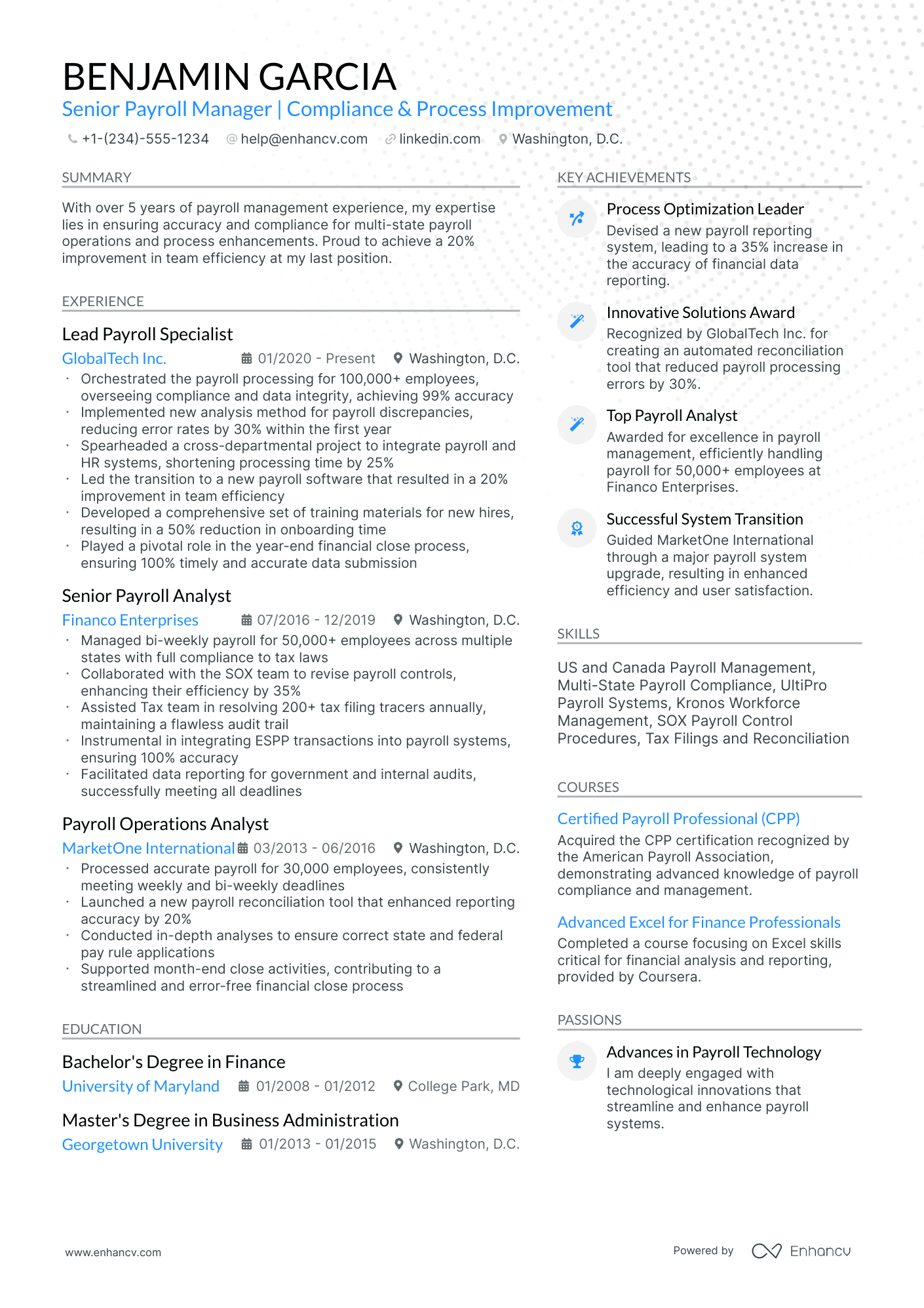

As a payroll manager, articulating your complex understanding of payroll systems and legislation in a concise resume can pose a significant challenge. Our guide provides insights and strategies to showcase your expertise effectively, ensuring that your resume stands out in a crowded field of professionals.

- Payroll manager resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out payroll manager skills that should make your resume.

- Styling the layout of your professional resume: take a page from payroll manager resume examples.

How to write about your payroll manager achievements in various resume sections (e.g. summary, experience, and education).

- Big 4 Accounting Resume Example

- Financial Reporting Manager Resume Example

- Oracle Project Accounting Resume Example

- Night Auditor Resume Example

- Phone Banking Resume Example

- Purchasing Director Resume Example

- General Ledger Accounting Resume Example

- Finance Associate Resume Example

- Audit Manager Resume Example

- Credit Manager Resume Example

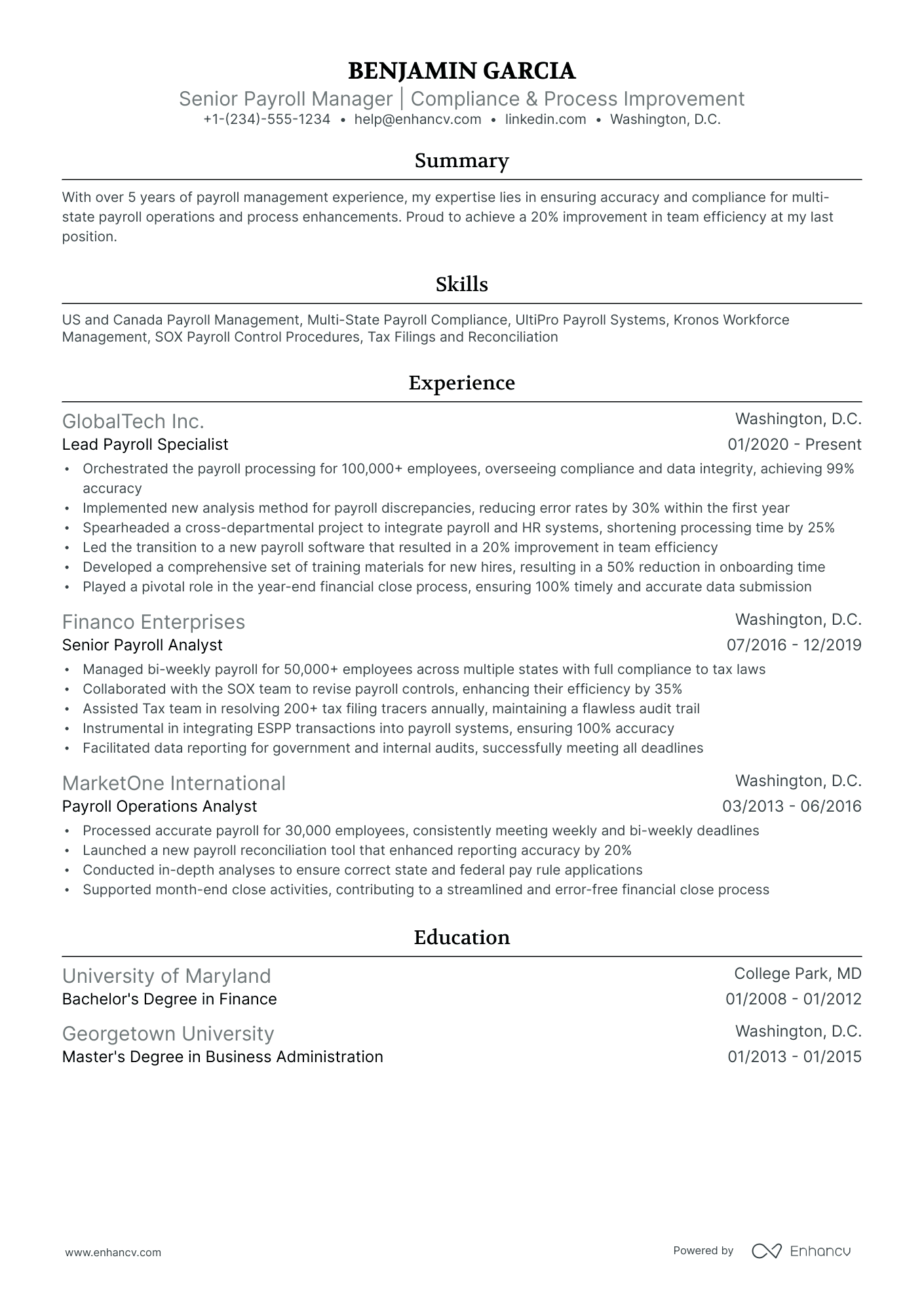

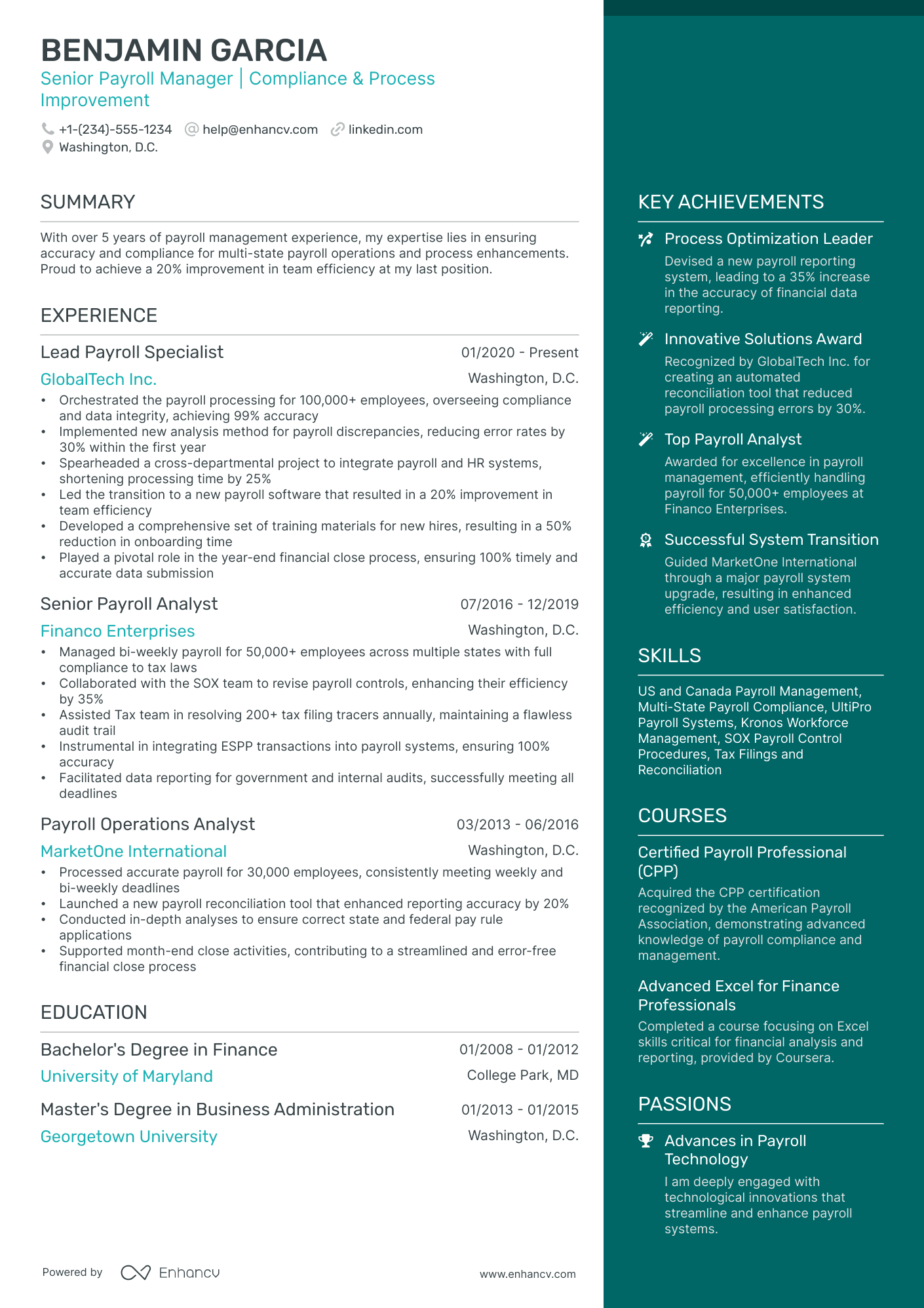

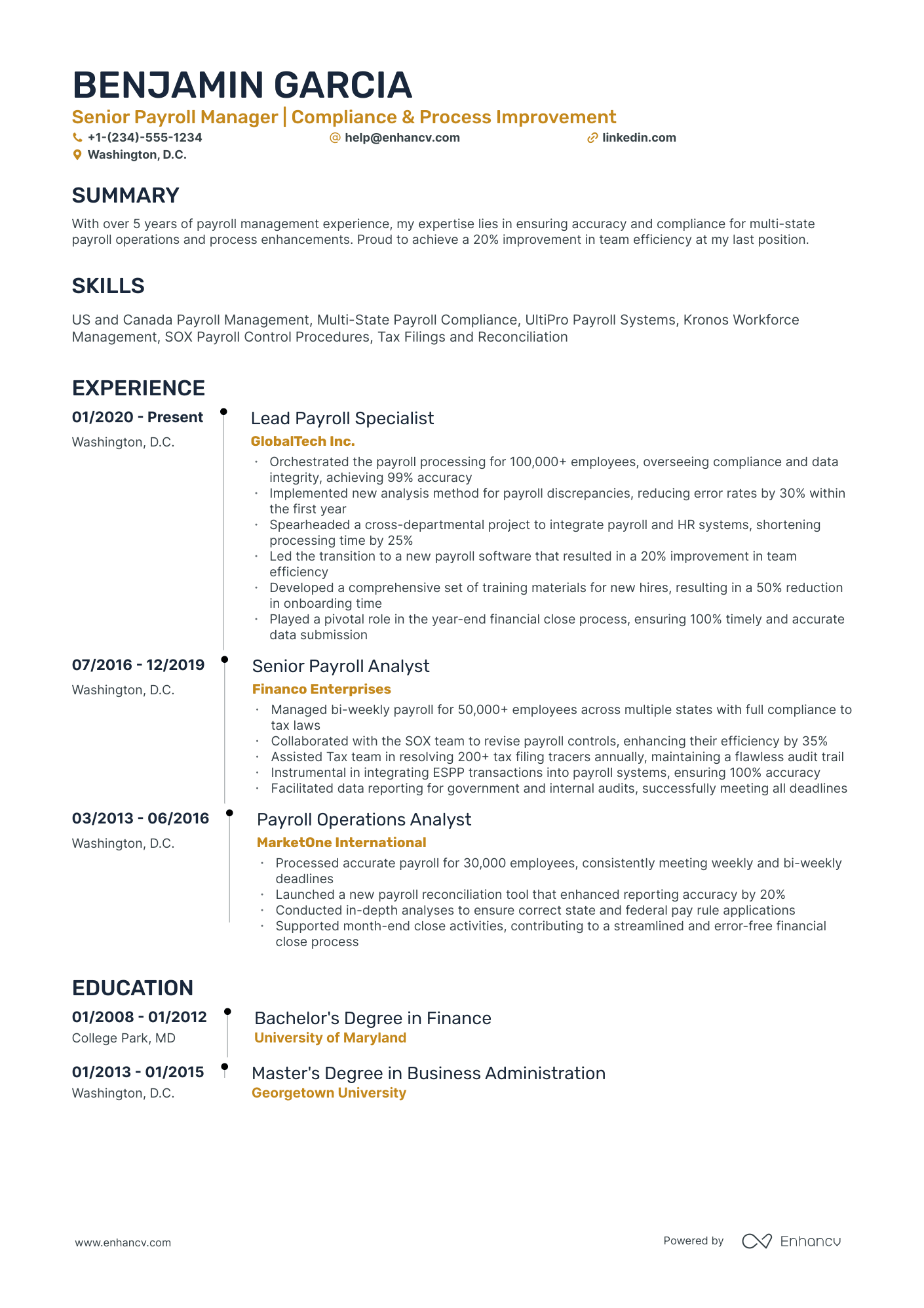

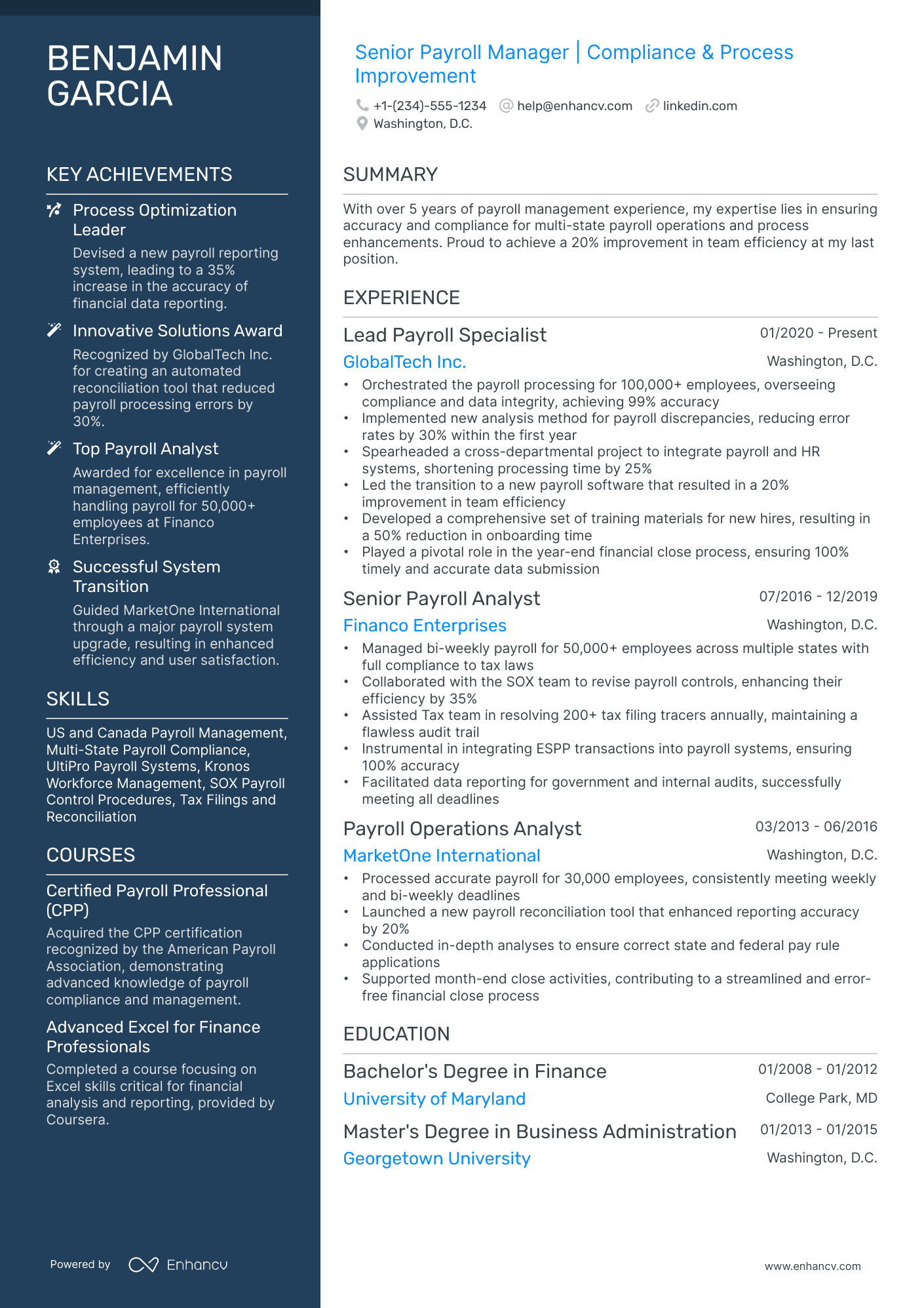

Professional payroll manager resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Think about the location of your application – Canadian resumes, for instance, might follow a different structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Traditional sections, appreciated by recruiters, for your payroll manager resume:

- Clear and concise header with relevant links and contact details

- Summary or objective with precise snapshot of our career highlights and why you're a suitable candidate for the payroll manager role

- Experience that goes into the nuts and bolts of your professional qualifications and success

- Skills section(-s) for more in-depth talent-alignment between job keywords and your own profile

- Education and certifications sections to further show your commitment for growth in the specific niche

What recruiters want to see on your resume:

- Demonstrated knowledge of payroll regulations and compliance with federal, state, and local laws.

- Proficiency with payroll software systems and technology like ADP, Paychex, or QuickBooks.

- Strong numerical aptitude and attention to detail for accurate payroll processing.

- Experience with benefits administration and understanding of various compensation structures.

- Proven track record of successfully managing a payroll team and improving departmental processes.

Quick guide to your payroll manager resume experience section

After deciding on the format of your resume, it's time to organize your experience within the dedicated section.

It's common for payroll manager professionals to be confused in this part of the process, as they may have too much or little expertise.

Follow the general rules of thumb to be successful when writing this part of your resume:

- The perfect number of bullets you should have under each experience item is no more than six;

- Select not merely your responsibilities, but the most noteworthy achievements for each role that match the job requirements;

- List any certificates or technical expertise you've gained on the job and how they've helped you progress as a professional;

- Carefully select the power verbs to go along with each bullet to avoid generic ones like "managed" and instead substitute those with the actuality of your particular responsibility;

- Integrate valuable keywords from the job advert in the form of achievements under each role you list.

If you're on the search for further advice on how to write your payroll manager experience section, get some ideas from real-world professional resumes:

- Led the transition to a new payroll system for over 1,500 employees, improving process efficiency by 25%.

- Negotiated with new payroll software providers to secure a contract that resulted in a 20% cost savings for the company.

- Developed and implemented strict payroll audit procedures that reduced payroll discrepancies by 95% within the first year.

- Managed payroll operations across 5 countries, ensuring full legal compliance and improving processing time by 10 days.

- Spearheaded a project to automate year-end tax reporting, reducing man-hours by 300 annually.

- Collaborated with HR to integrate payroll with employee benefits, increasing data accuracy and employee satisfaction.

- Oversaw bi-weekly payroll processing for over 800 employees, maintaining a 99.9% accuracy rate.

- Initiated a payroll self-service portal that was adopted by 80% of the workforce in the first year.

- Implemented a new payroll policy that streamlined overtime payouts and saved the company over $50,000 annually.

- Upgraded payroll software to enhance reporting functions, which provided executives with better decision-making data.

- Conducted comprehensive training for payroll staff, increasing team productivity by 40%.

- Reviewed and processed salary increases and bonuses with a total distributed value exceeding $2 million.

- Enhanced the payroll process using a lean methodology approach, resulting in the reduction of payroll cycle time by 15%.

- Led a task force to manage the payroll integration of two merging companies, including 1,200 new employees.

- Increased payroll processing accuracy to 99.98% by introducing new double-check mechanisms.

- Supervised the payroll team during a software upgrade, ensuring a smooth transition with no major disruptions to payroll processing.

- Cultivated a culture of continuous improvement in payroll processes, which facilitated a 10% reduction in payroll errors.

- Represented payroll in inter-departmental meetings, ensuring payroll considerations were factored into broader company financial strategies.

- Created a comprehensive set of payroll reports that provided leadership with insights, which drove a 5% decrease in labor costs.

- Built strong relationships with department leaders to ensure payroll needs were met promptly and efficiently.

- Coordinated with IT to launch a mobile application for timesheet submission, which was used by over 1,000 field employees.

- Oversaw the company-wide payroll compliance initiative to address new regulatory requirements, which was completed 1 month ahead of schedule.

- Initiated and led quarterly payroll forums to address stakeholder questions and concerns, improving inter-departmental communication.

- Managed payroll for expatriate employees, ensuring accurate withholding and reporting to respective countries' tax authorities.

- Directed a payroll department of 10 staff, handling payroll for over 2,000 employees across multiple sites.

- Enhanced the direct deposit enrollment to 98%, reducing paper checks and related costs by 75%.

- Successfully managed the year-end payroll reconciliation and W2 issuance with zero penalties.

- Orchestrated a significant overhaul of the payroll system that supported a workforce of 1,200 employees, catapulting system reliability and user satisfaction.

- Introduced an employee payroll education program, resulting in a substantial decrease in individual payroll queries.

- Managed salary benchmarking and payroll budgeting to align with company financial targets.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for payroll manager professionals.

Top Responsibilities for Payroll Manager:

- Direct preparation and distribution of written and verbal information to inform employees of benefits, compensation, and personnel policies.

- Design, evaluate, and modify benefits policies to ensure that programs are current, competitive, and in compliance with legal requirements.

- Fulfill all reporting requirements of all relevant government rules and regulations, including the Employee Retirement Income Security Act (ERISA).

- Analyze compensation policies, government regulations, and prevailing wage rates to develop competitive compensation plan.

- Identify and implement benefits to increase the quality of life for employees by working with brokers and researching benefits issues.

- Manage the design and development of tools to assist employees in benefits selection, and to guide managers through compensation decisions.

- Administer, direct, and review employee benefit programs, including the integration of benefit programs following mergers and acquisitions.

- Mediate between benefits providers and employees, such as by assisting in handling employees' benefits-related questions or taking suggestions.

- Plan, direct, supervise, and coordinate work activities of subordinates and staff relating to employment, compensation, labor relations, and employee relations.

- Prepare detailed job descriptions and classification systems and define job levels and families, in partnership with other managers.

Quantifying impact on your resume

- Include the total number of employees for whom you've managed payroll to show the scale of your experience.

- List the percentage of accuracy you've maintained in payroll processing to demonstrate your attention to detail.

- Mention any reduction in payroll errors under your management to highlight your improvement initiatives.

- Quantify any cost savings achieved through efficient payroll management or vendor negotiations.

- Detail the number of payroll-related audits you have successfully passed to establish your compliance knowledge.

- Specify the size of your team if you have leadership experience to show management capabilities.

- Include any time you've saved for the company through streamlining or automating payroll processes.

- Note the number of payroll systems you are proficient in to showcase your technical skills and adaptability.

Action verbs for your payroll manager resume

Remember these four tips when writing your payroll manager resume with no experience

You've done the work - auditing the job requirements for keywords and have a pretty good idea of the skill set the ideal candidate must possess.

Yet, your professional experience amounts to a summer internship .

Even if you have limited or no professional expertise that matches the role you're applying for, you can use the resume experience section to:

- List extracurricular activities that are relevant to the job requirements. Let's say you were editor-in-chief of your college newspaper or part of the engineering society. Both activities have taught you invaluable, transferrable skills (e.g. communication or leadership) that can be crucial for the job;

- Substitute jobs with volunteer experience. Participating in charity projects has probably helped you develop an array of soft skills (e.g. meeting deadlines and interpersonal communications). On the other hand, volunteering shows potential employers more about you: who you are and what are the causes you care about;

- Align job applications with your projects. Even your final-year thesis work could be seen as relevant experience, if it's in the same industry as the job you're applying for. Ensure you've listed the key skills your project has taught you, alongside tangible outcomes or your project success;

- Shift the focus to your transferrable skills. We've said it before, but recruiters will assess your profile upon both job requirements and the skills you possess. Consider what your current experience - both academic and life - has taught you and how you've been able to develop your talents.

Recommended reads:

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Payroll manager skills and achievements section: must-have hard and soft skills

A key principle for your payroll manager resume is to prominently feature your hard skills, or the technologies you excel in, within the skills section. Aim to list several hard skills that are in line with the job's requirements.

When it comes to soft skills, like interpersonal communication abilities and talents, they're trickier to quantify.

Claiming to be a good communicator is one thing, but how can you substantiate this claim?

Consider creating a dedicated "Strengths" or "Achievements" section. Here, you can describe how specific soft skills (such as leadership, negotiation, problem-solving) have led to concrete achievements.

Your payroll manager resume should reflect a balanced combination of both hard and soft skills, just as job requirements often do.

Top skills for your payroll manager resume:

ADP Workforce Now

Paychex Flex

QuickBooks Payroll

Microsoft Excel

SAP Payroll

Oracle HCM

Ceridian Dayforce

Paylocity

Gusto

Timekeeping Software

Attention to Detail

Problem-Solving

Communication

Time Management

Analytical Thinking

Team Leadership

Confidentiality

Adaptability

Customer Service

Interpersonal Skills

Next, you will find information on the top technologies for payroll manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Payroll Manager’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Human resource management software HRMS

- Vantage Point Software HRA

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Payroll manager-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular payroll manager certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your payroll manager resume:

- Certified Payroll Professional (CPP) - American Payroll Association (APA)

- Fundamental Payroll Certification (FPC) - American Payroll Association (APA)

- Certified payroll manager (CPM) - Canadian Payroll Association (CPA)

- Payroll Compliance Practitioner (PCP) - Canadian Payroll Association (CPA)

- Chartered Institute of Payroll Professionals (CIPP) - The Chartered Institute of Payroll Professionals

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for payroll manager professionals.

Top US associations for a Payroll Manager professional

- International Society of Certified Employee Benefit Specialists

- American Benefits Council

- College and University Professional Association for Human Resources

- International Foundation of Employee Benefit Plans

- National Management Association

PRO TIP

Listing your relevant degrees or certificates on your payroll manager resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Recommended reads:

Adding a summary or objective to your payroll manager resume

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

- Either a resume summary - your career highlights at a glance. Select the summary if you have plenty of relevant experience (and achievements), you'd like recruiters to remember about your application.

- Or, a resume objective - to showcase your determination for growth. The perfect choice for candidates with less experience, who are looking to grow their career in the field.

If you want to go above and beyond with your payroll manager resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life payroll manager professionals, whose resumes have helped them land their dream jobs:

Resume summaries for a payroll manager job

- With 10+ years of expertise, I am a seasoned payroll manager adept in the latest payroll systems and compliance regulations. At my current role at a Fortune 500 company, I successfully managed payroll for over 5,000 employees, reducing processing errors by 25% through strategic process improvement initiatives.

- Dedicated Payroll Professional transitioning from a highly successful 7-year career in accounting, eager to leverage in-depth knowledge of financial reconciliations and tax planning to expertly manage payroll systems, ensuring accuracy and compliance at a multinational corporation.

- Accomplished Human Resources Specialist with a passion for numbers and details, seeking to transfer 8 years of benefits administration and compliance management experience to excel in payroll management, and contribute to the streamlined financial operations of a progressive tech startup.

- Boasting a 12-year tenure as a payroll manager for a leading retail chain, my career is highlighted by introducing an automated payroll system that bolstered efficiency by 40% and was replicated across regional outlets, indicative of my commitment to operational excellence and innovation in payroll administration.

- Desire to embark on a career as a payroll manager, offering my recent certification in payroll processing and a fresh perspective from my academic background in Business Administration. I am enthusiastic about applying analytical skills and meticulous attention to achieve excellence in payroll operations for a dynamic financial services firm.

- Eager to commence a payroll manager career with a focus on bringing my strong work ethic, quick learning ability, and a degree in finance to contribute effectively to the financial team of a high-growth tech company, ensuring accurate and timely compensation for its diverse employee base.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for payroll manager professionals

Local salary info for Payroll Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $136,380 |

| California (CA) | $154,530 |

| Texas (TX) | $125,010 |

| Florida (FL) | $116,850 |

| New York (NY) | $179,110 |

| Pennsylvania (PA) | $100,740 |

| Illinois (IL) | $116,580 |

| Ohio (OH) | $140,240 |

| Georgia (GA) | $147,490 |

| North Carolina (NC) | $126,290 |

| Michigan (MI) | $134,100 |

More sections to ensure your payroll manager resume stands out

If you're looking for additional ways to ensure your payroll manager application gets noticed, then invest in supplementing your resume with extra sections, like:

These supplementary resume sections show your technical aptitude (with particular technologies and software) and your people skills (gained even outside of work).

Key takeaways

- The logic of your resume presentation should follow your career highlights and alignment with the role;

- Curate information within different sections (e.g. summary, experience, etc.) that helps highlight your strengths;

- Exclude from your resume irrelevant experience items - that way you'd ensure it stays no longer than two pages and is easy to read;

- Dedicate space within the summary, experience, and/or achievements to highlight precisely why you're the best candidate for the role via your previous success;

- Both your technical and people capabilities should also play a crucial role in building up your payroll manager application. Prove your skill set in various resume sections.