Many banking business analyst resumes fail because they read like task logs and bury risk, controls, and measurable impact. That hurts when an ATS screens keywords fast and recruiters scan in seconds. Competition stays high, even for strong candidates.

A strong resume shows outcomes tied to business value and regulated delivery. Knowing how to make your resume stand out means you should highlight quantified savings, reduced fraud loss, improved reconciliation accuracy, faster cycle times, cleaner audit results, and adoption across branches. Show scope, stakeholders, and what changed.

Key takeaways

- Quantify every major achievement with metrics like cost savings, cycle time, or error reduction.

- Tailor experience bullets to each job posting's tools, terminology, and success metrics.

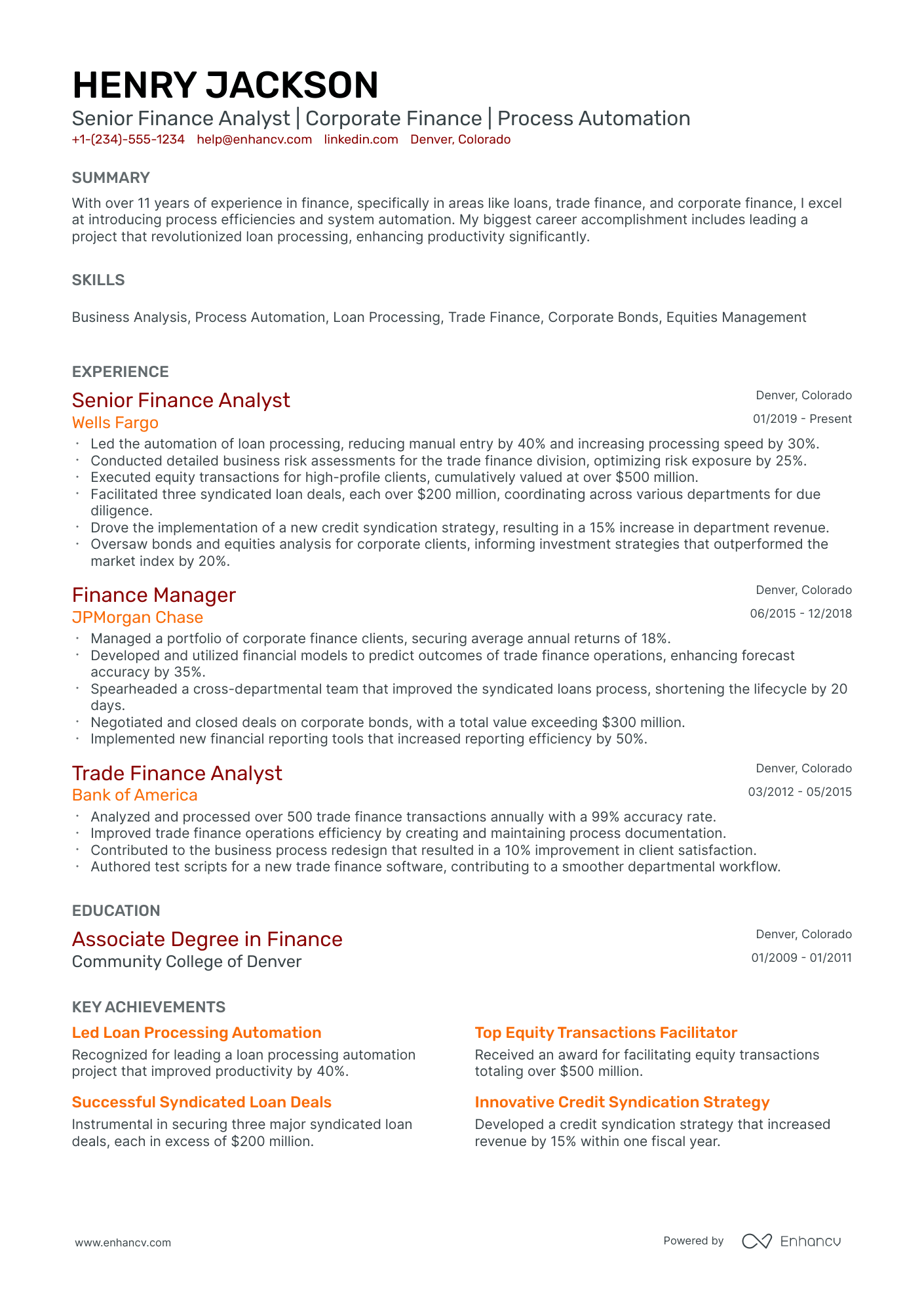

- Use reverse-chronological format for experienced candidates and hybrid format for career changers.

- Show ownership scope, execution approach, and business outcomes in every role entry.

- Back every listed skill with a specific action and measurable result from your experience.

- Write a three-to-four-line summary featuring your domain focus, core tools, and top achievement.

- Use Enhancv's tools to turn vague duties into focused, recruiter-ready resume bullets.

How to format a banking business analyst resume

Recruiters hiring banking business analysts prioritize domain knowledge in financial services, proficiency with data analysis and requirements-gathering tools, and a clear record of delivering measurable process or system improvements. Choosing the right resume format ensures these signals surface quickly during both ATS parsing and the initial six-to-ten-second recruiter scan.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your banking business analyst experience in a clear, progression-driven timeline. Do:

- Lead each role entry with your scope of ownership—number of stakeholders managed, business lines supported, or project budgets influenced.

- Highlight domain-specific tools and skills such as SQL, Tableau, JIRA, UAT coordination, BRD/FRD documentation, and regulatory frameworks like Basel III or AML/KYC.

- Quantify outcomes tied to efficiency gains, cost reductions, risk mitigation, or revenue impact for every major initiative.

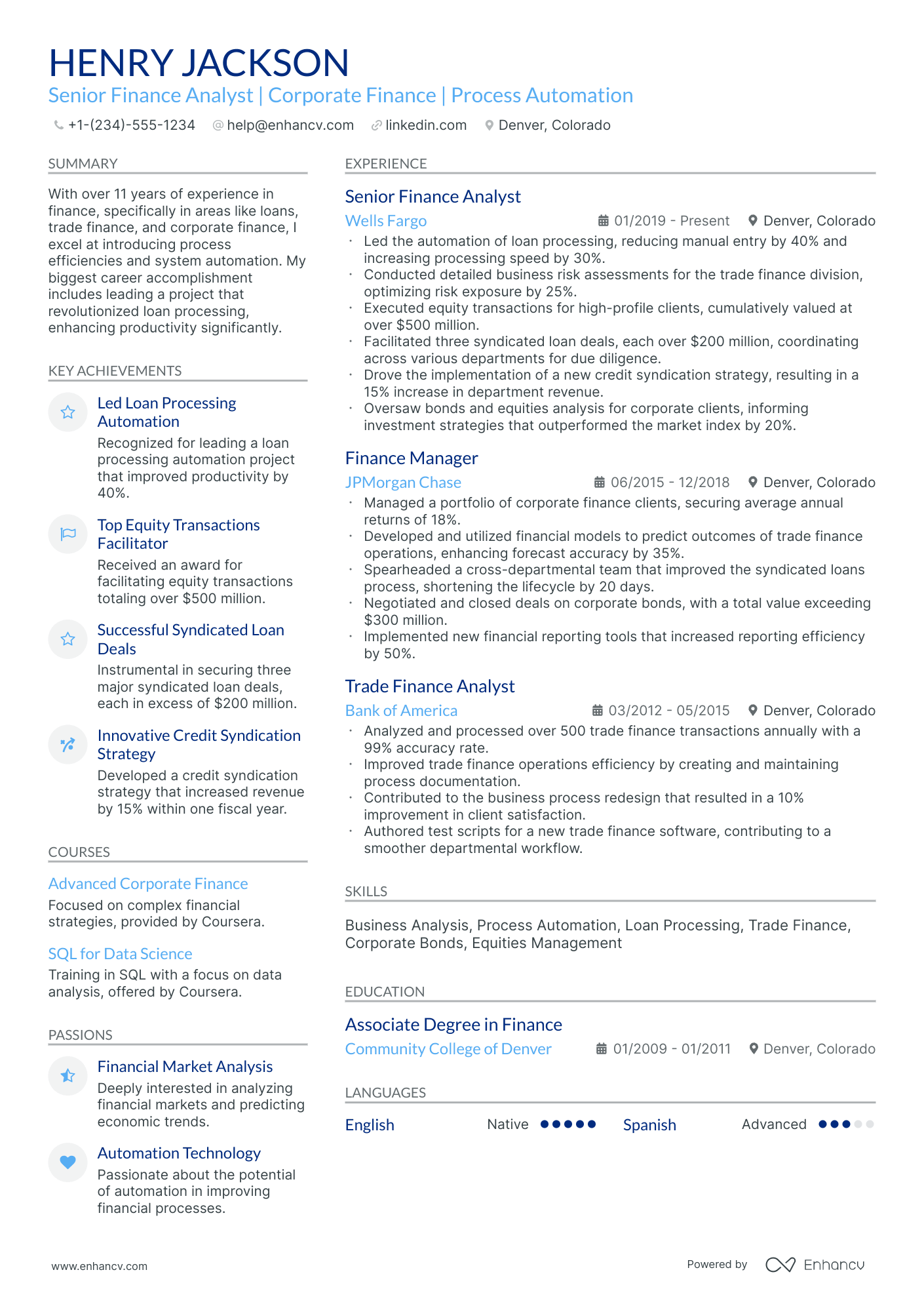

I'm junior or switching into this role—what format works best?

A hybrid format works best, allowing you to lead with a targeted skills section while still showing concrete work or project history underneath. Do:

- Place a skills section near the top of your resume featuring banking-relevant competencies such as requirements elicitation, data modeling, process mapping, and familiarity with core banking platforms.

- Include academic projects, internships, or cross-functional work that demonstrates analytical rigor in financial or regulated environments.

- Connect every listed skill to a specific action and a measurable or observable result.

Why not use a functional resume?

A functional format strips away the timeline and context that recruiters need to verify where, when, and how you applied your banking analysis skills—making it harder to assess your readiness for the role.

- A functional format may be acceptable if you're making a career change from a related field (such as financial operations or IT analysis), have limited formal work history, or need to address resume gaps—but only if every listed skill is tied directly to a specific project, deliverable, or outcome rather than presented as a standalone claim.

Once your layout and structure are in place, the next step is filling them with the right sections to showcase your qualifications effectively.

What sections should go on a banking business analyst resume

Recruiters expect a clean, business-focused resume that proves you can translate banking requirements into measurable outcomes. Understanding what to put on a resume is critical for banking business analysts who need to balance technical depth with business impact.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Your experience bullets should emphasize business impact, quantified results, stakeholder scope, and the banking processes, products, and regulatory constraints you improved.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now that you’ve organized the key parts of your resume, the next step is to write your banking business analyst resume experience section so each role supports that structure with clear, relevant detail.

How to write your banking business analyst resume experience

Your work experience section should highlight the projects you've delivered, the analytical tools and methodologies you've applied, and the measurable outcomes you've driven within banking environments. Hiring managers prioritize demonstrated impact—tangible results tied to business objectives—over descriptive task lists that simply recount daily responsibilities.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the banking products, regulatory domains, data systems, or cross-functional initiatives you were directly accountable for—whether that involved lending platforms, risk reporting, compliance workflows, or core banking migrations.

- Execution approach: the requirements-gathering frameworks, data analysis tools, modeling techniques, or documentation standards you used to translate stakeholder needs into actionable specifications and informed decisions.

- Collaboration context: how you partnered with technology teams, risk officers, compliance units, operations groups, or external vendors to align business requirements with technical delivery across the banking organization.

- Value improved: the specific dimensions of performance you strengthened, such as process efficiency, data accuracy, regulatory adherence, report reliability, turnaround time, or risk exposure within banking operations.

- Impact delivered: the business outcomes your work produced, expressed through results and scale rather than activity—think revenue protected, costs reduced, processes streamlined, or launches completed that moved the bank's strategic priorities forward.

Experience bullet formula

A banking business analyst experience example

✅ Right example - modern, quantified, specific.

Senior Business Analyst, Digital Banking

HarborPoint Bank | Charlotte, NC

2021–Present

Regional bank serving 1.2M customers, focused on mobile-first retail banking and risk-managed growth.

- Led requirements discovery and user story mapping in Jira and Confluence for a mobile deposit redesign, partnering with product managers, designers, and engineers to cut deposit failures by 28% and reduce average time-to-funds by 14%.

- Built SQL and Power BI dashboards to monitor onboarding funnel, Know Your Customer (KYC) completion, and fraud flags; surfaced root causes that improved account-opening conversion by 9% and reduced manual review volume by 17%.

- Facilitated workshops with compliance, risk, and operations to translate regulatory and policy changes into acceptance criteria and test scenarios, lowering audit findings from six to one across two quarterly reviews.

- Authored end-to-end process maps and swimlanes in Visio and BPMN for dispute and chargeback workflows; aligned stakeholders on target-state changes that shortened case cycle time from nine days to six days and improved first-contact resolution by 11%.

- Coordinated user acceptance testing using Azure DevOps, creating traceability matrices and defect triage routines with quality assurance and engineering; increased release pass rate from 92% to 98% and cut production hotfixes by 35%.

Now that you've seen what a strong experience section looks like in practice, let's break down how to adapt yours to match the specific role you're targeting.

How to tailor your banking business analyst resume experience

Recruiters evaluate your banking business analyst resume through both human review and applicant tracking systems (ATS). Tailoring your resume to the job description ensures your qualifications register with both.

Ways to tailor your banking business analyst experience:

- Mirror the exact tools and platforms listed in the job description.

- Match terminology for methodologies like Agile or Waterfall from the posting.

- Reflect the specific KPIs or success metrics the employer prioritizes.

- Highlight regulatory compliance experience when the role requires it.

- Include relevant banking domain knowledge such as lending or treasury operations.

- Align your workflow descriptions with collaboration models the posting references.

- Emphasize data analysis techniques or SQL skills if the job specifies them.

- Reference risk assessment or audit support experience when listed as essential.

Tailoring means aligning your real accomplishments with what the employer asks for, not forcing keywords where they don't belong.

Resume tailoring examples for banking business analyst

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Gather and document business requirements for core banking system migrations, working with stakeholders across retail and commercial banking divisions | Gathered requirements from stakeholders and created documentation for various projects. | Gathered and documented business requirements for a core banking system migration across retail and commercial banking divisions, facilitating 30+ stakeholder sessions to align functional specifications with platform capabilities. |

| Perform data analysis using SQL and Tableau to identify trends in loan portfolio performance and support credit risk reporting | Analyzed data and created reports for management review. | Queried loan portfolio data using SQL and built Tableau dashboards that tracked delinquency trends, prepayment rates, and concentration risk—reducing credit risk reporting turnaround by 40%. |

| Lead UAT efforts for regulatory reporting enhancements to ensure compliance with Basel III and CECL standards | Participated in testing activities and helped ensure project deliverables met quality standards. | Led UAT for regulatory reporting enhancements aligned with Basel III capital adequacy and CECL expected credit loss standards, coordinating 15 test cycles and resolving 95% of defects before production release. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your banking business analyst achievements so hiring managers can quickly see the impact behind those choices.

How to quantify your banking business analyst achievements

Quantifying your achievements proves business impact and de-risks your claims. Focus on cycle time, defect leakage, compliance outcomes, revenue lift, and operational cost—plus volumes, scope, and delivery speed across systems, teams, and releases.

Quantifying examples for banking business analyst

| Metric | Example |

|---|---|

| Cycle time | "Cut loan-origination requirements cycle time from 15 to nine business days by standardizing user stories in Jira and tightening sign-off criteria with underwriting." |

| Quality | "Reduced post-release defects by 32% by adding acceptance criteria, SQL-based data validations, and a UAT defect triage workflow across three scrum teams." |

| Compliance risk | "Closed eight audit findings in six weeks by mapping controls to requirements, updating traceability in Confluence, and validating evidence with compliance and internal audit." |

| Cost savings | "Saved $420K annually by identifying duplicate KYC checks, redesigning the workflow, and eliminating two vendor API calls per application across 180K yearly applications." |

| Delivery speed | "Delivered a core-banking fee-rule update two sprints early by aligning stakeholders, clarifying edge cases, and coordinating regression testing across five downstream systems." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong, impact-driven bullet points for your experience section, it's equally important to strategically present your hard and soft skills to give recruiters a complete picture of your qualifications.

How to list your hard and soft skills on a banking business analyst resume

Skills matter because banking business analysts must translate business needs into compliant, data-backed solutions, and recruiters and applicant tracking systems (ATS) scan your skills section to confirm fit, typically expecting a balance of hard skills and role-specific soft skills.

banking business analyst roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Requirements elicitation, user stories

- Business process mapping, BPMN

- SQL, data profiling

- Advanced Excel, Power Query

- Tableau, Power BI

- Data lineage, metadata management

- Core banking systems, payment rails

- AML and KYC requirements

- Regulatory reporting, audit readiness

- API integration, Swagger, Postman

- Jira, Confluence

- UAT planning, defect triage

Soft skills

- Translate risk into requirements

- Lead stakeholder workshops

- Align priorities across teams

- Challenge scope creep with data

- Write clear functional specs

- Present trade-offs to leaders

- Drive decisions under constraints

- Manage dependencies and handoffs

- Negotiate timelines and scope

- Own end-to-end delivery

- Communicate with compliance partners

- Escalate risks early and clearly

How to show your banking business analyst skills in context

Skills shouldn't live only in a bulleted list on your resume. Explore resume skills examples to see how top candidates weave competencies into their narratives.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what strong, contextual skill use looks like in practice.

Summary example

Senior banking business analyst with 10 years in retail banking operations. Skilled in SQL, Tableau, and process reengineering. Led a cross-functional deposit platform migration that cut transaction processing errors by 34% and saved $1.2M annually.

- Reflects senior-level experience clearly

- Names specific, relevant tools

- Leads with a measurable outcome

- Signals cross-functional collaboration

Experience example

Senior Business Analyst

Ridgeline Federal Credit Union | Charlotte, NC

March 2019–Present

- Partnered with compliance and IT teams to redesign AML transaction monitoring workflows in SQL, reducing false-positive alerts by 41%.

- Built Tableau dashboards tracking mortgage pipeline KPIs, helping leadership cut average loan approval time from 18 to 11 days.

- Facilitated requirements-gathering workshops with stakeholders across three departments, delivering a core banking system upgrade two weeks ahead of schedule.

- Every bullet includes measurable proof

- Skills appear naturally within achievements

Once you’ve tied your strengths to real banking outcomes and workflows, the next step is to apply that same approach to building a banking business analyst resume with no experience.

How do I write a banking business analyst resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Bank process mapping class projects

- Requirements gathering capstone deliverables

- SQL and Excel analytics coursework

- Internship in finance operations

- Case competitions on lending workflows

- Volunteer budgeting for nonprofits

- Shadowing analysts in a bank

Our guide on building a resume without work experience walks you through how to position these assets effectively.

Focus on:

- Requirements artifacts with traceability

- Banking domain knowledge and regulations

- Data analysis with SQL, Excel

- Measurable outcomes from projects

Resume format tip for entry-level banking business analyst

Use a functional resume format because it highlights projects, coursework, and tools when you lack full-time banking business analyst experience. Do:

- Lead with a Projects section.

- Add a Tools section with SQL, Excel, Jira, and Visio.

- Quantify results using time, error, or cost metrics.

- Include banking business analyst keywords from postings.

- Attach links to a portfolio or GitHub.

- Built a loan onboarding requirements package in Jira and Visio, mapped eight steps, and reduced simulated rework by 20% in a capstone project.

Even without direct experience, your educational background can demonstrate the analytical and financial knowledge that qualifies you for the role.

How to list your education on a banking business analyst resume

Your education section helps hiring teams confirm you have the foundational knowledge needed. It validates your analytical, financial, and technical background for the banking business analyst role.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a banking business analyst:

Example education entry

Bachelor of Science in Finance

Georgetown University, Washington, D.C.

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Financial Modeling, Data Analytics, Risk Management, Banking Regulations, Business Process Optimization

- Honors: Magna Cum Laude, Dean's List (six consecutive semesters)

How to list your certifications on a banking business analyst resume

Certifications on your resume show your commitment to learning, proficiency with banking tools, and industry relevance as a banking business analyst. They also validate specialized skills that employers want for regulated, data-driven banking work. Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degree is recent and your certifications add supporting skills, not core banking business analyst requirements.

- Place certifications above education when they are recent, highly relevant, or required for the banking business analyst roles you target.

Best certifications for your banking business analyst resume

- Certified Business Analysis Professional (CBAP)

- Certification of Capability in Business Analysis (CCBA)

- PMI Professional in Business Analysis (PMI-PBA)

- Agile Analysis Certification (AAC)

- Professional Scrum Product Owner (PSPO I)

- Certified Anti-Money Laundering Specialist (CAMS)

- Lean Six Sigma Green Belt

Once you’ve positioned your credentials to reinforce your qualifications, move on to your banking business analyst resume summary to quickly connect those strengths to the role you’re targeting.

How to write your banking business analyst resume summary

Your resume summary is the first thing a recruiter reads. A strong one immediately signals you're qualified for a banking business analyst role.

Keep it to three to four lines, with:

- Your title and total years of relevant experience.

- Domain focus, such as retail banking, capital markets, or payments.

- Core tools and skills like SQL, JIRA, Agile, or business process modeling.

- One or two quantified achievements that show measurable impact.

- Soft skills tied to real outcomes, such as stakeholder communication that reduced approval cycles.

PRO TIP

At this level, emphasize technical skills, domain relevance, and early wins that prove you can deliver. Highlight specific tools you've used and results you've contributed to. Avoid vague phrases like "passionate self-starter" or "eager to learn." Recruiters want proof of capability, not motivation statements.

Example summary for a banking business analyst

Banking business analyst with three years of experience in retail banking operations. Skilled in SQL, JIRA, and Agile methodologies. Streamlined loan processing workflows, reducing turnaround time by 18% across two regional branches.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure your header presents the essential contact and professional details recruiters need to reach you.

What to include in a banking business analyst resume header

A resume header is the contact and identity block at the top, and it boosts visibility, credibility, and fast recruiter screening for a banking business analyst.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening across roles, dates, and employers.

Do not include a photo on a banking business analyst resume unless the role is explicitly front-facing or appearance-dependent.

Match your header title and headline to the banking business analyst job posting, and keep every link current and easy to scan.

Banking business analyst resume header

Jordan Lee

Banking business analyst | Retail banking requirements, SQL reporting, and stakeholder alignment

Charlotte, NC, United States

(704) 555-01XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

Once your contact details and key identifiers are set at the top, you can strengthen the rest of your application with additional sections that add relevant context to your banking business analyst experience.

Additional sections for banking business analyst resumes

Adding extra sections helps you stand out when your core qualifications match other candidates. They build credibility and show depth relevant to banking. For example, listing language skills can be a differentiator in roles that support multilingual customer bases or international banking operations.

- Languages

- Certifications

- Industry publications

- Professional affiliations

- Volunteer experience in financial literacy

- Awards and recognitions

- Conferences and speaking engagements

Once you've strengthened your resume with relevant additional sections, it's worth pairing it with a cover letter to maximize your impact.

Do banking business analyst resumes need a cover letter

A cover letter isn't required for a banking business analyst, but it often helps in competitive roles or teams with strict hiring expectations. Understanding what a cover letter is and when to use one can make a difference when your resume needs context, or when the role demands strong stakeholder communication.

Use a cover letter when it adds clear, role-specific value:

- Explain fit for the team: Match your strengths to the bank's priorities, such as risk, compliance, operations, data, or digital channels.

- Highlight one or two outcomes: Pick a project with measurable impact, like reduced losses, faster onboarding, fewer exceptions, or improved reporting accuracy.

- Show business context: Reference the product, users, and constraints, such as branch staff workflows, call center volumes, fraud controls, or regulatory requirements.

- Address transitions: Clarify a move from another industry, a gap, or a non-obvious path, and connect it to banking business analyst responsibilities.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you choose to submit a cover letter to strengthen your application, the next step is using AI to improve your banking business analyst resume so it communicates your value clearly and consistently.

Using AI to improve your banking business analyst resume

AI can sharpen your resume's clarity, structure, and overall impact. It helps reframe weak bullet points and tighten language. But overuse kills authenticity. Once your content feels clear and role-aligned, step away from AI. For a deeper look at effective prompts, check out our guide on ChatGPT resume writing.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your resume:

- Sharpen your summary: "Rewrite my resume summary to highlight my core strengths as a banking business analyst in under four sentences."

- Quantify experience bullets: "Add measurable outcomes to these banking business analyst experience bullets using percentages, dollar amounts, or timeframes."

- Align skills section: "Review my skills section and remove anything irrelevant to a banking business analyst role. Suggest replacements."

- Strengthen project descriptions: "Rewrite this project description to clearly show my banking business analyst contributions, deliverables, and business impact."

- Tighten action verbs: "Replace weak or vague verbs in my banking business analyst experience section with stronger, more specific alternatives."

- Refine certification relevance: "Reorder and describe my certifications to emphasize those most relevant to a banking business analyst position."

- Improve education details: "Rewrite my education section to highlight coursework and achievements directly applicable to banking business analyst roles."

- Remove filler language: "Identify and remove filler words or redundant phrases throughout my banking business analyst resume."

- Tailor to job posting: "Compare my banking business analyst resume against this job description and flag missing keywords or requirements."

- Clarify technical tools: "Rewrite my tools and technologies section so each item clearly connects to banking business analyst responsibilities."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong banking business analyst resume proves impact with measurable outcomes, role-specific skills, and a clear structure. It highlights requirements, process mapping, data analysis, stakeholder management, and risk and compliance work. It stays scannable with focused sections and consistent formatting.

This approach shows you can deliver results in today’s hiring market and adapt to near-future needs. Your banking business analyst resume should read like a record of decisions, improvements, and outcomes, not a task list.