Many financial auditor resume drafts fail because they list duties and software but omit audit scope, quantified results, and risk impact. That's costly when an ATS filters quickly and recruiters scan in seconds in a crowded market.

A strong resume shows what you improved and how you delivered assurance. Knowing how to make your resume stand out is essential—you should highlight findings that reduced control failures, dollars protected, audits completed on schedule, compliance rates raised, material weaknesses prevented, and stakeholders supported across multi-entity or global scopes.

Key takeaways

- Quantify audit outcomes like cycle time, error rates, and dollars recovered in every experience bullet.

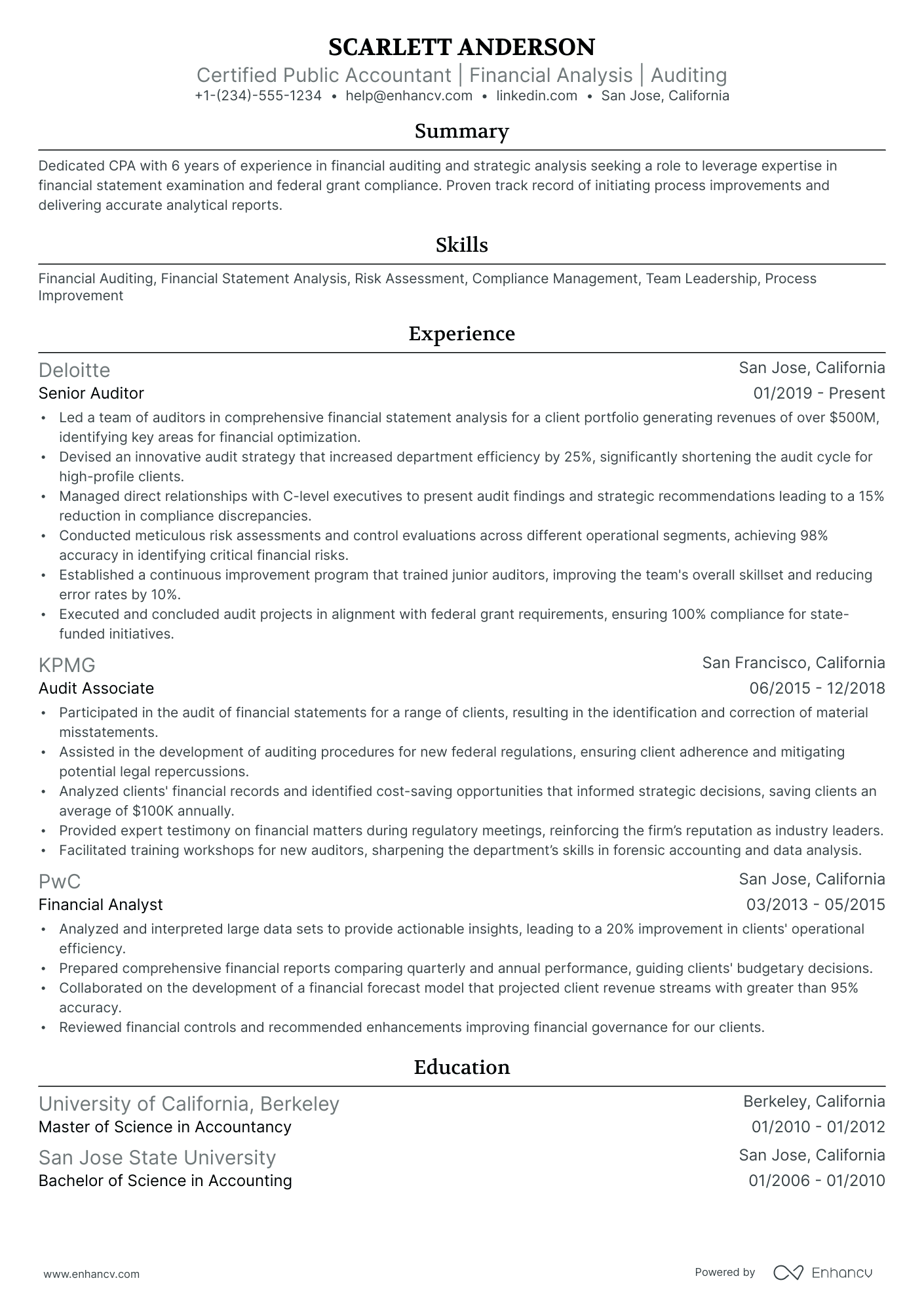

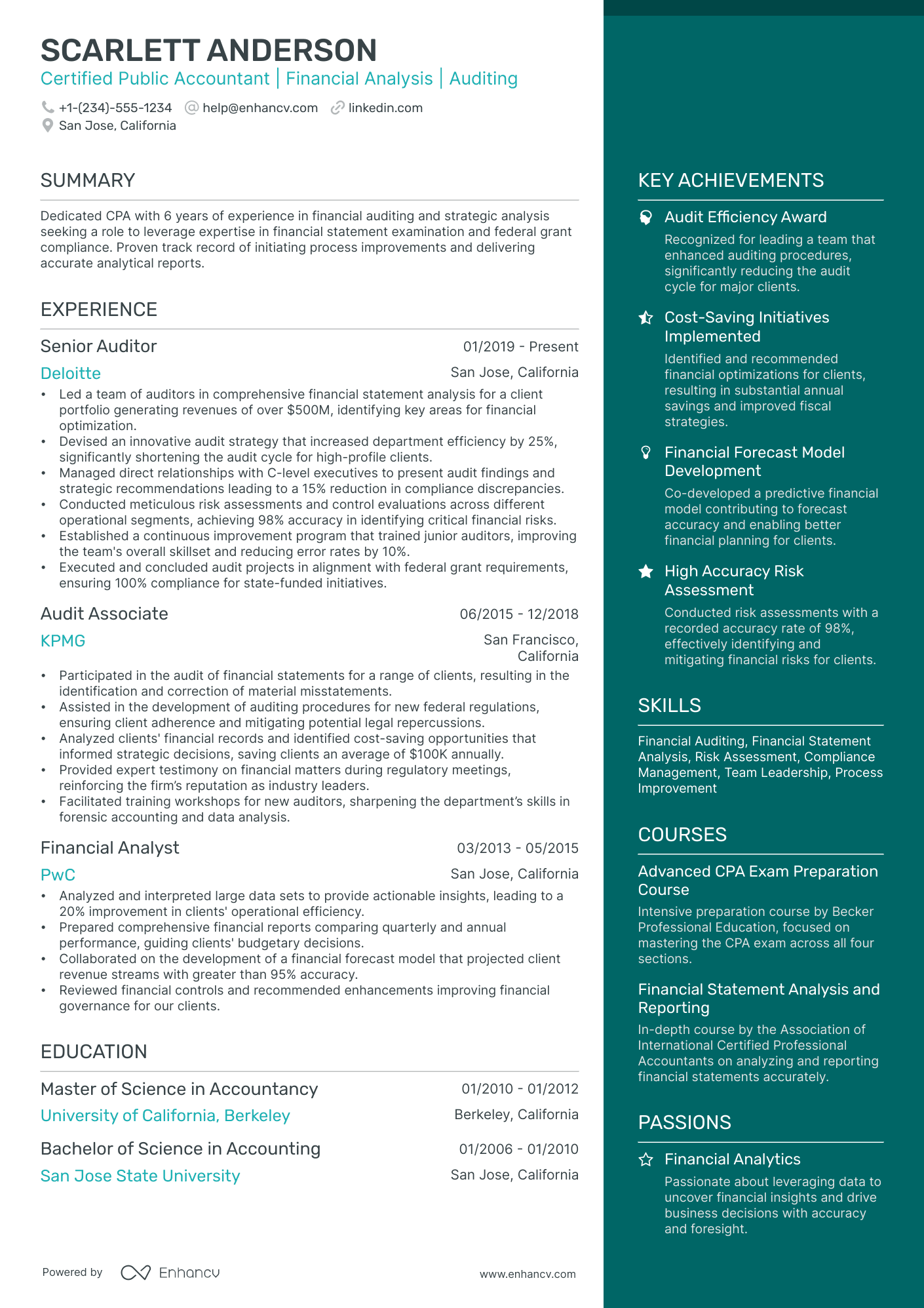

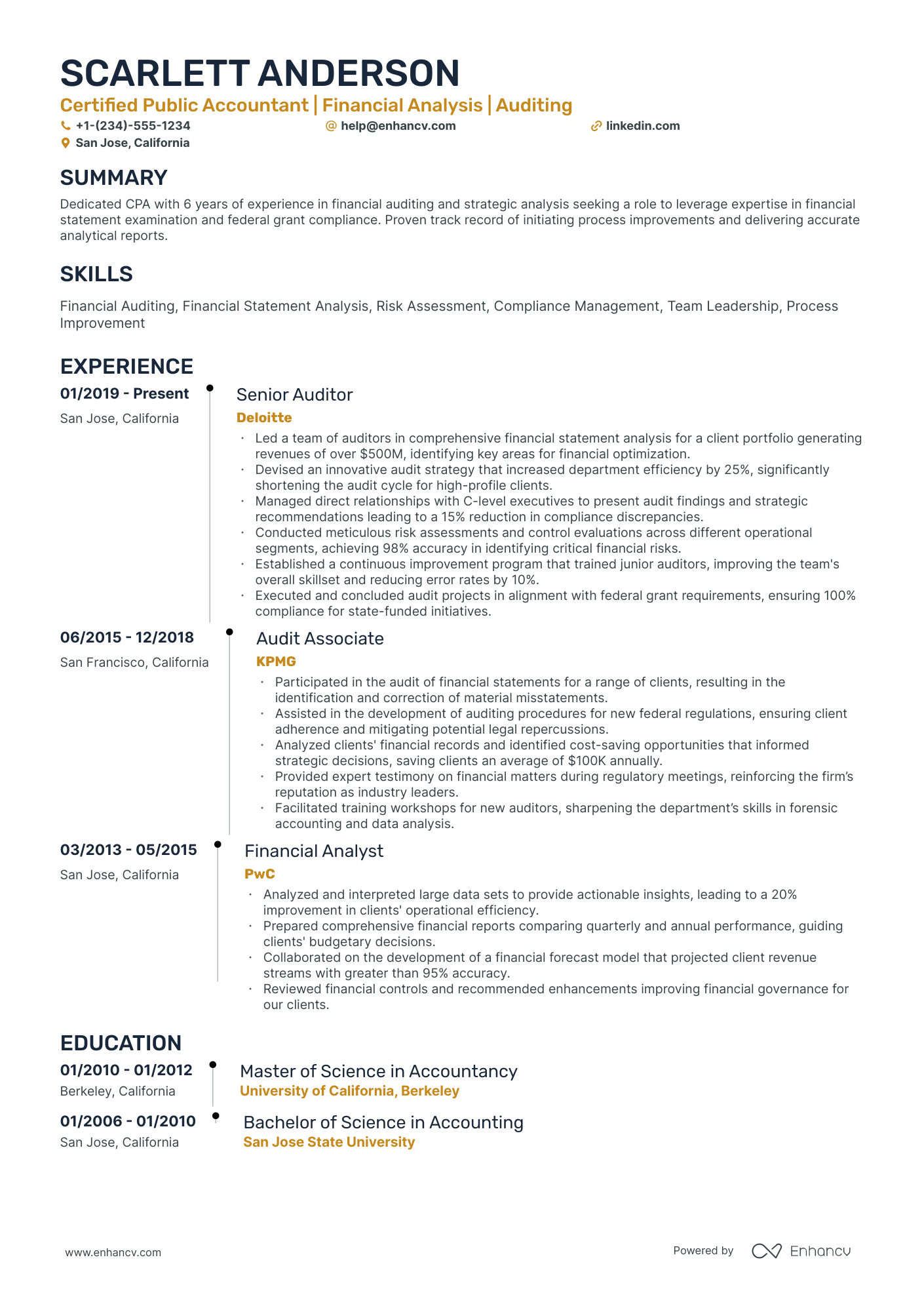

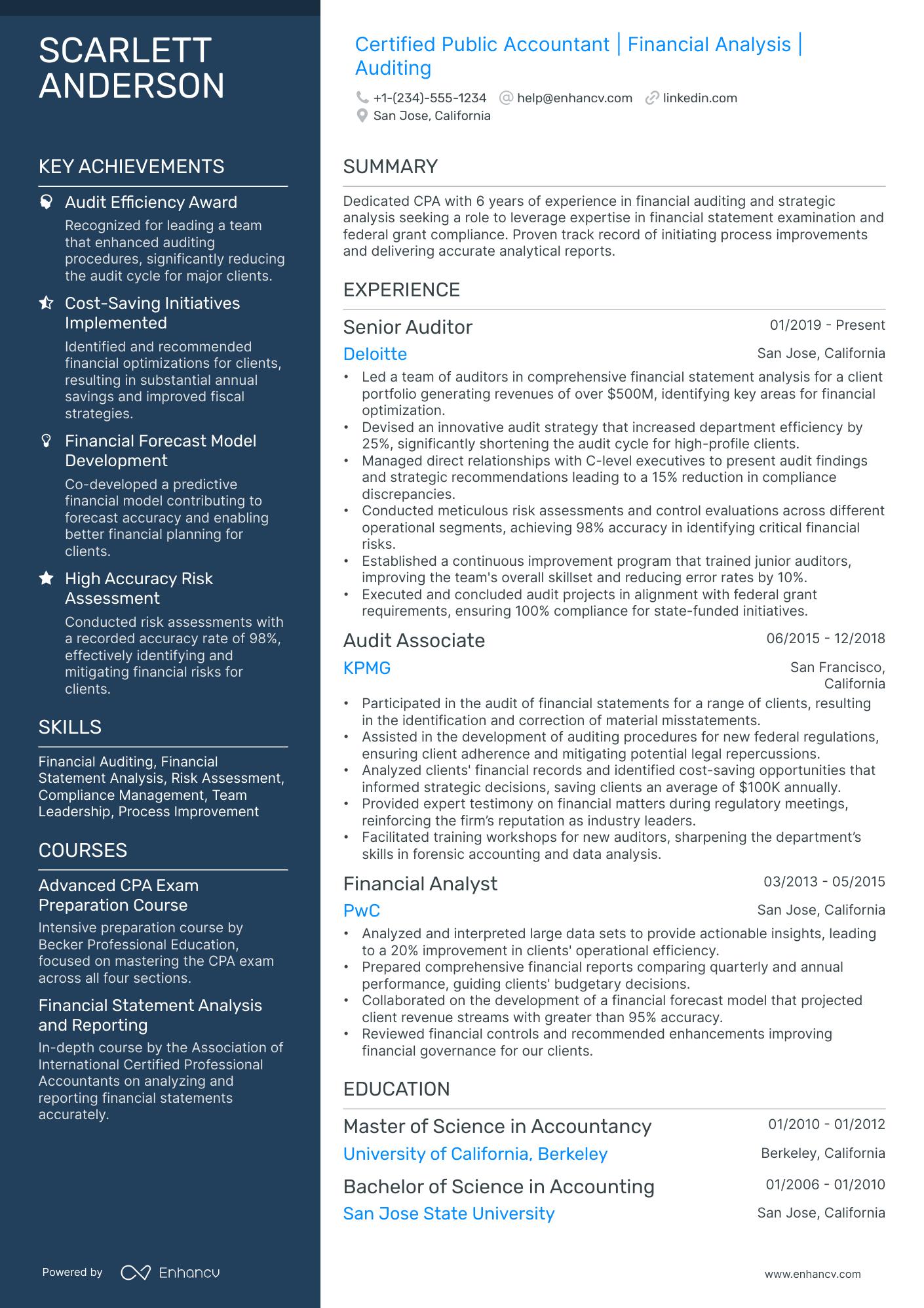

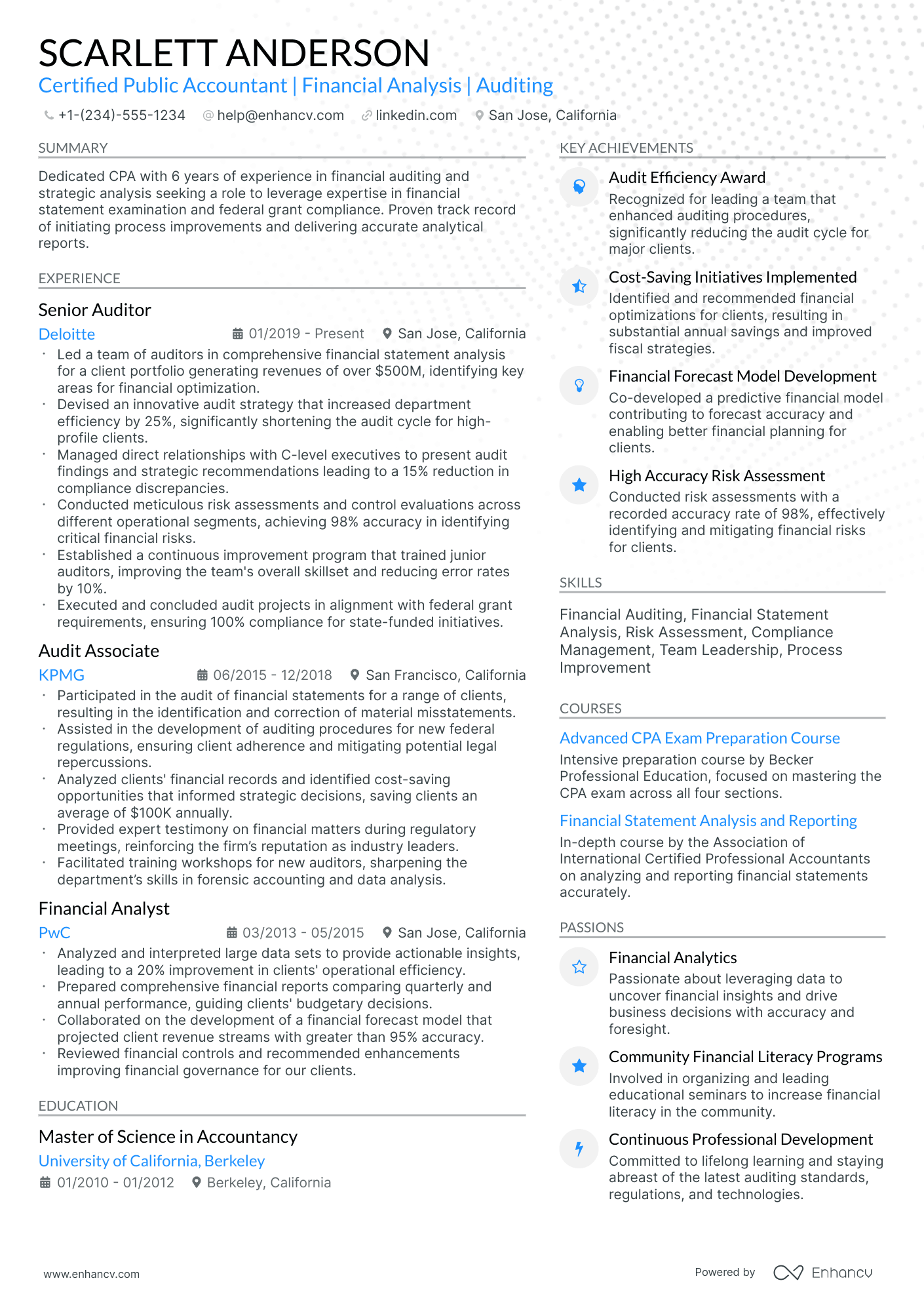

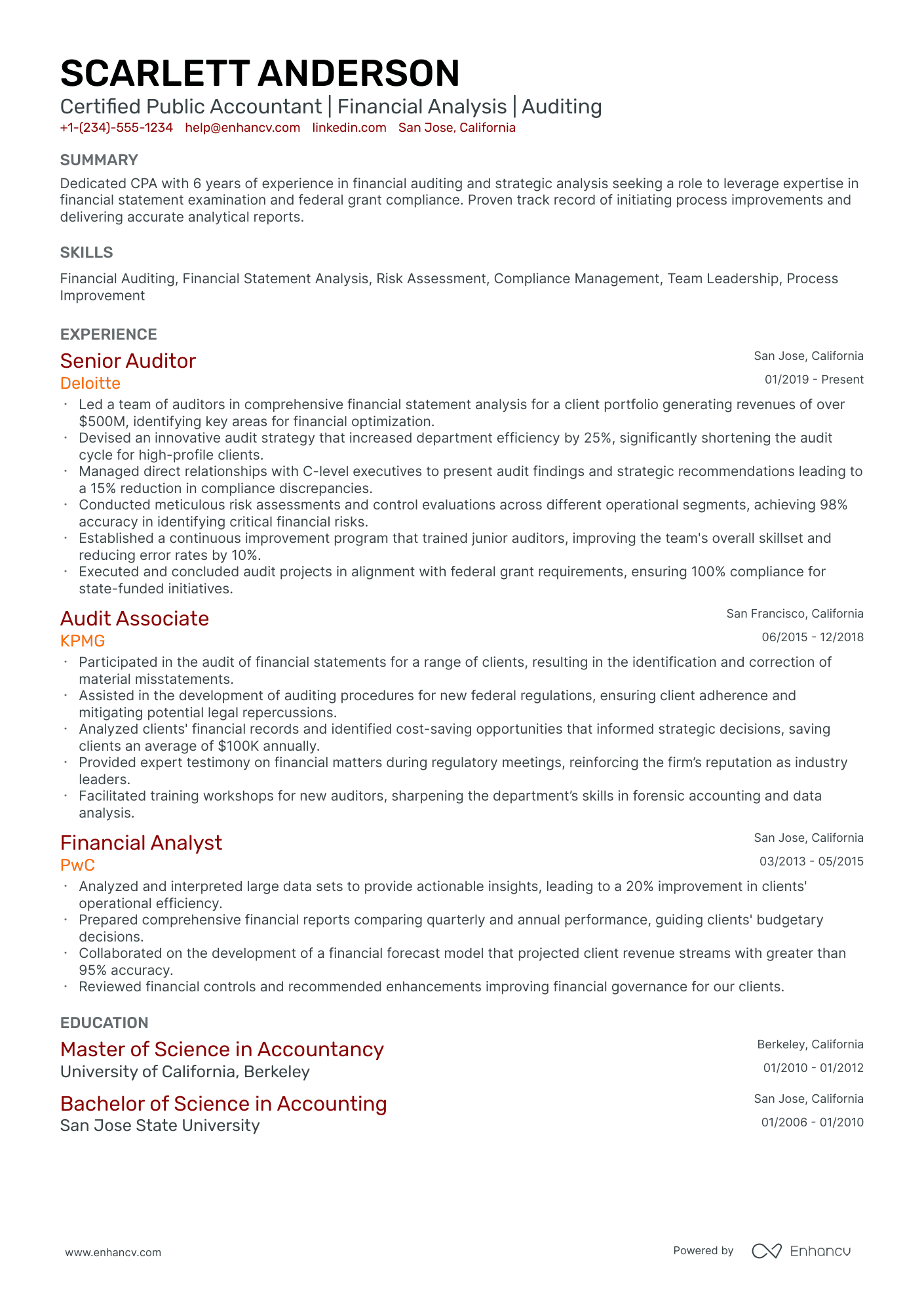

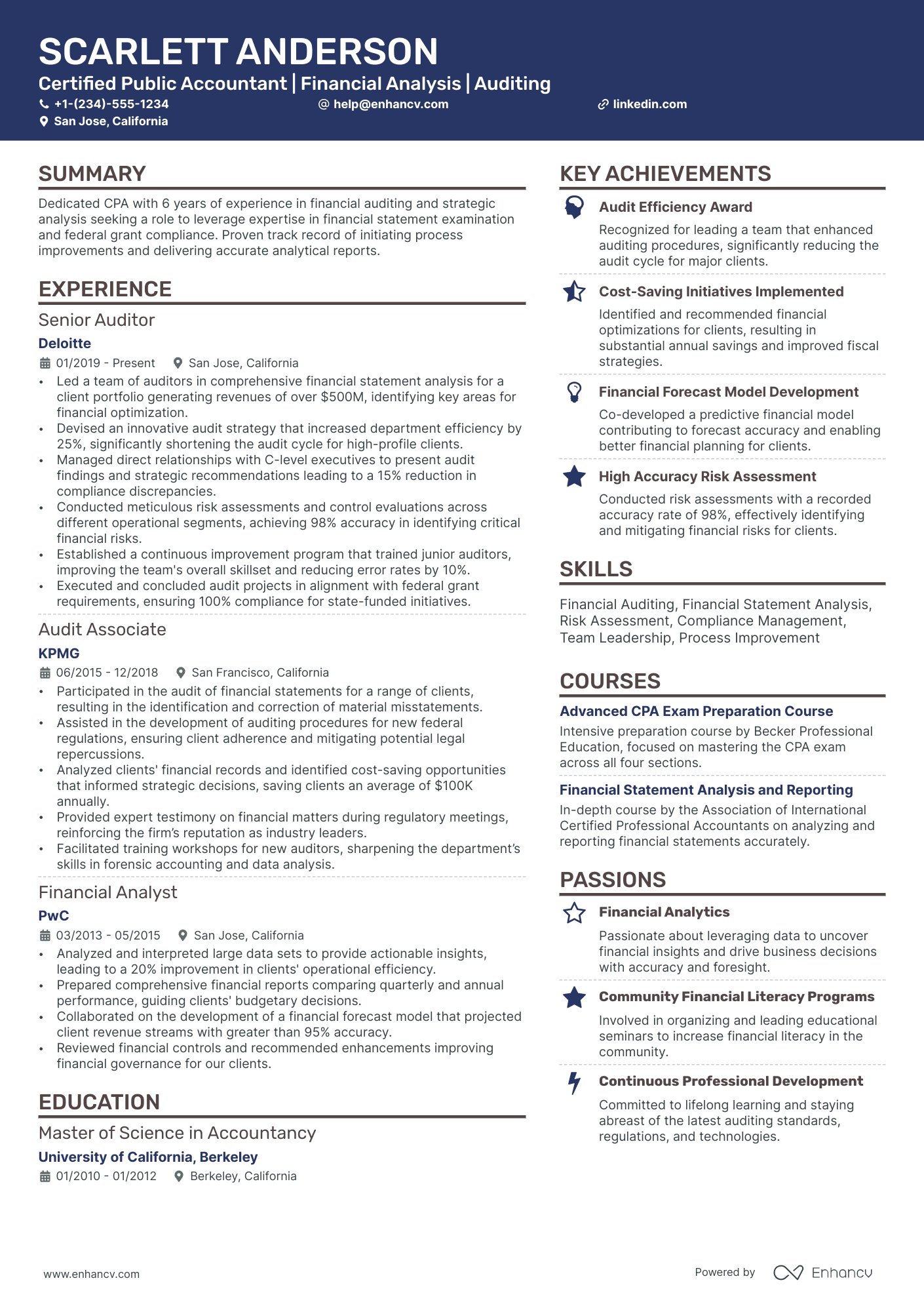

- Use reverse-chronological format for senior roles and hybrid format for career changers.

- Tailor each resume to the job posting's specific standards, tools, and frameworks.

- Tie every listed skill to a measurable result in your experience or summary section.

- Place certifications like CPA or CIA where recruiters notice them—above or below education.

- Write a three- to four-line summary featuring your title, industry, tools, and top achievement.

- Use Enhancv to turn vague duties into focused, metric-driven resume bullets faster.

How to format a financial auditor resume

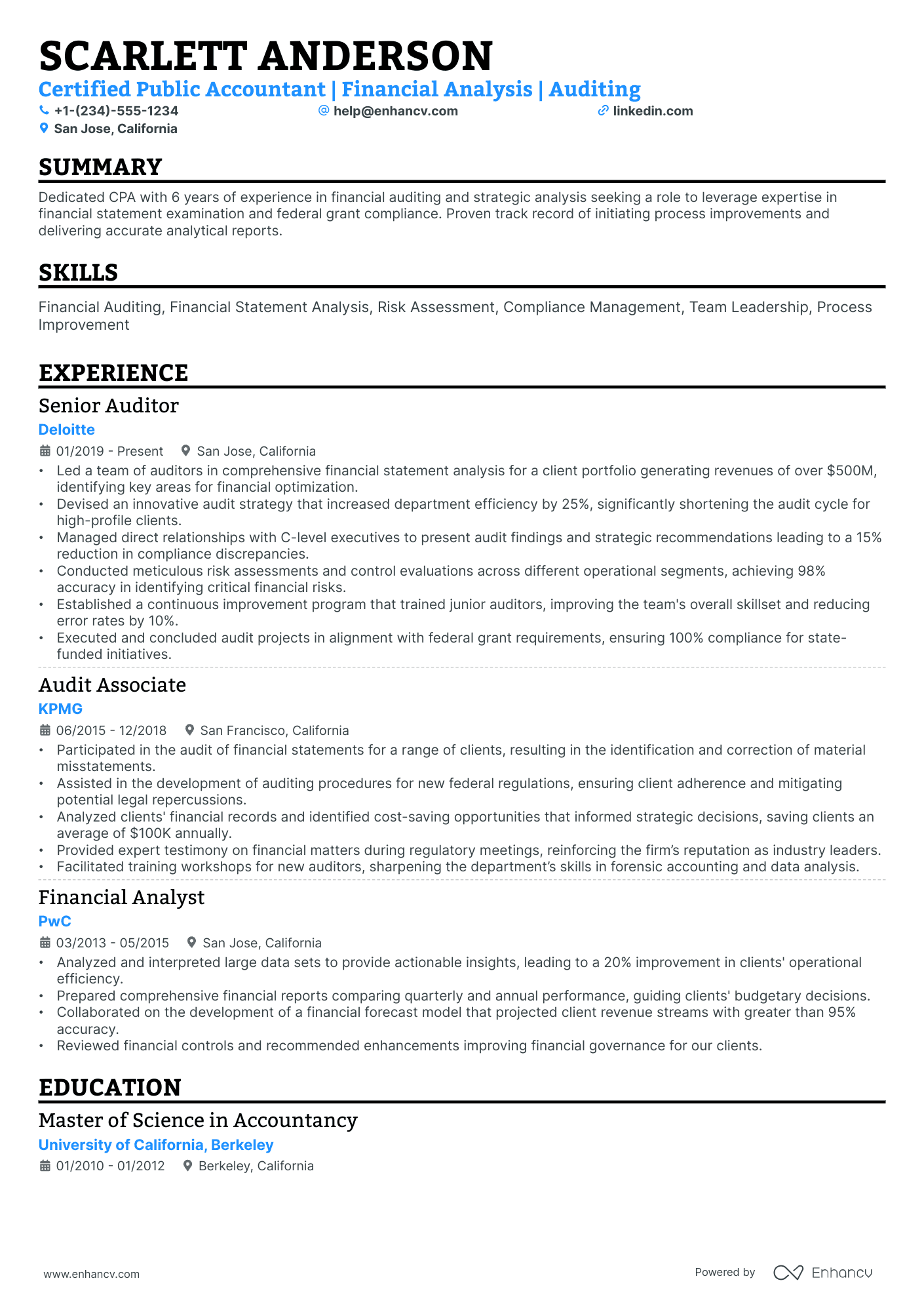

Recruiters evaluating financial auditor resumes prioritize accuracy in financial reporting, regulatory compliance expertise, and evidence of thorough analytical methodology. Choosing the right resume format ensures these core signals—along with relevant certifications like CPA or CIA—surface quickly during both human review and applicant tracking system scans. A clean, well-structured resume layout makes that possible.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your deepest and most relevant auditing experience first. Do:

- Lead with your most senior audit engagements, specifying scope such as portfolio size, number of entities audited, or regulatory frameworks covered.

- Highlight proficiency in role-specific tools and domains, including ACL, IDEA, SAP, SOX compliance, GAAP, IFRS, and internal controls testing.

- Quantify outcomes and business impact tied to each position, such as cost savings identified, risk reductions achieved, or process improvements implemented.

- Executed full-cycle financial audits for 12 mid-market clients with combined annual revenues exceeding $400M, identifying $1.2M in compliance discrepancies and reducing reporting errors by 18% year over year.

I'm junior or switching into this role—what format works best?

A hybrid format works best, allowing you to feature relevant skills and certifications prominently while still demonstrating a clear work history. Do:

- Place a dedicated skills section near the top of your resume, highlighting audit methodologies, accounting software, and regulatory knowledge such as SOX, GAAP, or internal controls.

- Include academic projects, internships, or transitional experience that involved financial analysis, reconciliation, or compliance review.

- Connect every listed skill to a specific action and a measurable or observable result.

- Data analysis (skill) → conducted variance analysis on quarterly financial statements during an internship (action) → flagged three material misstatements before external review (result).

Why not use a functional resume?

A functional format strips away the timeline and context recruiters need to verify where and when you applied your audit skills, which weakens your credibility for a role built on accountability and precision.

- A functional resume may be acceptable if you're transitioning into financial auditing from a related field like accounting or banking, have a gap in your work history, or lack formal audit titles—but only if every listed skill is tied directly to a specific project, engagement, or measurable outcome.

Once you've established a clean, readable layout, the next step is deciding which sections to include and how to order them for maximum impact.

What sections should go on a financial auditor resume

Recruiters expect a financial auditor resume to show a clear audit track record, strong compliance knowledge, and measurable results. Understanding which resume sections to include helps you present this information effectively.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Your experience bullets should emphasize audit scope, risk and control findings, regulatory alignment, and quantified outcomes such as reduced exceptions, faster close timelines, or improved control effectiveness.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now that you’ve set up the key parts of your resume, the next step is to write your financial auditor resume experience section so it supports those elements with specific, relevant details.

How to write your financial auditor resume experience

The experience section of your financial auditor resume should demonstrate the audit engagements you've completed, the standards and tools you've applied, and the measurable outcomes you've produced for clients or organizations. Hiring managers prioritize demonstrated impact—such as risk reduction, compliance improvements, and process efficiencies—over descriptive task lists that simply restate job duties.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the audit engagements, financial portfolios, regulatory areas, internal control systems, or client relationships you were directly accountable for as a financial auditor.

- Execution approach: the auditing standards, analytical frameworks, enterprise resource planning platforms, data analytics tools, or sampling methodologies you used to plan fieldwork, assess risk, and arrive at audit conclusions.

- Value improved: the changes you drove in financial accuracy, regulatory compliance, internal control effectiveness, fraud detection capability, or operational efficiency within the organizations you audited.

- Collaboration context: how you coordinated with controllers, CFOs, legal counsel, external regulators, tax teams, or client management to resolve findings, align on remediation plans, and strengthen financial reporting.

- Impact delivered: the outcomes your audit work produced—expressed through reductions in material misstatement risk, shortened audit cycle times, strengthened compliance postures, or cost savings—rather than a summary of tasks performed.

Experience bullet formula

A financial auditor experience example

✅ Right example - modern, quantified, specific.

Senior Financial Auditor

NorthBridge Insurance Group | Chicago, IL

2021–Present

Mid-market property and casualty insurer operating across twelve states with $1.8B in annual premiums.

- Led risk-based audits across premium revenue, claims reserves, and reinsurance using TeamMate+ and ACL Analytics, reducing high-risk findings by 28% year over year.

- Built continuous auditing dashboards in Power BI from SAP S/4HANA and Workday Financials extracts, cutting fieldwork cycle time from six weeks to four weeks.

- Tested controls under the COSO framework and SOX compliance requirements, increasing key control pass rate from 89% to 96% through targeted remediation with finance and IT.

- Performed statistical sampling and journal entry testing with IDEA and SQL, identifying $620K in duplicate claim payments and recovering 92% within one quarter.

- Partnered with FP&A, underwriting operations, and external auditors to align PBC (prepared by client) schedules and walkthroughs, reducing audit adjustments by 35% and avoiding a material weakness.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific job you're applying for.

How to tailor your financial auditor resume experience

Recruiters evaluate your financial auditor resume through both human review and applicant tracking systems. Tailoring your resume to the job description increases your chances of passing both filters.

Ways to tailor your financial auditor experience:

- Match audit software and ERP systems named in the job description.

- Mirror the exact regulatory standards like GAAP or IFRS referenced.

- Use the same terminology for internal control frameworks listed.

- Reflect specific KPIs or audit quality metrics the employer prioritizes.

- Highlight industry experience in sectors the posting explicitly mentions.

- Emphasize compliance and risk assessment methods when the role requires them.

- Align your workflow language with the audit methodology they reference.

- Showcase cross-functional collaboration if the posting stresses team-based audits.

Tailoring means aligning your real accomplishments with the employer's stated requirements, not forcing disconnected keywords into your experience bullets.

Resume tailoring examples for financial auditor

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Conduct risk-based audits of financial statements in compliance with GAAS and PCAOB standards, using ACL and IDEA for data analytics | Performed audits and reviewed financial documents for accuracy. | Executed risk-based audits of financial statements under GAAS and PCAOB standards, leveraging ACL and IDEA to analyze transaction-level data across 12 business units. |

| Evaluate internal controls over financial reporting (ICFR) under SOX 404, document deficiencies, and communicate findings to the audit committee | Helped assess company controls and wrote reports for management. | Evaluated ICFR effectiveness under SOX 404 for a $2B revenue organization, identified three material weaknesses, and presented remediation plans directly to the audit committee. |

| Perform substantive testing of revenue recognition, accounts receivable, and allowance for doubtful accounts using SAP and Oracle ERP systems | Tested accounts and verified financial data using company software. | Performed substantive testing of revenue recognition and accounts receivable balances within SAP and Oracle ERP environments, reducing unresolved variances by 35% during year-end close. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your financial auditor achievements so employers can see the impact behind those choices.

How to quantify your financial auditor achievements

Quantifying your achievements proves audit impact beyond responsibilities. Focus on cycle time, error rates, control effectiveness, findings severity, dollars recovered, and compliance outcomes across audits, processes, and stakeholders.

Quantifying examples for financial auditor

| Metric | Example |

|---|---|

| Audit cycle time | "Reduced audit fieldwork from six weeks to four by standardizing walkthrough templates and using ACL Analytics for sampling across twelve locations." |

| Error rate | "Cut substantive testing rework from 8% to 2% by tightening tie-out checks in Excel and adding a second-review checklist for all workpapers." |

| Risk reduction | "Identified three high-risk revenue recognition gaps and drove remediation that lowered repeat findings from five to one in the next quarter." |

| Cost recovery | "Recovered $185,000 in vendor overpayments by reconciling invoices to contracts and testing three-way matches for 1,200 transactions." |

| Compliance coverage | "Expanded SOX (Sarbanes-Oxley) control testing coverage from 60 to 95 key controls by redesigning the risk-control matrix and prioritizing high-impact processes." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points for your experience section, you'll want to apply that same precision to presenting your hard and soft skills effectively.

How to list your hard and soft skills on a financial auditor resume

Your skills section shows you can test controls, validate financial reporting, and reduce risk, and recruiters and an ATS (applicant tracking system) scan this section to confirm role fit fast—aim for a hard skill-heavy mix supported by audit-ready soft skills. financial auditor roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Financial statement auditing (GAAP)

- Internal controls testing (SOX)

- Risk assessment and audit planning

- Control design and walkthroughs

- Substantive testing and sampling

- Audit documentation and workpapers

- Data analytics, Excel, Power Query

- SQL for audit testing

- ERP systems: SAP, Oracle, NetSuite

- Audit tools: TeamMate, AuditBoard

- Financial reporting and disclosures

- Revenue recognition testing (ASC 606)

Soft skills

- Interviewing process owners

- Writing clear audit narratives

- Presenting findings to leadership

- Translating issues into actions

- Challenging assumptions with evidence

- Prioritizing risks under deadlines

- Managing stakeholders and expectations

- Coordinating cross-functional requests

- Negotiating remediation timelines

- Escalating issues with judgment

- Maintaining independence and ethics

- Following up to closure

How to show your financial auditor skills in context

Skills shouldn't live only in a dedicated skills list. Explore common resume skills to see how other professionals present theirs effectively.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Senior financial auditor with 12 years in healthcare compliance. Skilled in GAAP, ACL Analytics, and internal controls—reduced audit cycle times by 30% while strengthening cross-departmental risk communication and regulatory adherence.

- Reflects senior-level expertise clearly

- Names industry-relevant tools and standards

- Includes a concrete, measurable outcome

- Highlights communication as a soft skill

Experience example

Senior Financial Auditor

Brevard Health Partners | Tampa, FL

March 2018–Present

- Led SOX compliance testing using ACL Analytics, identifying $2.1M in revenue leakage across three fiscal quarters.

- Collaborated with finance and legal teams to redesign internal controls, cutting audit findings by 45% year over year.

- Streamlined risk assessment workflows in TeamMate+, reducing documentation turnaround time by 28% across all departments.

- Every bullet includes measurable proof

- Skills appear naturally through real outcomes

Once you’ve tied your audit-related strengths to measurable outcomes and real examples, the next step is learning how to build a financial auditor resume with no experience by applying that same approach to coursework, projects, and transferable work.

How do I write a financial auditor resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Audit-focused coursework and case studies

- Internal audit student organization roles

- Accounting lab reconciliations and testing

- Excel-based financial statement analysis

- Internship in accounting or finance

- Volunteer treasurer for a nonprofit

- Capstone project on controls

If you're starting out, our guide on writing a resume without work experience offers strategies that apply directly to entry-level financial auditor candidates.

Focus on:

- Audit procedures and documentation samples

- Control testing and risk assessment

- Excel and data analysis outputs

- Accounting standards and compliance exposure

Resume format tip for entry-level financial auditor

Use a combination resume format because it highlights audit skills and projects first, while still showing education and any related work history. Do:

- Lead with a skills summary tied to audit tasks.

- Add two to four audit-style projects with results.

- List tools: Excel, Power Query, SQL.

- Quantify scope: transactions tested, variances found.

- Mirror job posting keywords in bullets.

- Built an Excel control-testing workbook for a capstone audit, sampled 120 transactions, and reduced documentation errors by 30% through standardized workpapers.

Since your education often serves as your strongest qualification when you lack professional experience, presenting it effectively on your resume is essential.

How to list your education on a financial auditor resume

Your education section helps hiring teams confirm you have the academic foundation for a financial auditor role. It signals relevant training in accounting, finance, and auditing principles.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to a financial auditor resume.

Example education entry

Bachelor of Science in Accounting

University of Illinois Urbana-Champaign, Champaign, IL

2021 | GPA: 3.8/4.0

- Relevant coursework: Auditing Theory, Financial Statement Analysis, Internal Controls, Forensic Accounting, Tax Law

- Honors: Magna Cum Laude, Beta Alpha Psi Honor Society

How to list your certifications on a financial auditor resume

Certifications on a resume show a financial auditor's commitment to learning, proficiency with audit tools and standards, and alignment with industry expectations in accounting, compliance, and risk.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degree is recent and your certifications add context, not core qualification, for a financial auditor role.

- Place certifications above education when they are recent, highly relevant, or required, and you want them noticed first by hiring teams.

Best certifications for your financial auditor resume

Certified Public Accountant (CPA) Certified Internal Auditor (CIA) Certified Information Systems Auditor (CISA) Certified Fraud Examiner (CFE) Chartered Financial Analyst (CFA) Certified Management Accountant (CMA) Certification in Risk Management Assurance (CRMA)

Once you’ve positioned your credentials where recruiters will notice them, shift to writing your financial auditor resume summary so it reinforces those qualifications upfront.

How to write your financial auditor resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly frames you as a qualified financial auditor worth interviewing.

Keep it to three to four lines, with:

- Your title and total years of auditing experience.

- The industries or domains you've worked in, such as banking, insurance, or public accounting.

- Core tools and skills like GAAP, IFRS, SOX compliance, ACL, or SAP.

- One or two measurable achievements, such as audit cost reductions or error detection rates.

- Soft skills tied to real outcomes, like stakeholder communication that shortened audit cycles.

PRO TIP

At a mid-level financial auditor position, emphasize technical depth and concrete results over broad claims. Highlight specific frameworks you've applied and efficiencies you've driven. Avoid phrases like "passionate professional" or "detail-oriented team player" without evidence backing them up.

Example summary for a financial auditor

Financial auditor with four years of experience in banking and insurance. Skilled in GAAP, SOX compliance, and ACL Analytics. Identified $1.2M in recoverable losses and reduced audit cycle time by 18% through improved testing procedures.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your audit expertise and value, make sure the header above it presents your contact details correctly so recruiters can actually reach you.

What to include in a financial auditor resume header

A resume header is the contact and identity block at the top, and it drives visibility, credibility, and fast recruiter screening for a financial auditor.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link lets recruiters verify roles, dates, and credentials quickly, which supports faster screening decisions.

Don't include a photo on a financial auditor resume unless the role is explicitly front-facing or appearance-dependent.

Keep the header on one to two lines, match your job title to the posting, and use consistent formatting across all links.

Example

Financial auditor resume header

Jordan M. Taylor

Financial Auditor | SOX, internal controls, and financial reporting

Chicago, IL | (312) 555-78XX | your.name@enhancv.com

github.com/yourname yourwebsite.com linkedin.com/in/yourname

Once your top-of-page details are clear and consistent, you can strengthen your application with additional sections that provide supporting context and credentials.

Additional sections for financial auditor resumes

When your core qualifications match other candidates, well-chosen additional sections can set your financial auditor resume apart. For example, listing language skills can be a differentiator if you work with international clients or multi-entity audits.

- Languages

- Certifications and licenses

- Professional affiliations and memberships

- Publications and research

- Continuing professional education

- Volunteer and pro bono auditing

- Awards and recognitions

Once you've rounded out your resume with the right supplementary sections, it's worth pairing it with a strong cover letter to make an even greater impact.

Do financial auditor resumes need a cover letter

A cover letter isn't required for every financial auditor role, but it helps in competitive searches or where hiring managers expect one. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can clarify its value. It can make a difference when your resume needs context, or when fit and judgment matter.

Use a cover letter to add details your resume can't:

- Explain role or team fit by matching your audit approach to their risk profile, reporting cadence, and stakeholder expectations.

- Highlight one or two relevant projects or outcomes, including scope, tools, and measurable results like reduced findings or faster close support.

- Show understanding of the product, users, or business context by naming key revenue drivers, control risks, and compliance needs.

- Address career transitions or non-obvious experience by connecting prior work to audit planning, testing, documentation, and issue follow-up.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide a cover letter won’t add value for your application, using AI to improve your financial auditor resume helps you strengthen the document employers review first.

Using AI to improve your financial auditor resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine wording and highlight measurable results. But overuse dulls authenticity. If you're exploring this approach, our guide on ChatGPT resume writing prompts offers practical starting points. Once your content is clear and role-aligned, step away from AI tools.

Here are 10 practical prompts to strengthen specific sections of your financial auditor resume:

Strengthen summary statement

Quantify experience bullets

Sharpen skills section

Tailor to job posting

Improve action verbs

Refine certifications section

Clarify project descriptions

Tighten education details

Eliminate redundancy

Align with seniority level

Conclusion

A strong financial auditor resume highlights measurable outcomes, role-specific skills, and a clear structure. Use metrics to show impact, and list audit planning, risk assessment, controls testing, and reporting skills with accuracy and consistency.

Keep your financial auditor resume easy to scan, with focused sections and clean formatting. This approach shows you can deliver reliable results and adapt to today’s hiring market and near-future expectations.