Most tax preparer resume drafts fail because they read like task lists and bury filing volume, accuracy, and client impact. That hurts in today's hiring process, where an ATS filters fast and recruiters scan in seconds.

A strong resume shows what changed because of your work, not every tool you used. Understanding how to write a resume that highlights returns completed per season, error rates, refunds secured, audits supported, turnaround time improvements, client retention, and savings from credits identified is essential.

Key takeaways

- Quantify filing volume, accuracy rates, and turnaround times in every experience bullet.

- Tailor your resume to each posting by mirroring its exact software, forms, and compliance language.

- Use reverse-chronological format with direct experience; switch to hybrid only when entering the field.

- Demonstrate skills through measurable outcomes in your summary and experience, not just a skills list.

- Pair certifications like the EA or AFSP with your education section to signal current, verified expertise.

- Use Enhancv to turn vague duties into specific, recruiter-ready bullets backed by real metrics.

- Stop using AI once your resume accurately reflects your real experience without inflated claims.

Job market snapshot for tax preparers

We analyzed 189 recent tax preparer job ads across major US job boards. These numbers help you understand skills in demand, industry demand, career growth patterns at a glance.

What level of experience employers are looking for tax preparers

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 34.4% (65) |

| 3–4 years | 33.3% (63) |

| 5–6 years | 0.5% (1) |

| Not specified | 31.7% (60) |

Tax preparer ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 65.6% (124) |

| Professional Services | 33.9% (64) |

Top companies hiring tax preparers

| Company | Percentage found in job ads |

|---|---|

| PwC | 34.4% (65) |

| Liberty Tax Service | 33.3% (63) |

| H&R Block, Inc. | 31.2% (59) |

Role overview stats

These tables show the most common responsibilities and employment types for tax preparer roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a tax preparer

| Responsibility | Percentage found in job ads |

|---|---|

| Amt | 34.4% (65) |

| Composite returns | 34.4% (65) |

| Partnership k-1 income | 34.4% (65) |

| State tax credits | 34.4% (65) |

| Tax compliance | 34.4% (65) |

| Tax planning | 34.4% (65) |

| Year-end planning | 34.4% (65) |

| Project management | 33.3% (63) |

| Individual tax returns | 28.6% (54) |

| Tax preparation software | 22.2% (42) |

| Microsoft office | 20.1% (38) |

| Windows | 19.0% (36) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 77.8% (147) |

| Hybrid | 22.2% (42) |

How to format a tax preparer resume

Recruiters evaluating tax preparer candidates prioritize accuracy-driven experience, familiarity with tax codes and filing software, and evidence of growing client responsibility. A clean, well-structured resume format ensures these signals surface quickly during both human review and applicant tracking system (ATS) scans.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your deepest and most relevant tax preparation experience first. Do:

- Lead each role with scope indicators such as client volume, return complexity, and seasonal team oversight.

- Highlight proficiency in role-specific tools like Drake Tax, Lacerte, UltraTax CS, or ProSeries, alongside knowledge of IRS regulations and state-specific codes.

- Quantify outcomes tied to accuracy, efficiency, or revenue—reviewers want measurable proof of impact.

I'm junior or switching into this role—what format works best?

A hybrid format works best, letting you lead with relevant tax skills and certifications while still showing your work history in chronological order. Do:

- Place a skills section near the top featuring tax software proficiency, IRS compliance knowledge, and relevant credentials such as a PTIN, EA designation, or VITA certification.

- Include academic projects, volunteer tax preparation (such as VITA or TCE programs), or internship experience that demonstrates hands-on filing work.

- Connect every listed skill to a concrete action and a measurable or observable result.

Why not use a functional resume?

A functional format strips away the timeline of your experience, making it difficult for recruiters and ATS software to verify when and where you applied your tax preparation skills—weakening your candidacy even at the entry level.

- A functional format may be acceptable if you're transitioning from a related field like bookkeeping or accounting, have a significant gap in employment, or lack formal tax preparation roles but hold relevant certifications and volunteer experience—provided you still tie every listed skill to a specific project, filing outcome, or measurable result.

With your format set, the next step is filling each section with content that highlights your qualifications as a tax preparer.

What sections should go on a tax preparer resume

Recruiters expect a clean, easy-to-scan resume that proves you can prepare accurate returns, stay compliant, and deliver measurable client results. Knowing what to put on a resume for a tax preparer role helps you prioritize the right details.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Volunteering, Languages

Strong experience bullets should emphasize filing volume, accuracy, compliance outcomes, client impact, and measurable results across the tax situations you handled.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components, focus next on writing the experience section to show how you’ve applied those qualifications in tax preparation work.

How to write your tax preparer resume experience

The work experience section is where you prove you've delivered real results—through the tax software you've used, the filing processes you've managed, and the measurable outcomes you've achieved for clients or employers. Hiring managers prioritize demonstrated impact over descriptive task lists, so focus on what you accomplished rather than what you were responsible for.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the client portfolios, return types, filing categories, or compliance areas you were directly accountable for as a tax preparer.

- Execution approach: the tax preparation software, regulatory frameworks, IRS guidelines, or research methods you applied to accurately complete and review returns.

- Value improved: the changes you drove in filing accuracy, turnaround time, client retention, audit risk reduction, or compliance rates within your tax preparation work.

- Collaboration context: how you coordinated with clients, accountants, bookkeepers, IRS representatives, or internal teams to resolve discrepancies and ensure complete, timely filings.

- Impact delivered: the outcomes you produced, expressed through client satisfaction, revenue growth, error reduction, or volume of returns processed—framed as results rather than activities.

Experience bullet formula

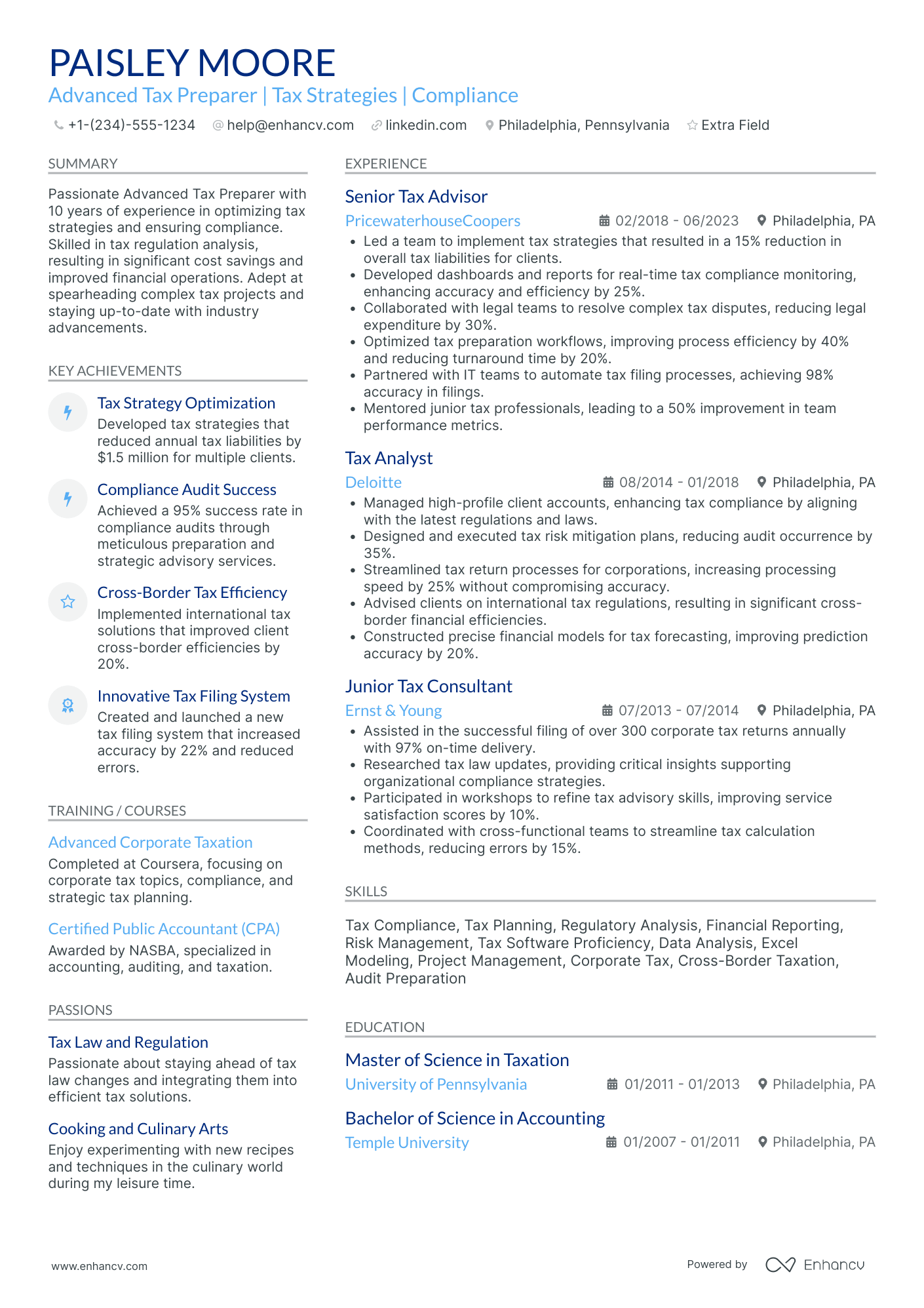

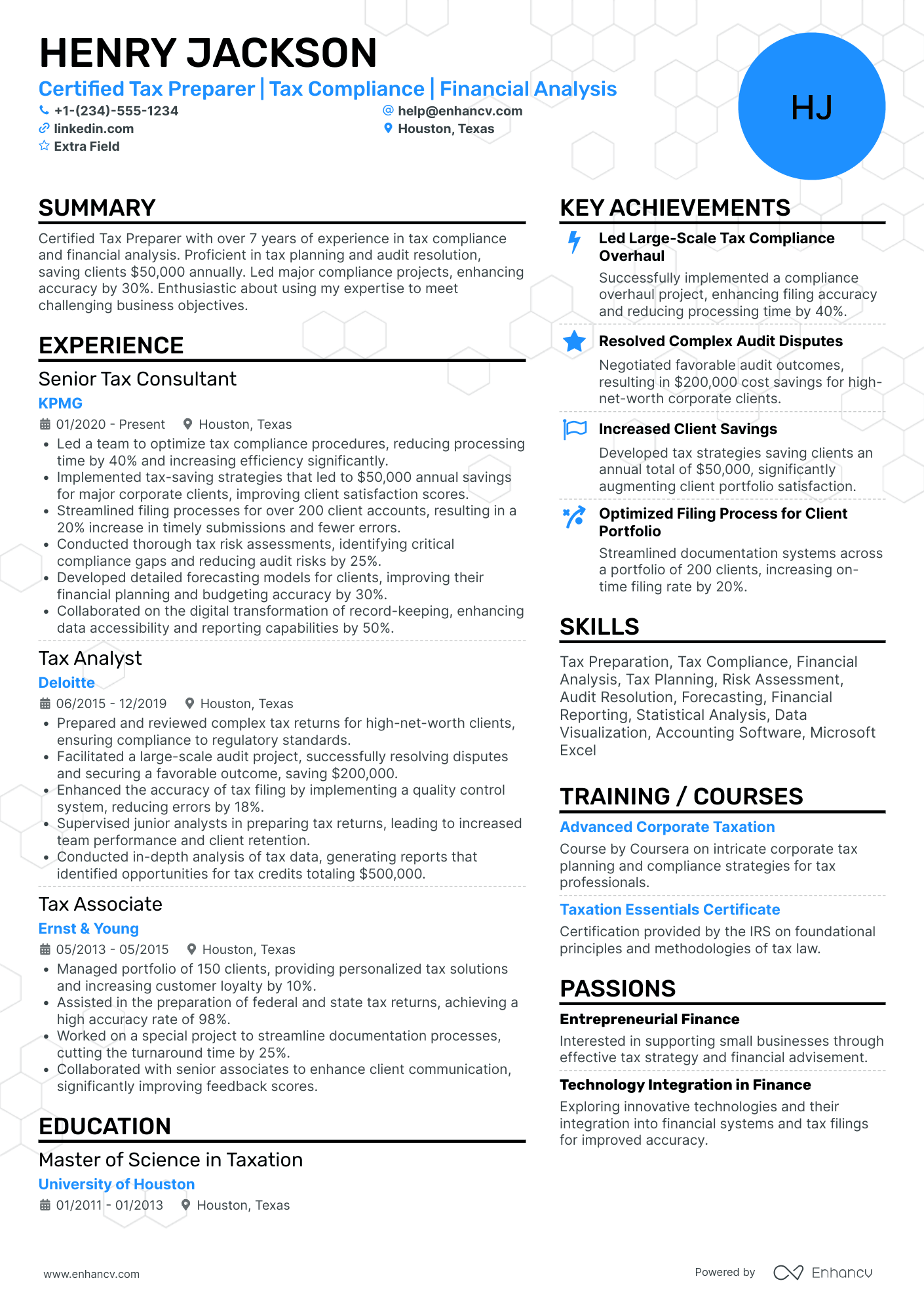

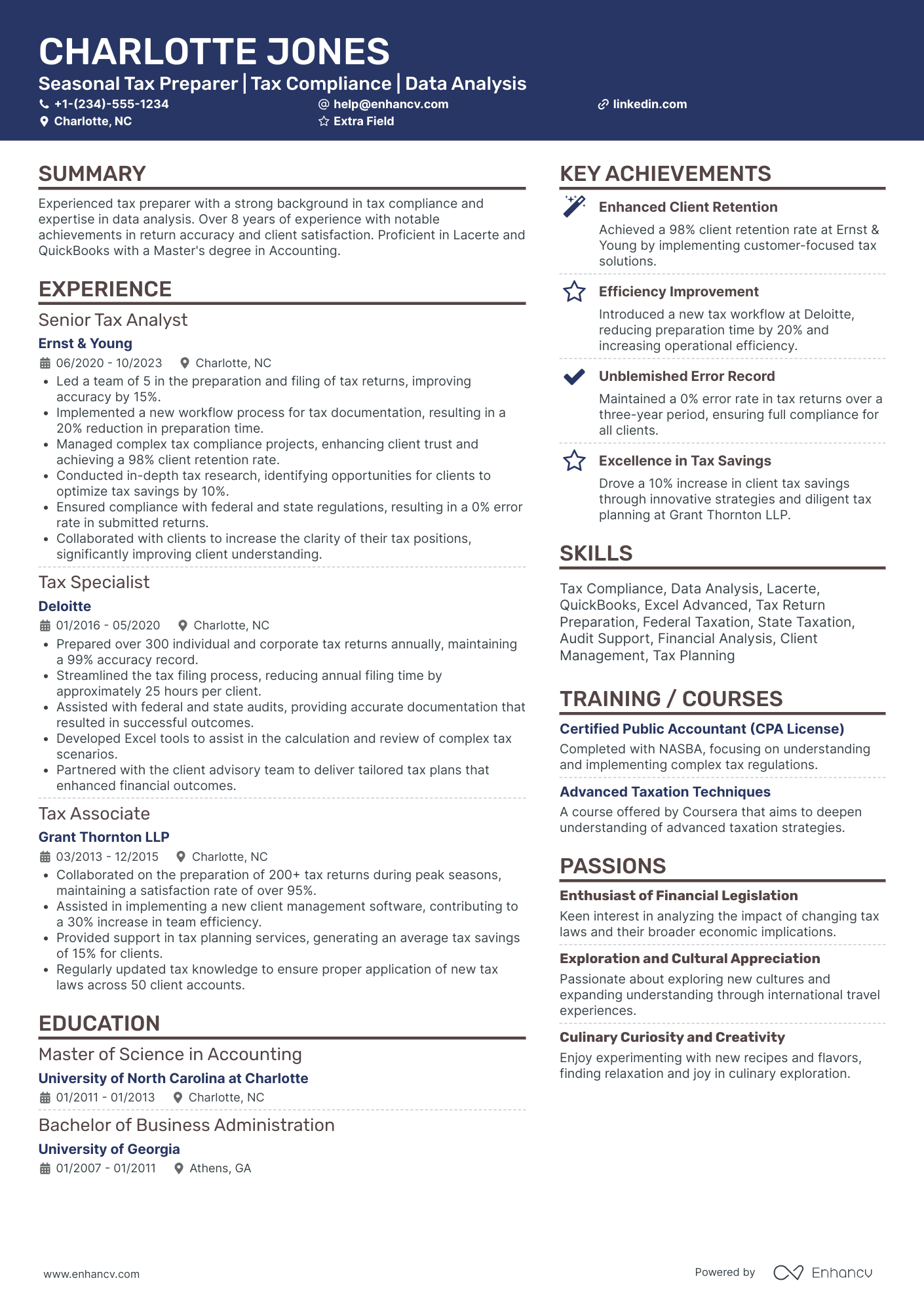

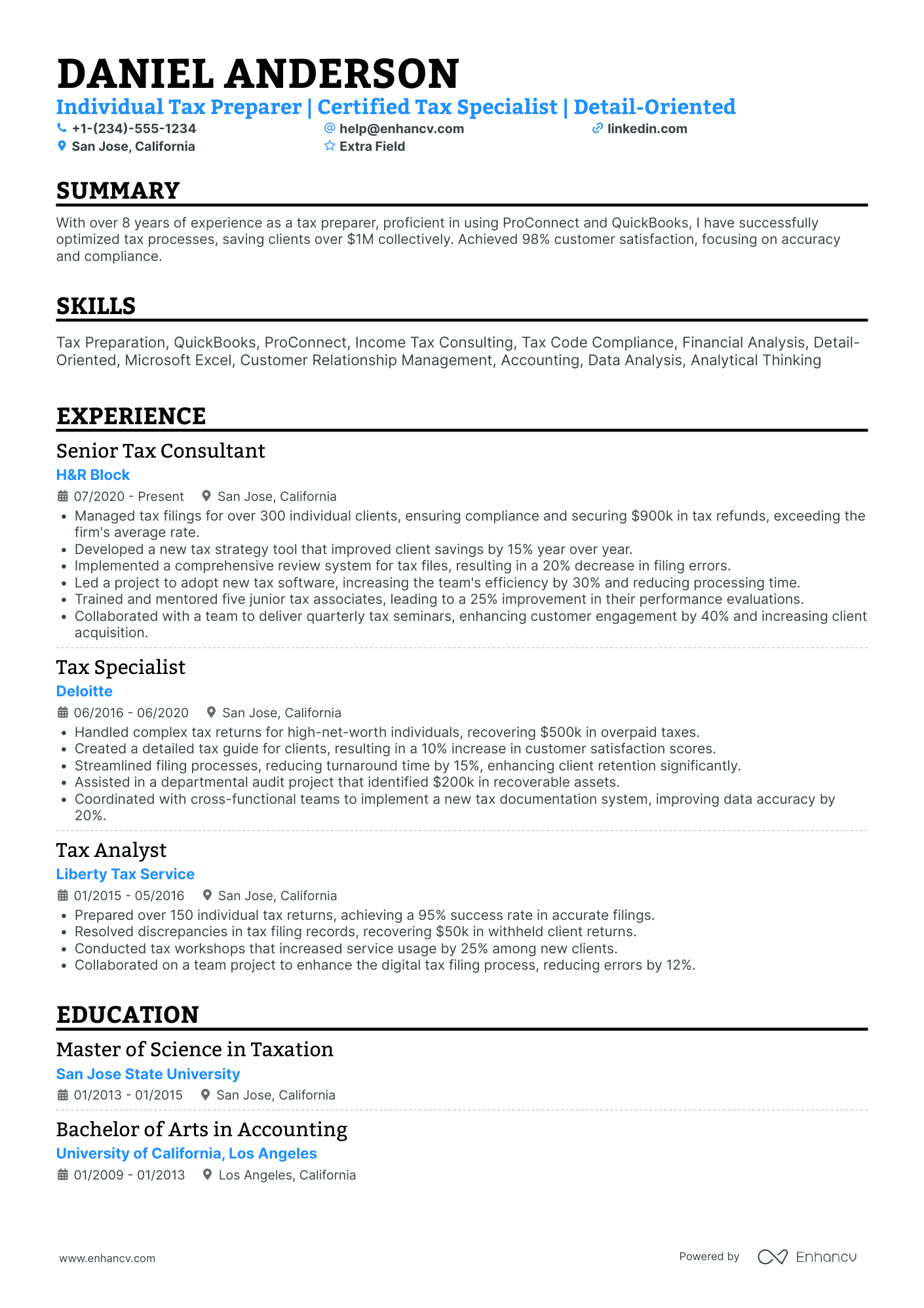

A tax preparer experience example

✅ Right example - modern, quantified, specific.

Tax Preparer

GreenOak Tax & Advisory | Austin, TX

2022–Present

Boutique tax firm supporting individuals and small businesses across Texas with high-volume seasonal workflows.

- Prepared and e-filed 420+ individual and small business returns per season using Intuit ProConnect Tax and Thomson Reuters Checkpoint, cutting average turnaround time from six days to four days.

- Reconciled client source documents against QuickBooks Online and bank feeds, reducing notices and amended returns by 18% year over year.

- Implemented a standardized organizer and document request workflow in Canopy and Microsoft Excel, increasing on-time client submissions by 27% and saving 120 staff hours each season.

- Identified and applied state and federal credits and deductions using IRS publications and SALT guidance, increasing average client refunds by $640 while maintaining a 99.2% acceptance rate on first submission.

- Partnered with clients, enrolled agents, and CPAs to resolve 35+ IRS and state correspondence cases via IRS e-Services and secure portal messaging, cutting resolution time by 22% and eliminating late-payment penalties in 12 cases.

Now that you've seen how a strong experience section comes together, let's look at how to adjust those details to match the specific job you're applying for.

How to tailor your tax preparer resume experience

Recruiters evaluate your tax preparer resume through both human review and applicant tracking systems. Tailoring your resume to the job description ensures your qualifications stand out in both screening methods.

Ways to tailor your tax preparer experience:

- Match the exact tax software and e-filing platforms listed in the posting.

- Mirror the specific tax forms and schedules the employer references.

- Use the same compliance and regulatory terminology from the job description.

- Reflect the return volume or accuracy benchmarks the role prioritizes.

- Highlight experience with the client types or industries the firm serves.

- Incorporate quality review or audit processes the employer mentions by name.

- Emphasize IRS regulation knowledge that aligns with stated job duties.

- Reference the workflow or seasonal filing procedures described in the posting.

Tailoring means aligning your real accomplishments with the employer's stated requirements, not forcing unrelated keywords into your experience section.

Resume tailoring examples for tax preparer

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Prepare and file individual and business tax returns using UltraTax CS, ensuring compliance with federal and state regulations for clients with multi-state filing obligations. | Prepared tax returns for various clients. | Prepared and filed 200+ individual and business tax returns annually using UltraTax CS, ensuring full compliance with federal and multi-state filing requirements across 12 jurisdictions. |

| Review client financial records to identify eligible deductions and credits, with a focus on Schedule C filers and rental property income under IRS guidelines. | Helped clients with their taxes and deductions. | Analyzed financial records for Schedule C filers and rental property owners, identifying an average of $4,800 in additional deductions and credits per client in accordance with current IRS guidelines. |

| Communicate directly with IRS and state tax authorities to resolve notices, respond to audits, and negotiate payment plans on behalf of individual and small business clients. | Handled client issues and communicated with agencies. | Resolved 35+ IRS and state tax notices per season, representing individual and small business clients during audits and negotiating installment agreements that reduced penalty assessments by an average of 40%. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your tax preparer achievements so employers can see the impact behind those choices.

How to quantify your tax preparer achievements

Quantifying your achievements shows the value you deliver beyond filing returns. Focus on volume handled, turnaround time, accuracy and rework rates, compliance outcomes, and revenue protected through credits, deductions, and penalty avoidance.

Quantifying examples for tax preparer

| Metric | Example |

|---|---|

| Return volume | "Prepared 320 individual and small business returns in one season using Intuit ProConnect and Lacerte, averaging 18 returns per week." |

| Turnaround time | "Cut average client turnaround from five days to two days by standardizing document checklists and batching W-2 and 1099 intake." |

| Accuracy rate | "Achieved a 99.2% first-pass acceptance rate with fewer than three e-file rejects across 380 filings by validating SSNs and withholding entries." |

| Compliance risk | "Reduced notices and penalty exposure by 30% by implementing a pre-filing review for Schedule C expenses and 1099-NEC matching." |

| Revenue impact | "Identified $145,000 in additional deductions and credits across 60 clients by optimizing depreciation schedules and confirming eligibility for energy credits." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points for your experience section, you'll want to apply that same precision to presenting your hard and soft skills.

How to list your hard and soft skills on a tax preparer resume

Your skills section shows you can prepare accurate, compliant returns under deadlines, and recruiters and an ATS (applicant tracking system) scan this section to confirm tool fit and core competencies—aim for a balanced mix of tax software and client-facing execution skills. Tax preparer roles require a blend of:

- Product strategy and discovery skills: Client intake, tax situation discovery, and return-scope planning.

- Data, analytics, and experimentation skills: Source document review, reconciliation, and error checking across forms.

- Delivery, execution, and go-to-market discipline: End-to-end filing workflow, deadline management, and e-file readiness.

- Soft skills: Clear client communication, judgment, and audit-ready documentation habits.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

Your hard skills demonstrate the technical tax knowledge employers need to see:

- IRS Form 1040 preparation

- Schedule C, E, and SE

- W-2, 1099, K-1 processing

- Itemized deductions, credits

- Multi-state individual returns

- Federal and state e-filing

- Tax research: IRS publications

- Depreciation and amortization

- Basis and capital gains reporting

- QuickBooks, bank reconciliation

- Intuit ProConnect, Lacerte, Drake Tax

- Workpaper documentation, tick marks

Soft skills

Equally important, your soft skills show how you work with clients and teams:

- Ask targeted intake questions

- Translate tax rules clearly

- Document assumptions and notes

- Flag missing or inconsistent data

- Prioritize returns by deadline

- Coordinate with bookkeepers and CPAs

- Set expectations with clients

- Maintain confidentiality under pressure

- Resolve notices with calm follow-up

- Escalate complex issues early

- Review work for preventable errors

- Manage multiple returns concurrently

How to show your tax preparer skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Senior tax preparer with 10+ years in individual and small-business returns. Skilled in Drake Tax, multi-state compliance, and IRS resolution. Reduced client filing errors by 35% through streamlined review workflows and proactive taxpayer education.

- Signals senior-level expertise immediately

- Names industry-standard tax software

- Quantifies error reduction with metrics

- Highlights client communication skills

Experience example

Senior Tax Preparer

Meridian Financial Group | Richmond, VA

March 2019–Present

- Prepared 400+ individual and business returns annually using Drake Tax, maintaining a 99.2% accuracy rate across multi-state filings.

- Collaborated with bookkeeping and payroll teams to reconcile discrepancies, reducing amended return volume by 28% year over year.

- Guided 150+ clients through IRS audit responses and notice resolutions, achieving favorable outcomes in 94% of cases.

- Every bullet includes measurable proof

- Skills appear naturally within achievements

Once you’ve demonstrated your tax preparer capabilities through relevant examples and outcomes, the next step is to apply that approach to building a tax preparer resume with no experience by highlighting transferable skills and comparable work.

How do I write a tax preparer resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- VITA volunteer tax return preparation

- IRS Link and Learn modules

- Tax preparation certificate coursework

- Accounting or bookkeeping class projects

- FreeTaxUSA practice returns and reviews

- Excel income, expense, and deduction tracking

- Client intake form simulations

- Tax law research memos and summaries

If you're building a resume without work experience, focus on:

- Accuracy checks and documented review steps

- Familiarity with tax preparation software

- Tax forms handled and volumes

- Compliance with IRS guidelines

Resume format tip for entry-level tax preparer

Use a skills-based resume format because it highlights tax preparation skills, tools, and relevant projects when your work history is limited. Do:

- Add a "Tax Preparation Projects" section.

- List forms you practiced: Form 1040, Schedule A.

- Name tools used: Excel, FreeTaxUSA.

- Quantify work: returns completed, errors found.

- Include training with dates and hours.

- Completed 25 FreeTaxUSA practice Form 1040 returns, reconciled W-2 and 1099 entries, and reduced calculation errors from six to one through a checklist review.

Even without hands-on experience, your educational background can demonstrate the foundational knowledge employers look for—so let's cover how to present it effectively.

How to list your education on a tax preparer resume

Your education section helps hiring teams confirm you have the foundational accounting, finance, or tax knowledge a tax preparer needs. It builds credibility fast.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a tax preparer resume.

Example education entry

Bachelor of Science in Accounting

University of Central Florida, Orlando, FL

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Federal Income Tax, Tax Research and Planning, Auditing Principles, Business Law

- Honors: Magna Cum Laude, Dean's List (six consecutive semesters)

How to list your certifications on a tax preparer resume

Certifications on your resume show your commitment to learning, proficiency with tax tools, and up-to-date industry knowledge, which helps employers trust you as a tax preparer. Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degree is recent and your certifications are older or less relevant to tax preparer work.

- Place certifications above education when they are recent, highly relevant, or required for the tax preparer role you target.

Best certifications for your tax preparer resume

IRS Annual Filing Season Program (AFSP) Record of Completion Enrolled Agent (EA) Certified Public Accountant (CPA) Certified Tax Preparer (CTP) H&R Block Income Tax Course Certificate Intuit QuickBooks Certified User National Association of Tax Professionals (NATP) Tax Professional Certificate

Once you’ve positioned your credentials where they’re easy to verify, use your tax preparer resume summary to reinforce that qualification upfront and set the context for the rest of your resume.

How to write your tax preparer resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly frames you as a qualified tax preparer worth interviewing.

Keep it to three to four lines, with:

- Your title and total years of tax preparation experience.

- The domain you work in, such as individual, small business, or corporate tax.

- Core tools and skills like TurboTax, Drake Software, QuickBooks, or IRS e-filing.

- One or two quantified achievements that show accuracy or efficiency.

- Soft skills tied to real outcomes, such as client communication that improved retention.

PRO TIP

At the entry level, lead with relevant tax software skills and any measurable early wins. Highlight coursework, certifications like the PTIN or AFSP, and seasonal filing volume. Avoid vague phrases like "passionate hard worker" or "eager to grow." Every word should prove you can do the job.

Example summary for a tax preparer

Detail-oriented tax preparer with two years of experience filing 200+ individual returns per season using Drake Software. Reduced client errors by 15% through structured review checklists and clear communication.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure recruiters can actually reach you by setting up a clear, complete resume header.

What to include in a tax preparer resume header

A well-crafted resume header lists your key contact details and role focus, helping tax preparers boost visibility, credibility, and pass recruiter screening fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify experience quickly and supports screening.

Do not include a photo on a tax preparer resume unless the role is explicitly front-facing or appearance-dependent.

Match your header job title to the posting and keep every link current, professional, and easy to scan.

Example

Tax preparer resume header

Jordan Lee

Tax preparer | Individual and small business returns (Form 1040, Schedule C)

Austin, TX

(512) 555-01XX

your.name@enhancv.com github.com/yourname yourwebsite.com linkedin.com/in/yourname

Once your contact details and professional identifiers are in place at the top, add supporting resume sections to strengthen your qualifications and provide relevant context.

Additional sections for tax preparer resumes

Extra resume sections help you stand out when your core qualifications match other candidates, showcasing unique strengths relevant to tax preparation. For example, listing language skills on your resume can be a differentiator when serving diverse client populations.

- Languages

- Certifications and licenses

- Professional affiliations

- Continuing education

- Volunteer tax preparation experience

- Publications

- Awards and recognitions

Once you've strengthened your resume with relevant additional sections, pairing it with a well-crafted cover letter can further set your application apart.

Do tax preparer resumes need a cover letter

A cover letter isn't required for a tax preparer, but it often helps. If you're wondering what a cover letter is and when it matters, it's most useful for competitive roles, client-facing teams, or firms that expect one. It can also influence decisions when several candidates have similar credentials.

Use a cover letter to add context your resume can't:

- Explain role and team fit: Match your experience to the firm's client types, volume, and workflow, such as 1040, 1065, or 1120 returns.

- Highlight one or two outcomes: Share a specific project, like cleaning up prior-year issues or improving organizer completion rates, and quantify the result.

- Show business and user understanding: Reference the firm's industries, busy season demands, and how you support clients with clear, compliant communication.

- Address transitions or non-obvious experience: Connect bookkeeping, payroll, audit support, or customer service work to tax preparer responsibilities and accuracy standards.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide a cover letter adds limited value for your application, using AI to improve your tax preparer resume helps you strengthen the document employers review first.

Using AI to improve your tax preparer resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine phrasing and highlight measurable results. But overuse strips authenticity. Once your content is clear and role-aligned, step away from AI. If you're exploring tools, learn which AI is best for writing resumes before committing to one platform.

Here are 10 practical prompts to strengthen specific sections of your tax preparer resume:

Strengthen your summary

Quantify experience bullets

Tighten action verbs

Align skills section

Clarify certification details

Improve project descriptions

Refine education entries

Remove redundant phrasing

Target seasonal experience

Enhance compliance language

Conclusion

A strong tax preparer resume proves results with numbers, highlights role-specific skills, and stays easy to scan. Show measurable outcomes like return volume, accuracy rates, audit support wins, and turnaround times. Keep sections clear, consistent, and focused on tax preparation work.

Today’s hiring market rewards tax preparers who show readiness, reliability, and strong client communication. Use a clean structure, relevant skills, and outcome-driven bullets to show you can deliver during peak season and beyond. Keep it direct, complete, and confident.