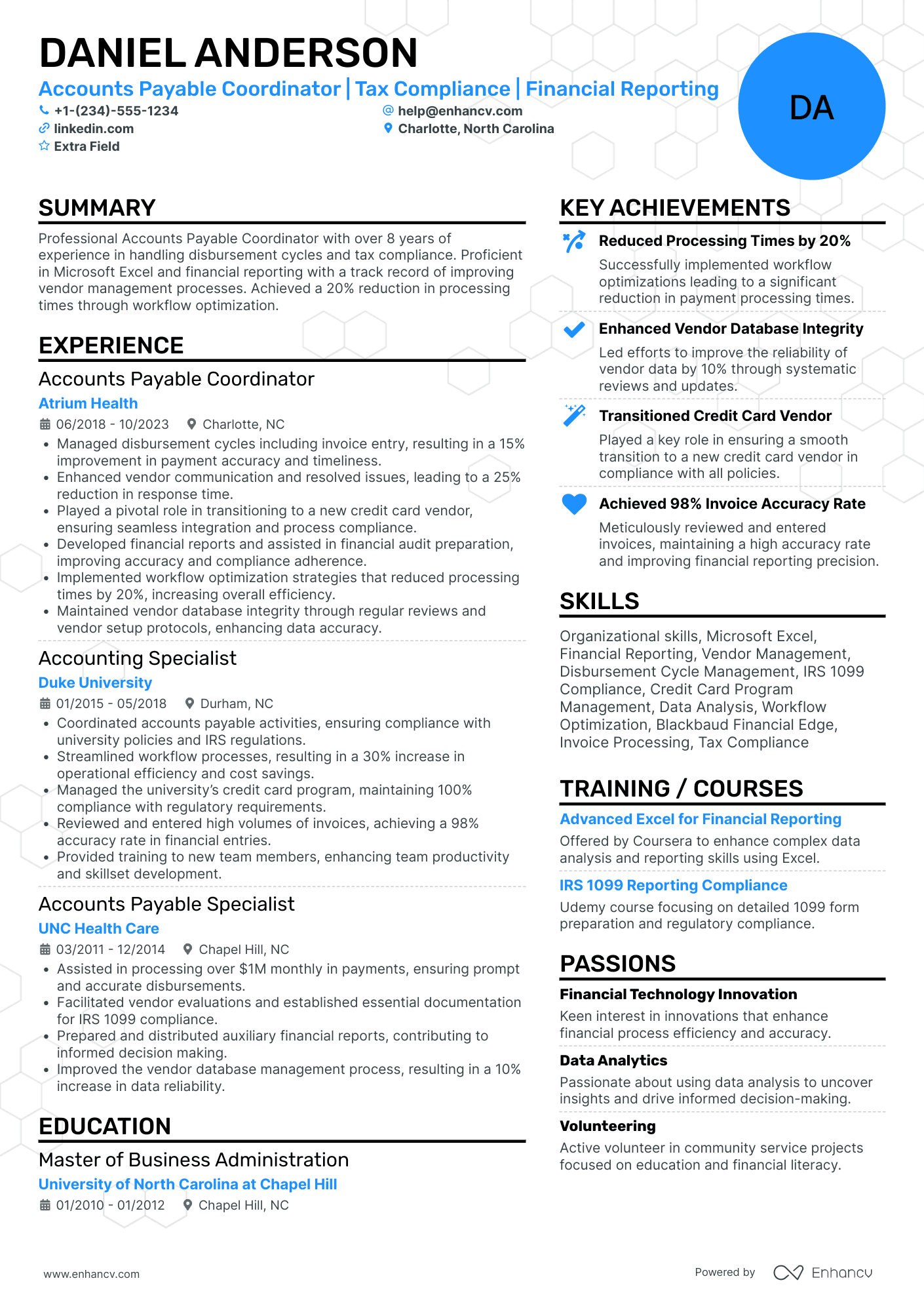

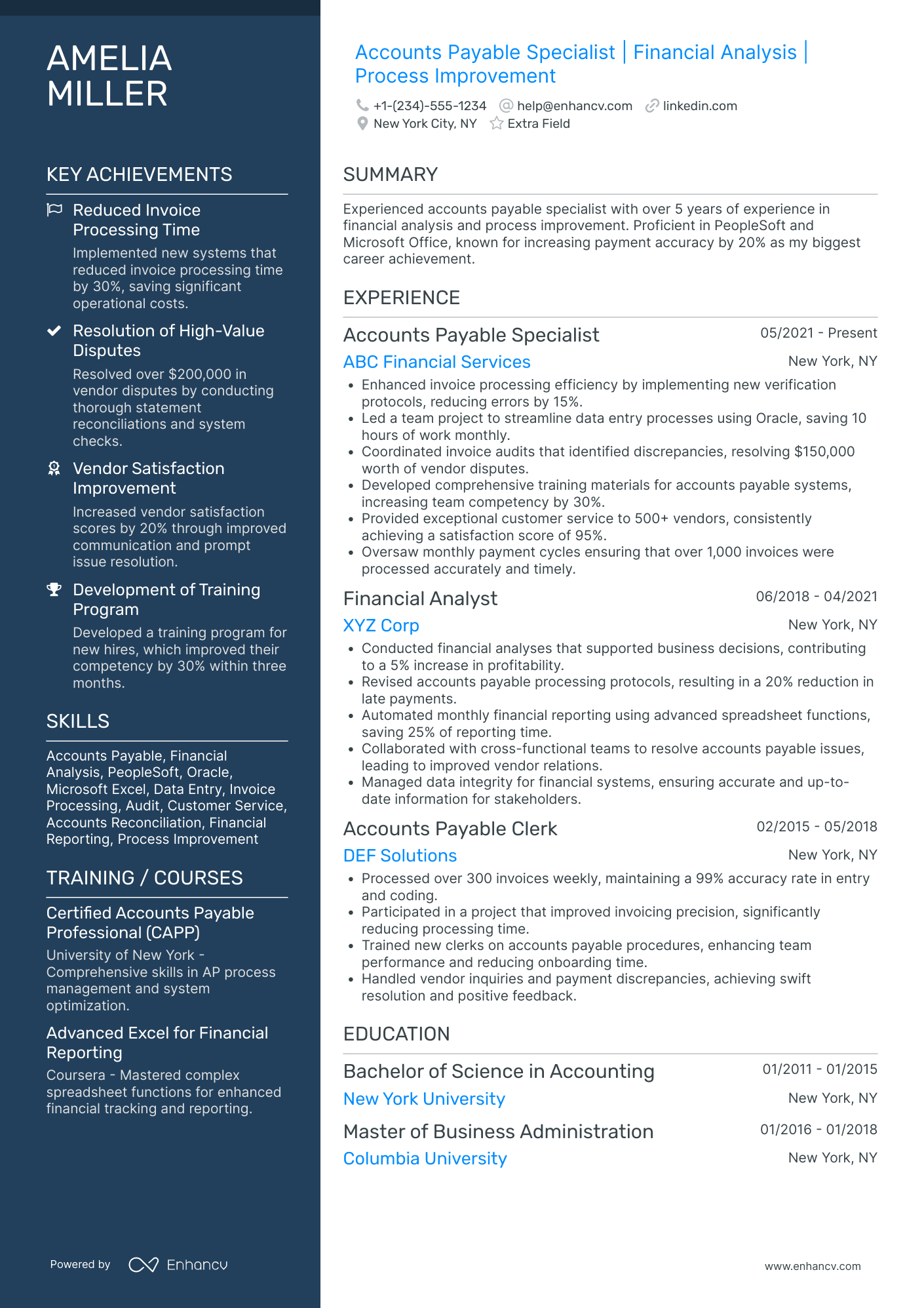

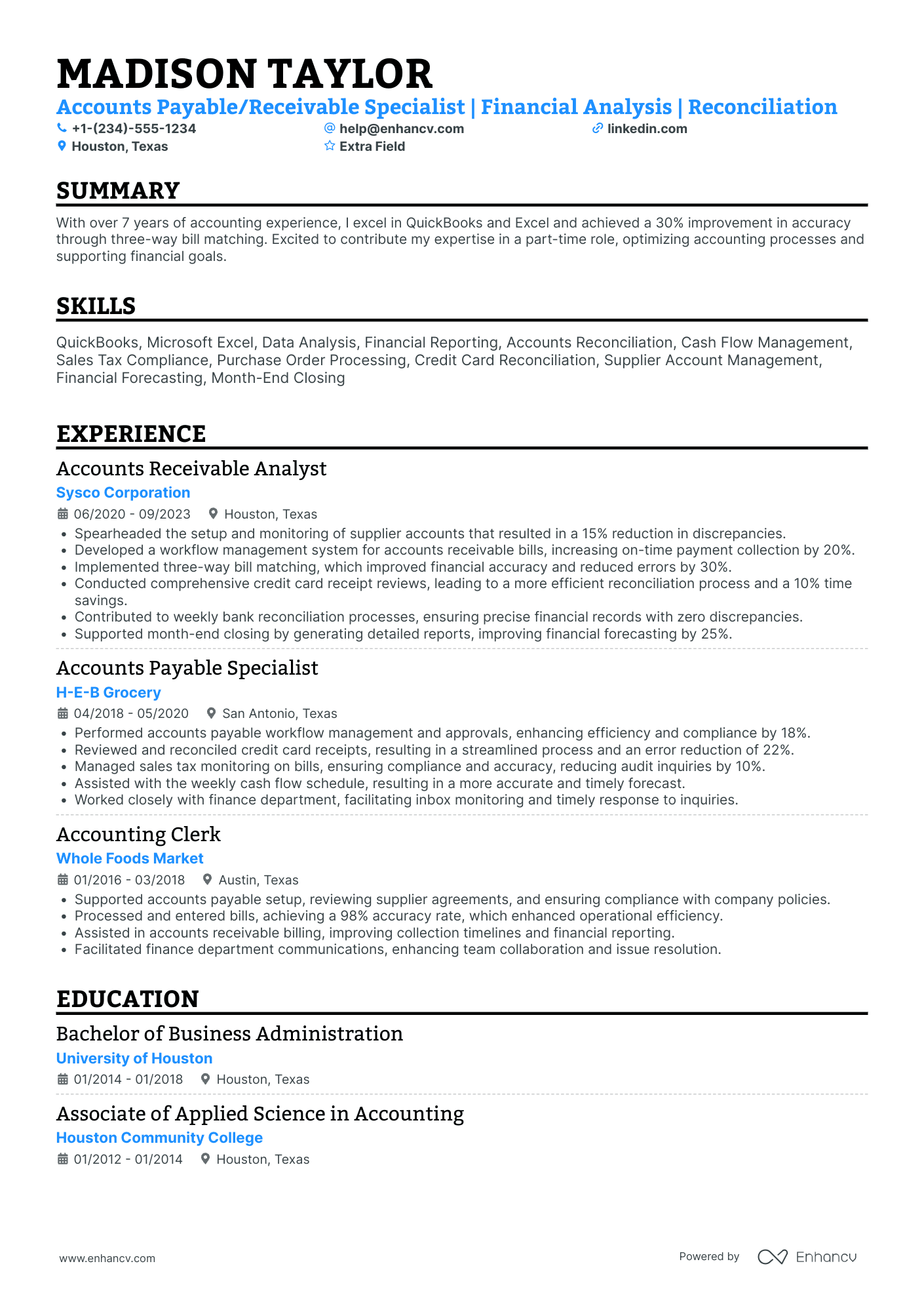

First, start by choosing the right resume format. Generally, you’d want to go with the hybrid (combination) format, as it allows you to display your chronological work history and specific skills and achievements. This versatile format enables you to highlight various aspects of your career—your expertise in managing payables, your knack for negotiating payment terms, and your proficiency in using finance software.

There are two more resume formats to consider. The reverse-chronological resume, for instance, is perfect for those with a substantial background in accounts payable and focuses on your career progression. Conversely, the functional resume emphasizes your skills and is particularly suitable for those new to the field or looking to pivot into accounts payable from another career.

Think about the market’s preferences – a Canadian resume, for instance, could have a different layout.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Accounts payable resume design and layout

Now, it’s time to present your skills and experiences in a way that's as clear and orderly as the work you do. Consider these tips for a resume that stands out for the right reasons.

- Create an informative header: Your resume header should include your full name, your professional title (e.g., Senior accounts payable Manager), and essential contact information — phone number, email address, and possibly a LinkedIn profile. If you have any professional certifications, such as a Certified accounts payable Professional (CAPP) designation, consider including this to bolster your credentials.

- Maintain an organized layout: Use professional fonts like Times New Roman for a traditional look, or choose a sans serif font like Arial, Rubik, Lato, or Calibri for a modern feel, ensuring legibility with a font size no smaller than 10 pt. Leave enough white space by setting margins at a minimum of 1 inch—this prevents your resume from looking cramped and facilitates readability.

- Minimize graphic elements: The financial sector tends towards conservatism in resume presentation, similar to the legal field. Avoid photos and icons, which could introduce bias or complicate ATS processing. The ideal resume template should prioritize clarity, organization, and professionalism, reflecting precision and attention to detail.

- Proofread thoroughly: Accuracy is non-negotiable in accounts payable roles, and your resume should reflect this. A careful review for typos and errors ensures professionalism and demonstrates your attention to detail.

- Opt for PDF format: Saving your resume as a PDF preserves your formatting across different devices and platforms, ensuring potential employers see your resume exactly as you intended. Name your resume file clearly with your name, job title, and use the word "resume" (e.g., JaneDoe_AccountsPayableSpecialist_resume.pdf).

This approach combines traditional elements with an understanding of modern hiring practices.

Now, look at the resume sections you’ll need to prioritize in order to appeal to recruiters and prospective employers.

The top sections on an accounts payable resume

- Professional summary: Summarizes skills and experience, showing you're right for the role.

- Finance experience: Details specific job roles and achievements to highlight expertise.

- Key skills in accounts payable: Lists specialized skills like invoice processing and financial software proficiency.

- Education and certifications: Shows relevant educational background and any certifications in finance or accounting.

- Software proficiency: Highlights experience with accounts payable and accounting software, critical for efficiency.

Here’s what hiring managers will be on the watch for:

What recruiters want to see on your resume

- Attention to detail: Critical for accurately processing invoices and avoiding financial discrepancies.

- Experience with accounting software: Shows you can efficiently manage payables within the company's system.

- Time management: Essential for meeting payment deadlines and managing multiple accounts simultaneously.

- Knowledge of accounting principles: Ensures you understand the financial implications of accounts payable processes.

- Communication skills: Important for coordinating with vendors and internal teams to resolve payment issues and discrepancies.

Next, let’s move on to the longest part of your resume—the experience section.

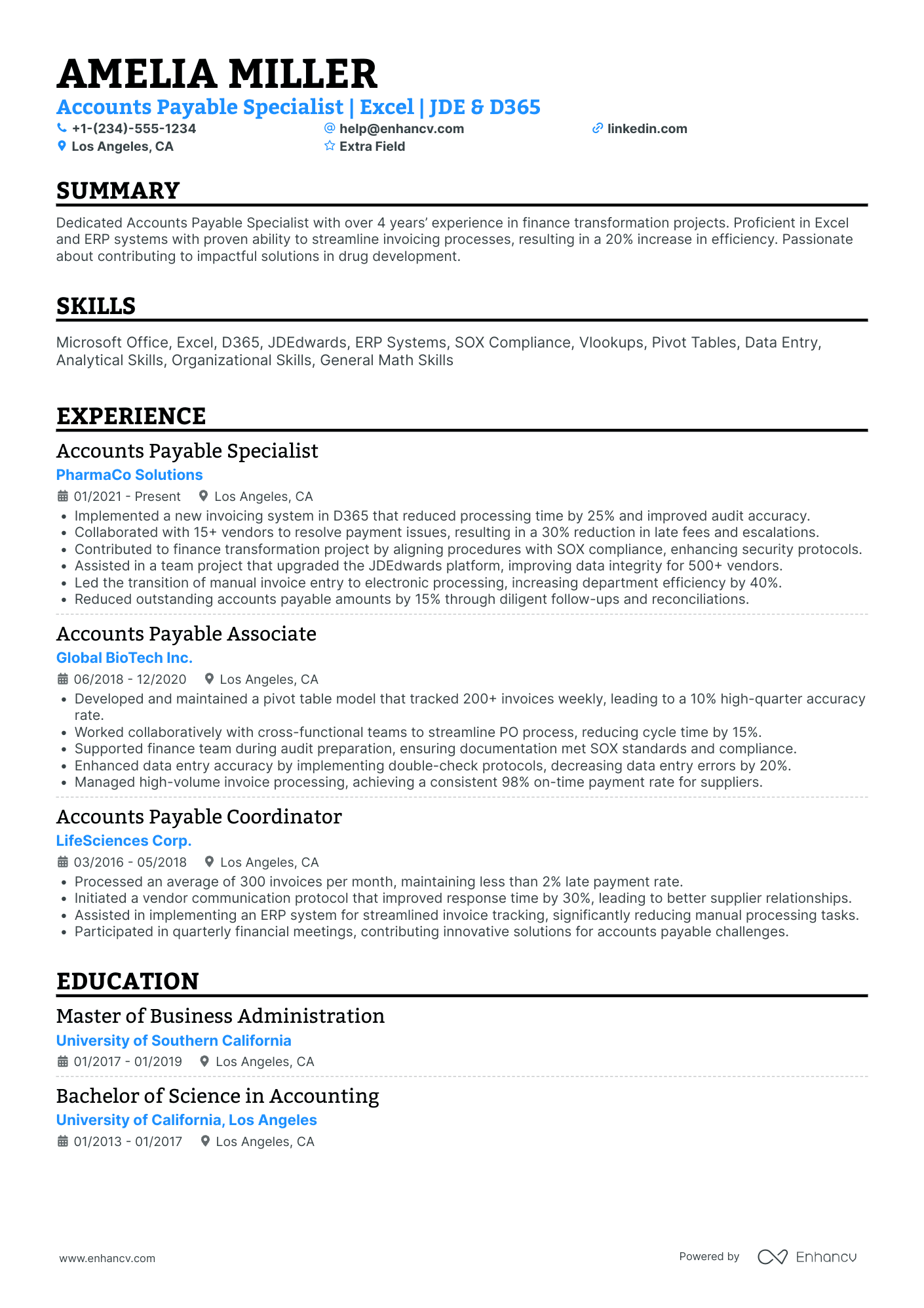

How to write your accounts payable resume experience

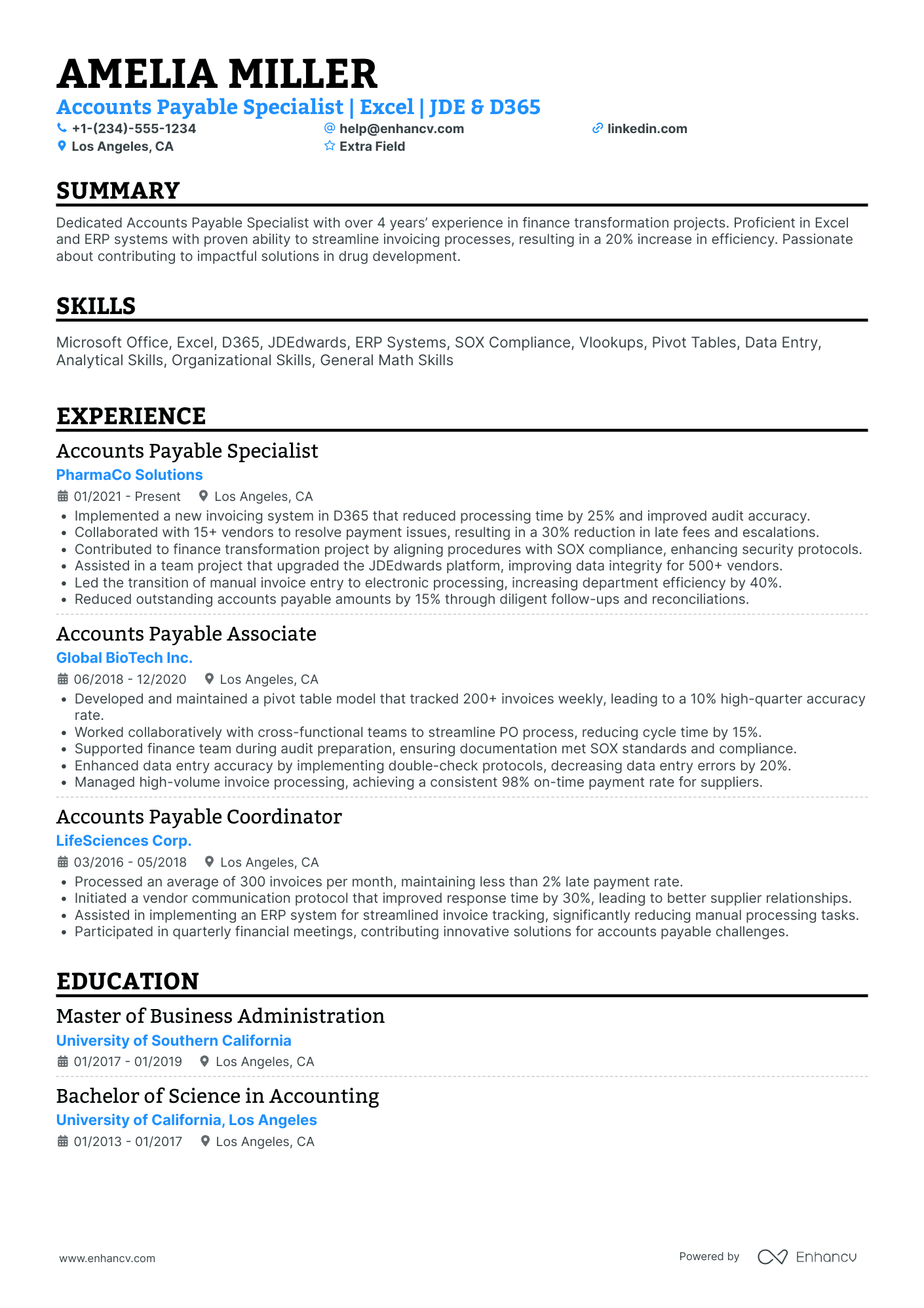

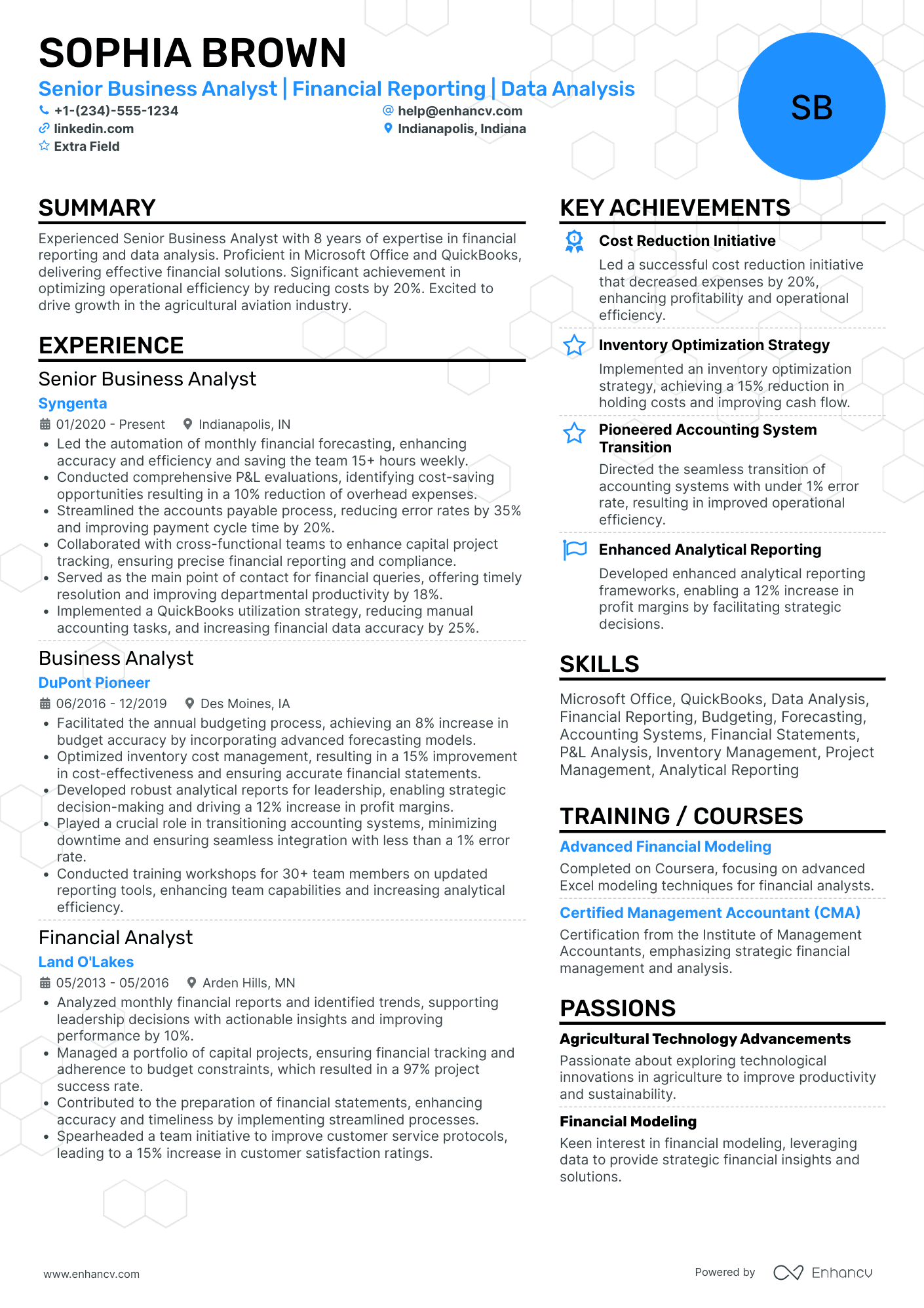

In your AP resume, especially in the experience section, move beyond just listing tasks and duties. You need to present your experiences in a way that highlights not just what you did, but how you thought about and approached your role. Here’s what you should consider:

- Define your most relevant experience. In this section, include only those aspects of your work history that align with what your future employer is looking for. Do it by carefully studying the job description for the role you’re targeting and making sure you have the same keywords in your resume.

- Tailor your experience section to each specific job. For example, if you’re transitioning from healthcare to retail, it's crucial to identify and highlight the transferable skills and relevant certifications. In this case, a targeted resume might be your best choice.

Let’s compare two examples of an AP resume experience.

- •Processed a high volume of invoices monthly with a high accuracy rate, leading to improved financial benefits.

- •Managed regular reconciliations for numerous vendor accounts, significantly reducing discrepancies and enhancing process efficiency.

- •Improved team communication, resulting in faster invoice processing and increased satisfaction among vendors.

While showcasing the candidate’s achievements, these bullet points lack specificity. They’re just broad statements without concrete examples. To enhance their effectiveness, the candidate needs to incorporate specific metrics that would make the resume more compelling and provide a clearer picture of their capabilities.

Here’s the revised version:

- •Processed over 500 invoices per month, maintaining a 98% accuracy rate in alignment with internal and tax compliance, leading to a 5% increase in cash discounts captured within the first year.

- •Coordinated and executed monthly reconciliations for 200+ vendor accounts, reducing outstanding reconciliation items by 75% and improving the reconciliation process completion rate from 85% to 99% within six months.

- •Enhanced inter-departmental communication, which streamlined the invoice processing cycle by 30%, and successfully resolved 150+ vendor queries monthly, improving vendor satisfaction scores by 20%.

Why it works:

- Quantified achievements: Each point includes specific figures, such as processing over 500 invoices monthly with a 98% accuracy rate, and improving cash discounts by 5%. This approach makes the accomplishments measurable and more credible.

- Action verbs: The use of strong action verbs like processed, coordinated, and enhanced conveys a sense of responsibility and action, and indicates the candidate's proactive approach to their role.

- Job-specific keywords: Terms like tax compliance, reconciliation, inter-departmental communication, and invoice processing cycle are relevant to the field. This not only demonstrates the candidate's familiarity with industry-specific practices but also ensures smooth ATS processing.

This enhanced resume experience example will be more compelling to potential employers compared to the first version. If you're aiming to create a similarly persuasive resume, stay tuned for the following section in which we’ll explore strategies for quantifying your performance and communicating these achievements on your resume.

How to quantify impact on your resume

When drafting your experience section, think about your unique contributions to the employers’ goals, whether through cost savings, efficiency gains, risk reduction, and/or team development. Then, provide concrete measures of your success.

Here’s what you can do in your AP resume:

- Include the average number of invoices processed per month to demonstrate your capability to handle high-volume tasks efficiently.

- Specify the accuracy rate of invoice processing to highlight your attention to detail and commitment to accuracy in financial documentation.

- Mention the percentage of cash discounts captured due to timely payments, showcasing your ability to contribute to cost savings.

- Detail the reduction in outstanding reconciliation items, indicating your problem-solving skills and ability to maintain accurate accounts.

- Note the improvement in the reconciliation process completion rate, reflecting your efficiency in managing and completing tasks.

- Quantify the reduction in the invoice processing cycle time to show your effectiveness in streamlining operations and improving workflow.

- State the number of vendor queries resolved monthly, illustrating your communication skills and dedication to maintaining positive vendor relationships.

- Highlight the increase in vendor satisfaction scores, demonstrating your impact on external stakeholder relationships and service quality.

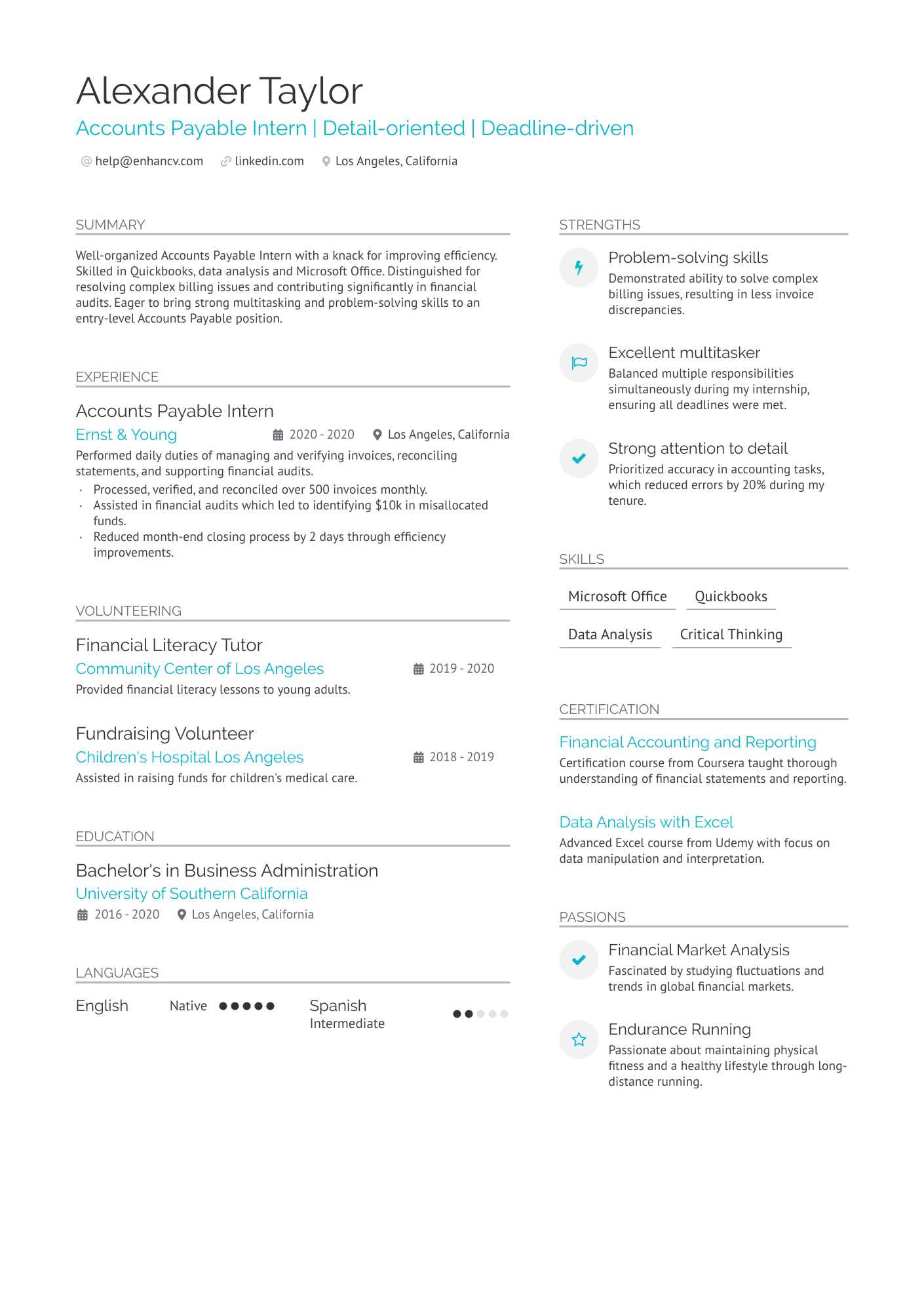

How do I write an AP resume with no direct experience

A recent article published on the Randstad USA blog points out: “If you're seeking a fulfilling entry-level role in the accounting field, consider becoming an accounts payable specialist. This profession provides a competitive salary and prospects for growth. You'll work indoors, collaborate with a team of professionals, and enjoy a regular "9 to 5" weekday schedule.”

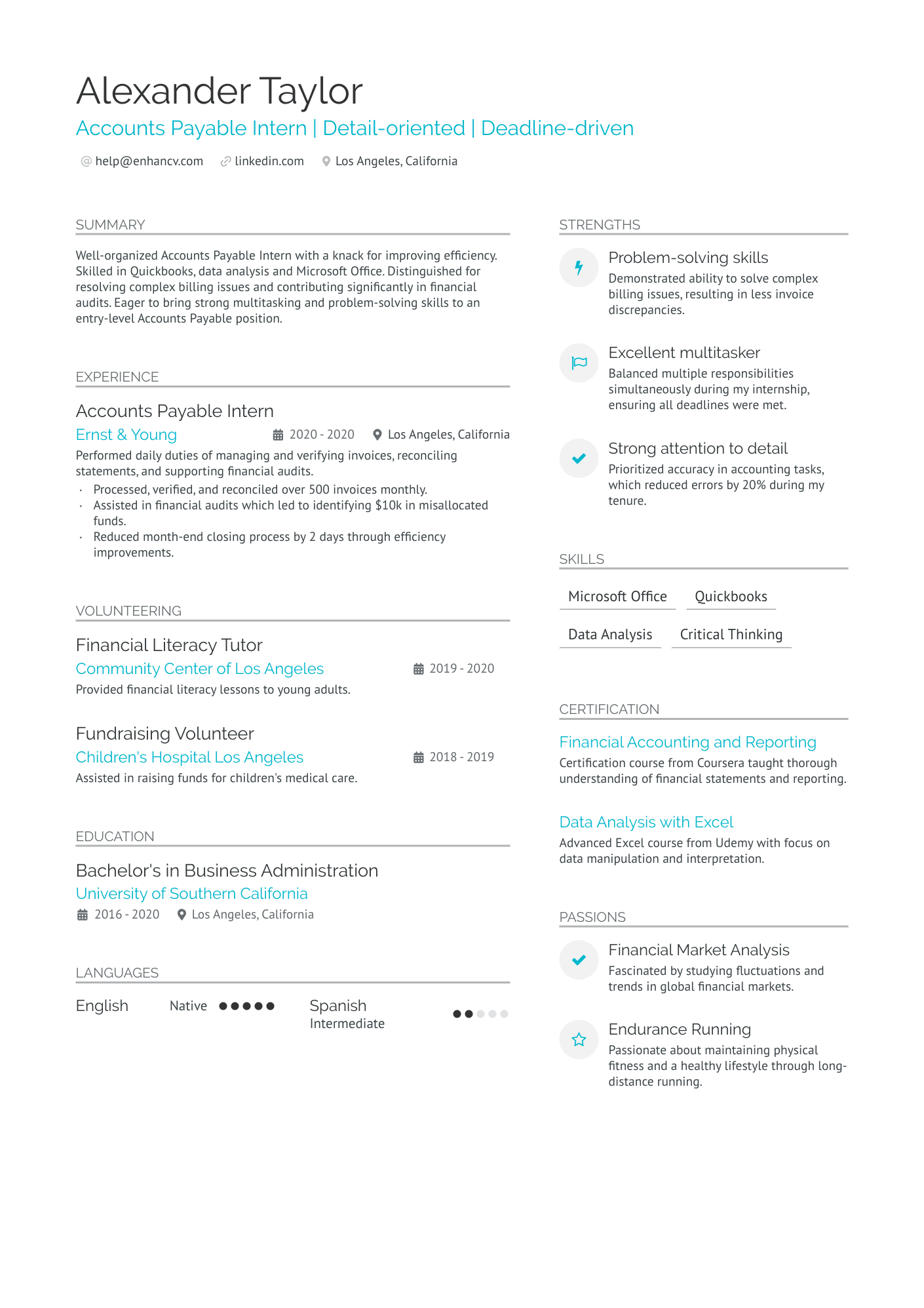

It’s easy to see why junior job seekers would be attracted to accounting. However, building a compelling entry-level resume requires a strategic approach that emphasizes transferable skills, adaptability, and potential. Here’s your best approach:

- Highlight transferable skills: Focus on skills that are relevant across various industries, such as communication, problem-solving, project management, and teamwork. These skills demonstrate your capability to adapt and excel in new environments.

- Leverage educational background: If you’re a first-time job seeker, your education can provide insights into your areas of knowledge and interest. Include relevant courses, projects, and achievements that align with the job you’re applying for.

- Include non-traditional experience: Volunteer work, internships, part-time jobs, and extracurricular activities can all showcase your skills, work ethic, and commitment. Describe these experiences in a way that highlights your contributions and what you learned.

- Focus on achievements and outcomes: Instead of listing tasks, concentrate on what you achieved in your roles and how you made a difference. Use numbers and data to quantify your impact where possible just like we showed you in the previous section.

- Use a functional resume format: This can be beneficial for those with less direct experience or gaps in their employment history.

- Objective statement: Resume objectives are perfect for people with less than 3 years of experience. They can articulate your career goals and how your unique blend of skills and education makes you an ideal candidate for the position.

- Optimize for ATS: Run your resume through the Enhancv resume checker to ensure your document passes through ATS filters.

Those of you aiming to progress in accounting will certainly need to expand your skill set in order to impress recruiters. Below, we’ll discuss why this is important and what you can do.

How to list your hard and soft skills on your resume

According to a MineralTree article, as technology automates manual tasks, AP professionals will shift focus from day-to-day operations to strategic roles in interpreting data and advising on cash flow and supplier relationships.

This only goes to show that to avoid competition with automation and AI, accounts payable specialists must continually prove their proficiency in the required technologies and their adaptability to new trends.

First, take a look at some of the most popular technical skills that an AP expert should have to be considered for an interview.

Best hard skills for your accounts payable resume

- Accounts payable processes

- Financial reporting

- Invoice processing

- QuickBooks

- SAP

- Oracle Financials

- General ledger management

- Cash flow management

- Vendor management

- Payment processing

- Reconciliation procedures

- Microsoft Excel

- Expense reporting

- Compliance auditing

- ERP systems

- Tax filing

- Accounts receivable

- Bookkeeping

- Data entry accuracy

- Financial software applications

Interpersonal skills shouldn’t be overlooked in favor of hard skills. As mentioned previously, strategic thinking and an analytical mindset can be invaluable assets in the accounts payable field.

Best soft skills for your accounts payable resume

- Communication skills

- Time management

- Problem-solving

- Adaptability

- Attention to detail

- Teamwork

- Organizational skills

- Critical thinking

- Conflict resolution

- Negotiation skills

- Customer service orientation

- Ethical judgment

- Stress management

- Initiative

- Empathy

- Leadership

- Patience

- Decision-making

- Interpersonal skills

- Analytical mindset

When deciding which skills to feature on your resume, refer back to the job description and include those that are explicitly mentioned there. Although listing your hard skills in a dedicated section is standard practice, the same doesn’t apply to your soft skills.

A resume shouldn’t exceed one page, so for the sake of space, distribute your strengths throughout the different sections of your resume and provide concrete evidence for each.

Next, let's discuss your educational background and professional certifications.

How to list your education and certifications on your resume

When listing education and certifications on an accounts payable resume, it's crucial to present the information clearly and concisely to showcase your qualifications effectively. Here are some tips you can use:

- Start with your most recent educational achievement: List your education in reverse chronological order, starting with the most recent degree or certification.

- Include relevant details: For education, this may include your degree, major, the institution you attended, and graduation date. If you’re a recent graduate or if you took courses directly relevant to accounts payable, listing these can demonstrate your knowledge and skills.

- Omit high school education if you have a college degree: If you’ve completed a higher education degree, there’s no need to include your high school information. Save this space for industry-specific training.

- Mention knowledge of financial principles: Understanding and adhering to financial regulations and standards (such as GAAP, IFRS, etc.) is crucial in accounts payable roles. Mention any courses, certifications, or training you've completed related to these regulations.

Here’s how your AP education section can look:

- •Relevant coursework: Advanced Financial Accounting, Cost Accounting, Auditing Principles, Corporate Finance

- •Completed intensive GAAP training, focusing on standards, principles, and procedures of generally accepted accounting principles

Certifications on a resume can significantly enhance your profile by showing your commitment to your profession and your expertise. Include any that are directly relevant to the field. Below are some of the most in-demand accounting certificates.

Top certifications for your accounts payable resume

How to write your accounts payable resume summary or objective

In your resume summary for an accounts payable position, you’ll want to give a quick snapshot of your experience and skills. Within these 3-5 sentences, talk about how you've efficiently handled invoices and payments, worked smoothly with vendors, and your knack for keeping things running smoothly.

Don't forget to mention your comfort with accounting software – it’s a great way to show you’re ready to jump right in and start making a difference in an accounts payable department.

Let’s look at two examples, a good and a bad one.

This summary is clearly not effective because it lacks specificity and quantifiable achievements, making it difficult for employers to grasp the candidate's actual impact. It uses vague descriptions like "several years of experience" and "general knowledge," and fails to differentiate the candidate from others.

Let’s focus now on the improved version.

What do we like here?

- Certification and experience: The mention of a CAPP certification and over 5 years of experience immediately establishes the candidate's credibility and specialized knowledge in the accounts payable field.

- Specific skills: Proficiency in industry-standard software software is highlighted.

- Quantifiable achievement: The specific achievement of reducing invoice processing time by 30% shows the candidate's impact on efficiency and productivity, making the summary results-oriented.

- Soft skills: Mentioning a collaborative approach and strong analytical skills underscores the candidate's ability to work well in team settings and their capacity to contribute to the financial and operational success of an organization.

- Choice of words: Using strong descriptive words like expertise, notable, strong, and enhancing shapes the professional image of the candidate

If you’re new to the field, consider crafting an objective statement instead of a summary. Objectives are similar yet shorter and more focused on your goals. In your resume objective, include:

- A brief overview of your career goals, aligning your strengths with the employer’s needs.

- A quick mention of key skills from past experiences, using keywords from the job description.

- A compelling value proposition that highlights your fit with the company’s mission and values.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

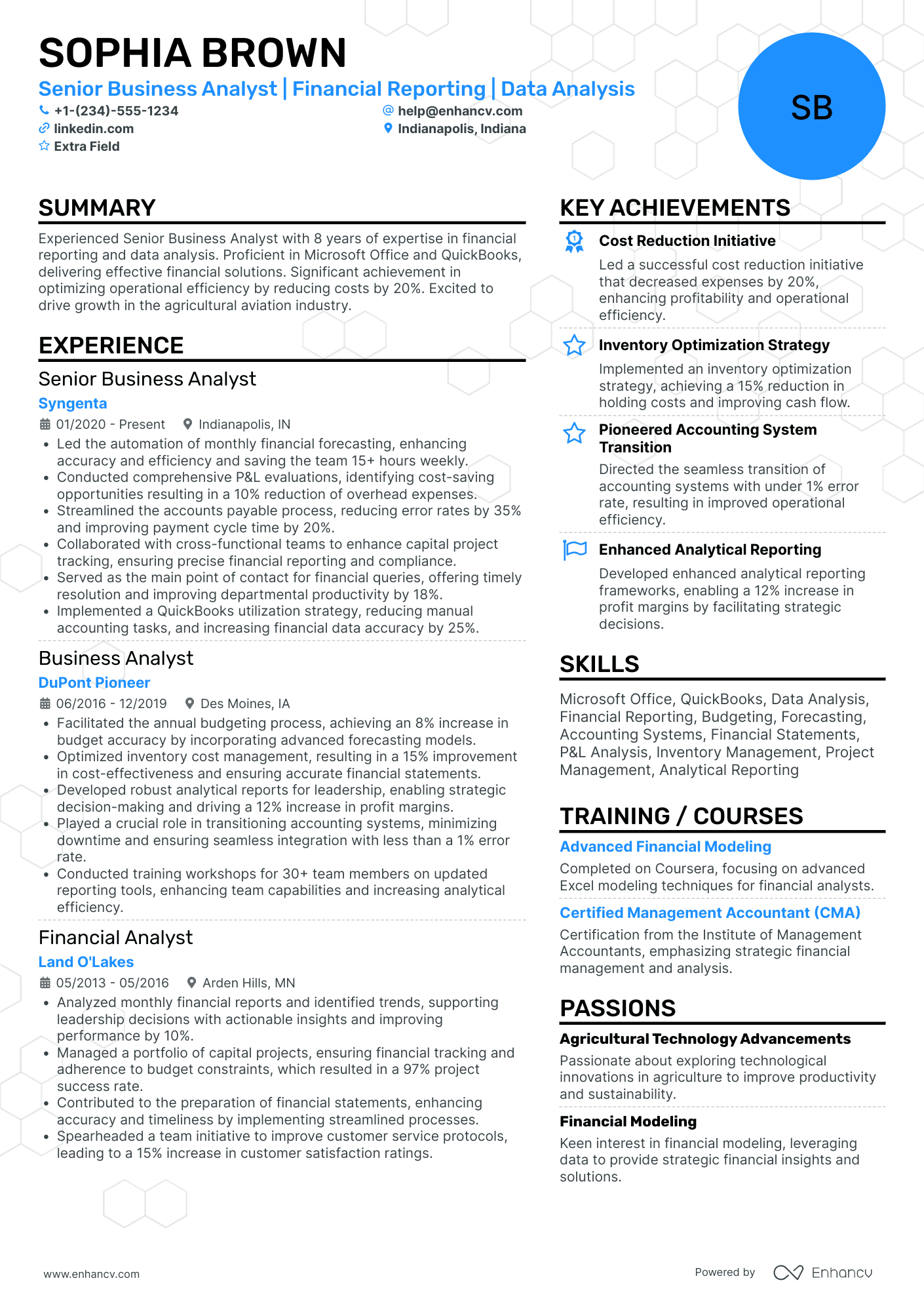

Additional sections for an ap resume

Adding specific sections to an AP resume can provide a more comprehensive view of your capabilities and experiences. Here are some examples:

- Projects: Project-based work, especially in accounts payable, often involves cross-departmental collaboration, problem-solving, and strategic planning. Describe significant projects you've contributed to in order to illustrate your ability to work in teams, manage tasks, and achieve results.

- Continuing education: If you have taken part in workshops, seminars, or courses relevant to accounts payable or finance, listing these can prove your initiative in furthering your knowledge and skills beyond formal education.

- Professional memberships: Membership in professional organizations (e.g., The Institute of Financial Operations) indicates your commitment to staying current with industry trends and best practices. It can also suggest a level of professionalism and a network of peers.

- Hobbies and interests: These can provide evidence that you’re a well-rounded individual and can subtly highlight skills relevant to the job. Plus, your interests can signal to an employer that you’ll fit in with the company culture, whether it’s a fast-paced start-up environment or a corporation with a commitment to community service.

- Languages: If you speak multiple languages, highlight them in a separate section to showcase your adaptability, cultural awareness, and readiness to thrive in a global environment.

Key takeaways

Crafting an impactful accounts payable resume is about blending your technical skills and achievements with a dash of personal flair. The goal is to present yourself not just as a skilled AP professional, but as a well-rounded candidate who brings value beyond just the technicalities of the job.

Here are some key points to take away:

- Prioritize clarity and detail: Choose the right resume format to highlight your skills, achievements, and career progression.

- Showcase technical proficiency and soft skills: Balance your expertise in accounting software and processes with interpersonal skills that enhance team dynamics.

- Quantify your achievements: Use specific metrics to demonstrate your impact on efficiency, cost savings, and operational improvements.

- Highlight relevant education and certifications: These add credibility and underscore your commitment to the field.

- Incorporate a personal touch: Including sections on hobbies, interests, and languages can offer a glimpse into your personality and potential cultural fit.

- Tailor your resume: Customize your resume for each job application, ensuring it resonates with the specific requirements and keywords mentioned in the job description.

Accounts Payable resume examples

By Experience

By Role