Many credit manager resume drafts fail because they don't quantify risk decisions, exposure limits, or portfolio impact. That omission hurts when ATS screening and fast recruiter scans filter out candidates in a crowded market. Knowing how to make your resume stand out starts with showing measurable results, not just listing responsibilities.

A strong resume shows what you improved, not what you used. Highlight reduced days sales outstanding, lowered bad-debt write-offs, increased approval speed, managed larger credit limits, improved dispute resolution cycle time, strengthened collections recovery, and protected margin through tighter terms.

Key takeaways

- Quantify credit decisions with metrics like DSO reduction, bad-debt write-offs, and recovery rates.

- Use reverse-chronological format for senior roles to show leadership progression clearly.

- Tailor every experience bullet to mirror the job posting's terminology and priorities.

- Demonstrate skills through measurable outcomes in your summary and experience sections.

- List certifications like CCE or CBA near education to signal specialized credibility.

- Use AI to tighten language and align keywords, but stop before it inflates claims.

- Build your resume faster with Enhancv to keep structure, metrics, and formatting consistent.

Job market snapshot for credit managers

We analyzed 75 recent credit manager job ads across major US job boards. These numbers help you understand employment type trends, experience requirements, regional hotspots at a glance.

What level of experience employers are looking for credit managers

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 5.3% (4) |

| 3–4 years | 8.0% (6) |

| 5–6 years | 17.3% (13) |

| 7–8 years | 6.7% (5) |

| 9–10 years | 1.3% (1) |

| 10+ years | 9.3% (7) |

| Not specified | 53.3% (40) |

Credit manager ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 93.3% (70) |

Role overview stats

These tables show the most common responsibilities and employment types for credit manager roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a credit manager

| Responsibility | Percentage found in job ads |

|---|---|

| Excel | 30.7% (23) |

| Credit management | 29.3% (22) |

| Microsoft office | 26.7% (20) |

| Accounting | 17.3% (13) |

| Accounts receivable | 17.3% (13) |

| Financial analysis | 16.0% (12) |

| Ms office | 12.0% (9) |

| Reporting | 12.0% (9) |

| Loan origination system | 10.7% (8) |

| Quality control | 10.7% (8) |

| Accounting software | 9.3% (7) |

| Communication skills | 9.3% (7) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 81.3% (61) |

| Hybrid | 17.3% (13) |

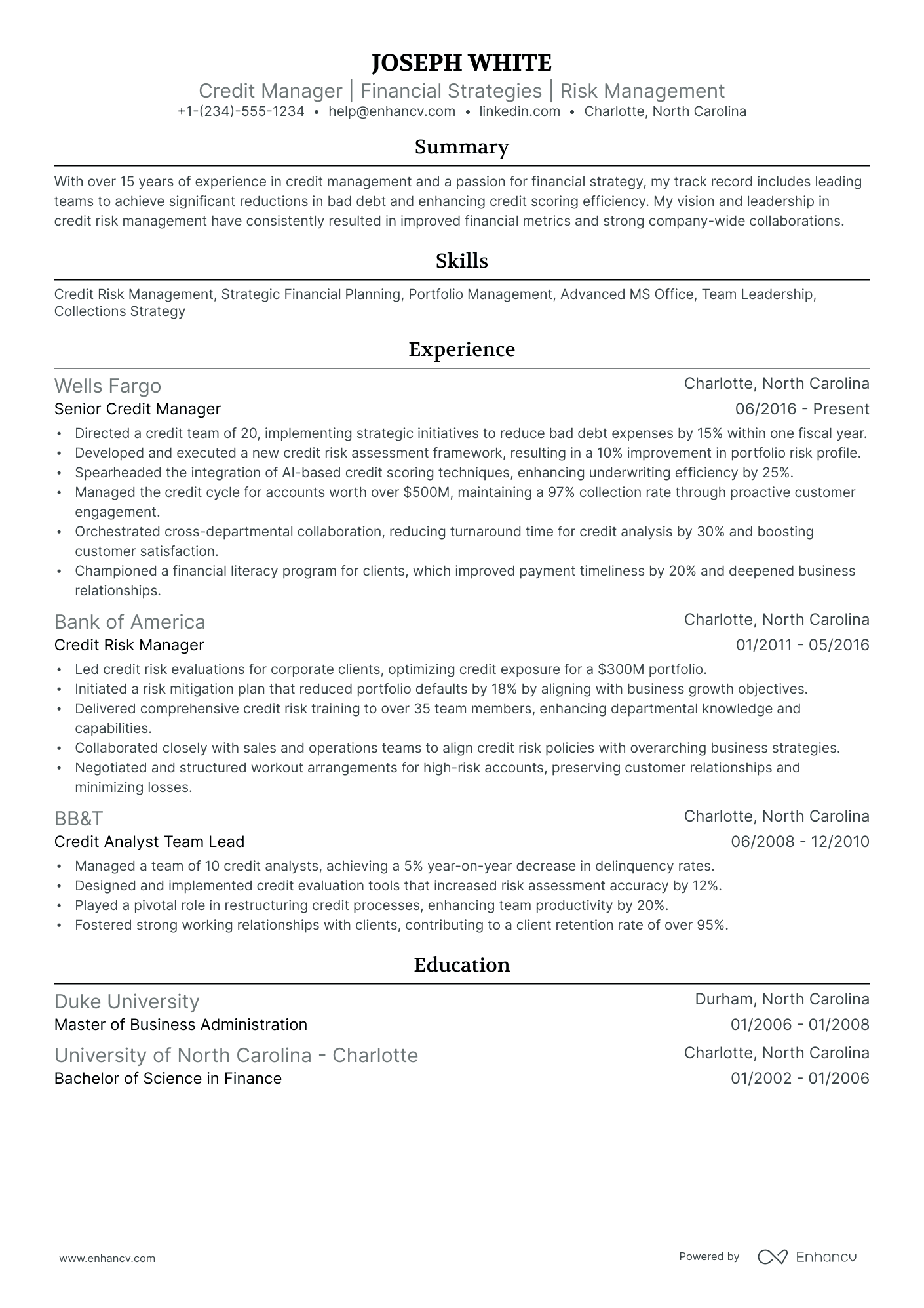

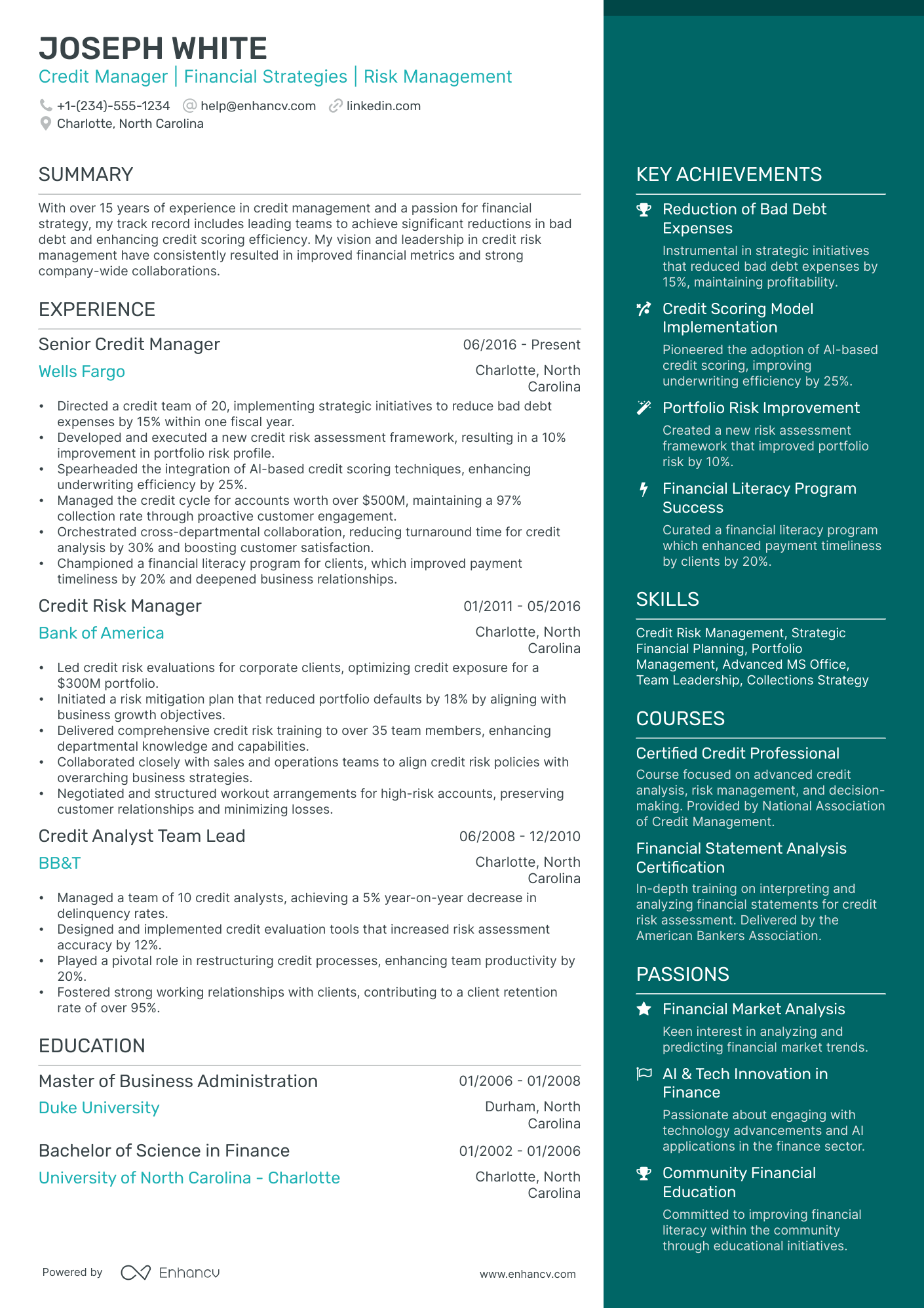

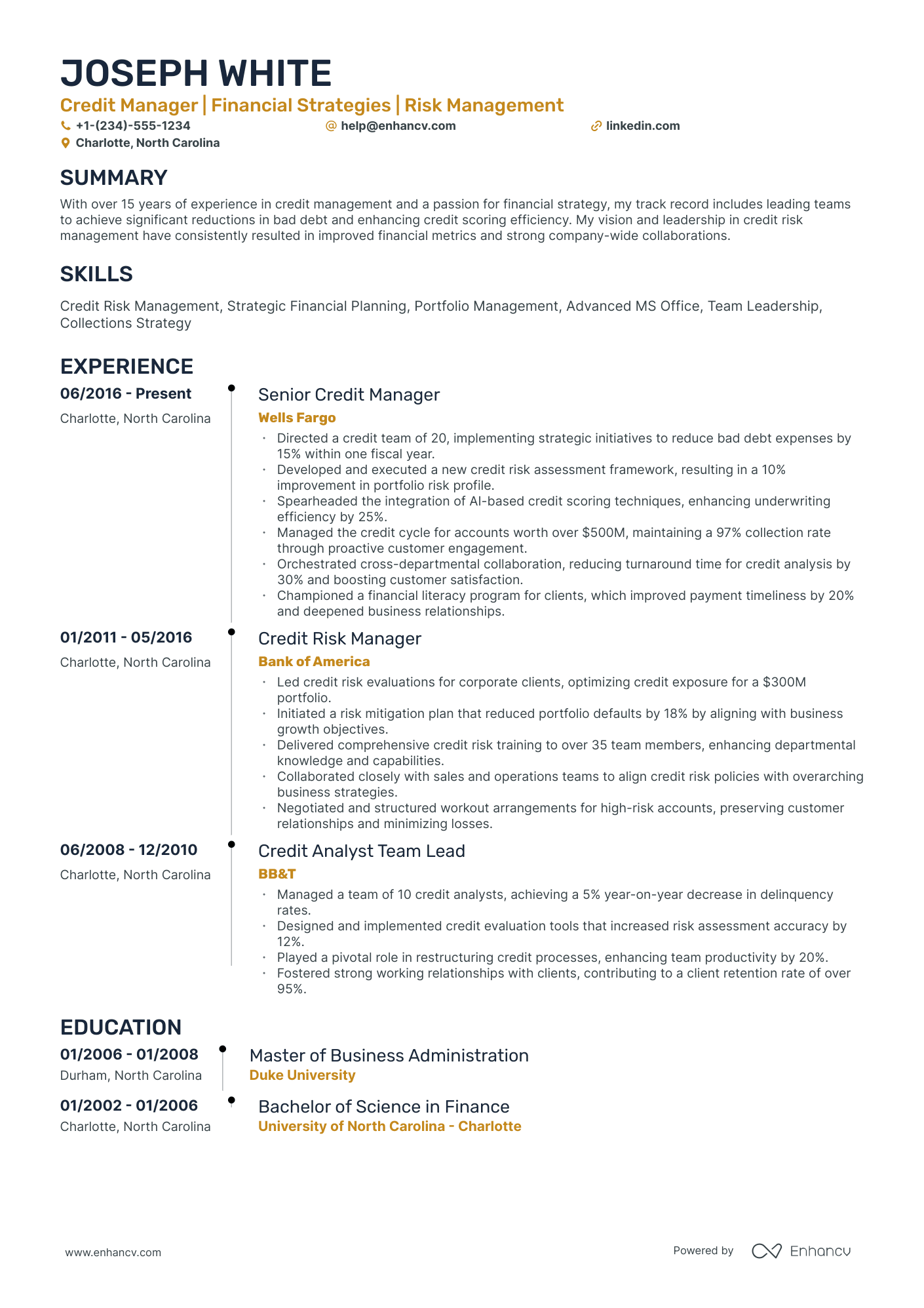

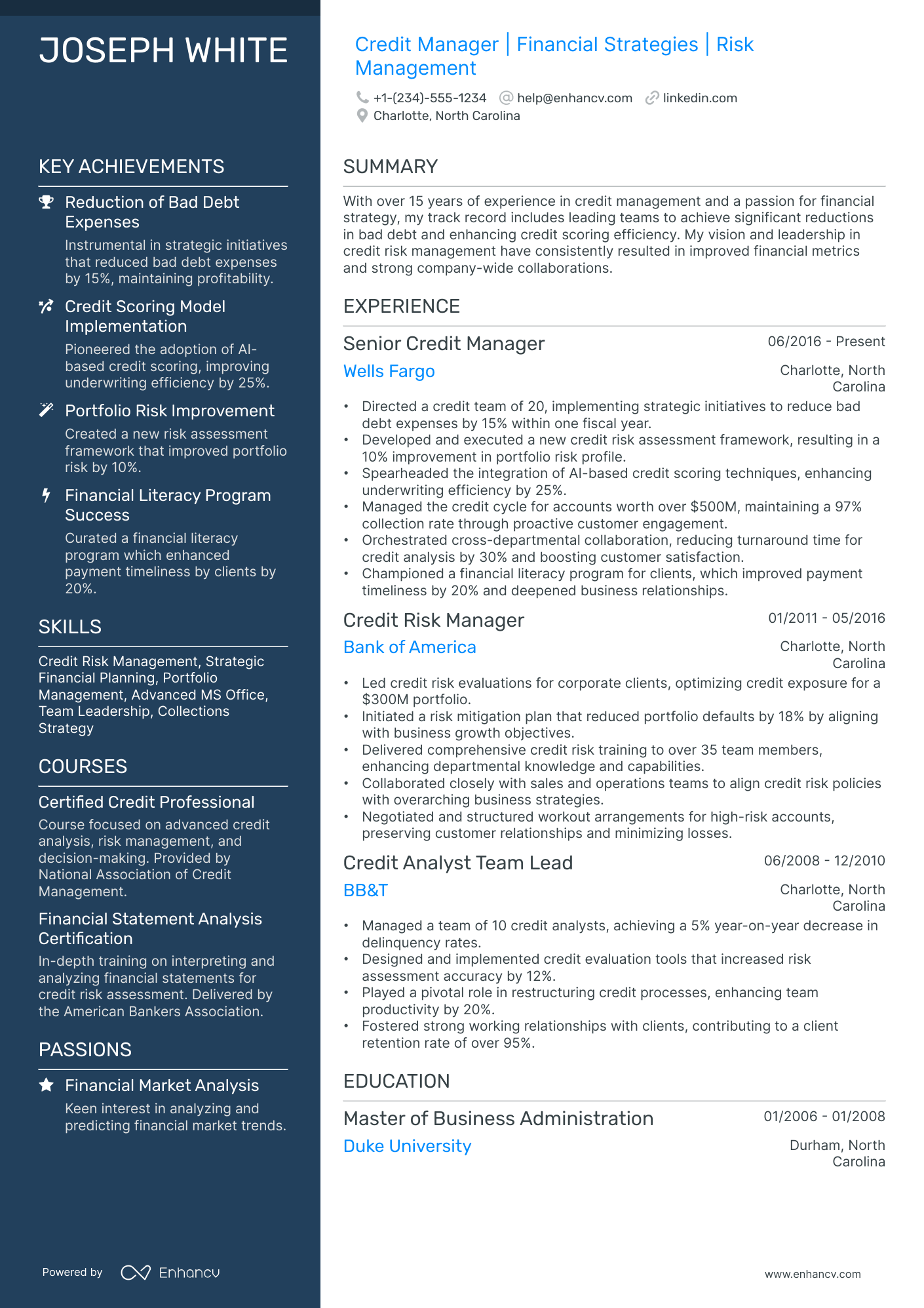

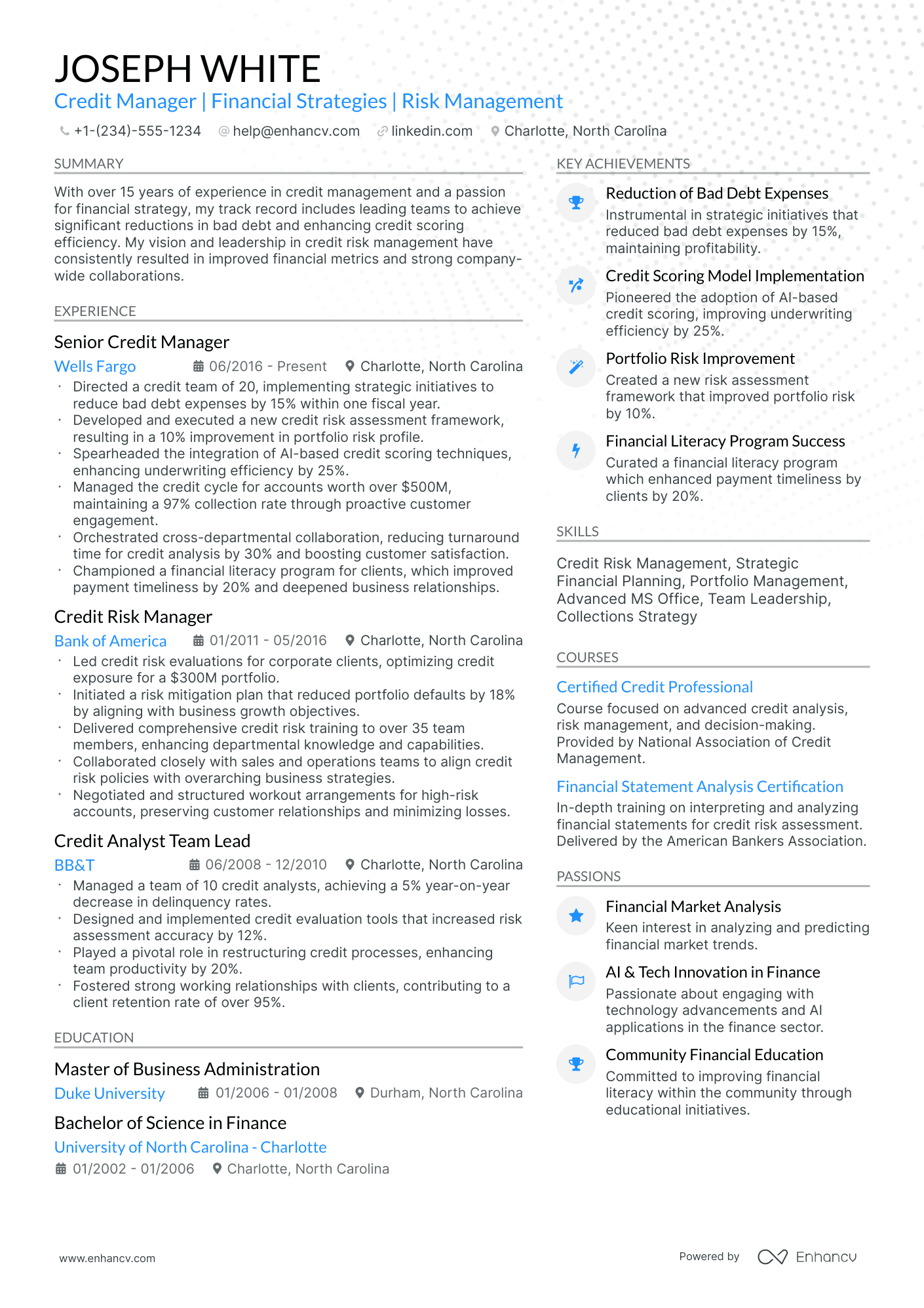

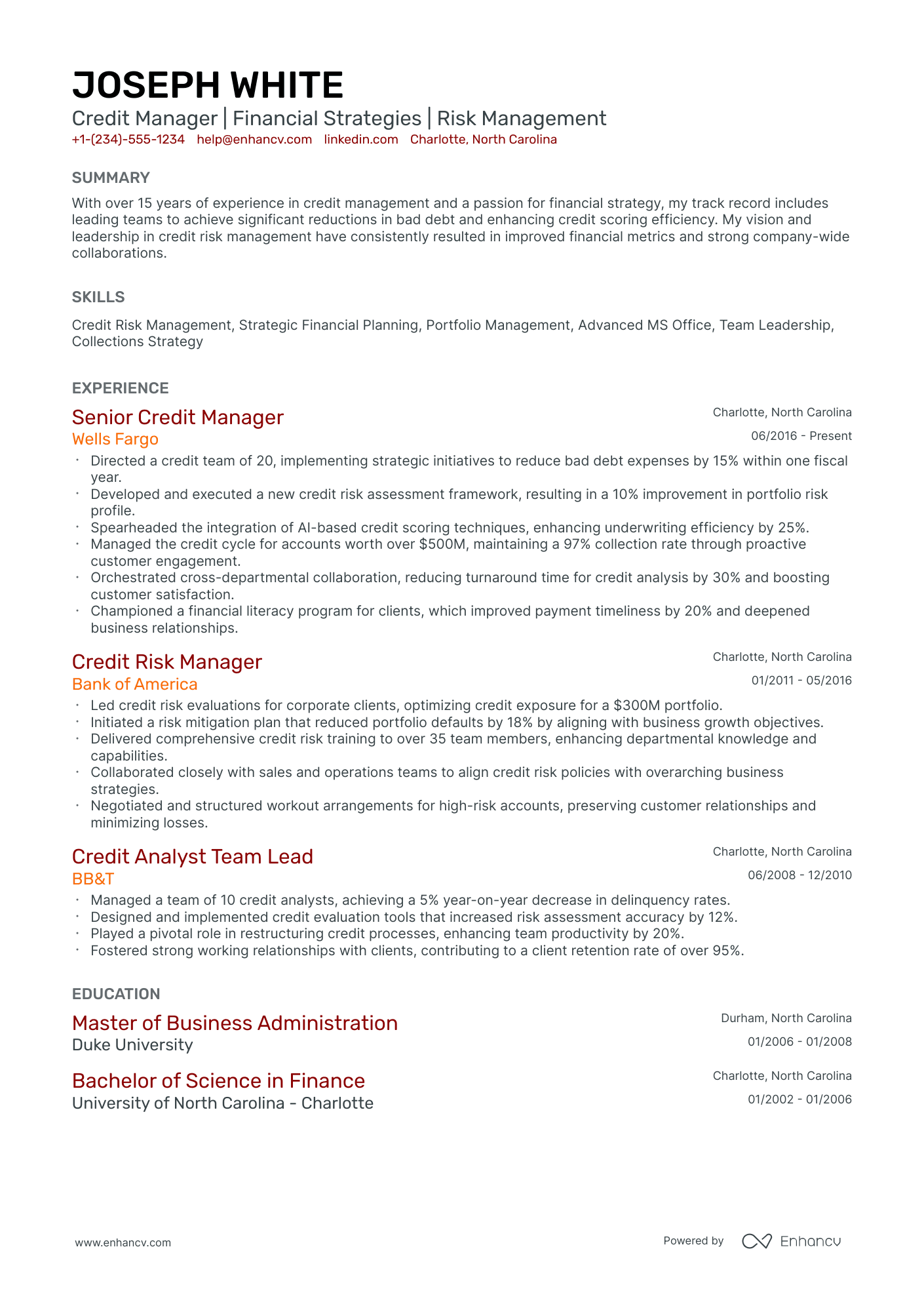

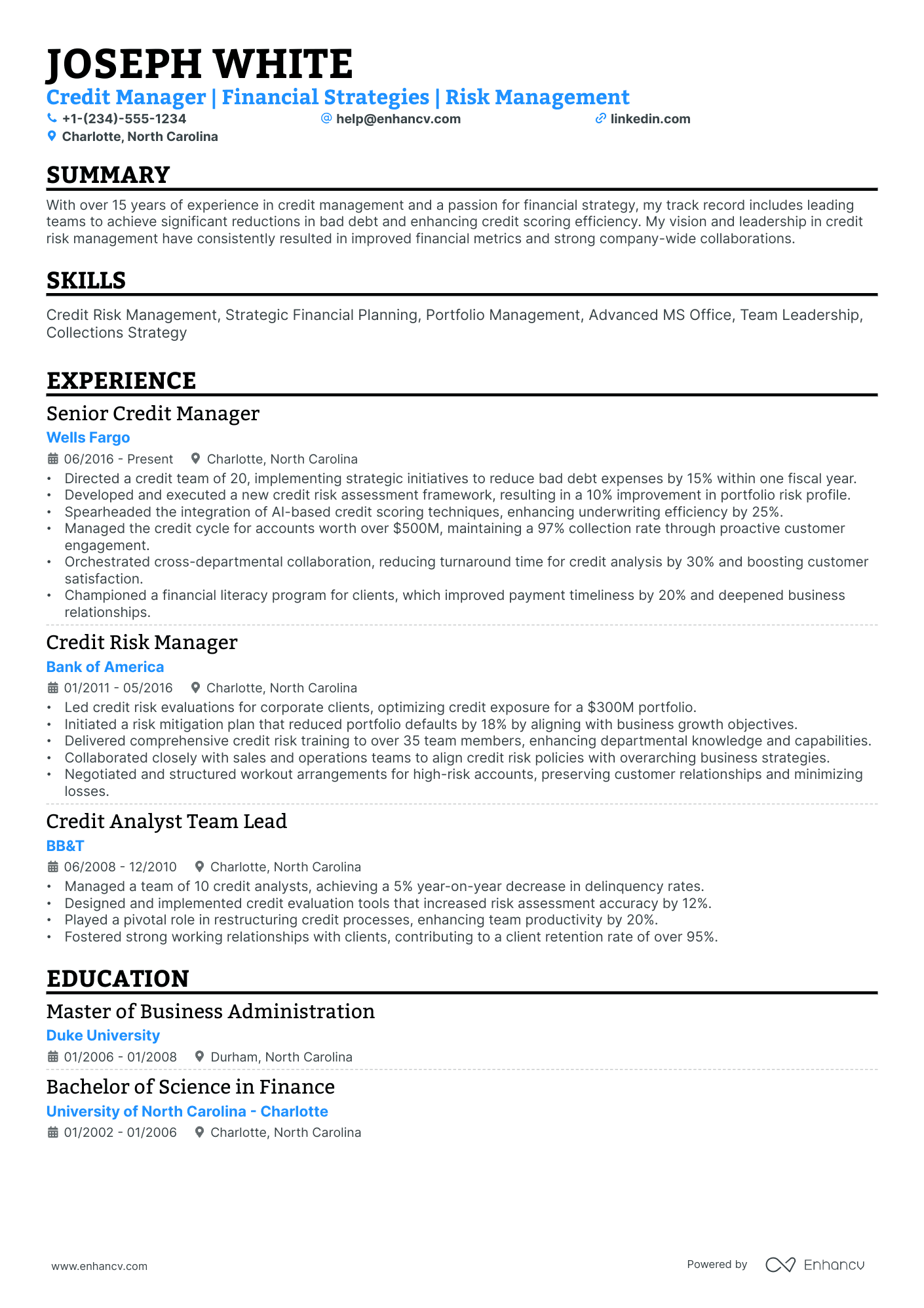

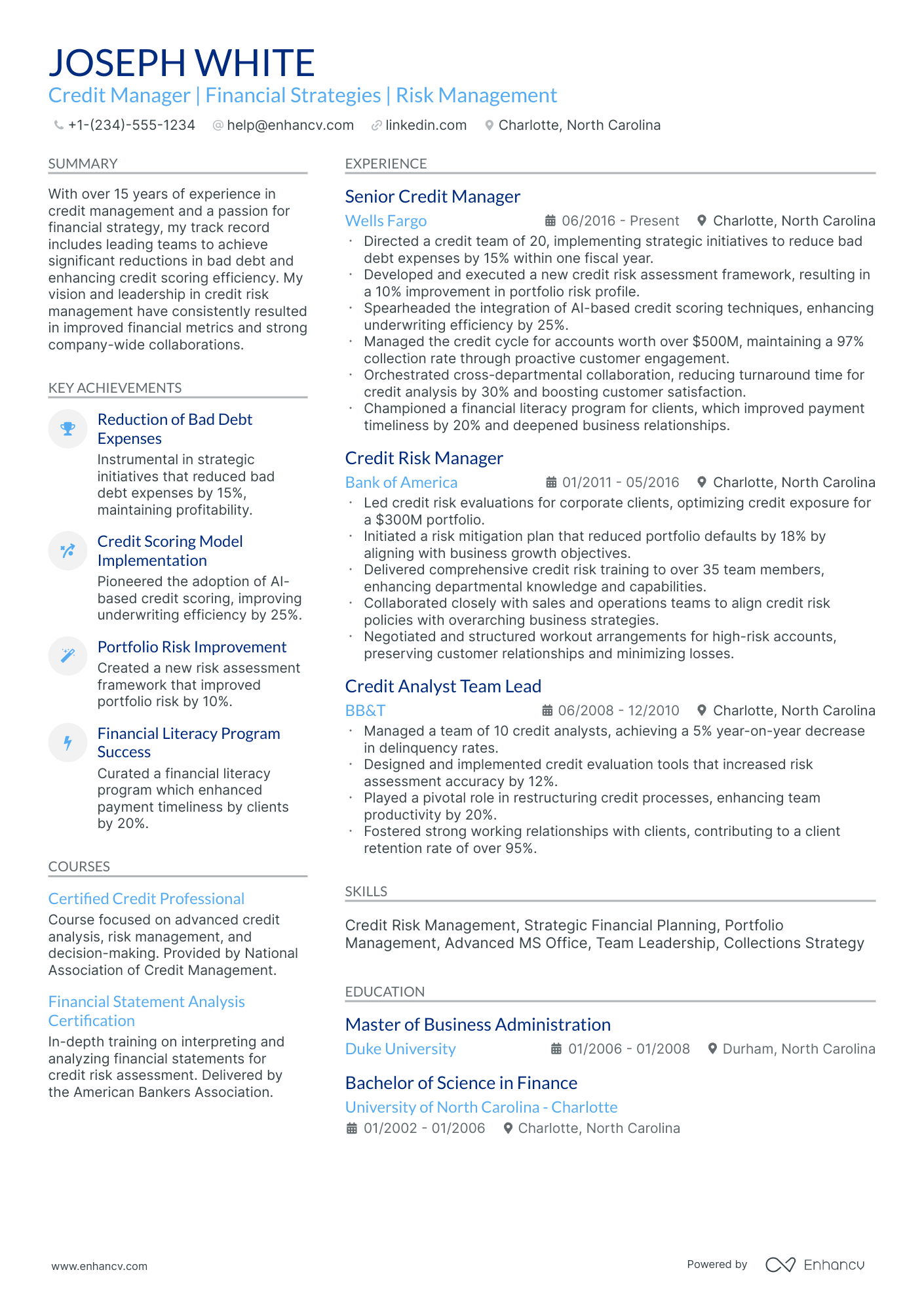

How to format a credit manager resume

Recruiters evaluating credit manager resumes prioritize risk assessment expertise, portfolio performance metrics, and a clear history of managing credit policies across growing teams or business units. A reverse-chronological format ensures these signals—especially leadership progression and decision-making scope—are immediately visible to both hiring managers and applicant tracking systems. Choosing the right resume format is critical to passing both automated screening and manual review.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your career progression and expanding scope of credit oversight. Do:

- Lead with your most senior role first, emphasizing the size of the credit portfolio, team headcount, and organizational scope you managed.

- Highlight domain-specific expertise such as credit risk modeling, collections strategy, ERP platforms (SAP, Oracle), and regulatory compliance frameworks.

- Quantify business impact through metrics like reduced delinquency rates, improved DSO, portfolio loss reduction, or credit policy outcomes.

- "Redesigned enterprise credit approval workflow for a $220M portfolio, reducing average DSO by 14 days and cutting write-offs by 32% within 18 months."

I'm junior or switching into this role—what format works best?

A hybrid format works best, allowing you to lead with relevant credit analysis and financial skills while still showing your work history in chronological order. Do:

- Place a dedicated skills section near the top featuring credit analysis, accounts receivable management, financial reporting tools, and relevant certifications like CBA or NACM credentials.

- Include project-based experience such as credit audits, collections process improvements, or risk assessment initiatives—even from adjacent roles.

- Connect every action to a measurable outcome so recruiters can see your direct contribution to financial results.

- Credit risk analysis → conducted quarterly portfolio reviews for 300+ commercial accounts → identified $1.4M in at-risk receivables, enabling proactive collections that recovered 89% before default.

Why hybrid and functional resumes don't work for senior roles

Hybrid and functional formats fragment your career timeline, obscuring the leadership progression and expanding decision-making authority that hiring managers need to verify for senior credit manager positions. These formats also dilute accountability context—making it unclear which results you owned versus inherited—and reduce the visible link between your strategic decisions and portfolio-level outcomes. Avoid hybrid and functional formats entirely if you have five or more years of progressive credit management experience, as they'll raise more questions than they answer.

- A functional format may be acceptable only if you're transitioning into credit management from a closely related field (such as commercial lending or financial risk consulting), have a significant employment gap, or lack continuous tenure—but even then, every listed skill must be tied to specific projects, portfolios, or measurable outcomes.

Once you've established a clean, readable format, the next step is deciding which sections to include and how to organize them for maximum impact.

What sections should go on a credit manager resume

Recruiters expect to see clear evidence that you can manage credit risk, drive collections performance, and protect cash flow. Understanding which resume sections to include ensures your document covers every qualification hiring teams look for. Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize measurable impact, portfolio scope, policy improvements, and results in risk reduction, delinquency control, and cash collections.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components in place, the next step is to write your credit manager experience section so it aligns with that structure and supports your qualifications.

How to write your credit manager resume experience

The experience section is where you prove you've managed credit risk, implemented lending policies, and delivered measurable improvements to portfolio performance. Hiring managers prioritize demonstrated impact—reduced delinquency rates, tightened credit controls, improved collections outcomes—over descriptive task lists that simply restate a job description. Building a targeted resume that reflects the specific role's priorities is essential to making your experience section resonate.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the credit portfolios, lending products, risk models, policy frameworks, or teams you were directly accountable for as a credit manager.

- Execution approach: the credit scoring tools, risk assessment frameworks, financial analysis methods, or enterprise platforms you used to evaluate borrower risk and make lending decisions.

- Value improved: changes to default rates, portfolio quality, underwriting accuracy, collections efficiency, or regulatory compliance that resulted from your credit management decisions.

- Collaboration context: how you worked with sales teams, underwriting staff, legal departments, senior leadership, or external auditors to align credit policies with broader business objectives.

- Impact delivered: outcomes expressed through portfolio growth, loss reduction, process optimization, or risk mitigation rather than routine credit review activities.

Experience bullet formula

A credit manager experience example

✅ Right example - modern, quantified, specific.

Credit Manager

Redwood Industrial Supply | Columbus, OH

2021–Present

Regional distributor serving 2,000+ B2B accounts across manufacturing, construction, and MRO with $180M annual revenue.

- Overhauled credit policy and scoring model using Experian Business data, Dun & Bradstreet reports, and ERP payment history; reduced bad debt write-offs by 22% year over year while supporting 14% sales growth.

- Implemented automated credit holds, limit reviews, and dunning workflows in SAP S/4HANA and HighRadius; cut past-due over 60 days by 18% and reduced manual follow-ups by eight hours per week per analyst.

- Negotiated revised payment terms and security instruments (personal guarantees, UCC filings, and letters of credit) with Sales and Legal; decreased high-risk exposure by $3.6M without increasing order cancellations.

- Built weekly accounts receivable and risk dashboards in Power BI from SAP and Salesforce; improved forecast accuracy for collections by 12% and enabled faster escalation decisions with sales leaders.

- Led a cross-functional dispute reduction program with Customer Service and Logistics using root-cause analysis and ticket tracking in Jira; lowered invoice disputes by 27% and improved days sales outstanding by five days.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match a specific credit manager job posting.

How to tailor your credit manager resume experience

Recruiters evaluate your credit manager resume through both applicant tracking systems and manual review. Tailoring your resume to the job description ensures your qualifications register with both.

Ways to tailor your credit manager experience:

- Match credit analysis software and ERP systems listed in the posting.

- Mirror the exact terminology used for credit risk assessment processes.

- Reflect specific portfolio size or accounts receivable scope mentioned.

- Include industry experience such as manufacturing or financial services when relevant.

- Emphasize regulatory compliance frameworks referenced in the job description.

- Align your KPIs with the performance metrics the employer prioritizes.

- Highlight cross-functional collaboration with sales or finance teams if specified.

- Use the same language for collections strategies or credit policies described.

Tailoring means aligning your real accomplishments with what the employer values, not forcing keywords where they don't belong.

Resume tailoring examples for credit manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Manage a portfolio of commercial accounts totaling $50M+, conduct credit analyses using D&B and Moody's RiskCalc, and establish appropriate credit limits based on financial statement review. | Responsible for reviewing accounts and setting credit limits for customers. | Managed a $55M commercial credit portfolio, leveraging D&B reports and Moody's RiskCalc to conduct credit analyses and set risk-based credit limits grounded in quarterly financial statement reviews. |

| Lead a team of four credit analysts, develop and enforce credit policies aligned with SOX compliance, and reduce DSO by improving collections workflows in SAP. | Supervised team members and helped improve department processes. | Led a team of four credit analysts while developing SOX-compliant credit policies and streamlining collections workflows in SAP, reducing DSO from 48 to 39 days within 12 months. |

| Partner with sales and finance to evaluate new customer creditworthiness, mitigate bad debt exposure across international markets, and maintain delinquency rates below 2% using Highradius automation tools. | Worked cross-functionally to support business goals and reduce risk. | Partnered with sales and finance to assess new customer creditworthiness across 12 international markets, using Highradius automation tools to hold delinquency rates at 1.7% and cut bad debt exposure by 22% year over year. |

Once you’ve aligned your experience with the role’s priorities, quantify your credit manager achievements to show the measurable impact of that work.

How to quantify your credit manager achievements

Quantifying your achievements shows how your credit decisions protected cash flow and reduced risk. Focus on days sales outstanding, delinquency, bad debt, credit limit accuracy, dispute cycle time, collections recovery, and compliance outcomes.

Quantifying examples for credit manager

| Metric | Example |

|---|---|

| Risk reduction | "Cut 90+ day delinquency from 4.8% to 2.9% in nine months by tightening scorecard thresholds and refreshing credit limits in SAP." |

| Cash flow | "Reduced days sales outstanding from 52 to 44 days by revising payment terms, enforcing hold releases, and partnering with sales on escalations." |

| Collections recovery | "Recovered $1.2M in past-due balances in one quarter using weekly aging reviews, dispute triage, and targeted payment plans for top twenty accounts." |

| Process efficiency | "Shortened credit application turnaround time from three days to one business day by standardizing documentation and automating checks in Salesforce." |

| Compliance accuracy | "Improved lien and UCC filing accuracy to 99.5% across 300 accounts by adding a two-step review and monthly audit checklist." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong bullet points in place, the next step is making sure your skills section highlights the right mix of hard and soft skills for a credit manager role.

How to list your hard and soft skills on a credit manager resume

Your skills section matters because credit managers balance risk, collections, and customer relationships; recruiters and ATS scan this section for role-matched keywords and capability signals, so aim for a mix weighted toward hard skills with targeted soft skills. credit manager roles require a blend of:

- Credit policy strategy and risk assessment skills.

- Data analysis, reporting, and portfolio monitoring skills.

- Collections execution, process control, and cross-functional coordination discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Credit risk assessment

- Credit policy development

- Financial statement analysis

- Credit scoring models

- Accounts receivable management

- Collections strategy

- Order-to-cash controls

- Aging, DSO, and CEI reporting

- Portfolio monitoring and segmentation

- ERP systems: SAP, Oracle, NetSuite

- Credit bureau data: Experian, Equifax, TransUnion

- Excel modeling, Power BI dashboards

Soft skills

- Make risk-based credit decisions

- Negotiate payment terms and plans

- Escalate issues with clear options

- Partner with sales on deal structure

- Influence stakeholders without authority

- Lead difficult customer conversations

- Document decisions and rationale

- Prioritize high-risk accounts quickly

- Hold teams accountable to policies

- Communicate trade-offs to leadership

- Resolve disputes with diplomacy

- Stay calm under delinquency pressure

How to show your credit manager skills in context

Skills shouldn't live only in a bulleted list on your resume. Explore resume skills examples to see how top candidates weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what both look like in practice.

Summary example

Senior credit manager with 12 years in wholesale distribution. Skilled in credit risk modeling, SAP FSCM, and cross-functional negotiation. Reduced portfolio write-offs by 34% while maintaining approval rates that supported $180M in annual revenue growth.

- Reflects senior-level experience clearly

- Names industry-specific tools and methods

- Leads with a measurable financial outcome

- Highlights negotiation as a soft skill

Experience example

Senior Credit Manager

Bowman & Kendall Distribution | Charlotte, NC

March 2018–Present

- Redesigned credit scoring criteria using SAP FSCM, cutting average approval turnaround from five days to two and reducing defaults by 22%.

- Partnered with sales and finance teams to build tiered credit limits, supporting a 15% increase in new account acquisitions year over year.

- Led quarterly portfolio reviews using Dun & Bradstreet analytics, identifying $2.4M in at-risk receivables and recovering 89% through early intervention strategies.

- Every bullet includes measurable proof.

- Skills appear naturally within real outcomes.

Once you’ve demonstrated your credit management strengths through specific outcomes and responsibilities, the next step is learning how to structure a credit manager resume with no experience so those same strengths still come through clearly.

How do I write a credit manager resume with no experience

Even without full-time experience, you can demonstrate readiness through: Our guide on writing a resume without work experience covers additional strategies for making a strong impression.

- Accounts receivable internships or rotations

- Credit analysis course projects

- Collections and dispute resolution work

- ERP invoice and aging reports

- Credit policy and SOP drafts

- Customer credit application reviews

- Financial statement ratio analysis

- DSO and delinquency dashboards

Focus on:

- Credit decisions backed by data

- Clear limits, terms, and controls

- Clean aging, DSO, and risk

- Tools: Excel, ERP, reporting

Resume format tip for entry-level credit manager

Use a combination resume format. It highlights relevant projects and skills first, while still showing work history, even if it is limited. Do:

- Lead with a skills summary tied to metrics.

- Add two to four project bullets under education.

- List tools: Excel, ERP, Power Query.

- Quantify results: DSO, aging, write-offs.

- Mirror credit manager keywords from postings.

- Built an Excel aging and DSO dashboard from ERP exports, flagged thirty past-due accounts, and reduced simulated delinquency by eighteen percent in a course project.

Even without direct experience, your education section can demonstrate the financial knowledge and analytical foundation that qualifies you for a credit manager role.

How to list your education on a credit manager resume

Your education section helps hiring teams confirm you have the foundational knowledge in finance, accounting, or business needed to succeed as a credit manager.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a credit manager resume.

Example education entry

Bachelor of Science in Finance

University of Illinois at Urbana-Champaign, Champaign, IL

Graduated 2019

GPA: 3.7/4.0

- Relevant Coursework: Credit Risk Analysis, Corporate Finance, Financial Statement Analysis, Managerial Accounting

- Honors: Dean's List, Magna Cum Laude

How to list your certifications on a credit manager resume

Certifications show a credit manager's commitment to learning, proficiency with financial tools, and relevance in a regulated industry. They also signal credibility when you handle risk, collections, and customer credit decisions. Learn more about how to list certifications on your resume to maximize their impact.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Put certifications below education when your degree is recent and the certifications are older or less relevant to credit manager work.

- Put certifications above education when they are recent, role-relevant, or required for the credit manager job you want.

Best certifications for your credit manager resume

Certified Credit Executive (CCE) Credit Business Associate (CBA) Credit Business Fellow (CBF) Certified Accounts Receivable Professional (CARP) Certified Treasury Professional (CTP) Certified Fraud Examiner (CFE) Certified Internal Auditor (CIA)

Once you’ve positioned your credentials where hiring teams can quickly verify them, use your credit manager resume summary to connect those qualifications to the value you deliver.

How to write your credit manager resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly positions you as a qualified credit manager worth interviewing.

Keep it to three to four lines, with:

- Your title and total years of credit management experience.

- The industry or domain you've worked in, such as commercial lending or trade credit.

- Core skills like credit analysis, risk assessment, or financial modeling.

- One or two quantified achievements, such as reduced delinquency rates or portfolio size managed.

- Soft skills tied to real outcomes, like cross-functional collaboration that improved approval turnaround.

PRO TIP

At the mid-level credit manager stage, emphasize hands-on portfolio management, process improvements, and measurable risk reduction. Highlight team coordination and decision-making authority over credit limits. Avoid vague phrases like "passionate professional" or "results-driven individual." Recruiters want specifics, not motivation.

Example summary for a credit manager

Credit manager with six years in commercial lending, skilled in risk assessment and SAP credit module management. Reduced portfolio delinquency by 18% while overseeing $45M in receivables across 200+ accounts.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Once your summary clearly conveys your value, make sure the header framing it presents your contact details correctly so recruiters can actually reach you.

What to include in a credit manager resume header

A resume header is the top section with your key contact details, and it boosts visibility, credibility, and recruiter screening for a credit manager role.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Do not include a photo on a credit manager resume unless the role is explicitly front-facing or appearance-dependent.

Match your header job title to the posting and align your headline with credit policy, collections, and risk control responsibilities.

Example

Credit manager resume header

Jordan Lee

Credit Manager | Commercial Collections, Credit Policy, and Risk Control

Chicago, IL

(312) 555-78XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

With your contact details and role identifiers set at the top, you can strengthen the rest of the document by adding additional sections that support your credit management qualifications.

Additional sections for credit manager resumes

When your core qualifications match other applicants, well-chosen additional sections can set your credit manager resume apart with proof of deeper expertise. For example, listing language skills on your resume can demonstrate your ability to manage credit relationships across international markets.

- Languages

- Certifications and licenses

- Professional affiliations

- Publications

- Awards and honors

- Volunteer experience

- Continuing education

Once you've rounded out your resume with the right supplementary sections, it's worth pairing it with a strong cover letter to make an even greater impact.

Do credit manager resumes need a cover letter

A cover letter isn't required for a credit manager, but it helps when the role is competitive or the employer expects one. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can clarify its value. It can make the difference when your resume doesn't clearly show fit, scope, or context.

Use a cover letter to add context your resume can't:

- Explain role and team fit by matching your experience to the credit manager's priorities, such as risk controls, collections strategy, or stakeholder management.

- Highlight one or two outcomes, such as reducing days sales outstanding, improving bad debt, or tightening credit policy without hurting sales.

- Show you understand the product, users, and business context, including customer segments, payment terms, and how credit decisions affect revenue.

- Address career transitions or non-obvious experience by connecting past roles to credit manager work, such as underwriting, accounts receivable, or customer operations.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Once you’ve decided whether a cover letter adds value for the role, the next step is using AI to improve your credit manager resume so it aligns more closely with the job requirements.

Using AI to improve your credit manager resume

AI can sharpen your resume's clarity, structure, and overall impact. It helps tighten language and highlight measurable results. But overuse strips authenticity. Once your content feels clear and role-aligned, step away from AI. If you're wondering which AI is best for writing resumes, the answer depends on the level of control and customization you need.

Here are 10 practical prompts to strengthen specific sections of your credit manager resume:

- Strengthen your summary. "Rewrite my credit manager resume summary to emphasize leadership in credit risk assessment and collections strategy in under four sentences."

- Quantify your achievements. "Add measurable results to these credit manager experience bullets using metrics like DSO reduction, recovery rates, or portfolio size."

- Tighten bullet points. "Shorten each credit manager experience bullet to one concise line that leads with a strong action verb."

- Align with job postings. "Compare my credit manager resume experience section to this job description and suggest missing keywords or responsibilities."

- Refine your skills. "Reorganize my credit manager skills section into hard skills and soft skills, removing anything generic or outdated."

- Improve project descriptions. "Rewrite this credit manager project description to highlight scope, tools used, and business outcomes clearly."

- Clarify certifications. "Format my credit manager certifications section consistently, listing credential name, issuing body, and year earned."

- Upgrade education details. "Revise my credit manager education section to feature relevant coursework, honors, or finance-related specializations."

- Remove filler language. "Identify and remove vague or redundant phrases across my entire credit manager resume without changing factual content."

- Enhance action verbs. "Replace weak or repetitive verbs in my credit manager experience bullets with precise alternatives that convey ownership and impact."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong credit manager resume proves impact with measurable outcomes, such as lower days sales outstanding, reduced bad debt, and improved cash flow. It highlights role-specific skills, including credit risk analysis, collections strategy, and policy compliance. Clear structure makes results and responsibilities easy to scan.

Keep each section focused and consistent, so hiring teams quickly see your fit for today’s and near-future market. When your credit manager resume shows outcomes, skills, and clarity, it signals readiness to lead credit decisions with confidence.