Many collections specialist resume submissions fail because they list duties and tools but skip measurable recovery results. That hurts when an ATS (applicant tracking system) filters fast and recruiters scan in seconds amid heavy competition.

A strong resume shows what you improved and how it affected cash flow and risk. Knowing how to make your resume stand out means highlighting recovery rate gains, dollars collected, delinquency reduction, dispute resolution speed, call volume handled, and compliance accuracy. Show portfolio size, accounts managed, and days sales outstanding impact.

Key takeaways

- Quantify recovery results like dollars collected, delinquency reduction, and days sales outstanding on every bullet.

- Use reverse-chronological format if experienced and hybrid format if junior or switching careers.

- Tailor each resume to the job posting by mirroring its tools, compliance standards, and KPIs.

- Demonstrate skills through measurable outcomes in your experience section, not just a standalone list.

- Place certifications above education when they're recent, role-critical, or employer-required.

- Write a three-to-four-line summary featuring your title, core tools, and one quantified achievement.

- Use Enhancv to turn routine collections tasks into focused, metric-driven resume bullets faster.

Job market snapshot for collections specialists

We analyzed 328 recent collections specialist job ads across major US job boards. These numbers help you understand top companies hiring, employment type trends, career growth patterns at a glance.

What level of experience employers are looking for collections specialists

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 24.7% (81) |

| 3–4 years | 7.9% (26) |

| 5–6 years | 2.1% (7) |

| 10+ years | 2.4% (8) |

| Not specified | 61.9% (203) |

Collections specialist ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 66.8% (219) |

| Healthcare | 23.5% (77) |

| Education | 3.7% (12) |

Top companies hiring collections specialists

| Company | Percentage found in job ads |

|---|---|

| Elevance Health | 4.9% (16) |

| HCA Healthcare | 4.0% (13) |

Role overview stats

These tables show the most common responsibilities and employment types for collections specialist roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a collections specialist

| Responsibility | Percentage found in job ads |

|---|---|

| Microsoft office | 22.0% (72) |

| Excel | 21.0% (69) |

| Collections | 13.7% (45) |

| Microsoft excel | 11.9% (39) |

| Accounts receivable | 11.3% (37) |

| Billing | 10.4% (34) |

| Word | 9.8% (32) |

| Customer service | 9.1% (30) |

| Outlook | 8.2% (27) |

| Erp | 6.1% (20) |

| Negotiation | 5.5% (18) |

| Sap | 5.5% (18) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 69.2% (227) |

| Hybrid | 18.6% (61) |

| Remote | 12.2% (40) |

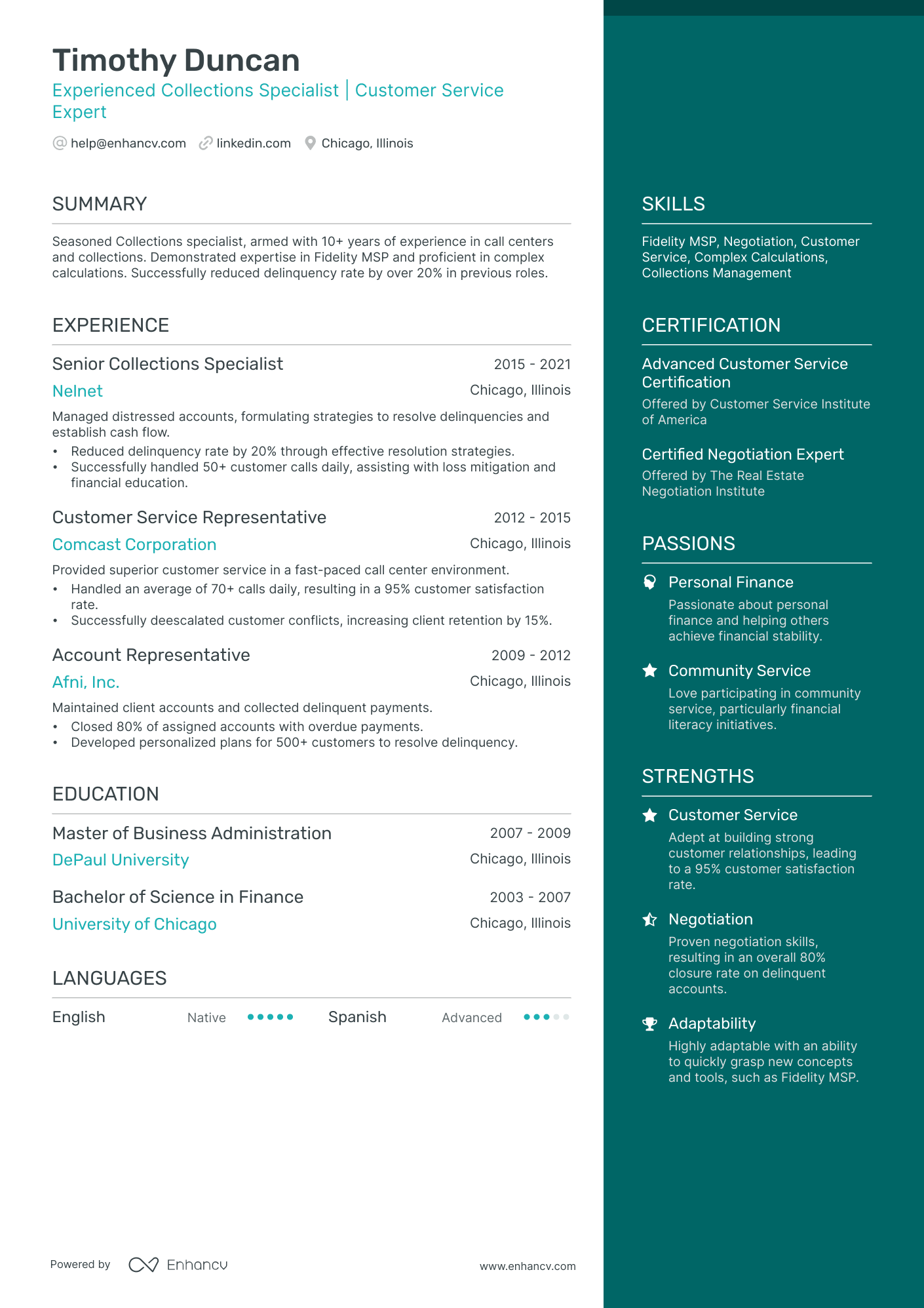

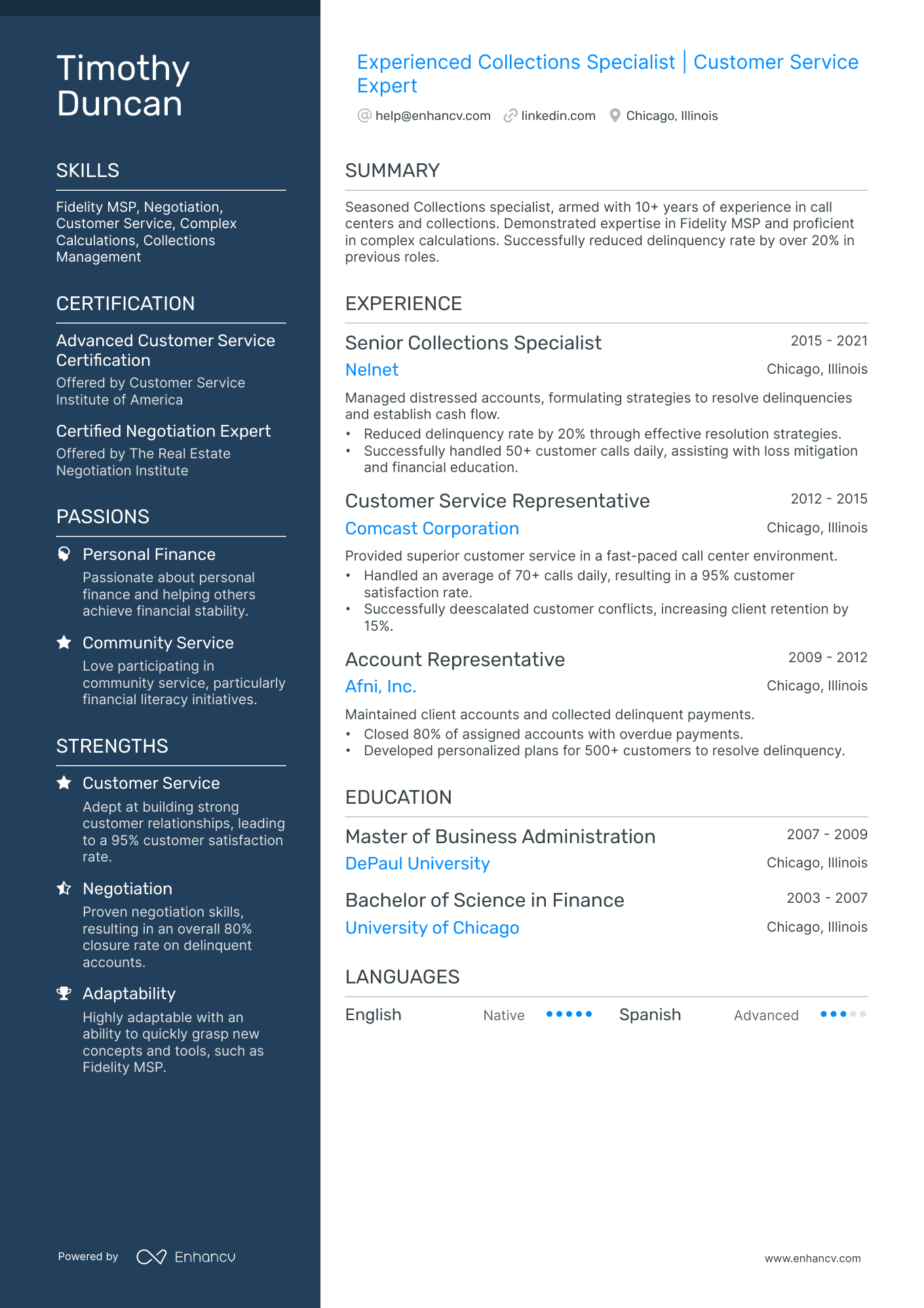

How to format a collections specialist resume

Recruiters hiring for collections specialist roles prioritize recovery rates, compliance knowledge, negotiation skills, and proficiency with collections software. A clean, well-structured resume format ensures these signals surface quickly during both automated screening and manual review.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your deepening expertise in collections, account management, and debt recovery processes. Do:

- Lead with your most recent role and highlight the scope of accounts you managed, including portfolio size, dollar volume, and delinquency stages.

- Feature collections-specific tools and domains—skip tracing software, auto-dialers, billing platforms (e.g., FICO Debt Manager, Experian), and knowledge of FDCPA, TCPA, or state-level compliance regulations.

- Quantify outcomes tied to recovery performance, delinquency reduction, or process improvements you directly influenced.

I'm junior or switching into this role—what format works best?

A hybrid format works best because it lets you lead with relevant skills while still providing a chronological work history that gives recruiters context. Do:

- Place a skills section near the top featuring negotiation, dispute resolution, accounts receivable, CRM tools, and any compliance knowledge you've developed.

- Include projects, internships, or transferable experience—such as customer service roles where you handled escalations, billing inquiries, or payment processing.

- Connect every action to an outcome so recruiters can see your potential impact, even without direct collections experience.

Why not use a functional resume?

A functional format strips away the timeline of your work history, making it difficult for recruiters and applicant tracking systems to verify where and when you applied your collections skills—ultimately weakening your candidacy.

- A functional resume may be acceptable if you're transitioning from a related field (e.g., customer service, billing, or banking), have a significant employment gap, or have limited formal work history—but only if you tie every listed skill to a specific project, result, or measurable outcome.

Once your layout and formatting choices are in place, the next step is deciding which sections to include so each one reinforces your qualifications effectively.

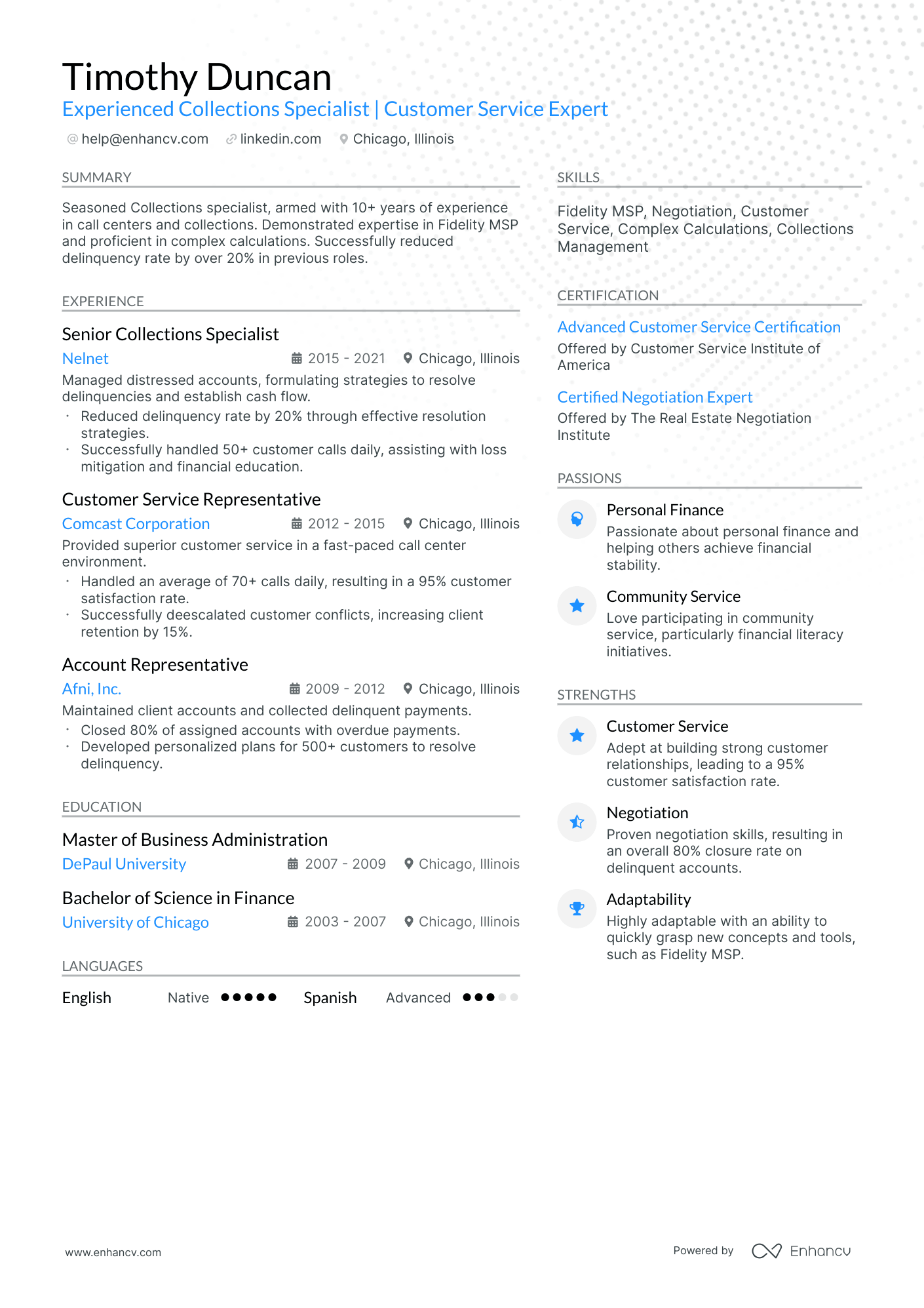

What sections should go on a collections specialist resume

Recruiters expect you to present a clear snapshot of your collections results, compliance, and account management experience. Understanding what to put on a resume helps you prioritize the right details for this role.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Languages, Volunteering

Strong experience bullets should emphasize dollars recovered, delinquency reduction, call and portfolio volume, compliance adherence, and measurable improvements in resolution rates and cycle times.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right sections, the next step is to write your collections specialist experience in a way that clearly supports each section’s purpose.

How to write your collections specialist resume experience

Your work experience section should highlight the collections work you've delivered, the tools and methods you used to recover outstanding balances, and the measurable outcomes you achieved. Hiring managers prioritize demonstrated impact—reduced delinquency rates, improved recovery percentages, and stronger account resolution—over descriptive task lists.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the portfolio segments, account tiers, delinquency stages, or customer groups you were directly accountable for managing and resolving.

- Execution approach: the collections platforms, skip tracing tools, auto-dialer systems, payment negotiation frameworks, or compliance protocols you used to pursue and secure recoveries.

- Value improved: changes to recovery rates, days sales outstanding, delinquency ratios, payment plan adherence, or regulatory compliance accuracy tied to your collections efforts.

- Collaboration context: how you coordinated with credit analysts, legal teams, billing departments, third-party agencies, or customers to resolve disputes, restructure payment terms, or escalate accounts appropriately.

- Impact delivered: outcomes expressed through portfolio recovery results, aging bucket improvements, loss mitigation contributions, or retention gains rather than a summary of daily activities.

Experience bullet formula

A collections specialist experience example

✅ Right example - modern, quantified, specific.

Collections Specialist

NorthBridge Medical Supply | Phoenix, AZ

2022–Present

Regional business-to-business distributor supporting three hundred plus clinic and hospital accounts across the Southwest.

- Reduced days sales outstanding by nine days by segmenting aging in Excel (Power Query) and prioritizing outreach in Salesforce, focusing on top one hundred delinquent accounts by balance and risk score.

- Recovered $1.2M in past-due accounts receivable within two quarters by negotiating payment plans, processing settlements in NetSuite, and documenting terms with DocuSign to ensure audit-ready approvals.

- Increased right-party contact rate by 18% by using LexisNexis Accurint, skip-tracing workflows, and call disposition tracking in Five9, then partnering with sales to validate contact data for key accounts.

- Cut dispute cycle time from fourteen days to eight days by coordinating with billing and operations, resolving proof-of-delivery and pricing issues in ServiceNow, and standardizing reason codes for cleaner reporting.

- Improved promise-to-pay kept rate by 12% by automating reminder cadences through Salesforce tasks and email templates, aligning follow-ups to payer cycles, and escalating high-risk accounts to finance leadership.

Now that you've seen how a strong experience section looks in practice, let's break down how to customize yours for each specific job posting.

How to tailor your collections specialist resume experience

Recruiters evaluate your collections specialist resume through both applicant tracking systems and manual review, so tailoring your resume to the job description is essential. Tailoring ensures the skills and accomplishments you highlight directly reflect what each employer prioritizes.

Ways to tailor your collections specialist experience:

- Match the debt recovery software or CRM platforms named in the posting.

- Mirror the exact compliance standards like FDCPA or TCPA referenced.

- Use the same terminology for collection workflows or escalation procedures.

- Reflect the KPIs or performance benchmarks the employer specifies.

- Highlight experience in the specific debt type or industry mentioned.

- Emphasize skip tracing tools or negotiation methods listed in requirements.

- Align your payment plan strategies with the frameworks they describe.

- Include quality assurance or call monitoring practices when requested.

Every tailored bullet should connect a real achievement to a specific job requirement rather than forcing keywords where they don't naturally belong.

Resume tailoring examples for collections specialist

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Contact delinquent account holders via phone, email, and written correspondence using FICO Debt Manager to negotiate payment plans and resolve outstanding balances within 90-day cycles." | Reached out to customers about past-due accounts and helped them make payments. | Contacted 120+ delinquent account holders monthly via phone, email, and written correspondence using FICO Debt Manager, negotiating payment plans that resolved 85% of outstanding balances within 90-day cycles. |

| "Skip trace hard-to-locate debtors using LexisNexis and TLO, ensuring all collection activities comply with FDCPA and state-level regulations." | Used databases to find customer information and followed company policies during collections. | Skip traced hard-to-locate debtors through LexisNexis and TLO, locating 93% of assigned accounts while maintaining full compliance with FDCPA and state-level collection regulations across 12 jurisdictions. |

| "Reduce portfolio delinquency rates by managing a high-volume queue of 500+ accounts in FACS (Financial Accounts Collection System) and escalating accounts to legal review when necessary." | Managed a portfolio of accounts and helped reduce the number of overdue balances. | Managed a high-volume queue of 500+ accounts in FACS, reducing portfolio delinquency rates by 18% over six months and escalating 40+ accounts per quarter to legal review based on documented recovery thresholds. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your collections specialist achievements so hiring managers can see the impact of your work.

How to quantify your collections specialist achievements

Quantifying your achievements proves you protect cash flow, reduce risk, and improve customer outcomes. Focus on recovery rate, days sales outstanding, resolution cycle time, compliance accuracy, and portfolio volume handled.

Quantifying examples for collections specialist

| Metric | Example |

|---|---|

| Cash recovered | "Recovered $425,000 in past-due balances in one quarter by prioritizing high-risk accounts in Salesforce and negotiating structured payment plans." |

| Cycle time | "Cut average delinquency resolution from 21 days to 14 days by standardizing call scripts and automating reminders through an applicant tracking system (ATS)." |

| Compliance accuracy | "Maintained 99.2% Fair Debt Collection Practices Act (FDCPA) compliance on audited calls by using call monitoring checklists and documenting disputes in Zendesk." |

| Portfolio throughput | "Managed a 1,150-account portfolio monthly, averaging 65 outbound contacts per day while keeping notes current within 24 hours in Microsoft Dynamics." |

| Risk reduction | "Reduced charge-offs by 18% year over year by flagging early-stage delinquencies and escalating high-balance disputes to legal within two business days." |

Turn your everyday tasks into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points to showcase your experience, you'll also need to highlight the specific hard and soft skills that make you an effective collections specialist.

How to list your hard and soft skills on a collections specialist resume

Your skills section shows recruiters and an ATS (applicant tracking system) that you can reduce delinquency, follow compliance rules, and protect customer relationships, so list role-specific tools and workflows, then balance them with communication and judgment skills that support effective collections. Collections specialist roles require a blend of hard skills like technical tools and compliance knowledge, alongside soft skills like negotiation and de-escalation:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Skip tracing tools

- FDCPA compliance

- TCPA compliance

- Credit bureau reporting

- Payment plan setup

- Dispute and chargeback handling

- Dunning letters and notices

- CRM systems, dialers, call logging

- Excel: PivotTables, VLOOKUP

- Aging reports and roll rates

- Promise-to-pay tracking

- Bankruptcy and deceased accounts

Soft skills

- De-escalate tense calls

- Negotiate win-win payment plans

- Communicate clear next steps

- Ask precise, compliant questions

- Listen for root-cause issues

- Document decisions consistently

- Prioritize high-risk accounts

- Escalate issues fast

- Coordinate with sales and billing

- Maintain firm, respectful tone

- Follow up without dropping tasks

- Handle sensitive data carefully

How to show your collections specialist skills in context

Skills shouldn't live only in a bulleted list on your resume. Explore resume skills examples to see how collections professionals weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what both look like in practice.

Summary example

Collections specialist with eight years in healthcare revenue cycle management. Skilled in FDCPA compliance, skip tracing, and payment negotiation using FACS. Reduced aged receivables over 90 days by 34% while maintaining positive patient relationships.

- Reflects senior-level experience clearly

- Names industry-specific tools and methods

- Includes a concrete, measurable outcome

- Highlights relationship-building soft skills

Experience example

Senior Collections Specialist

Meridian Financial Services | Remote

March 2019–January 2024

- Recovered $2.1M in delinquent accounts annually by leveraging skip tracing tools and structured payment plans through FACS.

- Partnered with legal and compliance teams to ensure 100% FDCPA and TCPA adherence across all outbound communications.

- Reduced average days sales outstanding by 18 days by implementing a tiered follow-up workflow with the billing department.

- Every bullet includes measurable proof

- Skills appear naturally through real outcomes

Once you’ve tied your strengths to real outcomes and responsibilities, the next step is structuring a resume that highlights those same strengths when you don’t have direct collections experience.

How do I write a collections specialist resume with no experience

Even without full-time experience, you can demonstrate readiness through transferable work. Our guide on writing a resume without work experience shows how to position yourself effectively. Consider highlighting:

- Accounts receivable class projects

- Call center billing resolution work

- Retail credit card collections support

- Volunteer payment plan coordination

- Small business invoicing and follow-up

- Customer service dispute documentation

- Internship in finance operations

- CRM-based follow-up tracking tasks

Focus on:

- Quantified follow-up and recovery results

- Accurate documentation in CRM systems

- Compliance with call and privacy rules

- Clear escalation and dispute workflows

Resume format tip for entry-level collections specialist

Use a combination resume format because it highlights relevant skills and projects while still showing work history, even if it is not collections specialist experience. Do:

- Add a core skills section with tools.

- Include project bullets with metrics.

- List compliance and documentation steps used.

- Mirror collections specialist keywords from postings.

- Show call volume and follow-up cadence.

- Built a weekly follow-up tracker in Salesforce; logged one hundred twenty accounts, scheduled callbacks, and improved on-time payments by eighteen percent in four weeks.

Even without direct experience, your education section can demonstrate the foundational knowledge and skills that qualify you for a collections specialist role.

How to list your education on a collections specialist resume

Your education section helps hiring teams confirm you have foundational knowledge in finance, accounting, or business. It validates your readiness for collections specialist responsibilities.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a collections specialist resume.

Example education entry

Bachelor of Science in Finance

University of Central Florida, Orlando, FL

Graduated 2021

GPA: 3.7/4.0

- Relevant coursework: Consumer Credit Management, Business Law, Financial Accounting, and Debt Recovery Strategies

- Honors: Dean's List, 2019–2021

How to list your certifications on a collections specialist resume

Certifications on a resume show a collections specialist's commitment to learning, proficiency with key tools, and relevance to credit and compliance standards. They also help hiring teams trust your ability to handle accounts, documentation, and sensitive conversations.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degrees are recent and directly relevant, and your certifications are older or secondary to the role.

- Place certifications above education when they are recent, role-critical, or required by the employer, especially if your education is older or unrelated.

Best certifications for your collections specialist resume

- Certified Credit and Collection Professional (CCCP)

- Credit Business Associate (CBA)

- Credit Business Fellow (CBF)

- Certified Accounts Receivable Professional (CARP)

- Certified Fraud Examiner (CFE)

- Notary Public Commission

- Microsoft Office Specialist (MOS)

Once you’ve placed your credentials where hiring managers can spot them quickly, focus on writing a collections specialist resume summary that ties those qualifications to the value you deliver.

How to write your collections specialist resume summary

Your resume summary is the first thing a recruiter reads. A sharp, focused opening can set you apart from dozens of other collections specialist applicants.

Keep it to three to four lines, with:

- Your title and years of experience in collections or accounts receivable.

- The industry or domain you've worked in, such as healthcare, financial services, or retail.

- Core tools and skills like skip tracing, debt negotiation, or software such as FICO Debt Manager.

- One or two quantified achievements, such as recovery rates or portfolio reduction percentages.

- Soft skills tied to real outcomes, like negotiation ability that improved payment plan adherence.

PRO TIP

At this level, emphasize specific skills, relevant tools, and early wins that prove you can perform. Highlight measurable contributions, even small ones, like reducing aging accounts by a set percentage. Avoid vague phrases like "hard worker" or "passionate professional." Recruiters want proof, not promises.

Example summary for a collections specialist

Collections specialist with two years of experience recovering delinquent accounts in consumer lending. Skilled in skip tracing, payment negotiation, and FICO Debt Manager. Reduced 90-day past-due accounts by 18% within the first year.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your collections expertise and value, make sure the header framing it presents your contact details correctly so recruiters can actually reach you.

What to include in a collections specialist resume header

A resume header is the contact and identity block at the top, and it boosts visibility, credibility, and recruiter screening for a collections specialist.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify experience quickly and supports screening.

Don't include a photo on a collections specialist resume unless the role is explicitly front-facing or appearance-dependent.

Match your header job title to the posting and add a short headline that reflects your collections focus and core tools.

Example

Collections specialist resume header

Jordan Taylor

Collections Specialist | B2B Collections, Dispute Resolution, and Payment Plans

Chicago, IL

(312) 555-01XX

jordan.taylor@enhancv.com

github.com/jordantaylor

jordantaylor.com

linkedin.com/in/jordantaylor

Once your contact details and role information are clear at the top, you can strengthen the rest of your resume with additional sections that add relevant context and credibility.

Additional sections for collections specialist resumes

Additional sections help you stand out when your core qualifications match other candidates, giving hiring managers more reasons to choose you. For example, listing language skills can be especially valuable if you work with multilingual customer bases.

- Languages

- Certifications

- Professional affiliations

- Volunteer experience

- Awards and recognitions

- Continuing education

- Software proficiencies

Once you've rounded out your resume with relevant additional sections, it's worth pairing it with a strong cover letter to make an even greater impression.

Do collections specialist resumes need a cover letter

A cover letter isn't required for a collections specialist, but it helps in competitive postings or strict hiring processes. If you're unsure where to start, learn what a cover letter is and how it complements your resume. It can make a difference when your resume needs context, or when the role expects strong communication and judgment.

Use a cover letter to add details your resume can't show:

- Explain role or team fit by matching your experience to the company's collections approach, customer segment, and compliance expectations.

- Highlight one or two relevant projects or outcomes, such as reducing days sales outstanding, improving cure rates, or raising promise-to-pay kept rates.

- Show understanding of the product, users, or business context, including billing flows, dispute drivers, and how collections affects retention and revenue.

- Address career transitions or non-obvious experience by connecting prior work to negotiation, documentation, de-escalation, and process improvement.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide a cover letter adds value for your application, the next step is using AI to improve your collections specialist resume so it matches the role’s requirements with less manual effort.

Using AI to improve your collections specialist resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight results. But overuse strips authenticity. If you're exploring this approach, our guide on ChatGPT resume writing prompts offers practical starting points. Once your content is clear and role-aligned, step away from AI.

Here are 10 prompts you can copy and paste to strengthen specific sections of your collections specialist resume:

Strengthen summary focus

Quantify experience bullets

Tighten action verbs

Align skills section

Improve certification descriptions

Clarify education relevance

Refine project descriptions

Remove redundant phrasing

Tailor for compliance

Sharpen accomplishment statements

Conclusion

A strong collections specialist resume highlights measurable outcomes, such as recovery rate, dollars collected, and days sales outstanding reduction. It shows role-specific skills, including negotiation, dispute resolution, account reconciliation, and compliance. Clear structure, clean formatting, and targeted keywords make it easy to scan.

Keep your collections specialist resume focused on results and the work you can deliver from day one. When your achievements are specific and your skills match the role, you’ll stand out in today’s hiring market. This approach also keeps you ready as hiring needs shift.