One CV challenge you may encounter as an insurance broker is differentiating yourself in a competitive job market. Our guide provides expert advice on tailoring your CV to showcase your unique skills and experiences, ensuring you stand out to potential employers.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

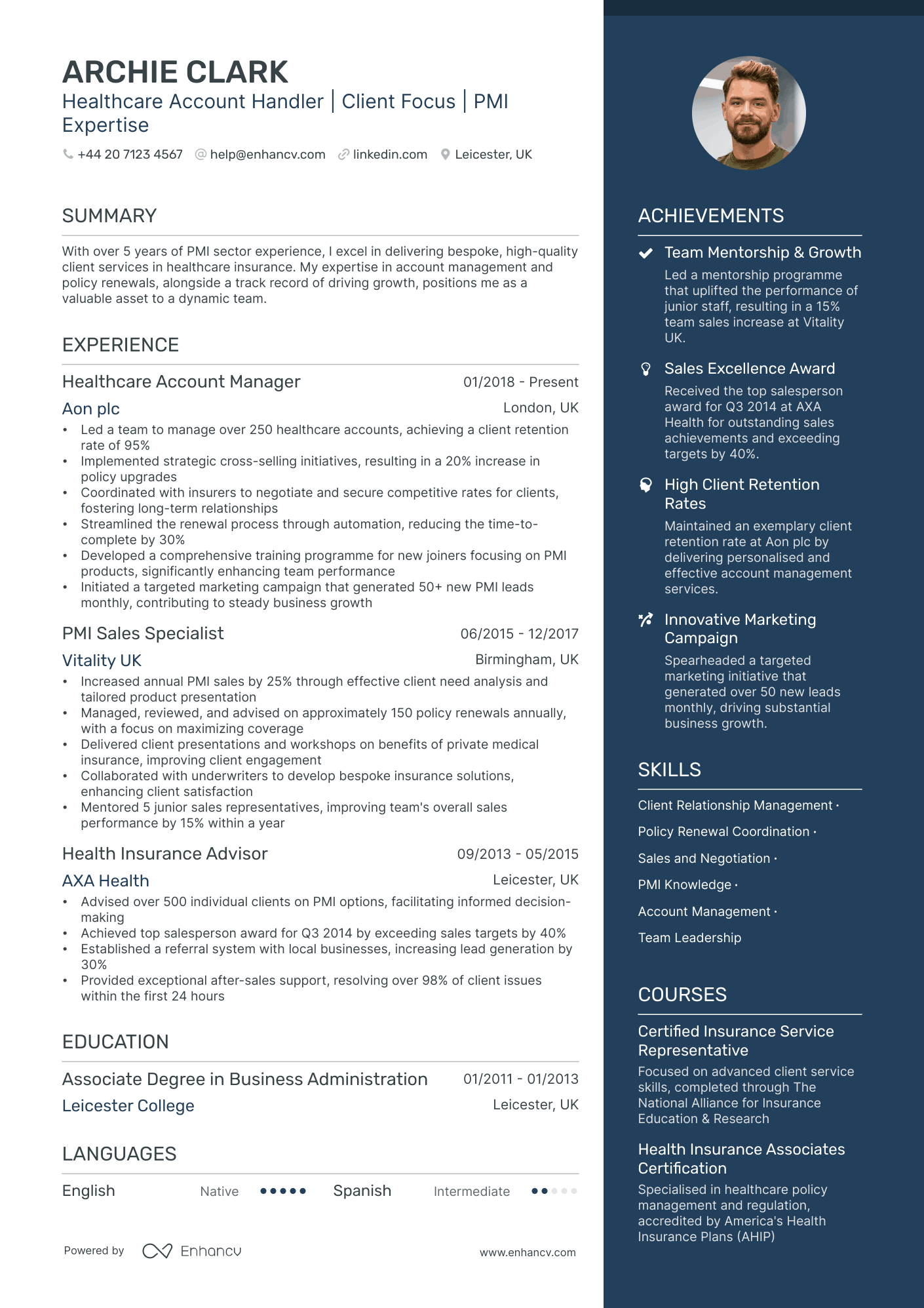

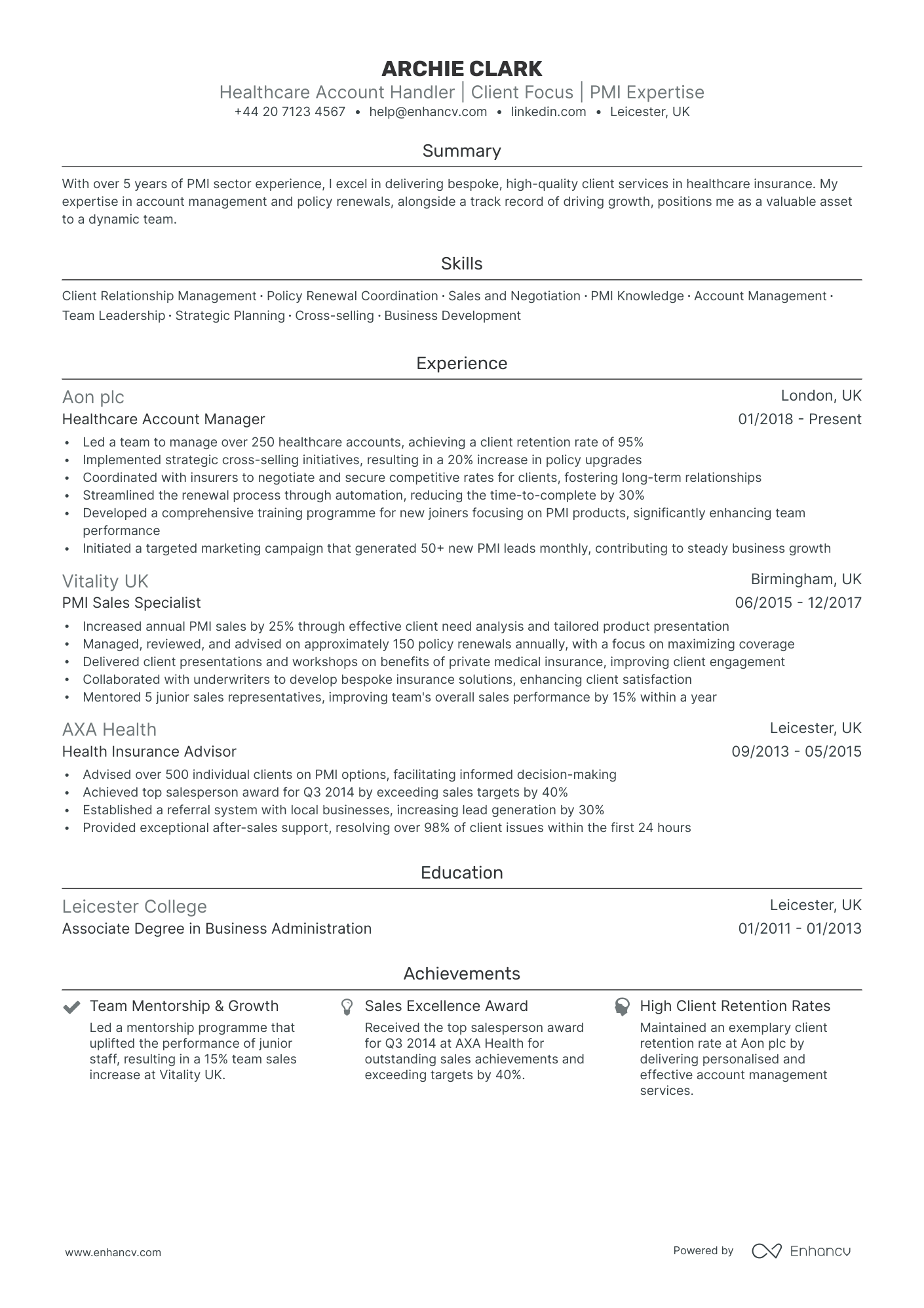

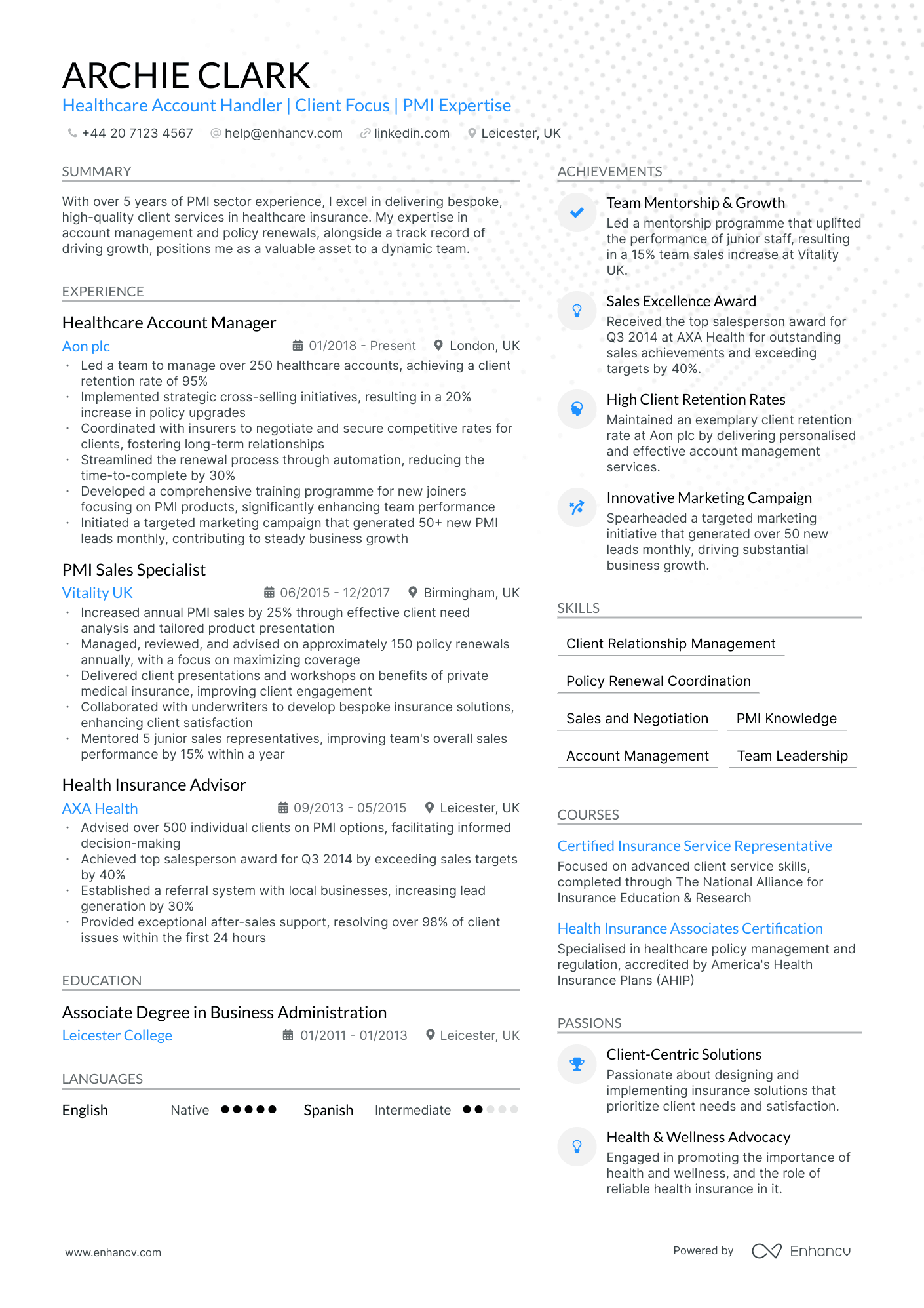

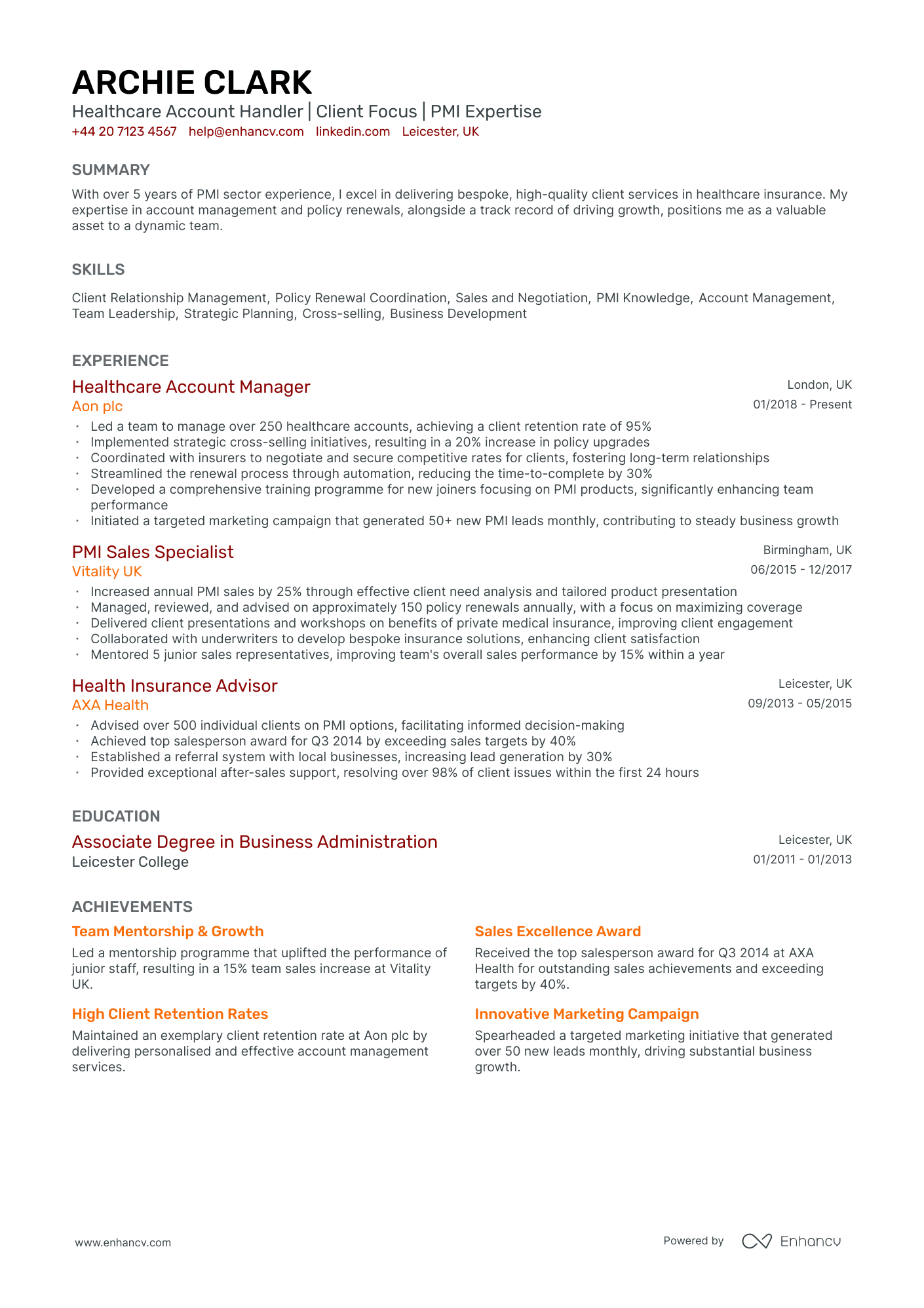

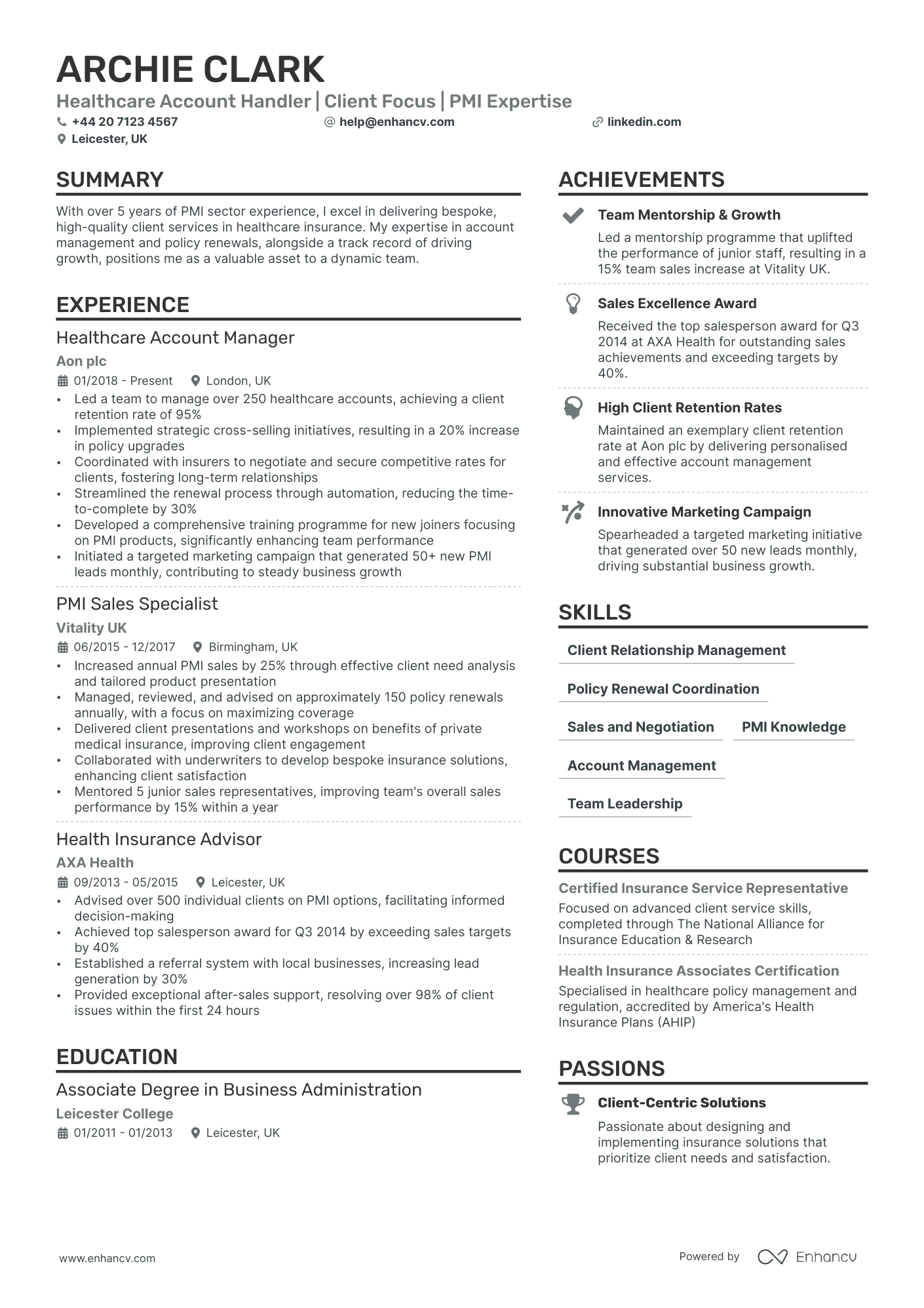

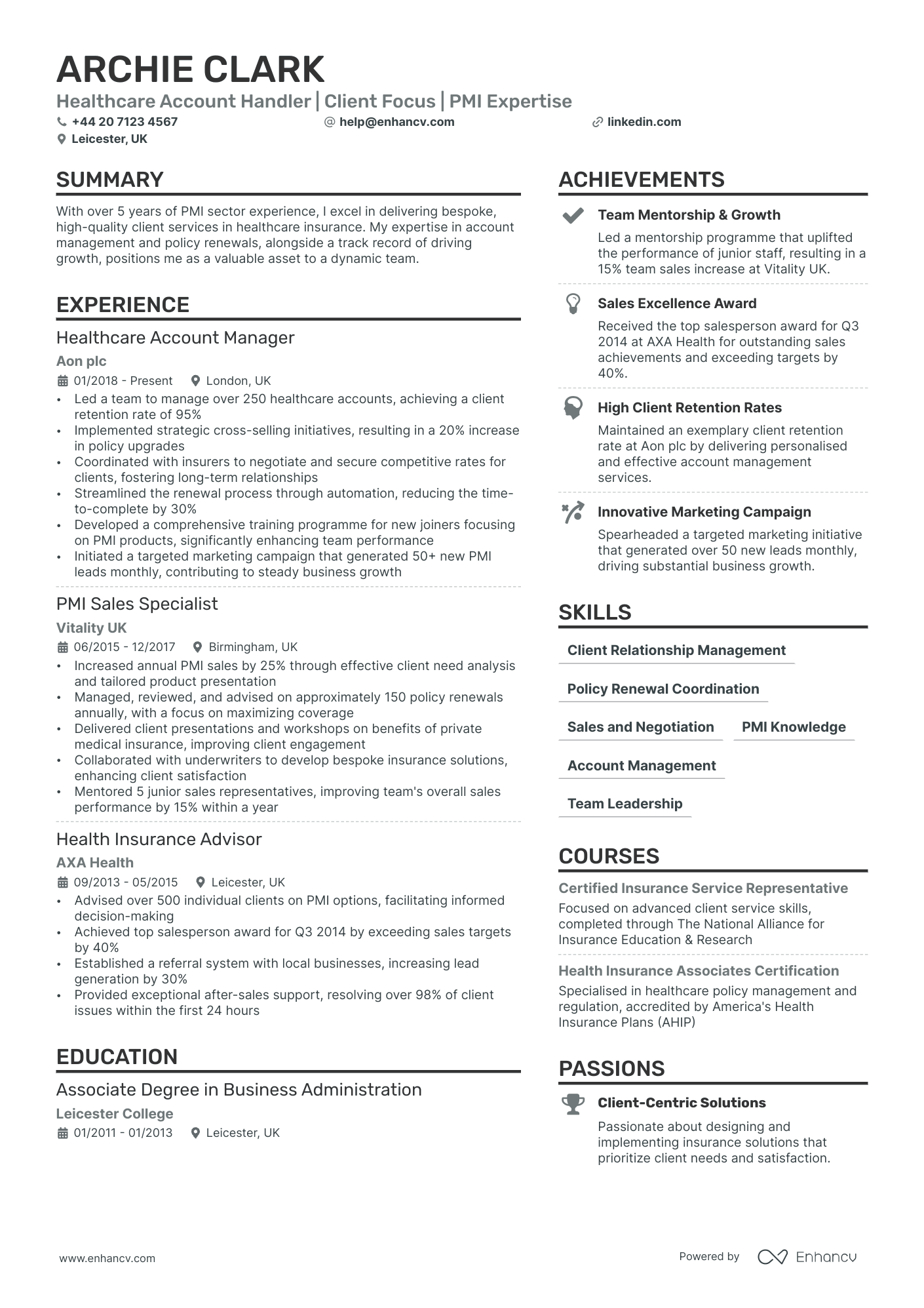

If you're writing your CV for a niche insurance broker role, make sure to get some inspiration from professionals:

Structuring and formatting your insurance broker CV for an excellent first impression

The experts' best advice regarding your CV format is to keep it simple and concise. Recruiters assessing your CV are foremost looking out for candidates who match their ideal job profile. Your white space, borders, and margins. You may still be wondering which format you need to export your CV in. We recommend using the PDF one, as, upon being uploaded, it never alters your information or CV design. Before we move on to the actual content of your insurance broker CV, we'd like to remind you about the Applicant Tracker System (or the ATS). The ATS is a software that is sometimes used to initially assess your profile. Here's what you need to keep in mind about the ATS:- All serif and sans-serif fonts (e.g. Rubik, Volkhov, Exo 2 etc.) are ATS-friendly;

- Many candidates invest in Arial and Times New Roman, so avoid these fonts if you want your application to stand out;

- Both single and double column CVs can be read by the ATS, so it's entirely up to you to select your CV design.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a insurance broker CV

- Professional Summary to provide a snapshot of key skills and experience.

- Insurance-Specific Skills detailing specific industry knowledge and proficiency.

- Relevant Work Experience to showcase direct experience and achievements.

- Education and Qualifications to show relevant academic and professional credentials.

- Industry Certifications to highlight specialised insurance brokerage training.

What recruiters value on your CV:

- Highlight your knowledge of different insurance products and markets; this showcases your ability to provide a range of options to clients.

- Emphasise your sales achievements and targets met or exceeded; firms are looking for brokers who can effectively close deals and grow their client base.

- Illustrate your strong communication and client relationship skills; as an insurance broker, the ability to establish trust and rapport with clients is crucial.

- Demonstrate your ability to accurately assess risk and your attention to detail; these are key in tailoring insurance policies to client needs.

- Showcase any relevant certifications or continuing education in the insurance sector, such as Chartered Insurance Institute qualifications; they affirm your commitment and expertise in the field.

Recommended reads:

Making a good first impression with your insurance broker CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for insurance broker:

- Chartered Insurance Broker | Risk Management Specialist | ACII Certified | 10+ Years’ Client Advisory Experience

- Expert in Commercial Insurance | BA in Business Administration | AIIN Holder | 5 Years at Industry Forefront

- Senior Insurance Advisor | Focus on SME Coverage | Claims Handling Expert | DipCII | 15 Years' Expertise

- Insurance Brokerage Leader | Specialised in Life & Pensions | Chartered Status | Innovation & Growth Driver | 20+ Years

- Associate Insurance Broker | Health & Benefits Strategist | Cert CII | Committed to Customer Excellence | 3 Years

- Insurance Broker Officer | Property & Casualty Focus | BSc in Finance | Market Analysis Enthusiast | 7 Years’ Experience

What's the difference between a insurance broker CV summary and objective

Why should it matter to you?

- Your insurance broker CV summary is a showcasing your career ambitions and your unique value. Use the objective to answer why your potential employers should hire you based on goals and ambitions. The objective is the ideal choice for candidates who happen to have less professional experience, but still meet some of the job requirements.

Before you select which one will be more relevant to your experience, have a look at some industry-leading CV summaries and objectives.

CV summaries for a insurance broker job:

- With over 10 years of dedicated experience in commercial insurance brokerage, a proven track record of exceeding sales targets by 30% consistently, and an expert level knowledge in risk management strategies, I am poised to deliver exceptional value to a forward-thinking insurance firm.

- Dynamic professional with 8 years' experience in the health insurance sector, boasting a Certified Insurance Broker credential and a history of developing tailored insurance solutions that resulted in a 25% client base expansion within just two years.

- Former financial analyst with 5 years' experience in the banking industry, now seeking to utilise an extensive background in data analysis, customer service excellence, and keen market insights to pivot seamlessly into a challenging new role within the insurance brokerage landscape.

- Accomplished retail manager recognised for team leadership and exceptional customer service, eager to transfer 7 years of client-focused experience to excel in fostering insurance client relationships and securing tailored coverage to meet diverse needs.

- As an aspiring insurance broker with a passion for helping others and a recent graduate in Business Administration, my objective is to leverage my academic understanding of finance and market trends to excel in providing comprehensive insurance advice and building strong client rapport.

- Goal-oriented individual with no prior insurance experience, but a strong desire to embrace a career where my analytical skills, quick learning ability, and commitment to client satisfaction can contribute to offering top-tier insurance solutions.

The best formula for your insurance broker CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Developed a deep understanding of various insurance products, including life, health, and property insurance, to provide tailored advice to clients.

- Negotiated with insurance companies on behalf of clients to secure the most favourable terms and comprehensive coverage, demonstrating strong negotiation skills.

- Maintained a high level of accuracy in preparing and reviewing policy documents and endorsements, ensuring compliance with industry regulations and standards.

- Conducted thorough risk assessments for clients to identify insurance needs, resulting in a 20% increase in policy uptake amongst mid-sized businesses.

- Implemented a client retention strategy that reduced policy lapses by 15%, underlining commitment to long-term client relationships and satisfaction.

- Leveraged cutting-edge CRM tools to manage client portfolios effectively, ensuring prompt and personalised service for over 200 active clients.

- Shared market intelligence and insurance trends through regular newsletters, enhancing the firm's reputation as a thought leader in the insurance sector.

- Collaborated with underwriters to develop custom insurance solutions, resulting in a 25% increase in closed deals with niche industries.

- Regularly attended professional development workshops and insurance industry conferences to keep abreast of the latest products, regulations, and best practices.

- Spearheaded the design and implementation of a new client onboarding system that improved customer satisfaction by 20% due to enhanced personalisation.

- Negotiated with insurance providers to secure more competitive premium rates, resulting in an average cost savings of 15% for our clients.

- Led a team of junior brokers and trained them in risk assessment and client management, increasing team productivity by 30%.

- Managed a portfolio of over 300 high-net-worth individuals, achieving 95% client retention rate through customized insurance solutions.

- Facilitated risk management workshops to educate clients on potential vulnerabilities, enhancing their coverage understanding and preparedness.

- Collaborated on the development of an industry-first, AI-driven risk analysis tool that increased the accuracy of policy recommendations by 25%.

- Instituted a new CRM system that optimised client interactions and policy renewals, boosting sales conversions by 18%.

- Devised bespoke insurance packages for small and medium-sized enterprises which enhanced their coverage by an average of 20%.

- Cultivated long-term relationships with underwriters, improving the underwriting process and reducing claim processing time by an average of 4 days.

- Piloted a cross-selling strategy that expanded product offerings to existing clients and grew annual revenue by 12%.

- Optimized policy renewals by implementing automated reminders and follow-ups, achieving a renewal rate increase of 8%.

- Conducted in-depth market research to stay ahead of industry trends, ensuring our insurance proposals were 15% more competitive.

- Orchestrated the negotiation of complex claims with insurers, achieving a 95% success rate in claims settlements for clients.

- Implemented tailored risk management strategies for clients in the manufacturing sector that resulted in a 10% reduction in workplace incidents and related claims.

- Delivered comprehensive training programs to new brokers, enhancing the overall knowledge base of our brokerage team within the first year of mentoring.

- Binder 98% of client renewals through pro-active engagement and strategic policy adjustments tailored to changing client lifestyles and asset acquisitions.

- Successfully diversified the company's insurance offerings into life and health sectors, increasing cross-sell opportunities by 15%.

- Consistently achieved top sales performance, being awarded 'Broker of the Year' for three consecutive years due to outstanding client service and sales success.

- Pioneered the company's entry into cyber insurance market, exceeding sales targets by 22% in the first year through effective client education and needs analysis.

- Developed and maintained strong professional relationships that led to 25 new corporate accounts over the period, fostering business growth and brand reputation.

- Crafted customised insurance packages for tech startups, ensuring adequate protection for their unique risks, contributing to a sector portfolio growth of 18%.

- Instrumental in launching an environment-focused insurance product line, resulting in the acquisition of 50+ new eco-conscious business clients in the first year.

- Regularly re-evaluated and updated insurance policies due to regulatory changes, ensuring all our clients' policies were compliant and competitive.

- Masterminded the digital marketing campaign for new insurance products, which captured a 20% increase in online engagement and inquiries.

How to ensure your insurance broker CV stands out when you have no experience

This part of our step-by-step guide will help you substitute your experience section by helping you spotlight your skill set. First off, your ability to land your first job will depend on the time you take to assess precisely how you match the job requirements. Whether that's via your relevant education and courses, skill set, or any potential extracurricular activities. Next:

- Systematise your CV so that it spotlights your most relevant experience (whether that's your education or volunteer work) towards the top;

- Focus recruiters' attention to your transferrable skill set and in particular how your personality would be the perfect fit for the role;

- Consider how your current background has helped you build your technological understanding - whether you've created projects in your free time or as part of your uni degree;

- Ensure you've expanded on your teamwork capabilities with any relevant internships, part-time roles, or projects you've participated in the past.

Recommended reads:

PRO TIP

If you have experience in diverse fields, highlight how this has broadened your perspective and skill set, making you a more versatile candidate.

Describing your unique skill set using both hard skills and soft skills

Your insurance broker CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your insurance broker CV:

Insurance Underwriting

Risk Management

Claims Handling

Product Knowledge

Regulatory Compliance

Customer Relationship Management (CRM)

Financial Analysis

Policy Structuring

Sales Techniques

Data Analysis

Communication

Negotiation

Problem-Solving

Customer Service

Networking

Attention to Detail

Time Management

Decision-Making

Adaptability

Teamwork

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Your university degree and certificates: an integral part of your insurance broker CV

Let's take you back to your uni days and decide what information will be relevant for your insurance broker CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Recommended reads:

Key takeaways

Your successful job application depends on how you well you have aligned your insurance broker CV to the job description and portrayed your best skills and traits. Make sure to:

- Select your CV format, so that it ensures your experience is easy to read and understand;

- Include your professional contact details and a link to your portfolio, so that recruiters can easily get in touch with you and preview your work;

- Write a CV summary if you happen to have more relevant professional experience. Meanwhile, use the objective to showcase your career dreams and ambitions;

- In your CV experience section bullets, back up your individual skills and responsibilities with tangible achievements;

- Have a healthy balance between hard and soft skills to answer the job requirements and hint at your unique professional value.