Navigating the competitive landscape of investment management can often lead to a challenging CV that struggles to stand out with clear, unique accomplishments. Our guide offers tailored strategies to refine your CV, ensuring it showcases your expertise and achievements in a manner that commands attention in the industry.

- Design and format your professional investment manager CV;

- Curate your key contact information, skills, and achievements throughout your CV sections;

- Ensure your profile stays competitive by studying other industry-leading investment manager CVs;

- Create a great CV even if you happen to have less professional experience, or switching fields.

When writing your investment manager CV, you may need plenty of insights from hiring managers. We have prepared industry-leading advice in the form of our relevant CV guides.

- Relationship Manager CV Example

- Strategy Consultant CV Example

- Business Owner CV Example

- Compliance Manager CV Example

- Business Development Executive CV Example

- IT Business Analyst CV Example

- Market Research CV Example

- Business Development CV Example

- Entry Level Business Analyst CV Example

- Category Manager CV Example

CV examples for investment manager

By Experience

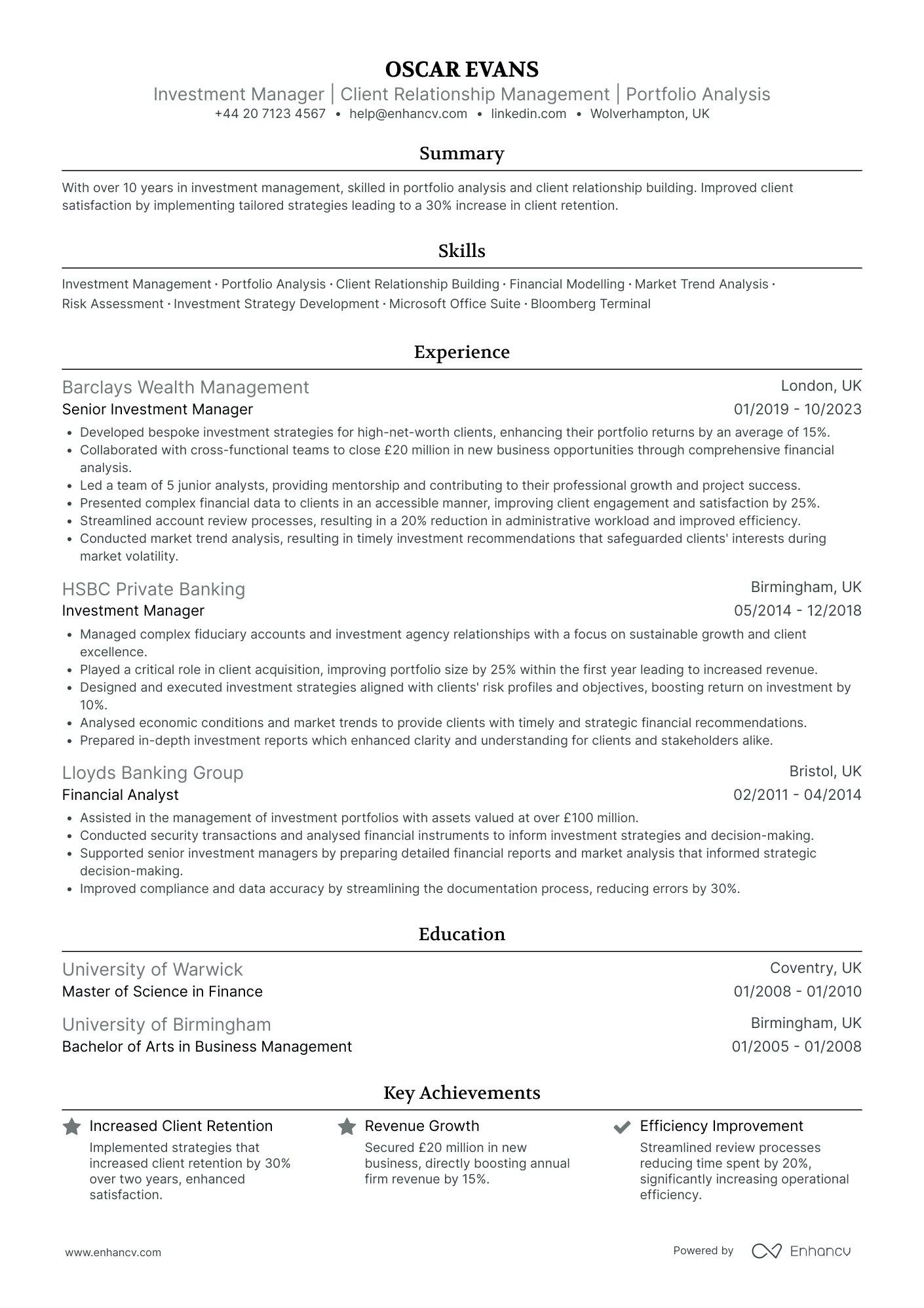

Senior Investment Manager

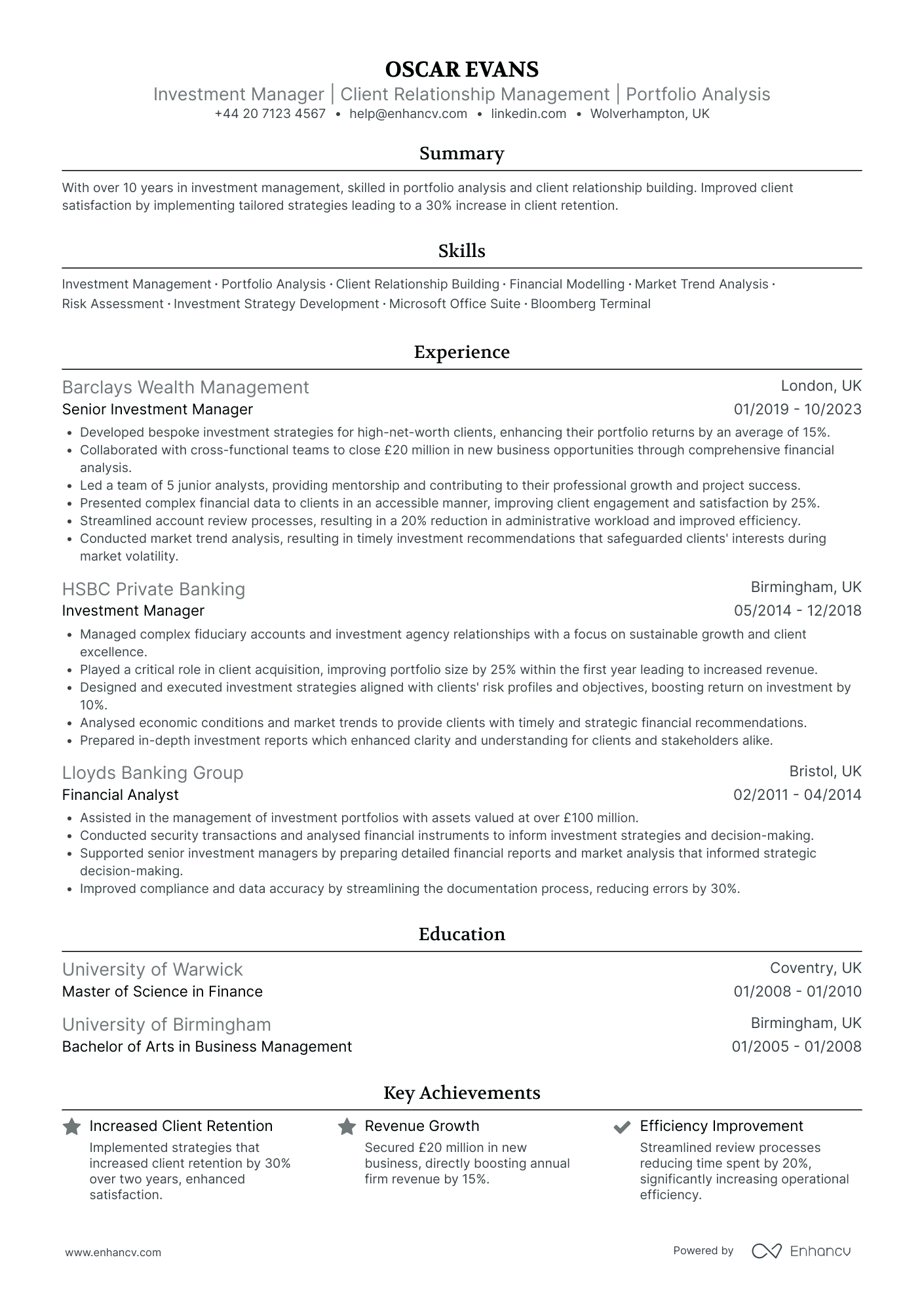

- Logical and Concise Presentation - The CV exhibits a well-organized structure, with clear headings and concise bullet points that allow for easy navigation through Oscar Evans' experience and qualifications. Each section is precisely formulated to maintain clarity and directness.

- Impressive Career Progression - The documented career trajectory shows significant growth, with Oscar moving from a role as a Financial Analyst to a Senior Investment Manager. This progression is marked by increasing responsibilities and leadership roles, underscoring a capable climb within the finance industry.

- Robust Soft Skills and Leadership Display - Oscar's capacity to lead is evident from his experience managing a team of junior analysts and improving client relations. His demonstrated ability to increase client engagement by 25% also showcases his strong interpersonal and communication skills.

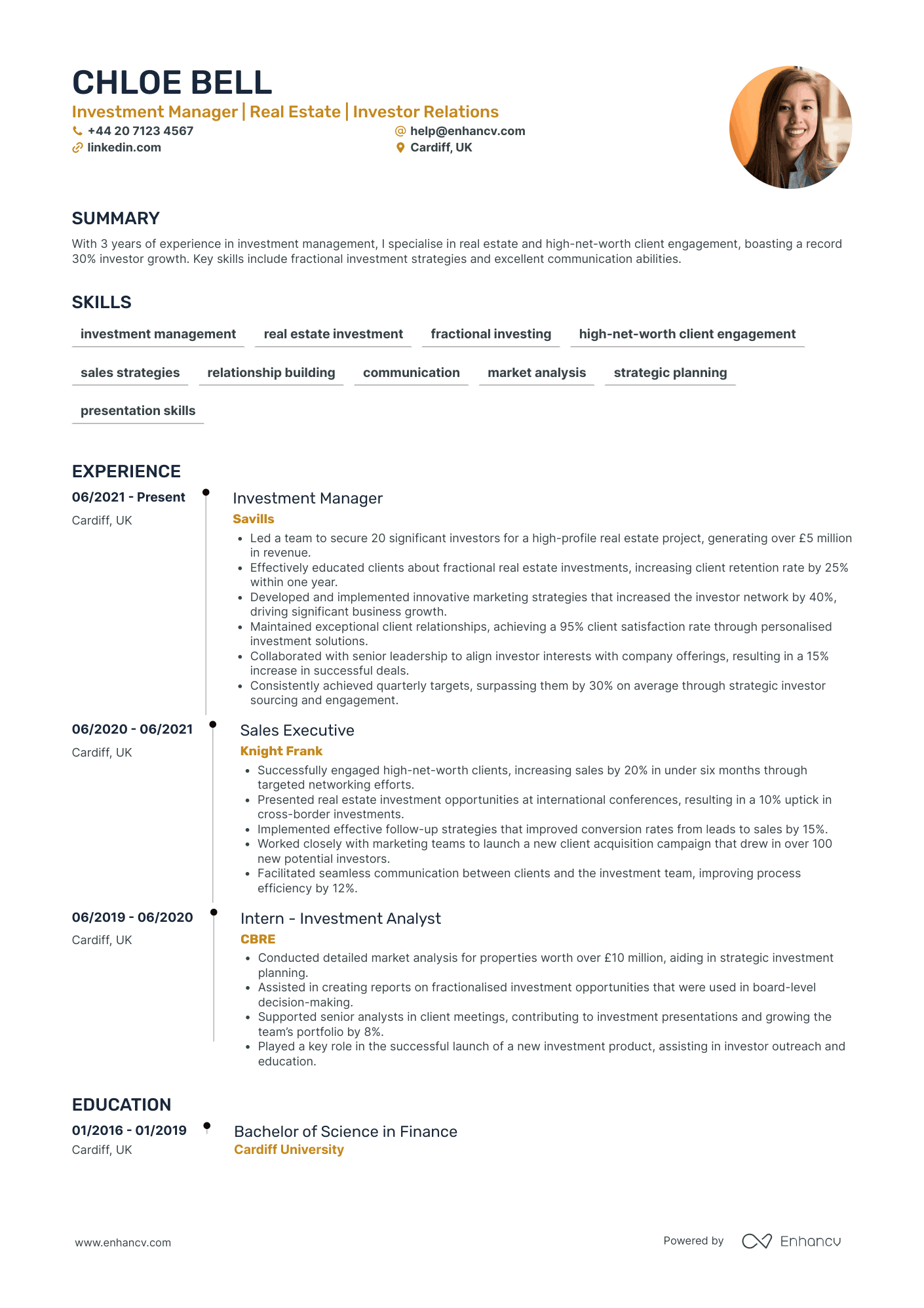

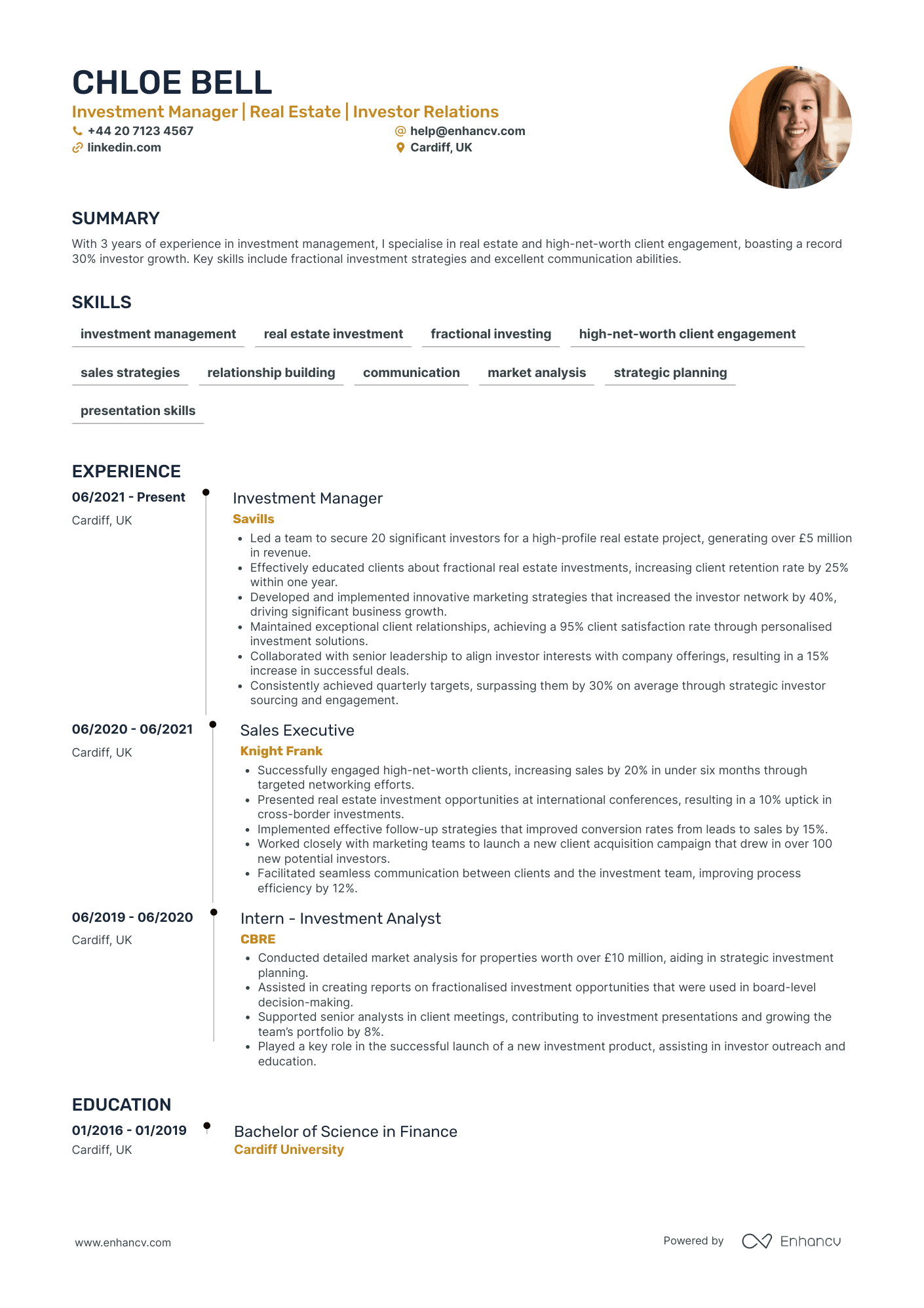

Junior Investment Manager

- Structured and Concise Presentation - The CV is neatly organized with clearly defined sections, presenting Chloe Bell's professional life in a structured manner. Each section is concise, with bullet points used effectively to highlight key accomplishments and experiences, making it easy for the reader to quickly grasp essential details.

- Impressive Career Growth in Real Estate Investment - Chloe demonstrates a strong career trajectory with growth from an Investment Analyst intern to an Investment Manager in a short span of time. Her steady progress at reputable companies such as CBRE, Knight Frank, and Savills underscores her competence and expertise in the real estate investment domain.

- Noteworthy Achievements with Business Impact - The CV highlights significant achievements tied to business outcomes, such as securing £5 million in revenue from investors and enhancing client satisfaction rates to 95%. These accomplishments not only demonstrate her ability to meet and exceed targets but also emphasize her contribution to business growth and investor engagement.

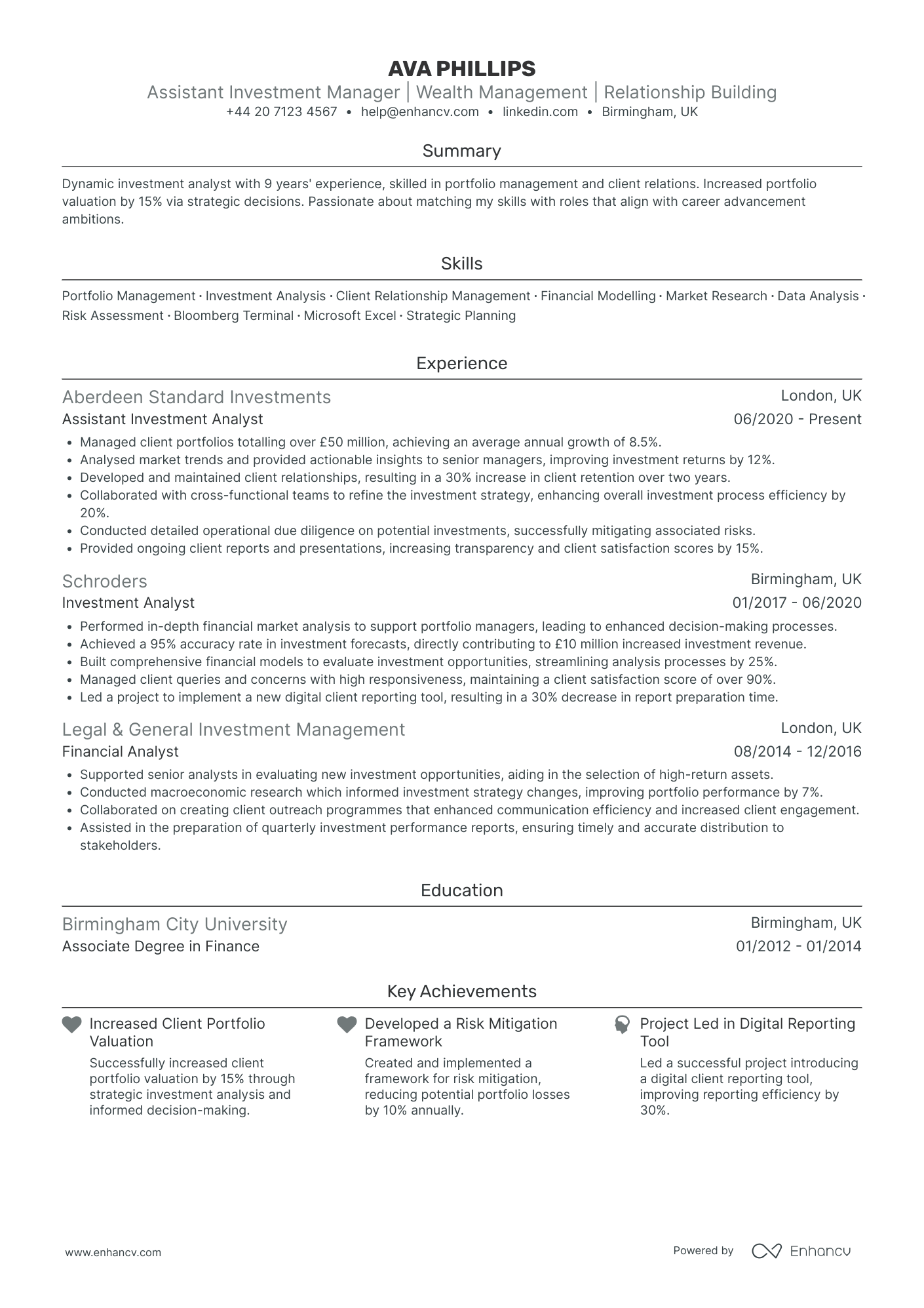

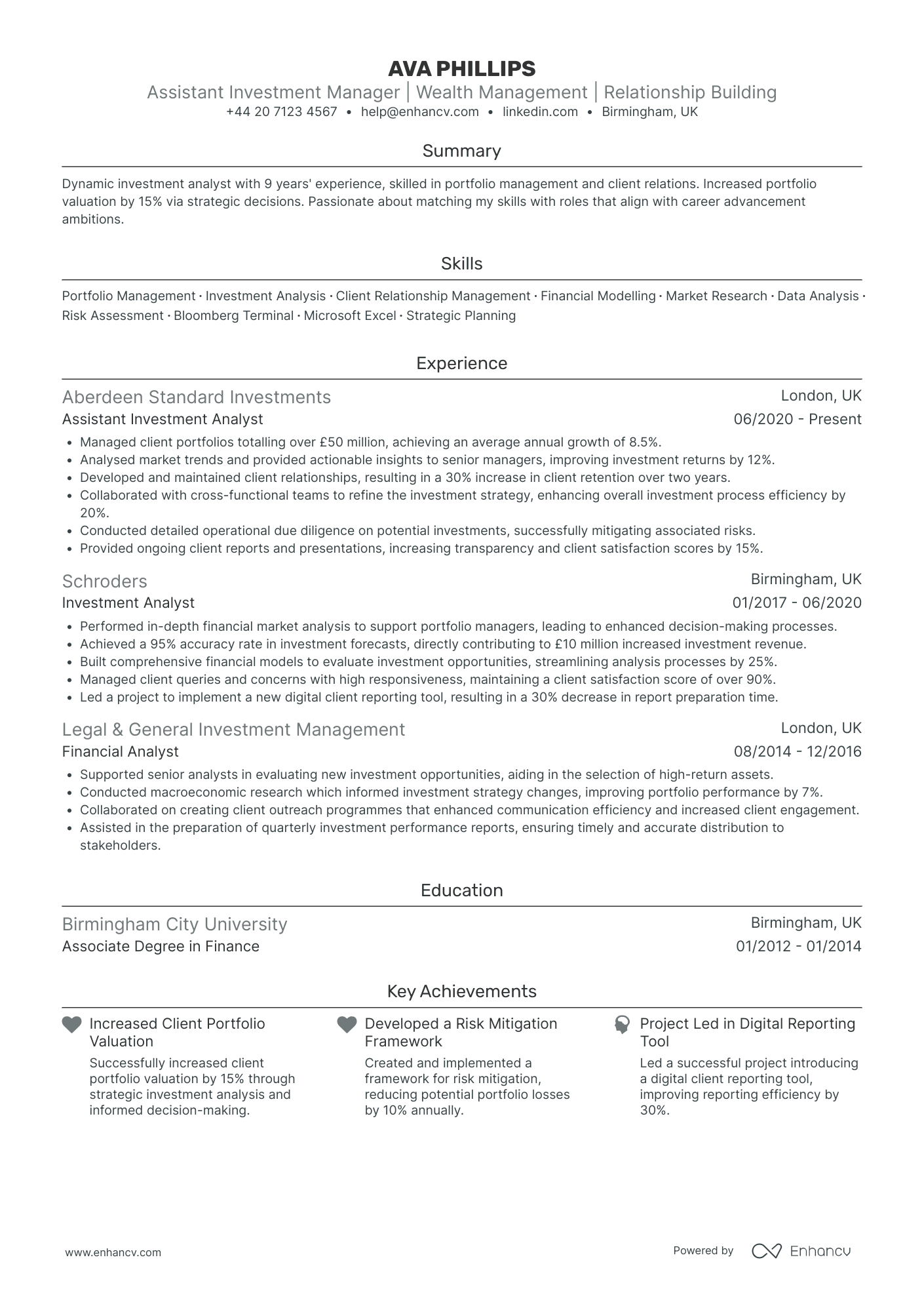

Assistant Investment Manager

- Clear Career Growth - Ava Phillips’ career trajectory demonstrates consistent advancement, moving from a Financial Analyst to an Assistant Investment Analyst, reflecting her ability to take on more responsibilities and embrace challenging roles in wealth management.

- Industry-Specific Tools and Methodologies - The CV highlights Ms. Phillips’ proficiency with specialized industry tools, such as Bloomberg Terminal and Microsoft Excel, which are crucial for investment analysis and portfolio management, enhancing her technical depth in the finance sector.

- Remarkable Achievements with Business Impact - The achievements section showcases substantial business impact, such as a 15% increase in client portfolio valuation and the development of a risk mitigation framework, emphasizing her ability to deliver valuable results that directly benefit the organizations she has worked for.

By Role

Investment Portfolio Manager

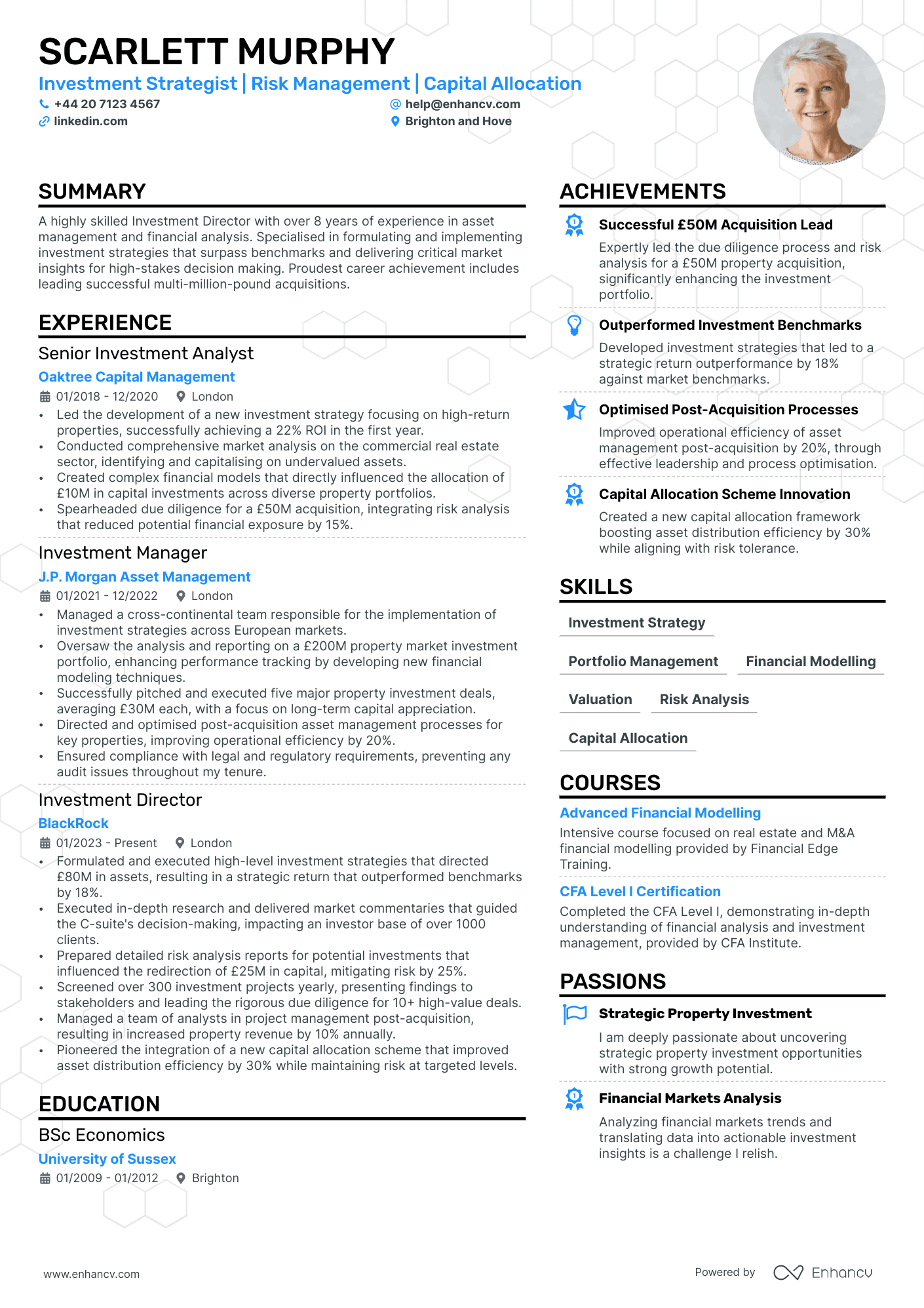

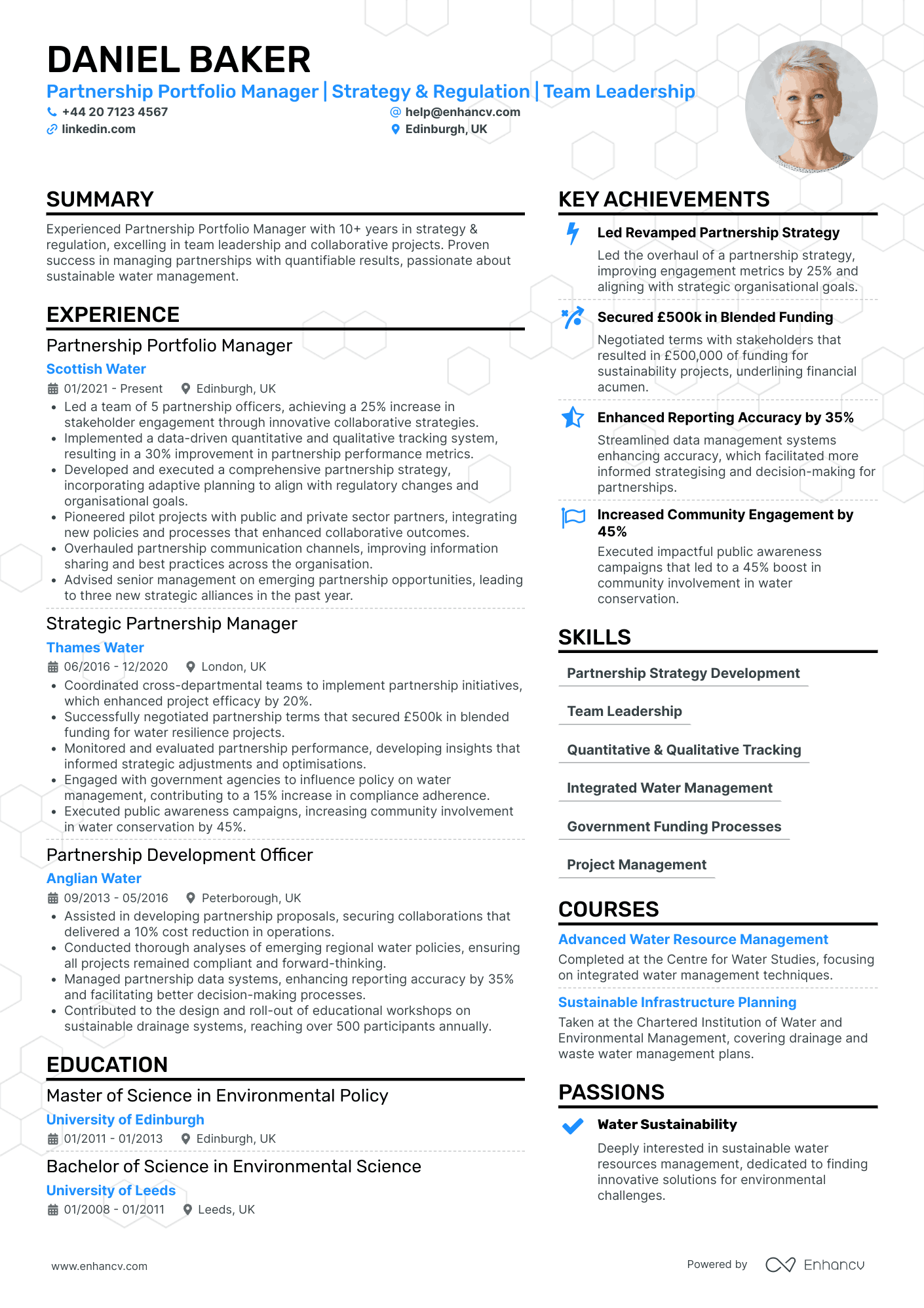

- Clear progression in responsibilities - The CV effectively illustrates a clear progression in the candidate's career, showcasing a swift ascent to senior managerial roles. This trajectory highlights the individual's dedication and capability to take on increased responsibilities over time, reflecting strong ambition and success in achieving career goals.

- Showcases technical prowess with industry-specific tools - Included in the CV is a comprehensive list of industry-specific tools and methodologies, demonstrating the candidate’s adeptness and technical depth in utilizing software like Python, SQL, and various data analytics platforms. This specialized knowledge is instrumental in executing complex tasks and delivering technical solutions effectively.

- Focuses on adaptability and cross-functional collaborations - The document emphasizes the candidate’s adaptability by demonstrating experience with various cross-functional teams and projects. This aspect reveals a capacity to seamlessly integrate into diverse environments while enhancing workflow efficiency through collaborative efforts across different organizational departments.

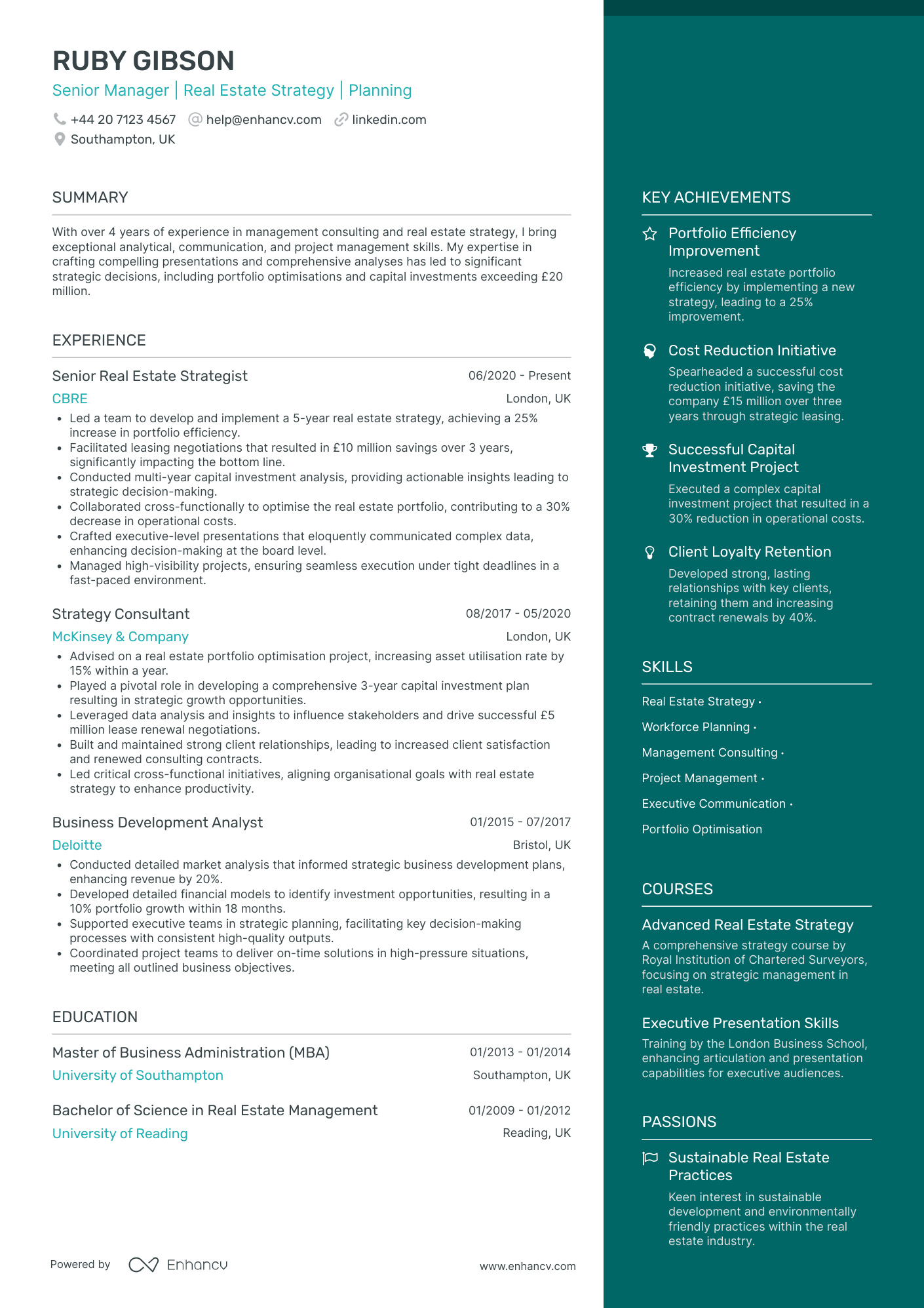

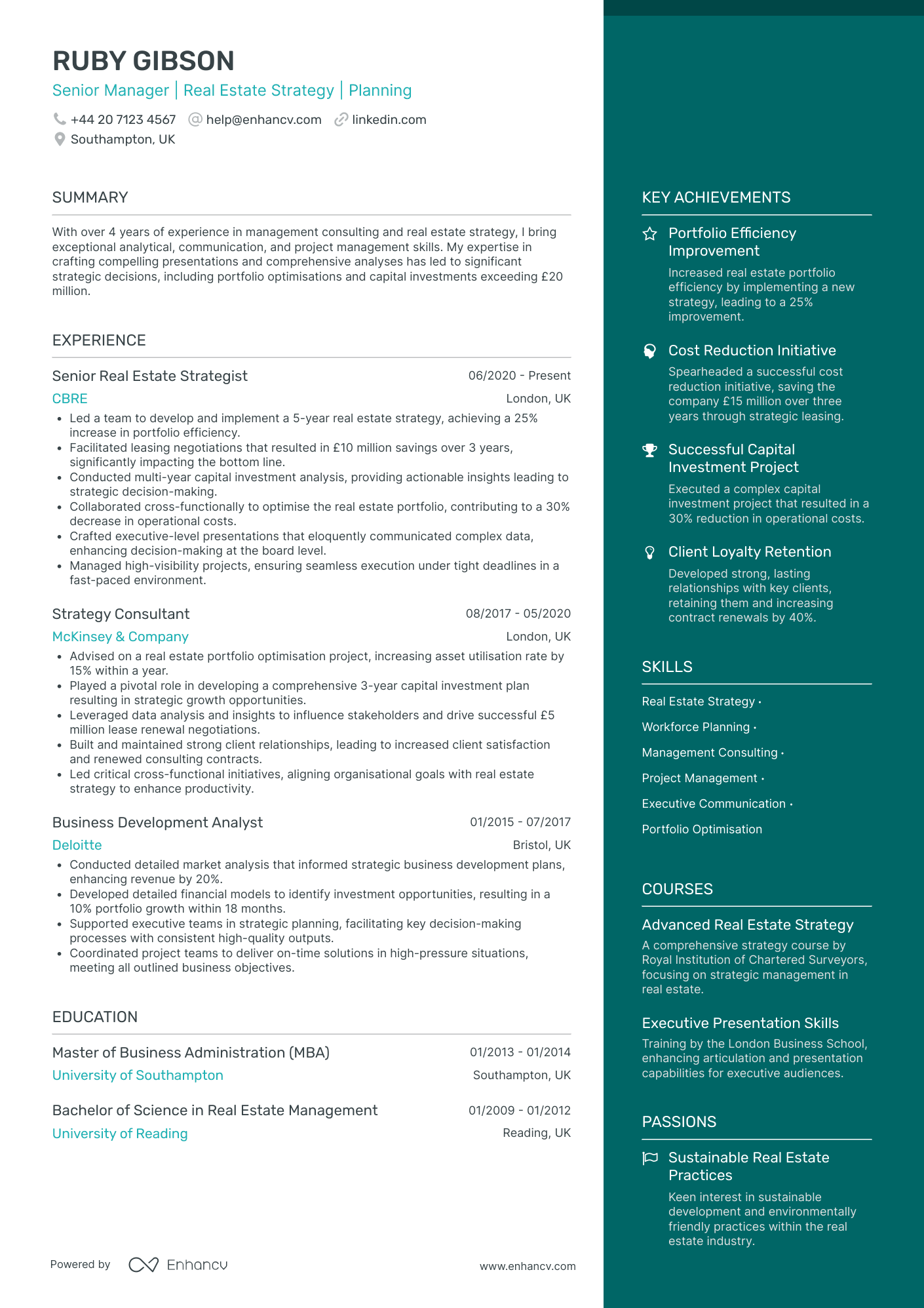

Investment Strategy Manager

- Structured Presentation with Strategic Focus - The CV is impressively structured to provide clear insights into Ruby Gibson's extensive background in real estate strategy and management consulting. Each section is distinct, concise, and provides valuable information, ensuring there is no ambiguity, which highlights her strong organizational and strategic skills.

- Progressive Career Development - Ruby's career trajectory demonstrates a significant growth from a Business Development Analyst at Deloitte to a Senior Real Estate Strategist at CBRE. This progression showcases her rising expertise in real estate strategy and planning, as well as her ability to take on increasingly senior roles within different prestigious firms in the industry.

- High Impact Achievements - The CV effectively showcases Ruby's contributions through significant achievements in real estate strategy. Not just presenting numbers, but highlighting impacts such as implementing a portfolio strategy that improved efficiency by 25% and leading initiatives that saved £15 million over three years, demonstrating her strategic impact on business operations and financial outcomes.

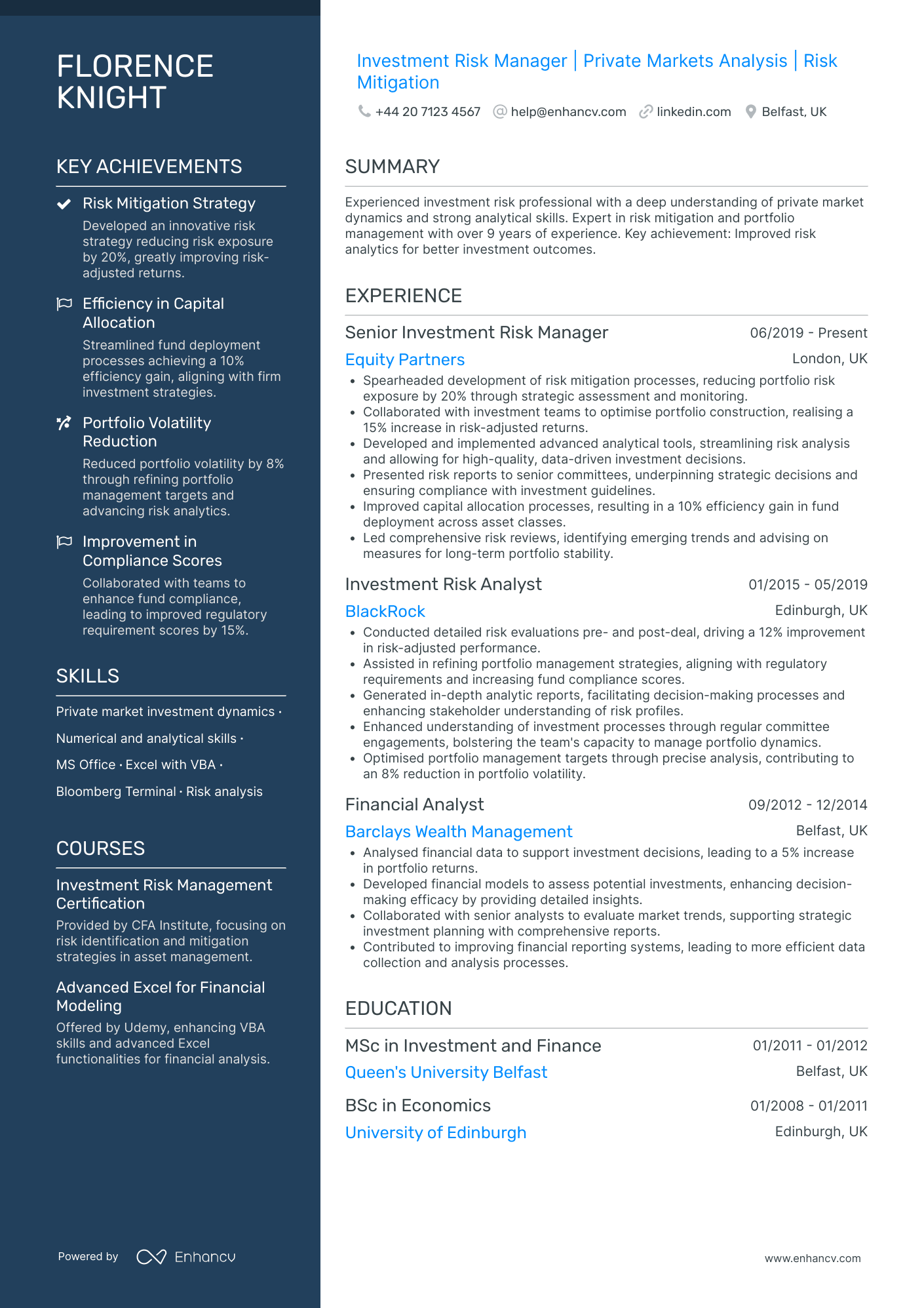

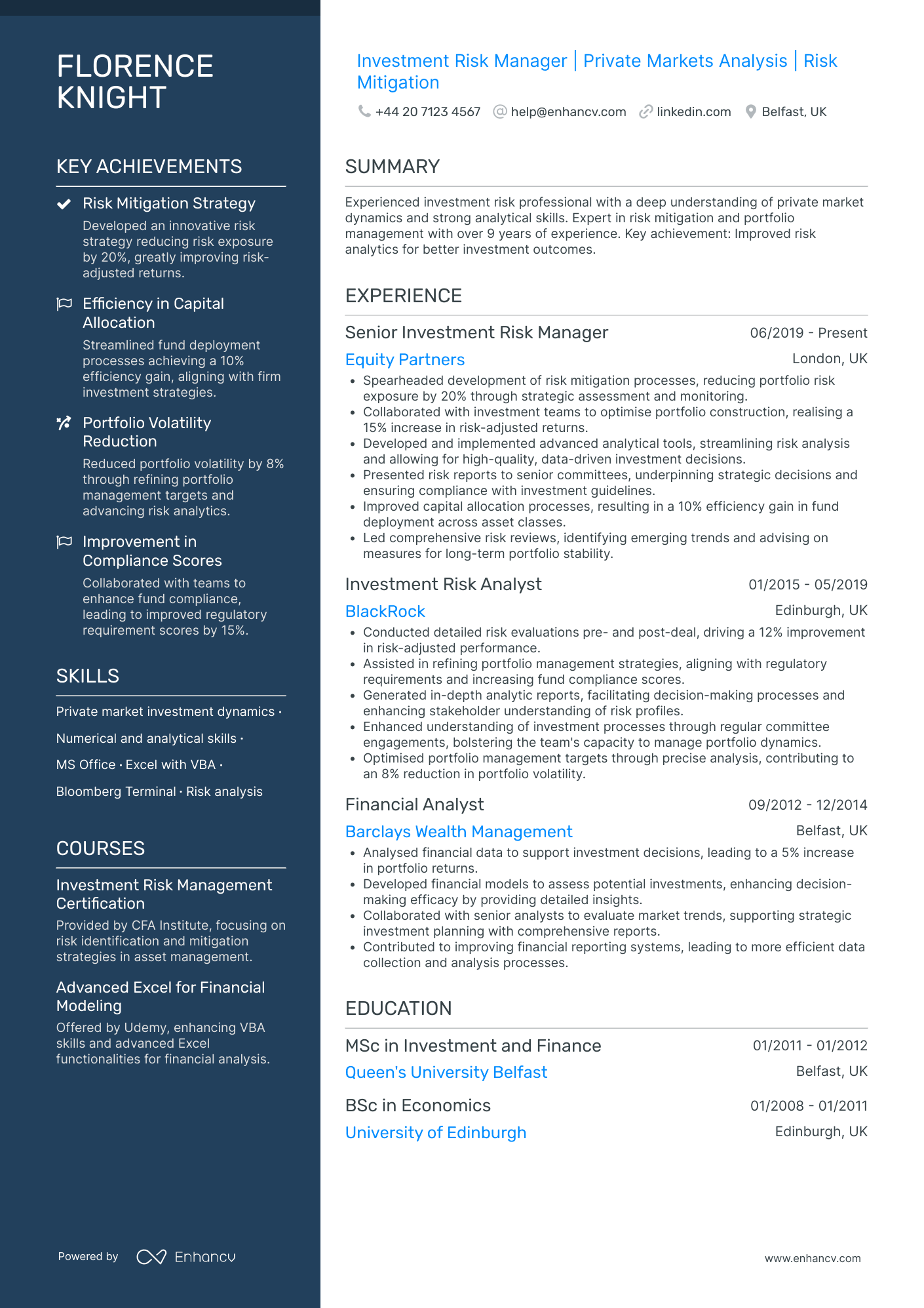

Investment Risk Manager

- Structured Presentation and Clarity - Florence Knight’s CV stands out with its clear, structured presentation that allows for easy navigation and comprehension. Each section is well-defined, providing concise information that quickly highlights relevant experience and skills, such as risk analysis, portfolio management, and private markets dynamics. The use of bullet points in the experience section enhances readability and emphasizes key achievements and responsibilities.

- Growth and Specialization in Career Trajectory - Florence's career progression is impressively reflected in her transition from a Financial Analyst at Barclays to a Senior Investment Risk Manager at Equity Partners. This trajectory demonstrates not only vertical growth but also a deepened expertise in risk management and private markets. Her roles suggest a consistent increase in responsibility and scope, emphasizing her capability to lead complex risk mitigation projects.

- In-depth Technical Proficiency and Industry Tools - The CV showcases Florence's strong grasp of industry-specific tools and methodologies, such as the Bloomberg Terminal, advanced Excel with VBA, and analytical tools for risk analysis. This technical depth supports her ability to drive data-driven investment decisions and optimize portfolio management strategies, setting her apart as a skilled investment risk manager in the financial sector.

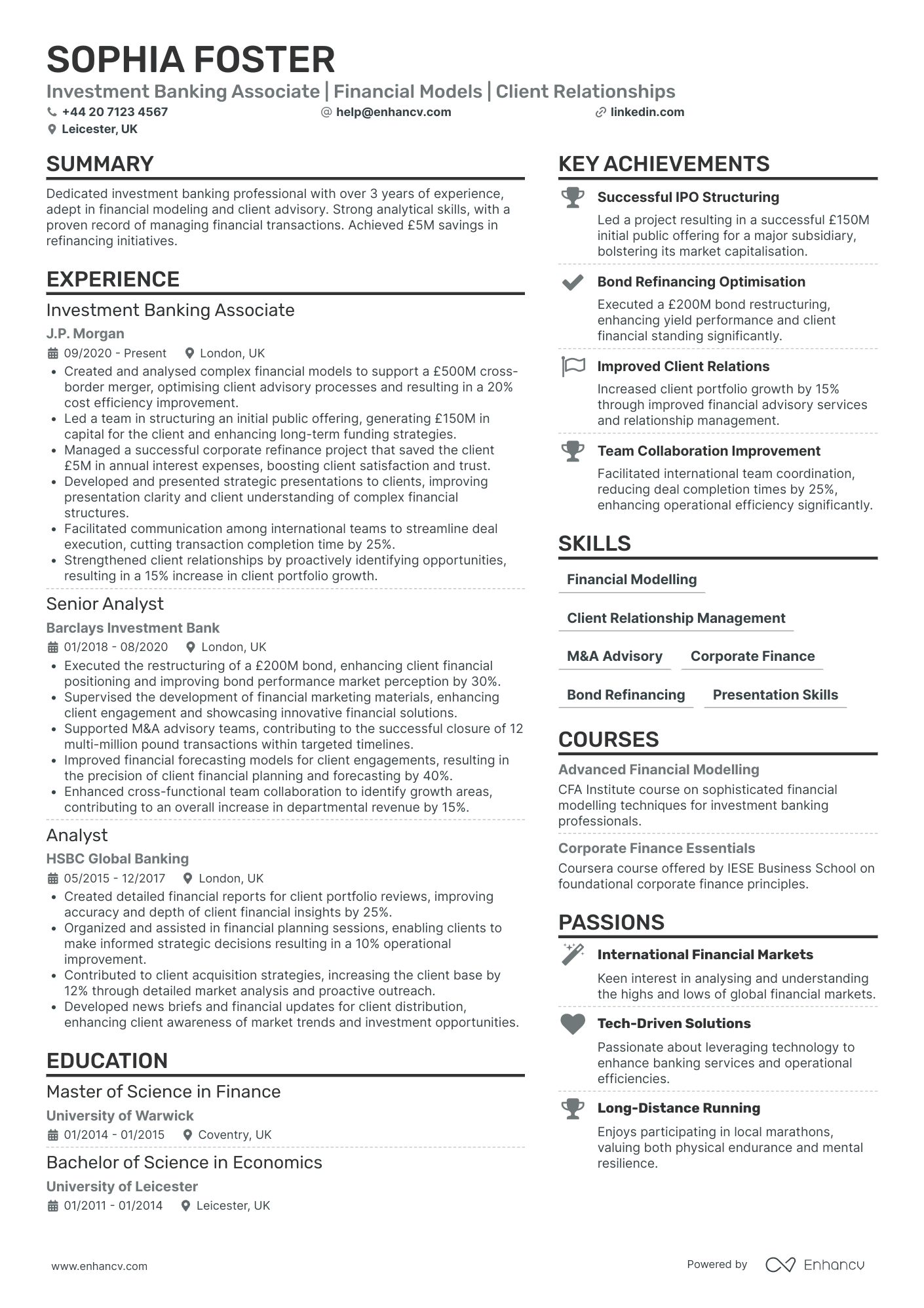

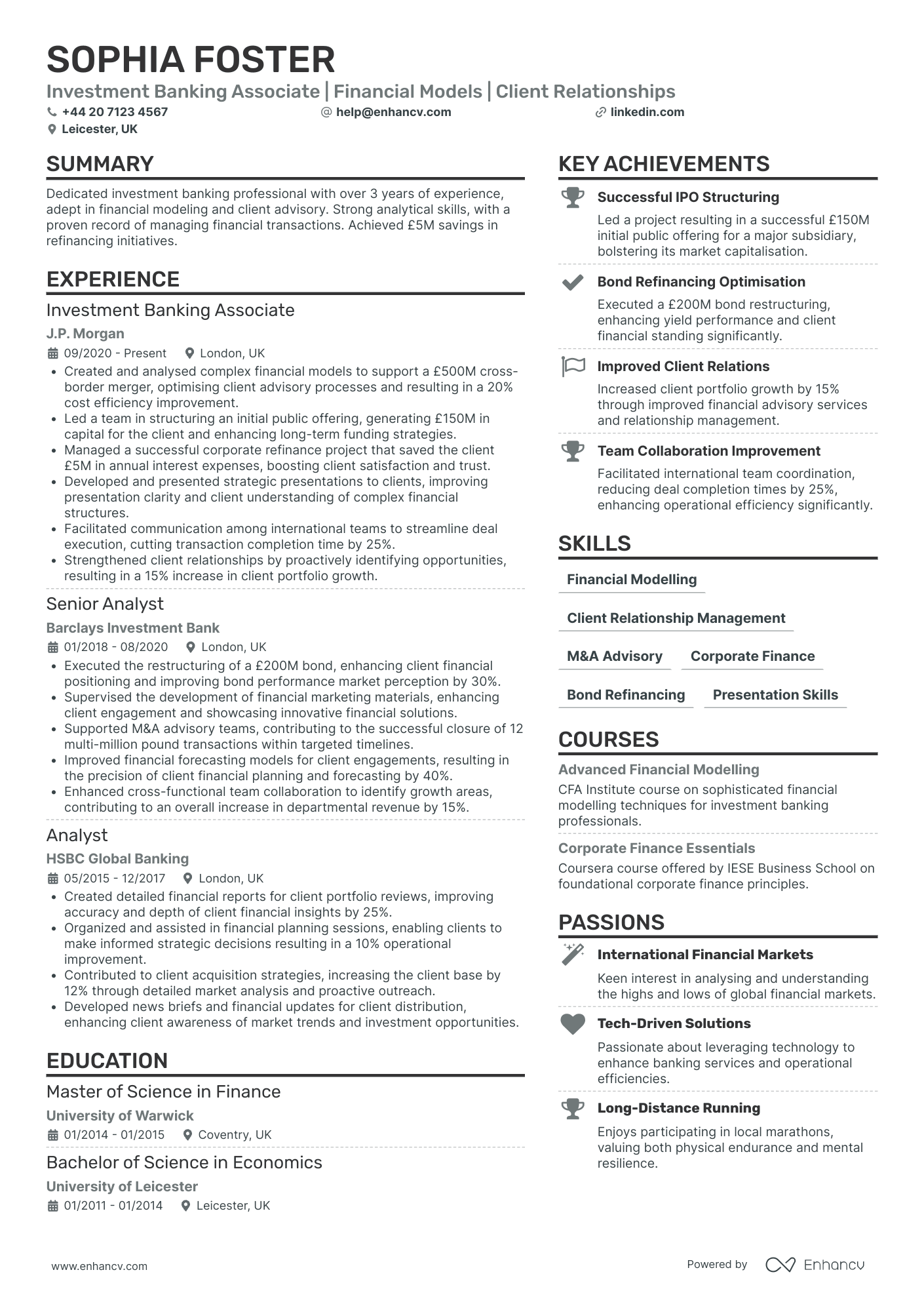

Global Investment Manager

- Structured Presentation and Flow - The CV is structured with clear headers and sections, making it easy for readers to navigate through Sophia Foster's career achievements. Each section is dedicated to a particular aspect of her professional journey, such as experience, education, skills, and achievements, allowing for a concise and coherent portrayal of her qualifications.

- Consistent Career Growth and Responsibility - The transition from an Analyst at HSBC to a Senior Analyst at Barclays, and later to an Investment Banking Associate at J.P. Morgan, highlights a clear trajectory of career growth and increasing responsibility. Each role demonstrates her advancement in the investment banking industry through progressively more challenging positions, reflecting her capacity for professional development and success in handling more complex financial transactions.

- Technical Proficiency and Methodological Expertise - Sophia’s CV incorporates specific industry-related methodologies and tools, such as financial modeling, corporate finance, and M&A advisory. Her ability to create, analyze, and improve complex financial models, as well as her involvement in significant financial projects like bond refinancing and IPO structuring, underscore her technical depth and expertise in investment banking.

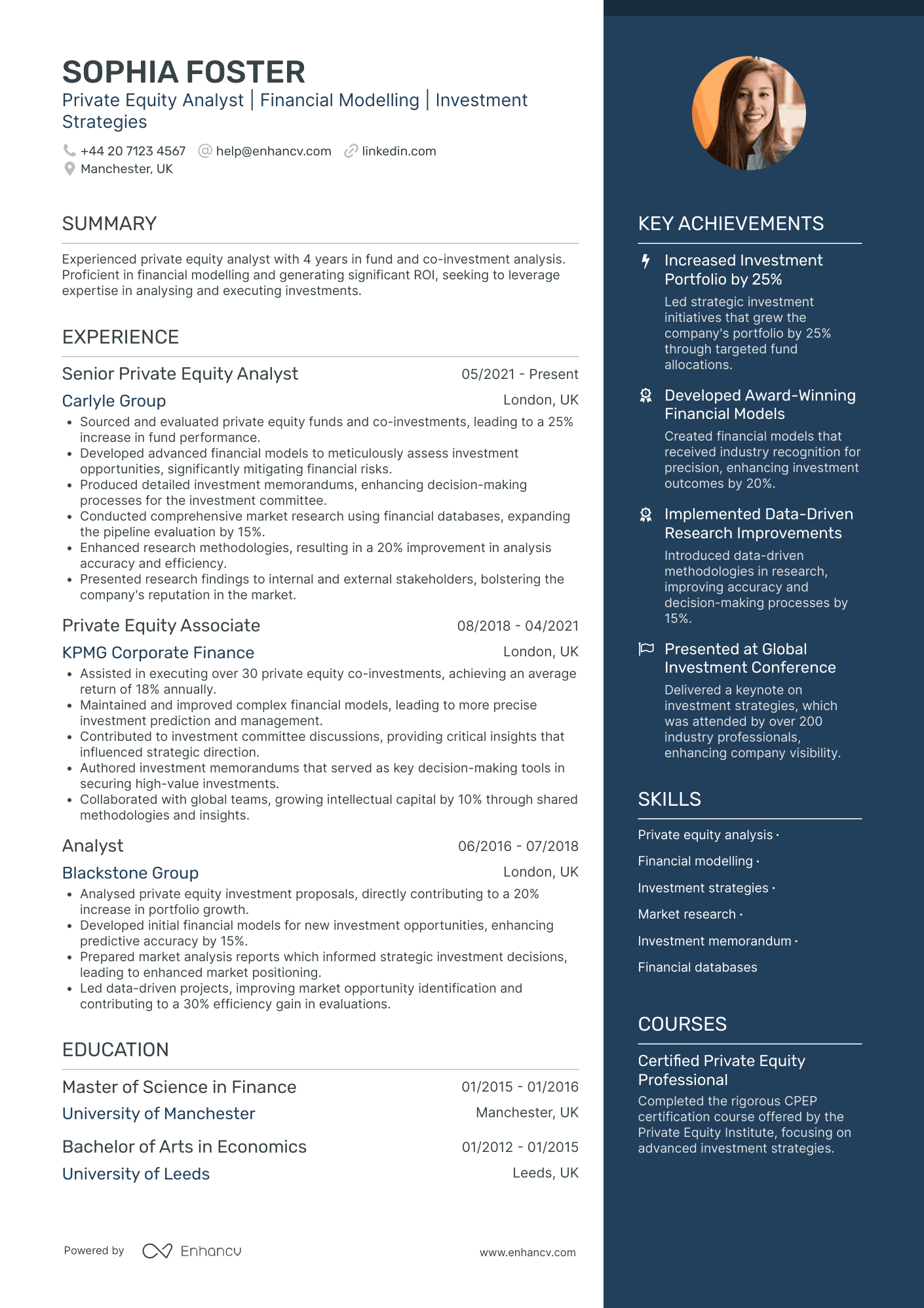

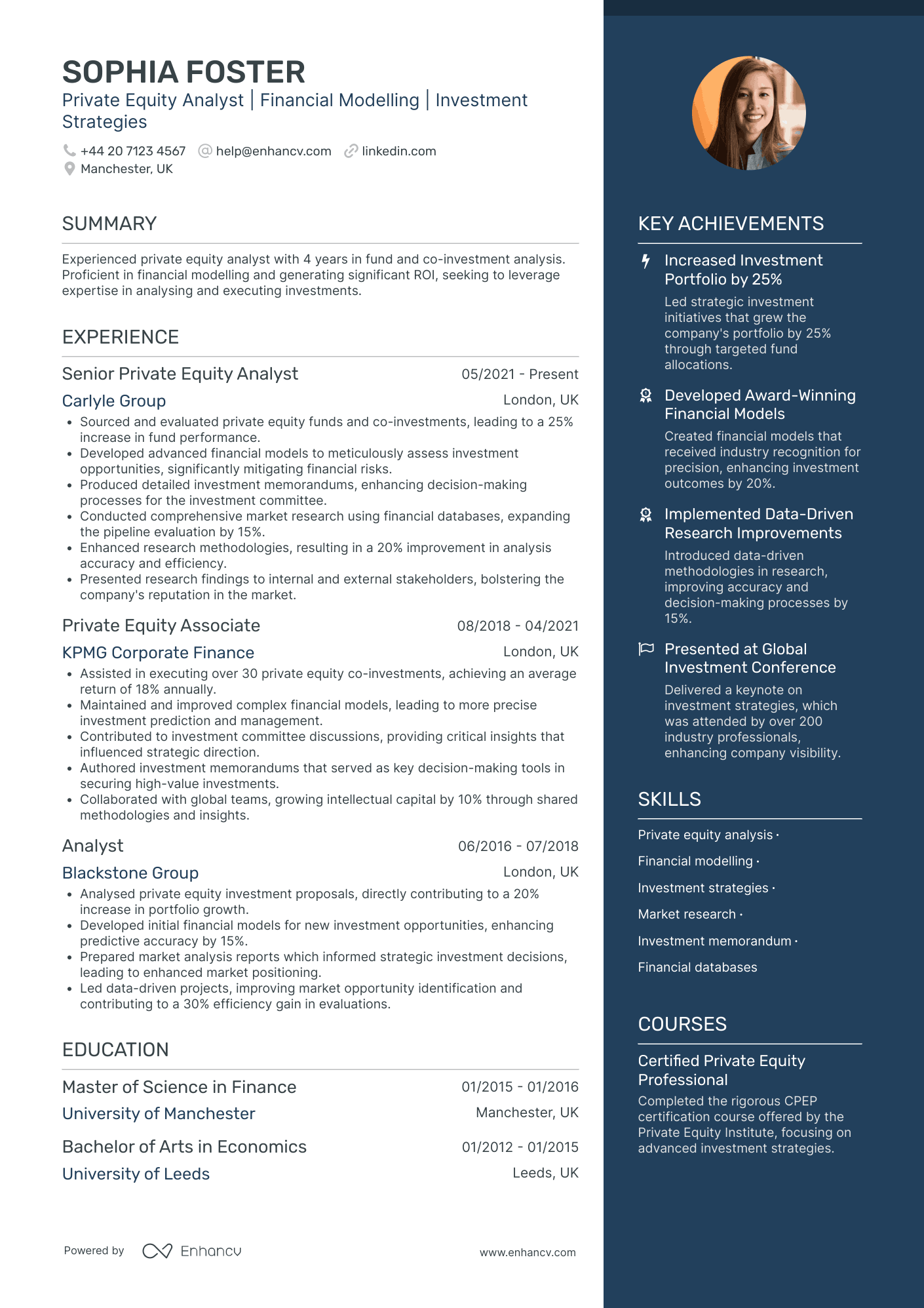

Private Equity Investment Manager

- Articulate structuring of professional experience - The CV is well-organized, with each role clearly detailing the responsibilities and accomplishments, making it easy for the reader to follow the candidate's career progression. The use of bullet points ensures conciseness and clarity, allowing for quick absorption of critical information and achievements.

- Impressive career trajectory - Starting as an Analyst and advancing to a Senior Private Equity Analyst at a prestigious firm like Carlyle Group, the CV highlights Sophia's steady career growth. This progression underscores her increasing responsibility and expertise in private equity, demonstrating her capability and potential for further advancement in the industry.

- Detailed focus on technical and analytical prowess - This CV showcases unique industry-specific skills and certifications, such as the Certified Private Equity Professional and the Financial Modelling and Valuation Analyst certifications, reflecting a deep technical understanding and mastery of complex financial modeling techniques. These qualifications enhance her credibility and specialization in the financial sector.

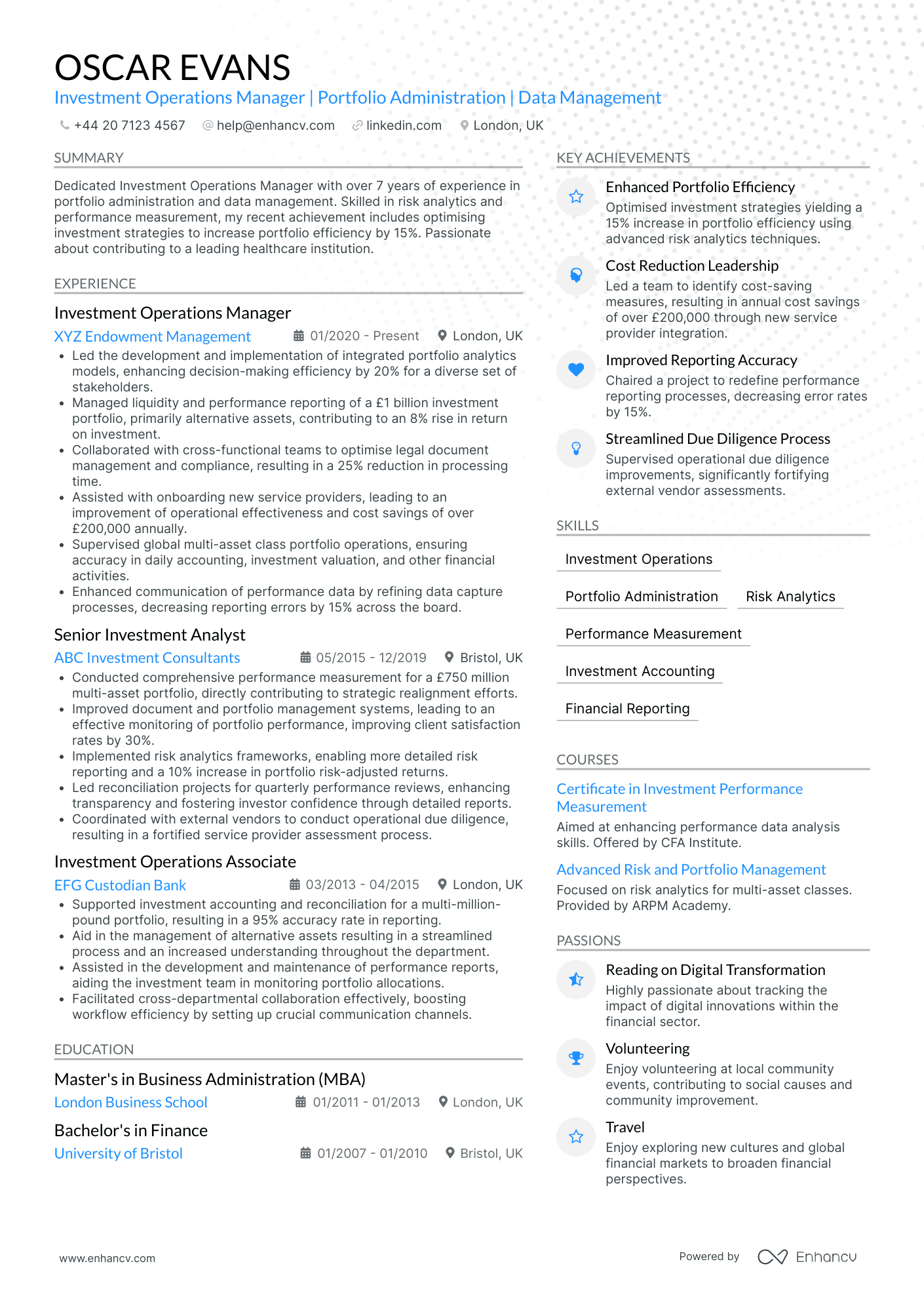

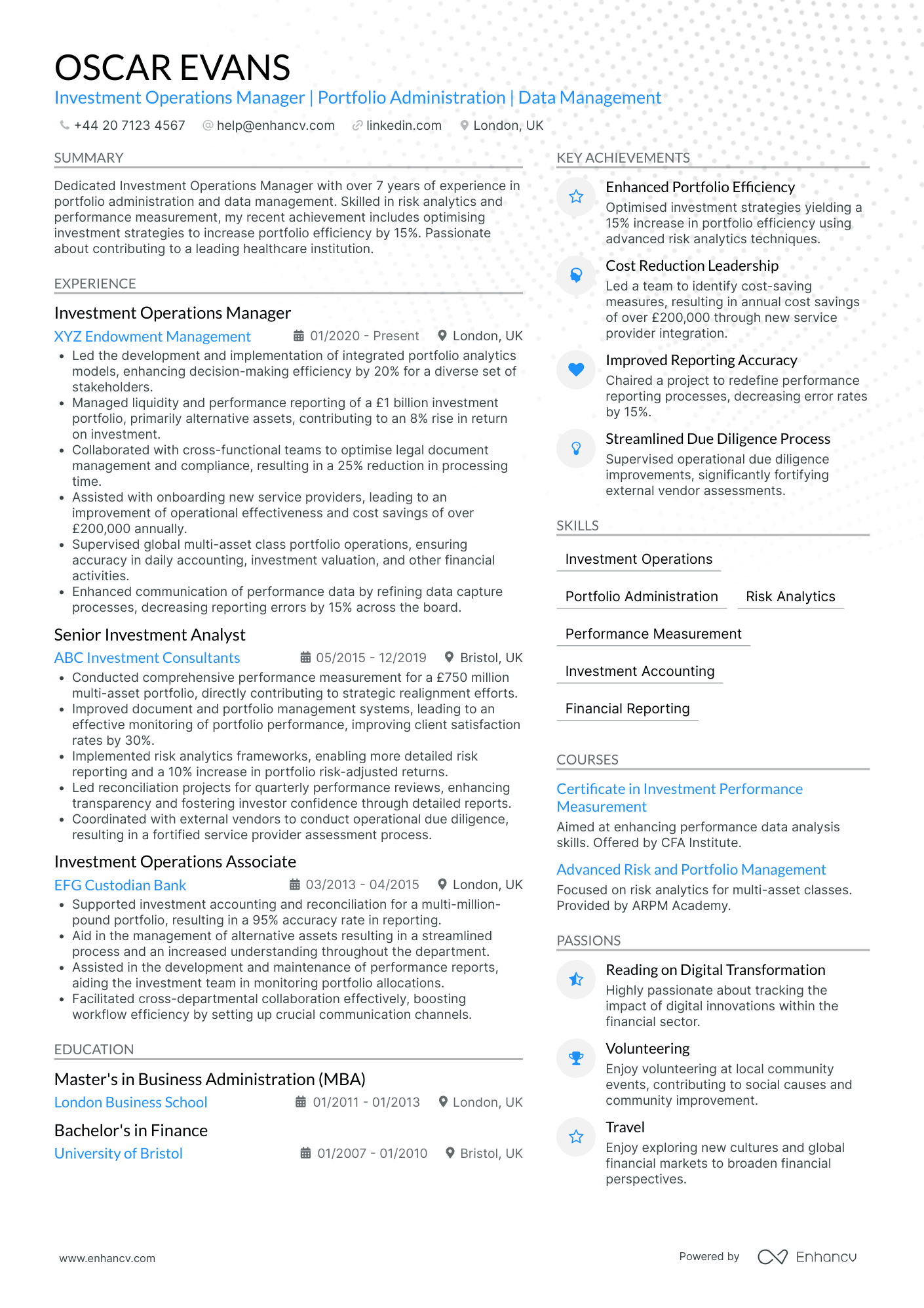

Investment Operations Manager

- Concise and Structured Presentation - The CV is organized methodically, presenting information in a concise manner that enhances the readability. Sections such as experience, education, and skills are clearly delineated, allowing for easy navigation through Oscar Evans’ professional history and qualifications.

- Defined Career Progression - Oscar Evans demonstrates clear career growth from an Investment Operations Associate to Investment Operations Manager, indicative of increased responsibilities and expertise. This trajectory within financial management reflects a robust understanding and capability in investment operations, vital for a leadership role in portfolio administration.

- Business-Relevant Achievements - The CV lists several significant achievements with direct business impacts, such as optimizing investment strategies to enhance portfolio efficiency by 15% and leading cost-saving initiatives resulting in over £200,000 in annual savings. These accomplishments underscore Evans' ability to contribute strategically valuable outcomes to organizational success.

Investment Manager in Renewable Energy

- Concise and well-organized structure - The CV is presented with clarity and precision, featuring distinct sections for education, experience, skills, and achievements. Each section is well-organized, allowing the reader to easily navigate through Isla King's professional journey, showcasing her advancement in the renewable energy sector.

- Progressive career growth in renewable energy - Isla King's career trajectory demonstrates consistent growth and increased responsibility in the renewable energy field. Starting as an Energy Design Engineer and advancing to a Renewable Energy Project Engineer, her promotions reflect a dedication to personal and professional development within the sector.

- Technical expertise in emerging energy solutions - The CV highlights Isla's proficiency in industry-specific tools and methodologies, such as AutoCAD and MATLAB. Her skills in solar PV design, wind energy systems, and hydrogen production showcase her technical depth and ability to contribute effectively to sustainable energy projects.

Investment Manager in Technology Industry

- Clear and structured content presentation - The CV is well-organized, with distinct sections that make it easy to navigate through the candidate's professional journey. Each section is concise, focusing on key aspects of the candidate's experience and achievements, ensuring that important details are communicated effectively without overwhelming the reader.

- Strong career trajectory and growth - Evie Perry's career demonstrates significant upward mobility, evident in her progression from roles in technology infrastructure to senior management positions within major financial institutions. Her continuous advancement reflects a robust career trajectory marked by increasing responsibilities and influential positions in reputable organizations such as Barclays, BlackRock, and HSBC.

- Industry-specific technical expertise - The CV highlights unique and advanced skills relevant to investment technology, such as data architecture, API integration, and multi-asset systems. These competencies, coupled with certifications from the CFA Institute and AWS, showcase the candidate's deep technical knowledge and her ability to leverage technology in optimizing investment strategies and operations.

Investment Manager in Real Estate

- Structured Presentation of Content - The CV is well-organized, with clear headings for each section, making it easy for readers to navigate through the candidate’s experience, education, and skills. Details are concise, yet comprehensive, providing just enough information to highlight expertise without overwhelming the reader.

- Career Trajectory and Growth - The candidate demonstrates a strong career progression within the real estate industry, moving from a Financial Analyst role to a Real Estate Investment Analyst. Each position is built upon the last, showing increased responsibility and leadership, particularly in investment strategy and management.

- Technical Depth in Industry Tools - Amelia's proficiency in industry-specific tools like ARGUS software is prominently featured, underlining her technical expertise in financial modeling and analysis. This specialization is crucial for a real estate analyst, enhancing her ability to deliver precise and effective investment strategies.

Investment Manager in Healthcare Industry

- Clear and Structured Presentation - The CV is well-organized, with distinct sections that allow the reader to easily navigate through the candidate's qualifications and experience. Each section is clearly labeled, providing a concise overview while diving into detailed bullet points that highlight the candidate's main responsibilities and achievements in their roles.

- Impressive Career Trajectory in Investment Banking - Alice Barnes' career shows a progressive growth path within the field of investment banking, from a Corporate Banking Analyst to an Investment Banking Associate. This upward trajectory highlights her increasing responsibilities, from analyzing financial statements to leading major cross-border mergers and IPOs, demonstrating her ability to manage significant financial operations and gain industry trust.

- Depth in Industry-Specific Finance Skills - The CV showcases Alice's deep competency in critical financial tools and methodologies such as financial modelling, valuation analysis, and transaction structuring. Her ability to leverage these skills to execute complex financial operations like IPOs, mergers, and acquisitions, particularly within the healthcare sector, underscores her technical expertise and industry-specific proficiency.

Investment Research Manager

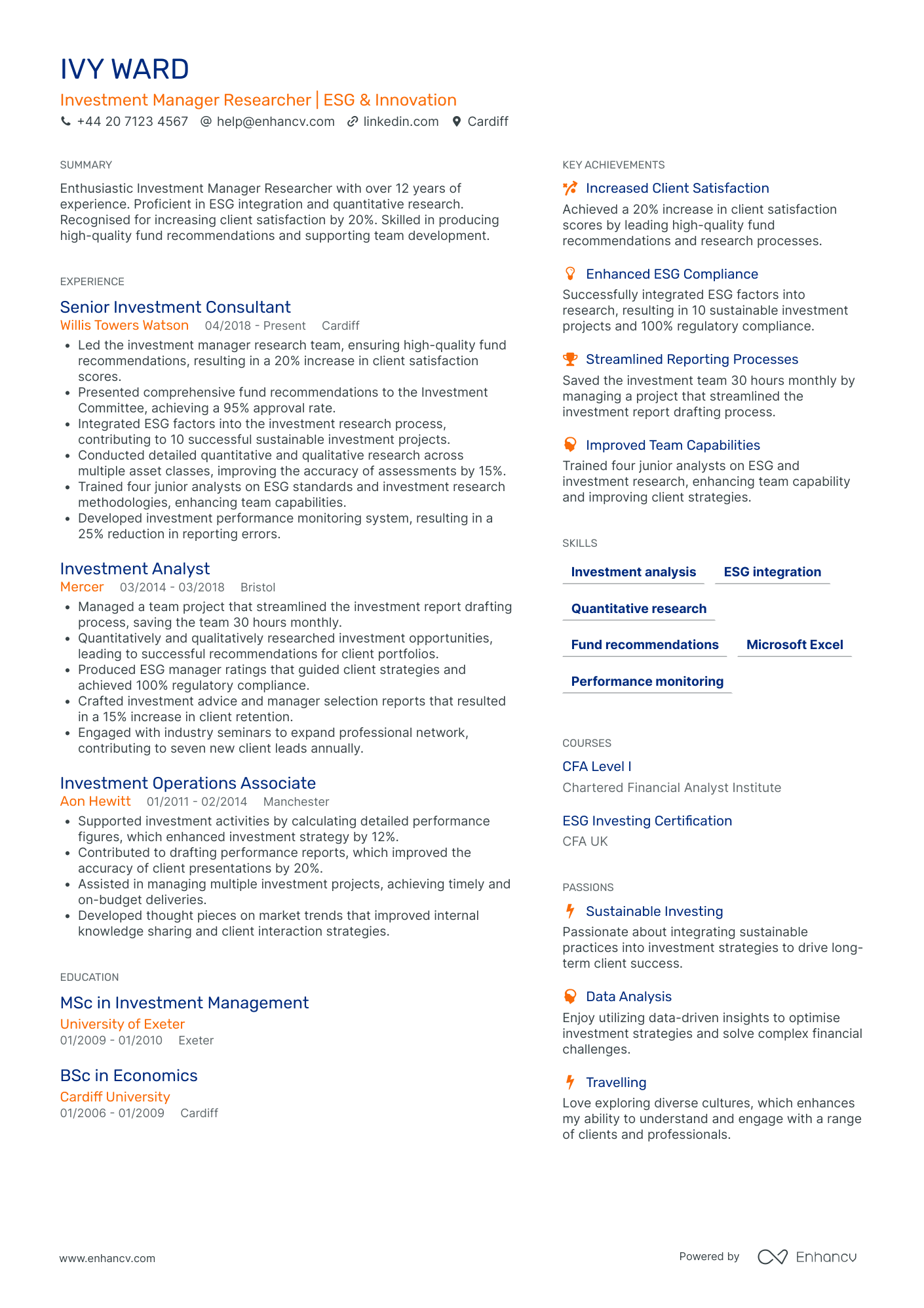

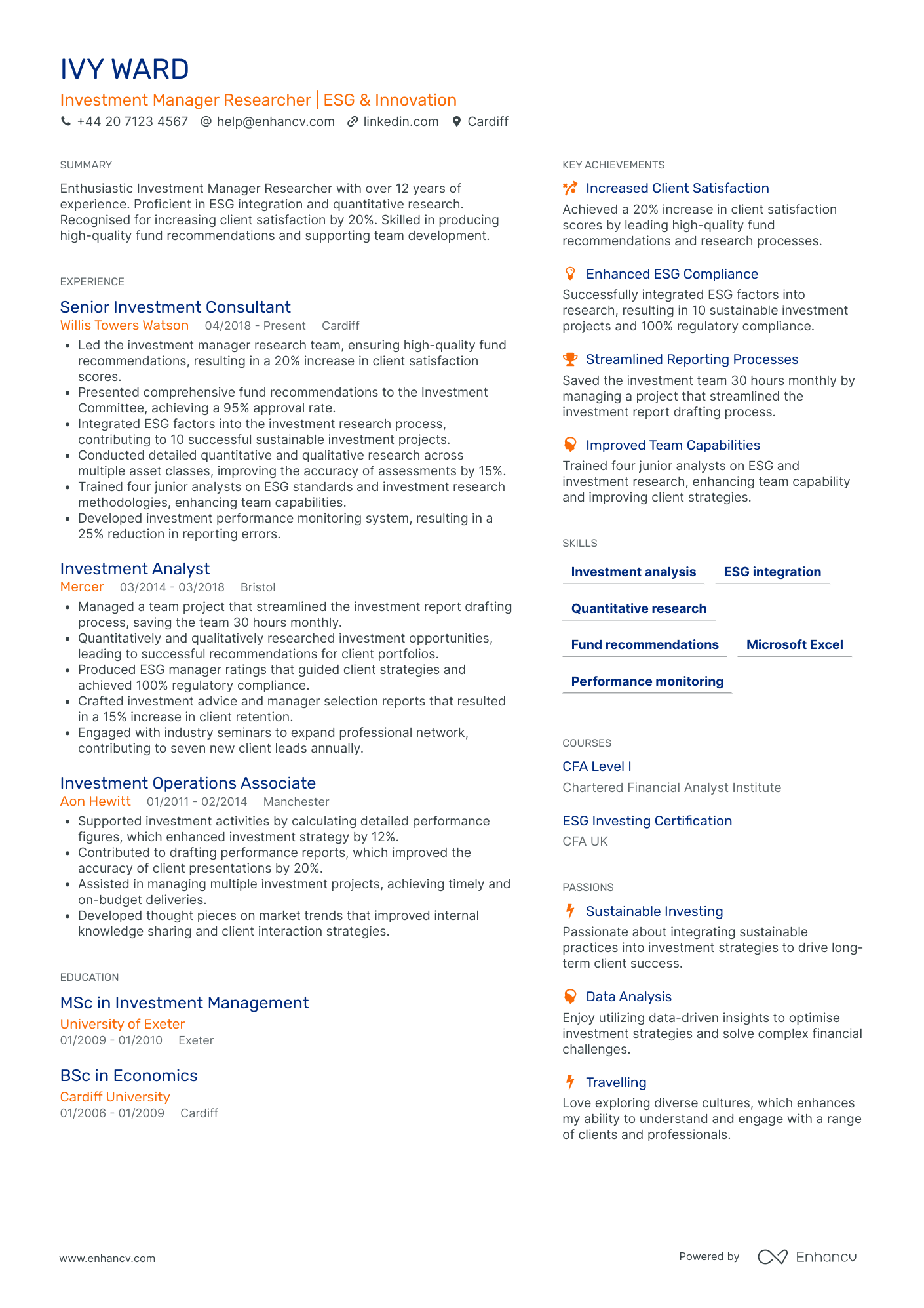

- Clarity and Structured Presentation - The CV is presented with clear headers and sections that intelligently segment the candidate’s experience, education, skills, and achievements. This organization facilitates easy navigation through Ivy Ward's professional backgrounds, such as roles, responsibilities, and accomplishments.

- Strong Career Trajectory and Growth - Ivy Ward's career progression is evident from the progression from Investment Operations Associate to Senior Investment Consultant. This trajectory indicates a steady growth in responsibilities and expertise, especially evident in her leadership positions that contributed to significant business outcomes.

- Emphasis on ESG Integration and Innovation - The CV highlights industry-specific methodologies like ESG (Environmental, Social, and Governance) integration, demonstrating her ability to align financial strategies with sustainable investments, which are crucial for modern investment management roles. This focus suggests that Ivy Ward is not only up-to-date with industry trends but also contributes to leading them.

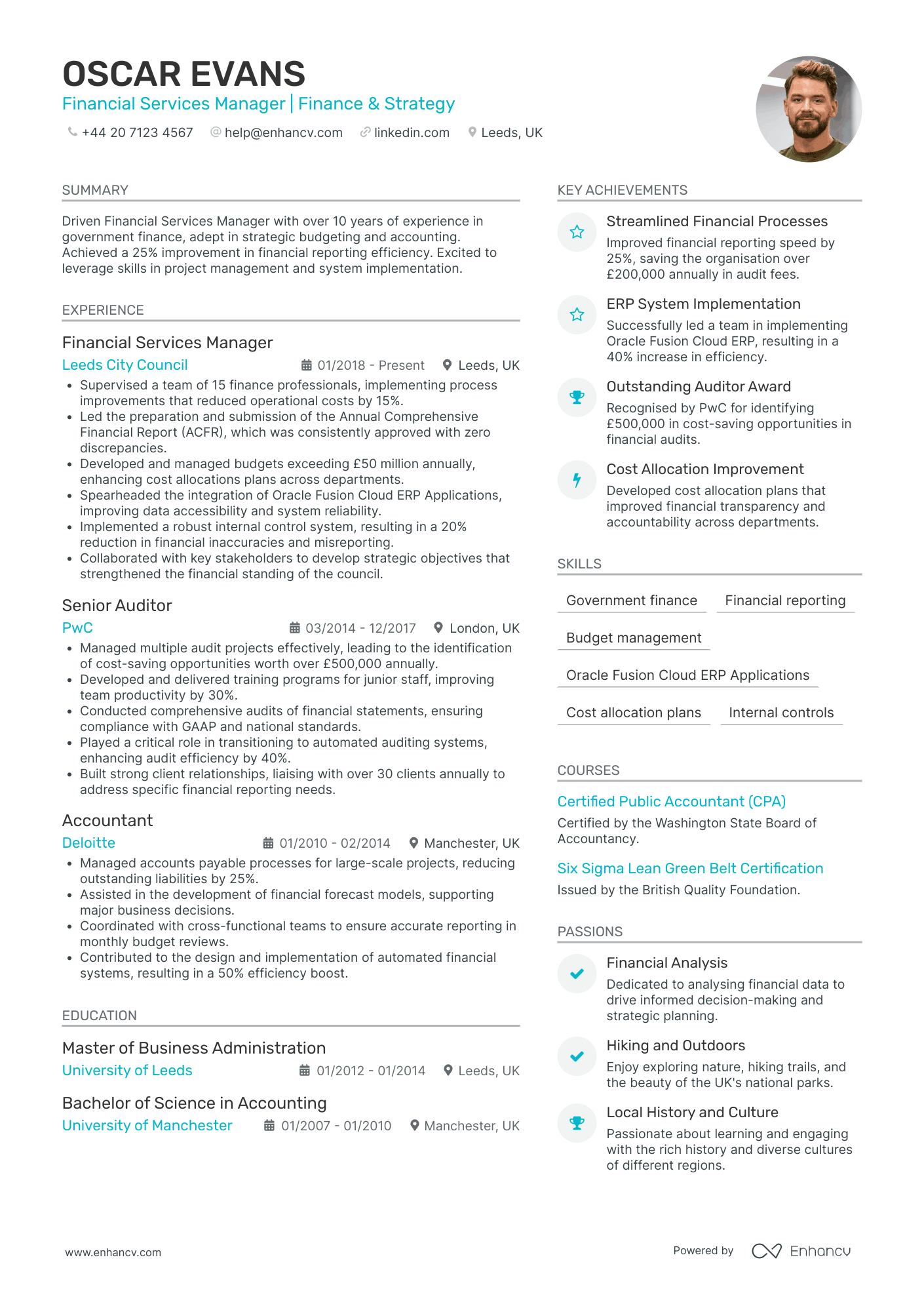

Investment Manager in Financial Services

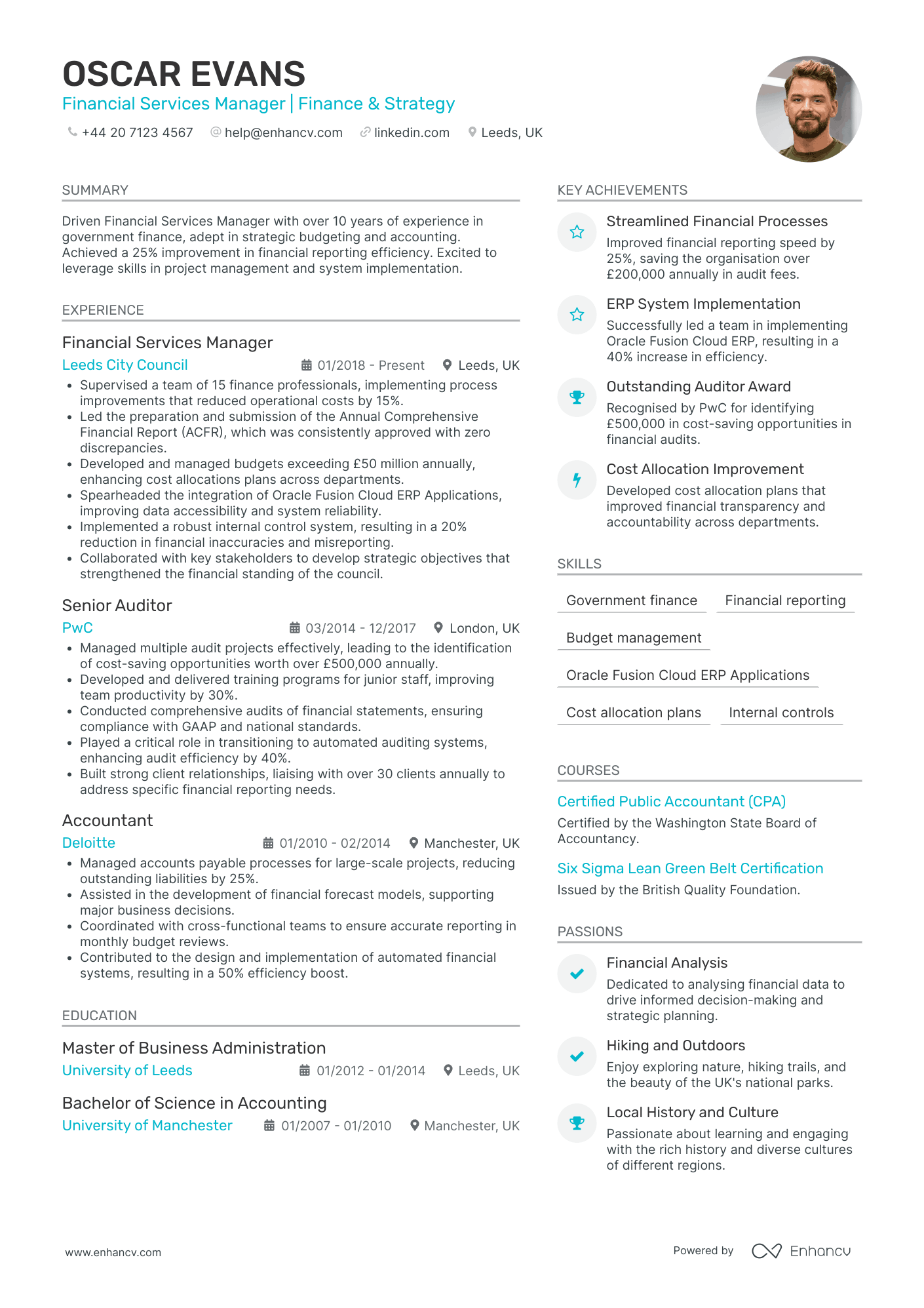

- Clear and Structured Presentation - The CV stands out for its clear and well-organized presentation, making it easy for potential employers to navigate through the candidate's extensive experience and qualifications. Sections are distinct and concise, allowing for quick access to key information such as skills, education, and achievements relevant to the role of a Financial Services Manager.

- Impressive Career Trajectory - Oscar Evans has demonstrated significant career growth, moving from an Accountant at Deloitte to a Senior Auditor at PwC, before taking on the role of Financial Services Manager at Leeds City Council. This progression showcases his ability to advance within the finance industry, gaining expertise and handling increasingly complex responsibilities over his decade-long career.

- Impactful Achievements with Business Relevance - The CV meticulously details Oscar's accomplishments, emphasizing their business impact. For example, reducing operational costs by 15% and improving financial reporting speed by 25% not only highlight his efficiency and leadership skills but also his ability to drive substantial savings and operational improvements, which directly benefit the organization's financial health.

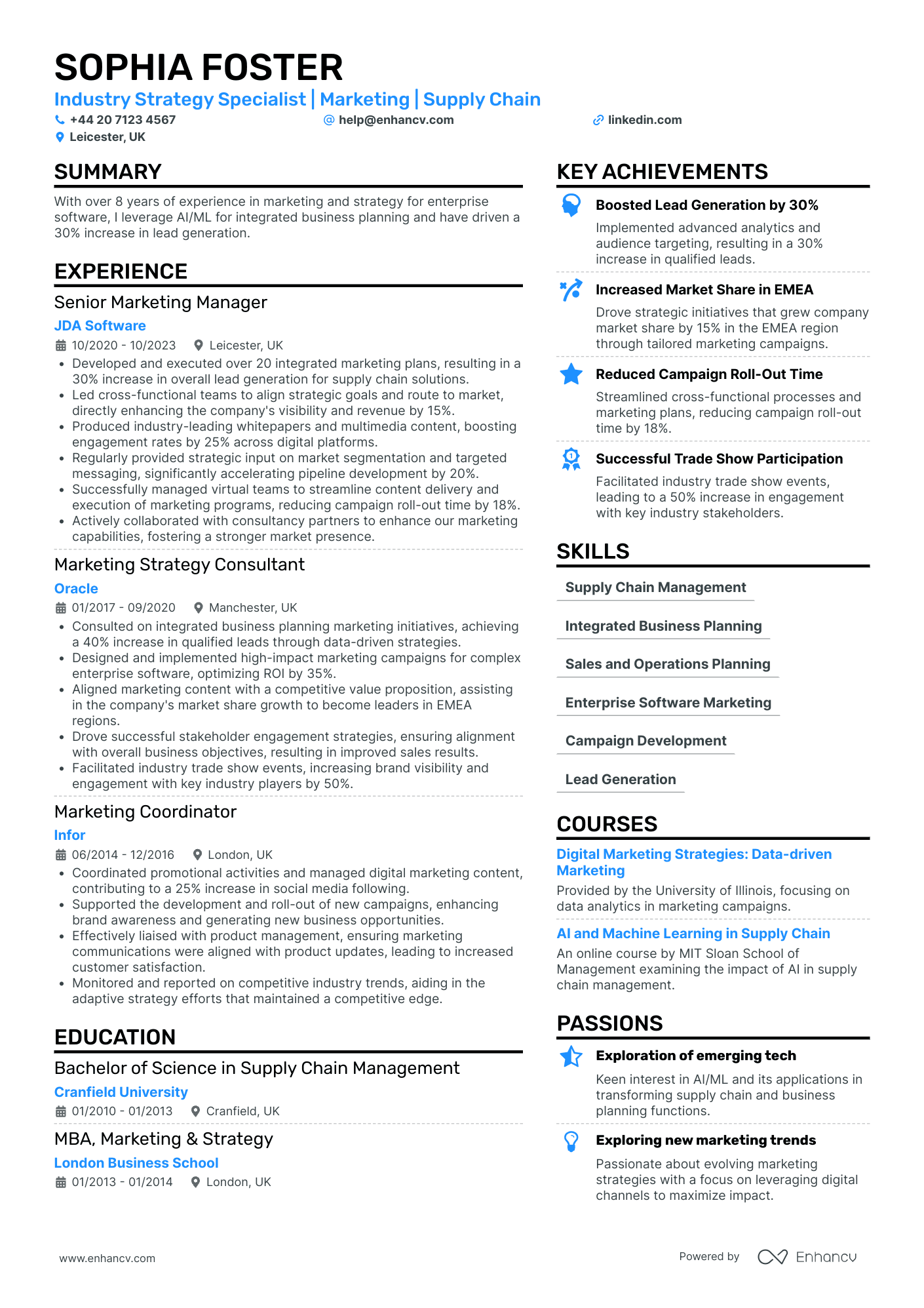

Investment Manager in Manufacturing Industry

- Structured and Focused Presentation - The CV is well-organized, presenting Sophia Foster’s expertise, experience, and achievements in a clear and concise manner. Each section is distinctly separated, effectively guiding the reader through her professional journey, skills, and impact made in the marketing and supply chain sectors.

- Impressive Career Progression - Sophia Foster demonstrates a robust career trajectory, beginning as a Marketing Coordinator and advancing to a Senior Marketing Manager position. Her progression highlights increased responsibilities and her ability to adapt and grow within the enterprise software industry, marking her as a professional with both strategic depth and managerial acumen.

- Technological Proficiency and Innovative Strategies - The CV emphasizes her use of AI/ML and data-driven methodologies to enhance marketing campaigns, integrate business planning, and support strategic initiatives. These unique industry-specific elements highlight her technical proficiency and ability to apply cutting-edge technologies to drive business success.

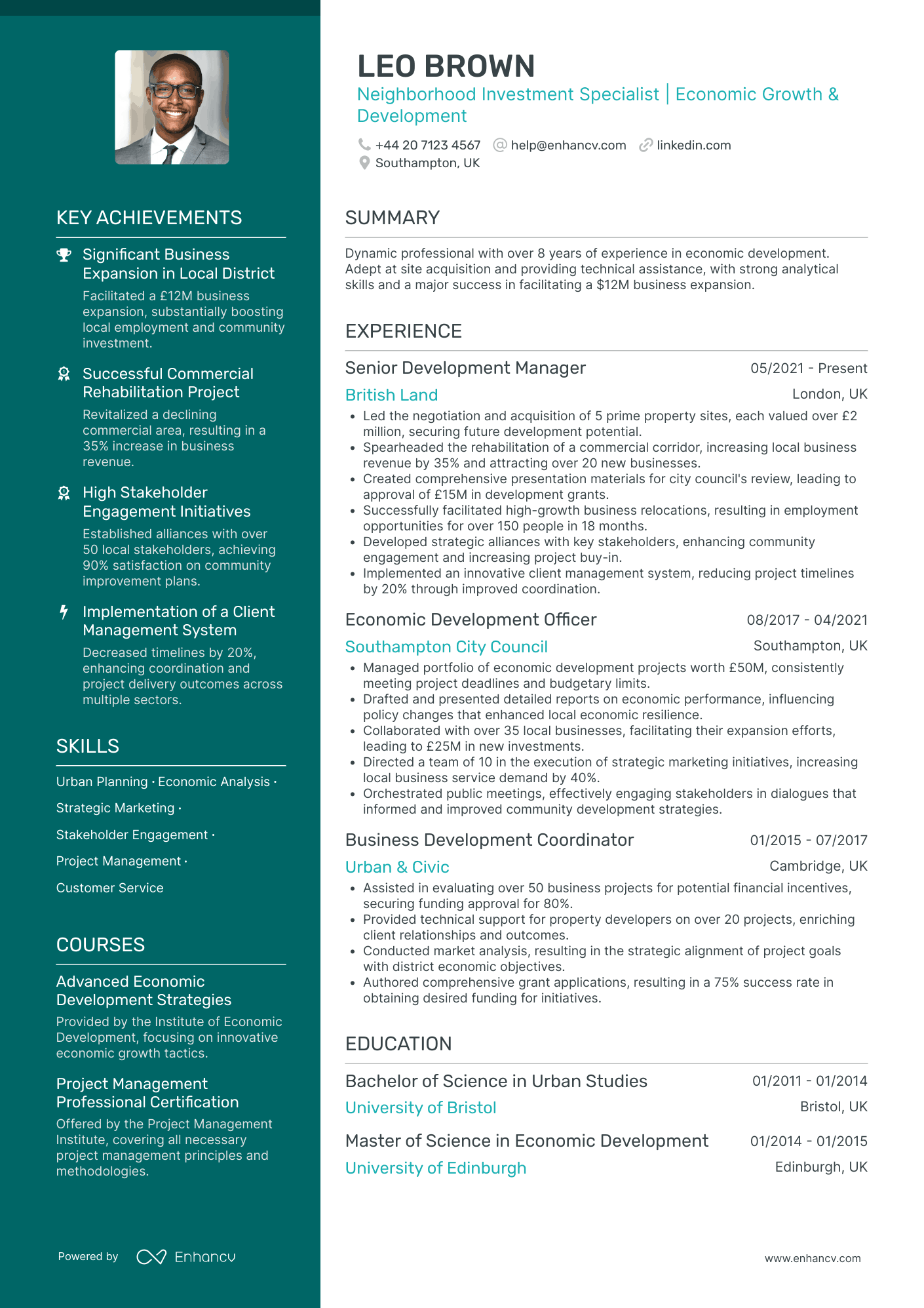

Investment Manager in Agriculture Industry

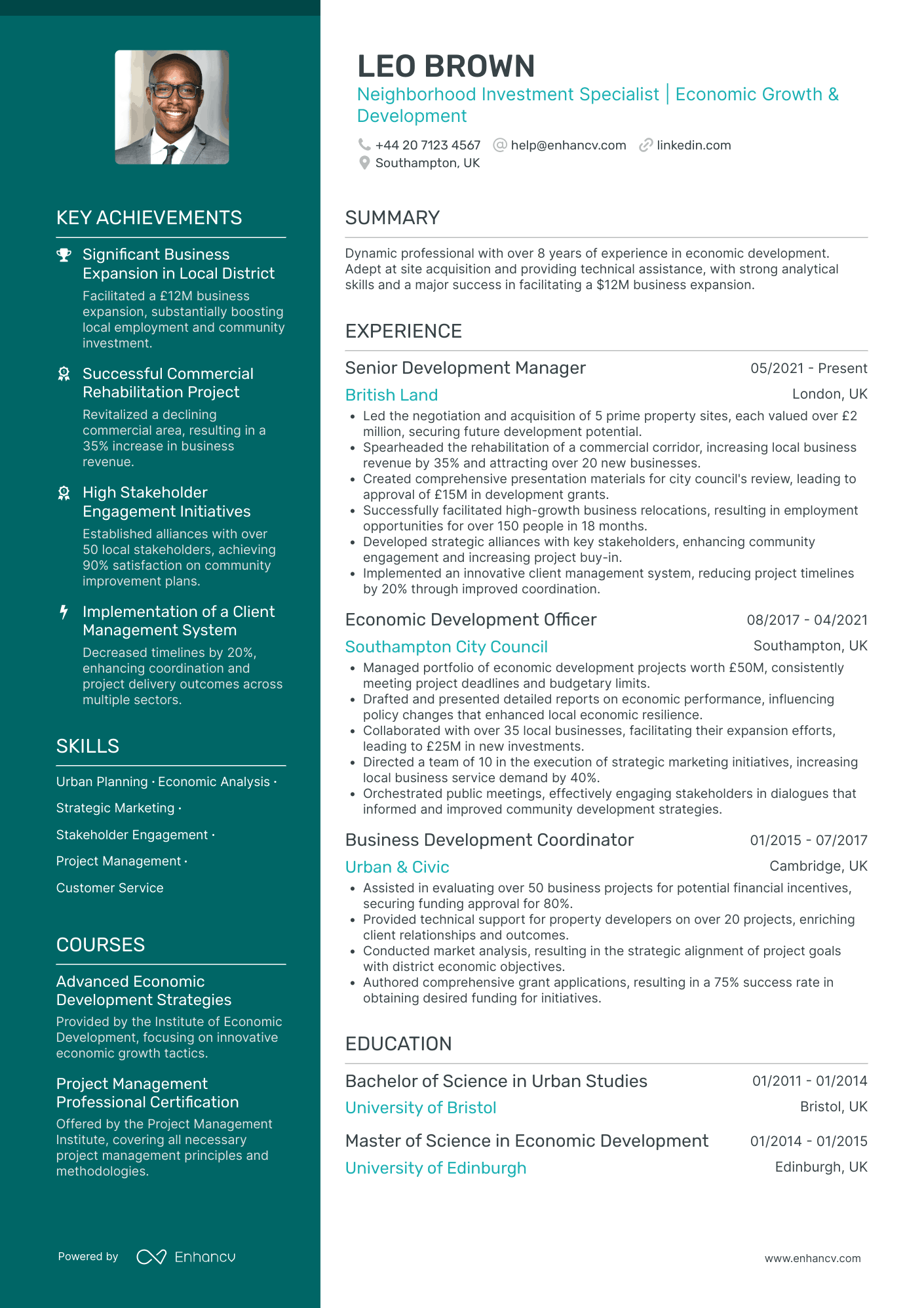

- Content presentation through structured sections - The CV is well-organized, with each section clearly titled and detailed, allowing for easy reading and quick access to specific information. The use of concise bullets effectively distills complex responsibilities and achievements into digestible points, making it reader-friendly while maintaining comprehensiveness.

- Strong career trajectory and progression - The career narrative demonstrates a consistent upward trajectory, with Leo moving from positions like Business Development Coordinator to Senior Development Manager. This progression reflects both recognition within the industry and an accumulation of responsibilities, highlighting his capability in increasingly senior and complex roles.

- Achievements with substantial community impact - The accomplishments listed, such as spearheading a commercial corridor rehabilitation that increased local business revenue by 35%, underscore Leo's capacity to make significant contributions to local economic development. This not only showcases the economic impact but also demonstrates a commitment to community improvement and sustainability.

Investment Manager in Retail Industry

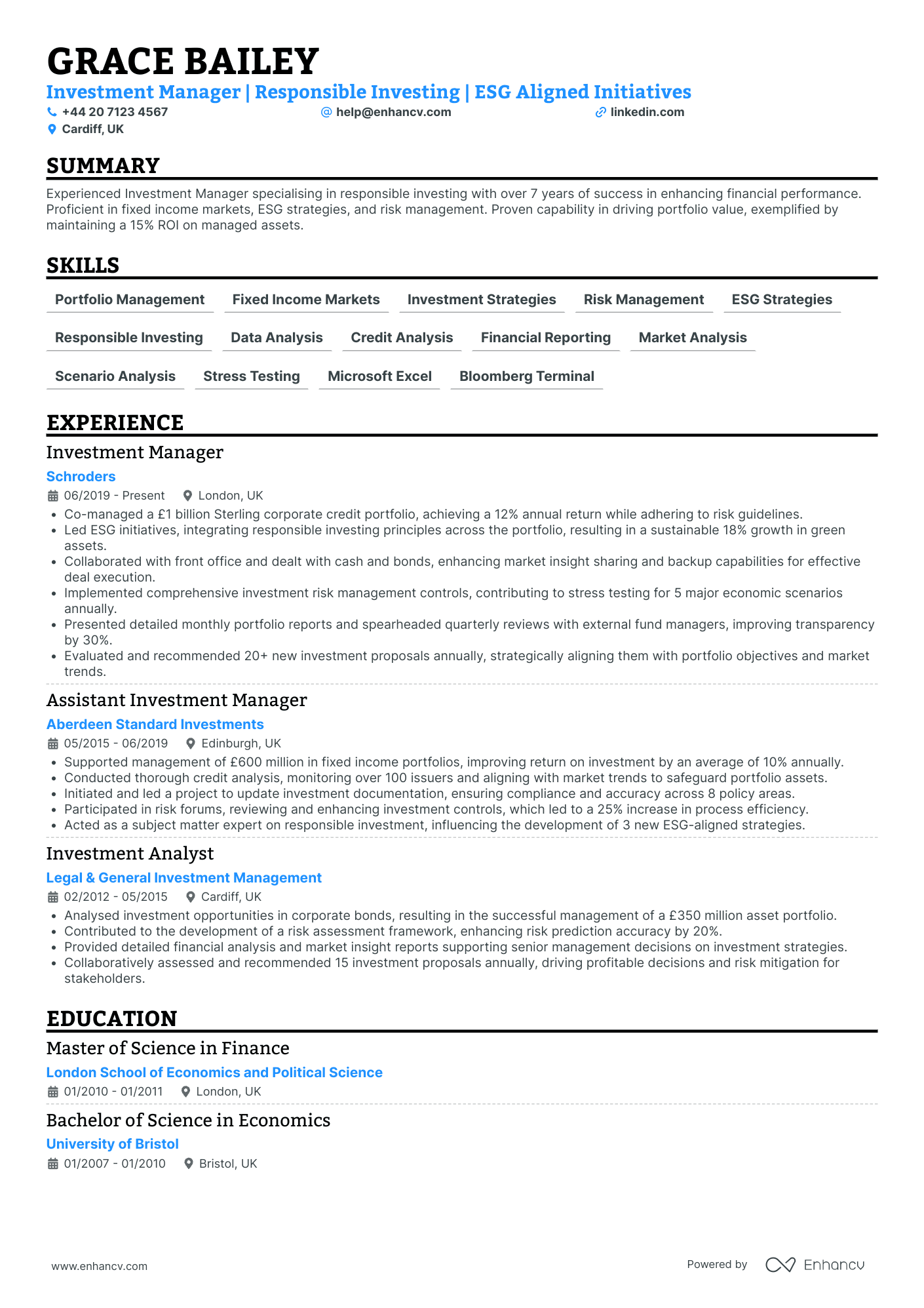

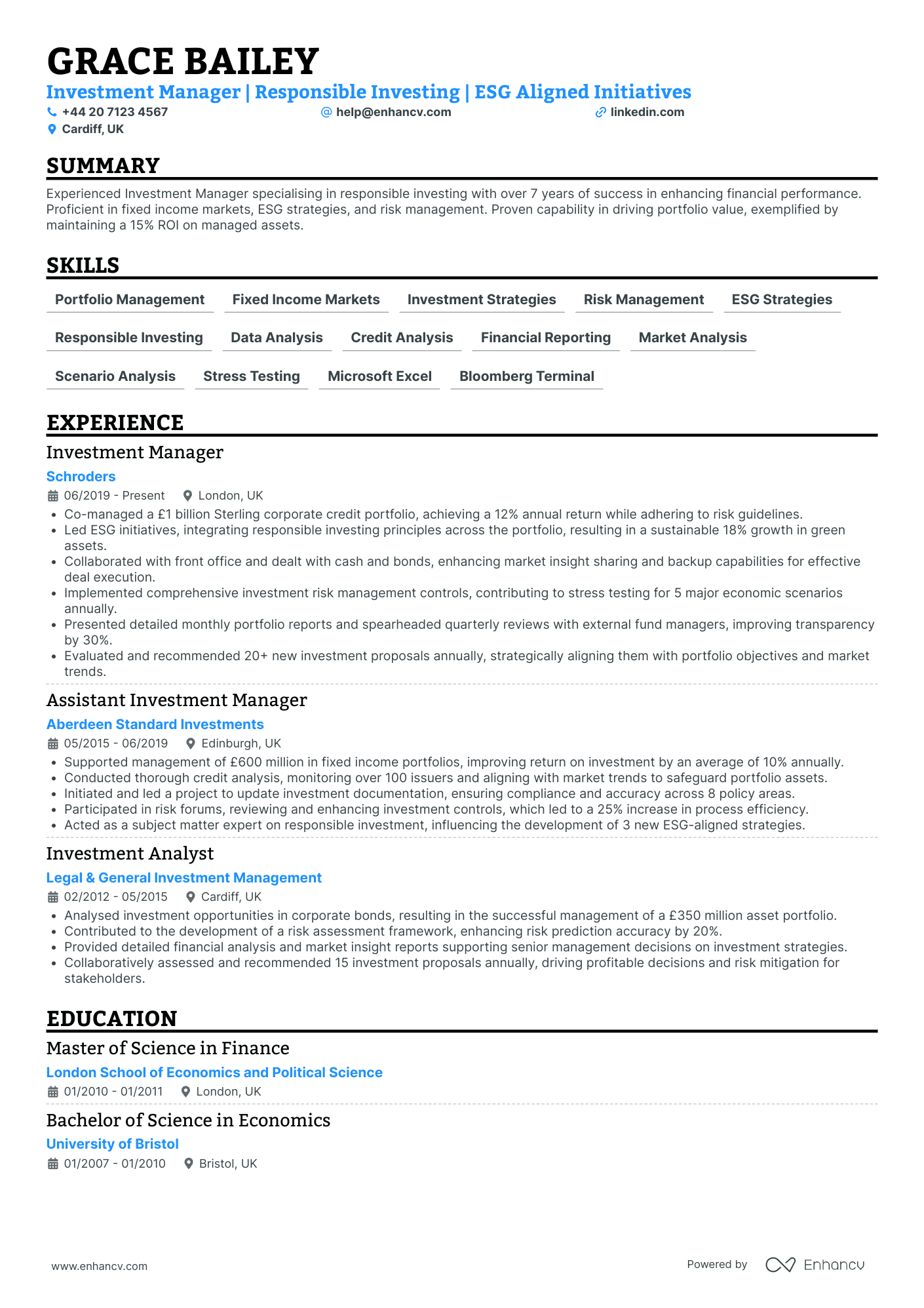

- Structured career progression - The CV showcases a robust career trajectory, highlighting significant growth from an Investment Analyst at Legal & General Investment Management to an Investment Manager at Schroders. This progression not only reflects industry expertise but also an increasing level of responsibility and leadership in managing large and complex portfolios.

- Emphasis on ESG and sustainable investing - A unique focus of this CV is its integration of ESG and responsible investing, which is increasingly important in today's financial industry. Grace Bailey distinctly positions herself as a leader in this niche, with significant achievements in ESG initiatives, such as leading the launch of responsible investment frameworks and growing green assets sustainably by 18%.

- Comprehensive skill set with a focus on finance-specific tools - The CV highlights a diverse range of specialized skills pertinent to investment management, like Portfolio Management, Fixed Income Markets, and Risk Management. Additionally, proficiency in industry-standard tools such as Bloomberg Terminal and Microsoft Excel underlines the candidate’s technical preparedness for data analysis and investment decision-making.

Investment Manager in Telecommunications

- Structured and Clear Presentation - The CV is well-organized with distinct sections, making it easy to navigate through Theodore Green's professional journey. Key areas like experience, education, skills, and achievements are neatly categorized, facilitating quick comprehension of his qualifications and accomplishments while maintaining conciseness and clarity.

- Demonstrated Career Growth and Leadership - Theodore Green's career trajectory showcases steady growth from a Telecommunications Specialist to a Telecommunications Manager. His progression reflects increasing levels of responsibility and leadership, culminating in his current role where he leads large teams and executes strategic initiatives, showcasing a strong capability for professional development within the telecommunications industry.

- Focus on Operational Efficiency and Innovation - A standout element in this CV is the emphasis on achievements that highlight operational efficiency and innovation. Initiatives leading to significant cost savings and increased system uptime illustrate Theodore's ability to implement strategies that not only meet but exceed business objectives, thereby reinforcing his impact on business outcomes beyond just numerical improvements.

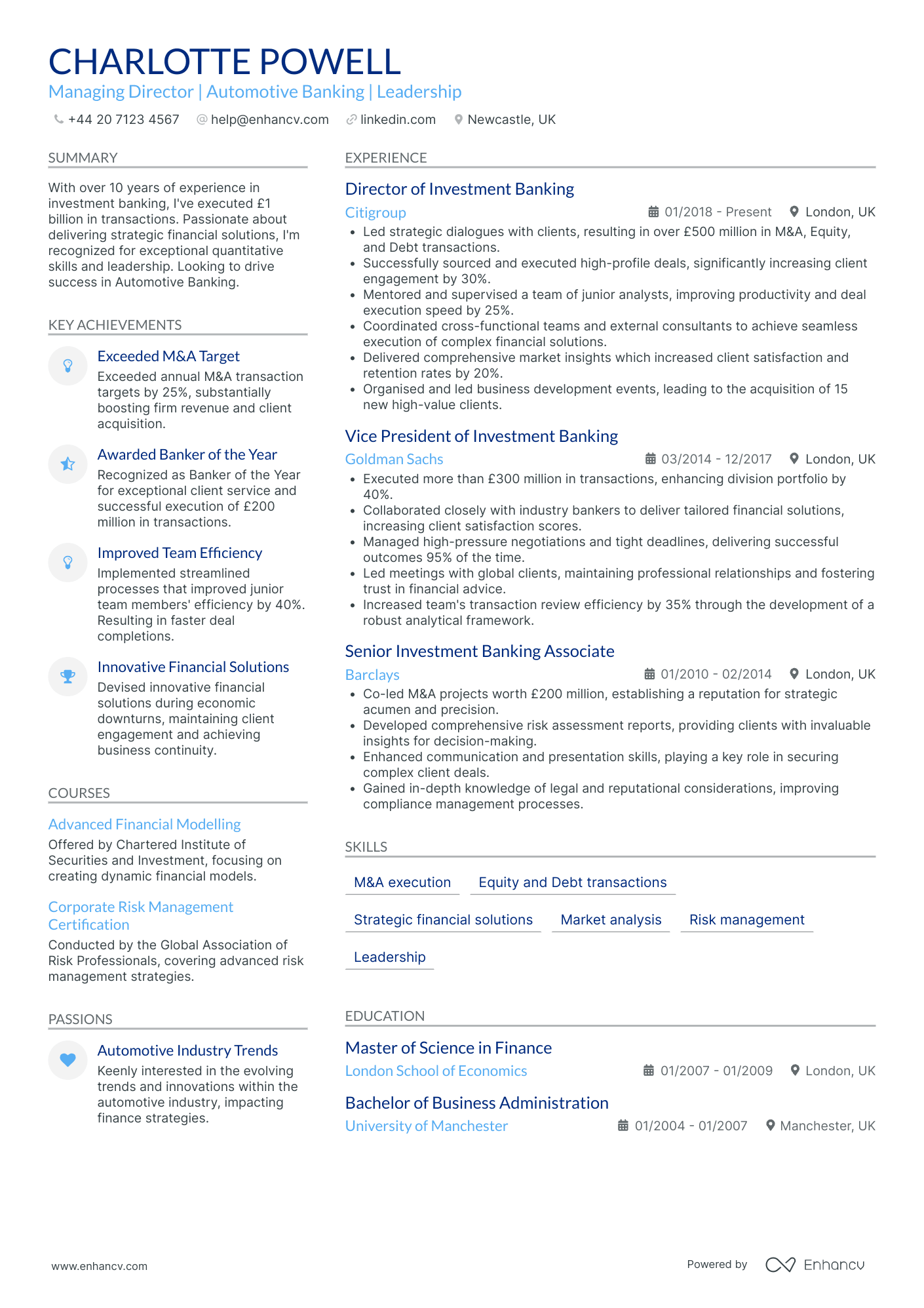

Investment Manager in Automotive Industry

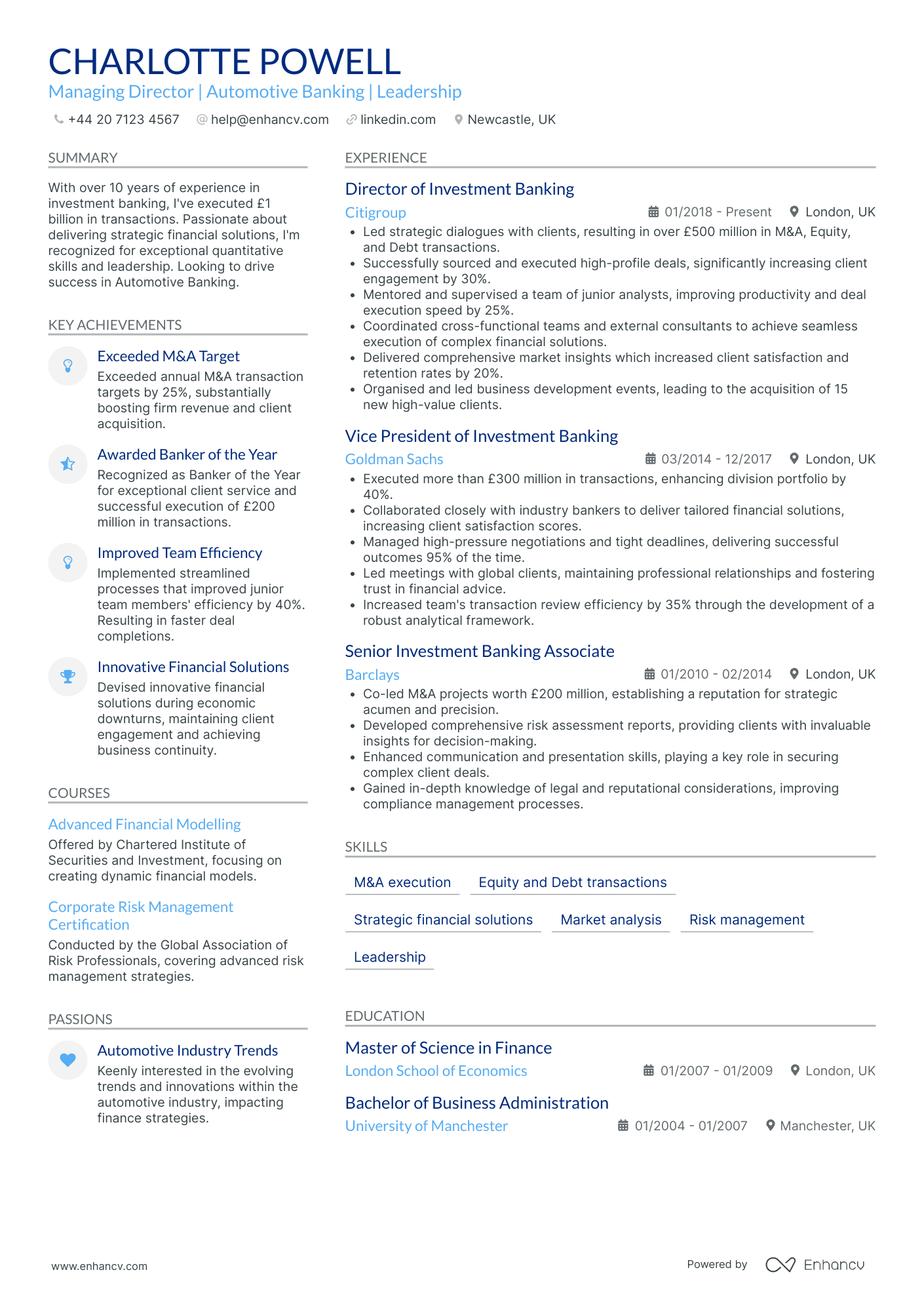

- Clarity and Structure - The CV is expertly structured, presenting information in a clear and concise manner. Each section is well-organized, ensuring the reader can easily navigate through Charlotte's extensive experience and achievements. The use of bullet points under each job role succinctly highlights key responsibilities and accomplishments without overwhelming the reader with excessive detail.

- Progressive Career Trajectory - Charlotte's career shows a strong upward trajectory, advancing from a Senior Investment Banking Associate to Director of Investment Banking within a relatively short span of time. This progression not only illustrates her capability for leadership and increased responsibility within top banking institutions but also her adaptability and growth in the competitive field of investment banking.

- Achievements with Business Impact - The CV emphasizes achievements that are not just number-focused but also highlight business impact. For instance, exceeding M&A transaction targets by 25% and leading to the acquisition of high-value clients demonstrates her ability to deliver results that directly contribute to a company's growth and client base expansion. These accomplishments are portrayed as integral to firm revenue and operational efficiency, underscoring their importance.

How complex should the format of your investment manager CV be?

Perhaps, you decided to use a fancy font and plenty of colours to ensure your investment manager CV stands out amongst the pile of other candidate profiles. Alas - this may confuse recruiters. By keeping your format simple and organising your information coherently, you'll ultimately make a better impression. What matters most is your experience, while your CV format should act as complementary thing by:

- Presenting the information in a reverse chronological order with the most recent of your jobs first. This is done so that your career history stays organised and is aligned to the role;

- Making it easy for recruiters to get in touch with you by including your contact details in the CV header. Regarding the design of your CV header, include plenty of white space and icons to draw attention to your information. If you're applying for roles in the UK, don't include a photo, as this is considered a bad practice;

- Organising your most important CV sections with consistent colours, plenty of white space, and appropriate margins (2.54 cm). Remember that your CV design should always aim at legibility and to spotlight your key information;

- Writing no more than two pages of your relevant experience. For candidates who are just starting out in the field, we recommend to have an one-page CV.

One more thing about your CV format - you may be worried if your double column CV is Applicant Tracker System (ATS) complaint. In our recent study, we discovered that both single and double-column CVs are ATS-friendly . Most ATSes out there can also read all serif and sans serif fonts. We suggest you go with modern, yet simple, fonts (e.g. Rubik, Lato, Raleway) instead of the classic Times New Roman. You'll want your application to stand out, and many candidates still go for the classics. Finally, you'll have to export your CV. If you're wondering if you should select Doc or PDF, we always advise going with PDF. Your CV in PDF will stay intact and opens easily on every OS, including Mac OS.

PRO TIP

Use font size and style strategically to create a visual hierarchy, drawing the reader's eye to the most important information first (like your name and most recent job title).

The top sections on a investment manager CV

- Professional Summary highlights your investment expertise and achievements, making a strong first impression.

- Investment Management Experience showcases your relevant job history and successful portfolio management.

- Education and Qualifications demonstrate your foundation in financial theories and practices pertinent to investments.

- Key Investment Successes provide specific examples of how you've positively impacted portfolios or firms.

- Relevant Skills and Competencies highlight your ability to analyse markets, manage risks, and use financial tools.

What recruiters value on your CV:

- Highlight your understanding of the financial markets and investment strategies, showcasing your successful portfolio management and decision-making processes that have led to tangible growth.

- Emphasise any qualifications relevant to an investment manager, such as a CFA charter, MBA with a finance specialisation, or equivalent, demonstrating your commitment to professional development and expertise.

- Illustrate your risk management capabilities by detailing specific instances where you identified, mitigated, or capitalised on financial risks, reflecting your ability to safeguard assets.

- Include evidence of strong analytical skills through examples of complex data interpretation, modelling, and forecasting, which are critical for informed investment decisions.

- Detail your leadership and team management experiences, as investment managers often oversee a team of analysts, so providing examples of successful team guidance and mentoring will bolster your CV.

Recommended reads:

Making a good first impression with your investment manager CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for investment manager:

- Portfolio Manager | Equities Specialist | CFA Charterholder | 10 Years of Asset Management Experience

- Senior Investment Analyst | Fixed Income & Derivatives Expert | MSc Finance | 8+ Years' Industry Insight

- Chief Investment Officer | Strategic Asset Allocation | MBA | Fintech Enthusiast | 15+ Years Leadership

- Junior Investment Advisor | Graduate | Wealth Management & Client Relations | ACII Accredited

- Risk Manager | Quantitative Analysis Savvy | FRM Certified | 12 Years in Risk Oversight

- Director of Investment Strategy | Global Markets Experience | PhD Economics | 20 Years Portfolio Management

Your investment manager CV introduction: selecting between a summary and an objective

investment manager candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you investment manager CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a investment manager job:

- With over 10 years of proven experience in asset management and a track record of delivering exceptional returns above market average, I continually maximise client portfolios through comprehensive market analysis, strategic asset allocation, and meticulous risk assessment.

- An accomplished investment professional with 15 years in the field, specialising in equities. Proficient in quantitative analysis and experienced in managing a £500 million portfolio with consistent outperformance of benchmarks, seeking to leverage expertise to drive financial success.

- Seasoned finance executive with two decades in corporate finance looking to transition into investment management, bringing strong analytical skills, experience in capital budgeting and investment strategies, and a successful history of managing a multimillion-pound budget.

- Eager to apply an extensive background in technology project management to investment management, incorporating adeptness in data analytics, robust leadership in coordinating cross-functional teams, and a passion for financial markets and portfolio optimisation methodologies.

- Intent on entering the investment management sector, bringing forward a keen analytical mindset nurtured through a Mathematics degree, dedication to mastering financial modelling and portfolio analysis, and an eagerness to contribute to successful investment strategies from the ground up.

- Aiming to utilise a fresh perspective gained from a successful career in management consulting to make a significant impact in investment management, utilising exceptional problem-solving abilities, a strong client-centric approach, and a newfound dedication to acquiring investment expertise.

Best practices for writing your investment manager CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Managed a diversified portfolio of equities, fixed income, and alternative investments, achieving a track record of 15% annualised returns over five years, demonstrating strong market acumen and risk management skills.

- Led a team of analysts in performing in-depth market research and due diligence for potential investment opportunities, resulting in an increase of investment performance by 20% year-on-year.

- Implemented innovative quantitative analysis techniques to drive investment strategy decisions, contributing to a 30% growth in client assets under management (AUM) in the first two years.

- Effectively communicated investment rationales and market outlooks to high-net-worth clients, ensuring portfolio alignment with their financial goals, risk tolerance, and time horizon.

- Developed and maintained strong relationships with institutional clients by consistently exceeding benchmark portfolio returns and providing insightful market commentary.

- Regularly reviewed and rebalanced client portfolios to optimise asset allocation, resulting in outperformance of peer group funds and enhanced client satisfaction.

- Initiated and led the adoption of Environmental, Social, and Governance (ESG) integration processes into the firm's investment strategies, demonstrating commitment to responsible investing.

- Utilised advanced financial modelling to forecast economic trends and guide the strategic positioning of portfolios, notably steering clients clear of downturns during volatile market periods.

- Authored a monthly investment newsletter that shared unique perspectives on global financial markets, reinforcing the firm's thought leadership and contributing to business development efforts.

- Spearheaded the diversification of investment portfolio for high-net-worth individuals, achieving a 20% increase in portfolio returns within the first year.

- Implemented advanced risk management strategies that decreased portfolio volatility by 15% whilst maintaining projected growth targets.

- Negotiated and secured preferential terms with new investment partners, leading to the successful launch of a private equity fund focused on technology startups.

- Managed a portfolio of £500 million in assets, consistently outperforming the benchmark index by 5% each year.

- Developed a comprehensive ESG investment framework which channelled over £75 million into sustainable investments.

- Led a team of analysts and junior managers, cultivating a results-driven culture that contributed to a 25% departmental efficiency increase.

- Initiated and led a cross-departmental project that utilised big data analytics to inform investment decisions, improving predictive accuracy by 30%.

- Orchestrated the successful acquisition and integration of a competitor’s asset portfolio, boosting the firm’s market share by 10%.

- Regularly conducted investment seminars and workshops for clients, which significantly improved client retention rates and attracted new business.

- Optimised the global investment strategy by identifying emerging markets, leading to a robust international portfolio expansion.

- Pioneered the use of AI-driven financial models, enhancing forecasting capabilities which brought about a 12% efficiency gain in asset allocation.

- Cultivated strategic partnerships with fintech companies to co-develop new investment platforms and tools, reducing the average transaction cost by 20% and increasing user engagement.

- Developed a multi-asset investment strategy that broadened the clientele reach and increased managed assets by £200 million.

- Conducted thorough due diligence for potential investments, resulting in the identification and mitigation of high-risk propositions.

- Fostered a culture of continuous improvement among junior managers through mentorship, leading to a 35% uplift in their performance metrics.

- Designed an algorithmic trading system that increased trade execution speed by 50%, leading to a more responsive investment strategy alignment with market changes.

- Successfully managed a commodities investment portfolio which outstripped sector averages by over 8% annually.

- Initiated a series of investor education programmes that enhanced the company’s brand as an industry thought leader and expanded the client base by 20%.

- Led the transition to a more agile investment decision-making process, which increased reaction capability to market shifts and improved overall portfolio performance by 18%.

- Drove the digitisation of client reporting processes, enhancing report accuracy and reducing production time by over 40%.

- Facilitated the successful negotiation of a series of equity investments that delivered a consistent yield over the 4-year growth period.

- Oversee the strategic investment planning for the firm’s largest institutional clients, with a combined asset value exceeding £1 billion.

- Implemented a sector rotation strategy that dynamically adapts to cyclical economic factors, delivering a 13% improvement in year-on-year performance.

- Directed the due diligence process for the firm’s M&A activities, resulting in three strategic acquisitions that expanded service offerings and clientele.

How to ensure your investment manager CV stands out when you have no experience

This part of our step-by-step guide will help you substitute your experience section by helping you spotlight your skill set. First off, your ability to land your first job will depend on the time you take to assess precisely how you match the job requirements. Whether that's via your relevant education and courses, skill set, or any potential extracurricular activities. Next:

- Systematise your CV so that it spotlights your most relevant experience (whether that's your education or volunteer work) towards the top;

- Focus recruiters' attention to your transferrable skill set and in particular how your personality would be the perfect fit for the role;

- Consider how your current background has helped you build your technological understanding - whether you've created projects in your free time or as part of your uni degree;

- Ensure you've expanded on your teamwork capabilities with any relevant internships, part-time roles, or projects you've participated in the past.

Recommended reads:

PRO TIP

Talk about any positive changes you helped bring about in your previous jobs, like improving a process or helping increase efficiency.

Mix and match hard and soft skills across your investment manager CV

Your skill set play an equally valid role as your experience to your application. That is because recruiters are looking for both:

- hard skills or your aptitude in applying particular technologies

- soft skills or your ability to work in a team using your personal skills, e.g. leadership, time management, etc.

Are you wondering how you should include both hard and soft skills across your investment manager CV? Use the:

- skills section to list between ten and twelve technologies that are part of the job requirement (and that you're capable to use);

- strengths and achievements section to detail how you've used particular hard and soft skills that led to great results for you at work;

- summary or objective to spotlight up to three skills that are crucial for the role and how they've helped you optimise your work processes.

One final note - when writing about the skills you have, make sure to match them exactly as they are written in the job ad. Take this precautionary measure to ensure your CV passes the Applicant Tracker System (ATS) assessment.

Top skills for your investment manager CV:

Portfolio Management

Financial Analysis

Risk Management

Equity Research

Quantitative Analysis

Asset Allocation

Derivatives Knowledge

Investment Strategies Development

Compliance and Regulations Understanding

Market Trends Analysis

Decision Making

Communication

Leadership

Problem-Solving

Time Management

Adaptability

Attention to Detail

Teamwork

Negotiation

Client Relationship Management

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Education and more professional qualifications to include in your investment manager CV

If you want to showcase to recruiters that you're further qualified for the role, ensure you've included your relevant university diplomas. Within your education section:

- Describe your degree with your university name(-s) and start-graduation dates;

- List any awards you've received, if you deem they would be impressive or are relevant to the industry;

- Include your projects and publications, if you need to further showcase how you've used your technical know-how;

- Avoid listing your A-level marks, as your potential employers care to learn more about your university background.

Apart from your higher education, ensure that you've curated your relevant certificates or courses by listing the:

- name of the certificate or course;

- name of the institution within which you received your training;

- the date(-s) when you obtained your accreditation.

In the next section, discover some of the most relevant certificates for your investment manager CV:

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Recommended reads:

Key takeaways

Impressing recruiters with your experience, skill set, and values starts with your professional investment manager CV. Write concisely and always aim to answer job requirements with what you've achieved; furthermore:

- Select a simple design that complements your experience and ensures your profile is presentable;

- Include an opening statement that either spotlights your key achievements (summary) or showcases your career ambitions (objective);

- Curate your experience bullets, so that each one commences with a strong, action verb and is followed up by your skill and accomplishment;

- List your hard and soft skills all across different sections of your CV to ensure your application meets the requirements;

- Dedicate space to your relevant higher education diplomas and your certificates to show recruiters you have the necessary industry background.