You know how to build complex models, pitch deals, and survive 80-hour work weeks—but writing your investment banking resume? That’s a different beast.

Whether you’re chasing your first analyst role or aiming for a jump to a top-tier firm, your current resume might not reflect the full weight of what you do. And in a field where every detail is scrutinized, a generic resume won’t cut it.

The good news is you don’t need flashy language—you need precision. This investment banking resume example and guide, built with Enhancv’s expert-backed tips, shows you exactlyhow to craft a resumethat’s sharp, ATS-friendly, and interview-worthy.

Key takeaways

- Quantify your impact with deal values and modeling contributions to set your resume apart in a highly competitive field.

- Tailor your resume to each IB role—generic bullet points won’t pass recruiter or ATS scrutiny.

- A clear, reverse chronological format with strong section order helps communicate experience and progression instantly.

- Include certifications, technical tools, and relevant training to reinforce your credibility, especially at junior levels.

- With Enhancv, you can build a sharp, customized investment banking resume that highlights your value from the first glance.

Ready to turn your resume into a high-performing asset?

Here’s a sample that gets the valuation right.

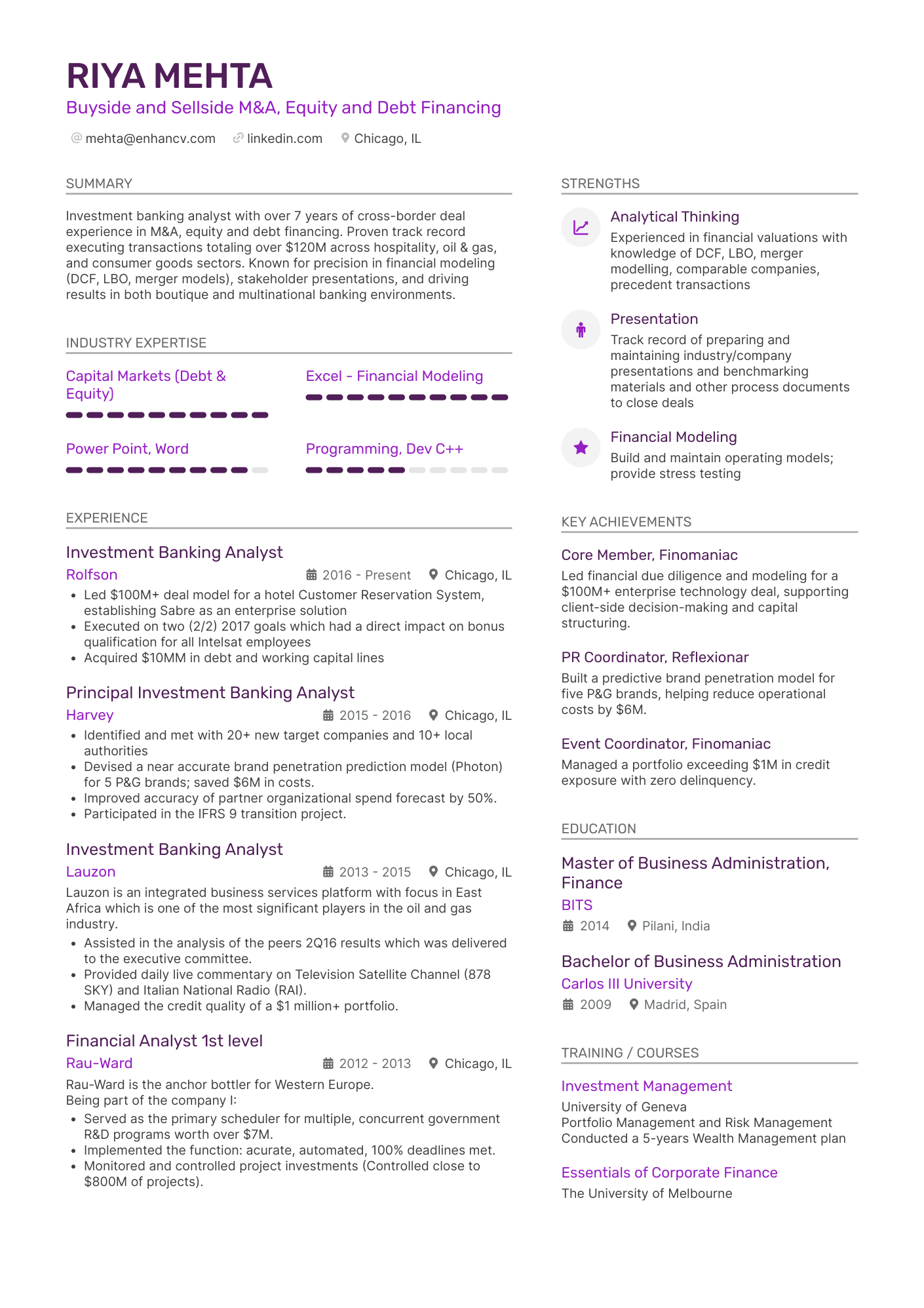

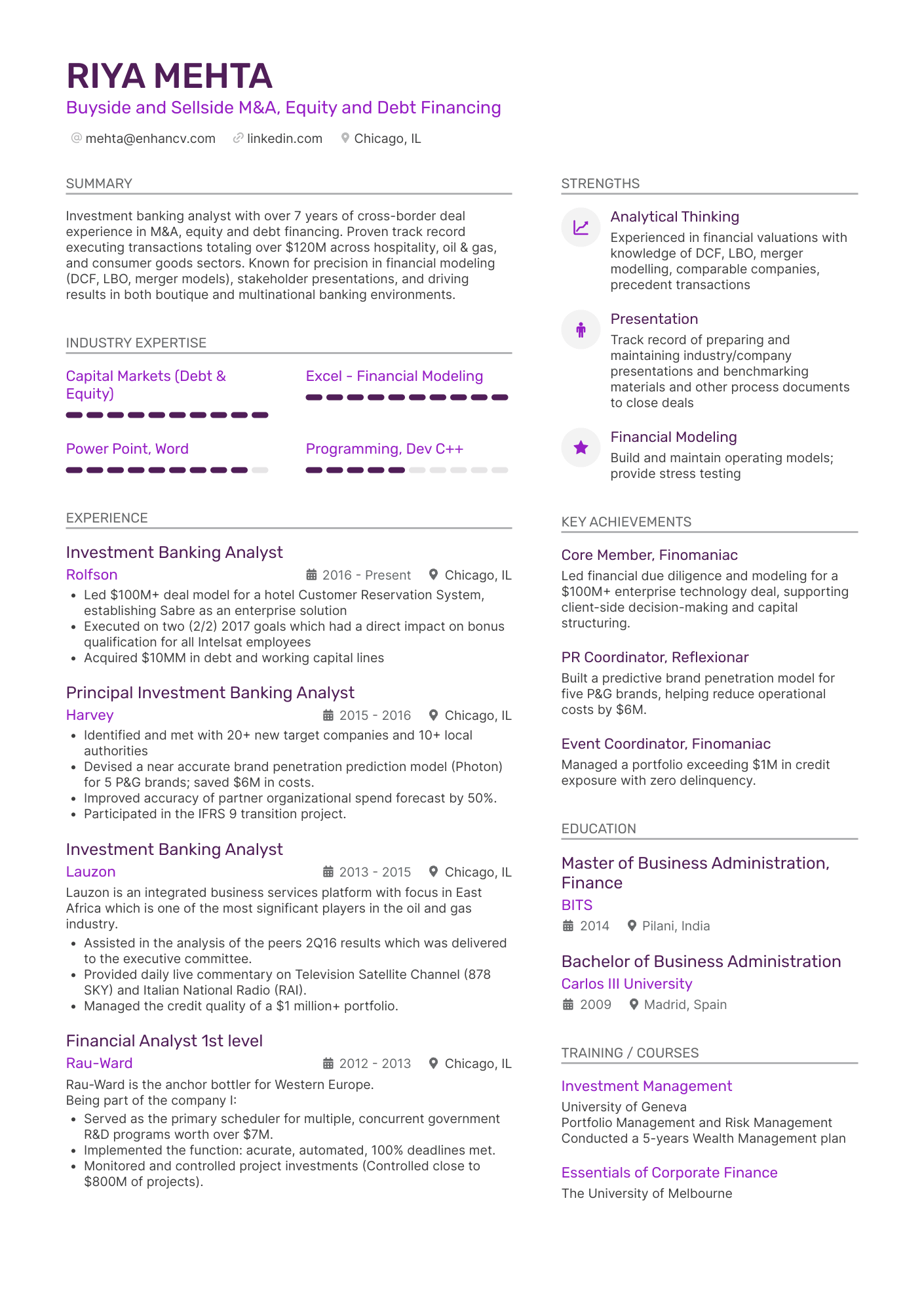

Investment banking resume sample

The example below is tailored for an entry-to-mid-level investment banker with a growing client-facing role.

Use it as a structure for your own resume: the layout, phrasing, and section order are all built to highlight the kind of high-impact, detail-driven approach banks want to see.

Michael Chen

Investment Banker | Product Strategist

(XXX) XXX-XXXX | chen@enhancv.com | @LinkedIn | New York, NY

Summary

Detail-oriented investment professional with 2 years of experience supporting strategic growth initiatives in financial markets. Proven ability to synthesize complex data into actionable insights, automate analytical workflows, and support cross-asset product development. Adept at communicating technical solutions in plain language and collaborating across structuring, trading, and research teams.

Experience

Investment Strategy Analyst

Franklin Advisory Partners | New York, NY

Jul 2022 – March 2025

- Collaborated with research and portfolio teams to develop backtested investment strategies across equities and multi-asset portfolios, contributing to a 12% YoY increase in structured product sales.

- Built and maintained internal models for scenario analysis and performance attribution, accelerating pricing turnaround time by 40% for custom client requests.

- Supported client relationship managers by preparing custom presentations and market updates, helping retain $300M+ in institutional assets under management.

- Automated weekly reporting using Python and Excel, reducing manual effort by 15 hours per week and improving data accuracy by 30%.

- Partnered with fixed income and derivatives desks to price structured notes, leading to the successful launch of 5 new cross-asset products in Q1–Q3 2023.

Financial Markets Intern

BMO Capital Markets | New York, NY

Summer 2021

- Modeled option strategies based on historical data and volatility projections, improving desk visibility on hedging scenarios and saving an estimated $50K in modeling overhead.

- Contributed to 6 client pitch decks featuring equity-linked products, 3 of which resulted in successful transactions worth over $100M.

- Analyzed ETF flow data and competitor activity to support investment theses, enabling senior analysts to adjust sector positioning ahead of Q3 2021.

Education

BSc in Business, Concentration in Finance & Data Science

New York University – Stern School of Business

Graduated: May 2022

Certifications

- CFA Level I Candidate – Exam scheduled December 2025

- Bloomberg Market Concepts (BMC) – Completed 2023

Skills

- Financial Modeling & Backtesting (Python, Excel, GS Tools)

- Equity & Fixed Income Product Knowledge

- Derivatives Pricing & Scenario Analysis

- Presentation Design (PowerPoint, Tableau)

- Agile Project Management

- Client Communication & Stakeholder Engagement

Languages

- English – Native

- Mandarin Chinese – Professional Working Proficiency

With Enhancv’s Resume Builder, you can create something as structured and polished as this sample in just minutes. But if you’d rather build it from the ground up, the sections below will walk you through how to craft an investment banking resume that meets the highest standards recruiters expect on the Street.

How to format an investment banking resume

The best format for an investment banking resume is reverse chronological, as it highlights your most recent and relevant deal experience and clearly shows your progression through high-performance roles.

This layout also aligns with what recruiters and applicant tracking systems (ATS) expect to see—especially in high-stakes industries like banking, where structure and clarity are non-negotiable.

To keep your resume clean and recruiter-friendly, follow this order:

- Contact information

- Professional summary or objective

- Work experience

- Education

- Certifications

- Skills

- Optional sections like Languages

The combination resume format can work well too—particularly if you’re pivoting from a different finance role or you want to emphasize technical skills like modeling or Python. It blends a skill-focused summary with a chronological work history, helping showcase both your capabilities and your upward trajectory—key in roles where growth matters.

Formatting your contact information

Your resume header should be clean, minimal, and easy to scan—no logos, no graphics, and definitely no clutter.

Include the following:

- Full name: Use the professional version you go by on LinkedIn and in formal settings.

- Job title or headline: Either your current title or the one you’re targeting. Be specific and strategic.

- Phone number: Double-check the area code and make sure it’s a number you actively monitor.

- Location: City and state is enough, especially if you're based in a financial hub like New York, Chicago, or San Francisco. No need for a full street address.

- LinkedIn profile link: Include a custom URL if possible (e.g. linkedin.com/in/michael-chen). Your profile should mirror your resume, especially in terms of job titles, skills, and achievements.

- Professional email address: Ideally a personal Gmail account (not your school or company email).

PRO TIP

If you're applying for internships or entry-level roles, it's okay to use your .edu email—especially if it's the one recruiters already have from on-campus events or info sessions. Just make sure it’s active and professionally formatted (e.g. firstname.lastname@school.edu)

Finally, skip the photo. Investment banking is not a photo-on-resume kind of industry—unless you’re applying internationally and it’s required, it’s best to leave it off.

Resume design tips for investment banking roles

In conservative fields like banking, your layout should be lean, structured, and compact.

The following rules will help you create a polished, recruiter-friendly resume that’s easy to read—both by humans and applicant tracking systems

- Keep margins between 0.5–1 inch for a tidy, readable resume.

- A traditional, one-column template best fits the industry’s no-fluff expectations.

- Stick to professional fonts like Arial, Lato, or Garamond, sized 10–12 pt.

- Avoid too much color unless using a subtle accent in section headers—this isn’t the place for bold branding.

- Keep it to one page, unless you’re at the VP level or higher with extensive transaction history.

PRO TIP

Investment banking roles receive thousands of applications—especially for analyst and associate positions at bulge bracket and elite boutique firms. ATS software is standard across the industry, not just to streamline hiring across multiple teams, but to screen for keywords.

That said, don’t stress over formatting “breaking” the system. The idea that certain fonts or design choices block ATS parsing is outdated. Instead, focus on using the right keywords from the job description and framing your experience with clarity and intent.

File format

When saving your resume:

- Use a clear, professional file name like “Michael_Chen_Investment_Banking_Resume.pdf.”

- Always save as a PDF unless the job posting specifically requests Word or another format.

- Review carefully for formatting glitches and typos—attention to detail is a given in banking, and one error can make a lasting impression (not the good kind).

Want to know how your current resume stacks up against real ATS software? Use the Enhancv Resume Checker to get actionable insights and a free score—before it ever hits a recruiter’s desk.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now that your layout is clean and recruiter-ready, it’s time to focus on the most scrutinized part of any investment banking resume: your experience.

How to write your investment banking resume experience

Your experience section isn’t just a list of jobs—it’s where you prove your value through results, deal exposure, and technical skills.

Let’s break down how to craft experience bullets that speak the language of bankers.

How to structure the experience section

- When deciding how far back to go, focus on the last 10–15 years and prioritize roles directly relevant to the position you’re targeting.

- If applicable, include the group or coverage area (e.g., Equity Capital Markets, M&A – Industrials) to add context and credibility.

- Limit each role tothree to five bullet points that highlight your most impactful contributions—think deals supported, tools used, and measurable outcomes.

- Focus on deal-related responsibilities and technical tasks. Think: backtesting, client presentations, or liaising with structuring teams.

- Consider using the STAR method to frame your achievements, and begin each bullet point with a strong action verb to emphasize your impact.

Next, you need to take care of tailoring your experience section for a specific investment banking role.

Why resume tailoring matters in banking

Tailoring your resume ensures you’re not just another candidate with “financial modeling experience.” Instead, you show hiring managers that your skill set aligns directly with what they need.

Here’s why it’s essential in a field this competitive:

- It proves you’ve read the job description and understand the expectations.

- It increases your chances of passing ATS filters by mirroring relevant keywords.

- It positions you as a strategic hire—not just someone applying to every open role out there.

The tips below will help you build your experience in a way that speaks directly to what the hiring manager—and the ATS—is looking for.

How to create a targeted experience section

- Review the job description line by line. Pay close attention to the responsibilities, technical skills, and tools mentioned.

- Highlight repeated keywords. Focus on industry terms, software, and soft skills that show up more than once.

- Match your past experience to those requirements. Look for overlap between your responsibilities and what the job is asking for.

- Write bullet points using targeted language. Be specific—include tools, methods, and outcomes that align with the role.

- Tailor your resume for each role you apply to.

We’ll take a real investment banking job description and show you how to translate its requirements into strong, targeted bullet points.

Investment Banking Associate: Mergers & Acquisitions

As an Associate in M&A you will be a key player in our business strategy and execution. You will participate in the "full cycle" of transactional execution including preparing marketing pitches, reviewing and formulating financial analysis, preparing and presenting internal committee memoranda and client presentations.

You will play a leadership role in implementing the execution function including working with analysts and associates, as well as assisting more senior bankers. You will develop strong function skills in the major areas of investment banking and will demonstrate the ability to become a senior officer who is capable of generating and executing their own transactions.

Responsibilities

- Develop content for strategic meetings with clients regarding M&A transactions.

- Interact with senior team members and client management teams on a daily basis to execute transactions and discuss strategic alternatives.

- Defining, guiding and reviewing detailed valuation analysis, including DCF, trading comparables, transaction comparables and LBO analyses.

- Defining, guiding and reviewing detailed combination and other financial analyses in the context of M&A transactions or pitch situations.

- Provide leadership, mentorship and supervision to associates and analysts.

Required qualifications, capabilities, and skills

- 3 years prior work experience in an investment banking front office role.

- Minimum Bachelor's degree from a top tier educational institution.

- Strong financial modelling skills.

- Understands transaction cycle and the steps in the process and is execution oriented.

- Self-directed, highly motivated, and able to work independently.

Here’s how the experience section looks once the key terms from the job description are thoughtfully woven in:

- •Reviewed and formulated financial analyses for 15+ transactions valued at over $18B, including buyouts, carve-outs, and strategic acquisitions across TMT and industrials.

- •Led over 25 strategic meetings with C-level clients and internal committees, contributing to successful execution of 7 closed deals ranging from $200M to $4.5B.

- •Guided a team of 4 analysts and supported senior bankers through all phases of execution, building detailed DCF, LBO, and comparable company models that informed $9B in deal structuring decisions.

See how the bullet points mirror key language from the job description? Terms like “financial analysis,” “strategic meetings,” and “execution” are woven in without sounding forced.

Here’s what else has been done well:

- Each line ties to a core expectation for M&A Associates: client exposure, leadership in deal flow, and sharp modeling skills.

- Financial modeling methods like DCF, LBO, and comparables are connected to real outcomes and deal sizes.

- Metrics like deal count and total transaction value help anchor the experience in results, not just responsibilities.

- The tone reflects ownership and clarity—showing the candidate isn’t just supporting deals but driving them forward.

Many job seekers skip the part where they quantify what they’ve done, assuming their responsibilities are enough to impress. But in investment banking, where everyone has similar duties on paper, numbers are what make your experience real.

Here’s how to make your impact tangible and measurable on your resume.

How to quantify experience on a banking resume

Using numbers on your resume helps hiring managers see your value clearly.

When writing your resume, consider any of the following:

- List the total transaction value you supported or led across your deals, broken down by industry or deal type.

- Mention how much revenue your analysis or recommendations helped generate, save, or protect during key transactions.

- Quantify how many strategic client presentations or pitchbooks you created and highlight those that led to a successful mandate.

- Include the size and type of models you built—like how many LBO scenarios you ran for a single deal or how many iterations were used in sensitivity analysis.

- Specify how much time you cut from execution timelines by refining internal processes or automating manual tasks.

Take our word for it—quantifying your impact shouldn’t stop at the experience section. It can elevate almost any part of your resume.

If you’re early in your career and unsure how to do that, the next tips are for you.

How do I write an investment banking resume with no experience?

“How does someone start by saying they didn’t have much experience until college? 99% of folks in IB don’t have experience when they get to college—until they start internships,” writes a frustrated YouTube commenter.

They’re not wrong. Many entry-level candidates panic at the thought of having “nothing” to put on their resume, assuming it means no interviews.

But here’s the truth: you’ve been building your resume long before you started formatting it. The key is knowing what to highlight to show you're competitive—even without years of experience.

Tips for writing a resume with no experience in investment banking

- Opt for a one-page, single-column layout that makes your content appear more substantial.

- Use a functional resume template to prioritize skills over limited work history.

- Group your skills by category and emphasize your strongest abilities in analysis or accounting—even if they come from coursework.

- Show that you’re proactive about learning, whether through certifications, side gigs, or self-study.

- Include any short-term roles (internships, summer jobs, project work) to demonstrate range and work ethic.

- Add extracurriculars that reflect qualities like precision, discipline, and communication.

- Write a short resume objective that explains why you’re pursuing investment banking and how your goals align with the firm’s.

Speaking of the objective—it’s that short, forward-looking statement right under your header. Think of it as your elevator pitch for where you’re headed.

Keep it to three clear, purposeful sentences that show your interest in the field and how you hope to grow within it.

Here’s an example for an internship position:

How to show career progression on an IB resume

If you’re applying for a senior-level role—VP, Director, or higher—you’re not starting from scratch. But you do need to show that you're ready for more.

These tips will help you highlight upward momentum and leadership potential:

- Use reverse chronological order to make your career trajectory easy to follow—hiring teams should instantly see your most recent (and senior) role first.

- Don’t list every task you’ve ever done—focus on outcomes like deal value, client wins, or leadership recognition that signal real impact.

- Highlight promotions or expanded responsibilities, especially within the same company.

- Lead with big-picture contributions—managing teams, owning client relationships, or originating deals.

- Include major transactions, awards, or firm-wide initiatives where your role went beyond execution.

Strong experience shows what you’ve done—but your skill set tells recruiters how you operate under pressure.

Let’s break down how to choose and present the right skills on your investment banking resume.

How to put skills on an investment banking resume

When listing skills on your resume, focus on those that directly reflect the demands of the role. In investment banking, that means highlighting technical precision, strategic thinking, and the tools that support high-stakes execution.

Hard skills—like financial modeling, valuation methods, and market research—should be listed in a dedicated skills section. This helps recruiters quickly assess your qualifications and increases your chances of passing ATS screening.

To make your skills easy to scan, consider grouping them into clear categories like:

Tailor these categories to match the role you’re targeting, and be selective—your goal is to reinforce your experience, not repeat it.

Here are some IB skills in high demand:

Best hard skills for an investment banking resume

- Financial modeling

- Valuation analysis (DCF, LBO, comparables)

- Accounting and financial statement analysis

- ESG literacy and strategic insight

- Digital fluency

- Market research and trend analysis

- Bloomberg Terminal

- FactSet

- Capital IQ

- Refinitiv Eikon

- Python for data analysis

- VBA for automation

- SQL

- Tableau

- Excel (advanced functions and modeling)

- PowerPoint (client presentations and pitchbooks)

- AI tools for data processing and modeling

- PitchBook

- Dealogic

- Financial reporting tools (e.g., Workiva)

When listing soft skills, go beyond vague terms like “teamwork” or “communication.” Instead, show how you’ve used those skills in high-stakes situations.

For example, rather than saying “strong communication,” you could note that you “presented valuation findings to senior clients during M&A deal pitches.”

Wherever possible, connect the skill to a concrete outcome—like “coordinated cross-border deal execution, contributing to a $500M acquisition close.” That’s what makes a soft skill believable—and memorable.

Best soft skills for IB resumes

- Analytical thinking

- Strategic decision-making

- Attention to detail

- Time management

- Client relationship management

- Verbal communication

- Written communication

- Presentation skills

- Problem-solving

- Adaptability

- Leadership

- Team collaboration

- Initiative

- Project management

- Confidentiality and discretion

Now it’s time to back it all up with your academic credentials and any certifications that prove your technical foundation.

How to list your education and certifications on your resume

While investment banking typically requires at least a bachelor’s degree, the education section on your resume does more than check a box—it helps show your academic rigor and technical grounding. If the job posting mentions specific majors, coursework, or academic honors, and you meet those criteria, make sure they’re clearly listed.

If you’ve been in the industry for years, your deal experience will likely matter more than your diploma. Still, for junior roles or lateral hires, education can help signal credibility—especially when paired with relevant certifications.

When you include an education section, make sure it shows:

- A degree that aligns with the role (finance, economics, accounting, or related field).

- The institution and graduation year.

- Relevant coursework like corporate finance or advanced accounting.

- Academic achievements (e.g. Dean’s List, honors) that highlight performance.

- Certifications such as CFA, FINRA licenses, or Bloomberg Market Concepts.

To enhance your application even further, consider listing your certifications in a separate section. This is especially important in investment banking, where technical competence and a commitment to professional development are key differentiators.

Here are some of the most relevant credentials for an investment banking resume:

Top certifications for an IB resume

Here’s an example of a training section based on the job posting we covered earlier in the guide:

This is a strong example because it features a top-tier institution, a relevant double major, and a solid GPA—all qualities that align with the expectations for an associate role.

Now that your education section is in place, let’s move to the top of your resume and craft a summary that captures your strengths in a few sharp, strategic lines.

How to write a strong summary for investment banking roles

The summary on your resume tells recruiters, in a few sharp lines, why you’re ready to step into the role and deliver. We recommend writing it last, once your experience and skills are clear and easy to draw from.

Like the rest of your resume, this section needs to be tailored to the role. It should highlight your most relevant strengths without reading like a generic script. Think of it as your way of showing impact, not just listing traits.

Here’s what a strong summary should include:

- Three to five concise sentences that spotlight your core strengths—deal experience, modeling skills, or client-facing exposure—with numbers where possible.

- A mention of your industry focus (e.g. tech, healthcare) or transaction type (e.g.

- capital markets).

- A line about how you contribute to business outcomes, like supporting deal execution or driving client strategy.

Here’s a summary example based on the investment banking role we discussed earlier:

This summary works because it’s specific, sharp, and numbers-driven—it gives a clear snapshot of the candidate’s deal experience, technical strengths, and client-facing abilities. It avoids fluff and shows exactly why they’re ready to step into a high-pressure, high-responsibility M&A role.

Before you hit save on your resume, there’s one more thing to consider—those optional sections at the bottom. Let’s look at when it makes sense to include extras and how to do it without cluttering the page.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Additional sections for an investment banking resume

As an investment banking candidate, you should only include additional sections when they bring depth to your profile and highlight qualifications that don’t fit neatly under experience or education. These extras can reinforce your competitive edge—especially at the junior or associate level.

Here are some relevant additions:

- Foreign languages: Fluency in another language, especially one tied to a key market, can be valuable for cross-border deal work and client communication.

- Volunteer work: Strategic or finance-related volunteer roles can demonstrate initiative, leadership, and the ability to apply your skills in new contexts.

- Awards and achievements: Academic honors, case competition wins, or deal-related recognition help set you apart as a high-performing candidate.

- Certifications and training: Short-form programs (like BMC or FMVA) show you’re invested in sharpening your technical skill set outside of formal education.

- Interests (used selectively): If space allows, a brief line on interests can offer a hint of personality—just make sure they’re professional and relevant (think marathon running, not poker nights).

Conclusion

Writing an investment banking resume isn’t easy—especially when you’re juggling intense hours, unclear expectations, or trying to move up the corporate ladder without overstating your role.

Whether you're an intern aiming for your first offer or an associate looking to break into a top-tier firm, this guide walks you through exactly what recruiters want to see—and what you can leave out. With real-world examples, tailored tips, and a focus on impact over fluff, you’ll be able to build a resume that actually gets read—and gets results.

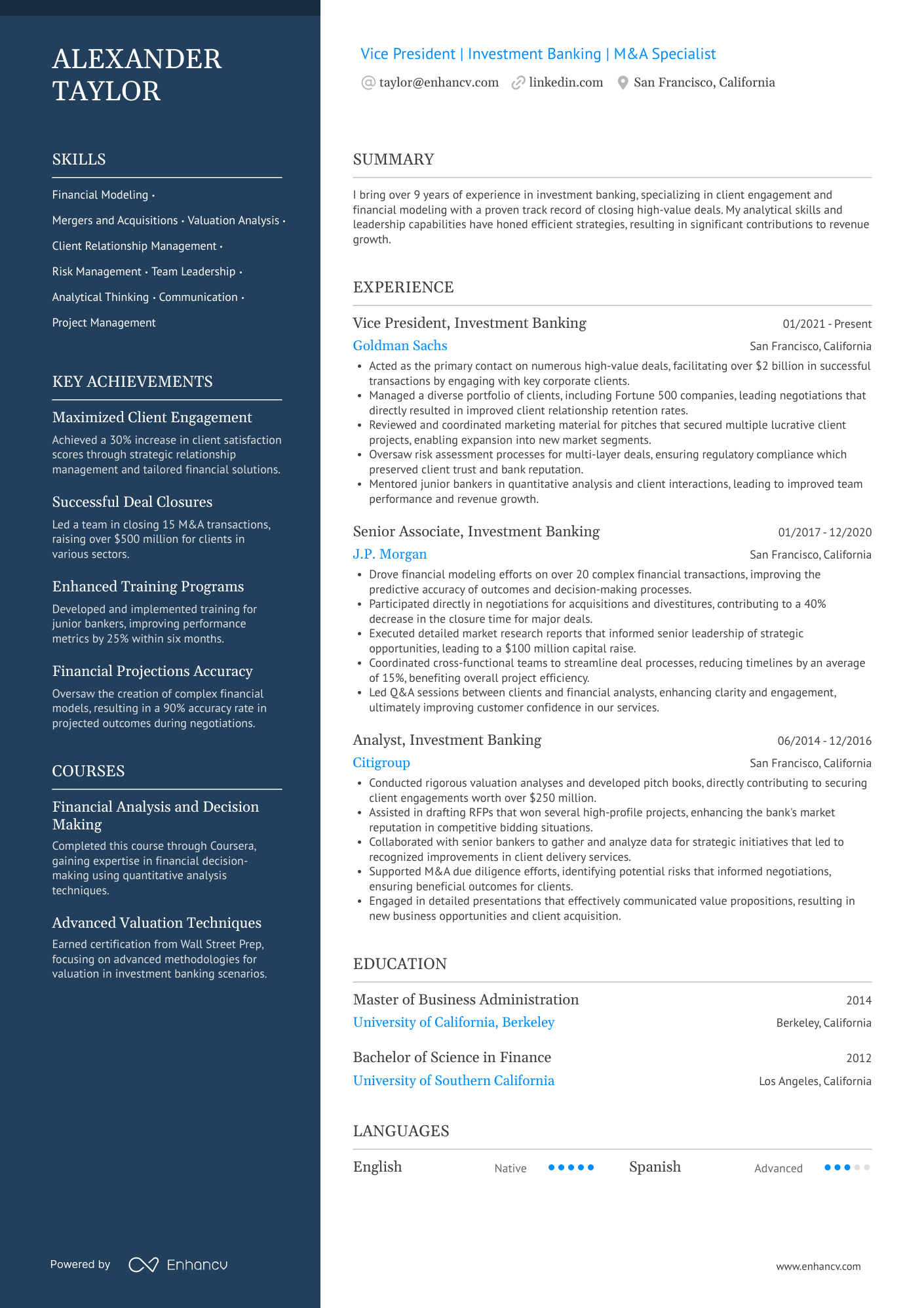

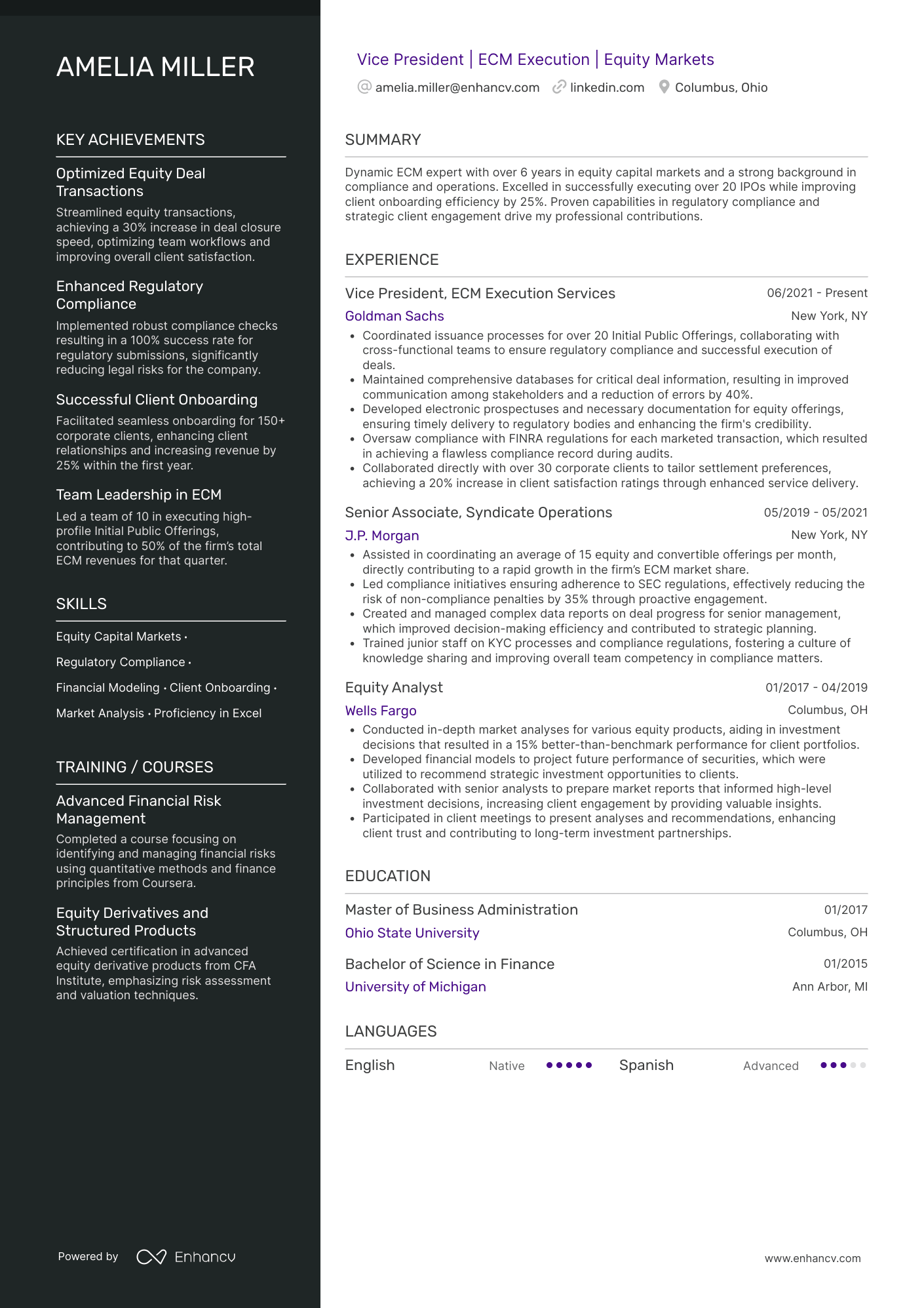

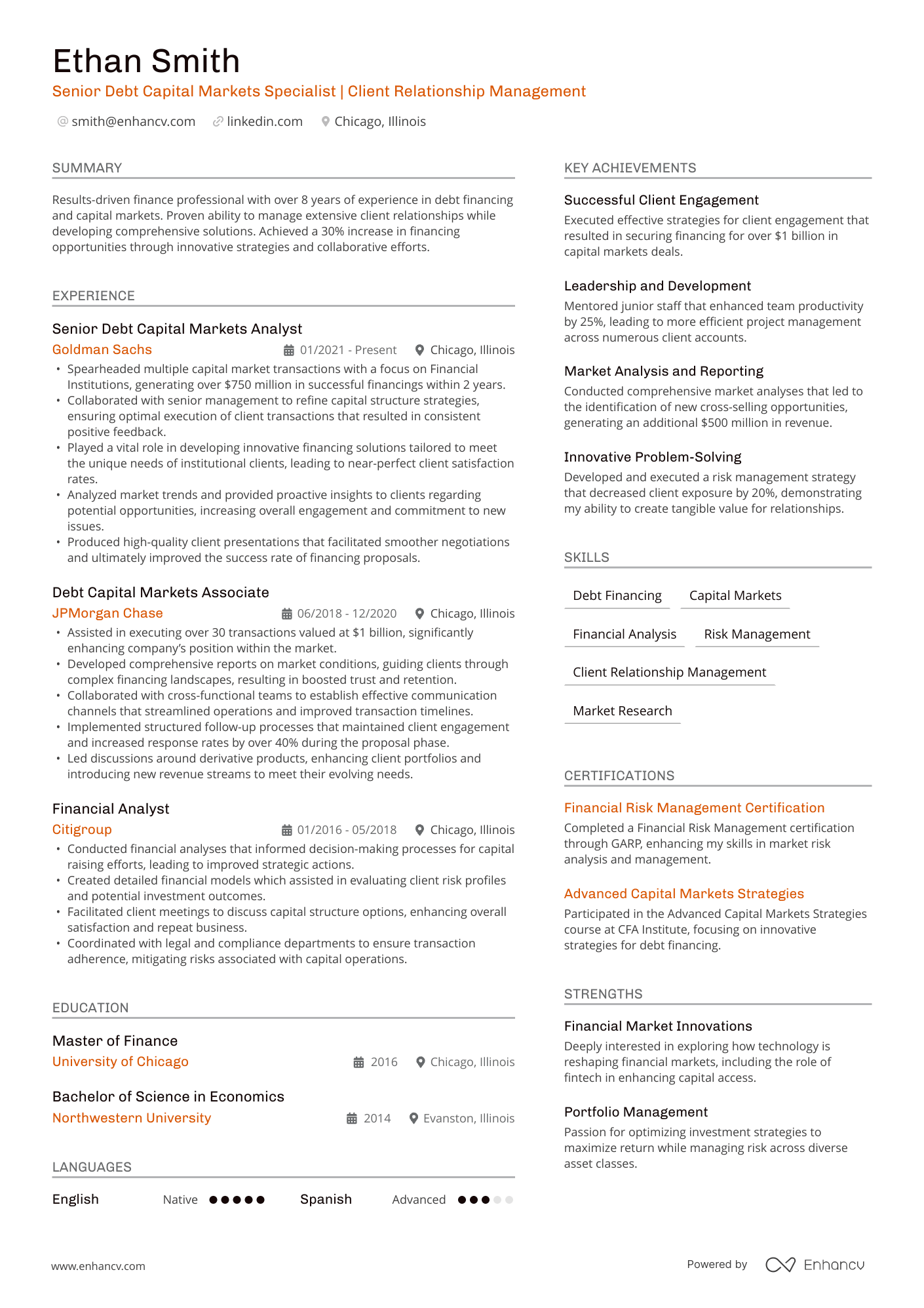

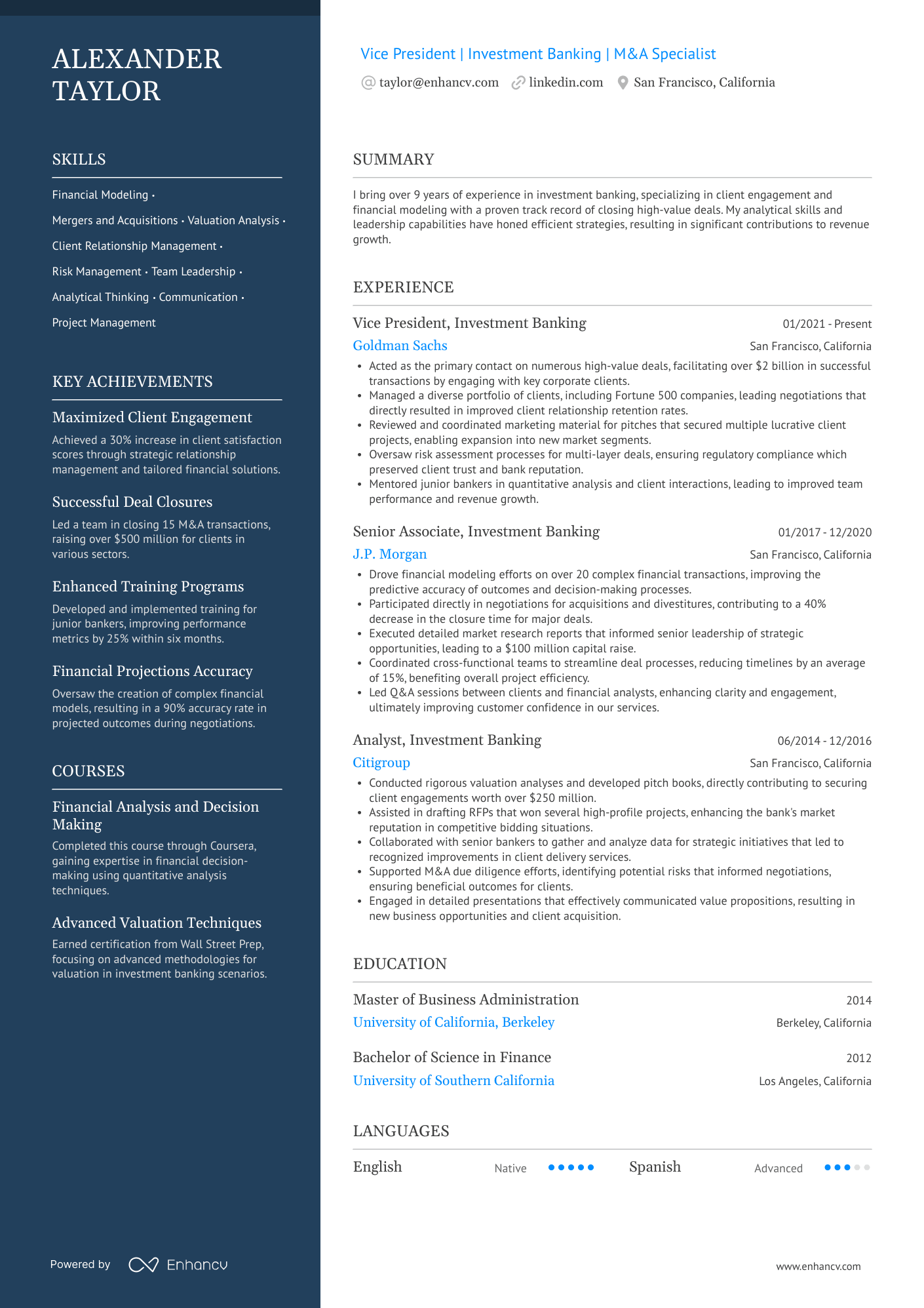

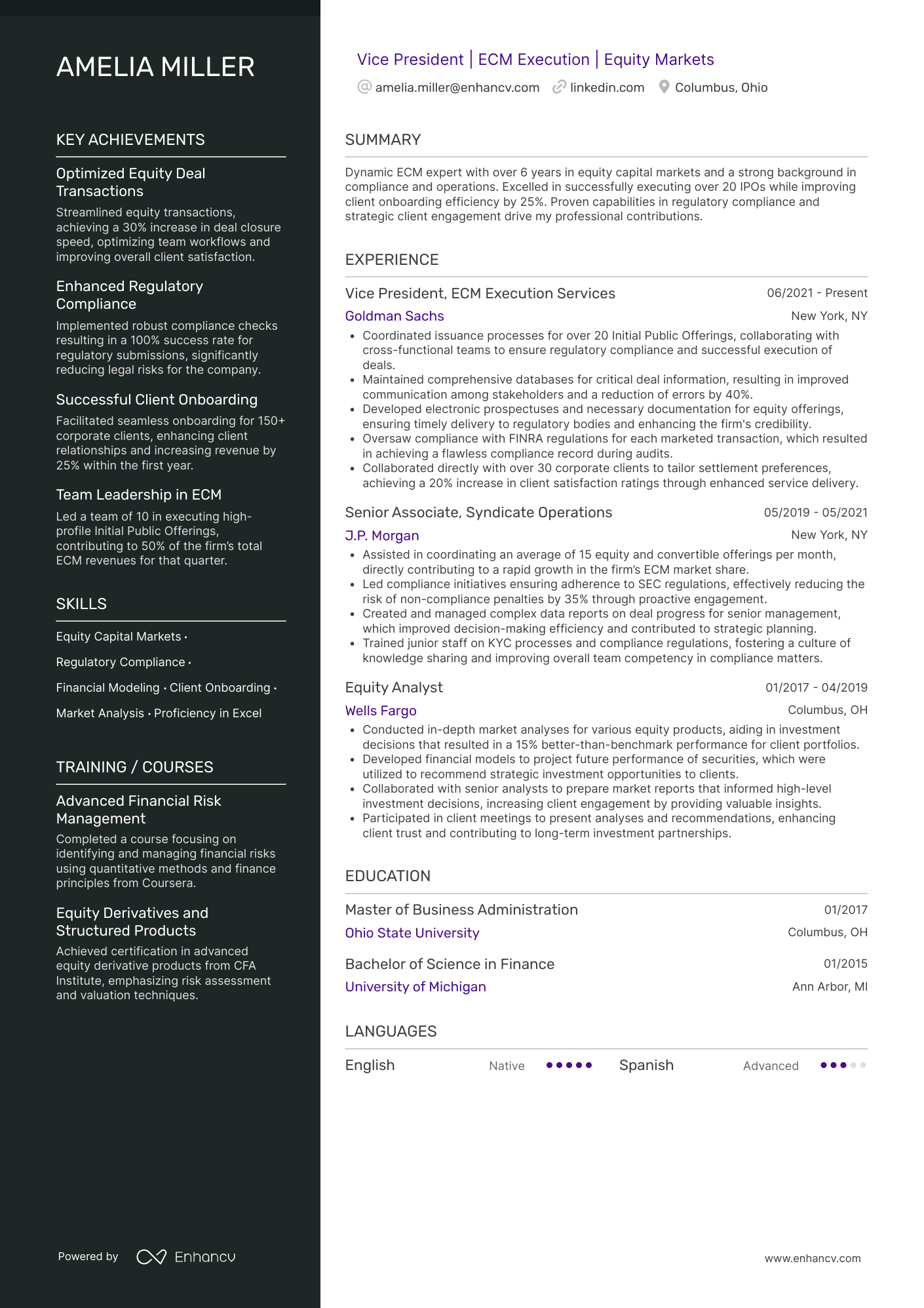

Investment Banking resume examples

By Experience

By Role