Frustrated by consistently low ATS scores on your finance resume?

You're not alone in this challenge. Different employers use applicant tracking systems in various ways, but they all share the common expectation that candidates will take the time to do the application properly. Those who shine the brightest are not just about stellar grades. The real standout factor lies beyond impressive academics. It's the detailed exposition of relevant, hands-on work experience.

Hiring managers want to see evidence that you can use numbers to influence. For example, "I mapped out the data flows and data lineage, which improved data quality by X%". This isn't just a bullet point. It's a powerful demonstration of how you leverage data to effect change and encourage fresh ideas.

If this strikes a chord, we're here to take your finance resume to new heights. Set your sights on mastering:

- Which sections of your resume can put you ahead in the race?

- What are the keys to leaving a strong first impression with your finance resume summary?

- How do you prove your financial credibility in the work experience section?

- Which skills are finance recruiters scanning for?

- How should you format your education and certifications on a finance resume?

If the broad scope of finance overwhelms you, dive into our selection of other finance-related resume examples:

How to format a finance resume

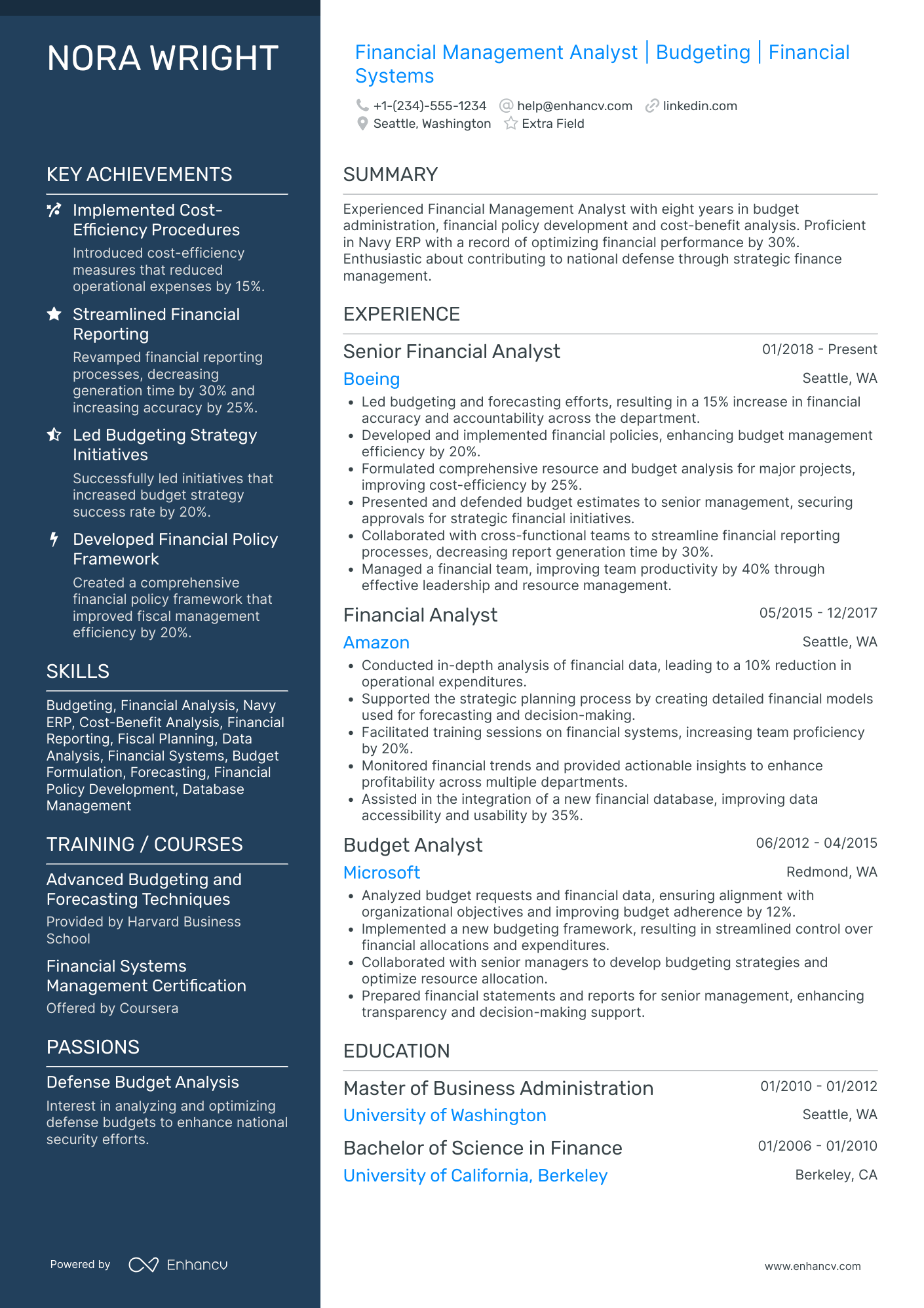

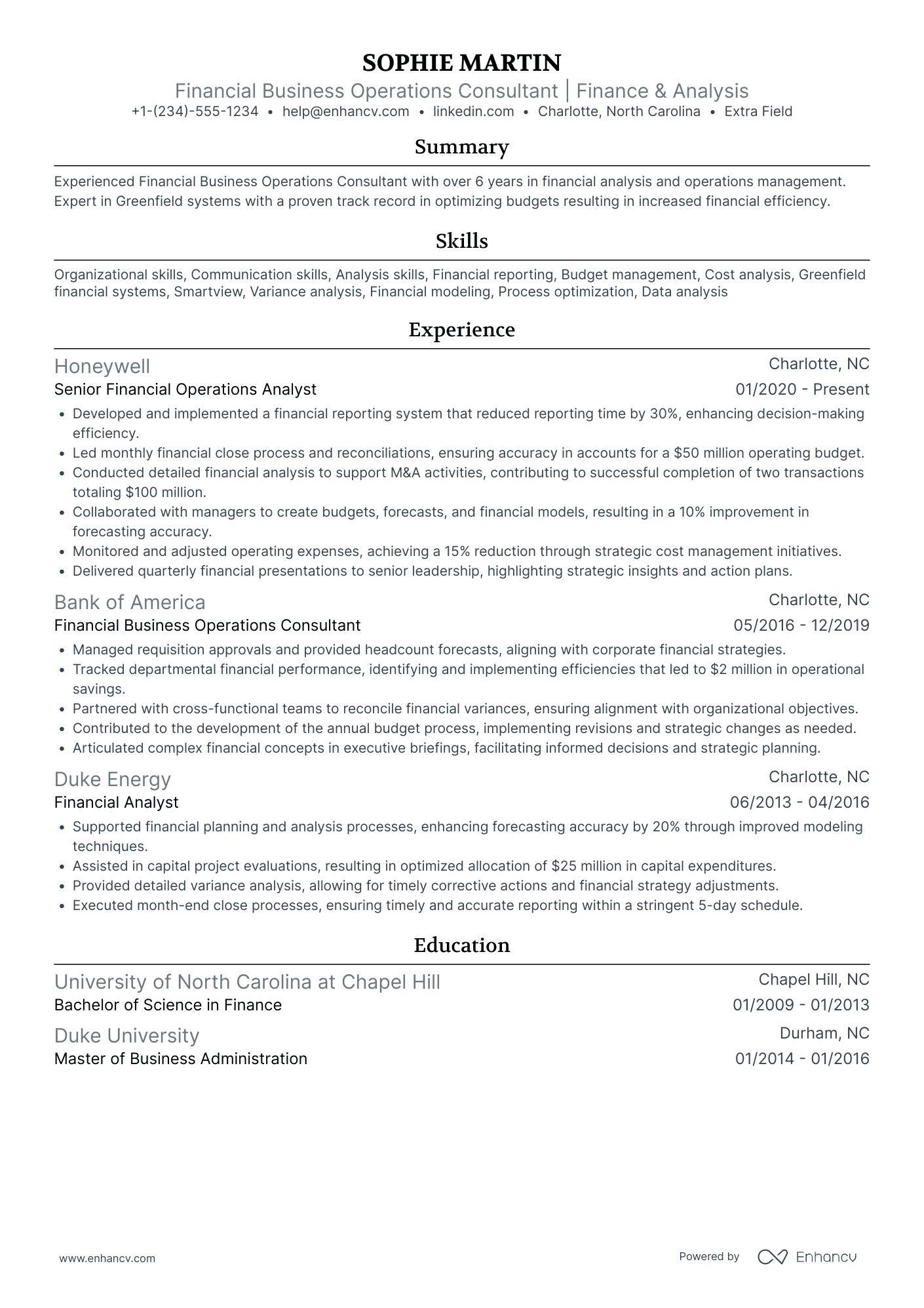

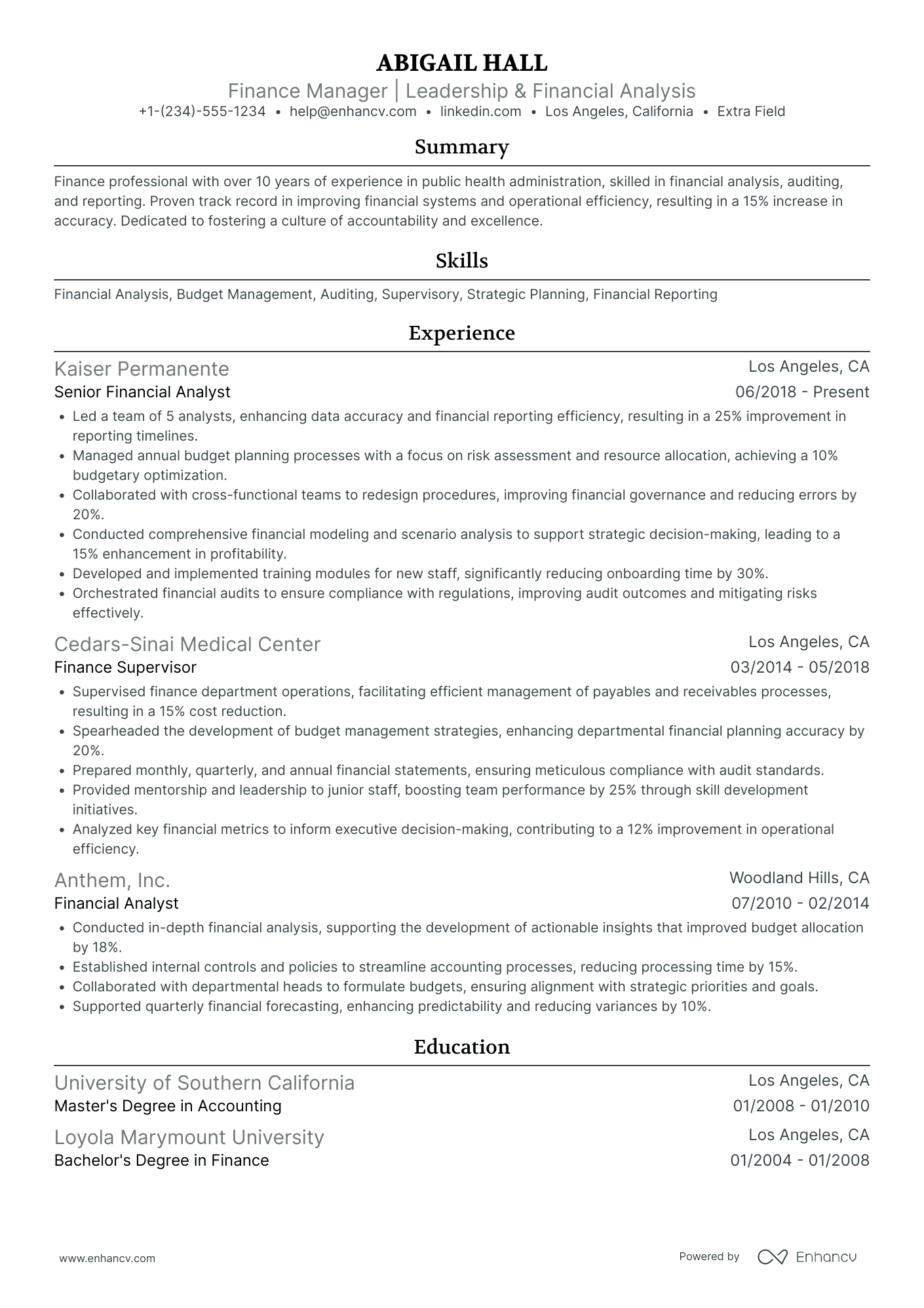

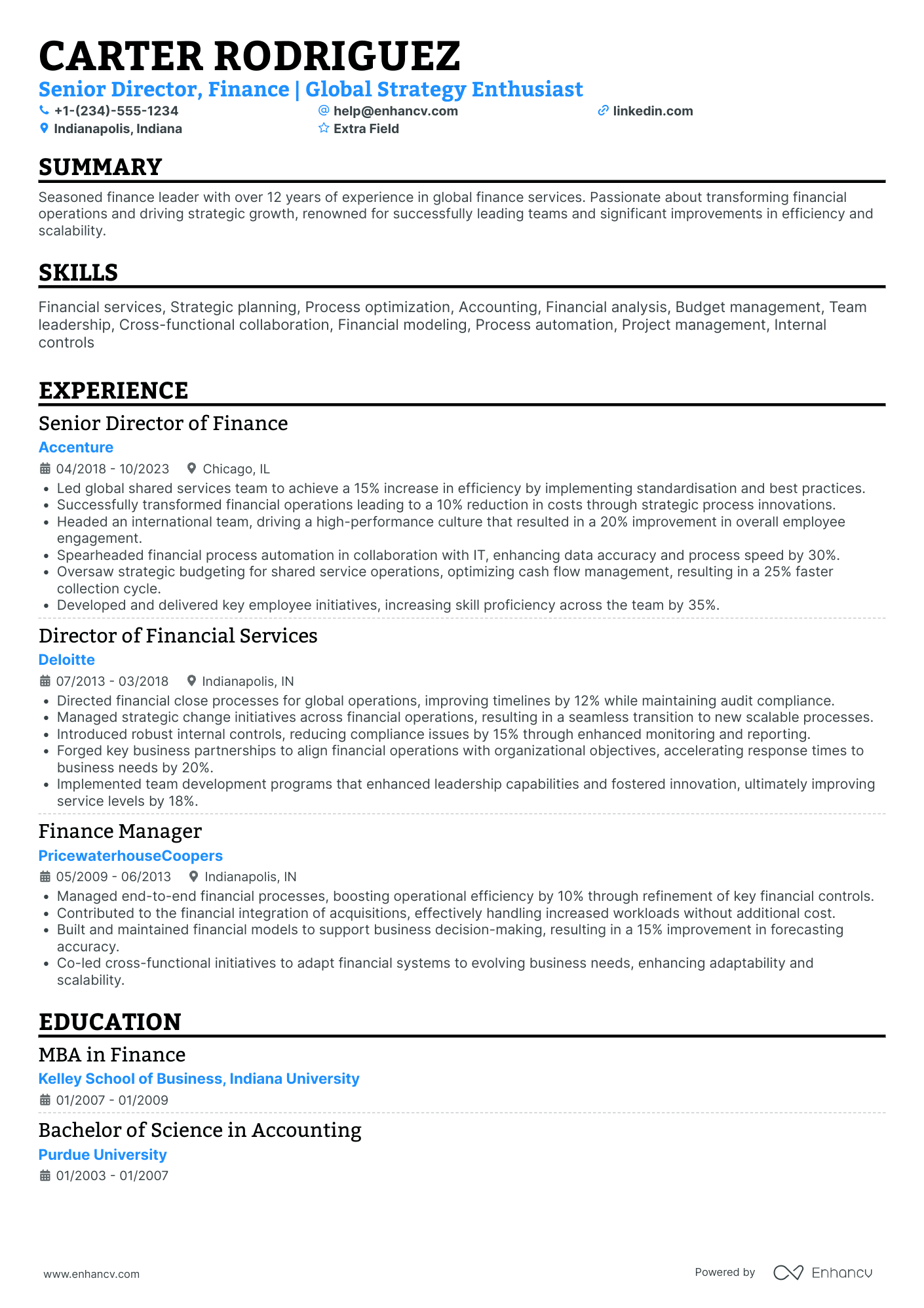

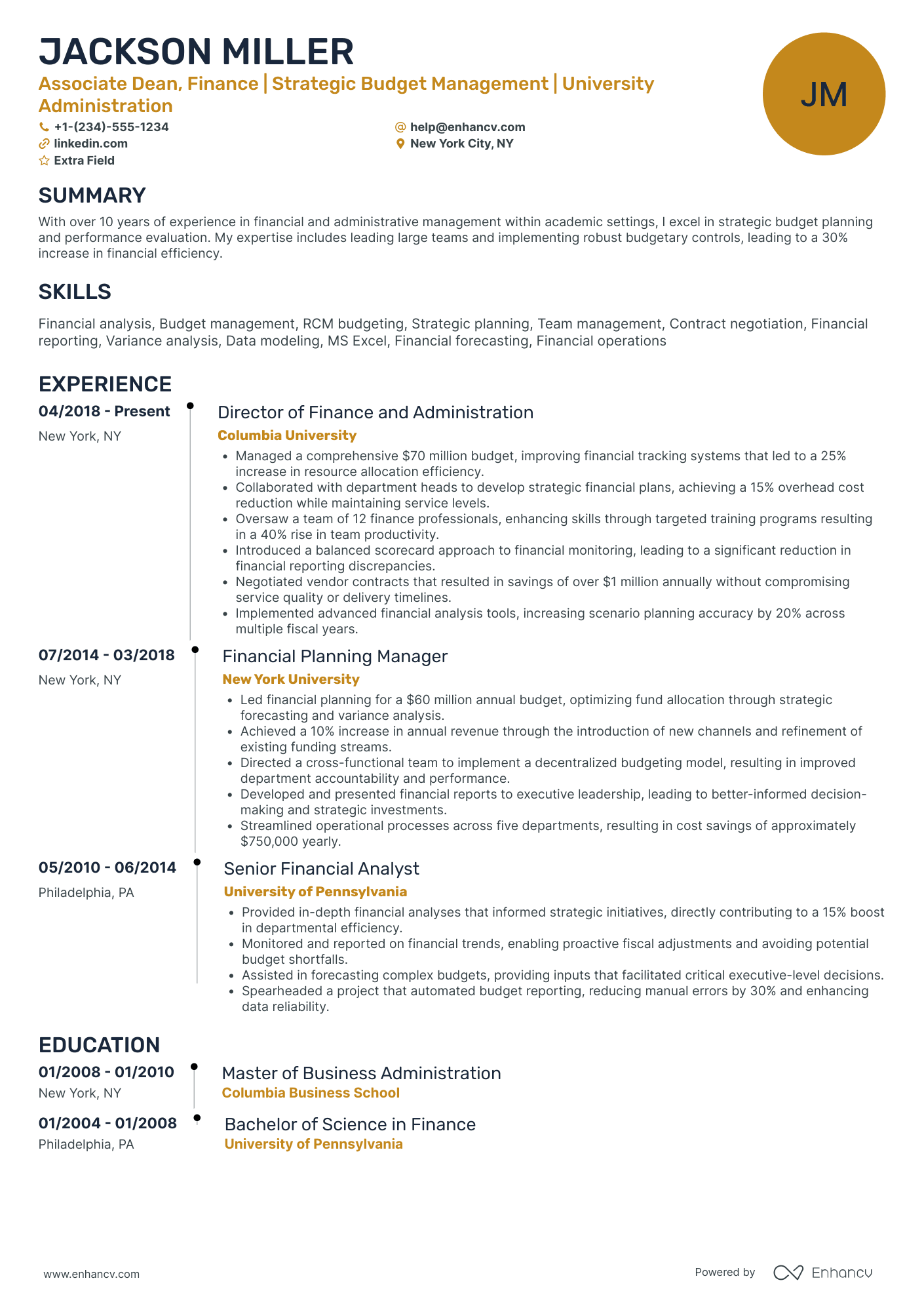

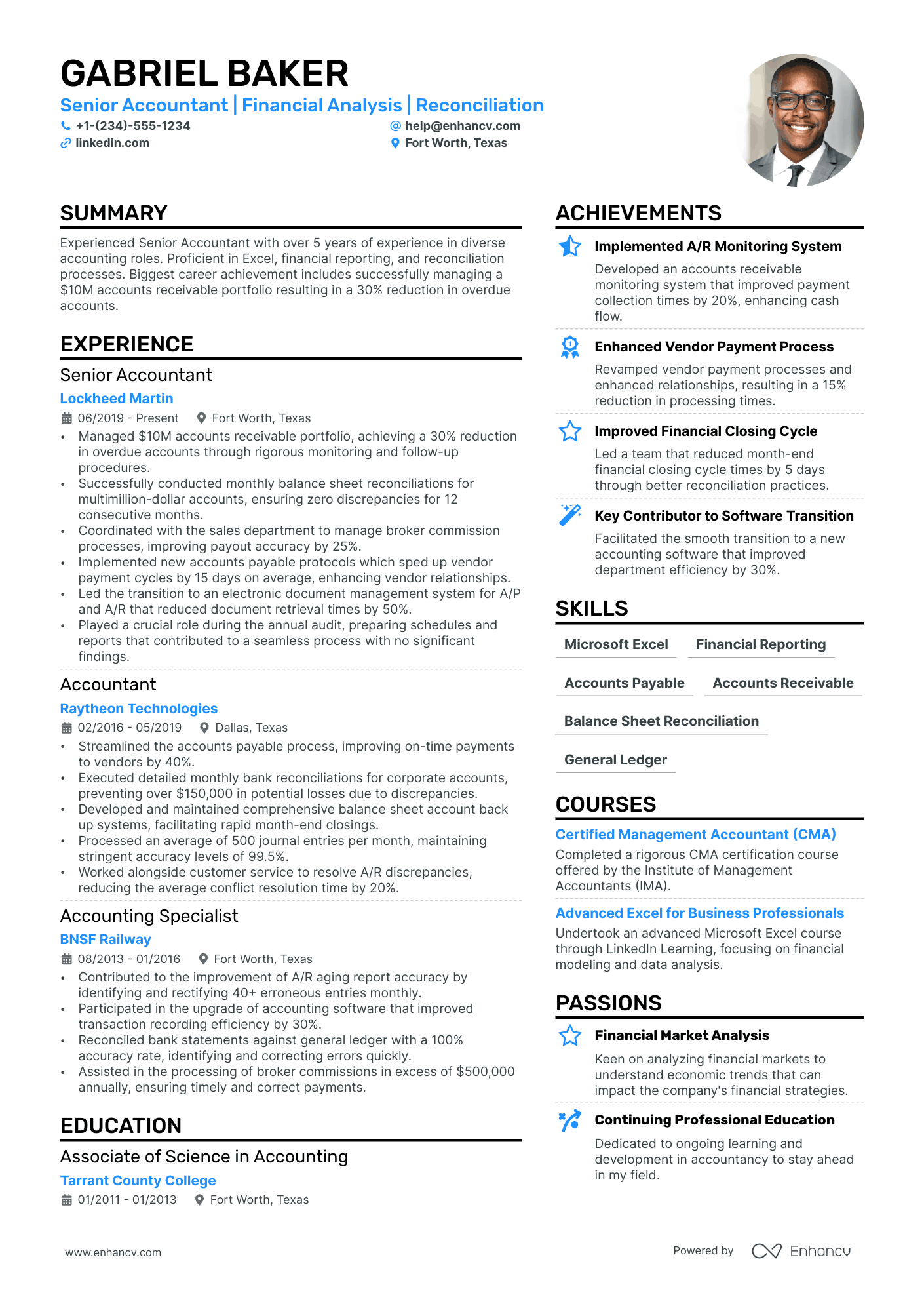

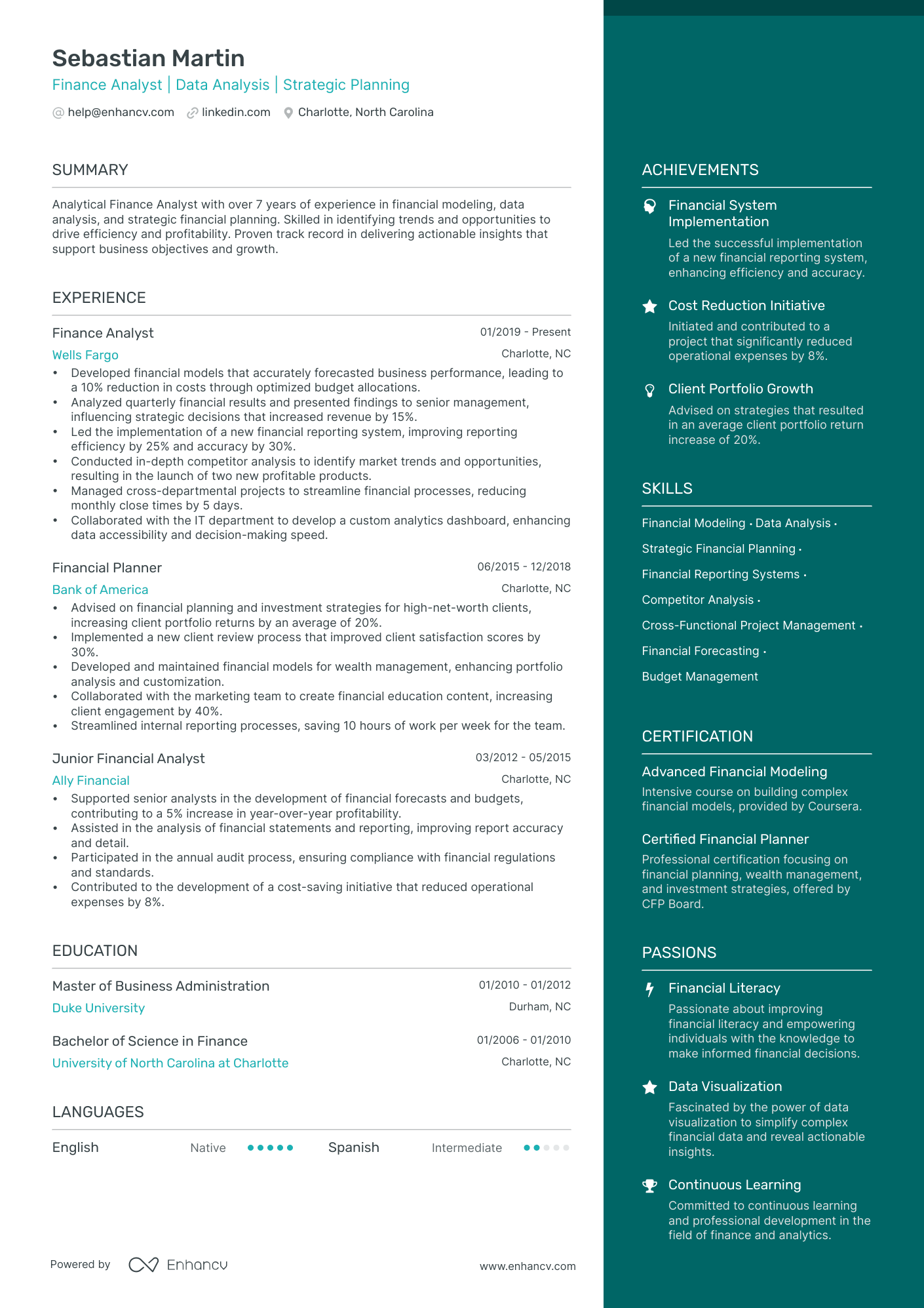

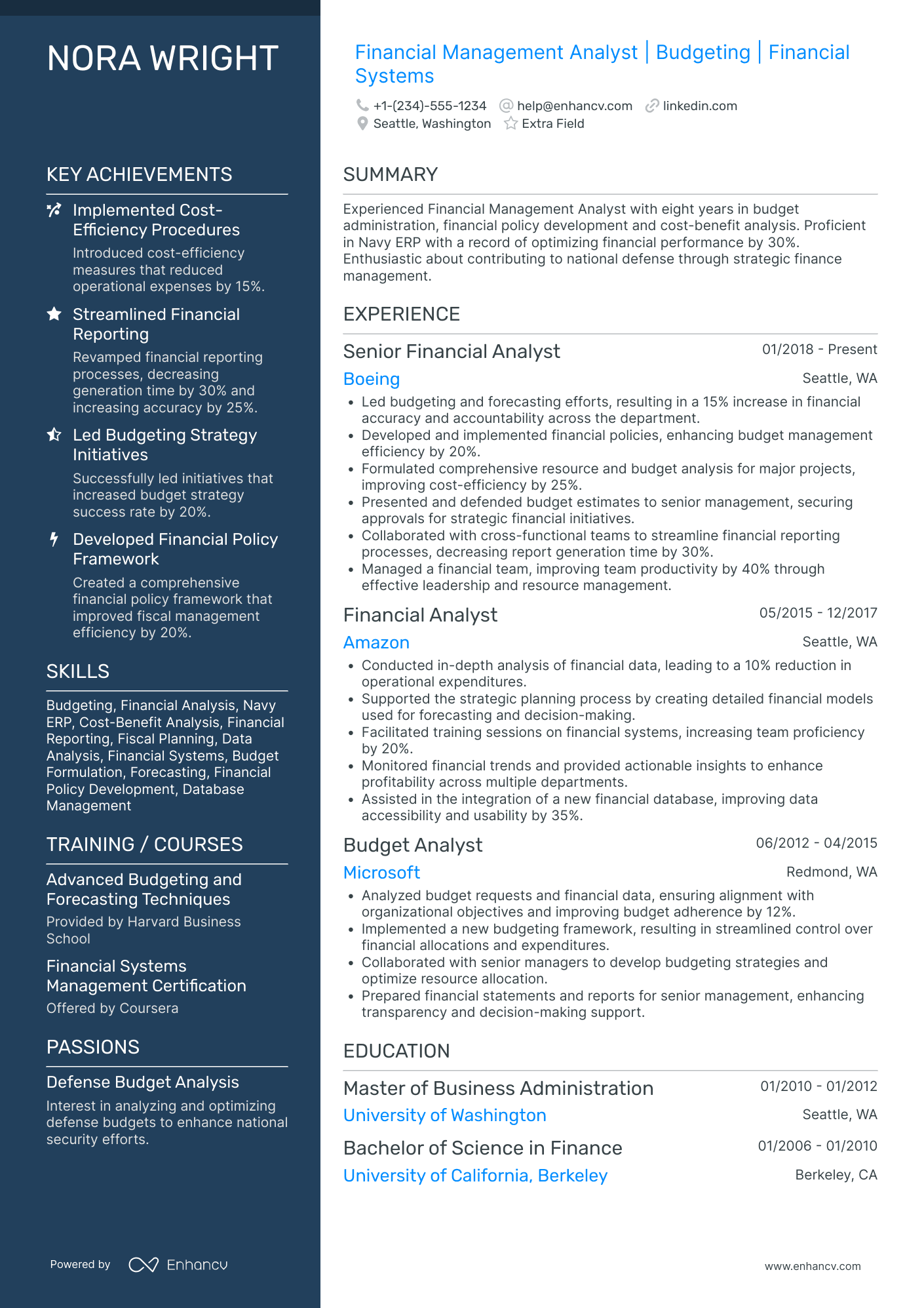

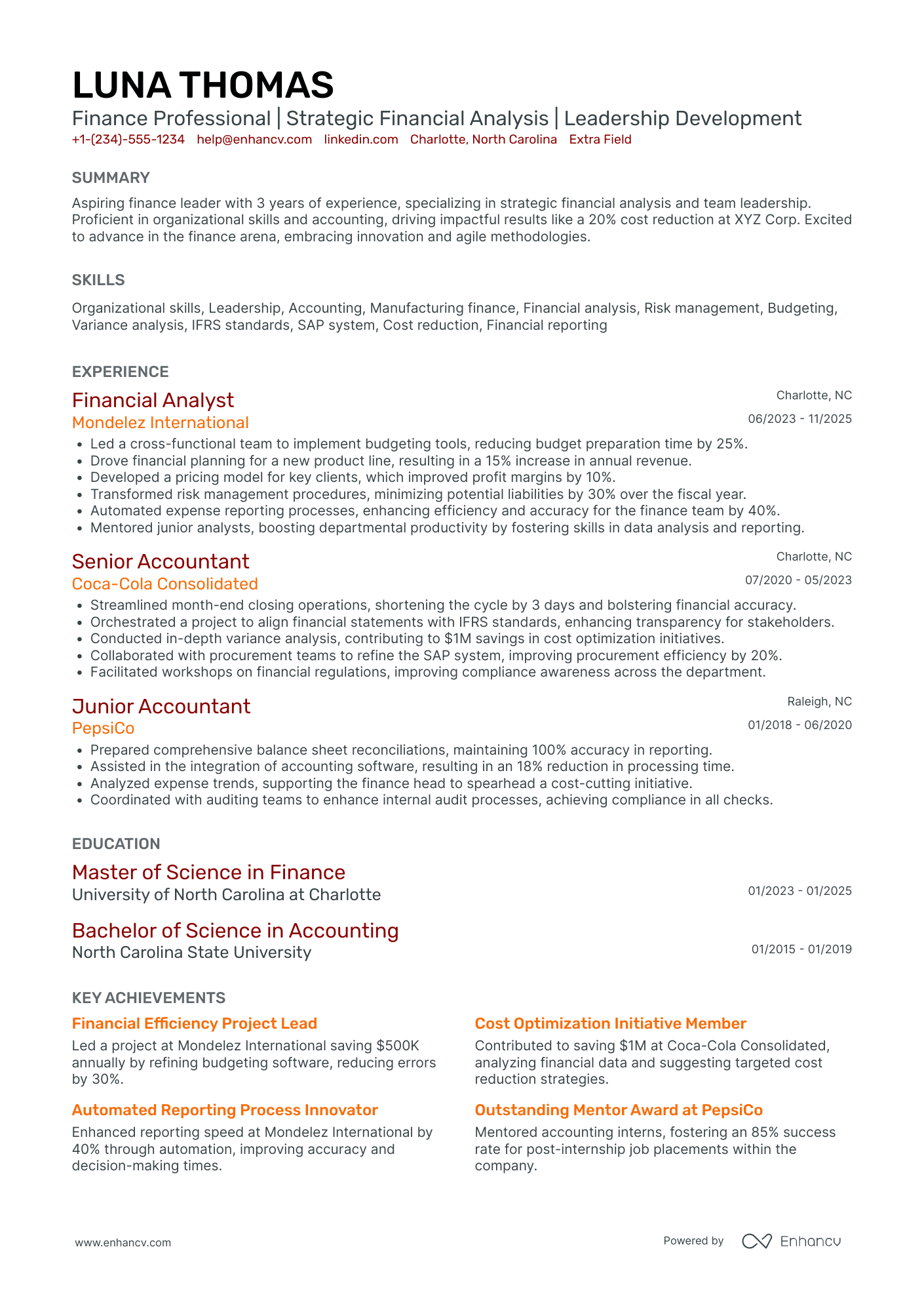

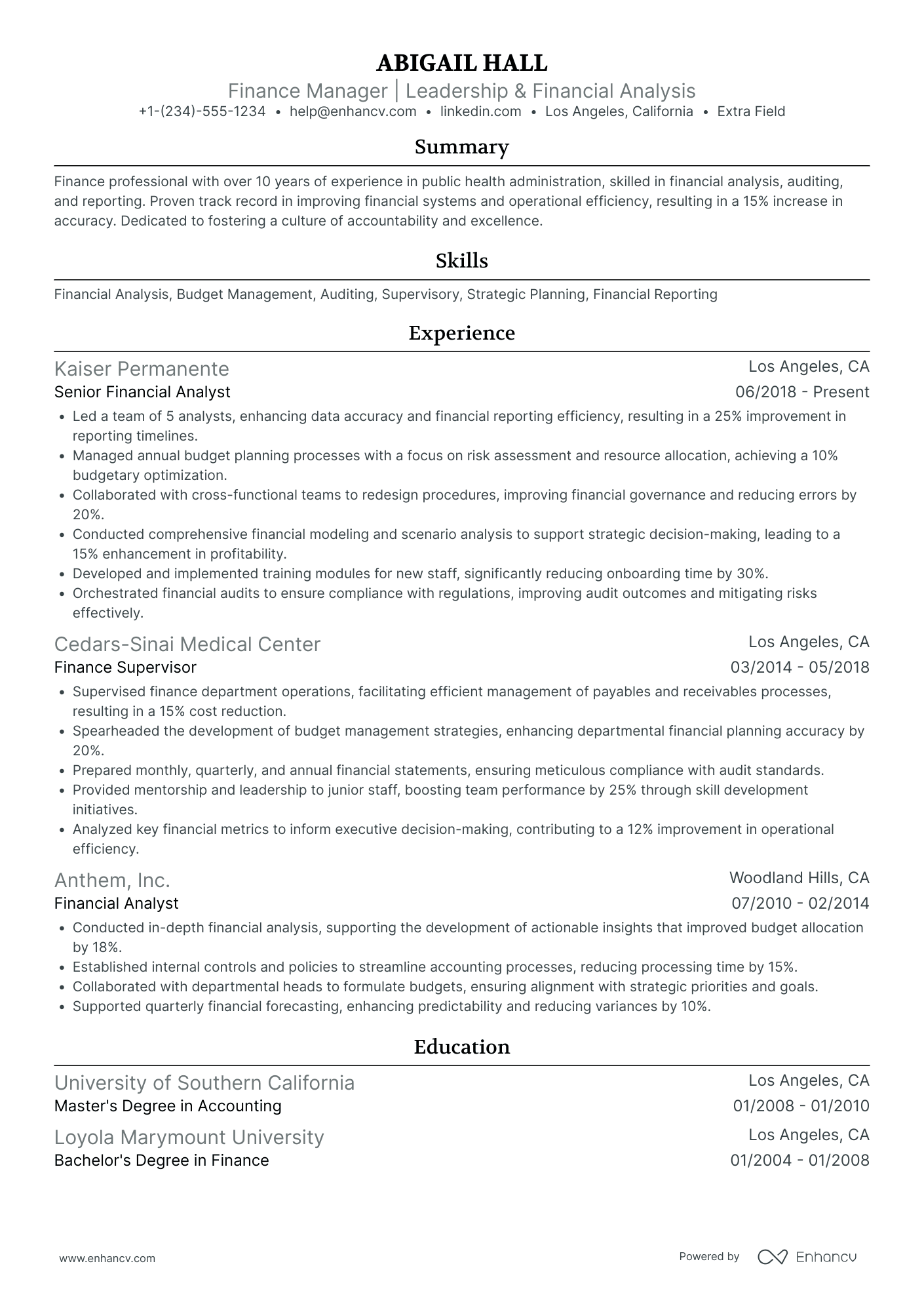

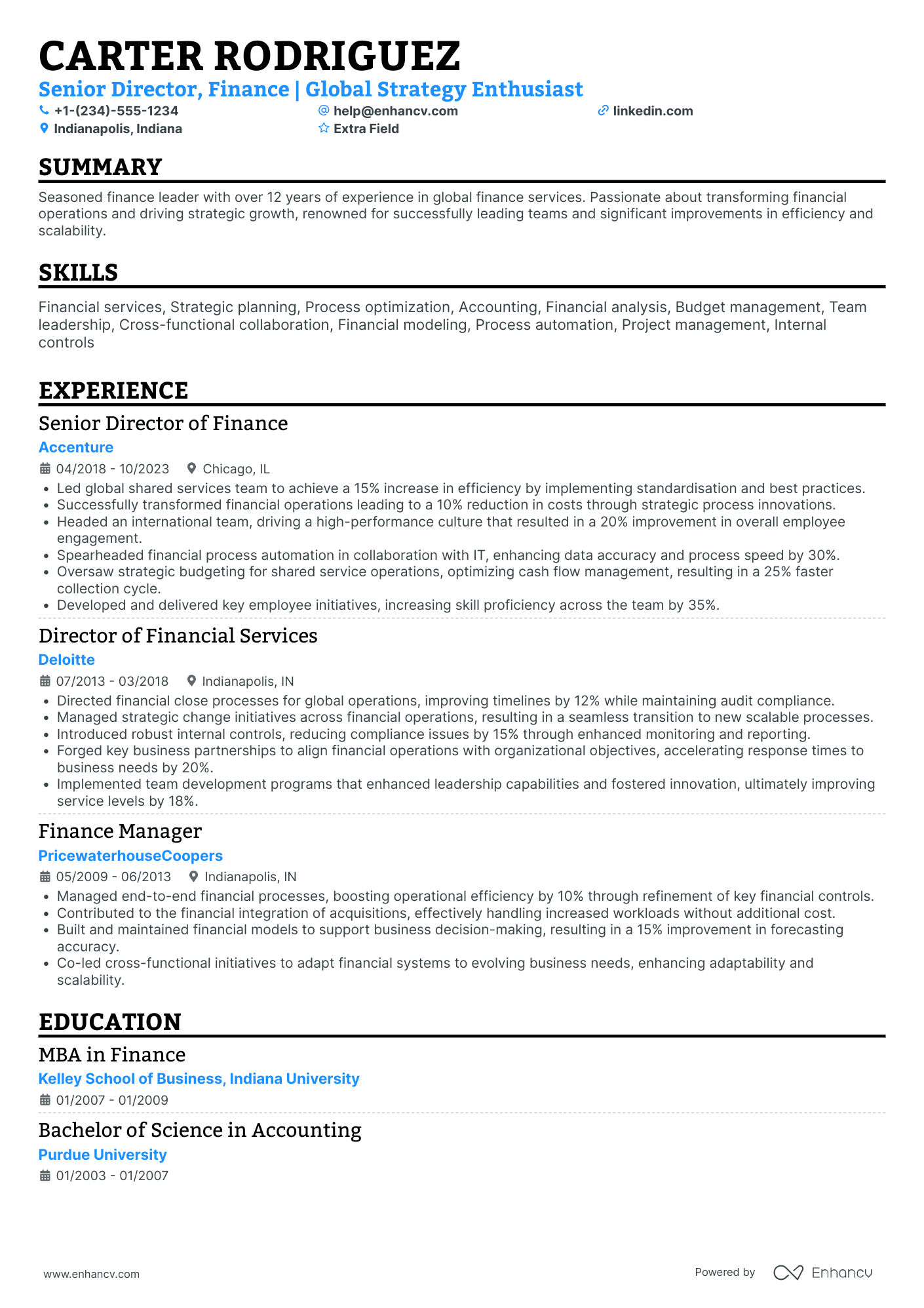

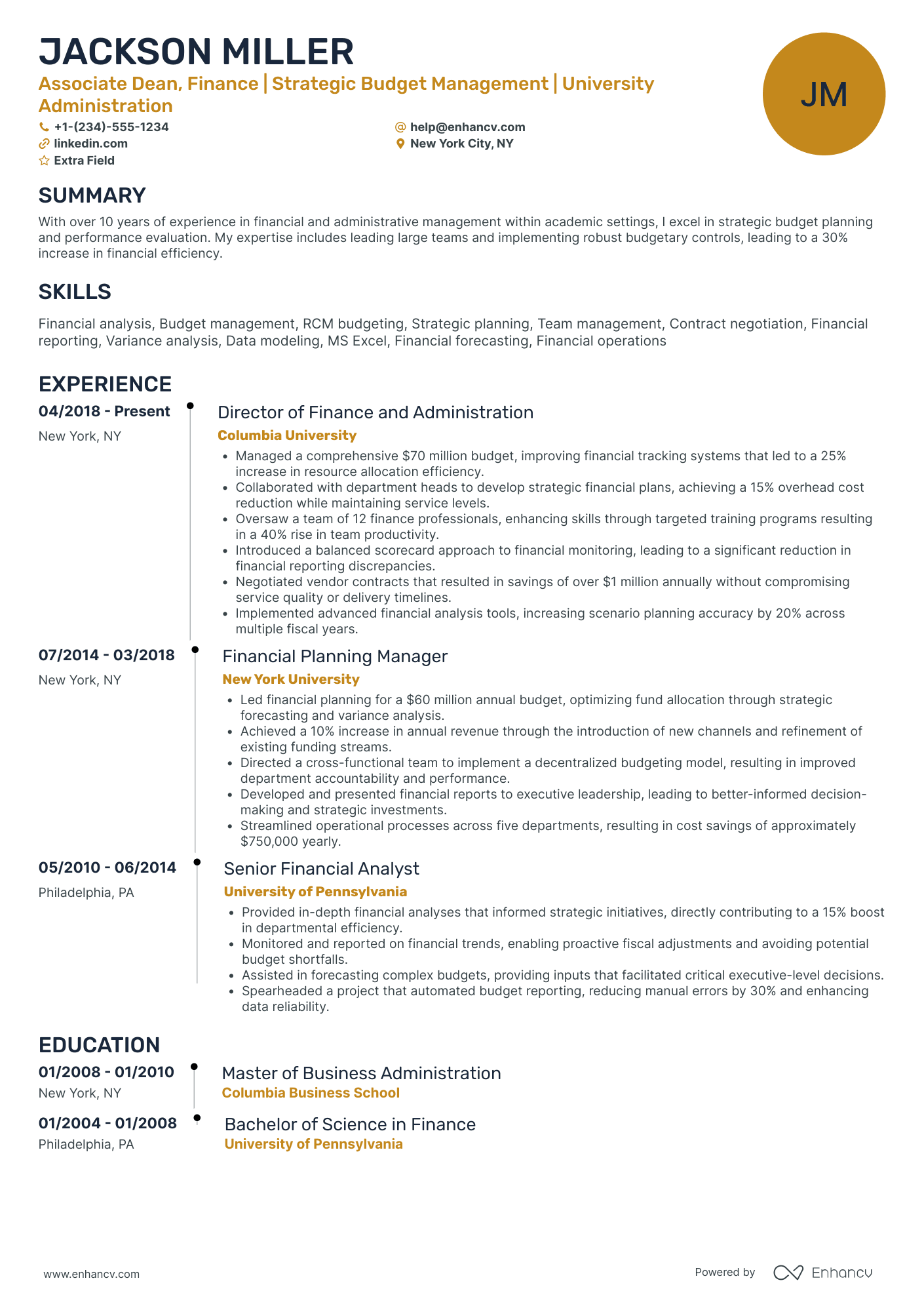

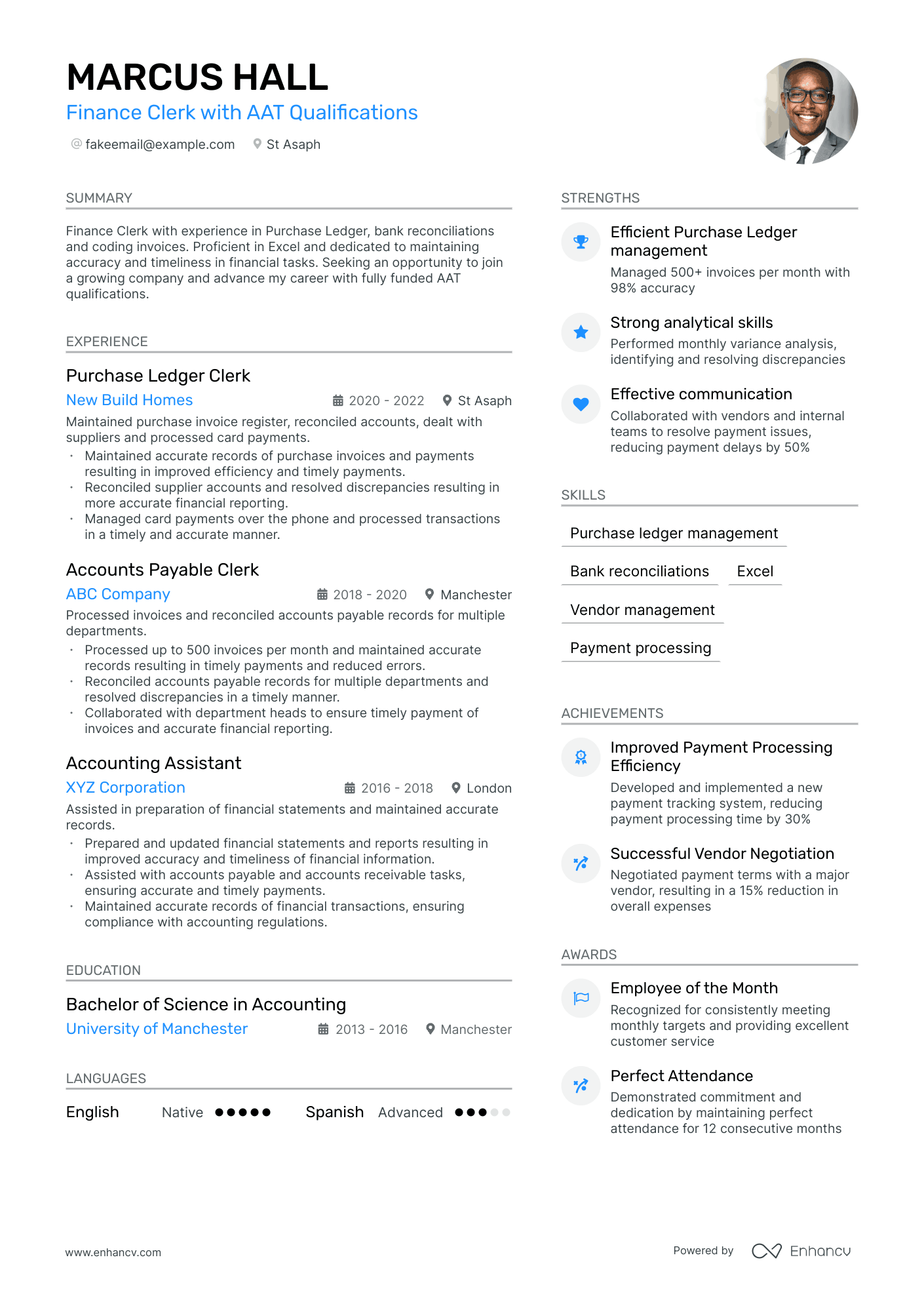

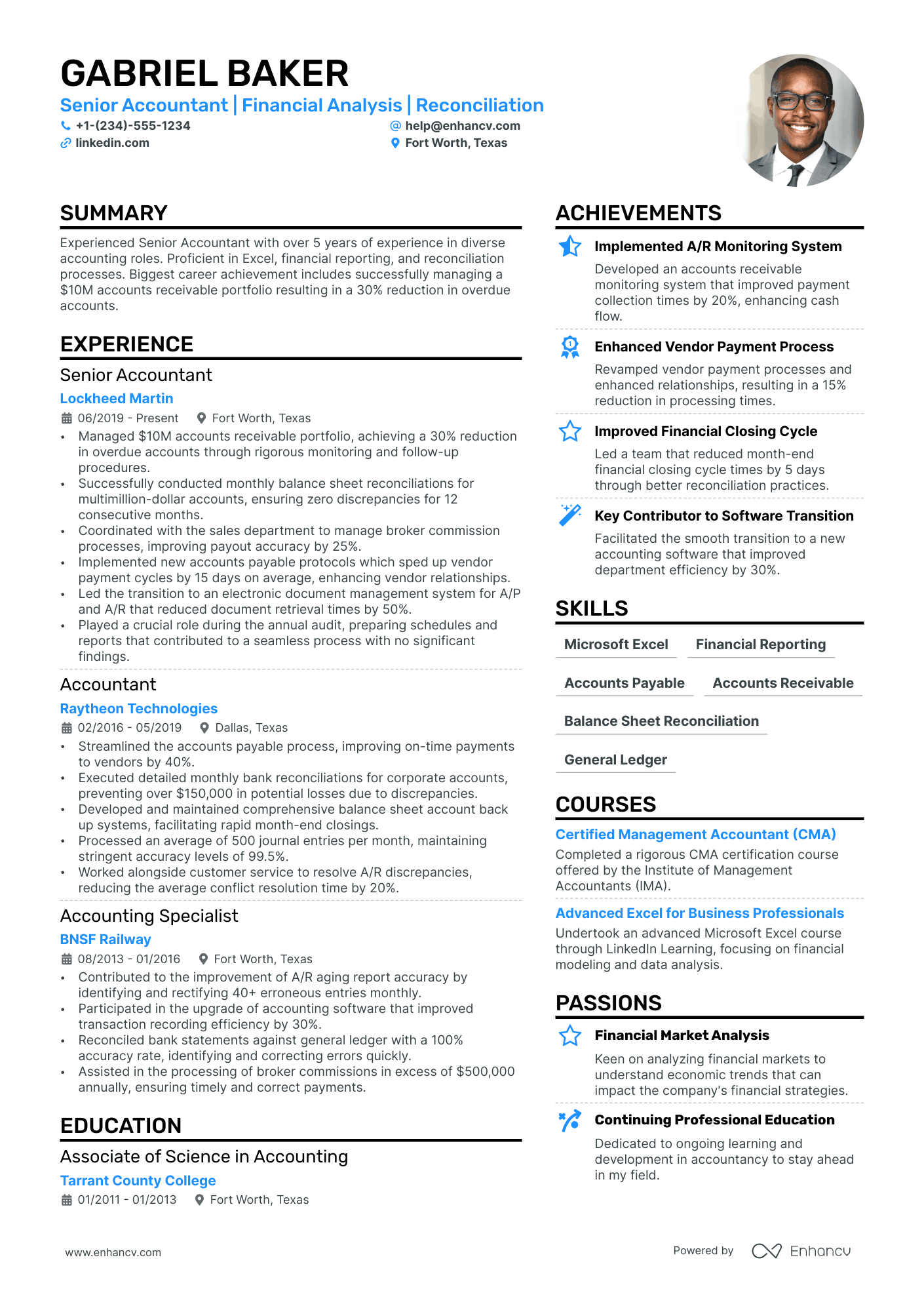

If you're a seasoned finance professional, the reverse-chronological resume layout is your best bet. It showcases your evolution and achievements within various finance roles or companies.

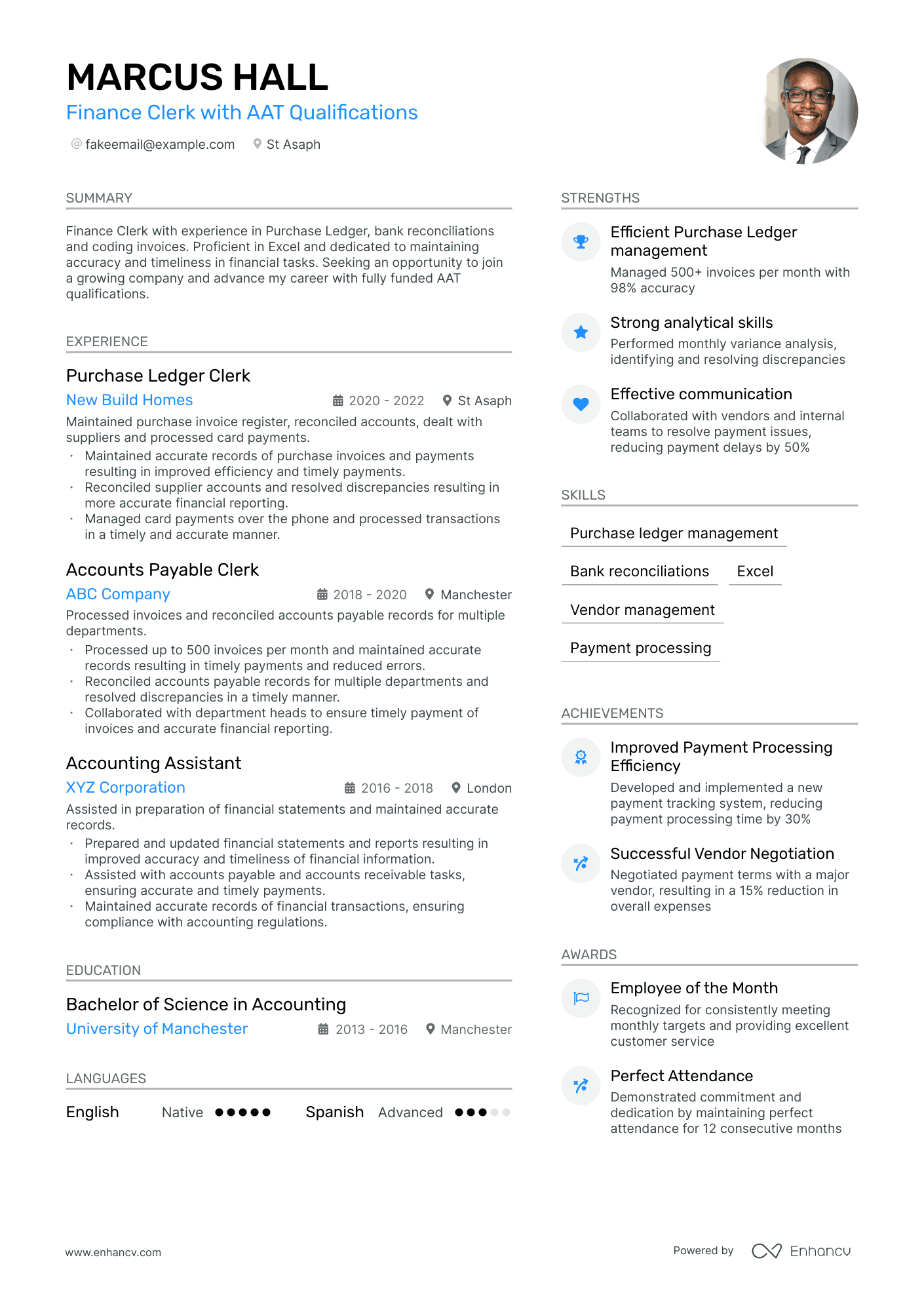

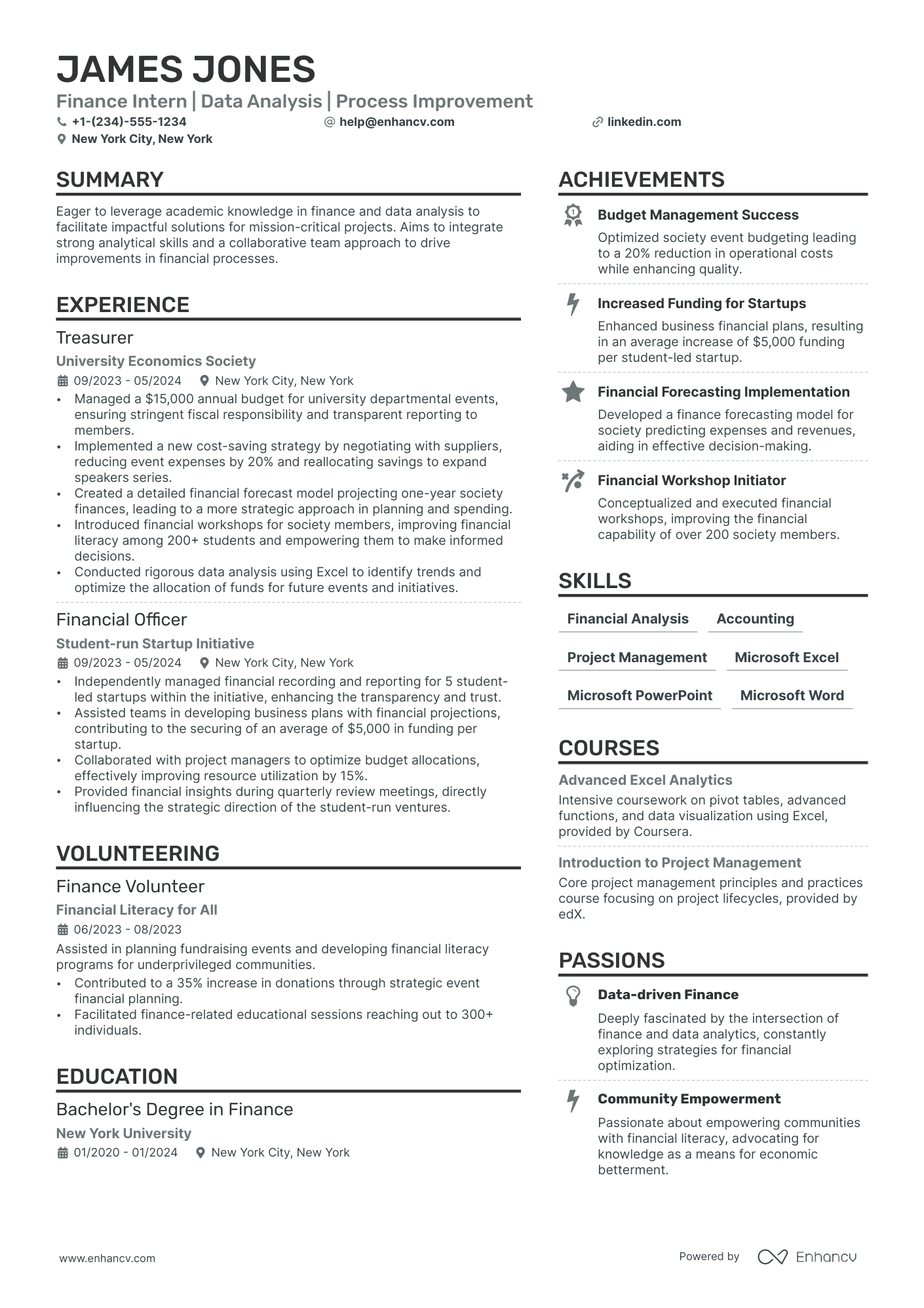

For those new to finance or branching out as freelancers, a hybrid layout or a functional resume format may serve you well. This approach emphasizes your unique skills, framing them as milestones in your career journey.

Choosing the right resume template is crucial for finance professionals aiming to highlight their analytical talents. Our professional resume examples offer a sleek, modern look that captures attention.

When tailoring your finance resume, remember these tips:

- Convert your finance resume to PDF to keep the formatting consistent across different platforms.

- Include precise contact information, such as a professional email, a current phone number, and your location, to boost your chances of landing job interviews.

- Use 1-inch margins to maintain a clean and professional layout and make your finance resume easy to scan.

- Opt for professional fonts like Rubik, Lato, Volkhov or Montserrat to make a strong first impression. A font size between 10-12 points balances ATS friendliness with easy readability.

- Choose resume colors that resonate with the finance sector. Blue stands out as a universally appealing choice, suitable for numerous finance styles.

Consider the local standards – Canadian resumes, for example, may have a different format.

In the United States, it's less common to include a photo on your resume. It's not a requirement and, in some instances, your application might be better off without it.

Even top finance professionals can find it challenging to market themselves effectively, especially when it's time to detail their expertise on a resume. Boost your resume's impact with our AI checker. Receive customized suggestions to spotlight your financial skills and boost your chances of landing interviews.

Already crafted your finance resume? Upload it here to uncover ways to enhance it further.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Shape your finance resume effectively by employing formatting strategies that spotlight essential sections and highlight your competencies.

The top sections on a finance resume:

- Professional summary: It reveals important financial accomplishments and expertise instantly.

- Education and certifications: Degrees and certifications, such as CPA, CFA, or MBA, notably boost your credibility in finance, often being prerequisites for specialized positions.

- Work experience within finance: Recruiters highly value your past work in similar roles, including your specific tasks and achievements.

- Skills relevant to the sector: It showcases competencies in finance-specific software, data analysis, or portfolio management demonstrating your readiness for the position.

- Achievements section: It highlights any high-stake projects, deals, or financial strategies you managed.

In the process of tailoring your finance resume, emphasize what makes you a standout candidate. Recruiters need assurance you’re a strong asset for their finance team.

What recruiters want to see on your resume:

- Financial certifications that speak volumes of your expertise and in-depth knowledge in the finance field.

- A rich background in financial analysis, highlighting your knack for dissecting financial data and crafting strategic business decisions.

- Expertise in financial software, emphasizing your adeptness with critical tools for contemporary financial analysis and reporting.

- Exceptional communication skills, illustrating your ability to present complex financial concepts to a varied audience.

- A track record of making strategic financial decisions, showcasing your talent for steering a company toward increased profitability.

Now that we have a good start, let's make our strategy even better. Let's jump into the main steps for detailing your work experience in finance.

How to write your finance resume experience

The experience section is crucial in your finance resume, acting as the primary space where recruiters assess whether your previous positions match the current job requirements. They seek solid achievements and the extent of your impact in former roles. Highlighting quantifiable achievements and important metrics is essential.

You must effectively prove you’re fit for the role with evidence of real results. Strive to outline three to four significant achievements for each position, prioritizing your accomplishments over mere job responsibilities.

Review these two descriptions of an identical finance job. The first offers a broad overview, whereas the second narrows down to tangible, measurable successes.

- •Boosted ROI through meticulous financial analysis and market trend evaluation

- •Negotiated cost-saving contracts, effectively reducing operational expenses

- •Designed and implemented strategic investment plans, markedly enhancing portfolio performance.

Several areas in this example could be enhanced:

- No specific metrics like growth percentages or cost savings.

- Duties and impacts lack detail on financial goal support.

- Fails to show teamwork with key departments.

By making focused changes, this part of the resume could be much more effective, better highlighting the candidate's strengths and successes within the industry.

- •Increased ROI by 30% through in-depth financial analysis and adapting to market trends

- •Secured contracts resulting in a 20% reduction in operational costs

- •Formulated and executed investment strategies that improved portfolio performance by 25%.

The second example stands out due to its use of specific outcomes and detailed role descriptions, making it a strong model for a finance resume. Here's why it's effective:

- It presents precise achievements, such as improved ROI and reduced operational costs with clear percentages.

- It details how the candidate employed financial analysis and market trends to make informed decisions.

- It highlights applicants' skills in enhancing growth and profitability by developing and applying effective investment strategies to improve portfolio performance.

For finance professionals, it's crucial to demonstrate hands-on experience to make an impactful impression. Ensuring your resume is compatible with Applicant Tracking Systems (ATS) is essential, as these systems screen applications by looking for specific finance-related keywords and qualifications.

If you find resume writing daunting, Enhancv provides ATS-friendly templates designed to streamline the process and effectively showcase your financial expertise.

After selecting a professionally designed template, the next consideration is the ideal length for your finance resume. Deciding whether to go for a neat one-page resume or a detailed two-page version really comes down to which one does a better job of shining a light on your skills and achievements. Lean into the experiences and talents that truly reflect your financial strength.

17% of hiring individuals would be deterred by a resume longer than two pages.

Next, we're about to dive into how to quantify your financial victories with numbers that speak volumes.

How to quantify the impact on a finance-related resume

finance experts need to spotlight how their actions improve finances and growth. Here are some clear tips:

- Include specific financial metrics you improved.

- Detail the cost efficiencies you have identified and implemented.

- Showcase your risk management skills by listing mitigated financial risks.

- Highlight specific business growth figures achieved through your financial strategies.

- Mention instances when you reduced debt or improved cash flow.

- Specify any improvements in audit scores or compliance rates.

In finance, first-time job seekers might find it difficult to demonstrate quantifiable achievements. Let's identify tactics to deal with the lack of experience.

To boost your chances of landing an interview, consider the following tips that can help you stand out, even without extensive experience.

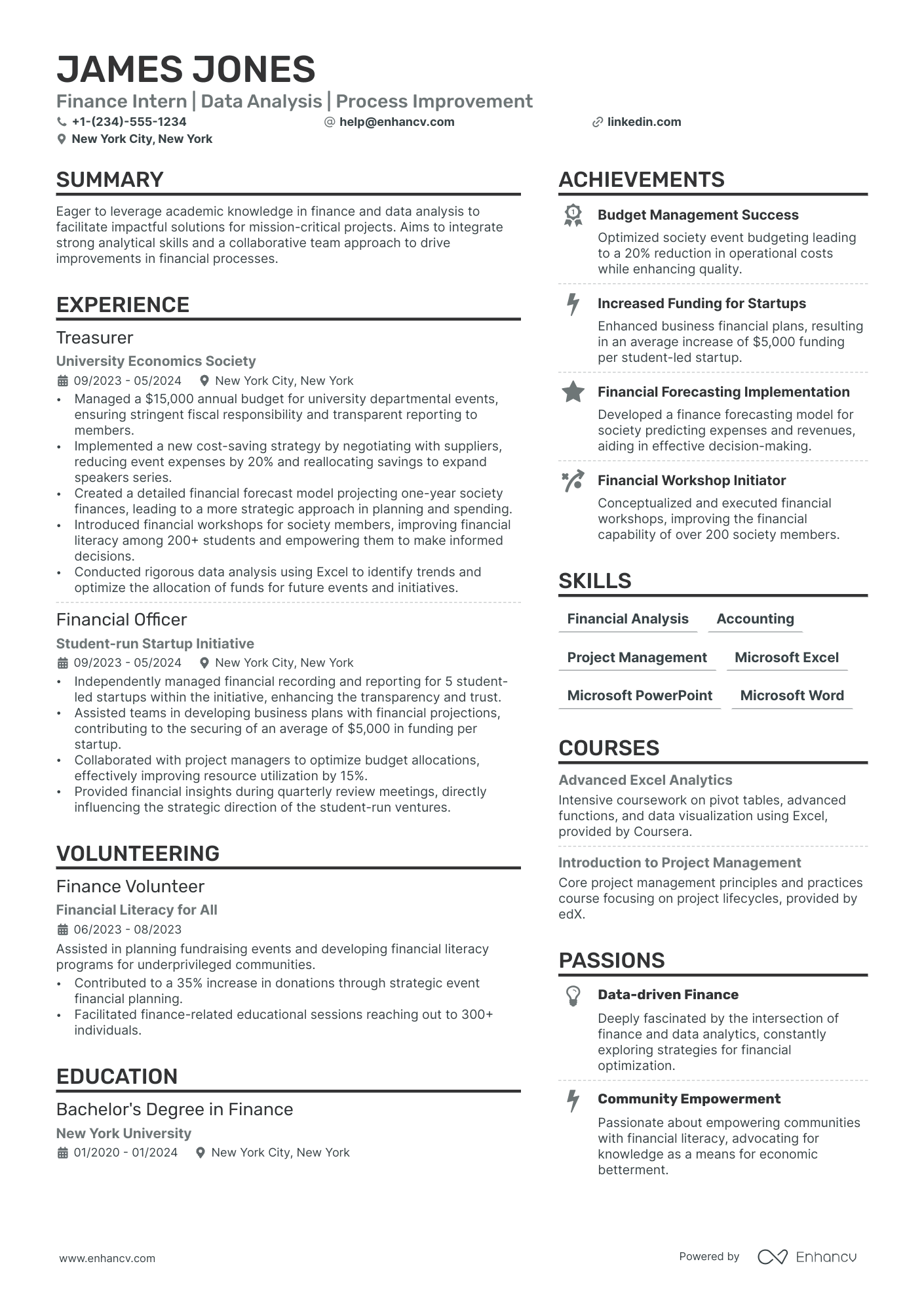

How do I write a finance resume with no experience

Ready to dive into the finance field? Showcasing your financial-savvy and proactive involvement in the finance community can distinguish you from the crowd. Consider volunteering your skills for budget analysis at local nonprofit organizations or participating in university finance clubs.

This proactive approach to engaging with the finance field can significantly enhance your credentials.

- Objective section: Compose a brief statement that highlights your enthusiasm for finance, describes your past involvement in the field, and shares your professional objectives. Ensure that recruiters can easily see how your ambitions match the goals of their firm.

- Skills: Catalog your relevant finance skills, both technical (financial analysis, portfolio management, use of financial software like Bloomberg and Excel) and soft skills (problem-solving, communication). Showcase how these abilities, whether developed in academic settings, through projects, or via self-study, make you a strong candidate for the finance role you're eyeing.

- Education section: Detail your degree and major, along with any finance-specific certifications (e.g., CFA or CPA) that underscore your commitment to the field.

- Projects: Highlight any freelance projects or personal investments that showcase your finance skills and the outcomes you've achieved.

- Internships: Include any finance-related internships. These experiences demonstrate your practical application of financial theories and your willingness to engage with the industry hands-on.

- Work experience section: Include any past job that showcases transferable skills relevant to finance, such as analytical thinking, market research, report writing, or technical expertise.

Include your graduation date to highlight your academic experience and its relevance to the finance position you're targeting. Plus, if it is above the average, listing your GPA on your resume underlines your educational accomplishments, making your candidacy stronger for the finance role. Your recent finance education and new outlook are key advantages. Don’t forget, in finance, soft skills hold as much weight as hard skills.

How to list your hard skills and soft skills on your resume

Skills are crucial for your finance resume. Hiring managers are keen to discover your capabilities and why you're the ideal candidate for their role.

It's important to list all finance tools and software you're proficient in, alongside your interpersonal skills.

Best hard skills for your finance resume

- Working with SAP

- Knowledge of SQL

- Proficiency in Excel

- Statistical & financial analysis

- Forecasting

- Accounting

- Tax preparation

- Risk management

- Portfolio management

- Investment analysis

- Budgeting

- Experience with Oracle ERP

Choose skills for your finance resume that align with the job description. Delve into the job ad, then adjust your skills to mirror the employer's needs.

Best soft skills for your finance resume

- Client relationship management

- Critical thinking

- Detail-oriented

- Decision-making

- Communication skills

- Problem-solving

- Time management

- Persistence

- Empathy

- Leadership

- Resilience

- Diplomacy

PRO TIP

Most US employers favor resumes customized for the specific job at hand over a one-size-fits-all resume. A tailored application can notably enhance your prospects of securing the position.

How to list your education and certifications on your resume

To qualify for a finance role, you'll typically need a Bachelor's degree in finance, economics, accounting, or a related discipline. Here's how to structure your education section.

What to include:

- Degree name: Indicate the degree you obtained.

- Institution name: The school where you earned your degree.

- Graduation date: The date of graduation or the expected graduation date.

- Major/Concentration: Mention your major and any minors related to finance.

- Relevant courses: Highlight if they are specifically related to finance or economics.

- GPA: Feature your GPA if it's notable and you've recently finished your studies.

Here’s an example:

- •Specialized Coursework: Investment analysis, corporate finance strategies, and financial risk management

- •Core Modules: Economic theory, quantitative analysis, and financial markets

In the finance industry, a commitment to continual learning and professional development is highly valued. Featuring certifications on your resume, whether in financial analysis, investment management, or compliance, demonstrates your effort to navigate the complexities of finance. Adding these to your resume tells hiring managers you're ready for the finance world's challenges. This makes you a strong candidate for finance jobs.

Here are the top five certifications finance recruiters look for, each a gateway to specialized expertise in the field:

Best certifications for your finance resume

It's time to create a compelling summary, the cornerstone of your finance resume.

How to write your finance resume summary or objective

For finance professionals with extensive portfolios, opting for a summary is strategic. This concise paragraph allows you to underline significant skills and milestones directly related to the job requirements, quickly informing recruiters of your qualifications for the finance position.

Let's check out a good and a not-so-good finance resume summary to see what works and what doesn't.

Obviously, the first example is a bad one, because:

- Fails to show quantifiable successes or examples of skill application.

- Employs broad language without specifying areas of finance specialization.

- Doesn't tailor the summary to the candidate's experiences or the job.

Let's see how some simple adjustments can greatly improve the message.

This improved example is better because:

- It mentions "8+ years," showing deeper industry experience.

- It highlights a specific improvement, like cutting reporting times by 20%.

- The mention of a CFA and skills in Excel and Tableau demonstrates specialized knowledge and technical abilities.

- References to teamwork and planning skills indicate well-rounded capabilities in both individual and group settings.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Additional sections for a finance resume

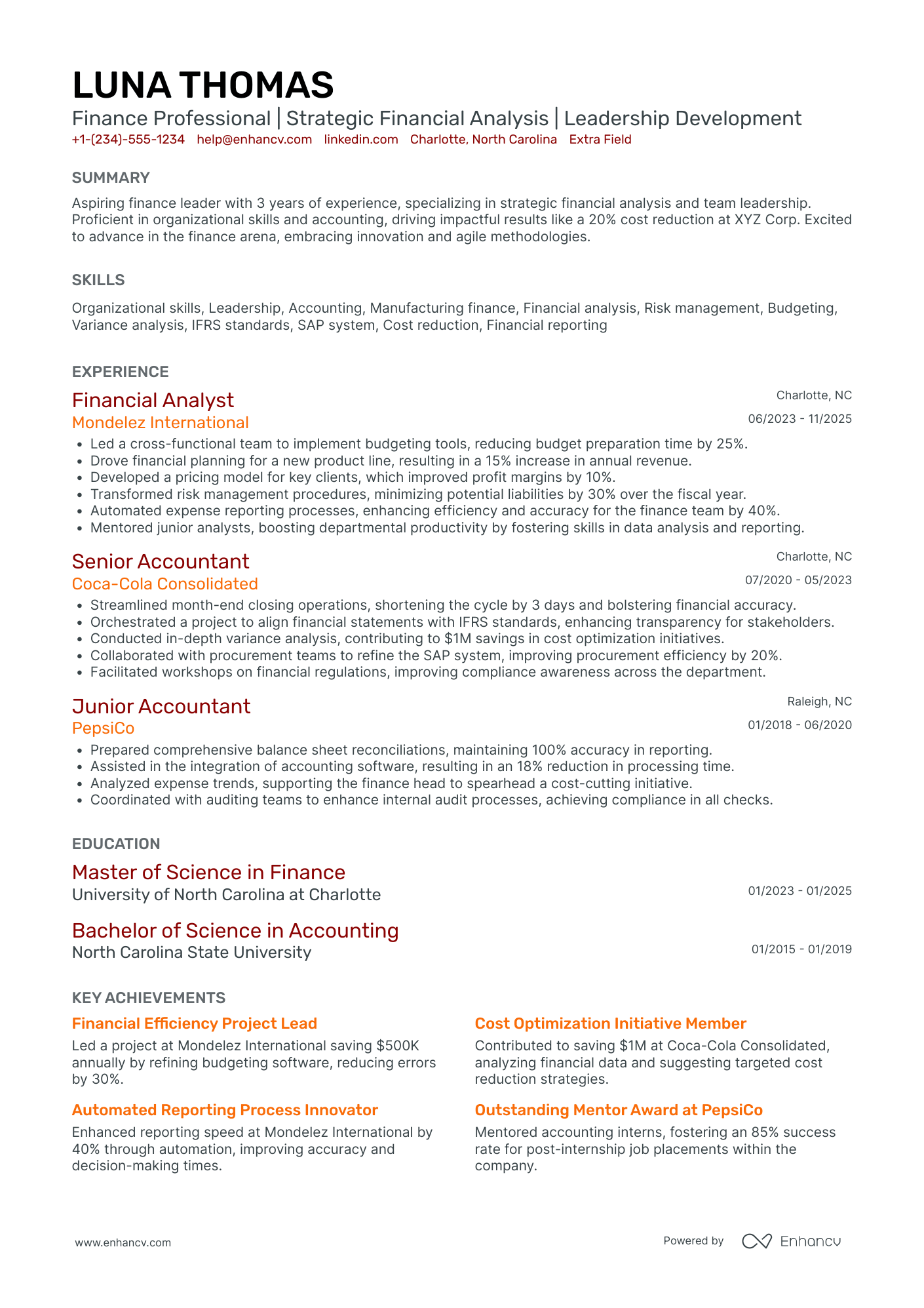

For success in finance, highlighting your strengths and notable achievements is key. Consider including these sections in your resume:

- Publications on your resume: Note any finance-related articles, research papers, or analyses you've authored in journals, websites, or books. This boosts your credibility and demonstrates your expertise in the field.

- Interests and hobbies: Feel free to share a mix of hobbies, such as chess, hiking, or reading economic literature, to display a well-rounded personality that balances finance passion with diverse pursuits.

- Language skills: Indicates your ability for broad communication in the international finance arena.

To effectively showcase your achievements, consider creating a separate section on your resume.

How to put an achievements section on a resume

Here's how to demonstrate your significant contributions and successes in the finance industry.

Key takeaways

- Tailoring your finance resume to the specific job and using a format that highlights your experience and skills can significantly increase your chances of landing an interview.

- Including precise contact information and choosing a professional layout and font are crucial steps to make your resume easy to read and ATS-friendly.

- Obtaining and listing relevant finance certifications (e.g., CFA, CPA) on your resume underscores your expertise and commitment to professional development.

- Adding sections for publications, interests, and hobbies can provide a more comprehensive view of your profile, showing you as a well-rounded candidate.

- Showcasing significant contributions and successes, such as optimized portfolio performance or cost reduction initiatives, in a separate achievements section can make your application stand out.

Finance resume examples

By Experience

By Role