Insurance brokers often struggle with effectively conveying their broad range of skills, such as risk assessment and client relationship management, in a concise manner on their resumes. Our guide can assist by offering targeted advice on how to succinctly articulate these diverse abilities, using industry-specific keywords, and formatting strategies that emphasize their most relevant experiences and accomplishments.

Dive into this guide to discover how to craft a compelling insurance broker resume:

- Explore top-tier insurance broker resume samples, spotlighting industry-leading skills and experiences.

- Uncover over ten tailored strategies to make your insurance broker resume resonate with the job description.

- Illuminate your unique value as a insurance broker candidate, using your professional achievements as a guide.

- Debunk the myth that education doesn't matter, and learn how to leverage your academic and certification credentials effectively.

Recommended reads:

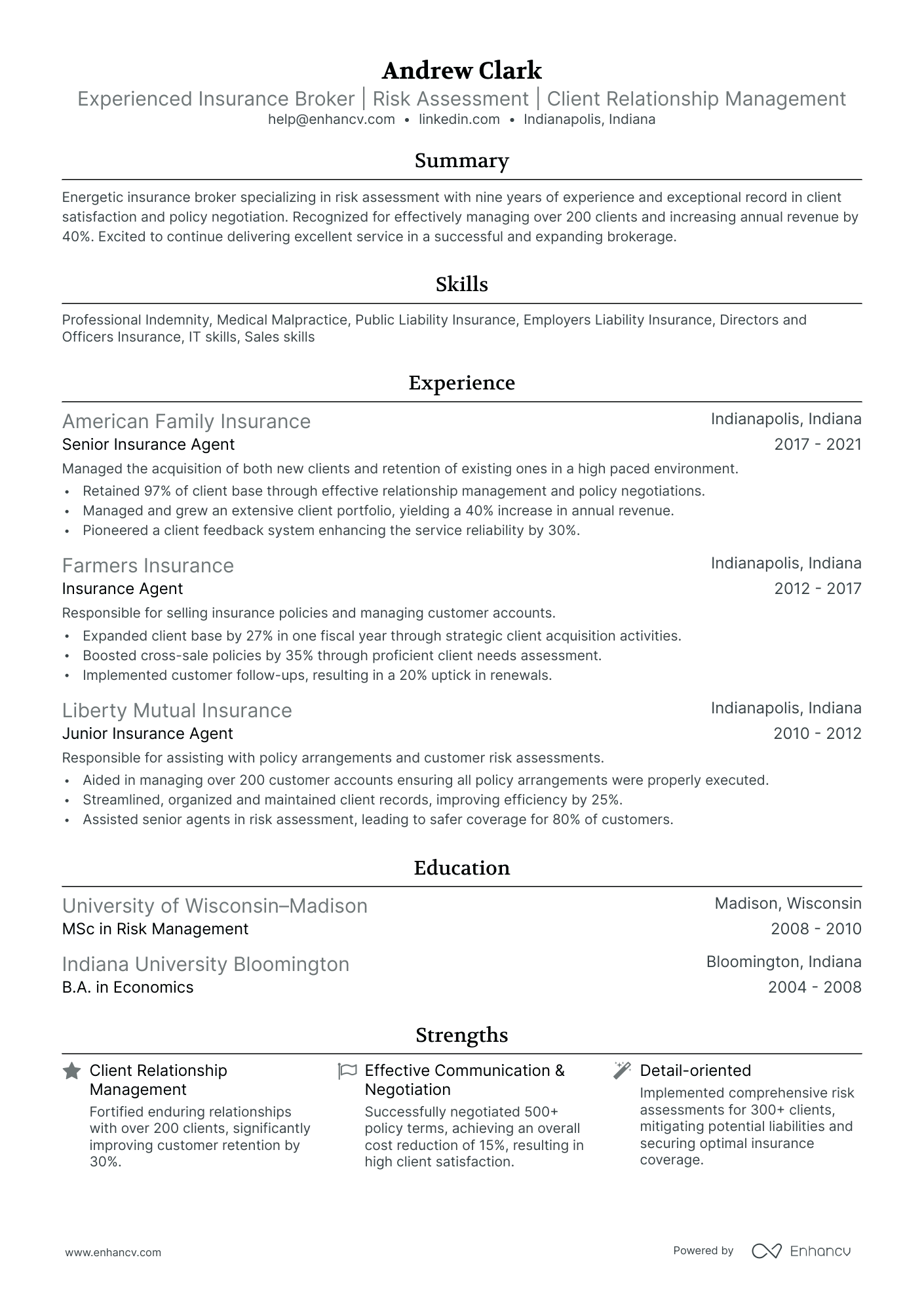

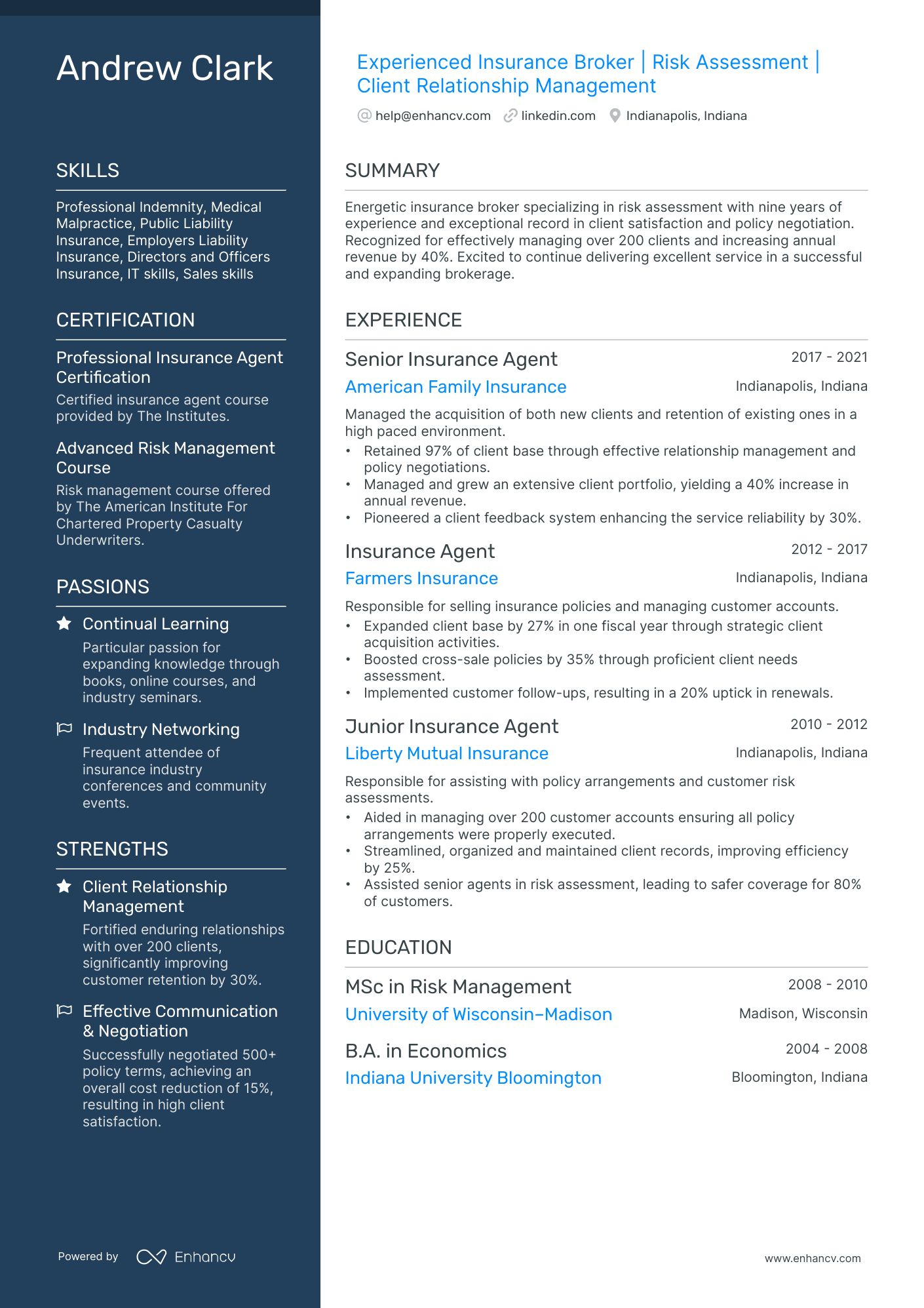

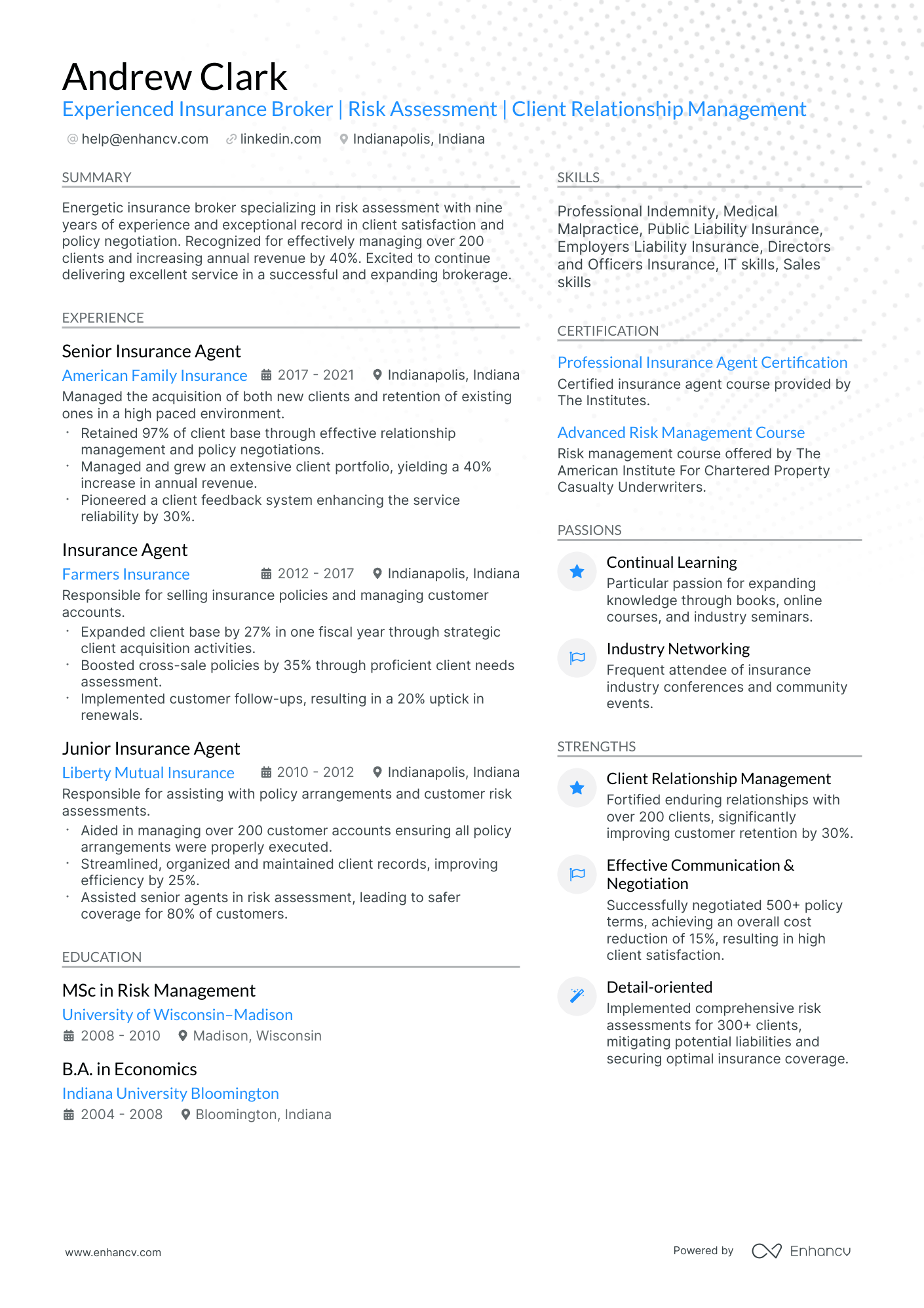

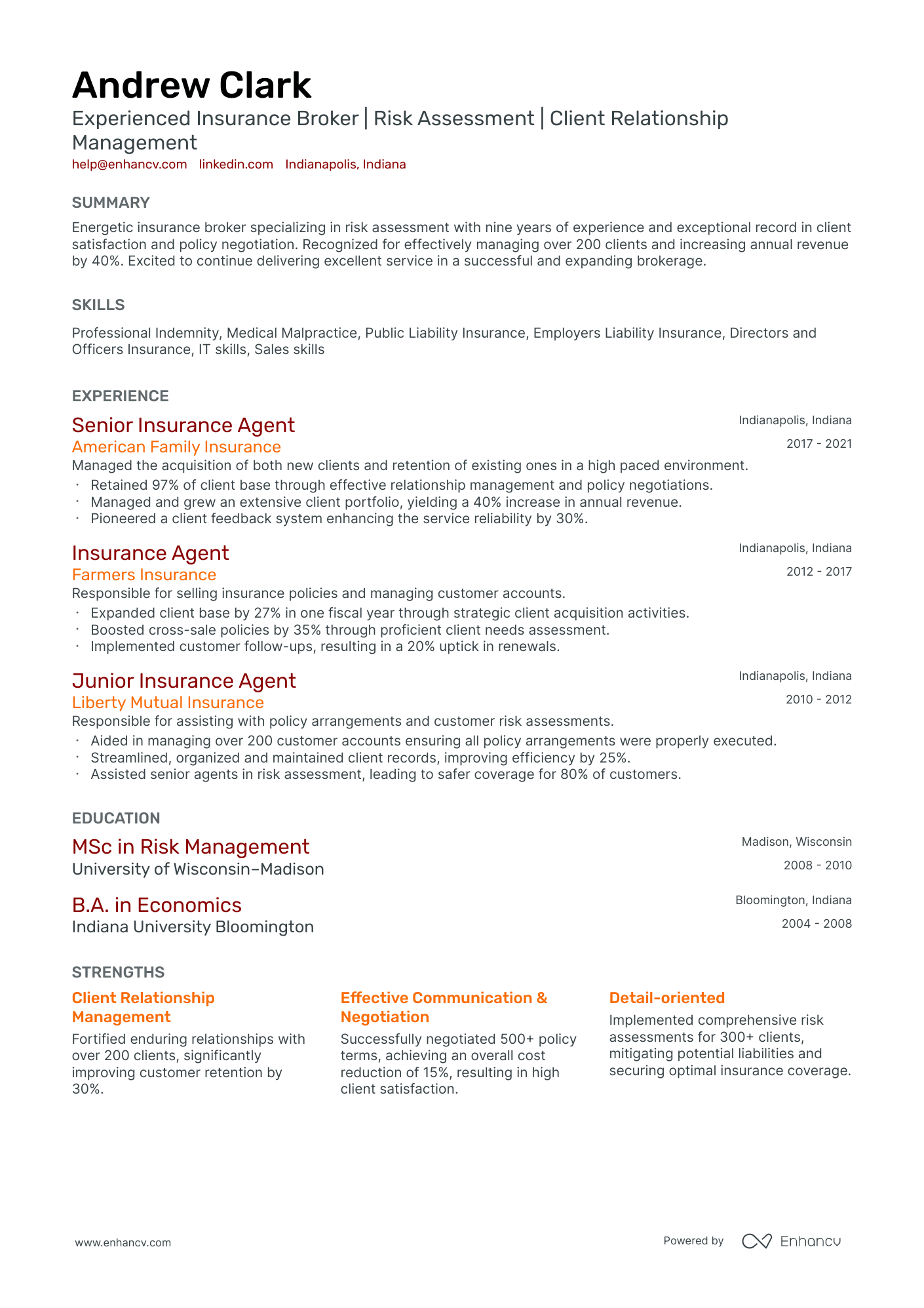

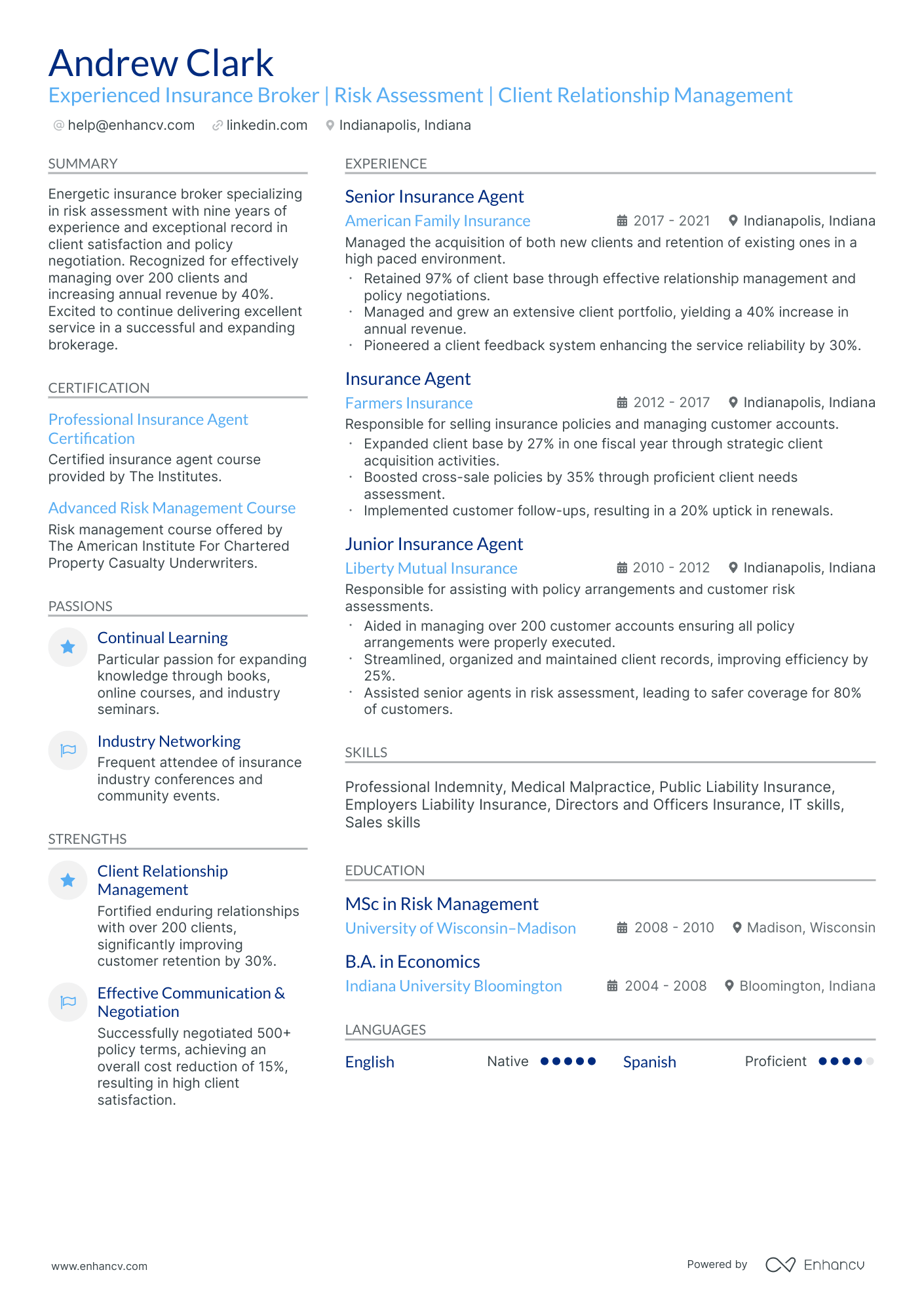

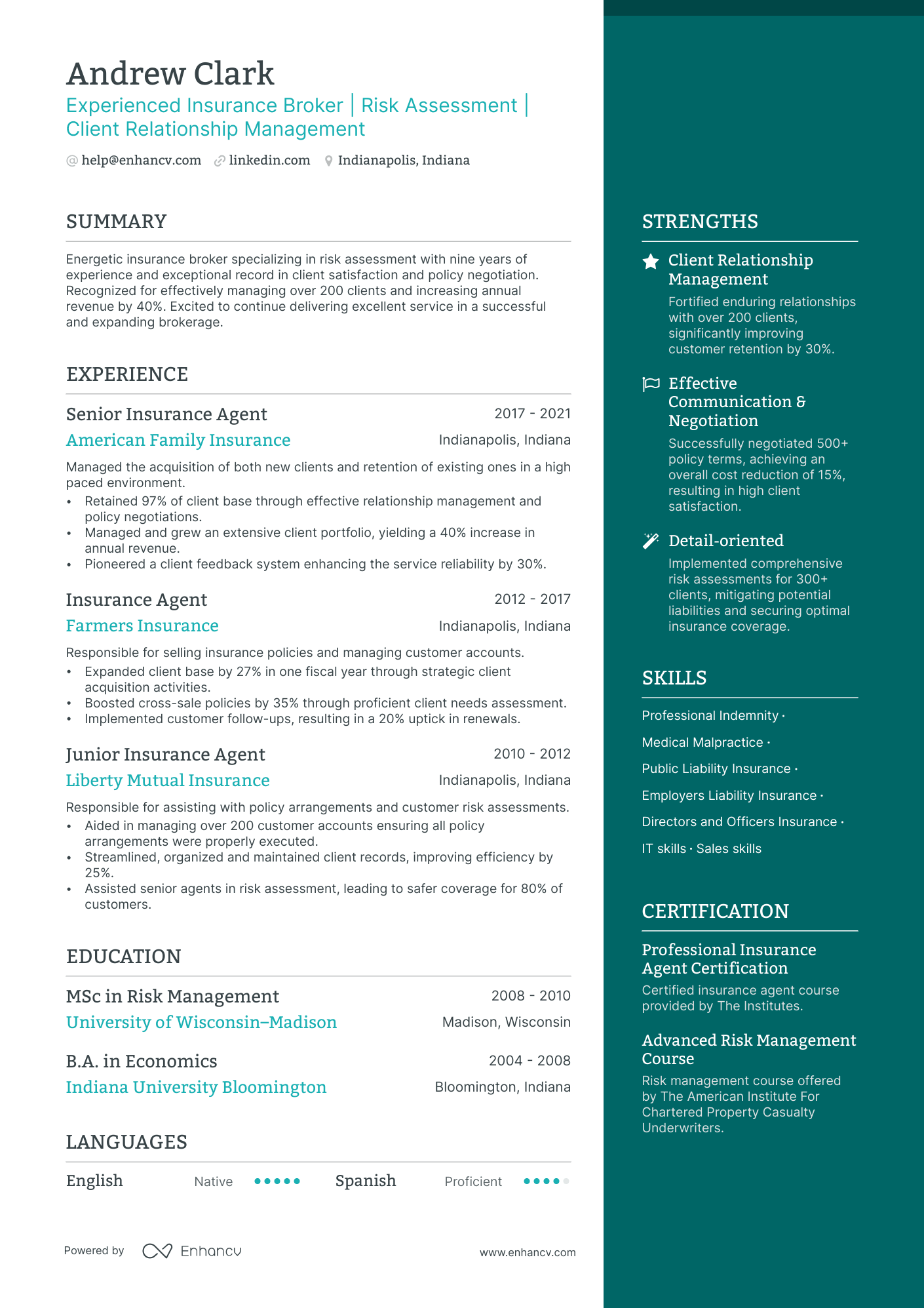

crafting an impeccable insurance broker resume format in four steps

Your insurance broker resume format should be both strategic and reader-friendly. Here's a concise guide to help you achieve that:

- Choose a format that aligns with the job's requirements. If your expertise is directly relevant, the reverse-chronological format is ideal. If you're focusing more on skills, consider the functional or hybrid formats.

- Header: Ensure it's populated with accurate contact details and any relevant portfolio links.

- Length: A one-page resume is standard, but if you have extensive experience, extending to two pages is acceptable.

- File type: To maintain formatting consistency, always opt for PDF.

Remember, resume layouts can vary by country – for example, a Canadian resume format could look different.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Prioritize clarity and organization in your insurance broker resume. Use ample white space, choose readable fonts, and clearly delineate each section.

Essential insurance broker resume sections for a comprehensive overview:

- Header: Enables recruiters to swiftly access your contact details and peruse your latest work portfolio.

- Summary or Objective: Offers a snapshot of your career milestones and aspirations.

- Experience: Demonstrates alignment with job prerequisites and highlights your tangible contributions.

- Skills: Captures the full spectrum of your expertise, making you a compelling insurance broker candidate.

- Education & Certifications: Bridges potential experience gaps and underscores your dedication to the field.

What recruiters want to see on your resume:

- Relevant Licensing: Evidence of the necessary state or national licenses to legally act as an insurance broker.

- Industry Experience: Detailed descriptions of past roles in the insurance industry, demonstrating knowledge of various types of insurance policies and client management.

- Sales Skills: Examples of successful sales history, including meeting or exceeding targets, retained business, and growth of new business.

- Communication Skills: Instances where you demonstrated strong ability to communicate complex insurance policies clearly to clients.

- Domain Knowledge: Familiarity with insurance laws, regulations, claim handling procedures, and current trends in the insurance market.

Recommended reads:

Optimizing your insurance broker resume experience section

Your resume's experience section should resonate with your accomplishments while aligning with the job's demands. Here's how:

- Highlight significant career moments, and back them up with relevant skills.

- Analyze the job description to address both basic and advanced requirements.

- If you have unrelated roles, consider a separate section, but emphasize transferable skills.

- Avoid listing roles from over a decade ago unless they showcase your trajectory, especially for senior roles.

- Illustrate how your contributions enhanced the team or company, linking challenges to solutions.

Review how seasoned insurance broker professionals have crafted their experience sections, emphasizing their contributions.

- Collaborated with clients to assess insurance needs and provide tailored solutions resulting in a 15% increase in policy sales.

- Negotiated favorable terms with insurance carriers, resulting in cost savings of over $100,000 annually for clients.

- Developed and maintained strong relationships with key clients, leading to a client retention rate of 95%.

- Managed a portfolio of high-net-worth clients, ensuring their insurance coverage met their specialized requirements.

- Conducted comprehensive risk assessments and advised clients on appropriate insurance strategies.

- Coordinated claims processing and provided support to clients throughout the claims settlement process.

- Assisted clients in understanding insurance products and coverage options, resulting in a 20% increase in policy conversions.

- Analyzed market trends and competitor offerings to recommend competitive insurance packages to clients.

- Processed policy applications, endorsements, and renewals accurately and efficiently.

- Provided exceptional customer service, resolving client inquiries and concerns promptly and effectively.

- Collaborated with underwriters to negotiate favorable terms and conditions for clients' insurance policies.

- Organized and conducted seminars on insurance planning for corporate clients.

- Built a book of business by prospecting and acquiring new clients through cold calling and referrals.

- Analyzed clients' existing insurance coverage to identify gaps and offered comprehensive solutions.

- Assessed clients' risk profiles and recommended appropriate coverage levels to mitigate potential risks.

- Negotiated policy terms, premiums, and endorsements with insurance carriers on behalf of clients.

- Provided ongoing customer support, addressing policy inquiries and resolving billing and claims issues.

- Developed marketing strategies to promote insurance products and services to target audiences.

- Managed a diverse client portfolio, ensuring their insurance needs were met within specified timelines.

- Educated clients on various insurance options, highlighting the benefits and coverage details.

- Processed policy changes, endorsements, and cancellations accurately and efficiently.

- Assisted in evaluating and assessing new insurance products for potential inclusion in the company's offerings.

- Collaborated with underwriters to resolve complex policy-related inquiries and exceptions.

- Maintained accurate client records and policy documentation for compliance purposes.

- Develop and implement targeted marketing campaigns resulting in a 30% increase in lead generation.

- Utilize digital platforms and social media channels to promote insurance products and engage with potential clients.

- Leverage data analytics to identify market trends and customer preferences, optimizing sales strategies.

- Collaborate with cross-functional teams to develop innovative insurance solutions tailored to specific industries.

- Advise clients on emerging risks and recommend appropriate coverage enhancements to mitigate potential losses.

- Manage a diverse book of business, providing ongoing support and proactive insurance solutions to clients.

- Prospected and cultivated relationships with local businesses resulting in a 25% increase in commercial policy sales.

- Analyzed clients' risk exposures and recommended customized insurance programs to protect their assets.

- Reviewed and negotiated policy terms and conditions to ensure adequate coverage for clients.

- Conducted regular policy reviews to identify coverage gaps and recommend appropriate adjustments.

- Collaborated with claims adjusters to expedite the resolution of clients' claims and provide exceptional service.

- Participated in industry conferences and seminars to stay updated on insurance trends and regulations.

- Developed and executed a lead generation strategy resulting in a 40% increase in new client acquisitions.

- Conducted comprehensive risk assessments and advised clients on appropriate insurance coverage options.

- Negotiated policy terms, premiums, and endorsements to meet clients' specific needs and budgets.

- Managed a high-volume workload effectively, meeting or exceeding sales targets consistently.

- Provided ongoing customer support, addressing billing inquiries, policy changes, and claims assistance.

- Collaborated with underwriters and claims adjusters to ensure timely and satisfactory claim settlements.

- Provided personalized insurance solutions to individual clients, resulting in a 15% increase in policy retention.

- Analyzed clients' coverage needs and recommended appropriate insurance products to meet their requirements.

- Assisted clients in understanding policy terms, coverage details, and exclusions for informed decision-making.

- Generated new business through referrals and networking, expanding the client base by 20% annually.

- Collaborated with insurance carriers to negotiate competitive pricing and favorable policy terms for clients.

- Managed renewals, endorsements, and claims processes efficiently to ensure customer satisfaction.

- Developed and maintained strong relationships with insurance carriers, ensuring access to a wide range of products.

- Assessed clients' risk profiles and advised on appropriate insurance solutions to mitigate potential losses.

- Conducted thorough policy reviews to identify gaps and recommend comprehensive coverage enhancements.

- Presented insurance proposals and options to clients, effectively communicating complex concepts.

- Processed policy applications, endorsements, and cancellations accurately and efficiently.

- Provided exceptional customer service, promptly resolving inquiries and concerns to ensure client satisfaction.

- Managed a team of junior brokers, providing training, guidance, and support to enhance their skills and productivity.

- Developed and implemented sales strategies resulting in a 25% increase in overall team performance.

- Established and nurtured relationships with key clients, ensuring their long-term satisfaction and loyalty.

- Collaborated with underwriters to negotiate favorable terms for complex and high-value insurance policies.

- Analyzed market trends and competitor offerings to identify business development opportunities.

- Provided leadership in developing marketing materials and campaigns to promote the company's insurance services.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for insurance broker professionals.

Top Responsibilities for Insurance Broker:

- Customize insurance programs to suit individual customers, often covering a variety of risks.

- Sell various types of insurance policies to businesses and individuals on behalf of insurance companies, including automobile, fire, life, property, medical and dental insurance, or specialized policies, such as marine, farm/crop, and medical malpractice.

- Explain features, advantages, and disadvantages of various policies to promote sale of insurance plans.

- Perform administrative tasks, such as maintaining records and handling policy renewals.

- Seek out new clients and develop clientele by networking to find new customers and generate lists of prospective clients.

- Call on policyholders to deliver and explain policy, to analyze insurance program and suggest additions or changes, or to change beneficiaries.

- Confer with clients to obtain and provide information when claims are made on a policy.

- Interview prospective clients to obtain data about their financial resources and needs, the physical condition of the person or property to be insured, and to discuss any existing coverage.

- Contact underwriter and submit forms to obtain binder coverage.

- Select company that offers type of coverage requested by client to underwrite policy.

Quantifying impact on your resume

<ul>

No experience, no problem: writing your insurance broker resume

You're set on the insurance broker role of your dreams. Yet, you have little to no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on the ones that align with the job you're applying for

- Include any valid experience in the field - whether it's a university research project, or a summer internship

- Highlight the soft skills you're bringing along - those that will have an added value to your application.

- Focus on your education and certifications, especially if they make sense for the role.

Recommended reads:

Pro tip

If your experience section doesn't directly address the job's requirements, think laterally. Highlight industry-relevant awards or positive feedback to underscore your potential.

Highlighting your insurance broker skills

Recruiters look for a mix of technical and personal skills in your insurance broker resume.

Technical or hard skills are specific tools or software you use for the job. They're easy to spot through your education and work achievements.

On the other hand, soft skills like communication or adaptability show how you work with others. They come from both your personal and work life.

To showcase your skills:

- Have a skills section for technical abilities and another for personal strengths.

- Be clear about your skills. Name the exact tools you use and describe how you've used your soft skills.

- Avoid common terms like "Microsoft Office" unless the job specifically asks for them.

- Choose up to ten key skills and organize them in different sections of your resume.

Make your resume pop with top technical and personal skills that recruiters value.

Top skills for your insurance broker resume:

Insurance Policy Management Software

Customer Relationship Management (CRM) Systems

Risk Assessment Tools

Claims Management Systems

Data Analysis Software

Microsoft Excel

Insurance Underwriting Software

Financial Modeling Tools

Regulatory Compliance Software

Quote Generation Tools

Communication Skills

Negotiation Skills

Analytical Thinking

Problem-Solving Skills

Customer Service Orientation

Attention to Detail

Time Management

Empathy

Networking Skills

Adaptability

Next, you will find information on the top technologies for insurance broker professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Insurance Broker’s resume:

- AMS Services AMS Sagitta

- Microsoft Dynamics

- Adobe After Effects

- YouTube

- Applied Systems Vision

- Tangle S Creations Your Insurance Office

Pro tip

If you're in the process of learning a pivotal skill for the role, mention this on your resume. It demonstrates initiative while maintaining transparency.

Detailing your education and top insurance broker certifications on your resume

Your education section can reflect a variety of skills and experiences relevant to the position.

- List post-secondary qualifications, noting the institution and duration.

- If you're currently studying, mention your expected graduation date.

- Exclude qualifications unrelated to the role or industry.

- If relevant, delve into your educational background, especially if it was research-intensive.

Including both relevant education and certifications on your insurance broker resume can set you apart. It not only showcases your qualifications but also your commitment to the profession.

When listing these on your insurance broker resume, make sure to:

- Highlight degrees and certificates relevant to the role.

- Mention the awarding institution for credibility.

- Include the start and end dates, or if the education/certification is ongoing.

- If relevant, incorporate a few keywords from the job advert within the description of the certification or degree.

If you have additional certifications not directly related to the role, consider placing them towards the end of your resume. This way, they can be viewed as personal interests rather than core qualifications.

For a quick update, check out our list of popular insurance broker certifications curated by the Enhancv team.

Best certifications to list on your resume

- Chartered Property Casualty Underwriter (CPCU), The Institutes

- General Securities Representative (Series 7), Financial Industry Regulatory Authority (FINRA)

- Chartered insurance broker (CIB), Chartered Insurance Institute (CII)

- Associate in Risk Management (ARM), The Institutes

- Life Underwriter Training Council Fellow (LUTCF), American College of Financial Services

- Chartered Life Underwriter (CLU), The American College of Financial Services

- Uniform Securities Agent State Law Examination (Series 63), FINRA

- Certified Insurance Counselor (CIC), The National Alliance for Insurance Education & Research

- Associate in Commercial Underwriting (AU), The Institutes

- Chartered Financial Consultant (ChFC), The American College of Financial Services

Pro tip

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Recommended reads:

Choosing between a resume summary or objective based on your experience

The relevance of a resume summary or a resume objective for your insurance broker application hinges on your experience.

Both provide a snapshot of your expertise and accomplishments. However:

- A resume objective emphasizes your career aspirations, ideal for candidates looking to balance their experience with future goals.

- A resume summary offers a space to detail your unique value and notable accomplishments, perfect for candidates with a rich career history.

Ensure your introduction aligns with the job description, and if possible, quantify details for a compelling narrative.

Resume summary and objective examples for a insurance broker resume

With a solid 10-year portfolio in the insurance industry, I have achieved an impressive record of securing advantageous policy terms for corporate clients. My expertise lies in risk assessment and negotiation, aided by my CII certification. A key achievement was implementing a strategy saving a client $500k annually on premiums.

Certified in Risk Management and holder of an MBA with over 7 years of experience in business consultancy, now aspiring to leverage my skills as an insurance broker. Proficient in financial analysis and contract negotiation, I once led a project that improved a company's financial health by 20% within a year.

As a former Real Estate Agent with over 5 years of experience, I am transitioning into the insurance sector. My strong negotiation skills, client-centric approach, and familiarity with property law will be instrumental. Notably, I successfully managed a real estate portfolio worth over $10 million.

Transitioning from a career in Sales Management, where I spent the last 8 years honing skills in client relationship-building and deal closing. In my previous role, I increased sales volume by 25%. My desire is to apply these transferable abilities in the insurance brokerage landscape.

Eager to embark on a career in insurance brokerage following completion of a Bachelor's degree in Economics. Possess strong analytical skills, a keen attention to detail, and a deep understanding of financial risk management principles.

Recently graduated with a Master's degree in Finance, seeking to apply learned concepts in the field of insurance. Armed with robust numerical competency and strong communication skills, I aspire to contribute significantly to insurance policy underwriting and broker-client liaison.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Additional sections to amplify your insurance broker resume

To further personalize your resume and showcase a broader spectrum of your professional journey, consider adding:

- Projects that highlight your hands-on experience.

- Awards that recognize your industry contributions.

- Volunteer work that underscores your community involvement and soft skills.

- Hobbies that offer a glimpse into your personality and passions.

Key takeaways

- Pay special attention to the tiny details that make up your insurance broker resume formatting: the more tailored your application to the role is, the better your chances at success would be;

- Select the sections you include (summary or objective, etc.) and formatting (reverse-chronological, hybrid, etc.) based on your experience level;

- Select experience items and, consequently, achievements that showcase you in the best light and are relevant to the job;

- Your profile will be assessed both based on your technical capabilities and personality skills - curate those through your resume;

- Certifications and education showcase your dedication to the particular industry.