As a claims manager, articulating the complex and varied experience gained from handling numerous claims can be a daunting challenge on your resume. Our guide provides targeted strategies to effectively showcase your expertise and accomplishments, enabling your resume to stand out to prospective employers.

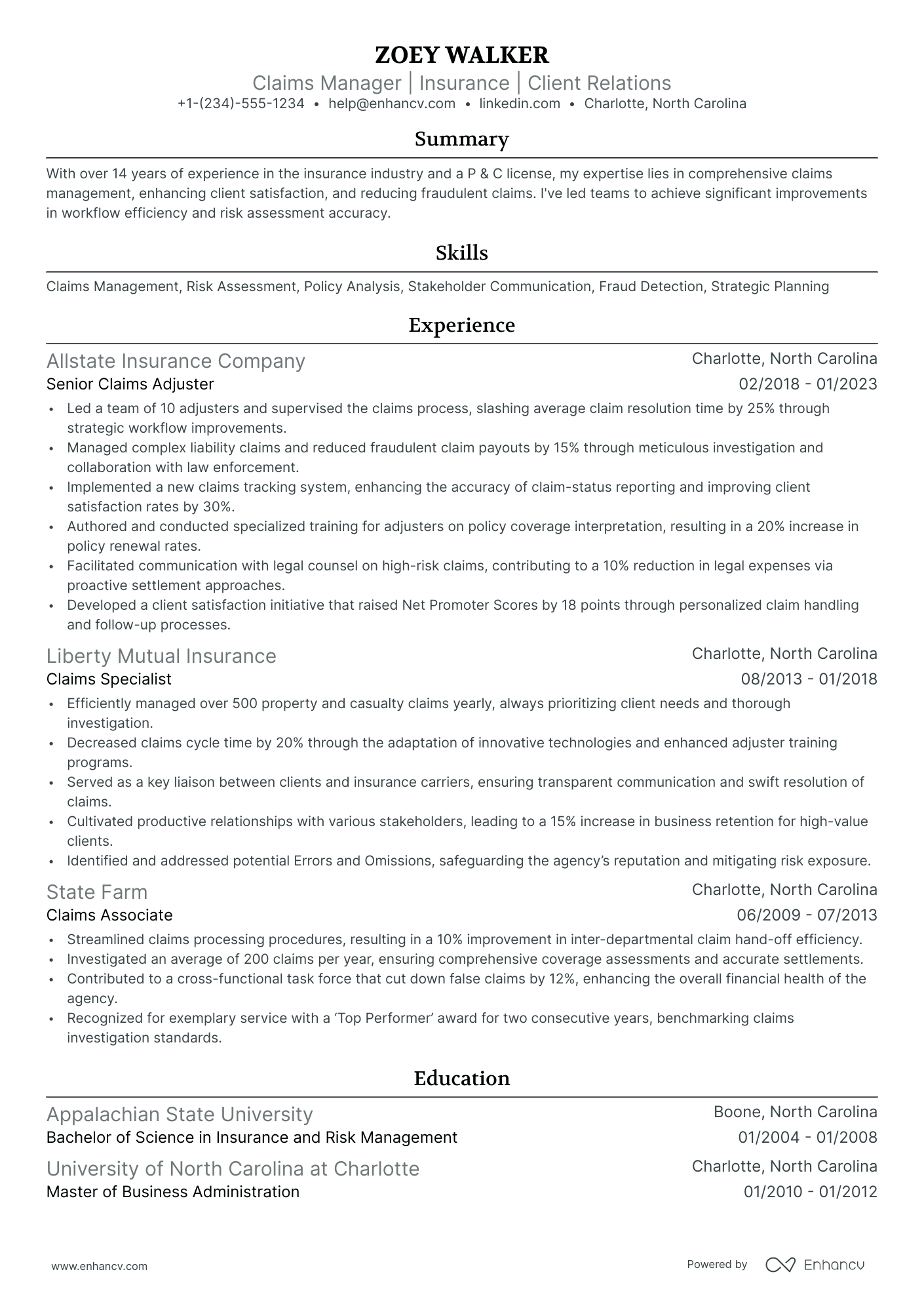

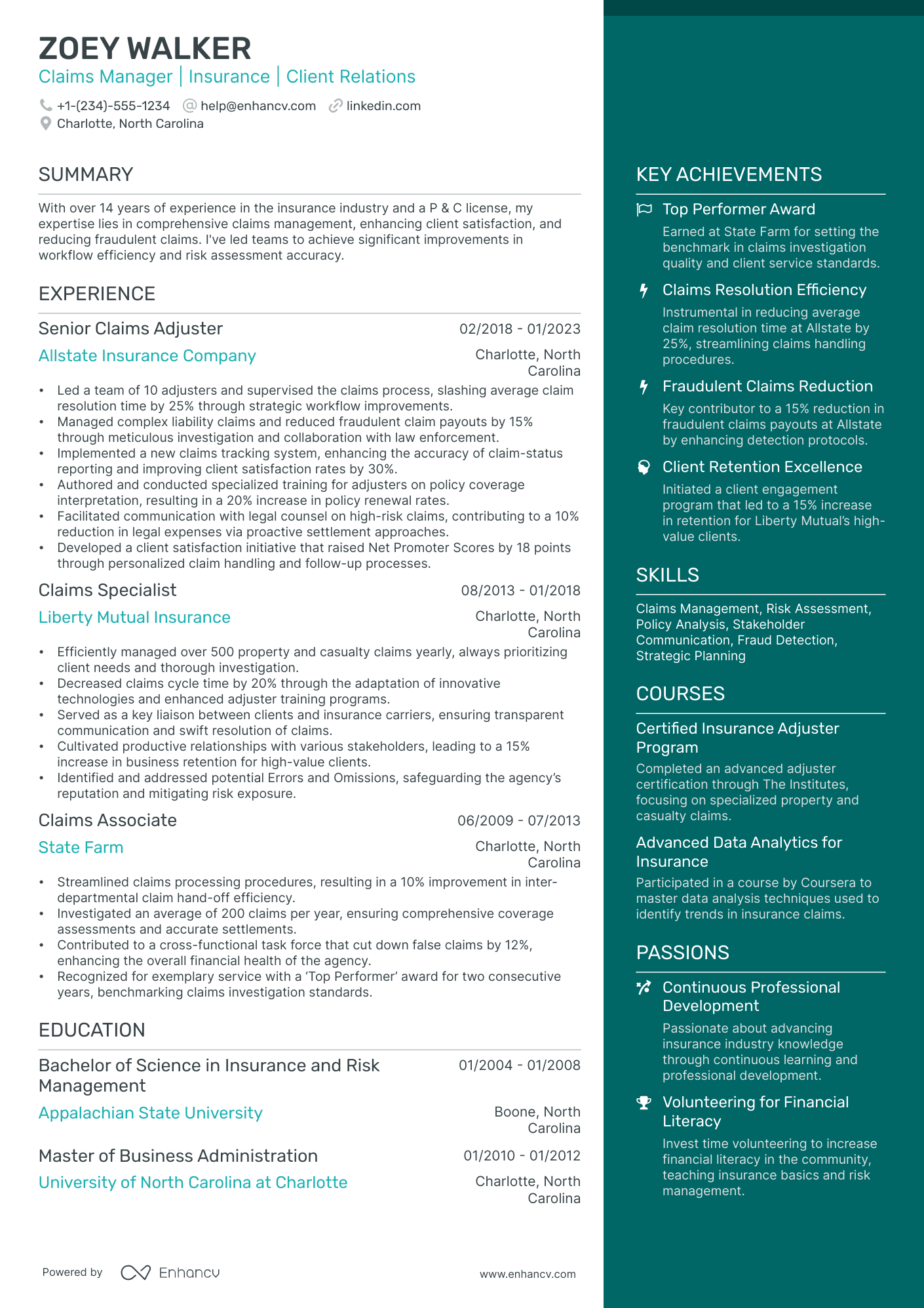

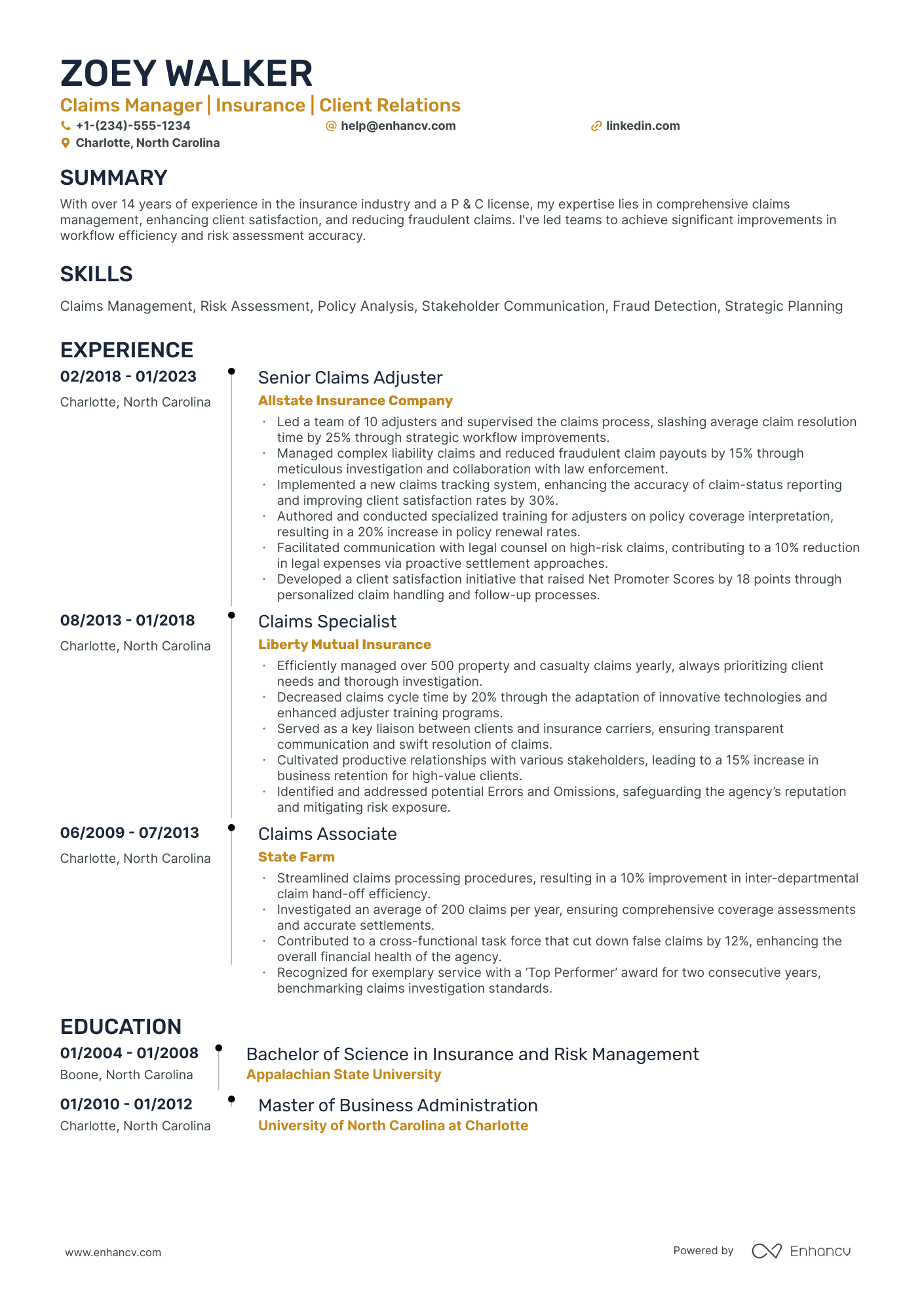

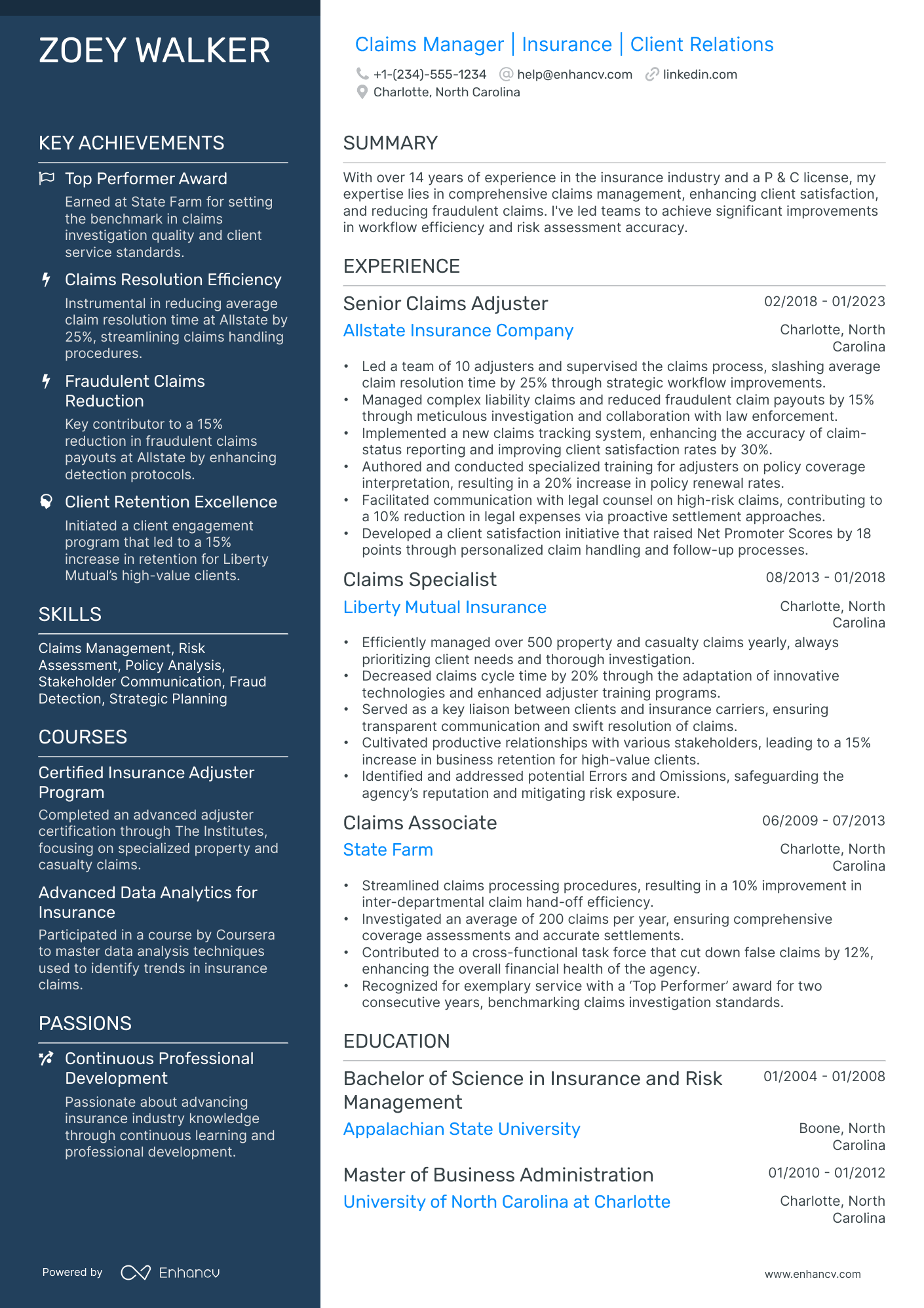

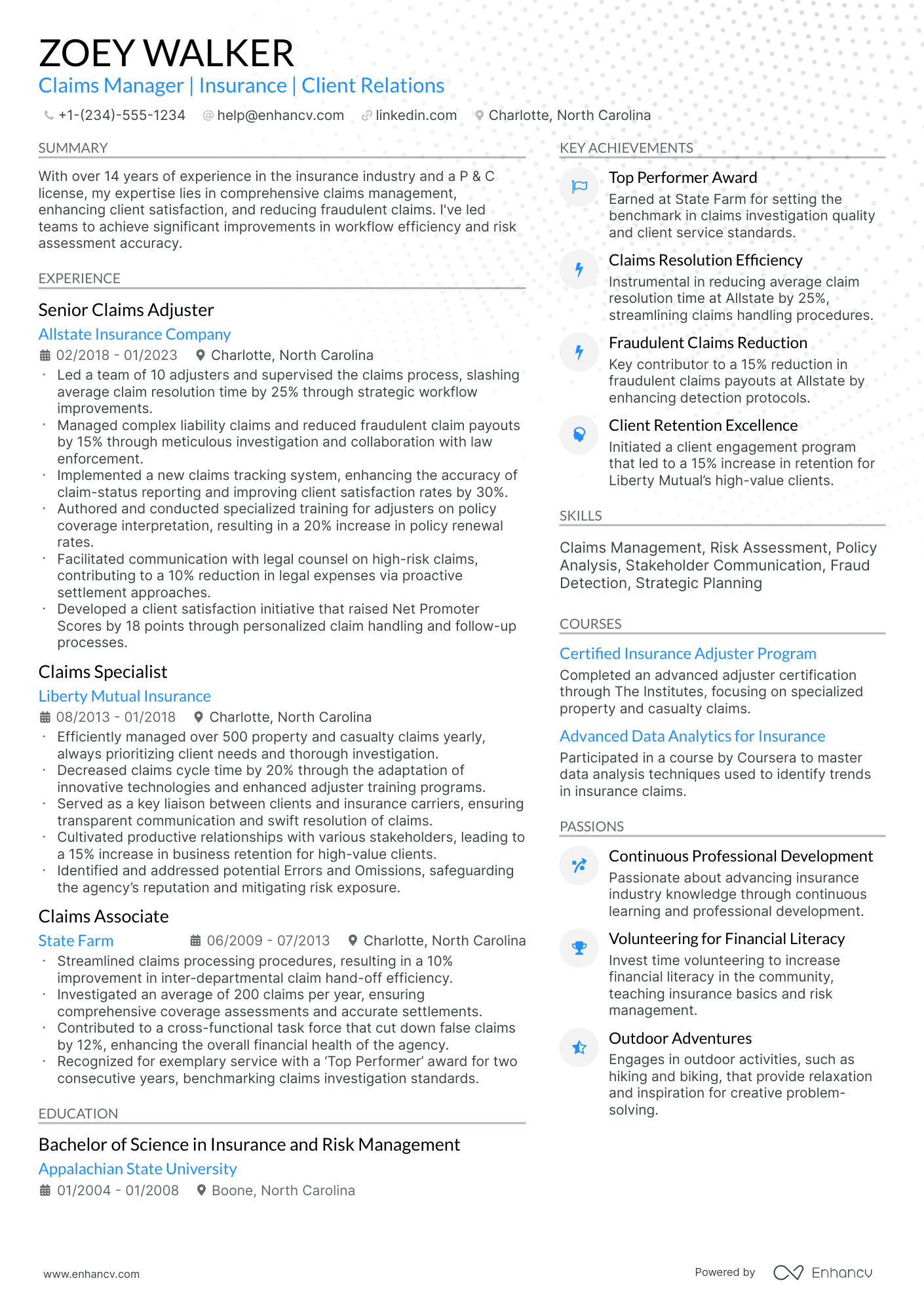

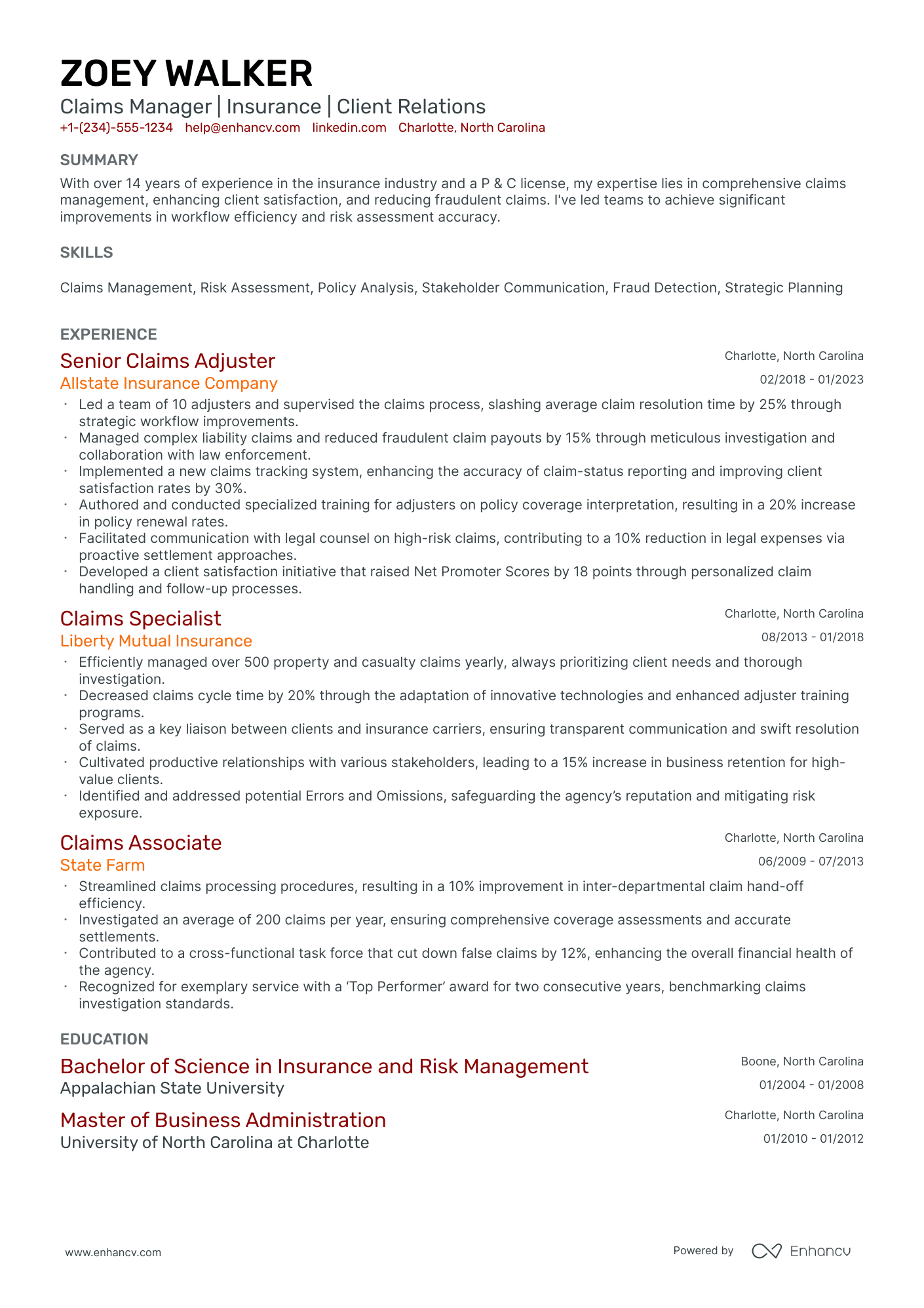

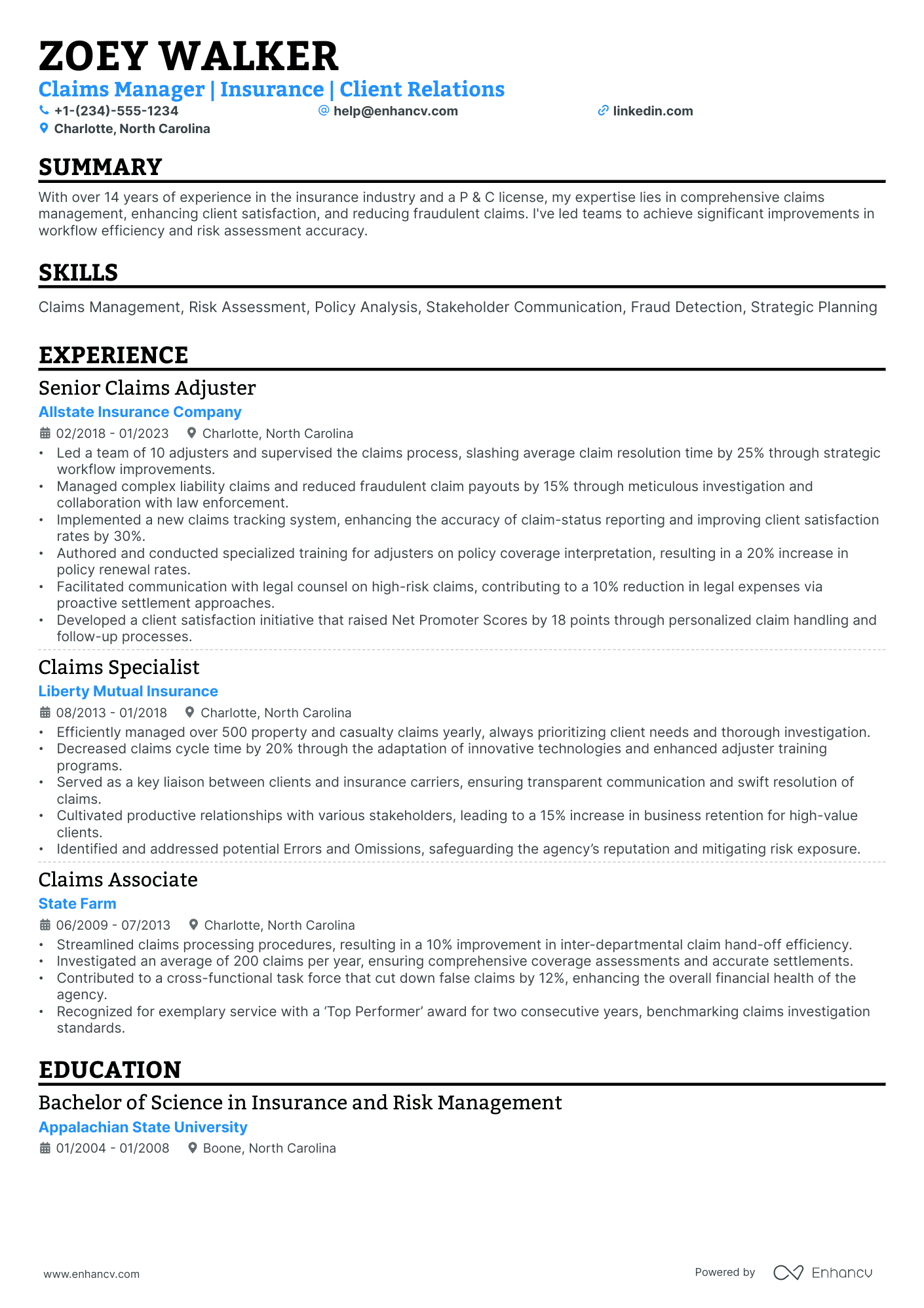

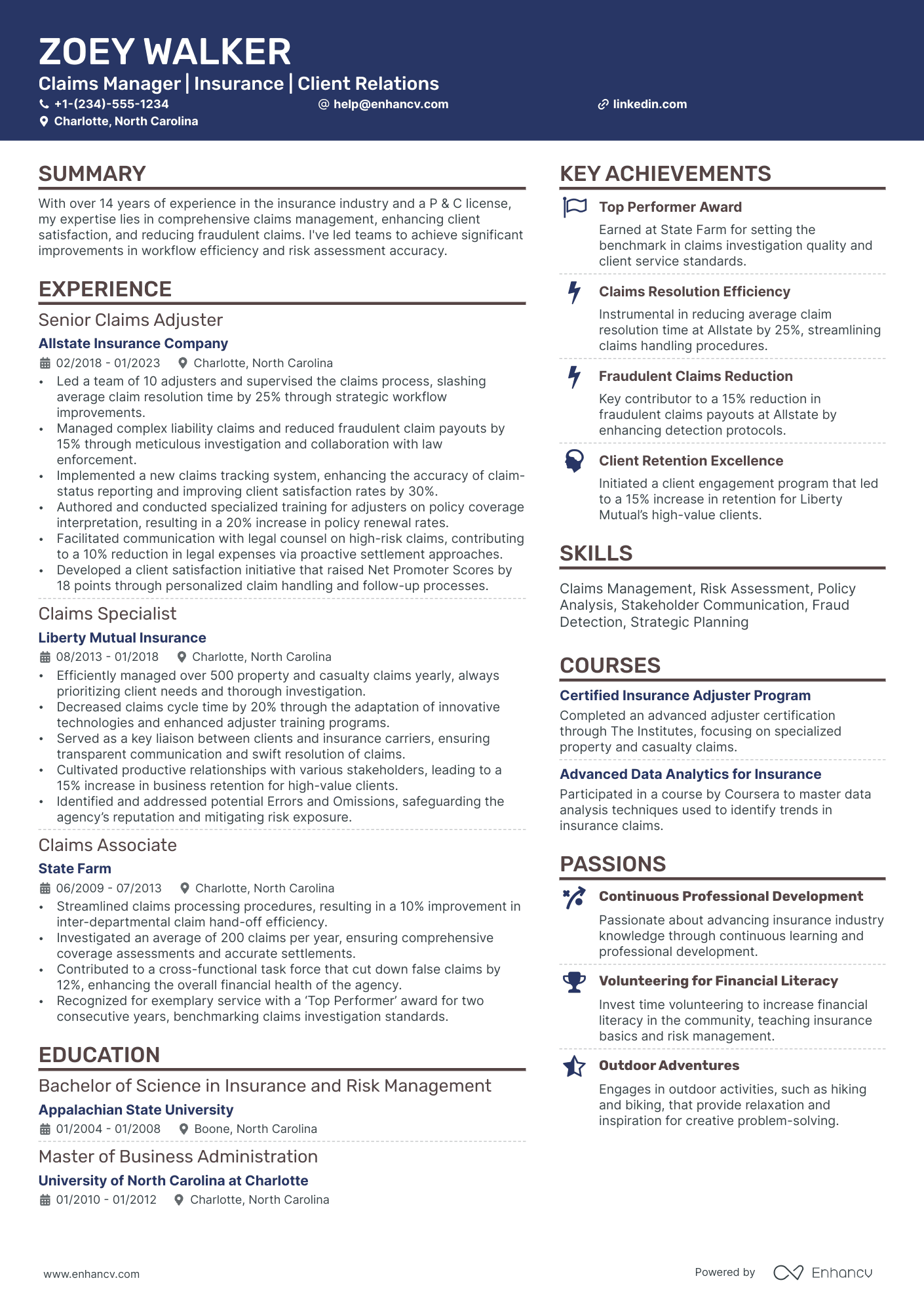

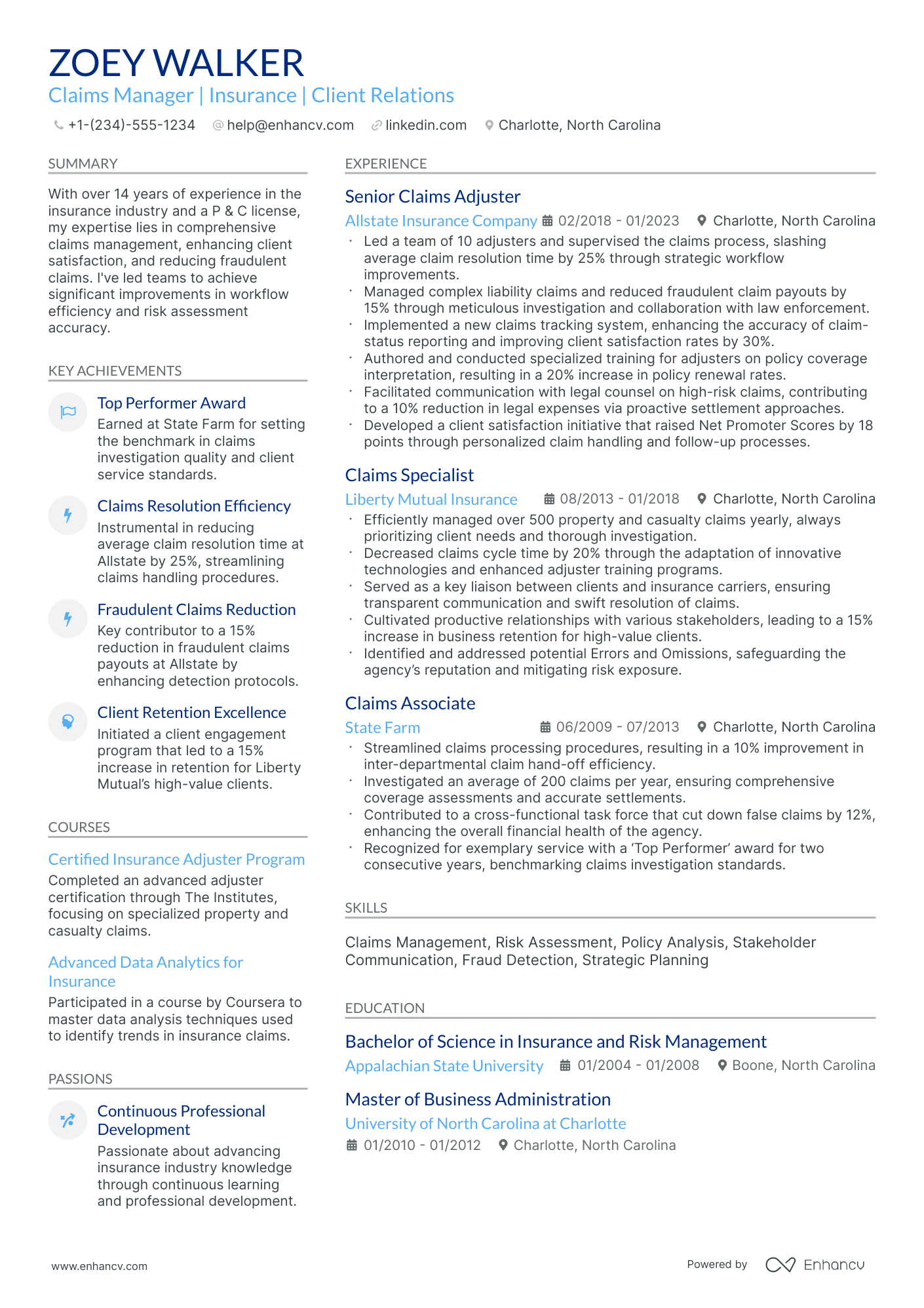

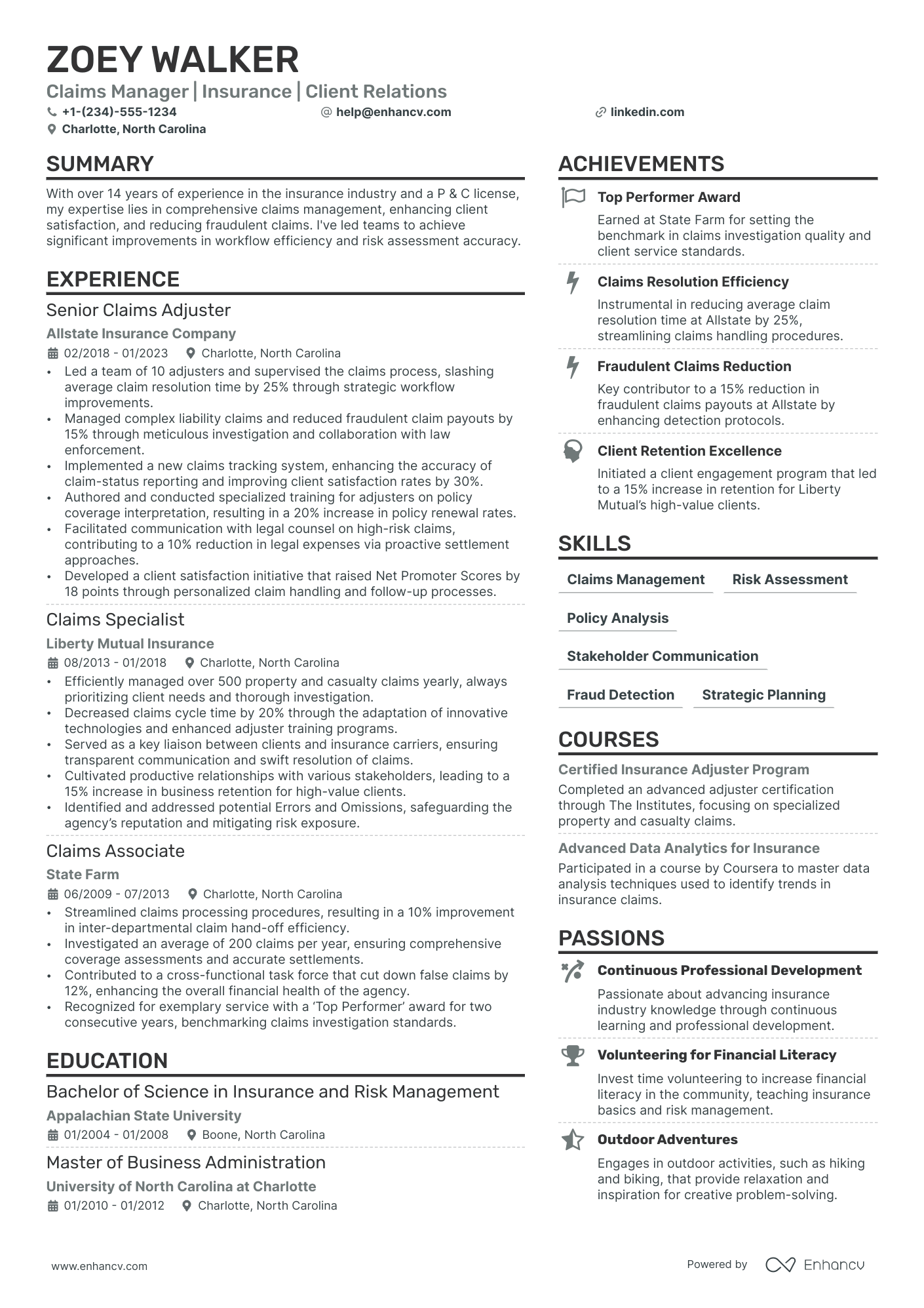

- The most straightforward and effective resume format, ensuring your claims manager resume stands out among numerous candidate profiles;

- The significance of the top one-third of your resume, including the header, summary or objective, and skills section, and its impact on recruiters;

- Frameworks and structures used by real claims manager professionals, offering insights on how to enhance your resume with industry-specific expertise;

- A variety of claims manager resume sections that bolster your profile, showcasing your comprehensive capabilities and distinctiveness.

Gaining insights from the best has never been easier. Explore more claims manager resume examples below:

- Junior Business Analyst Resume Example

- Business Development Executive Resume Example

- Marketing Account Manager Resume Example

- Fitness General Manager Resume Example

- Construction General Manager Resume Example

- Service Delivery Manager Resume Example

- Sourcing Manager Resume Example

- Business Director Resume Example

- Supply Chain Business Analyst Resume Example

- Casino Manager Resume Example

Designing your claims manager resume format to catch recruiters' eyes

Your claims manager resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your claims manager resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your claims manager resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Fundamental sections for your claims manager resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Proven experience in claims management and adjudication procedures specific to the industry (e.g., healthcare, insurance, workers' compensation).

- Proficiency with claims software and technology used for processing and tracking claims.

- Demonstrated ability to manage and lead a team of claims adjusters or processors, including performance monitoring and training.

- Strong understanding of regulatory compliance and laws pertaining to the specific sector of claims management.

- Evidence of successful negotiation and settlement of complex claims, showcasing excellent decision-making and conflict resolution skills.

Advice for your claims manager resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

Take a look at how real-life claims manager professionals have presented their resume experience section - always aiming to demonstrate their success.

- Spearheaded a team of claims adjusters, improving case resolution efficiency by 40% over a 3-year period through the implementation of advanced claims analytics.

- Directed the strategic overhaul of the claims processing system at Allstate Insurance, which led to a reduction in average claim handling time by 25%.

- Negotiated and settled complex claims in excess of $1M, while maintaining a 97% customer satisfaction rate.

- Oversaw a team of 30 claims professionals at Geico, handling over 10,000 claims annually with a focus on minimizing fraud and reducing payout expenses.

- Implemented a customer service initiative that increased positive policyholder feedback by 35%.

- Coordinated with legal counsel to successfully defend against litigation, saving the company an estimated $3M in potential losses.

- Developed a comprehensive training program for new claims adjusters at Progressive Insurance, which reduced onboarding time by 50%.

- Collaborated with the IT department to enhance the online claims submission portal, resulting in a 20% increase in customer usage.

- Led a task force that targeted insurance claims overpayment, recovering $500K for the fiscal year.

- Managed a portfolio of complex insurance claims at State Farm, achieving a 98% accuracy rate in claims assessment and adjustment.

- Piloted a fraud detection program that identified and prevented $2.5M in fraudulent claims in its first year.

- Enhanced interdepartmental collaborations by initiating regular communication channels with the underwriting and actuarial departments.

- Initiated and led a task force focused on catastrophic loss claims at Liberty Mutual, effectively expediting the processing of disaster-related claims.

- Designed and implemented a claims satisfaction survey program that improved overall service ratings by 30%.

- Managed and resolved high-profile claims, involving public attention, while upholding the company's reputation.

- Orchestrated a digital transformation in the claims department at Farmers Insurance, leading to a 50% reduction in paper usage and a faster turnaround for claimants.

- Fostered strong relationships with law enforcement and anti-fraud organizations to bolster investigative efforts into fraudulent claims.

- Leveraged data-driven insights to adjust claim policies, resulting in a 15% decrease in overall claims costs while maintaining high customer satisfaction levels.

- Led the regional claims resolution team at Hartford Financial Services, handling over 5,000 claims yearly with a focus on commercial property losses.

- Played a pivotal role in negotiating settlement agreements with claimants, ensuring favorable outcomes for all parties involved.

- Introduced a peer-review mechanism within the claims department that improved the accuracy of initial claims determinations by 22%.

- Facilitated an initiative to integrate AI technology in claims processing at Nationwide Insurance, increasing claims processing speed by 35%.

- Monitored and reported on key performance indicators, identifying trends and implementing tactical strategies to enhance departmental efficiency.

- Champion of customer experience, overseeing outreach initiatives that informed policyholders of claims process improvements, resulting in heightened trust and loyalty.

- Initiated a collaborative workflow system between claims and sales departments at AIG, ensuring a 24-hour response time to new claims, thereby boosting customer retention rates.

- Conducted in-depth trend analysis of claim patterns to identify areas susceptible to higher risks and devised preemptive plans to mitigate them.

- Slashed operational costs by 18% by pioneering a remote claims adjuster program, reducing the need for in-office presence.

- Directed a comprehensive audit of past claims at Chubb Group, identifying opportunities to reclaim $1M in overpaid settlements.

- Established a claims triage system that prioritized claims based on complexity and value, ensuring high-impact cases received immediate attention.

- Developed and maintained relationships with external vendors, which streamlined the claims process and improved turnaround time by 20%.

Quantifying impact on your resume

- Include the total amount of claims managed annually to demonstrate the scale of your responsibilities.

- List the percentage of claims resolved within target timeframes to showcase efficiency and ability to meet deadlines.

- Mention the dollar value of claims settled to highlight your experience with significant financial transactions.

- Quantify any improvements in claim resolution times under your management to show effectiveness at process optimization.

- Specify any percentage reduction in claim denial rates to indicate proficiency in claims accuracy and compliance.

- Present the number of personnel you've supervised to establish leadership and team management capabilities.

- State any budgetary savings achieved through efficient claims management to emphasize cost-control expertise.

- Detail the number of training sessions or workshops conducted to reflect your role in staff development and knowledge sharing.

Action verbs for your claims manager resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

Listing your relevant degrees or certificates on your claims manager resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Bringing your claims manager hard skills and soft skills to the forefront of recruiters' attention

Hard skills are used to define the technological (and software) capacities you have in the industry. Technical skills are easily defined via your certification and expertise.

Soft skills have more to do with your at-work personality and how you prosper within new environments. People skills can be obtained thanks to your whole life experience and are thus a bit more difficult to define.

Why do recruiters care about both types of skills?

Hard skills have more to do with job alignment and the time your new potential employers would have to invest in training you.

Soft skills hint at how well you'd adapt to your new environment, company culture, and task organization.

Fine-tune your resume to reflect on your skills capacities and talents:

- Avoid listing basic requirements (e.g. "Excel"), instead substitute with the specifics of the technology (e.g. "Excel Macros").

- Feature your workplace values and ethics as soft skills to hint at what matters most to you in a new environment.

- Build a separate skills section for your language capabilities, only if it makes sense to the role you're applying for.

- The best way to balance claims manager hard and soft skills is by building a strengths or achievements section, where you define your outcomes via both types of skills.

There are plenty of skills that could make the cut on your resume.

That's why we've compiled for you some of the most wanted skills by recruiters, so make sure to include the technologies and soft skills that make the most sense to you (and the company you're applying for):

Top skills for your claims manager resume:

Claims Management Software

Data Analysis Tools

Microsoft Excel

Customer Relationship Management (CRM) Systems

Fraud Detection Software

Document Management Systems

Regulatory Compliance Tools

Database Management Systems

Claims Processing Systems

Reporting and Analytics Tools

Communication Skills

Problem-Solving

Leadership

Negotiation

Attention to Detail

Empathy

Time Management

Critical Thinking

Team Collaboration

Adaptability

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Including your education and certification on your claims manager resume

The significance of your resume education section is paramount. It can show your diverse talents and experiences that are relevnt to the position.

- Incorporate educational qualifications, mentioning the institution and period.

- If you're on your academic journey, pinpoint your expected completion date.

- Opt for leaving out degrees that don't serve the job's purpose.

- Provide an overview of your educational experiences if it spotlights your milestones.

When recruiting for claims manager roles, candidates with relevant education and certification definitely stand out amongst competitors.

Showcase your academic background in the best way possible by:

- Listing all degrees and certifications that are part of the candidate qualifications in the claims manager advert

- Including any extra certificates, if they make sense to your application

- Not going over the top in details - the certificate name, institution, and dates are enough

- If you're in the process of obtaining a degree or certificate that's relevant to the job, include your expected graduation/certification dates

The education and certification sections help back up your application with years of experience in the industry or niche.

Select some of the most cutting-edge or applicable credentials for your next claims manager application from our list:

The top 5 certifications for your claims manager resume:

- Certified Professional in Healthcare Risk Management (CPHRM) - American Hospital Association (AHA)

- Associate in Claims (AIC) - The Institutes

- Senior Claims Law Associate (SCLA) - American Educational Institute, Inc.

- Chartered Property Casualty Underwriter (CPCU) - The Institutes

- Registered Professional Liability Underwriter (RPLU) - Professional Liability Underwriting Society (PLUS)

PRO TIP

Always remember that your claims manager certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Recommended reads:

Practical guide to your claims manager resume summary or objective

First off, should you include a summary or objective on your claims manager resume?

We definitely recommend you choose the:

- Resume summary to match job requirements with most noteworthy accomplishments.

- Resume objective as a snapshot of career dreams

Both the resume summary and objective should set expectations for recruiters as to what your career highlights are.

These introductory paragraphs (that are no more than five sentences long) should help you answer why you're the best candidate for the job.

Industry-wide best practices pinpoint that the claims manager resume summaries and objectives follow the structures of these samples:

Resume summaries for a claims manager job

- Seasoned claims manager with over 15 years of robust experience in the insurance industry, adept at streamlining claims processes to enhance efficiency and customer satisfaction. Instrumental in managing a team that achieved a 30% reduction in processing times, evidencing strong leadership and process optimization skills.

- Dedicated professional with a decade of expertise in healthcare administration, transitioning to claim management, brings a unique perspective on patient advocacy and insurance liaising. Excelling in reducing claims disputes by 25% at previous role through meticulous analysis and effective communication.

- With 8 years of experience in auto insurance claims management, this expert boasts a record of reducing fraudulent claims by 20% through the implementation of advanced investigative protocols. Renowned for advanced knowledge of liability determination and commitment to maintaining a high customer retention rate.

- A former financial analyst with 5 years of experience seeking to leverage extensive background in data analysis and risk assessment into claims management. Recognized for enhancing budgeting accuracy by 35% through predictive modeling, ready to apply quantitative skills to manage claim expenses effectively.

- Ambitious newcomer to the field of claims management, eager to apply a strong academic background in business administration and deep-seated analytical skills. Aspires to contribute to a high-performing team by developing comprehensive claim handling strategies that prioritize effective resource allocation and customer satisfaction.

- Fresh graduate passionate about embarking on a claims management career, launching from a rich foundation in legal studies and intern experiences at top law firms. Keen on incorporating nuanced understanding of regulations into claims processing to ensure meticulous compliance and dedication to client advocacy.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Bonus sections for your claims manager resume

Looking to show more personality on your claims manager resume? Then consider including a couple of extra sections.

They'd benefit your application by highlighting your most prominent:

Key takeaways

Writing your claims manager resume can be a structured and simple experience, once you better understand the organization's requirements for the role you're applying to. To sum up, we'd like to remind you to:

- Always select which experiences, skills, and achievements to feature on your resume based on relevancy to the role;

- In your resume summary, ensure you've cherry-picked your top achievements and matched them with the job ad's skills;

- Submit your claims manager resume as a one or two-page long document at the most, in a PDF format;

- Select industry leading certifications and list your higher education to highlight you have the basis for technical know-how;

- Quantify your people's skills through various resume sections (e.g. Strengths, Hobbies and interests, etc.) to show recruiters how your profile aligns with the organizational culture.