As a risk manager, articulating your experience in mitigating complex risk across diverse projects on a resume can be daunting. Our comprehensive guide offers targeted advice to help you effectively showcase your strategic prowess and decision-making capabilities, ensuring your resume stands out to potential employers.

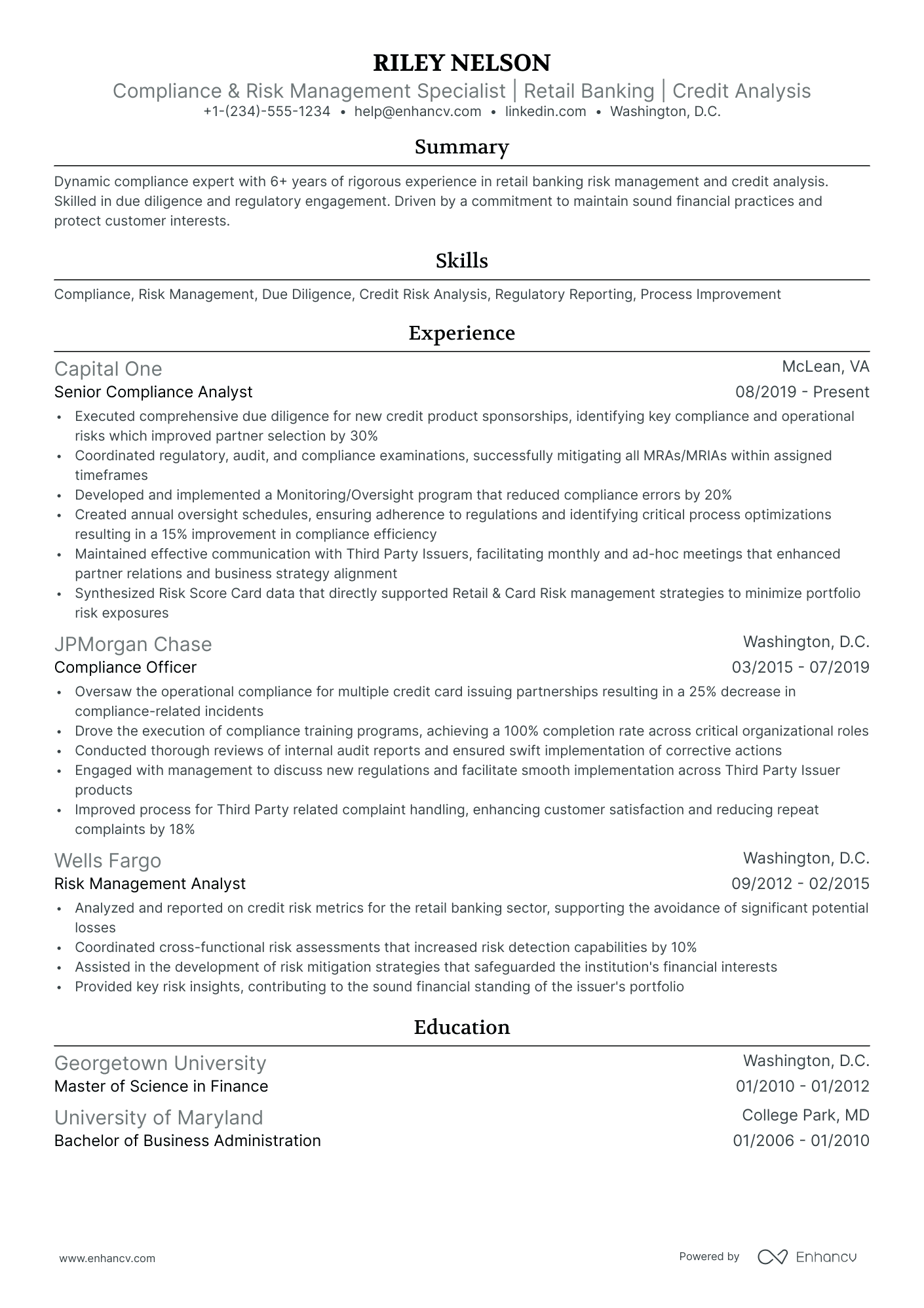

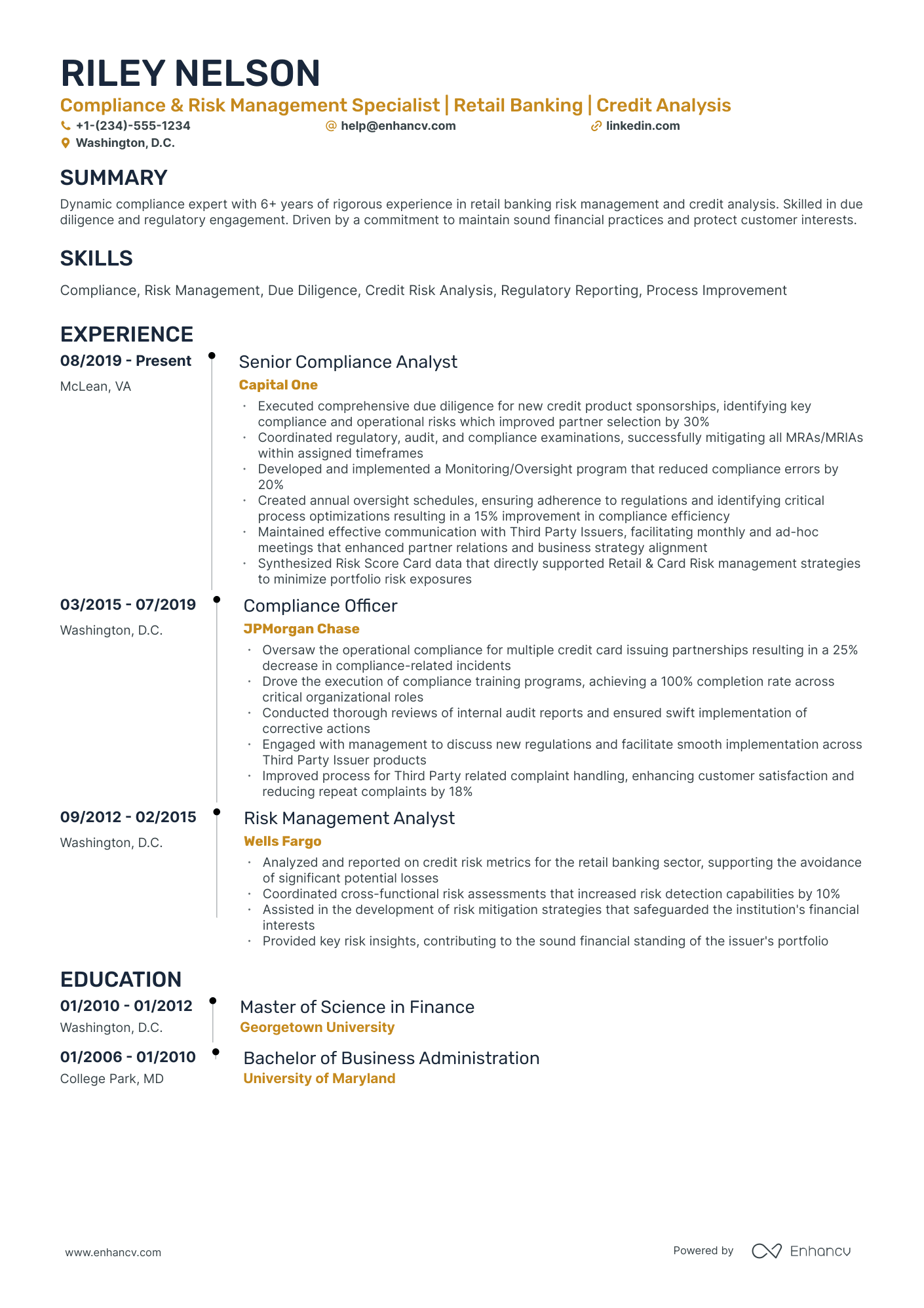

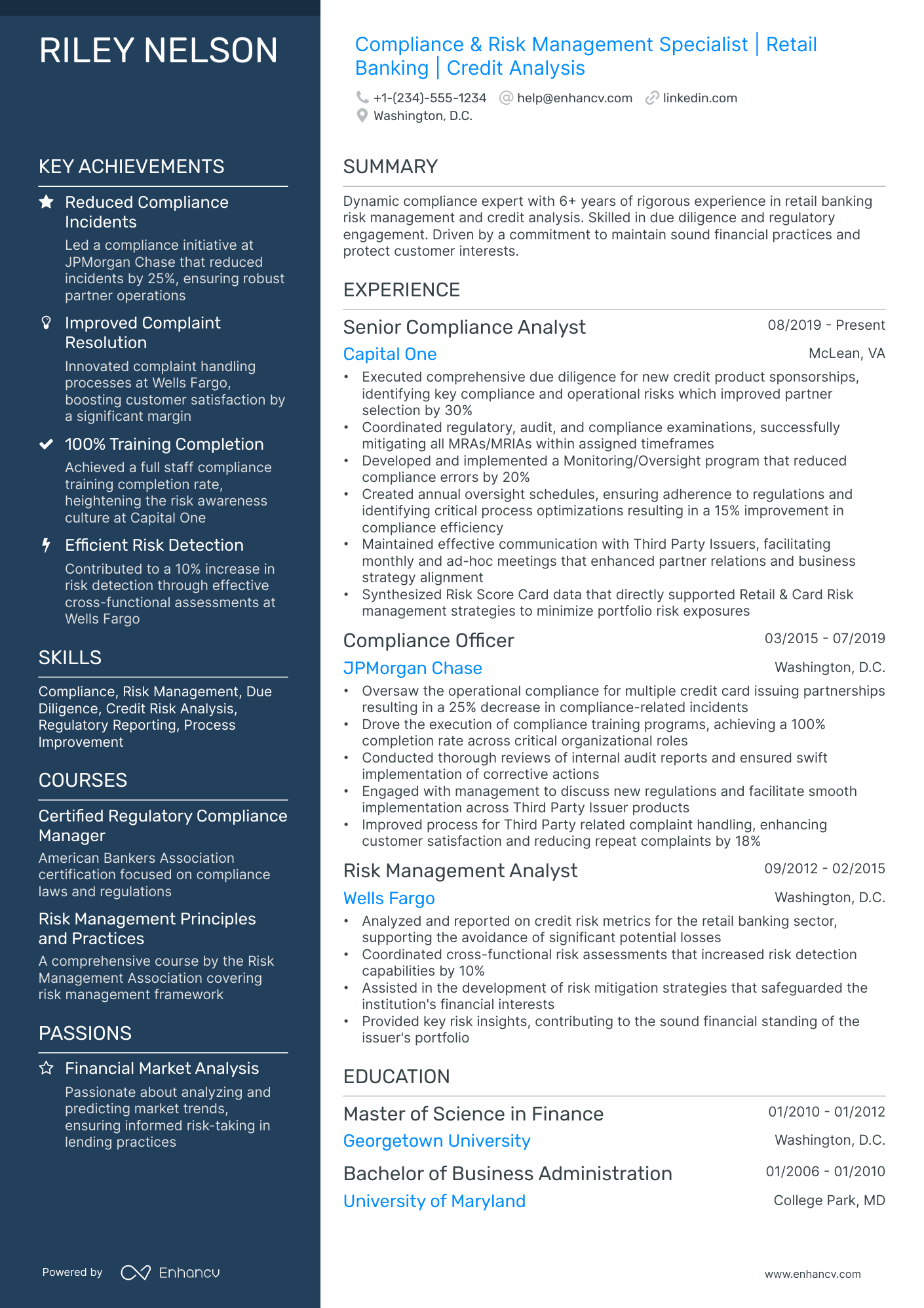

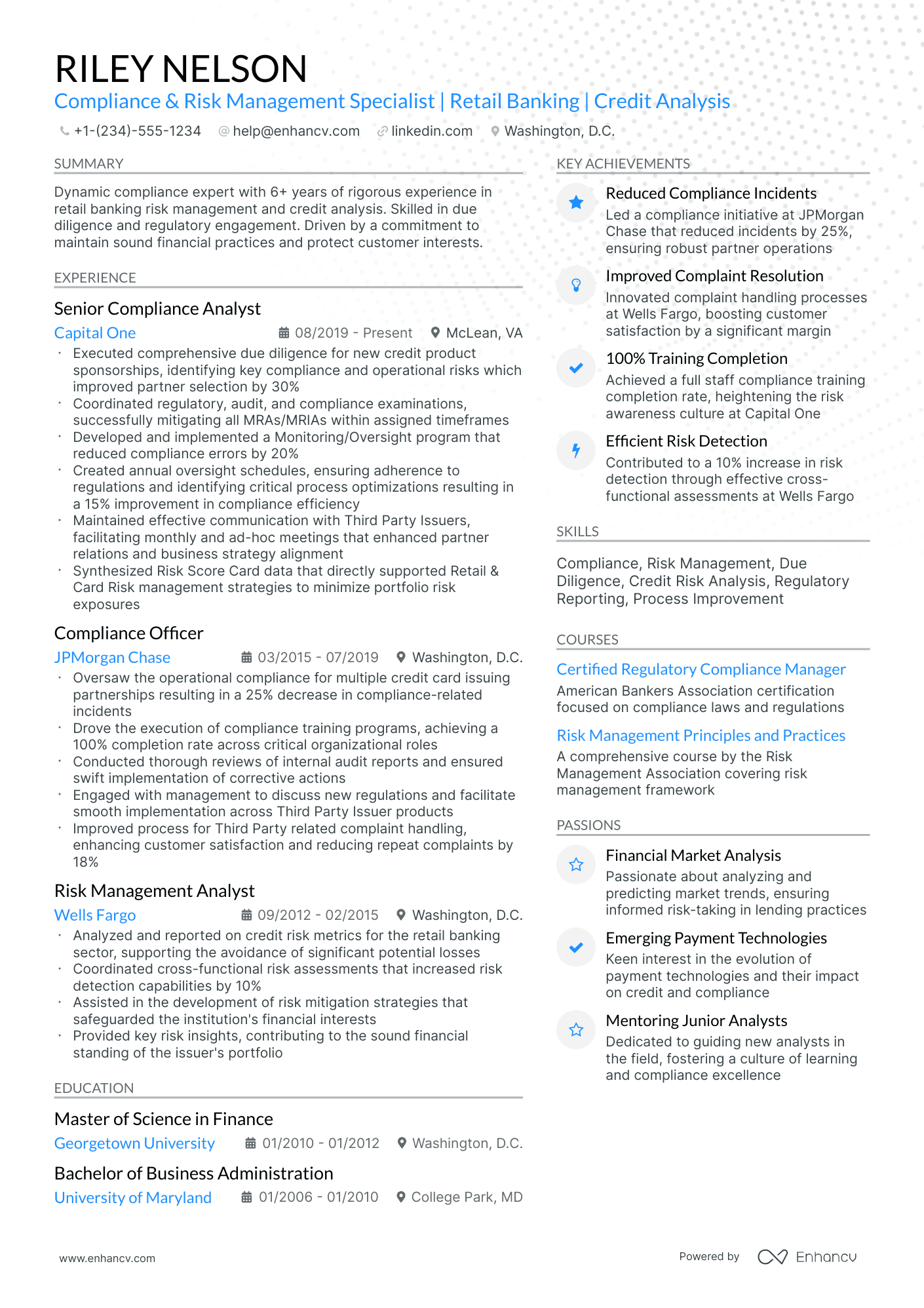

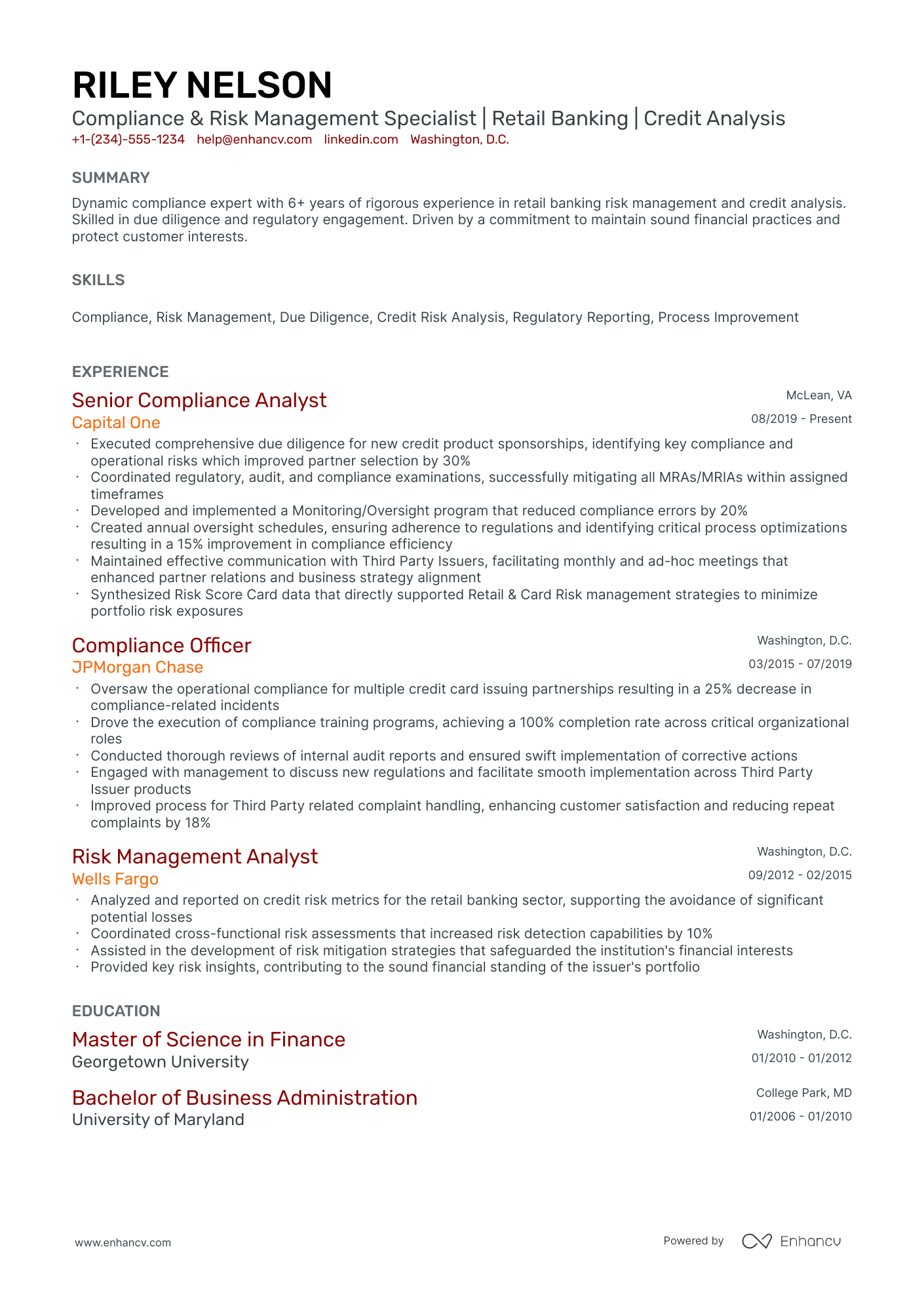

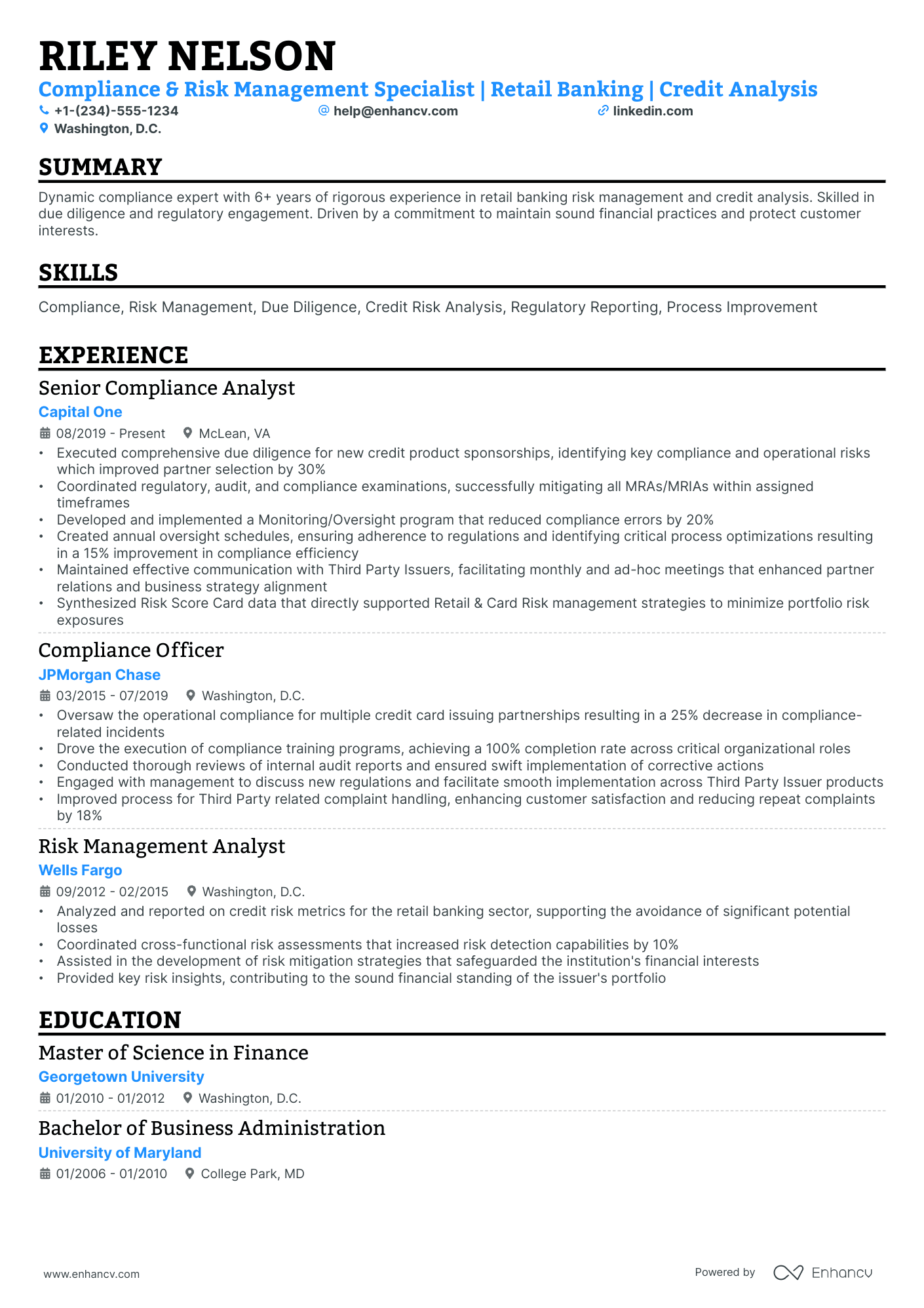

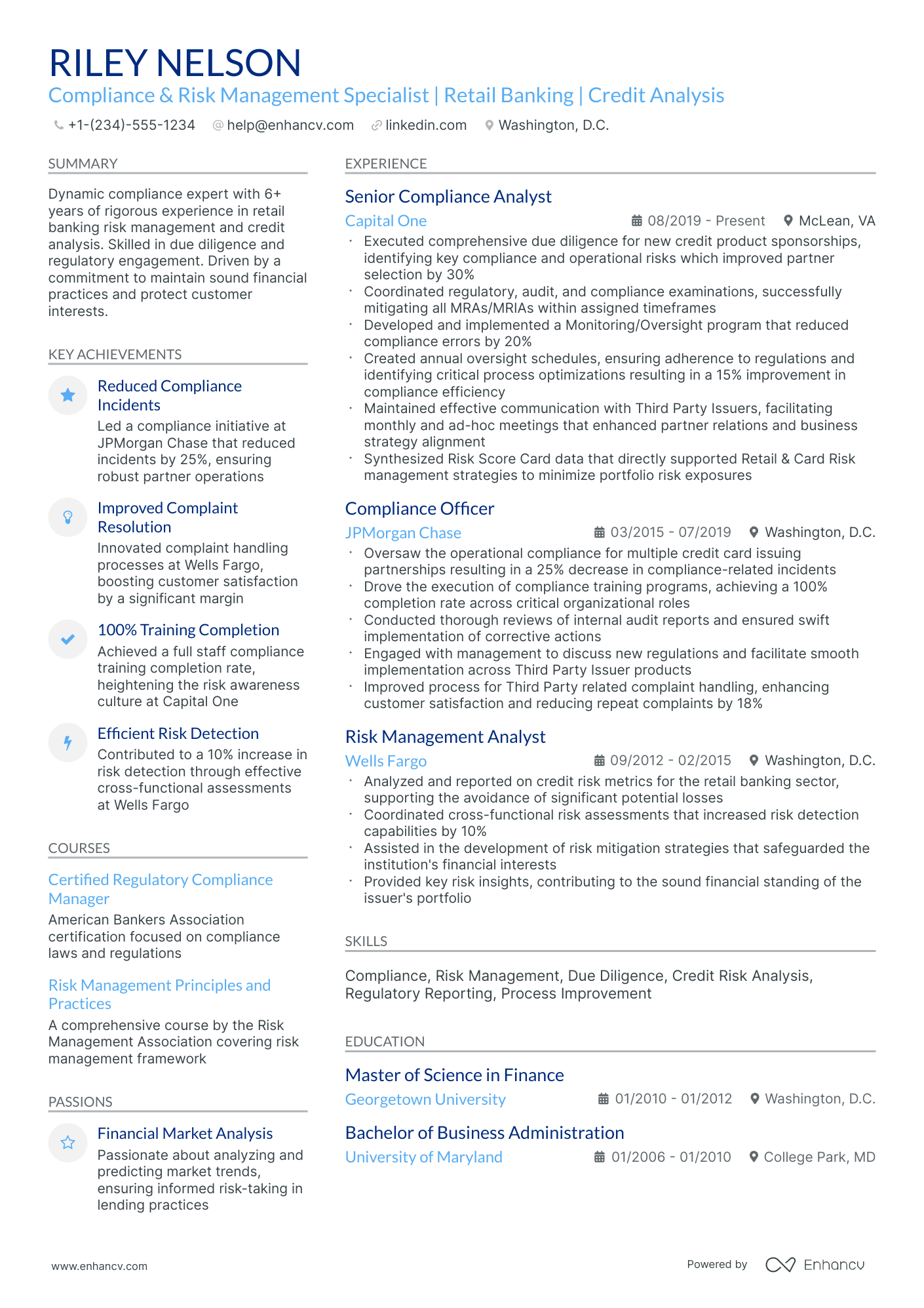

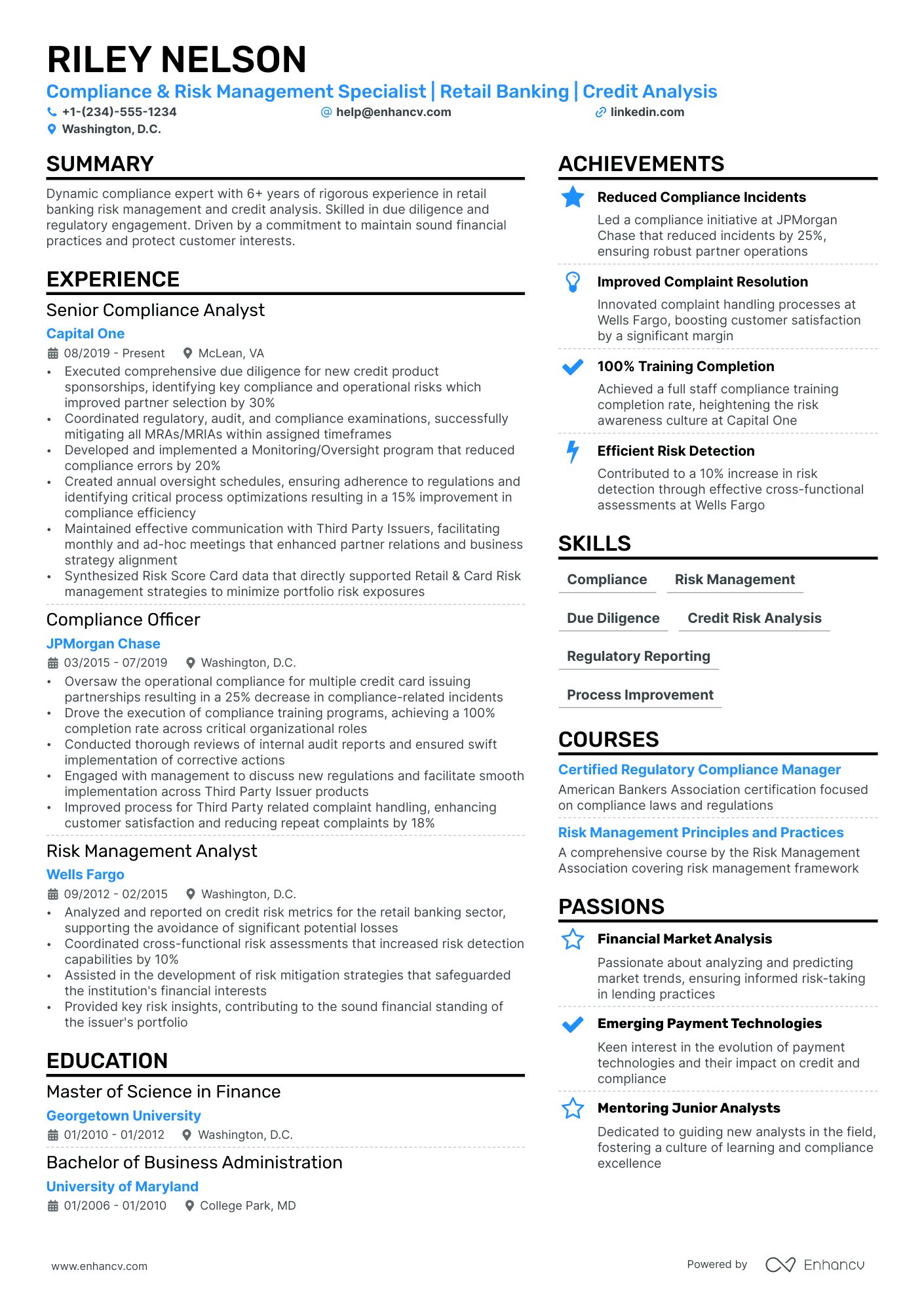

- The most straightforward and effective resume format, ensuring your risk manager resume stands out among numerous candidate profiles;

- The significance of the top one-third of your resume, including the header, summary or objective, and skills section, and its impact on recruiters;

- Frameworks and structures used by real risk manager professionals, offering insights on how to enhance your resume with industry-specific expertise;

- A variety of risk manager resume sections that bolster your profile, showcasing your comprehensive capabilities and distinctiveness.

Gaining insights from the best has never been easier. Explore more risk manager resume examples below:

Formatting the layout of your risk manager resume: design, length, and more

When it comes to the format of your risk manager resume , you've plenty of opportunities to get creative. But, as a general rule of thumb, there are four simple steps you could integrate into your resume layout.

- If you have plenty of experience, you'd like to showcase, invest in the reverse-chronological resume format . This format focuses on your latest experience items and skills you've learned during your relevant (and recent) jobs.

- Don't go over the two-page limit, when creating your professional risk manager resume. Curate within it mainly experience and skills that are relevant to the job.

- Make sure your risk manager resume header includes all of your valid contact information. You could also opt to display your professional portfolio or LinkedIn profile.

- Submit or send out your risk manager resume as a PDF, so you won't lose its layout and design.

Different markets have specific resume styles – a Canadian resume, for instance, may require a different approach.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Essential sections that should make up your risk manager resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the risk manager role

What recruiters want to see on your resume:

- Proven experience in risk assessment and mitigation strategies specific to industry and market trends.

- Strong understanding of regulatory compliance and ability to ensure adherence to legal and ethical risk standards.

- Demonstrated ability to implement robust risk management frameworks and programs.

- Proficient in quantitative risk analysis, statistical modeling, and use of risk management software.

- Exceptional decision-making skills with the ability to communicate complex risk scenarios to stakeholders.

Advice for your risk manager resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

Take a look at how real-life risk manager professionals have presented their resume experience section - always aiming to demonstrate their success.

- Designed and implemented a comprehensive risk management system for a multinational bank, reducing financial risk exposure by 25% within the first year of operation.

- Led a team in the development of risk models using advanced statistical analysis, which improved the prediction of credit defaults and saved the company an estimated $10 million annually.

- Collaborated with senior management to establish risk management priorities that aligned with business strategy, driving the integration of risk considerations into the corporate decision-making process.

- Spearheaded the execution of enterprise risk management initiatives across global markets, facilitating a 15% reduction in operational risks through enhanced internal controls.

- Conducted rigorous risk assessments for new product launches, ensuring compliance with international regulations and safeguarding the firm's reputation and assets.

- Negotiated with insurance providers to optimize coverage for corporate assets worth over $500 million while maintaining a 10% reduction in premium costs.

- Coordinated with cross-functional teams to manage and mitigate operational risks for high-profile technology projects, contributing to the successful launch of secure online banking platforms.

- Implemented risk assessment tools and technologies that improved the speed and accuracy of risk detection by 40%, substantially improving the organization's risk response times.

- Provided risk management and mitigation training to over 300 employees, significantly enhancing the organization's overall risk culture and awareness.

- Oversaw the risk management framework for regional banking operations, leading to a 20% improvement in compliance with federal and state regulatory requirements.

- Authored risk policy documentation used throughout the corporation, setting the standard for risk management practices and procedures.

- Expertly managed a portfolio of assets, resulting in a consistent risk-adjusted rate of return that outperformed benchmarks by 5%.

- Developed and led a cybersecurity risk management program that reduced the incidence of security breaches by 30% through proactive threat assessment and mitigation strategies.

- Partnered with IT departments to integrate risk management best practices into software development lifecycles, enabling safer product releases with a 98% success rate in risk aversion.

- Advised the executive team on strategic acquisitions from a risk perspective, supporting successful deals that expanded the company's market presence while managing the risk portfolio.

- Formulated a dynamic financial risk management strategy that adapted to evolving market conditions, leading to a 15% increase in profitability through optimized risk-taking.

- Pioneered the use of AI-driven risk assessment models that cut down risk analysis time by 50%, allowing for real-time risk management decisions.

- Orchestrated the company's response to regulatory changes, maintaining 100% compliance while streamlining processes to prevent any disruption to business operations.

- Revolutionized risk reporting protocols by creating an automated, real-time dashboard that provided executives with actionable insights, ultimately improving decision-making accuracy.

- Led a successful project to re-evaluate the organization's risk appetite, aligning it with long-term growth objectives and resulting in a more competitive stance in the marketplace.

- Played a key role in developing a culture of risk awareness by initiating a company-wide educational program that resulted in a 40% improvement in risk incident reporting.

- Managed a comprehensive risk management program across all consumer banking divisions, identifying key risk indicators and reducing loan delinquency rates by 18%.

- Formed strategic alliances with data analytics firms, enhancing risk prediction capabilities and enabling a more sophisticated approach to credit risk management.

- Championed a successful initiative to revamp the risk assessment framework, incorporating stress testing that significantly bolstered the bank's resilience to economic fluctuations.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for risk manager professionals.

Top Responsibilities for Risk Manager:

- Report violations of compliance or regulatory standards to duly authorized enforcement agencies as appropriate or required.

- Identify compliance issues that require follow-up or investigation.

- Discuss emerging compliance issues to ensure that management and employees are informed about compliance reporting systems, policies, and practices.

- File appropriate compliance reports with regulatory agencies.

- Maintain documentation of compliance activities, such as complaints received or investigation outcomes.

- Consult with corporate attorneys as necessary to address difficult legal compliance issues.

- Conduct or direct the internal investigation of compliance issues.

- Provide employee training on compliance related topics, policies, or procedures.

- Serve as a confidential point of contact for employees to communicate with management, seek clarification on issues or dilemmas, or report irregularities.

- Verify that all regulatory policies and procedures have been documented, implemented, and communicated.

Quantifying impact on your resume

- Include the number of risk assessments conducted to demonstrate the breadth of your experience.

- Specify the dollar value of assets protected through risk mitigation strategies to illustrate financial responsibility.

- Detail the percentage reduction in operational losses due to implemented risk controls to highlight efficiency improvements.

- Document the number of risk management policies developed to show your contribution to organizational standards.

- Mention the scale of projects managed, using budget or team size, to establish leadership and project management skills.

- Cite quantifiable improvements in compliance rates post risk management interventions to prove regulatory impact.

- Enumerate the number of training sessions led on risk awareness to reflect your role in promoting risk culture.

- Report the frequency of reporting and monitoring activities to display vigilance and consistency in risk oversight.

Action verbs for your risk manager resume

Making the most of your little to none professional experience

If you're hesitant to apply for your dream job due to limited professional experience, remember that recruiters also value the unique contributions you can offer.

Next time you doubt applying, consider this step-by-step approach for your resume's experience section:

- Rather than the standard reverse chronological order, opt for a functional-based format. This shifts the focus from your work history to your achievements and strengths;

- Include relevant internships, volunteer work, or other non-standard experiences in your risk manager resume's experience section;

- Utilize your education, qualifications, and certifications to bridge gaps in your risk manager resume experience;

- Emphasize your interpersonal skills and transferable skills from various industries. Often, recruiters seek a personality match, giving you an advantage over other candidates.

Recommended reads:

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

How to showcase hard skills and soft skills on your resume

Reading between the lines of your dream job, you find recruiters are looking for candidates who have specific software or hardware knowledge, and personal skills.

Any technology you're adept at shows your hard skills. This particular skill set answers initial job requirements, hinting at how much time your potential employers would have to invest in training you. Showcase you have the relevant technical background in your communicate, solve problems, and adapt to new environments. Basically, your interpersonal communication skills that show recruiters if you'd fit into the team and company culture. You could use the achievements section to tie in your greatest wins with relevant soft skills.

It's also a good idea to add some of your hard and soft skills across different resume sections (e.g. summary/objective, experience, etc.) to match the job requirements and pass the initial screening process. Remember to always check your skill spelling and ensure that you've copy-pasted the name of the desired skills from the job advert as is.

Top skills for your risk manager resume:

Risk Assessment Software

Data Analysis Tools

Statistical Analysis Techniques

Project Management Software

Regulatory Compliance Tools

Financial Modeling Software

Enterprise Risk Management (ERM) Systems

GRC (Governance, Risk, and Compliance) Tools

Cybersecurity Risk Assessment Tools

Quantitative Risk Analysis Techniques

Analytical Thinking

Problem Solving

Communication Skills

Attention to Detail

Negotiation Skills

Leadership

Decision Making

Interpersonal Skills

Adaptability

Time Management

Next, you will find information on the top technologies for risk manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Risk Manager’s resume:

- Email software

- Microsoft Outlook

- Microsoft PowerPoint

- Actimize Brokerage Compliance Solutions

- Thomson Reuters Paisley Enterprise GRC

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Discover the perfect certification and education to list on your risk manager resume

Value the insights your resume education section offers. It can shed light on various proficiencies and experiences tailored for the job.

- Add only college or university degrees, stating the institution and duration.

- If you're nearing the end of your degree, note your graduation date.

- Weigh the pros and cons of including unrelated degrees - it might not be your best choice with so little space on your resume.

- Talk about your educational achievements if they amplify your relevant experience.

There are so many certificates you can list on your resume.

Just which ones should make the cut?

- List your prominent higher education degree in a separate box, alongside the name of the institute you've obtained it from and your graduation dates

- Curate only relevant certificates that support your expertise, hard skills, and soft skills

- Certificates that are more niche (and rare) within the industry could be listed closer to the top. Also, this space could be dedicated to more recent certifications you've attained

- Add a description to your certificates or education, only if you deem this could further enhance your chances of showcasing your unique skill set

When listing your certificates, remember that it isn't a case of "the more, the merrier", but rather "the more applicable they are to the industry, the better".

Recruiters have hinted that these are some of the most in-demand certificates for risk manager roles across the industry:

The top 5 certifications for your risk manager resume:

- Financial risk manager (FRM) - Global Association of Risk Professionals (GARP)

- Professional risk manager (PRM) - PRMIA (Professional risk managers' International Association)

- Certified risk manager (CRM) - The National Alliance for Insurance Education & Research

- Certified Risk and Information Systems Control (CRISC) - ISACA (Information Systems Audit and Control Association)

- Chartered Enterprise Risk Analyst (CERA) - Society of Actuaries (SOA)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for risk manager professionals.

Top US associations for a Risk Manager professional

- American Bankers Association

- American Society for Quality

- Association for Certified Anti-Money Laundering Specialists

- Institute of Internal Auditors

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Recommended reads:

Best practices to your risk manager resume summary or objective

To start, how do you know if you should include a resume summary or a resume objective ?

- Resume summaries are ideal for risk manager professionals with more experience, who'd like to give a quick glimpse of their biggest career achievements in the top one-third of their resumes.

- On the other hand, resume objectives serve as a road map for recruiters. Candidates use the objective to show how their experience aligns with the risk manager role they're applying for while showcasing the North Star of their career (or where they want to be as a professional in the next couple of years).

The resume summary or resume objective could be the perfect fit for your risk manager resume. The function of both is to highlight your professionalism succinctly. So, keep your writing specific: include no more than four sentences and target your application to the role. Here's how these specific resume sections help the risk manager candidates stand out.

Resume summaries for a risk manager job

- With over a decade of experience in financial risk management for multinational banks, this candidate excels in implementing robust risk assessment frameworks and has a proven track record of mitigating potential losses, evidenced by a 20% reduction in risk-related incidents over three years at their last position.

- Transitioning from a successful 8-year cybersecurity career, this professional brings a unique technical skill set to financial risk management, including expertise in data protection laws, which will enhance the security of sensitive financial information and align with industry compliance standards.

- Boasting a strong background in insurance underwriting and a recent Master’s in Risk Management, this candidate seamlessly blends analytical prowess with strategic planning, aiming to transfer a decade-long experience towards fostering a resilient financial environment within a dynamic risk management landscape.

- Migrating their expertise from a 12-year tenure in corporate law to financial risk management, this adept professional leverages their in-depth understanding of legal compliance and contracts to fortify risk mitigation strategies and enhance operational due diligence procedures.

- Eager to embark on a career in risk management, this recent finance graduate combines a fervent commitment to mastering risk assessment techniques with a solid academic foundation in quantitative analysis and a keen interest in contributing to the development of comprehensive risk abatement initiatives.

- Armed with a recent MBA with a specialization in Risk Management and an unyielding motivation to learn, this passionate individual is ready to apply outstanding analytical and statistical modeling skills to help shape and uphold strategic risk management policies in a dynamic financial setting.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for risk manager professionals

Local salary info for Risk Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $133,560 |

| California (CA) | $168,600 |

| Texas (TX) | $131,840 |

| Florida (FL) | $119,350 |

| New York (NY) | $154,170 |

| Pennsylvania (PA) | $130,840 |

| Illinois (IL) | $132,070 |

| Ohio (OH) | $125,280 |

| Georgia (GA) | $110,780 |

| North Carolina (NC) | $124,110 |

| Michigan (MI) | $125,490 |

Four more sections for your risk manager resume

Your risk manager resume can be supplemented with other sections to highlight both your personality and efforts in the industry. Use the ones you deem most relevant to your experience (and the role):

- Awards - to celebrate your success;

- Interests - to detail what you're passionate about outside of work (e.g. music, literature, etc.);

- Publications - to show your footprint in the wider community;

- Projects - to pinpoint noteworthy achievements, potentially even outside of work.

Key takeaways

We trust that this Enhancv guide has been informative and useful. To summarize the essential points:

- Opt for a simple and readable format, focusing more on your risk manager achievements rather than just duties;

- Emphasize your accomplishments in the risk manager experience section over mere responsibilities;

- If lacking relevant experience, utilize various resume sections like education and volunteering to demonstrate your suitable skill set;

- Never overlook the significance of pertinent higher education, training, and certifications;

- Incorporate diverse sections in your resume to highlight not just your skills expertise but also your personality.