As an investment manager, articulating your complex financial strategies and achievements without overwhelming potential employers is a challenge on your resume. Our guide offers clear examples and effective techniques to help you succinctly convey your expertise and value, ensuring your resume stands out in a competitive field.

- Utilize real-life examples to refine your investment manager resume;

- Effectively write the experience section of your investment manager resume, even if you have minimal or no professional experience;

- Incorporate the industry's top 10 essential skills throughout your resume;

- Include your education and certifications to highlight your specific expertise.

If the investment manager resume isn't the right one for you, take a look at other related guides we have:

- Relationship Manager Resume Example

- Library Director Resume Example

- Small Business Manager Resume Example

- Strategy Manager Resume Example

- Center Manager Resume Example

- Solution Manager Resume Example

- Shift Manager Resume Example

- Venue Manager Resume Example

- Logistics Account Manager Resume Example

- Marketing Account Manager Resume Example

The ultimate formula for your investment manager resume format

Our best advice on how to style your investment manager resume is this - first, take the time to study the job advert requirements.

The resume format you select should ultimately help you better align how your experience matches the specific role.

There are four crucial elements you need to thus take into consideration:

- How you present your experience. If you happen to have plenty of relevant expertise, select the reverse-chronological resume format to organize your experience by dates, starting with the latest.

- Don't go over the top with writing your resume. Instead, stick with a maximum of two-page format to feature what matters most about your profile.

- Headers aren't just for "decoration". The header of your resume helps recruiters allocate your contact details, portfolio, and so much more.

- The PDF format rules. It's the most common practice to submit your investment manager resume as a PDF so that your resume doesn't lose its layout. However, make sure the read the job well - in some instances, they might require a doc file.

Consider the local standards – Canadian resumes, for example, may have a different format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Traditional sections, appreciated by recruiters, for your investment manager resume:

- Clear and concise header with relevant links and contact details

- Summary or objective with precise snapshot of our career highlights and why you're a suitable candidate for the investment manager role

- Experience that goes into the nuts and bolts of your professional qualifications and success

- Skills section(-s) for more in-depth talent-alignment between job keywords and your own profile

- Education and certifications sections to further show your commitment for growth in the specific niche

What recruiters want to see on your resume:

- Demonstrated investment analysis and portfolio management skills

- Evidence of strong financial modeling and quantitative analysis abilities

- Track record of achieving superior financial returns and managing risk

- Knowledge of investment theory, various asset classes, and financial markets trends

- Relevant certifications such as CFA (Chartered Financial Analyst) or similar credentials

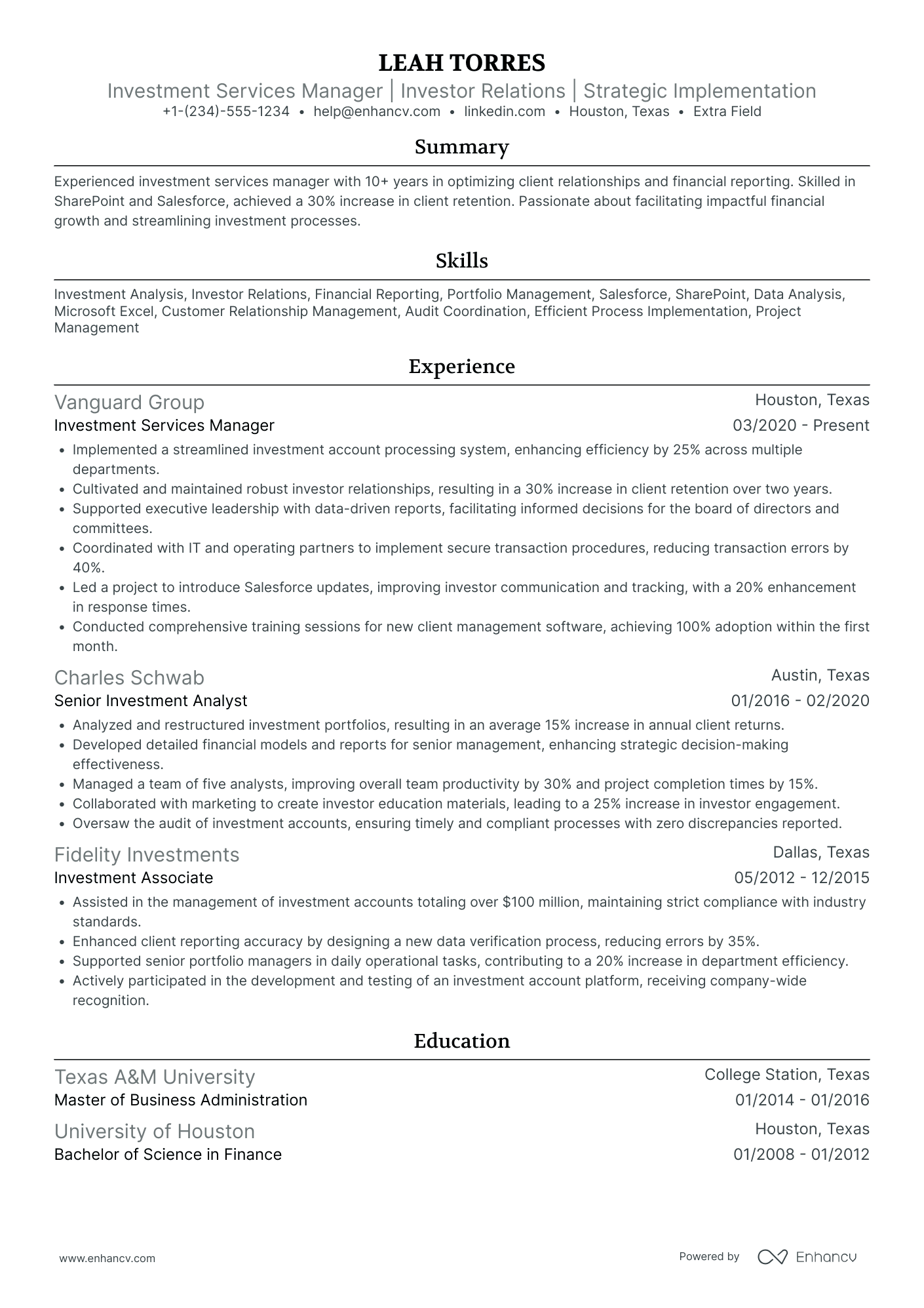

Essential tips for crafting your investment manager resume experience section

The experience section is indeed the core of your investment manager resume. It's where you present your past and current job roles. But how should you approach this crucial part?

A common error is treating the experience section as merely a list of job duties. Many candidates fall into the trap of detailing what they did without illustrating the impact of their actions.

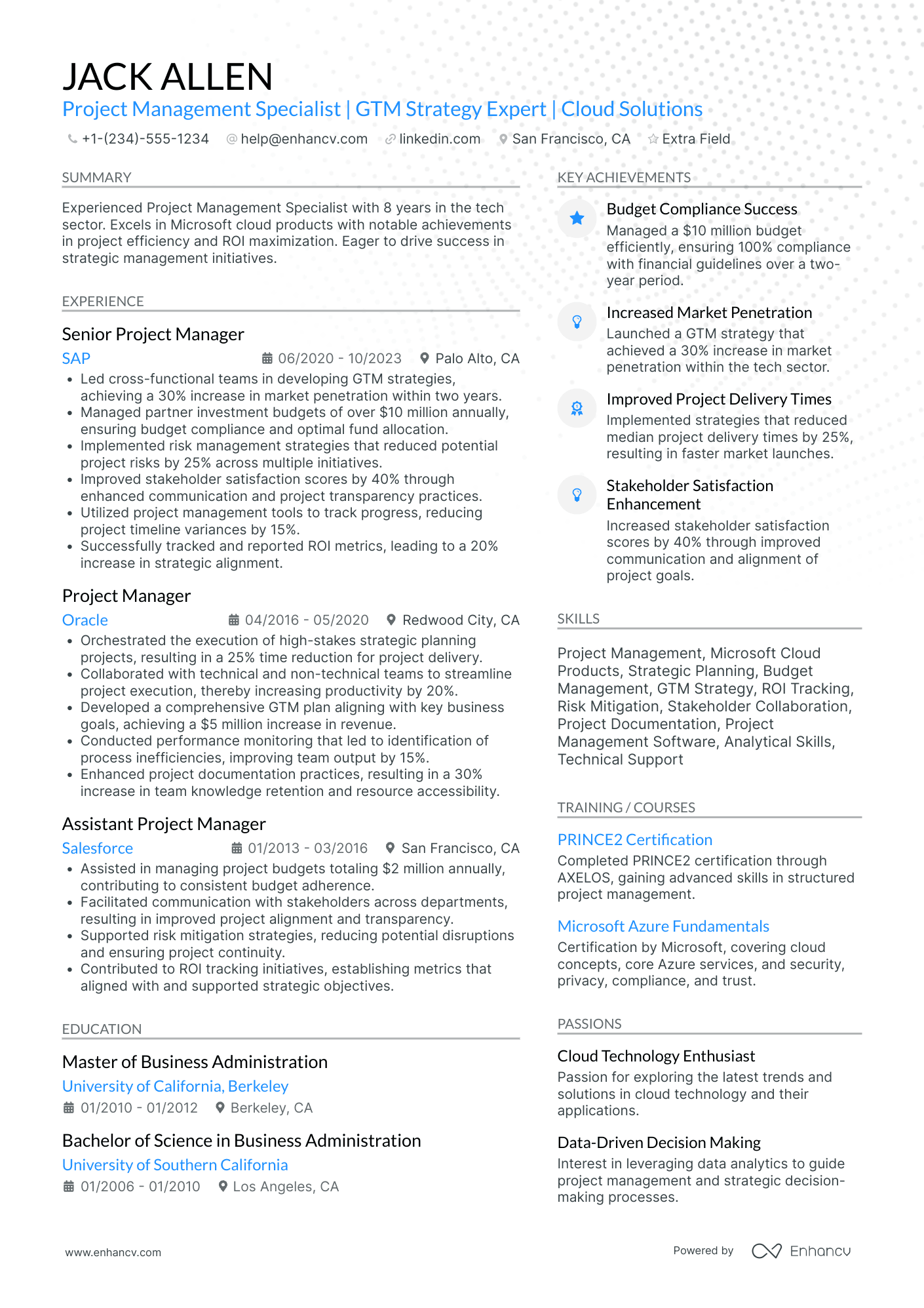

To effectively write your investment manager resume experience section, consider these guidelines:

- Emphasize your achievements, supported by concrete metrics such as percentages, revenue increases, or customer satisfaction rates;

- Avoid using generic buzzwords like communication, hard work, or leadership. Instead, demonstrate how these skills added value in your previous roles;

- Begin each bullet point with a strong action verb, followed by a skill, and then the result of your actions;

- Tailor your resume for each job application by selecting the most relevant experiences, responsibilities, and successes.

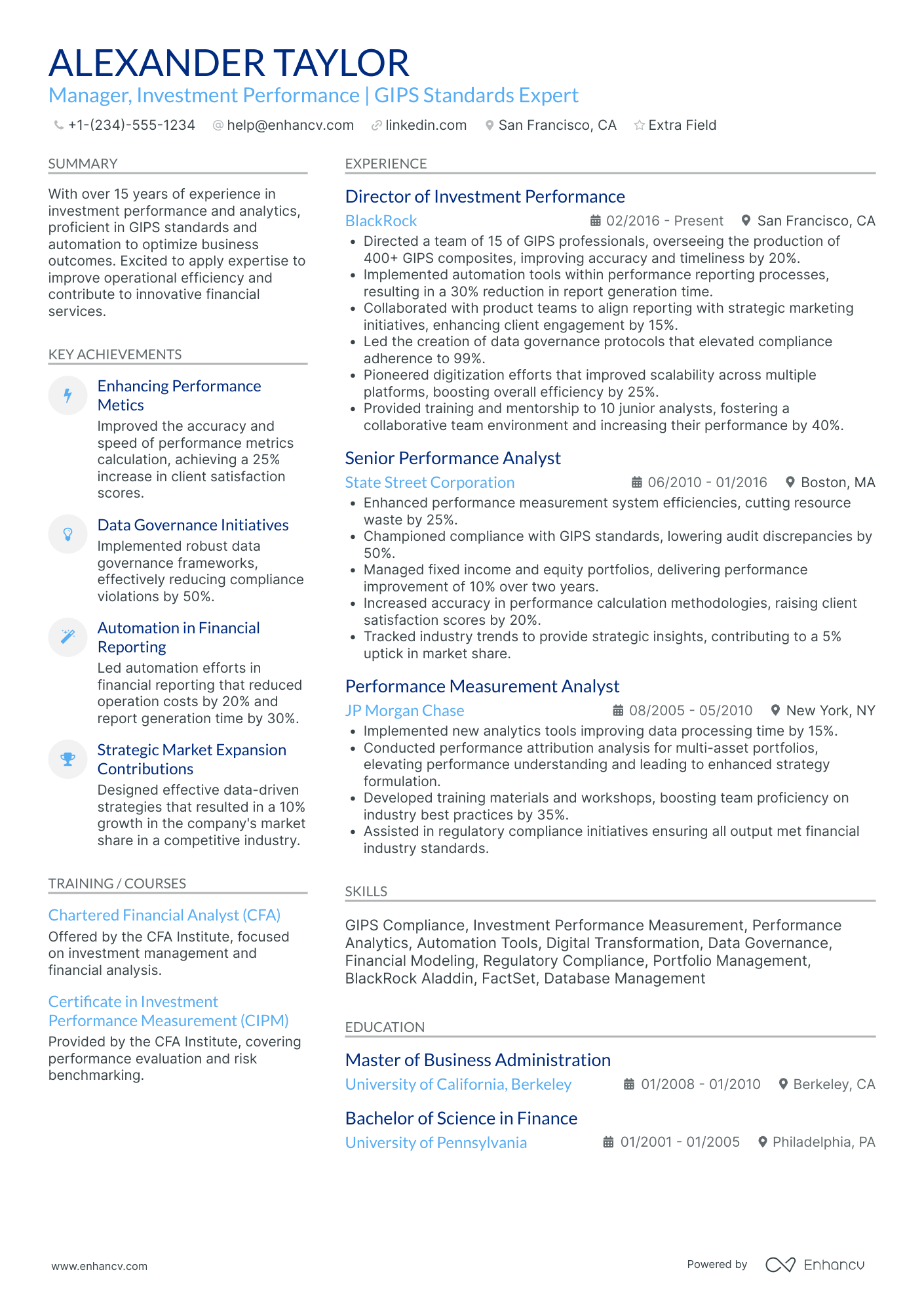

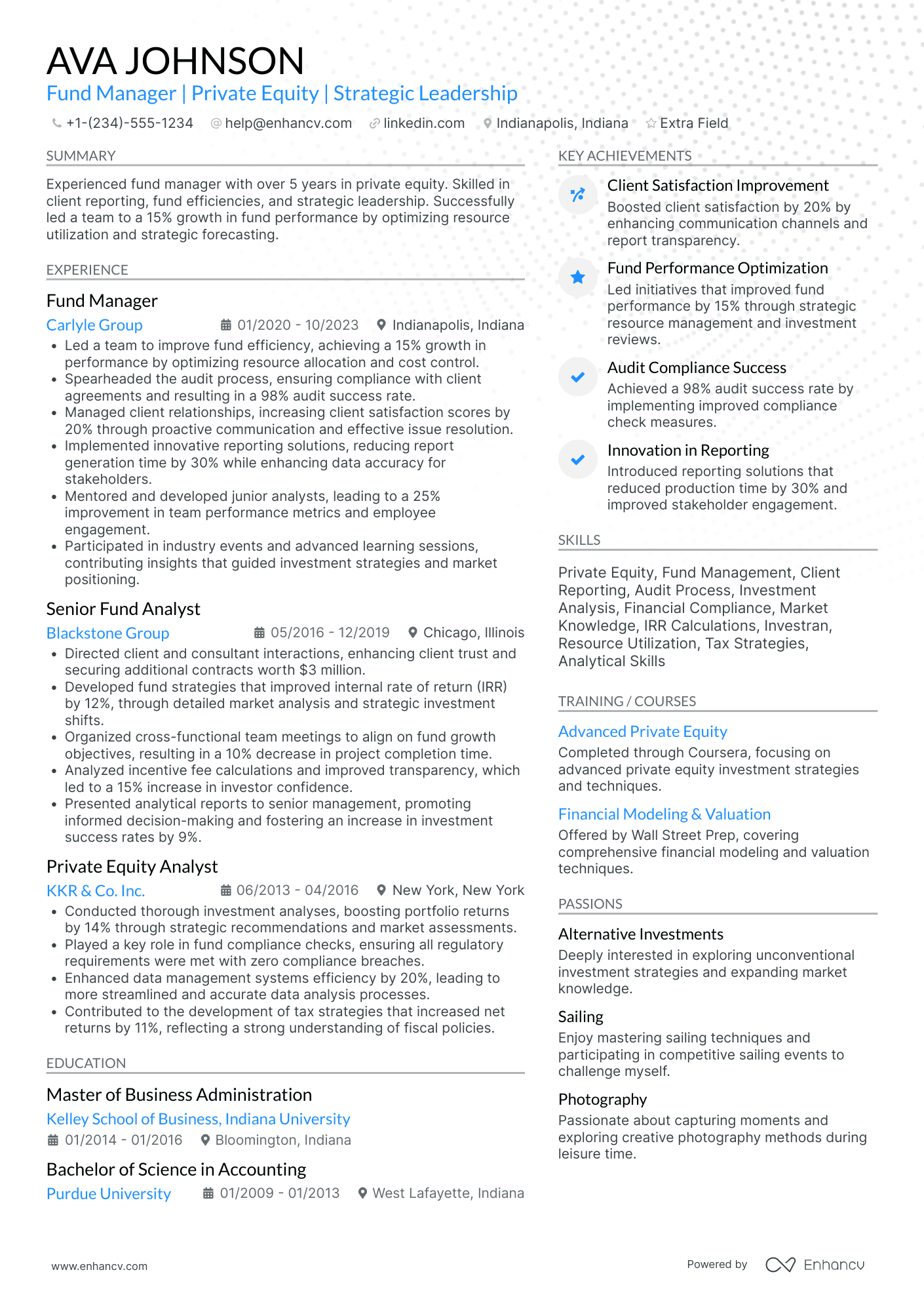

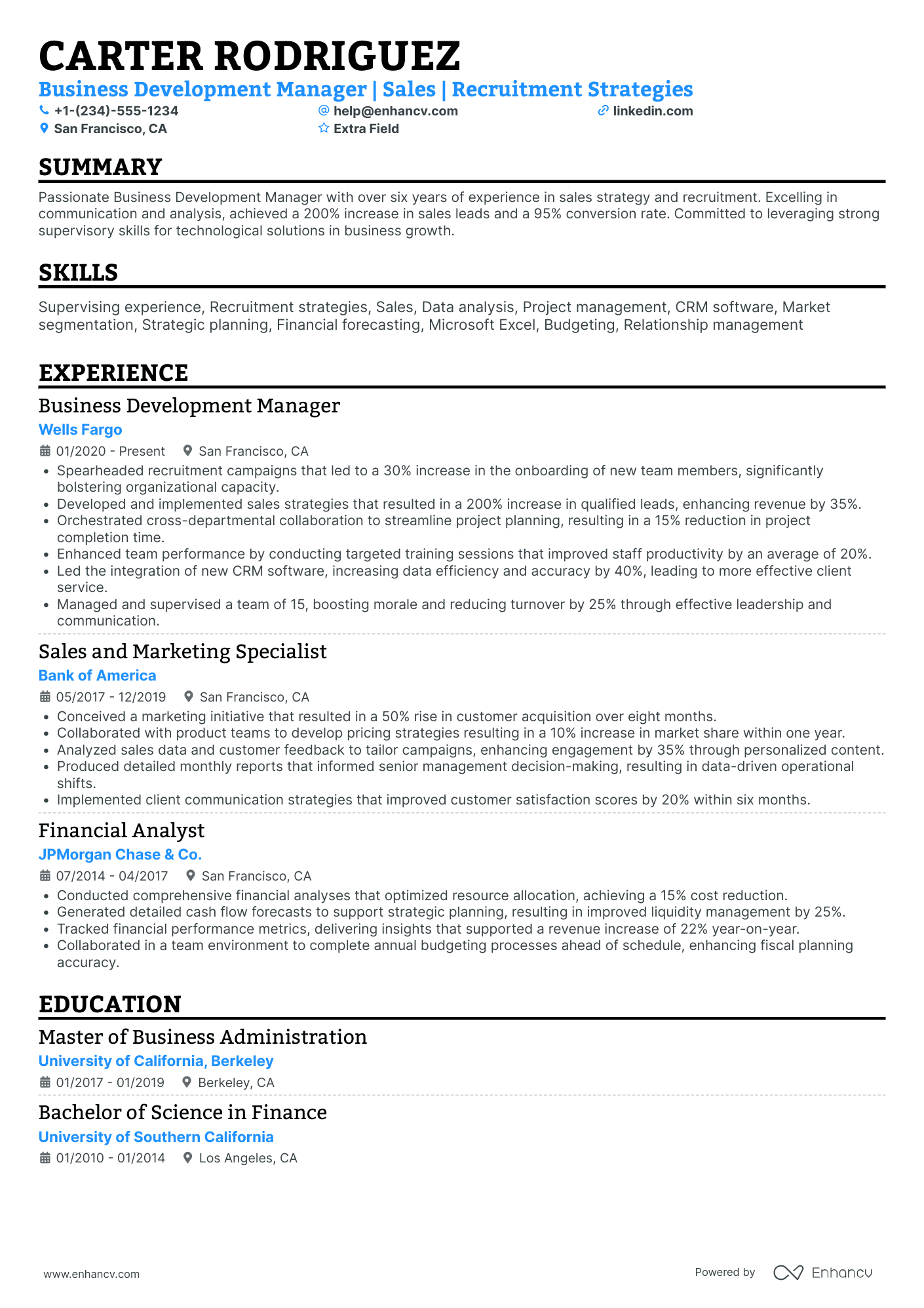

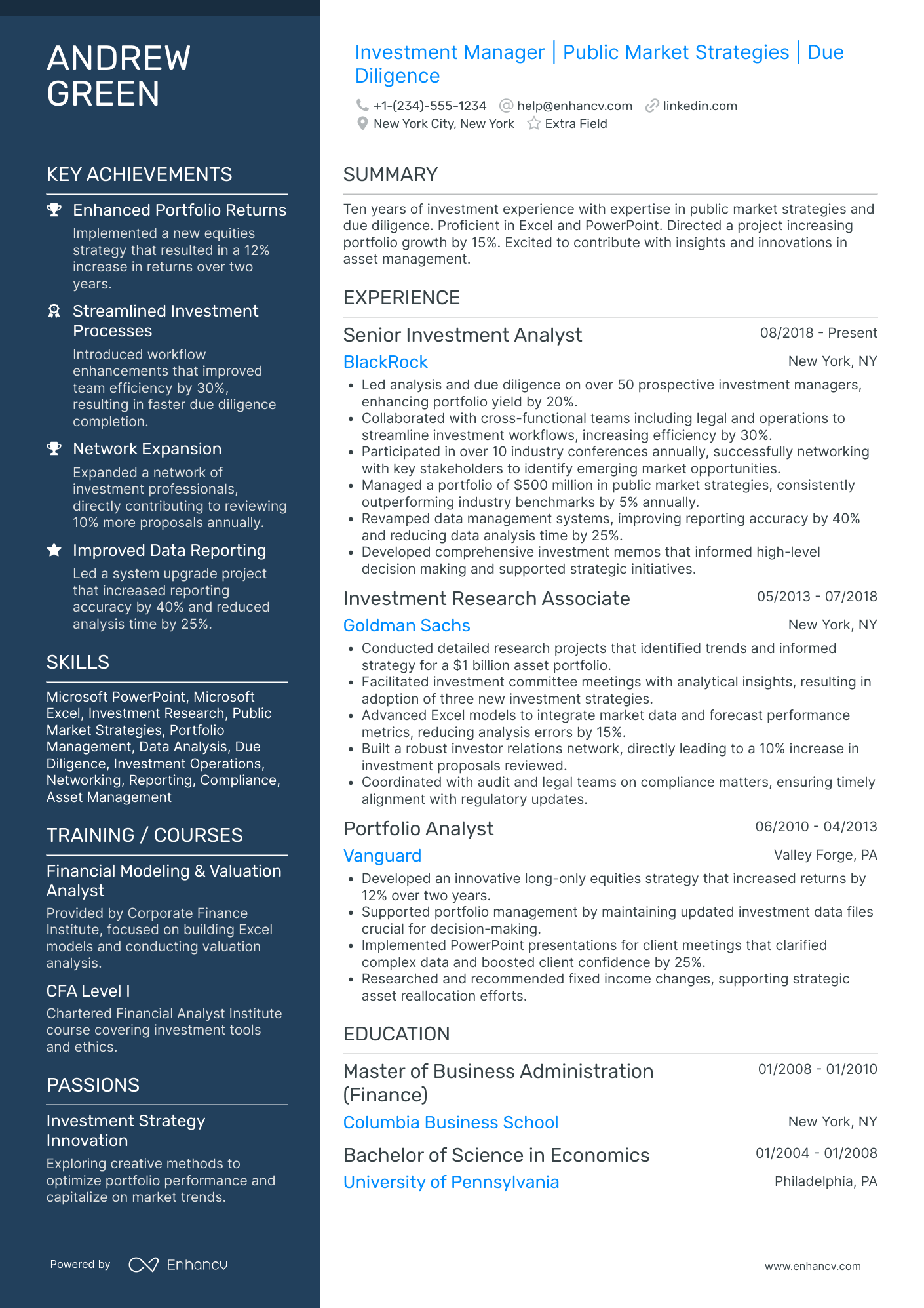

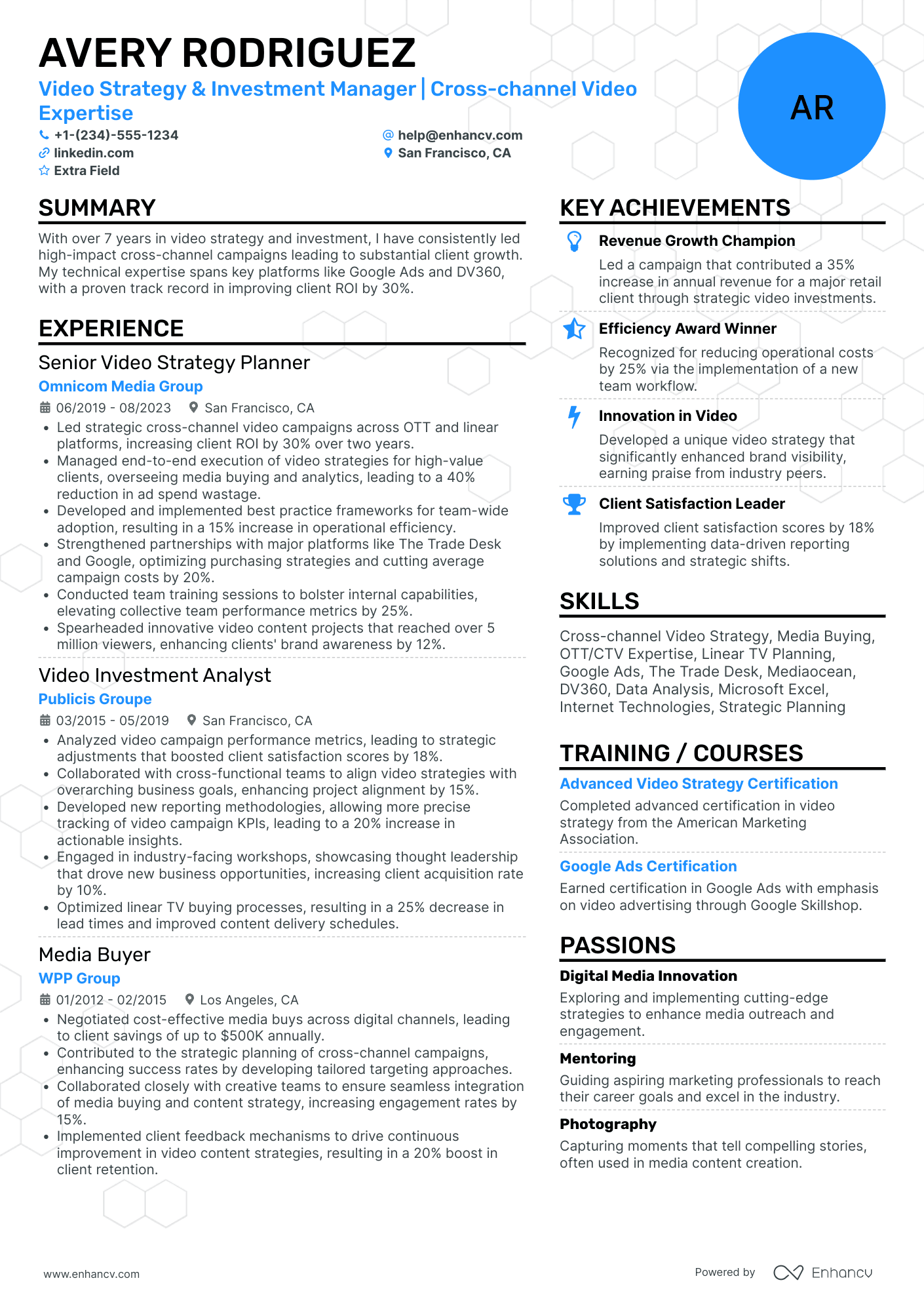

We have an array of resume examples that illustrate how to optimally curate your investment manager resume experience section.

- Managed a diversified investment portfolio totaling $200 million, focusing on high-growth tech equities and fixed income securities, achieving 15% year-over-year growth.

- Designed and implemented a proprietary quantitative analysis platform that increased portfolio efficiency by 30%, allowing for more accurate risk assessment and optimization.

- Led a team of junior analysts and directed the strategic asset allocation process, resulting in the outperformance of benchmark indices by 10% over three years.

- Formulated investment strategies for high-net-worth clients that generated on average 20% return on investment annually across all client portfolios.

- Successfully navigated market downturns by employing tactical asset allocation and hedging strategies, significantly limiting losses to under 5%.

- Cultivated relationships with institutional clients, resulting in a 40% increase in managed assets over a 2-year period through referrals and direct business development efforts.

- Assisted in the management of a $300 million global equities fund, contributing to a consistent outperformance of the MSCI World Index by 5%.

- Played a key role in developing environmental, social, and governance (ESG) investment criteria that doubled the inflow of sustainable investment funds within a year.

- Implemented a client-centric service approach, resulting in a 95% client retention rate over my tenure.

- Oversaw a team of analysts to conduct in-depth market research which informed investment decisions, contributing to a 12% compound annual growth rate of the managed portfolios.

- Developed and launched an emerging market investment initiative that attracted $150 million in new capital investments within the first 18 months.

- Orchestrated the due diligence process for potential investment opportunities, increasing deal flow efficiency by 25% through enhanced selection criteria.

- Crafted and executed a global macro strategy, leveraging geopolitical and economic analysis to achieve superior returns in emerging markets.

- Integrated a sophisticated artificial intelligence model for predictive analysis, resulting in a 20% decrease in forecasting errors across international investment ventures.

- Increased the AUM (Assets Under Management) for strategic investment funds by 35% through innovative fund structuring and investor education campaigns.

- Supervised the allocation of $50 million in capital investments across domestic and international projects, which yielded an average IRR (Internal Rate of Return) of 18%.

- Developed a comprehensive risk management framework that decreased volatility in client portfolios by 20% during periods of economic uncertainty.

- Established a mentorship program for junior staff that improved team productivity by 15% and fostered professional development within the firm.

- Directed all investment operations, ensuring compliance with regulatory standards and facilitating smooth execution of trade strategies and transactions.

- Implemented a series of process improvements using Lean Six Sigma methodologies, which cut costs by 10% across operational processes.

- Enhanced the investment reporting system to provide more insightful analytics and metrics, which improved investment decision-making for the firm's clients and stakeholders.

- Focused on equity investments within the technology and healthcare sectors, leading to an outperformance of the S&P 500 Health Care Sector Index by 8%.

- Negotiated and finalized seed funding deals for startups totaling over $25 million, providing clients early access to high-potential investment opportunities.

- Implemented an investor education series which empowered clients to understand market trends and investment strategies, increasing client satisfaction scores by 30%.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for investment manager professionals.

Top Responsibilities for Investment Manager:

- Establish and maintain relationships with individual or business customers or provide assistance with problems these customers may encounter.

- Oversee the flow of cash or financial instruments.

- Plan, direct, or coordinate the activities of workers in branches, offices, or departments of establishments, such as branch banks, brokerage firms, risk and insurance departments, or credit departments.

- Recruit staff members.

- Evaluate data pertaining to costs to plan budgets.

- Oversee training programs.

- Establish procedures for custody or control of assets, records, loan collateral, or securities to ensure safekeeping.

- Communicate with stockholders or other investors to provide information or to raise capital.

- Develop or analyze information to assess the current or future financial status of firms.

- Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans.

Quantifying impact on your resume

- Specify the assets under management (AUM) figures to showcase the scale of your investment responsibilities.

- Highlight the percentage growth of your investment portfolios to demonstrate your ability to generate returns.

- Include the number of investment strategies you've developed and executed to illustrate your strategic acumen.

- Quantify risk-adjustment metrics, such as Sharpe ratio, to prove your capability in managing and optimizing risk.

- Mention the size of the team you've led or collaborated with to reflect your leadership and teamwork skills.

- Document the number of investment analysis reports you've produced to indicate your proficiency in due diligence.

- Detail the number and size of deals or transactions you've closed to emphasize your effectiveness in securing investments.

- Record the amount of capital you've raised or contributed to in fundraising efforts to exhibit your networking and capital deployment skills.

Action verbs for your investment manager resume

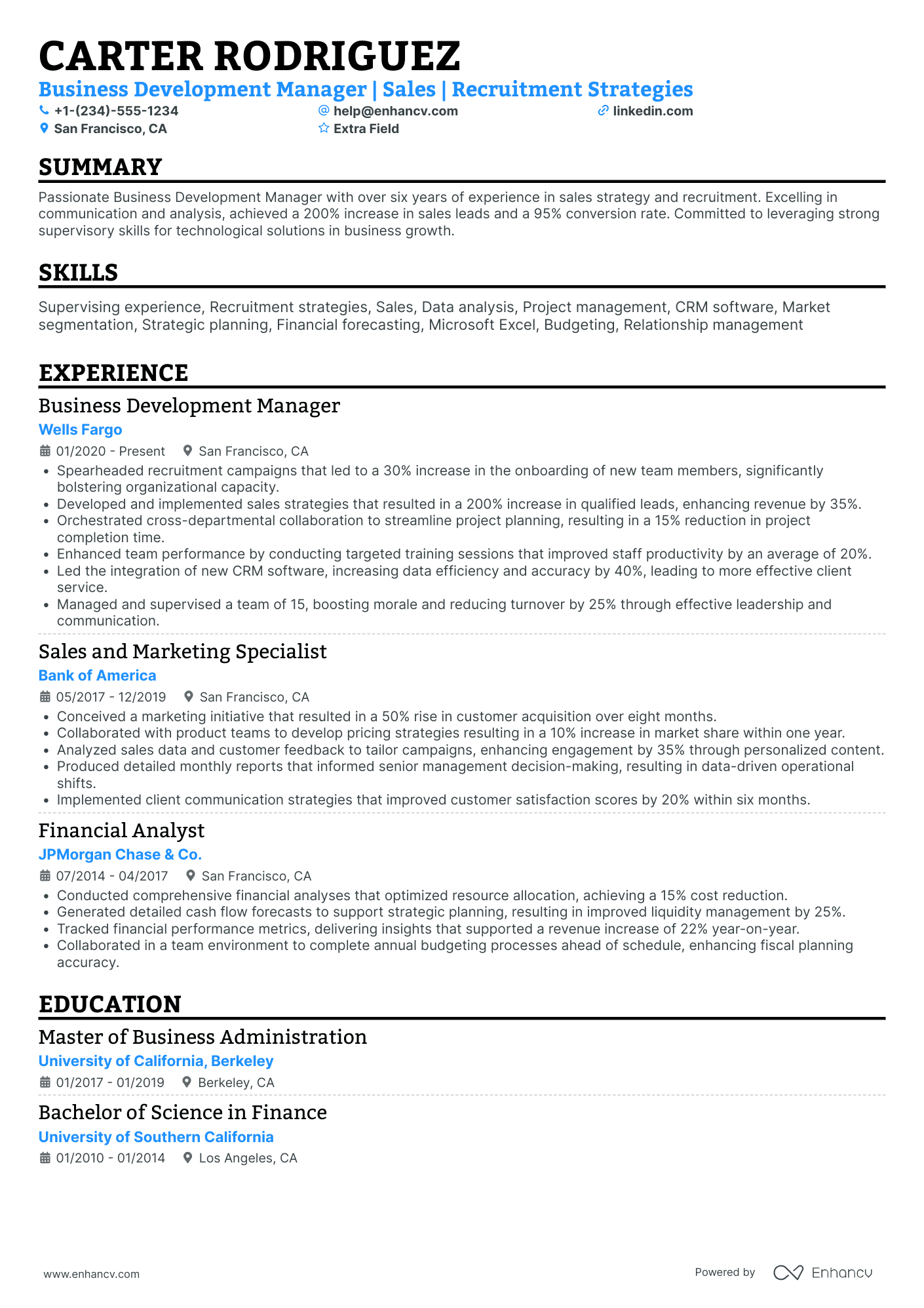

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, investment manager resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

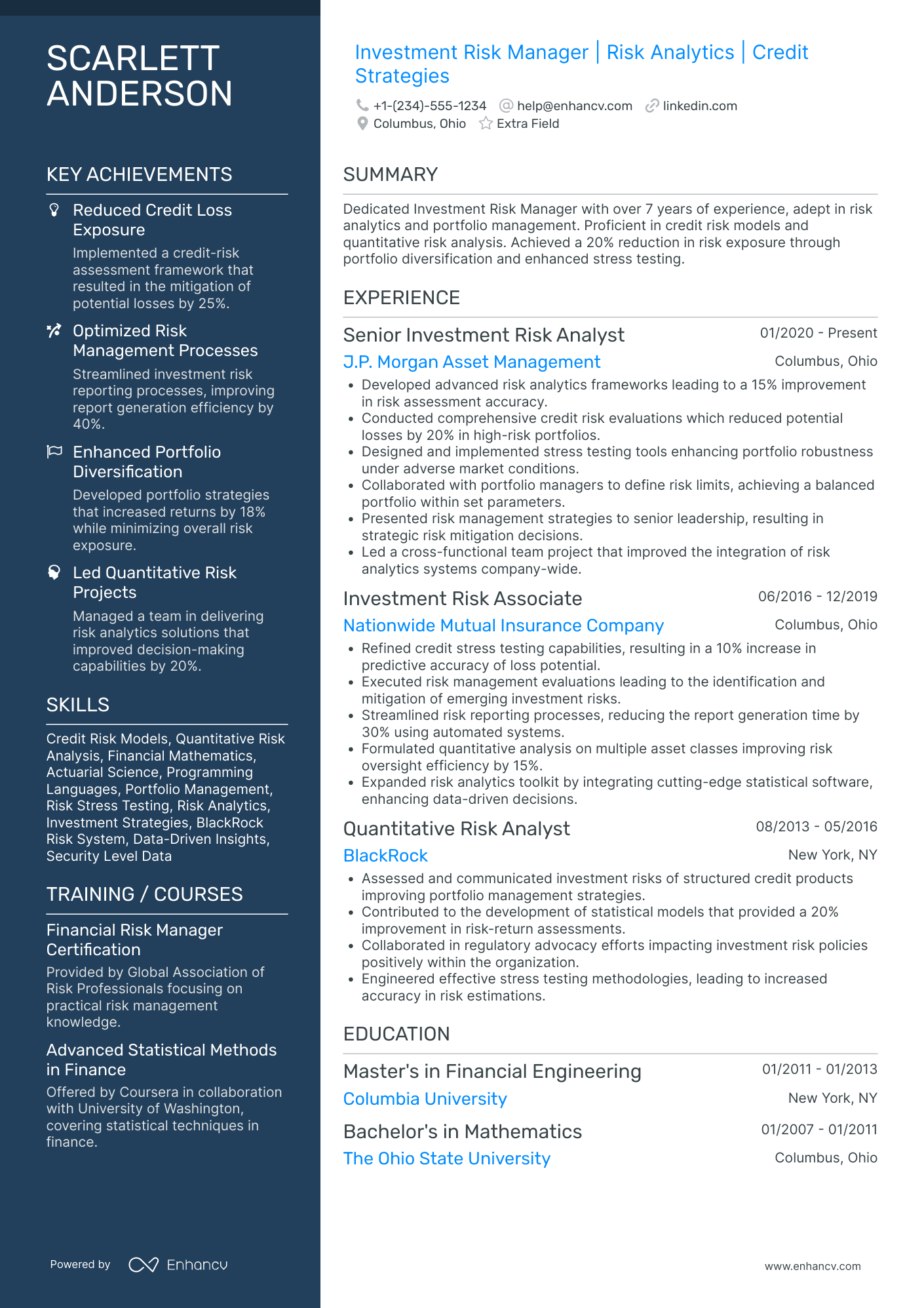

Investment manager resume skills: the essential hard skills and soft skills checklist

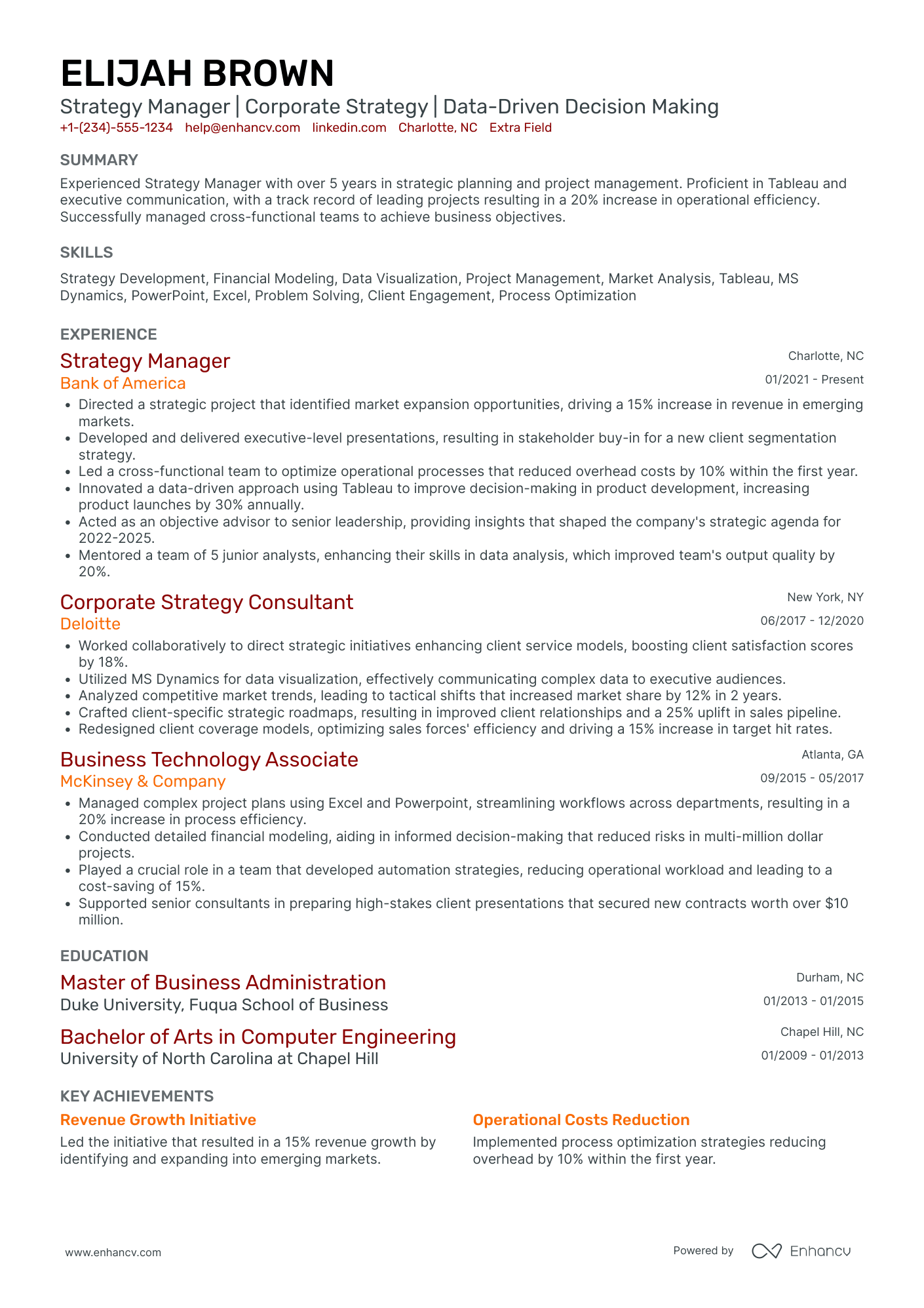

Ultimately, your investment manager resume should hint to recruiters that you possess an array of talents that are indispensable to the role.

For example, listing the technologies and software you're apt at using (or your hard skills) and how you apply them in your day-to-day responsibilities would ensure you meet the technical requirements of the role.

But is this enough to ensure that you make a good impression on recruiters?

Go a step further by detailing the soft skills or personality traits you've attained thanks to your work and life experience.

The best way to balance hard skills and soft skills on your investment manager resume is by:

- Highlighting up to three of your most noteworthy career accomplishments in a separate section.

- Listing at least one hard skill and one soft skill you've used to solve a particular challenge or problem.

- Feature niche skills and technologies that would help you stand out amongst candidates.

- Think back on the social impact your efforts have had towards improving the work environment - were you able to always maintain a professional ethic, while enhancing the team culture? Write about your contribution to the role, department, or organization itself as a metric of success.

The skills section of your resume provides you with plenty of opportunities to detail your technical and personal traits.

All you have to do is select the talents that best fit your application and expertise. Make note of some of the most prominent hard and soft skills across the industry from our list:

Top skills for your investment manager resume:

Financial Modeling

Portfolio Management Software

Risk Assessment Tools

Valuation Techniques

Investment Research Platforms

Excel Advanced Functions

Bloomberg Terminal

Quantitative Analysis Tools

Data Visualization Software

Trading Platforms

Analytical Thinking

Communication Skills

Decision-Making

Negotiation Skills

Attention to Detail

Team Collaboration

Problem-Solving

Adaptability

Time Management

Interpersonal Skills

Next, you will find information on the top technologies for investment manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Investment Manager’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Microsoft SQL Server

- Yardi software

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

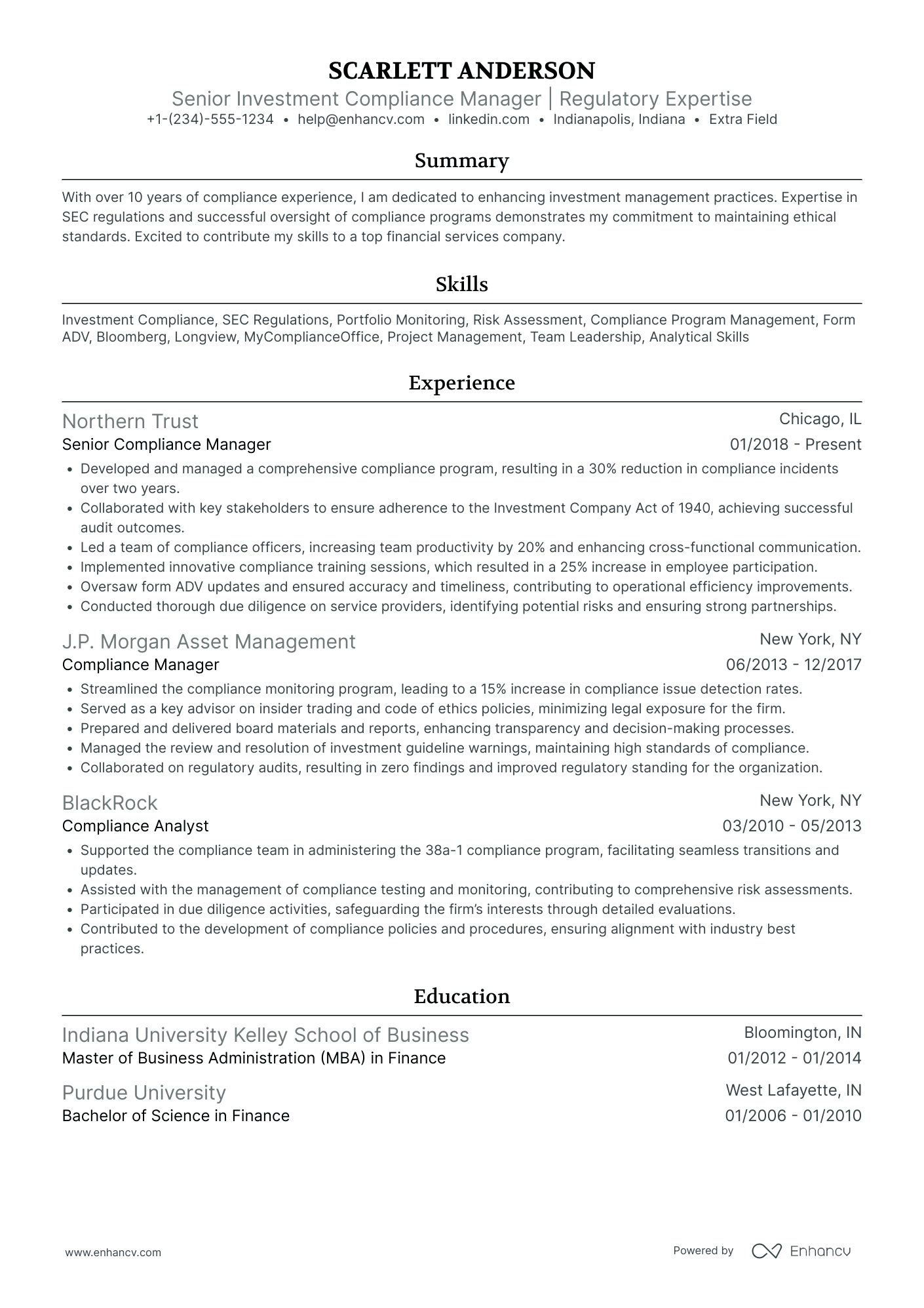

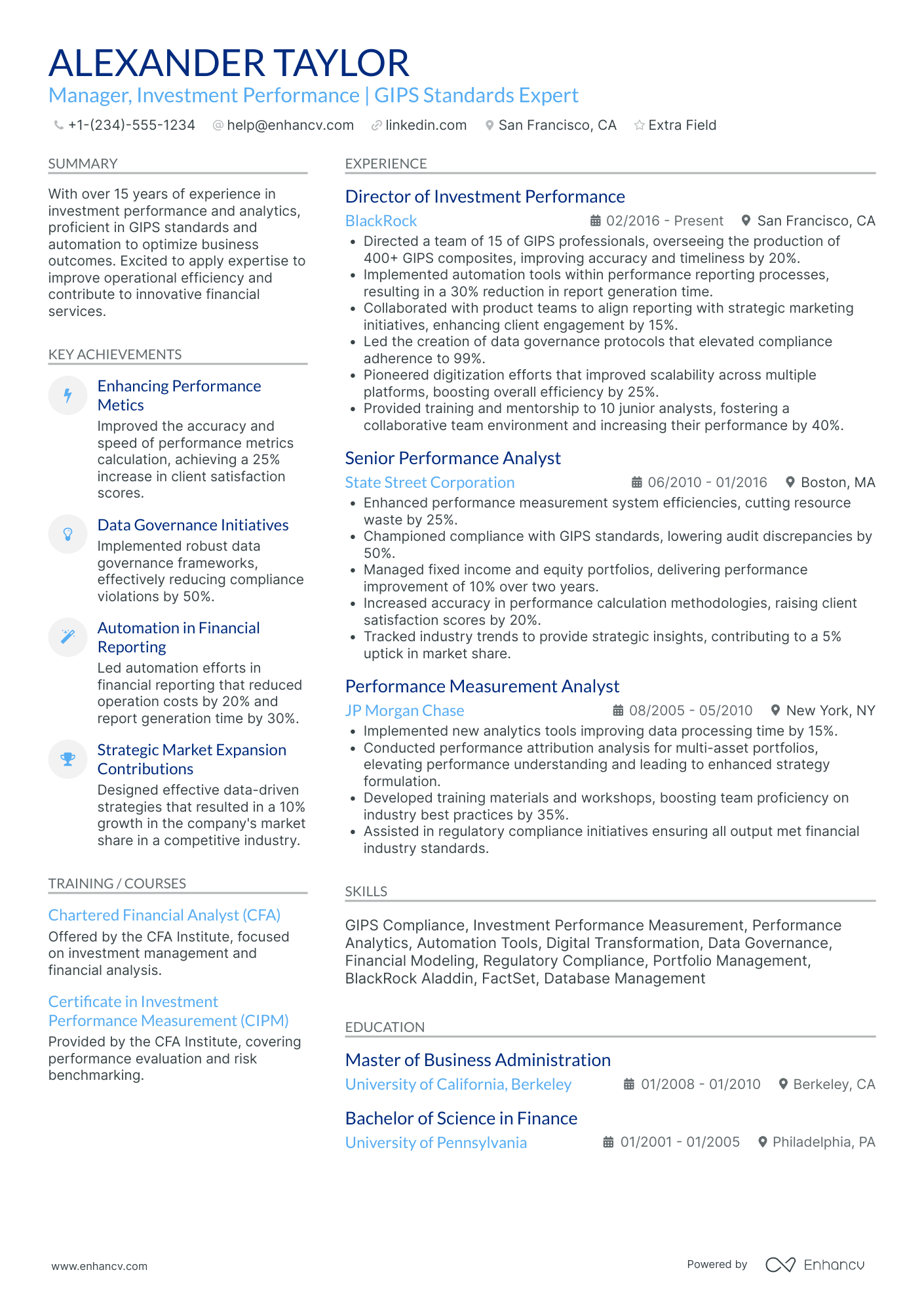

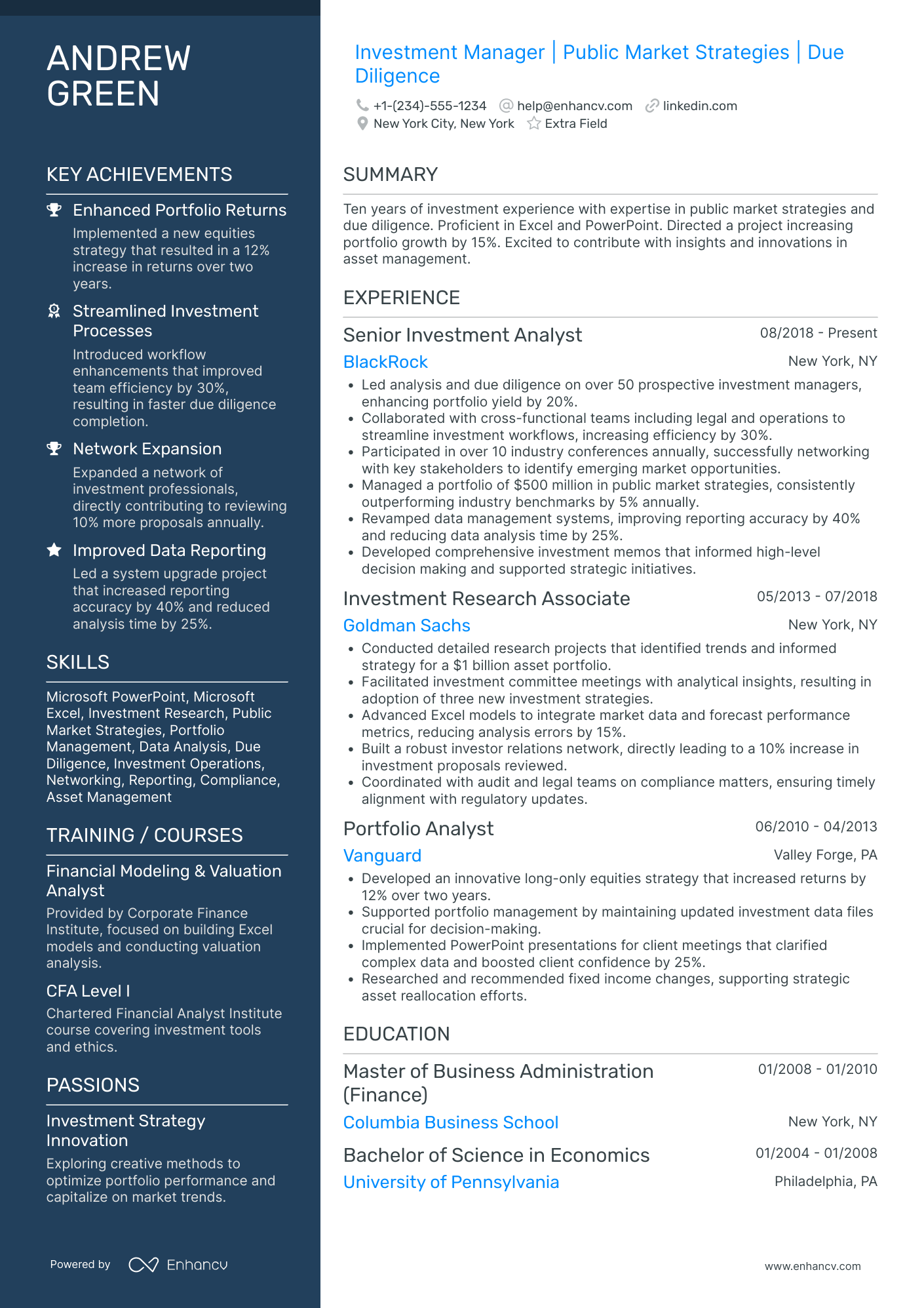

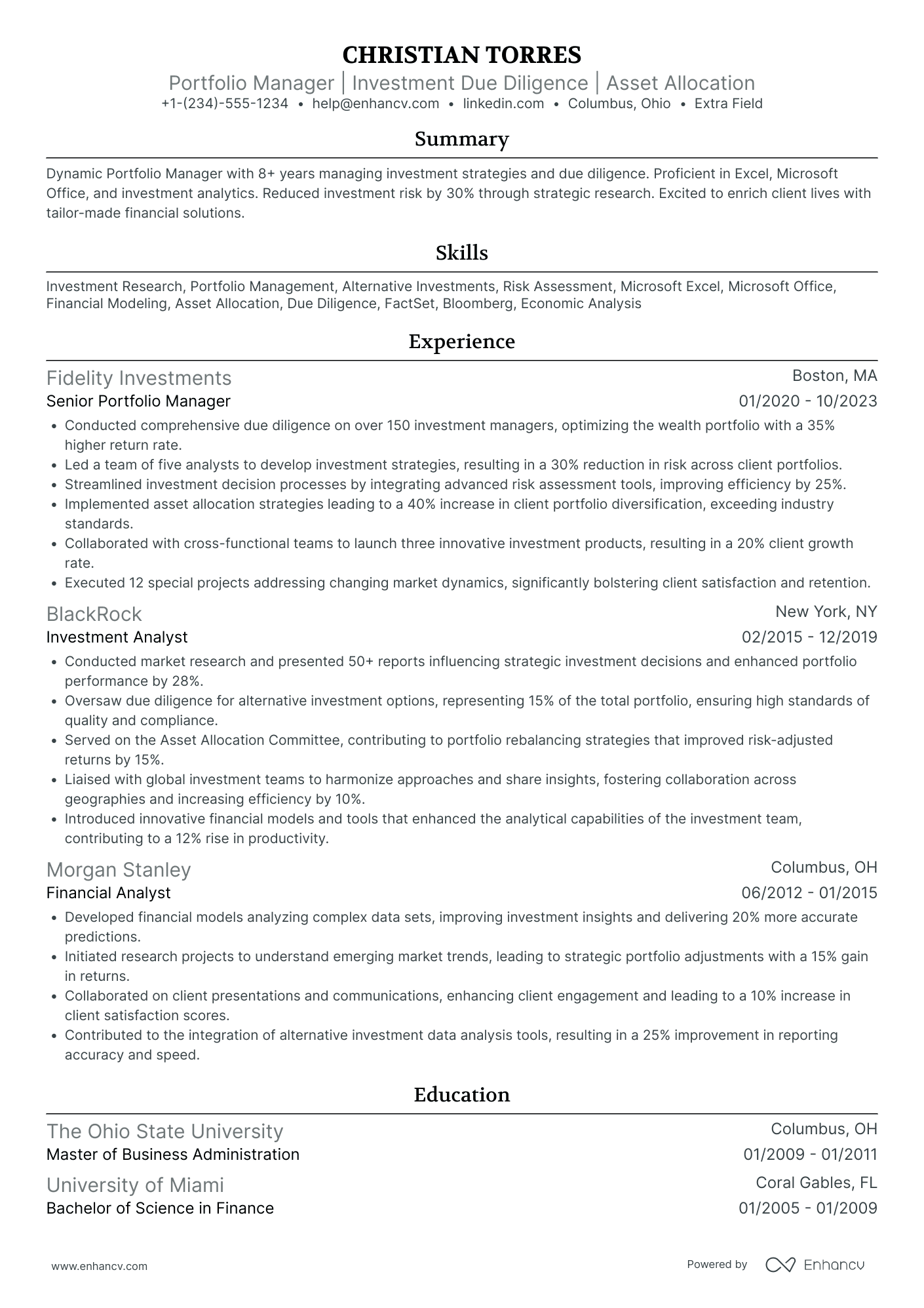

Discover the perfect certification and education to list on your investment manager resume

Value the insights your resume education section offers. It can shed light on various proficiencies and experiences tailored for the job.

- Add only college or university degrees, stating the institution and duration.

- If you're nearing the end of your degree, note your graduation date.

- Weigh the pros and cons of including unrelated degrees - it might not be your best choice with so little space on your resume.

- Talk about your educational achievements if they amplify your relevant experience.

There are so many certificates you can list on your resume.

Just which ones should make the cut?

- List your prominent higher education degree in a separate box, alongside the name of the institute you've obtained it from and your graduation dates

- Curate only relevant certificates that support your expertise, hard skills, and soft skills

- Certificates that are more niche (and rare) within the industry could be listed closer to the top. Also, this space could be dedicated to more recent certifications you've attained

- Add a description to your certificates or education, only if you deem this could further enhance your chances of showcasing your unique skill set

When listing your certificates, remember that it isn't a case of "the more, the merrier", but rather "the more applicable they are to the industry, the better".

Recruiters have hinted that these are some of the most in-demand certificates for investment manager roles across the industry:

The top 5 certifications for your investment manager resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Investment Management Analyst (CIMA) - Investments & Wealth Institute

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

- Certified Financial Planner (CFP) - CFP Board

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for investment manager professionals.

Top US associations for a Investment Manager professional

- AICPA and CIMA

- American Bankers Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Recommended reads:

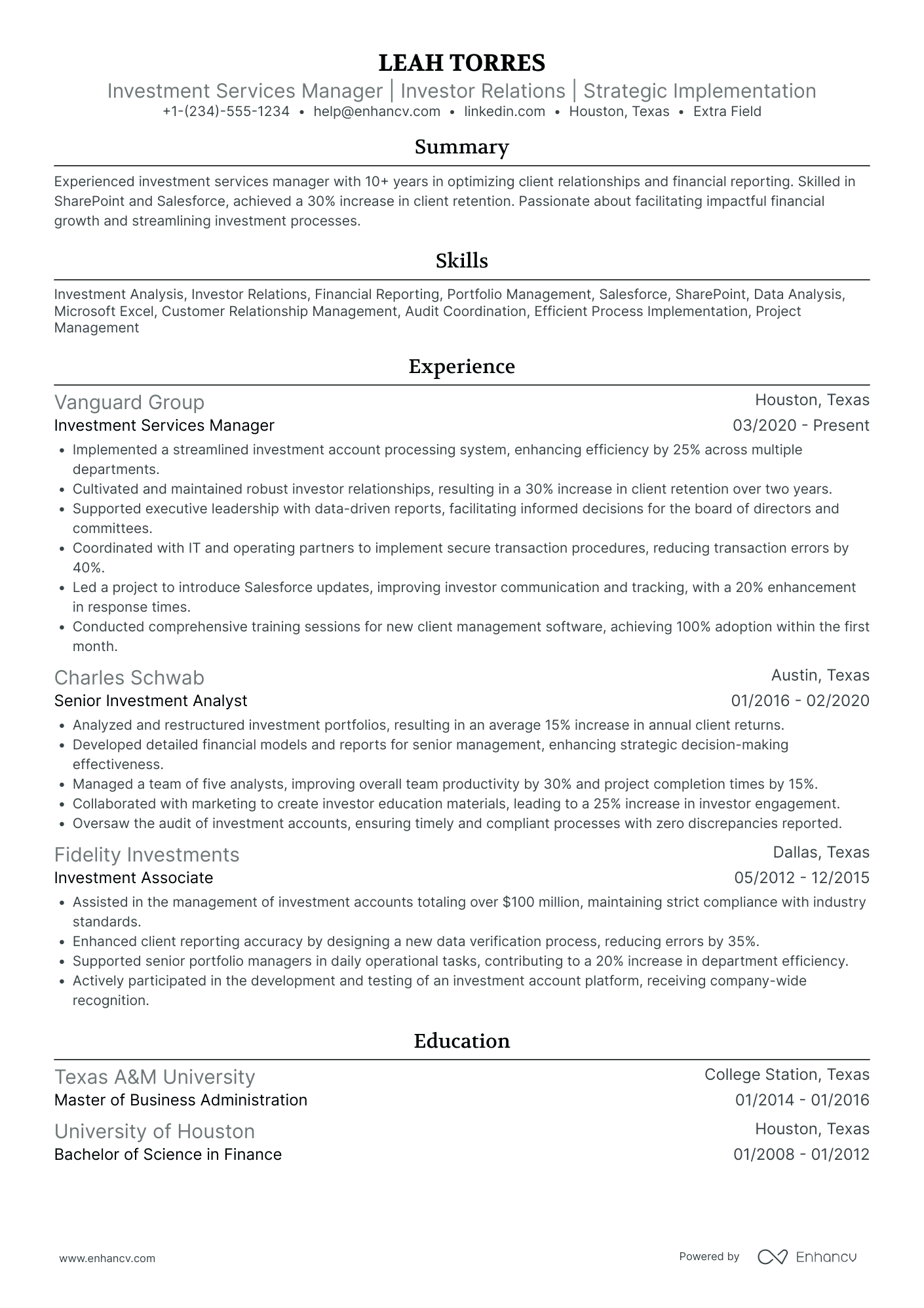

The ideal investment manager candidate resume summary or objective

You may have heard that your resume top one-third plays an important part in your application.

It basically needs to show strong alignment with the job advert, your unique skill set, and your expertise.

Both the resume summary and resume objective could be used to ensure you've shown why you're the best candidate for the role.

Use the:

- Resume objective to pinpoint your current successes, that are applicable to the field, and your vision for your career. Remember to state how you see yourself growing within this new career opportunity.

- Resume summary as an instrument to pinpoint what is most applicable and noteworthy form your professional profile. Keep your summary to be no more than five sentences long.

At the end of the day, the resume summary or objective is your golden opportunity to shine a light on your personality as a professional and the unique value of what it's like to work with you.

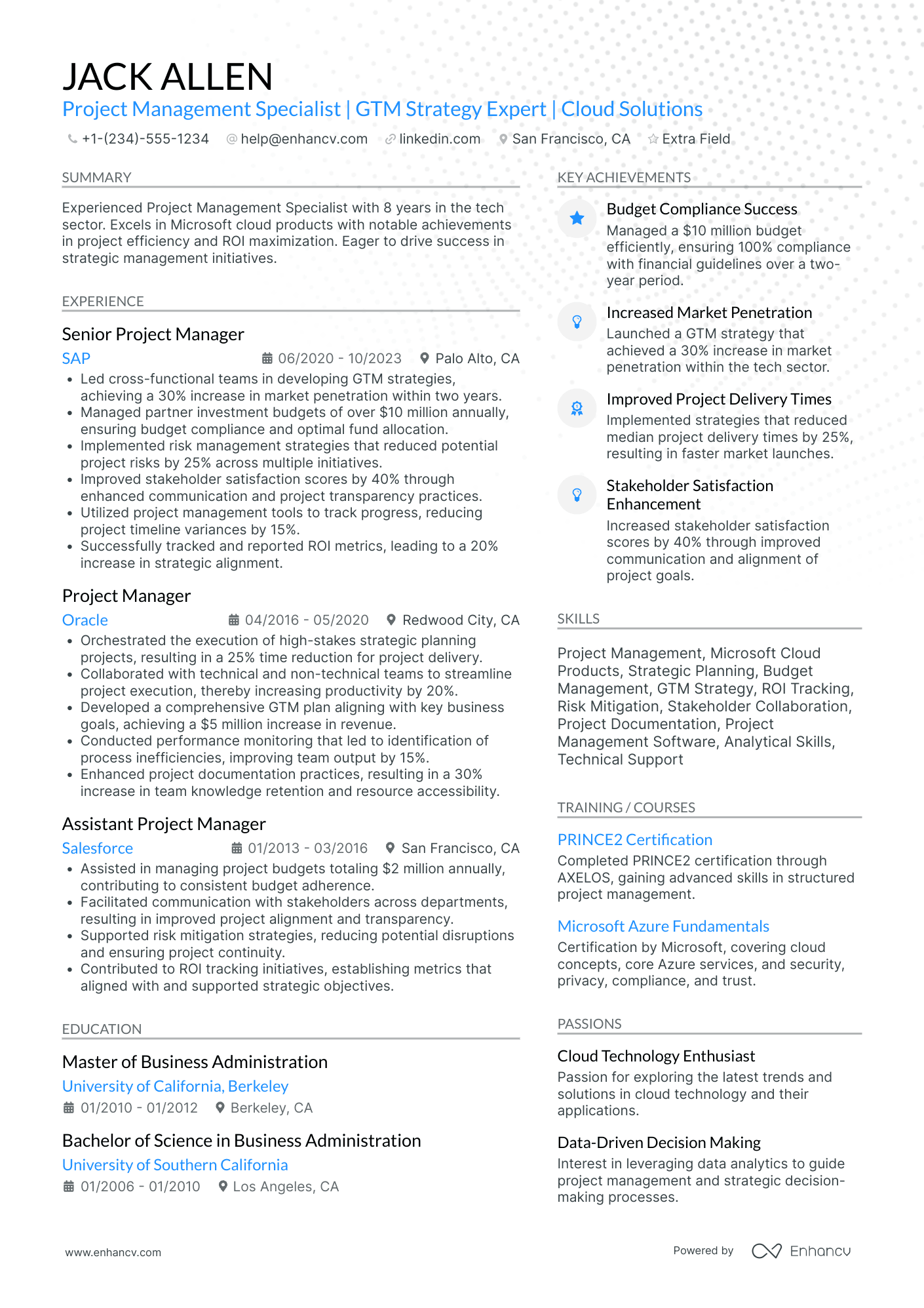

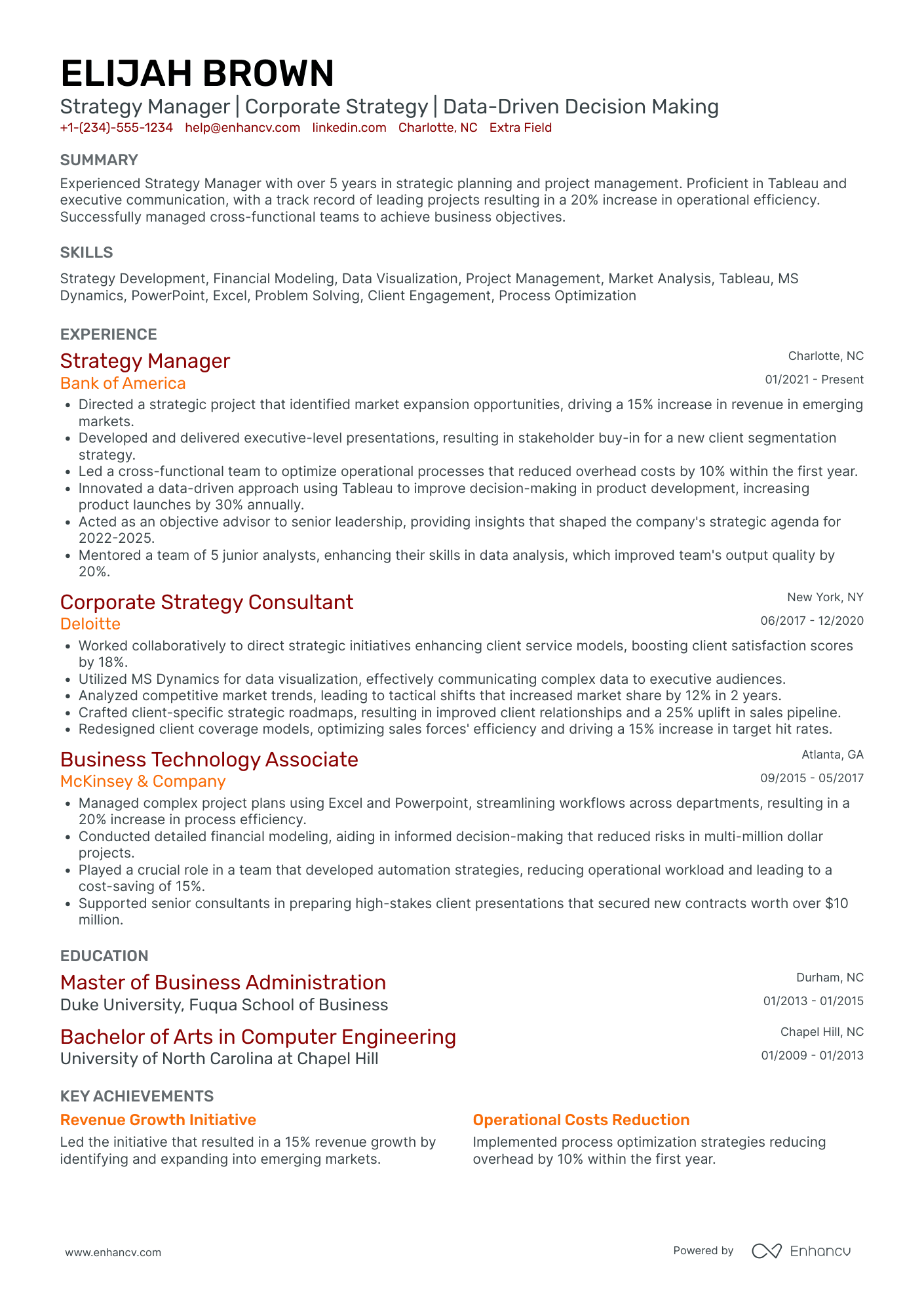

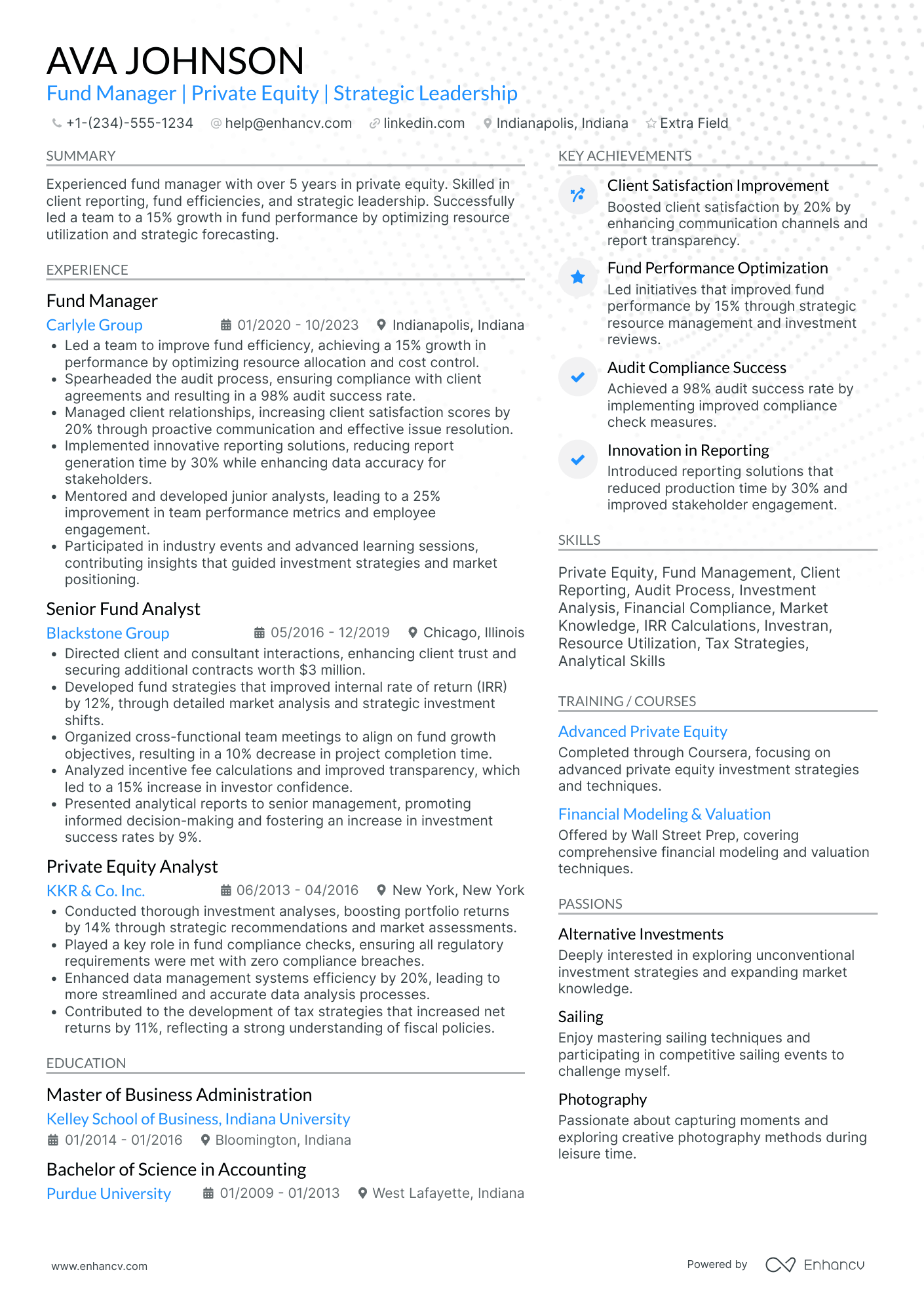

Get inspired with these investment manager resume examples:

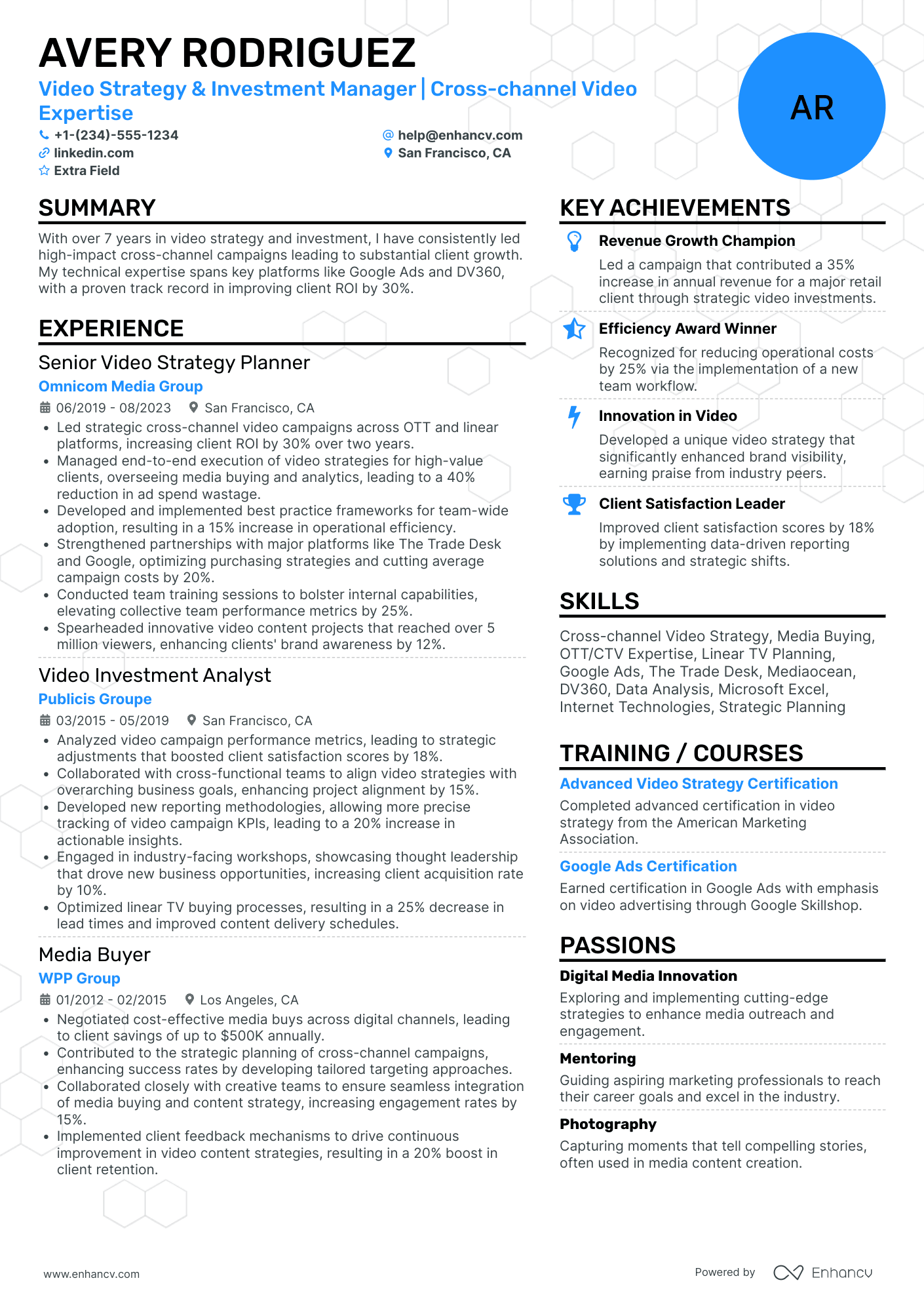

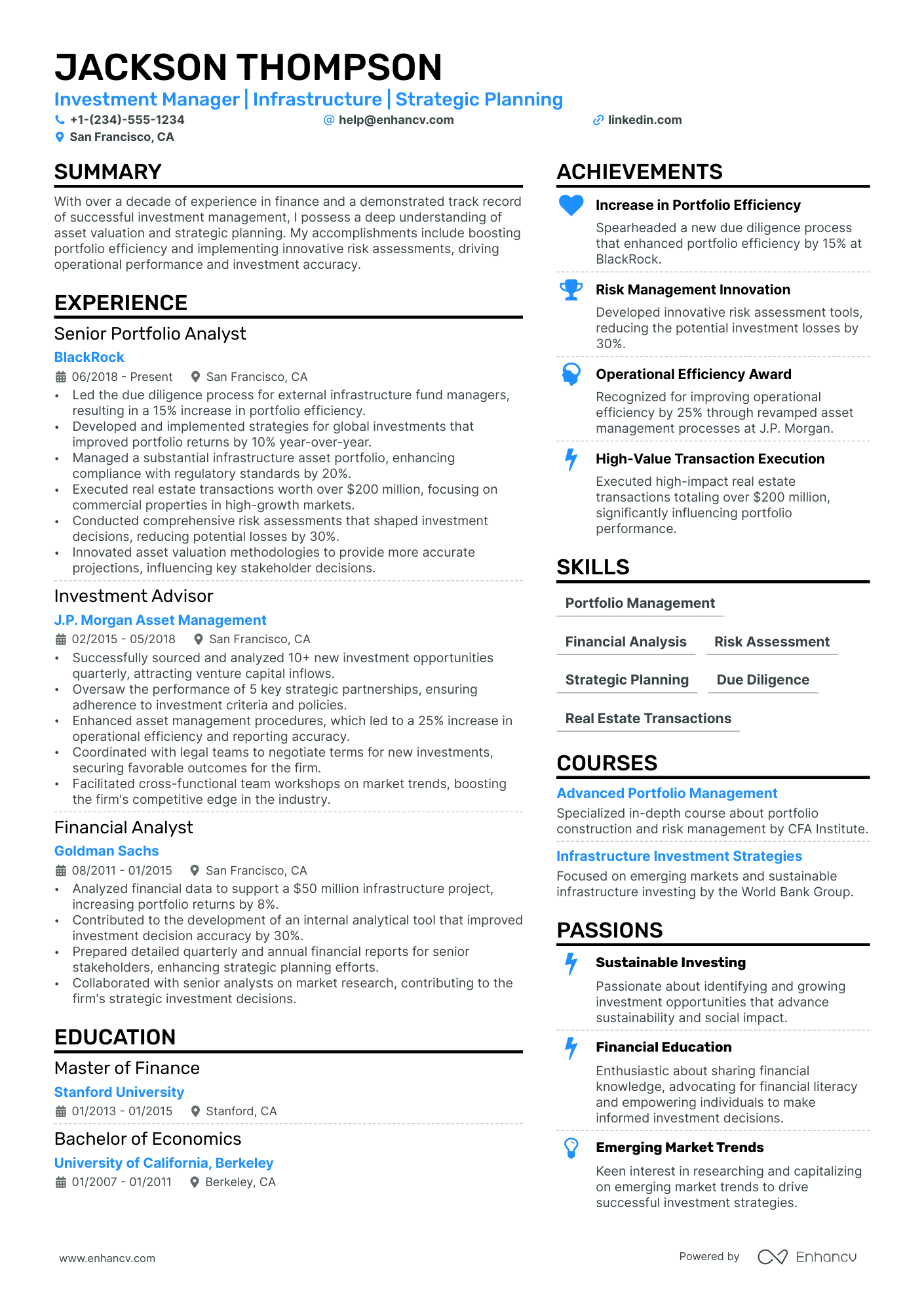

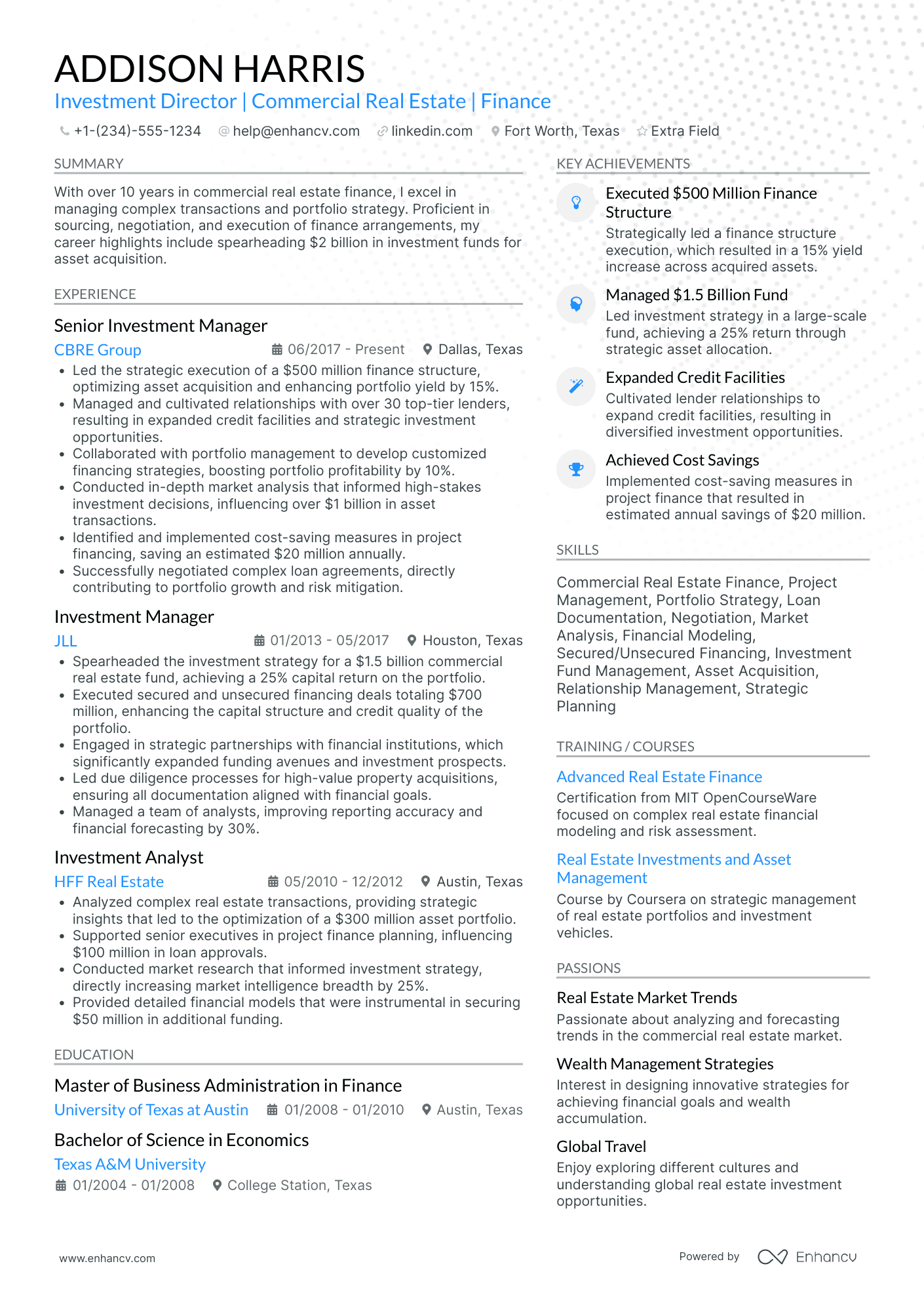

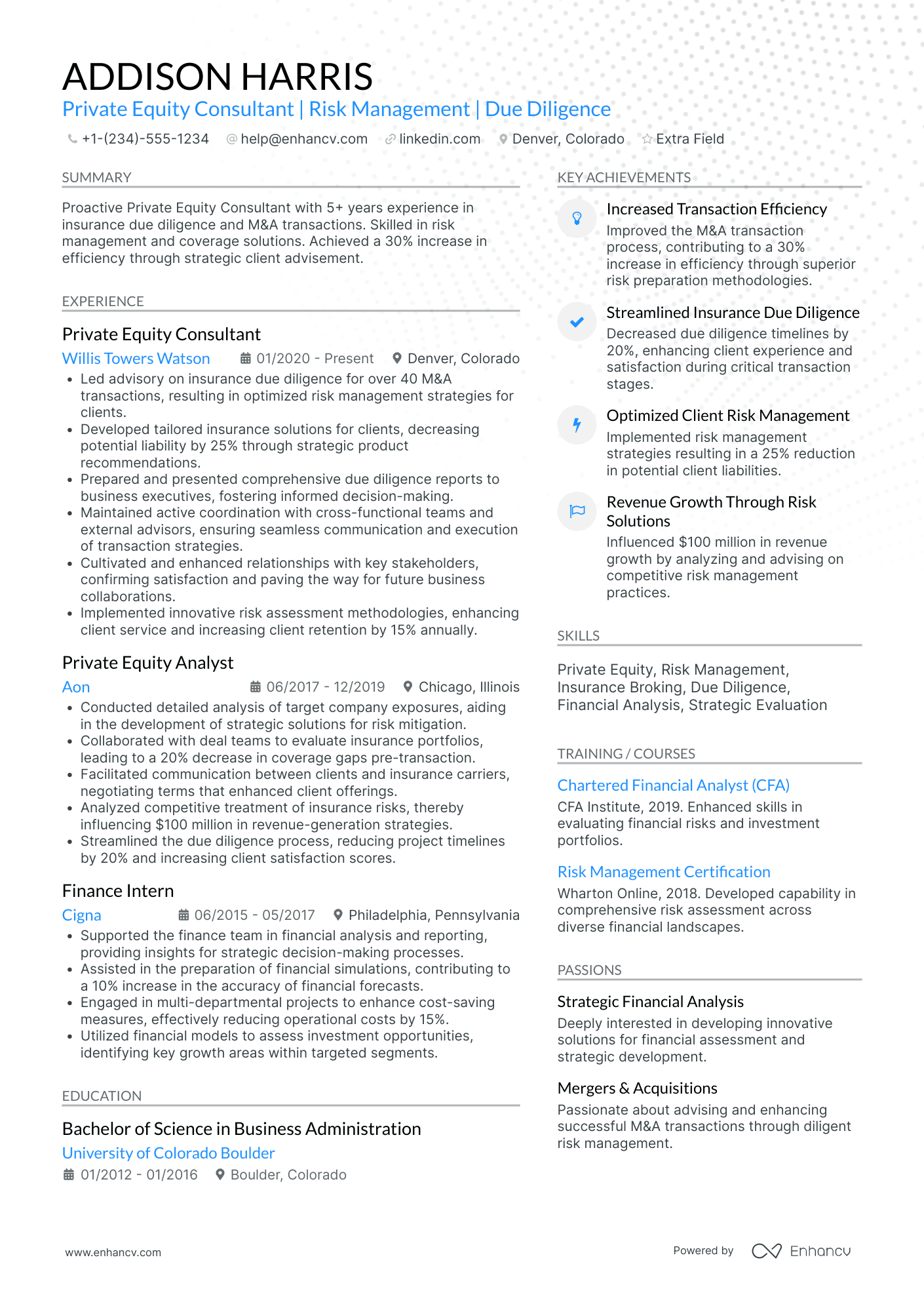

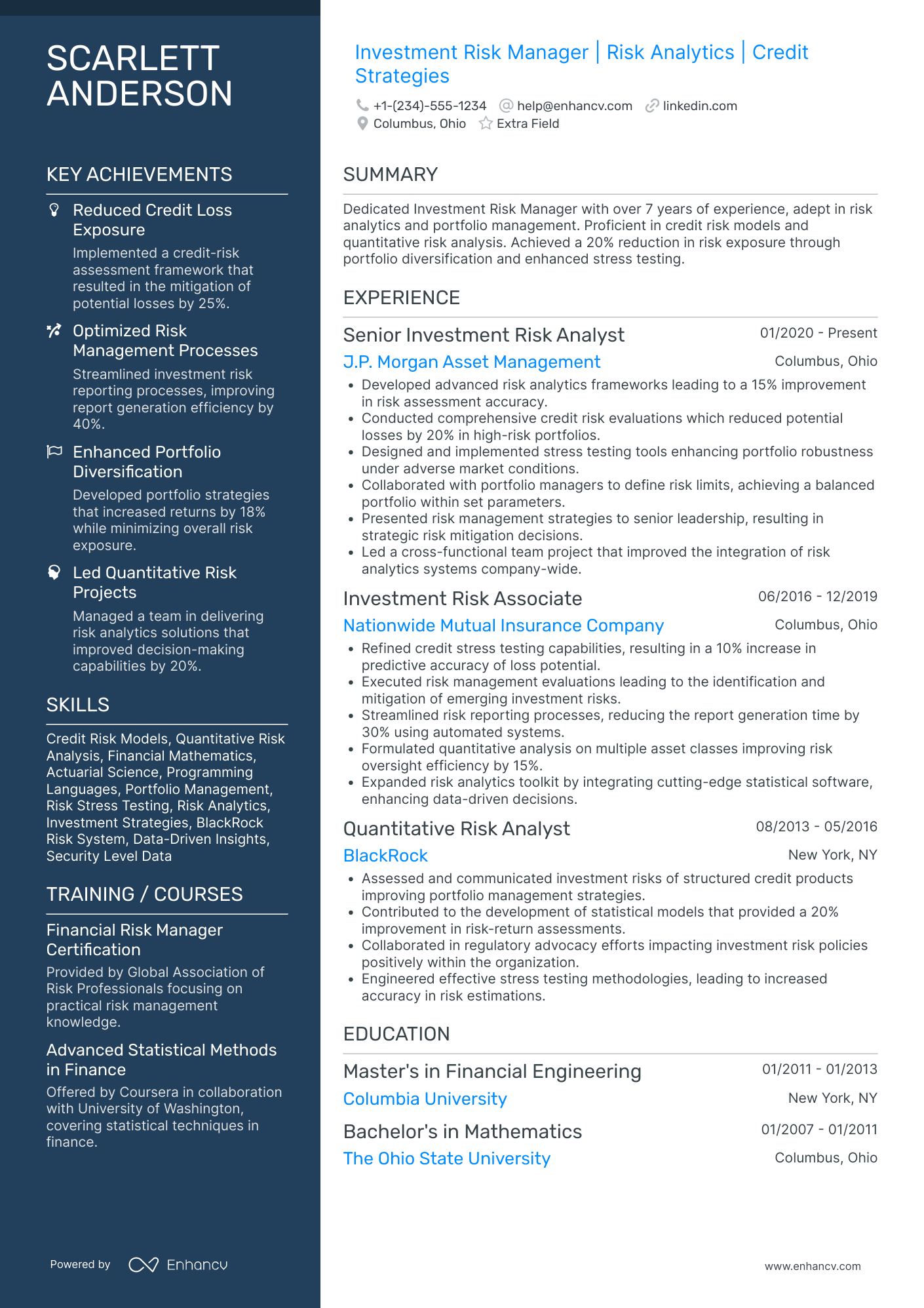

Resume summaries for a investment manager job

- Seasoned investment manager with over a decade of experience in managing multi-million dollar portfolios, leveraging deep technical knowledge in asset allocation, risk management, and financial analysis. Notably increased portfolio performance by 25% over the past five years through strategic investment decisions and market trend analysis.

- Dynamic professional with a robust 15-year career in real estate development, transitioning to investment management to apply extensive capital budgeting and project financing expertise. Distinguished for securing high-value investments and driving ROI by 30% through keen market insights and strong negotiation skills.

- With an enriched background in software sales management, including a track record of exceeding sales targets by over 40%, the candidate is now eager to channel analytical acumen and robust client relationship skills into the domain of investment management, pinpointing high-yield opportunities.

- Adept in leading investment strategies for a regional bank, this professional brings eight years of judicious financial planning, client portfolio management, and customized investment solutions. Fostered a client-centric approach resulting in a client retention rate of over 95% and a 20% growth in new client acquisition.

- Eager to embark on a career in investment management, this fresh MBA graduate brings a rich understanding of financial modeling, macroeconomic analysis, and a fervent commitment to mastering the intricacies of the financial markets to deliver exceptional investment solutions.

- Aspiring to leverage a strong foundation in quantitative analysis from a mathematics background, combined with cutting-edge machine learning coursework, the candidate is motivated to contribute fresh insights to investment strategies and portfolio optimizations in a challenging and dynamic financial environment.

Average salary info by state in the US for investment manager professionals

Local salary info for Investment Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Showcasing your personality with these four investment manager resume sections

Enhance your investment manager expertise with additional resume sections that spotlight both your professional skills and personal traits. Choose options that not only present you in a professional light but also reveal why colleagues enjoy working with you:

- My time - a pie chart infographic detailing your daily personal and professional priorities, showcasing a blend of hard and soft skills;

- Hobbies and interests - share your engagement in sports, fandoms, or other interests, whether in your local community or during personal time;

- Quotes - what motivates and inspires you as a professional;

- Books - indicating your reading and comprehension skills, a definite plus for employers, particularly when your reading interests align with your professional field.

Key takeaways

We trust that this Enhancv guide has been informative and useful. To summarize the essential points:

- Opt for a simple and readable format, focusing more on your investment manager achievements rather than just duties;

- Emphasize your accomplishments in the investment manager experience section over mere responsibilities;

- If lacking relevant experience, utilize various resume sections like education and volunteering to demonstrate your suitable skill set;

- Never overlook the significance of pertinent higher education, training, and certifications;

- Incorporate diverse sections in your resume to highlight not just your skills expertise but also your personality.

Investment Manager resume examples

By Experience

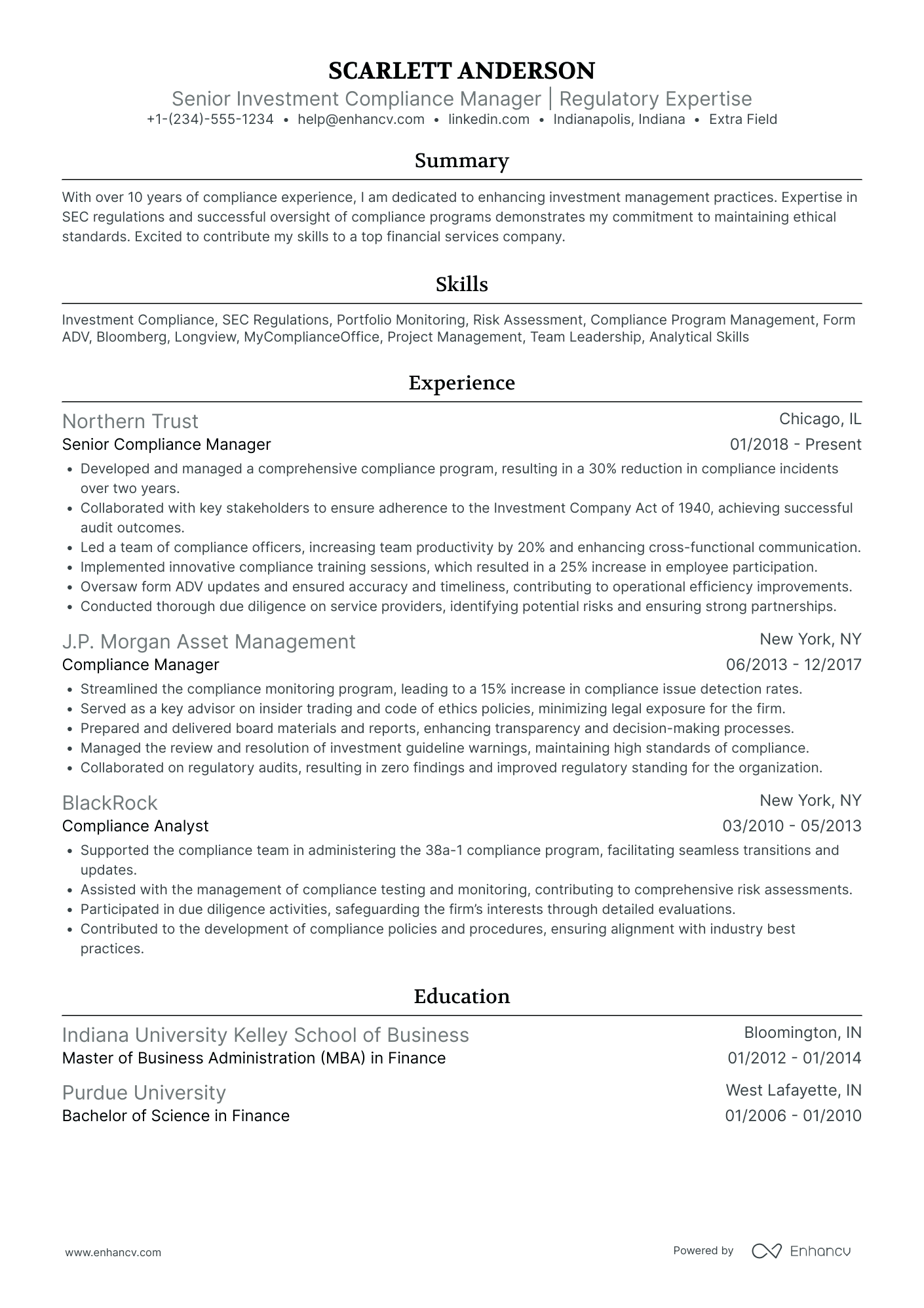

Entry-Level Investment Banking

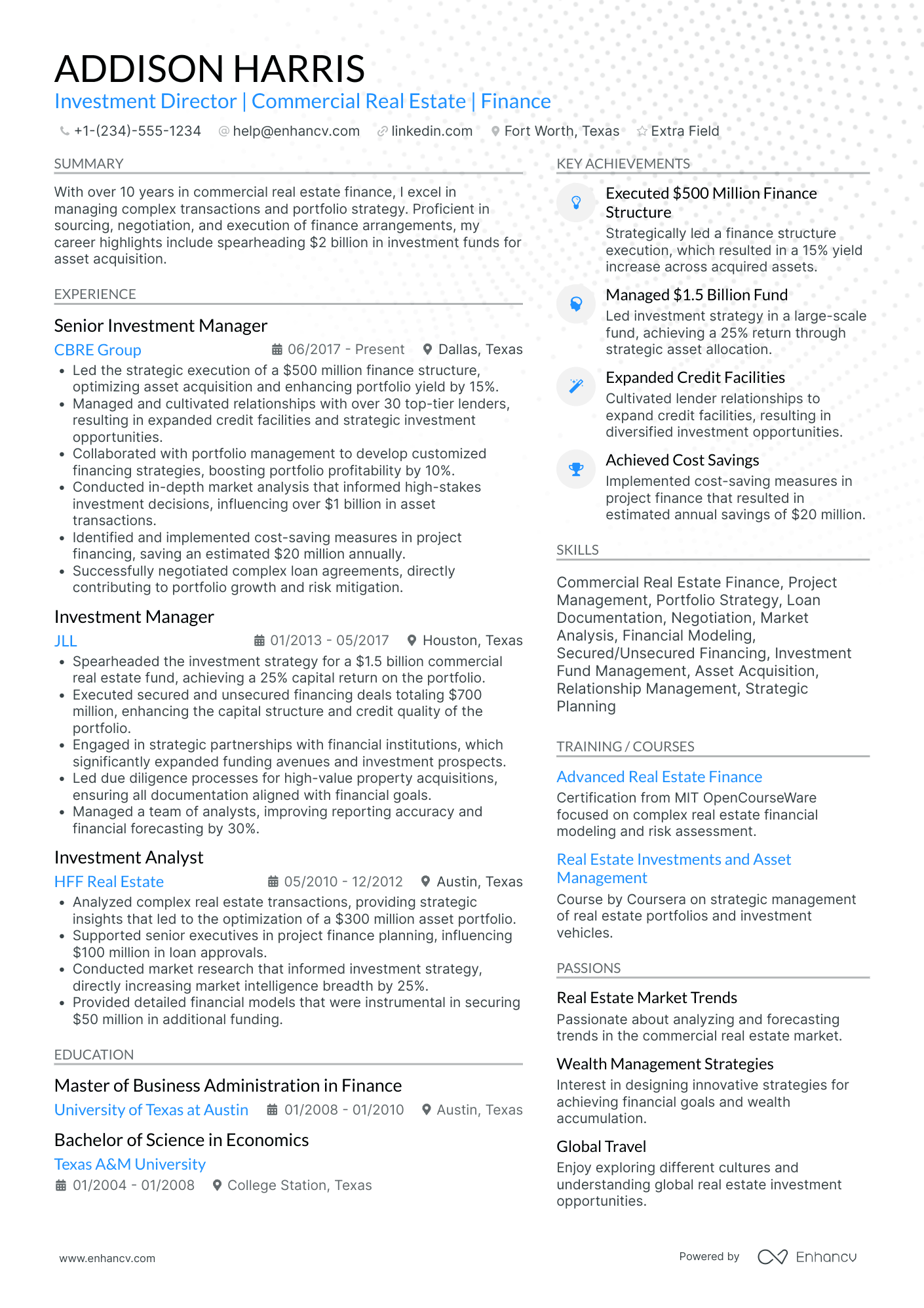

Senior Investment Manager

Junior Investment Manager

Assistant Investment Manager

By Role

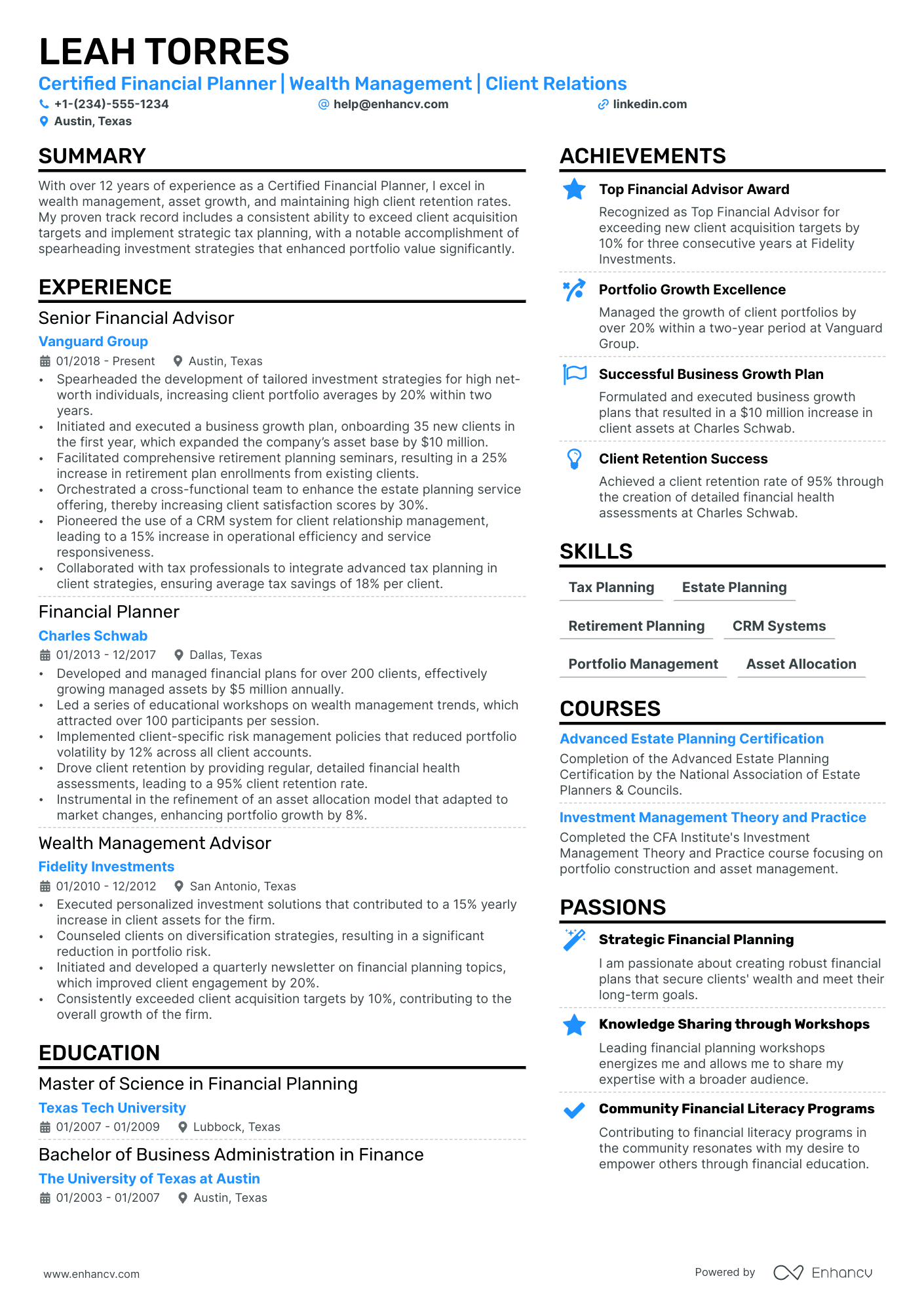

Certified Financial Planner

The Certified Financial Planner role has deep roots in financial analysis and planning. Below are some strategies to showcase your qualifications effectively for this position:

- Relevant education and certification are of utmost importance. Highlight your Certified Financial Planner (CFP) certification prominently.

- Exhibit your analytical skills that have led to customer financial growth. This can be shown by explaining how you've helped clients meet financial goals.

- Point out communication skills. As a CFP, you must effectively relay complex financial strategies to clients, so include noteworthy experiences.

- Don't just list your skills — show their impact, like ‘Increased client portfolio value by...’, following the 'skill-action-results' pattern.

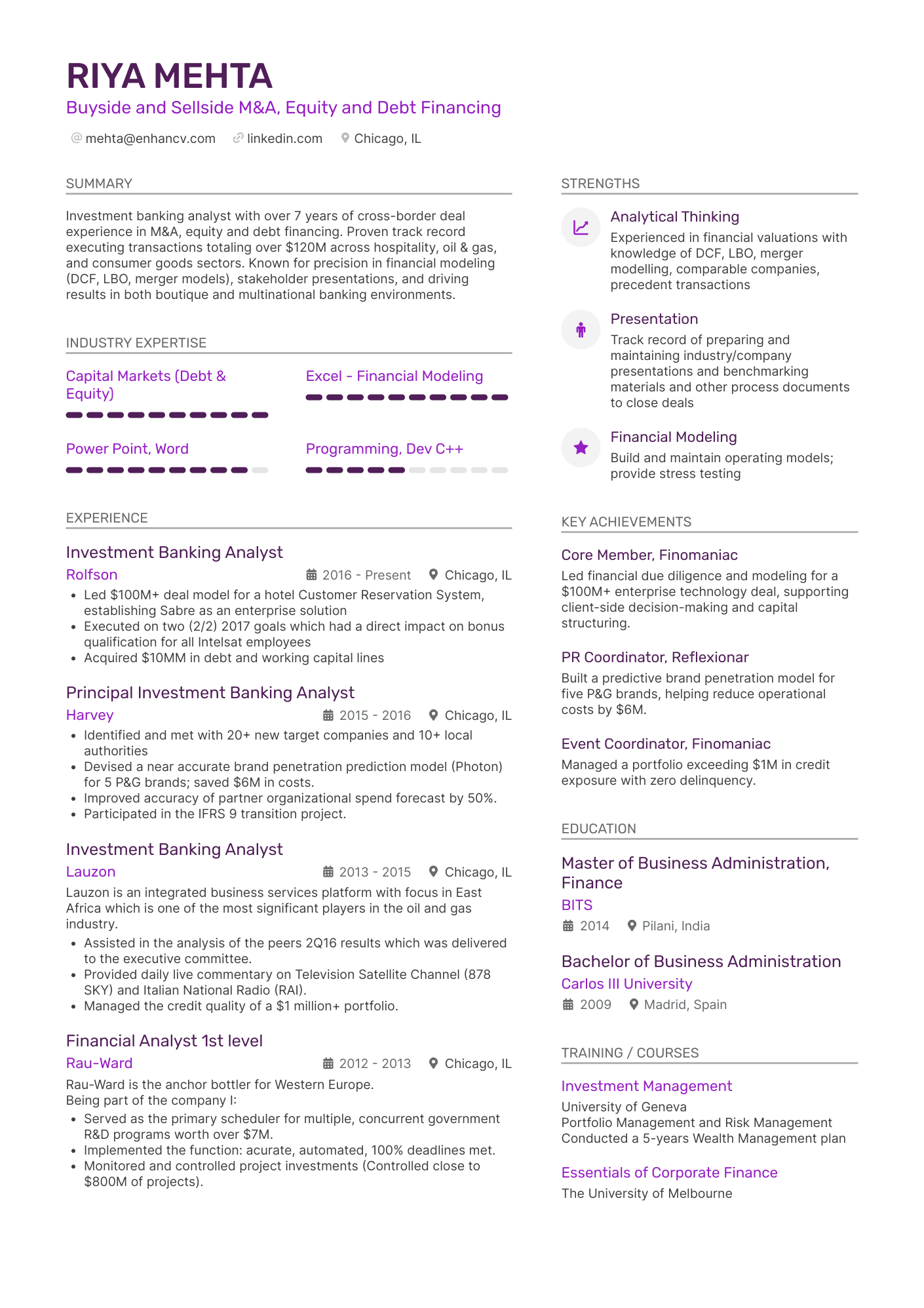

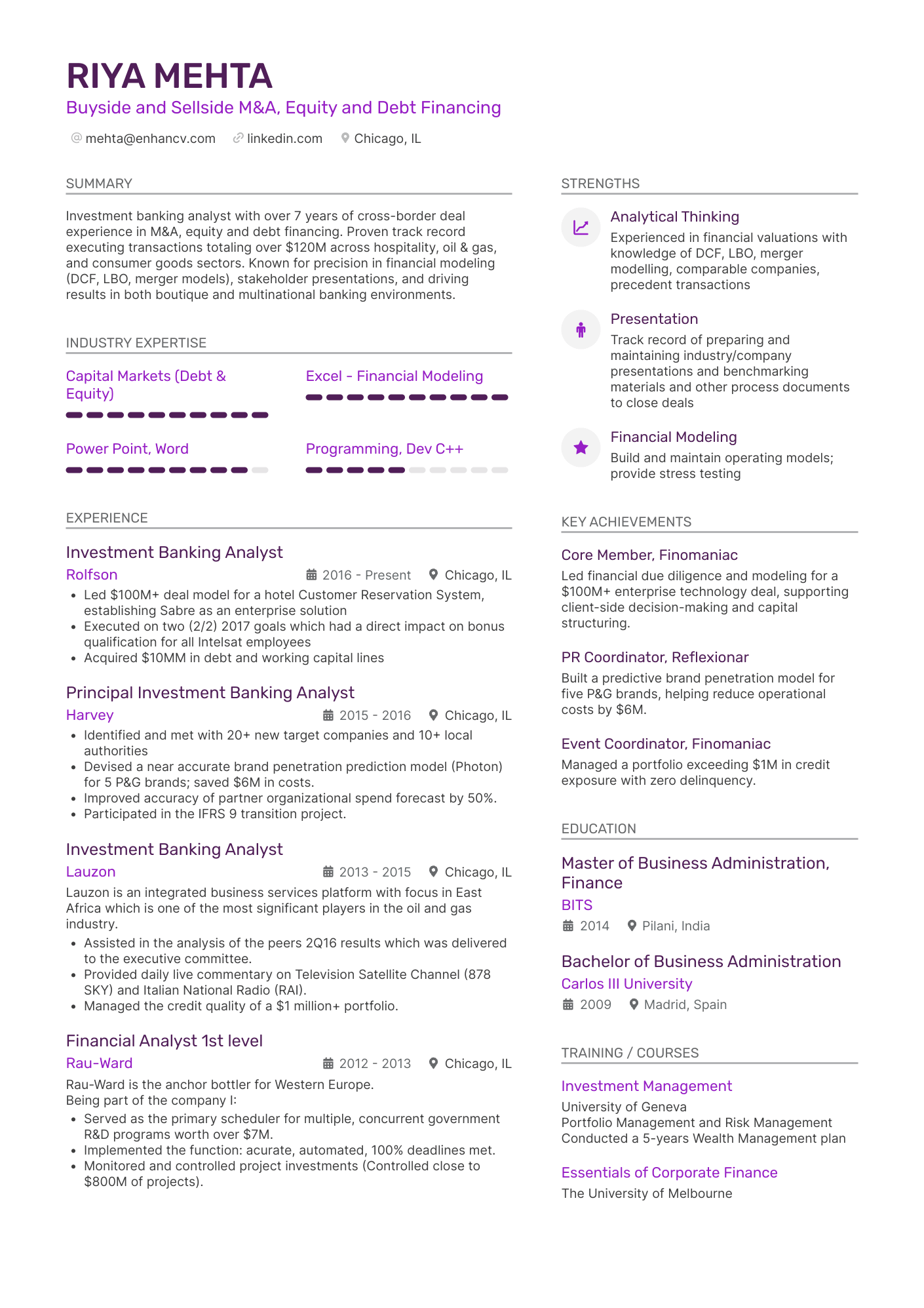

Investment Banking Analyst

As an Investment Banking Analyst, your role evolved from financial analytics and banking. Here are some suggestions to strengthen your application:

- Highlight your financial management education and CFA or equivalent qualifications.

- Describe your roles in managing significant financial transactions like M&As or IPOs.

- Don't forget to demonstrate your research and quantitative analysis skills.

- Value addition to financial deals, such as 'Facilitated successful IPO for...', should be your main focus. Follow the 'skill-action-results' model.

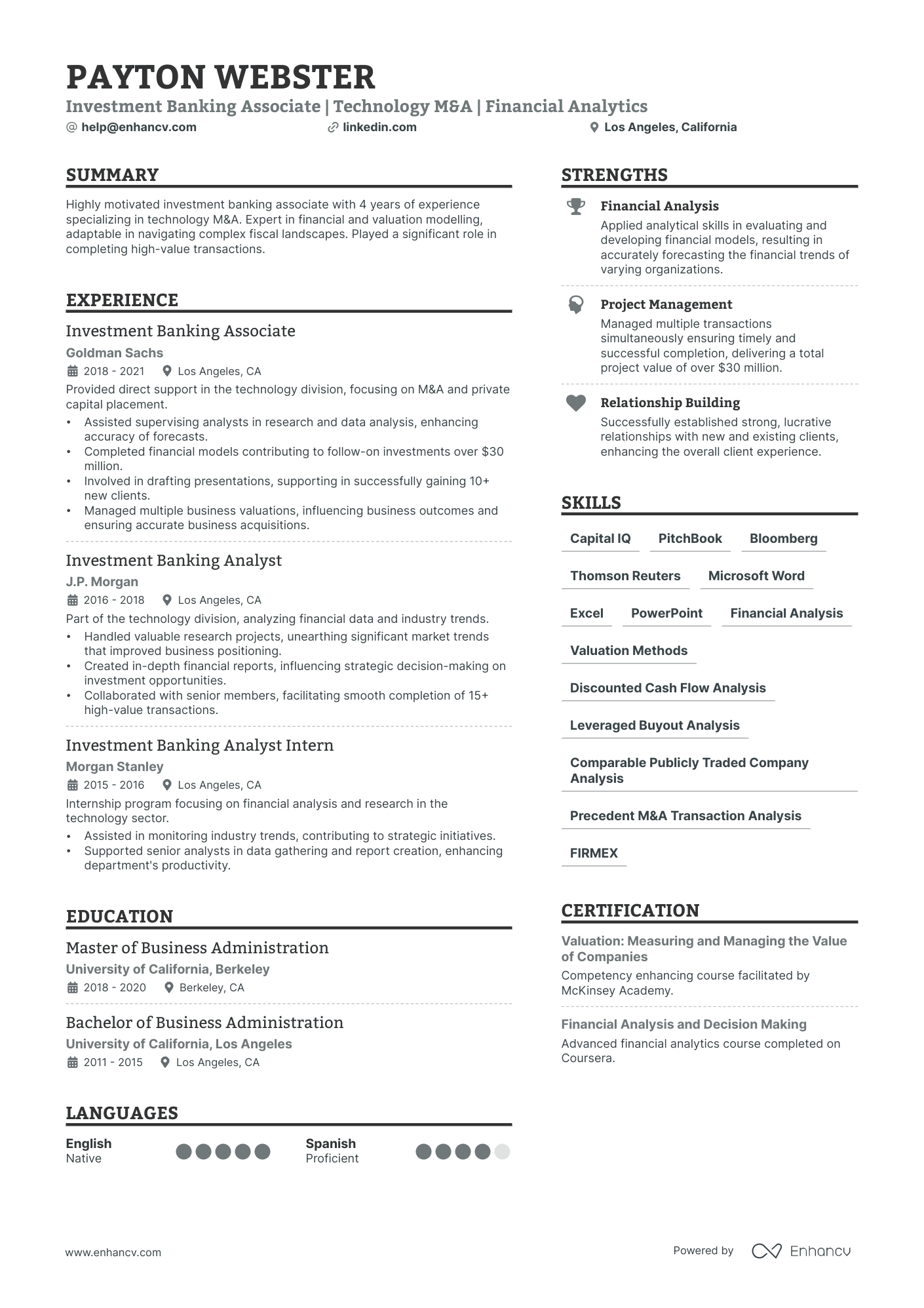

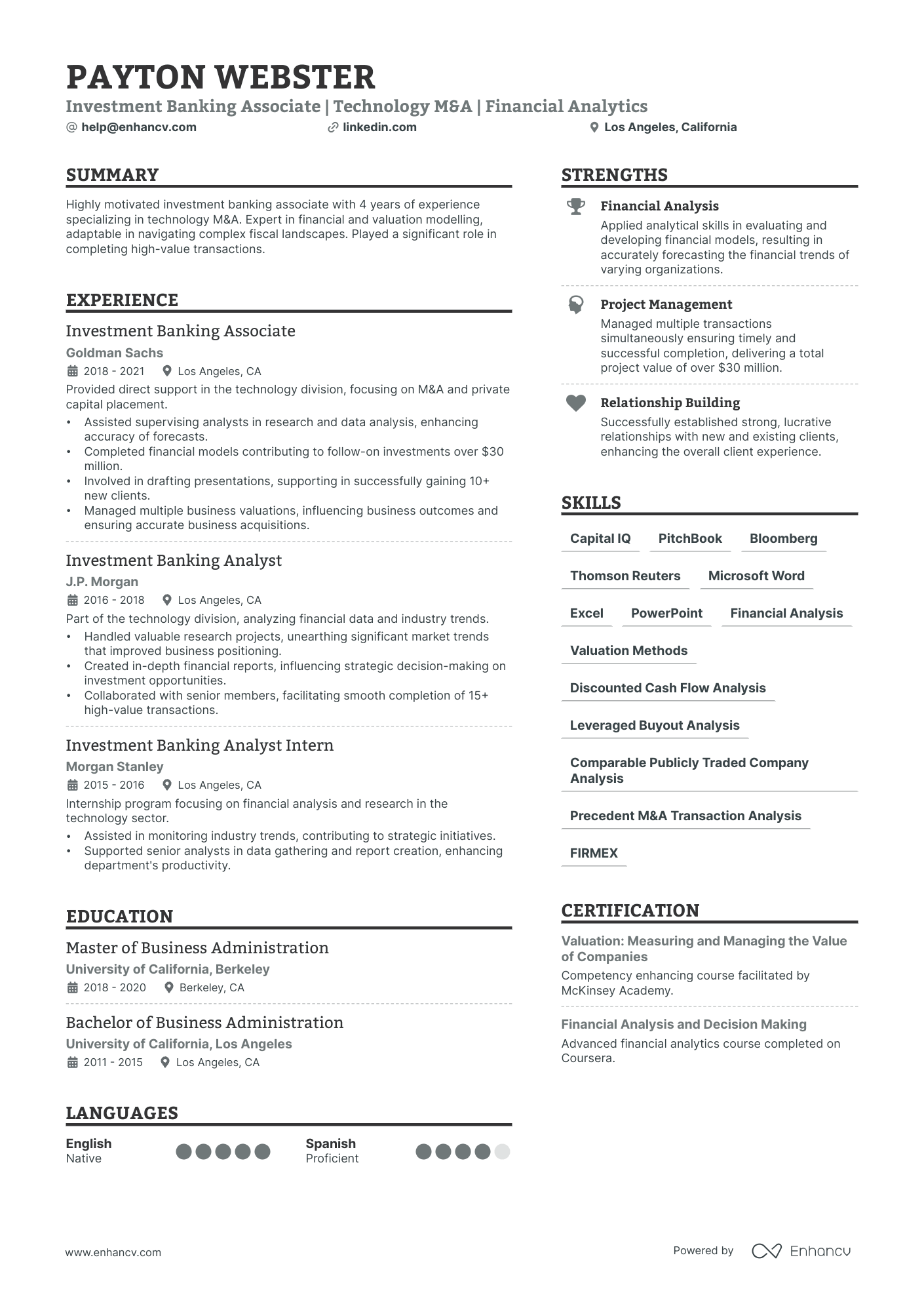

Investment Banking Associate

Investment Banking Associate positions demand a solid financial and banking background. Here are tips to improve your job application:

- Emphasize your MBA degree or relevant educational qualifications.

- Experience in managing financial transactions and managing client relationships is crucial.

- Showcase your leadership skills and ability to meet banking deadlines.

- The most critical point on your resume would be concrete examples of successful financial deals, like 'Led M&A deal that...' adhering to 'skill-action-results' format.

Real Estate Investment Banking

Bankers in Real Estate Investment Banking sprout from finance and real estate fields. Here are ways to better present your competencies:

- A strong educational background in finance or real estate investment is a must.

- Show successful workouts in real estate financial structures and transactions.

- Real estate market analysis is a valuable skill. Ensure this is highlighted.

- Your resume should show your direct results, like 'Managed $xx finance deal for commercial property...', following the 'skill-action-results' structure.

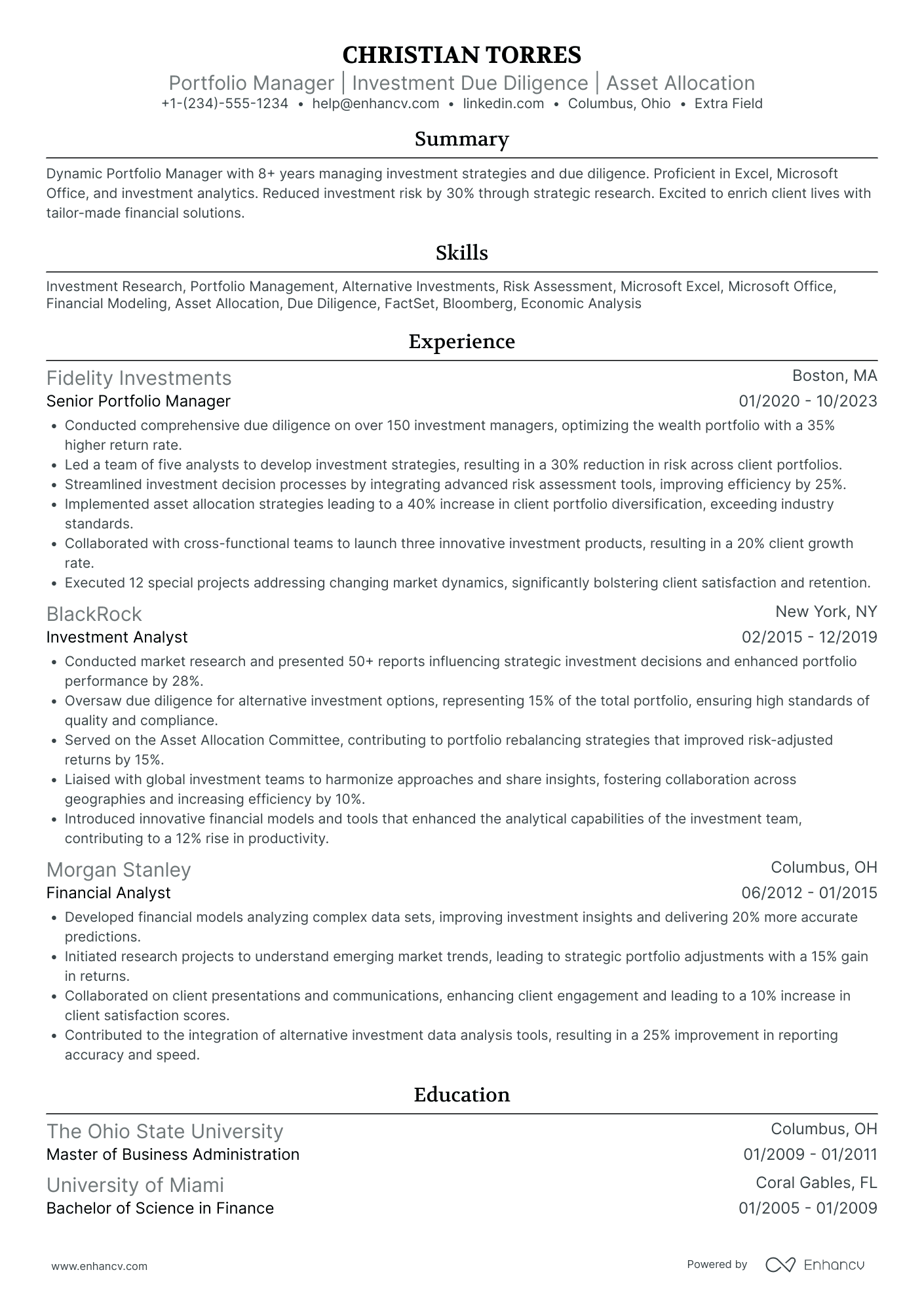

Portfolio Manager

Portfolio Manager jobs require a robust financial, banking, or economics background. Here's how to enhance your profile:

- Highlight your finance qualifications like CFA or similar on your resume.

- Past roles in managing portfolios and asset allocation must be present.

- Include your ability to strategize and take financial decisions based on market trends.

- Feature your successes, such as 'Expanded client portfolio by...', using the 'skill-action-results' pattern.

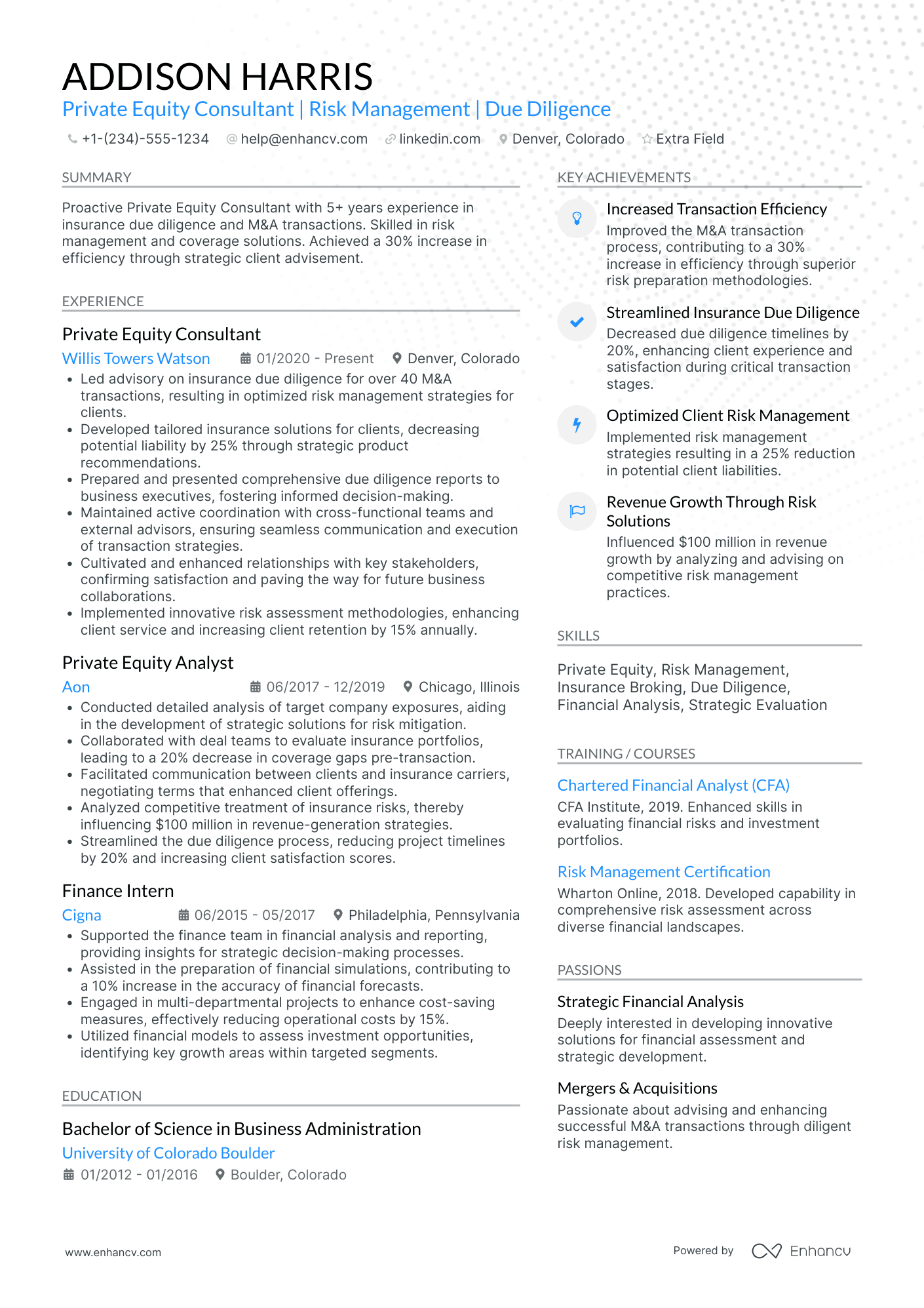

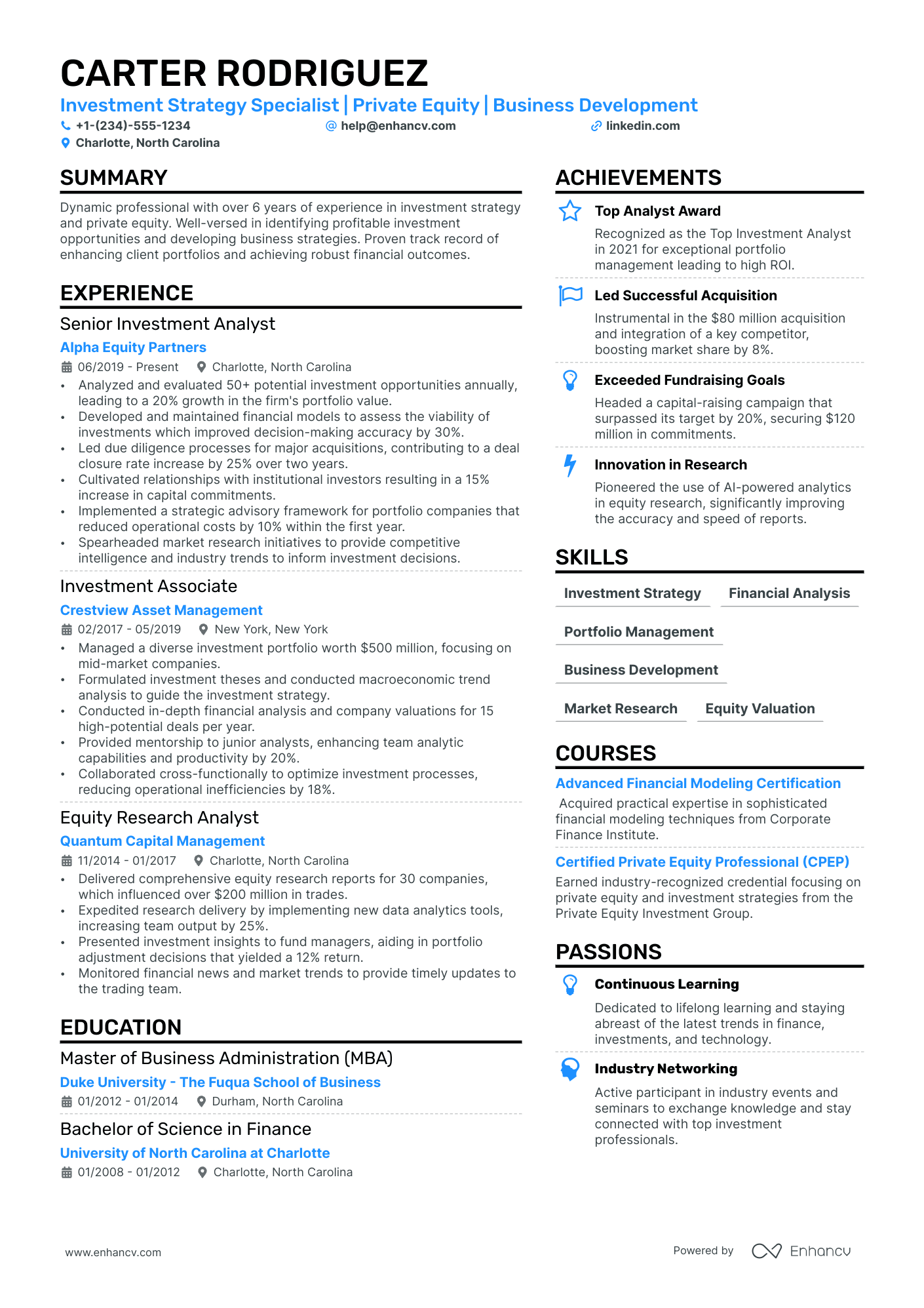

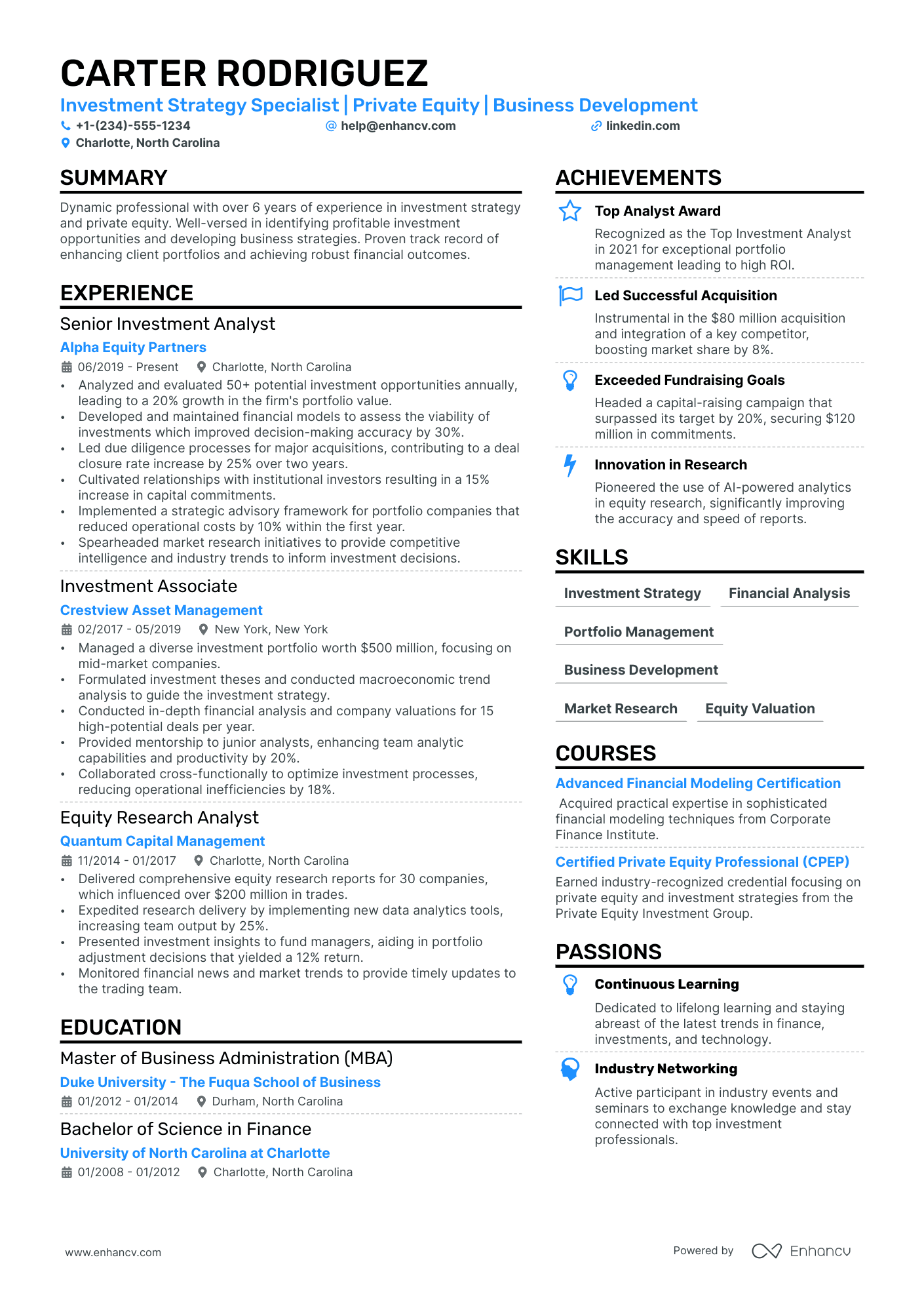

Private Equity

Private Equity roles need a particularly strong background in finance, banking, or economics. Strengthen your job application with these tips:

- Focus on your educational credentials like an MBA or equivalent.

- Your track record in sourcing and managing investment opportunities is critical.

- Showcase your ability to work with financial models and manage risks.

- It's crucial to demonstrate impact like 'Secured $xx investment by...', always following the ‘skill-action-results’ method.