Many mortgage broker resumes fail because they read like task lists and bury measurable production in dense blocks of text. That matters now because applicant tracking system screening and fast recruiter scans reward clear keywords, structure, and proof in a crowded market.

A strong resume shows what you delivered, not just what you used. Knowing how to make your resume stand out means you should highlight funded volume, pull-through rate, cycle time reductions, referral growth, compliance accuracy, and complex files closed on schedule. Show pipeline size, average loan amount, and revenue impact.

Key takeaways

- Quantify funded volume, pull-through rate, and cycle time in every experience bullet.

- Use reverse-chronological format for experienced brokers and hybrid format for career switchers.

- Tailor each resume to the job posting's exact tools, loan products, and compliance terms.

- Anchor skills in measurable outcomes rather than listing them in isolation.

- Place certifications like your NMLS license where hiring managers spot them immediately.

- Write a three- to four-line summary featuring your title, domain focus, and top metric.

- Use Enhancv's Bullet Point Generator to turn routine tasks into recruiter-ready achievement statements.

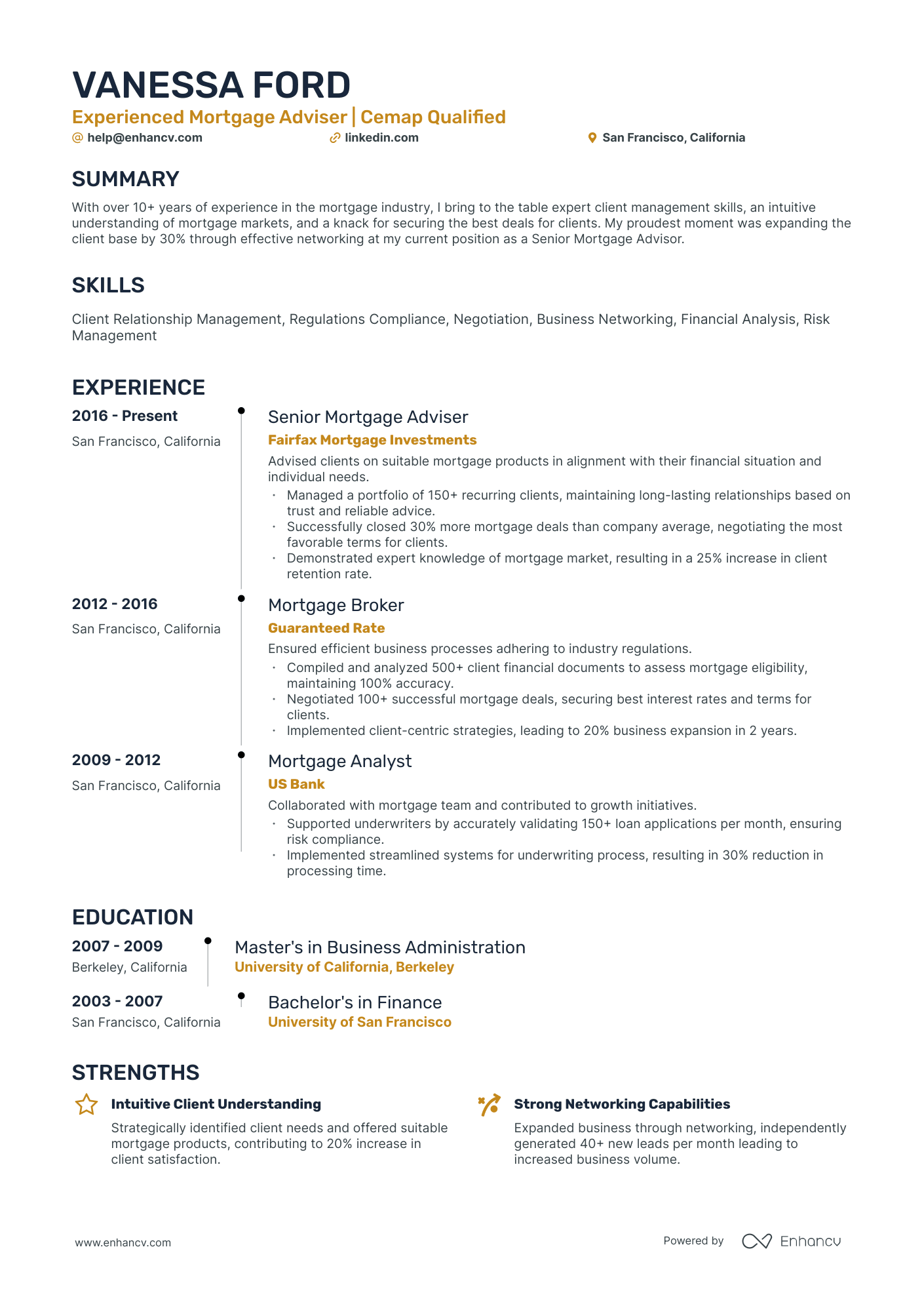

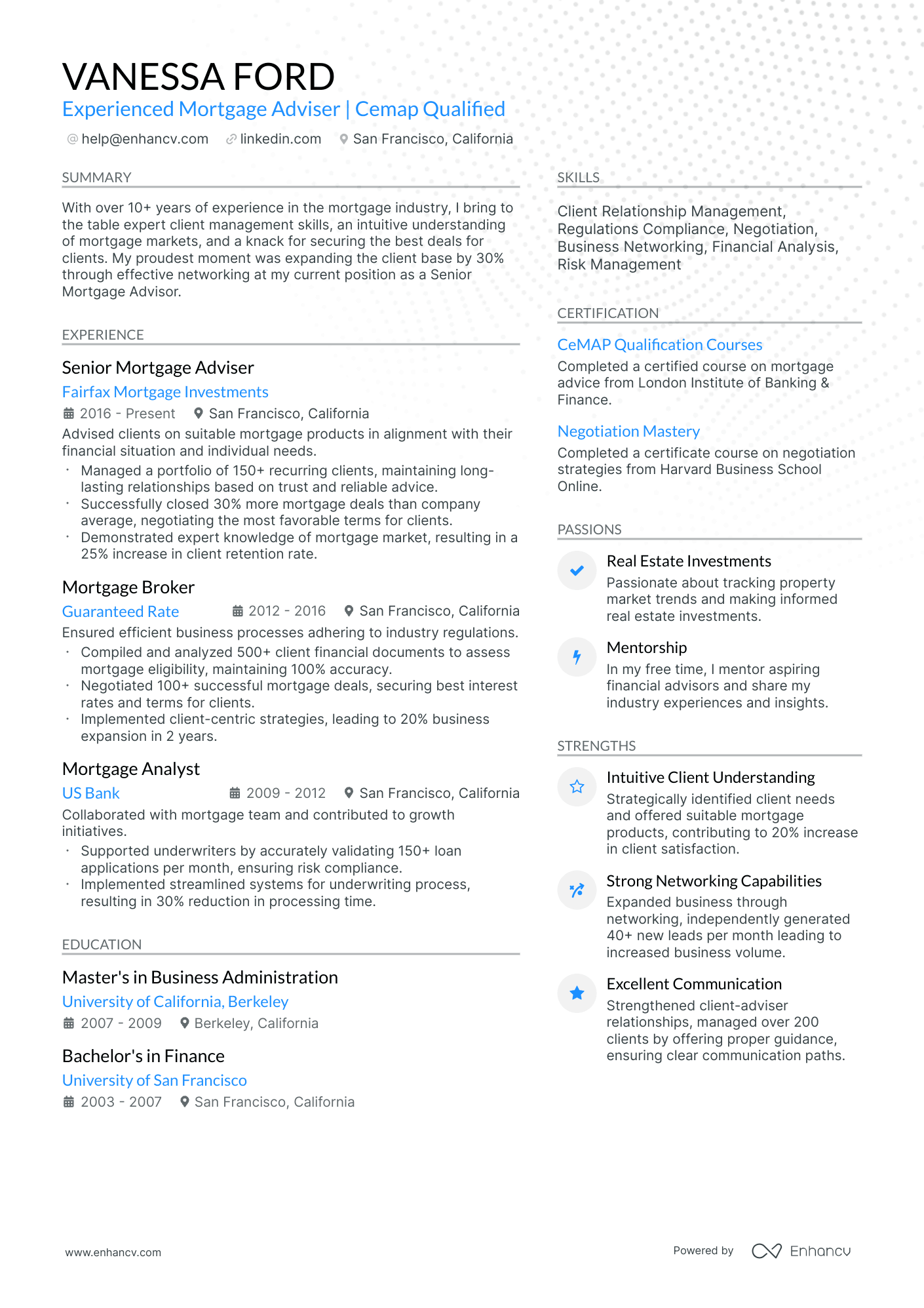

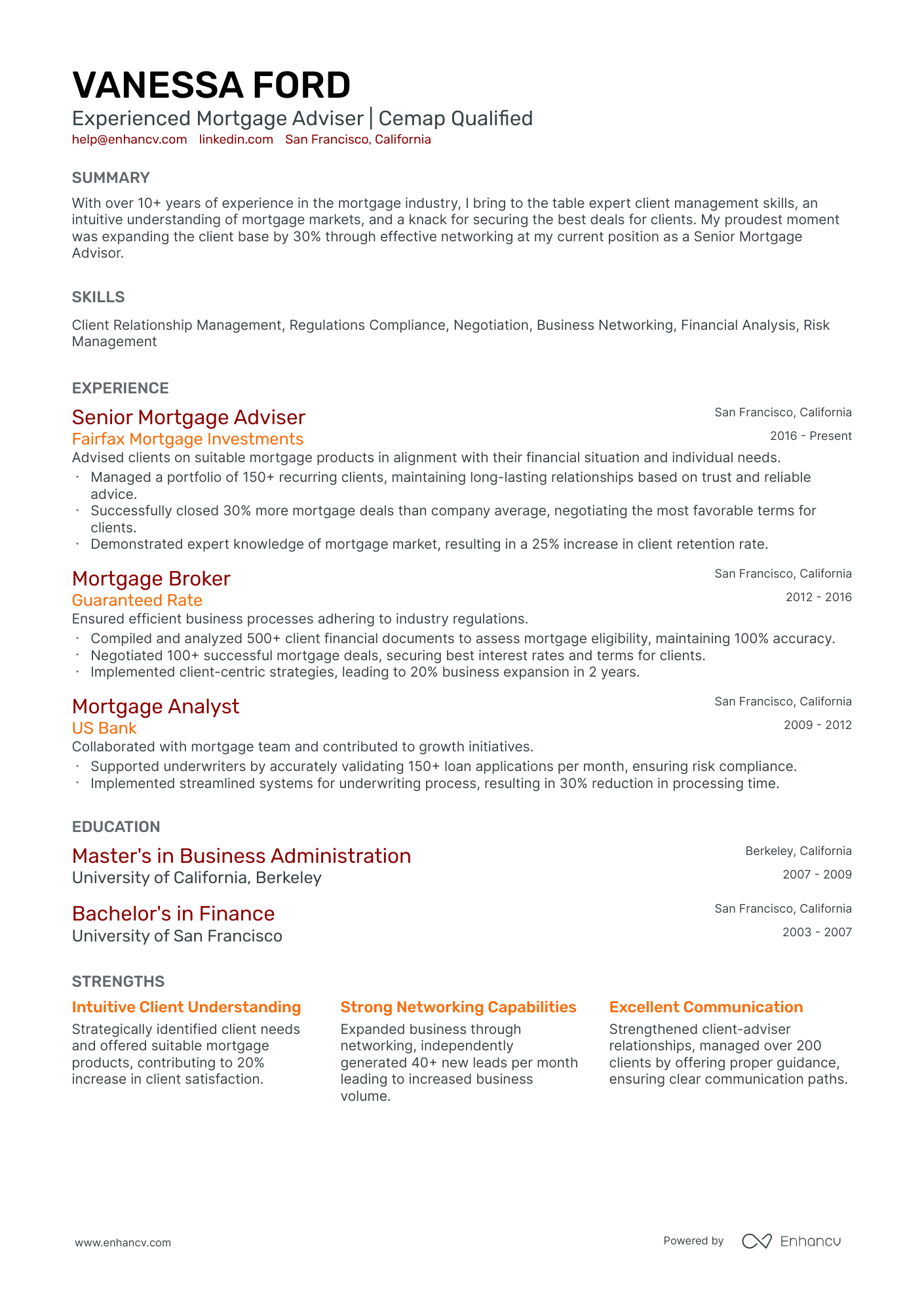

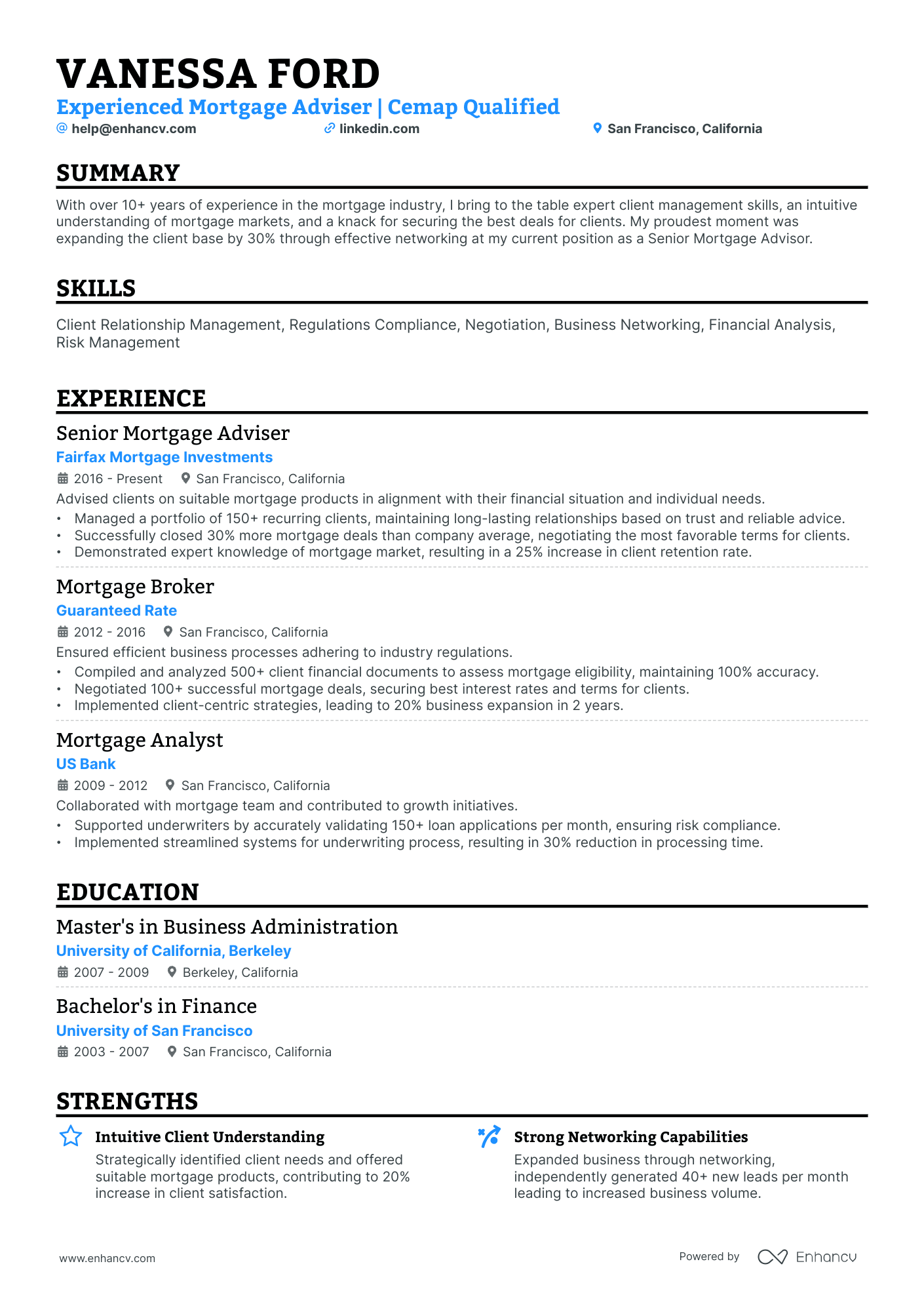

How to format a mortgage broker resume

Recruiters evaluating mortgage broker resumes prioritize loan production volume, client relationship management, regulatory compliance knowledge, and the ability to close deals across diverse lending products. A clean, well-structured resume format ensures these signals surface quickly during both human review and applicant tracking system (ATS) scans.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your mortgage brokerage career in a clear, progression-driven timeline. Do:

- Lead each role entry with your scope of responsibility—loan volume managed, team size, lender network breadth, and client portfolio scale.

- Highlight expertise in mortgage-specific tools and domains such as Encompass, Calyx, FHA/VA/conventional lending guidelines, and rate-lock management.

- Quantify production outcomes, client retention rates, and revenue contributions tied directly to your brokerage activity.

I'm junior or switching into this role—what format works best?

A hybrid format works best, allowing you to lead with relevant skills and certifications while still showing your work history in chronological order. Do:

- Place a skills section near the top featuring mortgage-relevant competencies such as loan structuring, compliance knowledge, CRM proficiency, and client needs assessment.

- Include internships, banking roles, real estate experience, or relevant coursework and licensing (NMLS, state mortgage broker license) as transitional experience.

- Connect every listed skill or project to a concrete action and a measurable or observable result.

Why not use a functional resume?

A functional format strips away the timeline context that hiring managers rely on to verify your production track record, compliance history, and growth within the mortgage industry. A functional resume might be acceptable if you're transitioning from a related field such as real estate, banking, or financial advising and have no direct mortgage brokerage titles—but only if you anchor every listed skill to specific projects, client outcomes, or licensing milestones rather than presenting skills in isolation.

Now that you've established a clean, readable layout, it's time to fill it with the right sections that showcase your qualifications effectively.

What sections should go on a mortgage broker resume

Recruiters expect a mortgage broker resume to show compliant loan production, strong borrower and referral partner relationships, and measurable results. Knowing what to put on a resume helps you prioritize the right content from the start.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize funded volume, pull-through rate, cycle time, approval rate, compliance quality, and referral growth, tied to clear outcomes and scope.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now that you’ve organized your resume with the right components in place, the next step is to write your mortgage broker experience section so it fits that structure and supports your qualifications.

How to write your mortgage broker resume experience

The experience section is where you prove you can originate, structure, and close mortgage loans—not just describe daily tasks. Hiring managers prioritize demonstrated impact, so every bullet should spotlight delivered results, the lending platforms or compliance frameworks you used, and measurable outcomes tied to loan volume, client retention, or process efficiency. Building a targeted resume ensures each bullet speaks directly to what the employer values most.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the loan products, borrower segments, referral pipelines, or geographic markets you were directly accountable for as a mortgage broker.

- Execution approach: the loan origination systems, underwriting guidelines, rate-lock tools, CRM platforms, or compliance methods you relied on to evaluate borrowers, structure deals, and move files from application to closing.

- Value improved: changes you drove in approval turnaround time, pull-through rates, borrower satisfaction, documentation accuracy, or regulatory compliance that strengthened the brokerage's performance.

- Collaboration context: how you partnered with underwriters, real estate agents, title companies, appraisers, processors, or financial planners to resolve conditions, accelerate closings, or expand referral networks.

- Impact delivered: outcomes framed around funded loan volume, portfolio growth, client retention, cost savings, or risk reduction rather than a list of routine activities.

Experience bullet formula

A mortgage broker experience example

✅ Right example - modern, quantified, specific.

Senior Mortgage Broker

HarborPoint Home Loans | Phoenix, AZ

2021–Present

Independent mortgage brokerage serving first-time buyers and self-employed borrowers across Arizona and Texas.

- Originated $38.6M in purchase and refinance volume across 142 closed loans by running end-to-end pipeline management in Encompass by ICE Mortgage Technology and Salesforce, improving pull-through rate from 62% to 74%.

- Reduced average clear-to-close time by nine days by standardizing document collection and verification workflows in Blend and DocuSign, aligning borrowers, real estate agents, and underwriters on weekly milestone check-ins.

- Increased pre-approval conversion by 21% by implementing a rate and scenario tracker in Microsoft Excel and Mortgage Coach, delivering same-day loan option comparisons for buyers and their agents.

- Cut pricing exceptions by 28% by tightening compliance checks for TRID (TILA-RESPA Integrated Disclosure) and anti-money laundering requirements, partnering with compliance and lender account executives to resolve conditions within forty-eight hours.

- Improved borrower satisfaction from 4.6 to 4.8 out of 5 by launching automated status updates through Twilio and HubSpot, reducing inbound “where are we” calls by 32% while maintaining a sub-two-hour response time.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific role you're applying for.

How to tailor your mortgage broker resume experience

Recruiters evaluate your mortgage broker resume through both applicant tracking systems and manual review, so tailoring your resume to the job description is essential. Tailoring ensures the specific skills, tools, and qualifications a lender or brokerage seeks are clearly reflected in your work history.

Ways to tailor your mortgage broker experience:

- Match loan origination software and CRM platforms named in the posting.

- Mirror the exact mortgage products or loan types the role requires.

- Use the same terminology for underwriting guidelines or compliance standards listed.

- Reflect volume or production KPIs the employer highlights as priorities.

- Include state licensing or NMLS credentials when the posting specifies them.

- Emphasize federal regulatory compliance experience if the role mentions it.

- Highlight referral partner or real estate agent collaboration the job references.

- Align your process descriptions with the specific loan lifecycle stages mentioned.

Tailoring means connecting your real accomplishments to what the employer asks for, not forcing keywords where they don't belong.

Resume tailoring examples for mortgage broker

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Originate and close residential mortgage loans using Encompass LOS, ensuring compliance with TRID and RESPA regulations while maintaining a pipeline of $5M+ monthly." | Helped clients with mortgage applications and loan processing. | Originated and closed an average of $6.2M in residential mortgage loans monthly using Encompass LOS, maintaining full compliance with TRID and RESPA throughout the disclosure and closing process. |

| "Build referral partnerships with real estate agents and financial planners to generate qualified leads, targeting a minimum of 15 closed units per quarter." | Worked with partners to find new business opportunities. | Developed and maintained referral partnerships with 30+ real estate agents and financial planners, generating a consistent pipeline that averaged 18 closed loan units per quarter. |

| "Analyze borrower financials, including DTI ratios and credit profiles, to structure conventional, FHA, and VA loan products that meet secondary market guidelines." | Reviewed financial documents and helped borrowers choose loan options. | Evaluated borrower DTI ratios, credit profiles, and income documentation to structure conventional, FHA, and VA loans, achieving a 94% first-submission approval rate against secondary market guidelines. |

Once you’ve aligned your experience with the role’s requirements, quantify your mortgage broker achievements to show the impact of that work.

How to quantify your mortgage broker achievements

Quantifying your achievements proves you drive approvals, revenue, and compliant closings. Focus on funded volume, pull-through rate, time-to-close, pricing impact, and error-free files across your lender and customer pipeline.

Quantifying examples for mortgage broker

| Metric | Example |

|---|---|

| Funded volume | "Closed $18.6M in funded loans across 62 files in 2025 while maintaining full documentation standards in Encompass and Salesforce." |

| Pull-through rate | "Improved application-to-funding pull-through from 58% to 71% by tightening pre-qualification and conditions tracking with a weekly pipeline dashboard." |

| Time to close | "Cut average clear-to-close time from 24 days to 17 days by standardizing borrower checklists and coordinating faster appraisal ordering with AMC partners." |

| Pricing impact | "Saved borrowers an average of 0.18% in rate by comparing five lenders per file and negotiating lender credits, producing $1,250 average monthly payment reduction." |

| Compliance accuracy | "Reduced post-submission condition rework by 32% by implementing a compliance checklist for TRID (TILA-RESPA Integrated Disclosure) and document naming rules." |

Turn your everyday tasks into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once your bullet points clearly convey your achievements, the next step is ensuring your skills section reinforces that same expertise through a strategic mix of hard and soft skills.

How to list your hard and soft skills on a mortgage broker resume

Your skills section shows you can qualify borrowers, structure compliant loans, and close on time, and recruiters and an ATS (applicant tracking system) scan this section to match you to the job post—aim for mostly hard skills with a focused set of role-specific soft skills. mortgage broker roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Loan origination systems, CRM

- Mortgage pre-qualification

- Debt-to-income calculations

- Loan-to-value analysis

- Credit report analysis

- FHA, VA, USDA guidelines

- Conventional, jumbo underwriting

- RESPA, TILA, TRID compliance

- Rate locks and pricing engines

- Document collection and review

- Automated underwriting systems (DU, LPA)

- Pipeline management and reporting

Soft skills

- Set clear borrower expectations

- Explain terms in plain language

- Ask targeted discovery questions

- Present options with tradeoffs

- Coordinate with processors and underwriters

- Follow up to unblock conditions

- Manage multiple files under deadlines

- Document decisions and next steps

- Handle objections and rate concerns

- Negotiate with lenders and agents

- Maintain confidentiality and trust

- Spot issues early and escalate

How to show your mortgage broker skills in context

Skills shouldn't live only in a dedicated skills list. You can explore common resume skills to identify which competencies align best with mortgage broker roles.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what that looks like in practice.

Summary example

Senior mortgage broker with 12 years in residential and commercial lending. Skilled in Encompass, FHA/VA compliance, and client advisory. Built a referral pipeline generating $48M in annual funded volume while maintaining a 96% closing ratio.

- Reflects senior-level experience clearly

- Names industry-specific tools and programs

- Quantifies production with dollar metrics

- Highlights relationship-building soft skills

Experience example

Senior Mortgage Broker

Pinnacle Home Lending | Denver, CO

March 2018–Present

- Originated $62M in annual loan volume using Encompass and Optimal Blue, exceeding branch targets by 18% each quarter.

- Collaborated with underwriters and real estate attorneys to cut average closing timelines from 38 days to 27 days.

- Mentored three junior brokers on FHA/VA guidelines, helping the team boost compliant submissions by 34% within one year.

- Every bullet includes measurable proof.

- Skills appear through real outcomes naturally.

Once you’ve tied your strengths to measurable outcomes and real-world scenarios, the next step is applying that same approach to a mortgage broker resume when you don’t have direct experience.

How do I write a mortgage broker resume with no experience

Even without full-time experience, you can demonstrate readiness through the strategies outlined in our guide on building a resume without work experience:

- NMLS coursework and exam prep

- Loan file shadowing with broker

- Mock loan applications and disclosures

- CRM pipeline tracking for leads

- Personal finance or lending blog

- Sales role with quota results

- Real estate transaction coordination

- Spreadsheet-based rate and fee comparisons

Focus on:

- Compliance knowledge and documentation accuracy

- Lead tracking and pipeline hygiene

- Loan math and scenario analysis

- Results from sales or projects

Resume format tip for entry-level mortgage broker

Use a combination resume format because it highlights relevant skills and projects first, while still showing steady work history and results. Do:

- Add an "Education and licensing" section with NMLS coursework, exam date, and state details.

- List tools you used: loan origination system, CRM, Excel, and e-signature platforms.

- Turn classwork into projects with deliverables, dates, and metrics.

- Quantify sales or service roles with volume, conversion rate, and accuracy.

- Include compliance tasks you completed, such as disclosure checklists and document collection.

- Built a CRM pipeline in HubSpot, logged 60 mock leads, and improved follow-up completion from 40% to 90% using scheduled tasks and call outcomes.

Even without direct experience, your educational background can serve as a strong foundation for your resume—so presenting it effectively matters.

How to list your education on a mortgage broker resume

Your education section helps hiring teams confirm you have the foundational knowledge needed. It validates your understanding of finance, lending principles, and real estate concepts relevant to the mortgage broker role.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a mortgage broker resume.

Example education entry

Bachelor of Science in Finance

University of Central Florida, Orlando, FL

Graduated 2021

GPA: 3.7/4.0

- Relevant coursework: Real Estate Finance, Consumer Lending, Risk Analysis, Financial Regulations

- Honors: Magna Cum Laude, Dean's List (six consecutive semesters)

How to list your certifications on a mortgage broker resume

Certifications show your commitment to learning, your proficiency with mortgage tools, and your relevance in a regulated industry as a mortgage broker.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, general, or less relevant than your degree and recent mortgage broker experience.

- Place certifications above education when they're recent, role-specific, or required for the mortgage broker roles you target.

Best certifications for your mortgage broker resume

- NMLS Mortgage Loan Originator License

- Certified Mortgage Advisor (CMA)

- Certified Residential Mortgage Specialist (CRMS)

- Certified Mortgage Consultant (CMC)

- FHA Direct Endorsement (DE) Underwriter Certification

- Certified Fraud Examiner (CFE)

- Anti-Money Laundering Certified Associate (AMLCA)

Once you’ve positioned your licenses and credentials where hiring managers can spot them quickly, shift to writing your mortgage broker resume summary to connect those qualifications to the value you deliver.

How to write your mortgage broker resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly signals you're qualified for the mortgage broker role.

Keep it to three to four lines, with:

- Your title and total years of mortgage brokerage experience.

- Domain focus, such as residential lending, commercial mortgages, or refinancing.

- Core skills like loan origination, underwriting analysis, and compliance management.

- One or two quantified wins, such as loan volume closed or client retention rates.

- Soft skills tied to outcomes, like client communication that shortened approval timelines.

PRO TIP

At this level, focus on specific skills, relevant tools, and early measurable contributions. Highlight loan products you've handled and compliance knowledge you've applied. Avoid vague phrases like "passionate professional" or "hard worker." Recruiters want proof, not promises.

Example summary for a mortgage broker

Mortgage broker with two years of experience in residential lending and FHA loan origination. Processed over $8M in loans annually while maintaining a 98% compliance audit pass rate.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Once your summary captures the value you bring, make sure the header above it presents your contact details clearly so recruiters can actually reach you.

What to include in a mortgage broker resume header

A resume header lists your key contact details and identity, helping a mortgage broker stand out in searches, build credibility, and pass recruiter screening fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Don't include photos on a mortgage broker resume unless the role is explicitly front-facing or appearance-dependent.

Match your header job title to the posting and keep every detail consistent with your licensing and employment history.

Example

Mortgage broker resume header

Jordan Taylor

Mortgage Broker | Residential Purchase and Refinance Loans

Austin, TX

(512) 555-01XX

your.name@enhancv.com github.com/yourname yourwebsite.com linkedin.com/in/yourname

Once your contact details and key credentials are clearly presented at the top, you can strengthen the rest of your application with additional sections that support your mortgage broker experience.

Additional sections for mortgage broker resumes

When your core qualifications match other candidates, well-chosen additional sections can set your mortgage broker resume apart with unique credibility. For example, listing language skills can demonstrate your ability to serve diverse borrower populations.

- Languages

- Professional affiliations

- Volunteer experience

- Industry publications

- Awards and recognitions

- Continuing education and professional development

- Community involvement

Once you've strengthened your resume with relevant additional sections, the next step is pairing it with a cover letter to give hiring managers a fuller picture of your qualifications.

Do mortgage broker resumes need a cover letter

A cover letter isn't required for most mortgage broker roles, but it helps in competitive markets or when hiring teams expect one. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can clarify its value. It can make a difference when your resume needs context, or when you want to show clear fit fast.

Use a cover letter to add details your mortgage broker resume can't show at a glance:

- Explain role or team fit: Match your experience to their loan mix, lead sources, compliance standards, and how the team works day to day.

- Highlight one or two outcomes: Share a specific pipeline win, pull-through improvement, referral growth, or cycle-time reduction, and name the actions you took.

- Show product and user understanding: Reference their borrower segments, lender partners, pricing approach, and how you manage expectations from pre-approval through closing.

- Address career transitions or non-obvious experience: Connect prior sales, banking, or real estate work to mortgage broker workflows, and clarify any gaps or market changes.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you choose not to include a cover letter, using AI to improve your mortgage broker resume follows naturally because it helps you strengthen your application’s impact within the document recruiters review first.

Using AI to improve your mortgage broker resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight results. But overuse kills authenticity. Once your content sounds clear and role-aligned, step away from AI. For specific guidance, explore ChatGPT resume writing prompts tailored to different resume sections.

Here are 10 practical prompts to strengthen specific sections of your mortgage broker resume:

- Strengthen your summary. "Rewrite my mortgage broker resume summary to emphasize loan volume, client relationships, and regulatory knowledge in three concise sentences."

- Quantify your results. "Add specific metrics like loan closings, approval rates, or revenue generated to each experience bullet on my mortgage broker resume."

- Tighten bullet points. "Rewrite my mortgage broker experience bullets using strong action verbs and remove any filler words or vague descriptions."

- Align with postings. "Compare my mortgage broker resume skills section against this job description and suggest missing keywords that match my real experience."

- Improve certifications format. "Reorganize the certifications section of my mortgage broker resume so the most industry-relevant credentials appear first with dates included."

- Clarify education details. "Rewrite my mortgage broker resume education section to highlight coursework, honors, or projects directly related to lending or finance."

- Refine technical skills. "Edit my mortgage broker resume skills list to prioritize loan origination software, CRM tools, and compliance platforms I've actually used."

- Showcase project impact. "Rewrite this mortgage broker resume project entry to clearly state the problem, my role, and the measurable outcome achieved."

- Remove redundancy. "Identify and eliminate any repeated phrases, overlapping bullet points, or redundant descriptions across my entire mortgage broker resume."

- Enhance compliance language. "Strengthen my mortgage broker resume experience section by incorporating accurate references to RESPA, TILA, and state licensing requirements."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong mortgage broker resume highlights measurable outcomes, such as loan volume, pull-through rate, approval speed, and referral growth. It also shows role-specific skills, including compliance, documentation, underwriting coordination, and relationship management. Keep the structure clear, consistent, and easy to scan.

When your mortgage broker resume ties results to the skills behind them, it reads as job-ready. It also signals you can perform in today’s market and adapt as lending standards, rates, and buyer needs shift.