As a public accounting auditor, articulating the depth and complexity of your auditing experience on a resume can be a daunting challenge. Our guide provides clear examples and powerful language suggestions to help you succinctly showcase the breadth of your expertise and stand out to potential employers.

- Public accounting auditor resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out public accounting auditor skills that should make your resume.

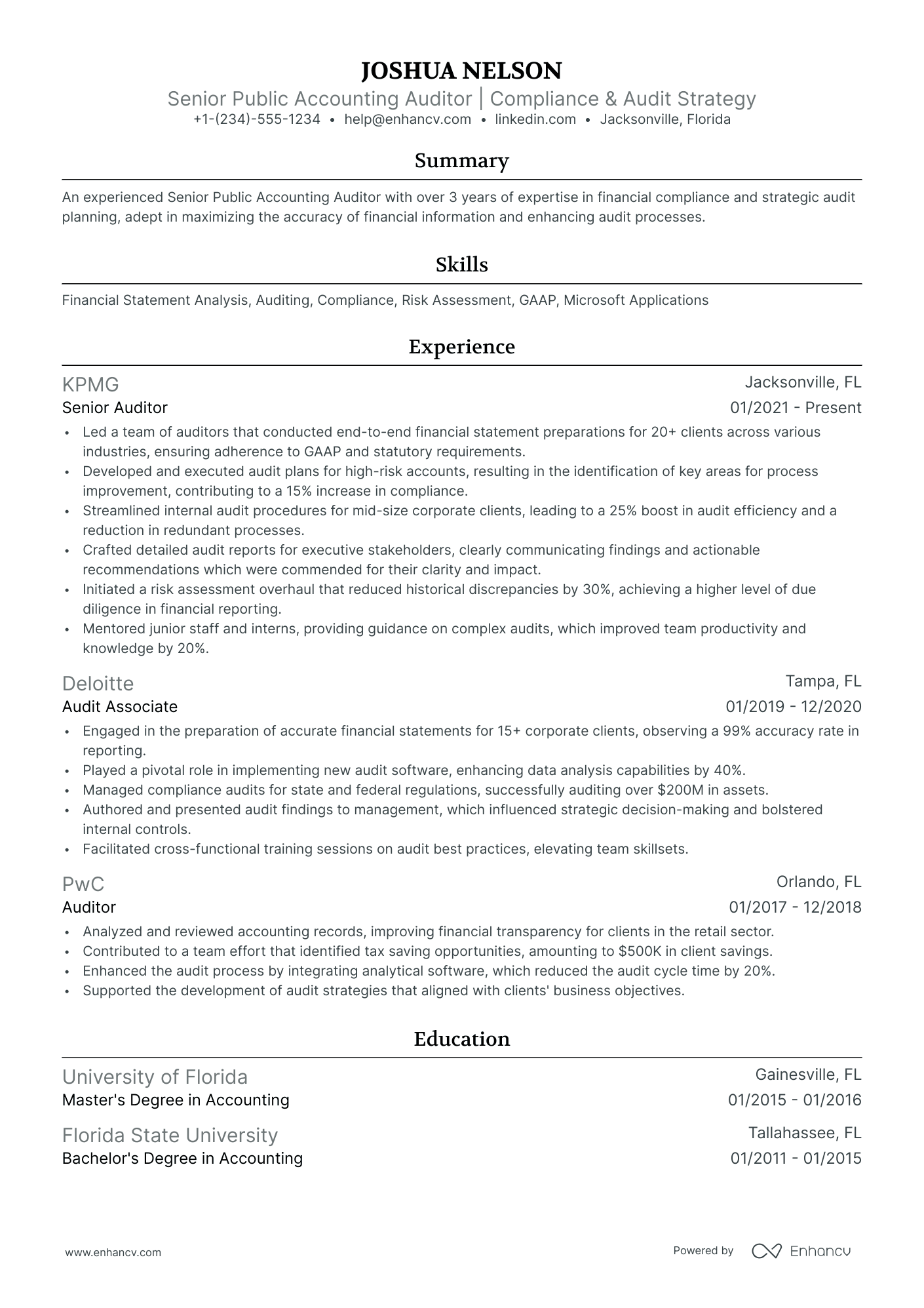

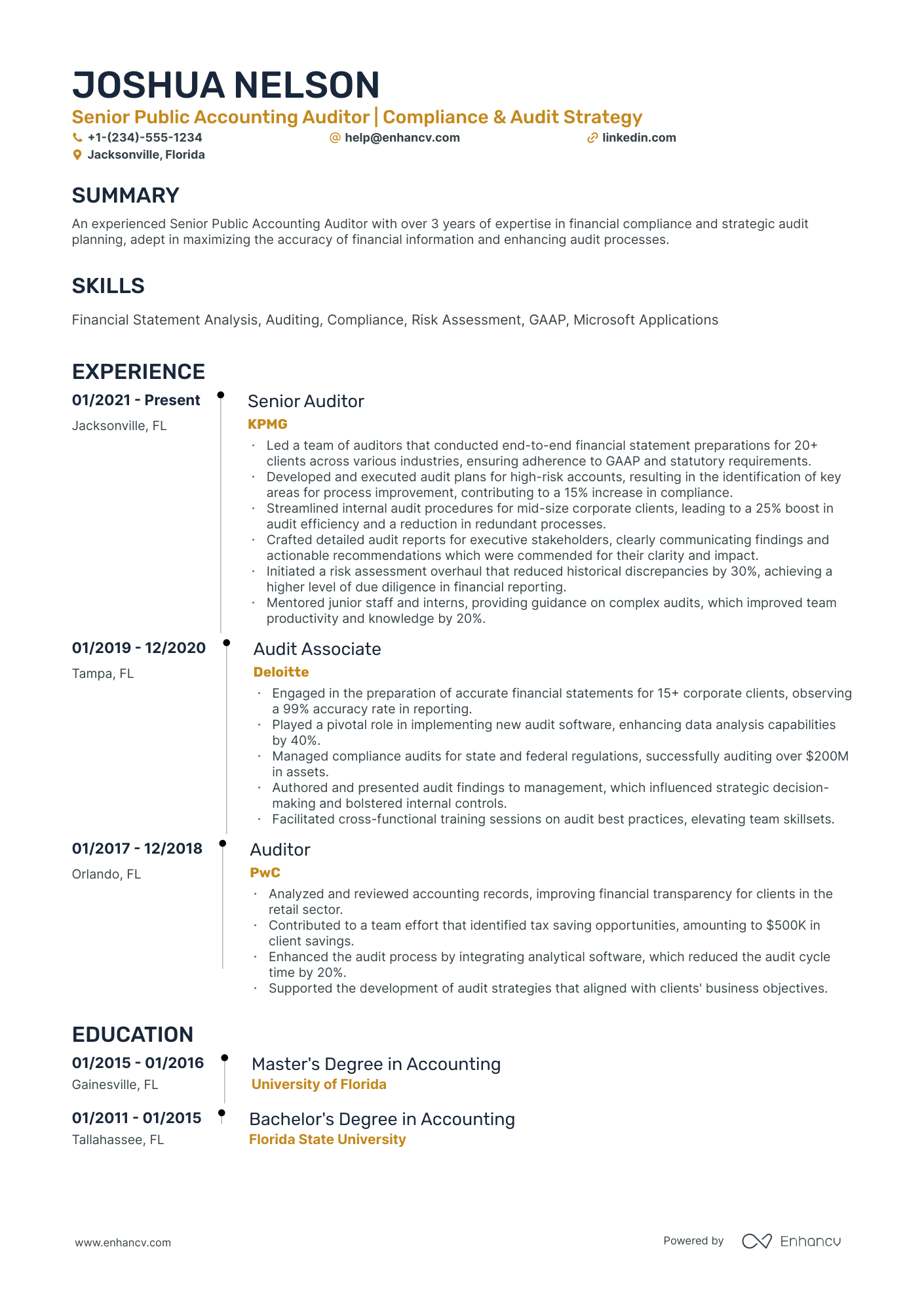

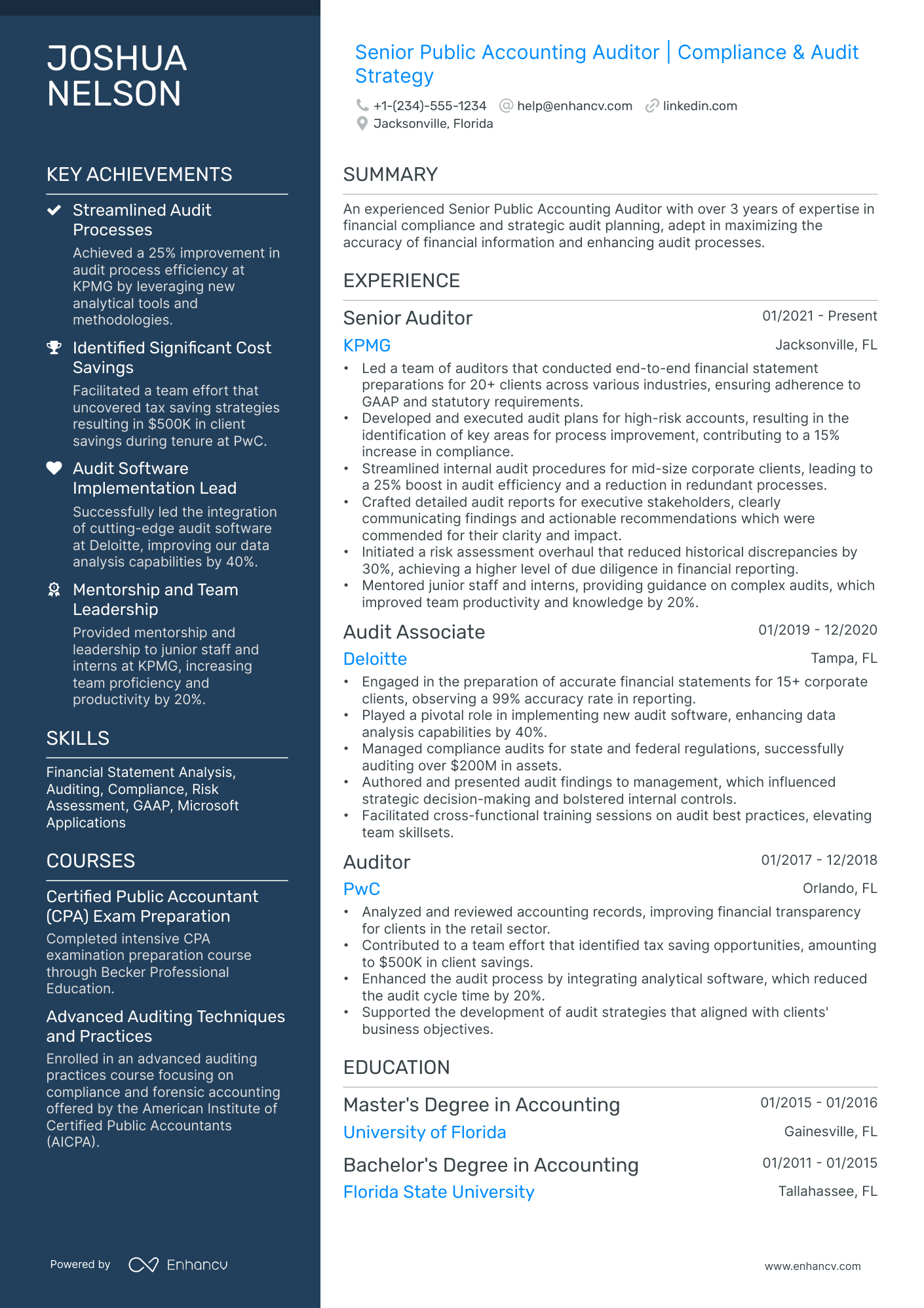

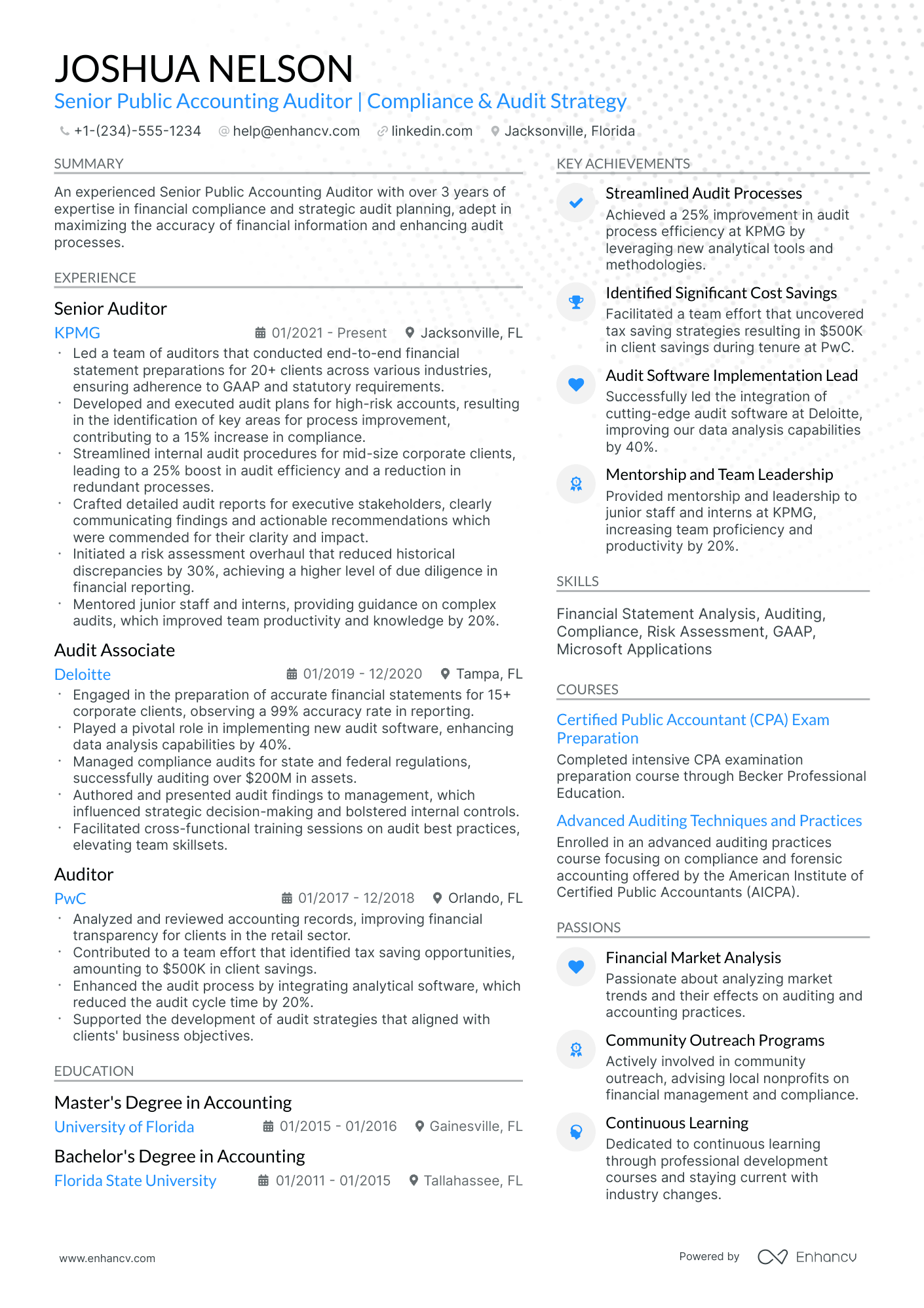

- Styling the layout of your professional resume: take a page from public accounting auditor resume examples.

How to write about your public accounting auditor achievements in various resume sections (e.g. summary, experience, and education).

- IT Auditor Resume Example

- Commercial Banking Resume Example

- Bank Branch Manager Resume Example

- Financial Project Manager Resume Example

- Audit Director Resume Example

- Billing Manager Resume Example

- Corporate Financial Analyst Resume Example

- Corporate Banking Resume Example

- Risk Manager Resume Example

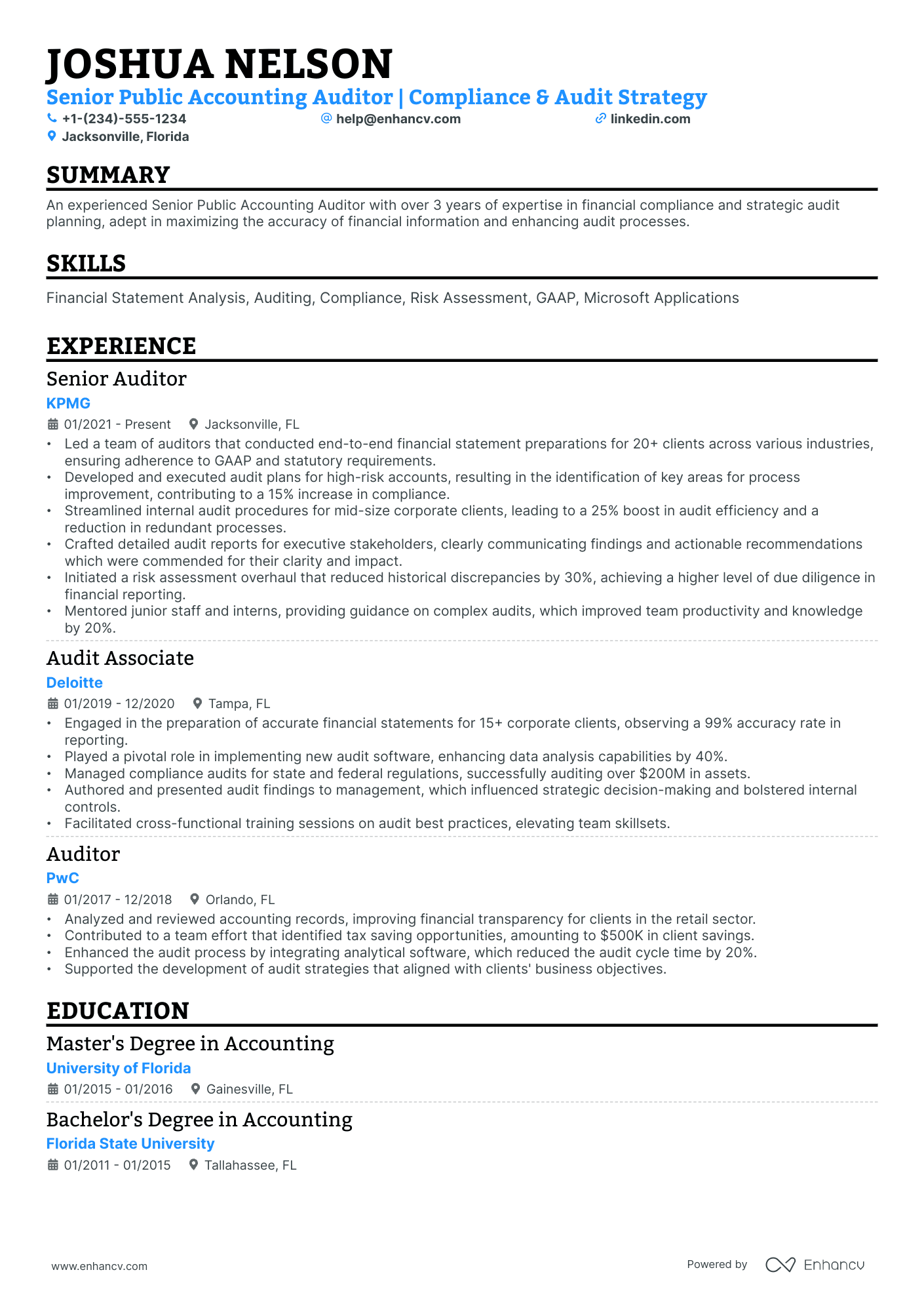

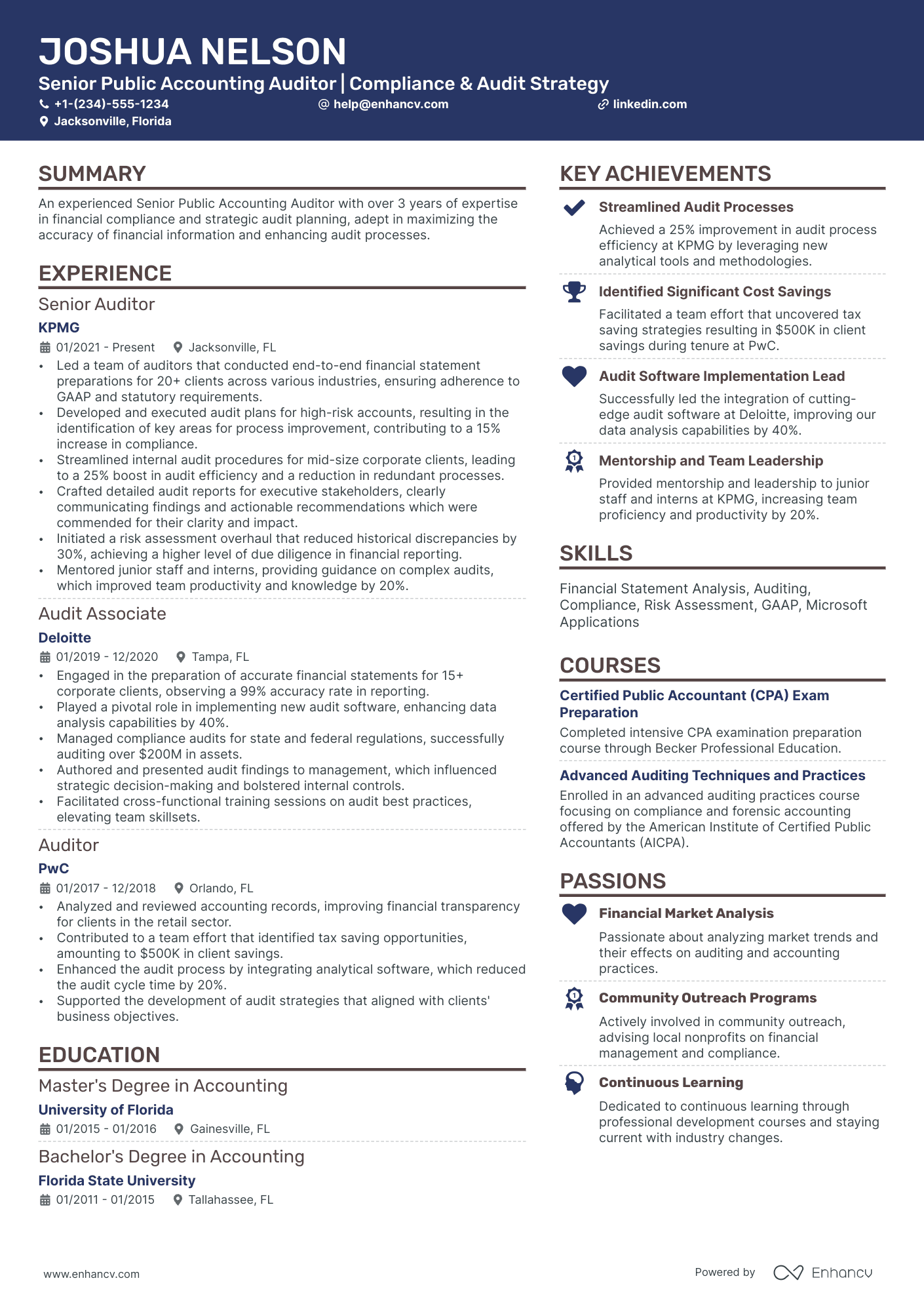

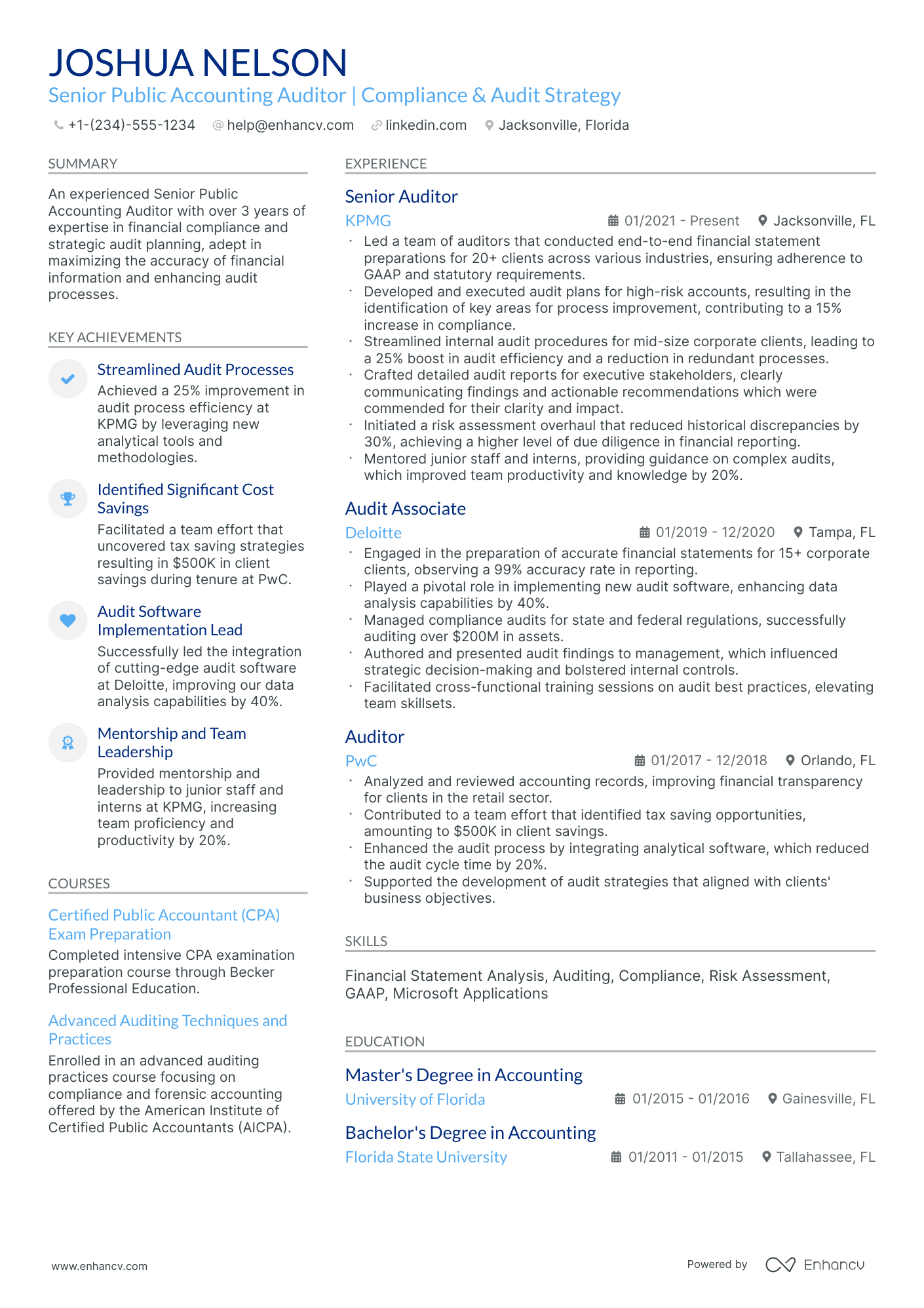

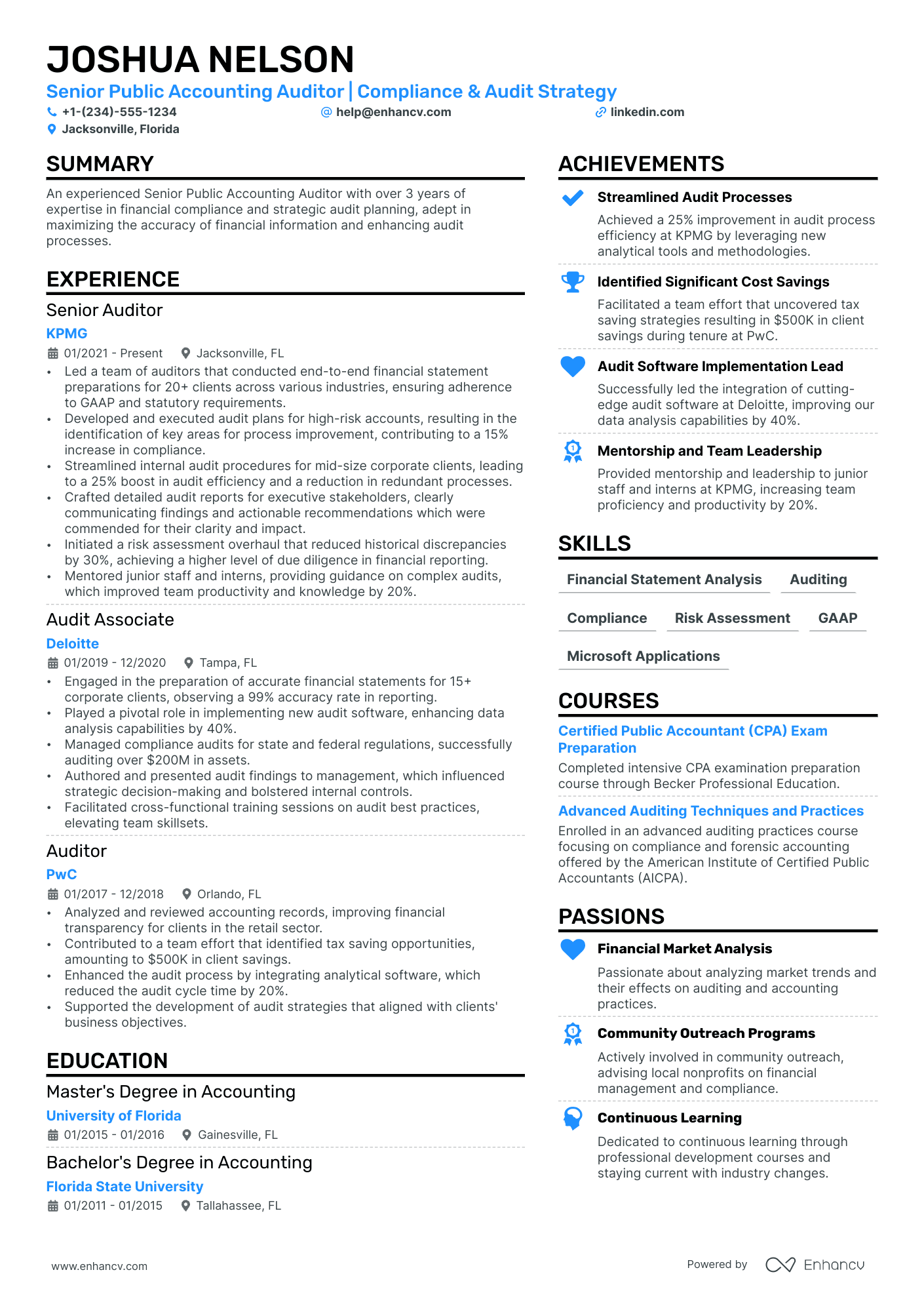

The importance of format and layout in your public accounting auditor resume

Consider you're an HR professional at company X, evaluating two public accounting auditor candidate resumes. John Smith presents a simple, traditional, and easy-to-read resume. Edward Price, however, uses a non-conventional, often illegible format. Whose resume would you spend more time on to understand their experience? This scenario underscores the importance of your public accounting auditor resume’s design. It should be simply formatted and clearly communicate why you are the ideal candidate for the role.

Achieve this balance by:

- Listing your experience, beginning with the most recent and relevant, in reverse chronological order;

- Ensuring your header contains essential information, such as contact details, a headline, and a portfolio link. Include a professional photo in the public accounting auditor resume header if you have one;

- Including only the most important and relevant resume sections to showcase your expertise and stand out from other candidates;

- Editing your public accounting auditor resume to be no longer than two pages if you have extensive relevant experience. Use your limited resume space judiciously.

Also, remember that your public accounting auditor resume might initially be scanned by an Applicant Tracker System (ATS).

When it comes to ATS:

- Opt for simple and legible fonts like Raleway, Rubik, Lato, etc., making your experience easy for the ATS to scan;

- Use serif and sans-serif fonts, both of which are ATS-friendly;

- Avoid overused options like Arial and Times New Roman, which, while suitable, may lack personality.

Contrary to a common myth, our recent study shows that the ATS can effectively process both one-column and two-column resumes. Learn more about this in the ATS myths guide.

Finally, when submitting your public accounting auditor resume, always export it as a PDF to ensure all information remains intact, making the document easier to print, read, and scan.

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Listing your relevant degrees or certificates on your public accounting auditor resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

The key to your public accounting auditor job-winning resume - present your expertise with these sections:

- A header to make your resume more scannable

- Snapshot of who you are as a professional with your resume soft skills, achievements, and summary or objective

- Job advert keywords in the skills section of your resume

- Resume experience quantifying your past job successes with metrics

- A relevant education, certification, and technical sills section to provide background to your technological/software capabilities

What recruiters want to see on your resume:

- CPA Certification or progress towards obtaining it, which demonstrates professional knowledge and commitment to the field.

- Audit experience with specific industries or types of audits, showing specialization or breadth of expertise (e.g., experience with SOX compliance, financial audits, or internal audits).

- Strong understanding and familiarity with GAAP (Generally Accepted Accounting Principles) and other regulatory standards relevant to auditing.

- Proficiency with auditing software and technological tools (e.g., ACL, IDEA, or familiarity with ERP systems like SAP or Oracle).

- Demonstrated ability to identify and assess financial risks and communicate findings effectively to management and clients.

Adding your relevant experience to your public accounting auditor resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your public accounting auditor resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the public accounting auditor advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample public accounting auditor resumes on how to best create your resume experience section.

- Led audits for over 20 client companies, identifying compliance issues and recommending solutions, increasing overall client satisfaction by 30%.

- Improved our audit process by integrating advanced data analytics techniques, which cut down on audit time by an average of 15% per engagement.

- Mentored a team of 10 junior auditors, enhancing their understanding of complex accounting standards and practices, which reduced error rates by 25%.

- Participated in comprehensive financial audits for multi-national corporations, ensuring adherence to GAAP and fiscal accuracy in financial reporting.

- Developed a standardized approach to testing internal controls, which helped streamline the audit process for our team.

- Contributed to a significant audit of a major technology firm, which involved assessing risks associated with cloud computing infrastructure.

- Effectively communicated audit findings to management, leading to the implementation of new risk mitigation strategies.

- Played a key role in a forensic audit that uncovered a long-running fraud scheme, resulting in the recovery of approximately $2.5 million in misappropriated funds.

- Assisted in developing a proprietary auditing software, tailored to our firm's methodology, which increased efficiency by 20%.

- Conducted external audits for small to medium-sized businesses, often uncovering key tax savings opportunities which resulted in an average of 10% savings for clients.

- Handled complex tax audit issues, securing favorable outcomes for our clients, and limiting penalties and adjustments by the IRS.

- Implemented new auditing techniques that enhanced evidence gathering, thereby reducing the reliance on client-provided information.

- Oversaw a team of auditors conducting compliance engagements for financial institutions, enhancing the firm's reputation in the financial services sector.

- Conducted operational audits resulting in improved business processes that increased operational efficiency by 18%.

- Designed and delivered customized training programs for new auditors, emphasizing the importance of regulatory compliance and ethical practices.

- Facilitated the transition to cloud-based audit software, reducing average audit cycle times and boosting client data security.

- Engaged in the audit of a Fortune 500 company, contributing to a 95% on-time completion rate of audit deliverables.

- Analyzed and reported on financial discrepancies, which were instrumental in strategic planning for clients facing economic downturns.

- Played a pivotal role in audits that evaluated multi-million dollar investment portfolios, ensuring compliance with SEC regulations and identifying potential risk exposures.

- Streamlined audit approaches for the healthcare sector, focusing on compliance with the Affordable Care Act and improving the effectiveness of audit procedures.

- Acted as the main contact point for clients during the audit process, leading to a track record of 100% client retention over the audit tenure.

- Completed field audits that ensured the integrity of financial information for public entities, significantly contributing to investor confidence.

- Reduced the risk of material misstatement through meticulous audit planning and execution, which in turn minimized post-audit adjustments.

- Presented audit findings and recommendations to client's board of directors, often leading to improvement in corporate governance.

- Identified financial reporting irregularities in Fortune 500 client, leading to restated financials and improved investor relations.

- Supervised a diverse team of auditors on international assignments, enhancing the firm's global footprint and expertise.

- Collaborated with IT specialists to integrate cybersecurity assessments into regular audits, addressing an increasing concern for client's digital vulnerabilities.

- Drove the adoption of new audit software that resulted in a 35% reduction in paper usage and contributed to the firm's sustainability goals.

- Coordinated directly with C-suite executives on high-stakes audits, which ensured high-level oversight and strategic alignment with business objectives.

- Implemented a continuous audit program for real-time monitoring of large transactions, providing clients with immediate insight into their financial status.

Quantifying impact on your resume

- Detail the number of audit engagements managed to demonstrate capacity to handle workload and complexity.

- Specify the size of financial statements audited, conveying expertise in dealing with big-budget entities.

- Include the percentage of cost savings identified through effective audit processes, highlighting efficiency and value addition.

- State the number of regulatory compliance issues resolved to showcase problem-solving skills and regulatory knowledge.

- Mention the frequency of audits performed to emphasize dedication and thoroughness.

- List the amount of accounting discrepancies rectified to underline attention to detail and accuracy.

- Quantify the number of audit team members supervised to show leadership and team management proficiency.

- Report on the number of audit reports prepared and presented to communicate written communication skills and accountability.

Action verbs for your public accounting auditor resume

Guide for public accounting auditor professionals kicking off their career

Who says you can't get that public accounting auditor job, even though you may not have that much or any experience? Hiring managers have a tendency to hire the out-of-the-blue candidate if they see role alignment. You can show them why you're the best candidate out there by:

- Selecting the functional skill-based or hybrid formats to spotlight your unique value as a professional

- Tailoring your public accounting auditor resume to always include the most important requirements, found towards the top of the job ad

- Substituting the lack of experience with other relevant sections like achievements, projects, and research

- Pinpoint both achievements and how you see yourself within this specific role in the public accounting auditor resume objective.

Recommended reads:

PRO TIP

Listing your relevant degrees or certificates on your public accounting auditor resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

In-demand hard skills and soft skills for your public accounting auditor resume

A vital element for any public accounting auditor resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your public accounting auditor skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "public accounting auditor skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your public accounting auditor resume:

GAAP

IFRS

Audit Software (e.g., ACL, IDEA)

Microsoft Excel

Tax Preparation Software

Accounting Software (e.g., QuickBooks, SAP)

Data Analytics Tools

Risk Assessment Techniques

Financial Statement Analysis

Regulatory Compliance Tools

Attention to Detail

Critical Thinking

Communication Skills

Problem-Solving

Time Management

Team Collaboration

Adaptability

Client Relationship Management

Ethical Judgment

Organizational Skills

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Public accounting auditor-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular public accounting auditor certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your public accounting auditor resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Certified Internal Auditor (CIA) - Institute of Internal Auditors (IIA)

- Chartered Accountant (CA) - Various global accounting bodies (ACCA, ICAEW, ICAS, CAANZ, and others)

- Certified Information Systems Auditor (CISA) - Information Systems Audit and Control Association (ISACA)

- Certified Fraud Examiner (CFE) - Association of Certified Fraud Examiners (ACFE)

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Recommended reads:

Best practices to your public accounting auditor resume summary or objective

To start, how do you know if you should include a resume summary or a resume objective ?

- Resume summaries are ideal for public accounting auditor professionals with more experience, who'd like to give a quick glimpse of their biggest career achievements in the top one-third of their resumes.

- On the other hand, resume objectives serve as a road map for recruiters. Candidates use the objective to show how their experience aligns with the public accounting auditor role they're applying for while showcasing the North Star of their career (or where they want to be as a professional in the next couple of years).

The resume summary or resume objective could be the perfect fit for your public accounting auditor resume. The function of both is to highlight your professionalism succinctly. So, keep your writing specific: include no more than four sentences and target your application to the role. Here's how these specific resume sections help the public accounting auditor candidates stand out.

Resume summaries for a public accounting auditor job

- Accomplished CPA with 8 years of experience in conducting external audits for mid to large-sized corporations at Smith & Associates. Specializes in implementing data analytics for enhanced audit efficiency, resulting in a 15% reduction in audit completion time. Recognized for significantly improving the financial reporting process for a Fortune 500 client.

- Senior Audit Manager retired from a ten-year tenure at Big Four, bringing extensive knowledge in financial regulations, compliance, and GAAP to pursue wider industry challenges. Orchestrated a company-wide audit for a multinational that cut compliance costs by 20% while increasing transparency.

- Finance professional with a strong background in budget analysis and management accounting, eager to transition into public accounting. Proven track record of identifying financial discrepancies, having managed a portfolio oversight for assets exceeding $30 million while consistently meeting deadlines.

- Engineer with 12 years at BlueTech Industries developing a keen analytical skill set, now pivoting to a career in public accounting. Demonstrated aptitude for precision and problem-solving with award-winning cost-saving project implementations, ready to apply a logical and systematic approach to financial audits.

- Seeking to apply my robust analytical and mathematical skills to a new career in public accounting. Fueled by a passion for integrity in financial reporting, I am committed to continuous learning and excelling in complex audit environments.

- Determined to leverage my strong organizational abilities and detail-oriented approach in the journey of becoming a distinguished public accounting auditor. Driven by a passion for accountability in financial practices and an unwavering commitment to professional development in the auditing field.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

What else can you add to your public accounting auditor resume

What most candidates don't realize is that their public accounting auditor resumes should be tailored both for the job and their own skillset and personality.

To achieve this balance between professional and personal traits, you can add various other sections across your resume.

Your potential employers may be impressed by your:

- Awards - spotlight any industry-specific achievements and recognitions that have paved your path to success;

- Languages - dedicate some space on your public accounting auditor resume to list your multilingual capabilities, alongside your proficiency level;

- Publications - with links and descriptions to both professional and academic ones, relevant to the role;

- Your prioritization framework - include a "My Time" pie chart, that shows how you spend your at-work and free time, would serve to further backup your organization skill set.

Key takeaways

At the end of our guide, we'd like to remind you to:

- Invest in a simple, modern resume design that is ATS friendly and keeps your experience organized and legible;

- Avoid just listing your responsibilities in your experience section, but rather focus on quantifiable achievements;

- Always select resume sections that are relevant to the role and can answer job requirements. Sometimes your volunteering experience could bring more value than irrelevant work experience;

- Balance your technical background with your personality traits across various sections of your resume to hint at how much time employers would have to invest in training you and if your profile would be a good cultural fit to the organization;

- Include your academic background (in the form of your relevant higher education degrees and certifications) to show recruiters that you have the technical basics of the industry covered.