Most commercial banking resume drafts fail because they read like a job description, not a deal record. That buries credit judgment and client impact, so ATS filters and fast recruiter scans miss your fit in a crowded market.

A strong resume shows what changed because of you: portfolio growth, deposit expansion, fee income, credit quality, and retention. Knowing how to write a resume that quantifies loan volume, average deal size, risk ratings, delinquency reductions, underwriting turnaround time, and cross-sell wins across a defined book is what sets top candidates apart.

Key takeaways

- Quantify portfolio size, deal volume, and credit outcomes in every experience bullet.

- Use reverse-chronological format for experienced bankers and hybrid format for career switchers.

- Tailor resume language to mirror each job posting's tools, metrics, and terminology.

- Anchor every listed skill to a measurable result in your experience or summary section.

- Place certifications above education when they're recent and central to the target role.

- Lead your summary with title, years of experience, domain focus, and a quantified win.

- Use Enhancv to turn routine banking duties into measurable, recruiter-ready bullet points.

Job market snapshot for commercial bankings

We analyzed 496 recent commercial banking job ads across major US job boards. These numbers help you understand employment type trends, experience requirements, role specialization trends at a glance.

What level of experience employers are looking for commercial bankings

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 11.7% (58) |

| 3–4 years | 12.5% (62) |

| 5–6 years | 13.3% (66) |

| 7–8 years | 5.0% (25) |

| 9–10 years | 5.2% (26) |

| 10+ years | 7.1% (35) |

| Not specified | 49.8% (247) |

Commercial banking ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 99.8% (495) |

Top companies hiring commercial bankings

| Company | Percentage found in job ads |

|---|---|

| Accenture | 16.9% (84) |

| Wells Fargo | 15.5% (77) |

| Citigroup Inc. | 13.9% (69) |

| WesBanco | 10.9% (54) |

| Bank of America Corporation | 4.2% (21) |

| JPMorgan Chase & Co. | 4.2% (21) |

| Citizens Financial Group, Inc. | 3.2% (16) |

| Northwest Bancorp, Inc. | 2.6% (13) |

| BMO (Bank of Montreal) | 2.4% (12) |

| Capital One | 2.2% (11) |

Role overview stats

These tables show the most common responsibilities and employment types for commercial banking roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a commercial banking

| Responsibility | Percentage found in job ads |

|---|---|

| Commercial banking | 24.8% (123) |

| Project management | 23.6% (117) |

| Microsoft office | 21.0% (104) |

| Loan iq | 17.1% (85) |

| Acbs | 16.9% (84) |

| Afs | 16.9% (84) |

| Data models | 16.7% (83) |

| Financial modeling | 14.9% (74) |

| Excel | 14.5% (72) |

| Risk management | 13.3% (66) |

| Operating model design | 12.1% (60) |

| Transformation strategy | 12.1% (60) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 82.1% (407) |

| Hybrid | 17.3% (86) |

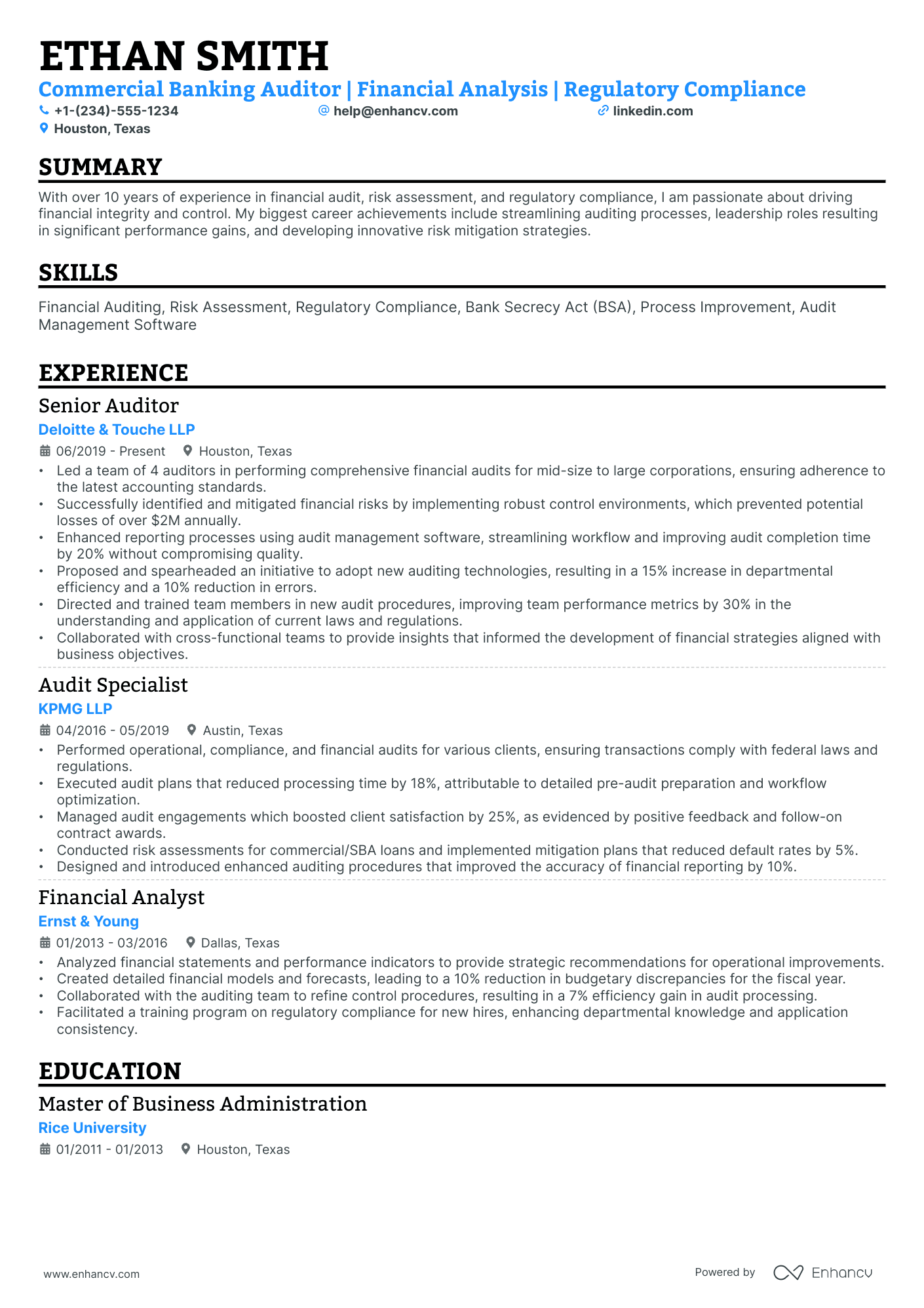

How to format a commercial banking resume

Recruiters evaluating commercial banking resumes prioritize credit analysis expertise, portfolio management scope, deal structuring experience, and measurable revenue or relationship growth. Choosing the right resume format ensures these signals surface quickly during both ATS screening and the 6–10 seconds a hiring manager spends on an initial scan.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your commercial banking career in a clear, progressive timeline that highlights growing portfolio responsibility and deal complexity. Do:

- Lead each role entry with your portfolio size, client segment, and lending authority to establish scope and ownership immediately.

- Emphasize domain-specific proficiencies such as credit underwriting, financial spreading, loan structuring, treasury management, and commercial real estate lending.

- Quantify outcomes in terms of loan volume originated, portfolio growth, credit loss ratios, cross-sell revenue, or relationship retention rates.

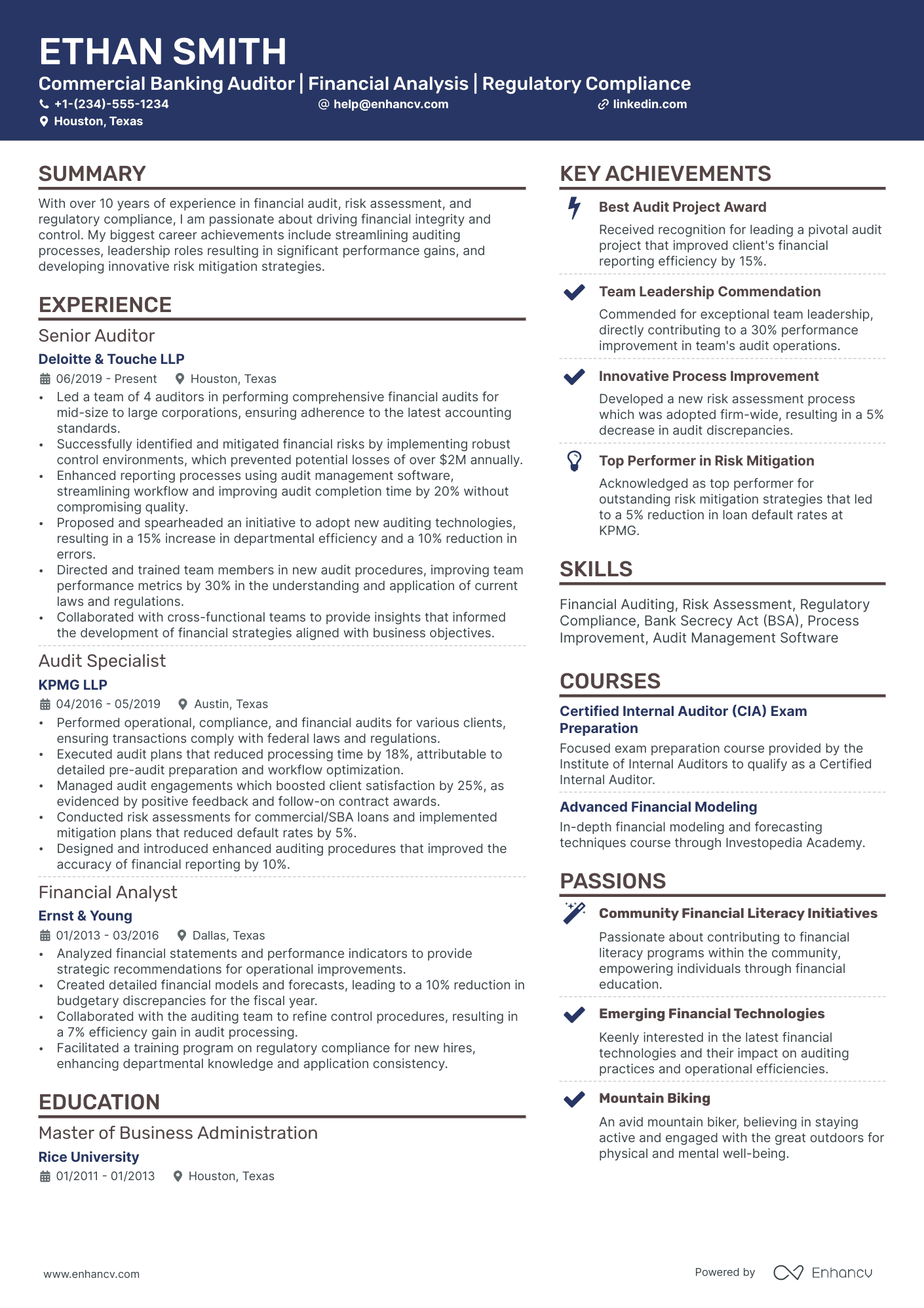

I'm junior or switching into this role—what format works best?

A hybrid format works best, letting you lead with relevant banking skills and financial competencies before a concise work history section. Do:

- Place a dedicated skills section near the top featuring credit analysis, financial modeling, cash flow analysis, and CRM or loan origination system proficiency.

- Highlight internships, rotational programs, relevant coursework, or case competitions that demonstrate exposure to commercial lending workflows.

- Connect every action to a result, even at a small scale, to show analytical thinking and business awareness.

Why not use a functional resume?

A functional format strips away the timeline context that hiring managers rely on to evaluate credit decision-making progression, portfolio growth, and increasing lending authority—all of which are central to commercial banking roles. A functional resume may be acceptable if you're transitioning from a related field such as corporate finance, risk management, or accounting and lack direct commercial lending titles, but only if every skill listed is anchored to specific projects, deal outcomes, or quantified results rather than presented in isolation.

Once you've established a clean, readable format, the next step is deciding which sections to include and how to organize them for maximum impact.

What sections should go on a commercial banking resume

Recruiters expect to see a clean, results-driven resume that shows your commercial lending performance, portfolio impact, and client relationship outcomes. Understanding what to put on a resume for commercial banking helps you prioritize the right details.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize credit quality, portfolio growth, deal size, risk mitigation, cross-sell results, and measurable outcomes tied to revenue, retention, and compliance.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components in the right order, the next step is to write your commercial banking experience section so it supports that structure with relevant, role-specific detail.

How to write your commercial banking resume experience

The experience section of your commercial banking resume should highlight the deals you've closed, the credit facilities you've structured, and the portfolio results you've achieved using industry-standard underwriting methods and financial analysis tools. Building a targeted resume that demonstrates impact on loan performance, client acquisition, and risk management matters far more than descriptive lists of daily responsibilities.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the commercial loan portfolios, client relationships, credit facilities, industry verticals, or revenue books you were directly accountable for managing and growing.

- Execution approach: the financial modeling techniques, credit analysis frameworks, risk rating systems, regulatory compliance standards, or CRM platforms you used to evaluate borrowers, structure deals, and inform lending decisions.

- Value improved: the changes you drove in portfolio quality, credit risk exposure, approval turnaround time, covenant compliance, loan loss mitigation, or client retention within your commercial banking practice.

- Collaboration context: how you partnered with credit officers, underwriting teams, treasury management specialists, legal counsel, relationship managers, or C-suite clients to advance deal execution and deepen banking relationships.

- Impact delivered: the business outcomes you produced—expressed through growth in loan commitments, expansion of deposit relationships, reduction in non-performing assets, or strengthened market positioning—rather than routine activities you performed.

Experience bullet formula

A commercial banking experience example

✅ Right example - modern, quantified, specific.

Commercial Banking Relationship Manager

NorthBridge Commercial Bank | Chicago, IL

2022–Present

Regional commercial bank serving middle-market clients across manufacturing, logistics, and professional services.

- Expanded a $95M commercial portfolio by 18% year over year by sourcing new C&I and owner-occupied real estate opportunities, using Salesforce, Moody’s Analytics spreads, and call-plan discipline to improve pipeline conversion by 22%.

- Reduced credit approval cycle time by 28% by standardizing underwriting packages in nCino, partnering with credit analysts and legal to tighten covenant language, collateral documentation, and policy exceptions.

- Improved risk-adjusted returns by 35 basis points by repricing renewals using SOFR-based models and Treasury management fee analysis, collaborating with Treasury sales and finance to align on profitability targets.

- Cut past-due exposure by 24% by implementing early-warning monitoring in Bloomberg and internal financial spreading tools, coordinating with special assets and clients to restructure two credits and avoid $1.6M in charge-offs.

- Increased non-interest income by $410K annually by bundling treasury management services—ACH, remote deposit capture, and positive pay—working with implementation teams to raise product adoption from 46% to 63%.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific role you're targeting.

How to tailor your commercial banking resume experience

Recruiters evaluate your commercial banking resume through both applicant tracking systems and manual review. Tailoring your resume to the job description ensures your qualifications surface clearly in both processes.

Ways to tailor your commercial banking experience:

- Match loan origination platforms or CRM systems named in the posting.

- Mirror the exact credit analysis methodology the job description specifies.

- Reflect portfolio size thresholds or revenue targets the role emphasizes.

- Include specific regulatory frameworks like Basel III or Dodd-Frank when listed.

- Highlight relationship management approaches referenced in the posting.

- Use the same terminology for underwriting standards or risk rating models.

- Emphasize cross-sell or treasury management experience when the role requires it.

- Reference industry verticals such as healthcare or real estate if specified.

Tailoring means aligning your real accomplishments with the language and priorities of each job posting, not forcing disconnected keywords into your experience.

Resume tailoring examples for commercial banking

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Manage a portfolio of middle-market commercial clients with revenues between $10M–$100M, driving deposit growth and cross-selling treasury management solutions. | Managed client relationships and helped grow business revenue. | Managed a 45-client middle-market portfolio ($10M–$100M revenue), growing deposits by $32M and cross-selling treasury management solutions that increased fee income by 18% year over year. |

| Underwrite and structure commercial real estate loans using Moody's CRE analytics, ensuring compliance with OCC risk guidelines and internal credit policy. | Assisted with loan processing and conducted financial reviews for various projects. | Underwrote and structured $120M in commercial real estate loans using Moody's CRE analytics, maintaining full compliance with OCC risk guidelines and reducing policy exceptions by 25%. |

| Develop new business by calling on prospects, COIs, and referral sources to originate C&I credit facilities and expand the bank's commercial lending footprint in the Southeast region. | Worked on business development and helped bring in new clients for the company. | Originated $47M in new C&I credit facilities across the Southeast by building a referral network of 30+ COIs, including CPAs and attorneys, expanding the bank's commercial lending footprint into three new metro markets. |

Once you’ve aligned your experience with the role’s priorities, quantify your commercial banking achievements to prove the impact you delivered.

How to quantify your commercial banking achievements

Quantifying your achievements proves business impact beyond duties. In commercial banking, focus on revenue growth, portfolio quality, credit risk, compliance accuracy, and efficiency across underwriting, renewals, and servicing.

Quantifying examples for commercial banking

| Metric | Example |

|---|---|

| Revenue growth | "Grew commercial loan originations by $18.4M in twelve months by targeting three industry verticals and using Salesforce pipeline stages to improve deal progression." |

| Credit risk | "Reduced delinquency rate from 1.9% to 1.2% across a $62M portfolio by tightening covenant tracking and escalating early-warning triggers in nCino." |

| Cycle time | "Cut average underwriting turnaround from nine business days to six by standardizing spread templates in Excel and automating tick-and-tie checks." |

| Compliance accuracy | "Improved Know Your Customer (KYC) file completeness from 92% to 99% across 140 annual reviews by adding a checklist and second-line QA sampling." |

| Client retention | "Retained 96% of top twenty relationships during a rate-driven repricing cycle by delivering quarterly reviews and renegotiating terms within policy limits." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points for your experience section, you'll want to apply that same precision to presenting your hard and soft skills throughout your commercial banking resume.

How to list your hard and soft skills on a commercial banking resume

Your skills section signals your ability to underwrite risk, grow relationships, and execute deals, and recruiters and an ATS (applicant tracking system) scan this section to match keywords fast—aim for a mix of role-specific hard skills and job-critical soft skills. commercial banking roles require a blend of:

- Product strategy and discovery skills

- Data, analytics, and experimentation skills

- Delivery, execution, and go-to-market discipline

- Soft skills

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Commercial credit underwriting

- Cash flow analysis, global debt service coverage ratio

- Financial statement spreading

- Credit memos, loan presentations

- Risk rating models, probability of default

- Collateral analysis, loan-to-value

- Covenant structuring, monitoring

- Commercial real estate underwriting

- Loan origination systems, customer relationship management

- Know your customer, anti-money laundering screening

- Portfolio management, concentration limits

- Microsoft Excel, Power BI

Soft skills

- Lead client discovery meetings

- Translate needs into deal terms

- Challenge assumptions with data

- Present credit decisions to committee

- Negotiate covenants and pricing

- Align lenders, legal, and operations

- Manage multiple deals under deadlines

- Write clear, decision-ready narratives

- Escalate risk issues early

- Maintain disciplined follow-through

- Communicate trade-offs transparently

- Build trust with stakeholders

How to show your commercial banking skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how banking professionals weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Commercial banking executive with 14 years of experience in credit structuring, portfolio risk management, and client advisory. Skilled in Moody's CreditLens and relationship-driven lending. Grew a $620M loan portfolio by 18% while maintaining a default rate under 1.2%.

- Signals senior-level expertise immediately

- Names industry-specific tools

- Leads with a measurable portfolio outcome

- Highlights client relationship soft skills

Experience example

Vice President, Commercial Lending

Ridgeline National Bank | Denver, CO

March 2018–August 2024

- Structured $430M in commercial credit facilities using Moody's CreditLens, reducing underwriting cycle time by 22% through streamlined risk modeling.

- Partnered with treasury and compliance teams to redesign covenant monitoring workflows, cutting portfolio review turnaround from 15 days to nine.

- Expanded middle-market client relationships across manufacturing and healthcare, driving $74M in new loan originations within 18 months.

- Every bullet includes measurable proof.

- Skills surface naturally through outcomes.

Once you’ve tied your strengths to real banking-related outcomes and responsibilities, the next step is to apply that same approach to building a commercial banking resume when you don’t have direct experience.

How do I write a commercial banking resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Commercial credit case competitions

- Financial modeling class projects

- Bank internship shadowing hours

- Small business lending simulations

- Student-managed investment fund work

- Accounting or finance tutoring roles

- Customer service cash-handling jobs

- Excel dashboard reporting projects

Our guide on building a resume without work experience walks through how to structure these entries effectively.

Focus on:

- Credit analysis with clear assumptions

- Financial statement analysis results

- Excel models and clean outputs

- Quantified impact and accuracy

Resume format tip for entry-level commercial banking

Use a combination resume format because it highlights relevant projects and skills first, while still showing work history and reliability. Do:

- Lead with a Projects section.

- Add a Skills section with tools.

- Quantify results with clear metrics.

- Include relevant coursework and grades.

- Tailor bullets to credit and lending.

- Built a three-statement Excel model for a $2M revenue manufacturer, analyzed debt service coverage ratio and leverage, and recommended a $250K term loan at 1.35x coverage.

Even without direct experience, your education section can demonstrate the financial knowledge and analytical foundation that commercial banking employers value most.

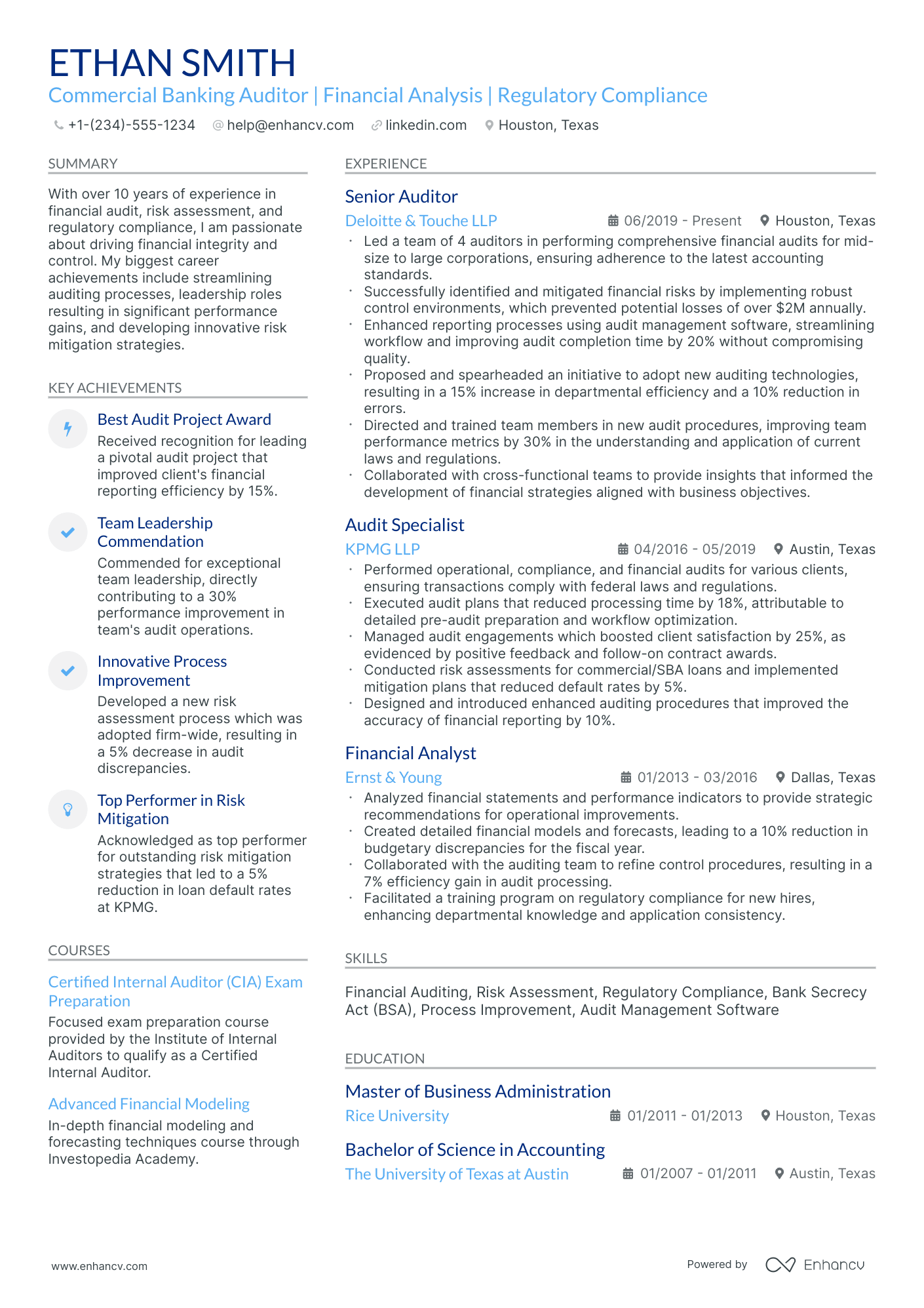

How to list your education on a commercial banking resume

Your education section helps hiring teams confirm you have the foundational knowledge commercial banking demands. It validates your academic background in finance, accounting, or related fields quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to commercial banking:

Example education entry

Bachelor of Science in Finance

Lehigh University, Bethlehem, PA

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Commercial Lending, Corporate Finance, Financial Statement Analysis, Credit Risk Management

- Honors: Magna Cum Laude, Dean's List (six semesters)

How to list your certifications on a commercial banking resume

Certifications on your resume show your commitment to learning, proficiency with commercial banking tools, and alignment with industry expectations. They also help employers trust your judgment in credit, risk, and relationship management.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant to commercial banking, or secondary to a strong degree.

- Place certifications above education when they're recent, highly relevant to commercial banking, or required for your target role.

Best certifications for your commercial banking resume

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Chartered Alternative Investment Analyst (CAIA)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Services Auditor (CFSA)

- Credit Risk Certification (CRC)

Once you’ve positioned your credentials where recruiters can spot them, you can build your commercial banking resume summary to reinforce that expertise upfront.

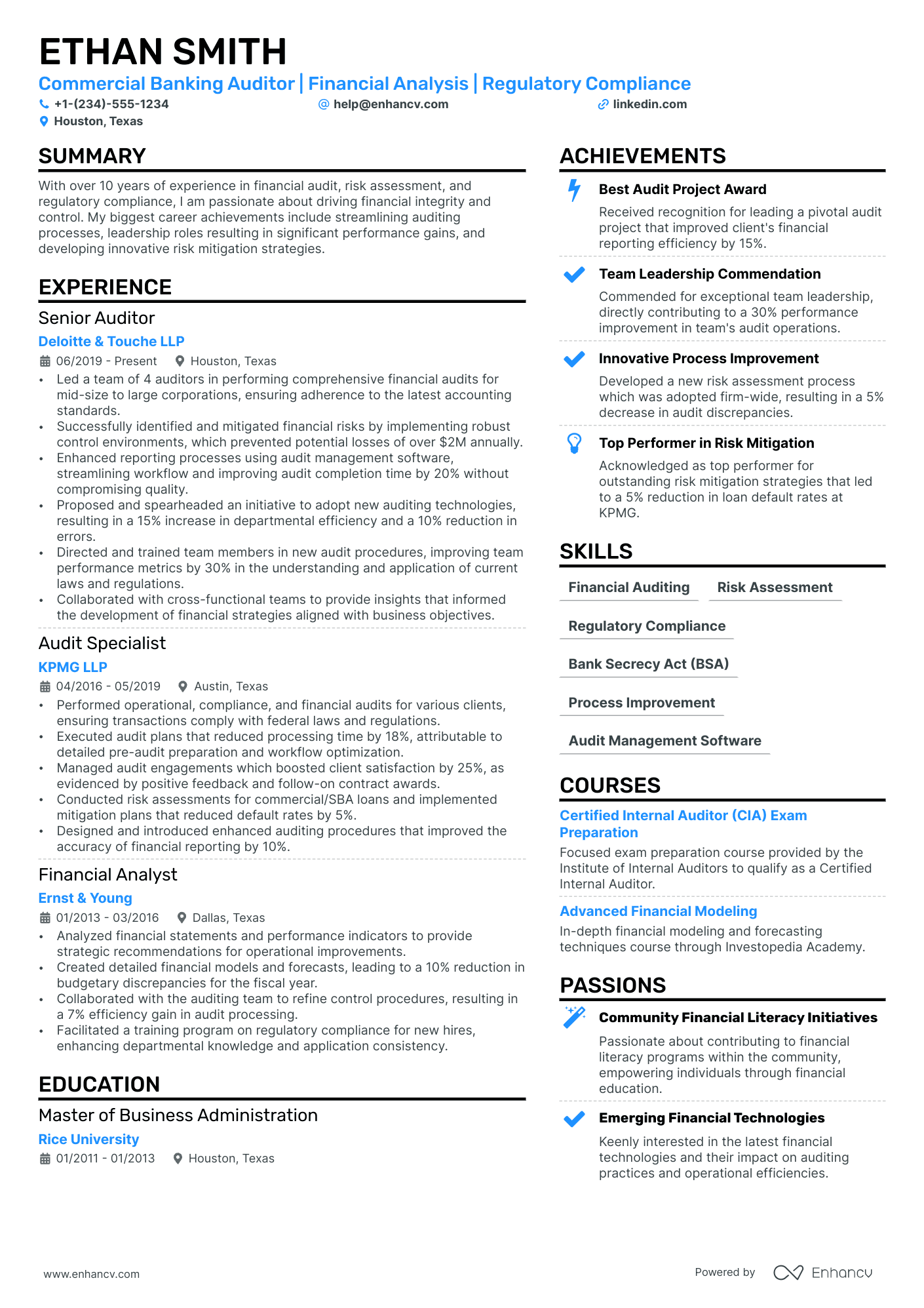

How to write your commercial banking resume summary

Your resume summary is the first thing a recruiter reads, so it needs to earn their attention fast. A strong opening positions you as a qualified commercial banking professional worth interviewing.

Keep it to three to four lines, with:

- Your title and total years of commercial banking experience.

- Domain focus, such as middle-market lending, treasury services, or trade finance.

- Core skills like credit analysis, financial modeling, or relationship management.

- One or two measurable wins, such as portfolio growth or deal volume.

- Soft skills tied to outcomes, like client retention or cross-functional collaboration.

PRO TIP

At the junior level, lead with relevant skills, tools, and early results that prove you can contribute. Avoid vague phrases like "passionate team player" or "eager to learn." Instead, show what you've already done with specifics and numbers.

Example summary for a commercial banking

Junior commercial banking analyst with two years of experience in credit underwriting and financial modeling. Supported $85M in loan originations and streamlined portfolio reporting for 40+ client accounts.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your value as a commercial banking professional, make sure the header framing it presents your contact details correctly so recruiters can actually reach you.

What to include in a commercial banking resume header

A resume header lists your key contact and profile details, and it matters in commercial banking because it boosts visibility, builds credibility, and speeds recruiter screening.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Don't include a photo on a commercial banking resume unless the role explicitly requires a front-facing or appearance-dependent presence.

Place the header at the top, keep it to one or two lines, and match your job title to the commercial banking role posting.

Example

Commercial banking resume header

Jordan Taylor

Commercial Banking Analyst | Credit Analysis, Financial Spreading, Relationship Support

Chicago, IL

(312) 555-67XX

jordan.taylor@enhancv.com

github.com/jordantaylor

yourwebsite.com

linkedin.com/in/jordantaylor

Once your contact details and key identifiers are clear at the top, add the following optional sections to strengthen your commercial banking resume and provide relevant context.

Additional sections for commercial banking resumes

When your core sections don't fully capture your qualifications, additional sections can strengthen your commercial banking resume with relevant credibility.

- Languages

- Industry certifications (CFA, CRC, CRCM)

- Professional affiliations and memberships

- Publications and research

- Volunteer experience in financial literacy

- Awards and recognitions

- Conference presentations and speaking engagements

With your resume's additional sections reinforcing your qualifications, it's worth ensuring your application package is complete by pairing it with a strong cover letter.

Do commercial banking resumes need a cover letter

A cover letter is not required for most commercial banking roles, but it helps when the role is competitive or hiring managers expect context. Understanding what a cover letter is and when to use one can make a difference when your resume needs a clear narrative or when fit is hard to infer.

Use these tips to decide when to include one and what to say:

- Explain role and team fit: Connect your experience to the team's portfolio, client segment, and priorities, such as credit, underwriting, or relationship management.

- Highlight one or two outcomes: Pick a deal, portfolio initiative, or process improvement, and quantify impact like risk reduction, revenue growth, or cycle-time savings.

- Show product and business understanding: Reference how commercial banking products support client needs, cash flow, and risk, and how you partner with sales and credit.

- Address transitions or non-obvious experience: Clarify why you're moving into commercial banking, and map prior work to credit analysis, client advisory, or compliance.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even when you skip a cover letter and rely on a strong resume to carry your application, AI can help you refine your commercial banking resume faster and more effectively.

Using AI to improve your commercial banking resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine bullet points, tighten language, and align content with commercial banking roles. Learn more about which AI is best for writing resumes before diving in. But overuse dulls authenticity. Once your resume reads clearly and fits the role, step away from AI.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your resume:

- Sharpen your summary: "Rewrite my resume summary to highlight my commercial banking experience, core competencies, and value proposition in three concise sentences."

- Quantify experience bullets: "Add measurable outcomes to these commercial banking experience bullets using dollar amounts, percentages, or portfolio sizes where possible."

- Align skills section: "Review this skills list and remove anything irrelevant to a commercial banking role. Suggest missing hard skills that hiring managers expect."

- Strengthen action verbs: "Replace weak or passive verbs in my commercial banking experience section with strong, specific action verbs that convey leadership and results."

- Tailor to job posting: "Compare my resume to this commercial banking job description and identify gaps in keywords, qualifications, or experience I should address."

- Tighten project descriptions: "Rewrite these commercial banking project descriptions to emphasize my specific role, the challenge addressed, and the measurable business outcome."

- Improve education relevance: "Revise my education section to highlight coursework, honors, or research directly relevant to a commercial banking career."

- Refine certification details: "Rewrite my certifications section to clarify how each credential applies to commercial banking responsibilities like credit analysis or risk management."

- Eliminate redundancy: "Identify and remove redundant phrases or repeated ideas across my commercial banking resume without losing important details."

- Fix tone inconsistencies: "Review my entire commercial banking resume for inconsistent tone, tense, or formatting and suggest corrections to unify the document."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong commercial banking resume proves impact with measurable outcomes, like portfolio growth, credit quality, and revenue results. It highlights role-specific skills, including underwriting, risk management, relationship management, and financial analysis, in a clear structure.

Keep your commercial banking resume easy to scan with focused sections, consistent formatting, and direct language. This approach shows you’re ready for today’s hiring market and near-future expectations, with results and skills that translate fast.