Most insurance account manager resume drafts fail because they read like task logs and bury results in dense blocks of text. That hurts in today's process, where an ATS filters keywords and recruiters scan fast in a crowded market.

A strong resume shows what you improved, not just what you handled. Knowing how to make your resume stand out means highlighting retention gains, premium growth, reduced claim cycle time, renewal rate lifts, book-of-business size, compliance accuracy, fewer client escalations, and service-level delivery across complex accounts.

Key takeaways

- Quantify retention rates, premium growth, and renewal cycle times in every experience bullet.

- Use reverse-chronological format if you have steady insurance account management experience.

- Choose a hybrid format when entering the field to lead with transferable skills.

- Tailor resume language to mirror the exact tools, policy types, and KPIs in each job posting.

- Place certifications like CPCU, CIC, or CISR near the top when they're recent and role-relevant.

- Demonstrate skills through measurable outcomes in your experience—not just in a skills section.

- Use Enhancv to turn vague duties into specific, recruiter-ready resume bullets faster.

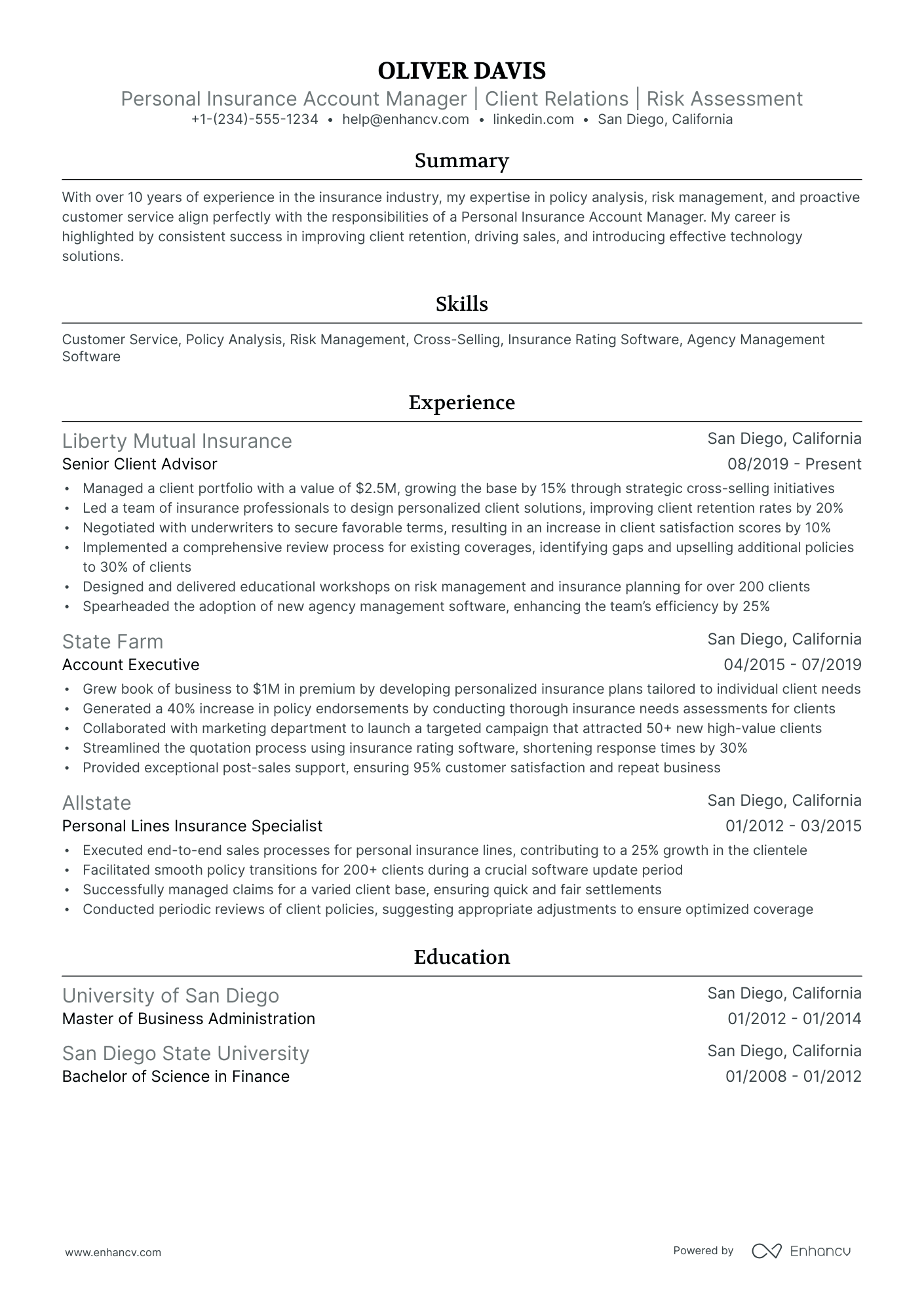

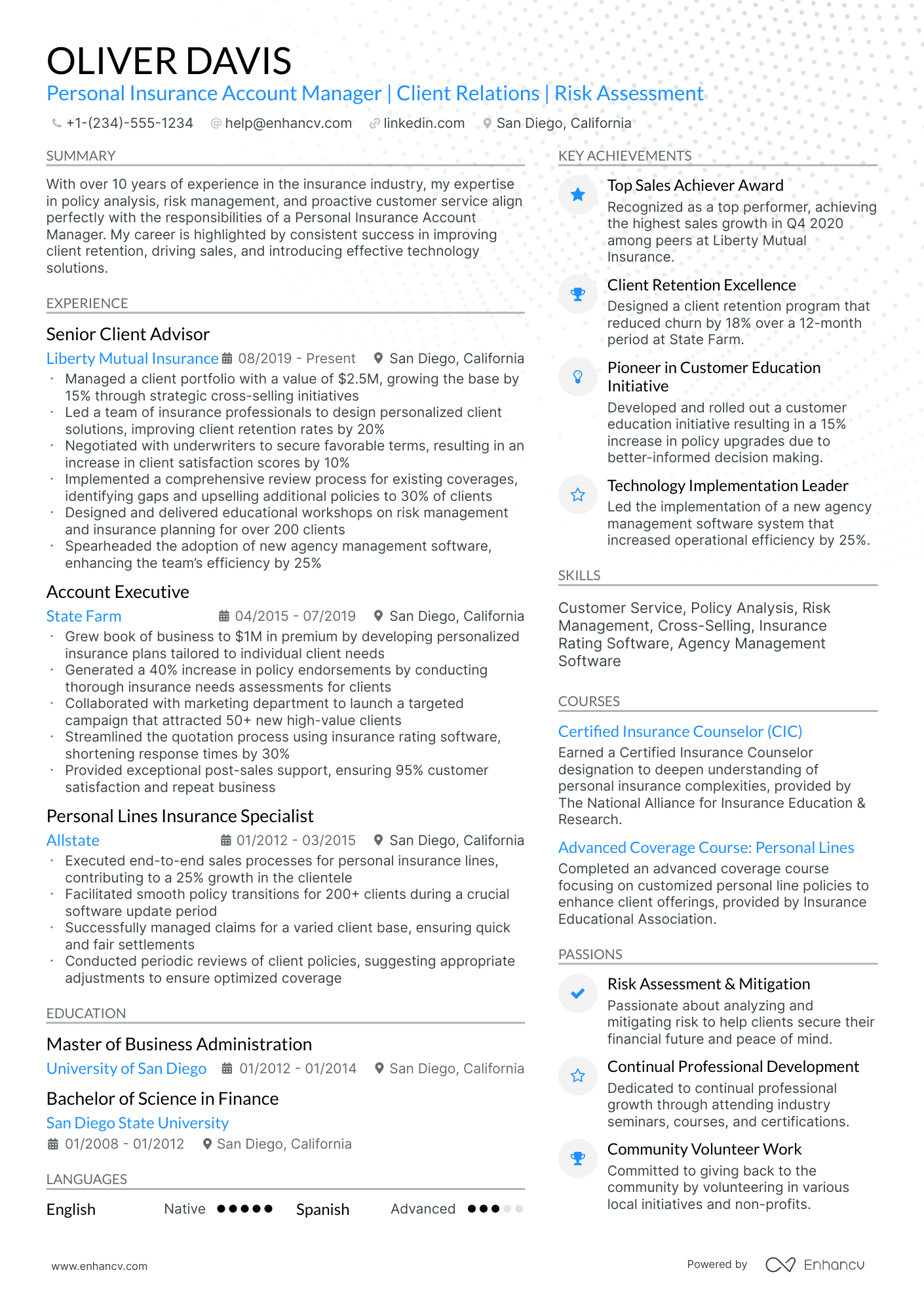

How to format a insurance account manager resume

Recruiters evaluating insurance account manager resumes focus on client retention metrics, policy portfolio size, revenue growth, and the ability to manage renewal cycles across commercial or personal lines. A clean, well-structured resume format ensures these signals surface quickly during both human review and applicant tracking system (ATS) scans, so choosing the right layout directly affects whether your core qualifications get noticed.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to place your most recent and relevant account management experience at the top where recruiters expect to find it. Do:

- Lead with your current scope of responsibility, including book of business size, number of accounts managed, and lines of insurance covered.

- Highlight proficiency with role-specific tools and domains such as Applied Epic, Salesforce, agency management systems, commercial underwriting guidelines, and carrier relationship management.

- Quantify outcomes tied to retention, cross-selling, and revenue—attach numbers to every achievement you list.

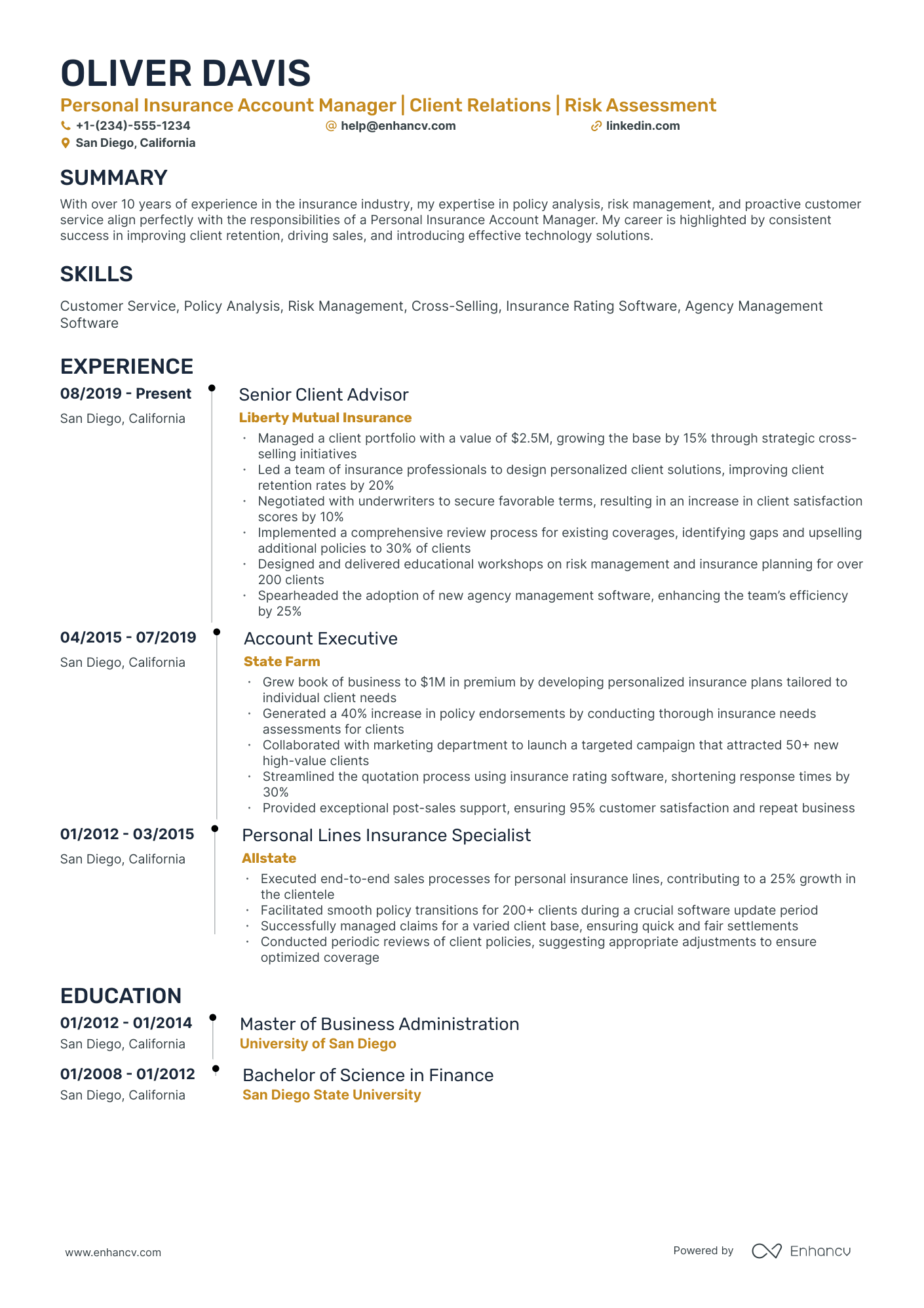

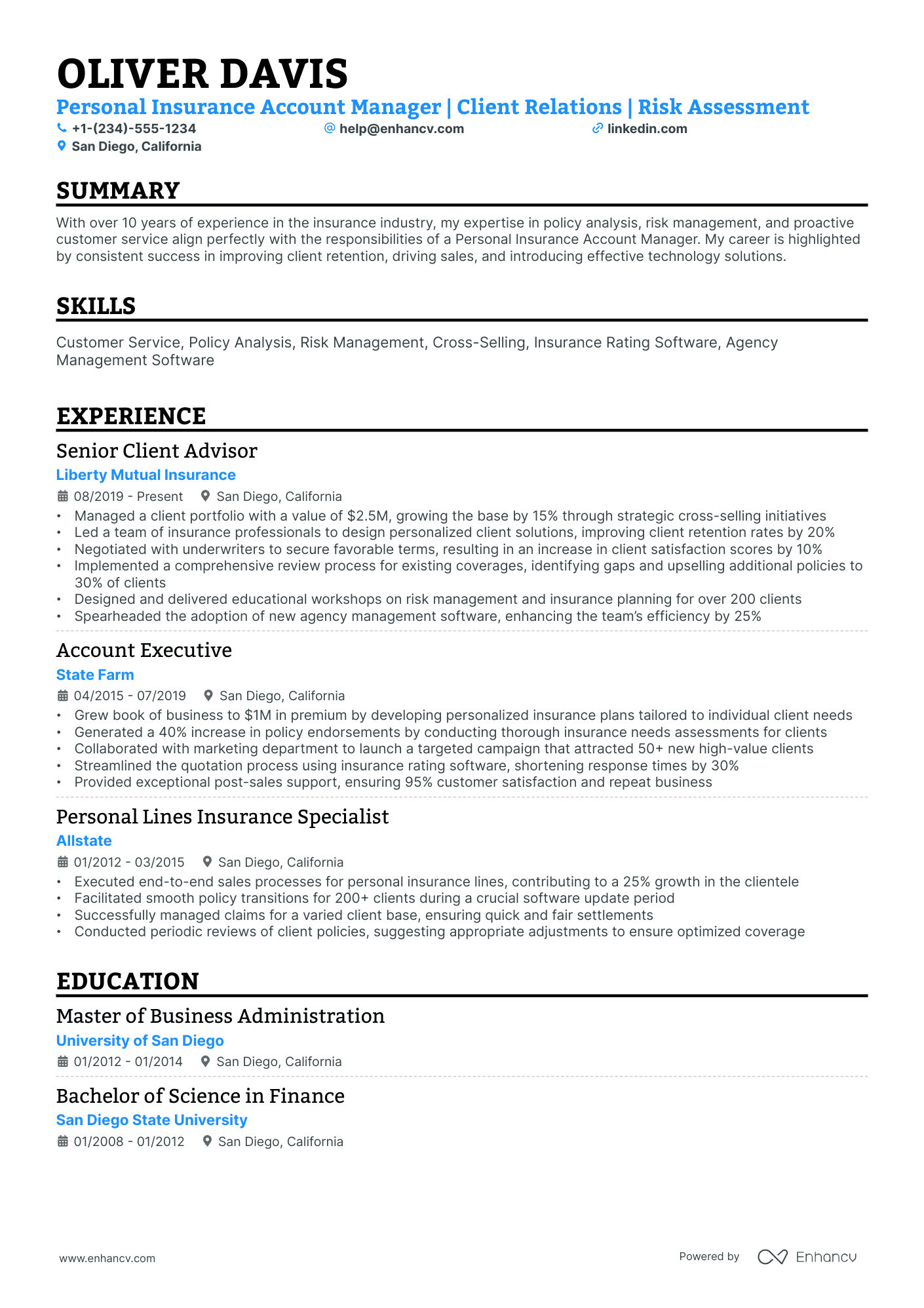

I'm junior or switching into this role—what format works best?

A hybrid format works best because it lets you lead with transferable skills and relevant training while still providing a chronological work history that shows professional momentum. Do:

- Place a skills section near the top featuring insurance-specific competencies like policy analysis, CRM platforms, claims coordination, and client communication.

- Include internships, licensing coursework (Property & Casualty, Life & Health), or project-based experience that demonstrates account management fundamentals.

- Connect every action to a result, even in non-insurance roles, to show recruiters you understand outcome-driven work.

Why not use a functional resume?

A functional format strips away the timeline and context that hiring managers need to evaluate how you built your skills, making it harder to demonstrate growth, accountability, or consistent client-facing performance—all critical for an insurance account manager role. A functional resume may make sense only in narrow circumstances:

- You're transitioning from a related field (such as claims adjusting or customer service) and need to foreground transferable skills before limited direct account management history.

- You have a significant gap in employment but completed relevant coursework or earned insurance licenses during that period.

- You have fewer than two years of professional experience and rely heavily on project-based or freelance insurance support work.

- A functional format is acceptable only when you tie every listed skill to a specific project, client outcome, or measurable result, ensuring the resume still communicates real-world impact rather than abstract competencies.

With your format established, the next step is identifying which sections to include so each one serves a clear purpose on your resume.

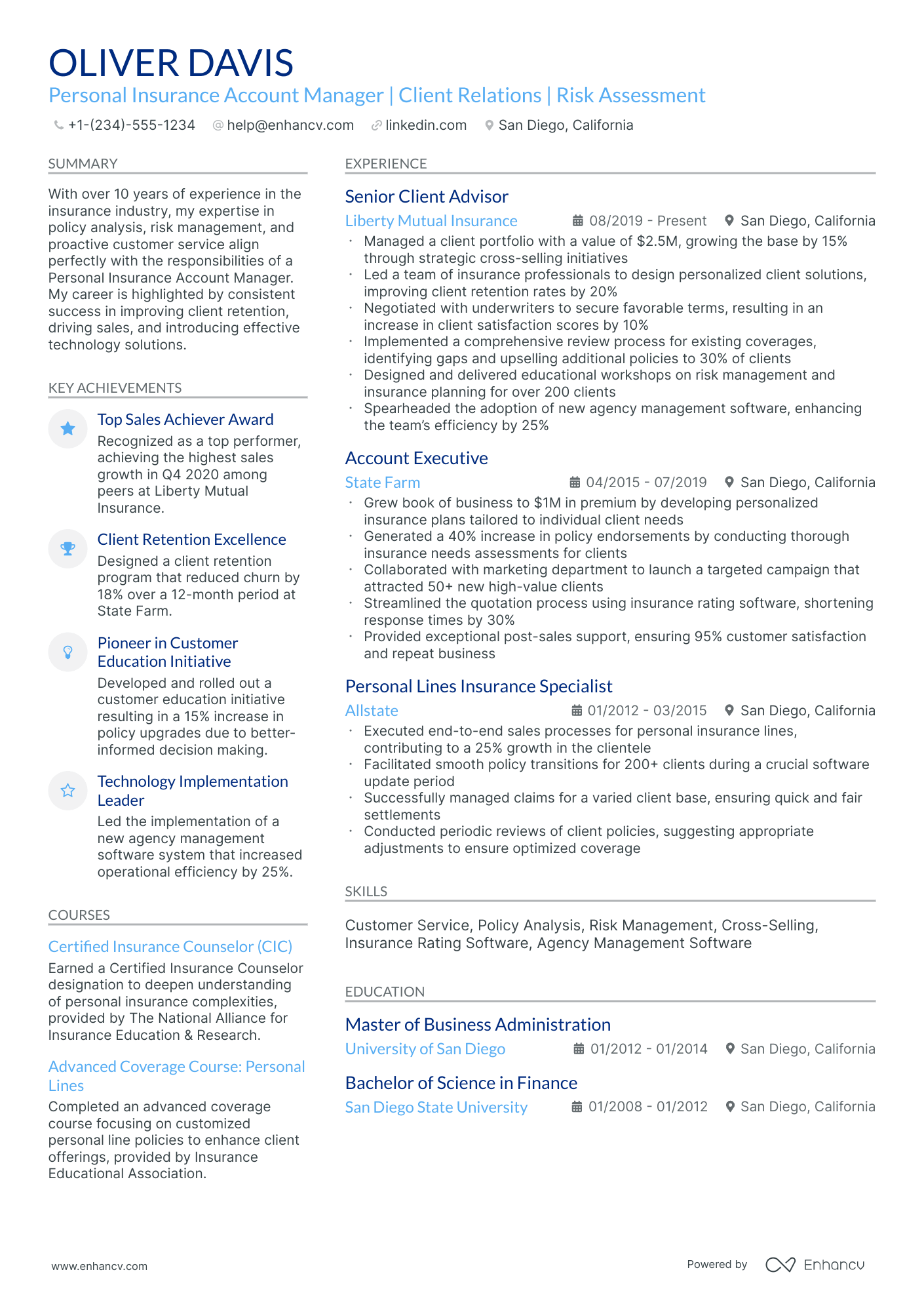

What sections should go on a insurance account manager resume

Recruiters expect a clean, client-focused resume that highlights your book of business, retention results, and carrier and coverage expertise. Understanding which resume sections to include helps you structure your document for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize measurable retention and renewal outcomes, premium and account scope, cross-sell and upsell impact, and service and compliance results.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right core components, the next step is to write your insurance account manager experience section so it supports that structure with clear, role-relevant detail.

How to write your insurance account manager resume experience

Your experience section should highlight the insurance account management work you've actually delivered—client portfolios you've grown, retention strategies you've executed, and measurable outcomes you've driven using industry-specific tools and methods. Hiring managers prioritize demonstrated impact over descriptive task lists, so every bullet should prove you've moved the needle on policy renewals, client satisfaction, or revenue targets. Building a targeted resume ensures each entry connects directly to the role you're pursuing.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the book of business, client segments, policy types, product lines, or account teams you were directly accountable for as an insurance account manager.

- Execution approach: the agency management systems, CRM platforms, underwriting guidelines, risk assessment frameworks, or client communication methods you used to service accounts and make informed recommendations.

- Value improved: changes to client retention rates, policy renewal ratios, claims resolution efficiency, coverage accuracy, or risk exposure that resulted from your direct involvement.

- Collaboration context: how you coordinated with underwriters, claims adjusters, carriers, brokers, or internal sales teams to resolve coverage issues, negotiate terms, or onboard new accounts.

- Impact delivered: outcomes expressed through portfolio growth, revenue retention, client satisfaction improvements, or loss ratio reductions rather than routine account maintenance activities.

Experience bullet formula

A insurance account manager experience example

✅ Right example - modern, quantified, specific.

Insurance Account Manager

HarborPoint Insurance Services | Denver, CO

2021–Present

Independent agency managing commercial property and casualty and employee benefits programs for mid-market clients across construction, manufacturing, and professional services.

- Managed a $6.8M book of business across 120 commercial accounts in Applied Epic customer relationship management (CRM), improving renewal retention from 88% to 94% through structured renewal timelines and coverage gap reviews.

- Led renewal strategy with carriers and wholesale brokers using Vertafore AMS360, delivering an average 9% premium reduction on comparable coverage for forty-two renewals while maintaining loss ratio targets.

- Analyzed loss runs and exposure data in Microsoft Excel and Power BI, identifying claim drivers and implementing risk control plans that cut open claims by 18% and reduced experience modification rates for six construction clients.

- Coordinated certificates of insurance, endorsements, and policy audits via DocuSign and SharePoint workflows, reducing turnaround time from three days to same-day for 75% of requests and lowering errors by 30%.

- Partnered with producers, underwriters, and client finance teams to redesign billing and payment schedules in QuickBooks and carrier portals, reducing accounts receivable over sixty days by 22% and preventing $180K in potential lapse-related revenue loss.

Now that you've seen what a strong experience section looks like in practice, let's break down how to customize yours to match the specific role you're targeting.

How to tailor your insurance account manager resume experience

Recruiters evaluate your insurance account manager resume through both applicant tracking systems and manual review. Tailoring your resume to the job description ensures your qualifications connect directly with what the hiring team needs.

Ways to tailor your insurance account manager experience:

- Match the exact insurance management software or CRM platforms listed in the posting.

- Mirror the policy types or coverage lines the employer specifically references.

- Use the same terminology for underwriting or claims processes they describe.

- Reflect retention rate or renewal growth KPIs the job description highlights.

- Include relevant licensing or regulatory compliance standards the role requires.

- Emphasize cross-functional collaboration with adjusters or underwriters if mentioned.

- Highlight experience with the specific client segments or industries they serve.

- Align your workflow descriptions with their referenced account review cycles.

Tailoring means framing your real accomplishments in language that directly reflects the job requirements, not forcing unrelated keywords into your experience.

Resume tailoring examples for insurance account manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Manage a book of business of 200+ commercial accounts, ensuring policy renewals exceed 90% retention rate using Applied Epic agency management system. | Handled client accounts and worked on renewing their policies each year. | Managed a book of 220+ commercial accounts in Applied Epic, driving a 94% policy renewal retention rate through proactive outreach 60 days before expiration. |

| Serve as primary point of contact for claims escalation, coordinating between policyholders, adjusters, and carriers to resolve complex property and casualty claims within 30 days. | Helped customers with their insurance claims and followed up as needed. | Served as the primary escalation contact for property and casualty claims, coordinating between policyholders, adjusters, and three carrier partners to resolve 95% of complex claims within the 30-day target. |

| Cross-sell and upsell umbrella, inland marine, and professional liability coverages to existing accounts, contributing to 15% annual revenue growth per territory. | Suggested additional insurance products to clients when opportunities came up. | Cross-sold umbrella, inland marine, and professional liability coverages across a 180-account territory, generating $320K in new premium revenue and exceeding the 15% annual growth target by 4%. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your insurance account manager achievements to show the measurable impact behind that fit.

How to quantify your insurance account manager achievements

Quantifying your achievements proves you protect revenue, reduce risk, and keep clients renewing. Focus on retention, premium growth, renewal cycle time, compliance accuracy, and service quality, using clear counts, percentages, and dollar impact.

Quantifying examples for insurance account manager

| Metric | Example |

|---|---|

| Renewal retention | "Improved book retention from 88% to 93% across 120 mid-market accounts by tightening renewal timelines and running quarterly coverage reviews in Salesforce." |

| Premium growth | "Grew annual written premium by $1.2M (14%) by identifying coverage gaps and cross-selling umbrella and cyber policies to twenty-five existing clients." |

| Cycle time | "Cut renewal turnaround time from twelve to seven business days by standardizing submission checklists and automating reminders with Outlook rules and agency management system tasks." |

| Compliance accuracy | "Reduced endorsement and certificate errors from 3.8% to 1.1% by adding a two-step QA review and tracking defects in Excel." |

| Claims risk | "Lowered claim frequency 9% year over year for a forty-location client by coordinating loss-control visits and implementing driver training and telematics reporting." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points that highlight your accomplishments, the next step is ensuring your resume also presents the right mix of hard and soft skills that insurance account manager roles demand.

How to list your hard and soft skills on a insurance account manager resume

Your skills section shows you can retain and grow accounts, manage renewals, and reduce risk, and recruiters and an ATS (applicant tracking system) scan this section for role keywords; aim for a hard-skill-heavy mix supported by client-facing soft skills. insurance account manager roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Commercial lines account management

- Policy renewals and remarketing

- Coverage analysis and gap assessments

- Endorsements, cancellations, reinstatements

- Certificates of insurance issuance

- Claims intake and escalation

- Risk exposure identification

- RFP and proposal development

- Carrier negotiations and quoting

- Agency management systems, CRM

- Excel, pivot tables, reporting

- Compliance documentation and audits

Listing hard skills on your resume like these demonstrates the technical competencies hiring managers prioritize for insurance account management roles.

Soft skills

- Lead renewal timelines end to end

- Set client expectations early

- Translate coverage into plain language

- Run structured client review meetings

- Escalate issues with clear options

- Coordinate brokers, carriers, and clients

- Prioritize high-risk accounts quickly

- Document decisions and follow-ups

- Negotiate trade-offs without friction

- Own errors and correct them fast

- Communicate urgency without alarm

- Protect confidentiality and trust

Including soft skills on your resume like these shows recruiters you can manage client relationships and internal coordination under pressure.

How to show your insurance account manager skills in context

Skills shouldn't live only in a skills section.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what that looks like in practice. You can explore common resume skills examples to see how other professionals in similar roles present their competencies.

Summary example

Insurance account manager with 12 years in commercial P&C, skilled in policy renewals, risk assessments, and Salesforce-driven client management. Retained 96% of a $9M book of business through proactive coverage reviews and relationship building.

- Reflects senior-level expertise immediately

- Names industry-specific tools and methods

- Quantifies retention with clear metrics

- Highlights relationship-building soft skills

Experience example

Senior Insurance Account Manager

Ridgeline Insurance Group | Denver, CO

March 2018–Present

- Managed a $12M commercial book using Applied Epic, achieving a 97% client retention rate through quarterly coverage audits and personalized renewal strategies.

- Collaborated with underwriters and claims teams to resolve complex policy disputes, reducing average resolution time by 34%.

- Led onboarding for 45 new mid-market accounts annually by conducting risk assessments and coordinating tailored coverage proposals with carrier partners.

- Every bullet includes measurable proof

- Skills surface naturally through real outcomes

Once you’ve demonstrated your insurance account manager strengths through specific, role-relevant examples, the next step is applying that same approach to build an insurance account manager resume when you don’t have direct experience.

How do I write a insurance account manager resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Insurance coursework and licensing prep

- Customer service roles handling accounts

- CRM data entry and cleanup projects

- Quote comparisons using carrier portals

- Internship in financial services office

- Volunteer billing and payments tracking

- Sales support for renewals follow-up

- Excel reporting for client metrics

If you're starting out, our guide on writing a resume without work experience walks you through how to position these assets effectively.

Focus on:

- Evidence of policy and coverage knowledge

- Accurate documentation and compliance habits

- Client account tracking and follow-ups

- Tools: CRM, Excel, email

Resume format tip for entry-level insurance account manager

Use a hybrid resume format because it highlights relevant skills and projects while still showing steady work history and results. Do:

- Put licenses, exams, and coursework first.

- Add a "Projects" section with metrics.

- List tools like Salesforce and Excel.

- Mirror insurance account manager keywords from the job post.

- Quantify accuracy, volume, and turnaround time.

- Built a Salesforce pipeline for fifty mock client accounts, logged renewal dates and follow-ups, and cut missed tasks from twelve to zero in four weeks.

Even without direct experience, your education section can demonstrate the foundational knowledge and relevant coursework that qualify you for an insurance account manager role.

How to list your education on a insurance account manager resume

Your education section helps hiring teams confirm you have the foundational knowledge needed for an insurance account manager role. It validates your academic background quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to an insurance account manager resume:

Example education entry

Bachelor of Science in Business Administration

University of Georgia, Athens, GA

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Risk Management, Insurance Principles, Financial Analysis, Business Communications

- Honors: Magna Cum Laude, Dean's List (six semesters)

How to list your certifications on a insurance account manager resume

Certifications on a resume show an insurance account manager's commitment to learning, proficiency with industry tools, and relevance to current regulations, products, and client service standards. Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when education is recent and the certifications are older or less relevant to insurance account manager work.

- Place certifications above education when certifications are recent, role-relevant, or required, especially if your education is older or in another field.

Best certifications for your insurance account manager resume

- Certified Insurance Service Representative (CISR)

- Certified Insurance Counselor (CIC)

- Associate in General Insurance (AINS)

- Associate in Commercial Underwriting (AU)

- Associate in Risk Management (ARM)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Risk Manager (CRM)

Once you’ve positioned your credentials to reinforce your qualifications, you can write your insurance account manager resume summary to highlight those strengths upfront.

How to write your insurance account manager resume summary

Your resume summary is the first thing a recruiter reads. A strong one immediately signals you're qualified for the insurance account manager role.

Keep it to three to four lines, with:

- Your title and total years of experience in insurance account management.

- The domain you specialize in, such as commercial lines, personal lines, or group benefits.

- Core tools and skills like agency management systems, Salesforce, or policy renewals.

- One or two measurable achievements, such as retention rates or portfolio growth.

- Soft skills tied to real outcomes, like client communication that improved renewal rates.

PRO TIP

At this level, emphasize hands-on skills, relevant tools, and early wins that prove your value. Highlight specific metrics like retention percentages or accounts managed. Avoid vague phrases like "passionate team player" or "results-driven professional." Recruiters want proof, not promises.

Example summary for a insurance account manager

Insurance account manager with three years of experience in commercial lines. Skilled in Applied Epic and policy renewals, maintaining a 94% client retention rate across 120 accounts.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary is crafted to highlight your strongest qualifications, make sure the header above it presents your contact details clearly so recruiters can actually reach you.

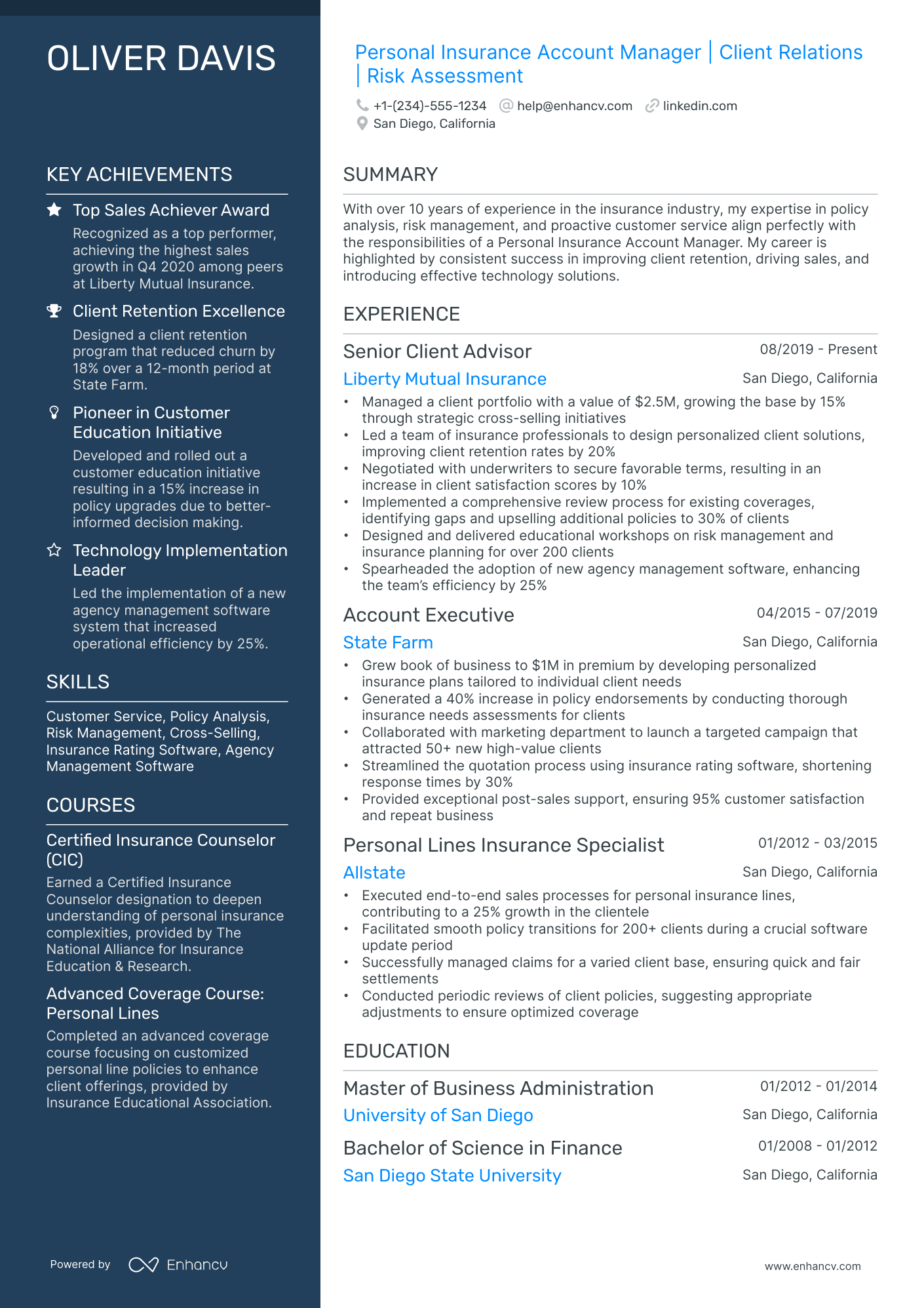

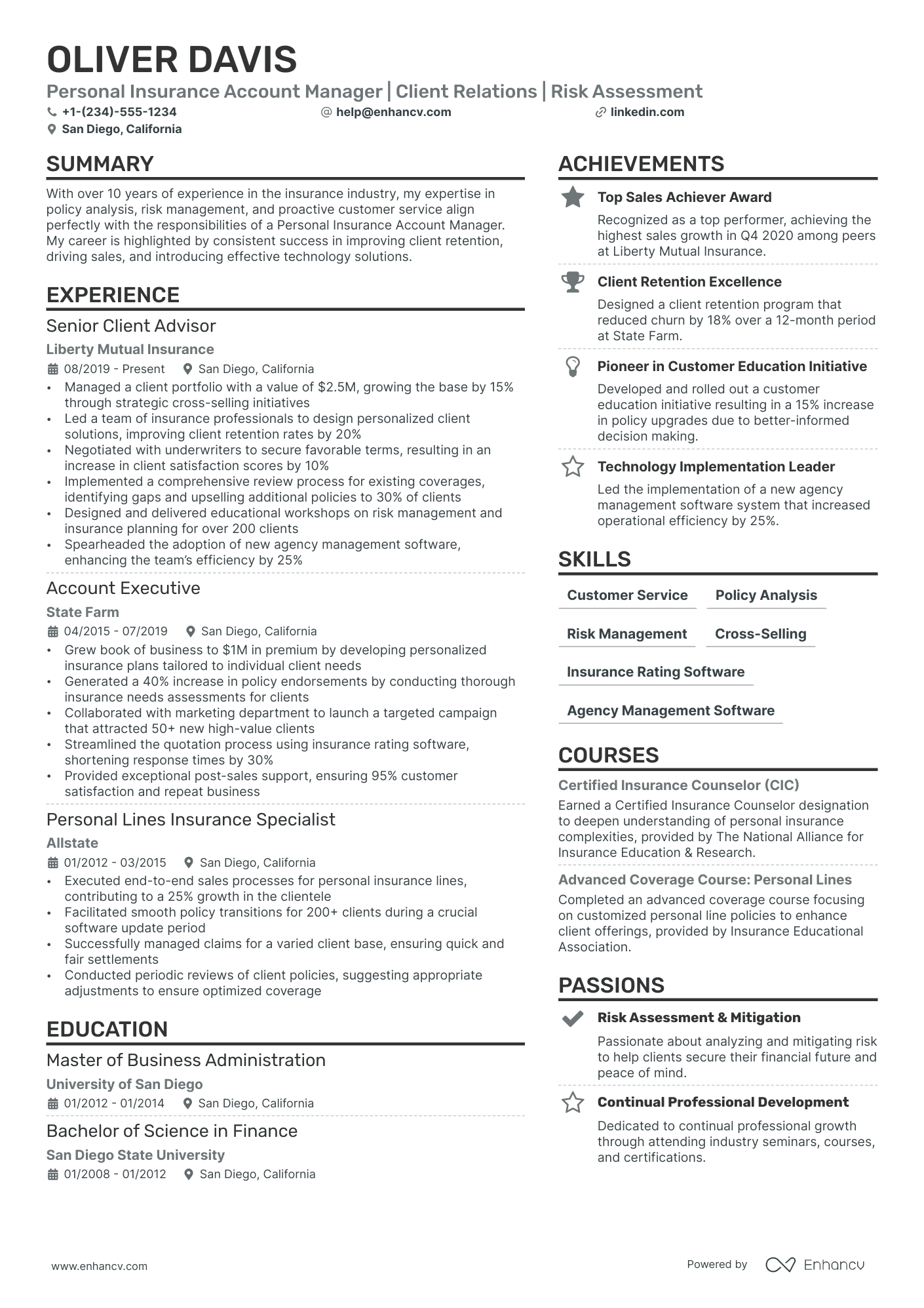

What to include in a insurance account manager resume header

A resume header lists your key contact details and role focus, boosting visibility, credibility, and fast recruiter screening for a insurance account manager.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Do not include photos on a insurance account manager resume unless the role is explicitly front-facing or appearance-dependent.

Keep your header consistent with your application, and match your job title to the posting to reduce screening errors.

Insurance account manager resume header

Jordan Lee

Insurance Account Manager | Commercial Lines Client Support

Austin, TX

(512) 555-01XX

jordan.lee@enhancv.com

github.com/jordanlee

yourwebsite.com

linkedin.com/in/jordanlee

Once your contact details and professional identifiers are set up to make a strong first impression, add the following optional sections to provide supporting context for your qualifications.

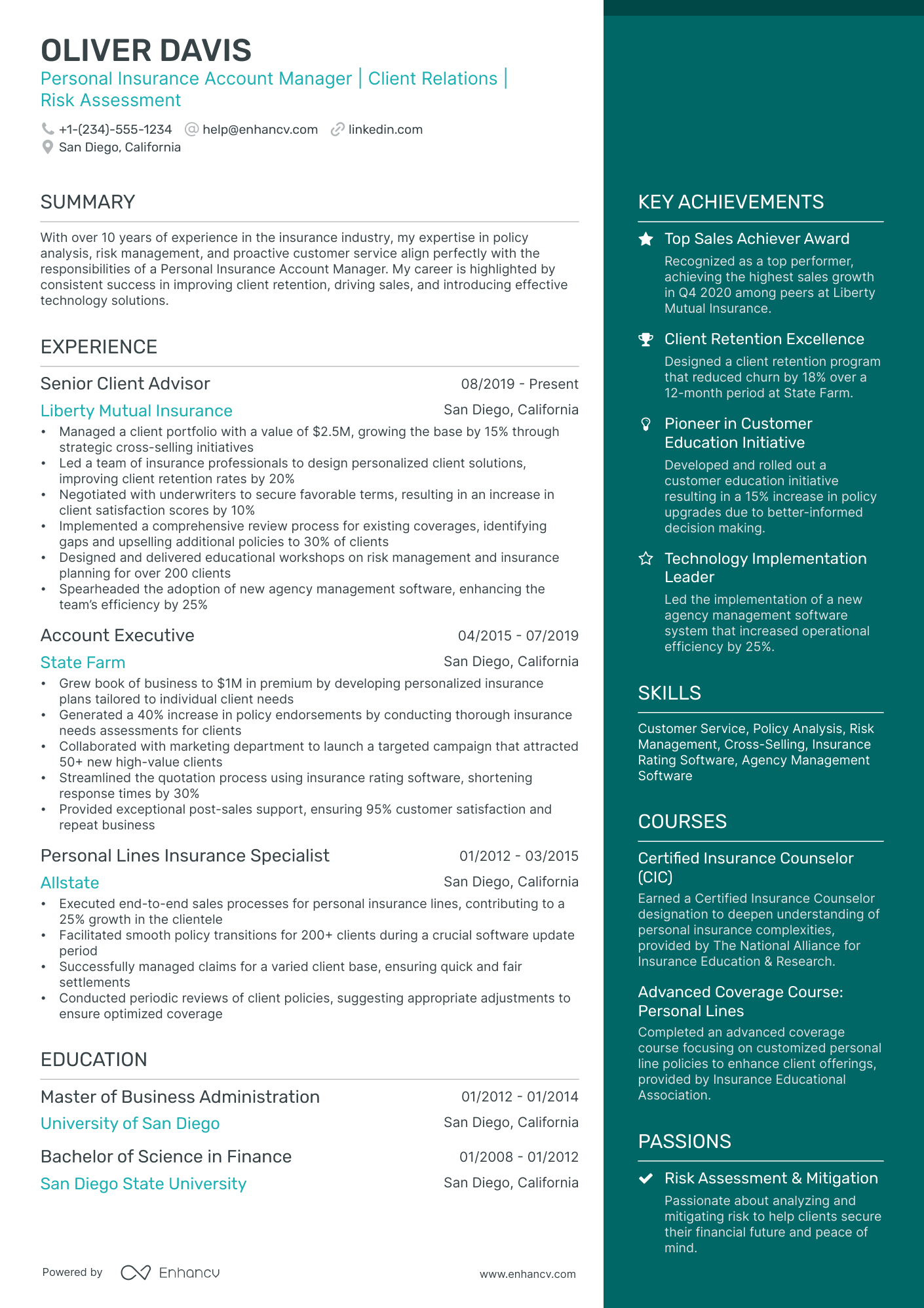

Additional sections for insurance account manager resumes

When your core qualifications match other candidates, additional resume sections help you stand out with role-specific credibility and depth.

- Languages

- Professional affiliations (e.g., NAIFA, CPCU Society)

- Industry certifications and continuing education

- Volunteer work in financial literacy or community outreach

- Awards and sales recognitions

- Conferences and industry speaking engagements

Once you've rounded out your resume with these supplementary sections, pair it with a tailored cover letter to give your application the strongest possible impact.

Do insurance account manager resumes need a cover letter

Insurance account manager resumes don't always need a cover letter. Many employers treat it as optional, but it helps in competitive searches or relationship-driven teams. If you're unsure what a cover letter is and when it adds value, it can make a difference when hiring managers expect clear communication and client-ready writing.

Use these guidelines to decide when to include one and what to say:

- Explain role and team fit by linking your book of business, service model, and collaboration style to the agency or carrier's structure.

- Highlight one or two outcomes, such as renewal retention, cross-sell growth, or reduced endorsement turnaround time, with clear numbers and your role.

- Show you understand the product, users, and business context by referencing lines of coverage, client segments, and how you manage risk and expectations.

- Address career transitions or non-obvious experience by connecting transferable skills, licensing, and training to the insurance account manager responsibilities.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you skip a cover letter and rely on your resume to carry the application, AI can help you strengthen your insurance account manager resume faster and with better alignment to the role.

Using AI to improve your insurance account manager resume

AI can sharpen your resume's clarity, structure, and overall impact. It helps you find stronger phrasing and tighter bullets. But overuse strips authenticity. Once your content feels clear and aligned with the insurance account manager role, step away from AI. If you're wondering which AI is best for writing resumes, the answer depends on your specific needs—but the prompts below work across most tools.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your resume:

Strengthen your summary

Quantify client retention

Sharpen skills relevance

Improve action verbs

Refine policy knowledge

Highlight certifications

Tighten education details

Clarify project contributions

Remove filler language

Align with job postings

Conclusion

A strong insurance account manager resume proves impact with measurable outcomes, like retention gains, premium growth, and faster renewals. It highlights role-specific skills, including policy servicing, carrier negotiations, risk review, and client communication. It stays easy to scan with clear headings and consistent formatting.

Hiring teams want insurance account manager candidates who can manage complex accounts, protect revenue, and support compliance. A focused structure and results-based bullets show you’re ready for today’s market and near-future expectations. Keep every line relevant, specific, and tied to business outcomes.