As a compliance manager, articulating the complexity of regulatory knowledge and its application in diverse situations on your resume can be a daunting task. Our guide will provide you with clear strategies to showcase your expertise and accomplishments in a concise manner, enhancing your resume's impact on potential employers.

- Sample industry-leading professional resumes for inspiration and compliance manager resume-writing know-how.

- Focus recruiters' attention on what matters most - your unique experience, achievements, and skills.

- Write various resume sections to ensure you meet at least 95% of all job requirements.

- Balance your compliance manager technical expertise with personality to stand out amongst candidates.

If the compliance manager resume isn't the right one for you, take a look at other related guides we have:

- Fitness General Manager Resume Example

- Revenue Manager Resume Example

- Sourcing Manager Resume Example

- Library Director Resume Example

- Financial Business Analyst Resume Example

- Technical Manager Resume Example

- Business Director Resume Example

- Marketing Account Manager Resume Example

- Construction General Manager Resume Example

- Configuration Manager Resume Example

Professional compliance manager resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Keep in mind the market you’re applying to – a Canadian resume, for instance, might have a unique layout.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have some basic certificates, don't invest too much of your compliance manager resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

The six in-demand sections for your compliance manager resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Knowledge of relevant regulatory standards and laws (e.g., GDPR, FCPA, HIPAA, SOX)

- Experience in developing and implementing compliance programs and policies

- Proven track record in conducting risk assessments and compliance audits

- Strong analytical skills to identify potential areas of compliance vulnerability

- Effective communication and training skills to educate staff on compliance practices and procedures

What to include in the experience section of your compliance manager resume

The resume experience section is perhaps the most important element in your application as it needs to showcase how your current profile matches the job.

While it may take some time to perfect your compliance manager experience section, here are five tips to keep in mind when writing yours:

- Assess the advert to make a list of key requirements and look back on how each of your past jobs answers those;

- Don't just showcase you know a particular skill, instead, you need proof in the form of tangible results (e.g. numbers, percent, etc.);

- It's perfectly fine to leave off experience items that don't bring anything extra to your skill set or application;

- Recruiters want to understand what the particular value is of working with you, so instead of solely featuring technologies, think about including at least one bullet that's focused on your soft skills;

- Take care with wording each bullet to demonstrate what you've achieved, using a particular skill, and an action verb.

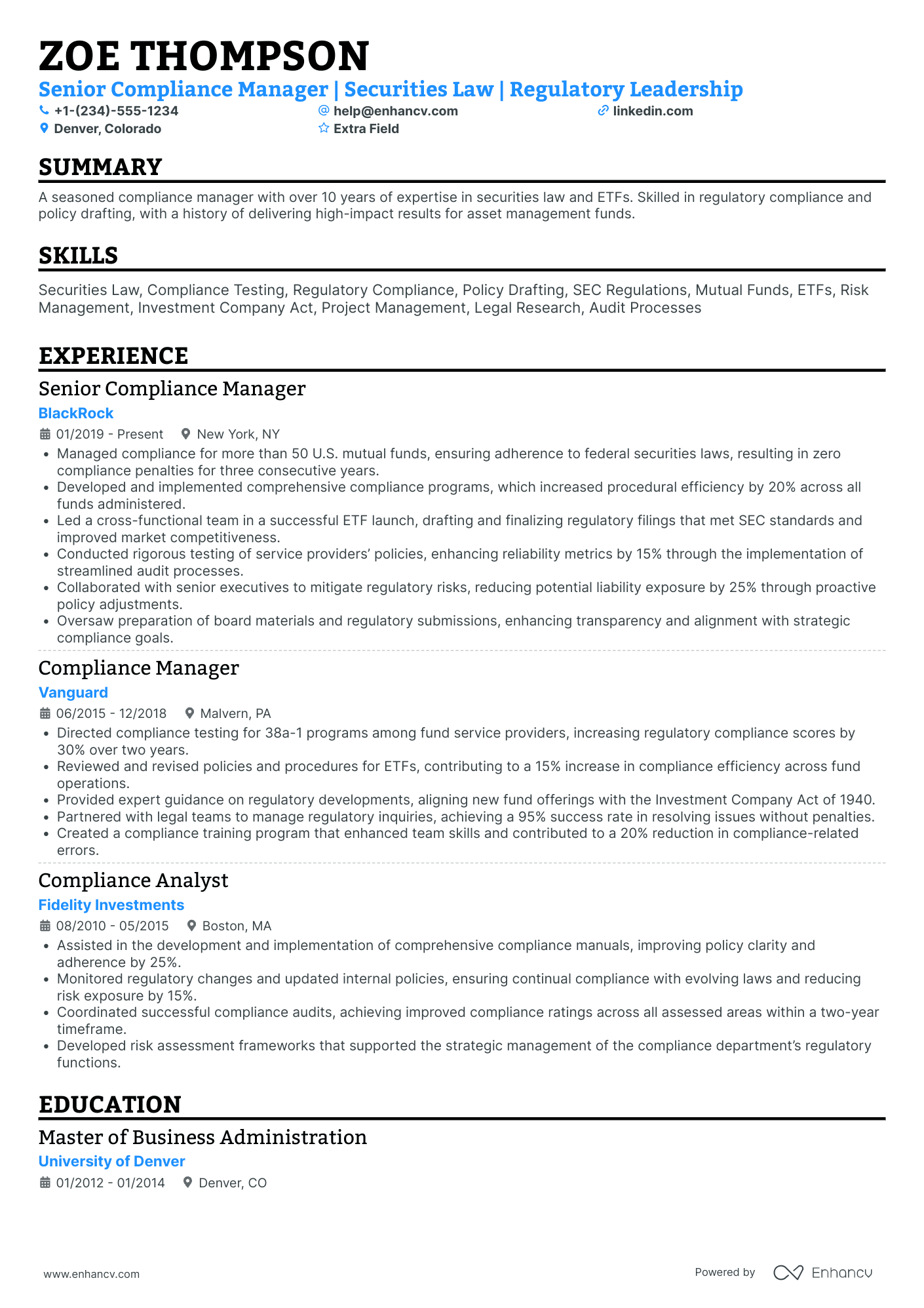

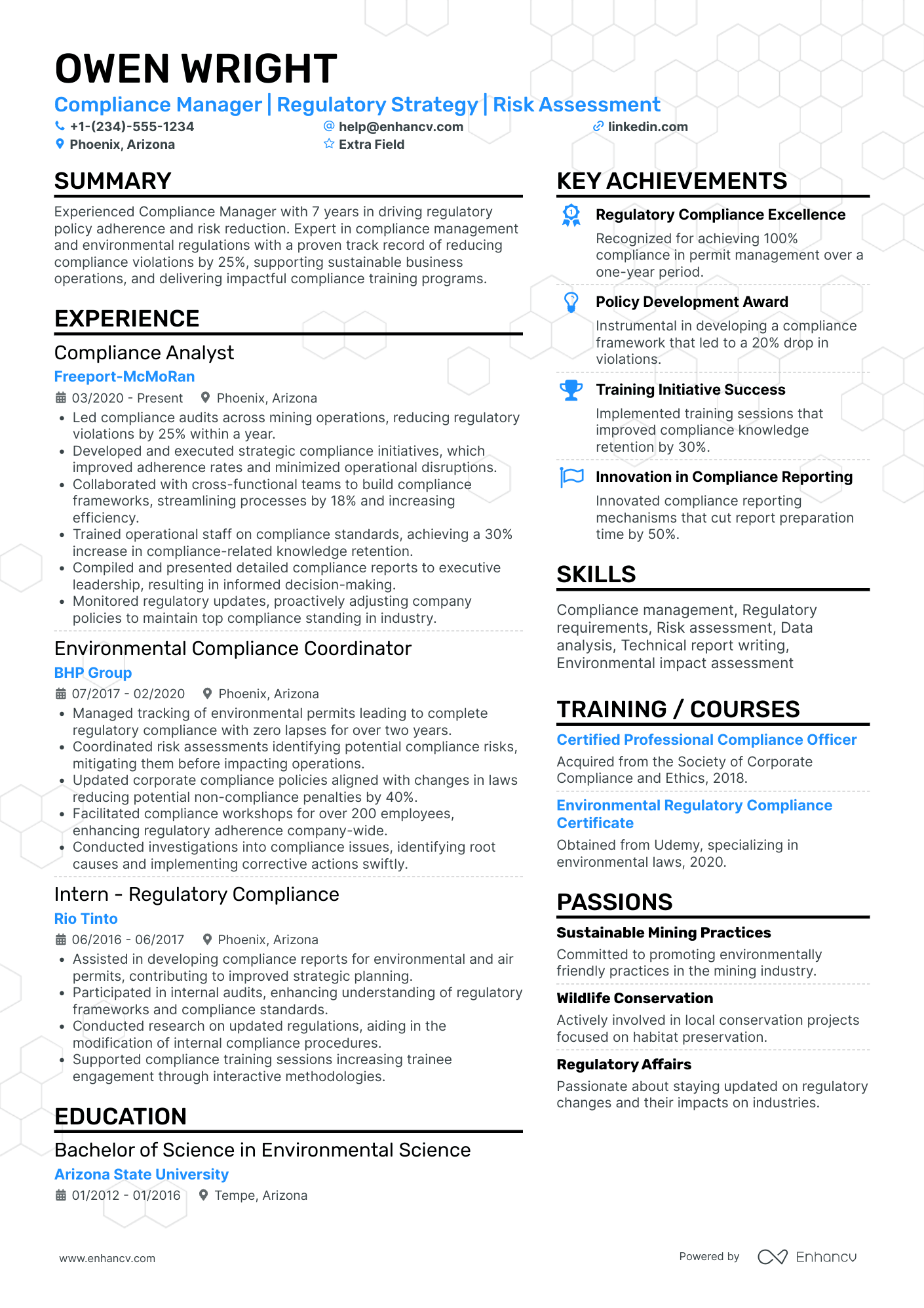

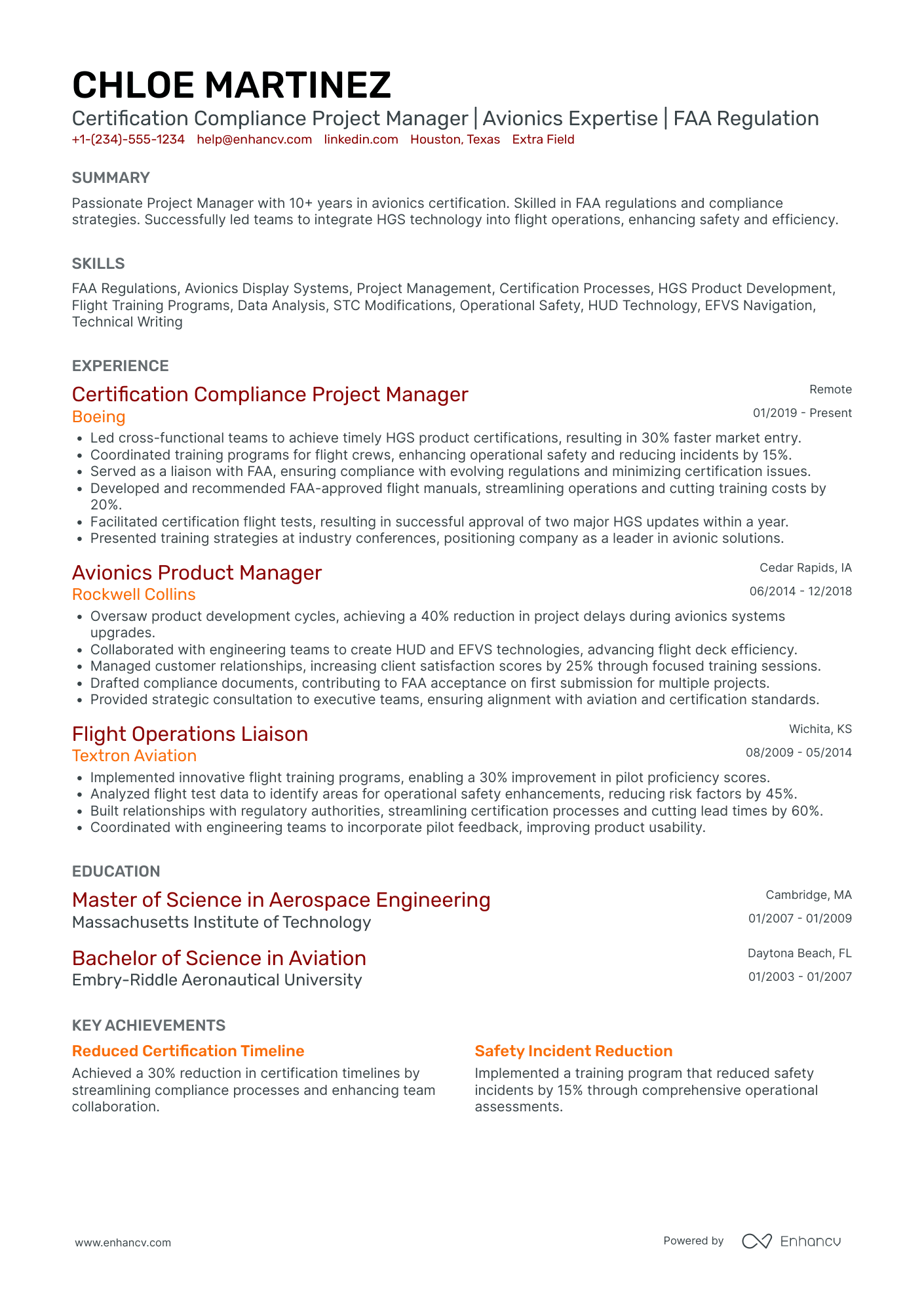

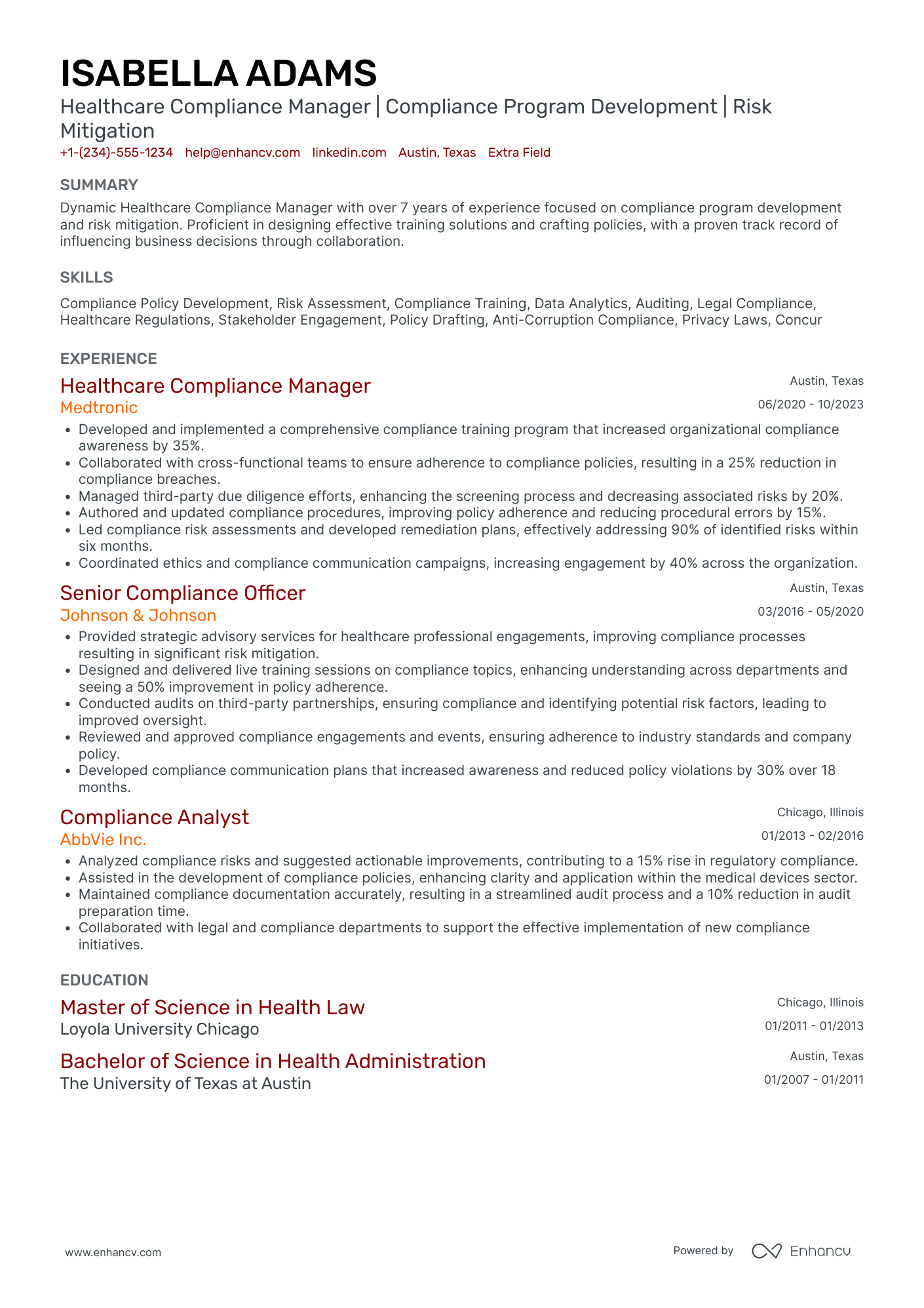

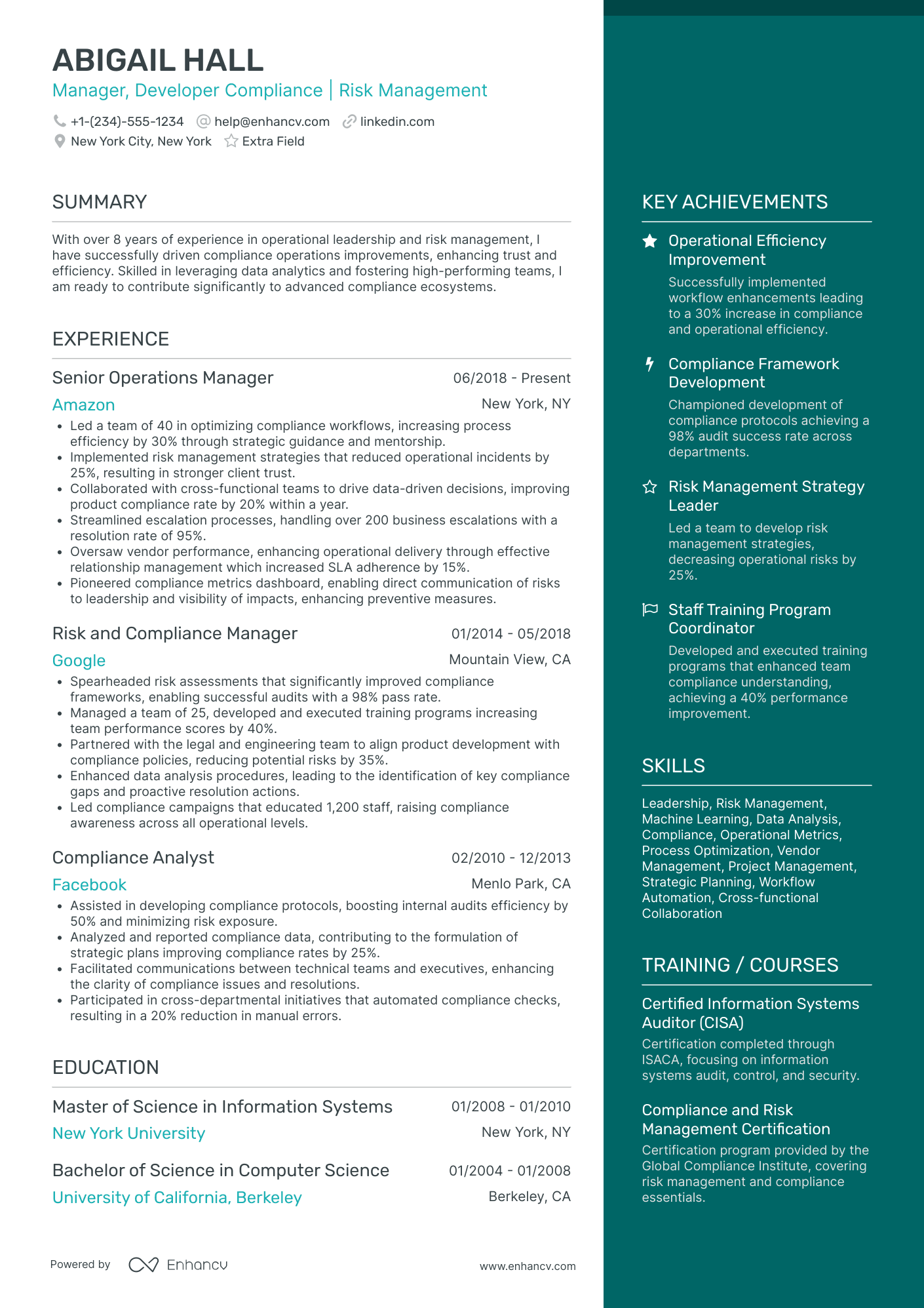

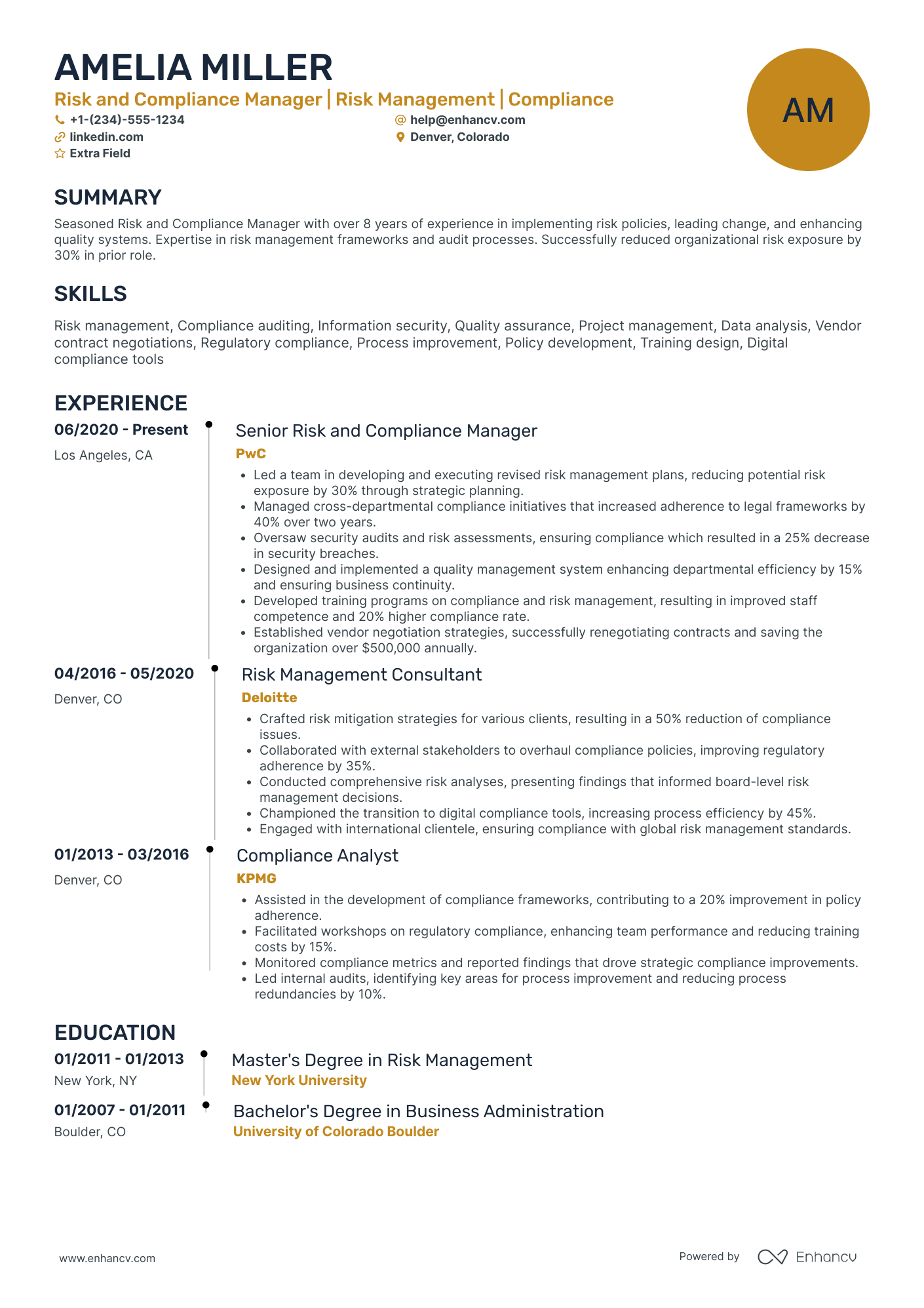

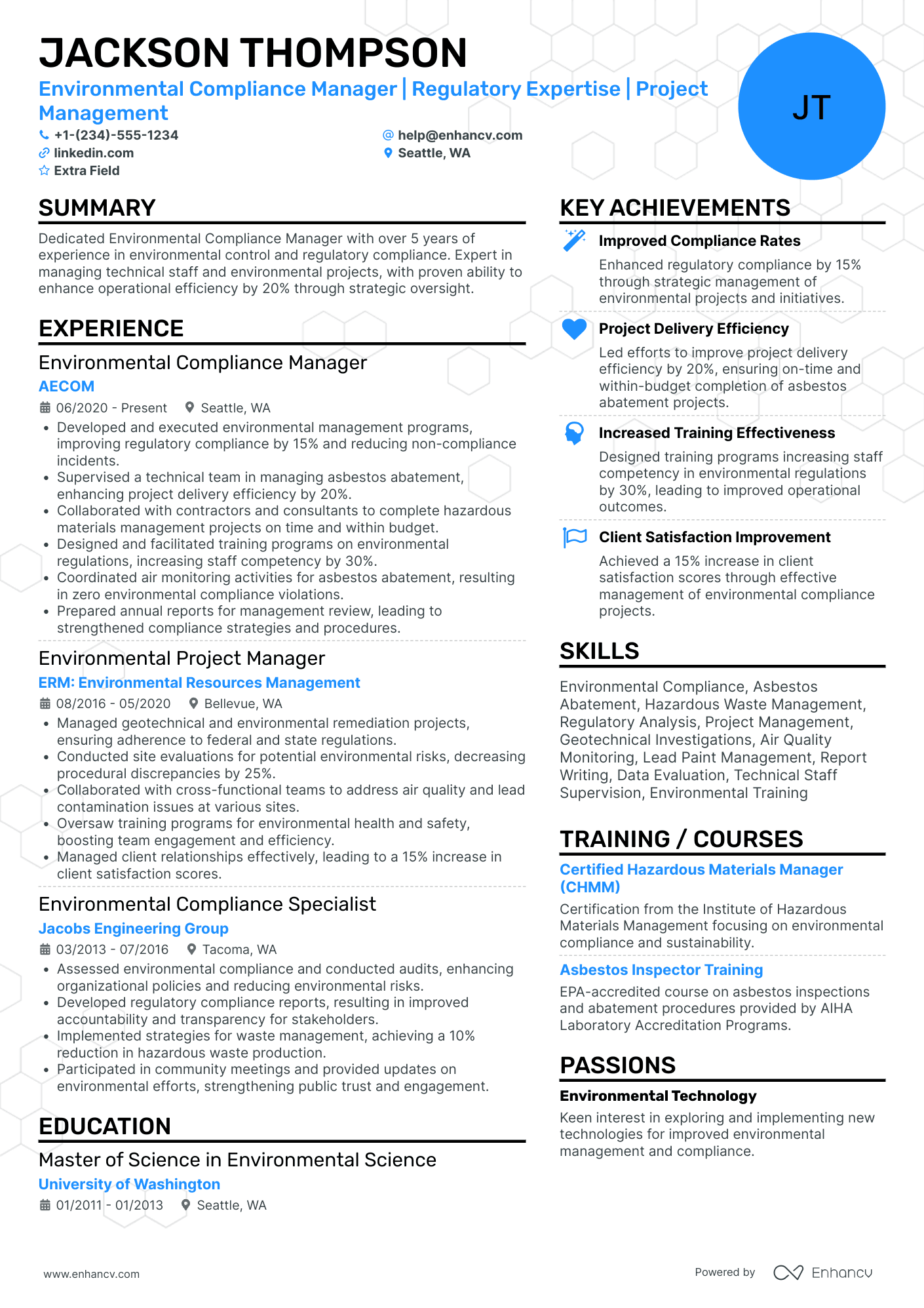

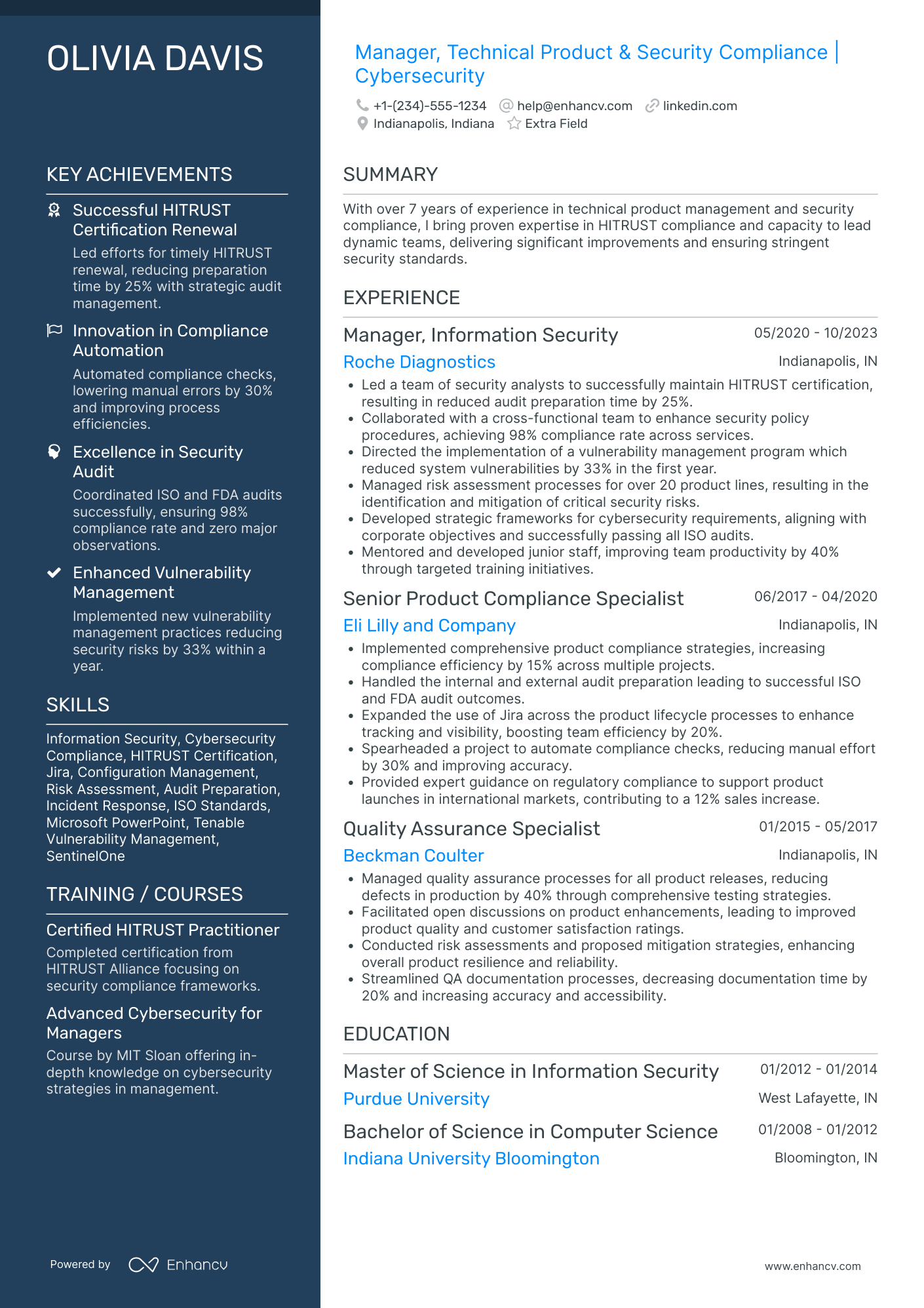

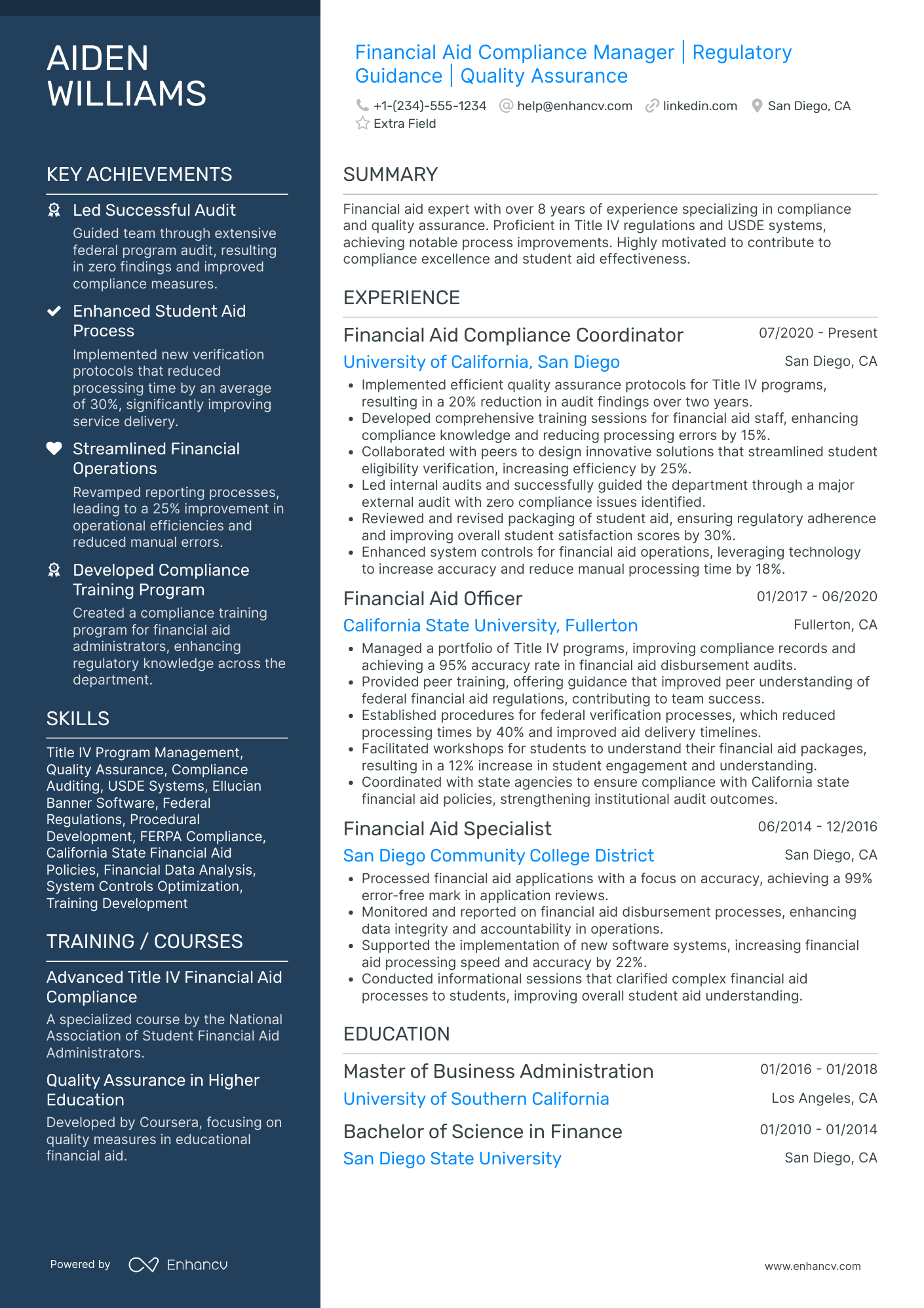

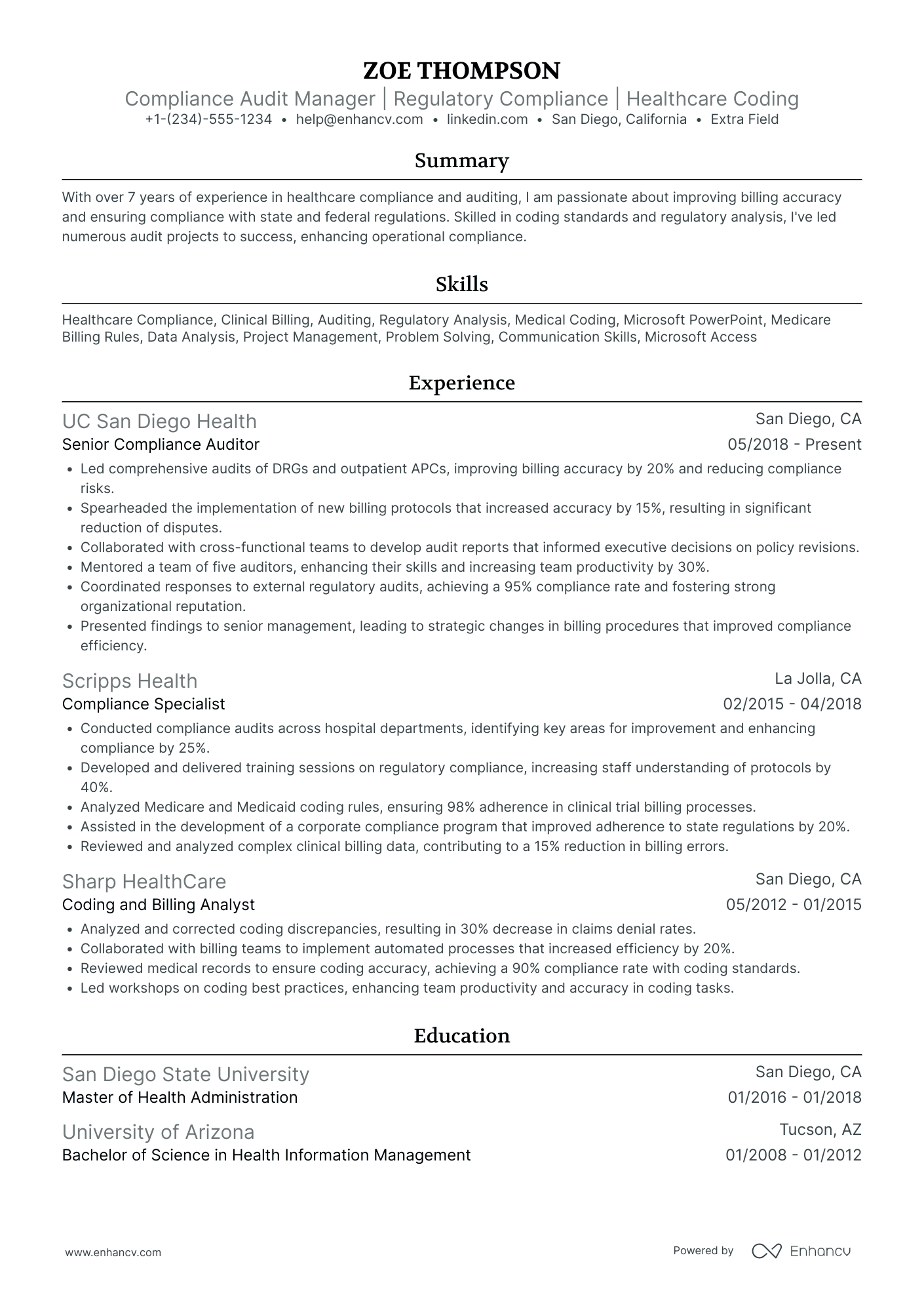

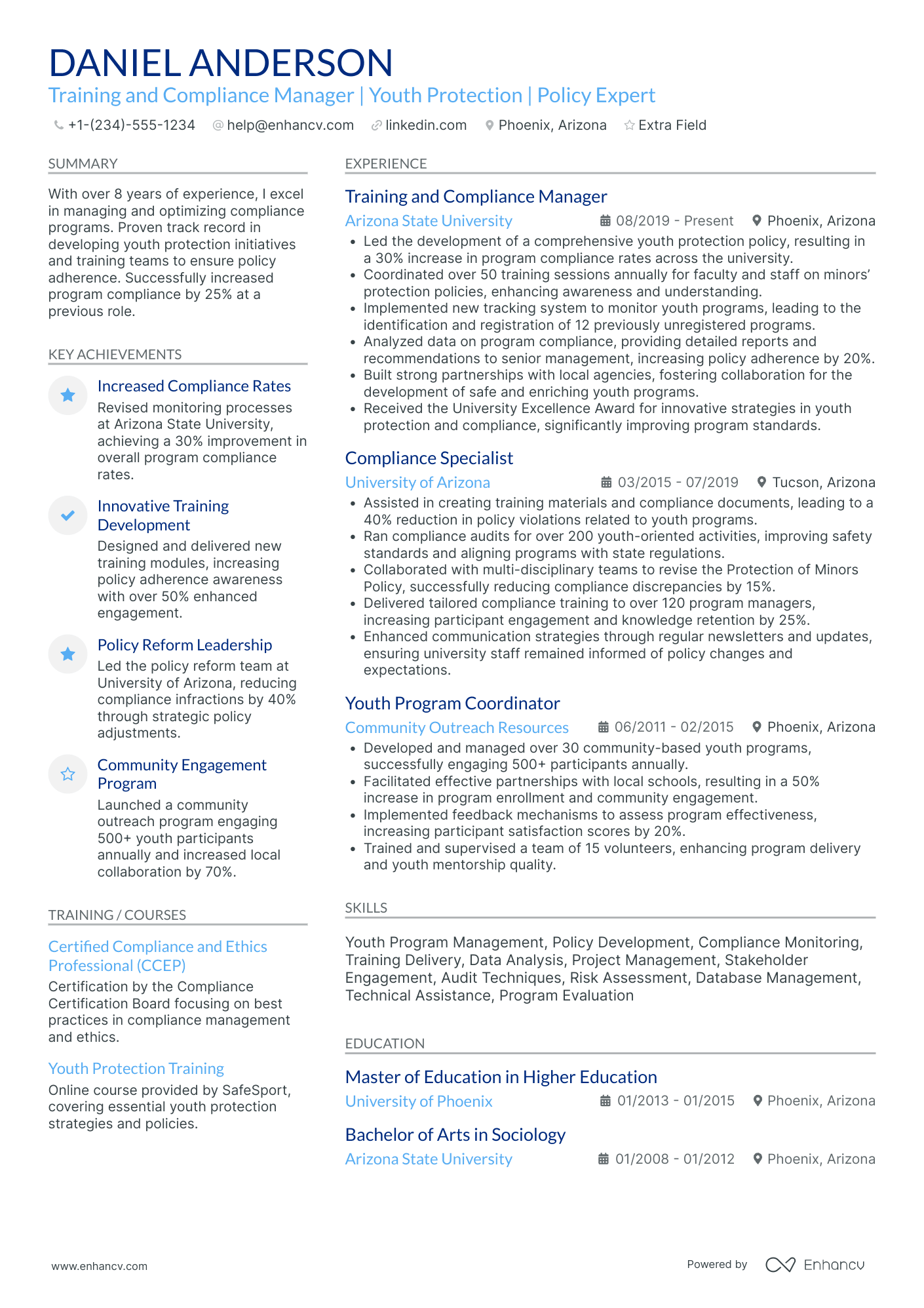

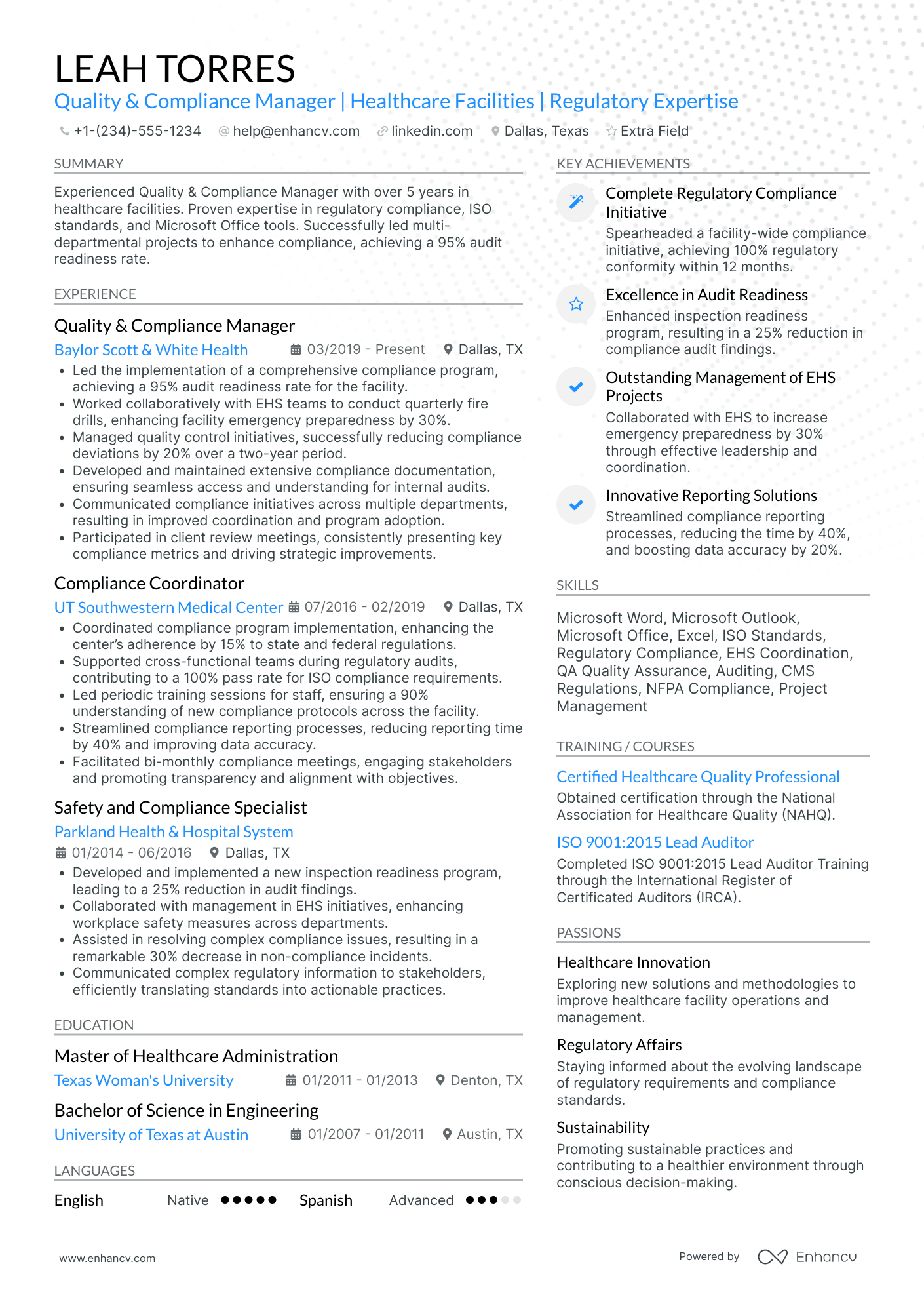

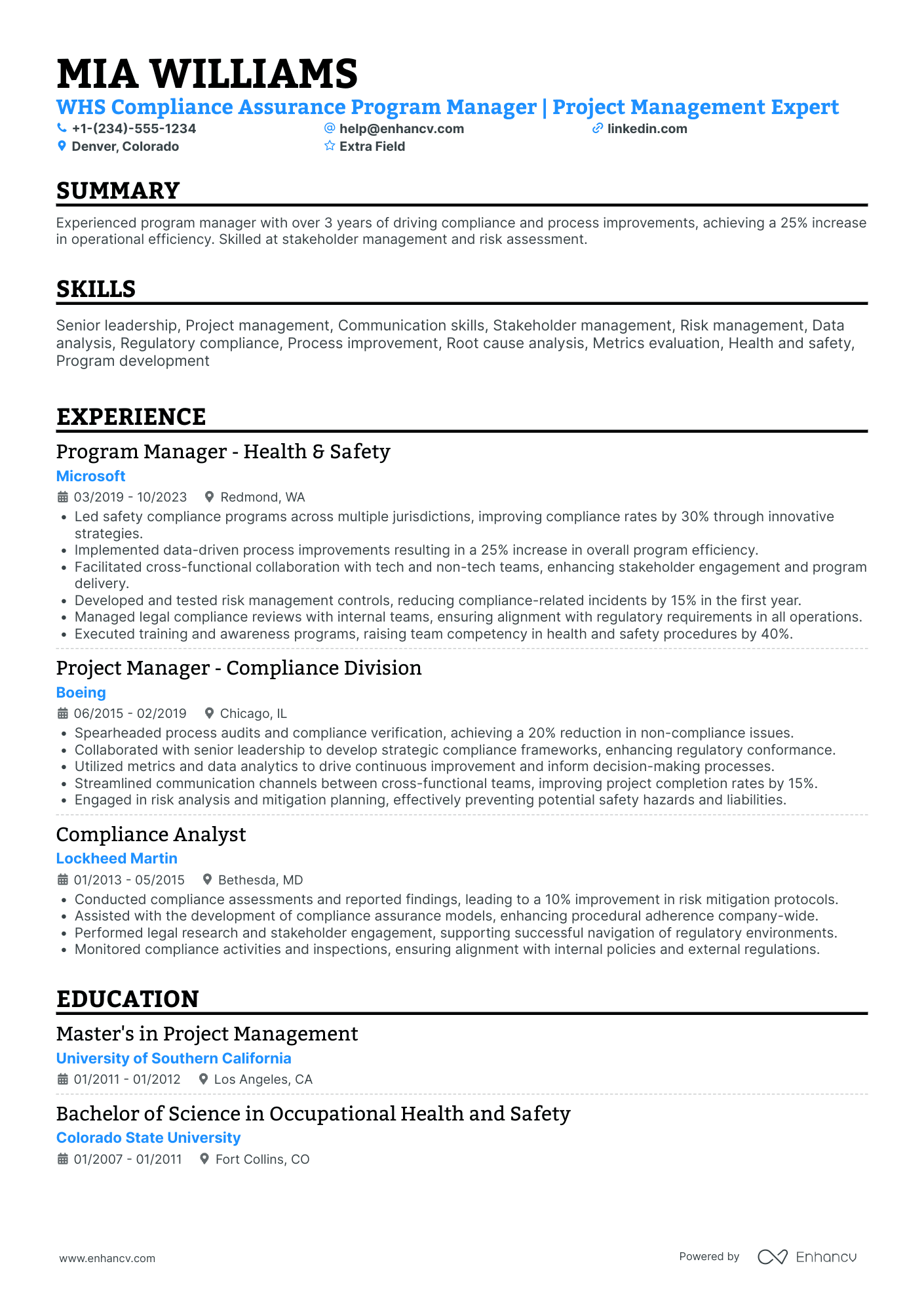

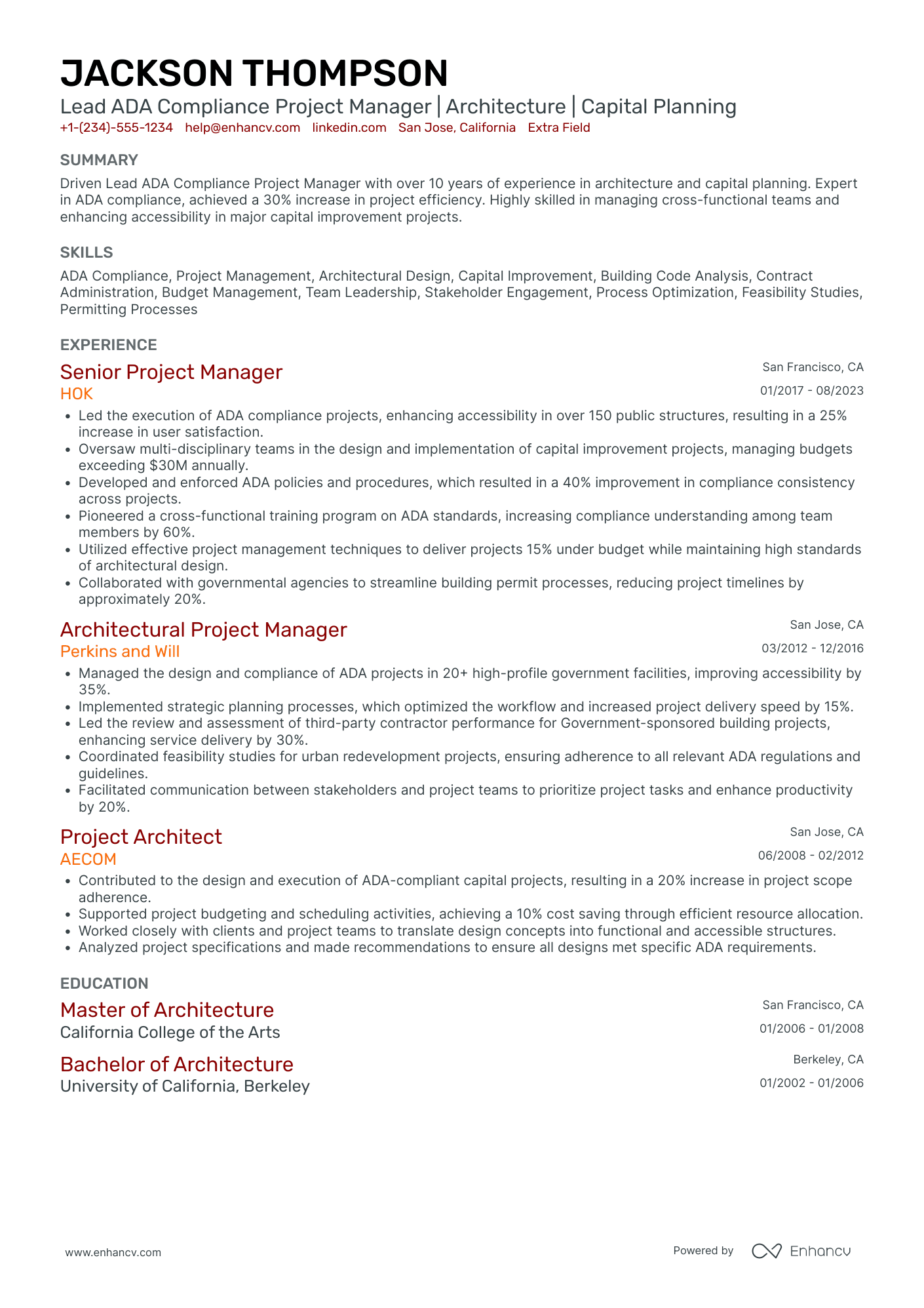

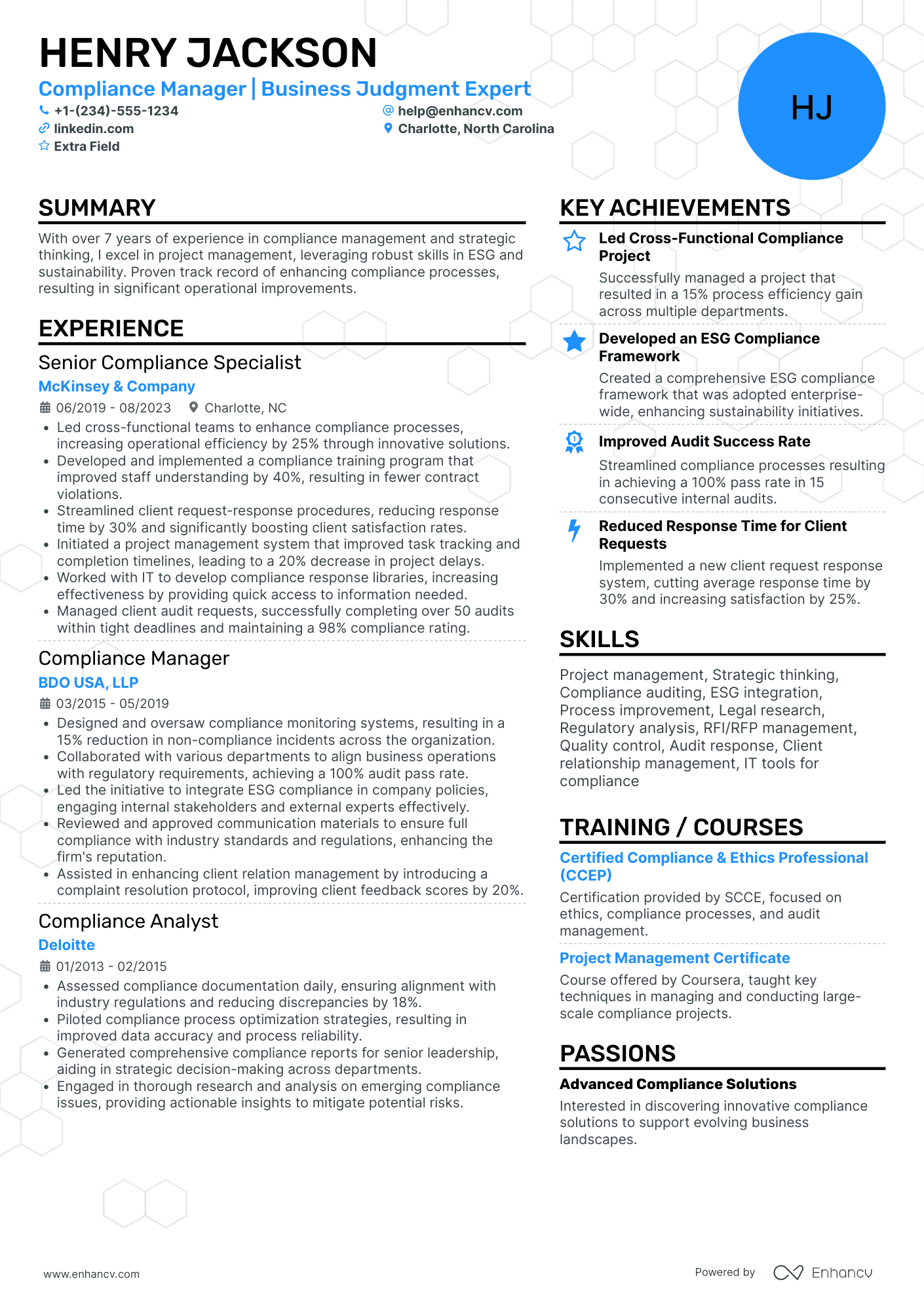

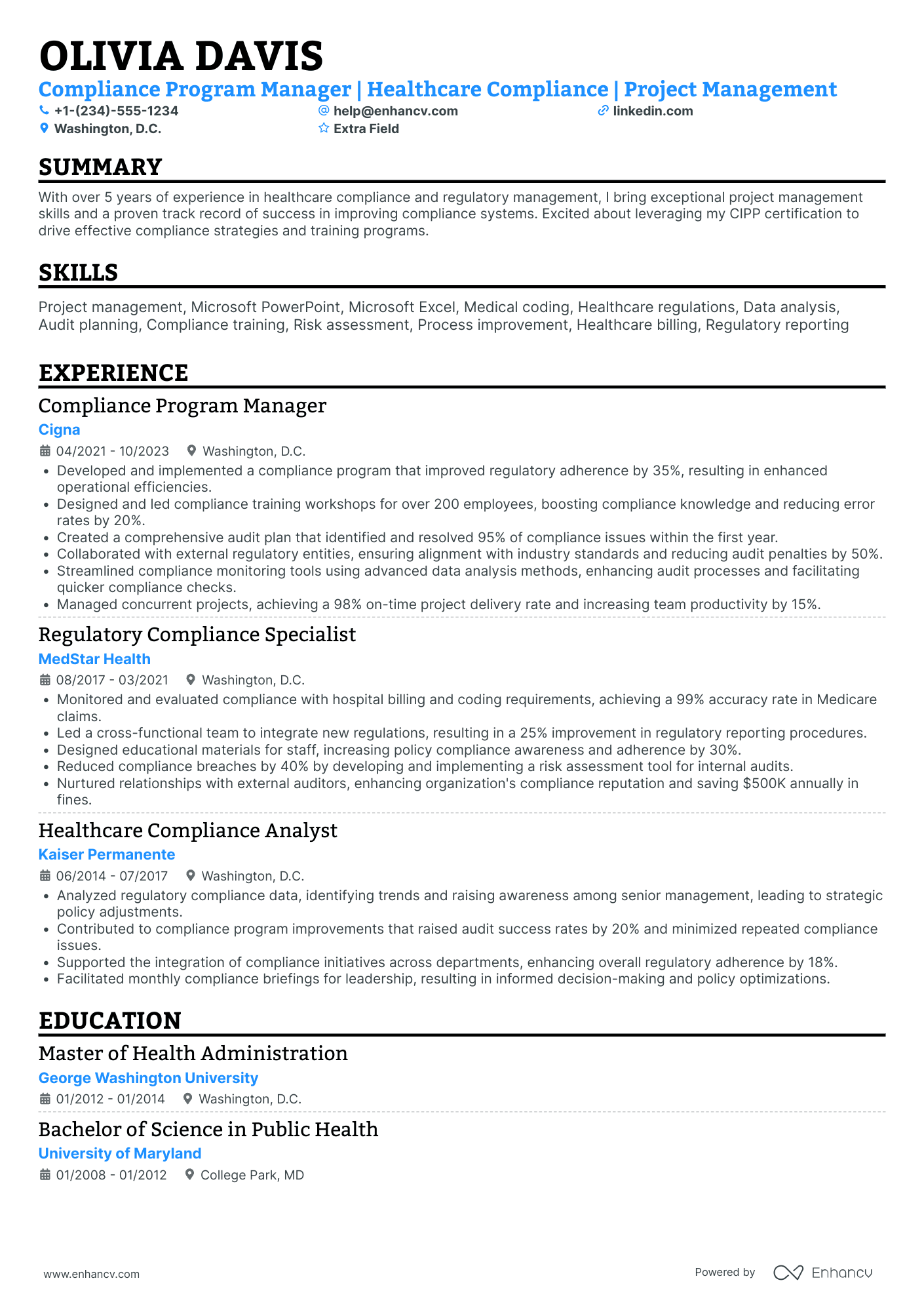

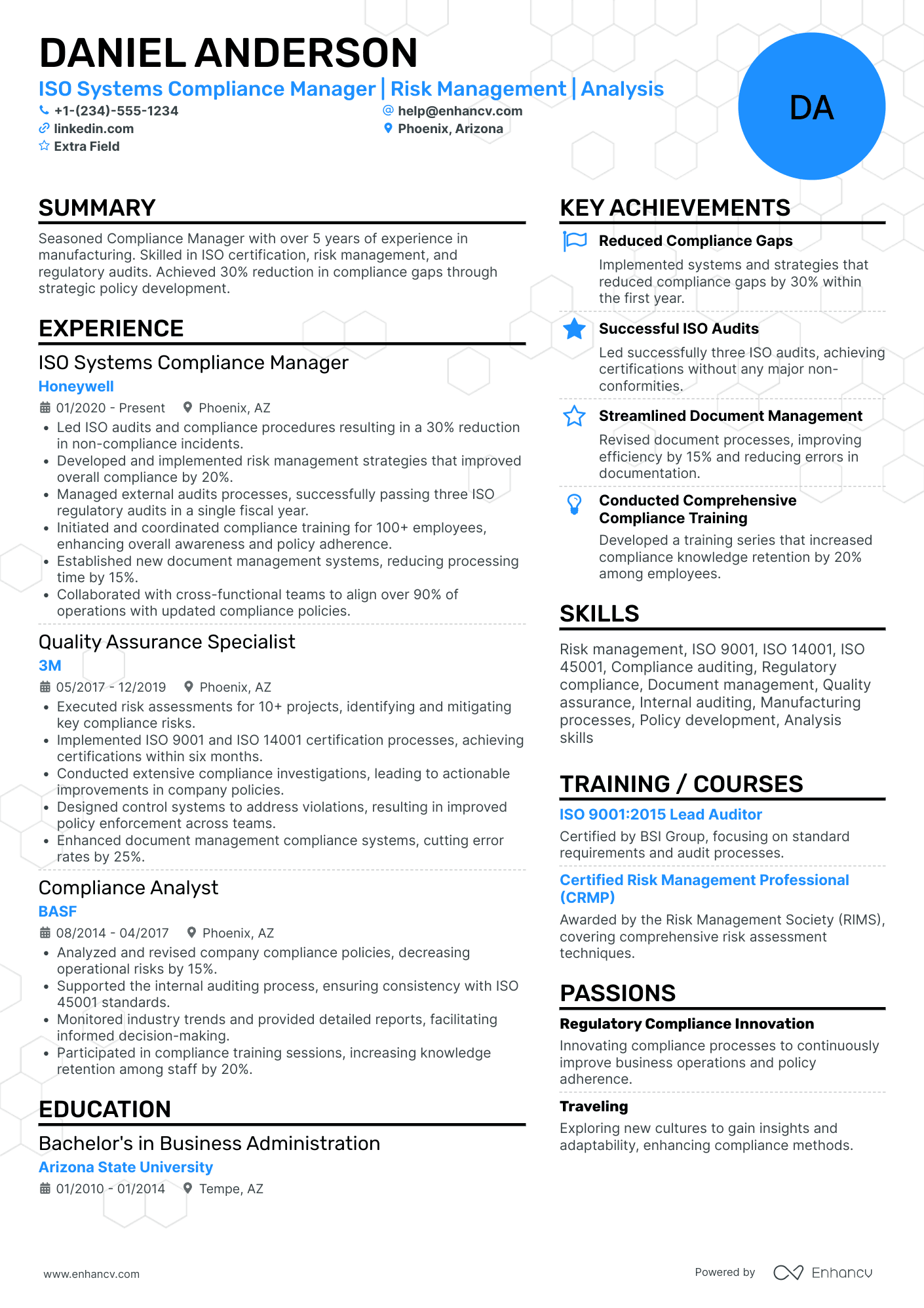

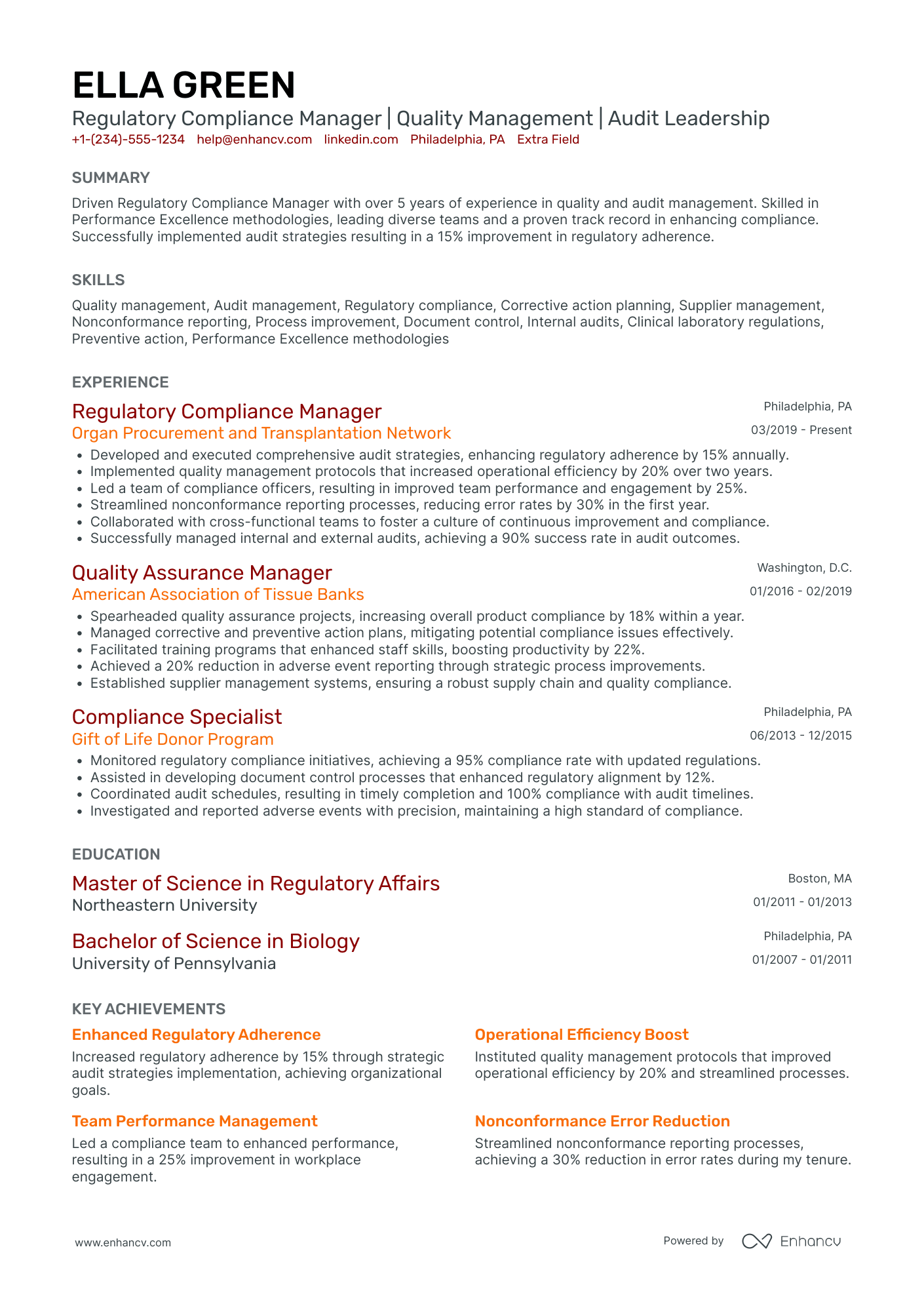

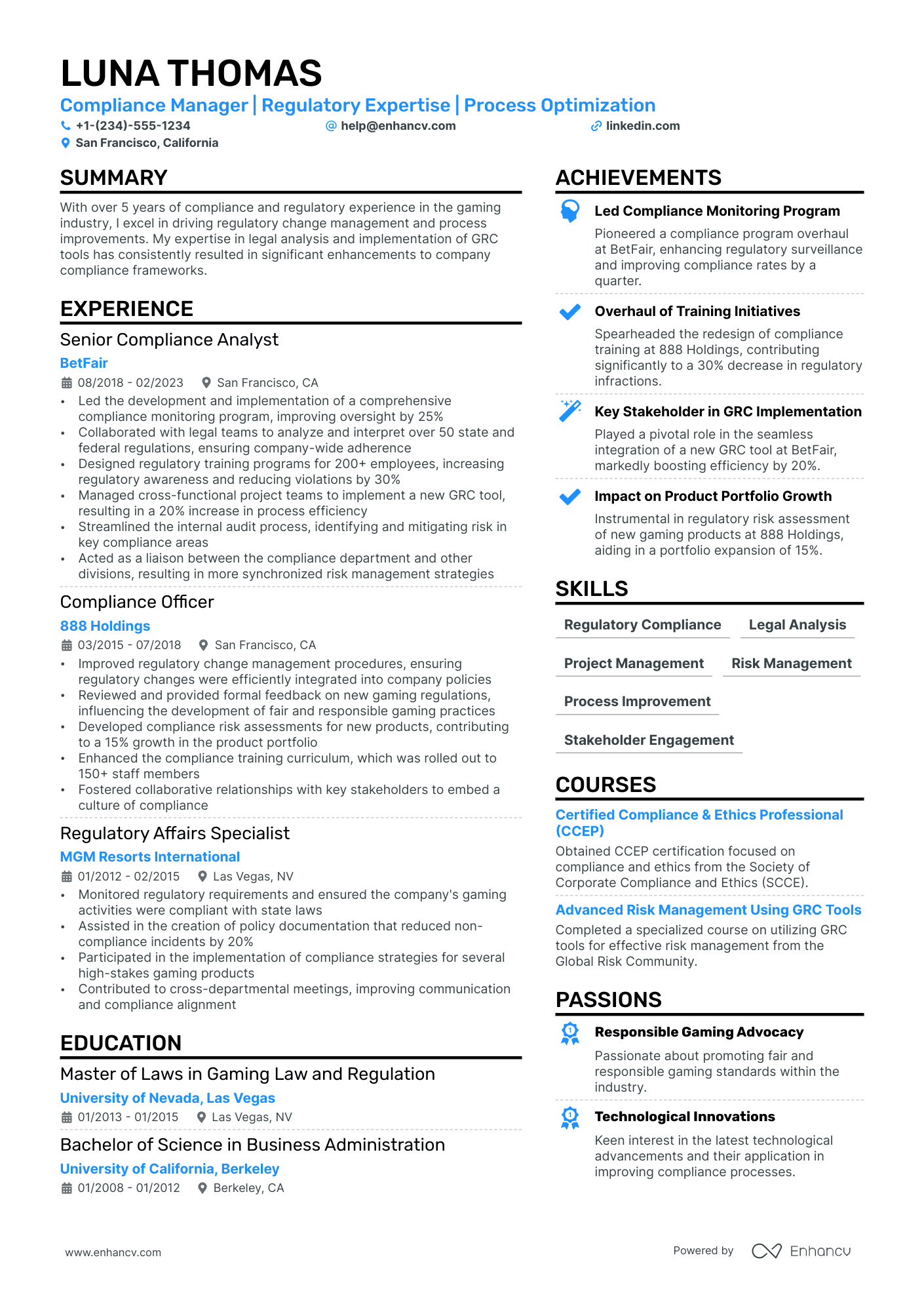

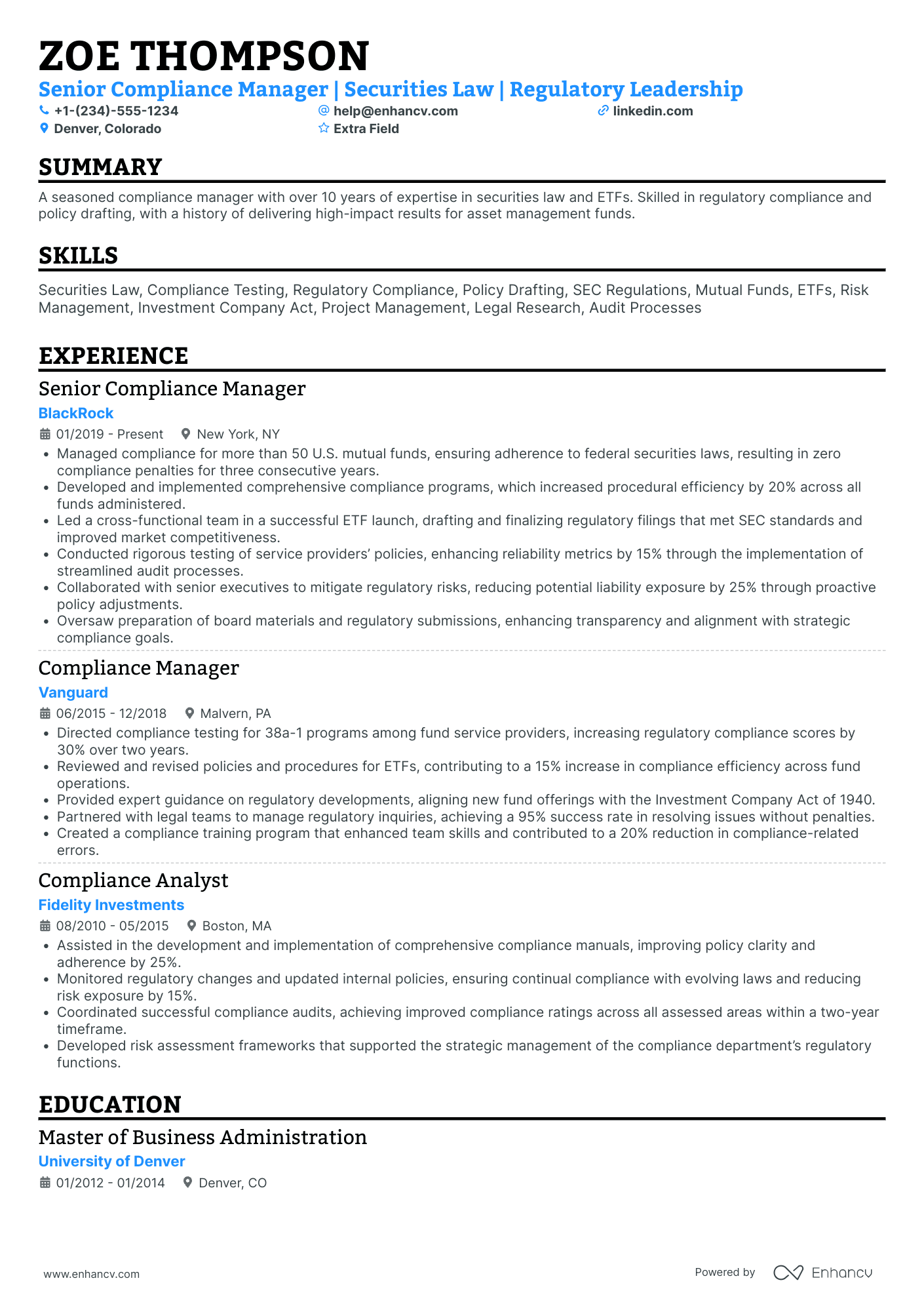

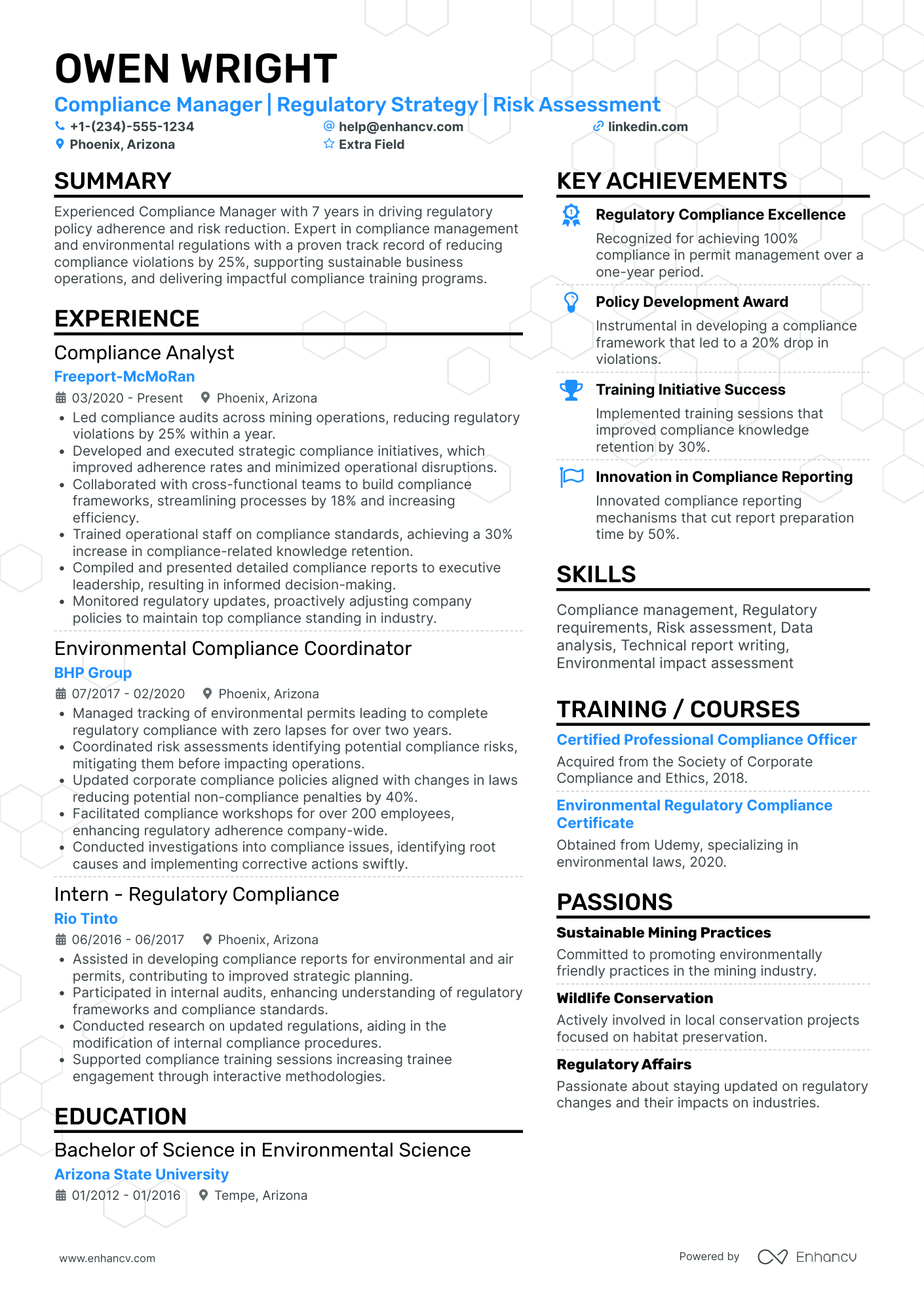

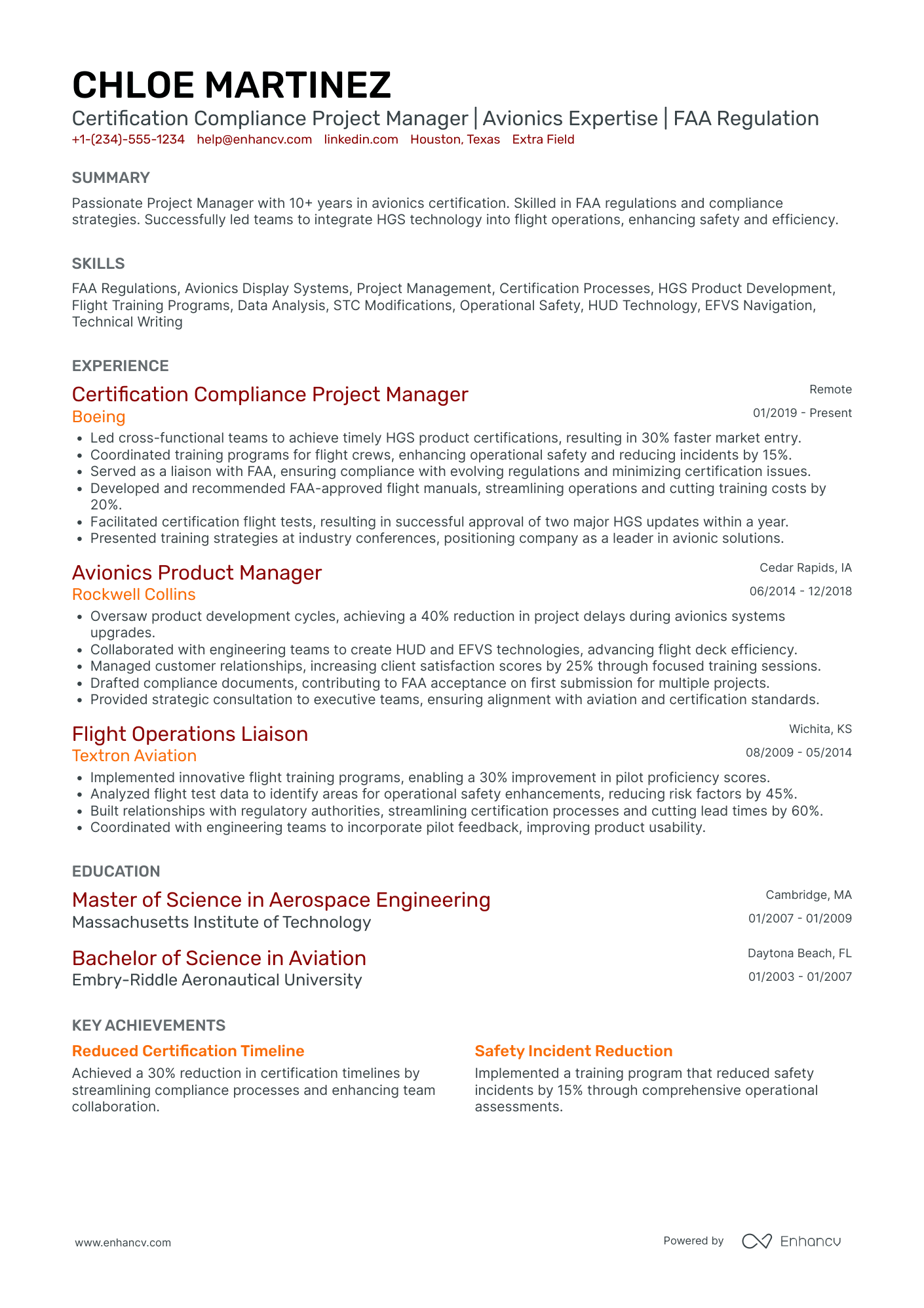

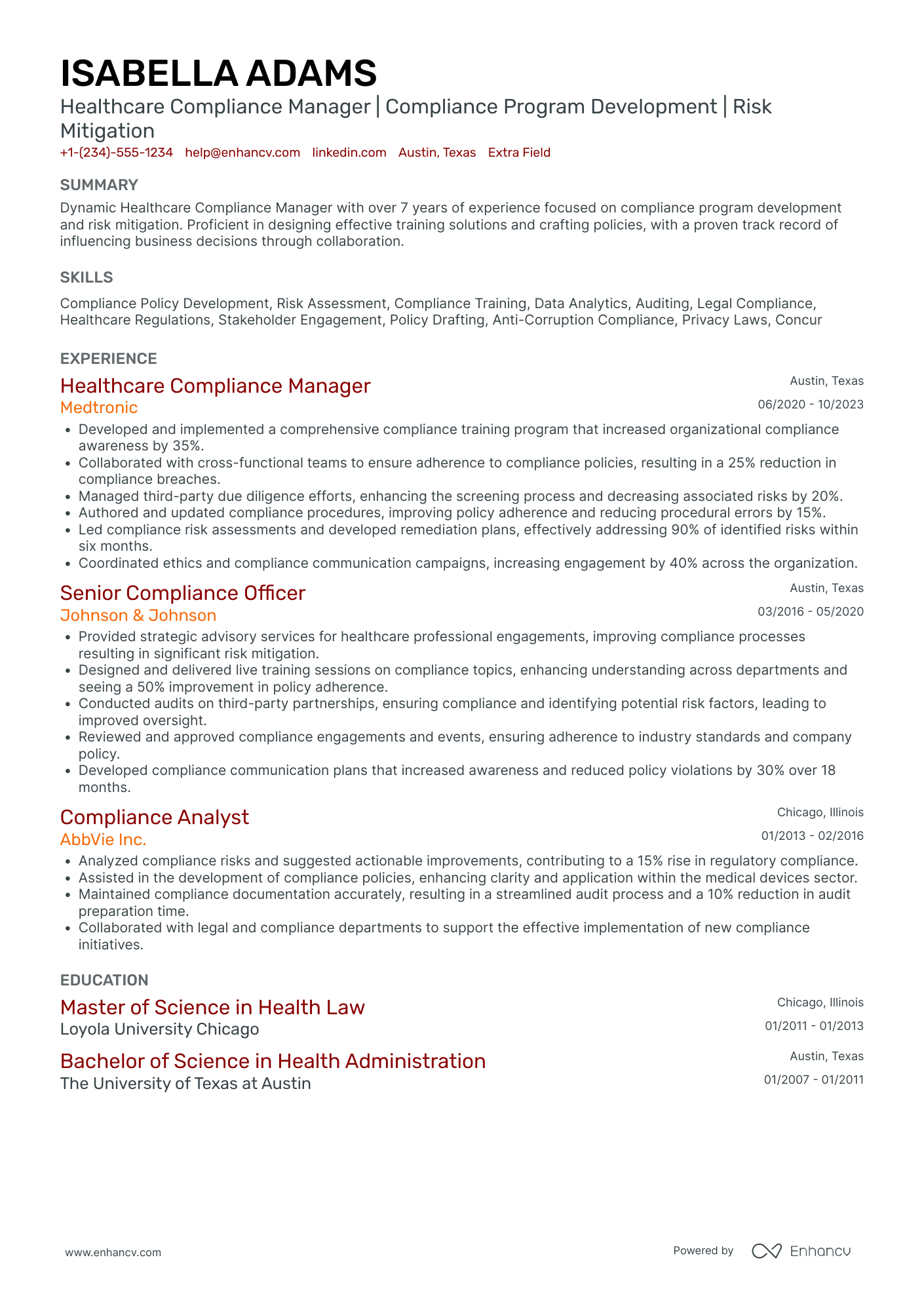

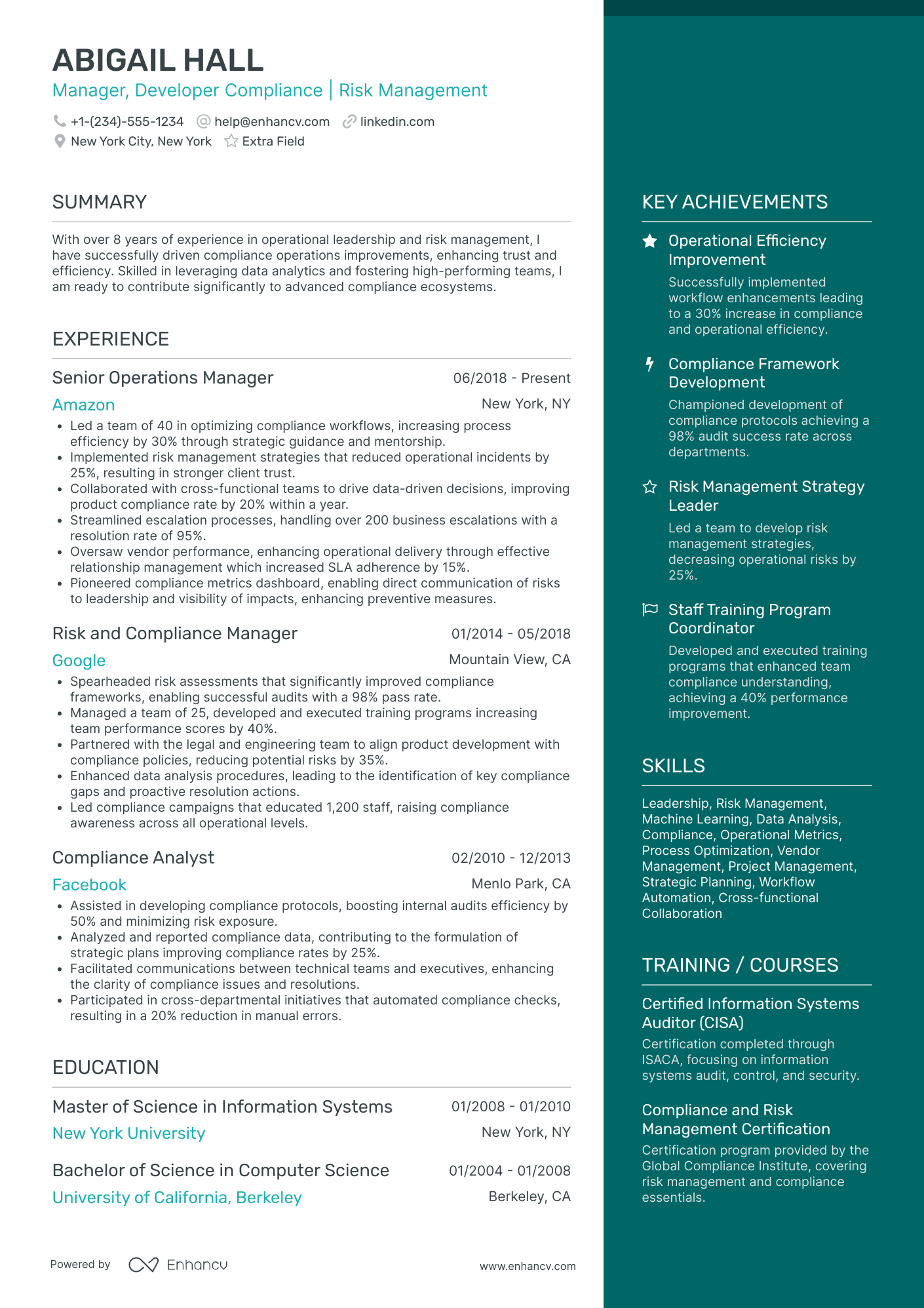

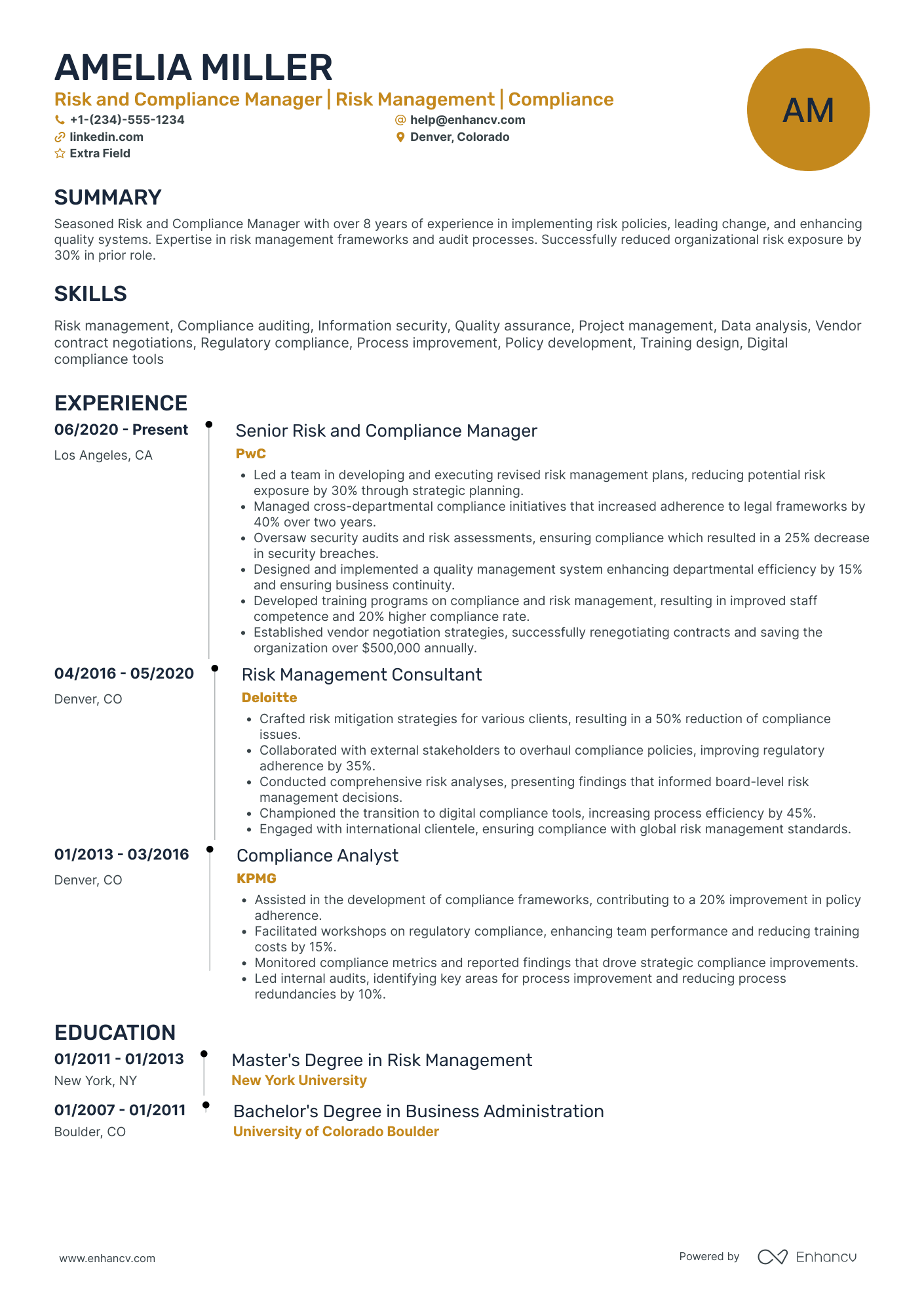

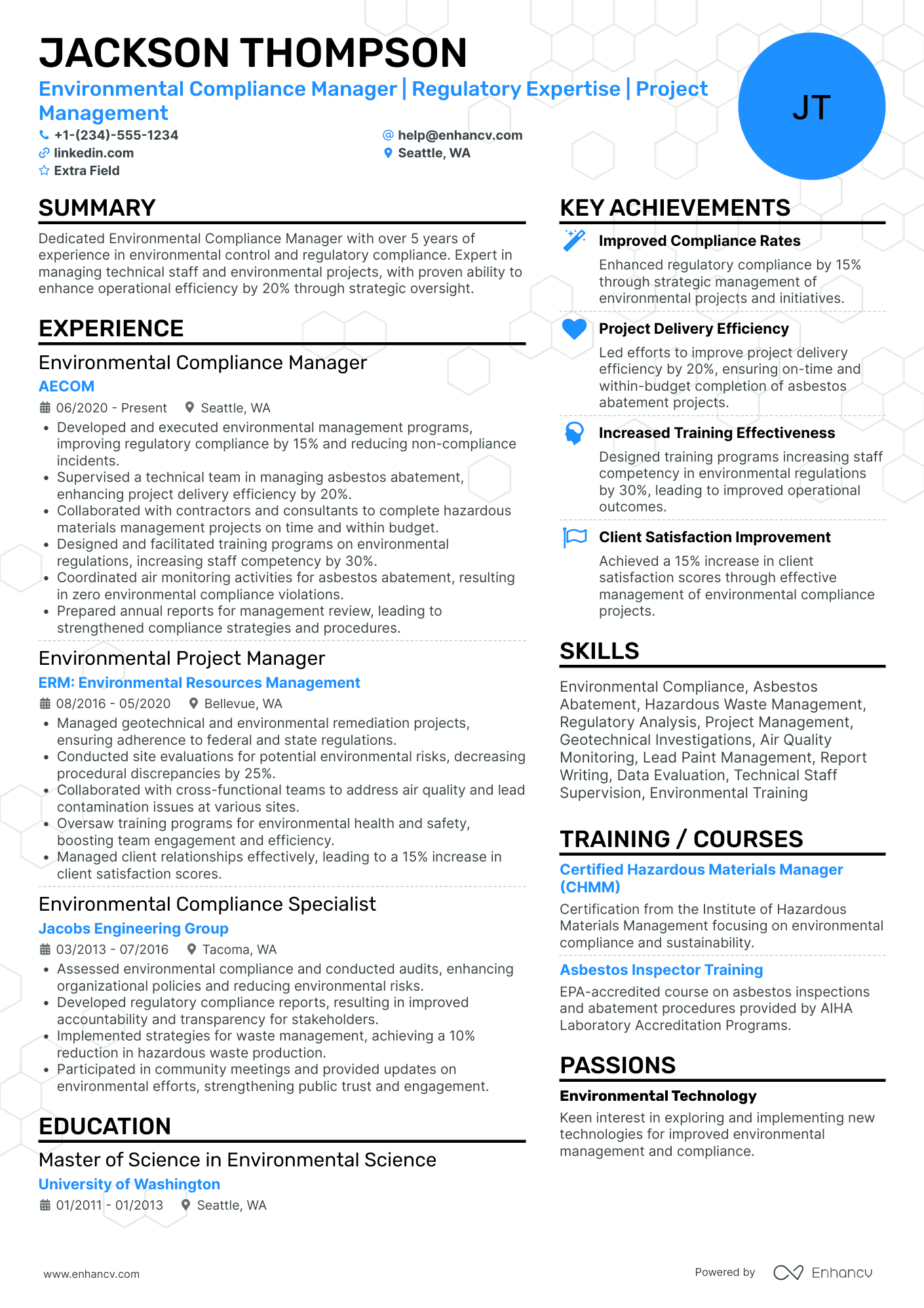

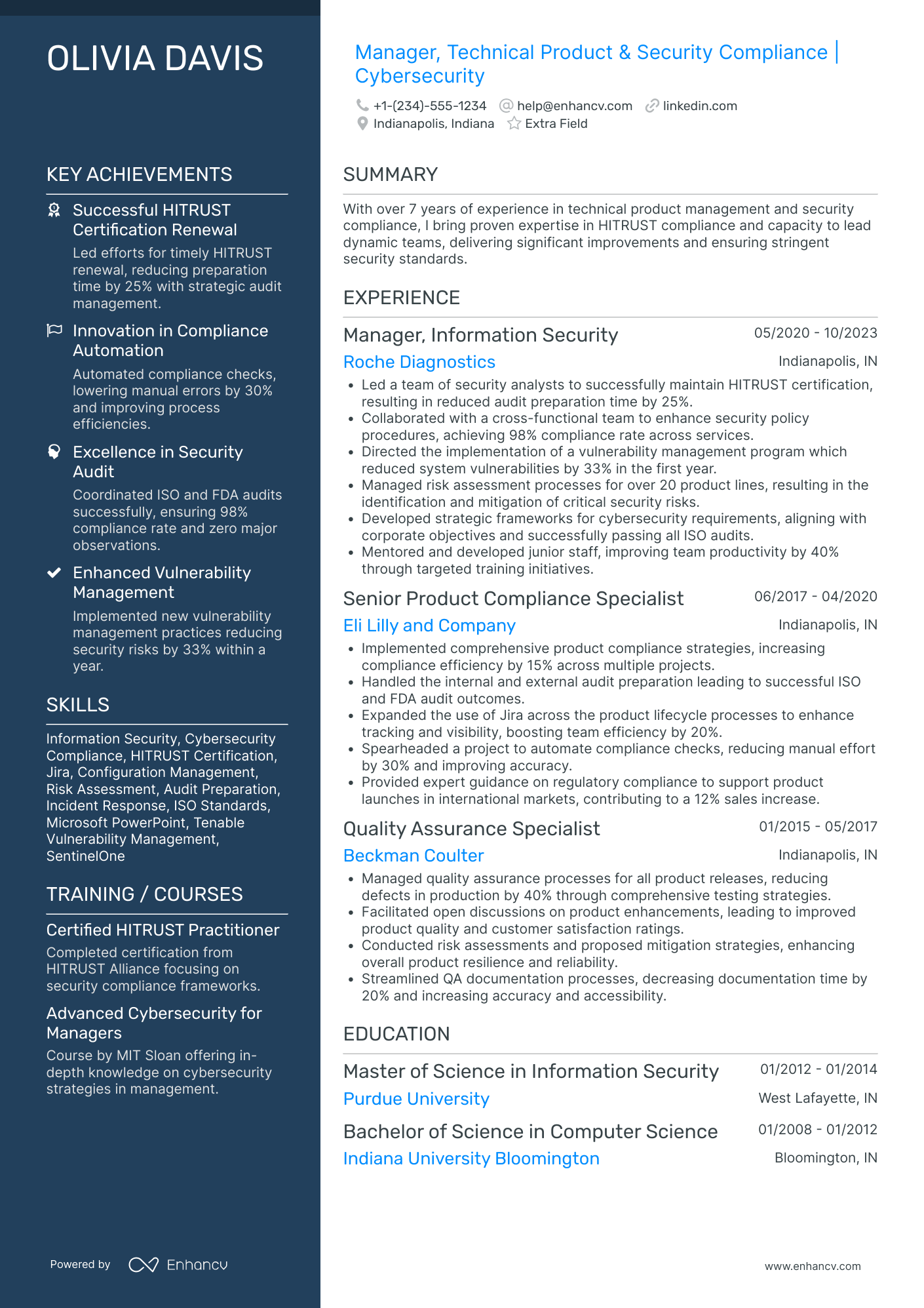

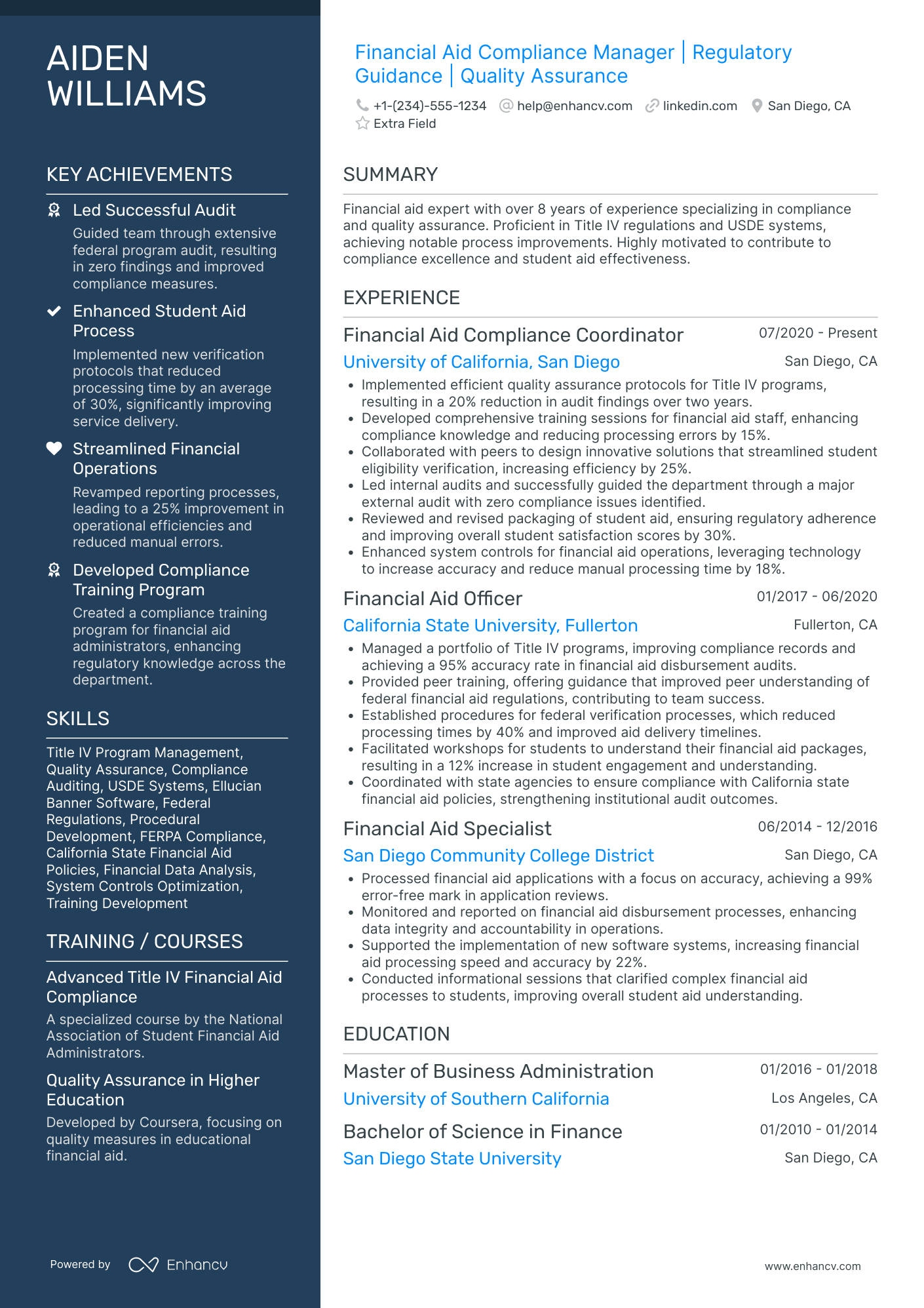

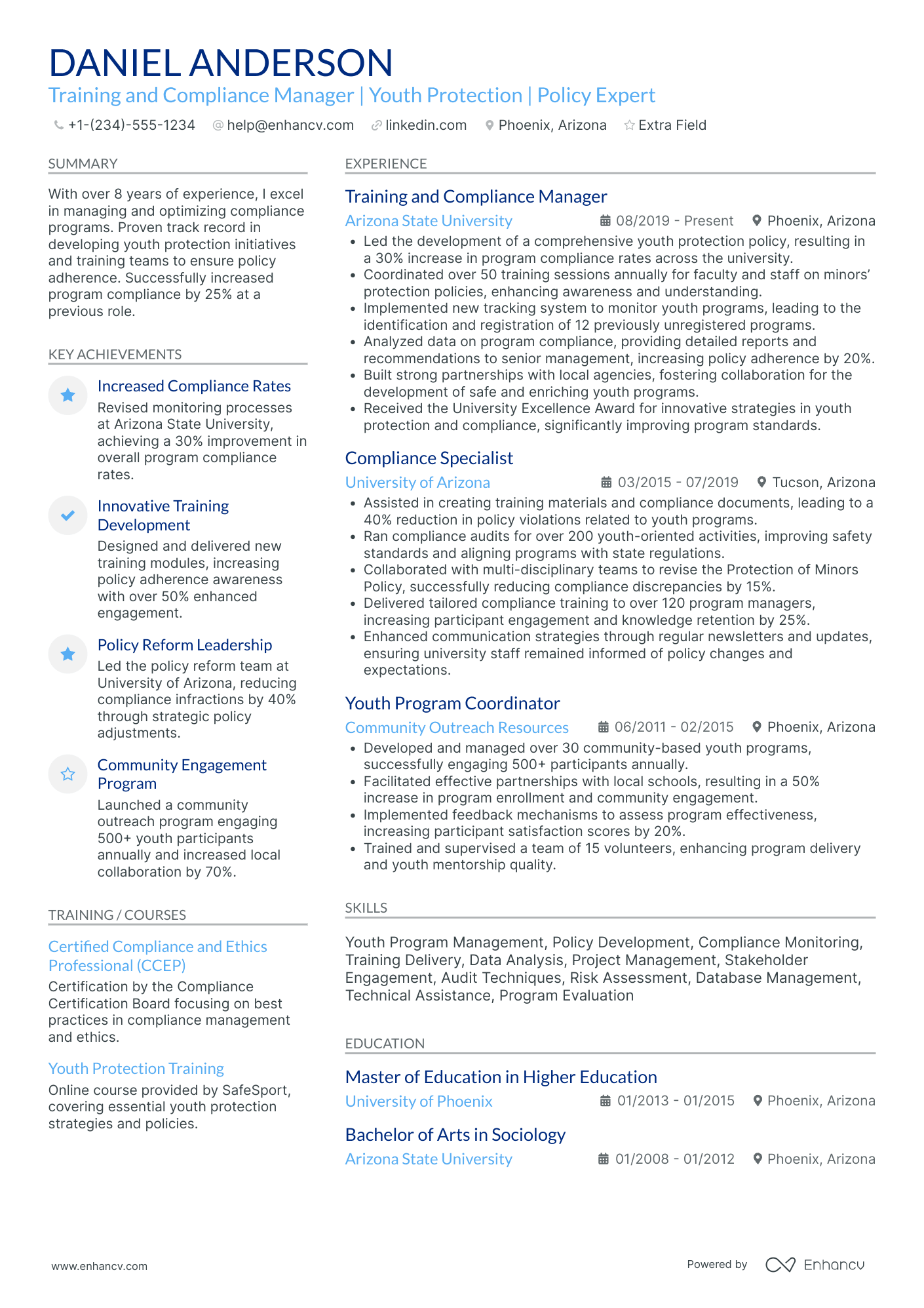

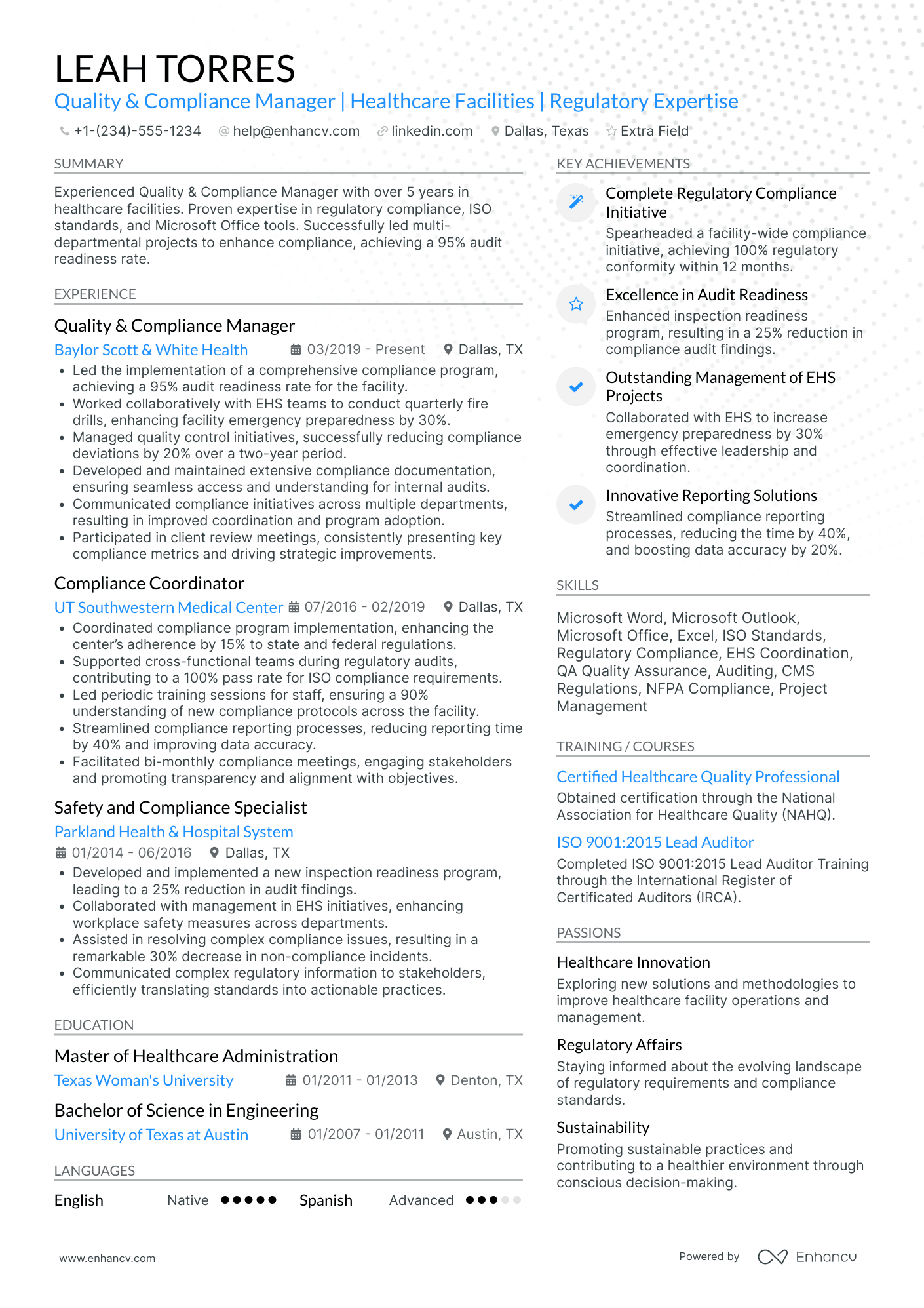

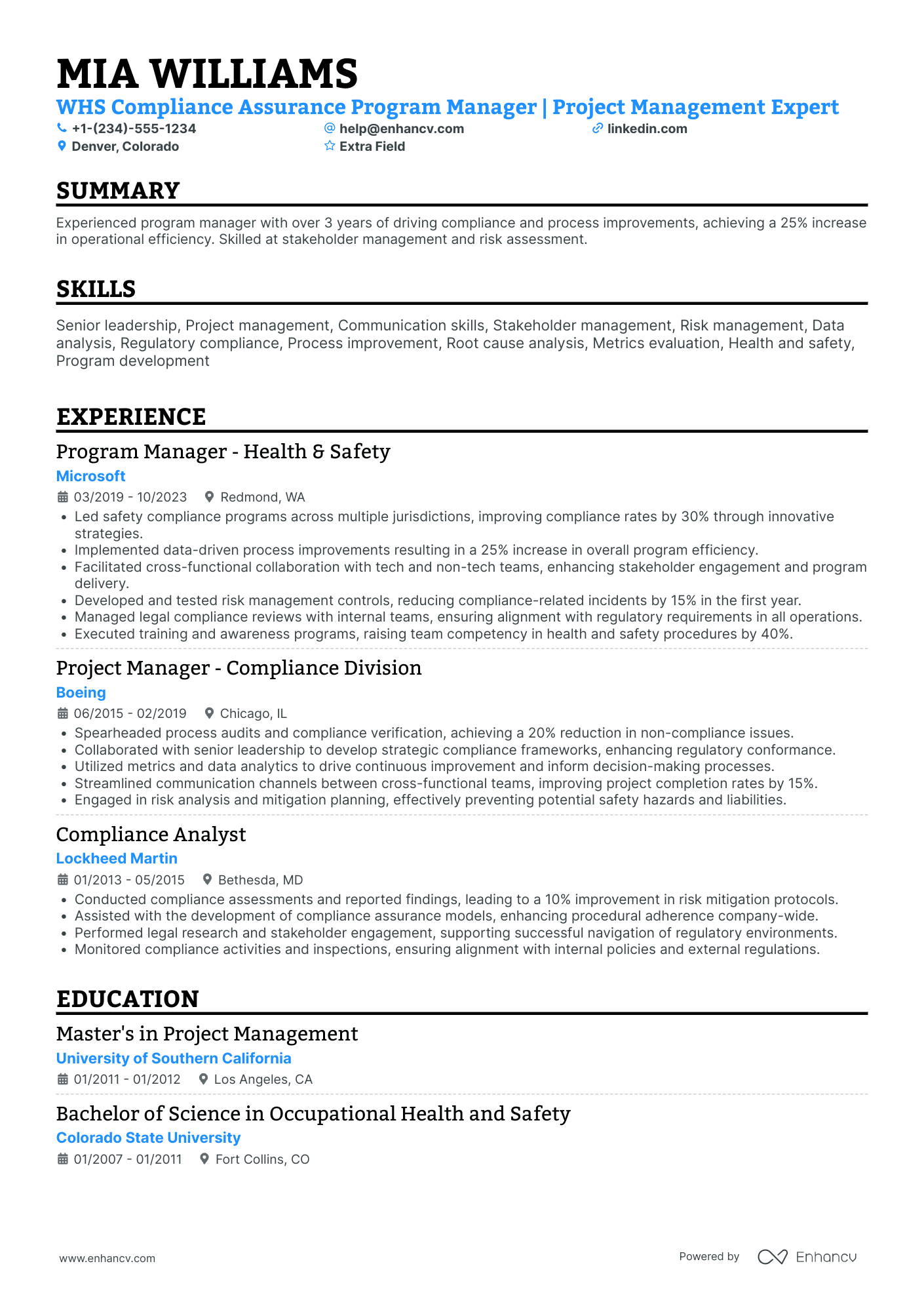

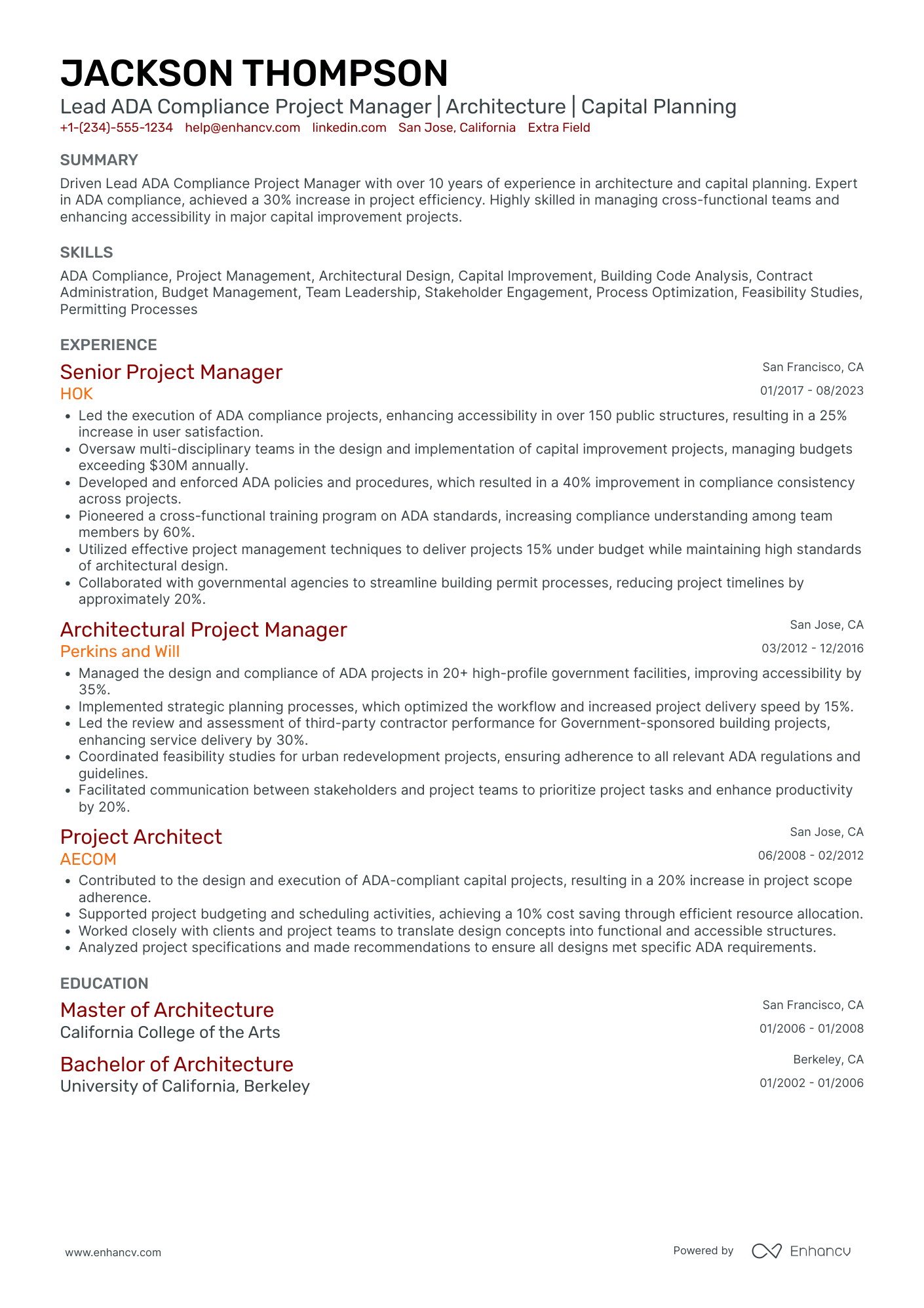

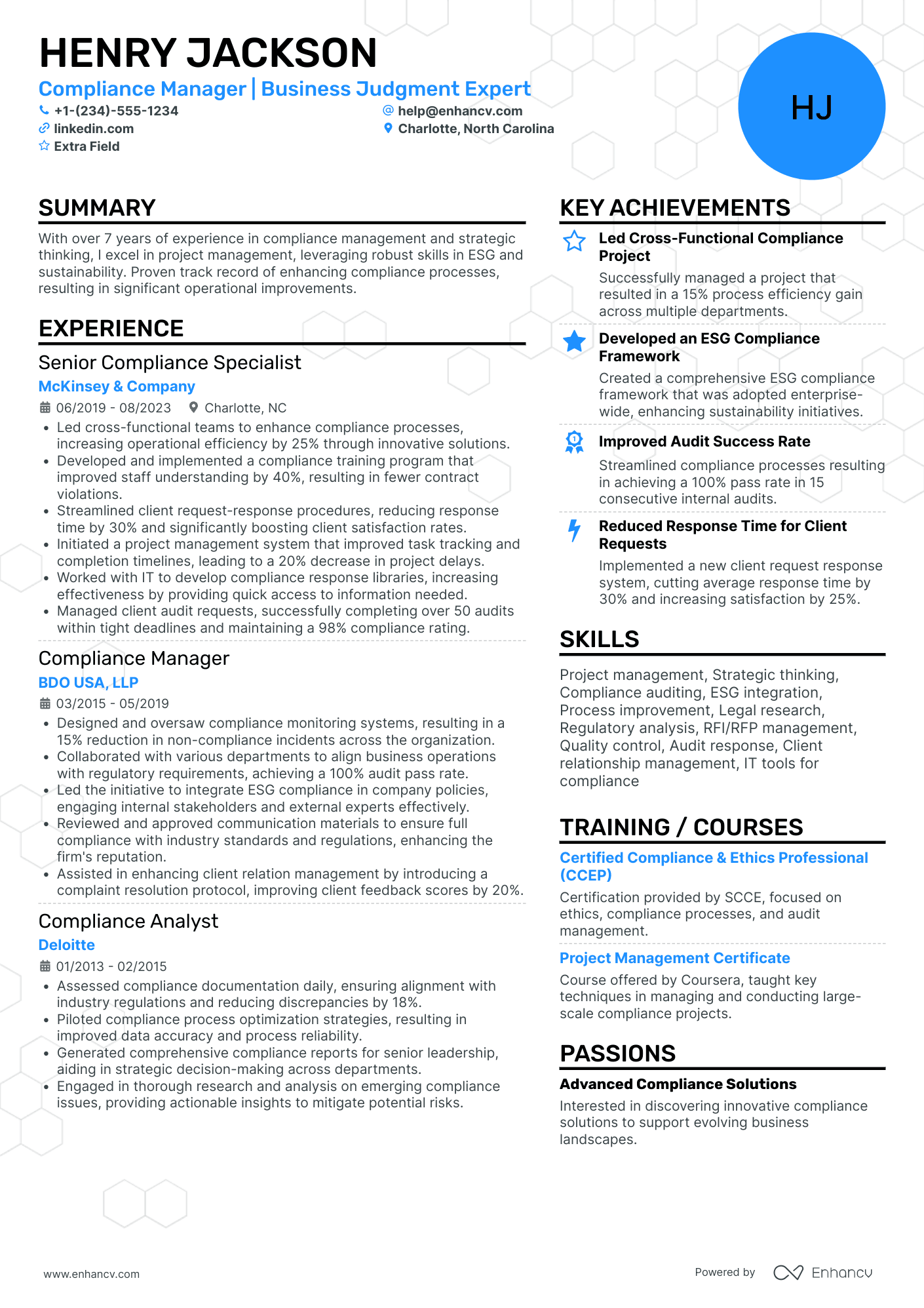

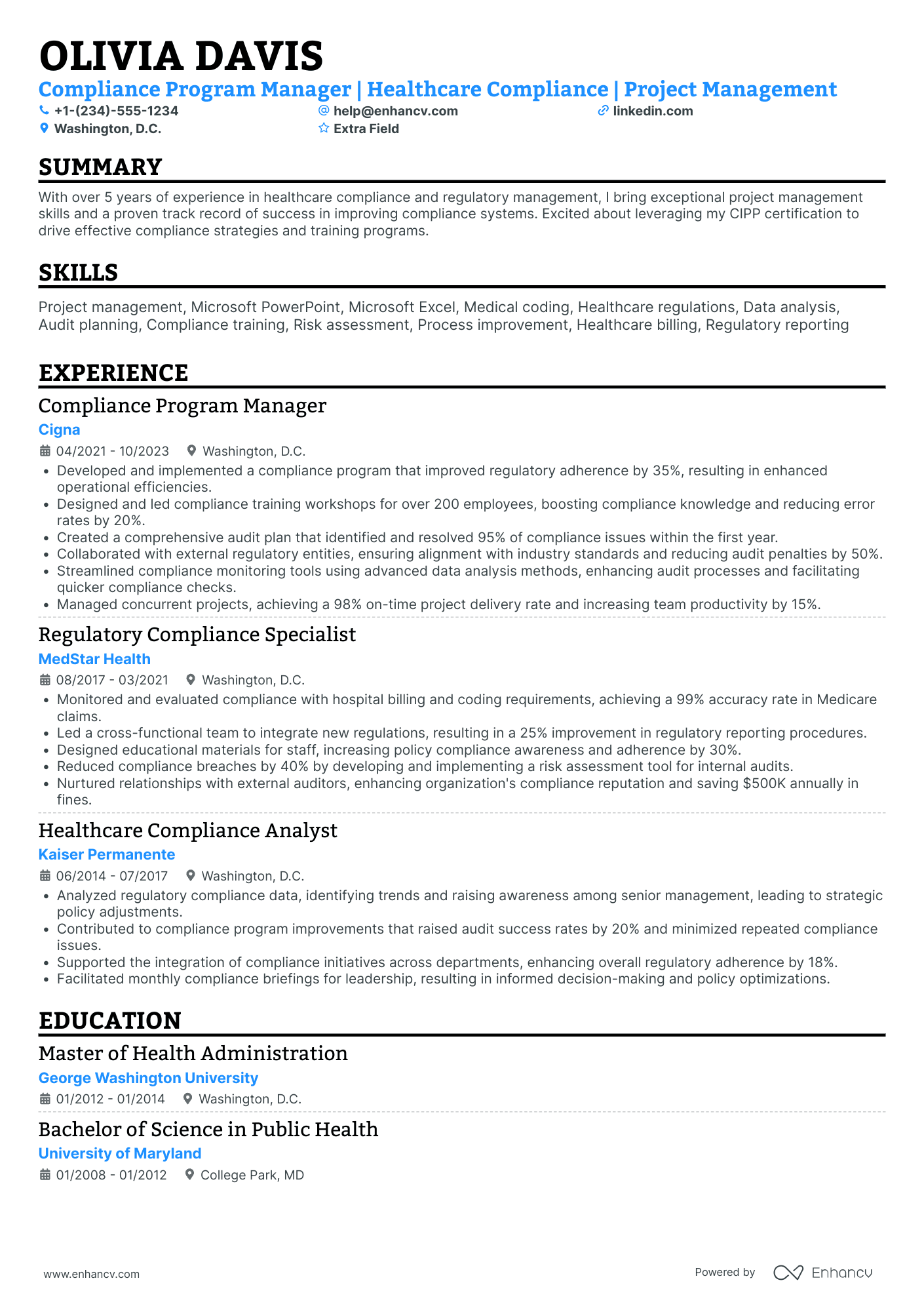

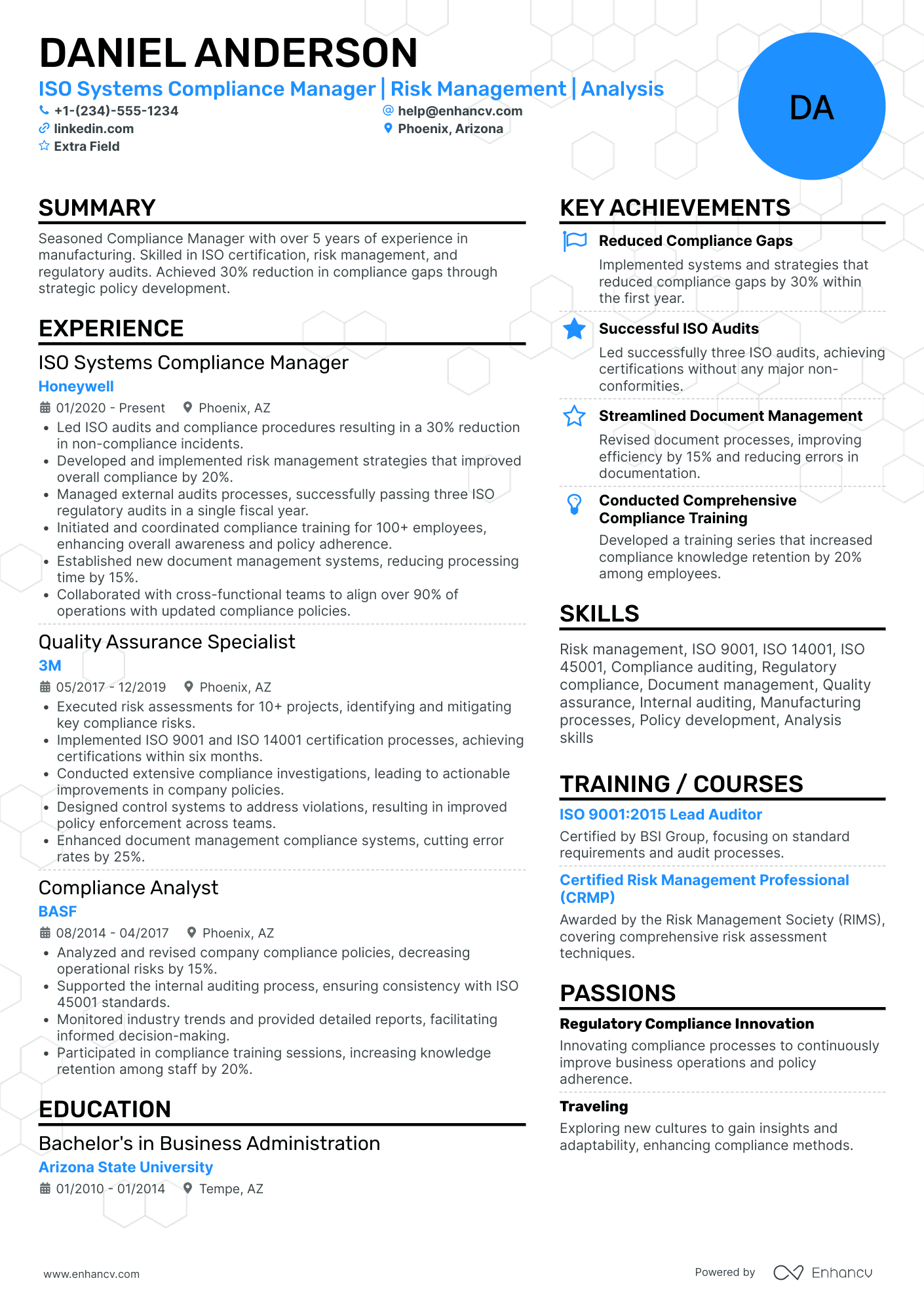

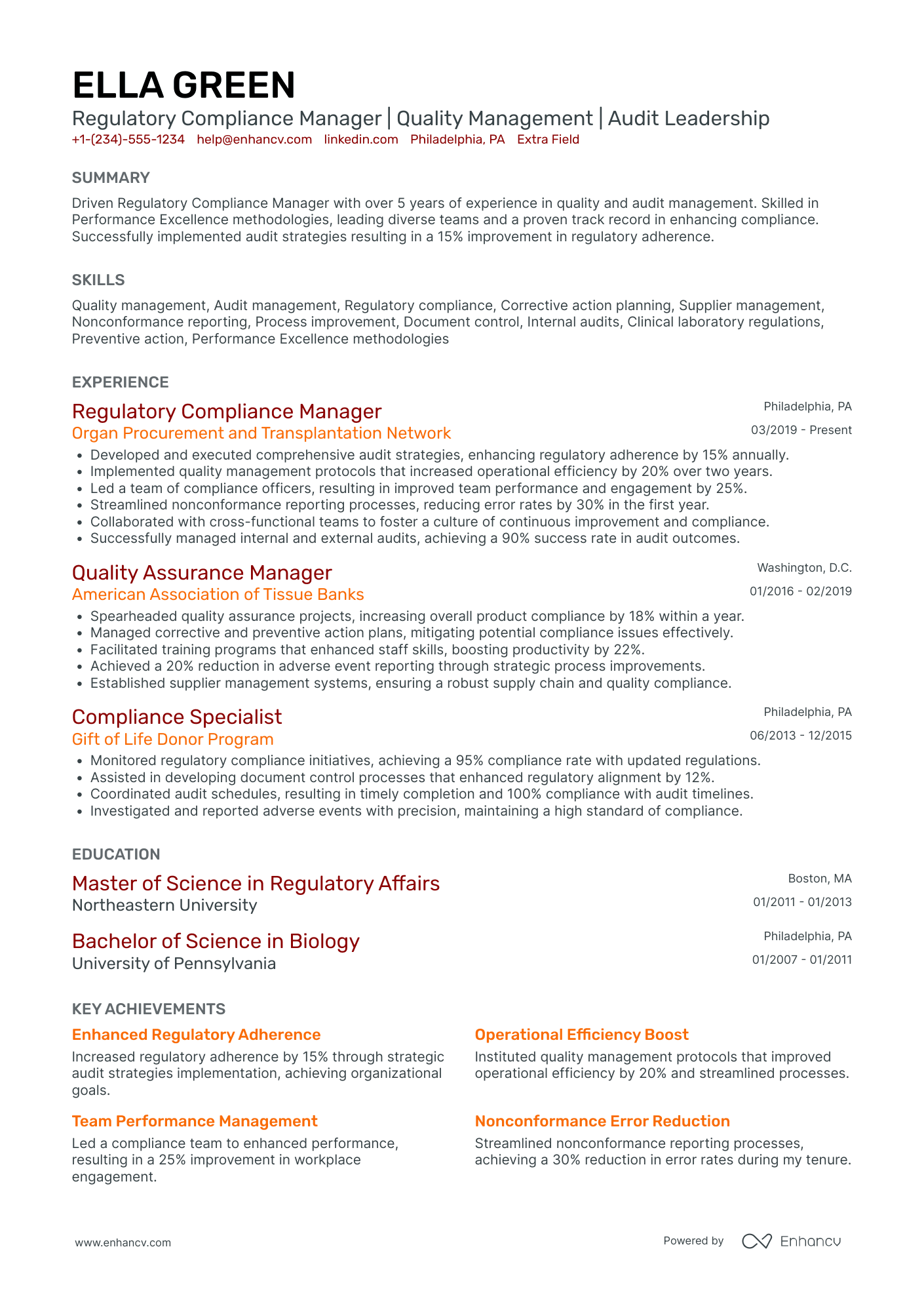

The below compliance manager resume examples can help guide you to curate your professional experience, following industry-leading tips and advice.

- Spearheaded the development and implementation of comprehensive compliance programs, resulting in a 30% reduction in legal violations across the organization.

- Collaborated with cross-functional teams to ensure adherence to state and federal regulations, enhancing compliance rates by 25% within the first year.

- Executed risk assessments and audits, leading to the identification and mitigation of 15 critical regulatory risks previously unrecognized.

- Designed and updated regulatory policies, keeping pace with evolving industry standards and avoiding any compliance incidents for the tenure.

- Trained over 200 employees on compliance protocols, enhancing the organization's risk management capacity and compliance knowledge base.

- Coordinated with legal teams to handle regulatory inquiries, effectively reducing potential legal costs by 20%.

- Established a company-wide ethics protocol, leading to a renowned industry award for best ethics practices in 2015.

- Managed internal investigations regarding ethical breaches, resulting in the resolution of 98% of cases without external mediation.

- Promoted a culture of integrity, contributing to a 40% improvement in employee-reported satisfaction relating to ethical workplace standards.

- Implemented risk management frameworks that reduced financial risk exposure by 35%, while aligning with strategic business objectives.

- Led quarterly compliance training sessions for staff, resulting in heightened awareness and understanding of risk protocols among 500+ employees.

- Liaised with regulatory bodies to ensure continuous compliance, mitigating the risk of penalties and fostering a transparent organizational culture.

- Directed the successful navigation of regulatory changes in the financial sector, integrating new requirements seamlessly into company practices.

- Oversaw the roll-out of a cloud-based compliance management system, improving process efficiency by 50% over a two-year period.

- Established robust monitoring systems that detected compliance drifts 60% faster than the industry average.

- Orchestrated a comprehensive global compliance strategy across 30 countries, harmonizing local regulations with global corporate standards.

- Championed the rollout of a new compliance software suite that enhanced data analysis capabilities, ultimately improving reporting accuracy by 45%.

- Facilitated a decrease in non-compliance incidents by 60% through the introduction of a proactive monitoring and training initiative that reached 10,000+ employees worldwide.

- Optimized compliance operational procedures, leading to a 25% increase in processing efficiency and reducing manual errors by 15%.

- Managed a team of 12 compliance officers, fostering a collaborative environment that exceeded departmental performance goals by 10 - 20% each quarter.

- Reviewed and rationalized compliance control frameworks, which clarified roles and responsibilities resulting in a 10% uplift in audit scores.

- Navigated a complex matrix of financial regulations, ensuring the company maintained a flawless record of compliance with SEC filings.

- Drove a 20% year-on-year increase in compliance reporting efficiency through the strategic deployment of advanced analytics tools.

- Initiated a company-wide fraud prevention program, successfully identifying and mitigating fraudulent activities totaling over $1.5 million in potential losses.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for compliance manager professionals.

Top Responsibilities for Compliance Manager:

- Report violations of compliance or regulatory standards to duly authorized enforcement agencies as appropriate or required.

- Identify compliance issues that require follow-up or investigation.

- Discuss emerging compliance issues to ensure that management and employees are informed about compliance reporting systems, policies, and practices.

- File appropriate compliance reports with regulatory agencies.

- Maintain documentation of compliance activities, such as complaints received or investigation outcomes.

- Consult with corporate attorneys as necessary to address difficult legal compliance issues.

- Conduct or direct the internal investigation of compliance issues.

- Provide employee training on compliance related topics, policies, or procedures.

- Serve as a confidential point of contact for employees to communicate with management, seek clarification on issues or dilemmas, or report irregularities.

- Verify that all regulatory policies and procedures have been documented, implemented, and communicated.

Quantifying impact on your resume

- Highlight the number of regulatory updates monitored and implemented to demonstrate ongoing compliance and adaptation to changing laws.

- Document the percentage reduction in non-compliance incidents as a result of improved processes or training programs you've introduced.

- Quantify the amount of money saved through effective risk management strategies and cost-efficient compliance solutions.

- Detail the number of compliance audits overseen and the rate of successful outcomes to showcase diligence and thoroughness.

- Specify the size of the teams you have managed and trained in compliance practices, reflecting leadership and management skills.

- Show the scale of compliance frameworks you have developed by noting the number of procedures and controls established.

- Express the volume of compliance documents reviewed or created, indicating expertise in documentation and attention to detail.

- Recount the number of successful negotiations with regulatory bodies or reduction in fines, demonstrating negotiation skills and effectiveness.

Action verbs for your compliance manager resume

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, compliance manager resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Balancing hard and soft skills in your compliance manager resume

Recruiters indeed pay close attention to the specific hard and soft skills candidates possess. Hard skills refer to technical abilities or your proficiency in technologies, while soft skills are the personal attributes and qualities developed over your lifetime.

If you're unsure about effectively quantifying these skills on your resume, follow our step-by-step guide. It's crucial to first understand the key job requirements for the role. Doing so enables you to accurately list your:

- Hard skills in sections like skills, education, and certifications. Your technical expertise is straightforward to quantify. Most organizations find it sufficient to mention the certificates you've earned, along with your proficiency level.

- Soft skills within your experience, achievements, strengths, etc. Defining interpersonal communication traits in your resume can be challenging. Focus on showcasing the accomplishments you've achieved through these skills.

Remember, when tailoring your compliance manager resume, ensure that the skills you list match exactly with those in the job requirements. For instance, if the job listing specifies "Microsoft Word," include this exact term rather than just "Word" or "MSO."

Top skills for your compliance manager resume:

Regulatory Compliance Software

Risk Management Tools

Data Analysis Tools

Document Management Systems

Audit Management Software

Compliance Monitoring Systems

Policy Management Software

Incident Management Systems

eLearning Platforms for Compliance Training

Microsoft Excel

Attention to Detail

Analytical Thinking

Communication Skills

Problem-Solving

Decision Making

Leadership

Interpersonal Skills

Time Management

Adaptability

Ethical Judgment

Next, you will find information on the top technologies for compliance manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Compliance Manager’s resume:

- Email software

- Microsoft Outlook

- Microsoft PowerPoint

- Actimize Brokerage Compliance Solutions

- Thomson Reuters Paisley Enterprise GRC

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Education section and most popular compliance manager certifications for your resume

Your resume education section is crucial. It can indicate a range of skills and experiences pertinent to the position.

- Mention only post-secondary qualifications, noting the institution and duration.

- If you're still studying, highlight your anticipated graduation date.

- Omit qualifications not pertinent to the role or sector.

- If it provides a chance to emphasize your accomplishments, describe your educational background, especially in a research-intensive setting.

Recruiters value compliance manager candidates who have invested their personal time into their professional growth. That's why you should include both your relevant education and certification . Not only will this help you stand out amongst candidates, but showcase your dedication to the field. On your compliance manager resume, ensure you've:

- Curated degrees and certificates that are relevant to the role

- Shown the institution you've obtained them from - for credibility

- Include the start and end dates (or if your education/certification is pending) to potentially fill in your experience gaps

- If applicable, include a couple of job advert keywords (skills or technologies) as part of the certification or degree description

If you decide to list miscellaneous certificates (that are irrelevant to the role), do so closer to the bottom of your resume. In that way, they'd come across as part of your personal interests, instead of experience. The team at Enhancv has created for you a list of the most popular compliance manager certificates - to help you update your resume quicker:

The top 5 certifications for your compliance manager resume:

- Certified Regulatory compliance manager (CRCM) - American Bankers Association (ABA)

- Certified Compliance & Ethics Professional (CCEP) - Compliance Certification Board (CCB)

- Certified Anti-Money Laundering Specialist (CAMS) - Association of Certified Anti-Money Laundering Specialists (ACAMS)

- Certified Information Privacy Professional (CIPP) - International Association of Privacy Professionals (IAPP)

- Certification in Risk Management Assurance (CRMA) - The Institute of Internal Auditors (IIA)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for compliance manager professionals.

Top US associations for a Compliance Manager professional

- American Bankers Association

- American Society for Quality

- Association for Certified Anti-Money Laundering Specialists

- Institute of Internal Auditors

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Recommended reads:

The ideal compliance manager candidate resume summary or objective

You may have heard that your resume top one-third plays an important part in your application.

It basically needs to show strong alignment with the job advert, your unique skill set, and your expertise.

Both the resume summary and resume objective could be used to ensure you've shown why you're the best candidate for the role.

Use the:

- Resume objective to pinpoint your current successes, that are applicable to the field, and your vision for your career. Remember to state how you see yourself growing within this new career opportunity.

- Resume summary as an instrument to pinpoint what is most applicable and noteworthy form your professional profile. Keep your summary to be no more than five sentences long.

At the end of the day, the resume summary or objective is your golden opportunity to shine a light on your personality as a professional and the unique value of what it's like to work with you.

Get inspired with these compliance manager resume examples:

Resume summaries for a compliance manager job

- Seasoned compliance manager with over 10 years of dedicated experience in the financial sector, adept at spearheading comprehensive compliance programs that mitigate risk and ensure company regulations align with federal laws. Proven track record of reducing non-compliance issues by 30% through stringent monitoring and training initiatives.

- Experienced Environmental Health and Safety Specialist transitioning into a compliance manager role brings 15 years of ensuring adherence to OSHA standards and promoting workplace safety. Holds a robust understanding of regulatory frameworks and is eager to apply expertise in developing and enforcing compliance policies within a dynamic regulatory environment.

- Former IT Project Manager now pursuing a career as a compliance manager, with over 8 years of experience managing complex projects, ensuring adherence to data protection standards, and effectively collaborating with cross-functional teams to meet strict deadlines. Brings a deep understanding of risk management strategies and a proven ability to implement robust compliance controls.

- Personable and proactive professional with 5+ years of experience in healthcare management, looking to leverage an in-depth understanding of HIPAA and patient privacy laws into the realm of compliance management. Key accomplishments include the successful redesign of compliance training materials that led to a 40% increase in staff compliance awareness.

- Eager to launch a career in Compliance Management, I hold a Master's degree in Business Administration with a focus on Corporate Ethics and Governance. While my practical experience is limited, my academic and internship experience, which includes a comprehensive project on regulatory compliance for a nonprofit, fuels my enthusiasm to contribute to a company that values integrity and accountability.

- Motivated graduate with a Law degree and honors in Regulatory Affairs, I am primed to embark on a career as a compliance manager. Though new to the field, my objective is to utilize my analytical skills, thorough understanding of regulatory compliance frameworks, and unwavering commitment to fostering ethical business practices in a challenging and dynamic environment.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for compliance manager professionals

Local salary info for Compliance Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $133,560 |

| California (CA) | $168,600 |

| Texas (TX) | $131,840 |

| Florida (FL) | $119,350 |

| New York (NY) | $154,170 |

| Pennsylvania (PA) | $130,840 |

| Illinois (IL) | $132,070 |

| Ohio (OH) | $125,280 |

| Georgia (GA) | $110,780 |

| North Carolina (NC) | $124,110 |

| Michigan (MI) | $125,490 |

What else can you add to your compliance manager resume

What most candidates don't realize is that their compliance manager resumes should be tailored both for the job and their own skillset and personality.

To achieve this balance between professional and personal traits, you can add various other sections across your resume.

Your potential employers may be impressed by your:

- Awards - spotlight any industry-specific achievements and recognitions that have paved your path to success;

- Languages - dedicate some space on your compliance manager resume to list your multilingual capabilities, alongside your proficiency level;

- Publications - with links and descriptions to both professional and academic ones, relevant to the role;

- Your prioritization framework - include a "My Time" pie chart, that shows how you spend your at-work and free time, would serve to further backup your organization skill set.

Key takeaways

- Impactful compliance manager resumes have an easy-to-read format that tells your career narrative with highlights;

- Select a resume summary or objective, depending on what sort of impression you'd like to leave and if your accomplishments are relevant to the job;

- If you don't happen to have much industry expertise, curate additional gigs you've had, like contracts and internships, to answer how your experience aligns with the compliance manager job;

- Be specific about the hard and soft skills you list on your resume to define your niche expertise and outcomes of using those particular skills;

- Always tailor your resume for each compliance manager application to ensure you meet all job requirements.

Compliance Manager resume examples

By Experience

Senior Compliance Manager

Junior Compliance Manager

By Role